Study on the Temporal and Spatial Evolution of Market Integration and Influencing Factors in the Yellow River Basin

Abstract

1. Introduction

2. Research Methods and Data Sources

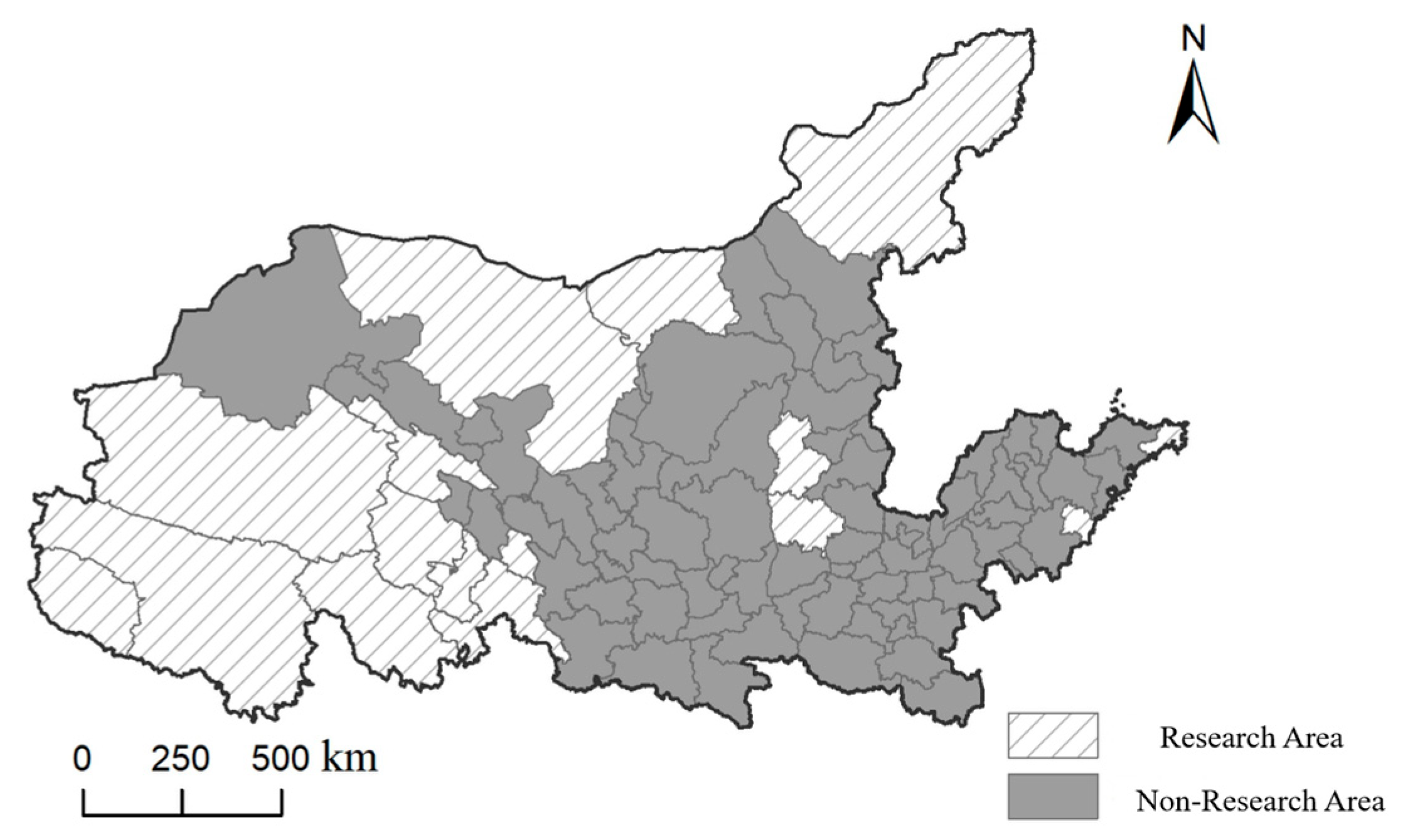

2.1. Study Area

2.2. Methodology

2.2.1. Pricing Method

2.2.2. Dagum Gini Coefficient

2.2.3. Panel Model

- Mixed Models

- 2.

- Fixed-Effect Model

- -

- Individual fixed-effect model:

- -

- Time fixed-effect model:

- -

- Two-way fixed-effect model:

- 3.

- Random-Effect Model

2.3. Data Sources

3. Results

3.1. Measurement and Spatiotemporal Evolution Characteristics of Market Integration in the Yellow River Basin

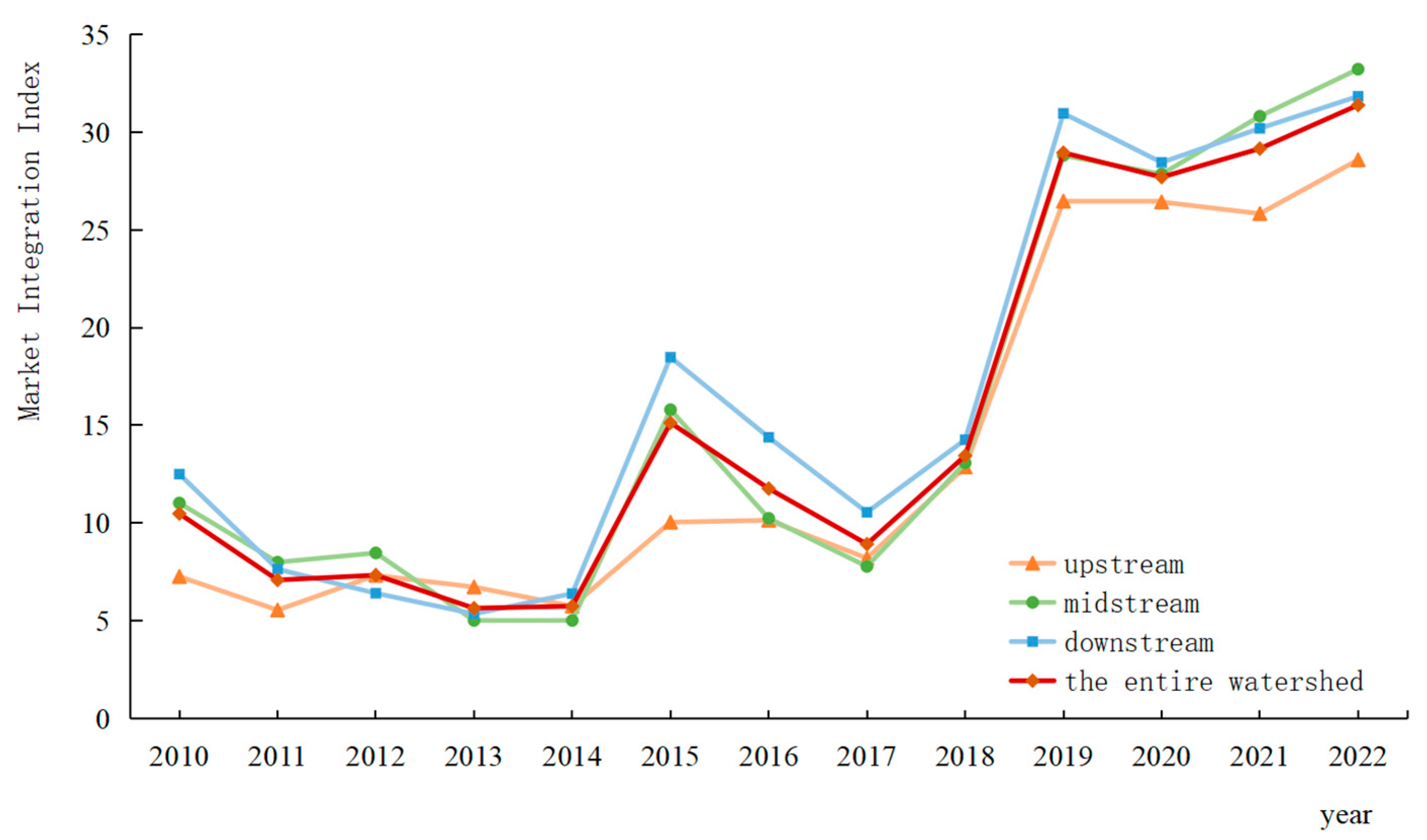

3.1.1. Basin Scale

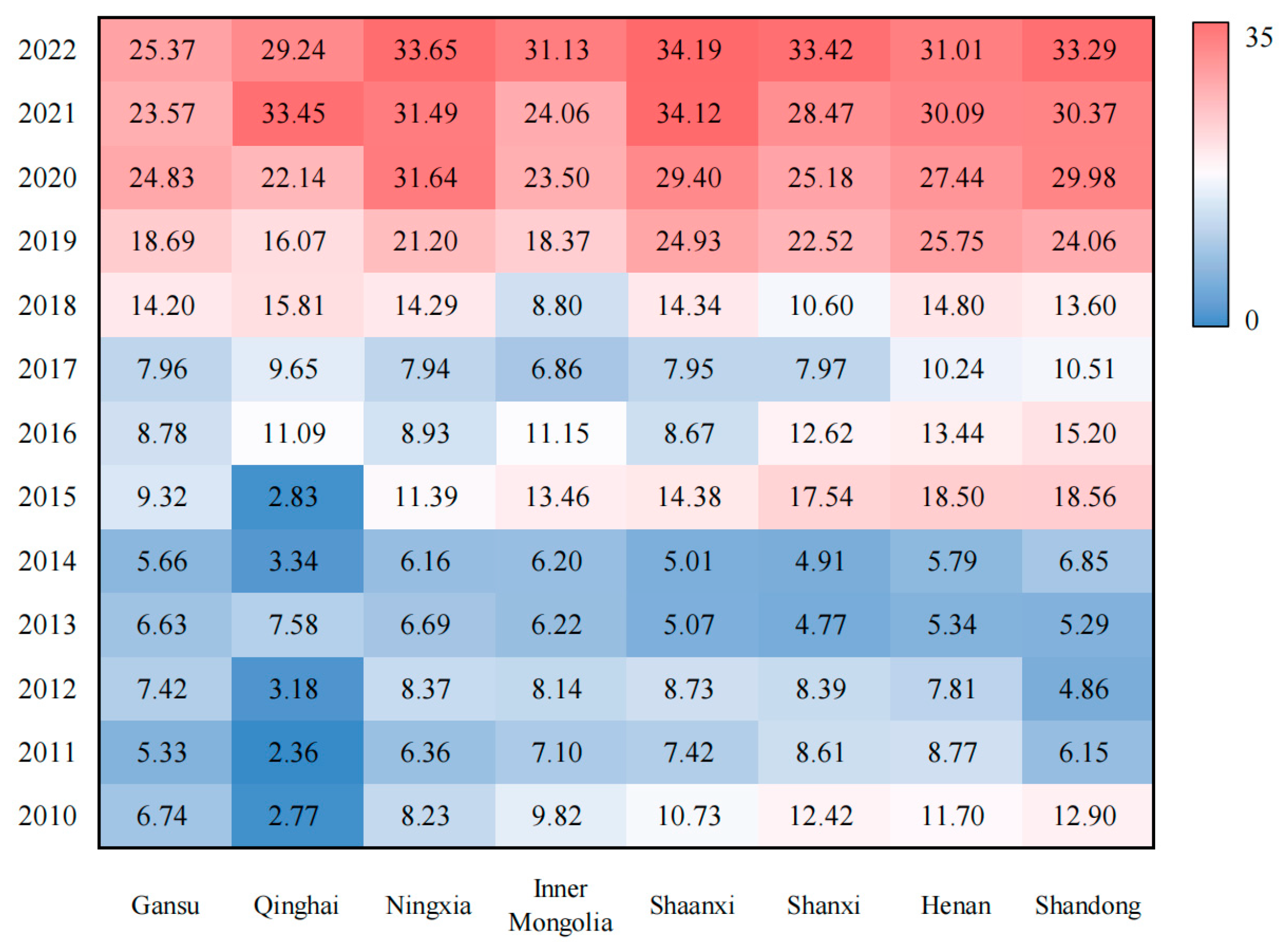

3.1.2. Provincial Scale

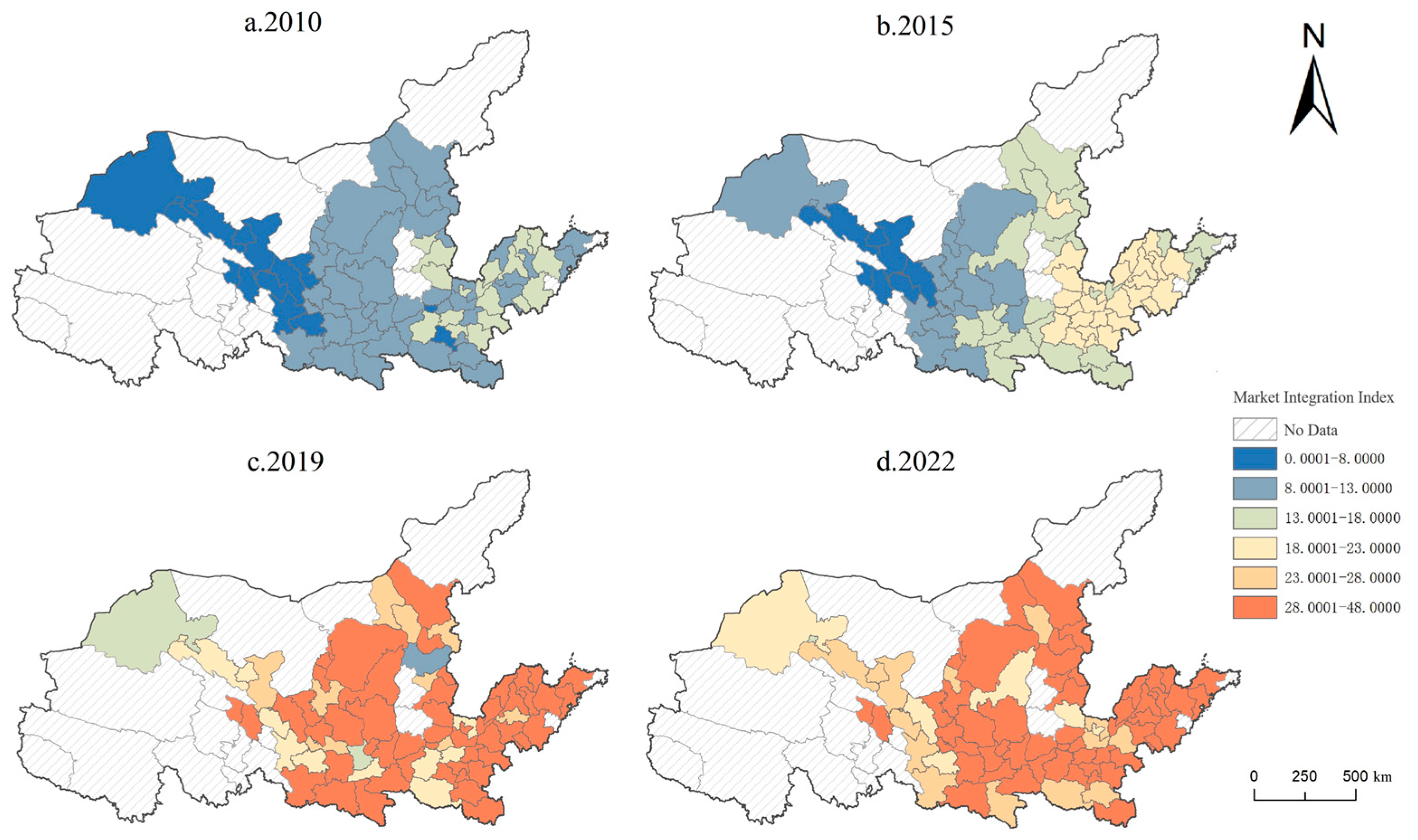

3.1.3. Prefectural Scale

3.2. Regional Differences in Market Integration of the Yellow River Basin

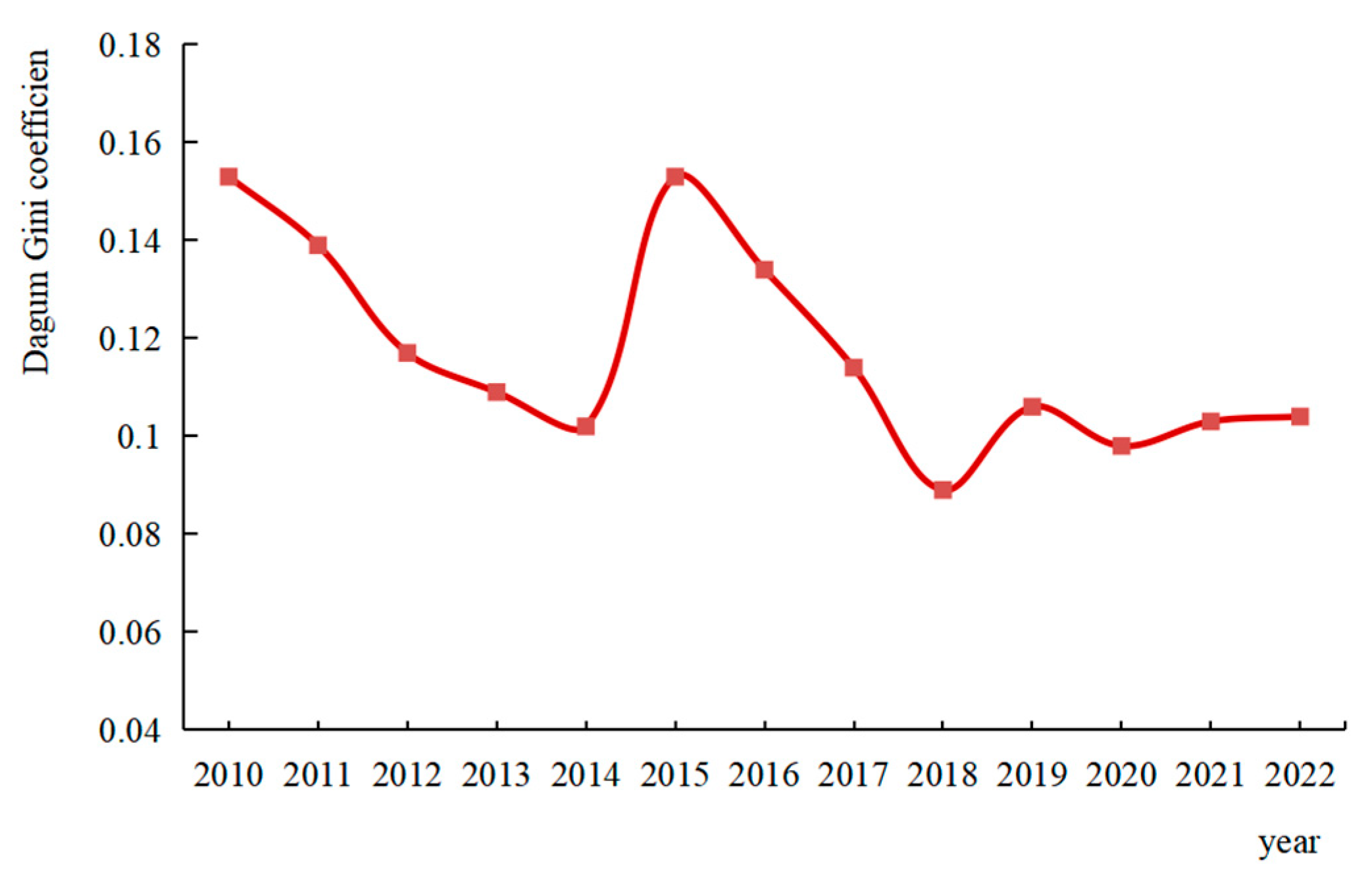

3.2.1. Overall Spatial Differences

3.2.2. Intraregional and Interregional Differences

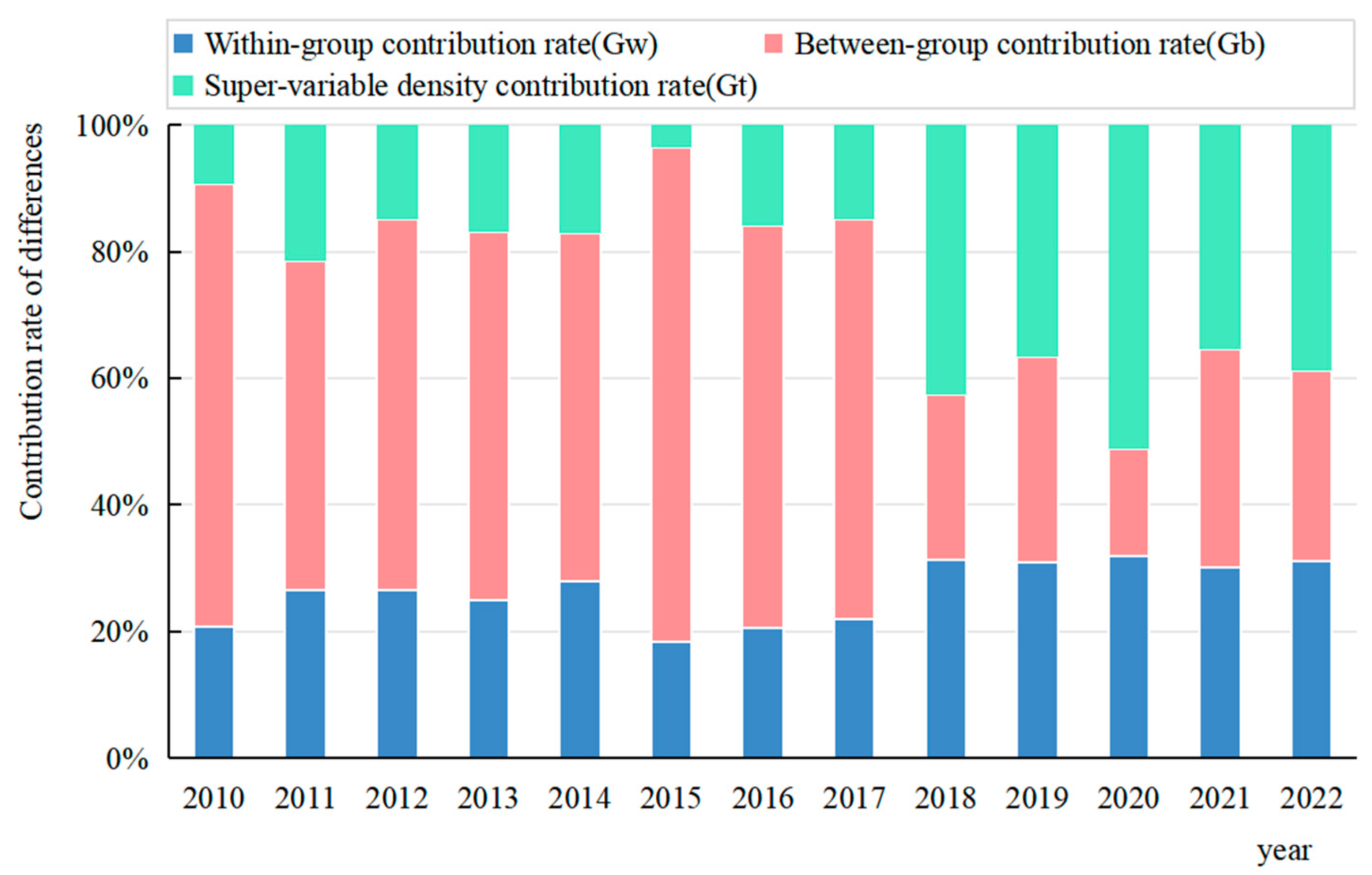

3.2.3. Sources of Differences and Their Contributions

3.3. Analysis of Influencing Factors

3.3.1. Selection of Driving Factor Variables

3.3.2. Analysis of Panel Model Results

4. Discussion

4.1. The Unique Path of Market Integration in the Yellow River Basin

4.2. Effectiveness of National Strategy Policies

4.3. The “Stage-Specific Negative Effects” of Opening Up

4.4. Future Research Prospects

5. Conclusions

- (1)

- Phased progression and spatial reorganization characterize evolution. Temporally, the basin’s market integration index rose steadily from 10.48 (2010) to 31.38 (2022), averaging 9.8% annual growth, indicating continuous improvement. Spatially, the western region’s average value (6.91) was less than 60% of the eastern region’s in 2010. By 2022, central and eastern regions had reached near parity, with the west attaining 89% of the east’s level. The spatial pattern thus shifted from “high east, low west” to a balanced “high central east, west catching up.” Future policies should consolidate this trend through sustainable infrastructure investment (e.g., renewable energy corridors, digital green logistics) and ecosystem service valuation in public fiscal transfers, ensuring growth decoupled from resource depletion.

- (2)

- Narrowing disparities with emerging structural contradictions. Regional disparities in market integration decreased significantly: the overall Gini coefficient declined from 0.153 (2010) to 0.104 (2022)—a 32.0% reduction. However, intraregional differentiation intensified as downstream Gini index values rose from 0.062 to 0.077 and midstream from 0.088 to 0.107. Concurrently, super-variable density contribution surged from 9.3% to 38.8%, becoming the primary source of variation and signaling accelerated multicenter network formation. While narrowing overall disparities benefit regional coordination, emerging multicenter complexity necessitates targeted policies: cultivate secondary centers to alleviate core-city siphoning pressure, enhance subregional collaboration, optimize resource allocation, and strengthen cross-regional infrastructure/institutional coordination among network nodes.

- (3)

- Multifactor synergy drives market integration. Industrial structure upgrading and economic development are core drivers. Financial development and internet penetration exert significant positive effects, while foreign openness shows stage-specific negative effects. The positive effects confirm high-quality development as fundamental to integration, with financial systems reducing transaction costs and digital infrastructure lowering information barriers. The openness paradox must be contextualized within the basin’s significant resource endowment disparities and distinct developmental gradients.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Yao, C.; Ke, Z.; Xiao, C. Ecological protection and high-quality development of the Yellow River Basin. Reg. Econ. Rev. 2020, 1, 8–22. [Google Scholar]

- Havens, R.; Balassa, B. The Theory of Economic Integration. J. Political Econ. 1961, 29, 47. [Google Scholar] [CrossRef]

- North, D. Institutions, Institutional Change and Economic Performance; Cambridge University Press: Cambridge, UK, 1990. [Google Scholar]

- Krugman, P. Increasing Returns and Economic Geography. NBER Work. Pap. 1990, 99, 483–499. [Google Scholar]

- Bai, C.; Du, Y.; Tao, Z.; Tong, S. Local protectionism and industrial concentration in China: Overall trend and important factors. Econ. Res. J. 2004, 4, 29–40. [Google Scholar]

- Parsley, D.; Wei, S. Convergence to the law of one price without trade barriers or currency fluctuations. Q. J. Econ. 1996, 111, 1211–1236. [Google Scholar] [CrossRef]

- Qi, G.; Min, C.; Ming, L. China’s Domestic Commodity Market Toward Segmentation or Consolidation: An Analysis Based on the Relative Price Approach. J. World Econ. 2006, 12, 20–30. [Google Scholar]

- Naughton, B. How Much Can Regional Integration Do to Unify China’s Markets? In Proceedings of the Conference for Research on Economic Development and Policy, Stanford, CA, USA, 18–21 November 1999. [Google Scholar]

- Zi, L.; Ru, Y.; Gui, T. Intra-national Trade Costs, International Trade Costs and the Promotion of the Domestic Circulation of China. Chin. Ind. Econ. 2022, 2, 62–79. [Google Scholar]

- Li, Y.; Guo, G. The evolution of ecology and environmental response to the regional economic integration and the influence factors in Jilin province. Geogr. Sci. 2014, 34, 464–471. [Google Scholar]

- Chun, T.; Yue, R. Measurement of Urban and Rural Integration Level in Chinese Province Based on Intuitionistic Fuzzy Method. Econ. Geogr. 2016, 36, 52–59. [Google Scholar]

- Jian, S.; Yu, S.; Li, C. The Process of Market Integration in China: Trends, Effects and Suggestions. Soc. Sci. J. 2021, 3, 57–170. [Google Scholar]

- Xin, H.; Shan, C.; Teng, L. Price Differences, Market Segmentation and Border Effects: Empirical Evidence from 15 Cities in the Yangtze River Delta. Econ. Res. J. 2014, 49, 18–32. [Google Scholar]

- Yong, Q.; Hang, Y. Market Integration, Spatial Spillover and Regional Export Quality Upgrading—Based on the Experience Analysis of Market Integration in the Yangtze River Delta. J. Int. Trade 2021, 10, 1–16. [Google Scholar]

- Xiao, L. Research on the Measurement of Beijing-Tianjin-Hebei Regional Market Integration. Price Theory Pract. 2020, 4, 76–79. [Google Scholar]

- Yuan, L.; Li, C.; Yuan, Z. Measurement and Influencing Factors of Labor Market Integration in the Chengdu-Chongqing Economic Circle. China Soft Sci. 2023, 10, 88–97. [Google Scholar]

- Jian, W. Spatial-temporal patterns and influencing factors of market segmentation in China. Sci. Geogr. Sin. 2018, 38, 1988–1997. [Google Scholar]

- Dong, L.; Xin, F.; Xin, Z. Regional Development Strategies, Market Segmentation and Economic Growth—An Empirical Analysis Based on the Relative Price Index Approach. Financ. Trade Econ. 2014, 8, 115–126. [Google Scholar]

- Santamaría, M.; Ventura, J.; Yeilbayraktar, U. Borders within Europe. Political Econ. Dev. Domest. Dev. Strateg. J. 2020. [Google Scholar] [CrossRef]

- Bing, L.; Jun, Z. The Analysis on the Influencing Factors of Regional Market Segmentation and Its Spatial Neighbor Effects: Based on the Panel Data of China’s Provinces in 1989–2014. Econ. Geogr. 2018, 38, 36–45. [Google Scholar]

- Wei, X.; Tian, J. Has the Market Integration Improved the Urban Economic Efficiency of the Yangtze River Delta Urban Agglomeration? A Study from the Perspective of “Local-Neighborhood” Effect and It’s Transmission Mechanism. East China Econ. Manag. 2022, 36, 35–43. [Google Scholar]

- Xi, C.; Fang, Y. Policy Effect Evaluation of Government-Led Regional Integration Strategy from a Coordinated Development Perspective: Evidence from Residents’ Income in 9 Provinces of the Pan-Pearl River Delta. Guizhou Soc. Sci. 2020, 5, 125–133. [Google Scholar]

- Jun, M.; Pei, H. Impacts of Market Integration on Ecological Efficiency Under the Dual Carbon Target in the Yangtze River Delta. Resour. Environ. Yangtze Basin 2025, 34, 937–949. [Google Scholar]

- Hong, Z.; Yue, X.; Gao, Y.; Jian, L. Research on the Welfare Effects of Building a Unified National Market. J. Manag. World 2025, 41, 15–40. [Google Scholar]

- Meng, Q.; Xiu, L.; Xiao, N. Regional Central City Scale, Market Integration and Coordinated Development of Urban-rural Areas. Financ. Trade Econ. 2025, 46, 159–176. [Google Scholar]

- Lan, L. Logical Framework and Theoretical Explanation of China’s Regional Coordinated Development Strategy. Econ. Perspect. 2020, 10, 19–35. [Google Scholar]

- Xiao, R.; Guan, L.; Rui, W. Development of Digital Economy, Marketization of Factors and the Changes in Regional Gaps. China Bus. Mark. 2022, 36, 55–70. [Google Scholar]

- Zhou, X.; Hao, H.; Ye, X.; Qin, Y.; Ma, X. A spatial-temporal analysis of regional economic inequality in Yellow River Valley. Hum. Geogr. 2016, 31, 119–125. [Google Scholar]

- Man, J.; Shan, X. Jing-Jin-Ji Regional Market Segmentation and Integration Over Time and Space. Nankai J. (Philos. Lit. Soc. Sci. Ed.) 2015, 1, 97–109. [Google Scholar]

- Bing, L. On The Trend of Regional Market Integration: Measurement and Analysis on Chinese Commodity Market Segmentation Based on City Data. Econ. Theory Bus. Manag. 2020, 40, 13. [Google Scholar]

- Mao, Q.; Sheng, B. Economic Opening, Regional Market Integration and Total Factor Productivity. China Econ. Q. 2012, 11, 181–210. [Google Scholar]

- Jia, W.; Lian, F.; Bo, L. Regional Differences, Dynamic Evolution and Convergence of Market-based Allocation Efficiency of Data Factors. Stat. Decis. 2023, 39, 143–148. [Google Scholar]

- Lu, Z.; Guo, L.; Xiao, L. Spatial differentiation and driving factors of urban economic resilience from the perspective of industrial structure upgrading. Geogr. Sci. 2024, 44, 577–1586. [Google Scholar]

- Hao, W.; Wei, W. Pattern Evolution and Spatial Spillover Effect of Urban Resilience in the Yangtze River Delta. Geogr. Geo-Inf. Sci. 2024, 40, 57–66. [Google Scholar]

- Xiao, W. Can digital inclusive finance promote the Internet business model? Empirical evidence from Chinese listed firms. Theory Pract. Financ. Econ. 2025, 46, 19–26. [Google Scholar]

- Hui, Z.; Han, Z.; Ren, J. Does Smart City Construction Promote New Urbanization and Market Integration: Can We Have Both? Trop. Geogr. 2023, 43, 681–694. [Google Scholar]

- Xue, L.; Yu, Z.; Bo, S. Does regional integration promote the efficiency of economic growth? an empirical analysis of the Yangtze River Economic Belt. China Population. Resour. Environ. 2017, 27, 10–19. [Google Scholar]

- Ling, W.; Ran, W. Impact of Market Integration on FDI in Guangdong-Hong Kong-Macao Greater Bay Area: Analysis based on fixed effect and heterogeneity test. Sci. Technol. Ind. 2021, 21, 58–65. [Google Scholar]

- Shu, Z.; Xin, W.; Geng, J. The relationship between regional structural imbalance of China’s foreign trade and regional income disparity. Financ. Trade Econ. 2009, 5, 85–90. [Google Scholar]

- Li, L.; Jing, L.; Yang, L. Dose Foreign Direct Investment Promotes the Coordinated Development of Regional Economy in the Yangtze River Economic Belt: A Spatial Convergence Analysis. Inq. Into Econ. Issues 2020, 3, 123–134. [Google Scholar]

- Bin, W.; Hai, H.; Zhi, Z. The impact of digital financial development on the integration of our markets and the mechanisms at play. J. Commer. Econ. 2023, 11, 107–111. [Google Scholar]

- Xia, Z.; Yong, X. Digital Distribution, Unified National Market and Dual Circulation of Domestic and International Markets. J. Bus. Econ. 2024, 3, 18–32. [Google Scholar]

- Miao, M. Research on the Impact of Agricultural Product Circulation Digitalization on China’s Market Integration: Empirical test based on panel threshold model. J. Commer. Econ. 2025, 9, 108–111. [Google Scholar]

- Feng, J. Coordinated Promotion Strategy of Ecological Protection and High-quality Development in the Yellow River Basin. Reform 2019, 11, 33–39. [Google Scholar]

- Jin, Z.; Chao, T.; Jiao, X.; Miao, Y.; Cheng, W. The Integrated Development and Regional Disparities of Urban Agglomerations in the Yellow River Basin, China. Sustainability 2024, 16, 10353. [Google Scholar] [CrossRef]

- Kanbur, R.; Zhang, X. Fifty Years of Regional Inequality in China: A Journey Through Central Planning, Reform and Openness. Rev. Dev. Econ. 2005, 9, 87–106. [Google Scholar] [CrossRef]

- Miao, C.; Hu, Z.; Geng, F.; Miao, J. Characteristics of Economic Evolution and the Influencing Factors of Resource-Dependent Cities in China: The role of Path Dependence, Vulnerability and Path Creation. Geogr. Res. 2018, 37, 1268–1281. [Google Scholar]

| Year | Within-Group Gini Coefficient | Between-Group Gini Coefficient | ||||

|---|---|---|---|---|---|---|

| Upstream | Downstream | Midstream | Upstream and Downstream | Upstream and Midstream | Downstream and Midstream | |

| 2010 | 0.188 | 0.062 | 0.088 | 0.275 | 0.224 | 0.095 |

| 2011 | 0.16 | 0.12 | 0.071 | 0.189 | 0.198 | 0.101 |

| 2012 | 0.1 | 0.146 | 0.042 | 0.144 | 0.086 | 0.153 |

| 2013 | 0.044 | 0.066 | 0.137 | 0.114 | 0.151 | 0.107 |

| 2014 | 0.077 | 0.05 | 0.142 | 0.075 | 0.123 | 0.136 |

| 2015 | 0.179 | 0.039 | 0.095 | 0.296 | 0.232 | 0.092 |

| 2016 | 0.068 | 0.042 | 0.151 | 0.175 | 0.125 | 0.173 |

| 2017 | 0.092 | 0.028 | 0.13 | 0.129 | 0.113 | 0.154 |

| 2018 | 0.112 | 0.041 | 0.113 | 0.084 | 0.114 | 0.083 |

| 2019 | 0.118 | 0.071 | 0.115 | 0.115 | 0.125 | 0.097 |

| 2020 | 0.112 | 0.065 | 0.111 | 0.097 | 0.116 | 0.091 |

| 2021 | 0.139 | 0.069 | 0.089 | 0.123 | 0.133 | 0.081 |

| 2022 | 0.108 | 0.077 | 0.107 | 0.104 | 0.127 | 0.097 |

| Influencing Factors | Indicator Explanation |

|---|---|

| Advanced Industrial Structure | Value added of the tertiary sector/value added of the secondary sector |

| Economic Development Level | GDP per capita |

| Level of Openness | Actual utilization of foreign investment/GDP |

| Degree of Financial Development | Year-end balance of loans and deposits of financial institutions/GDP |

| Internet Penetration Rate | Number of internet users per 10,000 people/resident population |

| Test Type | Test Value | Test Conclusion |

|---|---|---|

| F | F(71,787) = 6.486, p = 0.000 | Model 1 (FE) |

| BP | χ2(1) = 54.242, p = 0.000 | Model 2 (RE) |

| Hausman | χ2(4) = 724.876, p = 0.000 | Model 3 (FE) |

| Item | Coeff. | Std. Err. | t | p | 95% CI |

|---|---|---|---|---|---|

| Intercept | −0.609 | 0.06 | −10.096 | 0.000 *** | −0.728~−0.491 |

| Advanced Industrial Structure | 0.906 | 0.105 | 8.655 | 0.000 *** | 0.701~1.112 |

| Economic Development Level | 1.239 | 0.114 | 10.888 | 0.000 *** | 1.016~1.462 |

| Level of Openness | −0.489 | 0.148 | −3.312 | 0.001 *** | −0.779~−0.200 |

| Degree of Financial Development | 0.489 | 0.142 | 3.452 | 0.001 *** | 0.211~0.767 |

| Internet Penetration Rate | 0.843 | 0.165 | 5.104 | 0.000 *** | 0.520~1.167 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Teng, C.; Jiao, X.; Jin, Z.; Wang, C. Study on the Temporal and Spatial Evolution of Market Integration and Influencing Factors in the Yellow River Basin. Sustainability 2025, 17, 6920. https://doi.org/10.3390/su17156920

Teng C, Jiao X, Jin Z, Wang C. Study on the Temporal and Spatial Evolution of Market Integration and Influencing Factors in the Yellow River Basin. Sustainability. 2025; 17(15):6920. https://doi.org/10.3390/su17156920

Chicago/Turabian StyleTeng, Chao, Xumin Jiao, Zhenxing Jin, and Chengxin Wang. 2025. "Study on the Temporal and Spatial Evolution of Market Integration and Influencing Factors in the Yellow River Basin" Sustainability 17, no. 15: 6920. https://doi.org/10.3390/su17156920

APA StyleTeng, C., Jiao, X., Jin, Z., & Wang, C. (2025). Study on the Temporal and Spatial Evolution of Market Integration and Influencing Factors in the Yellow River Basin. Sustainability, 17(15), 6920. https://doi.org/10.3390/su17156920