Abstract

This study examines the contributions of renewable energy transition (RET) and environmental innovation (EI) to environmental performance in G7 countries from 2003 to 2021, with a focus on the transmission channels of green finance and environmental governance. Using the Augmented Mean Group (AMG) estimator and confirming robustness through the Dynamic Common Correlated Effects Mean Group (DCCE-MG) method, the study explores both direct and indirect effects of RET and EI on two key environmental indicators: the Environmental Performance Index and the Load Capacity Factor. The results reveal that both RET and EI have a significant impact on environmental performance. Moreover, green finance and environmental governance serve as crucial channels through which RET and EI exert their influence. These findings underscore the importance of developing effective financial instruments and robust regulatory frameworks to translate energy and innovation policies into tangible environmental benefits. By highlighting the interplay between technological advancement, financial capacity, and institutional quality, this study provides novel insights into the environmental policy landscape of advanced economies and offers guidance for designing integrated strategies to achieve long-term sustainability goals.

1. Introduction

Despite their leadership in global economic and technological domains, achieving environmental sustainability remains a formidable challenge for G7 countries. These advanced economies are responsible for a disproportionate share of global carbon emissions and natural resource consumption, making them central to global climate mitigation efforts [1,2]. Rising levels of air pollution, climate-related disasters, ecological degradation, and biodiversity loss continue to threaten long-term sustainability and economic resilience in these countries [3,4]. Although the G7 nations have implemented various policy frameworks and committed to international agreements—such as the Paris Agreement and the 2030 Agenda for Sustainable Development—progress has been uneven and, in some cases, insufficient to meet established climate targets. Traditional environmental policy tools have often struggled to bring about transformative change, particularly when faced with structural dependence on fossil fuels, aging infrastructure, and complex political economy dynamics [5,6]. In this context, there is growing recognition of the need for integrated, systemic interventions that target energy systems and technological pathways. Two strategies increasingly emphasized in policy and academic circles are renewable energy transition and environmental innovation, both of which are seen as critical for enabling G7 countries to decouple economic growth from environmental degradation and move toward low-carbon, resource-efficient development models.

A growing body of empirical literature has investigated the environmental benefits of renewable energy transition and environmental innovation, largely confirming their positive impact on various sustainability indicators. For instance, Saidi and Omri [7] demonstrate that renewable energy significantly reduces carbon emissions across major energy-consuming countries. Similarly, Taghizadeh-Hesary and Yoshino [8] highlight the role of innovation in promoting decarbonization through clean technologies. Several recent studies have also linked RET and EI to improvements in environmental performance [9,10]. However, much of this research tends to focus narrowly on direct relationships, often overlooking the structural conditions under which renewable energy transition and environmental innovation are most effective. Specifically, few studies have explained the mechanisms or channels—such as financial systems and institutional governance—through which the transition to renewable energy and environmental innovation contributes to improved environmental performance. For instance, while green finance can mobilize the necessary capital to fund clean energy projects and eco-innovation [5] and environmental governance ensures regulatory enforcement and policy continuity [11], their roles as transmission channels are rarely incorporated into empirical models. As a result, the current literature lacks an integrated understanding of how the transition to renewable energy and environmental innovation interact with enabling systems to drive meaningful ecological outcomes.

To fill this gap, this study examines the direct and indirect effects of renewable energy transition and environmental innovation on environmental performance in the G7 countries from 2003 to 2021. Specifically, it examines the roles of green finance and environmental governance as transmission channels that facilitate the impact of the renewable energy transition and environmental innovation on environmental outcomes. While prior studies have emphasized the role of renewable energy transition (RET) and environmental innovation (EI) in improving environmental performance, many of them have focused primarily on direct relationships without accounting for the systemic conditions under which RET and EI are most effective. For instance, Taghizadeh-Hesary and Yoshino [8] highlight how innovation fosters decarbonization through clean technologies, while recent empirical works [9,10] confirm the positive environmental effects of RET and EI. However, these studies typically neglect the enabling structures—such as financial systems and institutional governance—that mediate or moderate these effects. Although a few contributions, such as those of Newell [5] and Gunningham [11], have conceptually emphasized the importance of green finance and regulatory frameworks, these elements are rarely incorporated into empirical models as operational transmission mechanisms. What sets our study apart is that it systematically investigates not only the direct impacts of RET and EI but also how their environmental benefits are contingent upon the presence of effective green finance and environmental governance systems. Unlike existing studies that treat financial and institutional variables as control factors or background conditions, our model explicitly incorporates these dimensions as transmission channels—captured through measurable proxies such as green bond issuance, public environmental expenditures, regulatory stringency, and environmental legislation. The empirical strategy is based on the Augmented Mean Group (AMG) estimator, which accounts for cross-sectional dependence and slope heterogeneity, with robustness confirmed through the Dynamic Common Correlated Effects Mean Group (DCCE-MG) method. By incorporating both direct and indirect effects, the study provides a comprehensive framework that not only quantifies the environmental benefits of RET and EI but also reveals how financial systems and governance institutions influence their effectiveness. Moreover, while the environmental benefits of RET and EI have been widely acknowledged, there is a lack of explicit empirical research examining the transmission channels through which these factors translate into improved environmental outcomes. To the best of our knowledge, this study is among the few that systematically explore the roles of green finance and environmental governance as operational channels in this relationship. It analyzes how green bond issuance, environmental protection expenditures, regulatory stringency, and legislative efforts facilitate or constrain the ability of RET and EI to deliver measurable improvements in ecological performance. By identifying these transmission mechanisms, the study underscores the importance of enabling financial and institutional systems to scale the impact of green technologies and sustainable energy solutions. Understanding these pathways is essential for policymakers and stakeholders seeking to design integrated policy frameworks that support both technological advancement and environmental stewardship in advanced economies. Finally, in terms of results, both RET and EI were found to significantly enhance environmental performance across the G7, with stronger effects observed on the EPI than on the LCF. Specifically, RET exhibited a robust positive impact on both indicators, indicating its central role in driving improvements in environmental quality and ecosystem efficiency. EI also showed a statistically significant and positive effect, highlighting its role in fostering cleaner technologies and sustainable production methods. Importantly, the moderating role of green finance—captured through green bond issuance and public environmental expenditure—proved crucial in amplifying the environmental gains associated with RET and EI. For instance, the interaction between RET and green bonds had a particularly strong influence on the EPI, while public environmental expenditures reinforced the contribution of EI to both EPI and LCF. Similarly, environmental governance—measured by the stringency of environmental policies and the frequency of environmental legislation—enhanced the effectiveness of RET and EI, confirming that institutional quality acts as a vital catalyst in this process. These findings collectively highlight that while RET and EI are indispensable tools in the sustainability transition, their success is highly contingent upon the presence of enabling financial structures and effective governance frameworks.

The rest of the article is organized as follows: Section 2 reviews the existing literature, Section 3 outlines the data and methodology, Section 4 and Section 5 respectively presents and discusses the empirical results, and Section 6 concludes with key implications and suggestions for future research.

2. Literature Review and Hypothesis Development

2.1. Environmental Innovation and Renewable Transition for Environmental Performance

Environmental innovation and the transition toward renewable energy have become foundational elements in the pursuit of enhanced environmental performance, particularly in developed economies such as the G7. The urgency to mitigate climate change, reduce ecological degradation, and achieve sustainable development has placed these two strategies at the forefront of policy and academic discourse. From a theoretical standpoint, both Endogenous Growth Theory and Ecological Modernization Theory provide compelling rationales for their efficacy. Endogenous Growth Theory, as introduced by Romer [12], emphasizes the critical role of technological innovation driven by internal factors such as R&D investment, knowledge spillovers, and human capital accumulation. This framework positions environmental innovation as an endogenous output of economic systems that, when properly incentivized, can drive both productivity and environmental quality. Similarly, Ecological Modernization Theory contends that economic growth and ecological reform are not necessarily at odds but can be harmonized through institutional modernization, clean technology deployment, and eco-efficient industrial restructuring [13]. In this view, the transition to renewable energy represents a systemic transformation of the energy regime, shifting economies from environmentally harmful fossil fuels to sustainable, clean energy systems. The integration of these two theoretical perspectives suggests that innovation and renewable energy are not just reactive environmental measures but proactive mechanisms for embedding sustainability into the very structure of modern economies [14,15].

Empirical studies have reinforced the theoretical expectation that environmental innovation significantly improves environmental performance. Through the development and diffusion of clean technologies, innovation enables firms and industries to reduce emissions, increase resource efficiency, and comply with stringent environmental regulations [16,17]. For instance, the proliferation of environment-related patents and eco-innovations in energy-intensive sectors has been shown to lead to reductions in greenhouse gas emissions, waste output, and air pollutants [18]. In advanced economies, especially those with mature innovation systems, these technological developments play a pivotal role in decoupling economic activity from environmental harm [19]. Additionally, environmental innovation contributes to long-term improvements in environmental indicators such as ecosystem vitality, air quality, and carbon intensity, thereby enhancing national environmental performance rankings [20,21]. The innovation process also yields indirect environmental benefits by stimulating shifts in production methods, consumption patterns, and corporate strategies. Firms that adopt clean technologies often experience increased competitiveness and reputational gains, further incentivizing green R&D investment [22]. Therefore, environmental innovation not only supports environmental goals directly but also helps establish a virtuous cycle of sustainable economic behavior aligned with the propositions of Endogenous Growth Theory.

In parallel, the renewable energy transition has demonstrated a robust and direct influence on environmental performance, particularly by reducing dependence on fossil fuels and lowering the carbon intensity of energy systems. Numerous empirical analyses confirm that increasing the share of renewable energy in total energy consumption contributes significantly to reductions in CO2 emissions and overall environmental degradation [7,23]. For example, Apergis and Payne [24] provide evidence across multiple countries that renewable energy consumption leads to substantial improvements in air and water quality, while Sadorsky [25] illustrates that investment in clean energy infrastructure has long-term benefits for environmental quality. The transition toward solar, wind, hydro, and geothermal energy has also been associated with reduced ecological footprint and increased biocapacity utilization, further supporting environmental sustainability objectives [26,27]. The theoretical foundation for these outcomes is rooted in Ecological Modernization Theory, which posits that structural changes in energy production and consumption, when supported by modern technology and institutional adaptation, can significantly mitigate environmental risks [28]. Unlike traditional energy systems reliant on carbon-intensive sources, renewable energy deployment inherently embodies ecological principles by aligning economic growth with natural limits. As nations expand their renewable capacity, they not only reduce emissions but also foster cleaner industries and more resilient energy systems, contributing to improved environmental performance metrics, such as air quality indices, biodiversity preservation, and resource sustainability [29,30].

Overall, there is clear and consistent support—both theoretical and empirical—for the hypothesis that environmental innovation and the transition to renewable energy contribute to improvements in environmental performance. Countries that invest in clean technologies typically experience reductions in environmental degradation alongside gains in technical efficiency and regulatory compliance [18,20]. Likewise, economies that increase the share of renewables in their energy mix consistently demonstrate stronger environmental outcomes, including reduced pollution and enhanced ecological balance [26,27]. These findings are aligned with the core arguments of Endogenous Growth Theory, which identifies innovation as a self-reinforcing source of growth and environmental improvement, and Ecological Modernization Theory, which emphasizes the transformative capacity of institutional and technological modernization. In this sense, both strategies—though distinct—serve as critical levers through which governments and societies can enhance their environmental performance. Therefore, there is robust support for the proposition that both environmental innovation and renewable energy transition contribute positively to environmental performance. Therefore, we propose the following hypothesis:

Hypothesis 1.

Environmental innovation and renewable energy transition positively contribute to environmental performance.

2.2. The Role of Green Finance

The pursuit of improved environmental performance has gained momentum with the growing recognition of climate change risks, environmental degradation, and the limitations of conventional financing mechanisms. Within this context, green finance—defined as the provision of financial services for investments that deliver environmental benefits—has emerged as a pivotal mechanism for directing capital flows toward sustainable technological transformation. It acts as a catalyst in promoting both environmental innovation and renewable energy deployment, which are key levers for enhancing environmental performance. Green finance mechanisms such as green bonds, concessional loans, and sustainability-linked investments provide the financial resources needed to support the high upfront costs often associated with eco-innovations and clean energy projects. According to Xiong and Dai [31], green finance not only mobilizes funds but also creates favorable economic conditions that stimulate investment in sustainable technologies. Similarly, Dong et al. [32] emphasize that green financial systems reduce investment risk and improve capital access for environmentally oriented firms. In this way, green finance supports theoretical arguments from Endogenous Growth Theory, which posits that capital allocation shapes innovation-led growth, and Ecological Modernization Theory, which emphasizes the importance of institutional and financial modernization as essential components of sustainable development. The provision of targeted environmental finance not only accelerates the production and adoption of cleaner technologies but also incentivizes long-term market behavior aligned with environmental performance improvements.

Green finance also plays a crucial role in facilitating the renewable energy transition, particularly by addressing the scale and timing of investments required to decarbonize energy systems. The shift toward renewable energy sources like solar, wind, and hydroelectric power requires considerable upfront capital for infrastructure development, grid integration, and technological deployment. In this regard, green bonds and environmental public expenditures have emerged as strategic financial instruments. The manuscript’s empirical evidence demonstrates a positive correlation between environmental public spending and green bond issuance, particularly with environmental performance metrics such as the Environmental Performance Index (EPI) and Load Capacity Factor (LCF). Similarly, Zhou et al. [33] demonstrate that green finance significantly enhances the utilization of renewable energy and natural resource management through financial technology and risk-sharing mechanisms. Likewise, Zhang et al. [34] find that green finance investment, when coupled with technological innovation, directly improves renewable energy efficiency and supports the achievement of long-term sustainable development goals. These findings align with the ecological modernization paradigm, in which institutional reform and financial sophistication are prerequisites for achieving high-impact environmental outcomes. Furthermore, Omri et al. [35] provide robust panel evidence showing that green financial development—particularly green bond markets and investment in eco-friendly technologies—can significantly improve environmental indicators when accompanied by coherent environmental governance and investment transparency.

Moreover, green finance enhances the environmental effectiveness of innovation and renewable energy transitions by functioning as a moderating factor that strengthens their outcomes. The empirical results presented in the manuscript demonstrate that green finance amplifies the positive impact of environmental innovation and renewable deployment on environmental performance, confirming that its presence significantly increases the efficacy of sustainability measures. Similarly, Zhang et al. [36] demonstrate that China’s green credit policy has resulted in tangible improvements in industrial environmental performance, validating the role of finance in promoting green development. These findings emphasize that financial mechanisms do not operate in isolation but rather shape the success of technological and energy transformations. Omri et al. [35] confirm that green finance serves as a structural enhancer of eco-innovation and energy transition, particularly in high-income and institutionally stable economies. The results from henda.pdf further corroborate this view by highlighting that well-structured green financial systems mobilize capital more effectively, reduce risk exposure, and incentivize cleaner production processes across sectors. This body of work supports the assertion that without green finance, many sustainability initiatives remain underfunded or inefficiently implemented. Therefore, based on both theoretical insights and empirical validation, we propose the following hypothesis:

Hypothesis 2.

The environmental performance effects of environmental innovation and renewable energy transition are stronger at higher levels of green finance.

2.3. The Role of Environmental Governance

Environmental governance has become an increasingly pivotal factor in determining the success of environmental innovation and renewable energy strategies in enhancing environmental performance. Defined as the institutional capacity, policy frameworks, and regulatory enforcement mechanisms that guide environmental decision-making, environmental governance ensures that sustainability objectives are not only designed but also effectively implemented. Strong governance provides the structural and legal backbone to enforce environmental regulations, monitor compliance, and reduce institutional voids that may hinder the effectiveness of environmental technologies and clean energy systems. According to Omri et al. [35], countries with robust environmental governance frameworks exhibit more effective integration of green finance and innovation into their environmental management systems, resulting in superior ecological outcomes. This institutional foundation facilitates the efficient allocation of green investments, ensures the credibility of environmental policies, and enhances the accountability of both public and private sectors in driving clean development initiatives. Empirical findings have consistently demonstrated that the environmental effectiveness of innovation and renewable energy transition is significantly amplified under strong governance conditions. Razi et al. [10] highlight that the presence of environmental governance mechanisms—such as transparent regulation, monitoring systems, and participatory policymaking—magnifies the emission-reduction effects of renewable energy deployment and enhances the impact of environmental technologies. Their results, derived from panel data on G7 economies, suggest that governance not only improves environmental outcomes directly but also serves as a moderating force that strengthens the influence of other sustainability drivers. Similarly, the manuscript presents robust econometric evidence indicating that the interaction term between environmental innovation or renewable energy and environmental governance is positively and significantly associated with key environmental performance indicators. The theoretical rationale for this effect is rooted in Ecological Modernization Theory, which posits that institutional reforms and governance mechanisms are central to enabling sustainable technological change. Without strong environmental governance, the benefits of innovation and clean energy are often diluted by regulatory failures, corruption, or weak enforcement. Governance ensures that technological and financial innovations are aligned with national environmental priorities and that these are translated into measurable ecological improvements. Moreover, in contexts where environmental policies are unstable or poorly enforced, green technologies may fail to gain traction or may be misallocated, leading to suboptimal outcomes. As Zhou et al. [33] and Zhang et al. [36] emphasize, governance not only improves the transparency and efficiency of environmental interventions but also enhances stakeholder trust and investor confidence—key factors in scaling clean energy and eco-innovation systems. Recent studies have also highlighted the evolving landscape of environmental performance research. Wu et al. [37] examine the role of environmental governance policy uncertainty in shaping carbon emissions in China’s heavy industries, demonstrating that fluctuations in policy certainty can significantly hinder or accelerate decarbonization within specific sectors. Meanwhile, Wu and Li [38] analyze how blockchain-enabled transparency within carbon trading markets influences carbon reduction in remanufacturing supply chains, showing that technological and financial innovations can enhance policy effectiveness under specific market conditions. These contributions underscore the importance of governance clarity and fintech tools in environmental outcomes, but their scope remains largely sectoral or country-specific. By comparison, our study offers a macro-level, cross-country analysis of the G7 that systematically integrates renewable energy transition and environmental innovation with green finance and environmental governance as operational transmission channels—advancing both the conceptual and empirical dimensions of recent literature. Therefore, a governance-rich context can be seen as an enabler that conditions the success of environmental innovation and renewable transition in producing tangible environmental performance improvements.

Hypothesis 3.

The environmental performance effects of environmental innovation and renewable energy transition are stronger at higher levels of environmental governance.

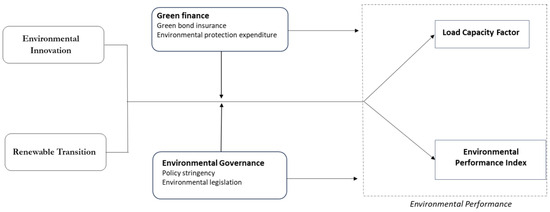

The above discussion provides robust evidence that environmental innovation and the transition to renewable energy are critical levers in enhancing environmental performance by improving resource efficiency, reducing pollutant emissions, and shifting economies toward sustainable energy systems. However, their influence is not automatic or equally effective across contexts—it depends on enabling conditions such as the depth of green financial markets and the strength of environmental governance frameworks. Together, these factors amplify the environmental benefits of innovation and renewable strategies, creating a more conducive environment for sustainable development. Based on these insights, Figure 1 illustrates the conceptual model underlying this study. It depicts the direct effects of environmental innovation and renewable energy transition on environmental performance, while also capturing the moderating roles of green finance and environmental governance in shaping these relationships.

Figure 1.

Conceptual model.

3. Methodology and Data

The transition to renewable energy (RET) and the advancement of environmental innovation (EI) are crucial drivers of improved environmental performance, a key pillar of sustainable development. As nations strive to meet the 2030 Agenda for Sustainable Development Goals, RET and EI have emerged as independent yet complementary strategies for achieving environmental sustainability. While RET focuses on shifting energy systems toward cleaner sources, EI drives the development and adoption of technologies and practices that reduce environmental impacts. Together, these strategies can significantly enhance environmental performance by reducing carbon emissions, improving resource efficiency, and fostering the adoption of cleaner technologies. However, the effectiveness of RET and EI in driving environmental performance is often influenced by moderating factors such as green finance (GF) and environmental governance (EG). A theoretical model can be constructed to explore these relationships and examine how RET, EI, and their interactions with moderating variables influence environmental performance in the G7 countries from 2003 to 2021. These countries are major industrialized economies that lead global innovation, drive policy development, and make significant environmental commitments. They are also among the largest contributors to both environmental degradation and global efforts to mitigate it. By analyzing the G7 countries, we can explore the dynamics of the renewable energy transition and environmental innovation in a context where financial systems are advanced, regulatory institutions are mature, and data availability is robust and consistent. This setting provides an ideal empirical laboratory for investigating the interaction effects of green finance and governance as transmission channels, consistent with Endogenous Growth Theory and institutional economic perspectives. The model can be expressed as follows:

where EPit represents environmental performance for country i at time t. RETit denotes the level of renewable energy transition, and EIit represents environmental innovation. The moderating variables Mit include green finance (GFit) and environmental governance (EGit), which are essential for amplifying the impact of RET and EI on environmental performance. The model can be expanded to include control variables Zit, such as GDP per capita, urbanization rate, and political stability, which may also influence environmental outcomes.

EPit = f(RETit, EIit, Mit); Mit = GFit, EGit

To capture the moderating effects of green finance and environmental governance on the relationship between RET and environmental performance, Equation (2) is specified as follows:

Here, EPit represents the environmental performance of country i at the time t. Two proxies measure EP: (i) the Environmental Performance Index (EPI), which evaluates countries based on critical environmental challenges in two primary policy domains: safeguarding human health from environmental hazards and preserving ecosystems and natural resources [39], and (ii) the Load Capacity Factor (LFC), which is measured by dividing a region’s per capita biocapacity by its per capita ecological footprint, indicating whether resource use is within ecological limits. RETit denotes the renewable energy transition level, measured as the share of renewable energy in total energy consumption. The interaction term (RET × M) captures the conditional effects of green finance and environmental governance on the relationship between RET and environmental performance. GFit and EGit represent the moderating variables—green finance and environmental governance—which are expected to enhance the impact of RET on environmental performance. GF is measured by the annual green bond issuance in USD billion, and the environmental policy stringency measures EG. Details on the used variables are provided in Table 1, which shows that the Load Capacity Factor, a key indicator of environmental performance measuring the ratio of biocapacity to ecological footprint, has a wide range from 0.002 to 48.159, with an average value of 2.654. The Environmental Performance Index records a mean of 74.264, ranging between 66.070 and 88.200. For the renewable energy transition, which represents the share of renewable energy in total energy consumption, the average value is 11.332%, from 0.9% to 23.9%. In terms of environmental innovation, measured by the number of environment-related technology patents, the data shows a mean of 26.963, with values ranging from 16.860 to 45.400. Regarding green finance, the first proxy (GF1), which represents green bond issuance, averages USD 13.318 billion, ranging from USD 0.014 billion to USD 94.593 billion. The second proxy (GF2), capturing environmental protection expenditures as a percentage of GDP, averages 0.850%, with a minimum of 0.509% and a maximum of 1.377%. Environmental governance, proxied by the Environmental Policy Stringency Index, has a mean value of 3.087, with values ranging from 1.222 to 4.889. Additionally, environmental legislation, measured by the annual count of new climate-related national laws, averages 0.812, with a maximum of 7 laws enacted yearly.

Table 1.

Descriptions and sources of the variables (2003–2021).

Similarly, to examine the moderating effects of green finance and environmental governance on the relationship between EI and environmental performance, Equation (3) is specified as follows:

where EIit denotes the level of environmental innovation. The interaction term (EI × M) captures the moderating effect of green finance and environmental governance on the relationship between EI and environmental performance.

To determine the net effects, the study follows the approach outlined by Brambor et al. [40], which involves calculating the combined impact of interaction and constitutive terms. This is achieved by taking the first derivative of Equations (2) and (3) in relation to the RET and EI, respectively. As a result, the model is specified as follows:

where ∂ denotes the partial derivative operator, and a one-unit change in EP resulting from a change in RET and EI is influenced by the signs and coefficients of and ϕ.

This study utilizes advanced panel data techniques to estimate the above equations, effectively addressing critical issues such as cross-sectional dependence, slope heterogeneity, and variable integration. First, cross-sectional dependence is tested using Pesaran’s [41] method, confirming its presence due to economic and environmental interconnections among G7 countries (Table 2). This justifies the use of techniques accounting for interdependence. Next, slope heterogeneity is tested using Blomquist and Westerlund’s approach, which controls for serial correlation. This table also shows heterogeneous slopes across countries, necessitating methods that accommodate such variations. For regression analysis, the study employs the Augmented Mean Group (AMG) method, as proposed by Eberhardt [42]. This method offers a robust solution for analyzing panel data with complex interdependencies and structural heterogeneity. One of its key strengths lies in its ability to produce consistent and efficient estimates, even in the presence of cross-sectional dependence, without requiring preliminary unit root and cointegrating tests; hence, it is more flexible [43,44]. Unlike conventional estimators, AMG accommodates heterogeneity across units by allowing for individual slope coefficients while also accounting for unobserved common factors through the inclusion of time dummy variables in the first-differencing step [42]. This makes AMG particularly useful when global shocks or common trends potentially bias standard estimates. Furthermore, its two-stage estimation process enhances its capacity to tackle endogeneity and omitted variable issues, thereby strengthening the empirical validity of results. Therefore, AMG stands out as a flexible and comprehensive approach well-suited for macro-panel data settings marked by cross-sectional interlinkages and dynamic behavior.

where the first-difference operator, ∆, is applied to eliminate unit-specific fixed effects by computing the change in each variable between consecutive time periods. Here, Yit represents the dependent variable, while Xit denotes the independent variable. To control for economy-wide shocks or global trends that may simultaneously affect all cross-sectional units, time-specific dummy variables (Dt) are introduced, with their associated coefficients represented by δt. In the second stage of the AMG procedure, these estimated δt coefficients are aggregated into a single cross-sectional outcome variable, θi, which serves to capture the influence of unobserved common factors. This dual-step methodology enables the estimation of heterogeneous slope coefficients (αi) for each unit, accommodating unit-level heterogeneity, while the constructed θi variables effectively address cross-sectional dependence. As a result, the AMG estimator offers a comprehensive and flexible framework that jointly captures individual unit characteristics and inter-unit interdependencies—critical features in macro-panel data analysis.

Table 2.

Results of cross-sectional dependence and homogeneity tests.

To demonstrate the robustness of our econometric analysis, we incorporate the Dynamic Common Correlated Effects Mean Group (DCCE-MG) estimator, which provides a nuanced approach to addressing unobserved common factors in panel data settings. Developed by Chudik and Pesaran [45], the DCCE-MG model extends the traditional Common Correlated Effects (CCE) framework by incorporating lagged dependent variables and cross-sectional averages of both the dependent and explanatory variables. This specification not only captures cross-sectional dependence and slope heterogeneity but also mitigates endogeneity issues, such as omitted variable bias and reverse causality. Moreover, the inclusion of lagged cross-sectional means allows the model to accommodate potential structural breaks and evolving dynamics within the data. The general form of the model is specified as follows:

where αi denotes the individual fixed effect, capturing the unique characteristics of each cross-sectional unit. The coefficients ϕij and θik represent the effects of the lagged dependent and explanatory variables, respectively. The terms λj and γk account for the lagged cross-sectional averages, thereby controlling for the influence of unobserved common factors across units. Additionally, μi reflects unit-specific effects, while εit represents the idiosyncratic error term.

4. Results

The empirical results initially highlight the direct effects of the renewable energy transition and environmental innovation on environmental performance. This is followed by an interactive regression analysis that incorporates the interaction between green finance, environmental governance, renewable energy transition, and environmental innovation. To ensure the robustness of the findings, each regression is re-estimated using alternative proxies for both green finance and environmental governance.

4.1. Direct Effects

Table 3 presents the direct effects of renewable energy transition (RET), environmental innovation (EI), green finance, and environmental governance on environmental performance, as captured by two key indicators: the Environmental Performance Index (EPI) and the Load Capacity Factor (LCF). The findings provide strong empirical evidence that both RET and EI exert consistently positive and statistically significant impacts on environmental performance. A 1% increase in RET is associated with a 0.177% rise in EPI and a 0.189% improvement in LCF, while a 1% increase in EI leads to a 0.161% and 0.158% rise in EPI and LCF, respectively. These effects, all statistically significant at the 1% level, underscore the fundamental role of clean energy transitions and technological advancement in driving ecological improvements. These results confirm the theoretical expectations that increasing the share of renewables and fostering eco-innovation are pivotal levers for reducing environmental stress and enhancing sustainability metrics. These results are consistent with the findings of Saidi and Omri [46] and Taghizadeh-Hesary and Yoshino [8], who highlight that renewable energy investments significantly contribute to environmental quality by reducing reliance on fossil fuels and promoting decarbonization.

Table 3.

The direct effect of renewable energy transition and environmental innovation on environmental performance.

The analysis also highlights the differentiated but complementary roles of green finance instruments in promoting environmental outcomes. Specifically, green bond issuance (GF1) is positively and significantly associated with both EPI (0.102%) and LCF (0.118%), significant at the 5% level, suggesting that access to environmentally targeted capital markets can facilitate investments in green infrastructure and energy-efficient technologies. These results echo the conclusions drawn by Razi et al. [10], who argue that green bond markets channel capital flows into sustainability-aligned sectors, thereby enhancing long-term ecological resilience. Similarly, environmental protection expenditures (GF2) contribute positively to EPI (0.093%) and LCF (0.092%), both significant at the 1% or 5% level, reflecting the tangible environmental benefits derived from direct government or institutional spending on sustainability initiatives. These findings align with Sun & Wang [9], who showed that public green investments exert a direct influence on emissions reduction and natural resource preservation, particularly when embedded in broader fiscal strategies. Together, these results demonstrate that both market-based (green bonds) and fiscal (public expenditure) channels of green finance effectively enhance environmental performance, offering important policy tools for climate-aligned development. This duality complements the conclusion of Newell [5], who emphasizes the need for a hybrid financial architecture that integrates private sector mobilization with state-led sustainability investments to address climate challenges comprehensively.

Finally, environmental governance, captured through the Environmental Policy Stringency Index (EPSI) and environmental legislation (LEGS), further amplifies environmental performance. EPSI exhibits a strong positive association with both EPI (0.166%) and LCF (0.188%), which is highly significant at the 1% level. Environmental legislation, meanwhile, has a statistically significant impact on EPI (0.149%) and LCF (0.133%) at the 5% level. These results support Gunningham’s [11] hypothesis that effective environmental regulation must be backed by capable institutional mechanisms to enforce and implement rules. The joint significance of EPSI and LEGS highlights the complementary nature of regulatory stringency and legislative depth in improving environmental outcomes. These results align with Eskeland and Harrison [6] and Liobikienė and Butkus [47], who argue that institutional strength and regulatory enforcement are critical mediators of policy effectiveness, particularly in countries where environmental legislation exists but suffers from implementation gaps. In essence, legal frameworks without rigorous enforcement or enforcement without clear mandates are unlikely to yield meaningful ecological gains.

4.2. Transmission Mechanisms

To better understand the effects of renewable energy transition and environmental innovation, it is essential to explore the transmission mechanisms through which this linkage operates. In this context, green finance and environmental governance are examined as potential channels. Building on the work of Altwaijri et al. [48], this study assesses the overall impact of interactions between renewable energy transition, environmental innovation, and both green finance and environmental governance on environmental performance (EPI and LCF) by calculating their net effects. Table 4 reports these mechanisms in relation to the EPI, while Table 5 presents the results in relation to LCF. In each table, the net indirect effects through green finance are reported in columns 1, 2, 5, and 6, while those through environmental governance are presented in columns 3, 4, 7, and 8.

Table 4.

Indirect effects of renewable energy transition and environmental innovation on EPI.

Table 5.

Indirect effects of renewable energy transition and environmental innovation on LCF.

Regarding the effects of green finance, it is observed that renewable energy transition interacts with key green finance indicators—namely, green bond issuance (GF1) and environmental protection expenditure (GF2)—to generate positive indirect net effects on environmental performance. For instance, Table 4 shows that the net effect on the EPI resulting from the interaction between RET and green bond issuance (GF1) is 1.013, calculated using the formula: ((0.069 × 13.318) + 0.095) = 1.013. Here, 13.318 is the mean value of GF1, 0.069 is the marginal effect of the interaction term, and 0.095 is the unconditional effect of RET. Similarly, the net effect on EPI resulting from the interaction between EI and GF1 (column 5) is 0.956. While the interaction of RET with GF2 does not yield statistically significant results, environmental innovation still shows a moderate net effect through GF2 (column 6), though insignificant, at 0.356. These findings underscore the crucial role of green financial systems in enhancing the environmental benefits of renewable technologies and eco-innovations. Turning to environmental governance, the interaction of RET with environmental policy stringency (EPSI) produces a net effect of 0.395 on the EPI (column 3). In contrast, the interaction with environmental legislation (LEGS) yields a net effect of 0.187. Likewise, environmental innovation exhibits meaningful net effects, as indicated by EPSI and LEGS, at 0.354 and 0.215, respectively. These values support the argument that robust environmental governance mechanisms—encompassing both regulatory intensity and legislative engagement—play a crucial role in translating technological and renewable-based inputs into tangible environmental benefits. A similar transmission pattern is observed in terms of the Load Capacity Factor (Table 5). Specifically, the interaction of RET with GF1 yields a net effect of 0.917, while the interaction with EPSI leads to a net effect of 0.408. Meanwhile, environmental innovation interacting with GF1 results in a net effect of 0.938, and through EPSI, the effect is 0.385. For environmental legislation, RET and EI yield net effects of 0.223 and 0.221, respectively, based on the respective interaction terms with LEGS. Although interactions with GF2 are not statistically significant in the case of LCF, the consistent positivity of net effects from the other channels underscores the complementary nature of financial and institutional mechanisms in driving ecological sustainability.

These results provide compelling evidence that green finance and environmental governance serve as effective strategic moderators, enhancing the environmental returns of renewable energy and environmental innovation. This supports the broader proposition that aligning financial incentives and institutional regulations with sustainable energy and technological efforts is crucial for ecological resilience. For instance, the interaction effects reported in both tables indicate that countries with more robust green financial systems and stronger environmental governance frameworks are better positioned to translate their innovation and renewable investments into tangible environmental benefits. This aligns with recent literature [49,50], which emphasizes the role of enabling institutions in scaling green transitions. In developing contexts, where financial constraints and weak regulatory environments persist, these findings underscore the importance of targeted reforms for establishing both green financial infrastructure and effective policy mechanisms. Consequently, a dual approach that promotes investment in renewable innovation while concurrently strengthening governance structures may prove most effective in achieving sustainable environmental outcomes.

As mentioned above, we also used the DCCE-MG method for a robustness check. This technique provides consistent and efficient estimates in the presence of cross-sectional dependence and heterogeneity of slopes across panel units. It controls for unobserved common factors that may influence all countries in the panel while allowing for individual heterogeneity in the slope coefficients. By incorporating cross-sectional averages of the dependent and independent variables, the DCCE-MG approach mitigates the bias arising from omitted common variables and cross-country spillovers. This robustness check ensures that the main findings regarding the impacts of renewable energy transition and environmental innovation, as well as their interaction with green finance and environmental governance, remain valid even under more flexible assumptions about the underlying data structure. The results from the DCCE-MG estimations—presented in Table 6, Table 7 and Table 8—corroborate the baseline results, strengthening our conclusions’ empirical credibility and reliability. Specifically, regarding the direct effects, Table 6 shows that a 1% increase in RET is associated with a 0.169% rise in EPI and a 0.171% improvement in LCF, while a 1% increase in EI leads to increases of 0.176% in EPI and 0.169% in LCF. These findings underscore the crucial role of clean energy deployment and technological innovation in improving environmental quality. Green finance also shows significant positive effects. Green bond issuance (GF1) is associated with increases of 0.121% in EPI and 0.130% in LCF, while environmental protection expenditure (GF2) contributes 0.088% and 0.072% to EPI and LCF, respectively. These results suggest that both market-based financial tools and public environmental spending contribute to improved environmental performance. Furthermore, environmental governance indicators also make a meaningful contribution. The Environmental Policy Stringency Index (EPSI) is associated with improvements of 0.156% in EPI and 0.139% in LCF, while environmental legislation (LEGS) exhibits positive effects of 0.132% and 0.129% on EPI and LCF, respectively. These outcomes underscore the importance of robust regulatory frameworks and strong legislative commitment in driving ecological sustainability. The robustness analysis confirms the positive and significant roles of renewable energy, innovation, finance, and governance in promoting environmental performance across both indicators.

Table 6.

Robustness check: direct effect of renewable energy transition and environmental innovation on environmental performance.

Table 7.

Robustness check: indirect effects of renewable energy transition and environmental innovation on EPI.

Table 8.

Robustness check: indirect effects of renewable energy transition and environmental innovation on LCF.

Regarding the transmission mechanisms, Table 7 and Table 8 show the robustness check results of the indirect effects of renewable energy transition (RET) and environmental innovation (EI) on environmental performance, as measured by the Environmental Performance Index (EPI) and the Load Capacity Factor (LCF), respectively. Both tables show the net indirect effects through green finance in columns 1, 2, 5, and 6, while those through environmental governance are reported in columns 3, 4, 7, and 8. Regarding green finance, the findings confirm that RET positively interacts with both green bond issuance (GF1) and environmental protection expenditure (GF2), resulting in favorable net effects on EPI. In particular, the interaction between RET and GF1 yields a net effect of 0.823 on EPI, whereas the interaction between environmental innovation and GF1 results in a higher net effect of 0.922. Although the interaction between RET and GF2 is statistically insignificant, the net effect of EI through GF2 is moderately positive at 0.379. These outcomes indicate that green finance, particularly through capital market mechanisms such as green bonds, enhances the environmental contributions of both renewable energy deployment and innovation efforts. Environmental governance also plays a significant mediating role. RET’s interaction with the Environmental Policy Stringency Index (EPSI) produces a positive net effect of 0.358 on EPI, and the interaction with environmental legislation (LEGS) yields a net effect of 0.217. For EI, the net effects through EPSI and LEGS are similarly meaningful, at 0.354 and 0.215, respectively. These results underscore the importance of robust policy frameworks and legislative measures in sustaining the environmental benefits of energy transition and technological advancements. A similar transmission pattern is evident in Table 8, which focuses on LCF. RET interacting with GF1 results in a substantial net effect of 0.958, while its interaction with GF2 remains statistically weak. The corresponding net effect of EI through GF1 is even higher, at 0.999, confirming the reinforcing role of green bond markets in promoting ecological balance. Though GF2-based interactions are less robust, their directional influence remains positive. Regarding environmental governance, RET shows net effects of 0.389 and 0.264 through EPSI and LEGS, respectively. Similarly, EI achieves net effects of 0.179 and 0.229 through these same governance channels. These values underline the continued importance of institutional and regulatory quality in translating green efforts into real ecological improvements.

These robustness results reinforce the conclusion that green finance and environmental governance are critical enablers that amplify the positive environmental impacts of renewable energy transition and environmental innovation. Countries with more advanced financial mechanisms and stronger institutional frameworks are better equipped to translate energy and innovation policies into tangible environmental benefits. These insights underscore the necessity for a dual approach that fosters green investment while also enhancing regulatory effectiveness to achieve sustainable environmental outcomes.

5. Discussion

This study provides robust empirical evidence on the roles of renewable energy transition (RET) and environmental innovation (EI) in enhancing environmental performance within the G7 context, thereby addressing long-standing gaps in the sustainability literature. While numerous studies have highlighted the direct benefits of RET and EI in lowering emissions and improving ecological indicators [7,18,24], relatively few have examined the systemic pathways through which these strategies become effective under different structural conditions. Our research fills this void by embedding RET and EI within a broader framework that accounts for green finance and environmental governance as strategic enablers. By explicitly modeling these transmission channels, this paper advances beyond the linear perspectives common in existing work and aligns more closely with the multidimensional nature of ecological transitions. Theoretically, this positioning draws on Endogenous Growth Theory, which underscores the importance of innovation and capital allocation in driving long-run growth and environmental outcomes [12], and Ecological Modernization Theory, which posits that institutional reforms and technological upgrading are central to decoupling economic activity from environmental harm [13,14]. Thus, our findings are not only empirically grounded but also conceptually aligned with the leading paradigms that explain how modern economies can internalize sustainability into their growth trajectories. By integrating RET and EI within this dual-theoretical lens and examining their interaction with financial and regulatory ecosystems, the study provides a more realistic and policy-relevant understanding of sustainability pathways in advanced economies.

Our empirical findings confirm that RET and EI have a positive impact on environmental performance, consistent with previous research. More importantly, they also demonstrate that these effects are significantly enhanced by green finance and environmental governance. For instance, the interaction terms between RET and green bond issuance, and between EI and environmental policy stringency, are statistically significant and yield high net effects on both the Environmental Performance Index (EPI) and Load Capacity Factor (LCF). These results substantiate recent studies by Omri et al. [35] and Zhou et al. [33], which argue that financial and regulatory frameworks play a catalytic role in scaling the environmental returns of sustainability-oriented strategies. The study also corroborates the dual-channel hypothesis advanced by Newell [5], which suggests that market-based instruments and regulatory oversight must operate in tandem to ensure the translation of green investments into ecological benefits. Furthermore, the robustness of these findings—confirmed through the DCCE-MG estimator—reinforces their empirical credibility and distinguishes this work from previous studies that relied solely on static or bivariate modeling approaches. In doing so, this research contributes methodologically by adopting advanced panel techniques that better account for cross-sectional dependence and slope heterogeneity—features particularly relevant for cross-country analyses within the G7 countries. Importantly, the strength of these transmission channels varies across G7 countries due to distinct geopolitical and institutional characteristics. For instance, Germany’s leadership in both renewable energy deployment and environmental policy enforcement has been reinforced by robust regulatory institutions and a mature green finance market, including an active role in green bond issuance and public support for clean technology innovation. This institutional alignment likely amplifies the observed effectiveness of both RET and EI in improving environmental performance. In contrast, the United States, although a technological leader, exhibits more fragmented environmental governance due to its federal structure, where environmental regulations vary significantly across states. This regulatory heterogeneity can dilute the national-level impact of governance indicators and may explain why financial and institutional transmission effects are less uniformly strong in the U.S. compared to more centralized systems, such as Germany or France. These geopolitical nuances highlight that enabling conditions are context-dependent, and understanding country-specific policy frameworks is crucial for understanding how RET and EI translate into ecological outcomes.

From a policy standpoint, this study delivers several novel insights that enhance the practical relevance of its findings and offer guidance for achieving the environmental targets outlined in frameworks such as the Paris Agreement and the 2030 Agenda for Sustainable Development. Crucially, the results demonstrate that neither RET nor EI can independently deliver sustained environmental improvements unless accompanied by complementary financial instruments and regulatory institutions. In other words, while technological progress and renewable deployment are necessary conditions, they are not sufficient for achieving meaningful environmental gains in the absence of robust financial markets and governance systems. This insight challenges the assumptions underlying many unilateral or sector-specific environmental policies, advocating instead for a holistic, multisectoral approach. For instance, our finding that green bond issuance and environmental policy stringency significantly moderate the effectiveness of RET and EI suggests that countries must simultaneously foster financial innovation and regulatory credibility. This has important implications for how governments prioritize investments, design fiscal incentives, and build institutional capacity. Furthermore, these findings have resonance beyond the G7 countries: they suggest that for emerging economies or countries undergoing energy transitions, scaling up RET and EI without establishing supportive institutional frameworks may result in limited or even counterproductive outcomes. Therefore, policymakers should aim to co-evolve technological, financial, and institutional reforms, ensuring that green investments are well-targeted, transparently governed, and strategically aligned with long-term ecological goals. In doing so, countries can build a resilient policy architecture that enables RET and EI to deliver not just marginal improvements but transformative environmental performance gains.

6. Conclusions and Policy Implications

This study contributes to the environmental sustainability literature by empirically examining how the transition to renewable energy and environmental innovation directly and indirectly influence environmental performance through the transmission mechanisms of green finance and environmental governance. Using a balanced panel of G7 countries over the period 2003–2021, the analysis is conducted within the framework of the AMG estimator, which is particularly suited for handling cross-sectional dependence and heterogeneous slope coefficients in macro-panel settings. To ensure the robustness of the results, we also employ the DCCE-MG estimator, which confirms the consistency of the main findings under alternative econometric specifications. The analysis finds that both RET and EI have consistently positive and statistically significant direct effects on environmental performance, as measured by the Environmental Performance Index and the Load Capacity Factor. These results underscore the crucial role of transitioning to clean energy and investing in environmental innovation in achieving sustainable development goals. More importantly, the study identifies green finance and environmental governance as key transmission channels through which RET and EI exert their influence. Specifically, instruments such as green bond issuance and environmental protection expenditures serve as financial conduits that facilitate the implementation and scaling of clean energy and environmental innovations. Likewise, regulatory tools such as environmental policy stringency and climate-related legislation function as institutional pathways that ensure the effective translation of RET and EI into environmental improvements. These findings support the conclusion that green finance and environmental governance are not simply supportive conditions but operational channels that enable RET and EI to impact environmental outcomes. For instance, green financial instruments help mobilize the necessary capital for renewable and innovative projects, while environmental policies and laws ensure accountability, implementation, and alignment with long-term ecological goals. The significance of these indirect effects through financial and governance routes reinforces the need to understand RET and EI not as isolated interventions but as components of a broader systemic framework.

These findings have several policy implications. First, governments should prioritize policies that integrate RET and EI into national sustainability strategies, supported by adequate financing and regulatory clarity. Accessible green financing mechanisms, including the expansion of green bond markets and the strategic allocation of environmental protection expenditures, must complement investments in renewable infrastructure and innovation ecosystems. Second, strengthening environmental governance through clear, enforceable policies and legislation is essential. Governments must enhance institutional capacity to enforce environmental rules and monitor progress, ensuring that RET and EI initiatives yield measurable outcomes. Third, the development of financial and regulatory channels should be context-sensitive, recognizing that the effectiveness of these pathways depends on national institutional maturity, financial development, and administrative capabilities. From a practical perspective, stakeholders, including businesses, financial institutions, and civil society organizations, must recognize the importance of aligning with national green strategies. Firms should develop project pipelines that are compatible with green finance eligibility criteria and actively engage with environmental regulations. Financial institutions should design tailored green products to meet the financing needs of clean energy and innovation projects. Meanwhile, regulatory bodies should ensure that environmental legislation is both inclusive and responsive to the evolving nature of sustainability challenges.

Despite its contributions, this study has several limitations that should be acknowledged. First, the analysis is limited to G7 countries, which, while ideal for studying advanced institutional and financial systems, constrains the generalizability of findings to emerging or developing economies where governance capacity and green finance infrastructure may be significantly weaker. Second, while we use internationally recognized proxies for green finance (e.g., green bond issuance, environmental protection expenditures), these indicators may not fully capture the qualitative dimensions of financial mechanisms, such as project-level outcomes, policy compliance, or private-sector dynamics. Third, although the use of AMG and DCCE-MG estimators accounts for endogeneity and cross-sectional dependence, residual causality concerns remain, particularly in complex interrelationships between institutional quality, innovation, and environmental performance. Building on these reflections, future research could expand the country sample to include non-G7 regions, especially those undergoing rapid industrialization or energy transitions. Comparative studies across income groups or institutional regimes would help to assess the conditional validity of the transmission mechanisms identified here. Moreover, future work should explore disaggregated dimensions of green finance (e.g., private vs. public sources, equity vs. debt instruments) and refine measures of environmental governance using micro-level data, such as regulatory compliance or institutional trust. Finally, applying causal inference frameworks—such as instrumental variable strategies or difference-in-differences approaches—could help better identify the directional effects of RET and EI under various governance and financial settings. By addressing these limitations, future research can deepen our understanding of how environmental innovations and policy instruments interact across diverse contexts.

Author Contributions

Conceptualization, A.O.; Methodology, A.O.; Software, A.O.; Formal analysis, A.O.; Investigation, A.O.; Resources, F.H.; Data curation, F.H.; Writing—original draft, A.O. and F.H.; Writing—review & editing, F.H. and N.A.; Visualization, N.A.; Supervision, A.O.; Project administration, A.O.; Funding acquisition, F.H. All authors have read and agreed to the published version of the manuscript.

Funding

Princess Nourah bint Abdulrahman University Researchers Supporting Project number (PNURSP2025R857), Princess Nourah bint Abdulrahman University, Riyadh, Saudi Arabia.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The authors confirm that the data used in this study will be made available upon reasonable request.

Acknowledgments

The authors acknowledge support from Princess Nourah bint Abdulrahman University Researchers Supporting Project number (PNURSP2025R857), Princess Nourah bint Abdulrahman University, Riyadh, Saudi Arabia.

Conflicts of Interest

The authors declare that they have no conflicts of interest.

Correction Statement

This article has been republished with a minor correction to the correspondence contact information. This change does not affect the scientific content of the article.

References

- International Energy Agency (IEA). World Energy Outlook 2023. 2023. Available online: https://www.iea.org/reports/world-energy-outlook-2023 (accessed on 24 July 2025).

- Bouckaert, S.; Pales, A.F.; McGlade, C.; Remme, U.; Wanner, B.; Varro, L.; Spencer, T. Net Zero by 2050: A Roadmap for the Global Energy Sector. 2021. Available online: https://iea.blob.core.windows.net/assets/7ebafc81-74ed-412b-9c60-5cc32c8396e4/NetZeroby2050-ARoadmapfortheGlobalEnergySector-SummaryforPolicyMakers_CORR.pdf (accessed on 24 July 2025).

- IPCC. Sixth Assessment Report (AR6): Synthesis Report; Intergovernmental Panel on Climate Change: Geneva, Switzerland, 2023. [Google Scholar]

- UNEP. Emissions Gap Report 2022; United Nations Environment Programme: Nairobi, Kenya, 2022. [Google Scholar]

- Newell, P. The governance of energy finance: The public, the private and the hybrid. Glob. Policy 2011, 2, 94–105. [Google Scholar] [CrossRef]

- Eskeland, G.S.; Harrison, A.E. Moving to greener pastures? Multinationals and the pollution haven hypothesis. J. Econ. Lit. 2022, 60, 751–798. [Google Scholar]

- Saidi, K.; Omri, A. The impact of renewable energy on carbon emissions and economic growth in 15 major renewable energy-consuming countries. Environ. Res. 2020, 186, 109567. [Google Scholar] [CrossRef] [PubMed]

- Taghizadeh-Hesary, F.; Yoshino, N. The way to induce private participation in green finance and investment. Financ. Res. Lett. 2020, 31, 100848. [Google Scholar] [CrossRef]

- Sun, J.; Li, P.; Wang, Y. Policy tools for sustainability: Evaluating the effectiveness of fiscal measures in natural resource efficiency. Resour. Policy 2024, 89, 104575. [Google Scholar] [CrossRef]

- Razi, U.; Karim, S.; Cheong, C.W. From turbulence to resilience: A bibliometric insight into the complex interactions between energy price volatility and green finance. Energy 2024, 304, 131992. [Google Scholar] [CrossRef]

- Gunningham, N. Regulatory reform and reflexive regulation: Beyond command and control. In Regulation & Governance; The MIT Press: Cambridge, MA, USA, 2011; Volume 5, pp. 473–496. [Google Scholar]

- Romer, P.M. Endogenous technological change. J. Political Econ. 1990, 98 Pt 2, S71–S102. [Google Scholar] [CrossRef]

- Mol, A.P.J.; Spaargaren, G. Ecological modernization theory in debate: A review. Environ. Politics 2000, 9, 17–49. [Google Scholar] [CrossRef]

- Jänicke, M. Ecological modernisation: New perspectives. J. Clean. Prod. 2008, 16, 557–565. [Google Scholar] [CrossRef]

- Andersen, M.M.; Massa, I. Ecological modernization–origins, dilemmas and future directions. J. Environ. Policy Plan. 2000, 2, 337–345. [Google Scholar] [CrossRef]

- Horbach, J. Determinants of environmental innovation—New evidence from German panel data sources. Res. Policy 2008, 37, 163–173. [Google Scholar] [CrossRef]

- Costantini, V.; Mazzanti, M. On the green and innovative side of trade competitiveness? The impact of environmental policies and innovation on EU exports. Res. Policy 2012, 41, 132–153. [Google Scholar] [CrossRef]

- Johnstone, N.; Haščič, I.; Popp, D. Renewable energy policies and technological innovation: Evidence based on patent counts. Environ. Resour. Econ. 2010, 45, 133–155. [Google Scholar] [CrossRef]

- Del Río, P.; Carrillo-Hermosilla, J.; Könnölä, T. Policy strategies to promote eco-innovation: An integrated framework. J. Ind. Ecol. 2015, 20, 1155–1175. [Google Scholar] [CrossRef]

- Cai, W.; Li, G. The drivers of eco-innovation and its impact on performance: Evidence from China. J. Clean. Prod. 2018, 176, 110–118. [Google Scholar] [CrossRef]

- Lee, K.H.; Min, B. Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J. Clean. Prod. 2015, 108, 534–542. [Google Scholar]

- Rennings, K. Redefining innovation—Eco-innovation research and the contribution from ecological economics. Ecol. Econ. 2000, 32, 319–332. [Google Scholar] [CrossRef]

- Inglesi-Lotz, R. The impact of renewable energy consumption to economic growth: A panel data application. Energy Econ. 2016 53, 58–63. [CrossRef]

- Apergis, N.; Payne, J.E. Renewable energy, output, CO2 emissions, and fossil fuel prices in Central America: Evidence from a panel of countries. Energy Econ. 2015, 42, 153–160. [Google Scholar]

- Sadorsky, P. Renewable energy consumption and income in emerging economies. Energy Policy 2009, 37, 4021–4028. [Google Scholar] [CrossRef]

- Sinha, A.; Shahbaz, M.; Sengupta, T. Renewable energy policies and contradictions in causality: A case of Next 11 countries. J. Clean. Prod. 2018, 197, 73–84. [Google Scholar] [CrossRef]

- Chen, Y.; Zhao, Y.; Tang, B. Renewable energy consumption and environmental quality: A panel data analysis across regions. Environ. Sci. Pollut. Res. 2022, 29, 21656–21671. [Google Scholar]

- Christoff, P. Ecological modernisation, ecological modernities. Environ. Politics 1996, 5, 476–500. [Google Scholar] [CrossRef]

- Omri, A.; Nguyen, D.K. On the determinants of renewable energy consumption: International evidence. Energy 2014, 72, 554–560. [Google Scholar] [CrossRef]

- Bhattacharya, M.; Paramati, S.R.; Ozturk, I.; Bhattacharya, S. The effect of renewable energy consumption on economic growth: Evidence from top 38 countries. Appl. Energy 2016, 162, 733–741. [Google Scholar] [CrossRef]

- Xiong, Y.; Dai, L. Does green finance investment impact on sustainable development: Role of technological innovation and renewable energy. Renew. Energy 2023, 214, 342–349. [Google Scholar] [CrossRef]

- Dong, C.; Wu, H.; Zhou, J.; Lin, H.; Chang, L. Role of renewable energy investment and geopolitical risk in green finance development: Empirical evidence from BRICS countries. Renew. Energy 2023, 207, 234–241. [Google Scholar] [CrossRef]

- Zhou, Z.; Chau, K.Y.; Sibghatullah, A.; Moslehpour, M.; Tien, N.H.; Shukurullaevich, K.N. The role of green finance, environmental benefits, fintech development, and natural resource management in advancing sustainability. Resour. Policy 2024, 92, 105013. [Google Scholar] [CrossRef]

- Zhang, L.; Saydaliev, H.B.; Ma, X. Does green finance investment and technological innovation improve renewable energy efficiency and sustainable development goals? Renew. Energy 2022, 193, 991–1000. [Google Scholar] [CrossRef]

- Omri, H.; Jarraya, B.; Kahia, M. Green finance for achieving environmental sustainability in G7 countries: Effects and transmission channels. Res. Int. Bus. Financ. 2025, 74, 102691. [Google Scholar] [CrossRef]

- Zhang, S.; Wu, Z.; Wang, Y.; Hao, Y. Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 2021, 296, 113159. [Google Scholar] [CrossRef]

- Wu, J.; Wang, Q.; Li, Y. Environmental governance policy uncertainty and carbon emission reduction: Evidence from high-emission sectors in China. J. Environ. Manag. 2025, 350, 125748. [Google Scholar] [CrossRef]

- Wu, R.; Li, M. Impact of blockchain technology on carbon reduction in remanufacturing under a carbon trading mechanism. Nonlinear Dyn. 2025, 111, 11183. [Google Scholar]

- Omri, A.; Kahouli, B.; Afi, H.; Kahia, M. Impact of environmental quality on health outcomes in Saudi Arabia: Does research and development matter? J. Knowl. Econ. 2023, 14, 4119–4144. [Google Scholar] [CrossRef] [PubMed]

- Brambor, T.; Clark, W.R.; Golder, M. Understanding interaction models: Improving empirical analyses. Political Anal. 2006, 14, 63–82. [Google Scholar] [CrossRef]

- Pesaran, M.H. General diagnostic tests for cross-sectional dependence in panels. Empir. Econ. 2021, 60, 13–50. [Google Scholar] [CrossRef]

- Eberhardt, M. Estimating panel time-series models with heterogeneous slopes. Stata J. 2012, 12, 61–71. [Google Scholar] [CrossRef]

- Omri, H.; Omri, A.; Abbassi, A. Entrepreneurship and Human Well-Being: A Study of Standard of Living and Quality of Life in Developing Countries. Soc. Indic. Res. 2025, 177, 313–344. [Google Scholar] [CrossRef]

- Zhao, Y.; Tang, K.K.; Wang, L.L. Do renewable electricity policies promote renewable electricity generation? Evidence from panel data. Energy 2013, 62, 887–897. [Google Scholar] [CrossRef]

- Chudik, A.; Pesaran, M.H. Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. J. Econom. 2015, 188, 393–420. [Google Scholar] [CrossRef]

- Saidi, K.; Omri, A. Reducing CO2 emissions in OECD countries: Do renewable and nuclear energy matter? Prog. Nucl. Energy 2020, 126, 103425. [Google Scholar] [CrossRef]

- Liobikienė, G.; Butkus, M. The European Union possibilities to achieve targets of Europe 2020 and Paris agreement climate policy. Renew. Energy 2020, 142, 318–325. [Google Scholar]

- Altwaijri, A.; Omri, A.; Alfehaid, F. Promoting entrepreneurship for sustainable development: Are education capital and ICT diffusion important? Sustain. Dev. 2024, 32, 5463–5487. [Google Scholar] [CrossRef]

- Wu, L.; Ma, T.; Bian, Y.; Li, S.; Yi, Z. Improvement of regional environmental quality: Government environmental governance and public participation. Sci. Total Environ. 2020, 717, 137265. [Google Scholar] [CrossRef]

- Kirikkaleli, D.; Adebayo, T.S. Political risk and environmental quality in Brazil: Role of green finance and green innovation. Int. J. Financ. Econ. 2024, 29, 1205–1218. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).