Leveraging Digitalization to Boost ESG Performance in Different Business Contexts

Abstract

1. Introduction

2. Literature Review

2.1. Digitalization

2.2. Digitalization and ESG Performance

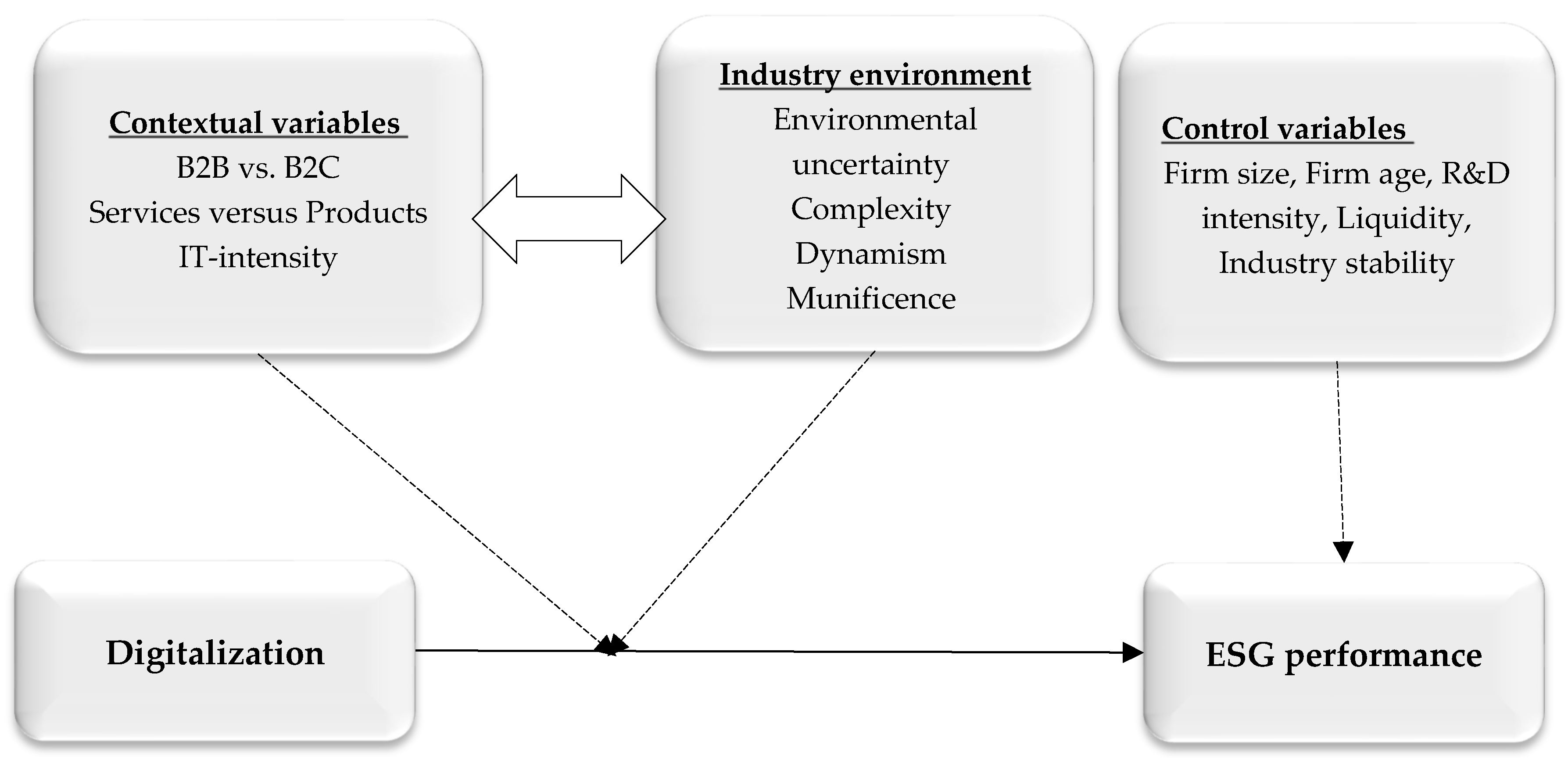

3. Conceptual Framework and Hypotheses Development

3.1. The Link Between Digitization and ESG Performance

3.2. ”The Moderating Effect of Environmental Uncertainty”

3.3. Heterogeneity Effect of Digitalization on ESG Performance

4. Research Methodology

4.1. Sample and Data Collection Process

4.2. Variables Operationalization

4.2.1. ESG Performance

4.2.2. Digitalization

4.2.3. Environmental Uncertainty

4.2.4. IT Intensity

4.2.5. Dynamism

4.2.6. Complexity

4.2.7. Munificence

4.3. Model Specification

4.4. Causality, Heterogeneity and Statistical Analysis Technique

4.5. Endogeneity Analysis

4.5.1. Heckman’s (1979) Two-Stage Analysis

4.5.2. ”Instrumental Variable Analysis in Estimating Our Regression Model”

5. Results

5.1. The Link Between DGT and ESG Performance

5.2. The Moderating Role of Environmental Uncertainty

5.3. The Moderating Role of Contextual Variables

5.4. The Moderating Role of Industry Environment

5.5. Robustness Checks

6. Discussion and Conclusions

6.1. Key Findings

6.2. Theoretical Implications

6.3. Managerial Implications

6.4. Implications for Policymakers

7. Limitations and Directions for Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Calderon-Monge, E.; Ribeiro-Soriano, D. The role of digitalization in business and management: A systematic literature review. Rev. Manag. Sci. 2024, 18, 449–491. [Google Scholar] [CrossRef]

- Purnomo, Y.J. Digital marketing strategy to increase sales conversion on e-commerce platforms. J. Contemp. Adm. Manag. 2023, 1, 54–62. [Google Scholar] [CrossRef]

- Rane, N. Enhancing Customer Loyalty through Artificial Intelligence (AI), Internet of Things (IoT), and Big Data Technologies: Improving Customer Satisfaction, Engagement, Relationship, and Experience. In Internet of Things (IoT), and Big Data Technologies: Improving Customer Satisfaction, Engagement, Relationship, and Experience; University of Mumbai: Mumbai, India, 2023. [Google Scholar]

- Wielgos, D.M.; Homburg, C.; Kuehnl, C. Digital business capability: Its impact on firm and customer performance. J. Acad. Mark. Sci. 2021, 49, 762–789. [Google Scholar] [CrossRef]

- Li, S.; Gao, L.; Han, C.; Gupta, B.; Alhalabi, W.; Almakdi, S. Exploring the effect of digital transformation on Firms’ innovation performance. J. Innov. Knowl. 2023, 8, 100317. [Google Scholar] [CrossRef]

- Dallocchio, M.; Lambri, M.; Sironi, E.; Teti, E. The role of digitalization in cross-border e-commerce performance of Italian SMEs. Sustainability 2024, 16, 508. [Google Scholar] [CrossRef]

- Gao, Y.; Liu, H. Artificial intelligence-enabled personalization in interactive marketing: A customer journey perspective. J. Res. Interact. Mark. 2023, 17, 663–680. [Google Scholar] [CrossRef]

- Okeke, N.I.; Alabi, O.A.; Igwe, A.N.; Ofodile, O.C.; Ewim, C.P.M. Customer journey mapping framework for SMEs: Enhancing customer satisfaction and business growth. World J. Adv. Res. Rev. 2024, 24, 2004–2018. [Google Scholar] [CrossRef]

- Gao, J.; Siddik, A.B.; Khawar Abbas, S.; Hamayun, M.; Masukujjaman, M.; Alam, S.S. Impact of E-commerce and digital marketing adoption on the financial and sustainability performance of MSMEs during the COVID-19 pandemic: An empirical study. Sustainability 2023, 15, 1594. [Google Scholar] [CrossRef]

- Mondal, S.; Das, S.; Vrana, V.G. How to bell the cat? A theoretical review of generative artificial intelligence towards digital disruption in all walks of life. Technologies 2023, 11, 44. [Google Scholar] [CrossRef]

- George, A.S.; George, A.H. A review of ChatGPT AI’s impact on several business sectors. Partn. Univers. Int. Innov. J. 2023, 1, 9–23. [Google Scholar]

- Raj, R.; Singh, A.; Kumar, V.; Verma, P. Analyzing the potential benefits and use cases of ChatGPT as a tool for improving the efficiency and effectiveness of business operations. BenchCouncil Trans. Benchmarks Stand. Eval. 2023, 3, 100140. [Google Scholar] [CrossRef]

- Halibas, A.S.; Van Nguyen, A.T.; Akbari, M.; Akram, U.; Hoang, M.D.T. Developing trends in showrooming, webrooming, and omnichannel shopping behaviors: Performance analysis, conceptual mapping, and future directions. J. Consum. Behav. 2023, 22, 1237–1264. [Google Scholar] [CrossRef]

- Sudrajad, A.I.; Tricahyono, D.; Yulianti, E.B.; SM, A.; Rosmawati, W. The role of digitalization performance on digital business strategy in indonesia msems International Journal of Professional Business Review. Int. J. Prof. Bus. Rev. 2023, 8, 26. [Google Scholar]

- Singh, P.; Khoshaim, L.; Nuwisser, B.; Alhassan, I. How information technology (it) is shaping consumer behavior in the digital age: A systematic review and future research directions. Sustainability 2024, 16, 1556. [Google Scholar] [CrossRef]

- Raji, M.A.; Olodo, H.B.; Oke, T.T.; Addy, W.A.; Ofodile, O.C.; Oyewole, A.T. E-commerce and consumer behavior: A review of AI-powered personalization and market trends. GSC Adv. Res. Rev. 2024, 18, 066–077. [Google Scholar] [CrossRef]

- Chowdhury, S.N.; Faruque, M.O.; Sharmin, S.; Talukder, T.; Al Mahmud, M.A.; Dastagir, G.; Akter, S. The impact of social media marketing on consumer behavior: A study of the fashion retail industry. Open J. Bus. Manag. 2024, 12, 1666–1699. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Noordhoff, C.S.; Sloot, L. Reflections and predictions on effects of COVID-19 pandemic on retailing. J. Serv. Manag. 2023, 34, 274–293. [Google Scholar] [CrossRef]

- Al Hamli, S.S.; Sobaih, A.E.E. Factors influencing consumer behavior towards online shopping in Saudi Arabia amid covid-19: Implications for E-businesses post pandemic. J. Risk Financ. Manag. 2023, 16, 36. [Google Scholar] [CrossRef]

- More, A.B. Implementing digital age experience marketing to make customer relations more sustainable. In New Horizons for Industry 4.0 in Modern Business; Springer: Cham, Switzerland, 2023; pp. 99–119. [Google Scholar]

- Suherlan, S.; Okombo, M.O. Technological innovation in marketing and its effect on consumer behaviour. Technol. Soc. Perspect. 2023, 1, 94–103. [Google Scholar] [CrossRef]

- Aripin, Z.; Yulianty, F. A quantitative performance management framework to improve community economy through omnichannel supply chain: A case study in the banking and marketing industry. KRIEZ Acad. J. Dev. Community Serv. 2023, 1, 15–24. [Google Scholar]

- Agustian, K.; Mubarok, E.S.; Zen, A.; Wiwin, W.; Malik, A.J. The impact of digital transformation on business models and competitive advantage. Technol. Soc. Perspect. 2023, 1, 79–93. [Google Scholar] [CrossRef]

- Pousttchi, K.; Dehnert, M. Exploring the digitalization impact on consumer decision-making in retail banking. Electron. Mark. 2018, 28, 265–286. [Google Scholar] [CrossRef]

- Ziakis, C.; Vlachopoulou, M. Artificial intelligence in digital marketing: Insights from a comprehensive review. Information 2023, 14, 664. [Google Scholar] [CrossRef]

- Hristov, I.; Searcy, C. Integrating sustainability with corporate governance: A framework to implement the corporate sustainability reporting directive through a balanced scorecard. Manag. Decis. 2025, 63, 443–467. [Google Scholar] [CrossRef]

- Kumar, P.; Thomas, S.; Sobhan, C.B.; Peterson, G.P. Activated carbon foam composite derived from PEG400/Terminalia Catappa as form stable PCM for sub-zero cold energy storage. J. Clean. Prod. 2024, 434, 139993. [Google Scholar] [CrossRef]

- Li, Y.; Cui, L.; Wu, L.; Lowry, P.B.; Kumar, A.; Tan, K.H. Digitalization and network capability as enablers of business model innovation and sustainability performance: The moderating effect of environmental dynamism. J. Inf. Technol. 2024, 39, 687–715. [Google Scholar] [CrossRef]

- Jovanović, M.; Dlačić, J.; Okanović, M. Digitalization and society’s sustainable development–Measures and implications. Zb. Rad. Ekon. Fak. U Rijeci Časopis Za Ekon. Teor. I Praksu 2018, 36, 905–928. [Google Scholar]

- Teng, Z.L.; Guo, C.; Zhao, Q.; Mubarik, M.S. Antecedents of green process innovation adoption: An AHP analysis of China’s gas sector. Resour. Policy 2023, 85, 103959. [Google Scholar] [CrossRef]

- Sarkis, J.; Kouhizadeh, M.; Zhu, Q.S. Digitalization and the greening of supply chains. Ind. Manag. Data Syst. 2021, 121, 65–85. [Google Scholar] [CrossRef]

- George, G.; Merrill, R.K.; Schillebeeckx, S.J. Digital sustainability and entrepreneurship: How digital innovations are helping tackle climate change and sustainable development. Entrep. Theory Pract. 2021, 45, 999–1027. [Google Scholar] [CrossRef]

- Settembre-Blundo, D.; González-Sánchez, R.; Medina-Salgado, S.; García-Muiña, F.E. Flexibility and resilience in corporate decision making: A new sustainability-based risk management system in uncertain times. Glob. J. Flex. Syst. Manag. 2021, 22 (Suppl. 2), 107–132. [Google Scholar] [CrossRef] [PubMed]

- Miceli, A.; Hagen, B.; Riccardi, M.P.; Sotti, F.; Settembre-Blundo, D. Thriving, not just surviving in changing times: How sustainability, agility and digitalization intertwine with organizational resilience. Sustainability 2021, 13, 2052. [Google Scholar] [CrossRef]

- Luo, F.; Tang, C.H. Navigating uncertainty: The impact of environmental instability on enterprise digital transformation. PLoS ONE 2024, 19, 0314688. [Google Scholar] [CrossRef] [PubMed]

- Trzaska, R.; Sulich, A.; Organa, M.; Niemczyk, J.; Jasiński, B. Digitalization business strategies in energy sector: Solving problems with uncertainty under industry 4.0 conditions. Energies 2021, 14, 7997. [Google Scholar] [CrossRef]

- Azimli, A.; Cek, K. Can sustainability performance mitigate the negative effect of policy uncertainty on the firm valuation? Sustain. Account. Manag. Policy J. 2024, 15, 752–775. [Google Scholar] [CrossRef]

- Laguir, I.; Stekelorum, R.; Beysül, A.; Mouadili, O.; Segbotangni, E.A. Eco-control systems and firm performance: Understanding the mediating role of circular economy practices and the moderating role of environmental uncertainty. J. Clean. Prod. 2024, 450, 141894. [Google Scholar] [CrossRef]

- Biemans, W.; Griffin, A. Innovation Practices of B2B Manufacturers and Service Providers: Are they Really Different? Ind. Mark. Manag. 2018, 75, 112–124. [Google Scholar] [CrossRef]

- Damanpour, F. Organizational complexity and innovation: Developing and testing multiple contingency models. Manag. Sci. 1996, 42, 693–716. [Google Scholar] [CrossRef]

- Fornell, C.; Johnson, M.D.; Anderson, E.W.; Cha, J.; Bryant, B.E. The American Customer Satisfaction Index: Nature, Purpose, and Findings. J. Mark. 1996, 60, 7–18. [Google Scholar] [CrossRef]

- Fornell, C.; Johnson, M.D. Differentiation as a Basis for Explaining Customer Satisfaction Across Industries. J. Econ. Psychol. 1993, 14, 681–696. [Google Scholar] [CrossRef]

- Johnson, M.D.; Herrmann, A.; Gustafsson, A. Comparing Customer Satisfaction Across Industries and Countries. J. Econ. Psychol. 2002, 23, 749–769. [Google Scholar] [CrossRef]

- Edson, K.; Padilha, L.S.; Sehnem, S.; Julkovski, D.J.; Roman, D.J. The Relationship Between Innovation and Sustainability: A Meta-Analytic Study. J. Clean. Prod. 2020, 259, 120745. [Google Scholar] [CrossRef]

- Liu, L. Environmental performance factors: Insights from CSR-linked compensation, committees, disclosure, targets, and board composition. J. Sustain. Financ. Invest. 2024, 15, 1–36. [Google Scholar] [CrossRef]

- Chen, X.; Huang, R.; Yang, Z.; Dube, L. CSR Types and the Moderating Role of Corporate Competence. Eur. J. Mark. 2018, 52, 1358–1386. [Google Scholar] [CrossRef]

- Xueming, L.; Du, S. Exploring the Relationship Between Corporate Social Responsibility and Firm Innovation. Mark. Lett. 2015, 26, 703–714. [Google Scholar]

- Homburg, C.; Wielgos, D.M. The value relevance of digital marketing capabilities to firm performance. J. Acad. Mark. Sci. 2022, 50, 666–688. [Google Scholar] [CrossRef]

- Ribeiro-Navarrete, S.; Botella-Carrubi, D.; Palacios-Marqués, D.; Orero-Blat, M. The effect of digitalization on business performance: An applied study of KIBS. J. Bus. Res. 2021, 126, 319–326. [Google Scholar] [CrossRef]

- Zhu, Z.; Lin, S.; Jiang, Y.; Liu, Q. The coordination effect of B2B digital process capabilities on competitive performance: Balancing or complementing. J. Enterp. Inf. Manag. 2022, 35, 918–946. [Google Scholar] [CrossRef]

- Oliveira, J.; Azevedo, A.; Ferreira, J.J.; Gomes, S.; Lopes, J.M. An insight on B2B firms in the age of digitalization and paperless processes. Sustainability 2021, 13, 11565. [Google Scholar] [CrossRef]

- Ohinok, S.; Hunka, V. The Impact of Digitalisation on the Efficiency and Competitiveness of an Organisation in the Modern Business Environment. Eкoнoмiкa Poзвиткy Cиcтeм 2023, 5, 54–58. [Google Scholar] [CrossRef]

- Martín-Peña, M.L.; Sánchez-López, J.M.; Díaz-Garrido, E. Servitization and digitalization in manufacturing: The influence on firm performance. J. Bus. Ind. Mark. 2020, 35, 564–574. [Google Scholar] [CrossRef]

- Bloom, N.; Sadun, R.; Van Reenen, J. Americans do IT better: US multinationals and the productivity miracle. Am. Econ. Rev. 2012, 102, 167–201. [Google Scholar] [CrossRef]

- Stiroh, K.J. Investing in information technology: Productivity payoffs for US industries. Curr. Issues Econ. Financ. 2001, 7, 1–6. [Google Scholar]

- Lee, S.; Kim, S.H. A lag effect of IT investment on firm performance. Inf. Resour. Manag. J. 2006, 19, 43–69. [Google Scholar] [CrossRef]

- Centre for Economics and Business Research (CEBR). Data Equity: Unlocking the Value of Big Data Report for SAS. April 2017. Available online: https://en.wikipedia.org/wiki/Centre_for_Economics_and_Business_Research?utm_source=chatgpt.com (accessed on 23 April 2025).

- Tambe, P. Big data investment, skills, and firm value. Manag. Sci. 2014, 60, 1452–1469. [Google Scholar] [CrossRef]

- Lee, K.; Song, Y.; Park, M.; Yoon, B. Development of Digital Transformation Maturity Assessment Model for Collaborative Factory Involving Multiple Companies. Sustainability 2024, 16, 8087. [Google Scholar] [CrossRef]

- Miao, Y.; Shi, Y.; Jing, H. Effect of servitization on performance in manufacturing firms: A mediating effect model of digitalisation moderated by ESG performance. Heliyon 2023, 9, e20831. [Google Scholar] [CrossRef]

- Wang, S.; Esperança, J.P. Can digital transformation improve market and ESG performance? Evidence from Chinese SMEs. J. Clean. Prod. 2023, 419, 137980. [Google Scholar] [CrossRef]

- Su, X.; Wang, S.; Li, F. The impact of digital transformation on ESG performance based on the mediating effect of dynamic capabilities. Sustainability 2023, 15, 13506. [Google Scholar] [CrossRef]

- Singhania, M.; Bhan, I.; Seth, S. Digitalisation and firm-level ESG performance and disclosures: A scientometric review and research agenda. Int. J. Financ. Econ. 2025. online ahead of print. [Google Scholar] [CrossRef]

- Hongbin, Y.; Fei, W.; Zhijie, L.; Cifuentes-Faura, J. Private vs. Public: Differential Impacts of Sustainable Innovation on ESG Performance in the Digitalize Era. Bus. Strategy Environ. 2025, 34, 4030–4047. [Google Scholar] [CrossRef]

- Kotrba, V.; Menšík, J.; Martinez, L.F. ESG consequences for companies in the digital environment: Insights from sector-specific performance across the EU-27. J. Mark. Anal. 2025, 3, 1–13. [Google Scholar] [CrossRef]

- Xu, X.; Sun, M. Digital Transformation, Internationalisation and ESG Performance of Multinational Companies. Manag. Decis. Econ. 2025, 46, 2709–2725. [Google Scholar] [CrossRef]

- Hao, P.; Alharbi, S.S.; Hunjra, A.I.; Zhao, S. How do ESG ratings promote digital technology innovation? Int. Rev. Financ. Anal. 2025, 97, 103886. [Google Scholar] [CrossRef]

- Guo, X.; Pang, W. The impact of digital transformation on corporate ESG performance. Financ. Res. Lett. 2025, 72, 106518. [Google Scholar] [CrossRef]

- Yang, X.; Han, Q. Nonlinear effects of enterprise digital transformation on environmental, social and governance (ESG) performance: Evidence from China. Sustainability Accounting. Manag. Policy J. 2024, 15, 355–381. [Google Scholar] [CrossRef]

- Eriandani, R.; Winarno, W.A. ESG and firm performance: The role of digitalization. J. Account. Invest. 2023, 24, 993–1010. [Google Scholar] [CrossRef]

- Abumalloh, R.A.; Nilashi, M.; Ooi, K.B.; Wei-Han, G.; Cham, T.H.; Dwivedi, Y.K.; Hughes, L. The adoption of metaverse in the retail industry and its impact on sustainable competitive advantage: Moderating impact of sustainability commitment. Ann. Oper. Res. 2024, 342, 5–46. [Google Scholar] [CrossRef]

- Karmaker, C.L.; Al Aziz, R.; Ahmed, T.; Misbauddin, S.M.; Moktadir, M.A. Impact of industry 4.0 technologies on sustainable supply chain performance: The mediating role of green supply chain management practices and circular economy. J. Clean. Prod. 2023, 419, 138249. [Google Scholar] [CrossRef]

- Lee, M.J.; Roh, T. Digitalization capability and sustainable performance in emerging markets: Mediating roles of in/out-bound open innovation and coopetition strategy. Manag. Decis. 2023. (ahead-of-print). [Google Scholar] [CrossRef]

- Ghanbarpour, T.; Crosby, L.; Johnson, M.D.; Gustafsson, A. The influence of corporate social responsibility on stakeholders in different business contexts. J. Serv. Res. 2024, 27, 141–155. [Google Scholar] [CrossRef]

- Zhou, H.; Liu, J. Digitalization of the economy and resource efficiency for meeting the ESG goals. Resour. Policy 2023, 86, 104199. [Google Scholar] [CrossRef]

- Tian, L.; Tian, W.; Guo, M. Can supply chain digitalization open the way to sustainable development? Evidence from corporate ESG performance. Corp. Soc. Responsib. Environ. Manag. 2025, 32, 2332–2346. [Google Scholar] [CrossRef]

- Zhao, F.; Han, Z.; Wang, L. Digitization path to improve ESG performance: A study on organizational perspectives. PLoS ONE 2024, 19, e0313686. [Google Scholar] [CrossRef]

- Ding, X.; Sheng, Z.; Appolloni, A.; Shahzad, M.; Han, S. Digital transformation, ESG practice, and total factor productivity. Bus. Strategy Environ. 2024, 33, 4547–4561. [Google Scholar] [CrossRef]

- Huang, Q.; Fang, J.; Xue, X.; Gao, H. Does digital innovation cause better ESG performance? an empirical test of a-listed firms in China. Res. Int. Bus. Financ. 2023, 66, 102049. [Google Scholar] [CrossRef]

- Zhao, Q.; Li, X.; Li, S. Analyzing the relationship between digital transformation strategy and ESG performance in large manufacturing enterprises: The mediating role of green innovation. Sustainability 2023, 15, 9998. [Google Scholar] [CrossRef]

- Xue, L.; Dong, J.; Zha, Y. How does digital finance affect firm environmental, social and governance (ESG) performance?—Evidence from Chinese listed firms. Heliyon 2023, 9, e20800. [Google Scholar] [CrossRef]

- Gu, J. Digitalization, spillover and environmental, social, and governance performance: Evidence from China. J. Environ. Dev. 2024, 33, 286–311. [Google Scholar] [CrossRef]

- Zhong, Y.; Zhao, H.; Yin, T. Resource bundling: How does enterprise digital transformation affect enterprise ESG development? Sustainability 2023, 15, 1319. [Google Scholar] [CrossRef]

- Wu, X.; Li, L.; Liu, D.; Li, Q. Technology empowerment: Digital transformation and enterprise ESG performance—Evidence from China’s manufacturing sector. PLoS ONE 2024, 19, e0302029. [Google Scholar] [CrossRef] [PubMed]

- Jin, X.; Wu, Y. How does digital transformation affect the ESG performance of Chinese manufacturing state-owned enterprises?—Based on the mediating mechanism of dynamic capabilities and the moderating mechanism of the institutional environment. PLoS ONE 2024, 19, e0301864. [Google Scholar] [CrossRef] [PubMed]

- Yu, G. Digital transformation, human capital upgrading, and enterprise ESG performance: Evidence from Chinese listed enterprises. Oeconomia Copernic. 2024, 15, 1465. [Google Scholar] [CrossRef]

- Fu, T.; Li, J. An empirical analysis of the impact of ESG on financial performance: The moderating role of digital transformation. Front. Environ. Sci. 2023, 11, 1256052. [Google Scholar] [CrossRef]

- Cao, G.; She, J.; Cao, C.; Cao, Q. Environmental protection tax and green innovation: The mediating role of digitalization and ESG. Sustainability 2024, 16, 577. [Google Scholar] [CrossRef]

- Ren, S.; Mohd Isa, S. The impact of digital transformation on corporate ESG performance: Empirical evidence from Chinese listed companies. J. Int. Bus. Econ. Entrep. 2023, 8, 1–10. [Google Scholar]

- Sang, Y.; Loganathan, K.; Lin, L. Digital Transformation and Firm ESG Performance: The Mediating Role of Corporate Risk-Taking and the Moderating Role of Top Management Team. Sustainability 2024, 16, 5907. [Google Scholar] [CrossRef]

- Bouattour, A.; Kalai, M.; Helali, K. The non-linear relationship between ESG performance and bank stability in the digital era: New evidence from a regime-switching approach. Humanit. Soc. Sci. Commun. 2024, 11, 1445. [Google Scholar] [CrossRef]

- Nath, P.; Mahajan, V. Marketing in the C-suite: A study of chief marketing officer power in firms’ top management teams. J. Mark. 2011, 75, 60–77. [Google Scholar]

- Luo, Y.; Tian, N.; Wang, D.; Han, W. Does digital transformation enhance firm’s ESG performance? Evidence from an emerging market. Emerg. Mark. Financ. Trade 2024, 60, 825–854. [Google Scholar] [CrossRef]

- Mo, Y.; Che, Y.; Ning, W. Digital finance promotes corporate ESG performance: Evidence from China. Sustainability 2023, 15, 11323. [Google Scholar] [CrossRef]

- Wang, J. Digital transformation, environmental regulation and enterprises’ ESG performance: Evidence from China. Corp. Soc. Responsib. Environ. Manag. 2025, 32, 1567–1582. [Google Scholar] [CrossRef]

- Davidson, D.K.; Tanimoto, K.; Jun, L.G.; Taneja, S.; Taneja, P.K.; Yin, J. Corporate social responsibility across Asia: A review of four countries. Corp. Soc. Responsib. 2018, 2, 73–132. [Google Scholar]

- Xu, R.; Farooq, U.; Alam, M.M.; Dai, J. How does cultural diversity determine green innovation? New empirical evidence from Asia region. Environ. Impact Assess. Rev. 2024, 106, 1074. [Google Scholar] [CrossRef]

- Zaman, R.; Jain, T.; Samara, G.; Jamali, D. Corporate governance meets corporate social responsibility: Mapping the interface. Bus. Soc. 2022, 61, 690–752. [Google Scholar] [CrossRef]

- Denter, N.M. Blockchain breeding grounds: Asia’s advance over the USA and Europe. World Pat. Inf. 2021, 67, 102082. [Google Scholar] [CrossRef]

- Barbieri, S.V.; Pellegrini, L. How much does matter ESG ratings in big pharma firms performances? In Climate Change Adaptation, Governance and New Issues of Value; Bellavite, P.C., Pellegrini, L., Catizone, M., Eds.; Palgrave Studies in Impact Finance, Palgrave Macmillan: Cham, Switzerland, 2022; pp. 185–225. [Google Scholar]

- Saleh, I.; Abu Afifa, M.; Alkhawaja, A. Environmental, social, and governance (ESG) disclosure, earnings management and cash holdings: Evidence from a European context. Bus. Ethics Environ. Responsib. 2023, 32, 295–308. [Google Scholar] [CrossRef]

- Berg, F.; Fabisik, K.; Sautner, Z. Rewriting History II: The (un) Predictable Past of ESG Ratings; Finance Working Paper; European Corporate Governance Institute: Brussels, Belgium, 2020; Volume 708, pp. 10–2139. [Google Scholar]

- Ahmed, Z.; Cary, M.; Shahbaz, M.; Vo, X.V. Asymmetric nexus between economic policy uncertainty, renewable energy technology budgets, and environmental sustainability: Evidence from the United States. J. Clean. Prod. 2021, 313, 127723. [Google Scholar] [CrossRef]

- Rajesh, R.; Rajendran, C. Relating environmental, social, and governance scores and sustainability performances of firms: An empirical analysis. Bus. Strategy Environ. 2020, 29, 1247–1267. [Google Scholar] [CrossRef]

- Wu, F.; Hu, H.; Lin, H.; Ren, X. Enterprise digital transformation and capital market performance: Empirical evidence from stock liquidity. Manag. World 2021, 37, 130–144. [Google Scholar]

- Fang, M.; Nie, H.; Shen, X. Can enterprise digitization improve ESG performance? Econ. Model. 2023, 118, 106101. [Google Scholar] [CrossRef]

- Zhu, S.; Dong, T.; Luo, X.R. A longitudinal study of the actual value of big data and analytics: The role of industry environment. Int. J. Inf. Manag. 2021, 60, 102389. [Google Scholar] [CrossRef]

- Nguyen, N.M.; Abu Afifa, M.M.; Thi Truc Dao, V.; Van Bui, D.; Vo Van, H. Leveraging artificial intelligence and blockchain in accounting to boost ESG performance: The role of risk management and environmental uncertainty. Int. J. Organ. Anal. 2025. [Google Scholar] [CrossRef]

- Arellano, M.; Bover, O. Another look at the instrumental variable estimation of error-components models. J. Econom. 1995, 68, 29–51. [Google Scholar] [CrossRef]

- Lu, Y.; Xu, C.; Zhu, B.; Sun, Y. Digitalization transformation and ESG performance: Evidence from China. Bus. Strategy Environ. 2024, 33, 352–368. [Google Scholar] [CrossRef]

- Flannery, M.J.; Hankins, K.W. Estimating dynamic panel models in corporate finance. J. Corp. Financ. 2013, 19, 1–19. [Google Scholar] [CrossRef]

- Deng, Q.; Karia, N. How ESG Performance Promotes Organizational Resilience: The Role of Ambidextrous Innovation Capability and Digitalization. Bus. Strategy Dev. 2025, 8, e70079. [Google Scholar] [CrossRef]

- Lan, L.; Zhou, Z. Complementary or substitutive effects? The duality of digitalization and ESG on firm’s innovation. Technol. Soc. 2024, 77, 102567. [Google Scholar] [CrossRef]

- Qi, Y.; Han, M.; Zhang, C. The synergistic effects of digital technology application and ESG performance on corporate performance. Financ. Res. Lett. 2024, 61, 105007. [Google Scholar] [CrossRef]

- Zhu, Y.; Zhang, Z. Supply chain digitalization and corporate ESG performance: Evidence from supply chain innovation and application pilot policy. Financ. Res. Lett. 2024, 67, 105818. [Google Scholar] [CrossRef]

- Behl, A.; Gaur, J.; Pereira, V.; Yadav, R.; Laker, B. Role of big data analytics capabilities to improve sustainable competitive advantage of MSME service firms during COVID-19–A multi-theoretical approach. J. Bus. Res. 2022, 148, 378–389. [Google Scholar] [CrossRef]

- Ning, Y.; Zhang, Y. Does digital finance improve corporate ESG performance? An intermediary role based on financing constraints. Sustainability 2023, 15, 10685. [Google Scholar] [CrossRef]

- Heckman, J.J. Sample selection bias as a specification error. Econometrica 1979, 47, 153–161. [Google Scholar] [CrossRef]

- Liu, H.; Jung, J.S. Impact of Digital Transformation on ESG Management and Corporate Performance: Focusing on the Empirical Comparison between Korea and China. Sustainability 2024, 16, 2817. [Google Scholar] [CrossRef]

- Kong, D.; Shu, Y.; Wang, Y. Corruption and corporate social responsibility: Evidence from a quasi-natural experiment in China. J. Asian Econ. 2021, 75, 101317. [Google Scholar] [CrossRef]

| Industry | Observations/Year | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Chemical industry | 289 | 289 | 289 | 289 | 289 | 289 | 289 | 289 | 289 | 289 |

| Industrial tools | 217 | 217 | 217 | 217 | 217 | 217 | 217 | 217 | 217 | 217 |

| Business services | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 | 159 |

| Machine building | 156 | 156 | 156 | 156 | 156 | 156 | 156 | 156 | 156 | 156 |

| Transportation equipment | 151 | 151 | 151 | 151 | 151 | 151 | 151 | 151 | 151 | 151 |

| Electronic equipment | 134 | 134 | 134 | 134 | 134 | 134 | 134 | 134 | 134 | 134 |

| Investment services | 93 | 93 | 93 | 93 | 93 | 93 | 93 | 93 | 93 | 93 |

| Paper industry | 90 | 90 | 90 | 90 | 90 | 90 | 90 | 90 | 90 | 90 |

| Quarry industry | 87 | 87 | 87 | 87 | 87 | 87 | 87 | 87 | 87 | 87 |

| Communications | 79 | 79 | 79 | 79 | 79 | 79 | 79 | 79 | 79 | 79 |

| Utilities industry | 72 | 72 | 72 | 72 | 72 | 72 | 72 | 72 | 72 | 72 |

| Business support services | 63 | 63 | 63 | 63 | 63 | 63 | 63 | 63 | 63 | 63 |

| Food industry | 61 | 61 | 61 | 61 | 61 | 61 | 61 | 61 | 61 | 61 |

| Primary metal industry | 57 | 57 | 57 | 57 | 57 | 57 | 57 | 57 | 57 | 57 |

| Air transport services | 51 | 51 | 51 | 51 | 51 | 51 | 51 | 51 | 51 | 51 |

| Insurance carries | 49 | 49 | 49 | 49 | 49 | 49 | 49 | 49 | 49 | 49 |

| Others | 31 | 31 | 31 | 31 | 31 | 31 | 31 | 31 | 31 | 31 |

| Total | 18,390 | |||||||||

| Construct | Role | Definition | Source (s) |

|---|---|---|---|

| Digitalization | Independent variable | “Digitization refers to firm digital transformation by applying traditional management, operation, and service models to achieve the intelligence, automation, and science of management, operation, and service through digital technology applications”. “Referring to Wu et al. (2021) [105] and Fang et al. (2023) [106], we use the text analysis function of Python 3.10.x to construct independent variable Digit in the following three steps: (1) summarize the specific keywords related to digitization based on the articles in the academic field and documents in the industrial field; (2) conduct the word frequency statistics of the annual reports of each listed firm in each year based on the keywords that have been mentioned, and after processing, obtain the panel data; (3) add 1 and take the natural logarithm to obtain the overall index of firm digitization, considering that this kind of word frequency data has typical “right bias” characteristics”. | Thomson Reuters Eikon Datastream. |

| ESG performance | Dependent variable | “The ESG performance was determined by applying a natural logarithmic transformation to the ESG score, derived from previous studies by Barbieri and Pellegrini (2022) [100] and Saleh et al. (2023) [101]. The decision to use this scale score was motivated by the variability in the score over time due to data source considerations [102]. This method of using the natural logarithm was chosen to minimize errors during data modifications [103]. The utilization of ESG scores offered the advantage of facilitating a more straightforward assessment of firms’ ESGP status for users [104] and served as a more robust indicator of firms’ sustainable performance [105]”. | Thomson Reuters Eikon Datastream |

| Environmental uncertainty | Moderator variable | “We measured dynamism as the volatility of sales in a dominant industry over a period of 5 years” | Thomson Reuters Eikon Datastream |

| IT intensity | Moderator variable | “Binary indicator variable: 1 indicates that the firm is in an IT-intensive industry; otherwise, 0” | Thomson Reuters Eikon Datastream |

| Dynamism | Moderator variable | “We measured dynamism as the volatility of sales in a dominant industry over a period of 5 years (Xue et al., 2023; Zhu et al., 2021)” [81,107] | Thomson Reuters Eikon Datastream |

| Complexity | Moderator variable | “We used the Herfindahl index to measure complexity (Xu et al., 2024)” [97]. “Herfindahl index is a well-known measure for market concentration”. | Thomson Reuters Eikon Datastream |

| Munificence | Moderator variable | “We used the sales growth in a dominant industry over a period of 5 years to measure munificence (Xu et al., 2024)” [97] | Thomson Reuters Eikon Datastream |

| Firm age | Control variable | “We operationalized firm age as the natural logarithm of difference between the current year and founding year”. | The American Hotel & Lodging Association (AHLA) database |

| Firm profitability | Control variable | “We calculated firm profitability using a firm’s return on assets”. | The American Hotel & Lodging Association (AHLA) database |

| “Industry stability” | Control variable | “Operationalized as the two-digit SIC industry’s lagged three-year standard deviation of the median sales growth (t–2, t–1, t)”. | (Nath & Mahajan, 2011) [92] |

| Variables | Mean | Std.dev | ESGP | DGT | ENV | IT | DYM | CMX | MUN | AGE | SZE | PFT | STB |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ESGP | 2.319 | 1.037 | 1 | ||||||||||

| DGT | 0.284 | 0.402 | 0.418 ** | 1 | |||||||||

| ENV | 0.184 | 0.215 | 0.210 * | 0.067 | 1 | ||||||||

| IT | 0.163 | 0.310 | 0.043 | 0.043 | 0.027 | 1 | |||||||

| DYM | 0.301 | 0.189 | 0.037 | 0.078 | 0.084 | 0.212 | 1 | ||||||

| CMX | 0.218 | 0.095 | 0.019 | 0.039 | 0.092 | 0.034 | 0.021 | 1 | |||||

| MUN | 0.0217 | 0.027 | 0.031 | 0.021 | 0.046 | 0.219 | 0.063 | 0.081 | 1 | ||||

| AGE | 0.04 | 0.053 | 0.136 | 0.027 | 0.104 | 0.029 | 0.017 | 0.027 | 0.091 | 1 | |||

| SZE | 0.063 | 0.142 | 0.034 | 0.129 | 0.127 | 0.162 | 0.032 | 0.012 | 0.082 | 0.124 | 1 | ||

| PFT | 0.015 | 0.047 | 0.173 * | 0.043 | 0.028 | 0.048 | 0.012 | 0.022 | 0.043 | 0.049 | 0.402 * | 1 | |

| STB | 0.328 | 0.201 | 0.034 | 0.036 | 0.024 | 0.019 | 0.037 | 0.067 | 0.029 | 0.043 | 0.029 | 0.039 | 1 |

| Second Stage Dependent Variable = ESG Performance | First Stage Dependent Variable = DGT | |||

|---|---|---|---|---|

| Model 4 | Model 3 | Model 2 | (Model 1) | |

| 0.039 ** (4.293) | 0.044 ** (5.016) | 0.0218 ** (4.129) | - | DGT |

| 0.031 ** (3.780) | 0.021 ** (3.129) | - | - | DGT × DYM |

| 0.027 ** (4.102) | - | - | - | DGT × CMX |

| 0.012 ** (3.239) | - | - | - | DGT × MUN |

| 0.319 ** (4.109) | - | - | - | DGT × IT |

| 0.018 ** (3.120) | - | - | - | DGT × UNC |

| 0.042 (1.038) | 0.026 (1.293) | 0.134 ** (3.289) | - | |

| 0.029 (1.128) | 0.028 (1.218) | 0.051 (1.026) | - | DYM |

| 0.030 (1.223) | 0.047 (1.248) | 0.062 (1.208) | - | CMX |

| 0.013 (1.472) | 0.018 (1.234) | 0.078 (1.210) | - | MUN |

| 0.210 ** (5.309) | 0.397 ** (7.139) | 0.127 ** (3.017) | - | IT |

| 0.018 (1.105) | 0.024 (1.315) | 0.012 (1.329) | 0.172 ** (2.038) | UNC |

| 0.130 ** (2.918) | 0.108 ** (2.839) | 0.179 ** (3.017) | 0.271 ** (5.011) | Firm size |

| 0.237 ** (5.120) | 0.212 ** (4.89) | 0.205 ** (5.128) | 0.208 ** (4.612) | Firm age |

| 0.036 (1.116) | 0.028 (1.124) | 0.035 (1.107) | 0.419 * (12.106) | Profitability |

| 0.039 (1.127) | 0.017 (1.138) | 0.016 (1.061) | 0.174 ** (2.419) | Industry stability |

| Industry growth | ||||

| −0.294(7.193) | −0.271 (7.208) | −0.296 (8.219) | - | IMR |

| 0.399 ** (11.203) | 0.361 ** (9.016) | 0.319 ** (8.210) | −2.189 ** (−6.219) | Constant |

| Yes | Yes | Yes | Yes | Year fixed effects |

| Yes | Yes | Yes | Yes | Industry fixed effects |

| Yes | Yes | Yes | Yes | Country fixed effects |

| 18,390 | 18,390 | 18,390 | 18,390 | Observations |

| 0.085 | 0.085 | 0.085 | 0.081 | Pseudo R-squared/R-squared |

| 14.49 *** | Test: INVOP þ INVOP 3 FEMOWN 5 0 | |||

| 13.44 *** | Test: INVOP þ INVOP 3 CONTROL 5 0 | |||

| Main Effect | Moderating Effect | |||||

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

| Constant | 0. 290 * (4.30) | 0.349 ** (5.20) | 0.318 ** (5.19) | 0.239 ** (4.39) | 0.218 ** (4.20) | 0.319 ** (6.30) |

| Lagged ESGP | 0.527 ** (12.20) | 0.326 ** (5.12) | 0.301 ** (5.06) | 0.410 ** (8.12) | 0.328 ** (6.16) | 0.282 ** (4.12) |

| DGT | 0.031 ** (2.08) | 0.023 ** (2.36) | 0.014 ** (2.29) | 0.045 ** (2.38) | 0.051 ** (2.19) | 0.024 ** (1.62) |

| Firm size | 0.061 (1.28) | 0.048 (1.28) | 0.051 (1.10) | 0.032 (1.29) | 0.038 (1.25) | 0.035 (1.28) |

| Firm age | 0.028 (1.026) | 0.134*(2.91) | 0.201 * (4.12) | 0.231*(3.78) | 0.231*(4.01) | 0.177 *(2.78) |

| Profitability | 0.129 * (3.12) | 0.040 (1.26) | 0.030 (1.06) | 0.035 (1.02) | 0.048 (1.26) | 0.030 (1.29) |

| Industry stability | 0.082 (1.28) | 0.102 * (2.41) | 0.147 * (3.01) | 0.208 * (3.88) | 0.204 * (4.06) | 0.214 * (4.78) |

| Industry growth | 0.106 * (2.10) | 0.118 * (2.89) | 0.104 * (2.66) | 0.104 * (2.51) | 0.132 * (2.77) | 0.206 * (4.12) |

| Moderating effect | ||||||

| Product | −0.063(1.52) | |||||

| DGT × product | 0.317 ** (5.07) | |||||

| 0.043 (1.20) | ||||||

| B2B | 0.209 ** (4.12) | |||||

| DGT × B2B | ||||||

| 0.047 (1.29) | ||||||

| IT intensity | 0.431 * (7.10) | |||||

| DGT × IT | 0.107 * (2.18) | |||||

| 0.319 ** (6.12) | ||||||

| UNC | −0.132 * (2.89) | |||||

| DGT × UNC | −0.236 ** (4.20) | |||||

| DYM | 0.218 * (4.12) | |||||

| DGT × DYM | 0.403 ** (7.82) | |||||

| CMX | 0.429 * (8.12) | |||||

| DGT × CMX | 0.633 ** (14.20) | |||||

| MUN | 0.146 * (3.20) | |||||

| DGT × MUN | 0.219 ** (4.01) | |||||

| Model information | ||||||

| Number of observations | 18,390 | 18,390 | 18,390 | 18,390 | 18,390 | 18,390 |

| Dependent Variable ESG Performance | |||||||

|---|---|---|---|---|---|---|---|

| Variables | VIF | (I) OLS | (II) Fixed Effect | (III) 2SLS | |||

| Coefficient | t Statistics | Coefficient | t Statistics | Coefficient | t Statistics | ||

| (Constant) | 1.026 | 129.037 | 11.210 ** | 115.21 | 7.315 | 127.0578 | 9.026 ** |

| DGT | 1.19 | 0.34 | 5.102 ** | 0.519 | 0.599 ** | 0.618 | 0.831 ** |

| Firm size | 1.364 | 0.219 | 4.016 ** | 0.182 | 0.210 ** | 0.254 | 0.305 * |

| 1.005 | 0.062 | 2.002 | 0.205 | 0.251 ** | 0.41 | 0.618 ** | |

| Firm age | 1.218 | 0.318 | 6.195 ** | 0.216 | 0.248 ** | 0.11 | 0.102 |

| 1.204 | 0.057 | 2.027 | 0.084 | 0.129 | 0.195 | 0.219 * | |

| Profitability | 1.417 | 0.299 | 4.027 ** | 0.105 | 0.289 * | 0.219 | 4.072 ** |

| Industry stability | |||||||

| 29.36 ** | 229.18 ** | 29.42 ** | |||||

| Industry growth | |||||||

| F-ratio | |||||||

| Dependent Variable ESG Performance | ||

|---|---|---|

| Variables | Robust Regression | |

| Coefficient | t Statistics | |

| (Constant) | 105.418 | 6.2430 * |

| DGT | 0.401 | 4.143 ** |

| Firm size | 0.289 | 3.120 * |

| 0.081 | 1.032 | |

| Firm age | 0.299 | 3.103 * |

| 0.078 | 1.427 | |

| Profitability | 0.31 | 4.011 ** |

| Industry stability | ||

| 27.59 ** | ||

| Industry growth | ||

| F-ratio | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Agag, G.; Aboul-Dahab, S.; El-Halaby, S.; Abdo, S.; Khashan, M.A. Leveraging Digitalization to Boost ESG Performance in Different Business Contexts. Sustainability 2025, 17, 6899. https://doi.org/10.3390/su17156899

Agag G, Aboul-Dahab S, El-Halaby S, Abdo S, Khashan MA. Leveraging Digitalization to Boost ESG Performance in Different Business Contexts. Sustainability. 2025; 17(15):6899. https://doi.org/10.3390/su17156899

Chicago/Turabian StyleAgag, Gomaa, Sameh Aboul-Dahab, Sherif El-Halaby, Said Abdo, and Mohamed A. Khashan. 2025. "Leveraging Digitalization to Boost ESG Performance in Different Business Contexts" Sustainability 17, no. 15: 6899. https://doi.org/10.3390/su17156899

APA StyleAgag, G., Aboul-Dahab, S., El-Halaby, S., Abdo, S., & Khashan, M. A. (2025). Leveraging Digitalization to Boost ESG Performance in Different Business Contexts. Sustainability, 17(15), 6899. https://doi.org/10.3390/su17156899