1. Introduction

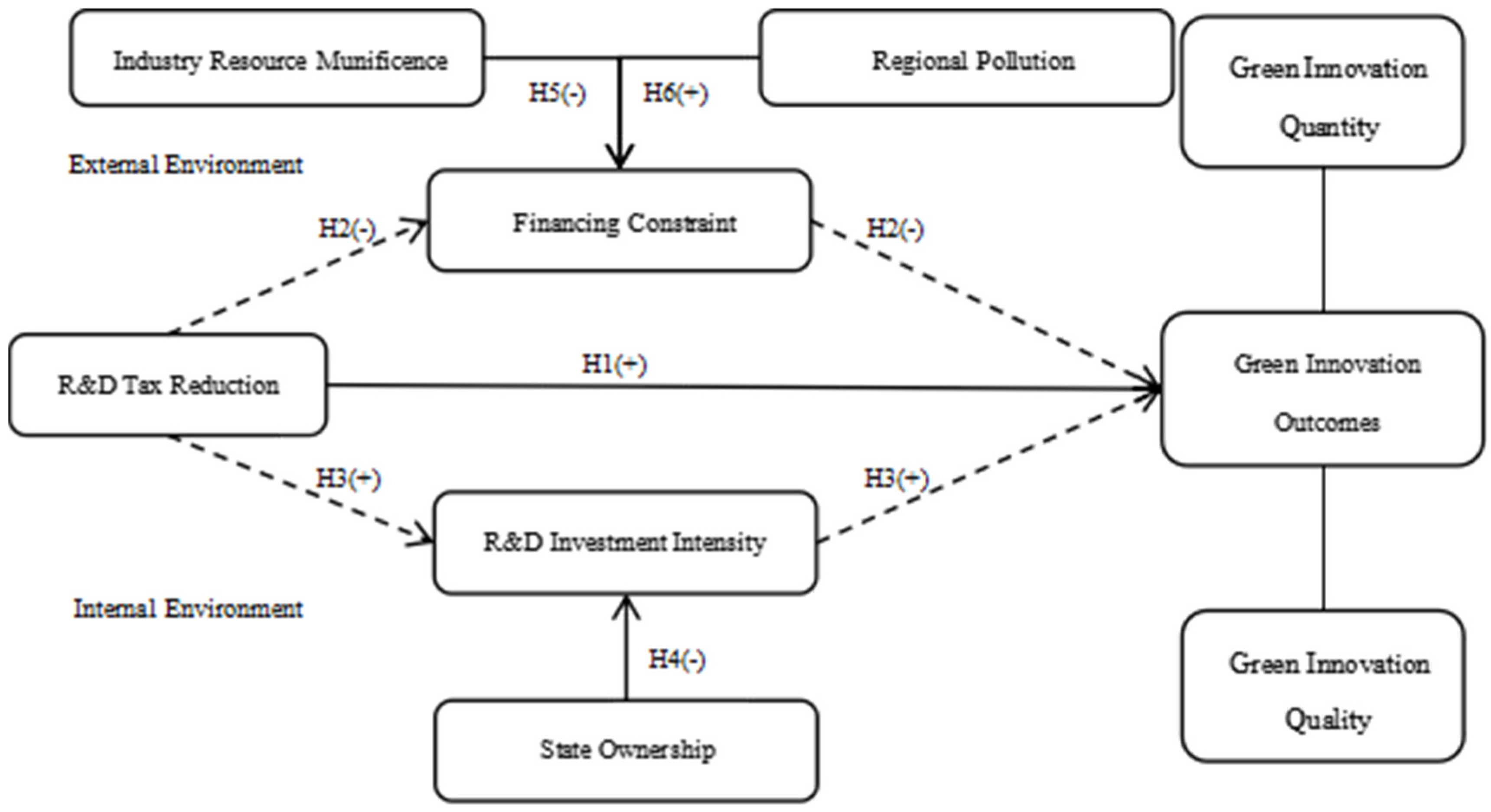

Against the backdrop of intensifying global climate change and escalating calls for sustainable development, green transformation has become a strategically urgent priority on the global modernization agenda. Prior studies systematically explore the antecedent influencing factors of green innovation mainly from three aspects: the individual, firm, and institutional levels. At the individual level, the experiences and backgrounds of management teams (Sang et al., 2024) [

1] directly shape the green innovation path of enterprises. At the firm level, internal capabilities such as R&D funding (Xu et al., 2020) [

2] and technological reserves serve as the key foundation for innovation, providing necessary resources and technical support for innovation activities. At the institutional level, government policies constitute an important component of the institutional environment, with government subsidies and environmental regulations being the two core dimensions. Government subsidies, in the forms of financial allocations, preferential policies, and other forms, on one hand, directly relieve the R&D funding constraints of enterprises (Sun et al., 2022) [

3] and, on the other hand, convey signals of support to reduce external financing costs, motivating enterprises to increase their investment in green technologies (Shi and Zhou, 2024) [

4]. Meanwhile, environmental regulations also act on the innovation willingness and capabilities of enterprises. Peng et al. (2021) [

5] found that environmental regulations promote innovation behavior by enhancing enterprises’ willingness to engage in green innovation.

Governmental preferential policies, such as preferential policies, have become a key instrument for countries to incentivize enterprises’ green innovation. From the perspective of international policy practices, varied preferential policies have taken shape: In 2008, France, in 2010, Australia, and in 2015, Ireland, respectively, transformed their original hybrid R&D tax reductions into simpler volume-based schemes, providing tax credits or allowances for all R&D expenditures. The United States has long adopted an incremental policy, granting preferential treatment only to R&D expenditures exceeding a historical baseline. South Korea, Portugal, and Spain employ “volume + incremental” hybrid tax credits, while the Czech Republic, Slovakia, and Turkey implement hybrid tax allowances. In recent years, most countries have been committed to enhancing the accessibility, simplicity, and generosity of R&D tax reductions, with the choice of policy models being closely linked to the objectives of “increasing the overall scale of R&D” or “encouraging high growth of R&D” [

6]. This aligns with China’s 2017 reform of increasing the tax deduction ratio for R&D expenditures in technology-based SMEs, jointly building a policy ecosystem that incentivizes green innovation.

In academic discourse, the impact of preferential policies on green innovation has continued to garner extensive attention. Existing research has primarily focused on the

“what” question—that is, the effects these preferential policies have on green innovation. However, the findings remain mixed, and scholars have yet to reach a consensus on the overall impact of such policies. On one hand, some scholars argue that preferential policies help internalize the positive externalities of green product innovation, enhance returns, lower risk, and encourage green R&D through leverage mechanisms (Bai et al., 2019; Guo et al., 2018; Dangelico, 2016) [

7,

8,

9]. Others, however, caution that firms may engage in strategic behavior—such as inflating R&D inputs or reallocating funds toward non-innovative purposes—to meet eligibility criteria without substantially enhancing their green technological capabilities (He et al., 2020; Yang et al., 2017) [

10,

11]. These inconsistent findings underscore the complex and multifaceted mechanisms through which such policies operate, as well as the importance of internal and external contingencies in shaping their effectiveness. Consequently,

a more pressing and nuanced question concerns how preferential policies function and when preferential policies prove most effective. Moreover, prior research has predominantly focused on large firms, often neglecting the critical role of SMEs. Given that SMEs represent the majority of firms and their green transformation is essential to the success of nationwide sustainability efforts, this oversight presents a significant gap in the literature (citations). In response to these gaps, this study employs a resource dependence framework—encompassing both internal and external mechanisms—to examine how R&D tax reductions influence green innovation outcomes among SMEs, thereby addressing the

“how” question. Furthermore, we incorporate multi-level analyses to explore the contingency factors that moderate these dependence relationships, shedding light on the

“when” question by identifying the conditions under which policy interventions are more or less effective.

This study leverages China’s 2017 policy reform, which raised the tax-deductible proportion of R&D expenditures for technology-based SMEs, as a quasi-natural experiment to empirically examine the proposed theoretical framework. Due to their limited operational scale, relatively weak capacity for risk management, and pronounced information asymmetries, SMEs tend to rely heavily on preferential government policies (Dong and Men, 2014) [

12]. Guided by resource dependence theory (Pfeffer and Salancik, 1979) [

13], we argue that such reliance on governmental resources grants the state a considerable degree of regulatory influence over firms’ strategic behavior. In this context, preferential policies, particularly R&D tax reductions, perform a dual role. Internally, they reduce firms’ actual tax burdens and enhance financial liquidity, thereby strengthening firms’ capacity for innovation. Externally, these policies signal improved creditworthiness to external stakeholders, contributing to the alleviation of financing constraints. Furthermore, we contend that the effectiveness of preferential policies is shaped by a range of contextual contingencies that alter the nature of resource dependence. Specifically, firms operating in resource-constrained industries, those with non-state ownership, and those located in environmentally degraded regions are more reliant on preferential policies and related government support. This heightened dependence increases the responsiveness of such firms to preferential policies, thereby amplifying the intended incentive effects. We select SMEs listed on the Small- and Medium-sized Enterprise Board, the Growth Enterprise Market, and the National Equities Exchange and Quotations (commonly known as the New Third Board) from 2013 to 2020 as the sample for empirical analysis. The regression results consistently support our theoretical hypotheses, confirming the robustness and explanatory power. To further ensure the validity of our findings, we conduct a series of robustness checks, including alternative model specifications, placebo tests, and propensity score matching, all of which continue to provide statistically significant support for our core hypotheses.

This study makes several important contributions. First, it integrates the resource dependence perspective and develops a dual-mediation framework through which R&D tax reductions influence green innovation, specifically, by lowering marginal R&D costs and alleviating financing constraints, thereby addressing the “how” question in the existing literature. Second, this study extends this framework by examining multi-level contingency factors that moderate these dependence relationships, offering a coherent and comprehensive explanation of “when” preferential policies are most effective. Third, by focusing on SMEs, this research addresses the prevailing large-firm bias in prior studies and enhances the generalizability of policy evaluations across different firm sizes. In doing so, this study also offers practical insights for policymakers and SMEs seeking to advance green transformation efforts.

4. Results

4.1. Baseline Results

Table 3 presents the results of our baseline regressions. Column (1) reports results without controlling for covariates, while Column (2) includes all control variables. The results show that the DID interaction term is significant in both cases, indicating that R&D tax reductions for small- and medium-sized enterprises significantly promote

green innovation at a 0.1% confidence level. Column (3) shows the results of analyzing with the Diff command, and it can be seen that its coefficient is similar to the original method, leading to a robust conclusion that H1 is true.

Columns (4) to (6) show the research models with the quality of green innovation as the dependent variable, and their analysis results are basically consistent with those with the quantity of green innovation as the dependent variable.

4.2. Analysis of Mediating Effects

According to the analysis of the mediation effect in the model based on the original hypothesis, we first estimate the direct effect of policy implementation and its impact on

corporate green innovation through reducing

financing constraints and promoting increased

R&D investment. The results show that tax reductions have reduced corporate

financing constraints and increased

R&D investment intensity. Both effects have a significant positive impact on the corporate

green innovation index, further supporting H2 and H3. The results are shown in

Table 4.

Among them, Columns (1) and (2) indicate that the R&D tax policy coefficient (did) for the KZ is −0.448 **, suggesting that the policy effectively reduces corporate financing constraints, which aligns with theoretical expectations. However, it is important to note that the KZ index is an inverse indicator; a decrease in its value indicates a reduction in financing constraints. The financing constraint coefficient is −0.010 * (p < 0.1), indicating that the higher the degree of financing constraints, the lower the level of green innovation. This result is consistent with the expectations of financing constraint theory, but the effect size is relatively small.

The third to sixth columns conducted triangular verification using the WW index and SA index, respectively, indicating the robustness of this mediating variable result and eliminating model issues caused by multicollinearity.

Columns (7) and (8) show that the regression coefficient of R&D tax reductions on R&D intensity is 0.485 (1%), indicating that R&D tax reductions significantly increase the R&D intensity of enterprises, meeting the second requirement for the mediation effect test. When both policy and R&D intensity are included, the coefficient of R&D intensity is 0.658 (1%), suggesting a significant positive impact on green innovation. The coefficient of R&D tax reductions decreases from 0.846 to 0.526 but remains significant (1%).

Subsequently, a mediation effect analysis was conducted using

green innovation quality as the dependent variable. The results showed that the coefficient of R&D tax reduction on the KZ index was −0.448 **, indicating that policy implementation significantly alleviated corporate

financing constraints. The coefficient of

financing constraints on

green innovation quality was −0.010 (10%), suggesting that higher financing constraints correspond to lower green innovation quality. From the perspective of

R&D investment, the coefficient of R&D tax reduction on

R&D intensity (

lrdratio) was 0.485 (1%), while the coefficient of

R&D intensity on

green innovation quality was 0.658 (1%). This further validates the original hypothesis (

Table 5 and

Table 6).

The regression results presented in Columns (1) and (2) demonstrate the effects after incorporating mediating variables into the baseline model, with Column (1) analyzing green R&D investment intensity (greenrd) and Column (2) examining green patent quality (greenrdq) as dependent variables. The key independent variable, GP (R&D tax reductions), maintains strongly positive and statistically significant coefficients, confirming that government support consistently promotes both the quantity and quality of corporate green innovation. Notably, the financial constraint variable KZ shows significantly negative coefficients, suggesting that firms facing financing difficulties tend to reduce green innovation activities, with this inhibitory effect being more pronounced for patent quality than investment intensity.

The analysis reveals particularly interesting findings regarding the centered variables (prefixed with c_). The centered financial constraint measure c_KZ exhibits negative coefficients, indicating that firms deviating from average financial constraints show reduced green innovation, possibly due to either excessive financial slack or severe constraints. Conversely, the centered R&D ratio c_lrdratio demonstrates positive effects (0.164 and 0.347 ***), suggesting that firms maintaining R&D investment above industry level are more likely to achieve both higher green innovation input and output quality. The substantially larger coefficient for c_lrdratio in Column (2) implies that sustained R&D investment contributes more significantly to innovation quality than quantity.

The models show good explanatory power with adjusted R-squared values of 0.342 and 0.435, respectively, and maintain consistency through the inclusion of both year and firm fixed effects. The results underscore the importance of considering both direct policy effects and mediating financial factors when analyzing corporate green innovation behavior, while the differential impacts on innovation quantity versus quality provide nuanced insights for policymaking. The centering approach helps isolate the pure marginal effects of financial constraints and R&D intensity by removing baseline differences, thereby offering more precise estimation of these variables’ influence on green innovation outcomes.

The results of the Variance Inflation Factor tests presented in

Table 7 demonstrate that the mediating variables in our regression model exhibit acceptable levels of multicollinearity, with all VIF values falling within a reasonable range between 2.03 and 3.27. These values are substantially below the commonly recommended threshold of 5, indicating no severe multicollinearity concerns that would compromise the stability or interpretability of our regression estimates. The reciprocal VIF values, ranging from 0.306 to 0.493 with a mean of 0.439, further confirm this conclusion, as none approach the problematic threshold of 0.5. While the “did” variable shows a moderately higher VIF of 3.27 compared to other predictors, this level remains within acceptable bounds and does not necessitate variable removal. The majority of variables cluster in the 2.0–2.5 VIF range, suggesting well-balanced independence among predictors. It is worth noting that certain variables like KZ and lrdratio appear multiple times with slightly different values, likely reflecting alternative model specifications. The overall pattern of results supports the appropriateness of our model specification and provides confidence in proceeding with the planned mediation analysis without requiring multicollinearity corrections. These findings suggest that the regression coefficients can be interpreted meaningfully, though researchers may wish to monitor variables with VIFs above 2.5 in sensitivity analyses as a precautionary measure. The absence of extreme VIF values reinforces the robustness of our analytical approach and the reliability of subsequent statistical inferences drawn from this model.

4.3. Heterogeneity Analysis—Moderating Effects

Table 8 and

Table 9 present the results of heterogeneity analysis on

the quantity and

quality of green innovation, categorized by whether they are state-owned enterprises, whether they belong to heavily polluting industries, and different levels of urban innovation. In terms of equity nature, state-owned enterprises do not significantly benefit from R&D tax reductions, possibly because their nature inherently emphasizes environmental protection and

green innovation, thus excluding the significant improvement in

green innovation driven by R&D tax reductions. Moreover, state-owned enterprises may already possess a high level of environmental awareness and green innovation capabilities, so the effect of tax reductions on enhancing their

green innovation is not significant. In contrast, non-state-owned enterprises are more likely to be guided by tax reductions to engage in

substantial green innovation. From the perspective of

ROA of industries, only low

ROA enterprises show significant results. Regarding

PM pollution levels, enterprises in cities with lower

PM pollution levels have stronger policy promotion effects.

The regression results presented in the table demonstrate the robustness of our research model examining the impact of R&D tax reductions on corporate green innovation, particularly through heterogeneity analysis using key grouping variables. Three critical moderating variables were selected for subgroup analysis: non-state-owned enterprises (non-SOE), firms with low return on assets (lowROA), and enterprises with high PM2.5 emissions (PM). The consistent statistical significance (at the 1% level) of these variables across all model specifications confirms their robust moderating effects. Notably, the coefficients for non-SOE remain positive and highly significant, suggesting that GP particularly effectively stimulates green innovation in private enterprises compared to their state-owned counterparts. Similarly, the lowROA variable shows remarkably stable coefficients, indicating that financially constrained firms respond more strongly to environmental R&D tax reductions. The PM variable exhibits an interesting pattern, with its impact magnitude increasing substantially in the greenrdq models (from 0.043 to 0.665 *), implying that high-pollution firms demonstrate particularly pronounced responses in quality-oriented green innovation. The inclusion of year and firm fixed effects (Year Y; Id Y) across all specifications, along with consistently large sample sizes (N = 7048) and satisfactory adjusted R-squared values (ranging from 0.056 to 0.253), further reinforces the model’s reliability. These findings collectively validate that our core conclusions about the heterogeneous effects of GP on green innovation hold across different firm characteristics and innovation quality measures (See

Table 10).

4.4. Robustness Test

4.4.1. Parallel Trend Test

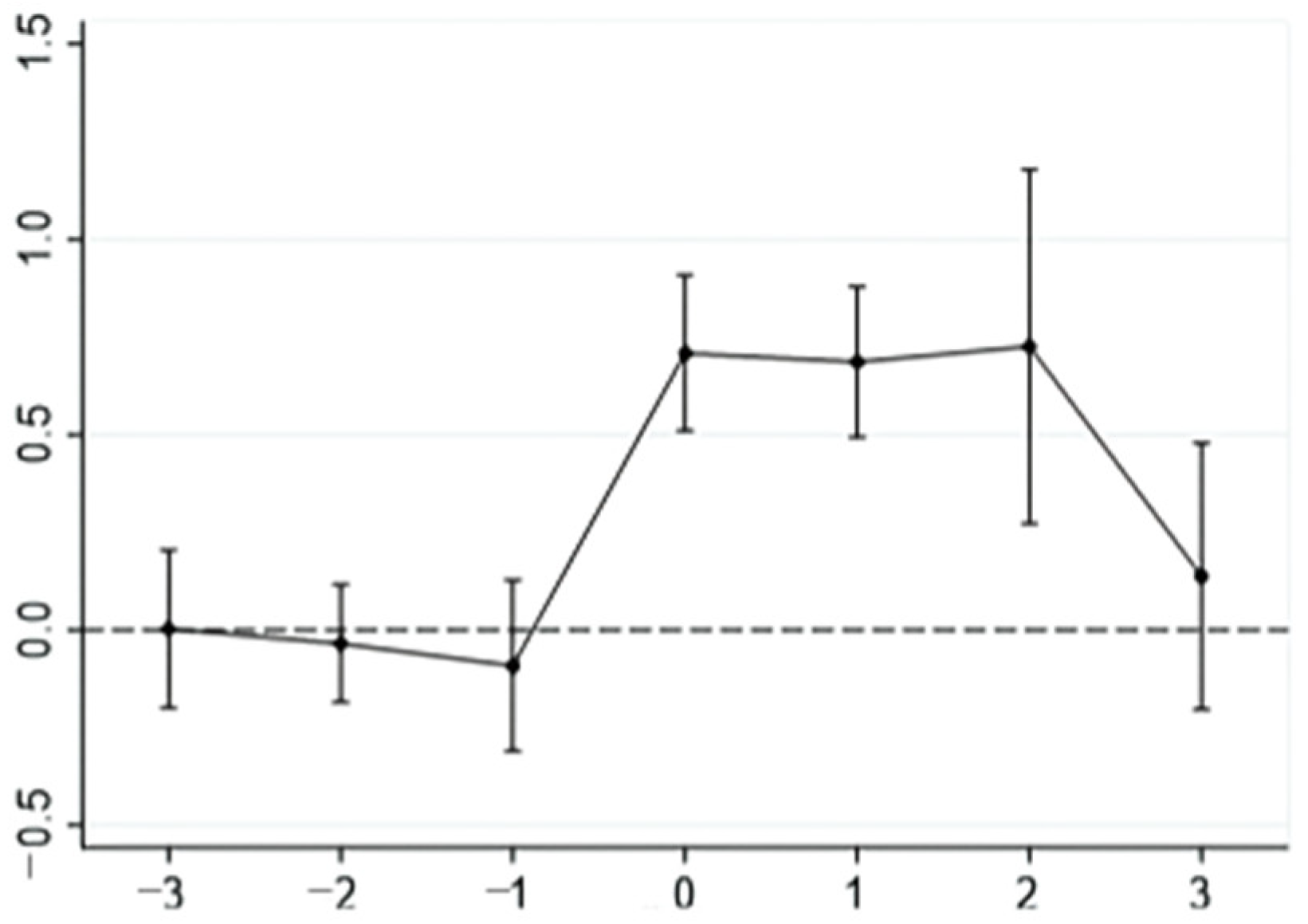

To verify that the green innovation trends of firms affected by policy (the treatment group) and those unaffected by policy should be parallel in the absence of R&D tax policy intervention, this section compares the changes in green innovation indicators before and after policy implementation using a parallel assumption test. The coefficients and significance levels of the interaction term are examined through testparm; the p-value is significantly less than 0.001, indicating that the parallel trend hypothesis holds. The parallel trend was also tested graphically, as shown in the following figure: before policy implementation, the two lines showed a parallel trend, but after implementation, a significant difference emerged.

Furthermore, the event study method was used to conduct parallel trend tests. The results showed that the first three periods of the policy met the requirements for parallel trend tests. During the policy period, the confidence intervals for all three experimental periods did not include 0. After the policy period ended, the confidence interval included 0 again. In this study, the parallel trend test criteria were fully met, and the testing standards were satisfied.

The analysis in this study examines the confidence intervals across seven consecutive periods, spanning from Period −3 to Period 3. The mean values demonstrate a clear upward trend over time, starting at 0 in Period −3 and progressively increasing to 0.734 by Period 0 (See

Figure 2).

In the initial periods (−3 to −1), the confidence intervals are relatively narrow, reflecting lower variability in the data. Although the mean points of the −2 period and the −1 period are not at 0, their confidence intervals still contain 0, which means they are still in a relatively parallel range. The transition to positive periods (0 through 3) reveals both higher mean values and greater dispersion.

The insignificant parallel trend test in the third policy period reflects the diminishing effect of the R&D tax reductions over time. R&D tax reductions often have a short- to medium-term impact, as firms exhaust their capacity to respond to the policy. By the third period, the marginal benefit of the policy could fade, leading to convergence between treated and control groups. Firms may have already optimized their behavior in earlier policy phases, leaving little room for additional effects in later stages. This aligns with the “front-loading” phenomenon common in policy evaluations.

4.4.2. Placebo Experiment

Table 11 presents the results of further placebo experiments, with

policy implementation times advanced by one and two periods, respectively. The results show that the did coefficient remains significant. Considering the possibility of other concurrent policies affecting the outcomes, further analysis is needed for verification. Meanwhile, Column (3) shows the regression conducted without the influence of this policy, where the DID coefficient is negative, inconsistent with the experimental results, further confirming the robustness of the findings.

4.4.3. PSM-DID

First of all, the balance of covariates was tested. The results showed that all covariates passed the balance test. Afterward, the model was matched with nearest neighbors, and the results remained significant. Upon further processing, the benchmark regression was analyzed again, and fixed effects were added; both analyses yielded significant results. Then, the model was matched with calipers, indicating that the model passed the caliper match, further confirming its robustness (

Table 12).

The empirical analysis employs a propensity score matching and Difference-in-Differences approach to evaluate the treatment effects on both the quantity and quality of green innovation. The baseline PSM-DID results demonstrate statistically significant positive effects, with the treatment variable showing coefficients of 0.179*** for innovation quantity and 0.277*** for innovation quality. These estimates, derived from models incorporating year and firm fixed effects along with comprehensive controls, establish a robust foundation for the treatment’s efficacy.

To validate the findings, multiple robustness checks were conducted. For instance, nearest-neighbor matching (1:1 without replacement) yielded a treatment coefficient of 0.172* for innovation quantity (greenrd), aligning with the baseline result. Caliper matching (δ = 0.01) further confirmed robustness, with coefficients of 0.181* (greenrd) and 0.269* (greenrdq)**. Additionally, placebo tests using pseudo-treatment groups showed insignificant effects (p > 0.1), ruling out spurious correlations. These results collectively reinforce the conclusion that the treatment significantly enhances both the scale (quantity) and value (quality) of green innovation.

4.4.4. Other Robustness Tests

Furthermore, this study conducts the following robustness tests: 1. The measurement of green innovation levels is changed to the proportion of green innovation in the current year, as shown in Columns (1) and (2). 2. Considering the varying implementation efforts and levels across different regions, this study introduces provincial-level control variables to account for unobservable factors at the regional level, as shown in Columns (3) and (4). 3. To avoid the impact of missing observations from individual companies on the regression results, samples with missing data during the study period are excluded and re-returned to the regression, as shown in Columns (5) and (6). 4. Excluding other policy interference and adding other policies that affect the green innovation of enterprises, this study selects pilot policies with similar times, including green finance pilot, low-carbon city pilot, and green factory identification, as shown in (7) and (8). 5. Considering the differences in industry demand for green innovation, most of the main bodies of green innovation are manufacturing enterprises, and heavy polluting industries have a greater demand for green innovation. Therefore, only manufacturing and heavy polluting industries are retained for regression. The results are shown in Columns (9) and (10). All these results indicate that the conclusions of this study remain valid after robustness tests (

Table 13).

5. Discussion

5.1. Theoretical Contribution

Our study aims to make the following theoretical contributions. First, grounded in RDT, our study develops a dual-mediation analytical framework that identifies and verifies the mechanisms through which preferential policies promote green innovation by enhancing internal R&D investment intensity and alleviating external financing constraints. In contrast to the existing literature that primarily focuses on direct policy effects or isolated mechanisms, our study emphasizes the synergistic effect between internal innovation capacity enhancement and external financial environment improvement, thereby systematically unpacking how policy instruments shape corporate green transformation through resource allocation channels. This mechanism-based explanation not only expands the research on policy impact pathways in the green innovation literature but also deepens the applicability of RDT in the context of green transition, addressing the theoretical gap surrounding the question of how preferential policies take effect.

Second, our study extends the theoretical lens of RDT by identifying multi-level contextual factors that moderate the effectiveness of tax reductions. By incorporating the firm ownership type, industry resource munificence, and regional pollution level as moderating variables, we find that the positive effect of tax reductions on green innovation is more pronounced among firms with non-state ownership, those operating in resource-constrained industries, and those located in regions with higher levels of pollution. These findings suggest that preferential policies are not equally effective across contexts but rather more pronounced under specific dependence conditions. This insight enriches the theoretical understanding of resource dependence dynamics under evolving institutional environments and provides a clear analytical framework for answering the question of when tax reductions are most effective, thereby extending the boundary conditions and contextual applicability of RDT in preferential policy research.

Third, our study focuses on SMEs, a pivotal but under-researched group in green transformation, thereby addressing the structural bias in the existing literature that tends to concentrate on large firms. Under the RDT framework, we demonstrate that SMEs, due to their inherent resource vulnerabilities, are more responsive to preferential policies. By empirically identifying the significant positive effects of tax reductions on both the quantity and quality of green innovation among SMEs, our study expands the theoretical scope of green innovation policy research across firm size dimensions, deepens the understanding of behavioral responses in high-dependence organizational contexts, and enhances the applicability and explanatory power of RDT within heterogeneous firm structures.

Fourth, this study compares policy designs across multiple jurisdictions, providing cross-institutional evidence to support the generalizability of its findings. For example, South Korea’s cap-and-trade program—targeting NO

x;, SO

x, and particulate emissions from 136 factories—promoted green patenting both before and after implementation, supporting the view that “policy interventions drive innovation through resource injection” (Tolliver et al., 2020) [

47]. In northern Italy, the Emilia-Romagna R&D subsidy program boosted patent applications, especially among small firms (Bronzini and Piselli, 2016) [

48], reinforcing this study’s conclusion that “resource-constrained firms are more responsive to policy incentives.” Similarly, OECD data show that R&D tax incentives yield an average ratio of 1.4, with stronger effects on experimental development than on basic research [

49]. This aligns with this study’s finding that “R&D tax relief enhances both the quantity and quality of green innovation in SMEs.” Together, these cases illustrate how resource dependency interacts with institutional environments to shape the effectiveness of innovation-driven policies. This contributes a cross-national framework for understanding the heterogeneous impacts of green innovation policies, moving beyond the constraints of single-context theoretical models.

5.2. Practical Implications

The findings of our study offer several important implications for policymakers seeking to improve the effectiveness of preferential policies. First, greater policy attention should be directed toward non-state-owned SMEs, which typically possess weaker resource endowments and higher dependence on external reductions. Priority should be given to these firms in terms of eligibility criteria and application procedures to improve the efficiency of policy resource allocation. Second, for industries with severe resource constraints, tax reductions should be supplemented with industry-specific tools—such as innovation subsidies, R&D vouchers, or university-industry collaboration support—to strengthen firms’ capacity to absorb and utilize policy resources. Third, in heavily polluted regions, tax reductions should be aligned with local environmental governance goals. For example, green innovation subsidies could be linked with regional emission reduction targets or integrated into carbon trading schemes to foster synergy between environmental performance and fiscal support.

For firms, the findings of our study highlight the need to act on two fronts during the green transition. First, firms should increase sustained investment in green R&D to strengthen their internal technological capabilities and enhance long-term innovation output. Second, they should actively identify and respond to government incentives, such as preferential policies, to alleviate financing constraints and reduce R&D costs by leveraging external institutional resources. For SMEs in particular, establishing a dual-drive mechanism that combines internal capacity building with external policy alignment can facilitate steady progress in green transformation amid both policy support and market pressures.

5.3. Limitations and Future Research

There are many deficiencies in the data, research perspectives, and methods of this study, which need to be further improved in the future to reveal the mechanism of preferential tax policies on the green innovation of SMEs in a more comprehensive and in-depth manner.

This study has explored the moderating effect of firm heterogeneity (such as ownership and industry differences) on policy effects, but the corporate governance, market competition, and industry sustainable development interactions of factors are still worth digging into. For example, this study analyzes the differences in the innovation response of enterprises with different governance structures under tax reductions or explores the impact of industry technology maturity on the effect of R&D tax reductions. In addition, it is necessary to conduct in-depth research on the potential negative effects of tax policies, such as exploring whether enterprises have short-term innovation behaviors, whether they are overly dependent on policy subsidies, and how to optimize policy design to avoid incentive distortions.

Through the DID method and the mediating effect model, we clearly reveal the short-term impact mechanism of tax reductions. The implementation of the fourth phase of the Golden Tax will bring more refined tax collection and sustainable management and data collection capabilities and provide new possibilities for the accurate matching of tax policies and enterprise innovation behaviors. Combined with new tax big data, such as the fourth phase of the Golden Tax, the dynamic matching relationship between policies and corporate behaviors can be more accurately evaluated. Future research can extend the observation window and explore the long-term cumulative effects of policies, such as whether firms form a stable green innovation path dependence due to continuous policy support.