Will Road Infrastructure Become the New Engine of Urban Growth? A Consideration of the Economic Externalities

Abstract

1. Introduction

2. Literature Review

2.1. Highway Economic Effect and Its Function Conversion

2.2. The Evaluation Methods

3. Case Background

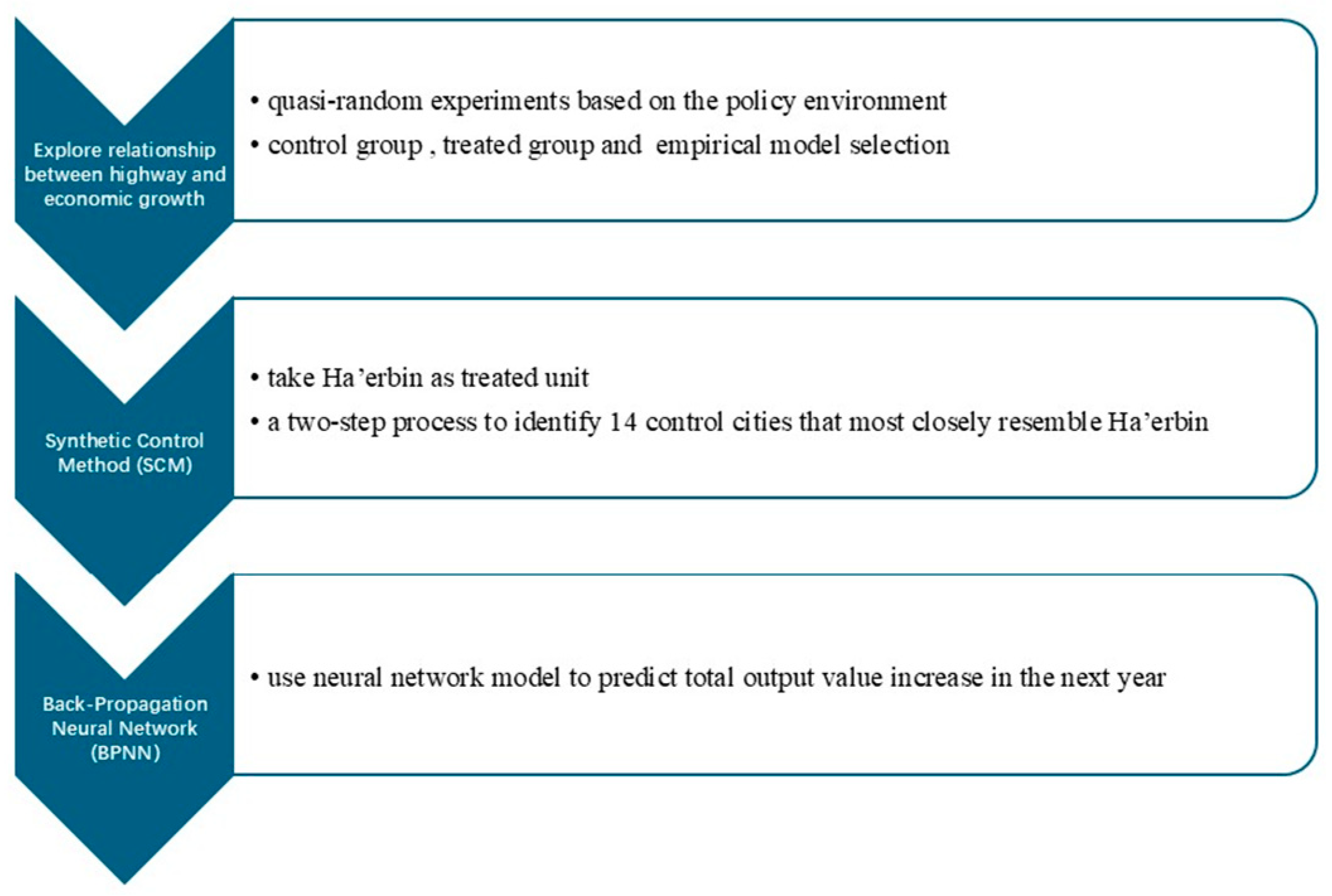

4. Research Method and Data

4.1. Selection of Control Cities

4.2. Back-Propagation Neural Network

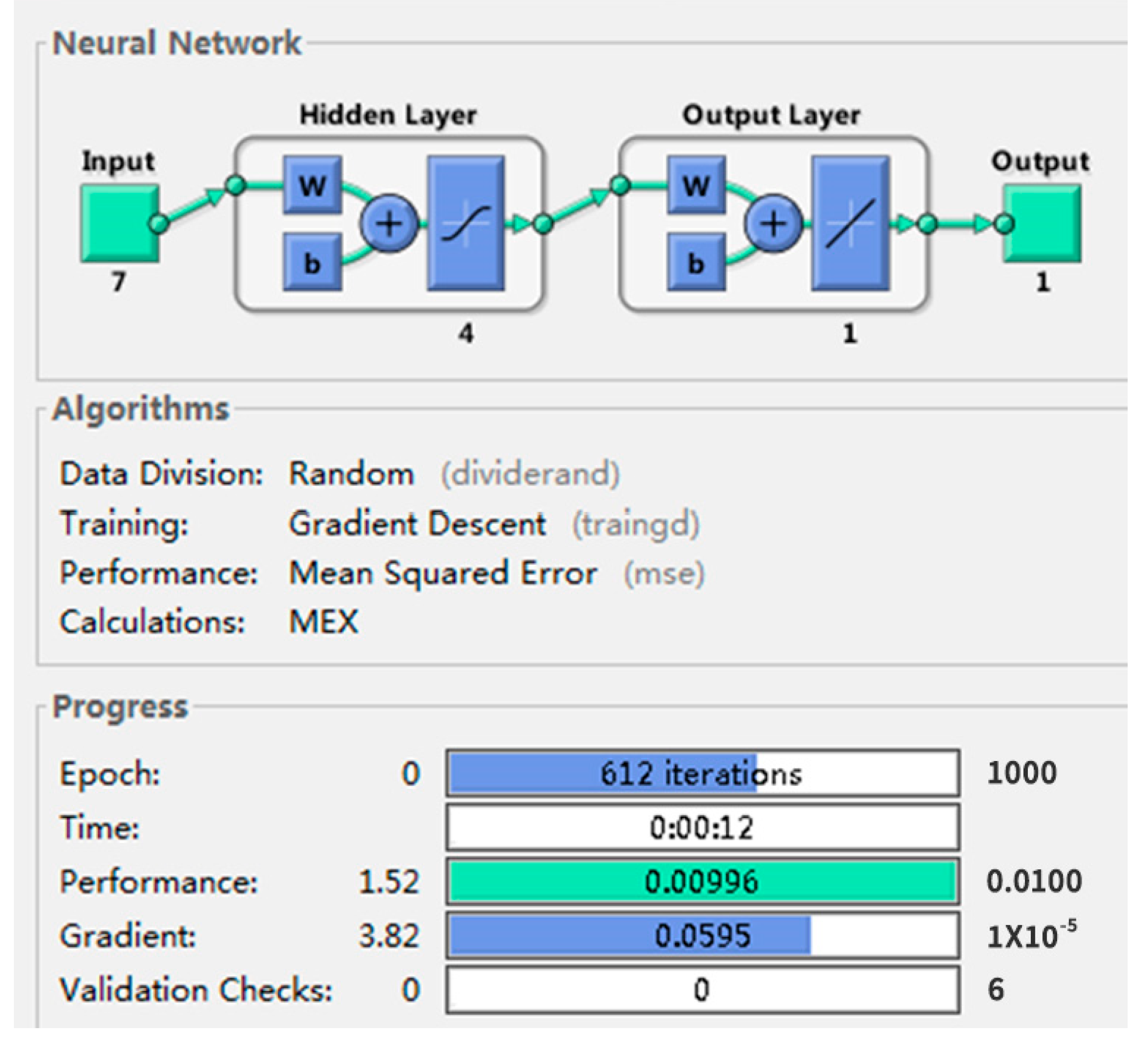

4.2.1. The Back-Propagation Neural Network Algorithm Model

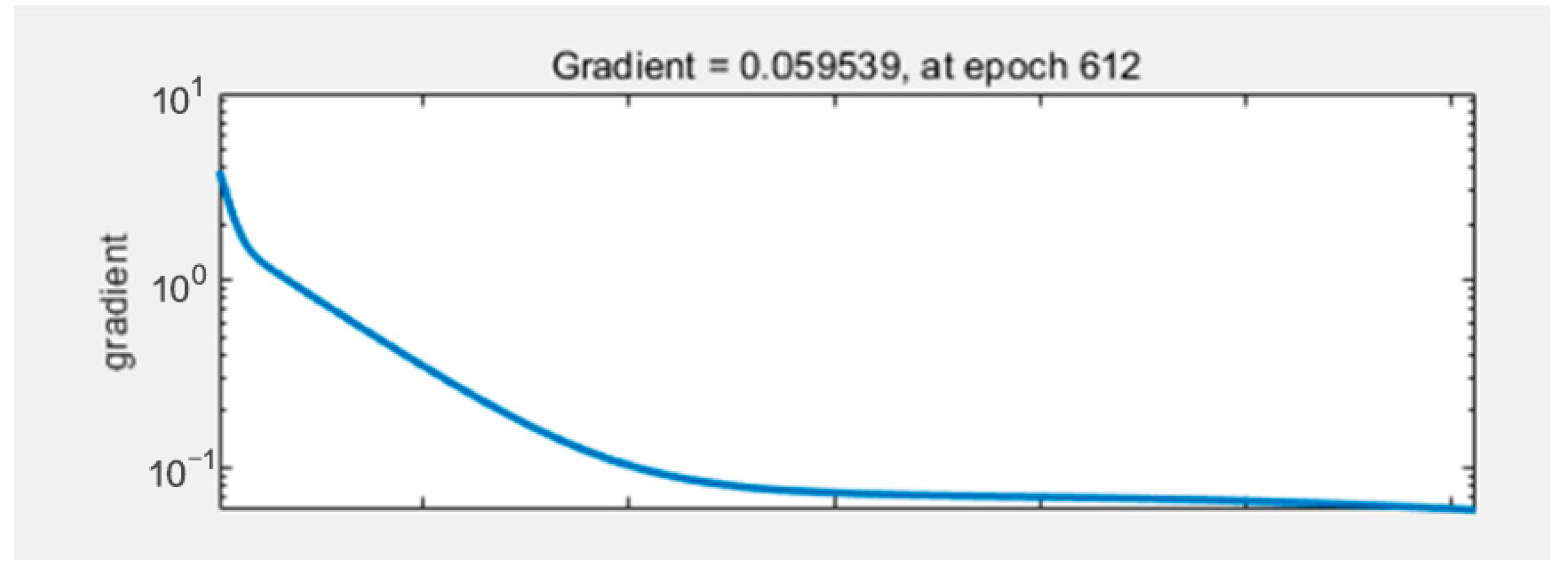

4.2.2. Network Model Solving and Designing

5. Results

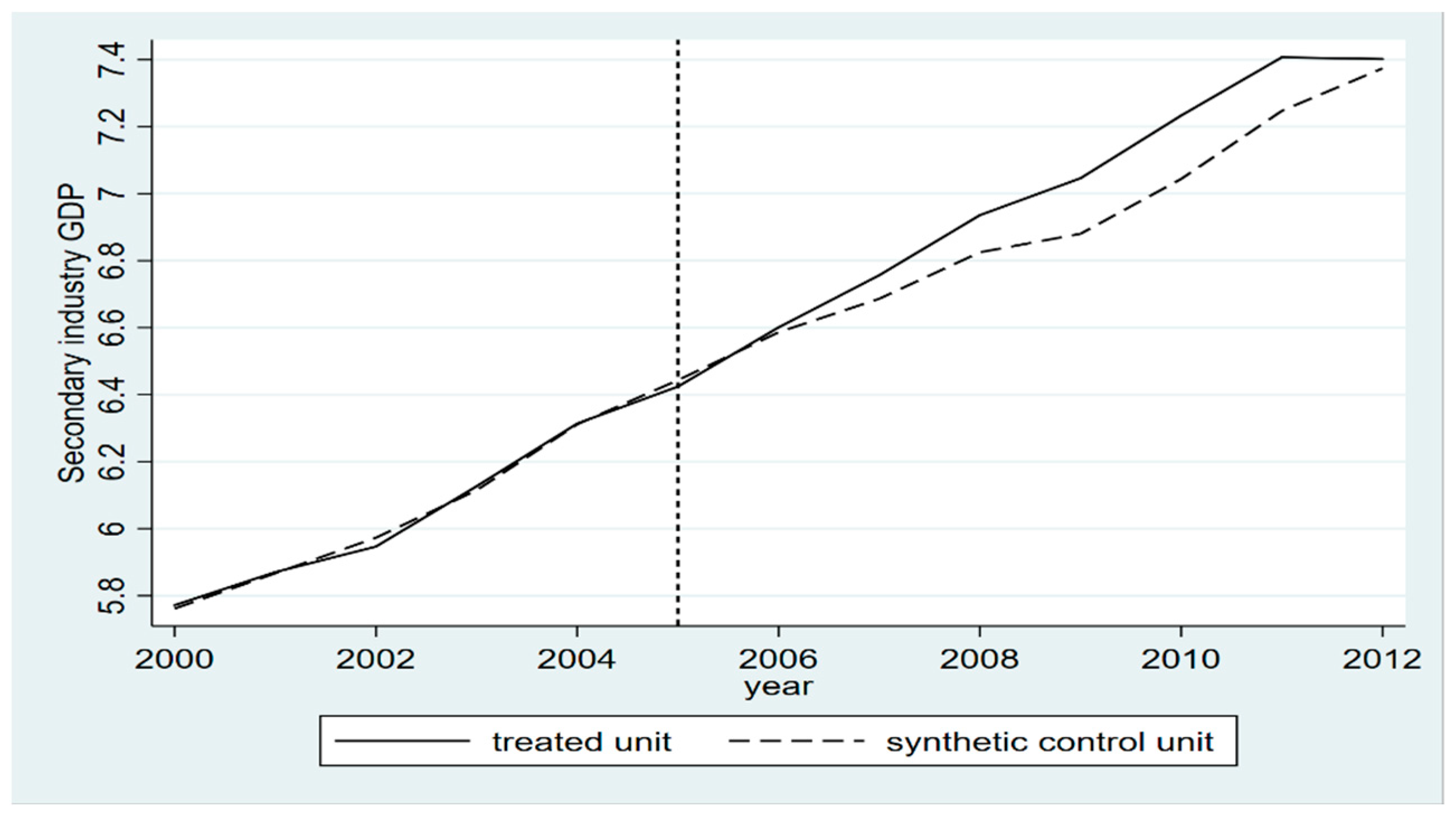

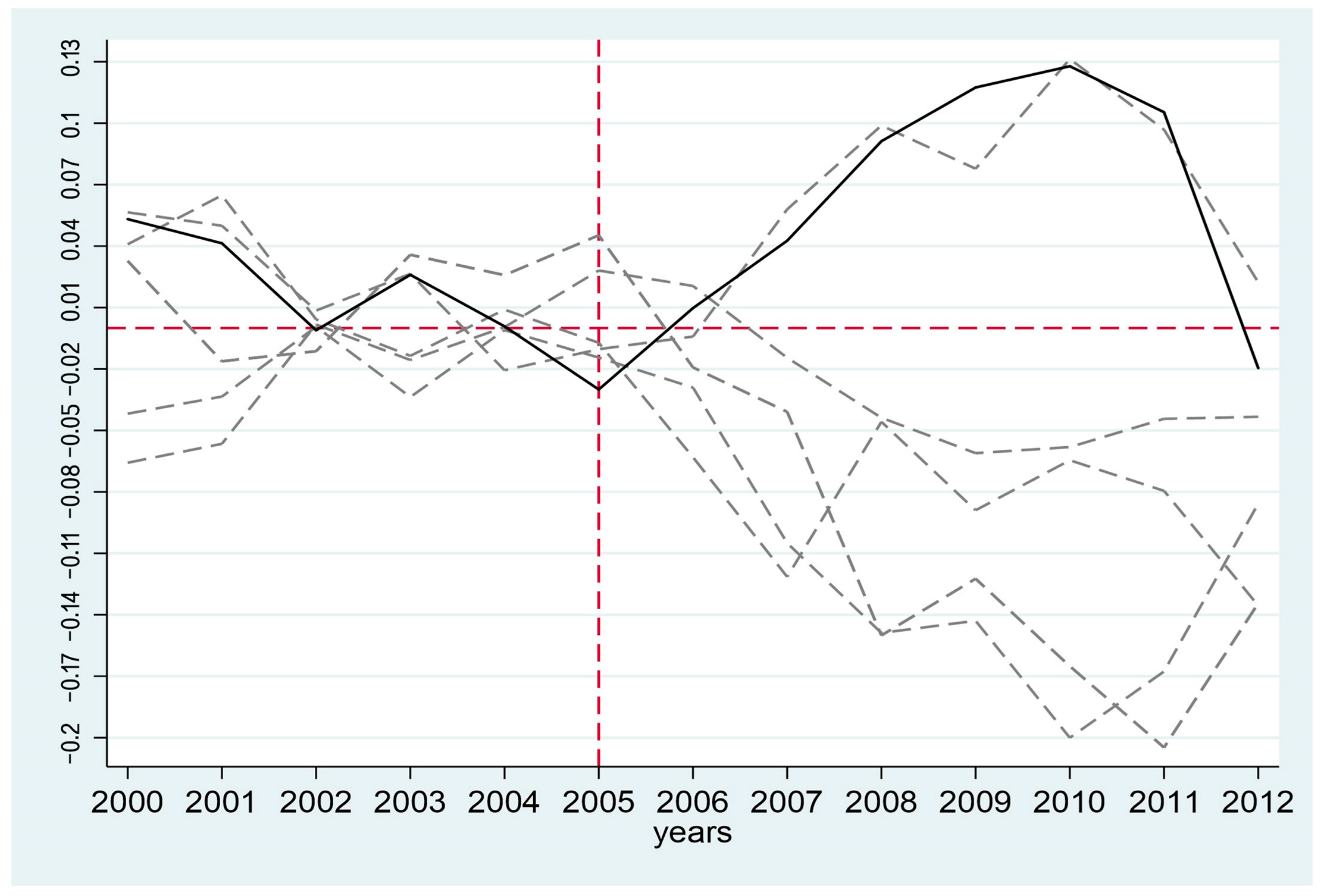

5.1. SCM Analysis at the City Level

5.2. Firm-Level SCM-BP Neural Network Predict by Using Controls from SCM

6. Conclusions and Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Code | Meaning |

| 13 | Processing of Agricultural and Sideline Products |

| 14 | Food Manufacturing |

| 15 | Manufacture of Alcoholic Beverages, Beverages and Refined Tea |

| 16 | Tobacco Products Manufacturing |

| 17 | Textile Industry |

| 18 | Textile Wearing Apparel and Accessories Manufacturing |

| 19 | Leather, Fur, Feather Products and Footwear Manufacturing |

| 20 | Wood Processing and Manufacture of Wood, Bamboo, Rattan, Palm and Straw Products |

| 21 | Furniture Manufacturing |

| 22 | Paper and Paper Products Manufacturing |

| 23 | Printing and Reproduction of Recorded Media |

| 24 | Manufacture of Cultural, Educational, Sporting and Entertainment Products |

| 25 | Petroleum, Coal and Other Fuel Processing Industry |

| 26 | Manufacture of Chemical Raw Materials and Chemical Products |

| 27 | Pharmaceutical Manufacturing |

| 28 | Manufacture of Chemical Fibers |

| 29 | Manufacture of Rubber and Plastics Products |

| 30 | Manufacture of Non-metallic Mineral Products |

| 31 | Smelting and Rolling of Ferrous Metals |

| 32 | Smelting and Rolling of Non-ferrous Metals |

| 33 | Manufacture of Metal Products |

| 34 | Manufacture of General-purpose Machinery |

| 35 | Manufacture of Special-purpose Machinery |

| 36 | Manufacture of Motor Vehicles |

| 37 | Manufacture of Railway, Shipbuilding, Aerospace and Other Transport Equipment |

| 38 | Manufacture of Electrical Machinery and Equipment |

| 39 | Manufacture of Computers, Communication and Other Electronic Equipment |

| 40 | Manufacture of Instruments and Meters |

| 41 | Other Manufacturing |

| 42 | Comprehensive Utilization of Waste Resources |

References

- Li, H.; Hu, T.; Ma, X.; Cheng, B. The Impact of Transportation Infrastructure on the Regional Economic Integration in China:A CGE Analysis. Int. Rev. Econ. Financ. 2025, 99, 104045. [Google Scholar] [CrossRef]

- Zou, Y.; Xiao, G.; Li, Q.; Biancardo, S.A. Intelligent Maritime Shipping: A Bibliometric Analysis of Internet Technologies and Automated Port Infrastructure Applications. JMSE 2025, 13, 979. [Google Scholar] [CrossRef]

- Chen, X.; Wu, S.; Shi, C.; Huang, Y.; Yang, Y.; Ke, R.; Zhao, J. Sensing Data Supported Traffic Flow Prediction via Denoising Schemes and ANN: A Comparison. IEEE Sens. J. 2020, 20, 14317–14328. [Google Scholar] [CrossRef]

- Liu, Z.; Zeng, S.; Jin, Z.; Shi, J. Transport infrastructure and industrial agglomeration: Evidence from manufacturing industries in China. Transp. Policy 2022, 121, 100–112. [Google Scholar] [CrossRef]

- Bian, F.; Yeh, A.G. Spatial–economic impact of missing national highway links on China’s regional economy. Transp. Res. Part D Transp. Environ. 2020, 84, 102377. [Google Scholar] [CrossRef]

- Jiang, X.; He, X.; Zhang, L.; Qin, H.; Shao, F. Multimodal Transportation Infrastructure Investment and Regional Economic Development: A Structural Equation Modeling Empirical Analysis in China from 1986 to 2011. Transp. Policy 2017, 54, 43–52. [Google Scholar] [CrossRef]

- Chen, Z.; Li, Y.; Wang, P. Transportation Accessibility and Regional Growth in the Greater Bay Area of China|Request PDF. Transp. Res. Part D Transp. Environ. 2020, 86, 102453. [Google Scholar] [CrossRef]

- Wang, H.; Han, J.; Su, M.; Wan, S.; Zhang, Z. The Relationship between Freight Transport and Economic Development: A Case Study of China. Res. Transp. Econ. 2021, 85, 100885. [Google Scholar] [CrossRef]

- Witte, P.; Wiegmans, B.; Rodrigue, J.-P. Competition or Complementarity in Dutch Inland Port Development: A Case of Overproximity? J. Transp. Geogr. 2017, 60, 80–88. [Google Scholar] [CrossRef]

- Van Klink, H.A.; Van Den Berg, G.C. Gateways and Intermodalism. J. Transp. Geogr. 1998, 6, 1–9. [Google Scholar] [CrossRef]

- Wilmsmeier, G.; Monios, J.; Lambert, B. The Directional Development of Intermodal Freight Corridors in Relation to Inland Terminals. J. Transp. Geogr. 2011, 19, 1379–1386. [Google Scholar] [CrossRef]

- Ng, A.K.Y.; Ducruet, C.; Jacobs, W.; Monios, J.; Notteboom, T.; Rodrigue, J.-P.; Slack, B.; Tam, K.; Wilmsmeier, G. Port Geography at the Crossroads with Human Geography: Between Flows and Spaces. J. Transp. Geogr. 2014, 41, 84–96. [Google Scholar] [CrossRef]

- Zheng, S.; Zhang, Q.; van Blokland, W.B.; Negenborn, R.R. The Development Modes of Inland Ports: Theoretical Models and the Chinese Cases. Marit. Policy Manag. 2021, 48, 583–605. [Google Scholar] [CrossRef]

- Monios, J.; Wang, Y. Spatial and Institutional Characteristics of Inland Port Development in China. GeoJournal 2013, 78, 897–913. [Google Scholar] [CrossRef]

- Banerjee, A.; Duflo, E.; Qian, N. On the Road: Access to Transportation Infrastructure and Economic Growth in China. J. Dev. Econ. 2020, 145, 102442. [Google Scholar] [CrossRef]

- Melo, P.C.; Graham, D.J.; Brage-Ardao, R. The Productivity of Transport Infrastructure Investment: A Meta-Analysis of Empirical Evidence. Reg. Sci. Urban Econ. 2013, 43, 695–706. [Google Scholar] [CrossRef]

- Brachert, M.; Titze, M.; Kubis, A. Identifying Industrial Clusters from a Multidimensional Perspective: Methodical Aspects with an Application to Germany. Pap. Reg. Sci. 2011, 90, 419–440. [Google Scholar] [CrossRef]

- Becchetti, L.; Panizza, A.D.; Oropallo, F. Role of Industrial District Externalities in Export and Value-Added Performance: Evidence from the Population of Italian Firms. Reg. Stud. 2007, 41, 601–621. [Google Scholar] [CrossRef]

- Hulten, C.R.; Bennathan, E.; Srinivasan, S. Infrastructure, Externalities, and Economic Development: A Study of the Indian Manufacturing Industry. World Bank Econ. Rev. 2006, 20, 291–308. [Google Scholar] [CrossRef]

- Pessoa, A. Agglomeration and Regional Growth Policy: Externalities versus Comparative Advantages. Ann Reg Sci 2014, 53, 1–27. [Google Scholar] [CrossRef]

- Berechman, J.; Ozmen, D.; Ozbay, K. Empirical Analysis of Transportation Investment and Economic Development at State, County and Municipality Levels. Transportation 2006, 33, 537–551. [Google Scholar] [CrossRef]

- Chiu, R.-H.; Lin, Y.-C. Applying input-output model to investigate the inter-industrial linkage of transportation industry in Taiwan. J. Mar. Sci. Technol. 2012, 20, 8. [Google Scholar] [CrossRef]

- Tong, T.; Yu, T.E. Transportation and Economic Growth in China: A Heterogeneous Panel Cointegration and Causality Analysis. J. Transp. Geogr. 2018, 73, 120–130. [Google Scholar] [CrossRef]

- Abadie, A.; Gardeazabal, J. The Economic Costs of Conflict: A Case Study of the Basque Country. Am. Econ. Rev. 2003, 93, 113–132. [Google Scholar] [CrossRef]

- Abadie, A.; Diamond, A.; Hainmueller, J. Synthetic Control Methods for Comparative Case Studies: Estimating the Effect of California’s Tobacco Control Program. J. Am. Stat. Assoc. 2010, 105, 493–505. [Google Scholar] [CrossRef]

- Abadie, A.; Diamond, A.; Hainmueller, J. Comparative Politics and the Synthetic Control Method: Comparative politics and the synthetic control method. Am. J. Political Sci. 2015, 59, 495–510. [Google Scholar] [CrossRef]

- Sun, J.; Wang, F.; Yin, H.; Zhang, B. Money Talks: The Environmental Impact of China’s Green Credit Policy. J. Policy Anal. Manag. 2019, 38, 653–680. [Google Scholar] [CrossRef]

- Graham, D.J. Identifying Urbanisation and Localisation Externalities in Manufacturing and Service Industries. Pap. Reg. Sci. 2009, 88, 63–85. [Google Scholar] [CrossRef]

- Mody, A.; Wang, F.-Y. Explaining Industrial Growth in Coastal China: Economic Reforms … and What Else? World Bank Econ. Rev. 1997, 11, 293–325. [Google Scholar] [CrossRef]

- ten Raa, T.; Wolff, E.N. Secondary Products and the Measurement of Productivity Growth. Reg. Sci. Urban Econ. 1991, 21, 581–615. [Google Scholar] [CrossRef]

- Productivity Change in Chinese Industry: 1953–1985. J. Comp. Econ. 1988, 12, 570–591. [CrossRef]

- Balakrishnan, P.; Pushpangadan, K.; Babu, M.S. Trade Liberalisation and Productivity Growth in Manufacturing: Evidence from Firm-Level Panel Data. Econ. Political Wkly. 2000, 35, 3679–3682. [Google Scholar]

- Balakrishnan, P.; Pushpangadan, K. Total Factor-Productivity Growth in Manufacturing Industry: A Fresh Look. Econ. Political Wkly. 1994, 29, 2028–2035. [Google Scholar]

- Laurenceson, J.; Chai, J.C.H. The Economic Performance of China’s State-Owned Industrial Enterprises. J. Contemp. China 2000, 9, 21–39. [Google Scholar] [CrossRef]

- Jefferson, G.H.; Rawski, T.G.; Li, W.; Yuxin, Z. Ownership, Productivity Change, and Financial Performance in Chinese Industry. J. Comp. Econ. 2000, 28, 786–813. [Google Scholar] [CrossRef]

- Bird, J.; Straub, S. The Brasília Experiment: The Heterogeneous Impact of Road Access on Spatial Development in Brazil. World Dev. 2020, 127, 104739. [Google Scholar] [CrossRef]

- Xu, M.; Feng, Y. How Transportation Infrastructure Affects Firm Productivity? Evidence from China. China Econ. Q. Int. 2022, 2, 55–69. [Google Scholar] [CrossRef]

- Medeiros, V.; Ribeiro, R.S.M.; Amaral, P.V.M.; Stein, A.Q. Road infrastructure and Economic Development: Measuring Causal Impacts of Infrastructure Investments Using a Three-Step Instrumental Variable Identification Strategy. Transp. Policy 2025, 163, 394–407. [Google Scholar] [CrossRef]

| Variables | City of Ha’erbin | Average of 14 Control Cities | |

|---|---|---|---|

| Real | Synthetic | ||

| Ln (Number of employee) | 6.206 | 5.735 | 5.328 |

| Ln (Fixed investment) | 5.095 | 5.957 | 6.682 |

| Ln (highway freight volume) | 8.842 | 8.879 | 8.990 |

| Ln (Secondary industry GDP) (2002) | 5.947 | 5.973 | 5.830 |

| Ln (Secondary industry GDP) (2004) | 6.314 | 6.312 | 6.235 |

| City Name | Weight | City Name | Weight | City Name | Weight |

|---|---|---|---|---|---|

| Beijing | 0.296 | Guangzhou | 0 | Hohhot | 0 |

| Changsha | 0.610 | Shanghai | 0 | Urumqi | 0 |

| Nanjing | 0.094 | Nanning | 0 | Yinchuan | 0 |

| Lanzhou | 0 | Guizhou | 0 | Zhengzhou | 0 |

| Wuhan | 0 | Nanchang | 0 |

| Manufacturing Sector | Ha’erbin City | Beijing City | Nanjing City | Changsha City | All Samples | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Number of Observations | % | Number of Observations | % | Number of Observations | % | Number of Observations | % | Number of Observations | % | |

| 13 | 1199 | 17.41 | 571 | 3.87 | 290 | 2.02 | 611 | 6.15 | 2671 | 5.82 |

| 14 | 328 | 4.76 | 482 | 3.27 | 236 | 1.65 | 306 | 3.08 | 1352 | 2.94 |

| 15 | 286 | 4.15 | 196 | 1.33 | 77 | 0.54 | 228 | 2.29 | 787 | 1.71 |

| 16 | 10 | 0.15 | 7 | 0.05 | 8 | 0.06 | 6 | 0.06 | 31 | 0.07 |

| 17 | 140 | 2.03 | 332 | 2.25 | 348 | 2.43 | 157 | 1.58 | 977 | 2.13 |

| 18 | 8 | 0.12 | 612 | 4.15 | 1075 | 7.50 | 155 | 1.56 | 1850 | 4.03 |

| 19 | 7 | 0.10 | 84 | 0.57 | 128 | 0.89 | 64 | 0.64 | 283 | 0.62 |

| 20 | 525 | 7.62 | 71 | 0.48 | 73 | 0.51 | 157 | 1.58 | 826 | 1.80 |

| 21 | 109 | 1.58 | 253 | 1.71 | 86 | 0.60 | 147 | 1.48 | 595 | 1.30 |

| 22 | 124 | 1.80 | 249 | 1.69 | 225 | 1.57 | 390 | 3.92 | 988 | 2.15 |

| 23 | 186 | 2.70 | 874 | 5.92 | 318 | 2.22 | 278 | 2.80 | 1656 | 3.61 |

| 24 | 133 | 1.93 | 101 | 0.68 | 272 | 1.90 | 43 | 0.43 | 549 | 1.20 |

| 25 | 49 | 0.71 | 114 | 0.77 | 98 | 0.68 | 40 | 0.40 | 301 | 0.66 |

| 26 | 255 | 3.70 | 930 | 6.30 | 1482 | 10.34 | 2289 | 23.03 | 4956 | 10.79 |

| 27 | 295 | 4.28 | 612 | 4.15 | 251 | 1.75 | 265 | 2.67 | 1423 | 3.10 |

| 28 | 9 | 0.13 | 22 | 0.15 | 35 | 0.24 | 4 | 0.04 | 70 | 0.15 |

| 29 | 48 | 0.70 | 147 | 1.00 | 179 | 1.25 | 103 | 1.04 | 477 | 1.04 |

| 30 | 263 | 3.82 | 631 | 4.28 | 638 | 4.45 | 500 | 5.03 | 2032 | 4.43 |

| 31 | 361 | 5.24 | 959 | 6.50 | 1016 | 7.09 | 868 | 8.73 | 3204 | 6.98 |

| 32 | 80 | 1.16 | 91 | 0.62 | 277 | 1.93 | 92 | 0.93 | 540 | 1.18 |

| 33 | 81 | 1.18 | 249 | 1.69 | 357 | 2.49 | 225 | 2.26 | 912 | 1.99 |

| 34 | 313 | 4.54 | 907 | 6.15 | 1197 | 8.35 | 377 | 3.79 | 2794 | 6.09 |

| 35 | 658 | 9.55 | 1162 | 7.87 | 1500 | 10.47 | 879 | 8.84 | 4199 | 9.15 |

| 36 | 325 | 4.72 | 1119 | 7.58 | 709 | 4.95 | 463 | 4.66 | 2616 | 5.70 |

| 37 | 396 | 5.75 | 881 | 5.97 | 946 | 6.60 | 423 | 4.26 | 2646 | 5.76 |

| 38 | 43 | 0.62 | 122 | 0.83 | 171 | 1.19 | 88 | 0.89 | 424 | 0.92 |

| 39 | 380 | 5.52 | 1027 | 6.96 | 1061 | 7.40 | 384 | 3.86 | 2852 | 6.21 |

| 40 | 96 | 1.39 | 986 | 6.68 | 727 | 5.07 | 138 | 1.39 | 1947 | 4.24 |

| 41 | 132 | 1.92 | 748 | 5.07 | 383 | 2.67 | 172 | 1.73 | 1435 | 3.13 |

| 42 | 37 | 0.54 | 182 | 1.23 | 118 | 0.82 | 81 | 0.81 | 418 | 0.91 |

| 43 | 12 | 0.15 | 36 | 0.24 | 48 | 0.33 | 6 | 0.06 | 102 | 0.22 |

| Total | 6888 | 100 | 14,757 | 100 | 14,329 | 100 | 9939 | 100 | 45,913 | 100 |

| Variables | Number of Observations | Mean | Std. Dev. | Min. | Max. |

|---|---|---|---|---|---|

| total value of output | 45,894 | 124,980.8 | 312,716.3 | 1075 | 2,356,620 |

| State-owned | 45,913 | 0.118 | 0.323 | 0 | 1 |

| Foreign | 45,913 | 0.081 | 0.273 | 0 | 1 |

| Others | 45,913 | 0.789 | 0.408 | 0 | 1 |

| Age | 45,909 | 11.793 | 10.424 | 1 | 57 |

| Asset | 45,911 | 127,680.1 | 377,671.1 | 1394 | 2,930,350 |

| Employees | 44,116 | 240 | 366 | 8 | 2581 |

| Fixed investment | 45,748 | 31,906.01 | 94,277.87 | 9 | 720,147 |

| Profit | 45,830 | 7870.823 | 26,922.49 | −24,955 | 201,031 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xue, C.; Chao, Y.; Xie, S.; Yuan, K. Will Road Infrastructure Become the New Engine of Urban Growth? A Consideration of the Economic Externalities. Sustainability 2025, 17, 6813. https://doi.org/10.3390/su17156813

Xue C, Chao Y, Xie S, Yuan K. Will Road Infrastructure Become the New Engine of Urban Growth? A Consideration of the Economic Externalities. Sustainability. 2025; 17(15):6813. https://doi.org/10.3390/su17156813

Chicago/Turabian StyleXue, Cheng, Yiying Chao, Shangwei Xie, and Kebiao Yuan. 2025. "Will Road Infrastructure Become the New Engine of Urban Growth? A Consideration of the Economic Externalities" Sustainability 17, no. 15: 6813. https://doi.org/10.3390/su17156813

APA StyleXue, C., Chao, Y., Xie, S., & Yuan, K. (2025). Will Road Infrastructure Become the New Engine of Urban Growth? A Consideration of the Economic Externalities. Sustainability, 17(15), 6813. https://doi.org/10.3390/su17156813