1. Introduction

As the global climate crisis intensifies, the formulation of carbon emission reduction policies has become the focus of the shipping industry. The Maritime Silk Road Initiative has contributed to the development of most participating countries and reduced their carbon intensity [

1]. The International Maritime Organization (IMO) has implemented short-term measures to enhance the energy efficiency of ships and reduce the average carbon intensity of shipping by approximately one-third in 2023 [

2], compared with the reference level in 2008. Nevertheless, promoting energy efficiency alone cannot achieve net-zero GHG emissions. To achieve the goal of reaching net-zero GHG emissions by or around 2050, the IMO adopted the 2023 IMO Strategy on Reduction of GHG Emissions from Ships [

3] to promote fuel transition [

4,

5,

6].

The primary alternative fuels for shipping include LNG [

7,

8,

9], methanol [

10,

11,

12], ammonia [

13,

14,

15], bio-diesel [

16,

17,

18], and e-fuels (fuels based on H

2) [

19,

20,

21]. However, regardless of which alternative fuel is adopted, shipowners’ costs will increase due to the high price of these fuels [

22,

23]. Among these options, LNG offers a relative economic advantage for achieving short-term decarbonization, while renewable ammonia and methanol are projected to be more cost-effective in the long term [

24,

25]. Bio-diesel can be used in existing engines without modification or retrofit costs, but its high fuel cost remains a significant barrier [

17]. No single fuel has demonstrated overwhelming economic advantages to dominate the future market alone [

26]. Although strategies such as chartering and retrofitting (depending on the ship size), combined with slow steaming and wind assistance, can partially reduce the cost of fuel transition [

26,

27], they are insufficient to alleviate the shipping industry’s anxiety over rising fuel transition costs. This challenge is further intensified by the heavy reliance of alternative fuels’ economic feasibility on the availability of bunkering infrastructure at ports [

28,

29,

30]. To this end, IMO is establishing a GHG pricing mechanism.

At the 83rd session of the IMO Marine Environment Protection Committee (MEPC 83), a global pricing mechanism for the shipping industry was approved. This mechanism, scheduled for formal adoption in October 2025 and entry into force in 2027 [

31], is based on a proposal known as the International Maritime Sustainable Fuels and Fund mechanism (IMSF&F) [

32]. Another notable proposal, combining a GHG fuel standard with a universal GHG contribution mechanism (GFS&UGC) [

33], had previously received strong support from many countries. Both mechanisms enforce the ‘polluter-pays’ principle and reward ships using zero or near-zero GHG emission fuels (ZNZs) [

34].

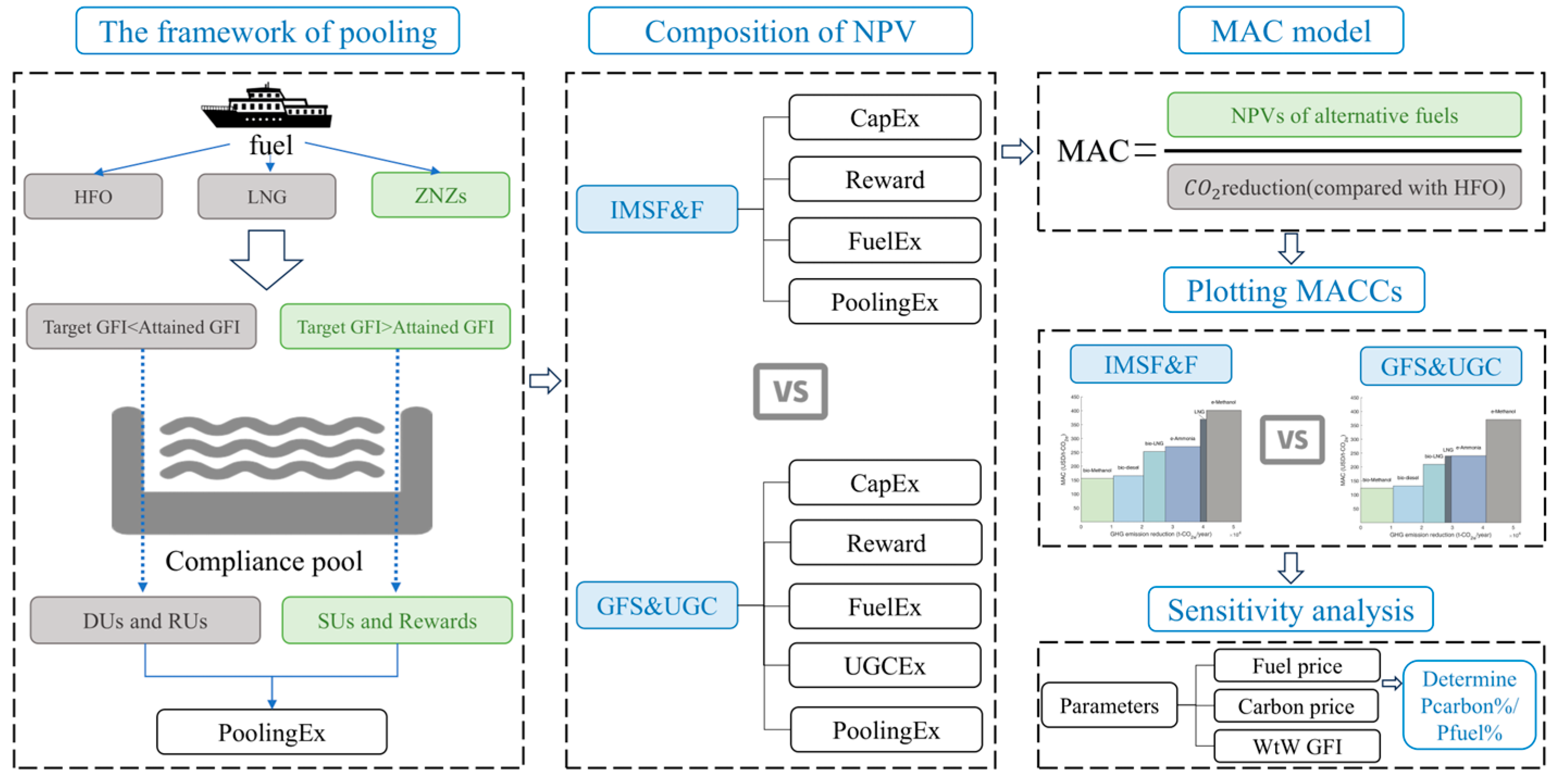

The IMSF&F mechanism’s core is a Flexible Compliance Mechanism (FCM) [

32]. Under the FCM, ships meeting their annual GFI target are considered compliant. Those below target earn surplus units (SUs), which are transferable within the compliance pool, bankable, or cancellable. Conversely, ships exceeding their targets incur deficit units (DUs), which must be balanced by acquiring SUs from the pool, using banked SUs, or purchasing remedial units (RUs). Vessels using ZNZs may receive rewards. The GFS&UGC mechanism similarly operates under an FCM framework but uses different parameters, such as the pooling price [

4]. Additionally, GFS&UGC imposes a universal GHG contribution (UGC) cost, requiring shipowners to pay a levy based on total vessel GHG emissions [

33]. Previous assessments of the economic performance of these two mechanisms have primarily focused on a total cost perspective of fleets, demonstrating that both mechanisms can promote shipping decarbonization and fuel transition, while reducing emissions and lowering maritime logistics costs [

4,

35,

36].

Marginal abatement cost (MAC), represented by the cost per unit of GHG emissions reduced, provides a clearer measure of cost-effectiveness and sustainability in fuel transitions compared to the total cost and is widely used to evaluate the economic efficiency of GHG reduction strategies [

34,

37,

38,

39,

40]. Uncertainties in such assessments stem primarily from the challenges in forecasting economic mechanisms, carbon prices, fuel GFI, and fuel prices. For instance, fuel prices are influenced not only by production costs and technological innovation but also by national energy policies [

23,

41]. In addition, inconsistencies in life cycle assessment boundaries affect the accuracy of fuel GFI estimates [

34,

37]. Consequently, obtaining comparable prediction results from previous studies has been difficult. However, since IMO regulations have now clarified life cycle boundaries, economic mechanisms, and carbon pricing, and an IMO report provides an accepted set of values for fuel GFI and prices [

4], it is feasible to conduct comparable assessments using standardized parameters, thereby reducing uncertainty.

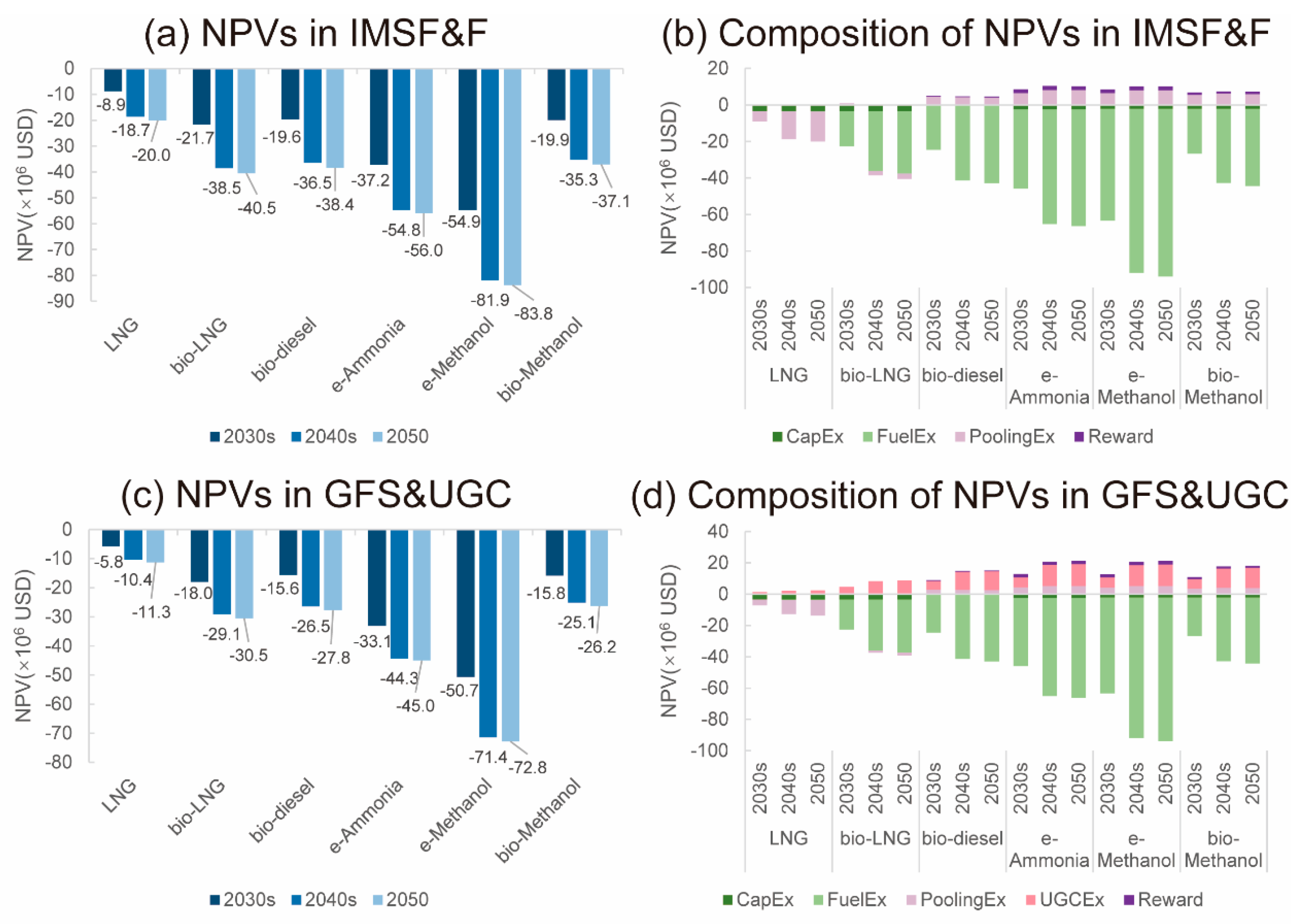

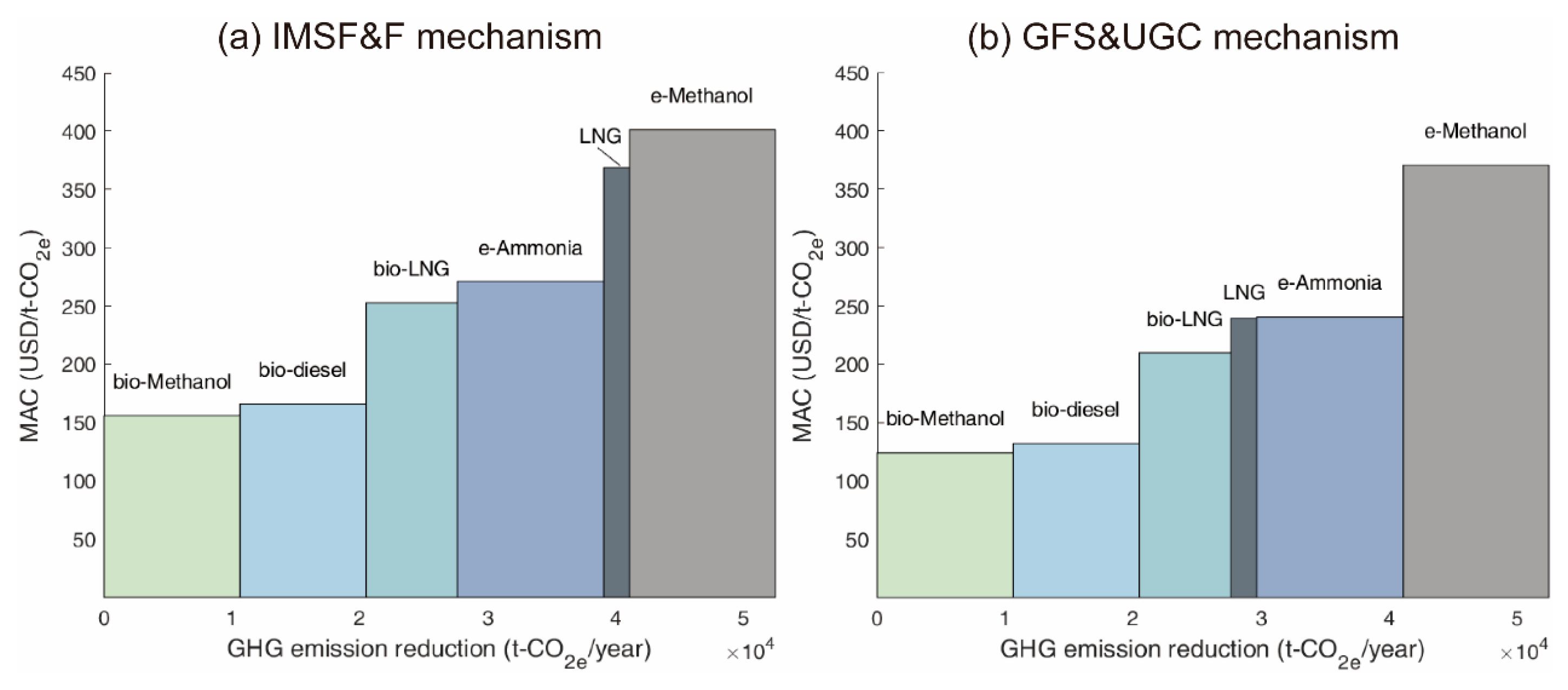

This study develops a model to evaluate the cost-effectiveness of alternative fuels for a 24,000 DWT short-sea bulk carrier using the MACC method. Only fuels with positive MAC values are considered, and the vessel operates on a single fuel type. We assume that standard units (SUs), dedicated units (DUs), and reserve units (RUs) are functionally equivalent and are transferable only within the compliance pool. By simulating carbon and fuel prices across different years, we compare the net present values (NPVs) and MACs of alternative fuels under both the IMSF&F and GFS&UGC mechanisms, determining their cost-effectiveness rankings for the period 2027–2050. Sensitivity analysis assesses the impact of ZNZ fuel price, carbon price, and Well-to-Wake GHG Fuel Intensity (GFIWtW) on MAC. Furthermore, the ratios of Pcarbon%/Pfuel% in equivalent sensitivity scenarios are determined to evaluate the relative importance of carbon price versus fuel price. The results provide insights for alternative fuel selection and GHG pricing policy formulation in shipping.

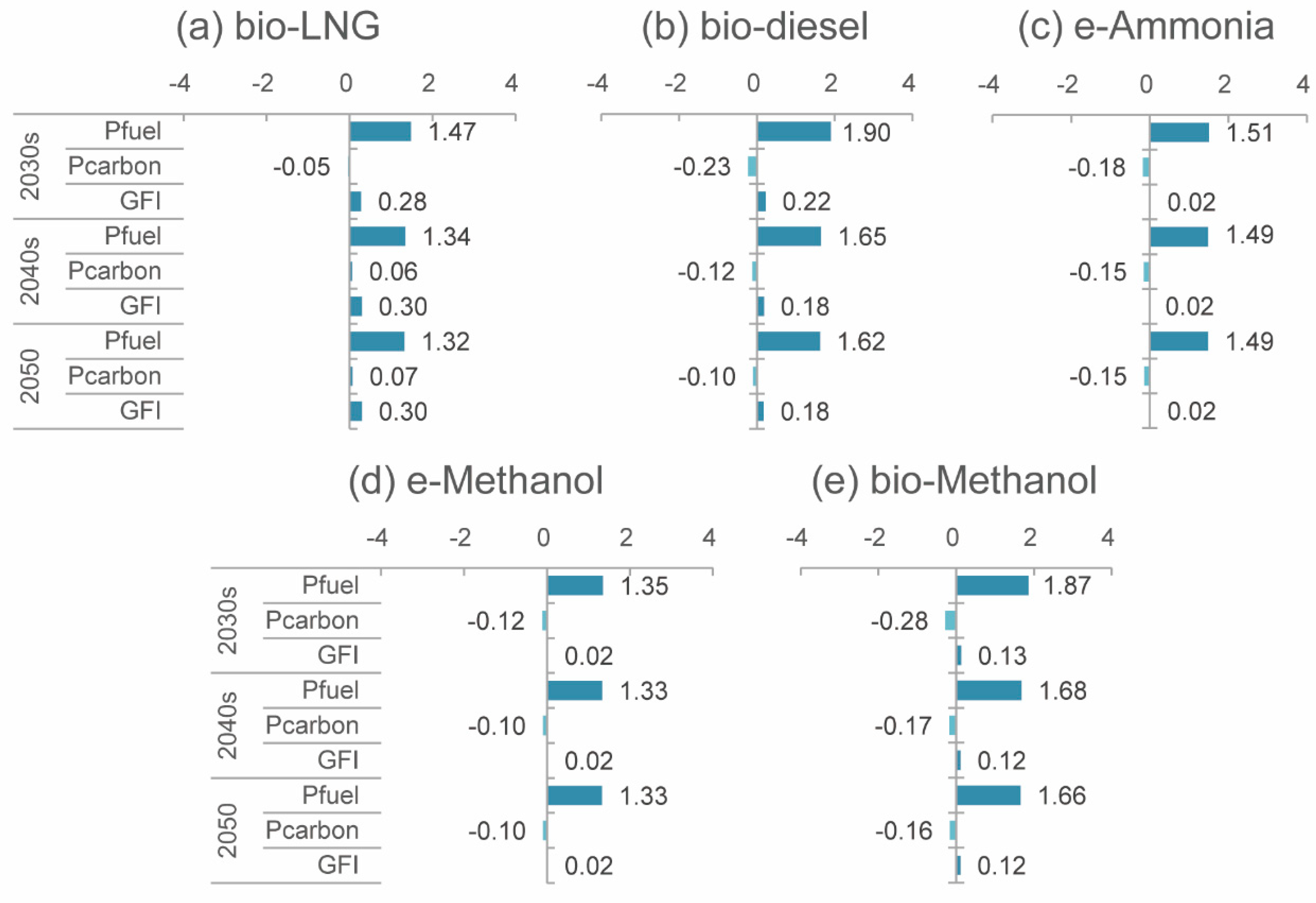

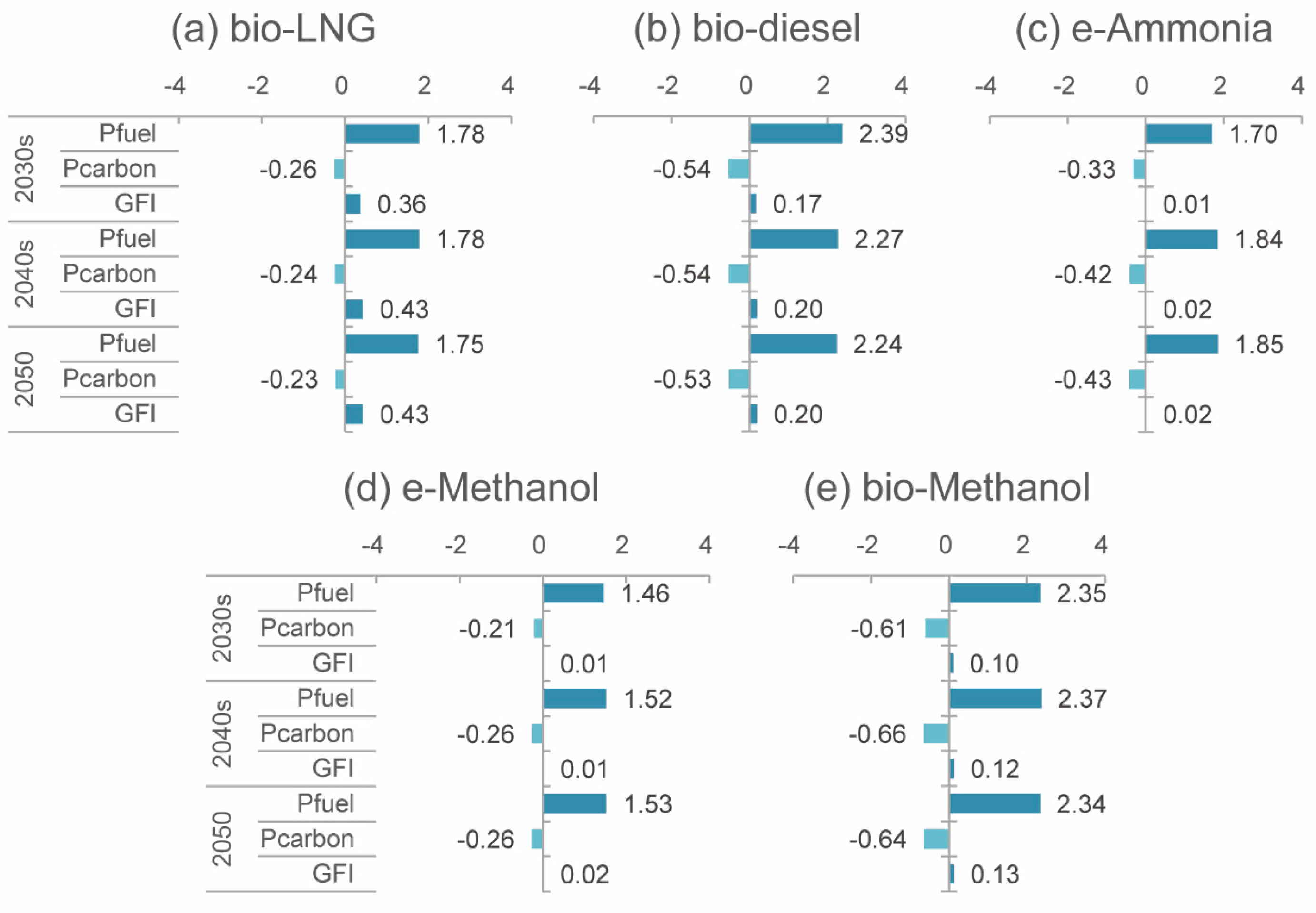

4. Sensitivity Analysis

The sensitivities of MAC to fuel price, carbon price, and

GFIWtW were presented by the variation rate of MAC with respect to

Pfuel (MAC%/

Pfuel%),

Pcarbon (MAC%/

Pcarbon%), and

GFIWtW (MAC%/

GFIWtW%), respectively.

Figure 6 and

Figure 7 illustrate that fuel price and

GFIWtW are positively correlated with MAC, while carbon price is negatively correlated, indicating that increasing carbon price or reducing fuel price and

GFIWtW could improve the cost-effectiveness. MACs were more sensitive to fuel price compared to carbon price and

GFIWtW under the price scope of this study, especially under the GFS&UGC mechanism. In addition, the cost-effectiveness of ZNZs with higher

GFIWtW had greater sensitivity to

GFIWtW such as bio-LNG and bio-diesel.

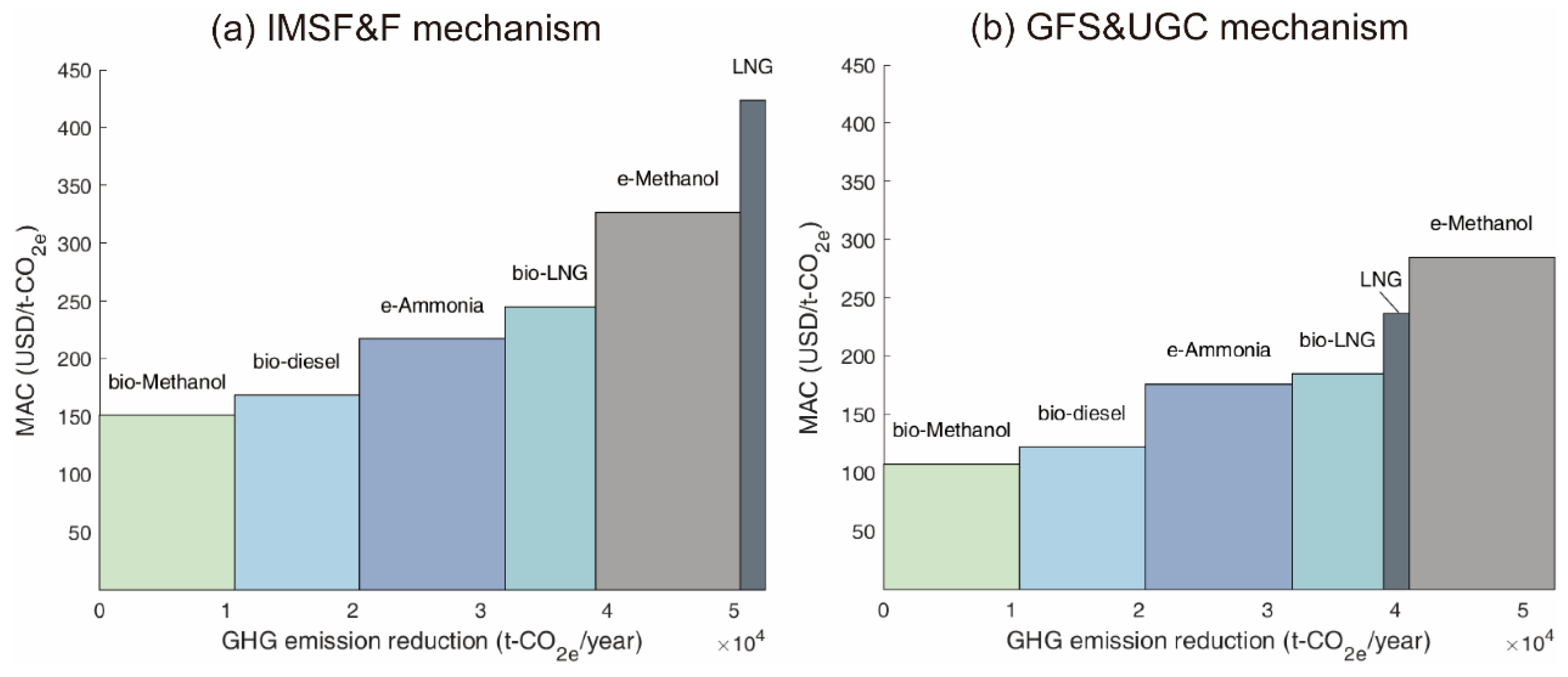

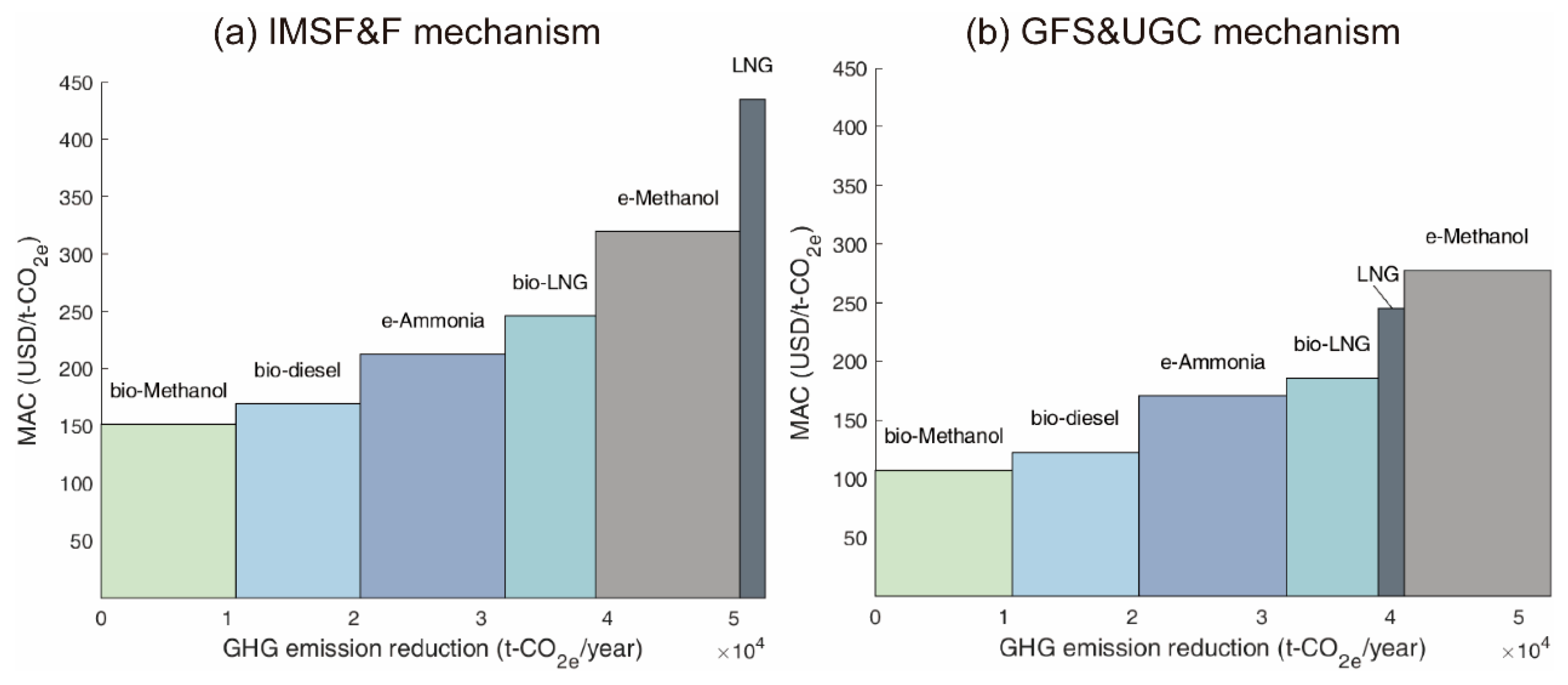

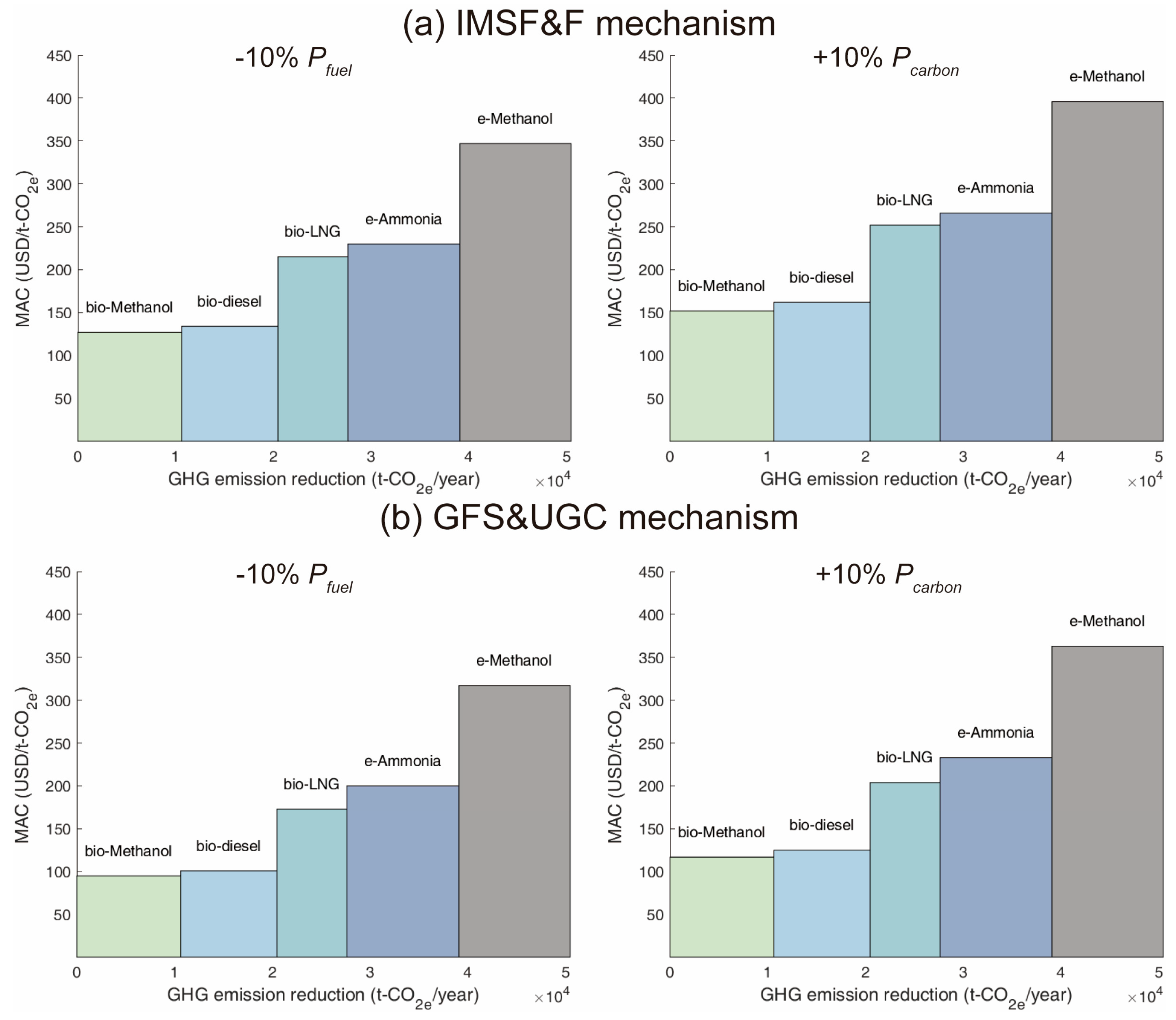

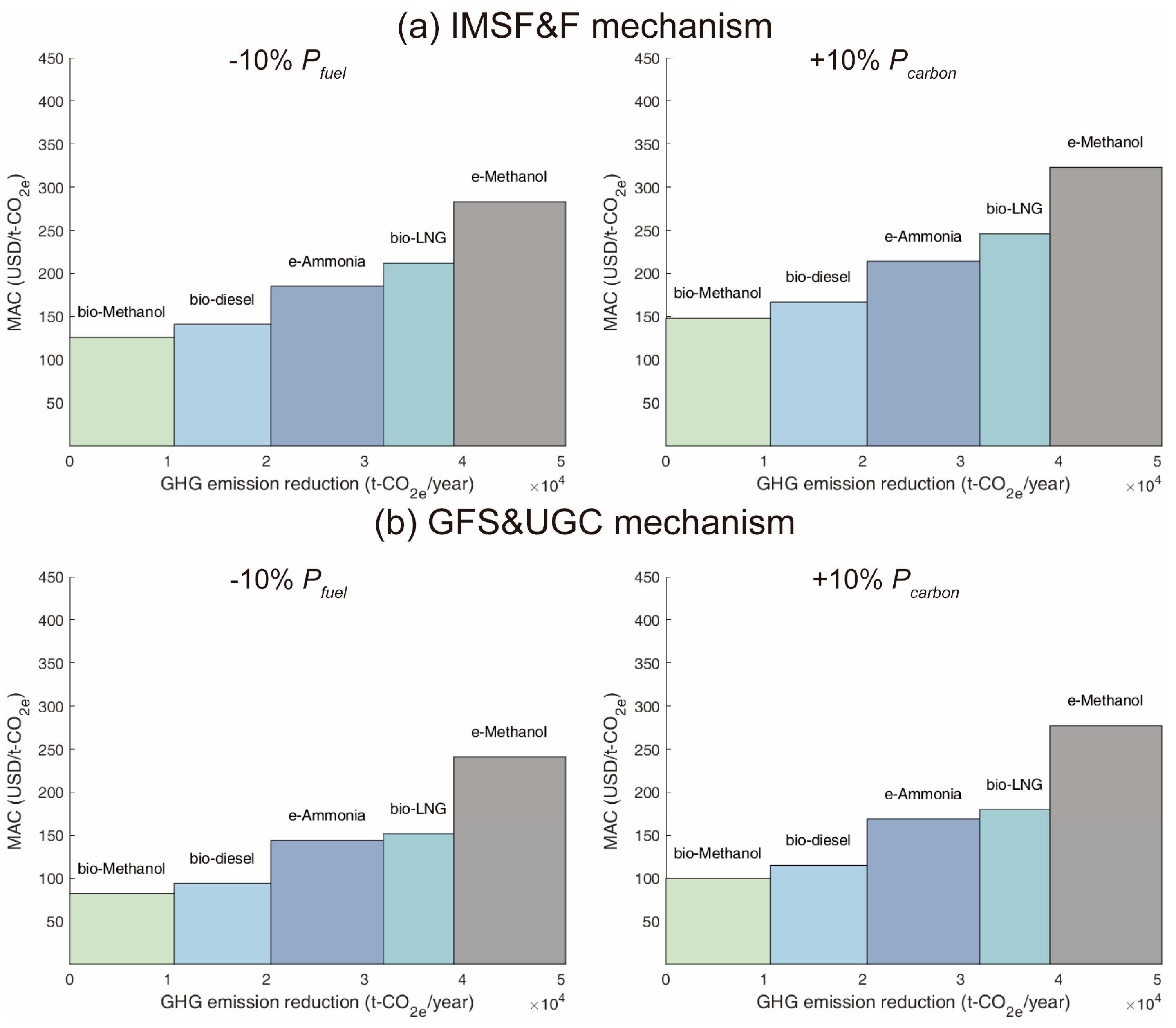

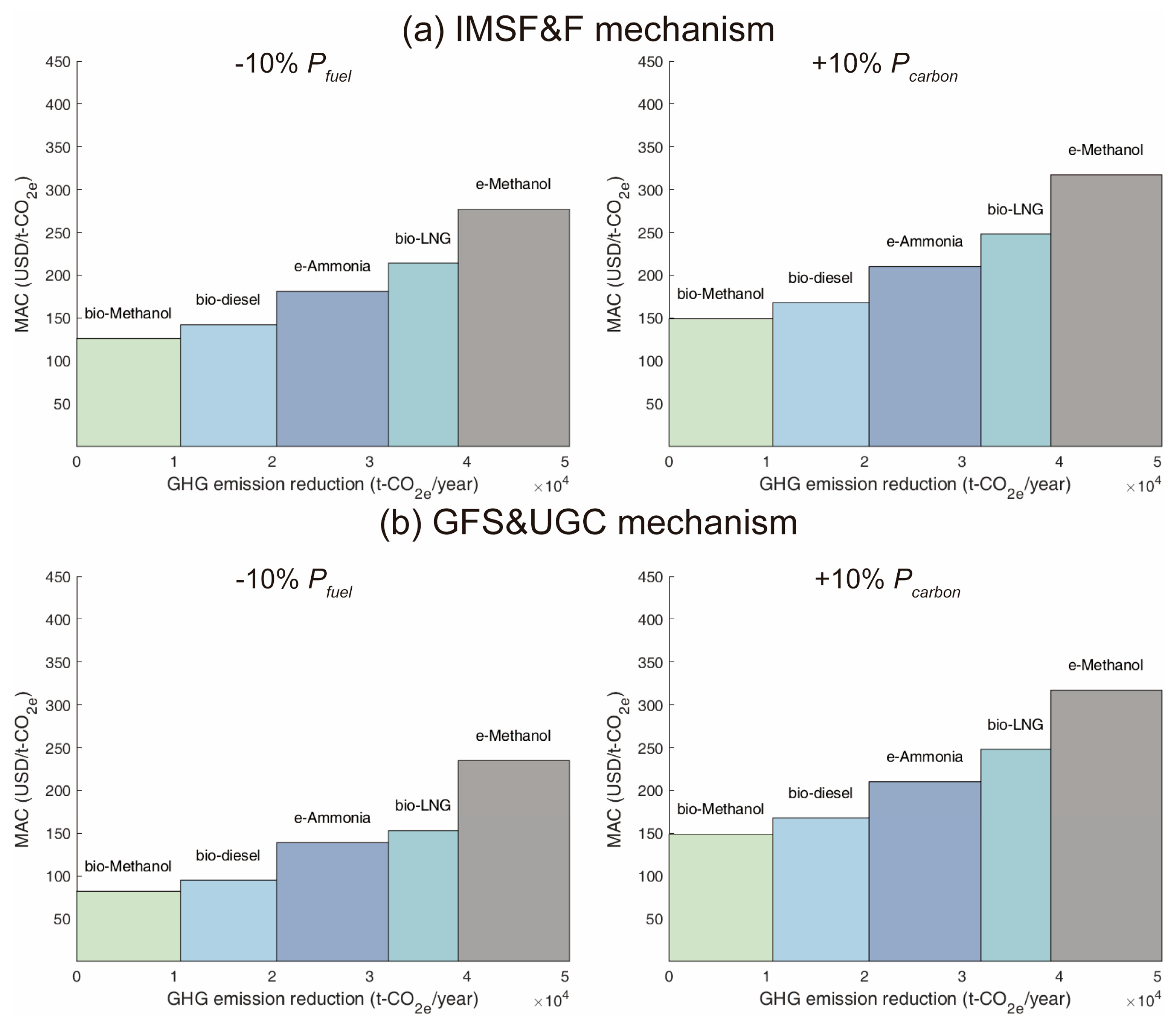

Figure 8,

Figure 9 and

Figure 10 present the marginal abatement costs (MACs) for zero or near-zero (ZNZ) fuels under ±10% fluctuations in fuel price or carbon price. The MACs from the sensitivity analysis align closely with the reference MACs (

Figure 3,

Figure 4 and

Figure 5), and the cost-effectiveness ranking of ZNZ fuels remains unchanged. This consistency confirms the robustness of our MAC model and the reliability of the findings [

54]. The consequent variations in MACs resulting from ±10% fluctuations in fuel price or carbon price are listed in

Table 7. The greatest variation in MAC was observed as USD −54/t-CO

2e for e-Methanol, derived from fuel price fluctuations under both mechanisms in the 2030s.

Furthermore, to assess the relative importance of carbon price and fuel price, the ratios of

Pcarbon%/

Pfuel% in equivalent sensitivity scenarios (i.e.,

Pcarbon%/

Pfuel% resulting in equivalent variation in MACs) were determined and are listed in

Table 8. If

Pcarbon%/

Pfuel% is higher than the values above, MAC variation is dominated by carbon price, and vice versa. The results also showed that the equilibrium

Pcarbon%/

Pfuel% ratios under the GFS&UGC mechanism were greater than those under the IMSF&F mechanism, indicating that MACs were more sensitive to the carbon price (in

PoolingEx and

UGCEx) under the GFS&UGC mechanism.

Although the GHG pricing mechanism approved at MEPC 83 introduces more detailed regulations for pooling under the IMSF&F framework, our results—developed within the broader IMO net-zero framework—remain applicable to the latest mechanism. Given the significantly lower MACs observed under the GFS&UGC mechanism, we demonstrate that incorporating a universal GHG contribution component into the IMO’s GHG pricing mechanism can reduce shipowners’ economic losses and promote a just and equitable transition to sustainable shipping fuels. This finding offers policymakers valuable new insights.