Sustainable Power Coordination of Multi-Prosumers: A Bilevel Optimization Approach Based on Shared Energy Storage

Abstract

1. Introduction

- A bilevel optimization model for power complementarity among multiple prosumers based on SES has been established. The upper level is the long-term energy storage configuration planning, while the lower level is the intra-day operation optimization considering P2P transactions between prosumers. The bilevel model ensures the interests of both energy storage and prosumers.

- Through a series of transformations, the original bilevel optimization problem is transformed into a single-level mixed integer linear programming problem, enabling the original problem to be solved quickly.

- An improved Nash bargaining revenue distribution model for prosumers was proposed, which made a reasonable distribution of the revenue from P2P transactions among prosumers.

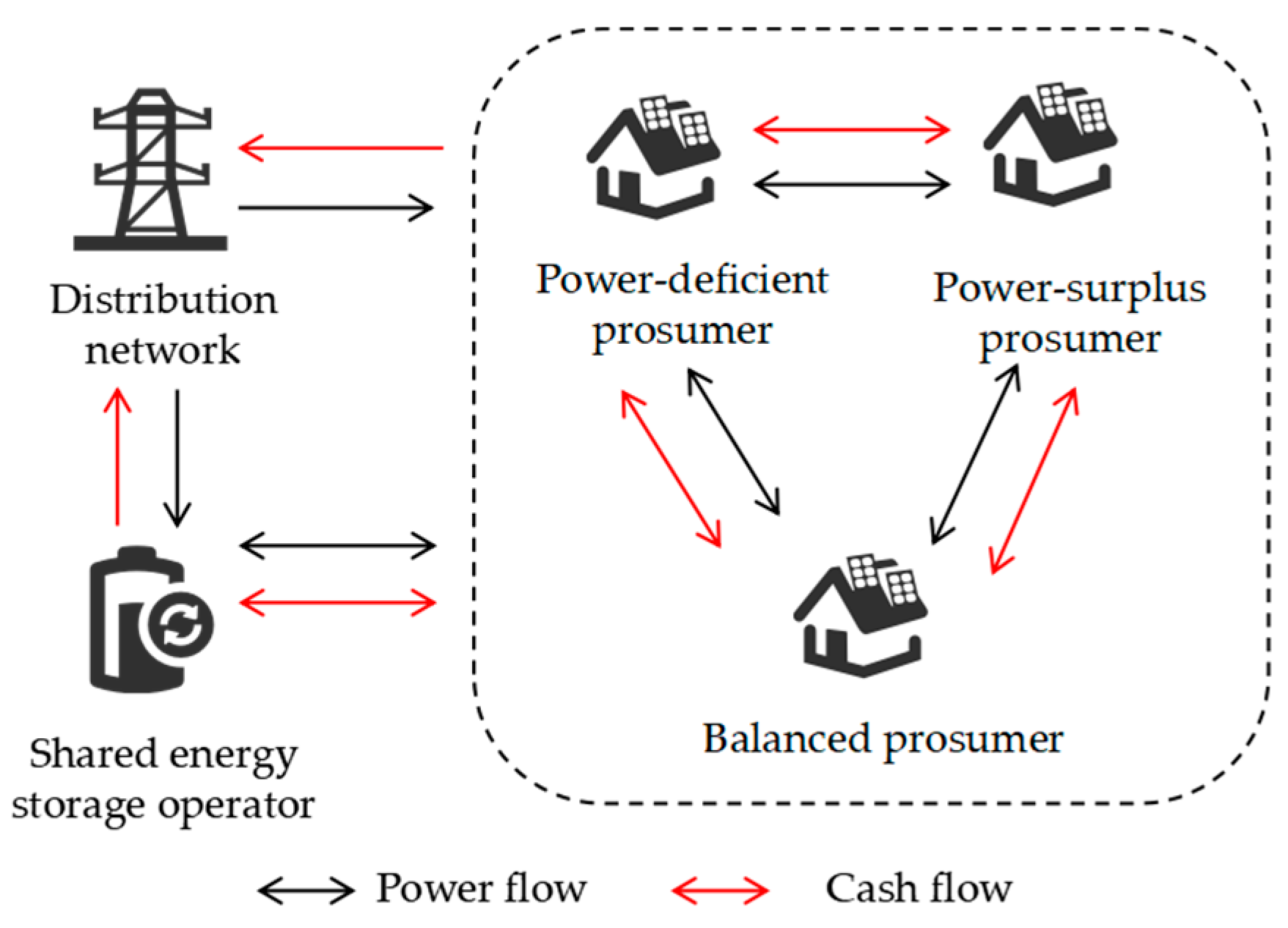

2. Structure of the Multi-Prosumer Power Complementarity System Based on SES

3. Bilevel Optimization Model for Multi-Prosumer Power Complementarity Based on SES

3.1. Upper-Level SES Configuration Optimization Model

3.1.1. Objective Function of the Upper-Level Model

- (1)

- The average daily investment and maintenance costs of SES are

- (2)

- The cost of electricity purchase from prosumers for SES is

- (3)

- The cost of electricity purchased from the grid for SES is

- (4)

- The revenue from electricity sales by SES to prosumers is

- (5)

- Storage service fees charged by SES to prosumers are

3.1.2. Upper-Level Model Constraints

- (1)

- The state of charge and charge/discharge power constraints are

- (2)

- Capacity ratio constraints of SES are

3.2. Optimization Model for Lower-Level Prosumers′ Operation

3.2.1. Objective Function of the Lower-Level Model

- (1)

- The cost for prosumers to purchase electricity from the power grid is

- (2)

- Network usage fees paid by prosumers to the power grid are

3.2.2. Lower-Level Model Constraints

- (1)

- The power balance constraint is

- (2)

- The power balance constraints for SES charging and discharging are

- (3)

- The power balance constraint between prosumers is

- (4)

- The upper and lower limits of constraints on the transaction power between prosumers are

- (5)

- The power constraints for electricity purchase and sale between prosumers and SES are

- (6)

- The power purchase constraint of prosumers from the power grid is

- (7)

- The constraint that prosumers cannot simultaneously purchase and sell electricity is

4. Prosumers′ Revenue Distribution Model Based on an Improved Nash Bargaining Method

- (1)

- The electricity cost when prosumers do not engage in transactions is

- (2)

- The electricity cost during transactions between prosumers is

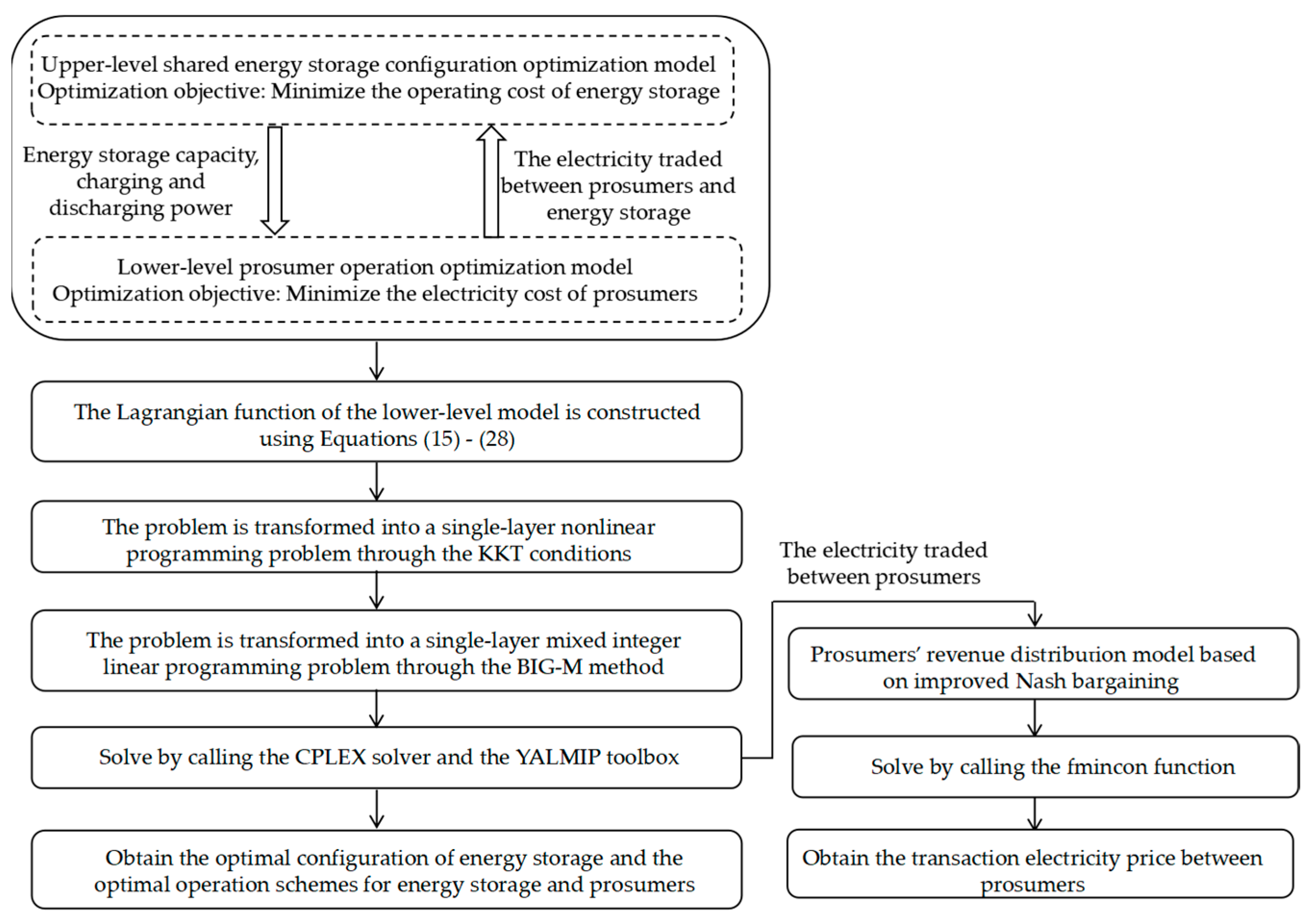

5. Solution Method

6. Case Study Analysis

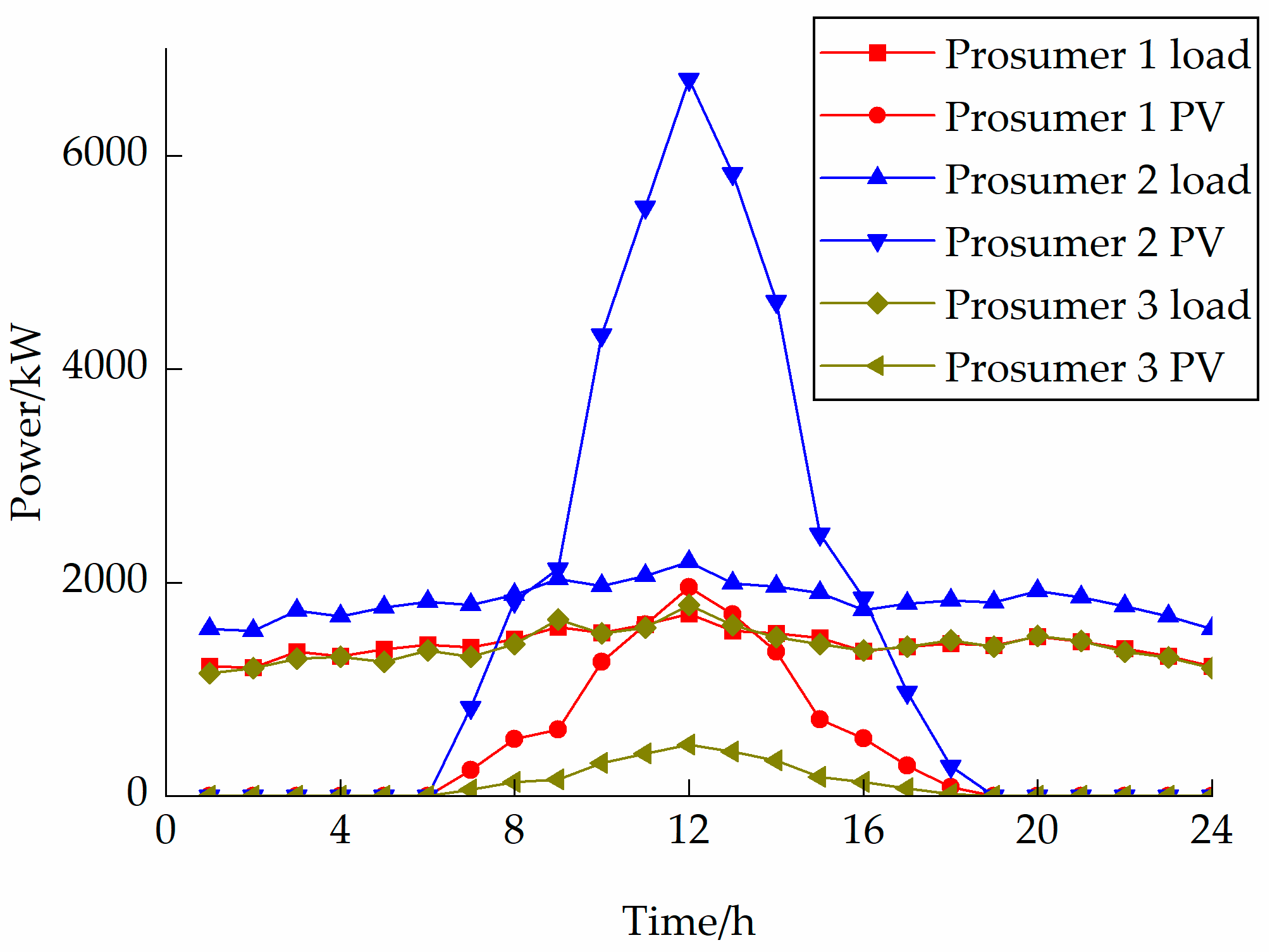

6.1. Basic Data of the Example

6.2. Scheme Settings

6.3. Comparative Analysis of System Benefits for Different Schemes

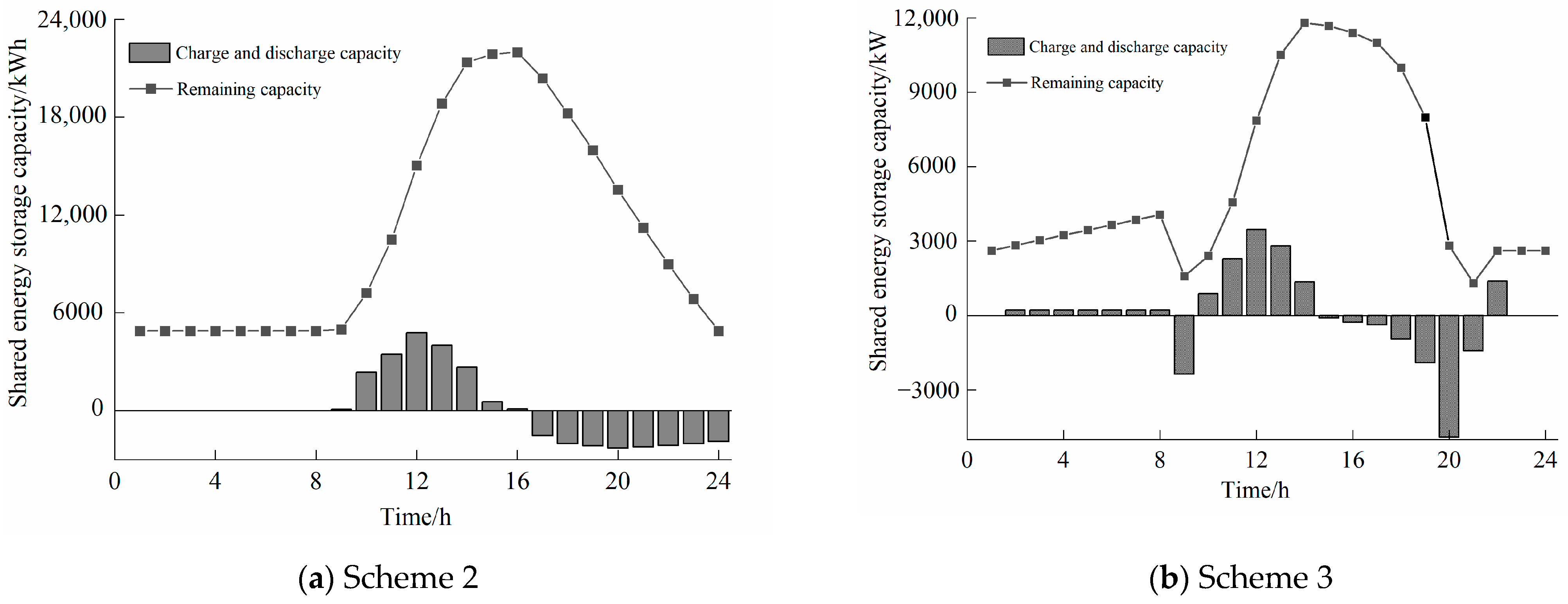

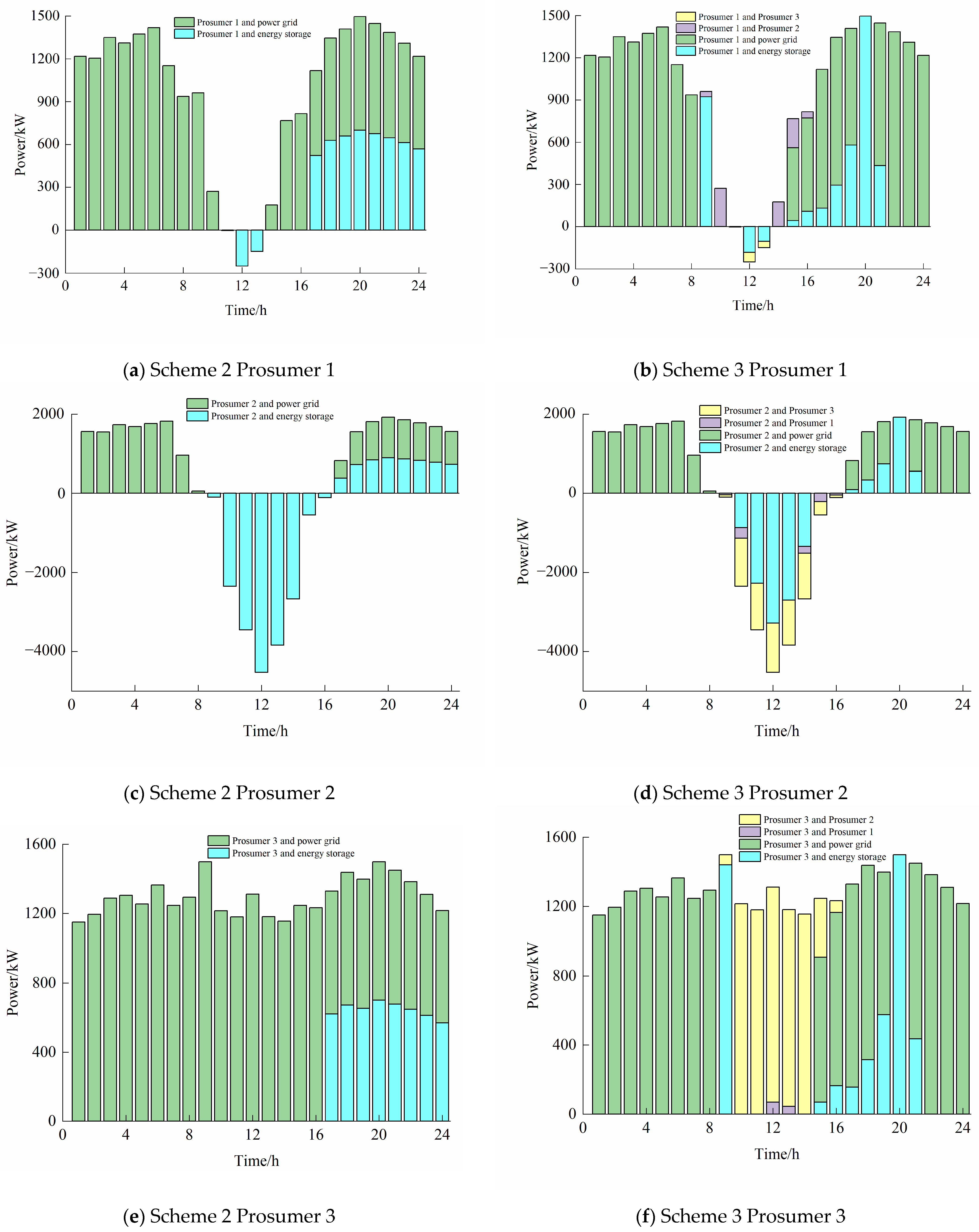

6.4. Analysis of the Operation Optimization Results of SES and Prosumers

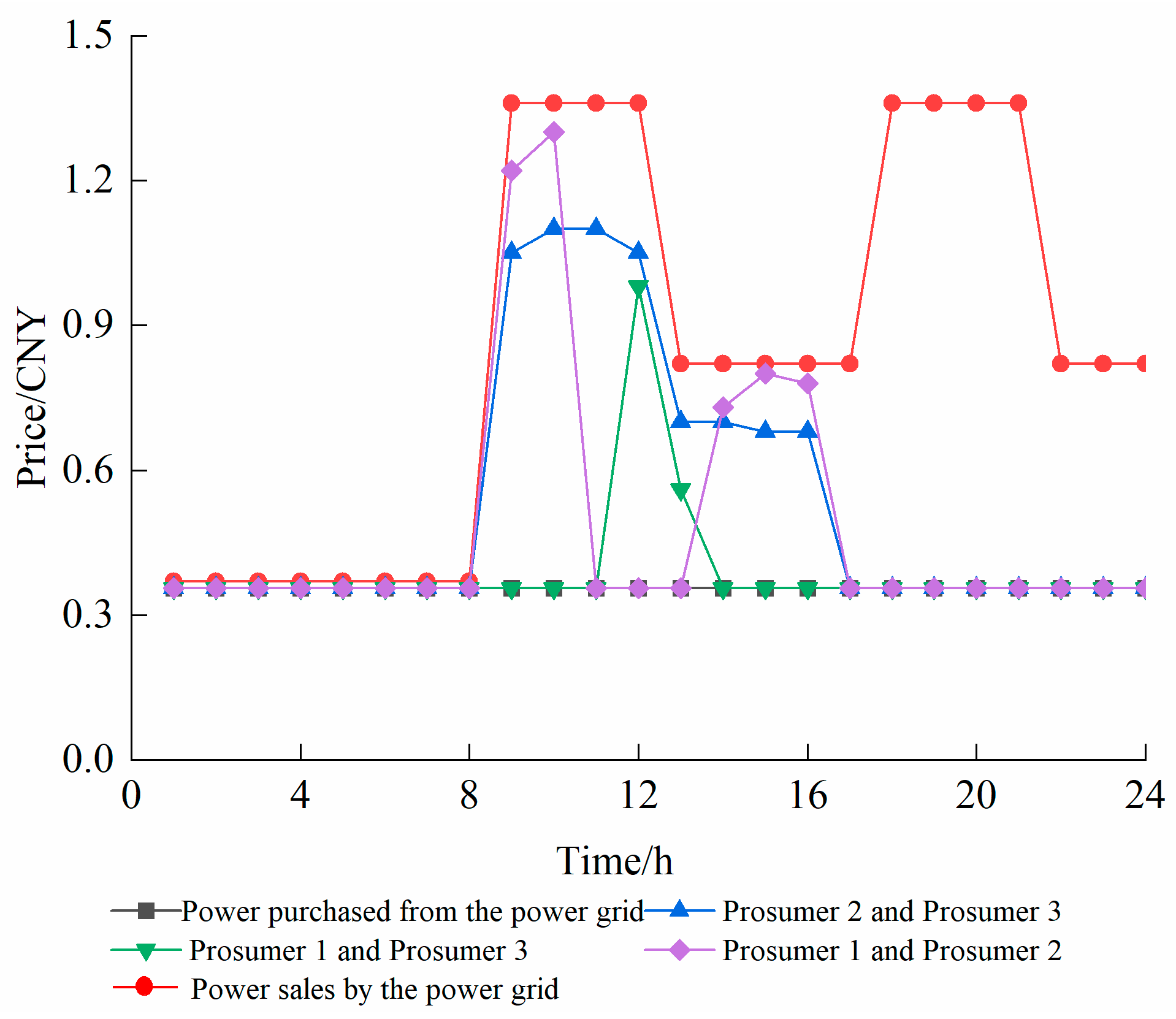

6.5. Analysis of the Transaction Results Between Prosumers

7. Conclusions

- (1)

- The bilevel optimization model for multi-prosumer power complementarity based on SES proposed in this paper can enhance the operational revenue of the energy storage station and reduce the electricity cost of prosumers by reasonably regulating the interaction between the energy storage station and prosumers, achieving a win–win situation for both.

- (2)

- The electricity trading among prosumers can leverage the complementarity of power generation and consumption among different types of prosumers. PV power generation is prioritized for internal trading among prosumers, reducing the demand for energy storage and significantly lowering the required capacity of energy storage.

- (3)

- The introduced improved Nash bargaining method can rationally allocate the benefits of P2P trading among prosumers based on their contributions to the trading process. Moreover, internal negotiation of pricing among prosumers enables them to set more favorable trading prices without being restricted by the grid and energy storage purchase and sale prices, thereby increasing the benefits of all prosumers.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Nomenclature

| Abbreviation | |

| ADMM | Alternating Direction Method of Multipliers |

| KKT | Karush–Kuhn–Tucker |

| MILP | Mixed Integer Linear Programming |

| MINLP | Mixed Integer Nonlinear Programming |

| PV | Photovoltaic |

| P2P | Peer-to-peer |

| SES | Shared energy storage |

| Parameters | |

| e | Natural constant |

| m | Unit power operation and maintenance cost of SES |

| Maximum power of transactions between prosumers | |

| Maximum power of transactions between prosumers and SES | |

| Maximum power that prosumers purchase from the power grid | |

| Operation time of SES | |

| Charging efficiency of SES | |

| Discharging efficiency of the SES | |

| Network usage fee price | |

| Unit energy capacity cost of SES | |

| Unit power capacity cost of SES | |

| Price of the SES service fee | |

| SES capacity ratio | |

| Variables | |

| Average daily investment and maintenance cost of SES | |

| Cost of purchasing electricity from prosumers by SES on a typical day | |

| Cost of purchasing electricity from the power grid by SES on a typical day | |

| Revenue from selling electricity to prosumers by SES on a typical day | |

| SES service fee on a typical day | |

| Cost of electricity purchased by prosumers from the power grid in a typical day | |

| Network usage fee paid by prosumers to the grid in a typical day | |

| Electricity cost when prosumers do not conduct P2P transactions | |

| Electricity cost when prosumers conduct P2P transactions | |

| Remaining energy of SES in the t time period | |

| Maximum capacity of SES | |

| Maximum charge and discharge power of SES | |

| SES purchases/sells electricity power to Prosumer u in the t time period | |

| Power purchased by SES from the grid in the t time period | |

| PV power generation of Prosumer u in the t time period | |

| SES charging/discharging power in the t time period | |

| Load power of Prosumer u in the t time period | |

| Power purchased by Prosumer u from the grid in the t time period | |

| Power purchased/sold by Prosumer u to Prosumer u′ in the t time period | |

| The electricity purchased/sold by Prosumer u in P2P transactions | |

| Total electricity purchase/sale volume in prosumers′ P2P transactions | |

| The status bit for the P2P transaction of electricity purchase/sale between prosumers | |

| The status bit for electricity purchase/sale from prosumers by SES | |

| The status bit of prosumers purchasing electricity from the power grid | |

| SES charging/discharging status bit | |

| Bargaining factor of Prosumer u | |

| Electricity selling price of the grid in the t time period | |

| Electricity purchase price of the SES in the t time period | |

| Electricity selling price of the SES in the t time period | |

| Electricity purchase price of the power grid in the t time period | |

| Electricity purchase/sale price from Prosumer u to Prosumer u′ in the t time period |

Appendix A

Appendix B

| Parameter | Unit | Numerical Value |

|---|---|---|

| Unit energy capacity cost | CNY/kWh | 1200 |

| Unit power capacity cost | CNY/kW | 600 |

| Operation and maintenance costs | CNY/(a·kW) | 72 |

| Energy storage service fee | CNY/kWh | 0.05 |

| Design service life | a | 10 |

| Charge and discharge efficiency | / | 0.95 |

| Capacity ratio | / | 2.67 |

| Parameter | Unit | Numerical Value |

|---|---|---|

| Grid network usage fee | CNY/kWh | 0.01 |

| Maximum transaction power between prosumers | kW | 4000 |

| Maximum transaction power between prosumers and SES | kW | 4000 |

| Maximum power that prosumers purchase from the power grid | kW | 4000 |

References

- Xu, M.Y.; Yang, Y.B.; Xu, Q.S.; Fang, L.L.; Tang, R.C.; Ji, H.M. Asymmetric Nash bargaining for cooperative operation of shared energy storage with multi-type users engagement. Front. Energy Res. 2024, 12, 1420393. [Google Scholar] [CrossRef]

- Pan, W.J.; Zhang, Y.; Jin, W.W.; Liang, Z.D.; Wang, M.N.; Li, Q.Q. Photovoltaic-Based Residential Direct-Current Microgrid and Its Comprehensive Performance Evaluation. Appl. Sci. 2023, 13, 12890. [Google Scholar] [CrossRef]

- Yang, H.J.; Yang, Z.C.; Gong, M.C.; Tang, K.; Shen, Y.M.; Zhang, D.B. Commercial operation mode of shared energy storage system considering power transaction satisfaction of renewable energy power plants. J. Energy Storage 2025, 105, 114738. [Google Scholar] [CrossRef]

- Cui, J.D.; Zhu, Z.C.; Qu, G.L.; Wang, Y.Q.; Li, R.T. Demand-side shared energy storage pricing strategy based on stackelberg-Nash game. Int. J. Electr. Power Energy Syst. 2025, 164, 110387. [Google Scholar] [CrossRef]

- Kang, W.F.; Chen, M.Y.; Li, Q.; Lai, W.; Luo, Y.Y.; Tavner, P.J. Distributed Optimization Model and Algorithms for Virtual Energy Storage Systems Using Dynamic Price. J. Clean. Prod. 2020, 289, 125440. [Google Scholar] [CrossRef]

- Vankudoth, L.; Badar, Q.A. Development and analysis of scheduling strategies for utilizing shared energy storage system in networked microgrids. J. Energy Storage 2024, 97, 112691. [Google Scholar] [CrossRef]

- Deng, W.Y.; Xiao, D.L.; Chen, M.L.; Tahir, M.F.; Zhu, D.R. Multi-regional energy sharing approach for shared energy storage and local renewable energy resources considering efficiency optimization. Int. J. Electr. Power Energy Syst. 2025, 167, 110592. [Google Scholar] [CrossRef]

- Wang, Z.C.; Chen, L.J.; Li, X.Z.; Mei, S.W. A Nash bargaining model for energy sharing between micro-energy grids and energy storage. Energy 2023, 283, 129065. [Google Scholar] [CrossRef]

- Sun, L.L.; Qiu, J.; Han, X.; Dong, Z.Y. Energy sharing platform based on call auction method with the maximum transaction volume. Energy 2021, 225, 120237. [Google Scholar] [CrossRef]

- Qiao, J.P.; Mi, Y.; Shen, J.; Lu, C.K.; Cai, P.C.; Ma, S.Y.; Wang, P. Optimization schedule strategy of active distribution network based on microgrid group and shared energy storage. Appl. Energy 2025, 377, 124681. [Google Scholar] [CrossRef]

- Wang, Y.X.; Chen, J.J.; Zhao, Y.L.; Xu, B.Y. Incorporate robust optimization and demand defense for optimal planning of shared rental energy storage in multi-user industrial park. Energy 2024, 301, 131721. [Google Scholar] [CrossRef]

- Li, Y.; Qian, F.Y.; Gao, W.J.; Fukuda, H.; Wang, Y.F. Techno-economic performance of battery energy storage system in an energy sharing community. J. Energy Storage 2022, 50, 104247. [Google Scholar] [CrossRef]

- Awnalisa, W.; Soongeol, K. Analysis on impact of shared energy storage in residential community: Individual versus shared energy storage. Appl. Energy 2021, 282, 116172. [Google Scholar]

- Zhang, W.Y.; Zheng, B.S.; Wei, W.; Chen, L.J.; Mei, S.W. Peer-to-peer transactive mechanism for residential shared energy storage. Energy 2022, 246, 123204. [Google Scholar] [CrossRef]

- Barkouki, B.E.; Laamim, M.; Rochd, A.; Chang, J.W.; Benazzouz, A.; Ouassaid, M.; Jeong, H. An Economic Dispatch for a Shared Energy Storage System Using MILP Optimization: A Case Study of a Moroccan Microgrid. Energies 2023, 16, 4601. [Google Scholar] [CrossRef]

- Xie, Y.Z.; Yao, Y.; Wang, Y.W.; Cha, W.Q.; Zhou, S.; Wu, Y.; Huang, C.Y. A Cooperative Game-Based Sizing and Configuration of Community-Shared Energy Storage. Energies 2022, 15, 8626. [Google Scholar] [CrossRef]

- Yang, Y.L.; Chen, T.; Yan, H.; Wang, J.Q.; Yan, Z.W.; Liu, W.Y. Optimization Operation Strategy for Shared Energy Storage and Regional Integrated Energy Systems Based on Multi-Level Game. Energies 2024, 17, 1770. [Google Scholar] [CrossRef]

- Zhang, B.Q.; Huang, J.W. Shared Energy Storage Capacity Configuration of a Distribution Network System with Multiple Microgrids Based on a Stackelberg Game. Energies 2024, 17, 3104. [Google Scholar] [CrossRef]

- Li, C.P.; Liu, Y.; Li, J.H.; Liu, H.J.; Zhao, Z.Q.; Zhou, H.G.; Li, Z.; Zhu, X.X. Research on the optimal configuration method of shared energy storage basing on cooperative game in wind farms. Energy Rep. 2024, 12, 3700–3710. [Google Scholar] [CrossRef]

- Wang, Z.C.; Chen, L.J.; Li, X.Z.; Mei, S.W. A two-stage optimization approach-based energy storage sharing strategy selection for limited rational users. J. Energy Storage 2024, 93, 112098. [Google Scholar] [CrossRef]

- Li, B.Y.; Yang, Q.M.; Kamwa, I. A Novel Stackelberg-Game-Based Energy Storage Sharing Scheme Under Demand Charge. IEEE/CAA J. Autom. Sin. 2023, 10, 462–473. [Google Scholar] [CrossRef]

- Xie, Y.L.; Li, L.; Hou, T.Y.; Luo, K.; Xu, Z.Y.; Dai, M.C.; Zhang, L.X. Shared energy storage configuration in distribution networks: A multi-agent tri-level programming approach. Appl. Energy 2024, 372, 123771. [Google Scholar] [CrossRef]

- Yang, M.; Zhang, Y.H.; Liu, J.H.; Yin, S.; Chen, X.; She, L.H.; Liu, H.M. Distributed Shared Energy Storage Double-Layer Optimal Configuration for Source-Grid Co-Optimization. Processes 2023, 11, 2194. [Google Scholar] [CrossRef]

- Du, X.L.; Li, X.Z.; Hao, Y.B.; Chen, L.J. Sizing of centralized shared energy storage for resilience microgrids with controllable load: A bi-level optimization approach. Front. Energy Res. 2022, 10, 954833. [Google Scholar] [CrossRef]

- Fernandez, E.; Hossain, M.J.; Mahmud, K.; Nizami, M.; Kashif, M. A Bi-level optimization-based community energy management system for optimal energy sharing and trading among peers. J. Clean. Prod. 2021, 279, 123254. [Google Scholar] [CrossRef]

- Li, Q.Q.; Pan, W.J.; Jin, W.W.; Li, Q.; Liang, Z.D.; Li, Y. A new method to improve the power quality of photovoltaic power generation based on 24 solar terms. Sci. Rep. 2025, 15, 14406. [Google Scholar] [CrossRef] [PubMed]

- Rodrigues, D.L.; Ye, X.M.; Xia, X.H.; Zhu, B. Battery energy storage sizing optimisation for different ownership structures in a peer-to-peer energy sharing community. Appl. Energy 2020, 262, 114498. [Google Scholar] [CrossRef]

- Fausto, A.C.; Patryk, S.; Egidijus, K.; Erik, J.; Irina, T.; Jakub, J. Temporal dynamics and extreme events in solar, wind, and wave energy complementarity: Insights from the Polish Exclusive Economic Zone. Energy 2024, 305, 132268. [Google Scholar]

- Jakub, J.; Paweł, T.; Bogdan, B.; Alban, K.; Egidijus, K.; Diyi, C.; Bo, M. Solar-hydro cable pooling—Utilizing the untapped potential of existing grid infrastructure. Energy Convers. Manag. 2024, 306, 118307. [Google Scholar]

- Shahzad, J.M.; Jurasz, J.; Ruggles, T.H.; Khan, I.; Ma, T. Designing off-grid renewable energy systems for reliable and resilient operation under stochastic power supply outages. Energy Convers. Manag. 2023, 294, 117605. [Google Scholar] [CrossRef]

- Cao, S.M.; Zhang, H.L.; Cao, K.; Chen, M.; Wu, Y.; Zhou, S.Y. Day-Ahead Economic Optimal Dispatch of Microgrid Cluster Considering Shared Energy Storage System and P2P Transaction. Front. Energy Res. 2021, 9, 645017. [Google Scholar] [CrossRef]

- Duan, P.F.; Zhao, B.X.; Zhang, X.H.; Fen, M.D. A day-ahead optimal operation strategy for integrated energy systems in multi-public buildings based on cooperative game. Energy 2023, 275, 127395. [Google Scholar] [CrossRef]

- Takayama, S.; Ishigame, A. A Voltage-Aware P2P Power Trading System Aimed at Eliminating Unfairness Due to the Interconnection Location. Energies 2024, 17, 841. [Google Scholar] [CrossRef]

- Yan, M.Y.; Shahidehpour, M.; Paaso, A.; Zhang, L.X.; Alabdulwahab, A.; Abusorrah, A. Distribution Network-Constrained Optimization of Peer-to-Peer Transactive Energy Trading Among Multi-Microgrids. IEEE Trans. Smart Grid 2021, 12, 1033–1047. [Google Scholar] [CrossRef]

- Zhao, W.H.; Xu, S.T.; Guo, P. Optimization Decision Study of Business Smart Building Clusters Considering Shared Energy Storage. Sustainability 2024, 16, 3422. [Google Scholar] [CrossRef]

- Chen, Y.; He, S.; Wang, W.Q.; Yuan, Z.; Cheng, J.; Cheng, Z.J.; Fan, X.C. Optimization Strategy for Shared Energy Storage Operators-Multiple Microgrids with Hybrid Game-Theoretic Energy Trading. Processes 2024, 12, 218. [Google Scholar] [CrossRef]

- Jung, S.P.; Seung, W.K.; Ji, W.L. P2P credit auction vs. net metering: Benefit analysis for prosumers under incremental block rate electricity tariff. Appl. Energy 2024, 364, 123095. [Google Scholar]

- Manchalwar, A.D.; Patne, N.R.; Pemmada, S.; Panigrahi, R.; Morey, C. Decentralized peer-to-peer model of energy trading in smart grid considering price differentiation. Energy Rep. 2023, 9 (Suppl. S10), 728–736. [Google Scholar] [CrossRef]

- Mohammad, H.G.; Hossein, Y.; Behnam, M.I. An internal pricing method for a local energy market with P2P energy trading. Energy Strategy Rev. 2025, 58, 101673. [Google Scholar]

- Noorfatima, N.; Choi, Y.; Jung, J. Two-stage peer-to-peer energy trading with combined uniform and discriminatory pricing mechanism. Renew. Energy 2025, 247, 123014. [Google Scholar] [CrossRef]

- Wang, G.Y.; Wang, C.F.; Niu, Y.F.; Yao, W.L.; Wang, K. Cooperative Optimal Decision-making for Active Distribution Network with Shared Energy Storage Leased by Prosumers. Power Syst. Autom 2025, 49, 105–116. [Google Scholar]

- Yu, J.W.; Bao, S.Y.; Li, S.; Wu, H.L.; Li, H.X. Robust Optimization of Multi-Microgrid Systems in CCHP Regions Considering Self-Built Shared Energy Storage Station. Acta Energiae Solaris Sin. 2025, 46, 503–513. [Google Scholar]

- Wu, S.J.; Li, Q.; Liu, J.K.; Zhou, Q.; Wang, C.G. Bi-level Optimal Configuration for Combined Cooling Heating and Power Multi-microgrids Based on Energy Storage Station Service. Power Syst. Technol. 2021, 45, 3822–3832. [Google Scholar]

- Ji, R.Q.; Hu, J.; Zhang, X.J.; Wang, L.; Yang, Z.J. Cost Optimization of Shared Energy Storage in Building Cluster Based on Service of a Third-party Agent. High Volt. Eng. 2024, 50, 2523–2536. [Google Scholar]

| Literature | Energy Storage Configuration Planning | Optimization of Energy Storage Dispatching | P2P Transactions Between Prosumers | P2P Transaction Price Optimization | Model |

|---|---|---|---|---|---|

| [15] | × | √ | × | × | MILP |

| [16] | √ | √ | × | × | cooperative game |

| [17] | √ | √ | × | × | multi-level game |

| [18] | √ | √ | × | × | Stackelberg game |

| [20] | × | √ | × | × | evolutionary game model |

| [33] | × | × | √ | × | IEEE 33 bus system |

| [31] | √ | √ | √ | × | / |

| [32] | × | √ | √ | √ | Nash bargaining model |

| [35] | × | √ | √ | × | / |

| [36] | × | √ | √ | √ | multi-objective master–slave game |

| [39] | × | √ | √ | √ | MINLP |

| [40] | × | × | √ | √ | ADMM |

| This article | √ | √ | √ | √ | bilevel optimization |

| Category | Time Period | Electricity Selling Price of Power Grid (CNY/kWh) | Storage Power Sales Price (CNY/kWh) | Storage Power Purchase Price (CNY/kWh) |

|---|---|---|---|---|

| Peak time | 08:00~12:00 17:00~21:00 | 1.36 | 1.15 | 0.95 |

| Flat time | 12:00~17:00 21:00~24:00 | 0.82 | 0.75 | 0.55 |

| Valley time | 00:00~08:00 | 0.37 | 0.40 | 0.20 |

| Scheme | Annual Electricity Cost for Prosumer 1/CNY 10,000 | Annual Electricity Cost for Prosumer 2/CNY 10,000 | Annual Electricity Cost for Prosumer 3/CNY 10,000 | Annual Operating Income of SES/CNY 10,000 |

|---|---|---|---|---|

| 1 | 677.6 | 412.2 | 982.8 | / |

| 2 | 653.1 | 185.7 | 965.2 | 117.1 |

| 3 | 646.7 | 135 | 907.9 | 200.4 |

| Scheme | Energy Storage Capacity/kWh | Maximum Charge and Discharge Power/kW |

|---|---|---|

| 1 | 26,824 | 6123 |

| 2 | 24,431 | 4776 |

| 3 | 13,107 | 4918 |

| Electricity Purchase Volume/kWh | Electricity Sell Volume/kWh | |

|---|---|---|

| Prosumer 1 | 736.5 | 113.5 |

| Prosumer 2 | 0 | 7130.6 |

| Prosumer 3 | 6507.6 | 0 |

| Total | 7244.1 | 7244.1 |

| Trading Entity | Bargaining Factor | Savings/CNY |

|---|---|---|

| Prosumer 1 | 0.054 | 96 |

| Prosumer 2 | 1.676 | 4077 |

| Prosumer 3 | 0.535 | 1396 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Q.; Jin, W.; Li, Q.; Pan, W.; Liang, Z.; Li, Y. Sustainable Power Coordination of Multi-Prosumers: A Bilevel Optimization Approach Based on Shared Energy Storage. Sustainability 2025, 17, 5890. https://doi.org/10.3390/su17135890

Li Q, Jin W, Li Q, Pan W, Liang Z, Li Y. Sustainable Power Coordination of Multi-Prosumers: A Bilevel Optimization Approach Based on Shared Energy Storage. Sustainability. 2025; 17(13):5890. https://doi.org/10.3390/su17135890

Chicago/Turabian StyleLi, Qingqing, Wangwang Jin, Qian Li, Wangjie Pan, Zede Liang, and Yuan Li. 2025. "Sustainable Power Coordination of Multi-Prosumers: A Bilevel Optimization Approach Based on Shared Energy Storage" Sustainability 17, no. 13: 5890. https://doi.org/10.3390/su17135890

APA StyleLi, Q., Jin, W., Li, Q., Pan, W., Liang, Z., & Li, Y. (2025). Sustainable Power Coordination of Multi-Prosumers: A Bilevel Optimization Approach Based on Shared Energy Storage. Sustainability, 17(13), 5890. https://doi.org/10.3390/su17135890