1. Introduction

The sustainable development of any enterprise requires adopting multiple strategies in production processes and related cost control. Under the long-term trend of globalization, enterprises usually deploy various stages of the production process in countries more favorable to them, namely production globalization (or offshoring production). One approach is offshoring production through greenfield investments and cross-border mergers and acquisitions to establish overseas manufacturing subsidiaries; another is international outsourcing through procurement partnerships with external suppliers [

1,

2,

3]. Additionally, the latest technological changes, particularly intelligent manufacturing technologies—such as the Internet of Things (IoT), robotics, Artificial Intelligence (AI), and the industrial internet—are helping enterprises develop new production methods to further reduce costs and improve efficiency [

4]. Therefore, both production globalization and the adoption of intelligent manufacturing technologies are critical strategies for modern enterprises to maintain competitiveness and sustainable development. These production decisions were originally inevitable choices made by modern enterprises following market principles. However, recent non-market interventions—such as U.S. President Trump’s use of “reciprocal tariffs” to forcibly increase the cost of corporate production globalization—have attempted to reverse this trend, making offshoring production and reshoring an immediate focal point of global discourse. Some scholars hold pessimistic views about reshoring, arguing that even if production returns to the U.S., it will not benefit labor forces, as new technologies like robotics and AI will ultimately dominate all processes [

5]. Our research interest lies in the following questions: How does the shift toward intelligent manufacturing in domestic production modes affect corporate offshoring production? Will it substitute offshoring and trigger reshoring or ultimately complement offshoring to become a driver for enterprises to further embrace production globalization?

In fact, the literature studying factors influencing offshoring production has made significant progress. Existing studies have conducted detailed research from cost-driven, resource-driven, and market-driven perspectives. Specifically, cost factors typically capture differences in labor costs between host and home countries; resource factors encompass the availability of raw materials, knowledge, and technology; and market factors represent the attractiveness of potential markets [

6,

7]. Against the backdrop of recent technological changes, research focusing on the impact of specific new technologies like robotics and next-generation information technologies on offshoring production—from the perspective of cost variations—has become a focal point. Using macro-level trade data from developed countries, some scholars find that the adoption of robots in developed nations, by substituting for high-cost labor and reducing domestic production costs, expands production scale and consequently promotes trade activities [

8] and offshoring production [

9] toward developing countries. However, other scholars find that robot adoption in developed countries significantly reduces the relative production costs compared to developing countries, eroding the comparative advantage of developing nations’ labor costs. This instead leads to the reshoring of offshoring production previously located in developing countries [

5,

10]. Faced with these divergent conclusions drawn from the same cost-driven factors, a few scholars have begun conducting research using micro-level firm data from developed countries. Nevertheless, relevant findings remain ambiguous or even conflicting. For instance, some scholars find that new technologies drive global production fragmentation [

11] because they reduce production costs [

12] and coordination costs [

11]. This enables firms to use increased cash flows to relocate segments of production to other countries, particularly developing nations [

12,

13]. However, other scholars draw opposite conclusions based on similar reasoning, arguing that new technologies provide low-cost production alternatives for firms in developed countries, diminishing the cost advantages of certain offshoring production and potentially triggering reshoring [

14], especially from developed countries with smaller cost differentials [

15]. This duality of perspectives and ambiguity of conclusions form the origin and motivation of this study.

Synthesizing and comparing these studies, this study observes that the existing literature fails to rigorously distinguish between offshoring production and international outsourcing. It typically relies on import data of intermediate goods to crudely measure offshoring production by capturing overseas production factors embedded in final products [

13,

16]. However, such measurements may exhibit stickiness and respond slowly to changes in other factors [

9]. This methodological limitation likely contributes significantly to the ambiguity in empirical findings. Consequently, it becomes imperative to examine the distinction between these two concepts. In offshoring production, enterprises face decisions between completing production tasks internally or externally procuring intermediate goods [

17]. Offshoring production essentially represents firms’ reconfiguration of production activities within organizational boundaries based on optimal resource allocation principles, enabling rapid and direct responses to cost and market fluctuations. In contrast, international outsourcing externalizes internal production activities, introducing additional complexities like bargaining dynamics with external suppliers and contractual frictions, resulting in greater inertia in responding to cost changes. Therefore, this paper focuses exclusively on corporate offshoring production, employing the number of overseas manufacturing subsidiaries as a precise metric to isolate its effects from international outsourcing interference, thereby generating more accurate and credible empirical results.

Building upon the existing literature’s preference for studying specific new technologies, this paper attempts to go further by directly exploring to what extent enterprises’ new production modes transformed by various new technologies—namely intelligent manufacturing—promote offshoring production or induce reshoring. Another major breakthrough of this study relative to the existing literature is it being the first to investigate how developing country enterprises’ adoption of intelligent manufacturing affects offshoring production. Typically, constrained by aging populations and rising labor costs, firms in developed countries may adopt intelligent manufacturing as a consequence of directed technological change induced by tight labor markets [

18,

19,

20]. On the one hand, this naturally leads to highly significant cost-reduction effects from intelligent manufacturing. On the other hand, studies using data from developed countries to examine the impact of intelligent manufacturing on firms’ production factor allocation often face severe endogeneity issues. Conversely, as a developing economy with abundant lower-cost labor, the cost-reduction effect of intelligent manufacturing in China is highly likely to be less significant than that in developed countries. Therefore, research based on Chinese firms will likely yield different conclusions. Furthermore, the adoption of intelligent manufacturing by Chinese firms is not the result of directed technological change but rather stems from the government’s forward-looking industrial planning for intelligent manufacturing—exemplified by policies such as “Made in China 2025” [

21] and the “Intelligent Manufacturing Development Plan (2016–2020)” [

22]. These policy-driven exogenous shocks provide a unique quasi-natural experiment for causal identification. Our starting point is utilizing China’s government-driven Intelligent Manufacturing Pilot Demonstration Projects (IMPDP) to accurately identify enterprise adoption of intelligent manufacturing, then employing a heterogeneity-robust nonlinear Difference-in-Differences (DID) method to identify the causal effects of intelligent manufacturing on corporate offshoring production. To strengthen the argument for causal effects, a task-based enterprise model is constructed to analyze the multiple mechanisms through which intelligent manufacturing affects corporate offshoring production.

Theoretical research reveals that intelligent manufacturing affects corporate demand for offshoring production through three mechanisms: First, there is the reshoring effect. On the extensive margin of task sets, intelligent manufacturing enhances capital productivity in specific tasks, prompting capital to execute originally offshored tasks, leading to their reshoring to domestic production. Second, there is the offshoring effect. On the extensive margin of task sets, intelligent manufacturing improves firms’ capabilities to build global supply chains, driving offshore output to replace tasks originally assigned to domestic labor, resulting in offshoring of these tasks. Third, there is the productivity effect. On the intensive margin of task sets, intelligent manufacturing boosts productivity in existing tasks, reduces per-unit production costs, thereby increasing overall corporate output and proportionally expanding offshoring scale. In summary, the task-based theoretical model unveils the underlying logic behind conflicting conclusions in the existing literature: intelligent manufacturing simultaneously generates reshoring pull and offshoring push forces on corporate offshoring production, explaining why empirical studies on firms from different countries yield divergent or even contradictory results.

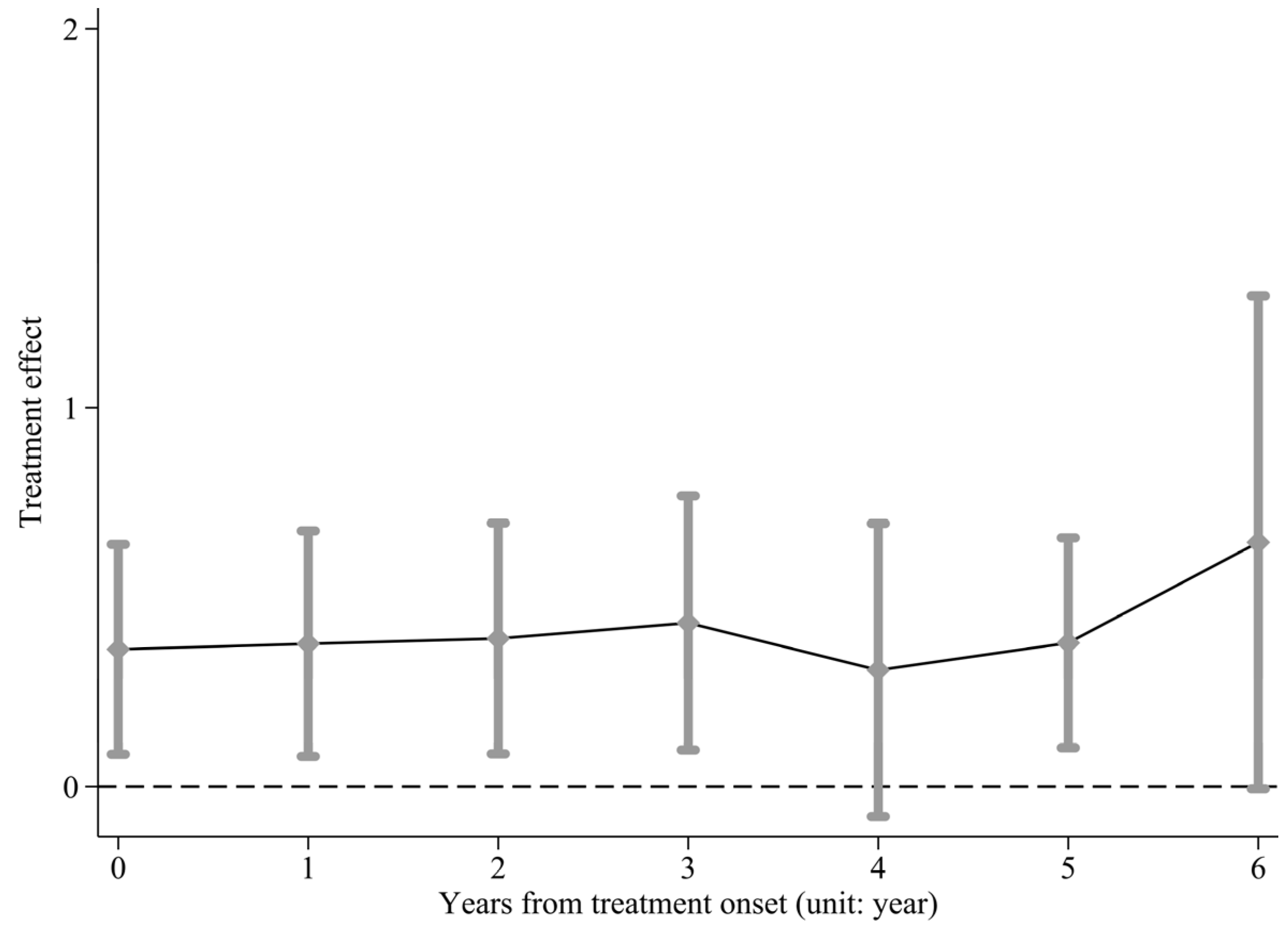

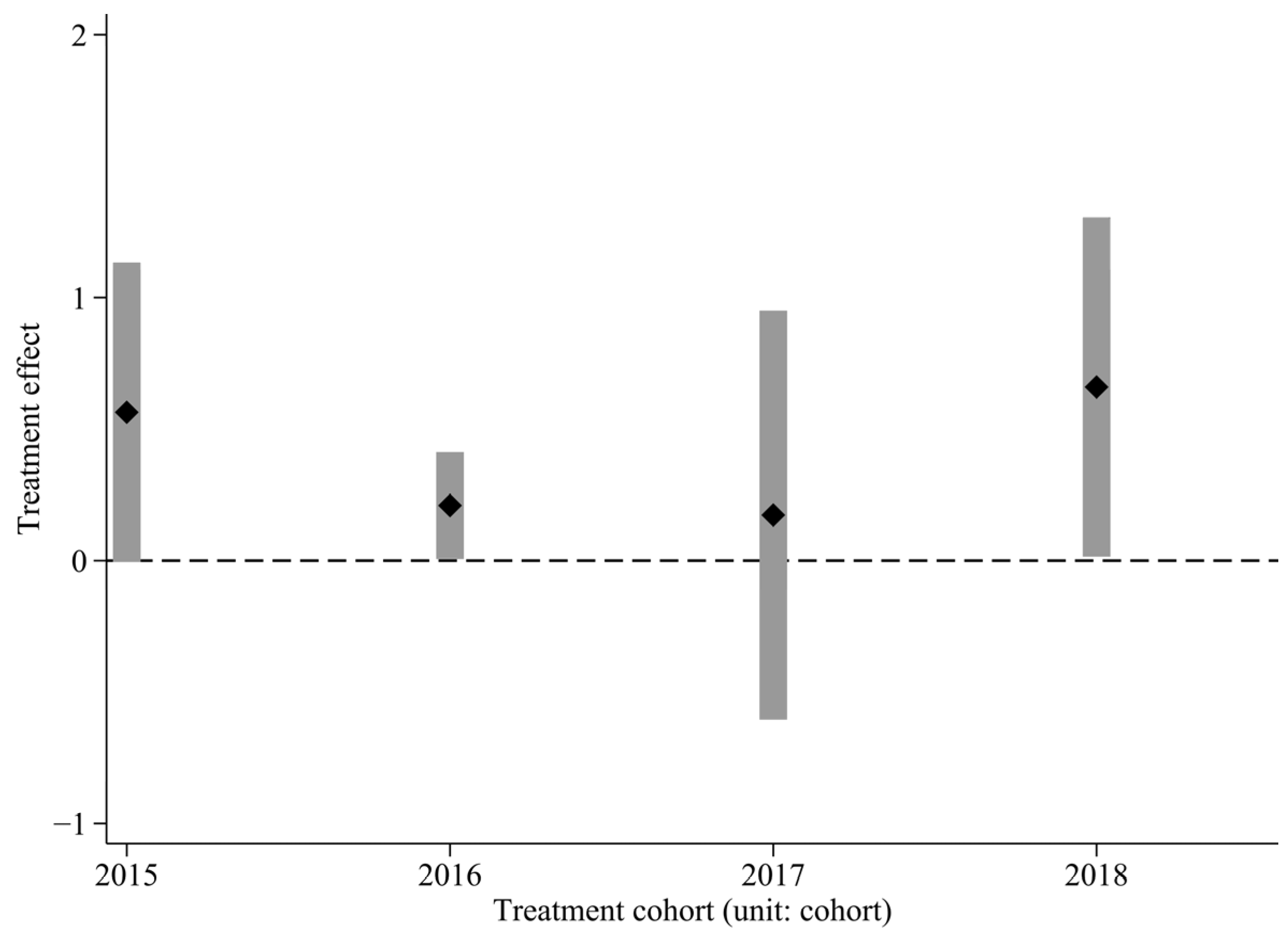

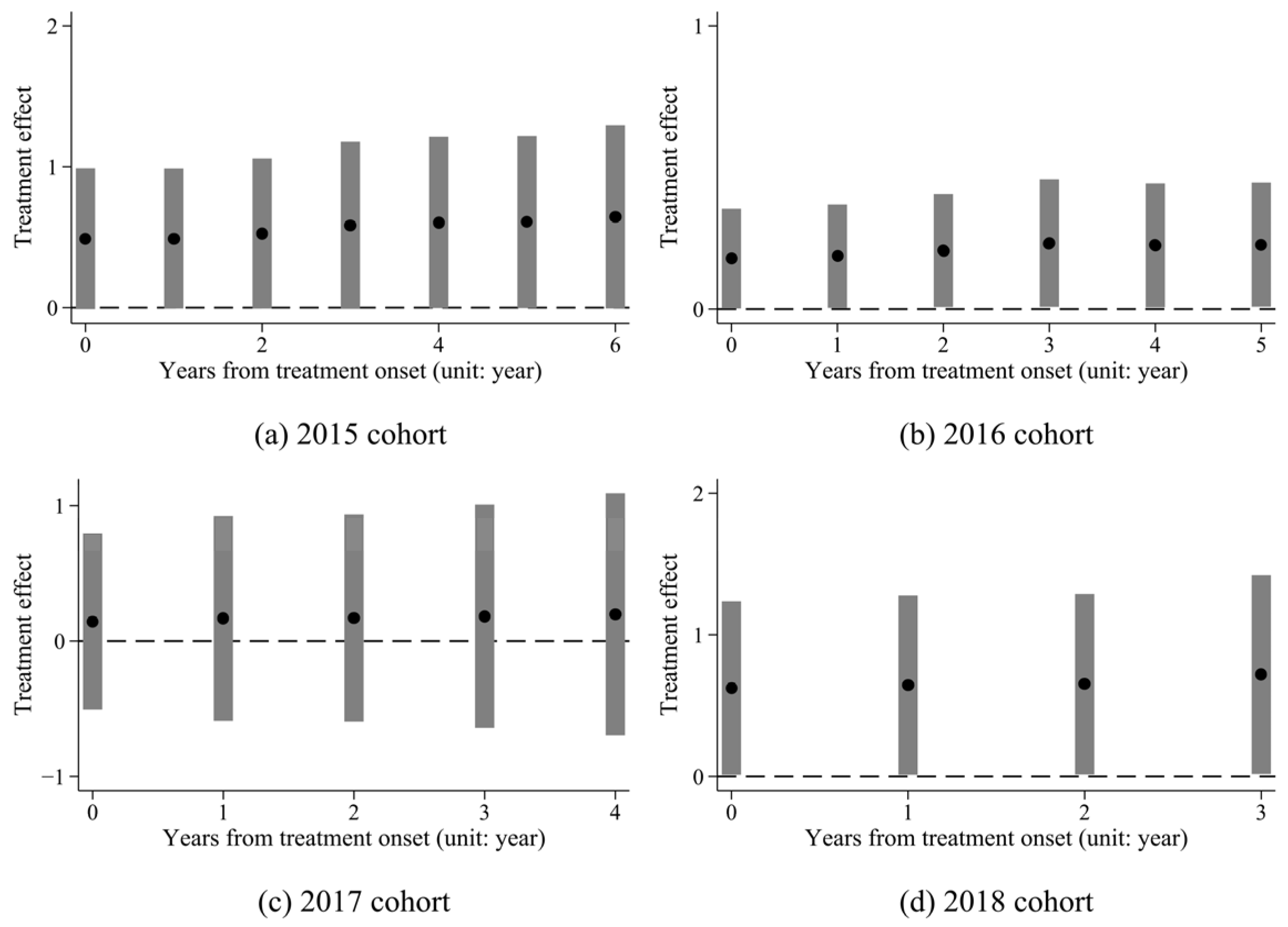

To enhance the robustness of causal effects as much as possible, the latest heterogeneity-robust extended two-way fixed effects (ETWFE) model is adopted [

23] in empirical research to evaluate the aggregate and dynamic impacts of intelligent manufacturing on Chinese manufacturing enterprises’ offshoring production. This paper also investigates the heterogeneity of intelligent manufacturing effects across different treatment cohorts and the dynamic evolution of effects in each treatment cohort. The main empirical analysis yields several conclusions. First, intelligent manufacturing significantly promotes corporate offshoring production. Specifically, an increase in corporate offshoring production intensity of 38.7% due to intelligent manufacturing is indicated by the preferred estimates. Second, the dynamic effects of intelligent manufacturing are highly stable and persistent both in average terms and across treatment cohorts. Finally, significant heterogeneity in the impacts of intelligent manufacturing on corporate offshoring production across different treatment cohorts is observed, confirming that this heterogeneity may be closely related to cohort-level average capital intensity. Additionally, the robustness of our results and main conclusions is tested and confirmed under DID- and ETWFE-specific assumptions, placebo treatment settings, and scenarios accounting for sample selection biases.

Beyond core empirical findings, this paper also provides comprehensive and nuanced analyses of intelligent manufacturing’s effects. First, through mechanism analysis, this study finds that in China’s context, the reshoring effect of intelligent manufacturing may be stronger than the offshoring effect, but the productivity effect is so powerful that it masks the existence of reshoring effects in aggregate results. Second, a heterogeneity analysis provides evidence that the positive effects of intelligent manufacturing are more pronounced in non-state-owned enterprises (non-SOEs) and capital-intensive firms. Third, this paper also finds that intelligent manufacturing simultaneously promotes Chinese enterprises’ offshoring production to both developing and developed countries, incentivizing firms to seek global cost control and technological upgrading more actively. Moreover, the effects of intelligent manufacturing are additionally significantly influenced by China’s Belt and Road Initiative. Finally, the impacts of intelligent manufacturing on corporate offshore trade and R&D activities are further examined, revealing that while intelligent manufacturing has significant positive effects on Chinese enterprises’ offshore trade, it leads to reshoring of offshore R&D activities.

This paper contributes to the emerging literature on how new technologies affect offshoring production in three aspects. First, existing studies focusing on offshoring and reshoring predominantly concentrate on developed countries, particularly the EU and the U.S. [

10], with nearly no attention to developing country perspectives. By examining corporate offshoring production in China’s context, this study supplements the relevant literature with evidence from developing countries. Second, studies using firm-level data to investigate how new technologies affect corporate offshoring production remain extremely limited and yield ambiguous empirical conclusions, let alone causal effect identification. This paper constructs a task-based enterprise model [

24,

25], theoretically demonstrating that intelligent manufacturing jointly influences corporate offshoring production through reshoring, offshoring, and productivity effects, thereby revealing the underlying logic behind conflicting conclusions in the existing literature and enriching discussions about the causal effects of new technologies on offshoring production and reshoring. Finally, this paper introduces the latest heterogeneity-robust ETWFE model [

23,

26] into the traditional literature domain of offshoring studies, employs comprehensive robustness checks and detailed multi-dimensional empirical analyses to strengthen causal effect arguments for intelligent manufacturing, and provides a novel empirical approach for the related literature.

The remainder of this paper is structured as follows:

Section 2 proposes a task-based firm model that motivates our empirical strategy and interpretation.

Section 3 describes data and variable measurement and introduces our empirical strategy.

Section 4 reports the main regression results of intelligent manufacturing effects.

Section 5 conducts a series of robustness analyses.

Section 6 performs a mechanism analysis of theoretical channels, with

Section 7 further testing these mechanisms through a heterogeneity analysis.

Section 8 expands additional analyses of intelligent manufacturing effects.

Section 9 summarizes the main conclusions and discusses the policy implications and limitations of this study.