Abstract

Under the background of globalization and the latest technological changes, many enterprises ensure corporate competitiveness and sustainable development by deploying production globalization and transforming production modes. This paper proposes a task-based enterprise model to study how enterprises’ production mode transformation toward intelligent manufacturing affects corporate offshoring production. Intelligent manufacturing forms relative push–pull forces on corporate offshoring production through reshoring effects and offshoring effects on the extensive margin of task sets while promoting corporate offshoring production through productivity effects on the intensive margin. Empirically, this paper constructs a staggered quasi-natural experiment using China’s Intelligent Manufacturing Pilot Demonstration Projects (IMPDP), adopts the heterogeneity-robust nonlinear Difference-in-Differences (DID) method, and confirms that intelligent manufacturing has significant positive causal effects on Chinese manufacturing enterprises’ offshoring production. The reshoring effect of intelligent manufacturing is stronger than the offshoring effect, but its powerful productivity effect masks the reshoring effect in overall empirical results. The positive effects of intelligent manufacturing are more significant in non-state-owned enterprises (non-SOEs) and capital-intensive enterprises. Further considering host country selection for corporate offshoring, this study finds that intelligent manufacturing simultaneously promotes corporate offshoring production to both developed and developing countries, but enterprises prefer Belt and Road Initiative countries. Additionally, intelligent manufacturing also promotes corporate offshore trade activities while causing the reshoring of offshore R&D activities. Overall, the transition of production modes toward intelligent manufacturing in Chinese manufacturing enterprises generally leads to a further expansion of corporate offshoring production.

1. Introduction

The sustainable development of any enterprise requires adopting multiple strategies in production processes and related cost control. Under the long-term trend of globalization, enterprises usually deploy various stages of the production process in countries more favorable to them, namely production globalization (or offshoring production). One approach is offshoring production through greenfield investments and cross-border mergers and acquisitions to establish overseas manufacturing subsidiaries; another is international outsourcing through procurement partnerships with external suppliers [1,2,3]. Additionally, the latest technological changes, particularly intelligent manufacturing technologies—such as the Internet of Things (IoT), robotics, Artificial Intelligence (AI), and the industrial internet—are helping enterprises develop new production methods to further reduce costs and improve efficiency [4]. Therefore, both production globalization and the adoption of intelligent manufacturing technologies are critical strategies for modern enterprises to maintain competitiveness and sustainable development. These production decisions were originally inevitable choices made by modern enterprises following market principles. However, recent non-market interventions—such as U.S. President Trump’s use of “reciprocal tariffs” to forcibly increase the cost of corporate production globalization—have attempted to reverse this trend, making offshoring production and reshoring an immediate focal point of global discourse. Some scholars hold pessimistic views about reshoring, arguing that even if production returns to the U.S., it will not benefit labor forces, as new technologies like robotics and AI will ultimately dominate all processes [5]. Our research interest lies in the following questions: How does the shift toward intelligent manufacturing in domestic production modes affect corporate offshoring production? Will it substitute offshoring and trigger reshoring or ultimately complement offshoring to become a driver for enterprises to further embrace production globalization?

In fact, the literature studying factors influencing offshoring production has made significant progress. Existing studies have conducted detailed research from cost-driven, resource-driven, and market-driven perspectives. Specifically, cost factors typically capture differences in labor costs between host and home countries; resource factors encompass the availability of raw materials, knowledge, and technology; and market factors represent the attractiveness of potential markets [6,7]. Against the backdrop of recent technological changes, research focusing on the impact of specific new technologies like robotics and next-generation information technologies on offshoring production—from the perspective of cost variations—has become a focal point. Using macro-level trade data from developed countries, some scholars find that the adoption of robots in developed nations, by substituting for high-cost labor and reducing domestic production costs, expands production scale and consequently promotes trade activities [8] and offshoring production [9] toward developing countries. However, other scholars find that robot adoption in developed countries significantly reduces the relative production costs compared to developing countries, eroding the comparative advantage of developing nations’ labor costs. This instead leads to the reshoring of offshoring production previously located in developing countries [5,10]. Faced with these divergent conclusions drawn from the same cost-driven factors, a few scholars have begun conducting research using micro-level firm data from developed countries. Nevertheless, relevant findings remain ambiguous or even conflicting. For instance, some scholars find that new technologies drive global production fragmentation [11] because they reduce production costs [12] and coordination costs [11]. This enables firms to use increased cash flows to relocate segments of production to other countries, particularly developing nations [12,13]. However, other scholars draw opposite conclusions based on similar reasoning, arguing that new technologies provide low-cost production alternatives for firms in developed countries, diminishing the cost advantages of certain offshoring production and potentially triggering reshoring [14], especially from developed countries with smaller cost differentials [15]. This duality of perspectives and ambiguity of conclusions form the origin and motivation of this study.

Synthesizing and comparing these studies, this study observes that the existing literature fails to rigorously distinguish between offshoring production and international outsourcing. It typically relies on import data of intermediate goods to crudely measure offshoring production by capturing overseas production factors embedded in final products [13,16]. However, such measurements may exhibit stickiness and respond slowly to changes in other factors [9]. This methodological limitation likely contributes significantly to the ambiguity in empirical findings. Consequently, it becomes imperative to examine the distinction between these two concepts. In offshoring production, enterprises face decisions between completing production tasks internally or externally procuring intermediate goods [17]. Offshoring production essentially represents firms’ reconfiguration of production activities within organizational boundaries based on optimal resource allocation principles, enabling rapid and direct responses to cost and market fluctuations. In contrast, international outsourcing externalizes internal production activities, introducing additional complexities like bargaining dynamics with external suppliers and contractual frictions, resulting in greater inertia in responding to cost changes. Therefore, this paper focuses exclusively on corporate offshoring production, employing the number of overseas manufacturing subsidiaries as a precise metric to isolate its effects from international outsourcing interference, thereby generating more accurate and credible empirical results.

Building upon the existing literature’s preference for studying specific new technologies, this paper attempts to go further by directly exploring to what extent enterprises’ new production modes transformed by various new technologies—namely intelligent manufacturing—promote offshoring production or induce reshoring. Another major breakthrough of this study relative to the existing literature is it being the first to investigate how developing country enterprises’ adoption of intelligent manufacturing affects offshoring production. Typically, constrained by aging populations and rising labor costs, firms in developed countries may adopt intelligent manufacturing as a consequence of directed technological change induced by tight labor markets [18,19,20]. On the one hand, this naturally leads to highly significant cost-reduction effects from intelligent manufacturing. On the other hand, studies using data from developed countries to examine the impact of intelligent manufacturing on firms’ production factor allocation often face severe endogeneity issues. Conversely, as a developing economy with abundant lower-cost labor, the cost-reduction effect of intelligent manufacturing in China is highly likely to be less significant than that in developed countries. Therefore, research based on Chinese firms will likely yield different conclusions. Furthermore, the adoption of intelligent manufacturing by Chinese firms is not the result of directed technological change but rather stems from the government’s forward-looking industrial planning for intelligent manufacturing—exemplified by policies such as “Made in China 2025” [21] and the “Intelligent Manufacturing Development Plan (2016–2020)” [22]. These policy-driven exogenous shocks provide a unique quasi-natural experiment for causal identification. Our starting point is utilizing China’s government-driven Intelligent Manufacturing Pilot Demonstration Projects (IMPDP) to accurately identify enterprise adoption of intelligent manufacturing, then employing a heterogeneity-robust nonlinear Difference-in-Differences (DID) method to identify the causal effects of intelligent manufacturing on corporate offshoring production. To strengthen the argument for causal effects, a task-based enterprise model is constructed to analyze the multiple mechanisms through which intelligent manufacturing affects corporate offshoring production.

Theoretical research reveals that intelligent manufacturing affects corporate demand for offshoring production through three mechanisms: First, there is the reshoring effect. On the extensive margin of task sets, intelligent manufacturing enhances capital productivity in specific tasks, prompting capital to execute originally offshored tasks, leading to their reshoring to domestic production. Second, there is the offshoring effect. On the extensive margin of task sets, intelligent manufacturing improves firms’ capabilities to build global supply chains, driving offshore output to replace tasks originally assigned to domestic labor, resulting in offshoring of these tasks. Third, there is the productivity effect. On the intensive margin of task sets, intelligent manufacturing boosts productivity in existing tasks, reduces per-unit production costs, thereby increasing overall corporate output and proportionally expanding offshoring scale. In summary, the task-based theoretical model unveils the underlying logic behind conflicting conclusions in the existing literature: intelligent manufacturing simultaneously generates reshoring pull and offshoring push forces on corporate offshoring production, explaining why empirical studies on firms from different countries yield divergent or even contradictory results.

To enhance the robustness of causal effects as much as possible, the latest heterogeneity-robust extended two-way fixed effects (ETWFE) model is adopted [23] in empirical research to evaluate the aggregate and dynamic impacts of intelligent manufacturing on Chinese manufacturing enterprises’ offshoring production. This paper also investigates the heterogeneity of intelligent manufacturing effects across different treatment cohorts and the dynamic evolution of effects in each treatment cohort. The main empirical analysis yields several conclusions. First, intelligent manufacturing significantly promotes corporate offshoring production. Specifically, an increase in corporate offshoring production intensity of 38.7% due to intelligent manufacturing is indicated by the preferred estimates. Second, the dynamic effects of intelligent manufacturing are highly stable and persistent both in average terms and across treatment cohorts. Finally, significant heterogeneity in the impacts of intelligent manufacturing on corporate offshoring production across different treatment cohorts is observed, confirming that this heterogeneity may be closely related to cohort-level average capital intensity. Additionally, the robustness of our results and main conclusions is tested and confirmed under DID- and ETWFE-specific assumptions, placebo treatment settings, and scenarios accounting for sample selection biases.

Beyond core empirical findings, this paper also provides comprehensive and nuanced analyses of intelligent manufacturing’s effects. First, through mechanism analysis, this study finds that in China’s context, the reshoring effect of intelligent manufacturing may be stronger than the offshoring effect, but the productivity effect is so powerful that it masks the existence of reshoring effects in aggregate results. Second, a heterogeneity analysis provides evidence that the positive effects of intelligent manufacturing are more pronounced in non-state-owned enterprises (non-SOEs) and capital-intensive firms. Third, this paper also finds that intelligent manufacturing simultaneously promotes Chinese enterprises’ offshoring production to both developing and developed countries, incentivizing firms to seek global cost control and technological upgrading more actively. Moreover, the effects of intelligent manufacturing are additionally significantly influenced by China’s Belt and Road Initiative. Finally, the impacts of intelligent manufacturing on corporate offshore trade and R&D activities are further examined, revealing that while intelligent manufacturing has significant positive effects on Chinese enterprises’ offshore trade, it leads to reshoring of offshore R&D activities.

This paper contributes to the emerging literature on how new technologies affect offshoring production in three aspects. First, existing studies focusing on offshoring and reshoring predominantly concentrate on developed countries, particularly the EU and the U.S. [10], with nearly no attention to developing country perspectives. By examining corporate offshoring production in China’s context, this study supplements the relevant literature with evidence from developing countries. Second, studies using firm-level data to investigate how new technologies affect corporate offshoring production remain extremely limited and yield ambiguous empirical conclusions, let alone causal effect identification. This paper constructs a task-based enterprise model [24,25], theoretically demonstrating that intelligent manufacturing jointly influences corporate offshoring production through reshoring, offshoring, and productivity effects, thereby revealing the underlying logic behind conflicting conclusions in the existing literature and enriching discussions about the causal effects of new technologies on offshoring production and reshoring. Finally, this paper introduces the latest heterogeneity-robust ETWFE model [23,26] into the traditional literature domain of offshoring studies, employs comprehensive robustness checks and detailed multi-dimensional empirical analyses to strengthen causal effect arguments for intelligent manufacturing, and provides a novel empirical approach for the related literature.

The remainder of this paper is structured as follows: Section 2 proposes a task-based firm model that motivates our empirical strategy and interpretation. Section 3 describes data and variable measurement and introduces our empirical strategy. Section 4 reports the main regression results of intelligent manufacturing effects. Section 5 conducts a series of robustness analyses. Section 6 performs a mechanism analysis of theoretical channels, with Section 7 further testing these mechanisms through a heterogeneity analysis. Section 8 expands additional analyses of intelligent manufacturing effects. Section 9 summarizes the main conclusions and discusses the policy implications and limitations of this study.

2. Theory

This model builds upon Acemoglu’s core theories and ideas [24,25], incorporates corporate offshoring production, and constructs a single-product task-based enterprise model to explore how intelligent manufacturing affects corporate offshoring production.

2.1. Tasks and Production

In theoretical framework, firm output is produced by combining outputs of tasks with unit elasticity. The firm’s production function is expressed as follows:

where represents the complete set of feasible tasks invested in production by the firm; is the firm’s total factor productivity (TFP); and reflects the importance of different tasks in the production process. We set to ensure the firm’s production exhibits constant returns to scale. Additionally, it is assumed that the firm faces a downward-sloping demand curve and sets its product price to maximize profits.

Offshoring production refers to the transfer of certain tasks originally completed by domestic production factors to foreign locations. It is crucial to emphasize that the execution of offshored tasks can occur either within corporate boundaries or beyond them. Specifically, manufacturing enterprises’ demand for foreign intermediates (or services) can be met either through establishing vertically integrated multinational enterprises or by outsourcing to foreign suppliers. The deployment of production globalization by enterprises is a complex and intriguing issue. However, regardless of whether firms delegate offshored tasks to overseas subsidiaries or outsource them to foreign suppliers; theoretically, their demand for foreign production factors remains equivalent, and such demand is similarly determined by task characteristics and production technologies. Therefore, to simplify model derivation, this distinction is neglected in theoretical research. Firms’ demand for offshore output is modeled as .

Currently, tasks can be executed by domestic labor , capital , or offshore output . The firm’s key economic decision is how to produce all tasks in the feasible task set , i.e., determining the quantity of domestic labor , capital equipment , or offshore output to allocate to task . Perfect substitutability between factors is assumed, with the firm’s task production function expressed as follows:

where represents the productivity of domestic labor in task ; denotes the productivity of capital in task ; and indicates the productivity of offshore output in task . Crucially, technological constraints are imposed on firm production: capital cannot substitute domestic labor or offshore output in certain tasks, i.e., for these tasks. Additionally, limited by firms’ global supply chain capabilities, offshore output cannot replace domestic labor in specific tasks, i.e., for these tasks. Most importantly, to simplify derivation, it is assumed that one unit of offshore output requires one unit of foreign labor (envisioning outsourced intermediate processing or algorithmic services), which can be formally expressed as . This implies that in offshoring tasks, the quantity of foreign labor input equals offshore output quantity . Additionally, this study assumes that firms are price takers in factor markets, with domestic labor, capital, and foreign labor prices being , , and , respectively, and domestic labor, capital, and foreign labor are inelastically supplied.

2.2. Demand for Offshore Output

The firm allocates all feasible tasks to domestic labor, capital, and offshore output to minimize production costs, denoted as , considering the initial condition where tasks are assigned to domestic labor, to capital, and to offshore output, with . Consequently, the production cost can be further expressed as follows:

Additionally, enterprises must satisfy production constraint conditions:

By combining Equations (3) and (4), solving the firm’s cost minimization problem allows us to derive the unit cost of production:

Then, the total demand of enterprises for offshore output can be expressed as follows:

2.3. The Impact of Intelligent Manufacturing on Offshoring Production

First, intelligent manufacturing is assumed as the enhancement of capital productivity within a subset of tasks () originally allocated to offshore output. For tasks , intelligent manufacturing transforms capital productivity from the initial to with . Consequently, within task set , executing tasks via capital becomes cheaper or more efficient than through offshore output. First, after firms adopt intelligent manufacturing, the task share of offshore output undergoes changes:

Secondly, unit costs also change:

Then, the total cost change can be expressed as follows:

where is the demand elasticity faced by the firm and is the firm’s price pass-through rate, reflecting how product prices respond to changes in unit costs.

Consequently, the change in enterprises’ aggregate demand for offshore output can be represented as follows:

This impact is summarized as Proposition 1.

Proposition 1.

Considering firms’ adoption of intelligent manufacturing, the improvement in capital productivity

for tasks

leads to capital deployment in these tasks, impacting offshoring production as follows:

Proposition 1 indicates that the direct impact of capital productivity improvements in specific tasks is to reduce the task set executed by offshore output, thereby directly decreasing corporate offshoring production. Some offshored tasks are repatriated to domestic capital production, an effect captured by the second term on the right side of Equation (11), which is termed the “reshoring effect”. Furthermore, the shift of tasks from offshore execution to domestic capital completion lowers unit costs and increases corporate output (the magnitude of output change depends on the firm’s demand elasticity and price pass-through rate), thereby indirectly proportionally expanding corporate offshoring production. This impact is reflected in the first term on the right side of Equation (11), which is summarized as the “productivity effect”.

More importantly, enterprises’ adoption of intelligent manufacturing not only enhances capital productivity but also improves their capability to build global supply chains—for instance, using AI computing to optimize and expand supply chains, implementing remote offshore operations and monitoring through industrial internet and digital twin technologies. This can be simplified as intelligent manufacturing reducing firms’ cross-border communication and coordination costs [11], enabling offshoring of tasks previously constrained by costs or technical limitations [27].

Therefore, intelligent manufacturing is further modeled as a technological leap in firms’ capability to construct global supply chains for tasks . Specifically, for tasks , the productivity of offshore output transforms from initial to with . Consequently, within task set , offshore production becomes cheaper or more efficient than domestic labor. First, the task share of offshore output changes:

Second, unit costs also change:

Then, total cost changes can be expressed as follows:

Therefore, the change in firms’ demand for offshore output can be represented as follows:

This impact is summarized as Proposition 2.

Proposition 2.

Considering firms’ adoption of intelligent manufacturing, which enhances their capability to build global supply chains—i.e., increases the productivity

of offshore output in tasks

—the impact on offshoring production is as follows:

Proposition 2 indicates that the direct impact of enhanced global supply chain capabilities is to expand the executable task set for offshore output [27], thereby increasing offshoring production. This effect is captured by the second term on the right side of Equation (16), which is termed the “offshoring effect”. Additionally, shifting tasks from domestic labor to offshore execution reduces unit costs and increases corporate output (the magnitude of output change depends on the firm’s demand elasticity and price pass-through rate), thereby indirectly proportionally raising demand for offshore output. This impact is reflected in the first term on the right side of Equation (16), which is summarized as the “productivity effect”.

In summary, the impact of intelligent manufacturing on corporate offshoring production can be categorized into three mechanisms: First, there is the reshoring effect. On the extensive margin of task sets, intelligent manufacturing enhances capital productivity in specific tasks, driving capital to replace tasks originally allocated to offshore output, causing these tasks to return to domestic production and thereby reducing corporate offshoring. Second, there is the offshoring effect. On the extensive margin of task sets, intelligent manufacturing improves firms’ capabilities to build global supply chains, promoting offshore output to replace tasks originally assigned to domestic labor, leading to the offshoring of these tasks. Third, there is the productivity effect. On the intensive margin of task sets, intelligent manufacturing reduces per-unit production costs, increases overall corporate output, and thus indirectly expands corporate offshoring production.

3. Empirical Design

Next, the data and variable measurement in this paper are first described, followed by an introduction of the models used for main empirical analysis.

3.1. Data and Variable Measurement

The largest estimation sample of this study was an unbalanced panel dataset containing detailed firm-level foreign direct investment data, covering all A-share listed manufacturing enterprises in China during the period of 2011–2021. It should be emphasized that the definition and classification of the manufacturing sector in this study are based on the industry classification system of the China Association for Public Companies which is “China Association for Public Companies Industry Statistical Classification Guidance for Listed Companies (2023 edition)” [28]. The research sample was defined as all manufacturing industries corresponding to two-digit industry codes ranging from C13 to C43, including but not limited to “Food Manufacturing (C14)”, “Pharmaceutical Manufacturing (C27)”, “Automobile Manufacturing (C36)”, and “Computer/Electronic Equipment (C39)”. Moreover, it was also demonstrated that the main results remained robust when using a balanced panel dataset. Additionally, to prevent data quality issues like missing values, extreme values, and outliers from affecting regression accuracy, the following data treatments were implemented: (1) ST, *ST, and PT-categorized firms were excluded; (2) insolvent enterprises were removed.

The dependent variable was corporate offshoring production (Offshore). This paper used the number of overseas manufacturing subsidiaries to measure corporate offshoring production. As the dependent variable was a count variable, this paper employed nonlinear regression methods. Data on overseas subsidiaries were sourced from the China Stock Market & Accounting Research (CSMAR) database [29]. This study first excluded subsidiaries located in tax havens, Hong Kong, Macau, and Taiwan, then identified subsidiary types based on business scope keywords. Subsidiaries containing keywords like “production”, “manufacturing”, “processing”, or “assembly” were classified as manufacturing subsidiaries. Similarly, subsidiaries with keywords like “sales”, “trade”, “commerce”, or “procurement” were identified as trading subsidiaries, while those with “R&D”, “research”, “development”, or “design” were classified as R&D subsidiaries.

The core explanatory variable was intelligent manufacturing (IM). This paper treated the impact of China’s four batches of Intelligent Manufacturing Pilot Demonstration Projects (2015–2018) on manufacturing enterprises as a staggered quasi-natural experiment, designating pilot enterprises as the treatment group (those adopting intelligent manufacturing) and others as the control group. The pilot enterprise list came from China’s Ministry of Industry and Information Technology (MIIT) [30]. Pilot enterprises are recommended by regional industry authorities and central enterprise groups, undergo expert review and centralized screening, and are finalized by MIIT. These enterprises must reform production methods under central government supervision to achieve goals like discrete/process-based intelligent manufacturing, networked collaboration, mass customization, or remote operations, significantly enhancing intelligent component autonomy and improving product/process/service intelligence. This measurement advantageously avoids self-reported cosmetic investment data, authentically capturing production transformation. For completeness, Table 1 reports observation counts, firms, and years in the unbalanced panel dataset.

Table 1.

Descriptive statistics: observations across different dimensions.

Furthermore, to obtain more robust estimates for baseline results, this paper selected covariates that comprehensively reflect corporate operations and governance, implementing 1% winsorization at both tails to mitigate extreme value interference. Relevant data were sourced from the CSMAR database. Table 2 reports descriptive statistics of the dependent variable and covariates.

Table 2.

Descriptive statistics: variables.

3.2. Empirical Models

To achieve the most precise estimation for the count variable offshore under the staggered quasi-natural experiment setting, this paper constructed a heterogeneity-robust nonlinear DID empirical model referencing the latest ETWFE framework [23,26]:

where the dependent variable is corporate offshoring production; is a dummy variable equal to 1 if the observation belongs to treatment group in period , otherwise 0. is a set indicating all treatment groups’ initiation timing; is the final analysis period. and are fixed effects for individual and time dimensions, respectively. The baseline empirical model focuses on identifying the conditional expectation of the outcome variable as a Poisson nonlinear function of treatment status , individual fixed effects , and time fixed effects , enabling average treatment effect estimation under different assumptions. This model allows flexible specification of , avoiding the bad controls and negative weighting problems identified in traditional TWFE estimators [23]. Additionally, regression standard errors are cluster-adjusted at the firm level.

4. Main Empirical Results

This section presents our main empirical results. First, the identifying assumptions of the ETWFE model were tested, followed by the derivation of the primary empirical findings on intelligent manufacturing effects. Further discussion is provided on the heterogeneity of these effects across different treatment cohorts as well as the dynamic evolution of effects within each cohort.

4.1. Test of Identifying Assumptions

In this section, the no-anticipation assumption and parallel trend assumption of the ETWFE model are tested. Generally, applying DID method requires verifying whether the outcome variable satisfies these assumptions, using the significance levels of pre-treatment coefficients from event study analyses as evaluation criteria. For nonlinear models, the linear parallel trend assumption can be imposed on the model’s latent variable rather than the outcome variable itself [23]. Therefore, the testing model is constructed by adding cohort-year-specific placebo effects before treatment initiation to the baseline specification (17):

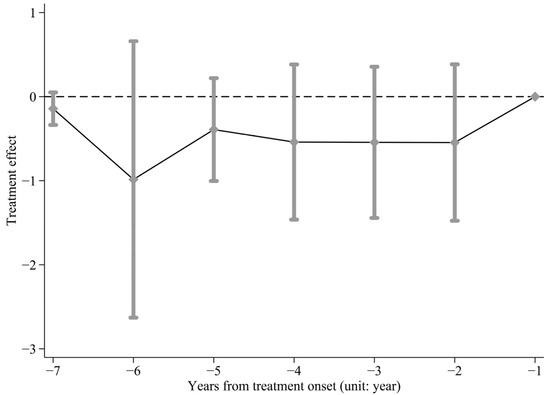

Figure 1 displays the cohort-aggregated placebo treatment effects across event time. To avoid misleading visual inferences, pre-treatment and post-treatment estimates are separated in presentation [31]. It is found that pre-treatment effects are statistically insignificant at the 5% level, providing evidence supporting the no-anticipation and parallel trend assumptions. Therefore, the main empirical analysis is proceeded with.

Figure 1.

Pre-treatment effects. Notes: This figure reports pre-trend estimates of cohort-year-specific placebo effects before treatment initiation using the most complete sample in this study. Cohort-year-specific treatment effects are aggregated across cohorts to obtain event-time-specific treatment effect estimates. The 95% confidence intervals are shown using firm-clustered standard errors.

4.2. Baseline Regression Results

The preferred primary estimates of the overall intelligent manufacturing effects are presented in Columns (3) and (4) of Table 3, using an estimation sample covering all normally operating listed manufacturing enterprises in China. The main implication of these results is that on average, firms’ adoption of intelligent manufacturing significantly enhances their offshoring production intensity. Specifically, after further controlling for covariates reflecting corporate operations and governance characteristics, the intelligent manufacturing estimate in Column (4) indicates that intelligent manufacturing increases corporate offshoring production intensity by 38.7%, significant at the 1% level. Highly similar intelligent manufacturing estimates are obtained using balanced panel data, confirming the robustness of these results, as shown in Columns (1) and (2) of Table 3.

Table 3.

Average intelligent manufacturing effects on firm’s offshoring production.

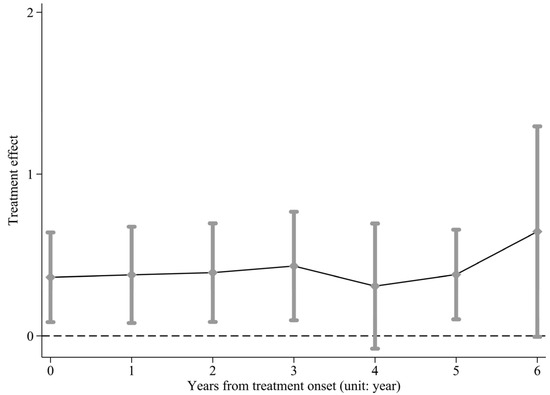

Furthermore, the aggregate intelligent manufacturing estimates in Table 3 are supplemented with a set of event-time-specific treatment effects, visualized in Figure 2. Several features stand out from the temporal evolution of intelligent manufacturing effects. First, consistent with our overall estimates, all estimates of the gradual impacts of intelligent manufacturing on corporate offshoring production are positive and statistically significant (except in Year 4). Second, during the treatment year and the subsequent three years, the effects of intelligent manufacturing increase smoothly over time. One plausible interpretation is that the “push” of intelligent manufacturing on corporate offshoring production is stable and persistent. Third, the estimated effect and significance of intelligent manufacturing show a slight “jump” decline in the fourth post-treatment year, possibly because average event-time-specific effects mask certain cohort-specific patterns, which is confirmed in the next section using cohort-disaggregated event studies.

Figure 2.

Event-time-specific intelligent manufacturing effects. Notes: This figure reports event-time-specific treatment effects. The 95% confidence intervals are shown using firm-clustered standard errors. Note that the estimate for the sixth post-treatment year is significant at the 10% level.

4.3. Disaggregated Intelligent Manufacturing Effects on Offshoring Production

To demonstrate the advantages and importance of the heterogeneity-robust staggered DID method in estimating the impact of intelligent manufacturing, and inspired by the event-study findings from the previous section, this section explores the heterogeneity of intelligent manufacturing effects across treatment cohorts and presents cohort-specific event-study results.

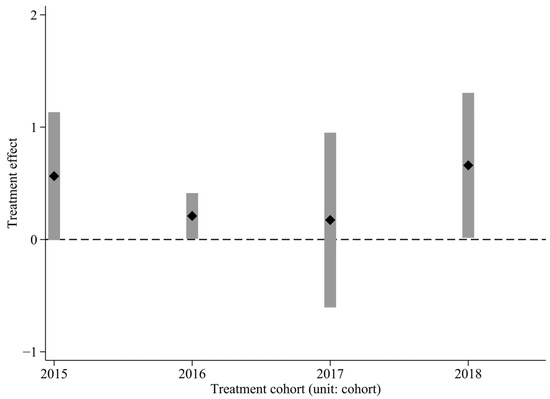

This subsection begins with cohort-disaggregated analysis, visualizing our estimates in Figure 3. First, all cohort estimates are positive, and except for the 2017 cohort, all are statistically significant at the 5% level. This aligns with our main findings, suggesting intelligent manufacturing promotes corporate offshoring production. The second conclusion from Figure 3 is that the effects exhibit substantial heterogeneity across cohorts. The 2015 (earliest) and 2018 (latest) cohorts show stronger effects, while the intermediate cohorts (2016–2017) demonstrate relatively weaker impacts. We posit that this heterogeneity likely stems from cross-cohort capital intensity differences. The theoretical analysis indicates that a key driver of intelligent manufacturing’s effect is its enhancement of capital productivity, which amplifies offshore production through scale effects. Thus, higher initial capital intensity should strengthen these effects. Observing cohort-level capital intensity (measured by fixed assets per employee), we find its ranking perfectly matches treatment effect magnitudes. Notably, the 2017 cohort’s average capital intensity is markedly lower—only 57.6% of the 2018 cohort’s level. The subsequent heterogeneity analysis confirms this correlation.

Figure 3.

Cohort-specific treatment effects. Notes: This figure reports cohort-specific treatment effects. Black squares denote the estimated coefficients for intelligent manufacturing. The 95% confidence intervals are shown using firm-clustered standard errors.

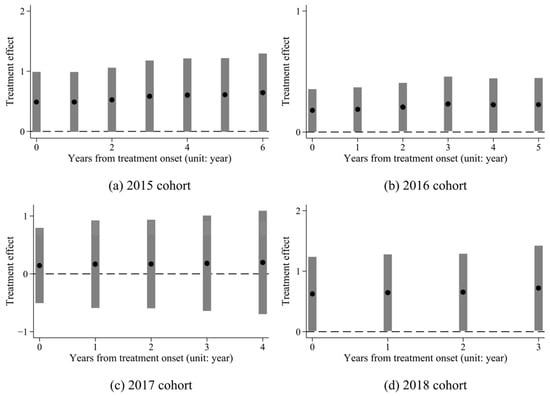

In subsequent experiments, this study obtains cohort-specific event-study results by disaggregating cohorts—i.e., tracing the temporal evolution of intelligent manufacturing effects for each cohort in the sample. The findings, visualized in Figure 4, collectively demonstrate that the more aggregated estimates discussed thus far indeed mask significant heterogeneity. Several results warrant emphasis. First, it is observed that event-study trajectories for all cohorts evolve smoothly over time without abrupt “jumps”. Notably, however, the 2018 adoption cohort lacks post-Year 4 observations due to sample window constraints, creating the discontinuity (“jump”) observed at Year 4 in the aggregated event-study plot (Figure 2)—this anomaly arises from compositional effects in sample construction. Second, except for the 2017 cohort, all cohorts exhibit statistically significant monotonically increasing treatment effects with no sign of termination within the observation window, suggesting potential long-term impacts of intelligent manufacturing.

Figure 4.

Event-time specific intelligent manufacturing effects by cohort. Notes: This figure reports event-time specific intelligent manufacturing effects by cohort. Black circles denote the estimated coefficients for intelligent manufacturing. The 95% confidence intervals are shown using firm-clustered standard errors.

5. Robustness Analysis

This section introduces a series of robustness checks categorized into three groups: first, tests related to DID- and ETWFE-specific assumptions, i.e., considering alternative weighting schemes; second, placebo tests with falsified treatment timing; and third, endogeneity issues addressing sample selection bias.

5.1. Alternative Weighting Schemes

In the baseline regression, when calculating the overall treatment effect, equal weight is assigned to each post-treatment observation. To verify robustness, this study considers three alternative weighting schemes: assigning equal weights to each cohort, each event year, and each cohort–year combination, with the results reported in Columns (1)–(3) of Table 4, respectively. It is found that the overall treatment effects under these alternative schemes are highly similar to our baseline estimates, indicating our results are robust to alternative weighting approaches.

Table 4.

Robustness analysis.

5.2. Placebo Test

The significant positive impact of intelligent manufacturing on corporate offshoring production has been demonstrated through aggregated treatment effects, event-time-specific effects, and cohort heterogeneity. To further strengthen the causal interpretation of intelligent manufacturing’s effects, placebo tests are conducted by replacing the actual treatment timing with falsified treatment timing shifted forward by 1, 2, and 3 periods. These results are reported in Columns (4)–(6) of Table 4. It is found that the estimated effects under falsified timing are statistically insignificant, confirming the robustness of the causal relationship between intelligent manufacturing and offshoring production.

5.3. Endogeneity Issue

Considering that pilot firms for intelligent manufacturing are first recommended by local authorities and then screened by experts based on specific criteria, the policy shock may exhibit non-randomness across firms. Although the baseline regressions control for firm and year fixed effects and include rich covariates, potential endogeneity from sample selection bias may persist. Therefore, this paper employs propensity score matching (PSM) to mitigate potential selection issues. Specifically, this study sequentially implements 1:1 nearest-neighbor, 1:3 nearest-neighbor, and 1:5 nearest-neighbor matching to pair treated firms with suitable controls. Matching covariates are selected to comprehensively reflect corporate operations and governance characteristics. Regression results in Columns (7)–(9) of Table 4 show that intelligent manufacturing retains positive and statistically significant (1% level) impacts on offshoring, reaffirming the robustness of our main findings.

6. Mechanism Analysis

Based on the theoretical analysis in this paper, intelligent manufacturing simultaneously affects corporate offshoring production through reshoring effects, offshoring effects, and productivity effects. Next, this section empirically tests the specific mechanisms through which intelligent manufacturing influences corporate offshoring production.

6.1. Reshoring Effect vs. Offshoring Effect

Due to data granularity limitations, the increase or decrease in production share undertaken by overseas subsidiaries cannot be precisely measured, preventing direct isolation of intelligent manufacturing’s reshoring and offshoring effects. However, given manufacturing firms’ existing production scale and offshore subsidiary portfolios, reshoring should reduce the proportion of overseas manufacturing subsidiaries relative to the total overseas subsidiaries, while expanded offshoring should increase this proportion. This study thus indirectly tests the relative strength of these effects by examining how intelligent manufacturing impacts the share of overseas manufacturing subsidiaries. This approach is implemented as follows: first, the sample is restricted to firms with pre-existing offshore operations; second, the Poisson nonlinear function in the baseline model (17) is replaced with an identity function; and third, the dependent variable is redefined as the overseas manufacturing subsidiary share. Column (1) of Table 5 shows that intelligent manufacturing significantly reduces this share. This implies that under fixed production scales, the reshoring effect of intelligent manufacturing may outweigh the offshoring effect.

Table 5.

Mechanism analysis.

6.2. Productivity Effect

According to the theoretical analysis, this study uses corporate capital productivity and the total overseas subsidiary count as mechanism variables to test the productivity effects of intelligent manufacturing. Capital productivity is measured as the ratio of operating revenue to net fixed assets. When regressing this continuous variable (capital productivity), the Poisson nonlinear function in the baseline model is replaced with an identity function, with the results shown in Column (2) of Table 5. For the overseas subsidiary count, the baseline Poisson specification is retained while redefining the dependent variable as the mechanism variable, with the results in Column (3). It is found that intelligent manufacturing has significant positive impacts on both corporate capital productivity and overseas subsidiary count, indicating that—as theorized—it stimulates enterprises to expand their overall production scale and offshore operations through productivity effects, thereby promoting corporate offshoring production.

7. Heterogeneity Analysis

Next, this section adopts grouped regression to examine the heterogeneous impacts of intelligent manufacturing on corporate offshoring production across ownership types and capital intensity dimensions, further validating the theoretical mechanisms through which intelligent manufacturing affects offshoring production.

7.1. Grouped by Enterprise Ownership Type

The full sample is divided into state-owned enterprises (SOEs) and non-SOEs, with intelligent manufacturing effects being estimated using the baseline model. The results in Columns (1)–(2) of Table 6 show insignificant impacts for SOEs but significantly positive effects for non-SOEs. In our mechanism analysis, we have identified that the reshoring effect of intelligent manufacturing may dominate its offshoring effect. Combining this with our theoretical framework, if the productivity effect of intelligent manufacturing is insufficiently strong, its significant positive impacts would not be observed. Therefore, the divergence in coefficient significance between SOEs and non-SOEs likely demonstrates that compared to SOEs, non-SOEs’ inherently higher cost sensitivity and market agility enable them to more swiftly align with market dynamics to restructure and expand global supply chain configurations when confronted with intelligent manufacturing transformations.

Table 6.

Heterogeneity analysis.

7.2. Grouped by Enterprise Capital Intensity

Based on our theoretical analysis, intelligent manufacturing motivates firms to expand domestic and offshore production scales by enhancing capital productivity in specific tasks. Therefore, stronger effects should be observed in capital-intensive firms. Capital intensity is measured as the ratio of fixed assets to employee count; the sample is split into capital-intensive and non-capital-intensive groups based on annual median values, and grouped regressions are conducted. The results in Columns (3)–(4) of Table 6 show significantly positive effects for capital-intensive firms but insignificant effects for non-capital-intensive ones. This indicates that with equivalent capital productivity gains from intelligent manufacturing, higher capital stock leads to greater overall production efficiency and stronger offshore production demand, providing additional evidence for productivity effect and validating prior conjectures about capital-intensity-driven cohort heterogeneity.

8. Further Analysis

8.1. Intelligent Manufacturing Effects and Firms’ Host Country Selection

When constructing global supply chains, enterprises typically establish cost-oriented manufacturing subsidiaries in developing countries and technology-oriented manufacturing subsidiaries in developed countries. New technologies may differentially impact offshoring production in these two types of host countries [15]. This paper therefore investigates whether intelligent manufacturing exerts distinct effects on different subsidiary types. Overseas manufacturing subsidiaries are separately counted and estimated based on whether host countries are classified as developed or developing economies (EU/OECD nations as developed; Latin America and others as developing). As shown in Columns (1)–(2) of Table 7, intelligent manufacturing increases firms’ manufacturing subsidiaries in both developing and developed countries, indicating firms strategically pursue global cost control and technological upgrading simultaneously.

Table 7.

Further analysis.

Additionally, in China, corporate overseas expansion trends and directions are generally closely linked to national opening-up strategies. Therefore, this study is interested in whether the impact of intelligent manufacturing on corporate offshoring production layouts is correspondingly influenced under the Belt and Road Initiative (BRI) [32]. This paper further disaggregates the count of overseas manufacturing subsidiaries based on whether host countries are BRI participants. As shown in Columns (3)–(4) of Table 7, it is found that intelligent manufacturing significantly increases corporate manufacturing subsidiaries in BRI countries, while its impact on non-BRI countries is statistically insignificant. This indicates that the geographical distribution of corporate offshore production subsidiaries is indeed shaped by China’s national strategic priorities.

8.2. The Impact of Intelligent Manufacturing on Offshoring Trade and R&D Activities

Broadly defined, corporate offshoring activities encompass not only production but also trade and R&D. Given that intelligent manufacturing incentivizes production scale expansion and promotes offshoring production, does it simultaneously drive the expansion of overseas trading subsidiaries? This subsection replaces the dependent variable with the count of overseas trading subsidiaries and re-estimates using the baseline model. As shown in Column (5) of Table 7, intelligent manufacturing significantly increases overseas trading subsidiaries, indicating that production scale expansion propagates to procurement and sales operations, further evidencing robust productivity effects.

Furthermore, if intelligent manufacturing encourages firms to establish technology-oriented manufacturing subsidiaries in developed countries, does it concurrently promote overseas R&D subsidiaries’ expansion? Replacing the dependent variable with overseas R&D subsidiary count, Column (6) of Table 7 reveals a significant reduction. Potential explanations include the following: (1) Intelligent manufacturing relies on industrial big data for AI training, but cross-border data flow barriers incentivize domestic retention of algorithm development. (2) Emerging R&D paradigms like digital twin technologies enable virtual testing environments, reducing reliance on geographically dispersed physical R&D units.

9. Main Conclusions, Policy Implications, and Limitations

9.1. Main Conclusions

This paper provides the first empirical evidence from a developing country for the literature investigating how new technologies affect corporate offshoring production. Existing firm-level empirical studies are extremely limited and yield conflicting conclusions. The task-based enterprise model constructed in this study successfully reveals the underlying logic behind these contradictions: intelligent manufacturing simultaneously exerts a reshoring “pull” effect and offshoring and productivity “push” effects on corporate offshoring production. Utilizing a heterogeneity-robust nonlinear staggered DID approach, it is found that intelligent manufacturing has significant and persistent positive effects on the offshoring production of Chinese manufacturing enterprises. Although the reshoring effect is likely stronger than the offshoring effect, the powerful productivity effect masks the presence of the reshoring effect in aggregate outcomes. Furthermore, significant heterogeneity in the impact of intelligent manufacturing across treatment cohorts is revealed by the latest ETWFE model, and this heterogeneity is likely closely related to corporate capital intensity. The subsequent heterogeneity analysis finds that the positive effects of intelligent manufacturing are more pronounced in non-SOEs and capital-intensive firms. Comparing firms’ choices regarding host countries for offshoring production, it is observed that intelligent manufacturing simultaneously drives firms to expand offshoring production in both developing and developed countries, with a particular bias towards BRI partner nations. Additionally, this study further investigates the impact of intelligent manufacturing on corporate offshore trade and R&D. While intelligent manufacturing is found to concurrently increase firms’ offshoring trade activities, it leads to the reshoring of offshoring R&D. This is likely attributable to the diminished necessity for geographically dispersed physical R&D due to the virtual R&D platforms enabled by intelligent manufacturing.

9.2. Policy Implications

Based on the dynamic mechanism where intelligent manufacturing generates coexisting “pull” and “push” forces on offshoring production, industrial policies should be designed as follows: First, strengthen the foundation of intelligent manufacturing to unleash productivity dividends. Technology upgrading subsidies or tax credits should be leveraged to support firms’ intelligent manufacturing transitions. The strong productivity effect facilitates flexible adjustments in global production layouts (whether offshoring or reshoring). Second, implement targeted measures to balance the dual effects. On one hand, dedicated industrial funds should be established to encourage the reshoring of high-value-added production and R&D segments. On the other hand, the integration of intelligent manufacturing into foreign cooperation frameworks should be expedited to proactively guide firms in utilizing their intelligent manufacturing advantages for deeper engagement in BRI partner nations, thereby promoting technology standard export and production capacity cooperation. Third, account for firm heterogeneity. Industrial policies need to be differentiated, with priority given to stimulating the intelligent manufacturing potential of non-SOEs and capital-intensive firms. Furthermore, cross-industry collaboration platforms should be established to encourage leading intelligent manufacturing enterprises and platform companies to provide substantive support to lagging firms urgently needing transformation.

9.3. Limitations

Additionally, there is no doubt that this study has several limitations. First, the sample data cannot observe the specific timing and direction of offshoring or reshoring at the production segment level within firms, limiting the analysis to indirect tests of intelligent manufacturing’s offshoring and reshoring effects. Second, the inherent focus on listed enterprises excludes small- and medium-sized manufacturing enterprises, potentially compromising the representativeness and applicability of the findings. Future work is planned to supplement the research through first-hand data collected via surveys distributed to local manufacturing enterprises in collaboration with government bodies, for instance, through cooperation with the Zhejiang Provincial Bureau of Commerce to distribute the “Survey on Intelligent Manufacturing Transformation in Manufacturing Enterprises”. Finally, the findings presented here need to be more thoroughly tested by empirical studies from other developing countries to further explore the multiple distinctions between developed and developing country enterprises regarding intelligent manufacturing and offshoring production.

Author Contributions

Conceptualization, J.X.; methodology, J.X.; formal analysis, J.X.; writing—original draft preparation, J.X.; writing—review and editing, J.X.; supervision, J.L.; project administration, J.L. All authors have read and agreed to the published version of the manuscript.

Funding

This study received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| IMPDP | Intelligent Manufacturing Pilot Demonstration Projects |

| DID | Difference-in-Differences |

| non-SOEs | Non-state-owned enterprises |

| IoT | Internet of Things |

| AI | Artificial Intelligence |

| ETWFE | Extended two-way fixed effects |

| CSMAR | China Stock Market & Accounting Research |

| MIIT | Ministry of Industry and Information Technology |

| PSM | Propensity score matching |

| SOEs | State-owned enterprises |

| BRI | Belt and Road Initiative |

References

- Antràs, P.; Helpman, E. Global Sourcing. J. Polit. Econ. 2004, 112, 552–580. [Google Scholar] [CrossRef]

- Musteen, M. Behavioral Factors in Offshoring Decisions: A Qualitative Analysis. J. Bus. Res. 2016, 69, 3439–3446. [Google Scholar] [CrossRef]

- Pereira, V.; Munjal, S.; Ishizaka, A. Outsourcing and Offshoring Decision Making and Its Implications for Businesses—A Synthesis of Research Pursuing Five Pertinent Questions. J. Bus. Res. 2019, 103, 348–355. [Google Scholar] [CrossRef]

- Acemoglu, D.; Lelarge, C.; Restrepo, P. Competing with Robots: Firm-Level Evidence from France. AEA Pap. Proc. 2020, 110, 383–388. [Google Scholar] [CrossRef]

- Faber, M. Robots and Reshoring: Evidence from Mexican Labor Markets. J. Int. Econ. 2020, 127, 103384. [Google Scholar] [CrossRef]

- Pinheiro, A.; Sochirca, E.; Afonso, O.; Neves, P.C. Automation and off(Re)Shoring: A Meta-Regression Analysis. Int. J. Prod. Econ. 2023, 264, 108980. [Google Scholar] [CrossRef]

- Roza, M.; Van den Bosch, F.A.J.; Volberda, H.W. Offshoring Strategy: Motives, Functions, Locations, and Governance Modes of Small, Medium-Sized and Large Firms. Int. Bus. Rev. 2011, 20, 314–323. [Google Scholar] [CrossRef]

- Artuc, E.; Bastos, P.; Rijkers, B. Robots, Tasks, and Trade. J. Int. Econ. 2023, 145, 103828. [Google Scholar] [CrossRef]

- Hallward-Driemeier, M.; Nayyar, G. Have Robots Grounded the Flying Geese? Evidence From Greenfield FDI Announcements. World Econ. 2025, 48, 1282–1296. [Google Scholar] [CrossRef]

- Krenz, A.; Prettner, K.; Strulik, H. Robots, Reshoring, and the Lot of Low-Skilled Workers. Eur. Econ. Rev. 2021, 136, 103744. [Google Scholar] [CrossRef]

- Fort, T.C. Technology and Production Fragmentation: Domestic versus Foreign Sourcing. Rev. Econ. Stud. 2016, 84, 650–687. [Google Scholar] [CrossRef]

- Stapleton, K.; Webb, M. Automation, Trade and Multinational Activity: Micro Evidence from Spain; University of Oxford: Oxford, UK, 2025. [Google Scholar] [CrossRef]

- Cilekoglu, A.A.; Moreno, R.; Ramos, R. The Impact of Robot Adoption on Global Sourcing. Res. Policy 2024, 53, 104953. [Google Scholar] [CrossRef]

- Bonfiglioli, A.; Crinò, R.; Gancia, G.; Papadakis, I. Robots, Offshoring, and Welfare. In Robots and AI, 1st ed.; Ing, L.Y., Grossman, G.M., Eds.; Routledge: London, UK, 2022; pp. 40–81. [Google Scholar]

- Calatayud, C.; Rochina-Barrachina, M.E. Robots and Firm Reshoring. Ind. Innov. 2025, in press. [Google Scholar] [CrossRef]

- Feenstra, R. Statistics to Measure Offshoring and Its Impact; National Bureau of Economic Research: Cambridge, MA, USA, 2017. [Google Scholar] [CrossRef]

- Nordås, H.K. Make or Buy: Offshoring of Services Functions in Manufacturing. Rev. Ind. Organ. 2020, 57, 351–378. [Google Scholar] [CrossRef]

- Acemoglu, D. Why Do New Technologies Complement Skills? Directed Technical Change and Wage Inequality. Q. J. Econ. 1998, 113, 1055–1089. [Google Scholar] [CrossRef]

- Acemoglu, D. Directed Technical Change. Rev. Econ. Stud. 2002, 69, 781–809. [Google Scholar] [CrossRef]

- Acemoglu, D.; Restrepo, P. Secular Stagnation? The Effect of Aging on Economic Growth in the Age of Automation. Am. Econ. Rev. 2017, 107, 174–179. [Google Scholar] [CrossRef]

- Made in China 2025. Available online: https://www.gov.cn/zhengce/content/2015-05/19/content_9784.htm (accessed on 15 June 2025).

- Intelligent Manufacturing Development Plan (2016–2020). Available online: https://www.gov.cn/xinwen/2016-12/08/content_5145162.htm (accessed on 15 June 2025).

- Wooldridge, J.M. Simple Approaches to Nonlinear Difference-in-Differences with Panel Data. Econom. J. 2023, 26, C31–C66. [Google Scholar] [CrossRef]

- Acemoglu, D.; Autor, D.; Hazell, J.; Restrepo, P. Artificial Intelligence and Jobs: Evidence from Online Vacancies. J. Labor Econ. 2022, 40, S293–S340. [Google Scholar] [CrossRef]

- Acemoglu, D.; Restrepo, P. A Task-Based Approach to Inequality. Oxf. Open Econ. 2024, 3, i906–i929. [Google Scholar] [CrossRef]

- Nagengast, A.; Rios-Avila, F.; Yotov, Y. The European Single Market and Intra-EU Trade: An Assessment with Heterogeneity-Robust Difference-in-Differences Methods; Center for Global Policy Analysis, LeBow College of Business, Drexel University: Philadelphia, PA, USA, 2025. [Google Scholar]

- Grossman, G.M.; Rossi-Hansberg, E. Trading Tasks: A Simple Theory of Offshoring. Am. Econ. Rev. 2008, 98, 1978–1997. [Google Scholar] [CrossRef]

- China Association for Public Companies Industry Statistical Classification Guidance for Listed Companies (2023 Edition). Available online: https://www.capco.org.cn/xhdt/tzgg/202305/20230521/j_2023052117544500016846630061707656.html (accessed on 15 June 2025).

- China Stock Market & Accounting Research (CSMAR) Database. Available online: https://data.csmar.com/ (accessed on 15 June 2025).

- Announcement on Publishing the List of 2015 Intelligent Manufacturing Pilot Demonstration Projects. Available online: https://www.miit.gov.cn/jgsj/zbes/wjfb/art/2020/art_486afe4ce87a43429a1383e8d40f65d2.html (accessed on 15 June 2025).

- Roth, J. Interpreting Event-Studies from Recent Difference-in-Differences Methods. arXiv 2024, arXiv:2401.12309. [Google Scholar]

- Belt and Road Initiative. Available online: https://eng.yidaiyilu.gov.cn/ (accessed on 15 June 2025).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).