The Impact of Urban Digital Intelligence Transformation on Corporate Carbon Performance: Evidence from China

Abstract

1. Introduction

2. Literature Review

3. Theoretical Analysis and Research Hypotheses

3.1. Policy Background

3.2. Theoretical Analysis of the Impact of Urban DIT on Corporate CP

3.3. Path Analysis of the Impact of Urban DIT on Corporate CP

4. Research Design and Methodology

4.1. Data and Sample

4.2. Variable Design

4.2.1. Dependent Variable

4.2.2. Independent Variables

4.2.3. Control Variables

4.2.4. Mechanism Variable

4.3. Modeling

5. Analysis of Empirical Results

5.1. Descriptive Statistics

5.2. Benchmark Regression

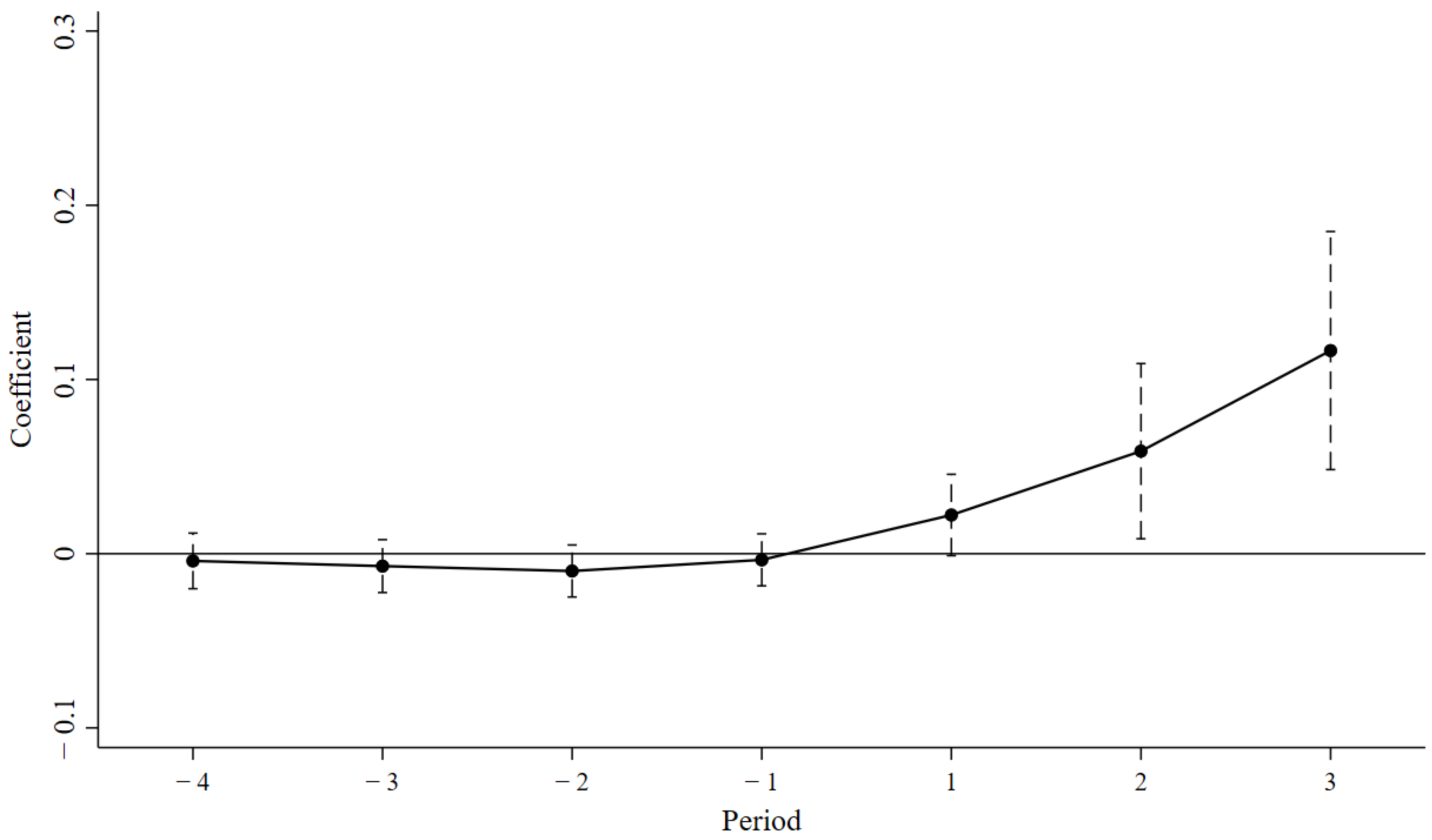

5.3. Parallel Trend Test

5.4. Endogeneity and Robustness Test

5.5. Heterogeneity Analysis

5.6. Further Effect Mechanism Analysis

6. Conclusions and Policy Recommendations

6.1. Conclusions

- The results of the baseline regression analysis reveal a statistically significant positive relationship between DIT and corporate CP. The baseline regression results, without incorporating control variables, reveal that urban DIT exhibits a positive and statistically significant coefficient of 0.035. After adding firm-level control variables, the coefficient for urban DIT remains at 0.035. When city-level control variables are included, the coefficient slightly decreases to 0.033. This suggests that after the policy implementation, corporate CP evaluations increased by 3.3%. The findings indicate that, even when considering both firm-level and city-level factors, urban DIT has a positive effect on corporate CP;

- The parallel trends test supports the validity of the DID method. Before the pilot policy was implemented, the CP level trends for the treatment and control groups were consistent, showing comparability between the two groups prior to the policy’s implementation. Following the implementation of the policy, the treatment group exhibited a notable improvement in CP, whereas the control group showed no significant change. This outcome further substantiates the positive effect of the AI pilot policy on corporate CP;

- An in-depth robustness analysis indicates that the placebo test, which assigns virtual strategies at random time points, yields no significant influence on corporate CP, thereby dismissing concerns related to random disturbances or model misspecification. Moreover, the application of the PSM-DID method—integrating propensity score matching with a Difference-in-Differences framework to address potential sample selection bias—further reinforces the reliability of the positive association between urban DIT implementation and corporate CP;

- Industry heterogeneity analysis revealed that, under policy incentives, non-SOEs and heavily polluting industries experienced significant improvements in ESG performance, while state-owned enterprises showed less improvement compared to non-state-owned enterprises, and there was no significant impact on non-heavy-polluting industries. This may be attributed to the governance structure of these enterprises, the market pressure they face, and the policy-driven incentives;

- Mechanism analysis shows that the implementation of the policy significantly enhanced corporate GI and R&D investment. Therefore, urban DIT, on the one hand, improves corporate CP performance by promoting innovation and enhancing green technology capabilities, and on the other hand, it incentivizes companies to increase R&D expenditure, which significantly boosts technological innovation and improves corporate CP performance.

6.2. Policy Recommendations

6.3. Discussion and Outlook

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Conversi, D. The ultimate challenge: Nationalism and climate change. Natl. Pap. 2020, 48, 625–636. [Google Scholar] [CrossRef]

- Chen, Z.; Zhang, X.; Chen, F. Do carbon emission trading schemes stimulate green accessed innovation in enterprises? Evidence from China. Technol. Forecast. Soc. Change 2021, 168, 120744. [Google Scholar] [CrossRef]

- Chen, P.; Gao, J.; Ji, Z.; Liang, H.; Peng, Y. Do artificial intelligence applications affect carbon emission performance?—Evidence from panel data analysis of Chinese cities. Energies 2022, 15, 5730. [Google Scholar] [CrossRef]

- Hoffmann, V.H.; Busch, T. Corporate carbon performance indicators: Carbon intensity, dependency, exposure, and risk. J. Ind. Ecol. 2008, 12, 505–520. [Google Scholar] [CrossRef]

- Zhu, B.; Xu, C.; Wang, P.; Zhang, L. How does internal carbon pricing affect corporate environmental performance? J. Bus. Res. 2022, 145, 65–77. [Google Scholar] [CrossRef]

- Pan, J.; Du, L.; Wu, H.; Liu, X. Does environmental law enforcement supervision improve corporate carbon reduction performance? Evidence from environmental protection interview. Energy Econ. 2024, 132, 107441. [Google Scholar] [CrossRef]

- Xie, Z.; Wu, R.; Wang, S. How technological progress affects the carbon emission efficiency? Evidence from national panel quantile regression. J. Clean. Prod. 2021, 307, 127133. [Google Scholar] [CrossRef]

- Zheng, H.; Song, M.; Shen, Z. The evolution of renewable energy and its impact on carbon reduction in China. Energy 2021, 237, 121639. [Google Scholar] [CrossRef]

- Zhang, R.; Sharma, R.; Tan, Z.; Kautish, P. Do export diversification and stock market development drive carbon intensity? The role of renewable energy solutions in top carbon emitter countries. Renew. Energy 2022, 185, 1318–1328. [Google Scholar] [CrossRef]

- Li, R.; Li, L.; Wang, Q. The impact of energy efficiency on carbon emissions: Evidence from the transportation sector in Chinese 30 provinces. Sustain. Cities Soc. 2022, 82, 103880. [Google Scholar] [CrossRef]

- Zheng, J.; Shao, X.; Liu, W.; Kong, J.; Zuo, G. The impact of the pilot program on industrial structure upgrading in low-carbon cities. J. Clean. Prod. 2021, 290, 125868. [Google Scholar] [CrossRef]

- Li, Z.; Huang, Z.; Su, Y. New media environment, environmental regulation and corporate green technology innovation: Evidence from China. Energy Econ. 2023, 119, 106545. [Google Scholar] [CrossRef]

- Doğan, B.; Chu, L.K.; Ghosh, S.; Truong, H.H.D.; Balsalobre-Lorente, D. How environmental taxes and carbon emissions are related in the G7 economies? Renew. Energy 2022, 187, 645–656. [Google Scholar] [CrossRef]

- Neves, S.A.; Marques, A.C.; Patrício, M. Determinants of CO2 emissions in European Union countries: Does environmental regulation reduce environmental pollution? Econ. Anal. Policy 2020, 68, 114–125. [Google Scholar] [CrossRef]

- Zhang, L.; Mu, R.; Zhan, Y.; Yu, J.; Liu, L.; Yu, Y.; Zhang, J. Digital economy, energy efficiency, and carbon emissions: Evidence from provincial panel data in China. Sci. Total Environ. 2022, 852, 158403. [Google Scholar] [CrossRef] [PubMed]

- Liang, P.; Sun, X.; Qi, L. Does artificial intelligence technology enhance green transformation of enterprises: Based on green innovation perspective. Environ. Dev. Sustain. 2024, 26, 21651–21687. [Google Scholar] [CrossRef]

- Gao, Q.; Cheng, C.; Sun, G. Big data application, factor allocation, and green innovation in Chinese manufacturing enterprises. Technol. Forecast. Soc. Change 2023, 192, 122567. [Google Scholar] [CrossRef]

- Khuntia, J.; Saldanha, T.J.; Mithas, S.; Sambamurthy, V. Information technology and sustainability: Evidence from an emerging economy. Prod. Oper. Manag. 2018, 27, 756–773. [Google Scholar] [CrossRef]

- Hasan, M.; Islam, M.Z.; Sumon, M.F.I.; Osiujjaman, M.; Debnath, P.; Pant, L. Integrating artificial intelligence and predictive analytics in supply chain management to minimize carbon footprint and enhance business growth in the USA. J. Bus. Manag. Stud. 2024, 6, 195–212. [Google Scholar] [CrossRef]

- Waltersmann, L.; Kiemel, S.; Stuhlsatz, J.; Sauer, A.; Miehe, R. Artificial intelligence applications for increasing resource efficiency in manufacturing companies—A comprehensive review. Sustainability 2021, 13, 6689. [Google Scholar] [CrossRef]

- Lu, Y.; Liao, Z. The influence of AI application on carbon emission intensity of industrial enterprises in China. Sci. Rep. 2025, 15, 12585. [Google Scholar] [CrossRef] [PubMed]

- Benzidia, S.; Makaoui, N.; Bentahar, O. The impact of big data analytics and artificial intelligence on green supply chain process integration and hospital environmental performance. Technol. Forecast. Soc. Change 2021, 165, 120557. [Google Scholar] [CrossRef]

- Ameh, B. Digital tools and AI: Using technology to monitor carbon emissions and waste at each stage of the supply chain, enabling real-time adjustments for sustainability improvements. Int. J. Sci. Res. Arch. 2024, 13, 2741–2754. [Google Scholar] [CrossRef]

- Zheng, L.J.; Zhang, J.Z.; Lee, L.Y.S.; Jasimuddin, S.M.; Kamal, M.M. Digital technology integration in business model innovation for carbon neutrality: An evolutionary process model for SMEs. J. Environ. Manag. 2024, 359, 120978. [Google Scholar] [CrossRef]

- Guo, X.; Xu, J. Can urban digital intelligence transformation promote corporate green innovation? Evidence from China. J. Environ. Manag. 2024, 371, 123245. [Google Scholar] [CrossRef]

- Chong, Y.; Zhang, Y.; Di, D.; Chen, Y.; Wang, S. Digital transformation and synergistic reduction in pollution and carbon Emissions—An analysis from a dynamic capability perspective. Environ. Res. 2024, 261, 119683. [Google Scholar] [CrossRef] [PubMed]

- Cheng, K.; Jin, Z.; Wu, G. Unveiling the role of artificial intelligence in influencing enterprise environmental performance: Evidence from China. J. Clean. Prod. 2024, 440, 140934. [Google Scholar] [CrossRef]

- Li, D.-y.; Liu, J. Dynamic capabilities, environmental dynamism, and competitive advantage: Evidence from China. J. Bus. Res. 2014, 67, 2793–2799. [Google Scholar] [CrossRef]

- Andersén, J. A relational natural-resource-based view on product innovation: The influence of green product innovation and green suppliers on differentiation advantage in small manufacturing firms. Technovation 2021, 104, 102254. [Google Scholar] [CrossRef]

- Seman, N.A.A.; Govindan, K.; Mardani, A.; Zakuan, N.; Saman, M.Z.M.; Hooker, R.E.; Ozkul, S. The mediating effect of green innovation on the relationship between green supply chain management and environmental performance. J. Clean. Prod. 2019, 229, 115–127. [Google Scholar] [CrossRef]

- Romer, P.M. The origins of endogenous growth. J. Econ. Perspect. 1994, 8, 3–22. [Google Scholar] [CrossRef]

- Boeing, P.; Eberle, J.; Howell, A. The impact of China’s R&D subsidies on R&D investment, technological upgrading and economic growth. Technol. Forecast. Soc. Change 2022, 174, 121212. [Google Scholar]

- Zhang, K.; Pan, Z.; Zhang, K.; Ji, F. The effect of digitalization transformation on greenwashing of Chinese listed companies: An analysis from the dual perspectives of resource-based view and legitimacy. Front. Environ. Sci. 2023, 11, 1179419. [Google Scholar] [CrossRef]

- Chen, Z.; Zhang, Y.; Wang, H.; Ouyang, X.; Xie, Y. Can green credit policy promote low-carbon technology innovation? J. Clean. Prod. 2022, 359, 132061. [Google Scholar] [CrossRef]

- Zhang, Q.; Chen, L.; Feng, T. Mediation or moderation? The role of R&D investment in the relationship between corporate governance and firm performance: Empirical evidence from the Chinese IT industry. Corp. Gov. Int. Rev. 2014, 22, 501–517. [Google Scholar]

- Bolton, P.; Kacperczyk, M. Do investors care about carbon risk? J. Financ. Econ. 2021, 142, 517–549. [Google Scholar] [CrossRef]

- Huang, Y.; Liu, S.; Gan, J.; Liu, B.; Wu, Y. How does the construction of new generation of national AI innovative development pilot zones drive enterprise ESG development? Empirical evidence from China. Energy Econ. 2024, 140, 108011. [Google Scholar] [CrossRef]

- Liu, X.; Li, Y.; Chen, X.; Liu, J. Evaluation of low carbon city pilot policy effect on carbon abatement in China: An empirical evidence based on time-varying DID model. Cities 2022, 123, 103582. [Google Scholar] [CrossRef]

- Li, P.; Lu, Y.; Wang, J. Does flattening government improve economic performance? Evidence from China. J. Dev. Econ. 2016, 123, 18–37. [Google Scholar] [CrossRef]

- Yu, P.; Hao, R.; Cai, Z.; Sun, Y.; Zhang, X. Does emission trading system achieve the win-win of carbon emission reduction and financial performance improvement?—Evidence from Chinese A-share listed firms in industrial sector. J. Clean. Prod. 2022, 333, 130121. [Google Scholar] [CrossRef]

| Variable Type | Variable Name | Variable Symbol | Measurement Method |

|---|---|---|---|

| Independent variables | Digital intelligence transformation | DIT | Treat × post |

| Dependent variables | Carbon performance | CP | Corporate revenue/corporate carbon emissions |

| Corporate control variables | Corporate listing age | ListAge | Ln (the current year − the listing year + 1) |

| Return on assets | ROA | Net profit/total assets | |

| Cash flow ratio | CashFlow | Net cash flow from operating activities/total assets | |

| Financial leverage | Lev | Total liabilities at year-end/total assets at year-end | |

| Equity concentration | TOP | The sum of the shareholding percentages of the top ten shareholders | |

| Fixed asset ratio | FIXED | Net fixed assets/total assets | |

| Tobin’s Q | TobinQ | Market value/replacement cost of assets | |

| City control variables | Economic development level | ECO | Ln (per capita regional) |

| Education level | EDU | Local education expenditure/local fiscal general budget expenditures | |

| Industrial structure | LND | The added value of the secondary industry/regional GDP | |

| Financial development level | FIN | The balance of loans from financial institutions at year-end/regional GDP | |

| Degree of openness | OPEN | Ln (the number of foreign − invested enterprises + 1) | |

| Mechanism variable | Green technological innovation | GI | Ln (green patent applications + 1) |

| Research and development | R&D | R&D expenditure/revenue |

| Variable | N | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| CP | 14,120 | 0.475 | 0.734 | 0.246 | 2.389 |

| DIT | 14,120 | 0.187 | 0.390 | 0 | 1 |

| ListAge | 14,120 | 2.001 | 0.949 | 0 | 3.497 |

| ROA | 14,120 | 0.0470 | 0.0700 | −1.130 | 0.969 |

| CashFlow | 14,120 | 0.0500 | 0.0710 | −0.528 | 0.726 |

| Lev | 14,120 | 0.411 | 0.205 | 0.00800 | 0.994 |

| TOP | 14,120 | 0.346 | 0.149 | 0.01300 | 0.900 |

| FIXED | 14,120 | 0.223 | 0.154 | 0 | 0.912 |

| TobinQ | 14,120 | 2.048 | 2.207 | 0.681 | 122.2 |

| PGDP | 14,120 | 10.23 | 0.788 | 7.601 | 12.58 |

| EDU | 14,120 | 0.185 | 0.0370 | 0.0220 | 0.364 |

| LND | 14,120 | 44.06 | 11.87 | 19.240 | 26.49 |

| FIN | 14,120 | 0.965 | 0.565 | 0.0750 | 6.193 |

| OPEN | 14,120 | 2.977 | 2.029 | 0 | 8.471 |

| GI | 14,120 | 0.390 | 0.823 | 0 | 6.142 |

| RD | 14,120 | 0.0660 | 2.663 | 0 | 317.3 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| CP | CP | CP | CP | |

| DIT | 0.035 *** | 0.034 *** | 0.034 *** | 0.033 ** |

| (0.0077) | (0.0099) | (0.0096) | (0.0105) | |

| ListAge | 0.033 *** | 0.031 ** | 0.032 ** | |

| (0.0061) | (0.0219) | (0.0192) | ||

| ROA | 0.182 *** | 0.218 *** | 0.219 *** | |

| (0.0076) | (0.0047) | (0.0046) | ||

| CashFlow | −0.019 | −0.018 | −0.020 | |

| (0.7426) | (0.7569) | (0.7231) | ||

| Lev | 0.086 ** | 0.087 ** | ||

| (0.0183) | (0.0163) | |||

| TOP | 0.141 | 0.140 | ||

| (0.2415) | (0.2446) | |||

| FIXED | 0.024 | 0.022 | ||

| (0.5972) | (0.6331) | |||

| TobinQ | −0.002 | −0.002 | ||

| (0.1608) | (0.1685) | |||

| PGDP | 0.007 | |||

| (0.6158) | ||||

| EDU | −0.056 | |||

| (0.6695) | ||||

| LND | −0.001 ** | |||

| (0.0424) | ||||

| FIN | −0.002 | |||

| (0.7254) | ||||

| OPEN | 0.000 | |||

| (0.9531) | ||||

| _cons | 0.456 *** | 0.370 *** | 0.287 *** | 0.285 * |

| (0.0000) | (0.0000) | (0.0000) | (0.0998) | |

| Corporate FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| N | 14,120 | 14,120 | 14,120 | 14,120 |

| R2 | 0.695 | 0.696 | 0.696 | 0.696 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| CP | CP | CP | CP | |

| DIT | 0.031 ** | 0.051 *** | 0.031 ** | 0.042 ** |

| (0.0178) | (0.0054) | (0.0160) | (0.0127) | |

| ListAge | 0.032 ** | 0.020 * | 0.031 ** | 0.026 |

| (0.0193) | (0.0868) | (0.0239) | (0.1979) | |

| ROA | 0.225 *** | 0.137 ** | 0.208 ** | 0.249 ** |

| (0.0027) | (0.0160) | (0.0111) | (0.0348) | |

| CashFlow | −0.012 | −0.024 | −0.013 | 0.010 |

| (0.8349) | (0.6786) | (0.8291) | (0.9060) | |

| Lev | 0.083 ** | 0.088 *** | 0.087 ** | 0.100 * |

| (0.0198) | (0.0037) | (0.0202) | (0.1000) | |

| TOP | 0.161 | 0.016 | 0.149 | 0.219 |

| (0.1923) | (0.7719) | (0.2386) | (0.3109) | |

| FIXED | 0.041 | −0.006 | 0.020 | 0.108 |

| (0.3738) | (0.8737) | (0.6805) | (0.2237) | |

| TobinQ | −0.003 | −0.003 | −0.002 | −0.003 |

| (0.1265) | (0.2040) | (0.1580) | (0.2209) | |

| PGDP | 0.021 | 0.003 | 0.006 | 0.009 |

| (0.1301) | (0.8187) | (0.6672) | (0.6554) | |

| EDU | −0.010 | −0.123 | −0.077 | −0.140 |

| (0.9430) | (0.3342) | (0.5696) | (0.4618) | |

| LND | −0.001 ** | −0.002 *** | −0.002 ** | −0.001 |

| (0.0214) | (0.0006) | (0.0309) | (0.1747) | |

| FIN | −0.002 | −0.006 | −0.011 | −0.003 |

| (0.7794) | (0.3686) | (0.4603) | (0.7764) | |

| OPEN | 0.001 | −0.005 | −0.000 | −0.001 |

| (0.8718) | (0.5434) | (0.9963) | (0.9094) | |

| _cons | 0.130 | 0.439 *** | 0.313 * | 0.254 |

| (0.4829) | (0.0035) | (0.0982) | (0.3505) | |

| Corporate FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| City FE | Yes | No | No | No |

| N | 14,120 | 10,911 | 13,790 | 9022 |

| R2 | 0.697 | 0.763 | 0.693 | 0.675 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| SOEs | non-SOEs | HPEs | non-HPEs | LEs | SMEs | |

| DIT | 0.024 * | 0.057 * | 0.042 ** | 0.011 | 0.040 * | 0.011 |

| (0.0621) | (0.0772) | (0.0127) | (0.4917) | (0.0543) | (0.4917) | |

| ListAge | 0.040 ** | 0.054 | 0.026 | 0.029 ** | 0.084 | 0.029 ** |

| (0.0127) | (0.1577) | (0.1979) | (0.0277) | (0.1764) | (0.0277) | |

| ROA | 0.234 ** | 0.142 | 0.249 ** | 0.175 *** | 0.142 | 0.175 *** |

| (0.0115) | (0.1520) | (0.0348) | (0.0050) | (0.2090) | (0.0050) | |

| CashFlow | −0.009 | −0.063 | 0.010 | −0.077 * | 0.086 | −0.077 * |

| (0.8873) | (0.5971) | (0.9060) | (0.0869) | (0.5171) | (0.0869) | |

| Lev | 0.088 * | 0.093 * | 0.100 * | 0.055 | 0.062 | 0.055 |

| (0.0649) | (0.0914) | (0.1000) | (0.1750) | (0.2898) | (0.1750) | |

| TOP | 0.231 | 0.075 | 0.219 | 0.004 | −0.008 | 0.004 |

| (0.2786) | (0.4134) | (0.3109) | (0.9527) | (0.9135) | (0.9527) | |

| FIXED | 0.007 | 0.060 | 0.108 | 0.018 | −0.006 | 0.018 |

| (0.9182) | (0.1881) | (0.2237) | (0.7190) | (0.9116) | (0.7190) | |

| TobinQ | −0.002 | −0.006 | −0.003 | −0.002 | −0.001 | −0.002 |

| (0.3118) | (0.1428) | (0.2209) | (0.3390) | (0.7579) | (0.3390) | |

| PGDP | −0.011 | 0.043 ** | 0.009 | −0.018 | 0.032 | −0.018 |

| (0.5238) | (0.0410) | (0.6554) | (0.3747) | (0.1021) | (0.3747) | |

| EDU | −0.010 | −0.269 | −0.140 | 0.105 | −0.276 | 0.105 |

| (0.9482) | (0.2193) | (0.4618) | (0.5103) | (0.2331) | (0.5103) | |

| LND | 0.000 | −0.005 *** | −0.001 | −0.001 | −0.003 *** | −0.001 |

| (0.6174) | (0.0000) | (0.1747) | (0.1971) | (0.0091) | (0.1971) | |

| FIN | 0.007 | −0.013 | −0.003 | −0.010 | 0.006 | −0.010 |

| (0.4090) | (0.2764) | (0.7764) | (0.2280) | (0.6471) | (0.2280) | |

| OPEN | 0.015 * | −0.033 * | −0.001 | −0.004 | 0.005 | −0.004 |

| (0.0636) | (0.0820) | (0.9094) | (0.5737) | (0.7447) | (0.5737) | |

| _cons | 0.326 | 0.139 | 0.254 | 0.597 *** | 0.049 | 0.597 *** |

| (0.1551) | (0.5052) | (0.3505) | (0.0061) | (0.8378) | (0.0061) | |

| Corporate FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 4418 | 9669 | 5090 | 9022 | 6064 | 7866 |

| R2 | 0.738 | 0.686 | 0.675 | 0.781 | 0.664 | 0.781 |

| (1) | (2) | (3) | |

|---|---|---|---|

| CP | GI | R&D | |

| DIT | 0.033 ** | 0.001 ** | 0.015 * |

| (0.0105) | (0.0105) | (0.0747) | |

| ListAge | 0.032 ** | 0.000 | 0.008 |

| (0.0192) | (0.9387) | (0.2814) | |

| ROA | 0.219 *** | −0.002 | 0.027 |

| (0.0046) | (0.3527) | (0.4812) | |

| CashFlow | −0.020 | 0.004 *** | 0.004 |

| (0.7231) | (0.0020) | (0.8980) | |

| Lev | 0.087 ** | −0.002 ** | −0.048 ** |

| (0.0163) | (0.0311) | (0.0336) | |

| TOP | 0.140 | 0.001 | 0.084 ** |

| (0.2446) | (0.6951) | (0.0414) | |

| FIXED | 0.022 | 0.007 *** | 0.007 |

| (0.6331) | (0.0000) | (0.8449) | |

| TobinQ | −0.002 | 0.000 | 0.000 |

| (0.1685) | (0.1518) | (0.7951) | |

| PGDP | 0.007 | −0.000 | −0.015 |

| (0.6158) | (0.4220) | (0.1667) | |

| EDU | −0.056 | −0.007 * | −0.058 |

| (0.6695) | (0.0556) | (0.5028) | |

| LND | −0.001 ** | −0.000 | −0.000 |

| (0.0424) | (0.1040) | (0.4258) | |

| FIN | −0.002 | 0.001 | −0.000 |

| (0.7254) | (0.2076) | (0.9798) | |

| OPEN | 0.000 | 0.001 *** | 0.007 * |

| (0.9531) | (0.0008) | (0.0728) | |

| _cons | 0.285 * | 0.024 *** | 0.209 ** |

| (0.0998) | (0.0000) | (0.0430) | |

| Corporate FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| N | 14,120 | 14,120 | 14,120 |

| R2 | 0.696 | 0.878 | 0.589 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Z.; Jia, H.; Wu, J. The Impact of Urban Digital Intelligence Transformation on Corporate Carbon Performance: Evidence from China. Sustainability 2025, 17, 5591. https://doi.org/10.3390/su17125591

Wang Z, Jia H, Wu J. The Impact of Urban Digital Intelligence Transformation on Corporate Carbon Performance: Evidence from China. Sustainability. 2025; 17(12):5591. https://doi.org/10.3390/su17125591

Chicago/Turabian StyleWang, Zhen, Hongwen Jia, and Jiale Wu. 2025. "The Impact of Urban Digital Intelligence Transformation on Corporate Carbon Performance: Evidence from China" Sustainability 17, no. 12: 5591. https://doi.org/10.3390/su17125591

APA StyleWang, Z., Jia, H., & Wu, J. (2025). The Impact of Urban Digital Intelligence Transformation on Corporate Carbon Performance: Evidence from China. Sustainability, 17(12), 5591. https://doi.org/10.3390/su17125591