1. Introduction

Amidst the dual imperatives of the global digital economy and carbon neutrality targets, digital–green synergy has become a core engine to promote high-quality economic growth. Through technology integration and resource optimization, digital–green synergy can achieve the carbon peak targets and neutrality targets of improved production efficiency, as well as environmental benefits, but it faces significant challenges in its implementation: contemporary businesses face the dual challenge of shouldering technological expenditures for digital overhaul and regulatory compliance expenses for ecological transitions simultaneously. Meanwhile, conventional financial mechanisms encounter difficulties in precisely aligning with multifaceted funding requirements, constrained by informational disparities and outdated risk evaluation methodologies. On the other hand, cross-domain technology integration is characterized by data silos and standard barriers, leading to inefficient synergies. Although the existing literature discusses digital financial tools [

1] and green capital allocation [

2], it focuses on a single dimension and has not yet formed a systematic solution.

As an outcome stemming from the profound convergence of innovative technologies and conventional financial systems, fintech harnesses next-generation tools, including artificial intelligence, big data analytics, and distributed ledger technologies. By maximizing the potential of technological empowerment and model innovation, it provides a new path for cracking problems of digital–green synergy. From one perspective, this field diminishes informational asymmetries between financial institutions and enterprises through real-time risk evaluation frameworks and blockchain-powered traceability systems, thereby enhancing the precision in eco-friendly credit distribution and mitigating the funding barriers encountered during enterprises’ dual transformation processes. Additionally, fintech steers investment toward sustainable technology development and environmentally conscious manufacturing practices by pioneering emission quantification instruments and climate-aligned financial instruments, effectively bridging digital advancement with ecological modernization. Nevertheless, prior investigations have predominantly concentrated on the macro-inclusive effect of fintech, while the exploration of its micro-enabling mechanism and heterogeneous adjustment path needs to be deepened.

This research employs data from A-share companies listed in Shanghai and Shenzhen from 2011 to 2022 for analysis, developing an integrated coupling coordination model to assess the enterprises’ digital–green synergy levels while systematically exploring fintech’s catalytic mechanisms. The scholarly contributions emerge through three distinct dimensions: First, by diverging from conventional single-dimensional analyses of digital or environmental transitions, this paper measures the interactive synergy between enterprises’ digital transformation and green development initiatives through the establishment of a coupled coordination degree model and demonstrates fintech’s critical bridging function in advancing this synergy, which furnishes novel theoretical frameworks for enterprises’ strategic choices regarding digital–green synergy. Second, the pathways through which fintech facilitates the development of enterprises’ digital–green synergy is systematically tested through three mechanisms: efficiency improvement, green innovation, and information disclosure. In addition, this paper adopts multidimensional indicators, such as patent data and environmental information disclosure, to innovatively quantify the empowering effect of fintech, and this innovation in research methodology provides an empirical framework that can be drawn upon for subsequent related studies. Third, this research expands the analytical framework by integrating the age variations in and occupational backgrounds of the executive teams of the enterprises and reveals how executive team diversity, in regard to career specialization and generational characteristics, significantly amplifies the beneficial impact of fintech on the growth of enterprises’ digital–green synergy. It not only expands the micro-theoretical framework of the fintech-enabled dual transformation of firms but also provides empirical evidence for policymakers to design differentiated technology inclusion and regulatory programs to help the sustainable improvement of new-quality productivity.

3. Research Hypothesis

Emerging from the convergence of innovative technologies and conventional financial systems, fintech leverages advanced technological tools to bridge information asymmetries and deliver sustainable capital solutions for businesses [

28]. Within today’s rapidly evolving commercial landscape marked by accelerated technological disruption, evolving consumer preferences, and unprecedented market volatility, enterprises’ organizations are compelled to strategically prioritize holistic digital transformation as a fundamental catalyst for attaining value-oriented developmental objectives [

29]. However, the substantial financial commitments to technological innovation, digital infrastructure modernization, and workforce upskilling initiatives frequently impose significant constraints on organizational resource allocation capabilities. Through the strategic aggregation of big data across financial ecosystems, the methodical mapping of technological–industrial value creation networks, and the multidimensional expansion of financial service accessibility channels, this paradigm-shifting innovation effectively reduces structural barriers to credit market participation [

30]. Such transformations empower enterprises to circumvent traditional funding obstacles, thereby catalyzing the full-spectrum implementation of enterprise-wide digital transformation initiatives across operational, strategic, and governance dimensions.

In the realm of the eco-friendly transition, fintech emerges as a critical enabler of targeted environmental empowerment through the strategic development of sustainable financial infrastructure. For instance, blockchain-enabled systems ensure the immutable tracking and verification of carbon footprint records, while IoT-enabled devices embedded across production chains enable the continuous monitoring of energy utilization and pollutant discharge. This integration generates comprehensive environmental profiles that evolve in real time. Leveraging these advancements, financial entities can design sophisticated evaluation systems for ecological creditworthiness, utilizing analytics-powered risk profiling to diminish financing hurdles for sustainability initiatives [

31]. Furthermore, by enhancing the reliability and auditability of enterprises’ environmental disclosures, fintech mitigates the fraudulent manipulation of ecological metrics, thereby curbing deceptive “greenwashing” practices [

32], maximizing profits [

33], and promoting corporate green transformation.

As a potent catalytic force in organizational modernization, fintech propels the simultaneous advancement of enterprises’ digitalization and ecological sustainability. The shift towards digital operations demands substantial computational power and expansive data infrastructure. However, this technological progression inevitably generates intensive energy demands [

34], which, to a certain extent, are potentially in conflict with the goal of green transformation. Nevertheless, by embedding environmental, social, and governance (ESG) metrics within investment evaluation systems, fintech effectively resolves this dichotomy, incentivizing businesses to prioritize eco-conscious technological upgrades [

35]. This strategic alignment not only strengthens institutional environmental stewardship but also fosters self-driven commitments to sustainable innovation. Consequently, organizations are increasingly pursuing harmonized digital–ecological strategies, enhancing operational productivity while mitigating ecological footprints to achieve the dual optimization of economic and environmental benefits. Fintech not only provides digital tools to optimize resource management and process efficiency but also promotes greening transformation by directing capital flow to environmental projects through green financial products. In addition, fintech also promotes information sharing and cooperation among enterprises, enabling them to learn from each other and make progress together on the road of “digital–green synergy”, forming a virtuous cycle. In light of the above analysis, the following research hypothesis is formulated:

H1. Fintech significantly enhances the digital–green synergy of enterprises by facilitating their dual transformation in digitalization and greening.

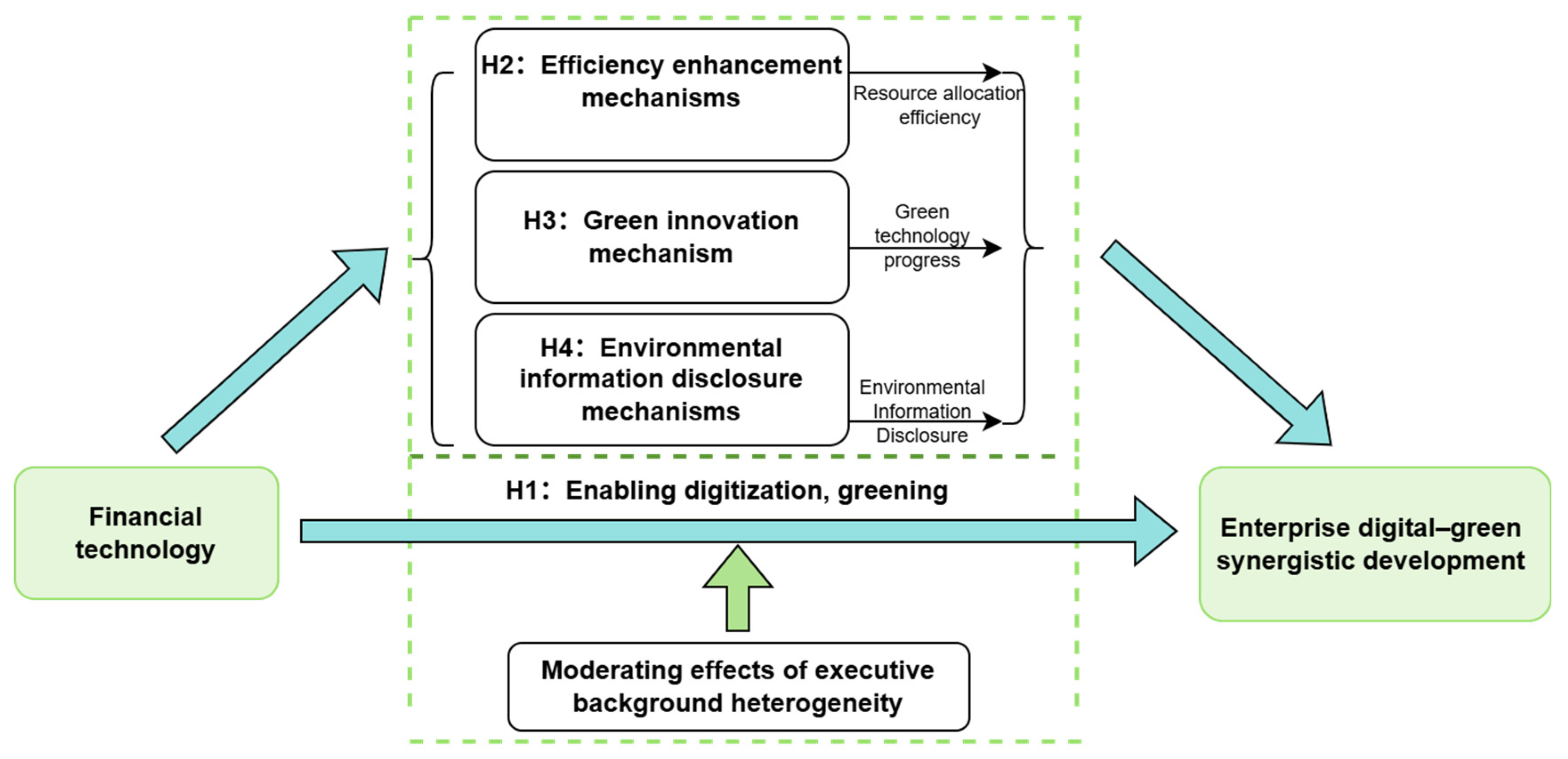

The theoretical research framework of this paper is shown in

Figure 1.

By harnessing the synergistic potential of advanced technological ecosystems, fintech reshapes conventional financial paradigms through big data analytics, artificial intelligence, and algorithmic innovations, enhancing capital distribution effectiveness via transparent information flows, precise risk evaluation frameworks, and automated transactional architectures. This digital transformation enhances capital allocation efficiency by establishing multidimensional information networks that aggregate both structured transactional data and unstructured behavioral patterns [

36], thereby addressing systemic information asymmetries through enhanced data granularity. By generating comprehensive informational networks, it mitigates distortions caused by data imbalance and realigns financial capital with industrial requirements [

2]. On the one hand, geography-agnostic capital mobilization directs societal surplus funds toward sustainable technology sectors, thereby lowering fiscal barriers to eco-friendly transitions. On the other hand, its algorithm-driven resource-matching mechanism can dynamically identify the synergistic needs of enterprises’ digitization and decarbonization development and promote the coupled allocation of factors such as arithmetic power, data, and clean energy. Drawing upon resource dependency frameworks and adaptive capability theories, the enhanced allocation efficiency empowers enterprises to rapidly acquire specialized assets for ecological innovation through digital marketplaces. Blockchain-enabled digital interfaces allow organizations to achieve the holistic governance of energy consumption analytics, carbon emission mapping through IoT sensors, and sustainable supply chain optimization via digital twins. These technological enablers establish mutually reinforcing cycles between digital transformation and green development, creating recursive improvement loops in both operational efficiency and environmental performance. In light of the above analysis, the following research hypothesis is formulated:

H2. Fintech enhances enterprises’ digital–green synergy by facilitating resource allocation efficiency.

Driven by carbon peak targets and neutrality targets and increasingly fierce market competition, green technology innovation has developed into a core path for manufacturing enterprises to achieve sustainable development. Through technological breakthroughs in energy saving and consumption reduction, enterprises can not only effectively reduce operating costs but also significantly enhance the endogenous motivation of enterprises to carry out green innovation [

36]. Fintech demonstrates multidimensional catalytic effects through digital financial platforms, effectively alleviating both financing bottlenecks and risk apprehension in green innovation ecosystems. From an informational economics perspective, fintech remedies structural market failures by deploying intelligent matching mechanisms that reconcile information asymmetries between capital allocators and technology developers. Sophisticated predictive modeling techniques incorporating advanced data analytics and machine learning algorithms substantially elevate credit assessment accuracy, thereby directing financial resources toward environmentally impactful projects with optimal market viability [

37]. From another angle, blockchain’s immutable architecture establishes reliable verification mechanisms for environmental intellectual property management. Distributed ledger technology ensures audit-proof documentation throughout green patent lifecycle processes—from certification protocols to carbon emission tracking. Such cryptographic assurance mechanisms significantly diminish transactional uncertainties in technology commercialization while preventing ethical violations in innovation transfers. Through the cost-efficient modernization of ecological practices and amplified technological convergence effects, fintech ultimately facilitates the harmonious integration of digital transformation and environmental sustainability objectives, creating self-reinforcing mechanisms for circular economic development. In light of the above analysis, the following research hypothesis is formulated:

H3. Fintech enhances enterprises’ digital–green synergy by promoting enterprises’ green technology innovation.

Enhanced environmental information disclosure acts as a pivotal mechanism to address enterprises’ environmental information gaps [

38], with its theoretical and practical logic for enabling digital-environment integration rooted in the dual drivers of external pressure and signaling theories [

39], fulfilling the essential function of systematically conveying organizational ecological initiatives, sustainability metrics, and associated operational risks to external entities through standardized, verifiable communication channels. The implementation of distributed ledger systems in ecological reporting frameworks substantially elevates data integrity, effectively neutralizing distortionary effects caused by informational imbalances within sustainable investment ecosystems [

40]. Such operational transparency generates a dual operational advantage within green finance markets: financial intermediaries acquire advanced capabilities for the precise identification of environmentally responsible enterprises through algorithmically processed environmental data streams, while enterprises face strengthened accountability pressures to optimize ecological transition outcomes. Empirical investigations reveal statistically significant correlations between rigorous disclosure regimes and demonstrable reductions in industrial emission intensity metrics [

16], establishing self-perpetuating market dynamics that incentivize ecological stewardship. Through the environmental information disclosure mechanism, fintech solutions effectively dismantle traditional information barriers between capital allocators and enterprises. This technological mediation enables the precision-targeted deployment of environmental financing instruments while simultaneously driving process innovations in enterprises’ sustainability management, resulting in synergistic improvements across both operational efficiency parameters and environmental impact mitigation trajectories throughout digital–green transformation journeys. In light of the above analysis, the following research hypothesis is formulated:

H4. Fintech enhances enterprises’ digital–green synergy by reducing information asymmetry through environmental information disclosure.

7. Conclusions

This study investigates the mechanisms through which fintech influences the synergistic development of enterprises’ digital–green synergy. The findings reveal three key results: First, fintech exerts a significant positive impact on enterprises’ digitalization, enterprises’ greening, and enterprises’ digital–green synergistic development. Second, the heterogeneity analyses indicated stronger fintech-driven effects on digital–green synergy for large firms compared to SMEs and greater impacts in highly polluting industries relative to less-polluting sectors. Third, the mechanism tests identified efficiency enhancement, green innovation, and environmental disclosure as three pathways through which fintech facilitates synergy development. Additionally, increased age and occupational diversity within executive teams amplify fintech’s positive influence on enterprises’ digital–green synergy.

Based on the above research conclusions, the challenges for the current enterprises’ digital–green synergistic development include the existence of a high technology application threshold, insufficient data governance, weak ecological synergy, and further obstacles and difficulties; we put forward the following fintech-enabled proposals for enterprises’ digital–green synergistic development.

First, the government should strengthen the overall enabling role of fintech in digital–green synergy. The government can introduce a “small and beautiful” technology inclusion program and join hands with financial institutions to launch a “technology + green” special loan to break the scale difference; it can also focus on heavily polluting industries and utilize technological bundling and regulation to force enterprises to use real-time data uploading tools when applying for technological reform loans or subsidies. For example, for high-carbon industries, enterprises applying for technological reform loans or subsidies must use fintech tools to upload data in real time.

Second, the government needs to smooth and deepen the path of efficiency, innovation, and transparency. The government can promote the “industrial internet + green finance” model, automatically matching green credit lines to enterprises accessing the national industrial internet platform; set up a “fintech green patent gas pedal”, which can provide priority review channels for green technology patents based on blockchain and AI; and compel enterprises to apply for technological reform loans or subsidies by using fintech tools to upload data in real time. The establishment of a “FinTech Green Patent Accelerator” can provide a priority review channel for blockchain- and AI-based green technology patents; listed companies can be mandated to disclose environmental data through standardized API interfaces, and natural language processing technology can be used to automatically verify “greenwashing” behavior and incorporate it into credit ratings.

Third, enterprises should focus on the heterogeneous capacity building of their executive team. The government can launch the professional certification of “enterprise green manager”, require at least one person in the executive team of heavily polluting industries and key emission enterprises to hold the certification, and incorporate it into the governance assessment index of listed enterprises. At the same time, enterprises should actively promote cross-industry executive exchanges and organize the posting of manufacturing executives in financial and technological enterprises so as to promote the transfer of cross-border experience and the enhancement of their composite decision-making capacity.

Although this paper explores the impact of fintech on enterprises’ digital–green synergy, there are some limitations. Specifically, our study relies on data from Chinese A-share companies listed on the SHSE and the SZSE from 2011 to 2022, for which there are limited corresponding findings in the Chinese region. Also, since our research is primarily based on data from large companies, it cannot be directly generalized to small enterprises. Moreover, future research could examine how different types of fintech innovations (e.g., digital payments, network security technology) specifically contribute to the observed synergy effects.