1. Introduction

As human society enters the 21st century, driven by scientific and technological progress, the global cognitive boundaries between environmental destruction and resource abuse continue to expand. Seeking a high-quality and sustainable green development path has become a rigid requirement for socioeconomic construction. In the field of agricultural production, the traditional development model that unilaterally pursues production efficiency while ignoring the destructive consequences to the ecosystem, environment, and natural resources has increasingly revealed deep-seated contradictions in the process of modernization [

1]. Existing research shows that agricultural production activities have become one of the main causes of environmental problems, such as water pollution [

2], greenhouse gas emissions [

3], and biodiversity reduction [

4]. There is a global consensus that governments must take measures to achieve an optimal balance between agricultural economic development and environmental protection. As a major agricultural country, China has inevitably encountered the same problems in the process of shifting towards a new development model. In recent decades, China has made remarkable progress in agricultural productivity. By utilizing less than 10% of the world’s arable land, it has achieved food security for 22% of the global population [

5,

6]. However, at the same time, the development path of “high resource consumption, high environmental degradation, low productivity” has also brought a series of long-term environmental risks, such as pesticide abuse, land desertification, and ecosystem imbalance [

7,

8]. The Chinese government has issued documents on multiple occasions in recent years, focusing on “promoting rural ecological revitalization through the comprehensive green transformation of development” and integrating agricultural and rural modernization with environmental protection to achieve high-quality rural development while maintaining sustainability [

9,

10]. Therefore, exploring the relationship between agricultural green total factor productivity (AGTFP) and the urban–rural income gap (URIG) and examining the synergy between socioeconomic development and ecological transition in rural revitalization initiatives are highly important for incorporating development and protection into a comprehensive theoretical framework and further advancing the rural revitalization strategy.

Among all factors influencing sustainable development, government macro-regulation is widely regarded as pivotal to the success of green development strategies. Within these macro-regulatory measures, fiscal expenditure stands out as a particularly crucial instrument. Agricultural fiscal expenditure refers to government budgetary allocations dedicated to the agricultural sector, encompassing investments in agricultural infrastructure, funding for agricultural technology, subsidies for farmers, and other related expenditures. As a key tool for government macro-control, agricultural fiscal expenditure provides public goods for agricultural production, stimulates the enthusiasm of agricultural producers, and supports sustainable agricultural development. Therefore, incorporating agricultural fiscal expenditure into the research framework holds significant practical implications for exploring future models of green agricultural development.

This study aims to construct a PVAR model integrating fiscal agricultural expenditure, agricultural green total factor productivity (AGTFP), and the urban–rural income gap (URIG), examining their dynamic interactions and effects from both static and dynamic perspectives. By clarifying these relationships, the research seeks to provide theoretical support and practical guidance for formulating more effective policy measures and advancing the implementation of the rural revitalization strategy.

The structure of this paper is organized as follows:

Section 2 reviews the existing literature,

Section 3 elaborates on the research methodology,

Section 4 presents the empirical analysis, and the final section summarizes the findings and policy recommendations.

2. Literature Review

In previous research, scholars employ agricultural total factor productivity (ATFP) as a core metric to measure the level of a country’s agricultural development, comprehensively considering the impact of factors such as policy formulation, personnel quality, and learning ability on agricultural production [

11]. However, ATFP does not consider environmental factors and sustainable development capabilities as potential costs, leading to deviations in the estimation of a country’s actual agricultural development [

12]. Therefore, compared with the original AFTP indicator, AGTFP has advantages and incorporates green and sustainable factors into the evaluation scope of agricultural production levels, directly reflecting the technological content and sustainability of agricultural development. It is a measurement indicator that better fits the theme of green development. The urban–rural income gap is an important indicator of social fairness and prosperity. Reducing the level of URIG has profound significance in promoting social fairness, achieving balanced regional development, and promoting reasonable labor mobility as well as common prosperity [

13,

14,

15]. This is a key measure for building a harmonious society, driving economic growth, and achieving long-term national development. Exploring the relationship between AGTFP and URIG can provide better data support and theoretical guidance for constructing a collaborative framework of “efficiency–equity–sustainability” during the implementation of sustainable rural development [

16]. Simultaneously, as important support for the state’s agricultural and rural development, fiscal expenditure for supporting agriculture is an effective regulatory measure for rural development [

17]. It is an essential part of enhancing comprehensive agricultural production capabilities and optimizing the efficiencies of the agricultural supply chain system while also developing more channels for augmenting farmers’ income, accelerating rural economic and social development, enhancing the rural living environment, and perfecting the rural governance system [

18,

19,

20]. By incorporating fiscal expenditure to support agriculture into the study of the relationship between AGTFP and URIG, not only can we analyze how fiscal tools such as green technology subsidies and ecosystem compensation affect total factor productivity through mediating effects but also, more comprehensively, reveal the importance of fiscal resource allocation in promoting the establishment of a dual-objective coordination mechanism for increasing green productivity and converging the income gap.

Scholars have conducted extensive research on the linkage mechanism between fiscal expenditures for supporting agriculture [

21,

22,

23,

24,

25], AGTFP [

26,

27,

28,

29,

30], and URIG. However, most studies focus only on the unidirectional impact between specific factors and do not integrate fiscal expenditure for supporting agriculture, AGTFP, and URIG into an integrated methodological framework. Current research is often limited to the causal relationship between single variables, and a systematic analysis of the complex interaction mechanism between fiscal expenditure for supporting agriculture, AGTFP, and URIG is lacking [

18,

26,

31]. Therefore, integrating fiscal expenditures to support agriculture, the AGTFP, and URIG into a unified analytical framework has become an important direction for current research.

With respect to the importance of fiscal expenditure in promoting agro-economic efficiency, a majority of empirical research has demonstrated that increased public expenditure in agriculture contributes to lowering sustainability-related expenditures and enhancing production efficiency within the sector [

32,

33,

34,

35,

36]. However, few studies have focused on the detailed structural characteristics and impact mechanisms of fiscal expenditures to support agriculture in this process. On the one hand, research shows that increasing the scale of fiscal expenditure for supporting agriculture can directly reduce environmental costs in agricultural production by subsidizing green technology R&D and promoting the application of eco-friendly agricultural machinery and equipment [

37,

38,

39]. Moreover, providing the economic public goods and services required for agricultural development and reducing agricultural operational risk can promote the accumulation of agricultural production resources and increase ATFP [

40,

41]. However, some researchers have noted that excessive fiscal expenditure for supporting agriculture does not necessarily lead to an augmentation in agricultural green productivity, and it is necessary to subdivide specific expenditure structures [

18]. In the spatial dimension, the impact of fiscal expenditure for supporting agriculture on agricultural green production also has spillover effects but shows regional heterogeneity in different provinces [

42]. At the same time, in terms of achievement transformation, research shows that fiscal expenditures for supporting agriculture also correlate positively with higher rural household earnings and a narrowing URIG. Increasing the intensity of agriculture-related support can significantly stimulate rural household earnings and reduce URIG [

43,

44].

When the relationship between the AGTFP and URIG is explored, the literature provides rich perspectives and profound insights. Overall, research generally shows that URIG has an obvious inverse effect on AGTFP, and this view has been verified in multiple studies [

45,

46,

47,

48,

49]. Research shows that a larger urban–rural income gap may lead to unreasonable resource allocation, thereby inhibiting the improvement of AGTFP. This is because, in a situation with a large income gap, rural areas may lack sufficient resources and incentives to adopt eco-friendly agricultural technologies and management methods, which in turn affects the green transformation of agricultural production [

50,

51]. Research has also revealed that a rural labor transfer positively moderates the negative correlation between the urban–rural income gap and AGTFP, whereas rural residents’ income negatively moderates this relationship, and this relationship exhibits significant regional heterogeneity, with the adverse consequences being particularly pronounced in China’s central and western provinces due to their distinct developmental contexts and resource constraints [

52]. In contrast, from the perspective of the mediating effect of labor transfer, Yu and Lu reveal a U-shaped relationship between agricultural productivity and inequality—more pronounced in central/western China due to rural industrial gaps—while further uncovering the dual-threshold dynamics between productivity and inequality, thereby demonstrating the existence of nonlinear and complex interactions [

53].

Although existing research has begun to focus on the individual effects of fiscal expenditure for supporting agriculture, AGTFP, and URIG, there is still an insufficient in-depth exploration of the mutual roles between these variables, especially the lack of empirical research that combines these three key factors for systematic analysis. Moreover, owing to the dynamic characteristics of the economic system, the mutual roles between these variables may have time lag or unstable characteristics which have not been fully investigated in the literature. Therefore, the present research was designed to bridge this research gap. On the basis of the construction of a PVAR model, combined with Granger causality tests, impulse response analysis, and variance decomposition methods, this study uses panel data from 30 provinces in mainland China between 2012 and 2022 to explore the dynamic relationships among fiscal expenditures for supporting agriculture, the AGTFP, and URIG. The innovations of this study are as follows. First, unlike previous studies, which have primarily focused on isolated variables and unidirectional relationships, this research integrates these three factors into a unified analytical framework and systematically examines their mutual influences and underlying logical connections [

26,

31,

54]. Second, through empirical analysis, it reveals the complex dynamic interaction between these variables, providing new perspectives for research in relevant fields and offering valuable references for policy formulators. Through these analyses, this study not only enriches the literature but also provides strategic suggestions for achieving sustainable agricultural development and promoting coordinated urban–rural development.

4. Empirical Analysis

4.1. Stationarity Test

Considering the potential non-stationarity of variables, regression analysis may yield false relationships which lead to biased results. To accurately depict the logical relationship between variables, before using PVAR for model estimation, this study conducts stationarity tests on panel data via three methods simultaneously: the LLC, Fisher-ADF, and Fisher-PP tests, as shown in

Table 3. The results show that the original data series of governmental expenditure for supporting agriculture (GOV), agricultural green total factor productivity (GTFP), and the urban–rural income gap (GAP) reject the null hypothesis of “the existence of unit roots”. The three variables are integrated in the same order and can be used to construct a panel vector regression (PVAR) model.

4.2. Determination of Optimal Lag Order

The selection of an appropriate lag order is a critical step in panel vector autoregression (PVAR) modeling, as it directly influences the consistency and efficiency of parameter estimates. An underspecified lag structure may fail to capture important dynamic relationships among variables, while an over-specified model can lead to overfitting, reduced degrees of freedom, and inefficient estimation. To systematically determine the optimal lag length, this study employs the PVAR2 computational procedure developed by Chia et al. [

76], which implements a comprehensive model selection framework. Specifically, we evaluate three widely accepted information criteria: AIC, BIC, and HQIC. As presented in

Table 4, all three criteria unanimously achieve their global minima at the third lag order, indicating robust evidence for this specification. Thus, we specify a PVAR(3) model, which optimally balances the trade-off between capturing dynamic interdependencies and maintaining model parsimony.

4.3. GMM Parameter Estimation

Before applying the generalized method of moments (GMM) to estimate the PVAR model, this study first uses the Helmert transformation to process the data, with the purpose of eliminating the time series and individual fixed effects in the sample to ensure the accuracy of parameter estimation [

77]. However, owing to the lack of a solid theoretical foundation for the PVAR model itself, the sign, magnitude, and statistical significance of the parameter estimates may not directly correspond to the actual economic meanings. Therefore, this study primarily examines the outcomes derived from model estimation procedures, including impulse response analysis, variance decomposition, and Granger causality tests, to explore the dynamic relationships and mutual roles between variables (

Table 5).

4.4. Granger Causality Analysis

To more precisely delineate the transient dynamic effects and causal linkages among variables, this study conducted a Granger causality test with a lag of one period on the basis of the constructed PVAR model and the outcomes are presented in

Table 6.

The table shows that at, the 1% significance level, GTFP is a unidirectional Granger cause of the GAP, indicating that the improvement in agricultural green productivity is a potential driving force for narrowing the urban–rural income gap, whereas narrowing the urban–rural income gap has not been able to improve agricultural green productivity. Second, GTFP is a unidirectional Granger cause of GOV, indicating that the current stage of fiscal expenditures for supporting agriculture has not been able to promote the improvement in agricultural green productivity. Third, there is a bidirectional Granger causal relationship between GAP and GOV, but neither GAP nor GOV is a Granger cause of the GTFP. This finding indicates that there is indeed a significant bidirectional causal circulation interaction mechanism between fiscal expenditure for supporting agriculture and the urban–rural income gap. However, at the current stage, this interaction mechanism cannot exert a significant positive impact on advancing agricultural green productivity through either the urban–rural income gap or fiscal expenditure for supporting agriculture.

4.5. Stability Test

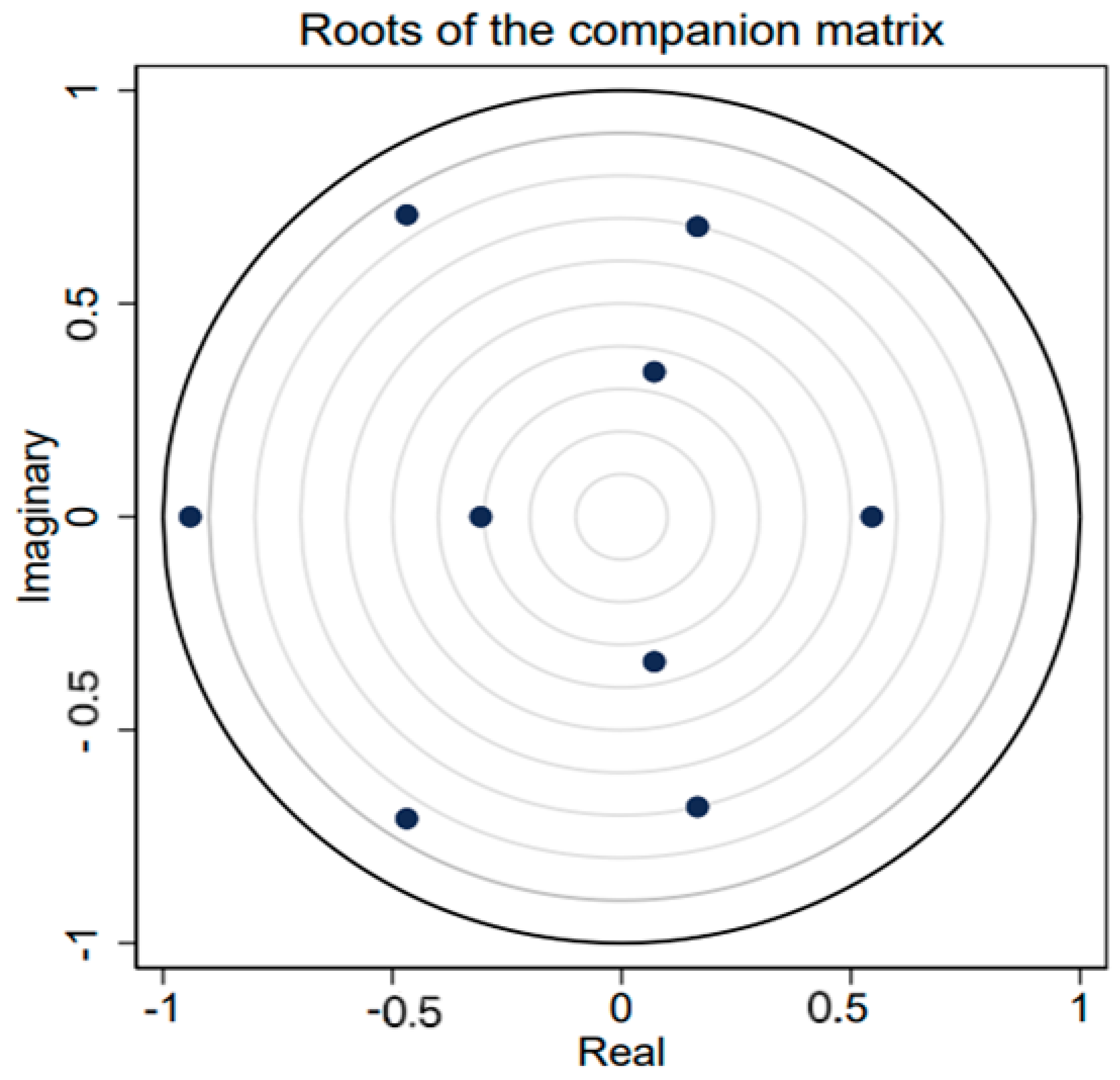

As stability testing constitutes an essential diagnostic step preceding impulse response analysis in PVAR modeling, we employ an inverse modulus analysis of the characteristic polynomial roots. The graphical results (

Figure 1) confirm that our PVAR(1) specification meets the stability condition, with all inverse roots falling inside the unit circle boundary. This validation ensures that the stationarity requirements for meaningful impulse response functions are satisfied.

4.6. Impulse Response

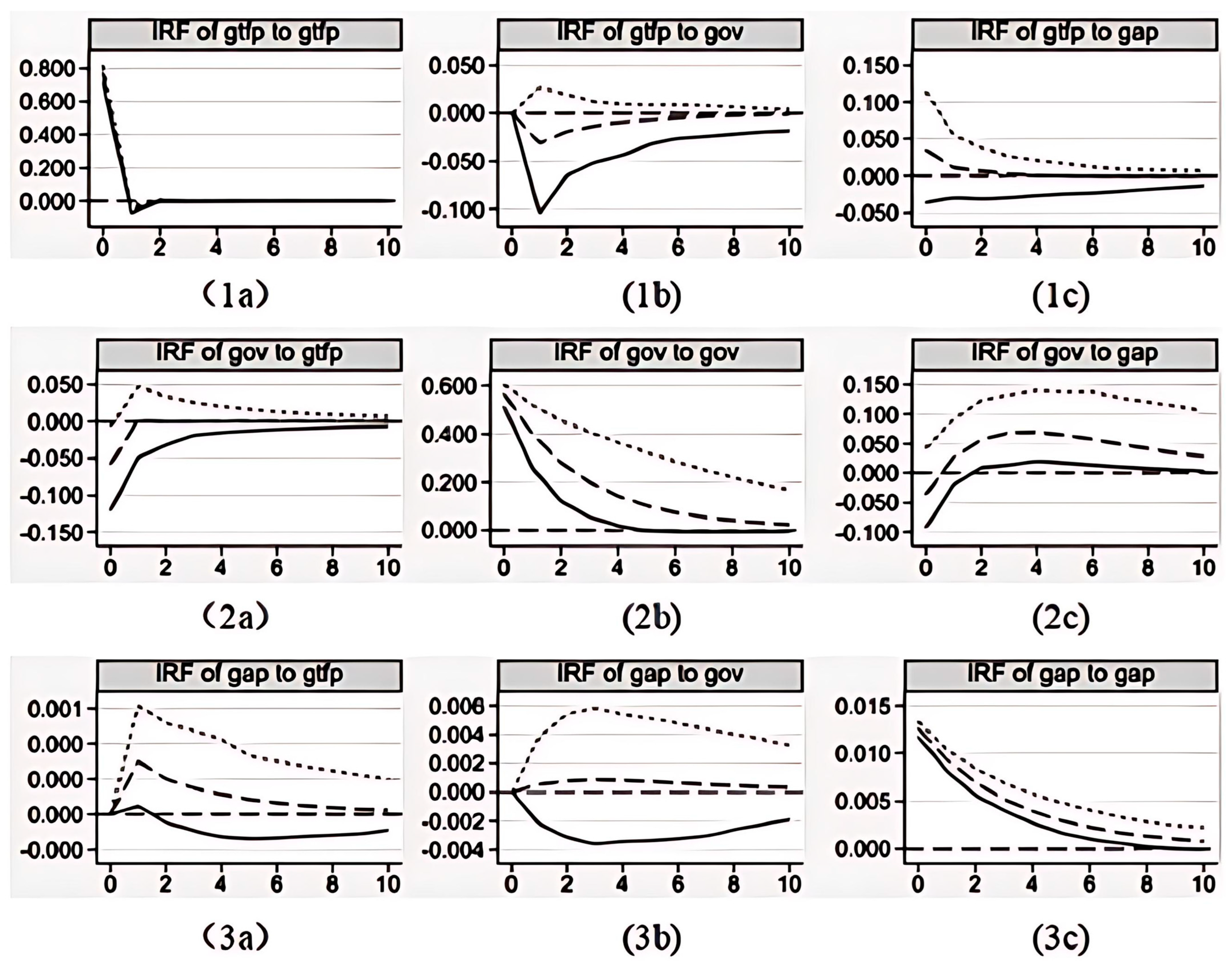

The impulse response function traces out the time-path effects of a one-standard-deviation shock to one variable affecting both contemporaneous and lagged values of other variables in the PVAR system. The impulse response analysis provides a visualized representation of the dynamic interdependencies among endogenous variables, enabling an examination of temporal spillover effects. For this investigation, we implemented 500 Monte Carlo simulations with a 10-period horizon to generate impulse response functions for all variables in both Model 1 and Model 2 specifications. The impulse responses of GOV, GTFP, and GAP are shown in

Figure 2.

The impulse response plot (

Figure 2(1a)) indicates that AGTFP displays significant positive own-shock persistence, achieving peak responsiveness in the impact period. It then decreases rapidly, falling to the lowest point slightly below the 0 value around period 1, then slightly rebounds, but remains near the 0 value level overall. This finding indicates that AGTFP has a strong self-reinforcing effect and that this reinforcing effect is more significant in the short term. From (2b) and (3c) in

Figure 2, it can be seen that, when fiscal expenditures for supporting agriculture and URIG are subjected to a one-standard-deviation shock from themselves, they will generate a strong positive response, then slowly decline and gradually approach zero around periods 8–10. This finding indicates that both URIG and fiscal expenditures for supporting agriculture have strong economic inertia and expansionary characteristics and that these effects are persistent and stable.

Figure 2(1c) shows that, when AGTFP is affected by URIG, it initially produces a relatively weak positive response but then quickly decreases until it disappears, indicating that the narrowing of the current stage of China’s urban–rural income gap has a very weak role in promoting agricultural green productivity.

Figure 2(1b) shows that, when AGTFP is shocked by fiscal expenditures to support agriculture, there is no obvious response in the current period, but a relatively significant negative effect follows, which first increases and then decreases, approaching the 0 value level around period 7. This finding indicates that the role of fiscal expenditure for supporting agriculture in AGTFP has a significant lag. In the short term, it may have a negative effect because of improper resource allocation or short-term objectives. In the long term, fiscal expenditure to support agriculture promotes technological progress, optimizes the industrial structure, and improves human capital through various channels, which is highly important for improving AGTFP.

Figure 2(2c) shows that, when fiscal expenditure for supporting agriculture is shocked by the urban–rural income gap, a negative response is generated in the current period, but the response curve quickly increases, turning from negative to positive, and then slowly decreases around period 5. This finding indicates that, in the short term, URIG inhibits the growth of fiscal expenditures to support agriculture, which may be related to fiscal decentralization and competition among local governments. Owing to the influence of promotion incentives, to pursue high GDP, local governments and officials prefer to invest funds in sectors with greater economic returns, resulting in a significant urban bias in fiscal expenditure. However, in the long run, owing to China’s institutional advantages and the development potential of rural areas, this fund bias will be greatly improved.

Figure 2(2a) shows that when fiscal expenditure for supporting agriculture is subjected to AGTFP, it generates a negative response in the short term, then quickly increases and remains near the 0 value level. A possible explanation is that the current agricultural development and production efficiency in China are not sufficiently high, and there is no sound investment mechanism, resulting in the low utilization efficiency of fiscal funds and insufficient attractiveness to fiscal funds in the short term.

Figure 2(3a) shows that the positive effect of AGTFP on URIG is not obvious at the beginning but quickly strengthens in the short term and remains stable for a relatively long period of time. These findings indicate that improvements in AGTFP are conducive to narrowing URIG. The role of improving AGTFP in rural development is not immediately apparent, but in the long run, the effect is significant and stable, which can fundamentally improve the quality of rural economic development. Therefore, improving AGTFP through the development of green agriculture, technological innovation, agricultural production system innovation, and other methods is highly important for advancing agricultural and rural modernization, narrowing the urban–rural gap, and promoting common prosperity.

Figure 2(3b) shows that, when URIG is shocked by fiscal expenditures to support agriculture, a positive response continues to be generated, which is relatively stable, but the effect is relatively weak. This may be because rural development is limited by various factors and the injection of fiscal funds alone is still insufficient.

4.7. Variance Decomposition

Variance decomposition can explain the role mechanism of changes in endogenous variables in the PVAR model and study the contribution rate of changes in each endogenous variable in the model, which helps clearly describe the degree of explanation between variables. The results are presented in

Table 7. Specifically,

(1) In the AGTFP equation, the variance explanatory power of AGTFP to itself is very high, always remaining above 75%, which also indicates that AGTFP has a very strong self-reinforcing effect, which is consistent with the analysis of impulse effects in the above text. The variance contribution rate of fiscal expenditure for supporting agriculture is the highest in the tenth period (18.8%), indicating that fiscal expenditure for supporting agriculture plays a significant role in improving AGTFP; in contrast, URIG has less explanatory power for AGTFP, with the highest variance contribution rate being only 2.4%.

(2) In the fiscal expenditure for supporting agriculture equation, the variance explanatory power of the green ATFP and URIG to fiscal expenditure for supporting agriculture is very low, with the sum of the two not exceeding 10%, whereas the variance explanatory power of fiscal expenditure for supporting agriculture itself remains above 90%. This finding indicates that fiscal expenditure for supporting agriculture has strong economic inertia and is not strongly affected by external factors such as green agricultural productivity and URIG, which mainly rely on its own role.

(3) In the URIG equation, both AGTFP and fiscal expenditure for supporting agriculture contribute to the narrowing of URIG, with AGTFP accounting for the main part, maintaining a variance explanatory power of over 10% after Period 5, whereas the contribution of fiscal expenditure for supporting agriculture, although small, shows an upward trend, reaching 7.1% in Period 10. Overall, both AGTFP and fiscal expenditure for supporting agriculture can facilitate a reduction in the urban–rural income gap while fostering sustainable development.

5. Conclusions and Suggestions

5.1. Conclusions

Using provincial-level panel data spanning the period 2012–2022, this study explores the dynamic interaction relationships among fiscal expenditure for supporting agriculture, AGTFP, and URIG and draws the following conclusions. First, AGTFP, URIG, and fiscal expenditures for supporting agriculture all have strong self-reinforcing effects and are greatly influenced by themselves. Second, there is a relatively obvious two-way interaction relationship between AGTFP and URIG in the short term. AGTFP and URIG can promote each other in the short term, but from a long-term perspective, the promoting role of URIG on AGTFP is not obvious, whereas AGTFP has a continuous and stable promoting role in narrowing URIG and is an important way to narrow URIG. Improving AGTFP is an important measure for cultivating and developing new quality productive forces in rural areas and is highly important for advancing rural revitalization, narrowing URIG, and promoting balanced urban–rural development. Third, there is a significant two-way interaction relationship between fiscal expenditure for supporting agriculture and URIG. Fiscal agriculture-related expenditures can provide financial support for rural development and alleviate the dilemma of insufficient funds for rural development to a certain extent, which has a positive role in narrowing URIG. The narrowing of URIG will also change the bias of local governments in the use of fiscal funds to a certain extent, leading to an increase in fiscal expenditure to support agriculture. Finally, fiscal expenditures for supporting agriculture have not been able to fully promote AGTFP. The improvement in AGTFP cannot simply rely on the use of government power but requires the collaborative cooperation of multiple entities, such as the government, enterprises, and universities. However, China has yet to establish a coordination mechanism. Coupled with the shortcomings of the fiscal fund management system and the linkages between policies, investments in green agriculture, agricultural technology promotion, agricultural scientific research support, and agricultural product quality and safety are seriously insufficient, and the utilization rate of fiscal agriculture-related funds is low, which cannot truly promote the improvement of AGTFP.

5.2. Suggestions

In view of the dynamic interaction relationship between fiscal expenditure supporting agriculture, AGTFP, and URIG, we suggest adopting the following comprehensive policy measures. First, priority should be given to enhancing agricultural S&T innovation and extension systems, with particular emphasis on increasing R&D investment in green agricultural technologies to boost both production efficiency and product quality. Concurrently, intensifying efforts in both the commercialization and popularization of scientific advancements will empower agricultural communities to readily adopt and implement innovative technologies. A collaborative cooperation mechanism among multiple entities, such as the government, enterprises, and universities, should be established to promote resource sharing and information exchange and jointly promote the improvement in AGTFP. Second, we further rationalize the structure of fiscal expenditures on agriculture and tilt more toward rural basic facility construction, education, medical care, and other fields to elevate comprehensive living conditions and earnings capacity in agricultural communities. Moreover, differentiated fiscal support policies should be implemented, and more fiscal support should be provided to regions with larger income gaps according to the specific situation of URIG to promote balanced regional development. Third, upgrade the fiscal fund management system for agriculture-related expenditures, increase the transparency and efficiency of fund use, and ensure that funds can be truly invested in fields such as green agriculture and agricultural technology promotion. In addition, it further strengthens the coordination and linkage between different policies to form a joint policy force and improve the overall effect of fiscal expenditure for supporting agriculture. Finally, we should enhance the balanced progression of AGTFP and fiscal expenditure for supporting agriculture, formulate long-term plans for agricultural green development and fiscal expenditure to support agriculture, and ensure the continuity and stability of policies. A performance evaluation mechanism for fiscal expenditures to support agriculture should be established to evaluate policy effects regularly, and policies should be adjusted and optimized according to the evaluation results to ensure the efficient use of fiscal funds and truly promote the improvement in AGTFP.

5.3. Limitations and Prospects

This study explores the dynamic interaction relationships among fiscal expenditures for supporting agriculture, the AGTFP, and URIG, but several shortcomings remain.

First, the PVAR model faces limitations in addressing endogeneity among fiscal support, AGTFP, and URIG due to their bidirectional relationships. While we employed system GMM estimation with Helmert transformation to mitigate this issue, residual endogeneity concerns remain. Future studies could adopt more robust approaches like instrumental variable techniques or natural experiments to better establish causal directions.

Second, regarding impulse response analysis, while our current PVAR framework follows established practice, alternative methods like local projections or structural impulse response may provide more flexible shock identification. These approaches could offer complementary insights, particularly in handling structural breaks and nonlinear dynamics that conventional IRFs may overlook.

Third, this study was conducted at the provincial level and did not consider the spatial relevance of the development of AGTFP in each province. In the future, based on the spatial spillover effect of AGTFP, spatial econometric models can be used to explore the spatial interaction roles between AGTFP and fiscal expenditure to support agriculture and URIG.

Fourth, this study selected data from 31 provinces in mainland China for analysis, but the fiscal expenditures for supporting agriculture, ATFP, and URIG in different provinces may differ. In the future, specific provinces can be selected for in-depth analyses via a combination of case studies and empirical analysis methods.

Finally, while the PVAR model effectively captures the dynamic interdependencies among fiscal agricultural support, AGTFP, and URIG, its simplified structure inherently limits the detailed differentiation of endogenous transmission mechanisms from exogenous shock impacts. To isolate these pathways, future research should incorporate mediating variables such as green credit supply and rural human capital, alongside shock-absorber indicators like climate vulnerability indices and trade openness metrics to control for disaster and geopolitical spillovers. Methodologically, advanced frameworks such as dynamic stochastic general equilibrium (DSGE) models would simulate shock-propagation scenarios, collectively enabling a “multi-loop” analytical system that reconciles theoretical depth with empirical precision in examining the GOV-AGTFP-URIG nexus.