Identifying and Assessing Vulnerable Micro-Enterprises in Lithuania

Abstract

1. Introduction

2. Literature Review

3. Research Methodology

3.1. Objective of Research Methodology

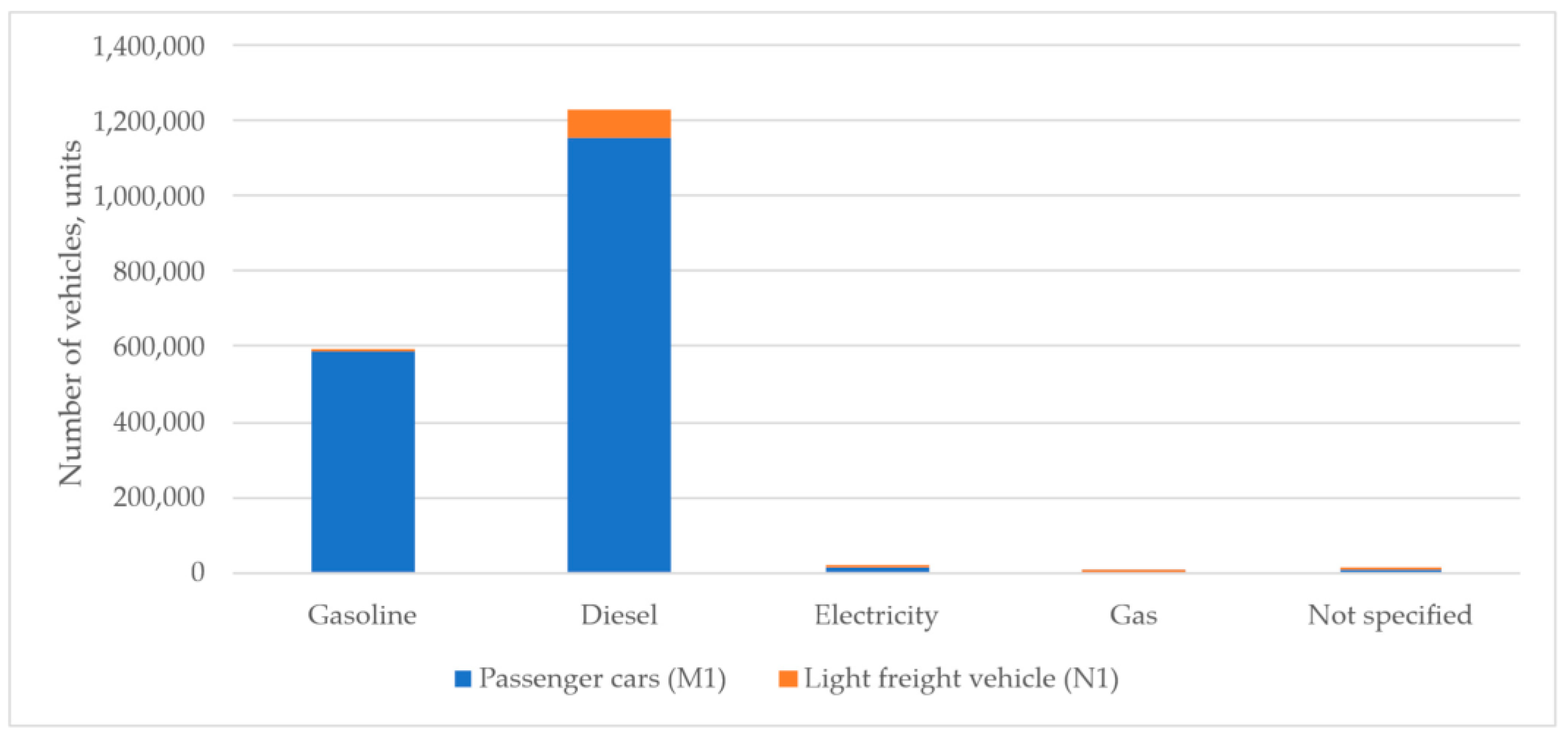

3.2. Subject and Sample Size

3.3. Data and Period

3.4. Vulnerability Factors

3.5. Vulnerability Indicators

3.6. Impacts

4. Results

4.1. Fuel Expenditure and Share of Fuel Expenditure in Total Operating Costs

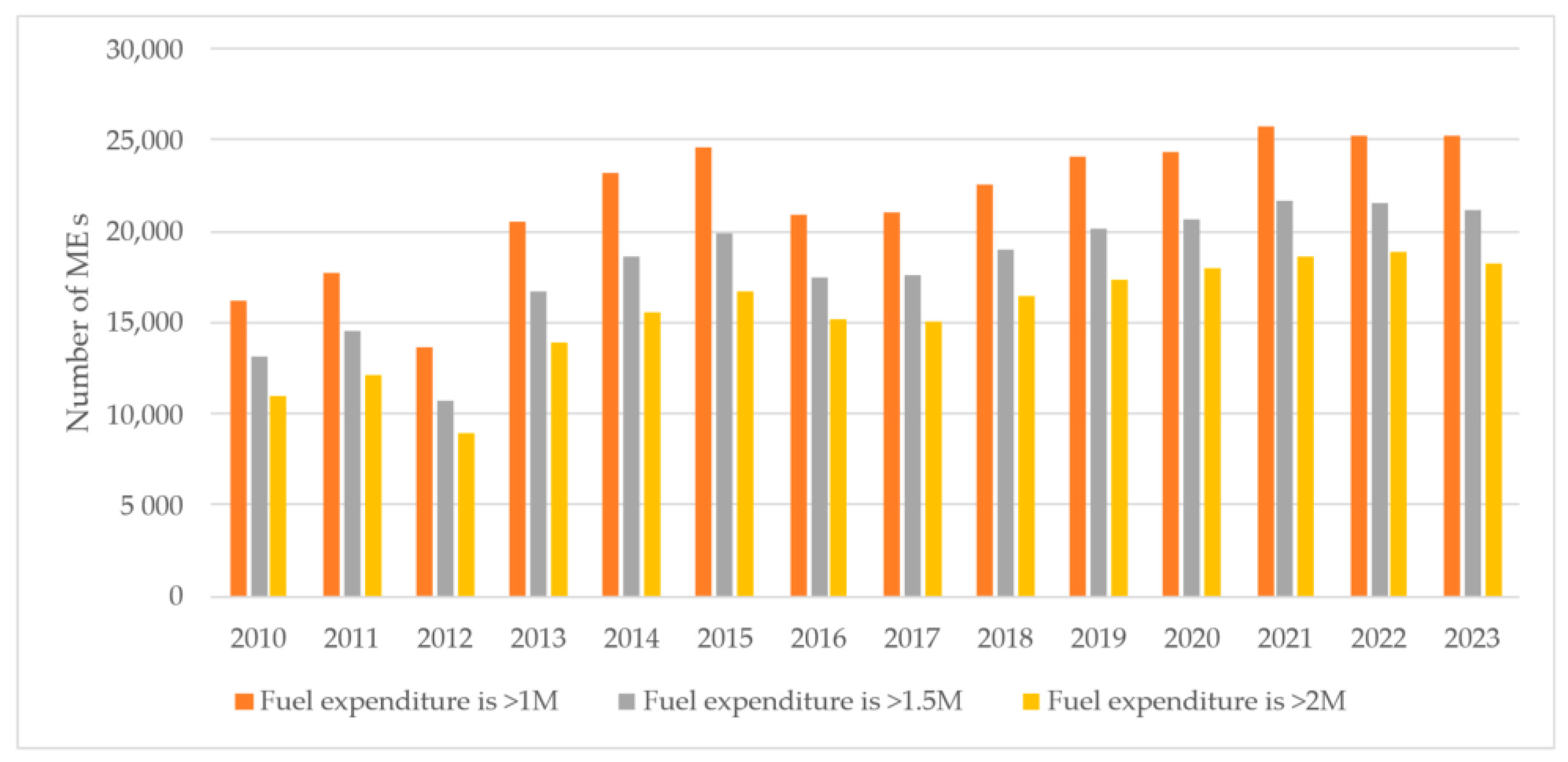

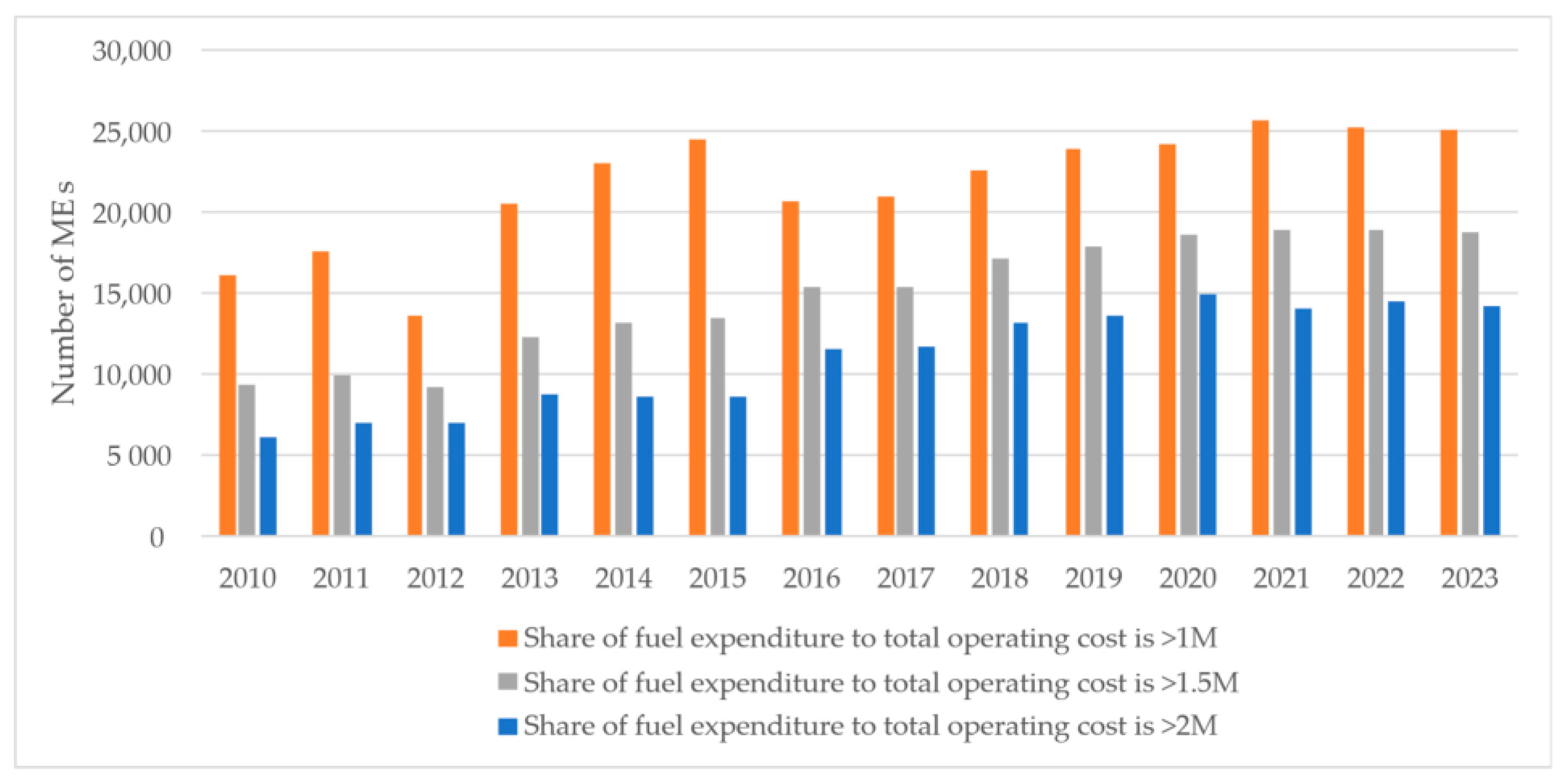

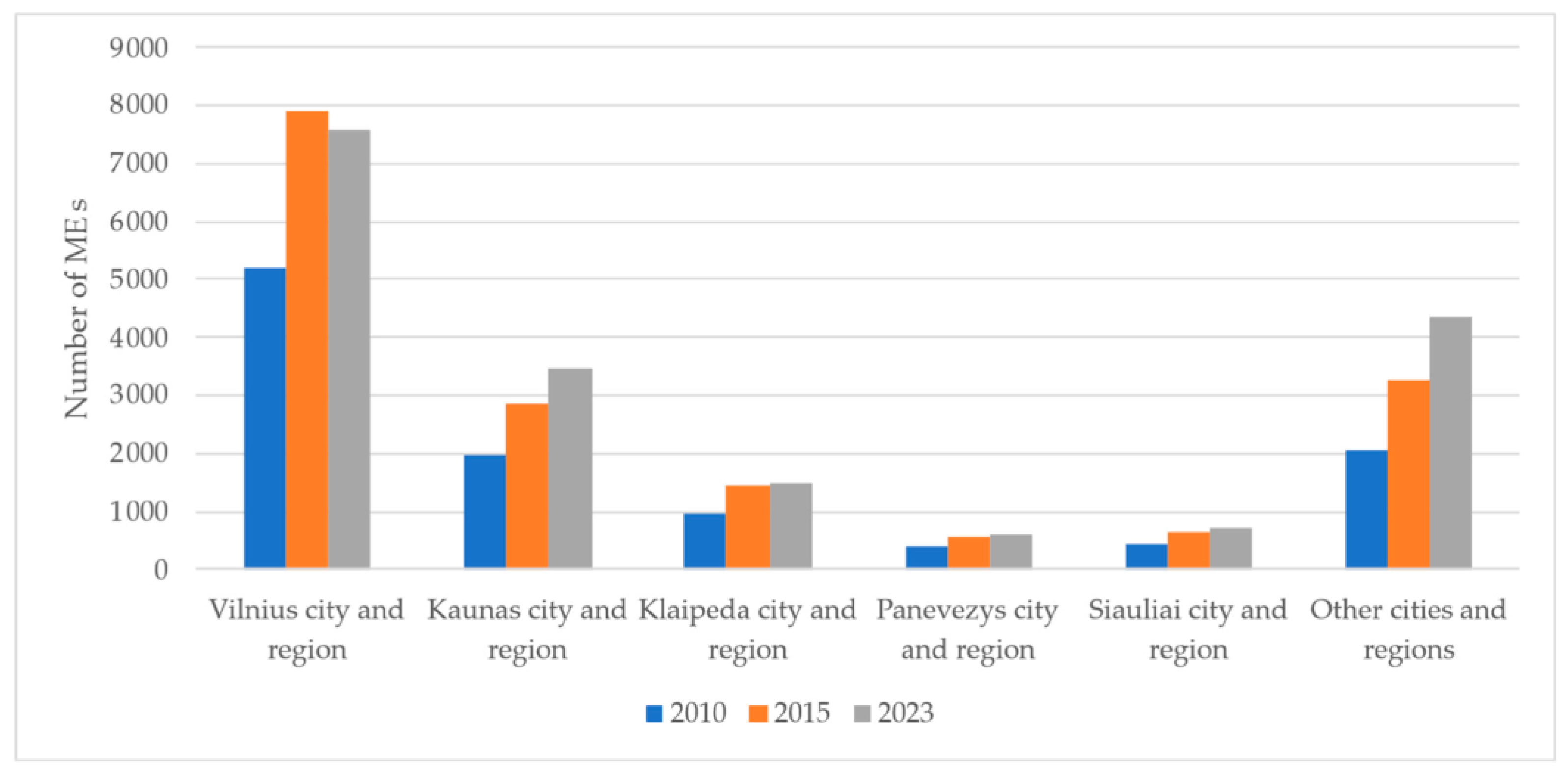

4.2. Number of Vulnerable Micro-Enterprises

4.2.1. Number of Micro-Enterprises with High Fuel Expenditure

4.2.2. Number of Micro-Enterprises with a High Share of Fuel Expenditure in Total Operating Costs

4.2.3. The Most Vulnerable Lithuanian Municipalities

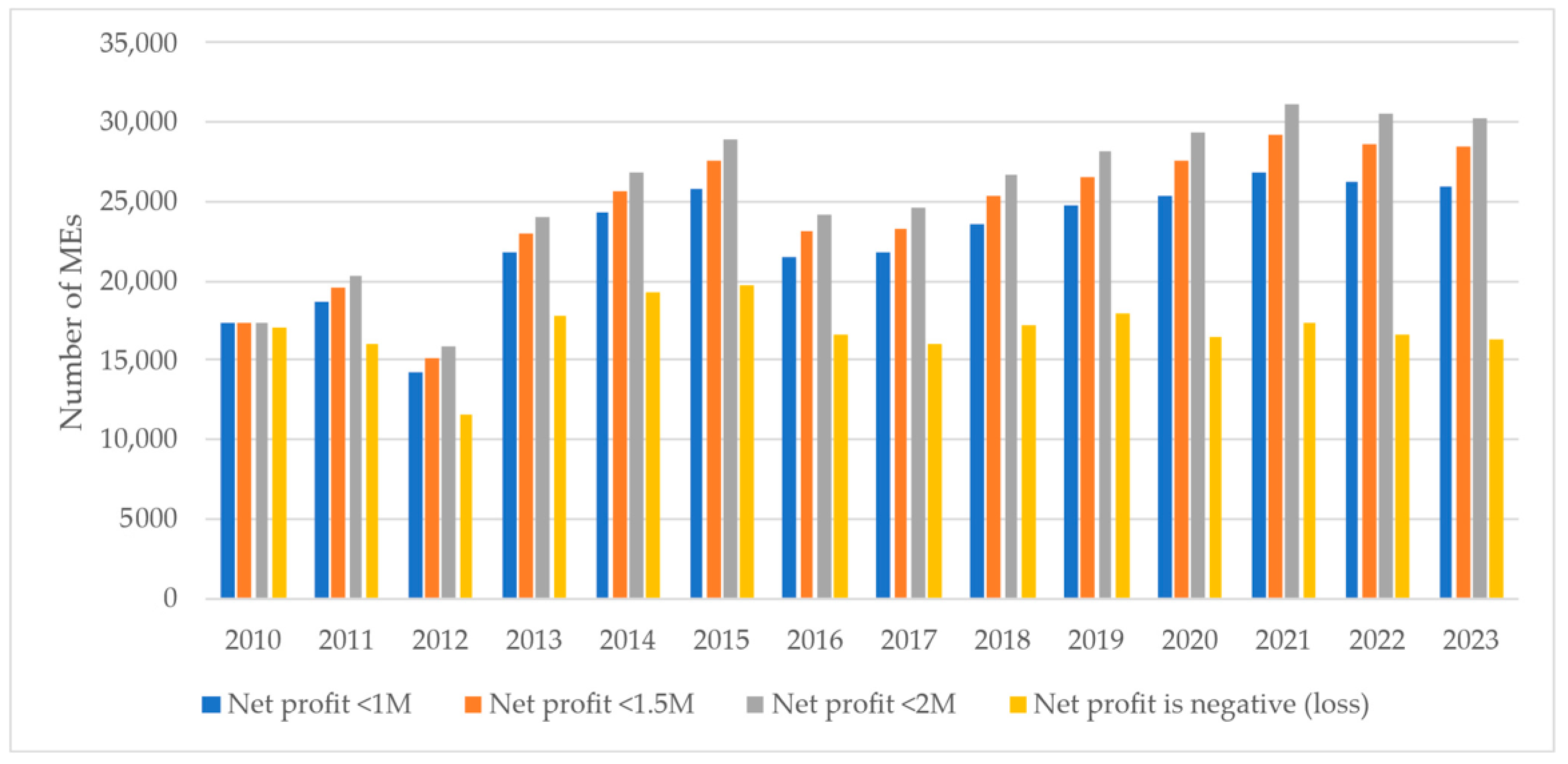

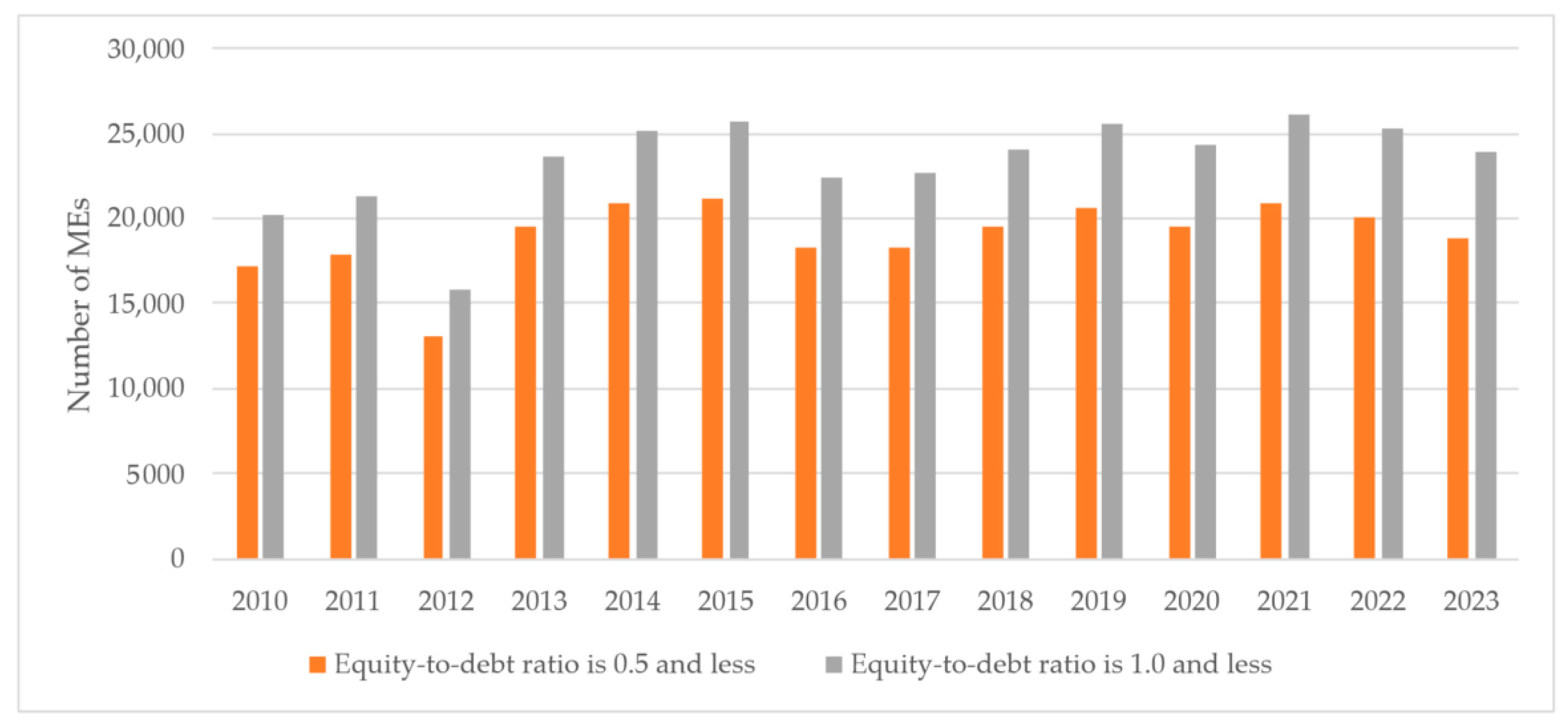

4.2.4. Number of Low-Profit and Low-Solvency Micro-Enterprises

4.3. Developments in Economic Outcome of Vulnerable Micro-Enterprises

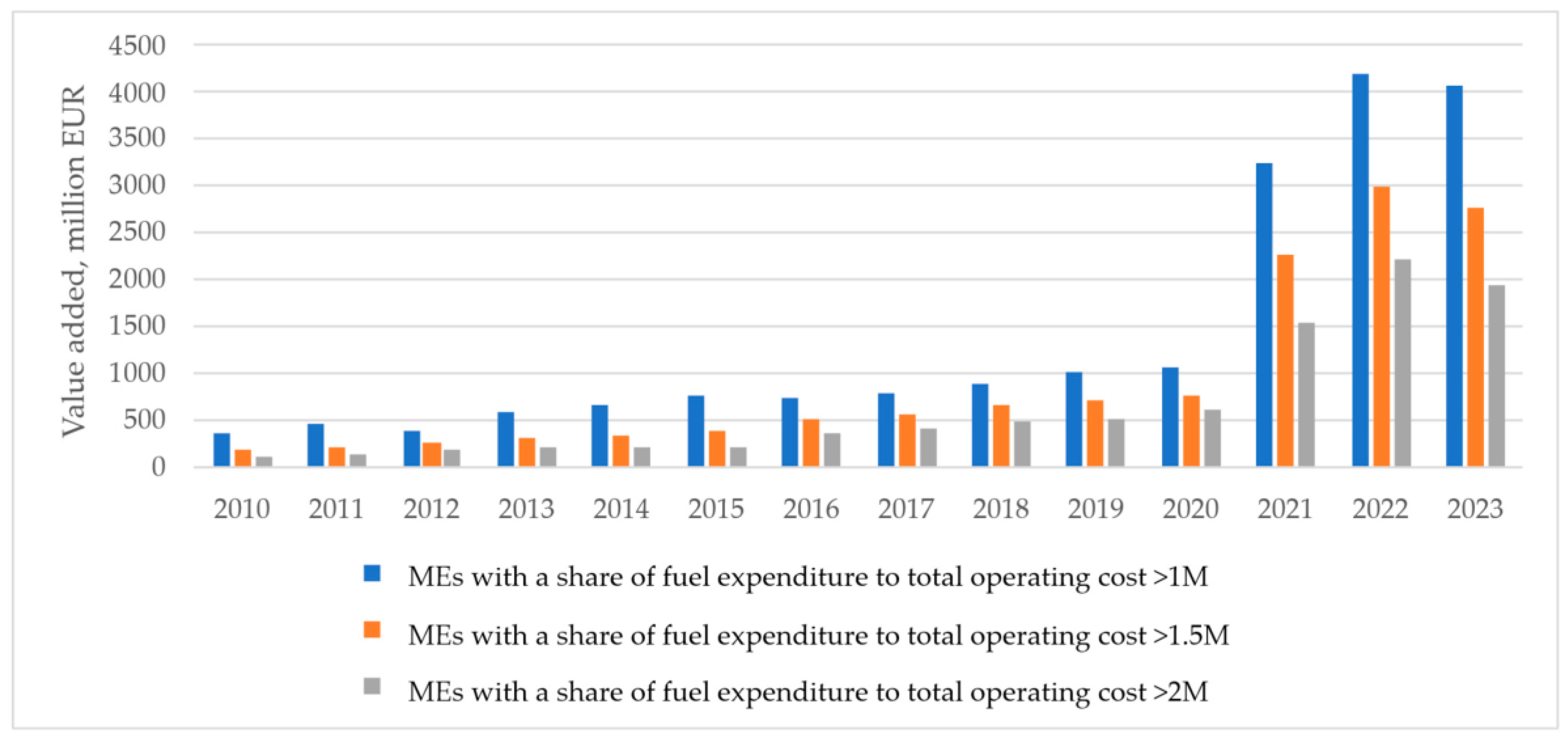

4.3.1. Value Added

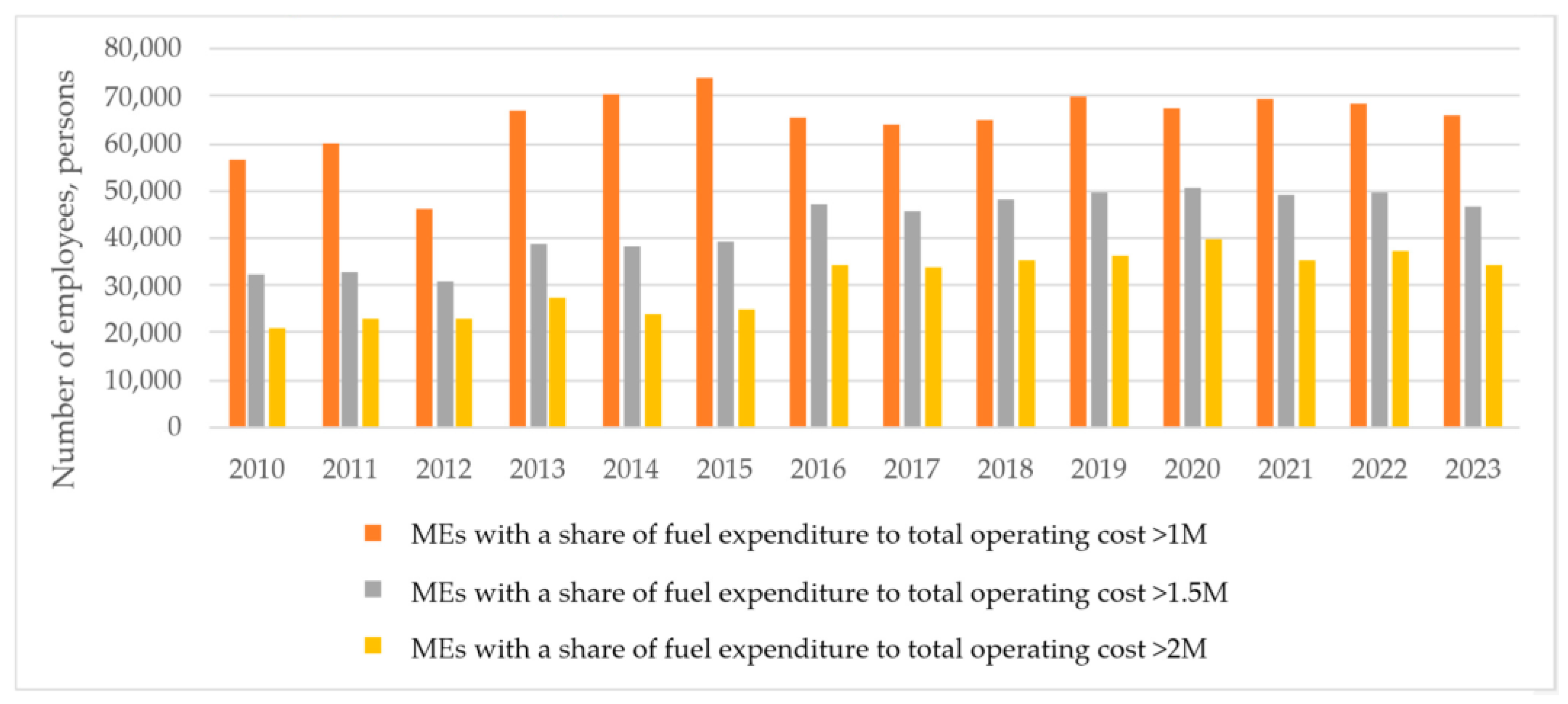

4.3.2. Number of Employees

5. Discussion

5.1. Practical Implications

5.2. Theoretical Implications

- –

- A share of fuel cost in total operating costs higher than the industry’s 2M. When the industry’s 2M is higher than the national 2M, then the indicator is calculated from the national 2M;

- –

- Net profitability lower than the industry’s 2M. When the industry’s 2M is lower than the national 2M, then the indicator is calculated from the national 2M;

- –

- The equity-to-liabilities ratio of the ME is 0.5 or less;

- –

- Fuel intensity is higher than the industry’s 2M. When the industry’s 2M is higher than the national 2M, then the indicator is calculated from the national 2M.

5.3. Comparison of Research Results with Global Findings

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- European Commission. Completion of Key ‘Fit for 55’ Legislation. 2023. Available online: https://ec.europa.eu/commission/presscorner/detail/en/ip_23_4754 (accessed on 8 April 2025).

- European Commission. About the EU ETS. Available online: https://climate.ec.europa.eu/eu-action/eu-emissions-trading-system-eu-ets/about-eu-ets_en (accessed on 8 April 2025).

- European Commission. Effort Sharing 2021–2030: Targets and Flexibilities. 2025. Available online: https://climate.ec.europa.eu/eu-action/effort-sharing-member-states-emission-targets/effort-sharing-2021-2030-targets-and-flexibilities_en (accessed on 23 May 2025).

- European Commission. ETS2: Buildings, Road Transport and Additional Sectors. 2025. Available online: https://climate.ec.europa.eu/eu-action/eu-emissions-trading-system-eu-ets/ets2-buildings-road-transport-and-additional-sectors_en (accessed on 23 May 2025).

- Wettengel, J. EU ETS Must Be Reformed to Make It More Resilient to Crises—Analysis. Clean Energy Wire. 2024. Available online: https://www.cleanenergywire.org/news/eu-ets-must-be-reformed-make-it-more-resilient-crises-analysis (accessed on 23 May 2025).

- The European Parliament and the Council of the European Union. Regulation (EU) 2023/955 of the European Parliament and of the Council of 10 May 2023 Establishing a Social Climate Fund and Amending Regulation (EU) 2021/1060. 10 May 2023. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32023R0955 (accessed on 8 April 2025).

- Ginevičius, R. The efficiency of municipal waste management systems in the environmental context in the countries of the European Union. J. Int. Stud. 2022, 15, 63–79. [Google Scholar] [CrossRef]

- Miškinis, V.; Galinis, A.; Konstantinavičiūtė, I.; Bobinaitė, V.; Niewierowicz, J.; Neniškis, E.; Norvaiša, E.; Tarvydas, D. Key Determinants of Energy Intensity and Greenhouse Gas Emission Savings in Commercial and Public Services in the Baltic States. Energies 2025, 18, 735. [Google Scholar] [CrossRef]

- Lazdinis, M.; Carver, A.; Tõnisson, K.; Silamikele, I. Innovative use of forest policy instruments in countries with economies in transition: Experience of the Baltic States. For. Policy Econ. 2005, 7, 527–537. [Google Scholar] [CrossRef]

- Lukkarinen, J.P.; Das, R.R.; Laakso, S.; Martiskainen, M. Using energy vulnerability framework to understand household agency in sustainability transitions: Experiences from Canada and Finland. Environ. Innov. Soc. Transit. 2024, 52, 100892. [Google Scholar] [CrossRef]

- Bardazzi, R.; Grazia, M. Vulnerable Households in the Energy Transition. Energy Poverty, Demographics and Policies; Studies in Energy, Resource and Environmental Economics; Springer: Berlin/Heidelberg, Germany, 2023. [Google Scholar] [CrossRef]

- Streimikiene, D.; Lekavičius, V.; Baležentis, T.; Kyriakopoulos, G.L.; Abrhám, J. Climate Change Mitigation Policies Targeting Households and Addressing Energy Poverty in European Union. Energies 2020, 13, 3389. [Google Scholar] [CrossRef]

- López, I.; García-Valdecasas, J.I.; Lasierra, C.M. Household strategies for coping with energy poverty: Technological and socio-familial dilemmas. Energy Build. 2025, 329, 115117. [Google Scholar] [CrossRef]

- Szczygieł, O.; Harbiankova, A.; Manso, M. Where Does Energy Poverty End and Where Does It Begin? A Review of Dimen-sions, Determinants and Impacts on Households. Energies 2024, 17, 6429. [Google Scholar] [CrossRef]

- Faulkner, J.P.; Murphy, E.; Scott, M. Rural household vulnerability a decade after the great financial crisis. J. Rural. Stud. 2019, 72, 240–251. [Google Scholar] [CrossRef]

- Tian, S.; Wu, Y.; Zhou, W. Digitalization and Income Inequality: Evidence from Households; Asian Development Bank: Mandaluyong City, Philippines, 2025. [Google Scholar] [CrossRef]

- Dorantes, L.M.; Murauskaite-Bull, I. Revisiting transport poverty in Europe through a systematic review. Transp. Res. Procedia 2023, 72, 3861–3868. [Google Scholar] [CrossRef]

- Primc, K.; Zabavnik, D.; Slabe-Erker, R.; Dominko, M. Transport poverty vulnerability index: Making use of standardised databases. Energy Res. Soc. Sci. 2025, 123, 104041. [Google Scholar] [CrossRef]

- Mamun, A.A.; Fazal, S.A.; Zainol, N.R. Economic Vulnerability, Entrepreneurial Competencies, and Performance of Informal Micro-Enterprises. J. Poverty 2019, 23, 415–436. [Google Scholar] [CrossRef]

- Caraka, R.E.; Kurniawan, R.; Nasution, B.I.; Jamilatuzzahro, J.; Gio, P.U.; Basyuni, M.; Pardamean, B. Micro, Small, and Medium Enterprises’ Business Vulnerability Cluster in Indonesia: An Analysis Using Optimized Fuzzy Geodemographic Clustering. Sustainability 2021, 13, 7807. [Google Scholar] [CrossRef]

- Mustapa, W.N.b.W.; Al Mamun, A.; Ibrahim, M.D. The Effect of Economic Vulnerability on the Participation in Development Programs and the Socio-Economic Well-Being of Low-Income Households. Societies 2018, 8, 60. [Google Scholar] [CrossRef]

- Zainol, N.R.; Al Mamun, A.; Hassan, H.; Muniady, R. Examining the effectiveness of micro-enterprise development programs in Malaysia. J. Int. Stud. 2017, 10, 292–308. [Google Scholar] [CrossRef]

- Pearlman, S. Too Vulnerable for Microfinance? Risk and Vulnerability as Determinants of Microfinance Selection in Lima. J. Dev. Stud. 2012, 48, 1342–1359. [Google Scholar] [CrossRef]

- Suarez Ambriz, D.; Sánchez-Garcia, J.Y.; Núñez-Ríos, J.E. An Organizational Framework for Microenterprises to Face Exogenous Shocks: A Viable System Approach. Adm. Sci. 2024, 14, 315. [Google Scholar] [CrossRef]

- Lo, A.Y.; Liu, S.; Chow, A.S.Y.; Pei, Q.; Cheung, L.T.O.; Fok, L. Business vulnerability assessment: A firm-level analysis of micro- and small businesses in China. Nat. Hazards 2021, 108, 867–890. [Google Scholar] [CrossRef]

- Safavian, M.S.; Graham, D.H.; Gonzalez-Vega, C. Corruption and Microenterprises in Russia. World Dev. 2001, 29, 1215–1224. [Google Scholar] [CrossRef]

- Ehlers, T.B.; Main, K. WOMEN AND THE FALSE PROMISE OF MICROENTERPRISE. Gend. Soc. 1998, 12, 424–440. [Google Scholar] [CrossRef]

- Abisuga-Oyekunle, O.A.; Fillis, I.R. The role of handicraft micro-enterprises as a catalyst for youth employment. Creat. Ind. J. 2016, 10, 59–74. [Google Scholar] [CrossRef]

- Garagorri, I. SME Vulnerability Analysis: A Tool for Business Continuity. In Competitive Strategies for Small and Medium Enterprises; North, K., Varvakis, G., Eds.; Springer: Cham, Switzerland, 2016. [Google Scholar] [CrossRef]

- Monsson, C.K. Chapter 4: Vulnerability and adaptability: Post-crisis resilience of SMEs in Denmark. In Creating Resilient Economies; Edward Elgar Publishing Ltd.: Cheltenham, UK, 2017. [Google Scholar] [CrossRef]

- Dallago, B.; Guglielmetti, C. The Consequences of the International Crisis for European SMEs; Routledge: London, UK, 2014. [Google Scholar] [CrossRef]

- Chen, S.; Lee, D. Small and vulnerable: SME productivity in the great productivity slowdown. J. Financ. Econ. 2023, 147, 49–74. [Google Scholar] [CrossRef]

- Heller, D.; Karapanagiotis, P.; Nilsen, Ø.A. Small and vulnerable during crises? Firm size and financing constraint dynamics. Small Bus. Econ. 2025, 1573-0913. [Google Scholar] [CrossRef]

- Erdiaw-Kwasie, M.O.; Abunyewah, M.; Yusif, S.; Arhin, P. Small and medium enterprises (SMEs) in a pandemic: A systematic review of pandemic risk impacts, coping strategies and resilience. Heliyon 2023, 9, e20352. [Google Scholar] [CrossRef]

- Dua, A.; Ellingrud, K.; Mahajan, D.; Silberg, J. Which Small Businesses Are Most Vulnerable to COVID-19—And When. McKinsey. 18 June 2020. Available online: https://www.mckinsey.com/featured-insights/americas/which-small-businesses-are-most-vulnerable-to-covid-19-and-when (accessed on 11 April 2025).

- Kaya, O. The impact of late payments on SMEs’ access to finance: Evidence from credit rationing and loan terms. Econ. Model. 2024, 141, 106896. [Google Scholar] [CrossRef]

- Udell, G. SME Access to Finance and the Global Financial Crisis. J. Financ. Manag. Mark. Inst. 2020, 8, 2040003. [Google Scholar] [CrossRef]

- Alam, A.; Du, A.M.; Rahman, M.; Yazdifar, H.; Abbasi, K. SMEs respond to climate change: Evidence from developing countries. Technol. Forecast. Soc. Change 2022, 185, 122087. [Google Scholar] [CrossRef]

- Nkwinika, E.; Akinola, S. The importance of financial management in small and medium-sized enterprises (SMEs): An analysis of challenges and best practices. Technol. Audit Prod. Reserves 2023, 5, 12–20. [Google Scholar] [CrossRef]

- Hojnik, B.; Huđek, I. Small and Medium-Sized Enterprises in the Digital Age: Understanding Characteristics and Essential Demands. Information 2023, 14, 606. [Google Scholar] [CrossRef]

- Pugnetti, C.; Casián, C. Cyber Risks and Swiss SMEs. An Investigation of Employee Attitudes and Behavioral Vulnerabilities 2021. ZHAW School of Management and Law, Winterthur. Available online: https://digitalcollection.zhaw.ch/server/api/core/bitstreams/4346e5a4-a78b-4e8f-bf48-e3615fa09d25/content (accessed on 11 April 2025).

- Fan, L.; Sun, Y.; Wu, T.-J. Is climate policy uncertainty an angel or a devil? Empirical evidence from corporate digital transformation. Int. Rev. Financ. Anal. 2025, 103, 104135. [Google Scholar] [CrossRef]

- Jayasekara, B.E.A.; Fernando, P.N.D.; Ranjani, R.P.C. A Systematic Literature Review on Financial Stress of Small and Medium Entrepreneurs. Appl. Econ. Bus. 2020, 4, 45–59. [Google Scholar] [CrossRef]

- Alshebami, A.S. Crisis Management and Customer Adaptation: Pathways to Adaptive Capacity and Resilience in Micro- and Small-Sized Enterprises. Sustainability 2025, 17, 3759. [Google Scholar] [CrossRef]

- European Commission. Internal Market, Industry, Entrepreneurship and SMEs. Data and Surveys—SAFE. Available online: https://single-market-economy.ec.europa.eu/access-finance/data-and-surveys-safe_en (accessed on 10 April 2025).

- European Central Bank. Corporate Vulnerabilities as Reported by Firms in the SAFE. 2024. Available online: https://www.ecb.europa.eu/press/economic-bulletin/focus/2024/html/ecb.ebbox202401_05~cc7bcaa7e2.en.html (accessed on 11 April 2025).

- Crick, F.; Eskander, S.M.; Fankhauser, S.; Diop, M. How do African SMEs respond to climate risks? Evidence from Kenya and Senegal. World Dev. 2018, 108, 157–168. [Google Scholar] [CrossRef]

- Kling, G.; Volz, U.; Murinde, V.; Ayas, S. The impact of climate vulnerability on firms’ cost of capital and access to finance. World Dev. 2021, 137, 105131. [Google Scholar] [CrossRef]

- Hampton, S.; Blundel, R.; Eadson, W.; Northall, P.; Sugar, K. Crisis and opportunity: Transforming climate governance for SMEs. Glob. Environ. Change 2023, 82, 102707. [Google Scholar] [CrossRef]

- Zhang, D.; Fang, Y. Are environmentally friendly firms more vulnerable during the COVID-19 pandemic? J. Clean. Prod. 2022, 355, 131781. [Google Scholar] [CrossRef] [PubMed]

- European Commission. The Recovery and Resilience Facility. Available online: https://commission.europa.eu/business-economy-euro/economic-recovery/recovery-and-resilience-facility_en (accessed on 8 April 2025).

- Fabbrini, F. The recovery and resilience facility as a new legal technology of European governance. J. Eur. Integr. 2024, 47, 85–103. [Google Scholar] [CrossRef]

- Lupo, N. The Recovery and Resilience Facility and Its Effects on the Rule of Law Conditionality: A (Potentially) Well-Functioning Connection. In EU Rule of Law Procedures at the Test Bench. Palgrave Studies in European Union Politics; Fasone, C., Dirri, A., Guerra, Y., Eds.; Palgrave Macmillan: Cham, Switzerland, 2024. [Google Scholar] [CrossRef]

- Famà, R. Beyond ‘Fit for 55’: The emergence of the ‘Do No Significant Harm’ principle in EU law and EU funding mechanisms. Rev. Eur. Comp. Int. Environ. Law 2025, 34, 62–75. [Google Scholar] [CrossRef]

- Mezei, M. Transitional justice through the social fund for climate. Juris Gradibus 2024, 4, 56–83. [Google Scholar] [CrossRef]

- Rimšaitė, L. Energy Sector Specific Regulation. In The Crossroads of Competition Law and Energy Regulation; Springer: Cham, Switzerland, 2024; pp. 43–121. [Google Scholar] [CrossRef]

- Schumacher, K.; Noka, V.; Cludius, J. Identifying and Supporting Vulnerable Households in Light of Rising Fossil Energy Costs; Interim Report; German Environment Agency: Dessau-Roßlau, Germany, 2025. [Google Scholar] [CrossRef]

- Oikonomou, V.; Livraghi, S.; Karalaiou, K.; Rogulj, I.; Spyridakos, S.; Tourkolias, C. How to Distinguish Income Indicators of Energy and Transport Vulnerability—A Case Study of Greece. Sustainability 2025, 17, 4275. [Google Scholar] [CrossRef]

- Reina, J.C.R.; Volt, J.; Toleikyte, A.; Carlsson, J. Impact of the New EU Emissions Trading System on Households. CYTEF 2024. Available online: https://revistas.innovacionumh.es/index.php/cytef2024/article/view/2681/2192 (accessed on 25 May 2025).

- Strambo, C.; Xylia, M.; Dawkins, E.; Suljada, T. The Impact of the New EU Emissions Trading System on Households. How Can the Social Climate Fund Support a Just Transition? SEI Report; Stockholm Environment Institute: Stockholm, Sweden, 2022. [Google Scholar] [CrossRef]

- Government of the Republic of Lithuania. Lithuanian Long-Term Buildings Renovation Strategy. 31 March 2021. Available online: https://energy.ec.europa.eu/system/files/2021-08/lt_2020_ltrs_en_0.pdf (accessed on 14 November 2024).

- Regitra. Database. Available online: https://www.regitra.lt/lt/atviri-duomenys/ (accessed on 18 November 2024).

- State Enterprise Centre of Registers. Database of Real Estate Cadastre and Register. Available online: https://www.registrucentras.lt/turtas/ (accessed on 26 November 2024).

- State Data Agency of Lithuania. Database of Business Structure Research Indicators. Available online: https://osp.stat.gov.lt/ (accessed on 16 December 2024).

- European Commission. Support to the Preparation of Social Climate Plans. Funded by European Union via Technical Support Instrument (2024–2025). ID—TSIC-RoC-25400. Available online: https://reform-support.ec.europa.eu/what-we-do/green-transition/support-preparation-social-climate-plans_en (accessed on 15 April 2025).

- Dominguez, J.G. Financial Capacity Assessment in Horizon Europe: What to Expect? 2023. Available online: https://getpolite.eu/financial-capacity-assessment-in-horizon-europe-what-to-expect/ (accessed on 15 April 2025).

- State Data Agency. Methodology on Business Structure Research Indicators. Available online: https://osp.stat.gov.lt/documents/10180/677335/SVSTM_metodika.pdf/e515bccf-fc20-4b12-bfb8-c7b135737877 (accessed on 25 September 2024).

| Group | Energy Performance Class | Total | Total, % | |||||

|---|---|---|---|---|---|---|---|---|

| ≤D | C | B | A | A+ | A++ | |||

| 1. Residential buildings | 342,160 | 176,116 | 43,305 | 8077 | 837 | 19 | 570,513 | 86 |

| 1.1. Private houses | 311,020 | 170,969 | 38,912 | 7814 | 765 | 12 | 529,492 | 80 |

| 1.2. Multi-apartment buildings | 31,140 | 5146 | 4393 | 263 | 72 | 7 | 41,021 | 6 |

| 2. Non-residential buildings | 78,175 | 6059 | 5689 | 713 | 125 | 9 | 90,770 | 14 |

| 2.1. Industrial buildings | 44,552 | 2091 | 1920 | 178 | 29 | 5 | 48,775 | 7 |

| 2.2. Administrative buildings | 9085 | 689 | 505 | 81 | 17 | 0 | 10,377 | 2 |

| Educational buildings | 3743 | 634 | 322 | 11 | 5 | 0 | 4715 | 0.7 |

| Trading buildings | 7129 | 526 | 865 | 103 | 35 | 2 | 8760 | 1.3 |

| Health care buildings | 1422 | 189 | 221 | 4 | 2 | 1 | 1839 | 0.3 |

| Cultural facilities | 4474 | 1066 | 1095 | 246 | 18 | 1 | 6900 | 1.0 |

| Accommodation buildings | 2029 | 155 | 147 | 7 | 3 | 0 | 2341 | 0.4 |

| Service facilities | 4121 | 411 | 438 | 78 | 11 | 0 | 5059 | 0.8 |

| Other buildings | 1620 | 198 | 176 | 5 | 5 | 0 | 2004 | 0.3 |

| Vulnerability Factor | Vulnerability Indicator | Indicator Restricted for Sharing: Ministry’s Set of Indicators | Indicator Not Restricted for Sharing: Researchers’ Set of Indicators |

|---|---|---|---|

| Impact of ETS2 on prices |

| √ | |

| √ | ||

| √ | ||

| √ | ||

| √ | ||

| √ | ||

| Limited access to capital |

| √ | |

| Financial capacity |

| √ | |

| √ | ||

| √ | ||

| √ | ||

| Market structure and competitiveness |

| √ | |

| √ | ||

| Regional development | The aforementioned indicators for Lithuanian regions. | √ | |

| Availability, accessibility, and affordability of public transport or transport alternatives | The vulnerability factors are covered in detail by the category “vulnerable households”; therefore, they are not considered as part of the category of “vulnerable MEs”. No primary and precise data on transport in MEs are available. | N/A | N/A |

| Mixed vulnerability indicator |

| √ | |

| √ | ||

| √ | ||

| √ |

| Economic Activity | Median of Fuel Expenditure, EUR | Median of Fuel Expenditure in Total Operating Costs, % | ||||

|---|---|---|---|---|---|---|

| 2010 | 2015 | 2023 | 2010 | 2015 | 2023 | |

| Agriculture, forestry, and fishing | 4209 | 4011 | 9431 | 8.93 | 9.53 | 12.73 |

| Manufacturing | 201 | 328 | 416 | 0.53 | 0.72 | 0.67 |

| Electricity, gas, steam, and air conditioning supply | 10,065 | 781 | 892 | 22.77 | 3.96 | 2.70 |

| Water supply; sewerage, waste management, and remediation activities | 2052 | 1846 | 3662 | 2.96 | 3.64 | 4.21 |

| Construction | 700 | 705 | 1877 | 1.87 | 1.43 | 3.05 |

| Wholesale and retail trade | 1010 | 1307 | 1084 | 1.53 | 2.48 | 0.62 |

| Transportation and storage | 4760 | 5926 | 17,216 | 12.93 | 17.17 | 24.96 |

| Accommodation and food service activities | 205 | 370 | 1022 | 0.71 | 0.98 | 1.18 |

| Publishing, broadcasting, and content production and distribution activities | 113 | 134 | 462 | 0.39 | 0.52 | 0.77 |

| Financial and insurance activities | 176 | 202 | 1348 | 0.56 | 0.62 | 1.52 |

| Real estate activities | 203 | 259 | 863 | 0.86 | 1.22 | 2.32 |

| Professional, scientific, and technical activities | 310 | 325 | 1932 | 1.15 | 1.2 | 3.43 |

| Public administration and defense; compulsory social security | 403 | 860 | 828 | 2,1 | 4.48 | 4.20 |

| Education | 159 | 211 | 640 | 0.73 | 0.75 | 1.55 |

| Human health and social work activities | 188 | 224 | 916 | 1.07 | 1.16 | 1.82 |

| Arts, sports, and recreation | 254 | 396 | 717 | 1.25 | 1.85 | 2.62 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bobinaite, V.; Neniskis, E.; Konstantinaviciute, I.; Tarvydas, D. Identifying and Assessing Vulnerable Micro-Enterprises in Lithuania. Sustainability 2025, 17, 5405. https://doi.org/10.3390/su17125405

Bobinaite V, Neniskis E, Konstantinaviciute I, Tarvydas D. Identifying and Assessing Vulnerable Micro-Enterprises in Lithuania. Sustainability. 2025; 17(12):5405. https://doi.org/10.3390/su17125405

Chicago/Turabian StyleBobinaite, Viktorija, Eimantas Neniskis, Inga Konstantinaviciute, and Dalius Tarvydas. 2025. "Identifying and Assessing Vulnerable Micro-Enterprises in Lithuania" Sustainability 17, no. 12: 5405. https://doi.org/10.3390/su17125405

APA StyleBobinaite, V., Neniskis, E., Konstantinaviciute, I., & Tarvydas, D. (2025). Identifying and Assessing Vulnerable Micro-Enterprises in Lithuania. Sustainability, 17(12), 5405. https://doi.org/10.3390/su17125405