The Dynamic Bidirectional Causality Between Carbon Pricing and Green Technology Innovation in China: A Sub-Sample Time-Varying Approach

Abstract

1. Introduction

2. Literature Review

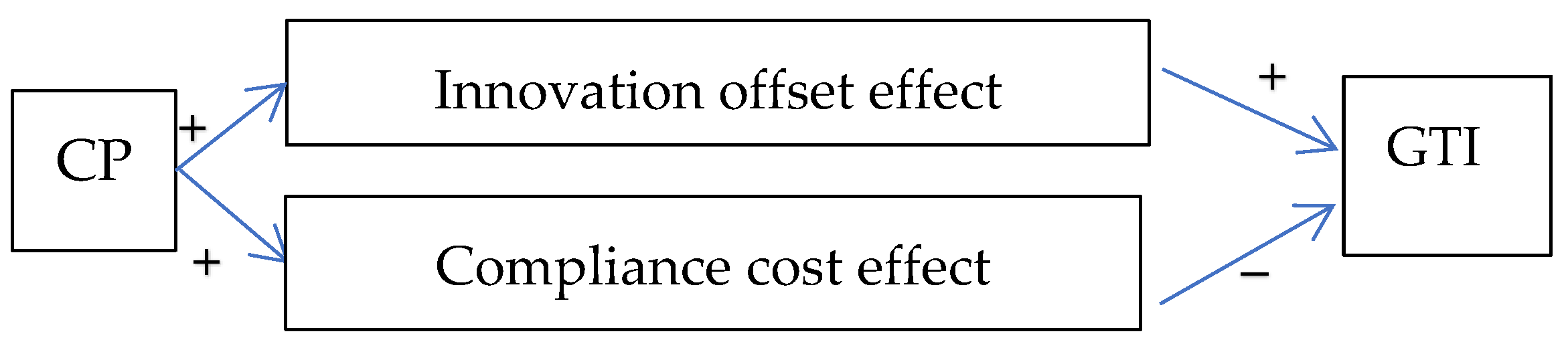

3. Theoretical Framework

- (1)

- Innovation offset effect: Rising CP incentivizes firms to invest in GTI to alleviate regulatory pressure. Such investments may lead to technological advancements, efficiency improvements, or new product development, which can offset compliance costs and generate additional economic benefits, thereby positively stimulating GTI [10,11,12,13,14].

- (2)

4. Methodology

4.1. Bootstrap Full-Sample Causality Test

4.2. Parameter Stability Test

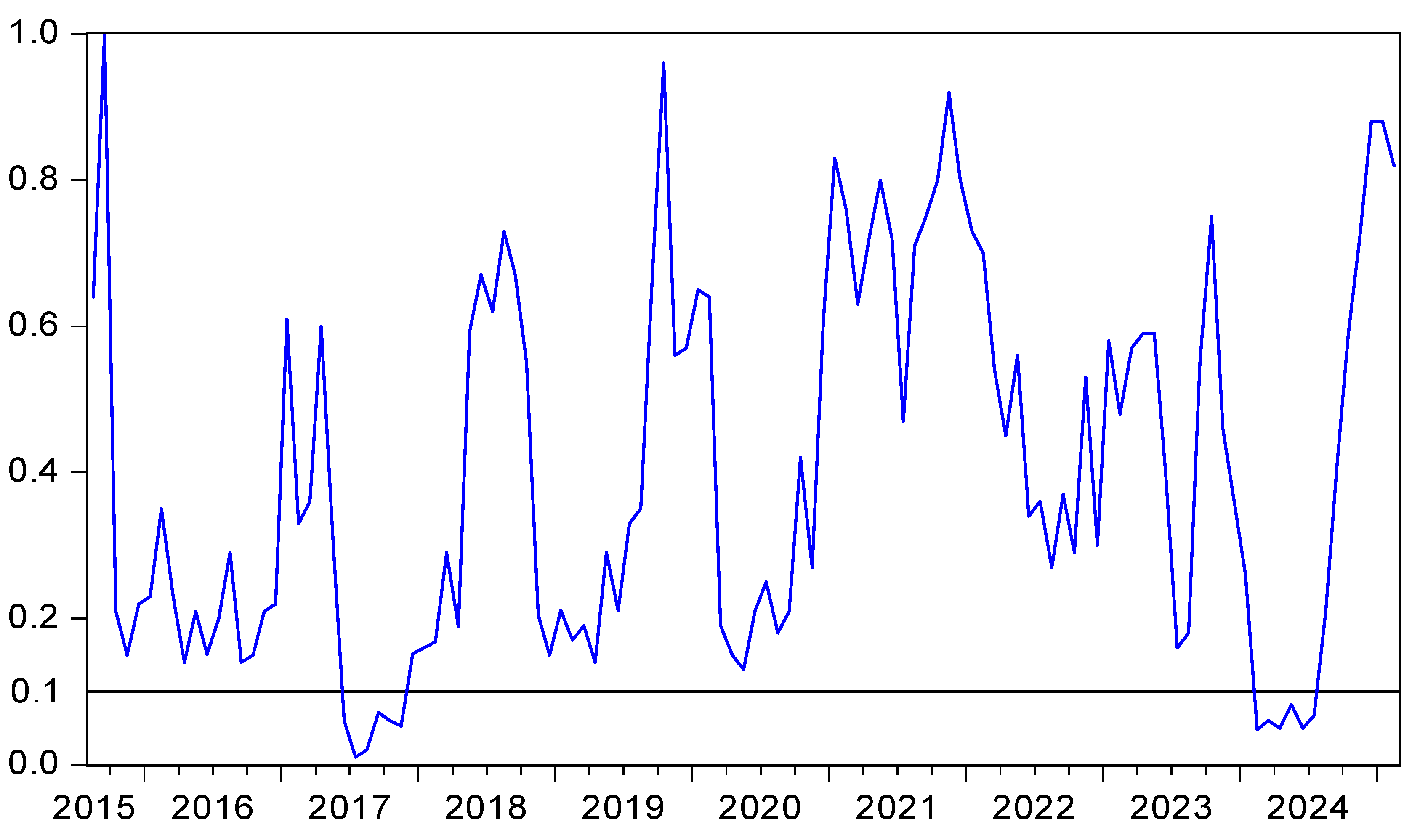

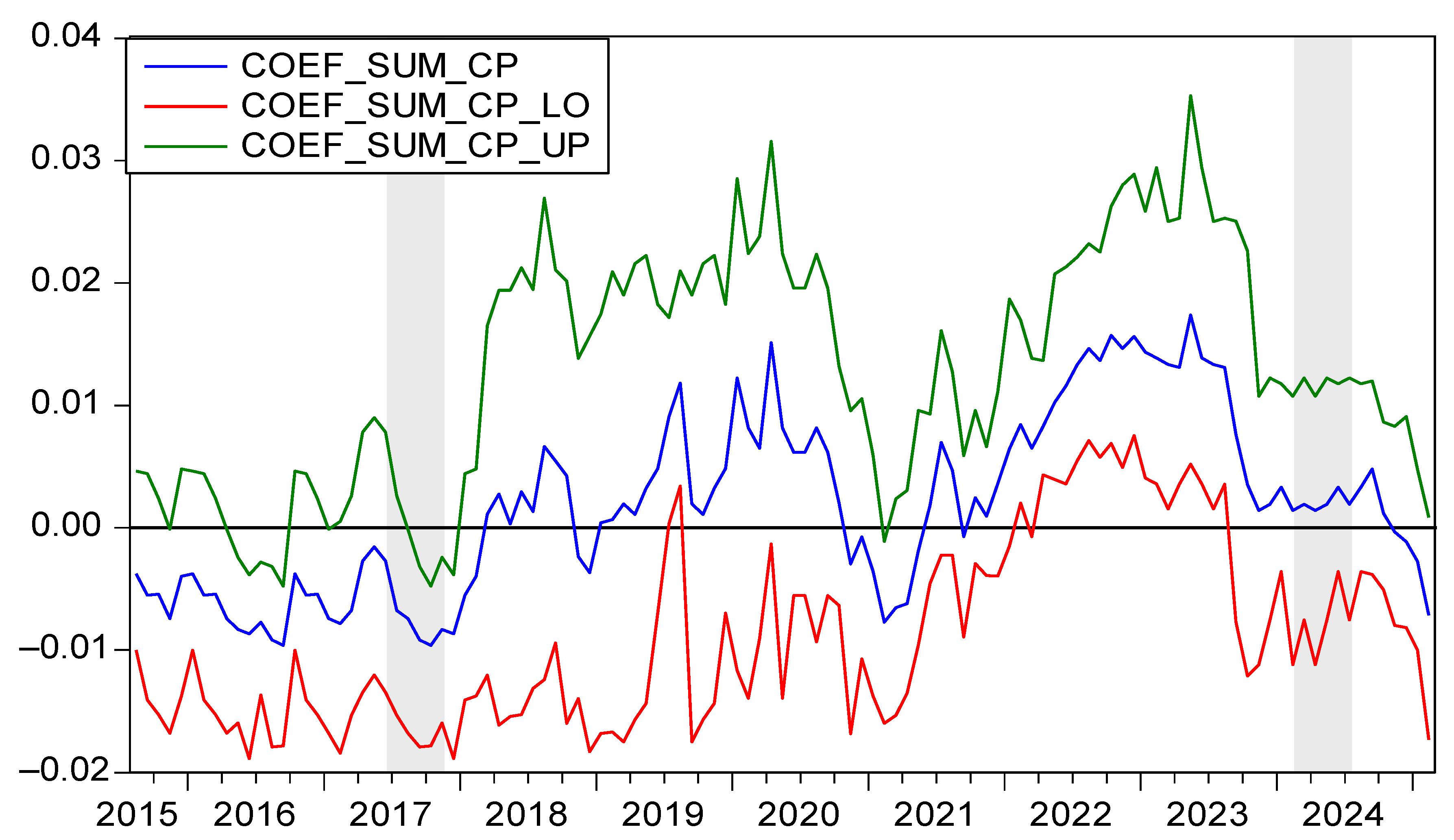

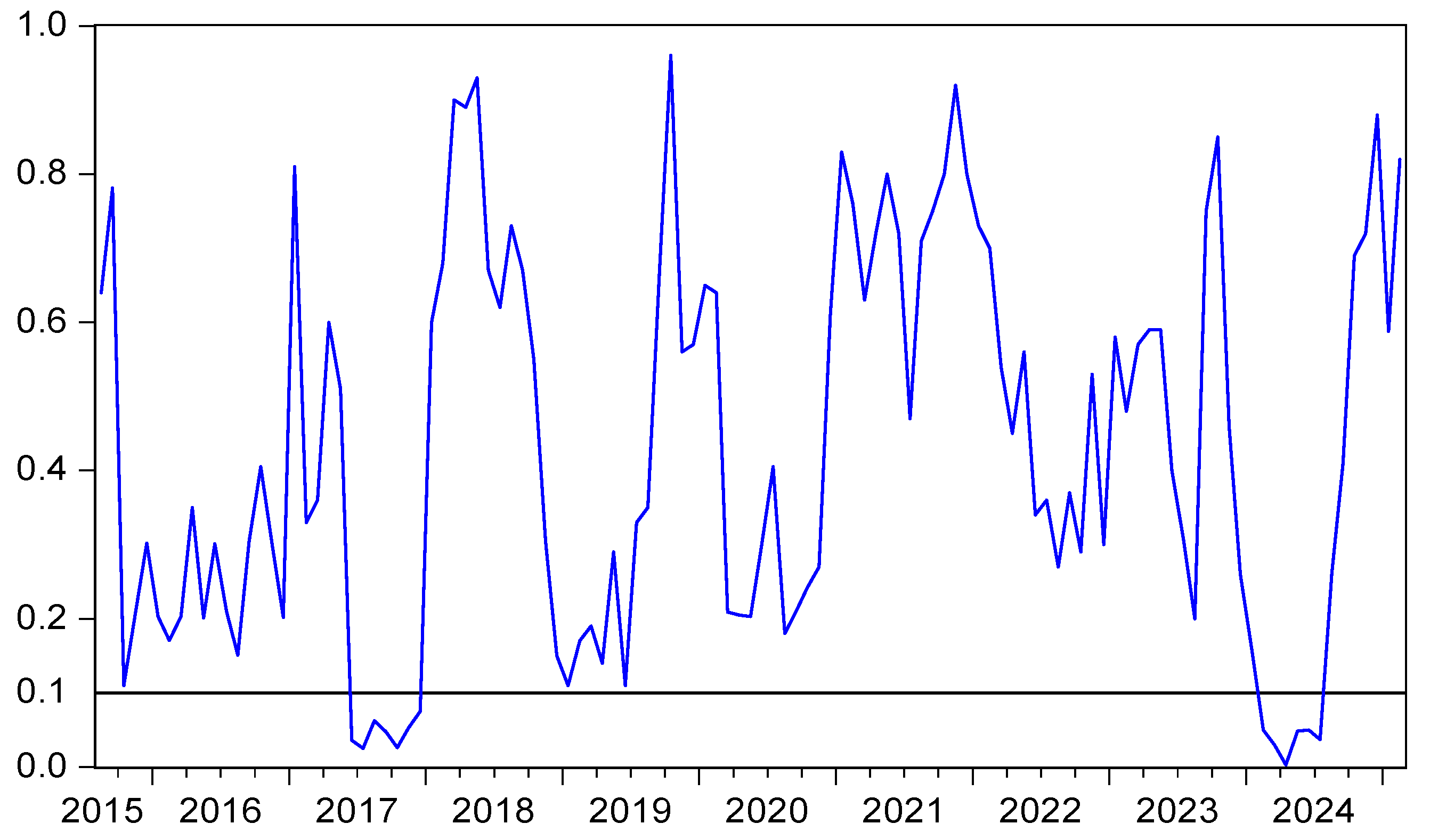

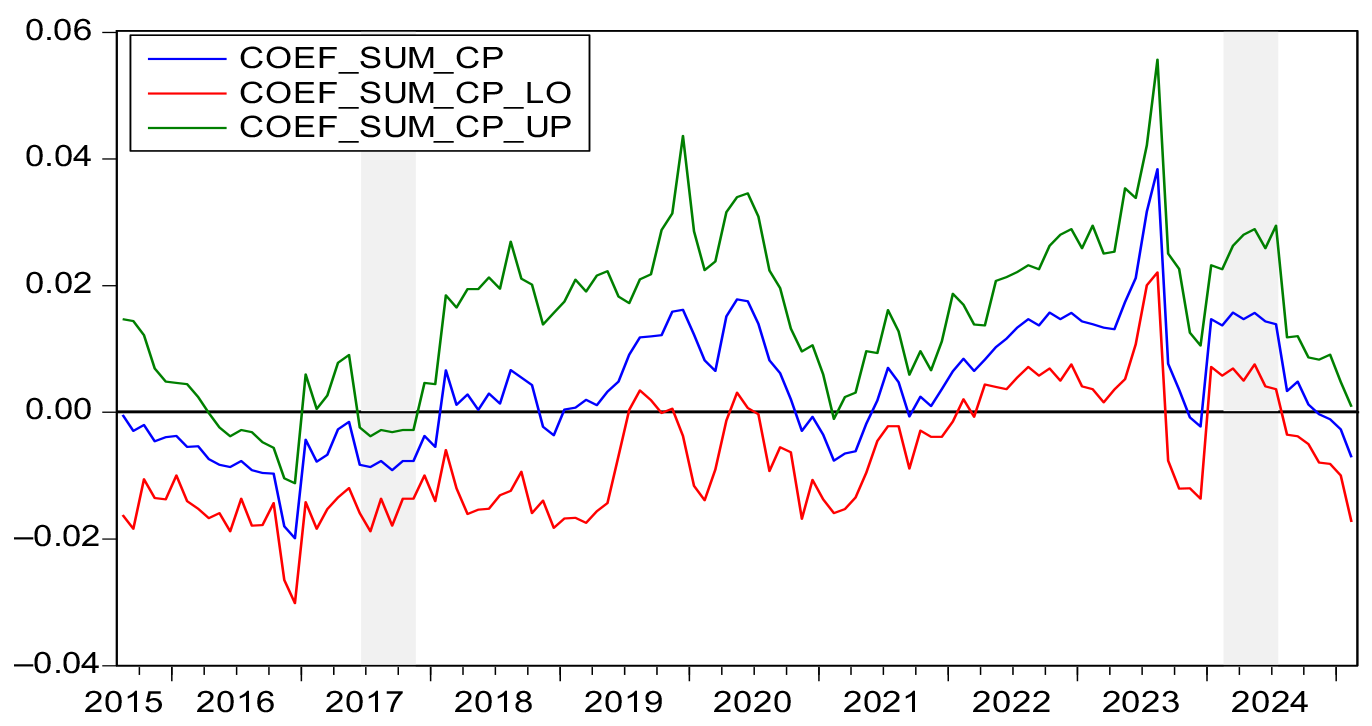

4.3. Bootstrap Sub-Sample Rolling-Window Causality Test

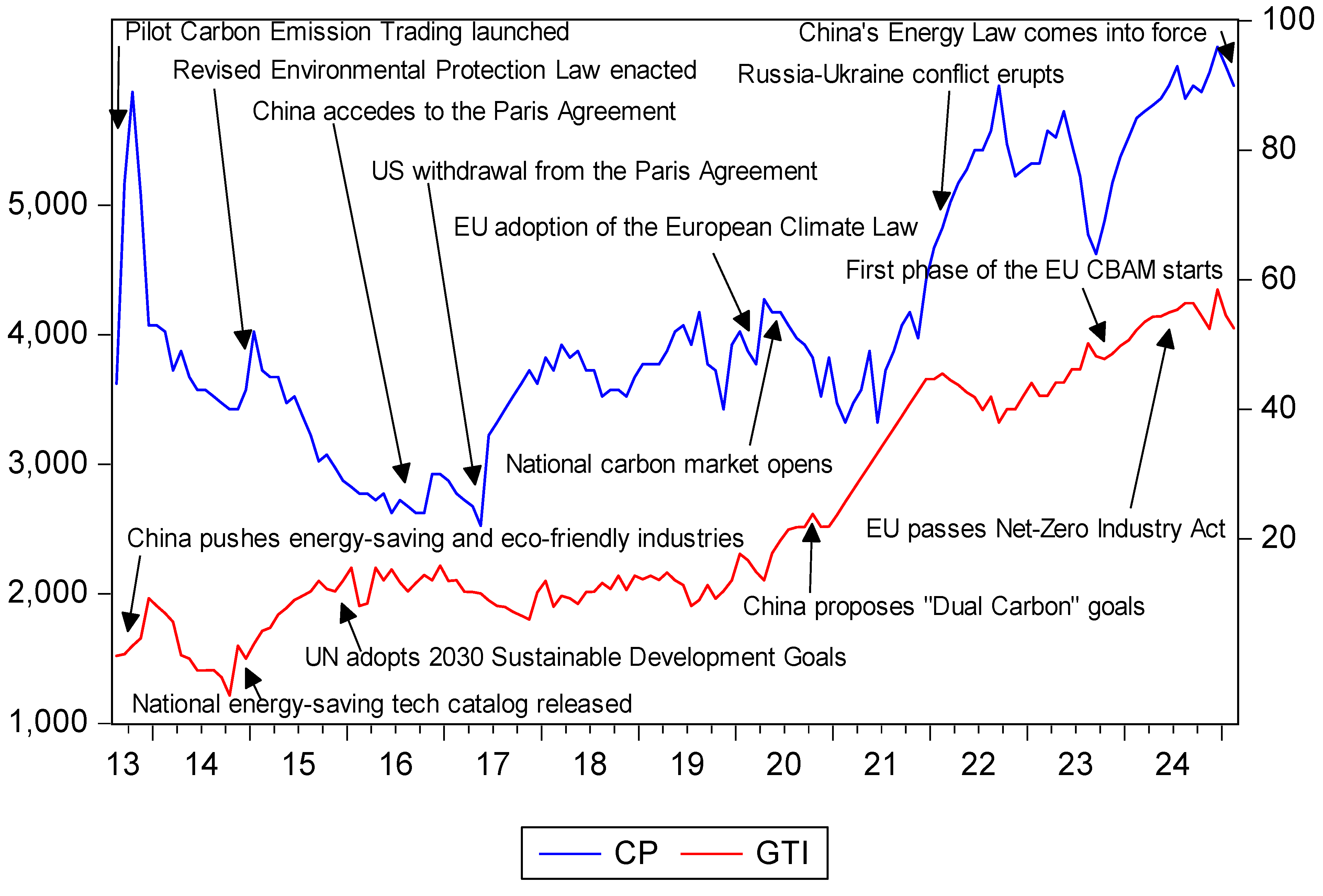

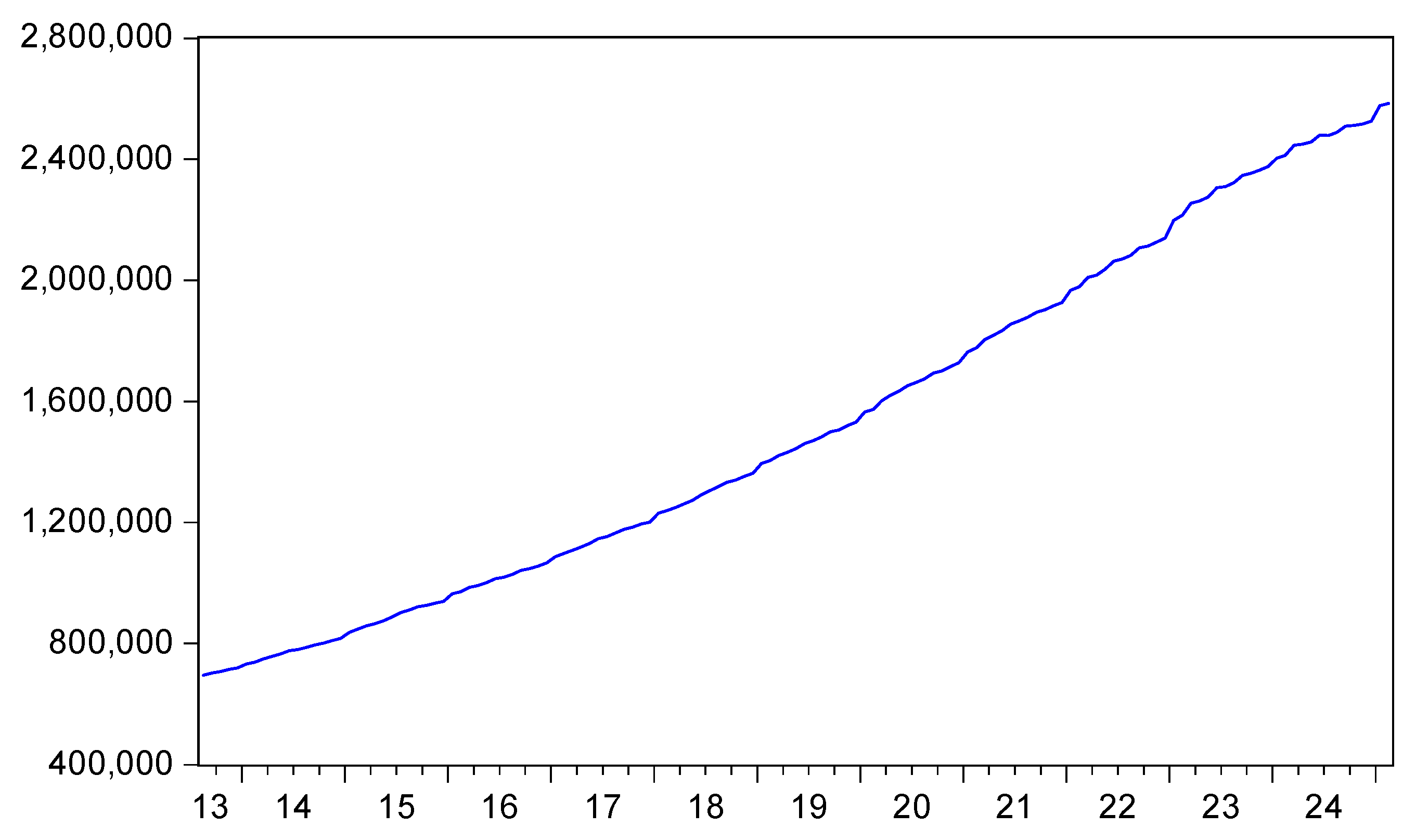

5. Data Source and Descriptive Analysis

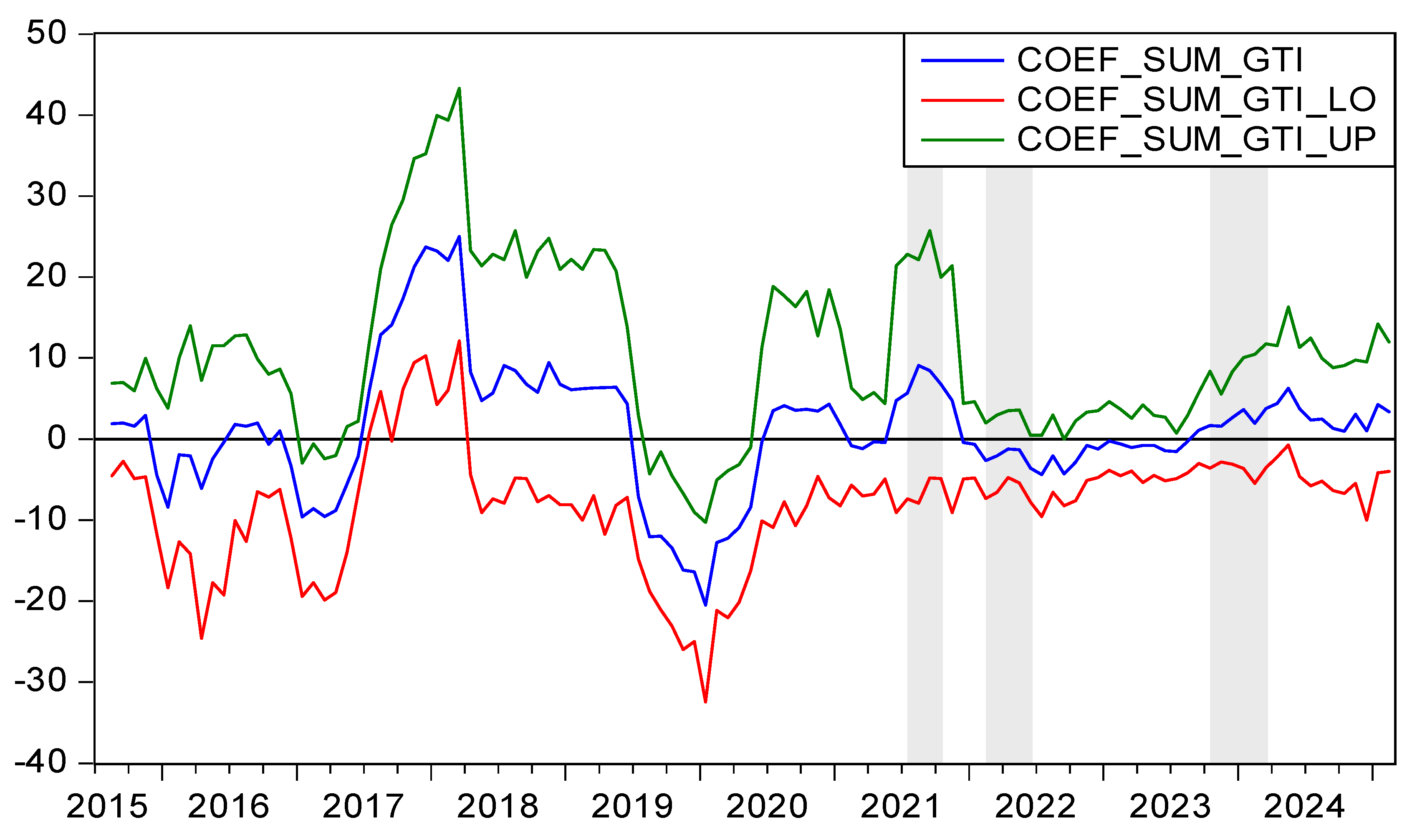

6. Empirical Results

7. Conclusions and Policy Implications

7.1. Conclusions

- (1)

- Policy synergy: When CP is effectively coordinated with complementary environmental policy instruments, the innovation offset effect predominates. Such policy combinations simultaneously reduce innovation costs and enhance expected returns, internalizing carbon costs as innovation incentives. Conversely, isolated CP without supporting measures increases pure compliance costs, leading firms to reduce R&D expenditures under budget constraints and thereby activating the compliance cost effect.

- (2)

- International competitive landscape: The global competitive environment shapes firm strategy. With robust carbon leakage prevention mechanisms such as carbon border adjustments, firms cannot evade carbon costs through relocation and are compelled to innovate to maintain competitiveness. In such cases, CP pressures translate into innovation drivers. In the absence of such trade policy coordination, firms favor geographical arbitrage over technological innovation, triggering the compliance cost effect.

- (3)

- Financial market conditions: Financial market completeness determines firms’ capacity to transform carbon signals. The developed green financial markets mitigate GTI FCs through diversified instruments, enabling firms to smooth intertemporal investments and convert carbon pressures into innovation inputs. Under financial friction, however, binding liquidity constraints amplify R&D budget displacement by rising carbon costs, reinforcing the compliance cost effect.

7.2. Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Rennert, K.; Errickson, F.; Prest, B.C.; Rennels, L.; Newell, R.G.; Pizer, W.; Kingdon, C.; Wingenroth, J.; Cooke, R.; Parthum, B.; et al. Comprehensive evidence implies a higher social cost of CO2. Nature 2022, 610, 687–692. [Google Scholar] [CrossRef] [PubMed]

- Revesz, R.; Greenstone, M.; Hanemann, M.; Sterner, T.; Grab, D.; Howard, P.; Schwartz, J. Best cost estimate of greenhouse gases. Science 2017, 357, 655–657. [Google Scholar] [CrossRef] [PubMed]

- Dietz, S.; Rising, J.; Stoerk, T.; Wagner, G. Economic impacts of tipping points in the climate system. Proc. Natl. Acad. Sci. USA 2021, 118, e2103081118. [Google Scholar] [CrossRef]

- Xiao, J.; Li, G.; Xie, L.; Wang, S.; Yu, L. Decarbonizing China’s power sector by 2030 with consideration of technological progress and cross-regional power transmission. Energy Policy 2021, 150, 112150. [Google Scholar] [CrossRef]

- Onifade, S.T.; Alola, A.A. Energy transition and environmental quality prospects in leading emerging economies: The role of environmental-related technological innovation. Sustain. Dev. 2022, 30, 1766–1778. [Google Scholar] [CrossRef]

- Ahmad, M.; Ahmed, Z.; Riaz, M.; Yang, X. Modeling the Linkage Between Climate-Tech, Energy Transition, and CO2 Emissions: Do Environmental Regulations Matter? Gondwana Res. 2024, 127, 131–143. [Google Scholar] [CrossRef]

- Sun, H.P.; Edziah, B.K.; Kporsu, A.K.; Sarkodie, S.A.; Taghizadeh-Hesary, F. Energy efficiency: The role of technological innovation and knowledge spillover. Technol. Forecast. Soc. Change 2021, 167, 120659. [Google Scholar] [CrossRef]

- Han, M.Y.; Sun, R.Y.; Feng, P.; Hua, E.R. Unveiling characteristics and determinants of China’s wind power geographies towards low-carbon transition. J. Environ. Manag. 2023, 331, 117215. [Google Scholar] [CrossRef]

- Nordhaus, W. Climate change: The ultimate challenge for economics. Am. Econ. Rev. 2019, 109, 1991–2014. [Google Scholar] [CrossRef]

- Porter, M.E.; Van der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Robertson, J.; Caruana, A.; Ferreira, C. Innovation performance: The effect of knowledge-based dynamic capabilities in cross-country innovation ecosystems. Int. Bus. Rev. 2021, 32, 101866. [Google Scholar] [CrossRef]

- Mu, Y.; Zhao, J. Production strategy and technology innovation under different carbon emission polices. Sustainability 2023, 15, 9820. [Google Scholar] [CrossRef]

- Gugler, K.; Szücs, F.; Wiedenhofer, T. Environmental Policies and directed technological change. J. Environ. Econ. Manag. 2024, 124, 102916. [Google Scholar] [CrossRef]

- Cantone, B.; Evans, D.; Reeson, A. The effect of carbon price on low carbon innovation. Sci. Rep. 2023, 13, 3673. [Google Scholar] [CrossRef] [PubMed]

- Goulden, S.; Negev, M.; Reicher, S.; Berman, T. Implications of standards in setting environmental policy. Environ. Sci. Policy 2019, 98, 39–46. [Google Scholar] [CrossRef]

- Teixidó, J.; Verde, S.F.; Nicolli, F. The impact of the EU emissions trading system on low-carbon technological change: The empirical evidence. Ecol. Econ. 2019, 164, 106347. [Google Scholar] [CrossRef]

- Zhang, W.; Wang, Y.; Zhang, W. How double-carbon policies affect green technology innovation capability of enterprise: Empirical analysis based on spatial Dubin model. IEEE Trans. Eng. Manag. 2024, 71, 9953–9965. [Google Scholar] [CrossRef]

- Chen, Z.F.; Zhang, X.; Chen, F.L. Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol. Forecast. Soc. Change 2021, 168, 120744. [Google Scholar] [CrossRef]

- Chen, M.; Wang, K. The combining and cooperative effects of carbon price and technological innovation on carbon emission reduction: Evidence from China’s industrial enterprises. J. Environ. Manag. 2023, 343, 118188. [Google Scholar] [CrossRef]

- Duan, H.; Zhou, S.; Jiang, K.; Bertram, C.; Harmsen, M.; Kriegler, E.; van Vuuren, D.P.; Wang, S.; Fujimori, S.; Tavoni, M.; et al. Assessing China’s efforts to pursue the 1.5 °C warming limit. Science 2021, 372, 378–385. [Google Scholar] [CrossRef]

- Cui, J.; Wang, C.; Zhang, J.; Zheng, Y. The effectiveness of China’s regional carbon market pilots in reducing firm emissions. Proc. Natl. Acad. Sci. USA 2021, 118, e2109912118. [Google Scholar] [CrossRef] [PubMed]

- Chu, J.; Shao, C.; Emrouznejad, A.; Wu, J.; Yuan, Z. Performance evaluation of organizations considering economic incentives for emission reduction: A carbon emission permit trading approach. Energy Econ. 2021, 101, 105398. [Google Scholar] [CrossRef]

- Zhang, X.; Yang, H.; Yu, Q.; Qiu, J.; Zhang, Y. Analysis of carbon-abatement investment for thermal power market in carbon-dispatching mode and policy recommendations. Energy 2018, 149, 954–966. [Google Scholar] [CrossRef]

- Wei, Y.; Zhu, R.; Tan, L. Emission trading scheme, technological innovation, and competitiveness: Evidence from China’s thermal power enterprises. J. Environ. Manag. 2022, 320, 115874. [Google Scholar] [CrossRef]

- Wu, Q.; Wang, Y. How does carbon emission price stimulate enterprises’ total factor productivity? Insights from China’s emission trading scheme pilots. Energy Econ. 2022, 109, 105990. [Google Scholar] [CrossRef]

- Ji, C.; Hu, Y.; Tang, B. Research on carbon market price mechanism and influencing factors: A literature review. Nat. Hazards 2018, 92, 761–782. [Google Scholar] [CrossRef]

- Chen, M.; Yao, T.; Wang, K. The economic impact of climate change: A bibliometric analysis of research hotspots and trends. Environ. Sci. Pollut. Res. 2023, 30, 47935–47955. [Google Scholar] [CrossRef]

- Lilliestam, J.; Patt, A.; Bersalli, G. The effect of carbon pricing on technological change for full energy decarbonization: A review of empirical ex-post evidence. Wiley Interdiscip. Rev.-Clim. Change 2021, 12, e681. [Google Scholar] [CrossRef]

- van den Bergh, J.; Savin, I. Impact of carbon pricing on low-carbon innovation and deep decarbonisation: Controversies and path forward. Environ. Resour. Econ. 2021, 80, 705–715. [Google Scholar] [CrossRef]

- Raza, Z. Effects of regulation-driven green innovations on short sea shipping’s environmental and economic performance. Transp. Res. D Transp. Environ. 2020, 84, 102340. [Google Scholar] [CrossRef]

- Lim, S.; Prakash, A. Does carbon pricing spur climate innovation? A panel study, 1986–2019. J. Clean. Prod. 2023, 395, 136459. [Google Scholar] [CrossRef]

- Jung, H.; Song, C. Effects of emission trading scheme (ETS) on change rate of carbon emission. Sci. Rep. 2023, 13, 912. [Google Scholar] [CrossRef] [PubMed]

- Gillingham, K.; Carattini, S.; Esty, D. Lessons from first campus carbon-pricing scheme. Nature 2017, 551, 27–29. [Google Scholar] [CrossRef]

- Calel, R.; Dechezleprêtre, A. Environmental policy and directed technological change: Evidence from the european carbon market. Rev. Econ. Stat. 2016, 98, 173–191. [Google Scholar] [CrossRef]

- Baranzini, A.; van den Bergh, J.C.J.M.; Carattini, S.; Howarth, R.B.; Padilla, E.; Roca, J. Carbon pricing in climate policy: Seven reasons, complementary instruments, and political economy considerations. Wiley Interdiscip. Rev.-Clim. Change 2017, 8, e462. [Google Scholar] [CrossRef]

- Brauneis, A.; Mestel, R.; Palan, S. Inducing low-carbon investment in the electric power industry through a price floor for emissions trading. Energy Policy 2013, 53, 190–204. [Google Scholar] [CrossRef]

- Hoffmann, V.H. EU ETS and investment decisions: The case of the German electricity industry. Eur. Manag. J. 2007, 25, 464–474. [Google Scholar] [CrossRef]

- Lilliestam, J.; Patt, A.; Bersalli, G. On the quality of emission reductions: Observed effects of carbon pricing on investments, innovation, and operational shifts. A response to van den Bergh and Savin. Environ. Resour. Econ. 2022, 83, 733–758. [Google Scholar] [CrossRef]

- Zhang, J.; Li, H.; Chen, W.; Liu, Y. The transformation of global climate governance: Mechanisms, challenges and China’s role. Sustainability 2025, 17, 963. [Google Scholar]

- Weng, Z.; Ma, Z.; Xie, Y.; Cheng, C. Effect of China’s carbon market on the promotion of green technological innovation. J. Clean. Prod. 2022, 373, 133789. [Google Scholar] [CrossRef]

- Zhou, F.; Wang, X. The carbon emissions trading scheme and green technology innovation in China: A new structural economics perspective. Econ. Anal. Policy 2022, 74, 365–381. [Google Scholar] [CrossRef]

- Liu, M.; Shan, Y.; Li, Y. Study on the effect of carbon trading regulation on green innovation and heterogeneity analysis from China. Energy Policy 2022, 171, 113290. [Google Scholar] [CrossRef]

- Cong, J.; Zhang, W.; Guo, H.; Zhao, Y. Possible green-technology innovation motivated by China’s pilot carbon market: New evidence from city panel data. Clim. Policy 2023, 24, 558–571. [Google Scholar] [CrossRef]

- Xie, L.; Zhou, Z.; Hui, S. Does environmental regulation improve the structure of power generation technology? Evidence from China’s pilot policy on the carbon emissions trading market (CETM). Technol. Forecast. Soc. Change 2022, 176, 121428. [Google Scholar] [CrossRef]

- Tan, R.; Lin, B. The long term effects of carbon trading markets in China: Evidence from energy intensive industries. Sci. Total Environ. 2022, 806, 150311. [Google Scholar] [CrossRef] [PubMed]

- Zhou, B.; Zhang, C.; Song, H.; Wang, Q. How does emission trading reduce China’s carbon intensity? An exploration using a decomposition and difference-in-differences approach. Sci. Total Environ. 2019, 676, 514–523. [Google Scholar] [CrossRef]

- Kong, Y.; Zhao, T.; Yuan, R.; Chen, C. Allocation of carbon emission quotas in Chinese provinces based on equality and efficiency principles. J. Clean. Prod. 2019, 211, 222–232. [Google Scholar] [CrossRef]

- Chen, H.; Kang, J.-N.; Liao, H.; Tang, B.-J.; Wei, Y.-M. Costs and potentials of energy conservation in China’s coal-fired power industry: A bottom-up approach considering price uncertainties. Energy Policy 2017, 104, 23–32. [Google Scholar] [CrossRef]

- Liu, X.; Fan, Y.; Li, C. Carbon pricing for low carbon technology diffusion: A survey analysis of China’s cement industry. Energy 2016, 106, 73–86. [Google Scholar] [CrossRef]

- Liu, B.; Sun, Z.; Li, H. Can carbon trading policies promote regional green innovation efficiency? Empirical data from pilot regions in China. Sustainability 2021, 13, 2891. [Google Scholar] [CrossRef]

- Guo, J.; Li, C. Does China’s carbon emissions trading policy improve enterprise green innovation? Financ. Res. Lett. 2024, 69, 106214. [Google Scholar] [CrossRef]

- Zhu, J.; Fan, Y.; Deng, X.; Xue, L. Low-carbon innovation induced by emissions trading in China. Nat. Commun. 2019, 10, 4088. [Google Scholar] [CrossRef] [PubMed]

- Li, C.; Yang, X.; Xu, H.; Ju, H. The impacts of different environmental regulations on firm’s performance in China based on R&D investment, environmental innovation and non-environmental innovation. Technol. Anal. Strateg. Manag. 2024, 1–13. [Google Scholar] [CrossRef]

- Guo, L.; Feng, C. Are there spillovers among China’s pilots for carbon emission allowances trading? Energy Econ. 2021, 103, 105574. [Google Scholar] [CrossRef]

- Cao, X.; Su, X. Has the carbon emissions trading pilot policy promoted carbon neutrality technology innovation? China Popul. Resour. Environ. 2023, 33, 94–104. [Google Scholar]

- Deng, M.; Zhang, W. Recognition and analysis of potential risks in China’s carbon emission trading markets. Adv. Clim. Change Res. 2019, 10, 30–46. [Google Scholar] [CrossRef]

- Wang, F.; Jiang, T.; Guo, X. Government quality, environmental regulation and enterprise green technology innovation. Sci. Res. Manag. 2018, 39, 26–33. [Google Scholar]

- Zhang, W.; Li, G.; Guo, F. Does carbon emissions trading promote green technology innovation in China? Appl. Energy 2022, 315, 119012. [Google Scholar] [CrossRef]

- Zhang, X.; Zhang, D.; Yu, R. Theory and practice of national carbon market design with Chinese characteristics. Manag. World 2021, 37, 80–95. [Google Scholar]

- Chang, H.; Zhao, Y. The impact of carbon trading on the “quantity” and “quality” of green technology innovation: A dynamic QCA analysis based on carbon trading pilot areas. Environ. Innov. Soc. Transit. 2024, 43, 25668. [Google Scholar] [CrossRef]

- Lin, S.; Wang, B.; Wu, W.; Qi, S. The potential influence of the carbon market on clean technology innovation in China. Clim. Policy 2017, 18 (Suppl. 1), 71–89. [Google Scholar] [CrossRef]

- Markowitz, H. The utility of wealth. J. Polit. Econ. 1952, 60, 151–158. [Google Scholar] [CrossRef]

- Wüstenhagen, R.; Menichetti, E. Strategic choices for renewable energy investment: Conceptual framework and opportunities for further research. Energy Policy 2012, 40, 1–10. [Google Scholar] [CrossRef]

- Toda, H.Y.; Phillips, P.C. Vector autoregressions and causality. Econometrica 1993, 61, 1367–1393. [Google Scholar] [CrossRef]

- Sims, C.A.; Stock, J.H.; Watson, M.W. Inference in linear time series models with some unit roots. Econometrica 1990, 58, 113–144. [Google Scholar] [CrossRef]

- Shukur, G.; Mantalos, P. A simple investigation of the Granger-causality test in integrated cointegrated VAR systems. J. Appl. Stat. 2000, 27, 1021–1031. [Google Scholar] [CrossRef]

- Shukur, G.; Mantalos, P. Size and power of the RESET test as applied to systems of equations: A bootstrap approach. J. Mod. Appl. Stat. Methods 2004, 3, 370–385. [Google Scholar] [CrossRef]

- Wang, S.; Liu, J.; Qin, X. Financing constraints, carbon emissions and high-quality urban development: Empirical evidence from 290 cities in China. Int. J. Environ. Res. Public Health 2022, 19, 2386. [Google Scholar] [CrossRef]

- Zhang, P.; Qi, J. Carbon emission regulation and corporate financing constraints: A quasi-natural experiment based on China’s carbon emissions trading mechanism. J. Contemp. Account. Econ. 2025, 21, 100452. [Google Scholar] [CrossRef]

- Wu, Y.; Liu, X.; Tang, C. Carbon Market and corporate financing behavior: From the perspective of constraints and demand. Econ. Anal. Policy 2024, 81, 873–889. [Google Scholar] [CrossRef]

- Andrews, D.W. Tests for parameter instability and structural change with unknown change point. Econometrica 1993, 61, 821–856. [Google Scholar] [CrossRef]

- Andrews, D.W.; Ploberger, W. Optimal tests when a nuisance parameter is present only under the alternative. Econometrica 1994, 62, 1383–1414. [Google Scholar] [CrossRef]

- Nyblom, J. Testing for the constancy of parameters over time. J. Am. Stat. Assoc. 1989, 84, 223–230. [Google Scholar] [CrossRef]

- Hansen, B.E. Tests for parameter instability in regressions with I(1) processes. J. Bus. Econ. Stat. 1992, 10, 321–335. [Google Scholar]

- Balcilar, M.; Ozdemir, Z.A.; Arslanturk, Y. Economic growth and energy consumption causal nexus viewed through a bootstrap rolling window. Energy Econ. 2010, 32, 1398–1410. [Google Scholar] [CrossRef]

- Su, C.; Liu, X.; Qin, M.; Umar, M. Is the uncertainty economic policy an impediment or an impetus to technological innovation? Emerging Mark. Financ. Trade 2024, 60, 2579–2593. [Google Scholar]

- Wu, C.; Xu, C.; Zhao, Q.; Lin, S. Research on financing strategy of low-carbon supply chain based on cost-sharing contract. Environ. Sci. Pollut. Res. 2022, 29, 48358–48375. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Peterson, S.R.; Portney, P.R.; Stavins, R.N. Environmental regulation and the competitiveness of US manufacturing: What does the evidence tell us? J. Econ. Lit. 1995, 33, 132–163. [Google Scholar]

- Niu, S.; Zhang, J.; Luo, R.; Feng, Y. How does climate policy uncertainty affect green technology innovation at the corporate level? New evidence from China. Environ. Res. 2023, 237, 117003. [Google Scholar] [CrossRef]

- Sun, G.; Fang, J.; Li, T.; Ai, Y. Effects of climate policy uncertainty on green innovation in Chinese enterprises. Int. Rev. Financ. Anal. 2024, 91, 102960. [Google Scholar] [CrossRef]

- Wang, L.; Wen, Y.; Zhang, Y. The impact of EU carbon border adjustment mechanism on China’s export and its countermeasures. Glob. Energy Interconnect. 2025, 8, 205–212. [Google Scholar] [CrossRef]

- Zhong, J.; Pei, J. Carbon border adjustment mechanism: A systematic literature review of the latest developments. Clim. Policy 2023, 24, 228–242. [Google Scholar] [CrossRef]

- Xu, L.; Yang, J.; Cheng, J.; Dong, H. How has China’s low-carbon city pilot policy influenced its CO2 abatement costs? Analysis from the perspective of the shadow price. Energy Econ. 2022, 115, 106353. [Google Scholar] [CrossRef]

- Agan, B. Sustainable development through green transition in EU countries: New evidence from panel quantile regression. J. Environ. Manag. 2024, 365, 121545. [Google Scholar] [CrossRef] [PubMed]

- Borghesi, S.; Cainelli, G.; Mazzanti, M. Linking emission trading to environmental innovation: Evidence from the Italian manufacturing industry. Res. Policy 2015, 44, 669–683. [Google Scholar] [CrossRef]

- Nie, Q.; Zhang, L.; Tong, Z.; Dai, G.; Chai, J. Cost compensation method for PEVs participating in dynamic economic dispatch based on carbon trading mechanism. Energy 2022, 239, 121704. [Google Scholar] [CrossRef]

- Valero-Gil, J.; Surroca, J.A.; Tribo, J.A.; Gutierrez, L.; Montiel, I. Innovation vs. standardization: The conjoint effects of eco-innovation and environmental management systems on environmental performance. Res. Policy 2023, 52, 104737. [Google Scholar] [CrossRef]

- Cainelli, G.; D’Amato, A.; Mazzanti, M. Resource efficient eco-innovations for a circular economy: Evidence from EU firms. Res. Policy 2020, 49, 103827. [Google Scholar] [CrossRef]

- Ibikunle, G.; Gregoriou, A.; Hoepner, A.G.F.; Rhodes, M. Liquidity and market efficiency in the world’s largest carbon market. Br. Account. Rev. 2016, 48, 431–447. [Google Scholar] [CrossRef]

- Habiba, U.; Xinbang, C.; Anwar, A. Do green technology innovations, financial development, and renewable energy use help to curb carbon emissions? Renew. Energy 2022, 193, 1082–1093. [Google Scholar] [CrossRef]

- Song, A.; Rasool, Z.; Nazar, R.; Anser, M.K. Towards a greener future: How green technology innovation and energy efficiency are transforming sustainability. Energy 2024, 290, 129891. [Google Scholar] [CrossRef]

- Van den Heuvel, S.; Gozgor, G.; Koengkan, M.; Lau, M.C.K.; Paramati, S.R.; Sheng, X. The dynamic effects of climate policy uncertainty: A machine learning approach. J. Clean. Prod. 2024, 434, 140123. [Google Scholar]

- Aghion, P.; Dechezleprêtre, A.; Hémous, D.; Martin, R.; Van Reenen, J. Climate policy and innovation: Evidence from the auto industry. Am. Econ. Rev. 2022, 112, 1917–1944. [Google Scholar]

- Dogan, E.; Madaleno, M. Oil prices, carbon emissions, and the Porter Hypothesis: A global perspective. Econ. Model. 2024, 131, 106614. [Google Scholar]

- Kocaarslan, B.; Soytaş, U. Do oil prices predict carbon prices? New evidence from G7 and BRICS. Energy Econ. 2023, 118, 106504. [Google Scholar]

- Sohag, K.; Chukavina, K.; Samargandi, N. Oil price shocks and green innovation: The role of political institutions. Renew. Sustain. Energy Rev. 2023, 184, 113555. [Google Scholar]

| Mean | Median | Maximum | Minimum | Standard Deviation | Skewness | Kurtosis | Jarque–Bera | |

|---|---|---|---|---|---|---|---|---|

| CP | 53.755 | 48.000 | 96.000 | 22.000 | 19.907 | 0.537 | 2.192 | 10.467 *** |

| GTI | 2582.712 | 2139.000 | 4349.000 | 1216.000 | 872.756 | 0.600 | 1.904 | 15.302 *** |

| FC | 1,530,099.000 | 1,443,055.000 | 2,583,669.000 | 694,962.200 | 575,680.800 | 0.286 | 1.798 | 10.256 *** |

| Tests | H0: CP Does Not Granger-Cause GTI | H0: GTI Does Not Granger-Cause CP | ||

|---|---|---|---|---|

| Statistics | p-Value | Statistics | p-Value | |

| Bootstrap LR test | 10.495 | 0.040 | 5.275 | 0.270 |

| Tests | CP | GTI | VAR System | |||

|---|---|---|---|---|---|---|

| Statistics | p-Value | Statistics | p-Value | Statistics | p-Value | |

| Sup-F | 24.332 *** | 0.003 | 102.902 *** | 0.000 | 49.192 *** | 0.000 |

| Ave-F | 8.912 ** | 0.020 | 28.814 *** | 0.000 | 21.282 *** | 0.000 |

| Exp-F | 15.534 ** | 0.014 | 57.312 *** | 0.000 | 36.346 *** | 0.000 |

| Lc | 5.391 *** | 0.000 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guan, Y.; Su, C.; Guan, T. The Dynamic Bidirectional Causality Between Carbon Pricing and Green Technology Innovation in China: A Sub-Sample Time-Varying Approach. Sustainability 2025, 17, 5371. https://doi.org/10.3390/su17125371

Guan Y, Su C, Guan T. The Dynamic Bidirectional Causality Between Carbon Pricing and Green Technology Innovation in China: A Sub-Sample Time-Varying Approach. Sustainability. 2025; 17(12):5371. https://doi.org/10.3390/su17125371

Chicago/Turabian StyleGuan, Yumei, Chiwei Su, and Tao Guan. 2025. "The Dynamic Bidirectional Causality Between Carbon Pricing and Green Technology Innovation in China: A Sub-Sample Time-Varying Approach" Sustainability 17, no. 12: 5371. https://doi.org/10.3390/su17125371

APA StyleGuan, Y., Su, C., & Guan, T. (2025). The Dynamic Bidirectional Causality Between Carbon Pricing and Green Technology Innovation in China: A Sub-Sample Time-Varying Approach. Sustainability, 17(12), 5371. https://doi.org/10.3390/su17125371