4.1. Results

Table 1 presents the demographic analysis of employees from the Libyan banking sector who participated in the study. The age distribution of the employees is diverse, with 63.1% falling between 25 and 44 years old. Specifically, 29.93% are aged 25 to 34, and 33.17% are aged 35 to 44. This indicates that the workforce is predominantly made up of young to middle-aged employees, a group likely more receptive to adopting emerging technologies like AI.

The gender distribution shows a male-dominated workforce, with 61.6% male (247 employees) and 38.4% female (154 employees). This disparity highlights the need for gender-inclusive policies in the banking sector, particularly in Libya, to ensure balanced representation in roles associated with emerging technologies and innovation.

Regarding education, 52.87% (212 employees) hold bachelor’s degrees, while 25.94% (104 employees) hold master’s degrees. This suggests a relatively well-educated workforce that may be more open to AI-driven initiatives and sustainable technologies.

In terms of experience, 31.17% (125 employees) have between 11 and 15 years in the banking sector, and 26.18% (105 employees) have 3 to 5 years. This indicates a mix of experienced and relatively newer employees, which could support the successful implementation of AI and innovation in the sector.

The roles of the employees are varied, with 23.69% (95 employees) working as customer service representatives, 17.71% (71 employees) as relationship managers, and 15.71% (63 employees) as risk management officers. This diversity emphasizes the need for a cross-departmental approach to AI implementation and sustainable innovation to ensure all levels of the bank are prepared for digital transformation. The data also shows that most employees work in Islamic banks (58.1%, 233 employees), compared to 41.9% (168 employees) in conventional banks, each operating under distinct regulatory and operational frameworks.

Table 2 presents the descriptive statistics of the study’s variables. The average score for AI reflects a strong consensus among employees regarding its importance and impact on their roles. This suggests that the banking sector views AI as crucial to enhancing operational efficiency, improving client experiences, and driving internal innovation. Banks are encouraged to continue investing in AI to ensure employees receive proper training, enhancing both performance and market competitiveness.

Employees also acknowledge the need for integrating sustainable practices within the banking sector. The average score for sustainable innovation performance highlights a clear focus on sustainability, indicating that staff are increasingly aware of and committed to their social and environmental responsibilities. Banks should develop strategies that align their operations with sustainability goals, ensuring that AI technologies contribute to these objectives.

The average score for organizational learning indicates a positive attitude toward continuous learning and adaptation among employees. This shows that bank personnel are open to adopting new ideas and methods, which is critical for successfully implementing AI and fostering sustainable innovation. Banks should nurture a culture of organizational learning that supports employees in enhancing their skills, ensuring their adaptability in a rapidly evolving technological landscape.

Before presenting the findings, it is important to assess the model’s fit to ensure that the structural SEM accurately represents the data and illustrates the relationships among the variables. The validity of the study’s conclusions depends on the model’s fit, which indicates how well the model reflects the observed data. A good model fit ensures that the expected correlations are supported by the data, strengthening the results and subsequent recommendations. The model’s fit was assessed using the Normed Fit Index (NFI) and the Standardized Root Mean Square Residual (SRMR), with results shown in

Table 3.

An SRMR value of 0.045, below the recommended threshold of 0.08 [

32], indicates that the model accurately reflects the relationships among the variables with minimal residuals. The NFI score of 0.962 exceeds the recommended threshold of 0.90 [

68], demonstrating an excellent fit, showing that the model captures a significant portion of the data’s variance. These results confirm that the model effectively represents the relationships within the dataset and provides strong support for the hypotheses being tested.

Convergent validity refers to the extent to which multiple indicators of a construct are correlated, confirming their measurement of the same underlying concept [

69]. It ensures that the components of a construct accurately reflect the construct itself, making it a key aspect of construct validity. In this study, convergent validity was assessed using standardized loadings and AVE, which are common methods for this type of assessment. The results are shown in

Table 4.

Standardized loadings greater than 0.70 are considered adequate, as they indicate a strong relationship between each variable and its construct [

70]. The standardized loadings for the constructs are displayed in

Figure 2 (Measurement model). Any item with a standardized loading below 0.70 was excluded due to its insufficient support for the construct. For instance, the MCAE1 for organizational learning had a standardized loading below 0.70 and was removed to improve construct validity. An AVE value above 0.50 indicates that the indicators contribute significantly to the variance of the construct [

71]. An AVE of 0.50 or higher ensures robust convergent validity, which is crucial for confirming the validity and reliability of constructs in the research findings.

The AI application in the banking sector shows strong convergent validity, with standardized loadings above 0.90—specifically ADAT1 (0.940) and CUSPT2 (0.967). These high values signal confidence in measuring the underlying concept. The AVE for this construct was 0.759, exceeding the recommended threshold of 0.50. The sustainable innovation performance construct also demonstrates strong convergent validity, with standardized loadings ranging from 0.760 to 0.928 and an AVE of 0.805. For organizational learning, items like EXPM1 (0.944) and MCAE5 (0.946) had high standardized loadings, indicating strong correlations with the construct. The AVE for organizational learning was 0.777, confirming robust convergent validity. Overall, the standardized loadings and AVE values affirm that the constructs in this study exhibit strong convergent validity, ensuring that the items accurately measure the intended attributes.

Reliability is a critical measure of how consistently constructs and their indicators reflect the underlying concepts [

72]. Cronbach’s alpha and composite reliability (CR) were used in this study to evaluate reliability. These metrics assess the internal consistency of the components within each construct, ensuring their reliable connection and representation of the same concept.

For AI in banking, Cronbach’s alpha (0.980) and Composite Reliability (0.982) indicate exceptional consistency. For instance, ADAT1 has a Cronbach’s alpha of 0.980, demonstrating high consistency among AI items. Similarly, the items evaluating sustainable innovation performance, such as SINP1 and SINP2, showed a higher Cronbach’s alpha of 0.973. Organizational learning exhibited strong consistency, with a Cronbach’s alpha of 0.937 and a Composite Reliability of 0.938. The high Cronbach’s alpha and Composite Reliability scores for all components demonstrate the reliability of the measurements used in this study, providing a solid foundation for assessing the proposed relationships in the model.

Discriminant validity is an essential measure for evaluating whether the components within a model are distinct and show minimal overlap [

73]. This study assessed discriminant validity using the Fornell and Larcker Criterion and the Heterotrait–Monotrait Ratio (HTMT), with the results presented in

Table 5.

The HTMT results indicate that all constructs in this study meet the criteria for discriminant validity, as all HTMT values are below the 0.85 threshold [

71]. Specifically, the HTMT values between AI in Banking and Organizational Learning (0.492), and between AI in Banking and Sustainable Innovation Performance (0.294), are well below the 0.85 threshold, confirming that these constructs are distinct. Additionally, the value of 0.306 between Organizational Learning and Sustainable Innovation Performance is also below the threshold, further supporting the distinctiveness of these constructs. These results confirm that each construct in the model represents a unique concept, ensuring discriminant validity.

The Fornell and Larcker Criterion further confirms discriminant validity. According to this criterion, the square root of the AVE for each construct must exceed the correlations between that construct and the others in the model [

74]. The AVE values for AI in Banking, Organizational Learning, and Sustainable Innovation Performance are 0.759, 0.777, and 0.805, respectively. The correlation coefficients between constructs are significantly lower than the square roots of the corresponding AVE values, indicating clear distinctions among the constructs. For example, the correlation between AI in Banking and Organizational Learning (0.559) is lower than the square root of the AVE for Organizational Learning (0.881), confirming discriminant validity. Both the HTMT and Fornell and Larcker criteria demonstrate that the constructs in this study possess strong discriminant validity, ensuring that each construct accurately measures a distinct component of the research model.

The structural model assessment evaluates the interactions among the model components, providing insights into their strength, predictive ability, and the impact of various variables. This study used R

2, Q

2predict, f

2, and Variance Inflation Factor (VIF) to assess the structural model, with the results presented in

Table 6. These metrics help evaluate explanatory strength, predictive relevance, effect size, and potential multicollinearity issues within the model.

R2 values indicate the extent to which independent variables explain variations in dependent variables. For example, the R2 value for Organizational Learning (0.312) shows that AI in banking accounts for 31.2% of the variance in organizational learning, suggesting a significant influence on how organizations learn. On the other hand, the R2 value for Sustainable Innovation Performance (0.099) indicates that AI in banking and organizational learning explain 9.9% of the variation in sustainable innovation performance, signifying a moderate impact.

The Q

2predict values indicate the model’s predictive significance. According to Lin & Huynh [

75], a Q

2predict score above zero indicates predictive relevance. The score of 0.300 for Organizational Learning and 0.068 for Sustainable Innovation Performance confirm the model’s predictive ability, with a medium predictive relevance for sustainable innovation performance.

The f2 values show the effect size of predictor variables on dependent variables. An f2 value of 0.454 suggests a substantial effect of AI in banking on organizational learning. The f2 value of 0.219 between AI in Banking and Sustainable Innovation Performance reflects a moderate effect size, while the f2 value of 0.330 for the correlation between Organizational Learning and Sustainable Innovation Performance highlights a significant effect size.

The VIF assesses multicollinearity among predictor variables. All of the VIF values in this study, ranging from 1.000 to 1.454, were below the common threshold of 5 [

76,

77,

78,

79,

80] indicating no issues with multicollinearity. Overall, the structural model evaluation reveals that the relationships among AI in banking, Organizational Learning, and Sustainable Innovation Performance are significant, with varying effect sizes and explanatory power.

4.3. Discussion of Findings

The study found that AI positively and significantly influences sustainable innovation performance. According to dynamic capabilities theory, organizations must skillfully integrate, cultivate, and reorganize internal and external resources to adapt to evolving environments [

82]. Banks utilizing AI develop capabilities to identify emerging trends, adjust operations, and seize new opportunities in line with sustainability standards. This enables banks to meet sustainability requirements, optimize operations, and introduce environmentally friendly financial services [

83]. The results highlight AI’s role in helping banks remain responsive to evolving environmental and technological changes, which is crucial to driving long-term innovation [

84].

AI’s transformative ability to automate complex processes, analyze large datasets, and generate actionable insights significantly impacts banking decisions [

85]. AI plays a crucial role in driving sustainable innovation by enhancing fraud detection, optimizing customer interactions, strengthening risk management, and ensuring better regulatory compliance. Furthermore, AI fosters a culture of continuous learning and flexibility within banks [

85], enabling them to remain competitive, enhance efficiency, and achieve long-term sustainability goals, positioning them as leaders in the rapidly evolving banking sector. Libya’s positive result may be influenced by its push for modernization in response to economic disruptions and political instability. The need to improve efficiency and resilience in a volatile environment likely encouraged banks to adopt AI-driven solutions. Additionally, limited traditional innovation infrastructure may have made AI a more attractive and immediate path to sustainable innovation.

From a financial perspective, these findings have important implications for investors and bank management. Banks integrating AI into their sustainable innovation strategies can enhance competitiveness and financial robustness, boosting long-term profitability. Bank management teams should prioritize investment in AI technology to improve operational efficiency, service offerings, and regulatory compliance, ultimately enhancing their banks’ reputations and ability to attract environmentally conscious investors.

The study also found that AI positively and significantly influences organizational learning. Dynamic capabilities theory highlights an organization’s ability to integrate and modify resources in response to changing circumstances [

86]. In this context, AI plays a critical role in facilitating knowledge application and learning. AI-driven data analytics enable banks to continuously learn from large datasets, improve decision-making, and adapt strategies based on new insights [

87]. This information assimilation process enhances the bank’s capacity to adapt operational and strategic capabilities over time.

AI accelerates organizational learning by automating routine tasks and improving the rate of knowledge acquisition, enabling easy access to information for employees across the organization. AI-driven systems can identify patterns, analyze trends, and generate insights, thereby enhancing decision-making, fostering creativity, and improving flexibility in the dynamic financial landscape [

88]. AI enables banks to remain competitive and agile by fostering a culture of continuous learning and real-time knowledge exchange, which helps them address challenges and capitalize on opportunities for innovation and growth [

89,

90]. Libya’s unstable economic and political environment may have driven organizations to adopt AI as a tool for adaptability and knowledge management. In such a context, AI can support faster decision-making, knowledge retention, and skill development—key elements of organizational learning—helping banks remain responsive and resilient amid uncertainty.

Economically, these outcomes are significant for investors and bank management. Banks that successfully integrate AI into their learning processes are likely to demonstrate improved efficiency, agility, and market responsiveness, ensuring consistent growth and profitability. By cultivating a culture of organizational learning supported by AI, bank management can gain a competitive advantage, enabling adaptation to market fluctuations, improving employee performance, and refining operational strategies, which ultimately enhances the bank’s competitiveness.

The study found that organizational learning positively and significantly influences sustainable innovation performance. Dynamic capabilities theory emphasizes the need for firms to integrate and reconfigure resources in response to external changes [

91]. Organizational learning is vital in this process, enabling banks to acquire knowledge, adapt to environmental shifts, and enhance sustainability efforts. Through continuous learning from both internal operations and external market conditions, banks can meet evolving regulatory mandates and industry expectations while advancing sustainable development [

92].

The results indicate that organizational learning helps banks convert knowledge into actionable strategies for sustainable innovation. By fostering continuous education, banks can identify new opportunities for eco-friendly products, services, and practices that align with long-term sustainability goals [

93]. This includes initiatives like energy efficiency, waste reduction, and improved social responsibility efforts. Organizational learning propels these advancements, equipping banks with the knowledge, agility, and flexibility needed to implement sustainable practices, meet market demands, and promote environmental and social well-being [

94]. In Libya’s challenging economic and political context, organizational learning plays a crucial role in enabling banks to adapt and innovate sustainably. With limited external stability, internal learning mechanisms become crucial to building resilience, fostering problem-solving, and continually improving processes, factors that directly contribute to sustainable innovation performance.

From an economic standpoint, these findings are critical for investors and bank management. Investors tend to favor banks that prioritize organizational learning, as it enhances adaptation, innovation, and sustainable development. Banks that consistently innovate to meet sustainability challenges can better satisfy client demand for eco-friendly products and services, boosting their financial performance. Prioritizing organizational learning ensures management maintains the bank’s agility, continuously improves sustainability initiatives, and retains a competitive edge in an increasingly environmentally conscious industry.

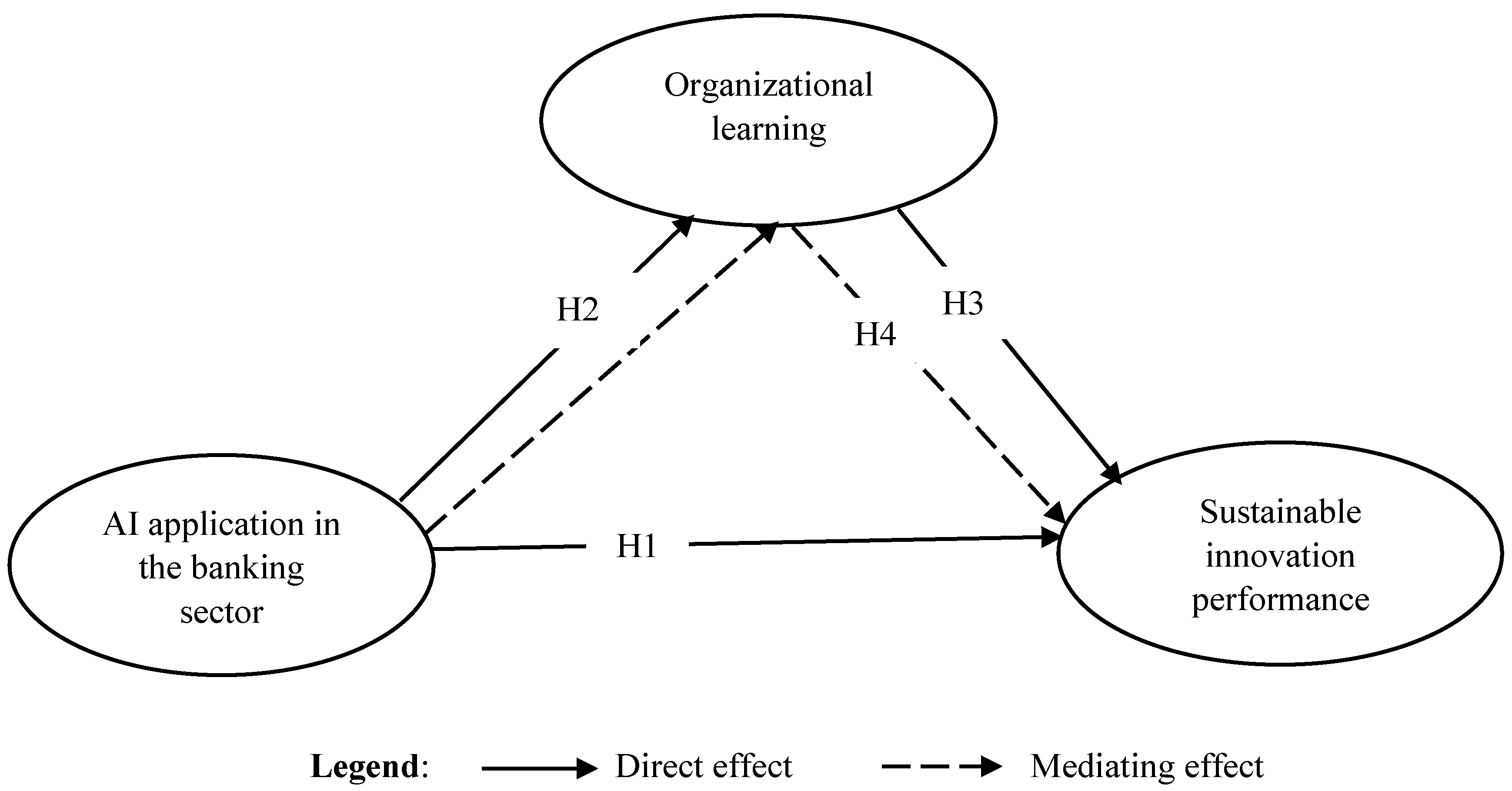

The study also found that organizational learning partially mediates the relationship between AI and sustainable innovation performance. According to dynamic capabilities theory, firms must skillfully combine, reconfigure, and modify their resources in response to environmental changes [

82]. Financial institutions can leverage AI to improve operational efficiency, customer satisfaction, and decision-making [

95]. Organizational learning plays a crucial role in sustaining the effectiveness of AI-driven insights, allowing banks to absorb, apply, and convert AI knowledge into sustainable practices.

The findings suggest that AI alone cannot drive continuous innovation. Organizational learning is essential to bridge the gap between AI capacity and actual innovation outcomes. Through ongoing education, banks can more effectively use AI to discover sustainability opportunities, develop green products, and improve eco-friendly operations [

96]. This ensures that AI not only automates existing tasks but also enables radical transformations aligned with sustainability objectives. Organizational learning enables banks to use AI-driven insights strategically, facilitating socially responsible, efficient, and sustainable innovations [

96].

The partial mediation effect indicates that while organizational learning enhances the impact of AI on sustainable innovation, both factors are necessary for optimal outcomes. This highlights the importance of investors supporting both AI capabilities and organizational learning cultures within banks. The results emphasize the need for bank management teams to invest in both educational initiatives and AI technologies. This dual approach ensures banks can adapt to market changes effectively, securing their survival and competitiveness. This indicates that bank management cannot simply allocate funds to AI technologies. Organizations must prioritize learning programs to ensure the proper utilization of AI-generated insights. These may include continuous staff training, mechanisms for knowledge dissemination, and adaptive cultures that evolve in response to the emergence of new information. Banks can achieve superior outcomes by integrating direct investments in AI with efforts to enhance learning.