Abstract

In the fast-growing new energy vehicle (NEV) industry, selecting an appropriate technological innovation strategy is vital for enterprises to achieve a competitive market position while effectively coordinating their resources to align with their technical capabilities. This paper integrates ambidextrous innovation theory and the resource-based view to propose a configurational model that examines how the synergy between technological innovation and resources influences NEV firm performance. Using regression analysis and qualitative comparative analysis (QCA) for 52 listed Chinese NEV companies, this study uncovered multiple growth paths and mechanisms. The findings include the following: (1) No single factor was a necessary condition for performance, but effective combinations of innovation strategies and resource elements led to multiple success paths. (2) Government subsidies and R&D investment emerged as key drivers of performance. (3) Four distinct configuration paths were identified, with variations across firms with different resource bases. (4) In response to reduced government subsidies, NEV firms must shift from policy-driven strategies to resource- and market-driven innovation approaches. These insights provide strategic guidance for NEV enterprises in selecting innovation strategies suited to their unique resource bases in the evolving post-subsidy market environment.

1. Introduction

The global automotive industry is undergoing a profound transformation driven by the transition to sustainable energy sources. With growing environmental concerns and stricter regulations on carbon emissions, governments worldwide are incentivizing the adoption of new energy vehicles (NEVs) through policies and subsidies [1]. The rise of NEVs has sparked unprecedented opportunities for both established automakers and emerging players. In response to this global shift, China, the world’s largest automobile market, has prioritized the development of its NEV industry [2]. The New Energy Automobile Industry Development Plan (2021–2035), released in 2020, outlines ambitious goals for the industry, including leveraging leading enterprises to foster innovation, promoting collaboration between large, medium, and small enterprises, and establishing globally competitive NEV clusters [3].

In China, the NEV industry has grown at an extraordinary pace, presenting both opportunities and challenges for enterprises. The core driving force of this sector lies in the advancement of the “three electric” (electric motor, electric control, battery) technologies [4]. However, the development paths of these technologies are highly diverse and complex. First, ensuring a stable supply of and cost control for key components—such as motors, electronic controls, and batteries—requires a solid resource base to enable large-scale production [5]. Second, technological innovation strategies are essential for driving breakthroughs in these “three electric” technologies, improving their efficiency, and enhancing safety [6]. Therefore, for NEV enterprises, the complementarity between technological innovation strategies and their resource base is critical [6], as it dictates their capabilities regarding research and development (R&D), production, and supply chain management. Technological innovation strategies, in particular, enable enterprises to overcome technical bottlenecks, boost their competitiveness, and achieve sustainable development [7]. Only by aligning innovation strategies with resource bases can firms secure a competitive position in this fiercely competitive market and contribute to the ongoing advancement of the NEV industry.

In this rapidly evolving market, NEV enterprises must formulate technological innovation strategies that are tailored to their specific resource bases to enhance their competitive advantages and ensure sustainable growth. A resource base refers to the sum total of all the kinds of tangible and intangible resources that an enterprise possesses or controls, which can create competitive advantages for it and help in achieving strategic goals. The resource base serves as the logical starting point for strategic decision-making, determining an enterprise’s ability to achieve its strategic goals [8]. The resource-based view (RBV) emphasizes that endogenous resources are essential for creating value and obtaining a competitive advantage, explaining performance disparities within industries [8]. Technological innovation strategy choices hinge on the analysis of an enterprise’s unique resources and capabilities, with different resource endowments leading to distinct innovation strategies, which in turn affect firm performance [9]. For NEV enterprises in emerging economies like China, these firms must navigate the complexities of resource constraints and technological advancement to compete effectively on the global stage. In contrast to firms in developed economies that often rely on absolute advantages in terms of technology ownership, latecomers must align their innovation strategies with their resource bases to improve their performance [10].

However, previous research on NEV firms’ technological innovation strategies has primarily focused on case studies of individual firms, analyzing their strategies and identifying existing challenges. These studies often overlook the multiple concurrent factors and paths influencing firm performance in the context of technological innovation. Given the diversity of the “three electric” (electric motor, electric control, battery) technology paths, NEV enterprises face numerous challenges in resource allocation. How these firms effectively coordinate their resources to match their technological characteristics and identify optimal development paths remains a critical question for both academia and industry [11]. In the post-subsidy era of new energy vehicles, as policy dividends gradually fade and industry competition becomes increasingly market-oriented, whether enterprises can choose matching innovation strategies based on their own resource endowments will directly determine their cost control capabilities, market response speed, and long-term competitive advantages and further affect their performance and survival and development. Research on this issue can not only fill the theoretical gap in enterprise strategic adjustment during the policy transition period but also provide differentiated practical guidance for new energy vehicle enterprises of different scales, which has important academic value and practical significance.

In light of this, this paper aimed to bridge this gap by integrating the strengths of regression analysis and configuration analysis to investigate the complex relationships between technological innovation strategies, resource bases, and firm performance in China’s NEV industry. Using a sample of listed Chinese NEV enterprises, this study was grounded in ambidextrous innovation theory and the resource-based view. It examined the key factors that influence NEV enterprise performance, explored the synergetic effects of innovation strategies and resource bases, and sought to answer the following questions. What are the relevant factors influencing the performance of NEV enterprises? What are the key factors that significantly affect their performance? What configurations lead to high performance in NEV enterprises? What are the similarities and differences between the results of a regression analysis and configuration analysis, and what causes these differences? By addressing these questions, this paper refined development models suited to the specific characteristics of different NEV enterprises. The findings further clarify the relationship between technological innovation behavior, resource base alignment, and firm performance, offering practical insights for Chinese NEV enterprises to select appropriate innovation strategies based on their resource base.

2. Theory and Framework

2.1. Technological Innovation Strategy and Enterprise Performance

Technological innovation is an important means for new energy automobile enterprises to implement a product differentiation strategy, which determines whether enterprises can obtain the competitiveness needed to occupy the market [12]. According to the scope and knowledge base of innovation, an ambidextrous innovation strategy can be divided into exploratory innovation and exploitative innovation [13]. Exploratory innovation is a kind of large-scale and radical innovation behavior, aiming at seeking new innovation possibilities [14]. Through exploratory innovation, enterprises can invent new products and open up new markets to provide services for consumers [15]. Exploratory innovation means that an enterprise acquires new knowledge and surpasses the limits of their existing knowledge base, in a way similar to radical innovation behavior [15]. Exploitative innovation is a kind of small-scale innovation based on existing knowledge, focusing on improving existing technology and structures and the use of existing distribution channels; its purpose is to cater to the existing market, akin to a kind of progressive innovation [16]. These two kinds of innovation behaviors are two kinds of strategic behaviors resulting in distinct performance differences [17].

Existing studies have explored how exploratory innovation and exploitative innovation shape the market competitiveness of enterprises to different degrees and allow enterprises to achieve a high level of performance from different angles [18]. New energy automobile enterprises develop new products and new technologies through exploratory innovation and open up new market channels [19]. Through exploitative innovation, we accumulate knowledge highly similar to that obtained already and improve existing products or services to better meet customer needs. Exploratory technology innovation and the utilization of a technology innovation strategy are conducive to improving enterprise performance [20]. No matter what kind of development strategy is adopted, enterprises that attach importance to innovation can develop a strategy that is different from that of their competitors, and the exploration and utilization of technology innovation strategies ensures enterprises benefit in various ways [21]. An exploratory technology innovation strategy involves trying new opportunities, searching for new knowledge, and opening up new markets, usually to find a new way to obtain a different competitive advantage; an advantage is that it can achieve higher returns once it is successful, but it is riskier and the realization period is longer [18]. An exploitative technology innovation strategy involves exploring existing knowledge, technology, and markets, so as to improve the innovation efficiency of the enterprise and carry out the in-depth application of original technology [22]. Its advantage is that its return is stable and the realization cycle is short, but it is easy for this strategy to cause a dependence on certain technology in the long term, which is not conducive to the long-term sustainable development of enterprises. It can be seen that exploratory innovation and exploitative innovation both promote enterprise performance in different ways [23]. In addition, based on the actual development of China’s new energy vehicle enterprises, there is still a large market demand and development potential; therefore, whether the aim is to develop new technologies or new markets or improve existing products, different types of technological innovation activities can improve the performance of new energy vehicle enterprises [24]. Based on this, this paper divides these two innovation strategies for new energy automobile enterprises into a positive technology innovation strategy and a reactive technology innovation strategy and discusses their impact on enterprise performance [25].

2.2. Resource Base and Enterprise Performance

The resource-based view holds that the acquisition of resources determines the strategic behavior and choices of a firm [26,27]. As an important strategic behavior of a firm, the technological innovation of the firm directly affects the differentiated competitive advantage of the firm, and the technological innovation of the firm is influenced by the firm’s resources [28]. Some scholars have pointed out that the resource base of SMEs is relatively lacking and limited by factors such as a small scale, a low level of influence, and information asymmetry, which make it difficult for SMEs to bear the cost and risk of technological innovation [29]. Therefore, the resource base affects the development of the technological innovation activities of SMEs. In addition, some small- and medium-sized enterprises, due to their small scale and insufficient initial resources, will suffer a lot of unfair treatment under completely rational market rules, and it is not easy to for them to achieve better performance using their own strength, so it is difficult for them to develop in the long run [30]. Research on enterprise resources based on the resource-based theory has gradually attracted the attention of scholars [31]. The resource-based theory of enterprises takes the heterogeneous resources owned by enterprises as a research object and establishes the sustainable competitive advantages of enterprises and improves the performance of enterprises by analyzing and using the unique resources of enterprises [32]. The competitive advantage of an enterprise depends on its unique, scarce, and irreplaceable resources, which play a crucial role in the operation of an enterprise.

Most of the existing studies have started by considering internal resources and external resources to explore the impact of the resource base on firm performance [27]. Specifically, the resource base characteristics that affect the choice of a technological innovation strategy and firm performance include government resources, market resources, and the firm’s own resource input [33]. Among these, government resources are the administrative resources obtained by enterprises in the course of operation [34,35], such as financial subsidies, tax incentives, etc. [2]. Although our country is a market economy, the government plays an important role in the process of economic development [36,37]; the government plays a role in regulation and management, and it will guide the enterprise’s expectation for the market and then affect the enterprise’s technological innovation strategy choice. Market resources are how enterprises create customer value and deal with market uncertainty [38]. They are specialized resources composed of marketing channels and brands and are especially important for enterprises’ technological innovation strategy selection [39]. Some studies have also found that market resources can help enterprises to establish a brand image and improve their business credit during operation; enterprises with abundant market resources are more likely to obtain good economic benefits and improve their performance [40]. Some scholars have pointed out that the better the business credit of an enterprise, the less likely it is to be constrained by external financing, so the more abundant the cash flow, the greater the technological innovation of the enterprise. Specifically, on the one hand, having a good business reputation helps enterprises to obtain more flexible financial support in the financing market, reducing the possibility of being restricted by external financing [41]. This means that companies are more able to rely on their own liquidity and more flexibly respond to market fluctuations and opportunities [42]. On the other hand, an ample cash flow provides companies with internal resources that can be used to support aggressive technological innovation initiatives. This includes investing in research and development, new product development, technology upgrading, and talent training, which helps companies to continuously improve their competitiveness and meet market demands. Therefore, a good business reputation can be regarded as strategic capital that can push a company to pursue technological innovation more actively, improve its market position, and remain competitive [43]. Enterprise resources refer to the enterprise’s own resource investment, and R&D investment is an important internal factor affecting enterprise innovation [44,45]. The enterprise scale is an important index representing an enterprise’s resources and capabilities, and enterprises of different scales have significant differences in their attitudes towards technological innovation [46]. In general, larger enterprises are more resistant to risk and more willing to actively invest in the research and development of new technologies.

Based on this, this research categorized the resource base into three components: government resources, market resources, and enterprise resources. Government resources are exemplified by government subsidies, while market resources are typified by business credit. Enterprise resources are determined by R&D investment and the enterprise scale [47].

2.3. Configuration Analysis Framework

The dual innovation theory and the resource-based perspective have inherent theoretical complementarity when explaining enterprise performance. The integration of the two constitutes a “strategy-resource” collaborative framework. The resource-based perspective emphasizes that heterogeneous resources are the source of an enterprise’s competitive advantage, while the dual innovation theory reveals how enterprises acquire dynamic capabilities by balancing exploratory and exploitative innovation. Specifically, the orientation of innovation strategies determines the way resources are allocated. An active strategy requires the concentration of R&D investment in breakthroughs in core technologies, while a reactive strategy demands that resources respond quickly to market changes.

Some researchers in the field of technology innovation strategies believe that there is a tension between exploratory innovation and exploitative innovation within an enterprise, which will compete with each other for resources within the enterprise [48]. Due to the scarcity of enterprise resources, whether these are tangible resources such as personnel and funds or intangible resources such as time, these are limited within a certain period of time [49]. If there is a large amount of investment in exploratory innovation, then the resources for exploitative innovation will be reduced [50], and vice versa. This means that when an enterprise does not have sufficient resources, it needs to choose between the two. However, in recent years, researchers have put forward the concept of “ambidextrous innovation”, suggesting that exploratory innovation and utilization innovation are not completely opposite and enterprises can obtain resources from outside through alliances and other mechanisms to reduce the constraint of internal resources [51]. Therefore, enterprises can choose the appropriate technology innovation strategy based on their own resource base or even have two kinds of technology innovation strategy at the same time and achieve their goal of improving enterprise performance [52,53].

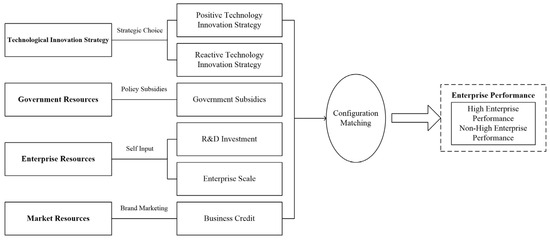

Based on this, this paper selects six antecedent variables, namely, a positive technology innovation strategy, a reactive technology innovation strategy, government resources (government subsidies), enterprise resources (including those determined by R&D investment and the enterprise scale), and market resources (business credit), relating to the two types of technological innovation strategy and resource bases of new energy vehicle enterprises. We chose the financial index as an evaluation standard for enterprise performance. We explored the key factors affecting the performance of new energy automobile enterprises regarding their choice of technological innovation strategy and resource-based factors and tried to combine the advantages of the two paradigms of empirical analysis and configuration analysis and investigated the key factors and configuration effects affecting the performance of new energy automobile enterprises from the perspective of complex causal effect analysis. Finally, some suggestions were put forward concerning the optimal direction for the development of new energy automobile enterprises.

Because the traditional regression analysis method can only deal with the interaction of three variables at most, it could not deal with the complex causal relationship of the interdependence and cooperation between the six variables in this paper. Therefore, we referred to Lewellyn’s practice of using regression analysis to find out the key factors affecting the results before QCA [54]. This paper first looked for the key conditions that have a significant impact on the performance of new energy vehicle enterprises; secondly, based on the two research perspectives of ambidextrous innovation theory and the resource-based view, six antecedent variables (a positive technology innovation strategy, a reactive technology innovation strategy, government subsidies, R&D investment, the enterprise scale, and business credit) were selected to explore how they synergically affect enterprise performance by using a qualitative comparative analysis method, and a research and analysis framework was constructed, as shown in Figure 1.

Figure 1.

Technological innovation strategy, resource base, and new energy vehicle enterprise performance research framework.

3. Data and Methods

3.1. Regression Analysis Combined with fs-QCA

A traditional regression analysis accepts the rational paradigm, assumes that each factor plays an independent role in the result, and then discusses the “net effect” of a single factor on the result through marginal analysis. However, there is a lack of discussion on the question of “how to combine the conditional factors to create the result”. From the perspective of set theory, fuzzy set qualitative comparative analysis (fs-QCA) holds that each condition factor cannot be strictly independent [55] and the causal relationship between the results depends on the combination of conditions in a specific context, an approach which makes up for the shortcomings of existing studies. Many existing studies combine traditional regression analysis with fs-QCA to provide a rich and in-depth basis for model interpretation. Fiss et al. provided two ways of combining regression analysis with fs-QCA: one was to use the conditional combination obtained through fs-QCA as a new variable and substitute it into the regression analysis framework to verify the robustness of the configuration; the second was to simulate the fs-QCA method in the regression analysis framework to test the substitutability or complementarity between the conditional combinations in the configuration [56]. Therefore, the combination of regression analysis and fs-QCA could fully play on the advantages of both and provide more comprehensive and in-depth analysis results for this research.

The combination of empirical regression analysis and the fs-QCA method in this paper had significant complementary value: regression analysis was good at identifying the net effect of a single variable on the performance of new energy vehicle enterprises and its significance, but it could not capture the configuration effect generated by the complex interaction of multiple factors; meanwhile, fs-QCA could reveal how the various paths combining different innovation strategies and resource conditions could lead to equally high performance, making up for the deficiency of regression analysis in explaining “multiple concurrent causal relationships”. The combination of the two methods not only verified the linear influence of the core variables through a regression but also uncovered the nonlinear cooperative relationships among the variables through fs-QCA, thereby providing a more refined strategic decision-making basis for enterprises.

3.2. Sample and Data

3.2.1. Sample Selection

This paper took data on China’s listed enterprises in the new energy vehicle concept sector from Flush Finance as its basic sample base. The sampling standards strictly adhered to the principles of industry representativeness and data availability. The samples covered the core links of the three major industrial chains of vehicle manufacturing, the production of core components, and intelligent technology enterprises, taking into account enterprises of different scales and ownerships, and excluded enterprises in insurance, advertising, and other industries, as well as samples with a serious amount of data missing. Ultimately, 64 new energy vehicle enterprises were selected as the research sample, and the missing data were eliminated, leaving 52 sample enterprises; the elimination of 12 enterprises was mainly due to a lack of R&D data for three consecutive years (7 enterprises) or an absence of data on more than 50% of key financial indicators (5 enterprises). All patent data in this paper were retrieved from the patent search and analysis system of the State Intellectual Property Office; other data were extracted from the annual reports of the companies, and the relevant financial data were checked against the CSMAR database data to increase the accuracy of the data.

3.2.2. Measurement of Variables

In this paper, the result variable was the enterprise performance, and the antecedent variables were a positive technology innovation strategy, a reactive technology innovation strategy, government subsidies, R&D investment, the enterprise scale, and business credit. The measurement methods for each variable are shown in Table 1.

Table 1.

Variable names and measurement methods.

- Outcome Variable

Enterprise performance: The outcome variable was the enterprise performance. This paper measured the enterprise performance using the average of the return on equity of the enterprises from 2020 to 2022 [57].

- 2.

- Antecedent Variables

Positive technology innovation strategy: Since invention patents possess high technical complexity and are the most challenging to obtain, they represent high-level technological innovation initiatives. Therefore, the average number of invention patent applications filed by enterprises from 2020 to 2022 was used to measure the extent to which they pursued a positive technology innovation strategy.

Reactive technology innovation strategy: Since non-invention patents typically involve lower technological complexity and are relatively easier to obtain, they represent a form of low-level innovation that aligns with market development or government policies. Therefore, the average number of non-invention patent applications filed by enterprises from 2020 to 2022 was used to measure the extent to which they pursued a reactive technology innovation strategy.

Government subsidies: The average amount of income from government subsidies listed under the non-operating income of enterprises from 2020 to 2022 was used to measure the amount of government subsidies received by enterprises [58].

R&D investment: The average amount of research and development investment by enterprises from 2020 to 2022 was used to measure the amount of R&D investment [59].

Enterprise scale: This paper measured the enterprise scale based on the average of the total assets of the enterprise from 2020 to 2022.

Business credit: An improvement in an enterprise’s business credit is conducive to obtaining market resources, thereby easing resource constraints. So, this paper took (accounts payable + notes payable + accounts received in advance)/total assets as a proxy variable and took the average from 2020 to 2022 to measure the business credit [60].

4. Empirical Analyses

4.1. Calibration

In this paper, the direct calibration method proposed by Ragin was followed, and the 75%, 50%, and 25% quantiles of each conditional factor and the result variable were selected as the threshold values of the three qualitative anchor points according to the distribution of the original data. In addition, the calibrated data were adjusted by adding 0.001 to the membership quantile of 0.5. In this paper, 52 enterprise samples with all the missing data removed were selected for configuration analysis. The original data were calibrated into fuzzy set data in FS-QCA 3.0 software, and the calibration information is shown in Table 2.

Table 2.

Calibration of result variables and condition variables.

4.2. Necessary Condition Analysis

According to the requirements of the QCA method, a necessary condition analysis of the condition variables needed to be carried out before the adequacy analysis. The calibrated fuzzy set data were imported into FS-QCA 3.0 software for the necessity test, and the test results are shown in Table 3. As can be seen from Table 3, the consistency of all the conditions was less than 0.9, indicating that no single factor was a necessary condition for high or non-high enterprise performance.

Table 3.

Analysis of the necessary conditions for the performance of new energy automobile enterprises.

4.3. Regression Analysis

Before applying regression analysis to the fs-QCA configuration analysis, this paper applied an auxiliary method to identify the key influencing factors of significance. Multivariate linear regression analysis was carried out on the remaining 39 enterprises after removing the extreme values in the 5% quantile. Before the configuration analysis, the key conditions that had a significant influence on the results among the six antecedent variables were first found. The application of this method had a relatively small impact on the overall analysis results. The main reason for this was that the new energy vehicle industry itself has a relatively high market concentration. About 80% of the core observed values in the sample (such as the number of patents, amount of R&D investment, and other innovation indicators) were concentrated in the 15–85% quantile range, and the proportion of extreme values was limited. Therefore, the elimination of extreme values not only conformed to the actual situation in the industry (avoiding the distortion of conclusions due to the abnormal data of individual enterprises) but also did not affect the validity of the core research findings.

The data obtained after removing the extreme values were imported into Stata17 software for the multiple linear regression of each variable. Considering that a positive technology innovation strategy requires that enterprises actively seek technological breakthroughs and promote the research and development of new products and technologies by constantly increasing their R&D investment to maintain competitive market advantages, there was a significant correlation between the two. However, under a reactive technology innovation strategy, enterprises often rely more on government subsidies to promote technological innovation activities, and there was a significant correlation between the two. In order to avoid potential interference in the analysis conclusions, this paper also alternated the variable “positive technology innovation strategy” with “R&D investment” and “reactive technology innovation strategy” with “government subsidies”. Multiple linear regression was carried out considering different cases. Table 4 reports the regression results for each case.

Table 4.

Results of multiple linear regression.

The regression results show that “government subsidies” and “R&D investment” were significantly correlated with the performance results, and it can be assumed that they are the potential key conditions that have a significant impact on the performance results. Among them, “government subsidies” was significantly positively correlated with the performance results, and “R&D investment” was significantly negatively correlated with the performance results. In addition, “R&D investment” was the key factor affecting the performance results in all cases, and its effect was negative. This was because government subsidies directly alleviate the high R&D risks and long-term pressure specific to this industry. By reducing cash flow constraints and sharing innovation costs, they effectively encourage enterprises to expand their production capacity and upgrade their technologies. However, R&D investment showed a phased negative effect. This was mainly due to the particularities of technological iteration in the new energy vehicle industry: in the early stages of development, when the technological route has not yet converged, excessive R&D investment is prone to falling into the “innovation trap”; that is, high R&D expenditures are difficult to quickly convert into market returns and instead lead to resource misallocation and short-term financial pressure. This discovery indicates that policy support remains the key external force driving the development of the industry at the current stage, and enterprises need to balance their intensity of research and development and their pace of commercialization more precisely to avoid the diminishing marginal benefits of innovation investment.

In the case retaining the variables “positive technology innovation strategy” and “reactive technology innovation strategy”, a “reactive technology innovation strategy” and the “enterprise scale” were the key factors that significantly affected the results.

Based on the above analysis, we believe that in a strict sense, the key variable that has a significant impact on the performance of new energy vehicle enterprises is “R&D investment”, while a “reactive technology innovation strategy” and the “enterprise scale” will be affected by other factors and only become the key conditions affecting the performance of new energy vehicle enterprises in specific circumstances.

4.4. Conditional Configuration Path Analysis

Considering a single factor analysis, the sufficient causal relationship between the results and the configuration formed by the combination of different conditions is further discussed. Referring to previous studies, the frequency threshold was set to 1, the consistency threshold was set to 0.8, and the PRI value was set to 0.75.

The calibrated fuzzy set data were imported into fs-QCA 3.0 software for configuration analysis. By referring to the method proposed by Fiss, an intermediate solution was mainly reported, supplemented by the core conditions of the reduced solution screening condition configuration, and the analysis results are shown in Table 5. Table 5 shows that there were four configurations that explained the high enterprise economic performance of new energy vehicle enterprises.

Table 5.

Configuration of conditions for achieving high enterprise performance.

4.5. Configurations Which Produce High Enterprise Performance

Path 1: Economies of scale. Under this path, a positive technology innovation strategy and business credit did not exist as core conditions, and a reactive technology innovation strategy did not exist as an edge condition. In this case, the enterprise only relied on having a larger enterprise scale to achieve high economic performance. Large enterprises have constructed unique innovation paths through their scale advantages—their huge asset base not only provides a risk-buffering capacity but also provides market monopoly power, enabling them to avoid the uncertainties brought by high-risk original innovations and instead achieve performance optimization through large-scale production efficiency and supply chain control. This combination confirms the theory of the “resource substitution effect”; that is, when enterprises have specific resource advantages, they can break through the traditional linear relationship of “technological innovation—performance” and form alternative competitive advantages through resource reorganization. In the new energy vehicle industry, this explains how some large traditional automakers have achieved their market positioning using their existing production capacity rather than technological breakthroughs during their transformation. It can be seen that in the absence of government resources and market resources, larger enterprises have advantages such as talent and capital and a higher fault tolerance and risk avoidance ability, and their innovation activities are easier to carry out, so it is easier to achieve higher economic benefits. Typical examples of this path include DONGGUAN DEVELOPMENT Co., Ltd (No. 28 Dongcheng Road, Dongguan, Guangdong, China), Hyunion Holding Co., Ltd (No. 1626 Qingwei Road, Qingdao, Shandong, China), and so on.

Path 2: Research-driven with government support. Under this path, a positive technology innovation strategy and business credit do not exist as core conditions, this time relying more on R&D investment, which, supplemented by certain government subsidies, can achieve higher economic performance for enterprises. Enterprises have formed a “focused innovation” path by concentrating on R&D investment—although they have not engaged in high-risk original innovation, they have achieved gradual technological improvement through continuous R&D. Meanwhile, government subsidies have partially alleviated financial constraints. This combination avoids the supply chain risks of business credit-dependent enterprises and forms a stable innovation model of “internal R&D drive + policy support”. In the field of new energy vehicles, this corresponds to some medium-sized enterprises achieving performance improvements by researching and absorbing external technologies (such as battery optimization) rather than making original breakthroughs, using the dividends from industrial policies, which confirms the value creation logic of “focusing on specialized and refined resources” in the resource-based perspective. It can be seen that in the case of small-scale enterprises with a lack of innovation and insufficient market resources, enterprises can increase their R&D investment and cater to certain government policies to achieve higher economic performance. Typical examples of this path are Goldcup Electric Apparatus Co., Ltd (No. 580 Dongfanghong Middle Road, Changsha, Hunan, China), etc.

Path 3: A reactive strategy under policy incentives. Under this path, government subsidies exist as the core condition, R&D investment and business credit do not exist as core conditions, and R&D investment does not exist as an edge condition. In this case, enterprises can still achieve high economic performance by adopting a reactive technology innovation strategy as their main approach and a positive technology innovation strategy as an auxiliary strategy. By giving up on scale expansion and supply chain financing, enterprises concentrate their resources on developing rapid market response capabilities, make up for resource deficiencies with government subsidies, and at the same time develop differentiated competitiveness through moderate technological exploration. This innovative model of “light assets + strong policies + rapid iteration” enables enterprises to quickly transform policy dividends into market-adaptive products (such as the development of vehicle models in line with subsidy policies) in the absence of traditional resource advantages and maintain necessary technological reserves through marginal technology exploration (such as the optimization of local three-electricity systems), ultimately achieving a high-performance development path that is “small but exquisite”. It can be seen that in the case of small-scale enterprises with a lack of market resources, enterprises can achieve their goal of improving their economic benefits by catering to government policies. Typical examples of this path are Hanwei Electronics Group Corporation (No. 169 Xuesong Road, Zhengzhou, Henan, China) and so on.

Path 4: A positive strategy driven by resources. Under this path, R&D investment and the enterprise scale exist as marginal conditions, while business credit exists as a core condition. In this scenario, enterprises fully adopt positive technology innovation strategies to generate high enterprise economic performance. By giving up on policy dependence and rapid imitation strategies, enterprises focus on core technology research and development and at the same time fully leverage the role of business credit in the supply chain, forming a dual-wheel drive model of “technology leadership + market synergy”. Among the relevant variables, business credit, as the core condition, not only alleviates the cash flow pressure of R&D investment but also strengthens the control over the industrial chain. The existence of the enterprise scale as part of the marginal condition indicates that this path has relatively loose requirements for the asset scale and places more emphasis on building a light-asset competitive advantage using technological barriers and business credit. In the new energy vehicle industry, this corresponds to the typical path taken by some technology-oriented start-ups (such as the early strategy adopted by Tesla) to achieve market breakthroughs through disruptive technological innovation and innovative business models (such as direct sales + advance payment) without obtaining large-scale government subsidies. It can be seen that when government subsidies are lacking, enterprises can positively invest in product research and development through the use of their own resources and market resources and develop new industry-leading technologies, so as to achieve the goal of improving their economic benefits. Typical examples of this route include the East China Engineering Science and Technology Co., Ltd. (No. 70 Wangjiang East Road, Hefei, Anhui, China), etc.

In addition, through the horizontal comparison of configuration 3 and configuration 4, it could be found that in the case of declining government subsidy policies, enterprises’ innovation enthusiasm is enhanced, and enterprises can make use of market resources to obtain the extra capital needed for research and development. In the future, with the adjustment of government subsidy policies, enterprises can make up for the disadvantages of relying on government funds by focusing on their own resources or market resources. In addition, business credit changed from being non-existent as a core condition to existing as a core condition, indicating that with the decline in government subsidies for new energy vehicles, enterprises can change from being policy-driven to synergistically driven by market resources and internal resources and adopt positive innovation strategies to achieve higher corporate economic performance.

4.6. Robustness Test

This paper used a method of increasing the PRI consistency threshold to test the robustness. The PRI consistency was increased from 0.75 to 0.8, and there was a clear subset relationship between the new configuration and the original configuration. At the same time, the consistency and coverage of the new configuration were only slightly changed, meeting the standard of robustness for QCA results. Therefore, the research results had a certain degree of robustness.

4.7. Comparison of Configuration Results and Regression Analysis Results

The regression analysis results show that “government subsidies” had a significant positive effect on the results and “R&D investment” had a significant negative effect on the results, and the fs-QCA results show that “government subsidies” only played a core role in one type of configuration and “R&D investment” only played a core role in one type of configuration. A theoretical explanation for this phenomenon is that enterprises rely on government subsidies to adopt reactive technology innovation strategies, which can effectively reduce the cost and risk in the initial stage of entrepreneurship. The process of innovation, especially the exploration and development of new technologies, often requires a large amount of capital and resource investment, which is a heavy burden for many enterprises. Government subsidy policies can directly relieve the financial pressure on enterprises. Although this reactive technology innovation strategy may not allow enterprises to become the pioneers setting the industry trends, it can ensure that enterprises can quickly adjust and adapt to market changes and meet the market demand by imitating or improving the existing technology, so as to improve their market competitiveness and improve their performance. On the other hand, enterprises can choose to increase their R&D investment and implement a positive technology innovation strategy, which may cause the enterprise performance to weaken by a certain amount in the short term. The adoption of a positive technology innovation strategy by enterprises often requires a large amount of upfront investment, which is difficult to immediately transform into economic benefits in the short term, especially as in the process of the research and development of new technologies and new products, there are high uncertainties and risks. Therefore, in the short term, the adoption of a positive technology innovation strategy relying only on increasing R&D investment may lead to the weakening of enterprise performance. It is necessary to obtain certain market resources to make up for this, so as to achieve the goal of improving enterprise performance.

This result also confirms that configuration analysis can supplement the shortcomings of regression analysis in the process of complex causal effect analysis. A single condition factor may not have a significant impact on the result, but the combination of conditions formed by its interaction with other conditions may have a configuration effect on the result.

5. Conclusions and Contributions

5.1. Conclusions

(1) Based on the analysis framework of ambidextrous innovation theory and resource-based theory, this paper proposed four different matching combinations of technological innovation strategies and resource bases, all of which can allow enterprises to achieve high performance, indicating that the high performance of new energy vehicle enterprises does not depend solely on a single technological innovation strategy or resource element. This research shows that no single factor can constitute the only key factor determining whether new energy vehicle enterprises achieve high or low performance in the development process. On the contrary, an improvement in performance depends more on the close linkage and matching between the technology innovation strategy and enterprise resource base. This means that enterprises cannot rely on only one resource, such as sufficient capital or advanced technology, nor can they focus only on a certain innovation strategy, such as product innovation or process innovation. It is about connecting technology innovation strategies with the resource base to achieve optimal performance. This method of linkage and matching can make enterprises more flexible so that they can adapt to the changing market demand, make better use of their resource advantages, and achieve more sustainable development. Therefore, in the pursuit of high performance, new energy vehicle enterprises should focus on integrating and balancing different elements of strategy [61], so that their technological innovation strategy and resource base can be coordinated to achieve sustainable performance improvements. This comprehensive approach helps enterprises to better cope with market challenges, improve competitiveness, and lay a solid foundation for sustainable development.

(2) The empirical results only show “government subsidies” as the key condition affecting the performance of new energy vehicle enterprises; however, the fs-QCA results show that “government subsidies” only played a central role in one configuration. The difference between the two conclusions highlights the importance of “conditional combination synergy”; that is, each factor does not affect firm performance in isolation, but they are interrelated and synergistic. This finding provides a more comprehensive and in-depth perspective for us to understand the performance of new energy vehicle enterprises and also provides an important reference for policy formulation and enterprise management. At the same time, “government subsidies” are the key factors that have a significant positive effect on the performance of new energy vehicle enterprises. Considering the actual context of the decline in subsidies for new energy vehicles, new energy vehicle enterprises are facing direct economic pressure from the reduction in subsidies [62]. In the coming period of time, new energy vehicle enterprises should accelerate technology research and development and innovation, improve their battery energy density, improve their charging efficiency, and optimize their vehicle performance to meet the consumer demand for high-performance, high-quality new energy vehicles [2]. Through technological innovation, enterprises can reduce their production costs and improve their product competitiveness, thus offsetting the negative impact of subsidy reduction to a certain extent [63].

(3) There is no single and rigid path for enterprises to pursue high performance. In fact, there are many different paths to success, and through the clever combination of different technology innovation strategies and resource base elements [64], enterprises can achieve significant performance improvements [65]. This diversified performance path reflects flexibility and innovation in the development of enterprises to meet the needs of different markets and industries [66]. Based on this diversity, different enterprises can choose the development direction that suits their own circumstances. For example, some enterprises may focus on technological innovation to gain a market share and competitive advantage by constantly introducing innovative products or services [67], while others may focus more on resource optimization to improve performance by increasing their production efficiency and reducing costs [68]. Still others may be successful in achieving market expansion and internationalization to increase their sales revenue and achieve performance growth [69]. In short, enterprises have a variety of strategic choices when pursuing high performance and can flexibly apply different technological innovation and resource allocation methods according to their own characteristics, market demands, and strategic objectives [70]. This diversity reflects the complexity and multi-dimensional nature of business development, underscoring the critical role of flexibility and innovation in achieving high performance. Companies should constantly review their situation and choose the most appropriate path to achieve sustainable success and performance improvements.

5.2. Contributions

(1) Technological innovation is an indispensable path for the development of new energy automobile enterprises [6]. When choosing the technological innovation strategy suitable for their own conditions and resource advantages, new energy automobile enterprises need to carefully consider these from a comprehensive perspective. This includes giving full consideration to the resource base of enterprises in terms of their scale, R&D investment [21], government subsidies [34], business credit, etc., as well as the heterogeneous resources needed to choose a positive technology innovation strategy or reactive technology innovation strategy. Companies can choose a positive technology innovation strategy that focuses on forward-looking research and development and the establishment of market leadership, which requires more capital, talent, and R&D investment. On the other hand, reactive technology innovation strategies, which focus on quickly responding to market demands and adjustments in competitor dynamics, may require greater flexibility and market insight. Therefore, when developing a technology innovation strategy, enterprises need to have a deep understanding of their resource base and wisely choose the path that suits them. In the new energy vehicle industry, the competition for government subsidies and market competition are fierce, so the technological innovation strategies of enterprises need to take into account their market orientation and internal capabilities. A comprehensive selection of technology innovation strategies will help enterprises better match their resources with their strategies, thus improving their competitiveness and allowing them to achieve more sustainable success [71]. This strategic approach will provide important guidance for companies to achieve long-term performance excellence in an ever-changing business environment.

(2) The development of China’s new energy automobile enterprises is a systematic science involving many aspects [72], and its success not only depends on the strategic choices and wise decisions of the enterprises themselves but also requires the government to provide effective policy support for the development of the new energy automobile industry [73]. Even after the implementation of the policy decreasing new energy vehicle subsidies, the government’s policy measures still have an important impact on the performance of new energy vehicle enterprises [74]. In this context, the government needs to continue to improve and adjust policies related to new energy vehicles to ensure the sustainable development of the industry. Government policy support can play a role in many ways, including resource signaling, policy capital leverage, and innovation policy incentives. First, the government can provide strategic guidance to enterprises by providing a clear direction and goals to help them better plan their future development path. Secondly, the government can also encourage enterprises to increase their R&D investment and technological innovation and improve their production capacity by providing financial support and tax incentives. In addition, the government can also promote international cooperation in the new energy vehicle industry and strengthen the formulation and implementation of industry standards to enhance the competitiveness of Chinese new energy vehicle enterprises in the international market [75].

(3) This study provides important advice for enterprises on how to balance innovation strategies and resource allocation in an environment of policy uncertainty: the research results indicate that enterprises should establish a dynamic and adaptive innovation resource allocation mechanism instead of adopting a single and fixed strategic model. When the policy environment fluctuates, one should neither rely entirely on policy support nor completely shift to a conservative strategy. Instead, it is necessary to develop a flexible combination of resources and flexible innovation transformation capabilities. Specifically, enterprises need to strike a balance between technological breakthroughs and market adaptation in light of changes in the policy orientation—during periods with favorable policies, they can focus on forward-looking technological development, while during periods of policy tightening, they should enhance the development of their commercialization capabilities. Meanwhile, by fostering a diversified resource base (considering their R&D capabilities, supply chain relationships, and the synergy of capital operations), an internal resource resilience capable of buffering policy shocks is developed. This combination of “strategic agility + resource redundancy” enables enterprises to maintain the sustainability of their innovation activities and the effectiveness of their resource allocation in an uncertain environment, ultimately achieving stable development.

(4) With the gradual decline in the subsidies for new energy vehicles, enterprises are facing direct challenges from the reduction in government subsidies [62]. In order to cope with this change, new energy vehicle enterprises can take a series of positive measures to increase their corporate resources and market resources, adopting technological innovation as their core strategy and actively innovating to make up for the disadvantages caused by insufficient government subsidies. First, enterprises can increase their R&D investment and enhance their technological innovation capabilities. Through the introduction of advanced technology and equipment, they can improve their product performance and quality and create competitive new energy vehicle products. At the same time, enterprises can strengthen their cooperation with universities and scientific research institutions to jointly develop new technologies and promote industrial technological progress. Secondly, enterprises can actively develop their market resources and expand their sales channels. Through attaining an in-depth understanding of market needs, enterprises can launch products that meet consumer needs and increase their market share. At the same time, enterprises should adopt a positive technology innovation strategy, develop innovative technologies and products to meet the market demand, and improve their competitiveness. In the process of technological innovation and market expansion, enterprises need to pay attention to the integration and optimal allocation of resources. By strengthening their internal management, improving their production efficiency, and reducing production costs, enterprises can better cope with the pressure brought about by the reduction in subsidies. Finally, through a positive technology innovation strategy and resource integration, new energy automobile enterprises can make up for the disadvantages caused by the reduction in government subsidies, improve their corporate performance, and achieve sustainable development. This not only helps the growth of the enterprise itself but also helps to promote the prosperity and development of the new energy automobile industry.

5.3. Research Limitations and Future Prospects

At present, this paper only focuses on the static relationship between the technological innovation strategy, resource base, and economic performance of new energy vehicle enterprises. However, with the continuous development and improvement of dynamic QCA methods, future studies can consider introducing applicable temporal QCA methods to more comprehensively understand the evolution of enterprise economic performance across different periods and analyze the reasons for this dynamic evolution.

The temporal QCA method is helpful to reveal the changing trend of enterprise economic performance at different time points or across specific periods. By examining this dynamic evolution, researchers can gain a deeper understanding of the impact of technology innovation strategies and resource bases on the long-term firm performance. For example, the relationship between the time series of investment in technological innovation and performance can be analyzed to determine whether there are differences in the degree of the impact on performance over different periods. The introduction of temporal QCA can provide more insights into the dynamic relationship between the technology innovation strategy, resource base, and firm performance, helping to reveal how these factors evolve over time and affect the long-term sustainability of the firm. The application of this method will provide a more comprehensive perspective and deep understanding for the research of new energy vehicle enterprises and other fields.

Additionally, due to data availability, this paper only used 52 Chinese-listed NEV companies as its research sample, which could not cover all types and regions of enterprises. The restricted coverage of different corporate types and regions may have compromise the conclusions’ validity. Future research should consider expanding the sample size and diversifying the types of enterprises, such as by including more small- and medium-sized enterprises, private enterprises, multinational corporations, etc., to enhance the generalizability of the research findings.

Author Contributions

Conceptualization, Y.L.; methodology, Y.L.; software, Z.G.; validation, Y.L., Z.G., and Q.H.; formal analysis, Y.L.; investigation, Y.L. and Z.G.; resources, Y.L.; data curation, Z.G.; writing—original draft preparation, Y.L.; writing—review and editing, Y.L., Z.G., and Q.H.; visualization, Y.L.; supervision, Q.H.; project administration, Y.L.; funding acquisition, Y.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China (72202001), the Anhui Provincial Department of Education Natural Science Fund Outstanding Youth Project (Grant No. 2023AH030013), Youth Project of Anhui Office of Philosophy and Social Science (No. AHSKQ2022D054), and the Graduate Research Innovation Fund Project of Anhui University of Finance and Economics (ACYC2023023, ACYC2023048).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article; further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Yao, X.; Ma, S.; Bai, Y.; Jia, N. When are new energy vehicle incentives effective? Empirical evidence from 88 pilot cities in China. Transp. Res. Part A Policy Pract. 2022, 165, 207–224. [Google Scholar] [CrossRef]

- Dong, F.; Liu, Y. Policy evolution and effect evaluation of new-energy vehicle industry in China. Resour. Policy 2020, 67, 101655. [Google Scholar] [CrossRef]

- Su, C.-W.; Yuan, X.; Tao, R.; Umar, M. Can new energy vehicles help to achieve carbon neutrality targets? J. Environ. Manag. 2021, 297, 113348. [Google Scholar] [CrossRef] [PubMed]

- Kapustin, N.O.; Grushevenko, D.A. Long-term electric vehicles outlook and their potential impact on electric grid. Energy Policy 2020, 137, 111103. [Google Scholar] [CrossRef]

- Dixit, M.; Witherspoon, B.; Muralidharan, N.; Mench, M.M.; Kweon, C.-B.M.; Sun, Y.-K.; Belharouak, I. Insights into the critical materials supply chain of the battery market for enhanced energy security. ACS Energy Lett. 2024, 9, 3780–3789. [Google Scholar] [CrossRef]

- Wu, Y.; Gu, F.; Ji, Y.; Guo, J.; Fan, Y. Technological capability, eco-innovation performance, and cooperative R&D strategy in new energy vehicle industry: Evidence from listed companies in China. J. Clean. Prod. 2020, 261, 121157. [Google Scholar] [CrossRef]

- Li, F.; Xu, X.; Li, Z.; Du, P.; Ye, J. Can low-carbon technological innovation truly improve enterprise performance? The case of Chinese manufacturing companies. J. Clean. Prod. 2021, 293, 125949. [Google Scholar] [CrossRef]

- Freeman, R.E.; Dmytriyev, S.D.; Phillips, R.A. Stakeholder theory and the resource-based view of the firm. J. Manag. 2021, 47, 1757–1770. [Google Scholar] [CrossRef]

- Chege, S.M.; Wang, D. The influence of technology innovation on SME performance through environmental sustainability practices in Kenya. Technol. Soc. 2020, 60, 101210. [Google Scholar] [CrossRef]

- Shao, S.; Hu, Z.; Cao, J.; Yang, L.; Guan, D. Environmental regulation and enterprise innovation: A review. Bus. Strateg. Environ. 2020, 29, 1465–1478. [Google Scholar] [CrossRef]

- Radicic, D.; Petković, S. Impact of digitalization on technological innovations in small and medium-sized enterprises (SMEs). Technol. Forecast. Soc. Change 2023, 191, 122474. [Google Scholar] [CrossRef]

- Zhang, Z.; Luo, C.; Zhang, G.; Shu, Y.; Shao, S. New energy policy and green technology innovation of new energy enterprises: Evidence from China. Energy Econ. 2024, 136, 107743. [Google Scholar] [CrossRef]

- Cao, X.; Xing, Z.; Zhang, L. Effect of dual network embedding on the exploitative innovation and exploratory innovation of enterprises-based on the social capital and heterogeneous knowledge. Technol. Anal. Strateg. Manag. 2021, 33, 638–652. [Google Scholar] [CrossRef]

- Slavova, K.; Jong, S. University alliances and firm exploratory innovation: Evidence from therapeutic product development. Technovation 2021, 107, 102310. [Google Scholar] [CrossRef]

- Gao, Y.; Hu, Y.; Liu, X.; Zhang, H. Can public R&D subsidy facilitate firms’ exploratory innovation? The heterogeneous effects between central and local subsidy programs. Res. Policy 2021, 50, 104221. [Google Scholar] [CrossRef]

- Gotteland, D.; Shock, J.; Sarin, S. Strategic orientations, marketing proactivity and firm market performance. Ind. Mark. Manag. 2020, 91, 610–620. [Google Scholar] [CrossRef]

- Jin, J.L.; Zhou, K.Z. Is ambidextrous innovation strategy beneficial to international joint venture performance? Evidence from China. J. Int. Mark. 2021, 29, 1–21. [Google Scholar] [CrossRef]

- Sun, Y.; Liu, J.; Ding, Y. Analysis of the relationship between open innovation, knowledge management capability and dual innovation. Technol. Anal. Strateg. Manag. 2020, 32, 15–28. [Google Scholar] [CrossRef]

- Farzaneh, M.; Wilden, R.; Afshari, L.; Mehralian, G. Dynamic capabilities and innovation ambidexterity: The roles of intellectual capital and innovation orientation. J. Bus. Res. 2022, 148, 47–59. [Google Scholar] [CrossRef]

- Aydin, H. Market orientation and product innovation: The mediating role of technological capability. Eur. J. Innov. Manag. 2021, 24, 1233–1267. [Google Scholar] [CrossRef]

- Qiu, L.; Jie, X.; Wang, Y.; Zhao, M. Green product innovation, green dynamic capability, and competitive advantage: Evidence from Chinese manufacturing enterprises. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 146–165. [Google Scholar] [CrossRef]

- Wen, J.; Qualls, W.J.; Zeng, D. To explore or exploit: The influence of inter-firm R&D network diversity and structural holes on innovation outcomes. Technovation 2021, 100, 102178. [Google Scholar] [CrossRef]

- Lei, H.; Khamkhoutlavong, M.; Le, P.B. Fostering exploitative and exploratory innovation through HRM practices and knowledge management capability: The moderating effect of knowledge-centered culture. J. Knowl. Manag. 2021, 25, 1926–1946. [Google Scholar] [CrossRef]

- Yang, T.; Xing, C.; Li, X. Evaluation and analysis of new-energy vehicle industry policies in the context of technical innovation in China. J. Clean. Prod. 2021, 281, 125126. [Google Scholar] [CrossRef]

- Ardito, L.; Raby, S.; Albino, V.; Bertoldi, B. The duality of digital and environmental orientations in the context of SMEs: Implications for innovation performance. J. Bus. Res. 2021, 123, 44–56. [Google Scholar] [CrossRef]

- Mahoney, J.T.; Pandian, J.R. The resource-based view within the conversation of strategic management. Strateg. Manag. J. 1992, 13, 363–380. [Google Scholar] [CrossRef]

- Gerhart, B.; Feng, J. The resource-based view of the firm, human resources, and human capital: Progress and prospects. J. Manag. 2021, 47, 1796–1819. [Google Scholar] [CrossRef]

- Tang, Z.; Hull, C.E.; Rothenberg, S. How corporate social responsibility engagement strategy moderates the CSR–financial performance relationship. J. Manag. Stud. 2012, 49, 1274–1303. [Google Scholar] [CrossRef]

- Jafari-Sadeghi, V.; Mahdiraji, H.A.; Bresciani, S.; Pellicelli, A.C. Context-specific micro-foundations and successful SME internationalisation in emerging markets: A mixed-method analysis of managerial resources and dynamic capabilities. J. Bus. Res. 2021, 134, 352–364. [Google Scholar] [CrossRef]

- Kusa, R.; Duda, J.; Suder, M. How to sustain company growth in times of crisis: The mitigating role of entrepreneurial management. J. Bus. Res. 2022, 142, 377–386. [Google Scholar] [CrossRef]

- Zhang, Y.; Hou, Z.; Yang, F.; Yang, M.M.; Wang, Z. Discovering the evolution of resource-based theory: Science mapping based on bibliometric analysis. J. Bus. Res. 2021, 137, 500–516. [Google Scholar] [CrossRef]

- Varadarajan, R. Resource advantage theory, resource based theory, and theory of multimarket competition: Does multimarket rivalry restrain firms from leveraging resource advantages? J. Bus. Res. 2023, 160, 113713. [Google Scholar] [CrossRef]

- Hadjimanolis, A. A resource-based view of innovativeness in small firms. Technol. Anal. Strateg. Manag. 2000, 12, 263–281. [Google Scholar] [CrossRef]

- Lin, R.; Xie, Z.; Hao, Y.; Wang, J. Improving high-tech enterprise innovation in big data environment: A combinative view of internal and external governance. Int. J. Inf. Manag. 2020, 50, 575–585. [Google Scholar] [CrossRef]

- Jung, S.H.; Feng, T. Government subsidies for green technology development under uncertainty. Eur. J. Oper. Res. 2020, 286, 726–739. [Google Scholar] [CrossRef]

- Li, J.; Ku, Y.; Yu, Y.; Liu, C.; Zhou, Y. Optimizing production of new energy vehicles with across-chain cooperation under China’s dual credit policy. Energy 2020, 194, 116832. [Google Scholar] [CrossRef]

- Wen, H.; Lee, C.-C.; Zhou, F. How does fiscal policy uncertainty affect corporate innovation investment? Evidence from China’s new energy industry. Energy Econ. 2022, 105, 105767. [Google Scholar] [CrossRef]

- Alqahtani, N.; Uslay, C. Entrepreneurial marketing and firm performance: Synthesis and conceptual development. J. Bus. Res. 2020, 113, 62–71. [Google Scholar] [CrossRef]

- Purchase, S.; Volery, T. Marketing innovation: A systematic review. J. Mark. Manag. 2020, 36, 763–793. [Google Scholar] [CrossRef]

- Zhou, H.; Li, L. The impact of supply chain practices and quality management on firm performance: Evidence from China’s small and medium manufacturing enterprises. Int. J. Prod. Econ. 2020, 230, 107816. [Google Scholar] [CrossRef]

- Lin, Q.; Zhang, T. Trade credit in economic fluctuations and its impact on corporate performance: A panel data analysis from China. Appl. Econ. 2020, 52, 1–18. [Google Scholar] [CrossRef]

- Lv, C.; Fan, J.; Lee, C.-C. Can green credit policies improve corporate green production efficiency? J. Clean. Prod. 2023, 397, 136573. [Google Scholar] [CrossRef]

- Le, T.T. Corporate social responsibility and SMEs’ performance: Mediating role of corporate image, corporate reputation and customer loyalty. Int. J. Emerg. Mark. 2023, 18, 4565–4590. [Google Scholar] [CrossRef]

- Arora, A.; Belenzon, S.; Sheer, L. Knowledge spillovers and corporate investment in scientific research. Am. Econ. Rev. 2021, 111, 871–898. [Google Scholar] [CrossRef]

- Lin, W.L.; Ho, J.A.; Sambasivan, M.; Yip, N.; Mohamed, A.B. Influence of green innovation strategy on brand value: The role of marketing capability and R&D intensity. Technol. Forecast. Soc. Change 2021, 171, 120946. [Google Scholar] [CrossRef]

- Shao, K.; Wang, X. Do government subsidies promote enterprise innovation?—Evidence from Chinese listed companies. J. Innov. Knowl. 2023, 8, 100436. [Google Scholar] [CrossRef]

- Assefa, D.Z.; Liao, C.T.; Misganaw, B.A. Unpacking the negative impact of initial informality on innovation: The mediating roles of investments in R&D and employee training. Technovation 2022, 114, 102455. [Google Scholar] [CrossRef]

- Liu, Y.; Collinson, S.; Cooper, C.; Baglieri, D. International business, innovation and ambidexterity: A micro-foundational perspective. Int. Bus. Rev. 2022, 31, 101852. [Google Scholar] [CrossRef]

- Jancenelle, V.E. Tangible-Intangible resource composition and firm success. Technovation 2021, 108, 102337. [Google Scholar] [CrossRef]

- Ferreras-Méndez, J.L.; Llopis, O.; Alegre, J. Speeding up new product development through entrepreneurial orientation in SMEs: The moderating role of ambidexterity. Ind. Mark. Manag. 2022, 102, 240–251. [Google Scholar] [CrossRef]

- Jiang, L.; Bai, Y. Strategic or substantive innovation?—The impact of institutional investors’ site visits on green innovation evidence from China. Technol. Soc. 2022, 68, 101904. [Google Scholar] [CrossRef]

- Baah, C.; Opoku-Agyeman, D.; Acquah, I.S.K.; Agyabeng-Mensah, Y.; Afum, E.; Faibil, D.; Abdoulaye, F.A.M. Examining the correlations between stakeholder pressures, green production practices, firm reputation, environmental and financial performance: Evidence from manufacturing SMEs. Sustain. Prod. Consum. 2021, 27, 100–114. [Google Scholar] [CrossRef]

- Tang, K.; Qiu, Y.; Zhou, D. Does command-and-control regulation promote green innovation performance? Evidence from China’s industrial enterprises. Sci. Total Environ. 2020, 712, 136362. [Google Scholar] [CrossRef]

- Thiem, A.; Duşa, A. Boolean minimization in social science research: A review of current software for Qualitative Comparative Analysis (QCA). Soc. Sci. Comput. Rev. 2013, 31, 505–521. [Google Scholar] [CrossRef]

- Pappas, I.O.; Woodside, A.G. Fuzzy-set Qualitative Comparative Analysis (fsQCA): Guidelines for research practice in Information Systems and marketing. Int. J. Inf. Manag. 2021, 58, 102310. [Google Scholar] [CrossRef]

- Fiss, P.C. Building better causal theories: A fuzzy set approach to typologies in organization research. Acad. Manag. J. 2011, 54, 393–420. [Google Scholar] [CrossRef]

- Achi, A.; Adeola, O.; Achi, F.C. CSR and green process innovation as antecedents of micro, small, and medium enterprise performance: Moderating role of perceived environmental volatility. J. Bus. Res. 2022, 139, 771–781. [Google Scholar] [CrossRef]

- Xu, J.; Wang, X.; Liu, F. Government subsidies, R&D investment and innovation performance: Analysis from pharmaceutical sector in China. Technol. Anal. Strateg. Manag. 2021, 33, 535–553. [Google Scholar] [CrossRef]

- Boeing, P.; Eberle, J.; Howell, A. The impact of China’s R&D subsidies on R&D investment, technological upgrading and economic growth. Technol. Forecast. Soc. Change 2022, 174, 121212. [Google Scholar] [CrossRef]

- Cao, Z.; Chen, S.X.; Lee, E. Does business strategy influence interfirm financing? Evidence from trade credit. J. Bus. Res. 2022, 141, 495–511. [Google Scholar] [CrossRef]

- Wu, Z.; Pagell, M. Balancing priorities: Decision-making in sustainable supply chain management. J. Oper. Manag. 2011, 29, 577–590. [Google Scholar] [CrossRef]

- Ji, S.-f.; Zhao, D.; Luo, R.-j. Evolutionary game analysis on local governments and manufacturers’ behavioral strategies: Impact of phasing out subsidies for new energy vehicles. Energy 2019, 189, 116064. [Google Scholar] [CrossRef]

- Barauskaite, G.; Streimikiene, D. Corporate social responsibility and financial performance of companies: The puzzle of concepts, definitions and assessment methods. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 278–287. [Google Scholar] [CrossRef]

- Mahmood, T.; Mubarik, M.S. Balancing innovation and exploitation in the fourth industrial revolution: Role of intellectual capital and technology absorptive capacity. Technol. Forecast. Soc. Change 2020, 160, 120248. [Google Scholar] [CrossRef]

- Wang, M.; Li, Y.; Li, J.; Wang, Z. Green process innovation, green product innovation and its economic performance improvement paths: A survey and structural model. J. Environ. Manag. 2021, 297, 113282. [Google Scholar] [CrossRef]

- Lin, H.-E.; Hsu, I.-C.; Hsu, A.W.; Chung, H.-M. Creating competitive advantages: Interactions between ambidextrous diversification strategy and contextual factors from a dynamic capability perspective. Technol. Forecast. Soc. Change 2020, 154, 119952. [Google Scholar] [CrossRef]

- Azeem, M.; Ahmed, M.; Haider, S.; Sajjad, M. Expanding competitive advantage through organizational culture, knowledge sharing and organizational innovation. Technol. Soc. 2021, 66, 101635. [Google Scholar] [CrossRef]

- Maddikunta, P.K.R.; Pham, Q.-V.; Prabadevi, B.; Deepa, N.; Dev, K.; Gadekallu, T.R.; Ruby, R.; Liyanage, M. Industry 5.0: A survey on enabling technologies and potential applications. J. Ind. Inf. Integr. 2022, 26, 100257. [Google Scholar] [CrossRef]

- Freixanet, J.; Rialp, J. Disentangling the relationship between internationalization, incremental and radical innovation, and firm performance. Glob. Strateg. J. 2022, 12, 57–81. [Google Scholar] [CrossRef]

- Yang, D.; Wei, Z.; Shi, H.; Zhao, J. Market orientation, strategic flexibility and business model innovation. J. Bus. Ind. Mark. 2020, 35, 771–784. [Google Scholar] [CrossRef]

- Tu, Y.; Wu, W. How does green innovation improve enterprises’ competitive advantage? The role of organizational learning. Sustain. Prod. Consum. 2021, 26, 504–516. [Google Scholar] [CrossRef]

- Li, J.; Jiao, J.; Xu, Y.; Chen, C. Impact of the latent topics of policy documents on the promotion of new energy vehicles: Empirical evidence from Chinese cities. Sustain. Prod. Consum. 2021, 28, 637–647. [Google Scholar] [CrossRef]

- Yu, F.; Wang, L.; Li, X. The effects of government subsidies on new energy vehicle enterprises: The moderating role of intelligent transformation. Energy Policy 2020, 141, 111463. [Google Scholar] [CrossRef]

- Jiang, Z.; Xu, C. Policy incentives, government subsidies, and technological innovation in new energy vehicle enterprises: Evidence from China. Energy Policy 2023, 177, 113527. [Google Scholar] [CrossRef]

- Zhao, D.; Ji, S.-f.; Wang, H.-p.; Jiang, L.-w. How do government subsidies promote new energy vehicle diffusion in the complex network context? A three-stage evolutionary game model. Energy 2021, 230, 120899. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).