Abstract

Based on sample data from A-share listed heavy polluters from 2012 to 2021, this paper adopts the double-difference method to explore the influence of the construction of national pilot zone for ecological conservation on the ESG performance of heavily polluting enterprises. Following several robustness tests, this study argues that the ESG performance of heavy-polluting companies is significantly enhanced by the construction of the national pilot zone for ecological conservation. Specifically, the construction of the pilot zone enhances the ESG performance of heavy polluters by easing financing constraints. The enhancing effect of the construction of the pilot zone on the ESG performance of heavy polluters is more prominent in terms of strengthening social responsibility and optimizing governance structure. Additionally, improving heavily polluting enterprises’ ESG performance is demonstrated to effectively enhance their financial performance. The facilitating effect of the construction of the pilot zone on ESG performance is more obvious among state-owned enterprises, enterprises with high media attention, enterprises established at a late stage, and enterprises with high-quality environmental information disclosure. This study offers an empirical foundation for the government to develop policies regarding the establishment of pilot zones and for heavily polluting enterprises to enhance their ESG performance.

1. Introduction

Humankind’s survival and advancement have faced serious threats in recent years due to factors such as desertification, biodiversity loss, and the increasing frequency of catastrophic weather events. The advancement of ecological civilization and the preservation of the ecological environment have been top priorities for the CPC Central Committee since the 18th National Congress [1]. The construction of ecological civilization involves changes in the mode of production, values, and other aspects, and is the key to building a new pattern of modernization in which man and nature coexist in harmony.

In 2016, the CPC Central Committee and the State Council issued Opinions on the Establishment of a Unified and Standardized National Pilot Zone for Ecological Conservation. The first batch of national ecological civilization pilot zones was set up in Fujian, Jiangxi, and Guizhou provinces [2]. Then, in 2020, the National Development and Reform Commission (NDRC) issued the Promotion List of Reform Measures and Experience Practices of the National Ecological Civilization Pilot Zone, promoting a total of 90 reform initiatives, experiences, and practices. The series of initiatives highlights China’s determination to focus on building an ecological civilization and resolutely abandon development models that damage or even destroy the ecological environment. As an important measure to promote the construction of ecological civilization, the policy effect of the construction of the national pilot zone for ecological civilization has attracted widespread attention.

In 2004, the United Nations Global Compact (UNGC) released the report “Who Cares Wins” at the Global Compact Leaders Summit, which explicitly mentioned the ESG concept for the first time. ESG is the acronym for Environmental, Social, and Governance and is used to measure the sustainability of corporate development. The United Nations Principles for Responsible Investment (UNPRI) was established in 2006. Subsequently, the ESG investment concept was officially proposed. The global financial crisis of 2008 forced nations to take action after realizing the importance of the ESG investment concept. For instance, in 2011, the Singapore Exchange released the Sustainability Reporting Guidelines for Listed Companies and the Sustainability Reporting Policy Statement. In the context of China’s commitment to sustainable development and high-quality development, it is of great significance for companies to practice ESG concepts [3]. However, the development of ESG concepts in China is relatively late, and most listed companies have only started to publish their ESG information in recent years [4]. Currently, ESG practices still face difficulties such as high input costs and uncertain output [5].

As the backbone of the microeconomy, businesses are essential to sustainable development since they are the primary consumers of resources and important players in green growth. Businesses that pollute a lot, in particular, cannot overlook their environmental harm while fostering economic expansion. A total of 42 industrial sectors released 1.803 million tons of sulfur dioxide, with the top five heavily polluting industries accounting for 92.8% of the emissions, according to statistics from the 2023 Annual Report of China’s Ecological and Environmental Statistics. Due to the impact of factors such as excessive pollution emissions from heavily polluting enterprises and the insufficient enforcement of government environmental regulations, some heavily polluting enterprises lack the incentive to proactively enhance their environmental practices. The United Nations Summit on Sustainable Development adopted the 2030 Agenda for Sustainable Development and established 17 sustainable development goals. The international community’s increasingly stringent environmental governance is forcing heavily polluting companies to focus on environmental, social, and governance issues. Thus, it is crucial to figure out how to help heavily polluting enterprises enhance their ESG performance.

An important manifestation of corporate sustainability is environmental, social, and governance (ESG) performance [6], and the degree of ESG performance is closely related to the efficiency of policy formulation and implementation. Therefore, it is necessary to examine the impact of the national ecological civilization pilot zone construction policy on the ESG performance of heavy-polluting enterprises.

The existing literature on the policy effect analysis of the construction of the national ecological civilization pilot zone still needs to be enriched. Most of the literature discusses the policy effect based on the macro-level and pays less attention to the policy effect at the micro-level. For example, Liu, Liu, Zheng, and Zhang [2] discussed and summarized the progress of the construction of three pilot zones in Fujian, Jiangxi, and Guizhou provinces from the city perspective. Lee and Nie [7] found that the policy of the national ecological civilization pilot zone construction has a positive impact on green innovation, based on the panel data of 282 cities and using a double-difference model. There is ample research on the economic consequences and influencing factors of ESG performance. On the one hand, corporate ESG performance can alleviate the mismatch of maturity [8] and promote the reduction of carbon emissions [9]. On the other hand, green factory certification [10], central environmental protection inspection [11], and the implementation of the Environmental Protection Tax Law [12] can improve corporate ESG performance, while carbon control policy risks can harm corporate ESG performance [6]. Previous studies have used the multi-period double-difference method to explore the impact of equity incentives on corporate ESG performance [13]. However, based on the policy of national ecological civilization pilot zone construction, the research on the influencing factors of enterprise ESG performance needs to be further explored.

In summary, this paper takes the construction of the first batch of national ecological civilization pilot zones as a quasi-natural experiment, takes A-share listed heavy polluters as the research object from 2012 to 2021, and uses the double-difference method to explore the impact of the construction of the national ecological civilization pilot zone on the ESG performance of heavy polluters. We focus on the following questions: (1) Can the construction of the pilot zone have an impact on the ESG performance of heavy polluters? (2) If it can have an impact, what is the specific mechanism of action? (3) Are all dimensions of ESG performance of heavy-polluting enterprises affected in the same way? (4) What is the economic consequence of the ESG performance of heavy polluters? (5) Is there heterogeneity in the ESG performance of heavily polluting enterprises?

The possible marginal contributions lie in the following points: First, in terms of the research object, it focuses on the specific production and operation subjects of heavily polluting enterprises, which provides micro-level empirical evidence for the assessment of the policy effect of the construction of the national ecological civilization pilot zone. Second, in terms of research method, based on the double-difference method and using the quasi-natural experiment of the construction of the national ecological civilization pilot zone, the endogenous problem can be somewhat mitigated. Third, in terms of research content, the analysis is based on the perspective of the construction of the national ecological civilization pilot zone, which expands the relevant research on the factors influencing the ESG performance of heavy polluters.

2. Literature Review

Ecological civilization is a new type of human civilization that emphasizes the balance and coordination between ecological environmental protection and economic development [14]. An assessment index system for the development of ecological civilization from several angles was built by earlier research, specifically, scholars designed the ECC index system [15], and the ECI framework [16]. As far as the degree of coupling of ecological civilization construction is concerned, Ge et al. [17] constructed a comprehensive indicator system applicable to large regions and multiple cities and evaluated the coupled and coordinated development of ecological civilization construction and urbanization. Chai et al. [18] established a performance evaluation index system for urban water ecological civilization construction and analyzed the coupling relationship between socio-economics and urban water ecology. In addition, to achieve sustainable urbanization, it is crucial to enhance the well-being of urban residents within limited ecological resources [19]. In the discussion of the policy evaluation aspect of the construction of the pilot zone, Hou et al. [20] concluded that the policy of the national pilot zone for ecological conservation has a positive influence on green innovation.

The main focus in the study of ESG performance is on both its economic consequences and the factors that influence it. Specifically, among the analyses concerning economic consequences, Friede et al. [21] examined the positive relationship between ESG factors and financial performance by synthesizing findings from over 2000 empirical studies. Being subjected to financial penalties is harmful to the reputation of banks; therefore, it is necessary for banks to improve their reputation by adopting ESG practices [22]. ESG performance can enhance the quantity and quality of corporate green innovation [23], reduce corporate default risk [24], and increase corporate value [25]. However, some scholars found that the process of conducting ESG performance increases costs and harms firms’ financial performance [26]. In a study about influencing factors, Yang et al. [27] argued that the participation of state-owned shareholders improves the ESG performance of private firms. Digital transformation [28,29] and banking relationships [30] improve corporate ESG performance. Husted and Sousa-Filho [31] found that the presence of independent directors and larger board sizes enhances ESG disclosure. In addition, the adoption of ESG Pay is accompanied by relative improvements in ESG ratings [32].

3. Theoretical Analysis and Research Hypothesis

The construction policy of the experimental zone is a beneficial exploration to strengthen the construction of the ecological civilization system and optimize industrial structure and consumption mode. Based on the signal transmission theory, the government issued a series of environmental protection policies and regulations to convey the signal to the heavy-polluting enterprises that the pilot zone attaches importance to sustainable development, forcing the heavy-polluting enterprises to adjust their production strategies to meet the policy requirements and improve the ESG performance. Heavy polluting enterprises in the pilot zone can form an ecological industrial chain with other enterprises and scientific research institutions, realize resource sharing and complementary advantages, and improve ESG performance.

First of all, heavy polluting enterprises in the ecological civilization pilot zone need to establish an environmental risk assessment and management system to identify and deal with potential environmental risks, which is conducive to reducing the probability of environmental accidents. Secondly, according to the theory of social responsibility, as society evolves, people’s concerns about businesses shift from maximizing profits to fulfilling social obligations, which forces businesses to take on social responsibility. For instance, through policy guidance, the pilot zone promotes heavily polluting enterprises to actively participate in social responsibility projects, such as community construction, public welfare, and charity, to enhance the social responsibility of heavily polluting enterprises. Although the construction of the ecological civilization pilot zone will increase the environmental treatment investment of heavily polluting enterprises, this initiative will also create more employment opportunities and enhance the employment level. In addition, it is widely recognized by corporate managers that CSR activities help build social capital and trust [33]. Lastly, to meet the requirements of policy assessment in the pilot zone, heavy-polluting enterprises will choose to optimize their management mechanism, reduce inefficient behaviors caused by poor management, and optimize the governance structure.

The continuous operation of enterprises needs to rely on the stable flow of capital [34]. The construction of the national ecological civilization pilot zone provides new development ideas for heavy-polluting enterprises. Specifically, ESG performance is optimized by easing financing constraints. The theory of financing constraints suggests that an enterprise’s ability to raise capital is affected by a variety of factors, including internal cash flow, external financing costs, and financing channels [35]. The aggravation of financing constraints can create significant cash flow pressure and operational risks for firms engaged in pollution control, impede their emission reduction work, and cause significant disruptions to the real economy [36]. As the pilot zone supports qualified heavy-polluting enterprises to issue green bonds, encourages banks and other financial institutions to provide green credit, and provides special financial support, the availability of funds for heavy-polluting enterprises is improved. The easing of financing constraints prompts heavily polluting firms to use funds for quality certification and employee training, which reduces the likelihood of legal and reputational problems and positively affects ESG performance. Well-funded heavy-polluting companies are more likely to attract high-quality board members and establish effective internal controls, which in turn improves ESG performance.

Based on the above analysis, the following hypothesis is proposed:

H1.

The construction of the national pilot zone for ecological conservation enhances the ESG performance of heavy polluters.

4. Research Design

4.1. Sample Selection and Data Source

In this paper, the data of A-share listed heavy polluters from 2012 to 2021 were selected as samples. Heavily polluting enterprises are recognized in 16 industries, including coal, mining, textiles, tanning, and so on. This paper’s specific variable processing procedure is as follows: (1) Samples were excluded from non-heavily polluting industries; (2) to reduce the influence of outliers on the research results, the specially marked samples such as ST and *ST were eliminated; (3) because Hainan Province was established as the second batch of the national ecological civilization pilot zone in 2019, samples with firms located in Hainan Province in 2019 and later were excluded to prevent their interference with the empirical results; and (4) the continuous variables were shrink-tailed at the 1% to 99% quantile to eliminate the impact of extreme values. Ultimately, 8624 samples were collected.

The ESG performance data came from the WIND database, the media attention data came from the CNRDS database, and the rest came from the CSMAR database.

4.2. Definition of Variable

4.2.1. Explained Variable

ESG performance: ESG performance is an investment philosophy and evaluation standard that focuses on the environment, social, and corporate governance. The ESG performance of businesses was measured in this article using Huazheng ESG rating indicators. Huazheng ESG rating refers to the international mainstream ESG evaluation system and incorporates domestic unique economic indicators into the evaluation system in combination with the actual situation of Chinese listed companies. The Huazheng ESG rating was summarized from three dimensions: environmental (E), social (S), and corporate governance (G). Climate change, resource utilization, environmental pollution, environmental friendliness, and environmental management are the five topics that are covered by the environmental dimension. Five themes are covered by the social dimension: human capital, product responsibility, suppliers, social contribution, and data security and privacy. The corporate governance dimension covers six themes: shareholder rights, governance structure, disclosure quality, governance risk, external sanctions, and business ethics. The ESG rating is divided into nine grades, from low to high, namely, C, CC, CCC, B, BB, BBB, A, AA, and AAA. Next, a nine-point system was used to assign points to each of the nine grades from C to AAA, with the higher the score representing the better the ESG performance of the enterprise. That is, when the rating is C, ESG performance is 1; when the rating is CC, ESG performance is 2; when the rating is CCC, ESG performance is 3, and so on.

4.2.2. Explanatory Variable

The construction of national pilot zones for ecological conservation: The provinces of Guizhou, Jiangxi, and Fujian were designated as the first group of national ecological civilization pilot zones in 2016. This paper uses a double-difference model to analyze the policy impact of national ecological civilization pilot zone construction on the ESG performance of heavily polluting companies, using the first batch of national ecological civilization pilot zone construction as a quasi-natural experiment. The dummy variable TT, which is produced by the interplay of Treat and Time, was used to gauge the net effect of the policy. Among them, Treat is a dummy variable for the policy test area, taking the first batch of the national ecological civilization pilot area (Fujian, Jiangxi, and Guizhou provinces) as the experimental group and the rest of the provinces as the control group. Treat takes the value of 1 when the location of the firm is in the experimental group category and 0 when the location of the firm is in the control group category. Time is a dummy variable for the time of the policy implementation, which takes the value of 1 when the time is 2016 and beyond and 0 for the rest of the time.

4.2.3. Control Variable

Firm age can reflect different maturities and affect its resource allocation and investment preference. Firms with an earlier founding date have more resources to devote to ESG investing but may also be more inclined to conservative investment strategies. Although enterprises established later are limited by resources, they may have a stronger willingness to invest in ESG.

The size of an enterprise is often related to the complexity and perfection of its governance structure. Larger companies often have better corporate governance structures, including environmental management and social responsibility departments, which can help improve ESG performance.

A company’s governance structure and decision-making mechanism are reflected in the size of the board of directors. More expertise and resources may be brought in with a larger board, which affects ESG performance.

Management’s behavioral choices are influenced by its ownership stake. Higher shareholding management might be more focused on ESG investments.

The book-to-market ratio affects how businesses allocate their resources and make decisions. Firms with high book-to-market ratios may be more inclined to focus on long-term projects.

Research reports’ level of focus reflects how transparent a company’s information is. Companies that receive high attention typically need to disclose ESG information more openly and transparently.

Companies with varying ownership types may have various governance structures and incentive mechanisms. State-owned enterprises are usually subject to more administrative intervention, while non-state-owned enterprises lack policy support, which affects the decision making and implementation of ESG.

To enable a more accurate evaluation of the independent effects of the national ecological civilization pilot zone’s construction on the ESG performance of heavily polluting companies, this paper introduces the control variables: firm age, firm size, board size, management shareholding, book-to-market ratio, attention by research reports, and nature of property right. Additionally, individual fixed effects and time fixed effects were introduced to the regression to control the possible impact of individual factors and time trends. The following Table 1 is a definition of the specific variables:

Table 1.

Definition of variables.

4.3. Model Construction

To identify the influence of the pilot zone construction on the ESG performance of heavy polluters, the following double-difference model was constructed:

where denotes the ESG performance of heavy polluting firm i in year t, indicates the policy effect of the construction of the pilot zone, denotes the selected control variables, denotes the random disturbance term, denotes the individual fixed effect, and denotes the time-fixed effect. In addition, to improve the accuracy and robustness of the estimation, this paper clusters the standard errors at the firm level.

5. Empirical Analysis

5.1. Descriptive Statistics

Table 2 shows the descriptive statistics of the main variables, the maximum value of ESG performance is 6, the minimum value is 1, and the standard deviation is large, which indicates that there are differences in the ESG performance ability of heavy polluters, but, from the mean value of 4.1027, the general grade is B, i.e., the ESG performance of heavy polluters needs to be improved. The influence of outliers on the results is eliminated because the values of the control variables are essentially consistent with predictions.

Table 2.

Descriptive statistics.

5.2. Benchmark Regression Analysis

The following are the regression results of the influence of the construction of the pilot zone on the ESG performance of heavy pollution businesses (Table 3). In column 1, fixing only individual and time effects and not including control variables, the coefficient of the construction of the pilot zone is 0.2756, which is significant at the 5% level. In column 2, fixing individual and time effects, and with the addition of control variables, the coefficient of the construction of the pilot zone is 0.3854, which is significant at a 1% level. This suggests that the policy shock of the construction of the pilot zone has a promoting utility on the ESG performance of heavy polluters, and hypothesis H1 is confirmed. The construction of the pilot zone can provide policy support and guidance, accelerate industrial upgrading and technological innovation, strengthen platform cooperation and resource sharing, and effectively improve the ESG performance of heavy-polluting enterprises.

Table 3.

Benchmark regression analysis.

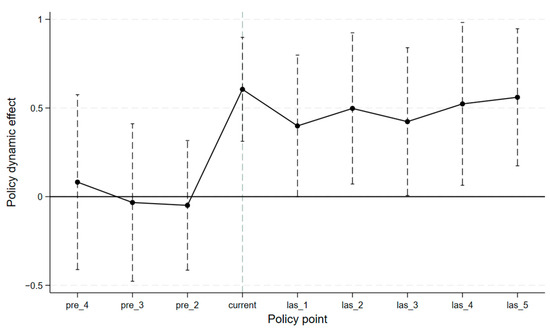

5.3. Parallel Trend Test

The parallel trend test should be passed to use the double-difference method for the empirical analysis. This paper defines the year 2016 as current, the year before policy implementation as pre_1, the two years before policy implementation as pre_2, the three years before policy implementation as pre_3, and the four years before policy implementation as pre_4. Likewise, one year following the policy’s introduction can be designated as las_1, and so on to produce las_2, las_3, las_4, las_5. On this basis, pre_1 is used as the base period. Referring to the practice of Beck et al. [37], there are several main steps. First, the mean value before the implementation of the policy is calculated. Specifically, since pre_1 is the base period and has been deleted, three periods are remaining before the policy is implemented, and the mean value before the policy is obtained by calculating the sum of the coefficients of the remaining three periods before the policy is implemented and dividing by the number of periods. Next, the regression coefficients and confidence intervals for each period are de-meaned to deal with the pre-policy trend as best as possible. Finally, the new coefficient after the de-mean is extracted, and the trend graph is drawn. Figure 1 displays the results of the parallel trend test. Before the construction of the pilot zone, the experimental and control groups did not differ significantly, and the regression coefficients of pre_4, pre_3, and pre_2 are not significant. However, after the construction of the pilot zone, the regression coefficients become significant overall, satisfying the parallel trend test, excluding the differences in the ESG performance of heavily polluting enterprises caused by different time trends, and capable of identifying the policy influence of the construction of the pilot zone using the double-difference method.

Figure 1.

Parallel trend test.

5.4. Robustness Test

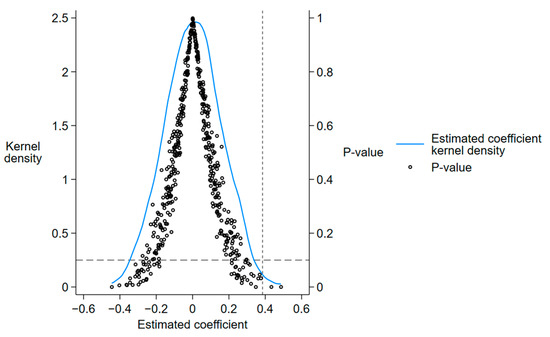

5.4.1. Placebo Test

- (1)

- Randomized sample test

Although the parallel trend test proves that improvements in the environmental, social, and governance performance of heavily polluting firms are driven by policy for the construction of pilot zones, to avoid the benchmark regression results caused by some chance factors, referring to La Ferrara et al. [38], random sampling is used to construct sham experimental and control groups. The kernel density and p-value distribution of the estimated coefficients in the 500 times placebo test for the experimental and control groups that are randomly selected are presented in Figure 2. The figure shows the kernel density and p-value on the y-axis, the estimated coefficients of the randomly generated policy on the x-axis, the true estimated coefficients on the dashed line parallel to the y-axis, and the dashed line parallel to the x-axis represents the 10% p-value level, where the curve is the kernel density distribution of the estimated coefficients, and the scatter represents the p-value corresponding to the estimated coefficients. The regression coefficients obey a normal distribution and are concentrated around 0. There is a certain difference between the estimated values of true coefficients and the kernel density distribution of false regression coefficients. Moreover, the p-value of the vast majority of the regression coefficients is greater than 0.1, which is not significant. Therefore, the benchmark regression results are not affected by other unobservable factors.

Figure 2.

Randomized sample test.

- (2)

- Counterfactual test

In addition to the policy change in the construction of the pilot zone, other random factors may also lead to differences in the ESG performance of heavy polluters, which are not related to the construction of the pilot zone, leading to the previous conclusion that is not valid. In this paper, we advance the implementation time of the construction of the pilot zone policy by three years, construct the dummy variable Time2 of the false policy implementation time, and cross-multiply it with Treat to construct a new dummy variable TT2 for regression to avoid the difference in the ESG performance of heavy polluters caused by the time change. Column 1 of Table 4 displays the regression results, and the coefficient of TT2 is not significant, suggesting that the pilot zone’s construction has a genuine influence on the ESG performance of highly polluting businesses.

Table 4.

Robustness test-1.

5.4.2. Increasing Industry Fixed Effect

To reduce the impact of interfering factors as much as possible, industry fixed effects are added based on fixed individual and year effects. The coefficient of the construction of the pilot zone is still significantly positive, as shown in column 2 of Table 4, demonstrating the validity of the earlier findings.

5.4.3. PSM-DID Estimation Method

There may still be some selective bias in the real operation process, even though the double-difference approach can effectively identify the impact of the construction of the pilot zone on the ESG performance of heavy polluters. To overcome this issue, the PSM-DID approach is used in this paper. Control variables such as firm age, firm size, board size, and management shareholding are selected as covariates, and, based on the 0.01 caliper range, 1:2, 1:3, and 1:4 nearest neighbor matching is performed. The matching results show that the standardized deviation (%bias) of all variables is less than 10%, and the p value is greater than 0.05, so the null hypothesis of no systematic difference between the treatment group and the control group cannot be rejected, and the balance test is passed. The impact of the national ecological civilization pilot zone’s construction policy on the ESG performance of heavy polluters is then re-identified using the double-difference method after the unmatched samples have been removed. The regression results are displayed in columns 1 through 3 of Table 5. The coefficients of the explanatory variables are all significantly positive, indicating that the construction of the pilot zone can enhance the ESG performance of heavy polluters, the original model does not have serious sample selection bias problems, and the conclusion drawn is reliable.

Table 5.

Robustness test-2.

5.4.4. Excluding Special Year

The outbreak of COVID-19 has exerted an impact on the production and operation decisions of enterprises. Therefore, this paper excludes the sample data of 2020 and 2021 for regression. The results in column 1 of Table 6 show that there is no significant change in the coefficient of the construction of pilot zone, which further verifies the robustness of the conclusion.

Table 6.

Robustness test-3.

5.4.5. Replacement of the Measurement of the Explained Variable

In this paper, the score of the ESG performance of heavy polluters is incorporated into the model as a new explained variable for regression. According to the regression results in Table 6’s column 2, the pilot zone construction coefficient is positive at the 1% level, which is in line with the findings of the earlier study.

6. Further Analysis

6.1. Mechanism Analysis

The construction of the pilot zone is positively correlated with the ESG performance of heavy polluters, according to the above research. Consequently, the specific mechanism is further discussed, and the mediating effect models are constructed as follows:

where stands for the financial constraint of heavy polluter firm i in year t. It is measured using the KZ index, where a larger KZ index indicates a more severe financing constraint suffered by the firm. The rest of the variables are consistent with the previous section.

The regression results of mediating variable financial constraints are shown in Table 7. According to the regression results in column 1, the coefficient of the construction of the pilot zone is −0.6436, which is significant at the 5% level, indicating that the construction of the pilot zone can alleviate the financing constraints faced by heavy-polluting enterprises. As can be seen from the regression results in column 2, the construction of the pilot zone has a coefficient of 0.2893, which is significant at the 5% level, and the financing constraints have a coefficient of −0.0408, which is significant at the 1% level. These findings suggest that the construction of the pilot zone can alleviate financial constraints, which enhances ESG performance. Financing constraints can cause firms’ investments to deviate from the optimal level [39], which ultimately restricts firms’ growth and hinders their development [40]. Information asymmetry is the main reason why firms face financing constraints [41]. In the pilot zone, heavy-polluting enterprises are encouraged to prepare and publish social responsibility reports and environmental reports, which reduces the degree of information asymmetry, improves the relationship with stakeholders, and alleviates the financing constraints faced by heavy-polluting enterprises. The improved availability of funds enables heavy-polluting enterprises to properly plan and implement development strategies and improve ESG performance.

Table 7.

Mechanism analysis.

6.2. Single-Dimension Analysis of ESG Performance

The ESG rating is constructed from the three dimensions of environment, social, and corporate governance according to the corresponding weights. It can be seen from the previous section that the impact of the construction of the pilot zone on the ESG performance of heavy-polluting enterprises is significantly positive. We further analyze whether the impact of the construction of the pilot zone on the ESG performance sub-dimensions is consistent. The detailed regression results are shown in Table 8. The coefficients of both the social and corporate governance dimensions are significantly positive. Although the coefficient of the environmental dimension is positive, it is not significant. Therefore, the improvement of ESG performance of heavily polluting enterprises by the construction of the pilot zone is more prominent in terms of undertaking social responsibility and optimizing governance structure, while it needs to be further improved in terms of environmental protection.

Table 8.

Single-dimension analysis of ESG performance.

On the one hand, the construction of the pilot zone can attract investors who are concerned about social responsibility and then guide heavy-polluting enterprises to take the initiative to improve employee welfare and participate in community construction. To cope with environmental risks, heavily polluting businesses in the pilot zone will improve their compliance management and internal controls, thus improving the level of governance. On the other hand, compared with other heavy-polluting enterprises, heavy-polluting enterprises in the pilot zone need to comply with stricter environmental protection standards and regulations. With the increase in pressure, some heavy-polluting enterprises may have environmental violations. At this time, the effect of the pilot zone construction policy on environmental improvement is limited. The construction of the pilot zone may have enhanced the public and media supervision of heavy-polluting enterprises, and any environmental problems of heavy-polluting enterprises are likely to be amplified. In addition, heavy-polluting enterprises often have problems such as low technical levels and obsolete equipment. However, technical optimization and equipment upgrades require a lot of time and capital, which makes it difficult to achieve results in a short period, resulting in a relatively slow improvement of the environment by the construction of the pilot zone.

6.3. Analysis of Economic Consequence

The construction of the pilot zone can promote the ESG performance of heavy-polluting enterprises and attract wide attention in the capital market. Due to the limited resources, heavily polluting enterprises cannot meet all their business needs by relying on their own accumulated resources. Then, can heavy-polluting enterprises benefit from the enhancement of ESG performance? Therefore, the changes in financial performance due to the ESG performance of heavy polluters are further analyzed. The financial performance of heavily polluting enterprises is measured in this article using the return on total assets, which comprehensively reflects their operating capacity, solvency, anti-risk capabilities, etc. The model is built as follows:

where stands for the financial performance of heavy polluter firm i in year t, and the rest as above.

The regression results of the impact of ESG performance on the financial performance of heavily polluting enterprises are shown in Table 9. It can be found that the coefficient of ESG performance is significantly positive, which means that the improvement of ESG performance promotes the growth of financial performance. The possible reasons for this are the following: First, corporate ESG performance brings advantages to business operations by sending positive signals and reducing transaction costs [42]. Second, ESG disclosure establishes informal complementary norms to discipline earnings management through accounting channels, thereby reducing opacity and financial irregularities [43]. Third, good ESG performance not only enhances a firm’s reputation and brand image [3] but also serves as a competitive means against risk [44]. Fourth, treating ESG performance as a resource investment can generate a differentiating advantage over competitors in the same industry, leading to greater economic benefits.

Table 9.

Analysis of economic consequence.

To test the robustness of the above finding, this paper changes the proxy variable and selects return on net assets as the explained variable for regression. According to the regression results in Table 10, it can be seen that the coefficient of ESG performance is significantly positive, indicating that ESG performance promotes the growth of financial performance and the conclusion is robust.

Table 10.

Robustness test for economic consequence.

It is evident from the above analysis that ESG performance has a positive effect on financial performance. However, enterprises with high financial performance may further improve ESG performance, and, at this time, ESG performance becomes the result of financial performance improvement. To address the endogeneity problem due to reverse causation, this paper re-estimates the regression using two-stage least squares. This paper chooses the average value of ESG performance in the industry year as the instrumental variable. The ESG performance of each enterprise will be affected by the ESG performance of its industry, which meets the condition of relevance. Industry ESG performance does not directly affect the financial performance of a certain enterprise, which meets the condition of exogeneity.

The regression findings for the first and second stages are shown in Table 11. According to the regression results, the regression coefficient of the impact of the instrumental variable on ESG performance in the first stage is 0.7792, which is significant at the level of 1%, indicating that there is a significant positive correlation between the instrumental variable and enterprise ESG performance. The value of the Kleibergen-Paap rk LM statistic is 47.083, which is significant at the 1% level and can reject the hypothesis that the instrumental variable is unidentifiable. The value of the Kleibergen-Paap rk Wald F statistic is 54.976, which exceeds the critical value for weak instrumental variables in Stock Yogo and can reject the hypothesis of weak instrumental variables. In the second stage of regression results, the regression coefficient of the effect of ESG performance on financial performance is significantly positive. Therefore, after solving the endogeneity problem that exists by constructing an instrumental variable, ESG performance still enhances the financial performance of heavy polluters.

Table 11.

Endogenous treatment of economic consequence.

6.4. Heterogeneity Analysis

6.4.1. Nature of Property Right

The construction of the pilot zone has a varying effect on heavy polluters’ ESG performance depending on the nature of property rights. Referring to the study of Li et al. [45], this paper divides the sample into state-owned enterprise and non-state-owned enterprise groups for regression. In this case, state-owned enterprises are assigned a value of 1, and non-state-owned enterprises are assigned a value of 0. The regression results are demonstrated in columns 1 and 2 of Table 12. The coefficient of only state-owned heavy polluters is significantly positive, suggesting that the construction of the pilot zone has a significant policy impact on state-owned heavy polluters’ ESG performance. State-owned enterprises, which bear an important mission given by the state to maintain social and economic stability as well as sustainable development [46], are the main regulatory targets of the pilot zone construction policy, focusing on reducing the dependence on the traditional production mode with high pollution and high energy consumption and shifting to a more environmentally friendly and sustainable production mode. However, to survive and grow, non-state-owned heavy polluters may have to contend with intense market competition. They prioritize short-term economic gains and profits over the construction of pilot zones, which results in their underinvestment in corporate governance, society, and the environment.

Table 12.

Heterogeneity analysis-1.

6.4.2. Media Attention

Media attention can increase a company’s visibility, leading to greater public attention and scrutiny [47]. To investigate the impact of the construction of the pilot zone on the ESG performance of heavy-polluting enterprises with different media attention levels, this paper conducts the following heterogeneity analysis. First, similar to the study by Feng et al. [48], we measure media attention by adding 1 to the number of newspaper media reports and taking the logarithm afterward. Second, the samples are grouped according to the median media attention, the samples with media attention above the median are assigned a value of 1, and the samples below the median are assigned a value of 0. Finally, the grouped samples are included in the regression model. The regression results based on media attention are displayed in columns 3 and 4 of Table 12. The construction of the pilot zone has a considerable policy influence on the ESG performance of heavy polluters with high media attention, as evidenced by the significantly positive coefficient of high media attention and the non-significant coefficient of low media attention. Media attention is essentially a signaling process [49]. The impact of information asymmetry and cognitive differences on the market is lessened when media professionals with professional information mining skills transform the information about the construction of pilot zones and the ESG performance of heavy polluters into more readable reports and deliver them to information users. The media can influence public perceptions and evaluations of a business [50], which provides direction for management to understand the needs of stakeholders. However, for firms that pollute heavily with insufficient media coverage, the outside world does not know enough about their environmental protection efforts, and the likelihood of utilizing the policies of the pilot zone construction to improve ESG performance becomes smaller.

6.4.3. Time of Establishment

The influence of the construction of the pilot zone on the ESG performance of heavily polluting enterprises may be heterogeneous due to the different establishment times of enterprises. Referring to the research of Bai and Meng [51], the age of a company is measured by the difference between the observation year and the establishment year. Next, according to the median age of enterprises, the sample is divided into two groups: enterprises established earlier and enterprises established later. Then, regression is performed on the two sets of samples. The regression results in columns 1 and 2 of Table 13 demonstrate that the late-established heavy-polluting firms’ coefficient is significantly positive, whereas the early-established heavy-polluting firms’ coefficient is insignificant. This shows that the construction of the pilot zone significantly improves the ESG performance of heavy-polluting enterprises established late. The pilot zone emphasizes the importance of green innovation and ecological protection, which points out the direction for the late-established heavy-polluting enterprises. By citing environmental protection technologies, they quickly gained a foothold in the green industry. However, heavily polluting enterprises established early may have developed a fixed production and business model and are relatively less adaptable and flexible to policies. These enterprises still need to look for new development opportunities in the market environment.

Table 13.

Heterogeneity analysis-2.

6.4.4. Quality of Environmental Disclosure

Environmental information disclosure reflects enterprises’ cognition of environmental problems and their ability to solve them [52]. This paper selects the quality of environmental information disclosure as a proxy variable, which covers eight aspects such as the environmental protection concept and environmental protection goal. When the enterprise discloses relevant information, the value is 1; when the enterprise does not disclose relevant information, the value is 0. Next, the scores are summarized to produce data on the quality of environmental disclosures. Finally, the sample is divided into groups with high and low degrees of disclosure according to the median quality of environmental information disclosure. The construction of the pilot zone has a facilitating effect on ESG performance among heavy polluters with a high level of environmental information disclosure, as indicated by the regression findings in Table 13’s columns 3 and 4. The construction of the pilot zone is usually accompanied by a series of policy incentives, which may provide tax incentives, financial subsidies, etc., to heavily polluting enterprises with high-quality environmental information disclosure to enhance sustainable development and achieve a virtuous cycle. When the quality of environmental information disclosure is low, it will lead to an increase in the costs of environmental investment and taxes [53], and the construction of the pilot zone has a more limited effect on the ESG performance of heavy polluters.

7. Conclusions and Recommendations

7.1. Conclusions

Based on the signal transmission theory, stakeholder theory, and other theories, this paper takes the construction of the national pilot zones for ecological civilization in 2016 as a quasi-natural experiment, selects the data of A-share listed companies from 2012 to 2021 as the research object, adopts the difference-in-differences method, takes heavy polluting enterprises as the entry point, and explores the impact of the construction of the pilot zone on ESG performance. In addition, this paper further analyzes the mediating role of financing constraints, the differential impact of the construction of the pilot zone on the three dimensions of ESG performance of heavy polluters, the economic consequence of ESG performance of heavy polluters, and the heterogeneity of ESG performance of heavy polluters.

After a series of tests, including the parallel trend test and the placebo test, and so on, the results show that the construction of the pilot zone has a positive impact on the ESG performance of heavy polluters. Specifically, the alleviation of financing constraints is the mechanism by which the construction of the pilot zone enhances the ESG performance of heavy-polluting enterprises. In the exploration of the differential impact of the three dimensions of ESG performance of heavy polluters, it is found that the improvement of ESG performance of heavily polluting enterprises by the construction of the pilot zone is more prominent in strengthening social responsibility and optimizing governance structure, while the improvement of ESG performance of heavily polluting enterprises by the construction of the pilot zone needs to be further optimized in protecting the environment. When exploring the economic consequence of ESG performance of heavily polluting firms, ESG performance is found to be effective in enhancing financial performance, a finding that remains valid after robustness test and endogeneity treatment. Heterogeneity analysis shows that the promotion effect of the construction of pilot zone on ESG performance is more significant in the heavily polluting enterprises with state-owned, high media attention, late establishment, and high level of environmental information disclosure, while the promotion effect of the construction of pilot zone on ESG performance still has room for improvement in the heavy polluting enterprises with not state-owned, low media attention, early establishment, and low level of environmental information disclosure.

Based on the national ecological civilization pilot zone construction policy as the starting point and based on the era background of sustainable development, this paper seeks the path to improve the ESG performance of heavy polluting enterprises, tries to enrich the relevant research on the governance effect of the national ecological civilization pilot zone construction on the ESG performance of heavy polluting enterprises, and provides an empirical basis for the government to formulate the pilot zone construction policy and the heavy polluting enterprises to improve the ESG performance. Nevertheless, there are still some limitations in this study, which are as follows:

First, this study primarily examines the policy effects of constructing the first batch of national ecological civilization pilot zones, without considering the potential contributions of Hainan Province as part of the second batch of such pilot zones. In subsequent research, we aim to conduct a comprehensive analysis of the policy impacts across multiple batches of national ecological civilization pilot zone constructions. Second, this paper focuses on the influence of the policy of the pilot zone construction on the ESG performance of heavily polluting enterprises, without accounting for the possible effects of other policies. In future studies, we will explore the impact of other policies on the ESG performance of heavy-polluting enterprises and make a comparative analysis of the effects of different policies.

7.2. Recommendations

At present, China’s economic situation is in a good situation of relatively stable, sustained growth, with a steady increase in economic and environmental benefits. To further promote the construction of ecological civilization and realize the sustainable development of heavy pollution enterprises, based on the above research conclusions, this paper puts forward the following suggestions.

On the one hand, the government should continue to promote the construction of the national pilot zone for ecological civilization. First, it is necessary to improve laws and regulations related to the pilot zone’s construction, strengthen supervision over environmental compliance behaviors of heavy polluters, and establish effective constraints. Second, a governmental financing guarantee institution should be established to provide credit guarantees for heavy polluters with strong ESG performance, thereby enhancing their chances of successful financing. Third, differentiated guidance programs should be developed to assist various types of heavy polluters in improving their ESG performance. Specifically, state-owned enterprises should be encouraged to innovate in green technology and products, serving as exemplary models. Meanwhile, the approval process for environmental protection projects should be optimized to offer convenient services to non-state-owned enterprises. Public opinion guidance should be strengthened to encourage enterprises with high media attention to continuously enhance their ESG performance, while enterprises with low media attention should be required to improve information transparency and accept social supervision. Early-established enterprises should be helped with overcoming challenges during their transformation processes, while late-established enterprises should be guided to integrate ESG performance optimization into their strategic planning. Enterprises with high-quality environmental information disclosure should be encouraged to further enhance their ESG performance, while those with low-quality environmental information disclosure should receive guidance and training.

On the other hand, heavily polluting enterprises should embrace the concept of sustainable development and strive to enhance their ESG performance. First, such enterprises should integrate ESG principles into their practices, making efforts to reduce environmental pollution, fulfill social responsibilities, and optimize governance structures. Second, these enterprises should strengthen the trust of investors and financial institutions by providing detailed disclosures of pollutant emissions, participating in environmental public welfare activities, and exploring green credit, thereby alleviating the financing constraints that they encounter. Furthermore, heavily polluting enterprises should develop personalized strategies for improving ESG performance based on characteristics such as ownership structure, media attention, and the quality of environmental information disclosure. Specifically, state-owned enterprises, enterprises with high media attention, enterprises with late establishment dates, and enterprises with high-quality environmental information disclosure should leverage their advantages to contribute to the construction of ecological civilization. Conversely, for non-state-owned enterprises, enterprises with low media attention, enterprises with earlier establishment, and enterprises with low quality of environmental information disclosure, it is critical to stimulate their dynamics for green transformation. Overall, heavily polluting enterprises should actively seize the opportunities presented by the construction of national pilot zones for ecological civilization to achieve comprehensive improvements in ESG performance levels within the pilot zones.

Author Contributions

Conceptualization, W.S.; methodology, W.S.; validation, L.Z.; formal analysis, W.S. and L.Z.; data curation, L.Z.; writing—original draft, W.S. and L.Z.; writing—review and editing, W.S. and L.Z.; funding acquisition, W.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by the National Social Science Fund General Project of China [grant number 22BJL047].

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available upon request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Fan, Z.; Deng, C.; Fan, Y.; Zhang, P.; Lu, H. Spatial-Temporal Pattern and Evolution Trend of the Cultivated Land Use Eco-Efficiency in the National Pilot Zone for Ecological Conservation in China. Int. J. Environ. Res. Public Health 2022, 19, 111. [Google Scholar] [CrossRef] [PubMed]

- Liu, D.; Liu, T.; Zheng, Y.; Zhang, Q. The construction efficiency study of China National Ecological Civilization Pilot Zone with network SBM model: A city-based analysis. Environ. Sci. Pollut. Res. 2023, 30, 47685–47698. [Google Scholar] [CrossRef] [PubMed]

- Zhao, C.; Wang, Z.; Tang, Y.; Yang, F. ESG performance, green technology innovation, and corporate value: Evidence from industrial listed companies. Alex. Eng. J. 2025, 123, 369–380. [Google Scholar] [CrossRef]

- Sun, L.; Zhang, X.; Zhao, Z.; Zhang, J. ESG is conducive to improving the operating efficiency of fishery enterprises—Based on DEA model and Tobit regression analysis. Reg. Stud. Mar. Sci. 2025, 85, 104158. [Google Scholar] [CrossRef]

- Gao, D.; Tan, L.; Chen, Y. Smarter is greener: Can intelligent manufacturing improve enterprises’ ESG performance? Humanit. Soc. Sci. Commun. 2025, 12, 529. [Google Scholar] [CrossRef]

- Shu, H.; Tan, W. Does carbon control policy risk affect corporate ESG performance? Econ. Model. 2023, 120, 106148. [Google Scholar] [CrossRef]

- Lee, C.-C.; Nie, C. Place-based policy and green innovation: Evidence from the national pilot zone for ecological conservation in China. Sustain. Cities Soc. 2023, 97, 104730. [Google Scholar] [CrossRef]

- Zhang, W.; Wen, H. Cracking the investment and financing dilemma for clean upgrading of carbon-intensive enterprises. Environ. Dev. Sustain. 2025. [Google Scholar] [CrossRef]

- Li, J.; Xu, X. Can ESG rating reduce corporate carbon emissions?—An empirical study from Chinese listed companies. J. Clean. Prod. 2024, 434, 140226. [Google Scholar] [CrossRef]

- Lin, H.; Ying, Q. The impact of green factory certification on ESG performance among selected Chinese companies. Environ. Dev. Sustain. 2025, 1–28. [Google Scholar] [CrossRef]

- Wang, L.; Le, Q.; Peng, M.; Zeng, H.; Kong, L. Does central environmental protection inspection improve corporate environmental, social, and governance performance? Evidence from China. Bus. Strategy Environ. 2023, 32, 2962–2984. [Google Scholar] [CrossRef]

- He, Y.; Zhao, X.; Zheng, H. How does the environmental protection tax law affect firm ESG? Evidence from the Chinese stock markets. Energy Econ. 2023, 127, 107067. [Google Scholar] [CrossRef]

- Wang, H.; Liu, H. Effects of equity incentives on corporate ESG performance–Multiperiod difference-in-differences method. Financ. Res. Lett. 2025, 79, 107191. [Google Scholar] [CrossRef]

- Zhang, L.; Wang, H.; Zhang, W.; Wang, C.; Bao, M.; Liang, T.; Liu, K.-D. Study on the development patterns of ecological civilization construction in China: An empirical analysis of 324 prefectural cities. J. Clean. Prod. 2022, 367, 132975. [Google Scholar] [CrossRef]

- Yan, X.; Sun, Q. How to Evaluate Ecological Civilization Construction and Its Regional Differences: Evidence from China. Sustainability 2023, 15, 12543. [Google Scholar] [CrossRef]

- Zhang, L.; Yang, J.; Li, D.; Liu, H.; Xie, Y.; Song, T.; Luo, S. Evaluation of the ecological civilization index of China based on the double benchmark progressive method. J. Clean. Prod. 2019, 222, 511–519. [Google Scholar] [CrossRef]

- Ge, S.; Zeng, G.; Yang, Y.; Hu, H. The coupling relationship and spatial characteristics analysis between ecological civilization construction and urbanization in the Yellow River Economic Belt. J. Nat. Resour. 2021, 36, 87–102. [Google Scholar] [CrossRef]

- Chai, N.; Zhou, W.; Wan, B. Research on performance evaluation and obstacle diagnosis for urban water ecological civilization construction based on GFAHP-cloud-FSE model: The case of Shizuishan, China. Stoch. Environ. Res. Risk Assess. 2022, 36, 3439–3465. [Google Scholar] [CrossRef]

- Bian, J.; Ren, H.; Liu, P. Evaluation of urban ecological well-being performance in China: A case study of 30 provincial capital cities. J. Clean. Prod. 2020, 254, 120109. [Google Scholar] [CrossRef]

- Hou, J.; Zhou, R.; Ding, F.; Guo, H. Does the construction of ecological civilization institution system promote the green innovation of enterprises? A quasi-natural experiment based on China’s national ecological civilization pilot zones. Environ. Sci. Pollut. Res. 2022, 29, 67362–67379. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Murè, P.; Spallone, M.; Mango, F.; Marzioni, S.; Bittucci, L. ESG and reputation: The case of sanctioned Italian banks. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 265–277. [Google Scholar] [CrossRef]

- Zhang, H.; Lai, J.; Jie, S. Quantity and quality: The impact of environmental, social, and governance (ESG) performance on corporate green innovation. J. Environ. Manag. 2024, 354, 120272. [Google Scholar] [CrossRef]

- Li, H.; Zhang, X.; Zhao, Y. ESG and Firm’s Default Risk. Financ. Res. Lett. 2022, 47, 102713. [Google Scholar] [CrossRef]

- Cheng, R.; Kim, H.; Ryu, D. ESG performance and firm value in the Chinese market. Invest. Anal. J. 2024, 53, 1–15. [Google Scholar] [CrossRef]

- Lu, P.; Hamori, S.; Tian, S. Policy effect of the “blue sky plan” on air pollution, ESG investment, and financial performance of China’s steel industry. Front. Environ. Sci. 2022, 10, 955906. [Google Scholar] [CrossRef]

- Yang, X.; Zhang, K.; Gao, P.; Yang, Z. State-owned shareholders’ participation and environmental, social, and governance performance of private firms: evidence from China. Appl. Econ. 2024, 1–22. [Google Scholar] [CrossRef]

- Lu, Y.; Xu, C.; Zhu, B.; Sun, Y. Digitalization transformation and ESG performance: Evidence from China. Bus. Strategy Environ. 2024, 33, 352–368. [Google Scholar] [CrossRef]

- Wang, J. Digital transformation, environmental regulation and enterprises’ ESG performance: Evidence from China. Corp. Soc. Responsib. Environ. Manag. 2025, 32, 1567–1582. [Google Scholar] [CrossRef]

- Houston, J.F.; Shan, H. Corporate ESG Profiles and Banking Relationships. Rev. Financ. Stud. 2022, 35, 3373–3417. [Google Scholar] [CrossRef]

- Husted, B.W.; Sousa-Filho, J.M.d. Board structure and environmental, social, and governance disclosure in Latin America. J. Bus. Res. 2019, 102, 220–227. [Google Scholar] [CrossRef]

- Cohen, S.; Kadach, I.; Ormazabal, G.; Reichelstein, S. Executive Compensation Tied to ESG Performance: International Evidence. J. Account. Res. 2023, 61, 805–853. [Google Scholar] [CrossRef]

- Lins, K.V.; Servaes, H.; Tamayo, A.N.E. Social Capital, Trust, and Firm Performance: The Value of Corporate Social Responsibility during the Financial Crisis. J. Financ. 2017, 72, 1785–1824. [Google Scholar] [CrossRef]

- Dai, Y.; He, R. The Impact of Carbon Emissions Trading Policy on the ESG Performance of Heavy-Polluting Enterprises: The Mediating Role of Green Technological Innovation and Financing Constraints. Sustainability 2025, 17, 1365. [Google Scholar] [CrossRef]

- Cheng, X.; Zheng, Y.; Tu, Y. Research on the dynamic interaction effects of litigation events, financing constraints, and the risk of corporate stock price crashes. Int. Rev. Econ. Financ. 2025, 99, 104008. [Google Scholar] [CrossRef]

- Zhang, P.; Qi, J. Carbon emission regulation and corporate financing constraints: A quasi-natural experiment based on China’s carbon emissions trading mechanism. J. Contemp. Account. Econ. 2025, 21, 100452. [Google Scholar] [CrossRef]

- Beck, T.; Levine, R.; Levkov, A. Big Bad Banks? The Winners and Losers from Bank Deregulation in the United States. J. Financ. 2010, 65, 1637–1667. [Google Scholar] [CrossRef]

- La Ferrara, E.; Chong, A.; Duryea, S. Soap Operas and Fertility: Evidence from Brazil. Am. Econ. J. Appl. Econ. 2012, 4, 1–31. [Google Scholar] [CrossRef]

- Zhang, M.; Bao, Z.; Chen, B.; Yu, F. Can enhanced intra-regional transport accessibility alleviate corporate financing constraints? Evidence from China. Pac.-Basin Financ. J. 2025, 91, 102724. [Google Scholar] [CrossRef]

- Zhou, S.; He, Q.; Zhao, T. How does improvements in regional security level mitigate corporate financing constraints? Financ. Res. Lett. 2025, 79, 107293. [Google Scholar] [CrossRef]

- Myers, S.C.; Majluf, N.S. Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef]

- Ren, L.; Gao, S.; Yang, F. ESG performance, supply chain relationship stability and enterprise technology innovation. Ind. Manag. Data Syst. 2025, 125, 1892–1914. [Google Scholar] [CrossRef]

- Yuan, X.; Li, Z.; Xu, J.; Shang, L. ESG disclosure and corporate financial irregularities—Evidence from Chinese listed firms. J. Clean. Prod. 2022, 332, 129992. [Google Scholar] [CrossRef]

- Li, T.-T.; Wang, K.; Sueyoshi, T.; Wang, D.D. ESG: Research progress and future prospects. Sustainability 2021, 13, 11663. [Google Scholar] [CrossRef]

- Li, C.; Yang, H.; Li, J.; Tao, C.; Zhong, Y. Do private placements exacerbate the degree of asset mispricing? A study based on theories of information asymmetry and signaling. Borsa Istanb. Rev. 2025, 25, 240–252. [Google Scholar] [CrossRef]

- Cheng, H.; Cao, A.; Hong, C.; Liu, D.; Wang, M. Can green investors improve the quality of corporate environmental information disclosure? Int. Rev. Econ. Financ. 2025, 98, 103901. [Google Scholar] [CrossRef]

- Prior, D.; Surroca, J.; Tribó, J.A. Are Socially Responsible Managers Really Ethical? Exploring the Relationship Between Earnings Management and Corporate Social Responsibility. Corp. Gov. Int. Rev. 2008, 16, 160–177. [Google Scholar] [CrossRef]

- Feng, H.; Zhang, Z.; Wang, Q.; Yang, L. Does a Company’s Position within the Interlocking Director Network Influence Its ESG Performance?—Empirical Evidence from Chinese Listed Companies. Sustainability 2024, 16, 4190. [Google Scholar] [CrossRef]

- Xi, K.; Shao, X. Impact of AI applications on corporate green innovation. Int. Rev. Econ. Financ. 2025, 99, 104007. [Google Scholar] [CrossRef]

- Wang, W.; Cao, Q.; Li, Z.; Zhu, J. Digital transformation and corporate environmental performance. Financ. Res. Lett. 2025, 76, 106936. [Google Scholar] [CrossRef]

- Bai, G.; Meng, D. Assessing Influence Mechanism of Management Overconfidence, Corporate Environmental Responsibility and Corporate Value: The Moderating Effect of Government Environmental Governance and Media Attention. Int. J. Environ. Res. Public Health 2023, 20, 577. [Google Scholar] [CrossRef] [PubMed]

- Feng, C.; Cheng, X.; Luo, J.; Zheng, H.; Wang, M. Can corporate site visits by institutional investors improve the quality of corporate environmental information disclosure? Evidence from China. Int. Rev. Financ. Anal. 2025, 102, 104138. [Google Scholar] [CrossRef]

- Yang, X.; Zheng, C.; Wang, M. The impact of environmental information disclosure quality on corporate value: The mediating role of innovation investment. Financ. Res. Lett. 2025, 79, 107304. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).