Abstract

The increasing economic engagement of China in Africa through foreign direct investment (FDI) and trade has raised concerns about its environmental consequences, particularly resource depletion. While the existing literature highlights the role of FDI and trade in resource exploitation, the varying impacts across governance contexts remain underexplored. This study investigates how Chinese FDI and trade influence resource depletion in Africa, integrating institutional and resource curse perspectives to explain divergent outcomes. Using dynamic panel data models and the system generalized method of moments (SGMM) to address endogeneity, we analyze data from 28 African countries between 1998 and 2022. The results show that Chinese FDI significantly accelerates resource depletion—particularly total resources, energy, and forests—especially in low-governance countries. In contrast, Chinese trade exhibits a limited relationship with depletion, with significant effects only on energy resources in weak institutional settings. Notably, neither FDI nor trade has significant effects in high-governance countries, underscoring the protective role of strong institutions. The study contributes to the literature by demonstrating how governance quality mediates the environmental impacts of Chinese economic engagements. It offers policy insights for African nations, emphasizing institutional strengthening to align foreign investments and trade with sustainable resource management. These findings call for balanced economic policies that prioritize environmental sustainability alongside economic growth.

1. Introduction

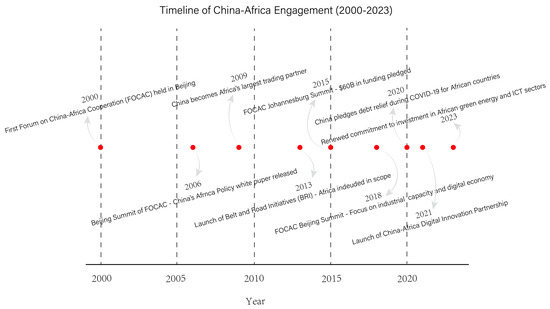

The engagement between China and Africa over the past two decades has significantly reshaped the socioeconomic, environmental, and political landscapes of the African continent [1]. Figure 1 shows the journey of China–Africa engagement. At the heart of this relationship lies a profound reliance on the extraction and trade of Africa’s abundant natural resources, which has become a cornerstone of China’s global economic strategy. These resources, ranging from oil and natural gas to timber and minerals such as cobalt, lithium, and rare-earth elements, are pivotal to China’s rapid industrialization and its ambition to lead technological advancements, particularly in renewable energy and electric vehicles [2]. While this engagement offers substantial economic opportunities for Africa [3], it also brings into sharp focus the sustainability of resource extraction practices, the governance of natural resources, and the accompanying environmental and social implications [4]. This study investigates the dual impact of Chinese investment in Africa, specifically examining the trade-offs between economic gains and the depletion of natural resources.

Figure 1.

Timeline of China–Africa engagement.

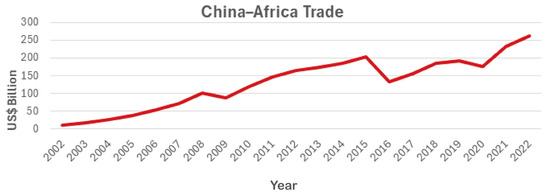

China’s involvement in Africa spans a wide array of economic activities, including bilateral trade, foreign direct investment (FDI), concessional development loans, and technical assistance [5]. Over the last two decades, bilateral trade has increased dramatically, rising from approximately CNY 10 billion in 2000 to over CNY 200 billion by 2020, making China the continent’s largest trading partner [5,6]. This trade relationship is complemented by significant Chinese FDI, which is predominantly directed toward resource-rich sectors in countries like Angola, Nigeria, Zambia, and the Democratic Republic of Congo (DRC) [5]. These investments are often executed through innovative mechanisms, such as resource-for-infrastructure agreements, whereby African countries receive concessional loans to finance critical infrastructure projects, including roads, railways, ports, and power plants, in exchange for the supply of raw materials [7]. Such arrangements highlight the centrality of Africa’s natural resources in the China–Africa partnership, facilitating mutual benefits but also raising questions about their long-term consequences.

However, current scholarship tends to oscillate between two dominant narratives—either portraying China as Africa’s benevolent development partner [8] or as a neo-colonial power exploiting the continent’s resources [9]—without adequately capturing the nuanced reality where economic benefits and environmental costs often coexist. A significant limitation in the existing literature is its predominant focus on macroeconomic indicators and geopolitical considerations while paying insufficient attention to the environmental externalities of resource extraction. Although case studies have highlighted specific instances of environmental degradation, such as deforestation in Gabon [10] or water pollution in the DRC’s cobalt mines [11], there remains a lack of systematic, cross-country empirical analyses examining how different forms of Chinese economic engagement affect various categories of natural resources. Furthermore, while governance challenges have been acknowledged as a contextual factor [4], few studies have quantitatively examined how institutional quality mediates the relationship between Chinese economic activities and resource depletion across different African countries.

This study addresses these gaps by providing a comprehensive empirical analysis of how Chinese FDI and trade impact resource depletion across 28 African countries from 1998 to 2022 while explicitly accounting for the moderating role of governance quality. By employing dynamic panel data models and the system generalized method of moments (SGMM) to address endogeneity concerns, we offer robust evidence that Chinese FDI significantly accelerates resource depletion, particularly in countries with weak governance structures, while the effects of trade are more limited and resource-specific. Our findings challenge the binary narratives prevalent in the existing literature by demonstrating that the environmental impact of Chinese engagement is not uniform but rather contingent upon the institutional context of host countries.

The theoretical contribution of this study lies in its integration of resource curse and institutional theories to explain the divergent environmental outcomes of Chinese economic activities across different governance contexts. Methodologically, we advance beyond case study approaches by providing comparative quantitative evidence across multiple resource categories and national contexts. From a policy perspective, our findings underscore the importance of strengthening institutional frameworks in African countries to ensure that resource extraction contributes to sustainable development while also suggesting the need for Chinese investors to adopt more environmentally responsible practices, particularly in weakly governed contexts. By bridging the gap between economic and environmental analyses of China–Africa relations, this study provides a more nuanced understanding of the complex trade-offs involved in this increasingly important international partnership.

The remainder of the paper is organized as follows: Section 2 discusses prior studies and argues how Chinese investment and trade are related to resource depletion. In Section 3, we present the research design, and Section 4 contains the results and discussions. The conclusion and policy implications are presented in Section 5.

2. Research Hypothesis and Modeling

2.1. Research Hypothesis

The economic relationship between China and Africa, characterized by substantial foreign direct investment (FDI) and bilateral trade, presents a complex scenario that warrants systematic empirical investigation. Drawing upon resource curse theory and existing empirical evidence, this study develops three key hypotheses to examine how Chinese economic engagement influences natural resource depletion across African countries.

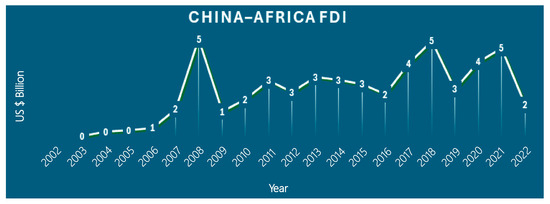

The resource curse literature [12,13] suggests that foreign investment in extractive industries tends to accelerate resource depletion while providing limited long-term economic benefits. Chinese FDI in Africa, which reached CNY 3.94 billion in 2023 [14], has been predominantly directed toward resource extraction sectors, including oil, minerals, and timber. This concentrated investment pattern creates conditions for rapid resource depletion through several mechanisms.

First, the enclave nature of Chinese extractive projects limits technology transfer and local value addition, creating economic structures that prioritize short-term extraction over sustainable resource management [15]. Second, the capital-intensive nature of these projects enables extraction at scales that surpass local regulatory capacities. For instance, Chinese-backed cobalt mining operations in the DRC have expanded production by 300% since 2010 [16], far exceeding the country’s capacity to monitor environmental impacts.

The infrastructure-linked nature of many Chinese investments further compounds depletion risks. Resource-for-infrastructure deals, which account for approximately 40% of Chinese FDI in Africa [7], create direct financial incentives for host governments to permit accelerated extraction rates to meet debt obligations. This is particularly evident in Angola’s oil sector, where production quotas increased by 25% following major infrastructure loans from Chinese banks [17].

Hypothesis 1 (H1).

Chinese FDI significantly increase resource depletion in African host countries.

While Chinese trade with Africa has grown exponentially to CNY 282 billion in 2022 [18], its impact on resource depletion differs from FDI due to distinct market mechanisms. Trade relationships create a sustained demand for specific commodities without the direct capital investments that characterize FDI. This generates more gradual but persistent depletion pressures, particularly in energy sectors (oil, gas, and coal), where China’s import needs are largest and most consistent.

The hypothesis of weaker trade effects stems from three factors: (1) trade allows for more diversified sourcing compared to FDI-led extraction, (2) price mechanisms may incentivize some conservation when prices rise, and (3) trade relationships often involve multiple suppliers rather than single-project focus. However, the extraordinary scale and consistency of Chinese demand—particularly for oil (35% of Africa’s exports to China) and minerals (28%)—creates structural incentives for overextraction [19].

Energy resources are particularly vulnerable to trade-driven depletion due to China’s strategic stockpiling policies and the relatively inelastic demand from Chinese state-owned enterprises. This is evidenced by the 15% annual growth in African oil exports to China between 2015 and 2022, outpacing the overall trade growth [18].

Hypothesis 2 (H2).

Chinese trade has a weaker but still positive relationship with resource depletion.

This comparative hypothesis emerges from the fundamental differences in how FDI and trade engage with host economies. FDI represents direct, concentrated capital deployment with immediate extraction capabilities, while trade operates through market mechanisms with more diffuse effects. Three theoretical arguments support this hypothesis:

First, FDI typically involves long-term contracts with guaranteed offtake agreements, creating locked-in extraction patterns that are less responsive to market signals [8]. Chinese mining investments in Zambia, for instance, operate under 15–20-year contracts with fixed production quotas that persist regardless of global price fluctuations [20]. Second, FDI brings specialized extraction technologies that enable access to previously uneconomical reserves, effectively expanding the depletion frontier. Chinese firms have pioneered deep water oil drilling in Angola and automated mining techniques in the DRC that dramatically increase extraction rates [16]. Third, the political economy of FDI creates stronger path dependencies. Large-scale Chinese projects often become “too big to fail” for host governments, leading to regulatory forbearance and extended depletion timelines. This contrasts with trade relationships, which can be more readily adjusted in response to policy changes or market conditions.

The Mediating Role of Governance

Drawing upon institutional theory and the existing literature on China–Africa relations, this study develops a set of hypotheses that examine how governance quality moderates the relationship between Chinese economic engagement and resource depletion in Africa. Institutional theory emphasizes how formal and informal rules, norms, and organizational structures shape economic behavior and outcomes [21]. In the context of natural resource management, institutional theory suggests that the quality of governance determines whether countries can avoid the resource curse by effectively regulating extraction activities, enforcing environmental standards, and ensuring equitable distribution of benefits [22].

Institutional theory posits that robust governance frameworks can constrain opportunistic behavior by foreign investors and ensure sustainable resource management [23]. This hypothesis builds on evidence that countries with effective regulatory institutions are better equipped to negotiate favorable terms in resource contracts, enforce environmental protections, and monitor compliance [24]. Specifically, we expect that three governance dimensions will moderate FDI impacts: (1) regulatory quality, which ensures environmental standards are implemented in extractive projects; (2) rule of law, which prevents illegal or excessive extraction; and (3) control of corruption, which reduces incentives for regulatory capture by foreign investors. For example, Botswana’s strong institutions have successfully mandated value-added processing in diamond mining partnerships [25], while weak governance in the DRC has enabled unsustainable Chinese cobalt mining practices [26]. The hypothesis implies an interaction effect where the marginal impact of Chinese FDI on depletion decreases as governance quality improves.

Hypothesis 3 (H3).

Strong governance institutions significantly attenuate the positive relationship between Chinese FDI and resource depletion.

This hypothesis reflects institutional theory’s distinction between market transactions (trade) and embedded organizational relationships (FDI). While governance quality affects all economic activities, its moderating influence should be stronger for FDI because (1) FDI involves a long-term organizational presence subject to host country regulations, whereas trade operates through arm’s length market transactions; (2) FDI projects require specific permits and approvals that governance institutions can condition on sustainability criteria; and (3) trade flows are more responsive to global price signals that may independently influence extraction rates. Evidence from Angola shows that Chinese oil trade continued despite governance improvements, while FDI projects were restructured under new environmental regulations [27]. We therefore expect governance to explain more variance in FDI–depletion relationships than in trade–depletion relationships.

Hypothesis 4 (H4).

The moderating effect of governance is weaker for trade relationships than for FDI.

2.2. Econometric Modeling

To address the complex challenge of establishing causal relationships in our analysis of Chinese engagement and natural resource depletion in Africa, we employ a rigorous econometric framework that combines fixed-effects modeling with complementary causal inference techniques. Our methodological approach was developed through a systematic review of established causality verification methods in similar panel data studies [28,29], which informed our selection of the most appropriate analytical tools for this research context. The foundation of our analysis utilizes a fixed-effects model, selected based on the Hausman test [30], which confirmed its superiority for our dataset by rejecting the random-effects specification (p < 0.01). This approach effectively controls for unobserved, time-invariant country-specific characteristics that could otherwise bias our estimates. By focusing on within-country variations over time, the fixed-effects model provides robust estimates of how changes in Chinese FDI and trade correlate with changes in resource depletion metrics while accounting for persistent national differences in geography, colonial history, or cultural factors.

To strengthen causal inference beyond the standard fixed-effects approach, we incorporate System GMM Estimation. For our dynamic models, we implement the system generalized method of moments [31] to account for potential endogeneity through appropriate instrumentation of potentially endogenous regressors.

The scientific rationale for this multi-pronged approach stems from recent methodological advancements in development economics [32] that emphasize the need for complementary techniques when analyzing observational panel data. While acknowledging that absolute causality cannot be definitively proven in observational studies, our combined methods provide stronger evidence of causal relationships than conventional single-method approaches while transparently reporting the limitations inherent in our research design.

The fixed effect baseline is specified below:

where Depletion equals Total resource depletion, Mineral depletion, energy depletion, or Forest depletion in separate equations. China equals China’s FDI or China’s trade in separate equations. Definitions and sources of the variables are presented in Table 1.

Table 1.

Variable description and sources.

3. Research Data and Descriptive Statistics

3.1. Data Sampling

The data for this study encompass 28 African countries from 1998 to 2022, selected based on the availability of consistent data on Chinese foreign direct investment (FDI), trade, and natural resource depletion indicators. We began the selection of the countries from all 55 recognized African countries. We dropped 18 countries with limited data from the main variable of interest, Chinese FDI, and trade. In the next stage, we dropped 9 countries with missing data from the World Development Indicators. The final dataset was 28 countries. These countries represent a diverse mix of resource endowments and economic structures, ensuring a comprehensive analysis of the dynamics between Chinese engagement and resource exploitation. The data sources include the China–Africa Research Institute for Chinese FDI and trade metrics and the World Development Indicators for economic and environmental variables, such as natural resource depletion, GDP, energy consumption, and total resource rent. Institutional quality indicators were derived from the World Governance Indicators database. In Figure 2 and Figure 3, we visualize China–Africa FDI and trade over the decades.

Figure 2.

China–Africa trade.

Figure 3.

China–Africa FDI.

3.2. Univariate Analysis

The descriptive statistics presented in Table 2 reveal significant variability in the levels of Chinese engagement and natural resource depletion across the sample countries. Chinese trade exhibits a high mean value of 328.7 as a percentage of GDP, with a substantial standard deviation of 1194. This is further corroborated by the median trade value of 68.55 and an interquartile range of 25.06 to 185.4, indicating that the majority of countries engage in relatively modest trade levels with China, while a small subset benefits from disproportionately higher trade volumes. Similarly, Chinese foreign direct investment (FDI) demonstrates a mean of 16.12 and a standard deviation of 24.18, with interquartile values spanning 1.772 to 18.93, signifying that Chinese capital inflows are concentrated in specific nations with high resource endowments, reinforcing the asymmetric nature of this engagement.

Table 2.

Descriptive statistics.

Energy depletion, with a mean of 29.24 and a staggering standard deviation of 638.9, reveals extreme heterogeneity, likely driven by energy-exporting nations facing accelerated resource exhaustion. Mineral depletion shows a mean of 6.095 and a standard deviation of 92.01, with a narrow interquartile range of −0.284 to 0.726 around a median of 0.080, suggesting that, while a few countries experience significant depletion, the majority remain at moderate levels. Total natural resource depletion averages 2.815, yet its high standard deviation of 75.64 reflects the trend of Chinese trade.

3.3. Bivariate Analysis

The Pearson pairwise correlation analysis in Table 3 highlights notable relationships among Chinese engagement, economic variables, and resource depletion factors. Chinese FDI and Chinese trade exhibit a negligible positive correlation (0.06), indicating distinct patterns of investment and trade flows across African nations. Both variables show weak or no correlation with GDP growth, suggesting a limited direct association between Chinese engagement and short-term economic expansion. Population and gross domestic product (GDP) are strongly correlated (0.75), reflecting the influence of population size on economic output, yet both show weak or negative correlations with Chinese FDI and trade. However, none of the variables have a high correlation above the standard threshold of 0.8 to pose any multicollinearity problems [33].

Table 3.

Pearson pairwise correlation matrix.

4. Results and Discussion

4.1. Chinese Foreign Direct Investment and Resource Depletion Empirical Results

The results presented in Table 4 provide a nuanced perspective on the effects of Chinese foreign direct investment (FDI) on resource depletion in Africa, revealing sector-specific dynamics and heterogeneous impacts across various natural resource categories. The results underscore the complexities of the China–Africa resource relationship, demonstrating significant positive associations between Chinese FDI and the depletion of total natural resources, energy resources, and forests. The results provide empirical evidence to support H1, which states that Chinese FDI significantly increase resource depletion in African host countries. A notable negative association emerges between Chinese FDI and mineral resource depletion, presenting a counterintuitive divergence that invites further scrutiny.

Table 4.

FDI and resource depletion.

In the case of energy resource depletion (β = 0.209, p < 0.01), the relationship with Chinese FDI is particularly pronounced. This reflects China’s strategic interest in securing oil, gas, and other energy resources from Africa to meet its industrial and energy security needs. The positive link between Chinese FDI and forest resource depletion (β = 0.006, p < 0.05) highlights another critical dimension of China’s growing demand for timber and other forest products. This relationship is consistent with studies documenting deforestation driven by Chinese logging activities in African countries such as Gabon, Cameroon, and Mozambique [34]. These activities often prioritise the export of timber to international markets, with limited consideration for local environmental impacts.

Interestingly, the negative association between Chinese FDI and mineral resource depletion (β = −0.370, p < 0.05) contrasts sharply with the trends observed in other sectors. Macroeconomic variables provide additional context for these sectoral differences. The negative association between GDP growth and total resource depletion (β = −0.020, p < 0.10) and forest resource depletion (β = −0.012, p < 0.05) aligns with the Environmental Kuznets Curve hypothesis. This hypothesis suggests that as economies grow and diversify, they gradually reduce their reliance on resource-intensive sectors, resulting in lower rates of resource depletion over time [35]. In contrast, the significant positive relationship between industrialization and forest resource depletion (β = 0.010, p < 0.01) highlights the environmental trade-offs associated with industrial expansion. As African economies industrialize, increased land clearance and resource extraction intensify pressures on forest ecosystems, exacerbating deforestation.

Discussions on the China FDI and Resource Depletion

Chinese investments in Africa, often resource-intensive, amplify the overall rate of resource extraction, reflecting a broader pattern of environmental stress driven by globalized economic demands. This finding corroborates earlier studies, such as [16], which identified robust links between resource-oriented FDI and environmental degradation indicators like deforestation and greenhouse gas emissions.

With regards to China FDI in energy resources, dependency theory provides a valuable lens to interpret this association, as it postulates that asymmetric economic relationships often result in the overexploitation of resources in developing regions to support the consumption patterns of more developed economies [36]. Empirical evidence supports this view, as Chinese investments in oil-exporting nations like Angola and Nigeria have facilitated large-scale extraction projects prioritising export markets over local energy security and sustainable management. Moreover, such investments intensify resource extraction practices, with substantial environmental consequences [1].

In the case of mineral resources, the finding may indicate a shift towards more sustainable and efficient practices in mineral extraction, potentially facilitated by Chinese investment. In some cases, technological advancements and stricter regulatory frameworks might mitigate the intensity of extraction, particularly in mineral-rich economies with relatively stronger institutional capacities. For example, while environmental degradation linked to Chinese copper mining in Zambia [20], other studies suggest that Chinese firms have increasingly adopted measures to reduce their ecological footprint in response to global environmental pressures. This divergence underscores the importance of sector-specific and country-specific factors in shaping the sustainability outcomes of Chinese investments.

Overall, the relationship between Chinese FDI and resource depletion in Africa is multifaceted, reflecting diverse impacts across resource categories and economic contexts. The significant positive associations with total, energy, and forest resource depletion underscore the mounting pressures on Africa’s natural resources, driven by China’s industrial demands and Africa’s structural dependency on resource exports. Conversely, the negative association with mineral resource depletion presents a potentially encouraging deviation, suggesting opportunities for more sustainable practices in specific sectors.

4.2. Chinese Trade and Resource Depletion Empirical Results

The results on the relationship between total trade with China and resource depletion in Africa are presented in Table 5. The findings reveal nuanced dynamics that align with the existing literature on trade, resource dependency, and environmental sustainability. The lack of a significant association between total trade and the depletion of total natural resources, minerals, and forests suggests that the structure of trade may influence resource extraction patterns. The results do not support Hypothesis 2.

Table 5.

China trade and resource depletion.

Discussions on the China Trade and Resource Depletion

A significant portion of Africa’s trade with China involves the importation of manufactured goods and consumer products [15], which limits the direct impact on resource depletion. These imports contribute to the diversification of African economies but may not directly exacerbate domestic resource extraction activities.

However, the significant positive relationship between trade and energy resource depletion points to the energy-intensive nature of economic activities driven by trade. Imports of Chinese products often include machinery, industrial equipment, and consumer electronics, which necessitate substantial energy inputs for their use and maintenance. As African economies strive to integrate into global production networks, energy consumption increases to support infrastructure and industrial activities, exacerbating the depletion of energy resources [37]. The absence of significant effects on forest resource depletion can be explained by the relatively limited role of timber exports in trade relations with China. Africa’s forest resources are increasingly subject to international conservation efforts, which may mitigate the direct impact of trade on deforestation. However, localized studies, such as those by [38], caution against complacency, noting that illegal logging and land use changes remain prevalent in some regions. Similarly, the insignificant relationship between trade and mineral resource depletion may reflect the influence of global commodity markets and regulatory frameworks, which mediate the intensity of mining activities [12].

While the results suggest that trade with China does not significantly drive resource depletion across most categories, the energy sector remains an exception. This finding highlights the interconnectedness of trade, energy demand, and resource sustainability, reflecting the broader challenges of integrating Africa into global value chains.

4.3. The Impact of Governance Structures—The Mechanism Analysis

Arguably, the extent to which China’s FDI and trade impact resource depletion will depend on the strength of the governance structures in the host countries. Therefore, consistent with [39,40], we present the impact of governance structures as the mechanism analysis. As presented in Table 6, the impact of Chinese foreign direct investment (FDI) on resource depletion varies significantly, depending on the governance structures of the host countries, with more pronounced effects observed in nations with weaker governance. This differential impact underscores the critical role of institutional quality in mediating the environmental consequences of foreign investment. In low-governance contexts, Chinese FDI exhibits a stronger and more significant association with total resource depletion (β = 0.017, p < 0.01), energy resource depletion (β = 0.755, p < 0.01), and forest resource depletion (β = 0.009, p < 0.01), reflecting the heightened vulnerability of these economies to extractive practices. In contrast, in high-governance countries, the coefficients for total resource depletion (β = 0.005, p < 0.100) and forest resource depletion (β = 0.002, p < 0.05) are smaller and less significant, suggesting a mitigated impact.

Table 6.

The effect of institutional quality—China FDI and resource depletion.

The large coefficients for energy (β = 0.755, p < 0.01) and forest depletion (β = 0.009, p < 0.01) in low-governance settings reflect this imbalance, where resource extraction intensifies to meet external demands, often at the expense of environmental sustainability. The findings align with previous studies, such as [37], which highlight the environmental degradation linked to resource-oriented FDI in weak institutional settings.

Conversely, high-governance countries demonstrate a capacity to moderate the adverse effects of Chinese FDI on resource depletion. In these contexts, the negative association between Chinese FDI and mineral resource depletion (β = −0.880, p < 0.05) and the comparatively small coefficients for total (β = 0.005, p < 0.10) and energy (β = 0.029, p < 0.05) resource depletion suggest that stronger governance structures can enforce regulatory frameworks, ensuring more sustainable resource extraction practices. The results support Hypotheses 3 and 4, that the governance structure of the host country matters.

Discussion on the Moderating Role of Governance Structures

These findings highlight the critical role of governance in shaping the environmental outcomes of Chinese FDI in Africa. In low-governance countries, weak institutional frameworks amplify the resource-depleting effects of foreign investment, particularly in the energy and forestry sectors. In contrast, high-governance countries demonstrate a capacity to mitigate these effects, as evidenced by lower coefficients for resource depletion and a negative association with mineral resource extraction. These results contribute to the broader literature on governance, foreign investment, and resource management, emphasizing the need for stronger institutions to ensure that economic benefits from FDI are not achieved at the expense of environmental sustainability.

The relationship between Chinese trade and resource depletion in Table 7 varies significantly based on the governance structures of the host countries, highlighting the moderating role of institutional quality. In low-governance countries, the findings reveal no significant association between Chinese trade and the depletion of total resources, minerals, or forests, aligning with the broader literature that suggests trade alone does not uniformly exacerbate resource depletion in poorly governed contexts [35]. However, a significant positive relationship is observed between Chinese trade and energy resource depletion (β = 0.008, p < 0.10). This suggests that, in low-governance countries, energy sectors may be more directly impacted by trade dynamics with China, potentially due to the increased demand for energy-intensive exports, weak environmental oversight, or limited enforcement capacity.

Table 7.

The effect of institutional quality—China trade and resource depletion.

Conversely, in high-governance countries, there is no significant relationship between Chinese trade and any form of resource depletion, including total resources, minerals, energy, or forests. This absence of significant effects (p > 0.10 across all categories) indicates that robust governance structures effectively shield resource stocks from the potential extractive pressures of international trade. Strong institutions in these countries likely enforce stringent environmental regulations, monitor trade practices, and promote sustainable resource management, mitigating the environmental risks associated with external trade flows.

The differentiated impact of Chinese trade on resource depletion between low- and high-governance countries suggests that the observed effects are primarily driven by the former. The significant association with energy resource depletion in low-governance countries underscores a pattern wherein weak institutions exacerbate the resource-depleting impacts of trade, particularly in sectors critical to China’s strategic interests. On the other hand, the lack of significant effects in high-governance countries reflects the capacity of these nations to decouple trade from resource depletion, leveraging strong institutions to align trade with sustainable development goals.

4.4. Robustness Check—Endogeneity Using SGMM

The system-generalized method of moments (SGMM) provides a robust framework for addressing endogeneity concerns in dynamic panel data models [41], ensuring the reliability of the estimated relationships between Chinese economic engagement and resource depletion. Endogeneity may arise from omitted variable bias, reverse causality, or measurement error, particularly in the context of resource depletion and its interaction with foreign direct investment (FDI) and trade. By employing SGMM, which utilizes internal instruments derived from lagged variables, the estimations account for potential simultaneity between dependent and independent variables and mitigate bias in the coefficients [41].

The SGMM results in Table 8 confirm the robustness of the primary findings. For Chinese FDI, the significant and positive effects on total resources (β = 0.013, p < 0.01), energy depletion (β = 0.360, p < 0.01), and forest depletion (β = 0.022, p < 0.01) are consistent with the baseline estimations. This suggests that Chinese FDI continues to exert a resource-depleting effect in these sectors, even after addressing endogeneity. Similarly, for Chinese trade, the SGMM results corroborate the main findings, with no significant relationship between trade and total resource depletion (β = −0.002, p > 0.10), mineral depletion (β = −0.040, p > 0.10), or forest depletion (β = −0.000, p > 0.10). However, the significant positive impact of trade on energy resource depletion (β = 0.037, p < 0.01) is again confirmed, underscoring the energy-intensive nature of Chinese trade activities and their concentrated effects on this resource category.

Table 8.

Endogeneity check SGMM.

The Arellano–Bond tests for serial correlation in the error terms (AR(1) and AR(2)) validate the use of SGMM, as the AR(1) test confirms the expected first-order serial correlation (p < 0.01), while the AR(2) test indicates no second-order serial correlation (p > 0.10). This ensures the validity of the lagged instruments used in the model. The consistency of the results across the robustness checks demonstrates that the observed relationships are not artefacts of endogeneity or model misspecification.

5. Conclusions and Policy Implication

This study has investigated the relationship between Chinese economic engagement—measured through foreign direct investment (FDI) and trade—and resource depletion in African countries, with particular attention to the moderating role of governance structures. By employing dynamic panel models and system generalized method of moments (SGMM) estimations to address endogeneity concerns, the analysis provided robust evidence on the differential effects of Chinese FDI and trade across varying governance contexts. The findings revealed that Chinese FDI significantly contributes to resource depletion, particularly in low-governed countries, with pronounced effects on total resources, energy, and forest resources. In contrast, the impact is muted in high-governed countries, where stronger institutional frameworks potentially mitigate the exploitative tendencies associated with external investment. For trade, the effects on resource depletion were generally insignificant, except for energy resources in low-governed countries, where the relationship was positive and significant, suggesting that trade-driven energy exploitation is influenced by weaker governance systems.

This paper makes several contributions to the literature. First, it expands the understanding of the environmental consequences of China’s economic presence in Africa by disentangling the distinct impacts of FDI and trade on resource depletion [4,11,42,43]. Second, it underscores the importance of governance structures as critical moderating factors, highlighting the role of institutional quality in shaping environmental outcomes [16]. Third, it employs advanced econometric techniques, including SGMM, to ensure the robustness of the findings, addressing potential biases from endogeneity that are often overlooked in related studies. These contributions provide a nuanced understanding of the interplay between foreign economic engagement and environmental sustainability in the African context.

The study makes three primary theoretical contributions. First, it bridges institutional theory with resource curse perspectives by demonstrating how governance quality systematically moderates the environmental impacts of external economic activities. Second, it challenges the prevailing tendency to treat Chinese engagement as monolithic by revealing fundamentally different depletion patterns between FDI and trade channels. Third, it extends conventional static analyses of institutional effects by employing dynamic modeling techniques that capture temporal variations in a governance capacity.

The findings carry significant policy implications. For policymakers in African countries, particularly those with weaker governance frameworks, the study highlights the need for stronger regulatory mechanisms to manage the environmental impacts of FDI and trade. Instituting policies that enforce sustainable resource extraction, promote environmental accountability, and incentivize green investments can mitigate the adverse effects of foreign economic activities. Strengthening governance structures through institutional reforms and capacity building is equally critical to ensure that resource exploitation aligns with sustainable development goals. For international actors, including Chinese investors, the results underscore the importance of adhering to environmental standards and fostering partnerships that prioritize sustainable practices.

Research Agenda for Future Studies

While this study provides valuable insights into the relationship between Chinese economic engagement and resource depletion in Africa, several promising avenues for future research emerge from its limitations. A critical next step involves moving beyond aggregate governance measures to examine how specific institutional dimensions—such as regulatory quality, corruption control, rule of law, and enforcement capacity—distinctly mediate the environmental impacts of foreign direct investment and trade. Disaggregating these governance components would yield more precise policy recommendations by identifying which institutional reforms are the most effective in mitigating resource depletion. Future studies could employ hierarchical modeling techniques to analyze how national-level institutional characteristics interact with subnational governance structures, particularly in federal systems where resource management responsibilities are decentralized.

Complementing the macro-level quantitative analysis with in-depth case studies would help uncover the contextual nuances obscured by secondary data. Longitudinal research designs tracking specific Chinese projects over time could reveal how local political dynamics, community resistance, and corporate social responsibility initiatives influence environmental outcomes. Such micro-level analyses would be particularly valuable in understanding the implementation gap between formal environmental regulations and their enforcement on the ground. Comparative case studies across sectors—such as mining versus agriculture—could also elucidate how resource-specific characteristics moderate the depletion effects of economic engagement.

The role of external factors warrants greater scholarly attention, particularly how international environmental agreements and transnational advocacy networks shape China–Africa resource politics. Future research could examine whether and how global climate commitments are influencing Chinese investment patterns in Africa’s energy sector, including potential shifts toward renewable energy projects. Similarly, the impact of commodity price volatility on extraction rates deserves closer scrutiny, especially how boom–bust cycles interact with governance quality to accelerate or mitigate resource depletion. The growing influence of environmental, social, and governance (ESG) criteria in international finance presents another important research frontier, particularly how Chinese banks and investors are responding to these pressures in their African operations.

Expanding the geographic scope beyond Africa would enhance the generalizability of the findings and provide valuable comparative perspectives. Studies of Chinese economic engagement in Latin America and Southeast Asia—regions with different governance traditions and resource endowments—could test whether the Africa-specific findings represent a broader pattern or reflect unique regional characteristics. Such comparative work could identify transferable policy lessons while highlighting context-specific factors that require tailored approaches.

Finally, future research should explore the emerging phenomenon of “green” Chinese investment in Africa, including renewable energy projects and sustainable infrastructure initiatives. As China positions itself as a leader in global climate governance, studies tracking the environmental performance of these purportedly sustainable investments will be crucial for assessing their actual impacts. This line of inquiry could provide insights into whether and how China’s economic engagement in Africa is evolving toward more environmentally sustainable models and what factors drive this transition. By pursuing these interconnected research directions, scholars can build a more comprehensive understanding of the complex relationships between foreign economic engagement, governance systems, and environmental sustainability in resource-rich developing countries.

Author Contributions

Conceptualization, V.T.; methodology, V.T.; software, V.T.; validation, V.T. and H.B.; formal analysis, V.T.; investigation, V.T.; resources, V.T.; data curation, V.T.; writing—original draft preparation, V.T.; writing—review and editing, H.B.; visualization, V.T. and H.B.; supervision, H.B.; project administration, H.B.; funding acquisition, H.B. All authors have read and agreed to the published version of the manuscript.

Funding

Princess Nourah bint Abdulrahman University Researchers Supporting Project number (PNURSP2025R856), Princess Nourah bint Abdulrahman University, Riyadh, Saudi Arabia.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All data are collected from public databases such as the China–Africa Research Institute, the World Development Indicators and the World Governance Indicators databases.

Acknowledgments

Princess Nourah bint Abdulrahman University Researchers Supporting Project number (PNURSP2025R856), Princess Nourah bint Abdulrahman University, Riyadh, Saudi Arabia.

Conflicts of Interest

The authors declare no conflicts of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of the data; in the writing of the manuscript; or in the decision to publish the results.

References

- Carmody, P.R. The New Scramble for Africa; John Wiley & Sons: Hoboken, NJ, USA, 2017. [Google Scholar]

- Alden, C.; Jiang, L. Brave new world: Debt, industrialization and security in China–Africa relations. Int. Aff. 2019, 95, 641–657. [Google Scholar] [CrossRef]

- Cheng, S.; Qi, S. The potential for China’s outward foreign direct investment and its determinants: A comparative study of carbon-intensive and non-carbon-intensive sectors along the Belt and Road. J. Environ. Manag. 2021, 282, 111960. [Google Scholar] [CrossRef] [PubMed]

- Tawiah, V.K.; Zakari, A.; Khan, I. The environmental footprint of China-Africa engagement: An analysis of the effect of China—Africa partnership on carbon emissions. Sci. Total Environ. 2021, 756, 143603. [Google Scholar] [CrossRef]

- China Africa Research Initiative. China-Africa Data. China Africa Research Initiative. Available online: http://www.sais-cari.org/other-data (accessed on 17 April 2025).

- Chen, W.; Dollar, D.; Tang, H. Why Is China Investing in Africa? Evidence from the Firm Level. World Bank Econ. Rev. 2018, 32, 610–632. [Google Scholar]

- Grimm, S. China–Africa Cooperation: Promises, practice and prospects. In China in Africa; Routledge: London, UK, 2015. [Google Scholar]

- Brautigam, D. The Dragon’s Gift: The Real Story of China in Africa, Illustrated, ed.; Oxford University Press: New York, NY, USA, 2011. [Google Scholar]

- Jiang, W. Fuelling the Dragon: China’s Rise and Its Energy and Resources Extraction in Africa. China Q. 2009, 199, 585–609. [Google Scholar] [CrossRef]

- Eba’a Atyi, R.; Hiol Hiol, F.; Lescuyer, G.; Mayaux, P.; Defourny, P.; Bayol, N.; Saracco, F.; Pokem, D.; Sufo Kankeu, R.; Nasi, R. The Forests of the Congo Basin: State of the Forests 2021; CIFOR: Bogor, Indonesia, 2022. [Google Scholar]

- Shinn, D.H. The Environmental Imact of China’s Investment in Africa 2015 Symposium—The Journey to Invest: China’s Economic Excursion to Africa. Cornell Int. Law J. 2016, 49, 25–68. [Google Scholar]

- Auty, R.M. Natural resources, capital accumulation and the resource curse. Ecol. Econ. 2007, 61, 627–634. [Google Scholar] [CrossRef]

- Sachs, J.D.; Warner, A.M. The big push, natural resource booms and growth. J. Dev. Econ. 1999, 59, 43–76. [Google Scholar] [CrossRef]

- Statista. Cash Flow of Chinese Direct Investments in Africa from 2003 to 2023. 2024. Available online: https://www.statista.com/statistics/277985/cash-flow-of-chinese-direct-investments-in-africa/ (accessed on 17 April 2025).

- Kaplinsky, R.; Morris, M. Chinese FDI in Sub-Saharan Africa: Engaging with Large Dragons. In The Power of the Chinese Dragon: Implications for African Development and Economic Growth; Henson, S., Yap, O.F., Eds.; Palgrave Macmillan: London, UK, 2016; pp. 123–148. [Google Scholar] [CrossRef]

- Chen, X.; Liu, B.; Tawiah, V.; Zakari, A. Greening African economy: The role of Chinese investment and trade. Sustain. Dev. 2024, 32, 1001–1012. [Google Scholar] [CrossRef]

- World Bank. Angola: Public Finance Review. 2023. Available online: https://documents1.worldbank.org/curated/en/099081003082325565/pdf/P17495906e11280f0b85e08270ab86477a.pdf (accessed on 17 April 2025).

- The State Council of the People’s Republic of China. China’s Trade with Africa Up 7.4% in First Seven Months of 2024. 14 August 2024. Available online: https://english.www.gov.cn/news/202408/14/content_WS66bca5aac6d0868f4e8e9e94.html (accessed on 17 April 2025).

- United Nations. UN Comtrade Database: International Trade Statistics. 2023. Available online: https://comtrade.un.org/ (accessed on 17 April 2025).

- Haglund, D. Regulating FDI in weak African states: A case study of Chinese copper mining in Zambia. J. Mod. Afr. Stud. 2008, 46, 547–575. [Google Scholar] [CrossRef]

- North, D.C. Institutions, Institutional Change and Economic Performance; Cambridge University Press: Cambridge, UK, 1990. [Google Scholar]

- Ayuk, E.; Pedro, A.; Ekins, P.; Gatune, J.; Milligan, B.; Oberle, B.; Christmann, P.; Ali, S.; Kumar, S.V.; Bringezu, S.; et al. Mineral Resource Governance in the 21st Century: Gearing Extractive Industries Towards Sustainable Development; International Resource Panel; United Nations Envio: Nairobi, Kenya, 2020; Available online: https://orbi.uliege.be/handle/2268/254890 (accessed on 17 April 2025).

- Dwumfour, R.A.; Ntow-Gyamfi, M. Natural resources, financial development and institutional quality in Africa: Is there a resource curse? Resour. Policy 2018, 59, 411–426. [Google Scholar] [CrossRef]

- Zallé, O. Natural resources and economic growth in Africa: The role of institutional quality and human capital. Resour. Policy 2019, 62, 616–624. [Google Scholar] [CrossRef]

- Hillbom, E. Diamonds and development: The developmental potential of mining and the politics of labour and land in Botswana. J. Agrar. Change 2018, 18, 366–385. [Google Scholar] [CrossRef]

- Amnesty International. Democratic Republic of Congo: ‘This Is What We Die For’: Human Rights Abuses in the Democratic Republic of the Congo Power the Global Trade in Cobalt. Amnesty International: 19 January 2016. England and Wales. Available online: https://www.amnesty.org/en/documents/afr62/3183/2016/en/ (accessed on 17 April 2025).

- Sun, Y.; Tian, W.; Mehmood, U.; Zhang, X.; Tariq, S. How do natural resources, urbanization, and institutional quality meet with ecological footprints in the presence of income inequality and human capital in the next eleven countries? Resour. Policy 2023, 85, 104007. [Google Scholar] [CrossRef]

- Angrist, J.D.; Pischke, J.-S. Mostly Harmless Econometrics: An Empiricist’s Companion; Princeton University Press: Princeton, NJ, USA, 2009. [Google Scholar]

- Imbens, G.W.; Rubin, D.B. Causal Inference for Statistics, Social, and Biomedical Sciences: An Introduction; Cambridge University Press: Cambridge, UK, 2015. [Google Scholar]

- Hausman, J.A. Specification Tests in Econometrics. Econometrica 1978, 46, 1251–1271. [Google Scholar] [CrossRef]

- Blundell, R.; Bond, S. Initial conditions and moment restrictions in dynamic panel data models. J. Econom. 1998, 87, 115–143. [Google Scholar] [CrossRef]

- Athey, S.; Imbens, G.W. The state of applied econometrics: Causality and policy evaluation. J. Econ. Perspect. 2017, 31, 3–32. [Google Scholar] [CrossRef]

- Tabachnick, B.G.; Fidell, L.S. Using Multivariate Statistics; Pearson Education: New York, NY, USA, 2013. [Google Scholar]

- Megevand, C.; Mosnier, A. Deforestation Trends in the Congo Basin: Reconciling Economic Growth and Forest Protection; World Bank Publications: Washington, DC, USA, 2013. [Google Scholar]

- Grossman, G.M.; Krueger, A.B. Economic Growth and the Environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- Frank, A.G. Capitalism and Underdevelopment in Latin America: Historical Studies of Chile and Brazil; Monthly Review Press: New York, NY, USA, 1967. [Google Scholar]

- Chen, Y.; Zhai, R.; Zhang, K.H. Natural resources and foreign direct investment in Africa: Evidence from Chinese firms. Sustainability 2020, 12, 9616. [Google Scholar] [CrossRef]

- Hansen, M.C.; Potapov, P.V.; Moore, R.; Hancher, M.; Turubanova, S.A.; Tyukavina, A.; Thau, D.; Stehman, S.V.; Goetz, S.J.; Loveland, T.R.; et al. High-Resolution Global Maps of 21st-Century Forest Cover Change. Science 2013, 342, 850–853. [Google Scholar] [CrossRef]

- Cheng, J.; Jiang, Y.; Cheng, J.; Jiang, Y. How can carbon markets drive the development of renewable energy sector? Empirical evidence from China. Data Sci. Financ. Econ. 2024, 4, DSFE-04-02-010. [Google Scholar] [CrossRef]

- Li, Z.; Guo, F.; Du, Z. Learning from Peers: How Peer Effects Reshape the Digital Value Chain in China? J. Theor. Appl. Electron. Commer. Res. 2025, 20, 41. [Google Scholar] [CrossRef]

- Arellano, M.; Bover, O. Another look at the instrumental variable estimation of error-components models. J. Econom. 1995, 68, 29–51. [Google Scholar] [CrossRef]

- Gordon, R. The Environmental Implications of China’s Engagement with Sub-Saharan Africa; Working Paper Series; Villanova University: Villanova, PA, USA, 2012. [Google Scholar]

- Zakari, A.; Khan, I. Boosting economic growth through energy in Africa: The role of Chinese investment and institutional quality. J. Chin. Econ. Bus. Stud. 2022, 20, 1–21. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).