Sustainable Governance of the Global Rare Earth Industry Chains: Perspectives of Geopolitical Cooperation and Conflict

Abstract

1. Introduction

2. Literature Review

2.1. Evolution of Rare Earth Trade Network Patterns

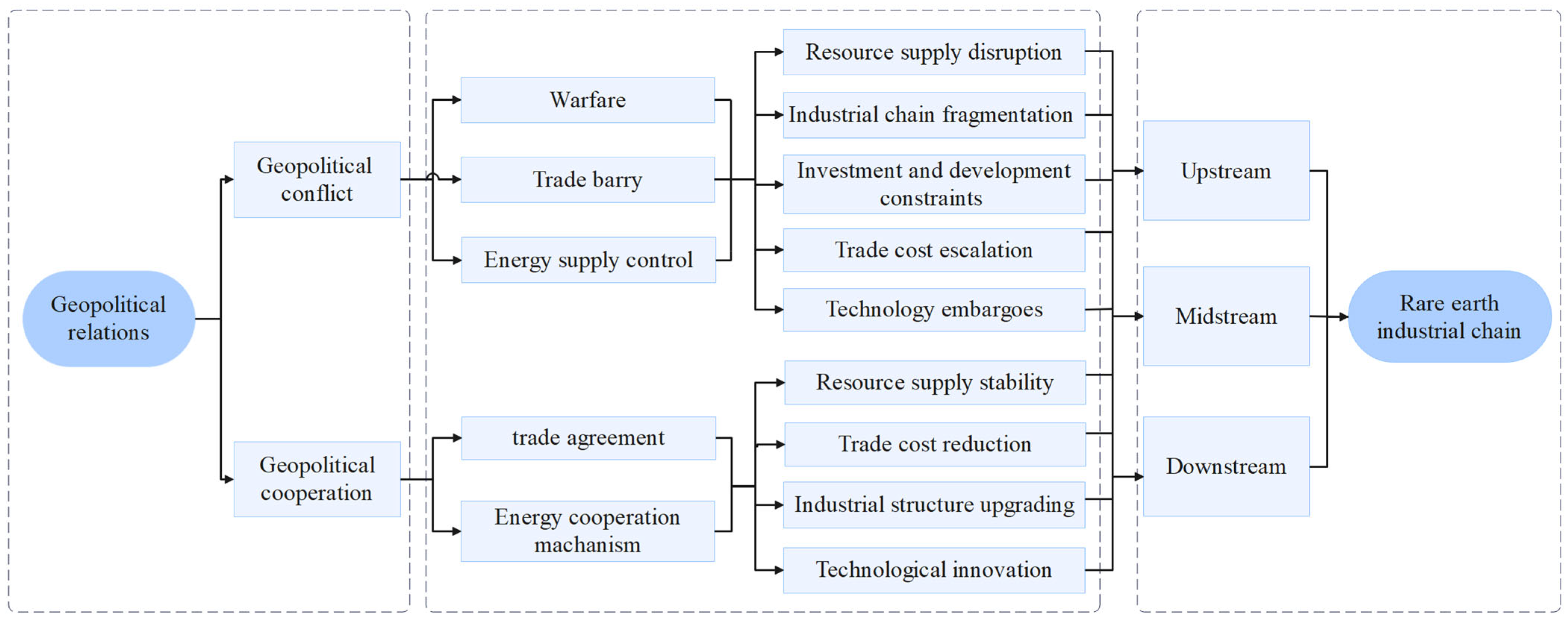

2.2. Geopolitical Relations and Their Impacts on Rare Earth Trade Networks

2.3. Methodologies and Modeling Approaches for Complex Trade Networks

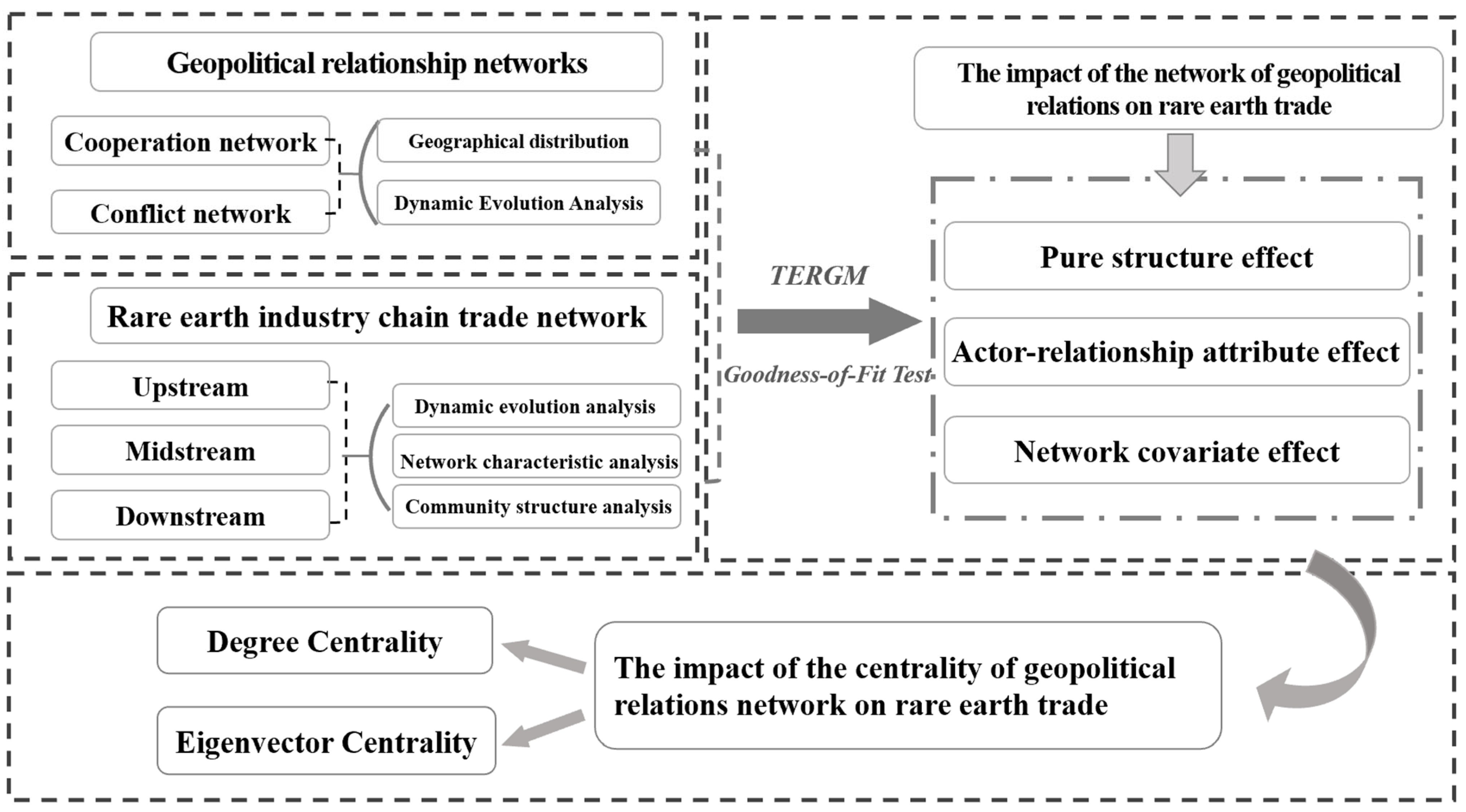

3. Theoretical Mechanism Framework

4. Data and Methods

4.1. Data

4.2. Method

4.2.1. Network Construction

- (1)

- Geopolitical relationship network

- (2)

- Rare earth trade dependency network

- (3)

- Other networks

4.2.2. Network Indicators

Global Network Indicators

- (1)

- Degree

- (2)

- Weighted degree

- (3)

- Clustering coefficient

- (4)

- Average path length

- (5)

- Density

- (6)

- Modularity

Node-Level Indicators

- (1)

- Degree centrality

- (2)

- Eigenvector centrality

4.2.3. Temporal Exponential Random Graph Model (TERGM)

- Memory term: memory (type = “stability”) to capture network persistence.

- Temporal dependence: handled via autoregressive network structures ( implicitly included through the memory term).

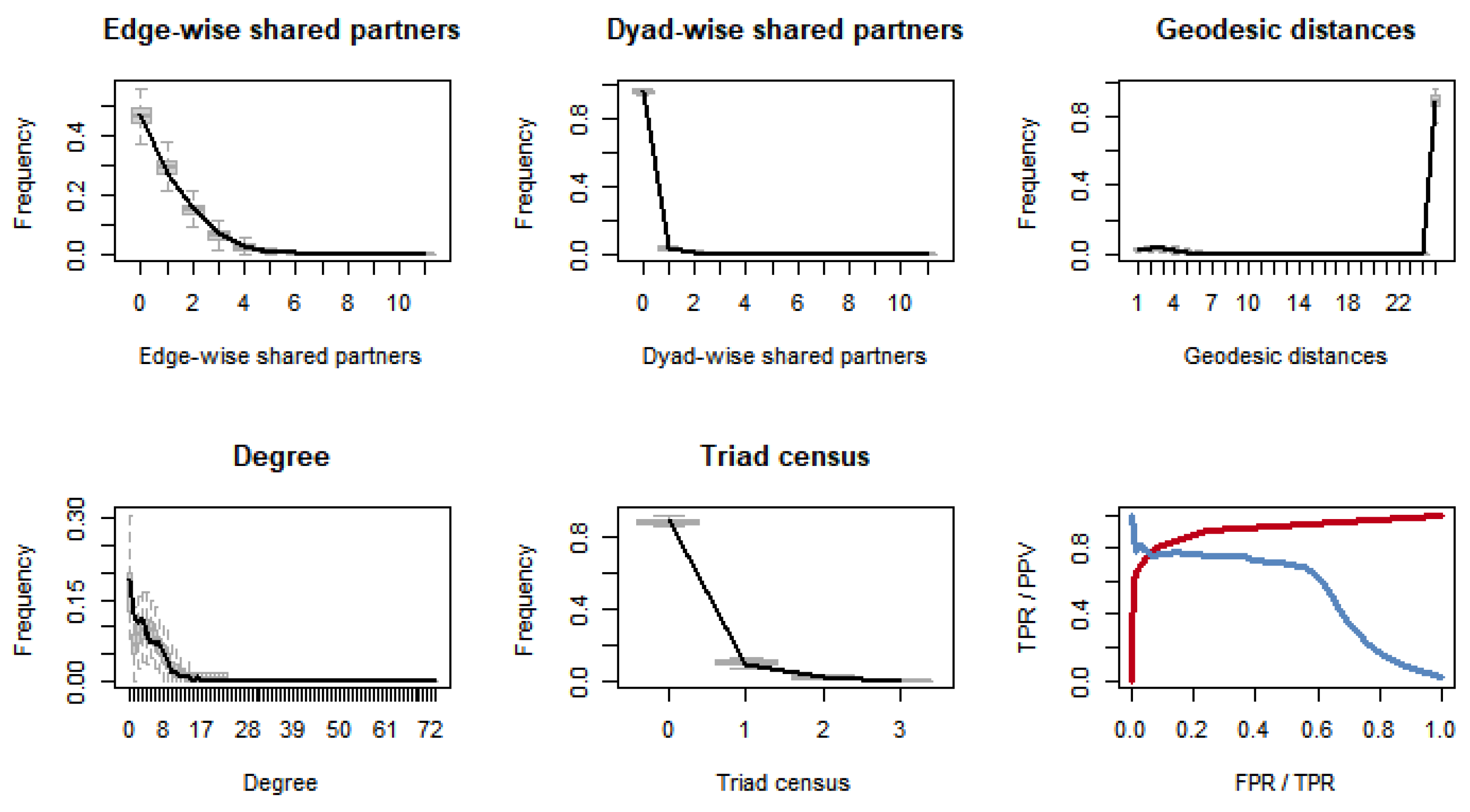

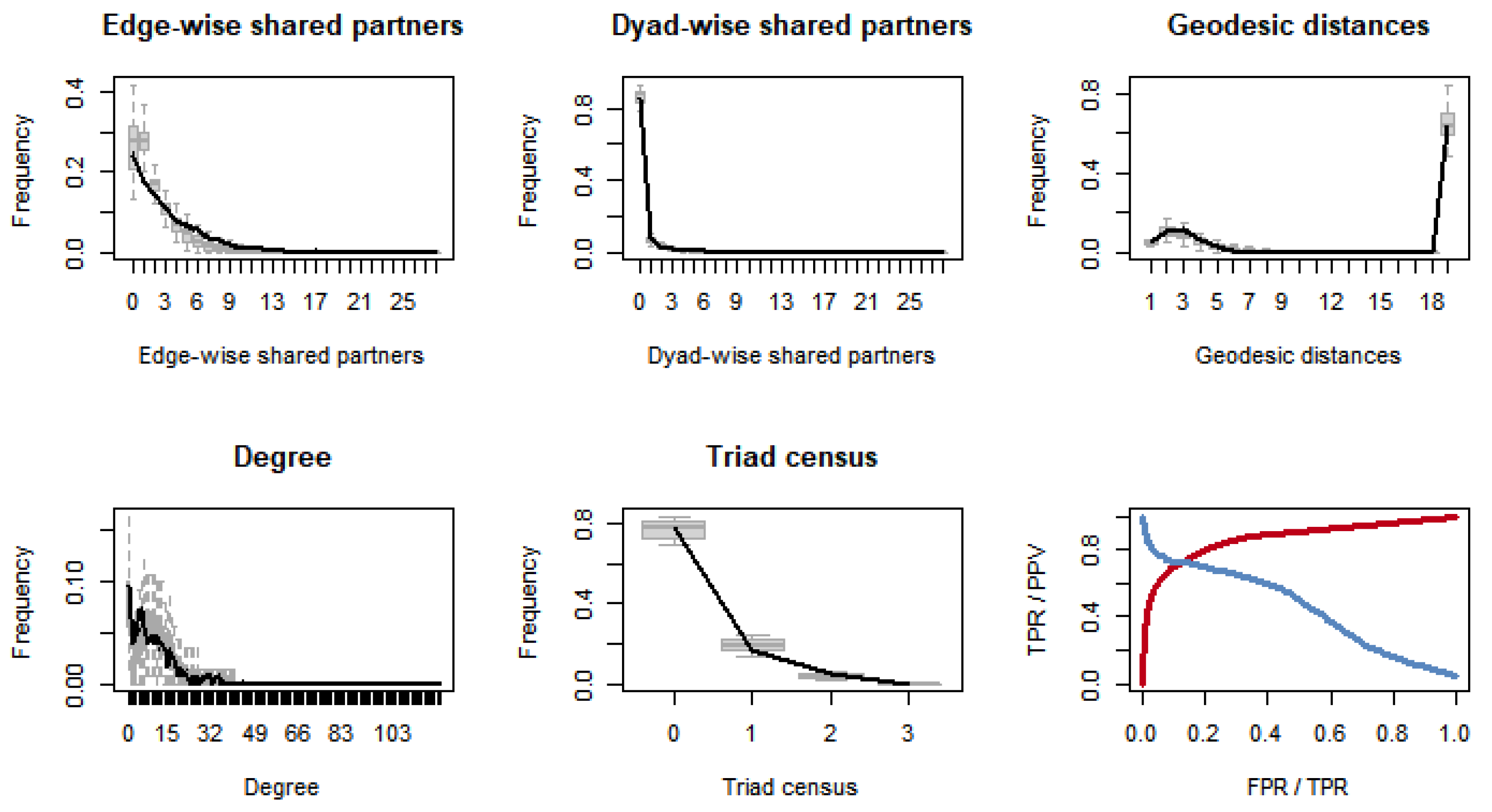

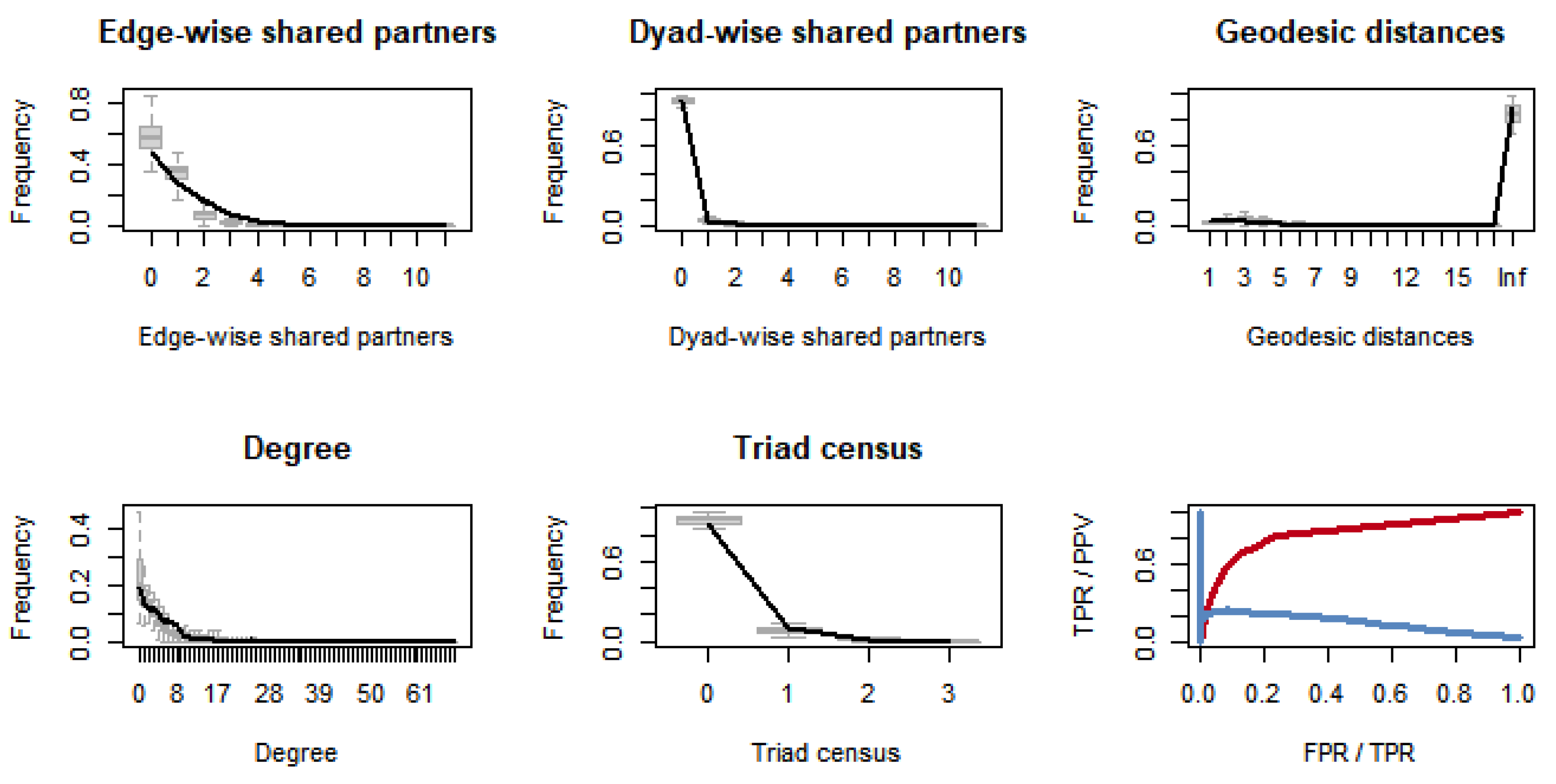

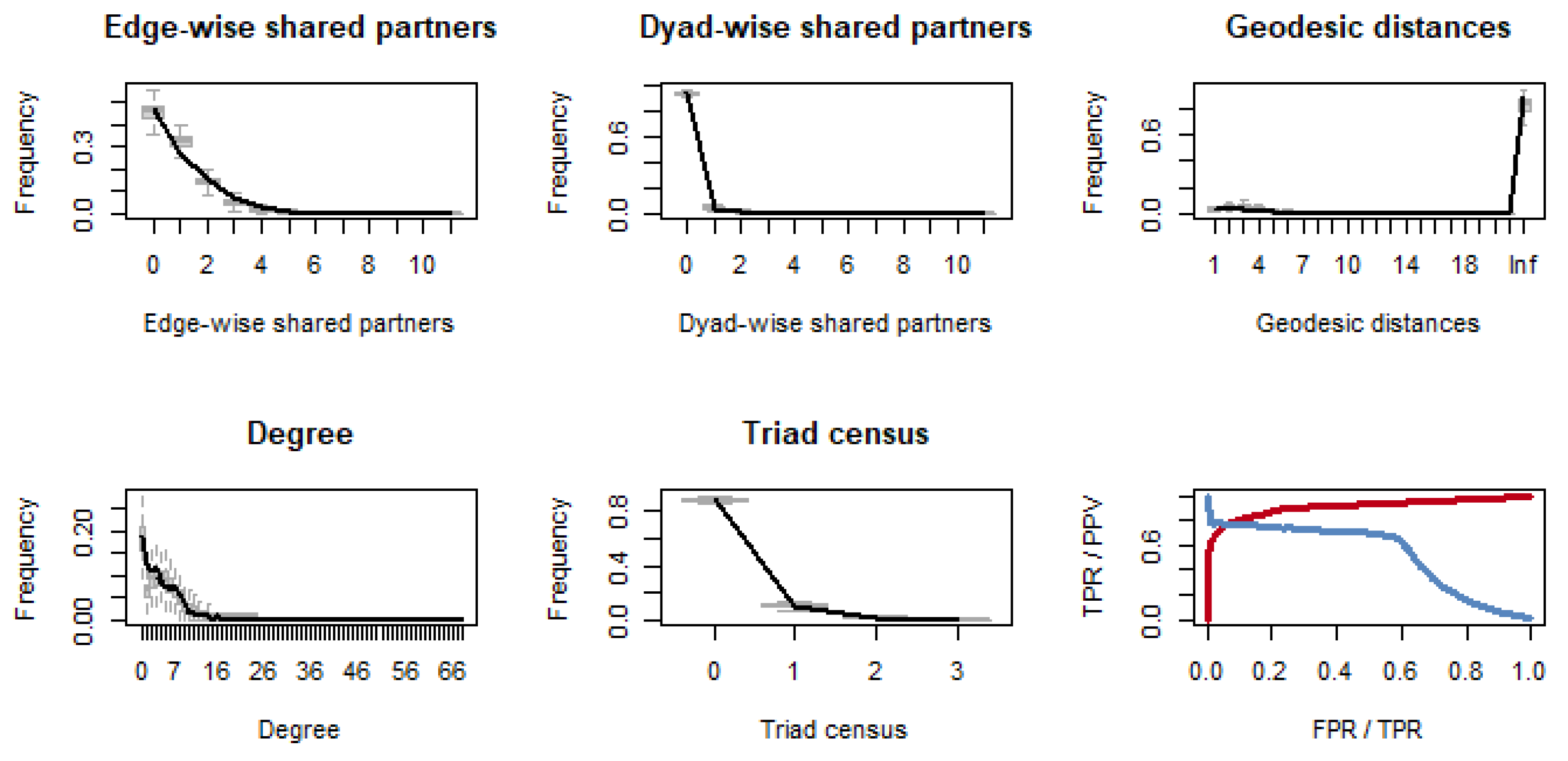

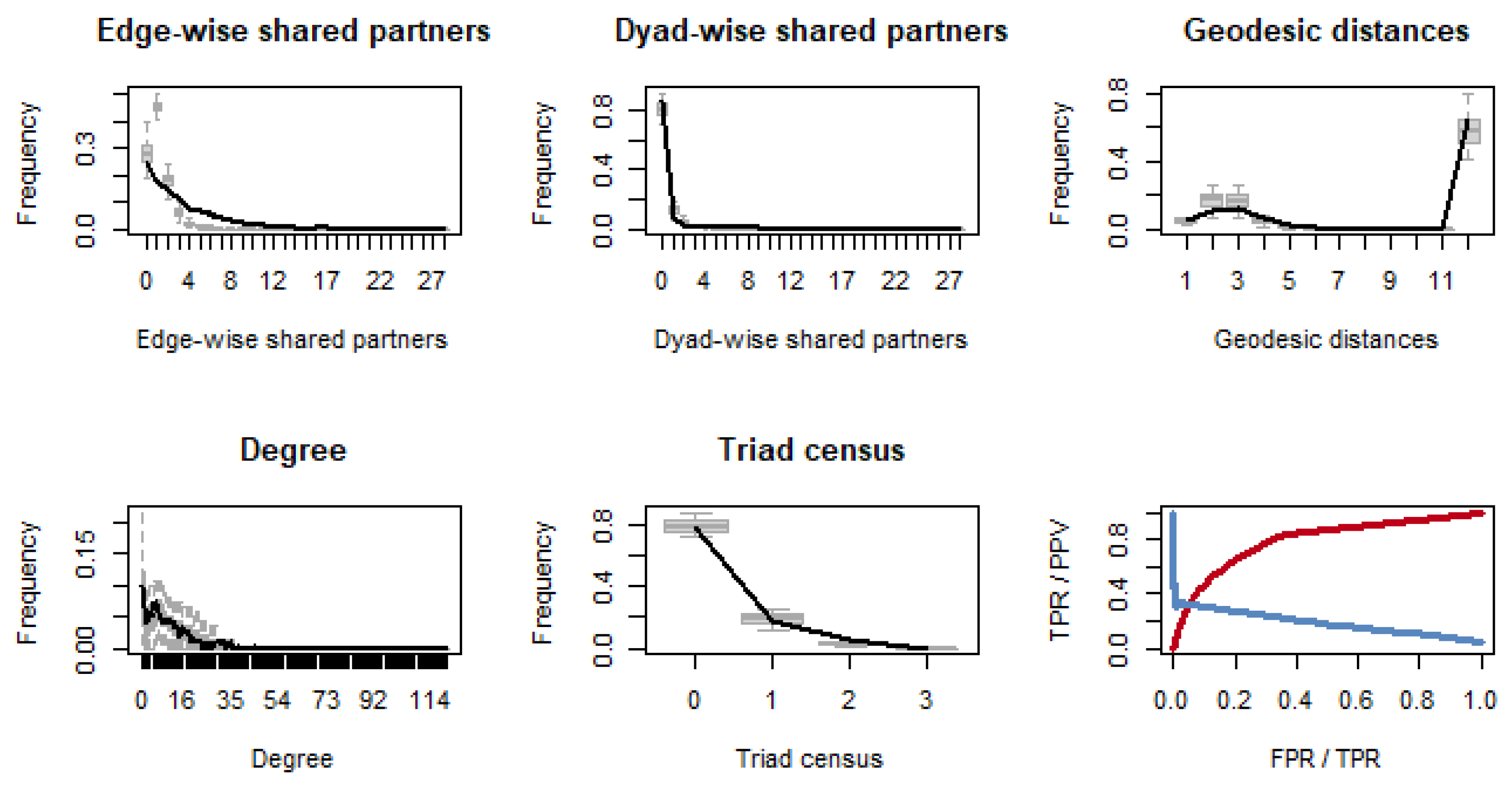

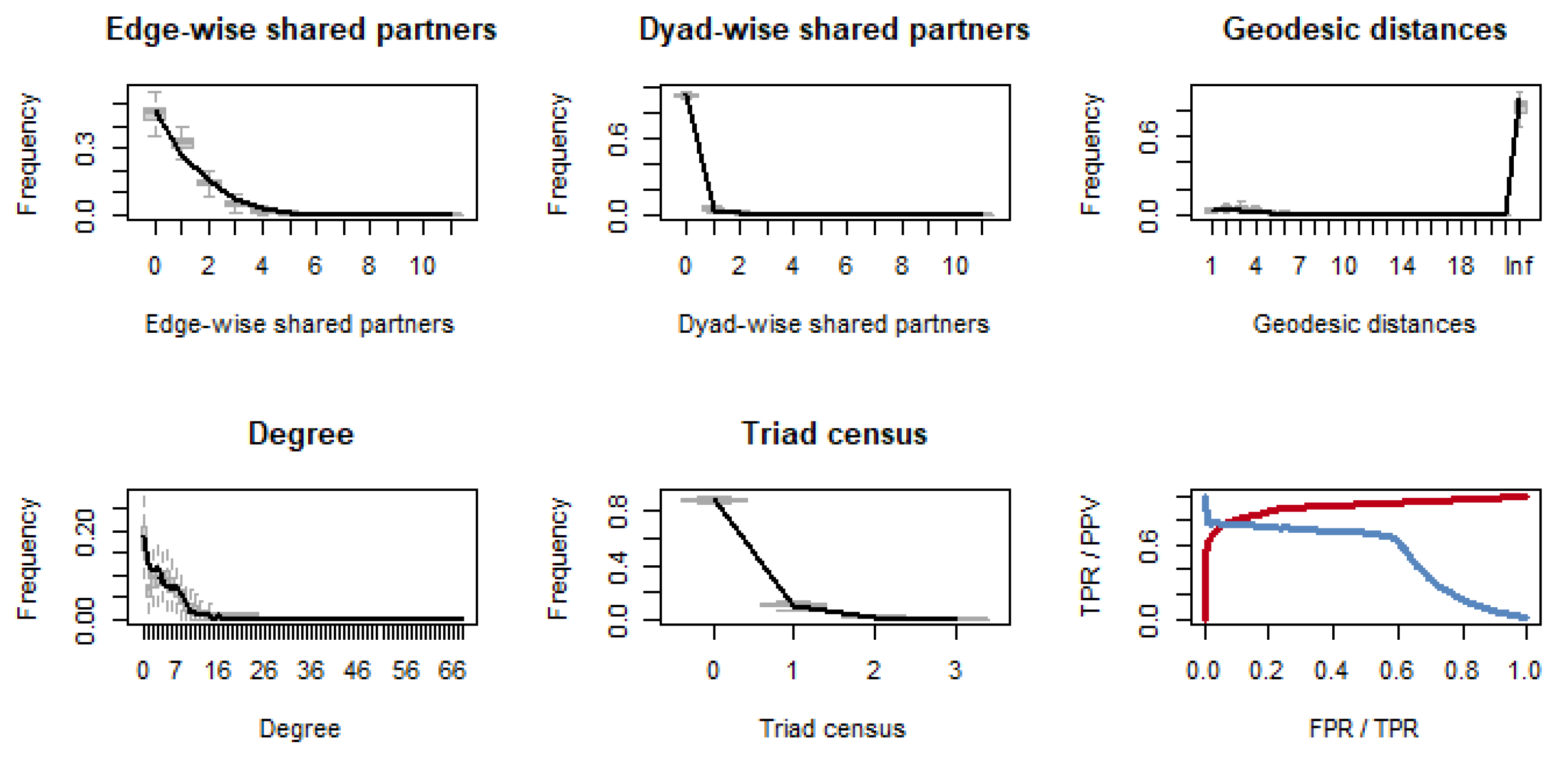

- Goodness-of-fit: by generating 100 simulated networks from the fitted TERGM using the btergm gof function and comparing observed versus simulated degree distributions, geodesic distances, triad census patterns, and so on.

- (1)

- Pure Structure Effects

- (2)

- Actor–relationship attribute effects

- (3)

- Network covariate effects

5. Network Analysis

5.1. Geopolitical Relationship Networks

5.1.1. Network Characteristics

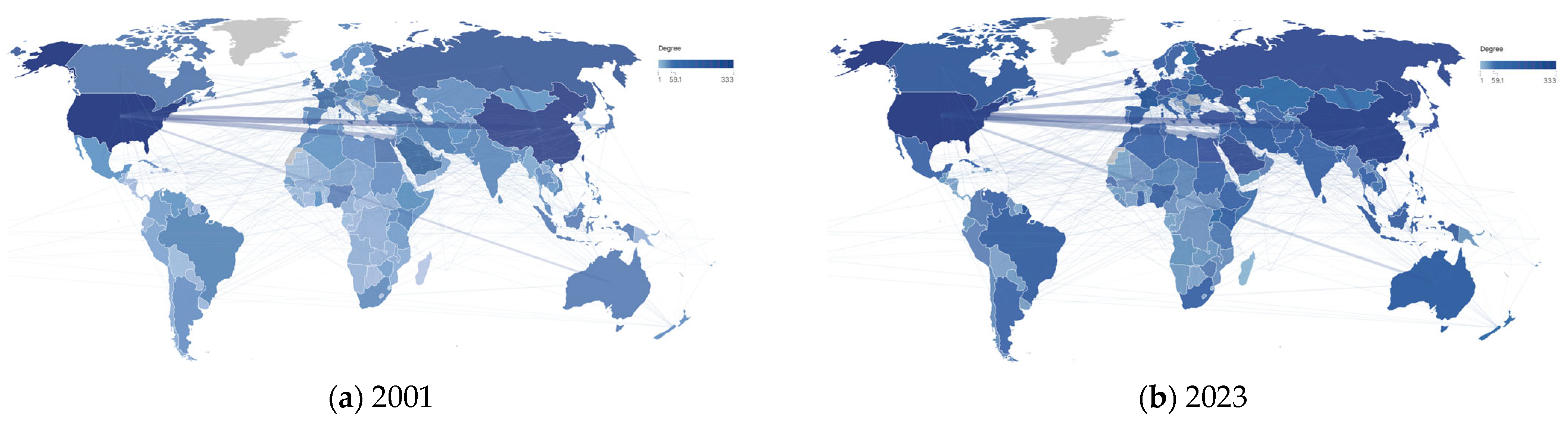

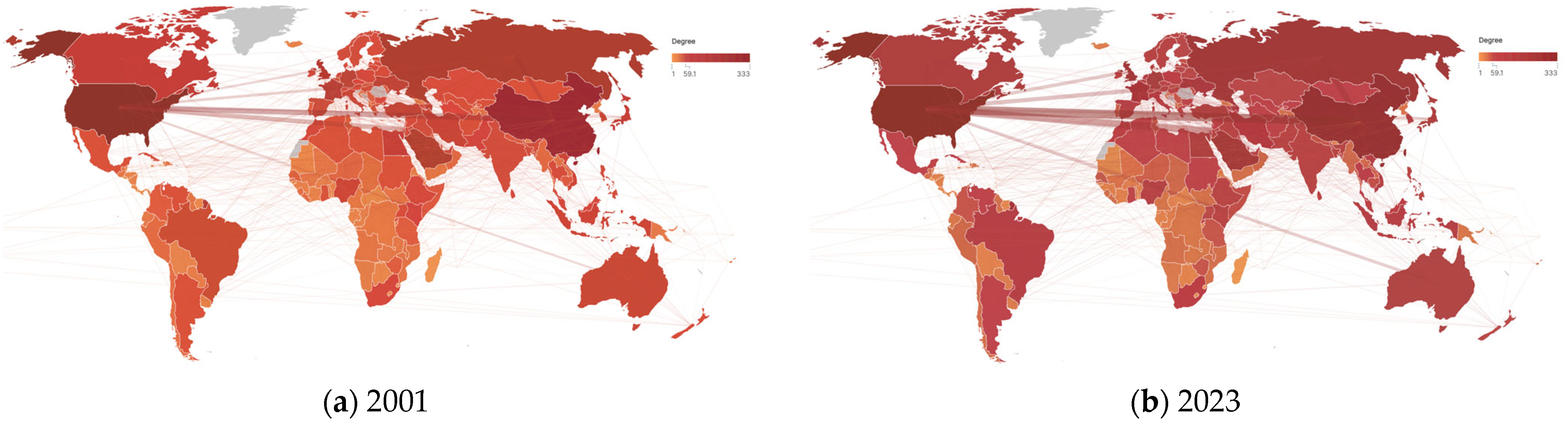

5.1.2. Geographical Distribution of Geopolitical Relationship Networks

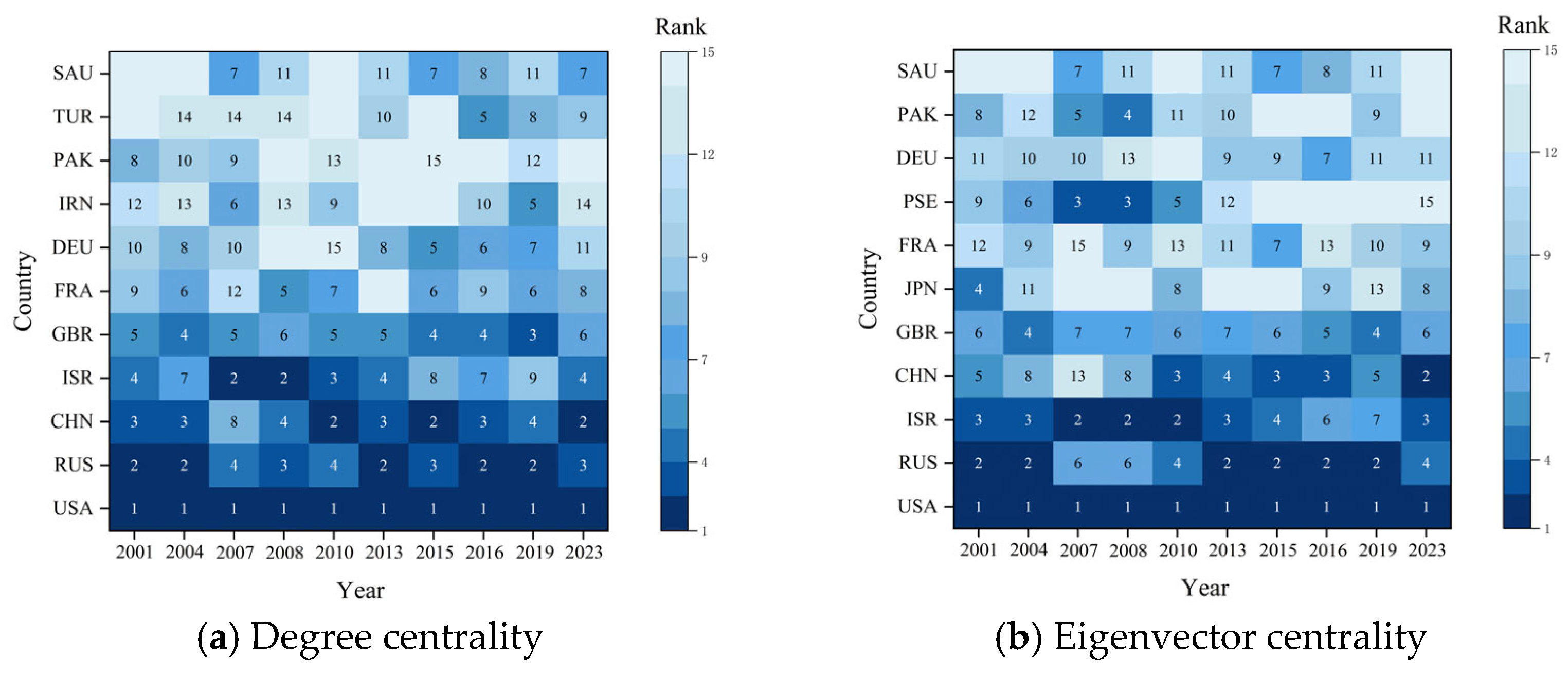

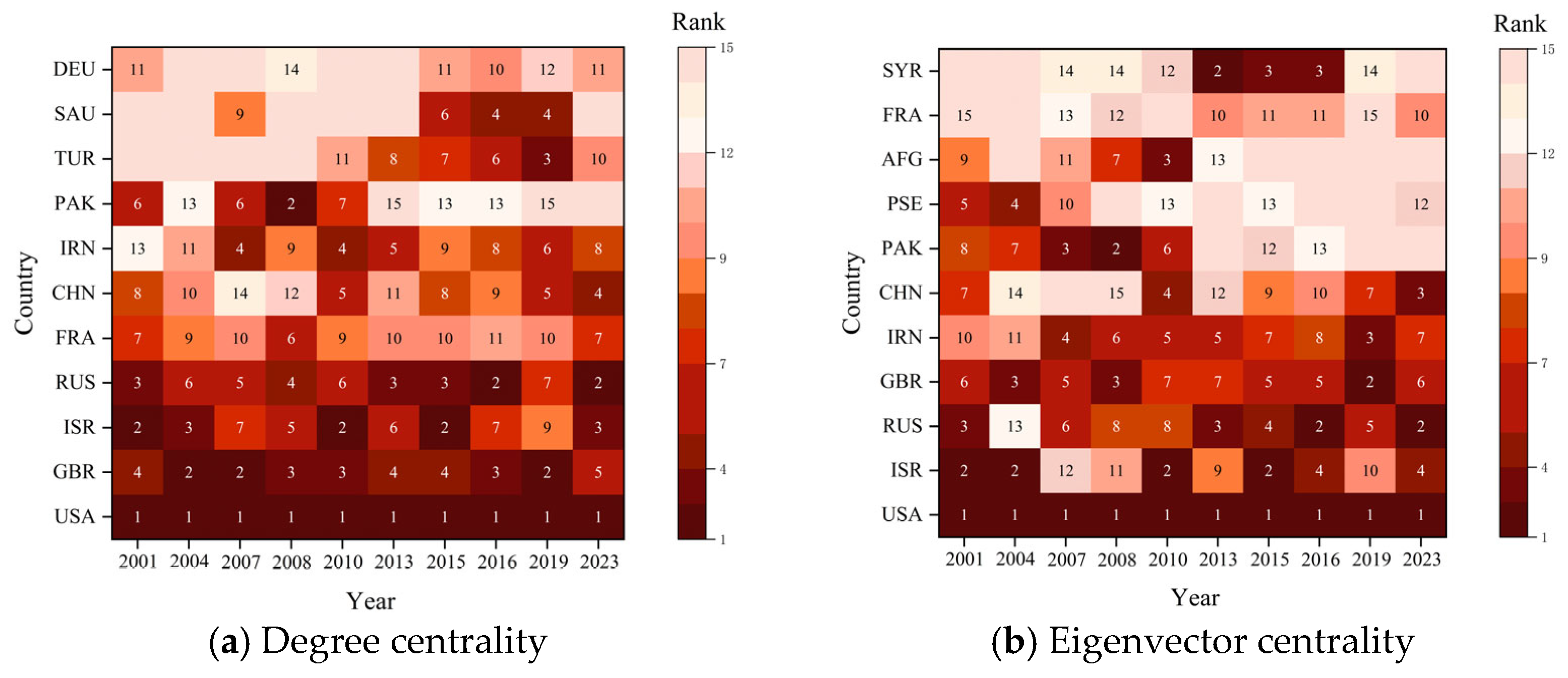

5.1.3. Evolutionary Analysis of Network Centrality Metrics

- (1)

- Cooperation network

- (2)

- Conflict network

5.2. Rare Earth Industry Chain Trade Network

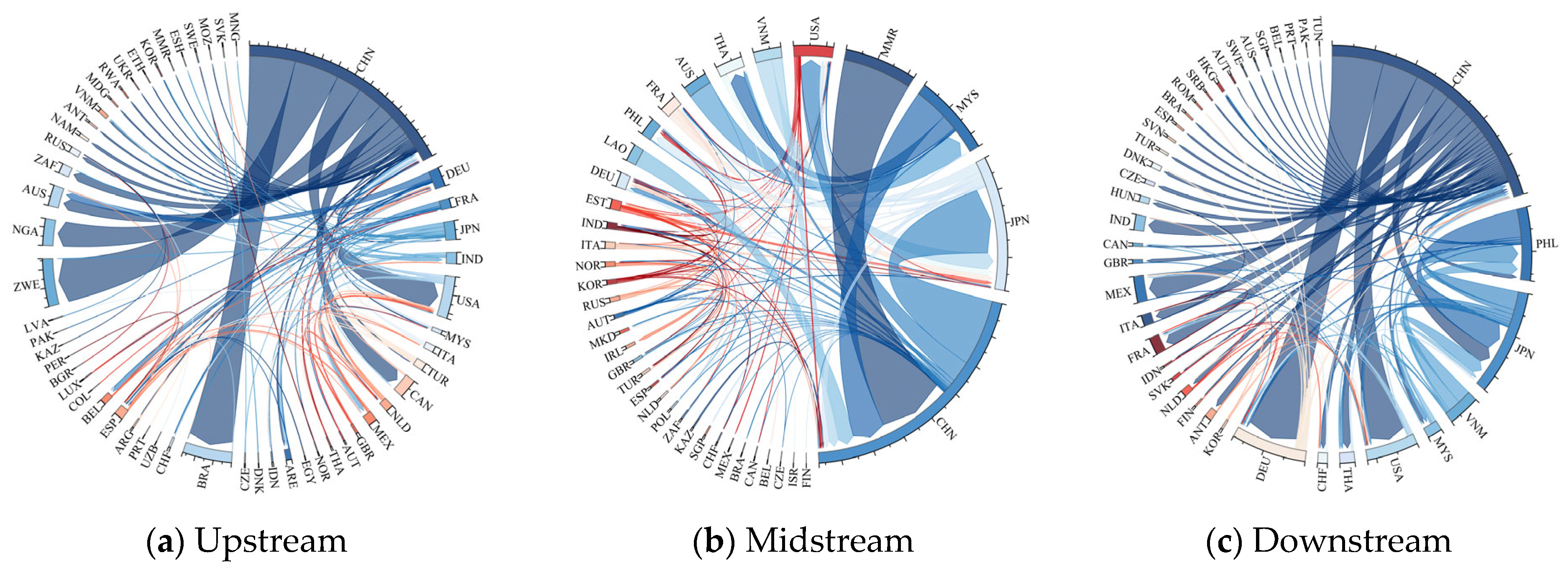

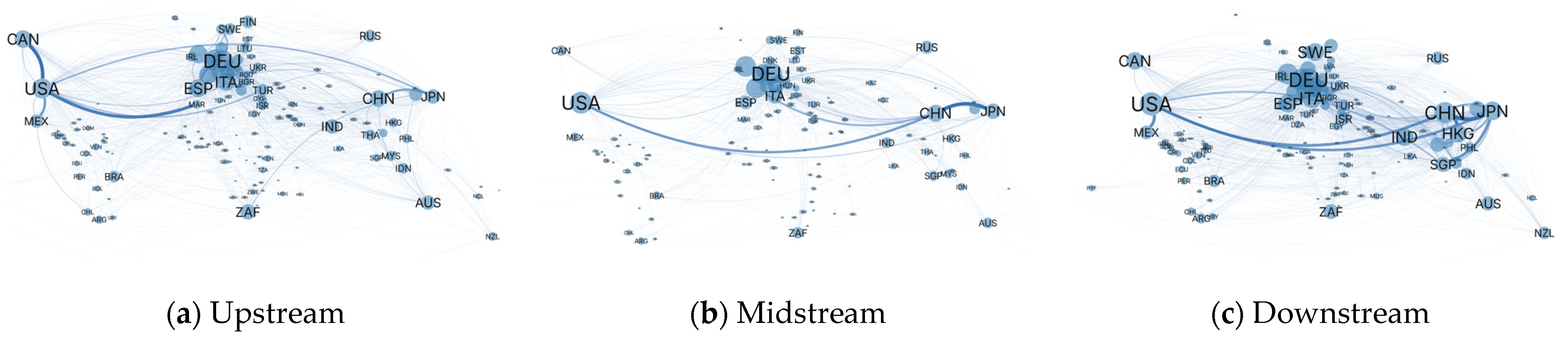

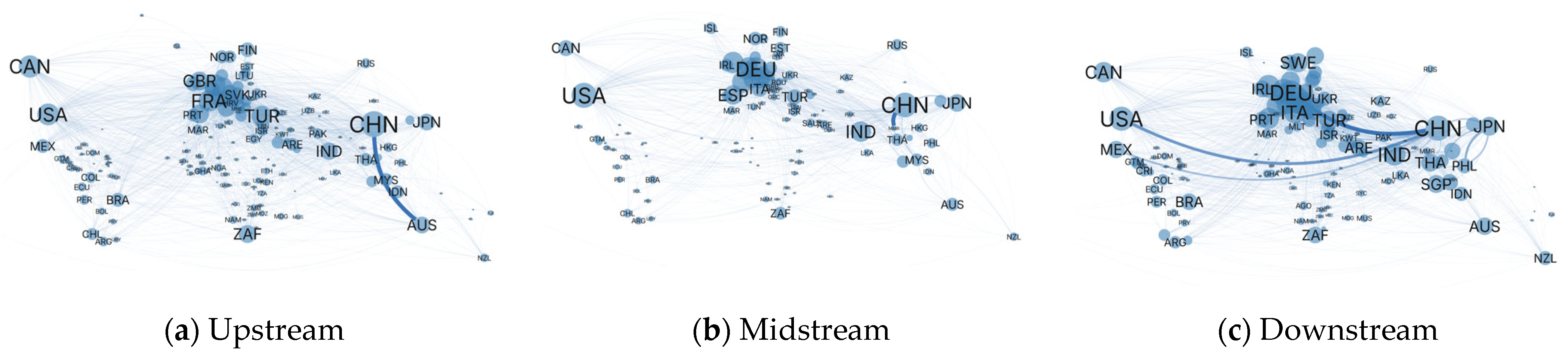

5.2.1. Community Structure Analysis

5.2.2. Network Characteristic Analysis

5.2.3. Evolutionary Dynamics Analysis

6. Empirical Analysis

6.1. The Impact of Geopolitical Relationship Networks on Rare Earth Trade

6.1.1. Pure Structure Effects

6.1.2. Actor–Relationship Attribute Effects

6.1.3. Network Covariate Effects

6.1.4. Goodness-of-Fit Test

6.2. The Impact of the Degree Centrality of the Geopolitical Relationship Network on Rare Earth Trade

6.3. The Impact of the Eigenvector Centrality of the Geopolitical Relationship Network on Rare Earth Trade

7. Research Conclusions and Prospects

7.1. Research Conclusions

7.2. Theoretical Contributions

7.3. Policy Recommendations

7.4. Research Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Telegina, E.A.; Khalova, G.O. Geoeconomic And Geopolitical Challenges Of Energy Transution: Implications For World Economy. Mirovaya Ekon. I Mezhdunarodnye Otnos. 2022, 66, 26–34. [Google Scholar]

- Chen, Y.F.; Zhang, S.; Miao, J.F. The negative effects of the US–China trade war on innovation: Evidence from the Chinese ICT industry. Technovation 2023, 123, 102734. [Google Scholar] [CrossRef]

- Mancheri, N.A.; Sprecher, B.; Deetman, S.; Young, S.B.; Bleischwitz, R.; Dong, L.; Kleijn, R.; Tukker, A. Resilience in the tantalum supply chain. Resour. Conserv. Recycl. 2018, 129, 56–69. [Google Scholar] [CrossRef]

- Opolski, M.; Wilson, I. Asthma and depression: A pragmatic review of the literature and recommendations for future research. Clin. Pract. Epidemiol. Ment. Health CP EMH 2005, 1, 18. [Google Scholar] [CrossRef] [PubMed][Green Version]

- Zepf, V. Rare Earth Elements: A New Approach to the Nexus of Supply, Demand and Use: Exemplified Along the Use of Neodymium in Permanent Magnets; Springer Science & Business Media: Berlin, Germany, 2013. [Google Scholar]

- Nece, M. The Impact of Colonial Ties of the Trade Relationships of African Countries; International Institute of Social Studies: The Hague, The Netherlands, 2022. [Google Scholar]

- Qin, K.; Luo, P.; Yao, B. Networked mining of GDELT and international relations analysis. Geo-Inf. Sci. 2019, 21, 4–24. [Google Scholar]

- Di Stefano, C.; Iapadre, P.L.; Salvati, I. Trade and Infrastructure in the Belt and Road Initiative: A Gravity Analysis Based on Revealed Trade Preferences. J. Risk Financ. Manag. 2021, 14, 52. [Google Scholar] [CrossRef]

- Gholz, E. Rare Earth Elements and National Security; Council on Foreign Relations: New York, NY, USA, 2014. [Google Scholar]

- Hatch, G.P. Dynamics in the Global Market for Rare Earths. Elements 2012, 8, 341–346. [Google Scholar] [CrossRef]

- Fan, J.H.; Omura, A.; Roca, E. Geopolitics and rare earth metals. Eur. J. Political Econ. 2023, 78, 102356. [Google Scholar] [CrossRef]

- Wübbeke, J. Rare earth elements in China: Policies and narratives of reinventing an industry. Resour. Policy 2013, 38, 384–394. [Google Scholar] [CrossRef]

- Hurst, C. China’s Rare Earth Elements Industry: What Can the West Learn? Institute for the Analysis of Global Security: Washington, DC, USA, 2010. [Google Scholar]

- MKJ. Rare Earth Frontiers: From Terrestrial Subsoils to Lunar Landscapes; Cornell University Press: New York, NY, USA, 2018. [Google Scholar]

- Hou, W.; Liu, H.; Wang, H. Structure and patterns of the international rare earths trade: A complex network analysis. Resour. Policy 2018, 55, 133–142. [Google Scholar] [CrossRef]

- Mancheri, N.A. An overview of Chinese rare earth export restrictions and implications. In Rare Earths Industry: Technological, Economic, and Environmental Implications; Elsevier: Amsterdam, The Netherlands, 2016; Chapter 2; pp. 21–36. [Google Scholar]

- Guo, Y.Q.; Li, Y.L.; Liu, Y.H.; Zhang, H.W. The impact of geopolitical relations on the evolution of cobalt trade network from the perspective of industrial chain. Resour. Policy 2023, 85, 103778. [Google Scholar] [CrossRef]

- Shuai, J.; Zhao, Y.; Shuai, C.; Wang, J.; Yi, T.; Cheng, J. Assessing the international co-opetitiondynamics of rare earth resources between China, USA, Japan and the EU: Anecological niche approach. Resour. Policy 2023, 82, 103446. [Google Scholar] [CrossRef]

- Leng, Z.; Sun, H.; Cheng, J.; Wang, H.; Yao, Z. China’s rare earth industry technologicalinnovation structure and driving factors: A social network analysis based on patents. Resour. Policy 2021, 73, 102233. [Google Scholar] [CrossRef]

- Golev, A.; Scott, M.; Erskine, P.D.; Ali, S.H.; Ballantyne, G.R. Rare earths supply chains: Current status, constraints and opportunities. Resour. Policy 2014, 41, 52–59. [Google Scholar] [CrossRef]

- Dutta, T.; Kim, K.H.; Uchimiya, M.; Kwon, E.E.; Jeon, B.H.; Deep, A.; Yun, S.T. Global demand for rare earth resources and strategies for green mining. Environ. Res. 2016, 150, 182–190. [Google Scholar] [CrossRef]

- Tong, X.; Lifset, R. International copper flow network: A blockmodel analysis. Ecol. Econ. 2007, 61, 345–354. [Google Scholar] [CrossRef]

- Ge, J.P.; Wang, X.B.; Guan, Q.; Li, W.H.; Zhu, H.; Yao, M. World rare earths trade network: Patterns, relations and role characteristics. Resour. Policy 2016, 50, 119–130. [Google Scholar] [CrossRef]

- Gulley, A.L.; McCullough, E.A.; Shedd, K.B. China’s domestic and foreign influence in the global cobalt supply chain. Resour. Policy 2019, 62, 317–323. [Google Scholar] [CrossRef]

- Alonso, E.; Sherman, A.M.; Wallington, T.J.; Everson, M.P.; Field, F.R.; Roth, R.; Kirchain, R.E. Evaluating Rare Earth Element Availability: A Case with Revolutionary Demand from Clean Technologies. Environ. Sci. Technol. 2012, 46, 3406–3414. [Google Scholar] [CrossRef]

- Wang, Q.Y.; Cao, S.Y.; Xiao, Y.Y. Statistical characteristics of international conflict and cooperation network. Phys. A—Stat. Mech. Its Appl. 2019, 535, 122334. [Google Scholar] [CrossRef]

- Bouzarovski, S. East-Central Europe’s changing energy landscapes: A place forgeography. Area 2009, 41, 452–463. [Google Scholar] [CrossRef]

- Daras, N.J.; Mazis, J.T. Systemic geopolitical modeling. Part 1: Prediction of geopolitical events. GeoJournal 2014, 80, 653–678. [Google Scholar] [CrossRef]

- Zhai, C.; Du, D.; Hou, C.; Duan, D.; Gui, Q. The evolution of geo-relation network in countriesaround the Asian water tower based on cooperation and conflict perspectives. Geogr. Res. 2021, 40, 3118–3136. [Google Scholar]

- De Soyres, F.; Mulabdic, A.; Murray, S. How much will the belt and roadinitiative reduce trade costs? Int. Econ. 2019, 159, 151–164. [Google Scholar] [CrossRef]

- Zhang, H.; Cao, H.; Guo, Y. The time-varying impact of geopolitical relations on rare earth trade networks: What is the role of China’s rare earth export restrictions? J. Technol. Forecast. Soc. Change 2024, 206, 123550. [Google Scholar] [CrossRef]

- Habib, K.; Wenzel, H. Exploring rare earths supply constraints for the emerging clean energy technologies and the role of recycling. J. Clean. Prod. 2014, 84, 348–359. [Google Scholar] [CrossRef]

- Boccaletti, S.; Latora, V.; Moreno, Y.; Chavez, M.; Hwang, D.U. Complex networks: Structure and dynamics. Phys. Rep.-Rev. Sec. Phys. Lett. 2006, 424, 175–308. [Google Scholar] [CrossRef]

- Gutiérrez-Moya, E.; Lozano, S.; Adenso-Díaz, B. Analysing the Structure of the Global Wheat Trade Network: An ERGM Approach. Agronomy 2020, 10, 1967. [Google Scholar] [CrossRef]

- Pan, S.; Chong, Z. Effects of FDI on trade among countries along the Belt and Road: A network perspective. LNT Trade Econ. 2022, 32, 84–103. [Google Scholar] [CrossRef]

- Cui, S.-J.; Cai, Y.; Jiang, M.-Q. Critical technology change and energy geopolitics transition. Nat. Resour. 2021, 35, 2585–2595. [Google Scholar] [CrossRef]

- Xu, S.; Ma, C.; Zhu, W. Study on the structure and evolution of rare earth trade network along the Belt and Road. Gold Sci. Technol. 2022, 30, 196–208. [Google Scholar]

- Feng, L.Y.; Xu, H.L.; Wu, G.; Zhao, Y.; Xu, J.L. Exploring the structure and influence factors of trade competitive advantage network along the Belt and Road. Phys. A—Stat. Mech. Its Appl. 2020, 559, 125057. [Google Scholar] [CrossRef]

- Zhao, G.M.; Li, W.X.; Geng, Y.; Bleischwitz, R. Uncovering the features of global antimony resource trade network. Resour. Policy 2023, 85, 103815. [Google Scholar] [CrossRef]

- Atacan, C.; Açik, A. Impact of Geopolitical Risk on International Trade: Evidence from Container Throughputs. Trans. Marit. Sci.-ToMS 2023, 12, 11. [Google Scholar] [CrossRef]

- Xu, J.; Li, J.; Charles, V.; Zhao, X. Evolution of the rare earth trade network: A perspective of dependency and competition. J. Geosci. Front. 2024, 15, 101653. [Google Scholar] [CrossRef]

- Ilankoon, I.M.S.K.; Dushyantha, N.P.; Mancheri, N.; Edirisinghe, P.; Neethling, S.; Ratnayake, N.; Rohitha, L.; Dissanayake, D.; Premasiri, H.; Abeysinghe, A.; et al. Constraints to rare earthelements supply diversification: Evidence from an industry survey. J. Clean. Prod. 2022, 331, 129932. [Google Scholar] [CrossRef]

- Liu, Z.G.; Wang, T.; Sonn, J.W.; Chen, W. The structure and evolution of trade relations between countries along the Belt and Road. J. Geogr. Sci. 2018, 28, 1233–1248. [Google Scholar] [CrossRef]

- Javorsek, M. Asymmetries in International Merchandise Trade Statistics: A Case Study of Selected Countries in Asia-Pacific; United Nations Economic and Social Commission for Asia and the Pacific: Bangkok, Thailand, 2016. [Google Scholar]

- Chen, W.; Zhang, H. Characterizing the Structural Evolution of Cereal Trade Networks in the Belt and Road Regions: A Network Analysis Approach. Foods 2022, 11, 1468. [Google Scholar] [CrossRef]

- Zheng, J.; Wang, J.F.; Shen, A.Z. Evolutionary game of international trade network based on trade policy differences. Sci. Rep. 2025, 15, 1095. [Google Scholar] [CrossRef]

- Zuo, X.-G.; Zhu, X.-H.; Chen, J.-Y. Trade dependence network structure of tantalum trade goods and its effect on trade prices: An industry chain perspective. Resour. Policy 2022, 79, 103065. [Google Scholar]

- Leifeld, P.; Cranmer, S.J.; Desmarais, B.A. Temporal Exponential Random Graph Models with btergm: Estimation and Bootstrap Confidence Intervals. J. Stat. Softw. 2018, 83, 1–36. [Google Scholar] [CrossRef]

- Whetsell, T.A. Democratic governance and global science: A longitudinal analysis of the international research collaboration network. PLoS ONE 2023, 18, e0287058. [Google Scholar] [CrossRef] [PubMed]

- Li, P.F.; Yang, D.H.; Qu, S.N.; Zhang, Y.F. Analysis on global supply risk of rare minerals: From the perspective of strategic emerging industry development. World Econ. Stud. 2015, 32, 96–104. [Google Scholar]

- Menkel-Meadow, C.; Schneider, A.K. International Conflict Resolution Processes; Carolina Academic Press: Durham, NC, USA, 2025. [Google Scholar]

- James, P. Conflict and cohesion: A review of the literature and recommendations for future research. Coop. Confl. 1987, 22, 21–33. [Google Scholar] [CrossRef]

- Mancheri, N.A. World trade in rare earths, Chinese export restrictions, and implications. Resour. Policy 2015, 46, 262–271. [Google Scholar] [CrossRef]

- Guo, Q.; Wang, Y. Rare earth trade dependence network structure and its impact on trade prices: An industry chain perspective. Resour. Policy 2024, 91, 104930. [Google Scholar] [CrossRef]

- Jianwei, L. The reconstruction of rare earth industry chain in the United States against the background of strategic competition among great powers and its impact. Pac. J. 2022, 12, 52–63. [Google Scholar]

- Ren, Y.W.; Yang, Y.; Wang, Y.; Liu, Y. Dynamics of the global semiconductor trade and its dependencies. J. Geogr. Sci. 2023, 33, 1141–1160. [Google Scholar] [CrossRef]

- Hoekman, B. Global Value Chains: Inter-Industry Linkages, Trade Costs and Policies. Rev. Ind. Organ. 2020, 57, 189–193. [Google Scholar] [CrossRef]

- Zuo, Z.; McLellan, B.C.; Li, Y.; Guo, H.; Cheng, J. Evolution and insights into the network and pattern of the rare earths trade from an industry chain perspective. Resour. Policy. 2022, 78, 102912. [Google Scholar] [CrossRef]

- Wu, Y.; Peng, Z.; Lai, D.; Zhao, S.; Wang, L.; Chen, W.; Wang, P. Exploring international rare earth industry landscape changes and China’s strategic responses. Bull. Chin. Acad. Sci. 2023, 38, 255–264. [Google Scholar]

- Li, Z.Z.; Meng, Q.; Zhang, L.L.; Lobont, O.R.; Shen, Y.J. How do rare earth prices respond to economic and geopolitical factors? Resour. Policy 2023, 85, 103853. [Google Scholar] [CrossRef]

- Yu, G.H.; Xiong, C.; Xiao, J.X.; He, D.Y.; Peng, G. Evolutionary analysis of the global rare earth trade networks. Appl. Math. Comput. 2022, 430, 127249. [Google Scholar] [CrossRef]

- Head, K.; Mayer, T.; Ries, J. The erosion of colonial trade linkages after independence. J. Int. Econ. 2010, 81, 1–14. [Google Scholar] [CrossRef]

| Industrial | Categories | HS Code |

|---|---|---|

| Upstream | Rare Earth Ores | HS253090 |

| Midstream | Rare Earth Metals and Their Compounds | HS280530 HS284690 HS284610 |

| Downstream | Rare Earth Permanent Magnets | HS850511 |

| Classification | Variable | Symbol | Interpretation |

|---|---|---|---|

| Pure Structure effect | Edge count | Edges | Basic directed network relationships, constant terms in the model. |

| Reciprocity structure | Mutual | Bilateral reciprocal trade relationships established between node countries. | |

| Geometrically weighted in-degree distribution | Gwideg | Distribution trends of trade connections received by economic entities from multiple economies. | |

| Geometrically weighted out-degree distribution | Gwodeg | Distribution trends of trade connections sent by economic entities to multiple economies. | |

| Geometrically weighted edgewise shared partnerships | Gwesp | The possibility of two countries forming a new trade network group through a third country. | |

| Geometrically weighted dyadwise shared partnerships | Gwdsp | The diversity of trade relationship transmission paths between two countries. | |

| Delayed reciprocity | Delrecip | Whether the formation of a unidirectional trade relationship between a pair of economies in period t − 1 will lead to a reciprocal trade relationship in period t. | |

| Stability | Stability | The persistence of connection relationships in the overall network structure from period t − 1 to t. | |

| Capturing temporal trend effects | Timecov | Analyzing the temporal trends in the formation of edges. | |

| Actor–relationship attribute effects | Logarithmic GDP of node countries | Nodecov.lnGDP | The propensity of countries with certain economic, cooperation, and conflictual characteristics to embrace trade dependency relationships. |

| Sender attributes | Nodeicov.coop Nodeicov.conf | ||

| Receiver attributes | Nodeocov.coop Nodeocov.conf | The propensity of countries with certain economic, cooperation, and conflictual characteristics to develop trade dependency relationships. | |

| Network covariate effects | Cooperation network | Edgecov.coop | The impact of cooperation networks, conflict networks, Geographical distances, common languages, and colonial relationships on the formation of a rare earth trade dependency network. |

| Conflict network | Edgecov.conf | ||

| Geographic distance network | Edgecov.dist | ||

| Common language network | Edgecov.lang | ||

| Colonial relationship network | Edgecov.colo |

| Network Indicator | Year | Nodes | Edges | Density | Average Path Length | Network Diameter | Clustering Coefficient | Average Degree | Mutual |

|---|---|---|---|---|---|---|---|---|---|

| Cooperation network | 2001 | 200 | 4139 | 0.104 | 1.93 | 5 | 0.575 | 20.695 | 0.89 |

| 2008 | 202 | 4429 | 0.109 | 1.908 | 4 | 0.575 | 21.926 | 0.86 | |

| 2015 | 207 | 6865 | 0.161 | 1.838 | 2 | 0.608 | 33.164 | 0.88 | |

| 2023 | 207 | 6404 | 0.150 | 1.863 | 4 | 0.584 | 30.937 | 0.87 | |

| Conflict network | 2001 | 180 | 989 | 0.031 | 2.063 | 5 | 0.522 | 5.494 | 0.50 |

| 2008 | 192 | 1281 | 0.035 | 2.013 | 4 | 0.546 | 6.672 | 0.62 | |

| 2015 | 204 | 2210 | 0.053 | 1.970 | 4 | 0.543 | 10.833 | 0.63 | |

| 2023 | 196 | 1879 | 0.049 | 1.971 | 4 | 0.566 | 9.587 | 0.62 |

| 2001 | 2008 | 2015 | 2023 | ||

|---|---|---|---|---|---|

| The top three in terms of the number of trading partners | Upstream | USA | USA | Australia | China |

| Japan | France | China | Japan | ||

| France | United Kingdom | Spain | German | ||

| Midstream | Japan | Japan | Japan | China | |

| USA | Thailand | USA | Japan | ||

| France | USA | Malaysia | USA | ||

| Downstream | China | USA | USA | Germany | |

| Singapore | China | Japan | Japan | ||

| USA | Thailand | China | USA | ||

| The top three in terms of trade intensity | Upstream | Japan | Spain | Japan | Spain |

| Germany | Germany | Poland | USA | ||

| China | China | Germany | Germany | ||

| Midstream | France | China | China | France | |

| USA | France | Germany | China | ||

| China | Germany | Austria | Austria | ||

| Downstream | Germany | China | China | China | |

| China | Germany | USA | Germany | ||

| United Kingdom | United Kingdom | Austria | United Kingdom |

| Variable | Upstream | Midstream | Downstream | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | |

| Pure structure effects | |||||||||

| Edges | −4.2024 *** (0.0010) | −3.2978 *** (0.0010) | −2.2292 *** (0.0010) | −2.0786 ** (0.0010) | −2.2803 *** (0.0010) | −1.1611 ** (0.0100) | −2.1266 *** (0.0010) | −2.7106 *** (0.0010) | −1.2703 *** (0.0010) |

| Mutual | −0.3878 *** (0.0010) | −0.1786 (1.0000) | −0.8414 *** (0.0010) | −0.2050 (1.0000) | −0.2164 * (0.0500) | −0.0798 (1.0000) | |||

| Gwideg | −1.9076 *** (0.0010) | −2.4481 *** (0.0010) | −5.8936 *** (0.0010) | −1.6849 *** (0.0010) | −5.4733 *** (0.0010) | −4.6086 *** (0.0010) | |||

| Gwodeg | −2.3715 *** (0.0010) | −2.3725 (0.0010) | −0.5672 *** (0.0010) | −4.6601 *** (0.0010) | −1.9248 *** (0.0010) | −3.2345 *** (0.0010) | |||

| Gwesp | 1.0451 *** (0.0010) | 0.8008 *** (0.0010) | 0.9496 *** (0.0010) | 0.4000 *** (0.0010) | 1.1117 *** (0.0010) | 0.07768 *** (0.0010) | |||

| Gwdsp | −0.2767 *** (0.0010) | −0.1892 *** (0.0010) | −0.5048 *** (0.0010) | −0.2109 *** (0.0010) | −0.4584 *** (0.0010) | −0.3296 *** (0.0010) | |||

| Delrecip | −0.2630 ** (0.0100) | −0.4154 (0.1000) | −0.2297 ** (0.0100) | ||||||

| Memory.stability | 1.3742 *** (0.0010) | 1.8165 *** (0.0010) | 1.2877 *** (0.0010) | ||||||

| Timecov | 0.0073 ** (0.0100) | −0.0148 ** (0.0100) | 0.0081 ** (0.0100) | ||||||

| Actor–relationship attribute effects | |||||||||

| Nodecov.lnGDP | 0.0047 (1.0000) | −0.0157 *** (0.0010) | −0.0113 * (0.1000) | −0.0510 *** (0.0010) | −0.0316 *** (0.0010) | −0.0161 * (0.0500) | −0.0307 *** (0.0010) | −0.0222 *** (0.0010) | −0.0240 *** (0.0010) |

| Nodeicov.coop | 0.0003 *** (0.0010) | 0.0001 (1.000) | 0.0000 ** (0.0100) | 0.0001 *** (0.0010) | 0.0001 *** (0.0010) | 0.0001 (1.0000) | 0.0001 *** (0.0010) | 0.0001 *** (0.0010) | 0.0000 *** (0.0010) |

| Nodeicov.conf | −0.0002 ** (0.0100) | −0.0000 (1.000) | −0.0002 ** (0.0100) | −0.0003 *** (0.0010) | −0.0003 *** (0.0010) | −0.0000 (1.0000) | −0.0002 *** (0.0010) | −0.0001 ** (0.0100) | −0.0001 (0.1000) |

| Nodeocov.coop | 0.0000 ** (0.0100) | 0.0000 (1.000) | 0.0000 (1.0000) | 0.0001 *** (0.0010) | 0.0000 ** (0.0100) | 0.0000 (0.1000) | 0.0000 ** (0.0100) | 0.0001 (0.1000) | 0.0000 (1.0000) |

| Nodeocov.conf | −0.0006 *** (0.0010) | −0.0003 *** (0.0010) | −0.0002 (0.1000) | −0.0021 *** (0.0010) | 0.0007 *** (0.0010) | −0.0004 ** (0.0100) | −0.0005 *** (0.0010) | −0.0002 *** (0.0010) | −0.0001 (0.1000) |

| Network covariate effects | |||||||||

| Edgecov.coop | 2.0092 *** (0.0010) | 1.3294 *** (0.0010) | 1.0412 *** (0.0010) | 2.2330 *** (0.0010) | 1.4582 *** (0.0010) | 1.0472 *** (0.0010) | 2.5914 *** (0.0010) | 1.5911 *** (0.0010) | 1.1471 *** (0.0010) |

| Edgecov.conf | −0.0736 ** (0.0100) | −0.0022 (1.000) | −0.0232 (1.0000) | −0.2107 ** (0.0100) | −0.1606 * (0.0500) | −0.0062 (1.0000) | −0.0507 (1.0000) | −0.0816 (1.0000) | −0.0174 (1.0000) |

| Edgecov.dist | 0.5446 *** (0.0010) | 0.5704 *** (0.0010) | 0.3374 *** (0.0010) | 0.0165 (1.0000) | 0.0982 (1.0000) | 0.0201 (1.0000) | 0.0642 (1.0000) | 0.1149 (1.0000) | 0.0569 (1.0000) |

| Edgecov.lang | −0.1656 ** (0.0100) | −0.1300 *** (0.0010) | −0.0522 (1.0000) | 0.1540 * (0.0500) | 0.1875 *** (0.0010) | 0.0404 (1.0000) | 0.1902 *** (0.0010) | 0.2172 *** (0.0010) | 0.1467 ** (0.0100) |

| Edgecov.colo | 0.0342 (1.0000) | 0.0216 (1.000) | −0.0091 (1.0000) | 0.1724 *** (0.0010) | 0.0326 (1.0000) | −0.0073 (1.0000) | 0.1039 *** (0.0010) | 0.0585 * (0.0500) | 0.0092 (1.0000) |

| Variable | Upstream | Midstream | Downstream | |||

|---|---|---|---|---|---|---|

| Model 10 | Model 11 | Model 12 | Model 13 | Model 14 | Model 15 | |

| Pure structure effects | ||||||

| Edges | −4.6097 *** (0.0010) | −4.0963 *** (0.0010) | −1.8098 *** (0.0010) | −3.1918 *** (0.0010) | −2.6942 *** (0.0010) | −3.1994 *** (0.0010) |

| Mutual | −0.9720 *** (0.0010) | −0.8568 *** (0.0010) | −0.6105 *** (0.0010) | −1.9495 *** (0.0010) | −0.2606 *** (0.0010) | −1.9543 *** (0.0010) |

| Gwesp | 1.8373 *** (0.0010) | 1.5850 *** (0.0010) | 1.1194 *** (0.0010) | 1.8774 *** (0.0010) | 1.5900 *** (0.0010) | 1.8766 *** (0.0010) |

| Gwdsp | −0.2982 *** (0.0010) | −0.2766 *** (0.0010) | −0.3566 *** (0.0010) | −0.6063 *** (0.0010) | −0.4580 *** (0.0010) | −0.6055 *** (0.0010) |

| Delrecip | 0.1110 * (0.0500) | −0.0418 (1.0000) | −0.5832 *** (0.0010) | −0.4943 *** (0.0010) | −0.5015 *** (0.0010) | −0.4939 *** (0.0010) |

| Stability | 1.3771 *** (0.0010) | 1.3745 *** (0.0010) | 2.2673 ** (0.0100) | 2.0324 *** (0.0010) | 1.5327 *** (0.0010) | 1.8185 *** (0.0010) |

| Actor–relationship attribute effects | ||||||

| Nodecov.lnGDP | 0.0000 (1.0000) | −0.0139 *** (0.0010) | −0.0191 *** (0.0500) | −0.0408 *** (0.0010) | −0.0079. (0.1000) | −0.0407 *** (0.0010) |

| Nodecov.coop | 0.0000 *** (0.0010) | −0.0000 *** (0.0010) | 0.0000 *** (0.0010) | 0.0000 *** (0.0010) | 0.0000 *** (0.0010) | 0.0000 *** (0.0010) |

| Nodecov.confl | −0.0005 ** (0.0100) | −0.0001 * (0.0500) | −0.0003 *** (0.0010) | −0.0000 (1.0000) | −0.0001 ** (0.0100) | −0.0000 (1.0000) |

| Network covariate effects | ||||||

| Edgecov.dist | 0.6610 *** (0.0010) | 0.5473 *** (0.0010) | 0.1545 (1.0000) | 0.1109 (1.0000) | 0.1186 (1.0000) | 0.1094 (1.0000) |

| Edgecov.lang | −0.1720 *** (0.0010) | −0.1529 *** (0.0100) | 0.0161 (1.0000) | 0.1034 (0.1000) | 0.0569 (1.0000) | 0.1058 (0.1000) |

| Edgecov.colo | 0.0711 * (0.0500) | 0.0039 (1.0000) | 0.0075 (1.0000) | 0.0269 (1.0000) | 0.0482 (1.0000) | 0.0257 (1.0000) |

| Edgecov.coop | 1.1698 *** (0.0010) | 1.4569 *** (0.0010) | 1.2099 *** (0.0010) | |||

| Edgecov.conf | −0.0262 *** (0.0010) | −0.0488 *** (0.0010) | −0.0165 *** (0.0010) | |||

| Variable | Upstream | Midstream | Downstream | |||

|---|---|---|---|---|---|---|

| Model 16 | Model 17 | Model 18 | Model 19 | Model 20 | Model 21 | |

| Pure structure effects | ||||||

| Edges | −3.2030 *** (0.0010) | −2.9509 *** (0.0010) | −1.8167 *** (0.0010) | −1.3736 ** (0.0500) | −2.6881 *** (0.0010) | −2.2160 *** (0.0010) |

| Mutual | −0.4538 *** (0.0010) | −0.4087 ** (0.0100) | −0.6000 * (0.0100) | −0.5708 * (0.0100) | −0.2702 * (0.0100) | −0.2771 * (0.0100) |

| Gwesp | 1.4016 *** (0.0010) | 1.2762 *** (0.0010) | 1.1233 *** (0.0010) | 0.9775 *** (0.0010) | 1.5882 *** (0.0010) | 1.4673 *** (0.0010) |

| Gwdsp | −0.2540 *** (0.0010) | −0.2172 *** (0.0010) | −0.3560 *** (0.0010) | −0.3501 *** (0.0010) | −0.4582 *** (0.0010) | −0.4369 *** (0.0010) |

| Delrecip | −0.3892 *** (0.0010) | −0.3510 *** (0.0010) | −0.6104 ** (0.0500) | −0.5075 * (0.1000) | −0.4983 *** (0.0010) | −0.3996 *** (0.0010) |

| Stability | 1.5685 *** (0.0010) | 1.4229 *** (0.0010) | 2.2661 *** (0.0010) | 2.0728 *** (0.0010) | 1.5352 *** (0.0010) | 1.3707 *** (0.0010) |

| Actor–relationship attribute effects | ||||||

| Nodecov.lnGDP | 0.0020 (1.0000) | −0.0093 * (0.0100) | −0.0187 * (0.0100) | −0.0369 *** (0.0010) | −0.0079. (0.1000) | −0.0232 *** (0.0010) |

| Nodecov.coop | 1.0267 *** (0.0010) | 1.7760 *** (0.0010) | 1.8288 *** (0.0010) | 1.7337 *** (0.0010) | 1.2276 *** (0.0010) | 1.3437 *** (0.0010) |

| Nodecov.confl | −1.4733 *** (0.0010) | −1.3238 *** (0.0010) | −0.7687 *** (0.0010) | −0.6940 *** (0.0010) | −1.3764 *** (0.0010) | −1.3495 *** (0.0010) |

| Network covariate effects | ||||||

| Edgecov.dist | 0.3725 *** (0.0010) | 0.3201 *** (0.0010) | 0.1558 (1.0000) | −0.0228 (1.0000) | 0.1109 (1.0000) | 0.0077 (1.0000) |

| Edgecov.lang | −0.0642 (1.0000) | −0.0762 (1.0000) | 0.0211 (1.0000) | 0.0035 (1.0000) | 0.0603 (1.0000) | 0.1225 * (0.0100) |

| Edgecov.colo | 0.0094 (1.0000) | −0.0302 (1.0000) | 0.0045 (1.0000) | −0.0640 (1.0000) | 0.0586 (1.0000) | −0.0043 (1.0000) |

| Edgecov.coop | 1.7465 *** (0.0010) | 1.8514 *** (0.0010) | 1.8516 *** (0.0010) | |||

| Edgecov.conf | −0.0914 (0.1000) | −0.2889 *** (0.0010) | −0.2884 *** (0.0010) | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, C.; Zhou, F.; Jiang, J.; Wen, H. Sustainable Governance of the Global Rare Earth Industry Chains: Perspectives of Geopolitical Cooperation and Conflict. Sustainability 2025, 17, 4881. https://doi.org/10.3390/su17114881

Liu C, Zhou F, Jiang J, Wen H. Sustainable Governance of the Global Rare Earth Industry Chains: Perspectives of Geopolitical Cooperation and Conflict. Sustainability. 2025; 17(11):4881. https://doi.org/10.3390/su17114881

Chicago/Turabian StyleLiu, Chunxi, Fengxiu Zhou, Jiayi Jiang, and Huwei Wen. 2025. "Sustainable Governance of the Global Rare Earth Industry Chains: Perspectives of Geopolitical Cooperation and Conflict" Sustainability 17, no. 11: 4881. https://doi.org/10.3390/su17114881

APA StyleLiu, C., Zhou, F., Jiang, J., & Wen, H. (2025). Sustainable Governance of the Global Rare Earth Industry Chains: Perspectives of Geopolitical Cooperation and Conflict. Sustainability, 17(11), 4881. https://doi.org/10.3390/su17114881