4.1. Findings

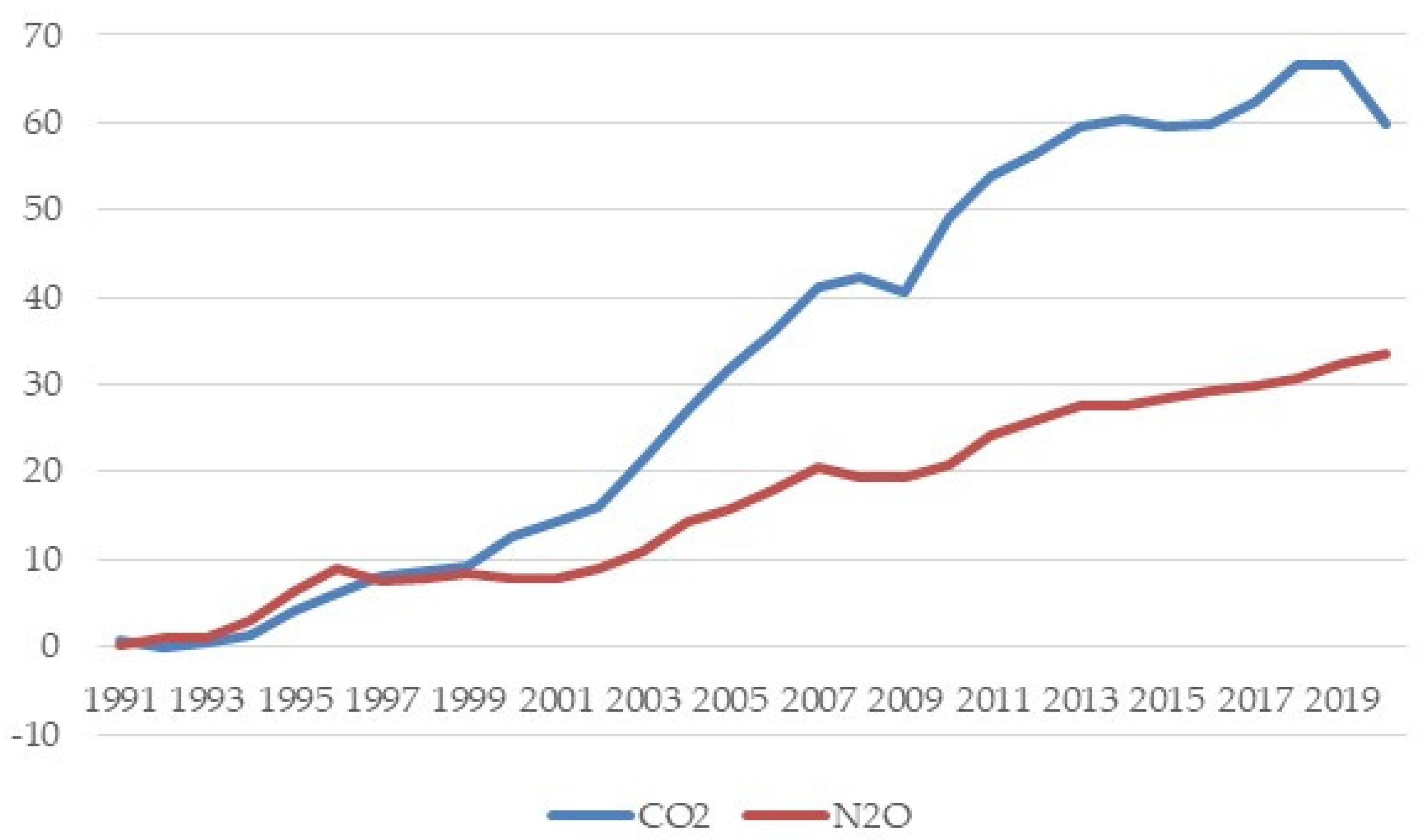

Table 2 presents descriptive statistics for the research variables. The average logarithm of CO

2 level is 9.62 (Std. dev. = 2.46), with Kiribati having the highest and China having the lowest emissions, corresponding to their CO

2 values. The average logarithm of N

2O level is 8.81 (Std. dev. = 2.23), with the Marshall Islands and China showing the highest and lowest emissions, respectively. Economic growth (EGR) has a mean value of 3.267 with a substantial standard deviation of 4.995, reflecting high variability in GDP growth across observations. The agricultural sector (AGR) accounts for an average of 12.893% of economic activity, although its high standard deviation of 11.869 suggests substantial cross-country differences, ranging from 0.000% to 64.673%. In contrast, the industrial sector (IND) has a higher average contribution of 26.923%, with values spanning from 0.000% to 74.113%, thus reinforcing its role as a dominant driver of emissions and economic output. Natural resource rents account for 6.31% of GDP on average. Average trade openness (OP) is 80.94%, indicating a high degree of integration of economies. According to the IMF, urbanisation averages 15.25% of the total population, while the financial development index remains at 0.309. These descriptive statistics highlight the diverse economic and environmental conditions across different economies and lay the foundation for subsequent analyses of emissions determinants.

Table 3 presents correlation coefficients between key variables. EGR exhibits a strong positive correlation with the logarithm of N

2O, while its correlation with the logarithm of CO

2 is not statistically significant. There is also a moderate correlation between IND and the logarithm of CO

2, indicating the sector’s contribution to environmental degradation. AGR, in contrast, shows a weaker or even negative correlation with emissions, implying that agricultural economies may have a smaller carbon footprint. Meanwhile, TRO shows a negative correlation with emissions, and URB and FID display positive correlations with pollution. Furthermore, the correlation coefficients among the independent variables are below 0.8, indicating no high multicollinearity among the independent variables.

Table 4,

Table 5 and

Table 6 assess the validity of the GMM regression results through the AR(2) and Hansen tests, which examine autocorrelation and the validity of instrumental variables, respectively. The

p-values for both tests are over 0.1, indicating that the null hypothesis is not rejected for both N

2O and CO

2. This suggests that the model errors are not autocorrelated after applying GMM estimation and that the instrumental variables used are appropriate, as they are uncorrelated with the model residuals [

98].

The results in

Table 4 highlight the significant and persistent influence of economic activities on CO

2 and N

2O emissions. The lagged emission variable (L.EMS) exhibits highly significant coefficients for CO

2 (0.9795) and N

2O (0.9825), with 1% statistical significance, indicating that past emissions strongly determine current levels. This persistence suggests that emissions tend to accumulate over time, reinforcing the long-term environmental impact of economic activities. Additionally, EGR has a positive and statistically significant effect on both CO

2 (0.0105) and N

2O (0.0031), implying that, as GDP per capita rises, emissions of both GHGs increase with a 1% statistical significance. However, the smaller coefficient for N

2O suggests N

2O’s relatively lower sensitivity to economic expansion compared to CO

2. These findings underscore the environmental trade-offs associated with economic growth. Moreover, NRR exhibits a small but statistically significant positive impact on both CO

2 (0.0003 with 10% statistical significance) and N

2O (0.0004 with 1% statistical significance) emissions, suggesting that economies reliant on resource rents tend to experience higher emissions. TRO also shows a significant but modest positive relationship with emissions (0.0001 for CO

2 and 0.0001 for N

2O) with statistical significance, indicating that increased trade activity is associated with higher emissions, likely due to the hypothesis of expansion of industrial production and transportation-related energy consumption.

Moreover, URB has a pronounced positive effect on emissions, with coefficients of 0.0164 * for CO2 and 0.0280 for N2O, suggesting that growing urban populations drive higher energy consumption and waste production, thereby increasing GHGs. FID presents mixed effects, with a significant positive association with CO2 emissions (0.0240), suggesting that increased financial resources may facilitate investments in emission-intensive industries. However, FID has a strongly negative effect on N2O emissions (−0.0645) with statistical significance, implying that the hypothesis of financial development could support technologies or policies that mitigate N2O, such as improved agricultural practices.

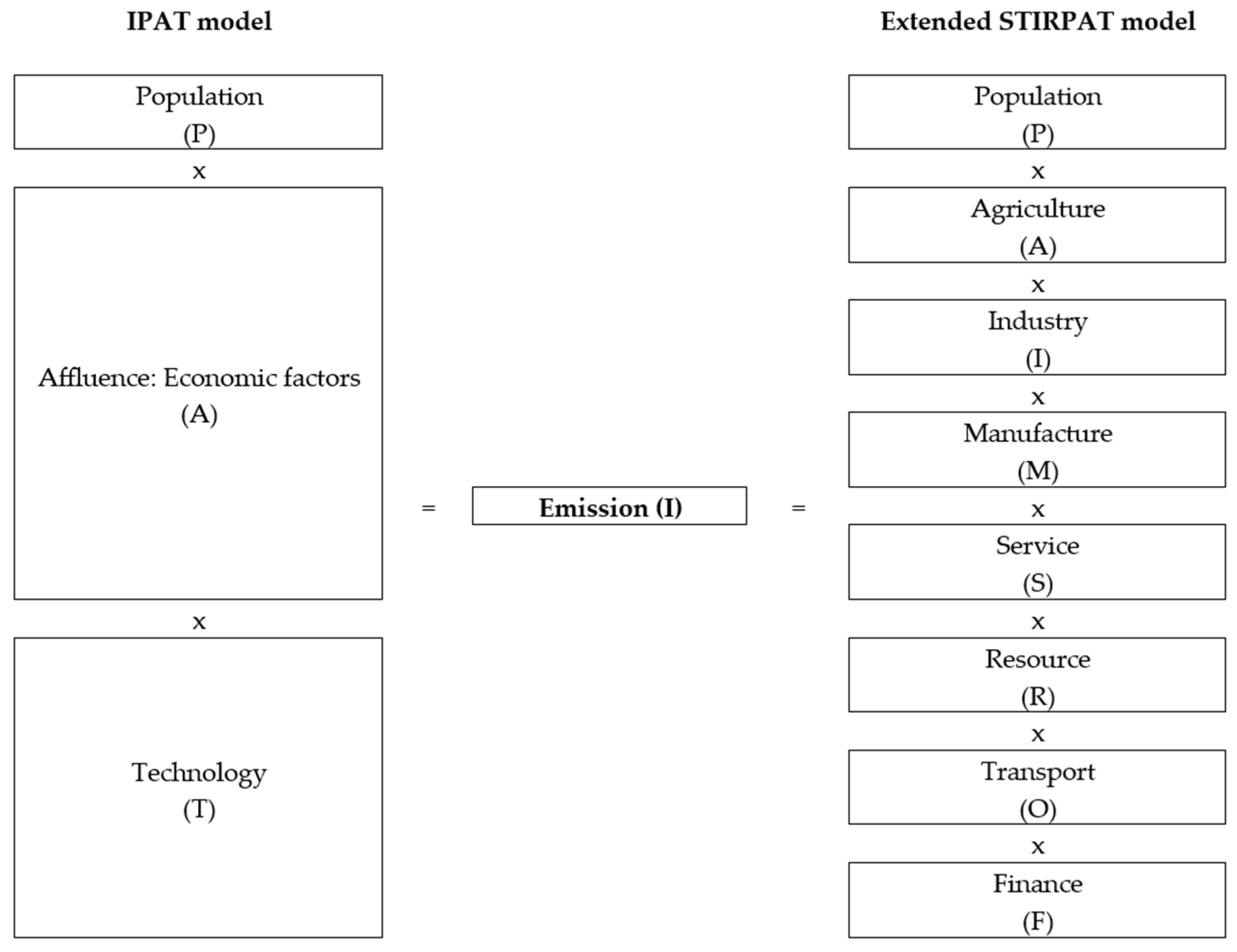

To examine the sectoral impacts of economic activities, economic activities are categorised into AGR, IND, MAF, and SER, and the below findings are estimated from Equations (3)–(6).

Table 5 and

Table 6 present the results on the relationship between economic activities and CO

2/N

2O emissions.

The results from

Table 5 and

Table 6 reveal key similarities and differences in the impact of economic activities on CO

2 and N

2O emissions, underscoring the sector- and gas-specific dynamics of environmental degradation. The persistence of emissions is evident for both GHGs, as indicated by the significant coefficients of the lagged emissions variable, which range from 0.9641 to 0.9795 for CO

2 (

Table 5) and from 0.9567 to 0.9919 for N

2O (

Table 6) across different sectors, similar to the findings reported in

Table 4. Although N

2O emissions exhibit slightly higher persistence levels, particularly in the industrial sector (0.9919) with 1% statistical significance, reflecting its long atmospheric lifespan and the sustained impact of industrial activities on N

2O release, sectoral production affects CO

2 and N

2O emissions in distinct ways. In the agriculture sector, AGR significantly increases emissions of both gases, but with a stronger effect for N

2O (0.0024, compared to 0.0013 for CO

2), likely due to the intensive use of nitrogen-based fertilisers that drive N

2O emissions. In contrast, IND contributes more to CO

2 (0.0018) than to N

2O emissions (0.0002), emphasising the predominance of fossil fuel combustion in industrial activities. MAF also exhibits a positive and significant impact on both gases, but its influence is relatively small for both CO

2 (0.0004) and N

2O (0.0012), suggesting that emissions depend on production processes and energy efficiency measures. Notably, SER reduces emissions of both gases, but with a more pronounced effect for CO

2 (−0.0014, compared to −0.0008 for N

2O), implying that transitioning towards service-based economies may be more effective in mitigating carbon emissions than N

2O.

URB consistently shows a significant and positive impact on emissions in all three tables, reinforcing the notion that increasing urbanisation drives higher emissions through intensified energy demand, industrialisation, and transportation expansion. However, the effect of URB is stronger for CO

2 emissions in

Table 5 (ranging from 0.0320 to 0.0389) compared to its impact in

Table 4 and

Table 6, where the effect varies across sectors (from 0.0089 to 0.0479 for N

2O). They suggest that while urbanisation contributes significantly to CO

2 and N

2O emissions, its influence on the former is more pronounced, particularly in the participation of explanatory variables of industries in empirical models. FID presents mixed findings across the tables. In

Table 6, FID has a negative and significant effect on N

2O emissions across all sectors (ranging from −0.0321 to −0.0797) except agriculture (insignificance), aligning with the results in

Table 4. However, in

Table 5, FID’s impact on CO

2 emissions varies by sector—it is significantly positive in the industrial (0.0277) and service (0.0519) sectors, but insignificant in agriculture and manufacturing. These findings suggest that financial development fuels carbon emissions primarily in industries that rely on capital-intensive production and energy consumption.

Table 7 presents a univariate analysis where the total sample is divided into developed and developing countries, following the classification recommended by UNCTAD (

https://unctadstat.unctad.org, accessed on 12 November 2024). Column (A) reports the mean values of the variables for developing countries, while column (B) provides the corresponding means for developed countries. Given that the variables follow a normal or approximately normal distribution, a

t-test is employed to compare the two groups, with the results displayed in column (C). The findings indicate that all variables have

p-values below 0.01, suggesting statistically significant differences between the two groups. These results support the hypothesis that economic growth affects emissions differently in developed and developing economies.

To further investigate these disparities, an interaction variable between the dummy variable for country classification (developing and developed countries, according to UNCTAD) and economic activities was incorporated into the research model, followed by a re-estimation of Equations (3)–(6). The results are presented in

Table 8 and

Table 9, respectively. DMY is a dummy variable, equalling 0 if the country is developing and 1 if the country is developed.

The findings from

Table 8 and

Table 9 provide deeper insights into how sectoral production affects CO

2 and N

2O emissions when considering country classifications, complementing the results from

Table 5 and

Table 6. A key finding is that the interaction term SEC*DMY exhibits significant variation across sectors, indicating that the relationship between economic activities and emissions is not uniform across different economies. For CO

2 emissions in

Table 8, SEC*DMY is positive and significant in the AGR sector (0.0117), suggesting that agricultural production in developed countries leads to greater carbon emissions than in developing economies. Conversely, IND (−0.0041), MAF (−0.0045), and SER (−0.0010) sectors in developed countries contribute less to CO

2 emissions compared to developing countries, indicating that advanced economies may benefit from cleaner technologies, greater energy efficiency, and stronger environmental regulations in these sectors. These conclusions are similar to those for N

2O emissions in

Table 9, where SEC*DMY is strongly positive in the agricultural sector (0.0281), indicating that developed countries produce significantly higher N

2O emissions from agricultural activities than developing nations. Meanwhile, IND (−0.0018), MAF (−0.0036), and SER (−0.0004) sectors in developed countries generate lower N

2O emissions than their developing counterparts.

4.2. Discussions

The above findings provide empirical insights into the relationship between economic activities and environmental degradation. Economic growth plays a significant role in shaping emissions, confirming the EKC hypothesis. The findings reveal that economic expansion is positively associated with emissions, particularly in the early stages of development, consistent with Yusuf, Abubakar, and Mamman [

17]. However, the smaller coefficient for N

2O compared to CO

2 suggests that industrial and energy production sectors contribute more significantly to carbon emissions, whereas N

2O emissions primarily arise from agricultural activities. The findings also indicate that industrial activities significantly contribute to environmental degradation through high fossil fuel consumption, aligning with Xie, Lu, and Xie [

15] and Roussilhe, Pirson, Xhonneux, and Bol [

28], as well as with Bui, Van Nguyen, Huynh, Bui, Nguyen, Perng, Bui, and Nguyen [

1]. Similarly, manufacturing also positively affects emissions, reinforcing the notion that energy-intensive production processes exacerbate environmental stress, as supported by Lee, McJeon, Yu, Liu, Kim, and Eom [

29]. Conversely, the service sector was found to reduce emissions, suggesting that transitioning to a service-based economy could serve as a viable strategy for mitigating emissions. This aligns with Hashmi, Hongzhong, Fareed, and Bannya [

38], who suggested that the service sector remains a low-polluting sector.

Interestingly, the role of urbanisation in emissions was also highlighted, with findings showing a strong positive association between urban expansion and GHG emissions. This supports prior studies, such as that by Vo, Vo, and Ho [

71], and by Huang, Zhang, Deng, Zhao, and Wu [

67], which linked rapid urbanisation to increased energy consumption, waste management, construction, and transportation—all of which contribute to higher emissions. Financial development yielded mixed results, showing a positive relationship with CO

2 emissions in certain sectors while contributing to N

2O emission reductions. This aligns with the complicated role of financial development identified by Tran [

55] and Nguyen, Duong, and Nguyen [

58], who found that, despite financial expansion’s positive influence on growth, it can either drive environmental degradation (through promoting energy consumption) or support sustainability (through enabling investments in clean technology). These findings stress the need to redirect financial systems towards sustainable financing mechanisms, such as green bonds and climate-conscious investments, to ensure economic expansion does not come at the cost of environmental harm. Additionally, trade openness had positive and negative effects on emissions, confirming the dual nature of trade’s environmental impact. While trade enhances resource allocation efficiency and promotes the diffusion of clean technologies [

59,

60], it can also intensify emissions, particularly in developing countries reliant on pollution-heavy industries [

61,

63]. The findings suggest that the environmental impact of trade openness is highly context-dependent, reinforcing the need for environmental policies that regulate emissions from export-driven industries.

A critical aspect of this study was the differentiation between developed and developing economies, examined through the interaction variable (SEC*DMY). The results reveal that developed countries exhibit lower emission intensities in industrial and manufacturing sectors, possibly due to stricter environmental regulations, cleaner production technologies, and energy efficiency improvements. However, agriculture in developed countries was found to significantly contribute to CO

2 and N

2O emissions, as aligned with the findings of Balogh and Jámbor [

22] and Ghimire, Lin, and Zhuang [

10], who highlighted the adverse effects of large-scale commercial farming, including excessive fertiliser use and soil degradation. In contrast, developed countries exhibit sectoral decoupling of emissions, where industrial and manufacturing activities contribute significantly to CO

2 and N

2O emissions, but these are reduced in the service sector. Hence, this study provides valuable insights into how economic activities shape environmental outcomes, emphasising the need for sector- and region-specific, and policy-driven approaches to emissions management.