Blockchain for Sustainable Development: A Systematic Review

Abstract

1. Introduction

2. Theoretical Foundations

3. Methodology

3.1. Identification

3.2. Screening

3.3. Eligibility

3.4. Inclusion and Synthesis

3.4.1. Articles’ Distribution by Source

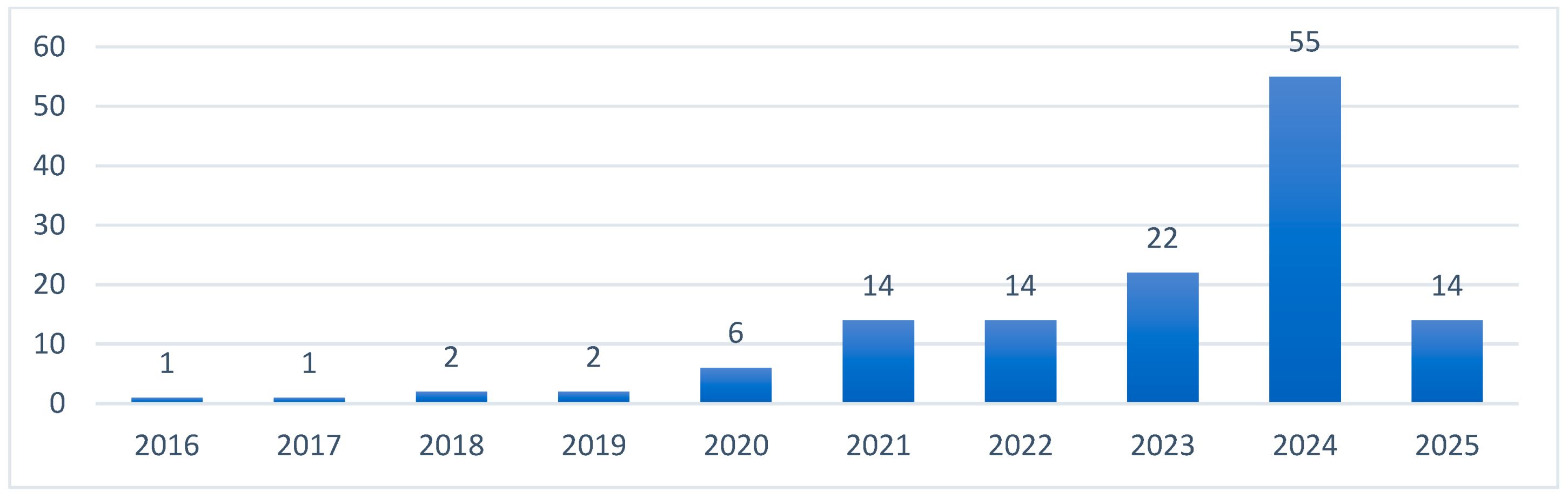

3.4.2. Articles’ Distribution by Publication Year

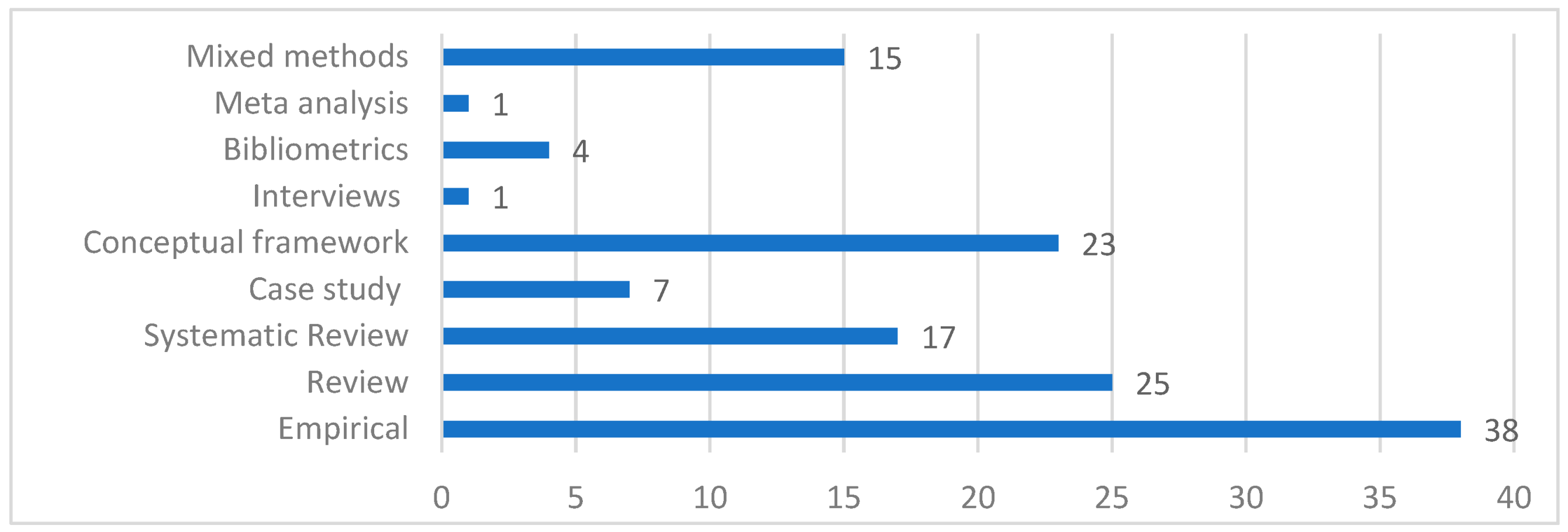

3.4.3. Methods Overview

4. Research Discussion

4.1. The Interplay Between BT and Sustainability

4.2. Mapping Blockchain Attributes onto Sustainability Capabilities and Impacts

5. Domain-Based Classification of Articles

5.1. Blockchain and Environmental Sustainability

5.1.1. Renewable Energy

5.1.2. Climate-Change Mitigation

5.1.3. Environmental Conservation

5.2. Blockchain in Economic Sustainability

5.2.1. Energy Efficiency

5.2.2. Promoting Fair Trade

5.2.3. Supply-Chain Management

5.2.4. Employment and Income Distribution

5.3. Blockchain for Social Sustainability

5.3.1. Equality, Social Inclusion, and Quality of Life

5.3.2. Secure Identity Verification

5.3.3. Business Ethics and Responsible Corporate Governance

5.3.4. Sustainable Consumption and Consumer Trust

5.4. Challenges and Solutions to Enhance Sustainability-Driven Blockchain Impact

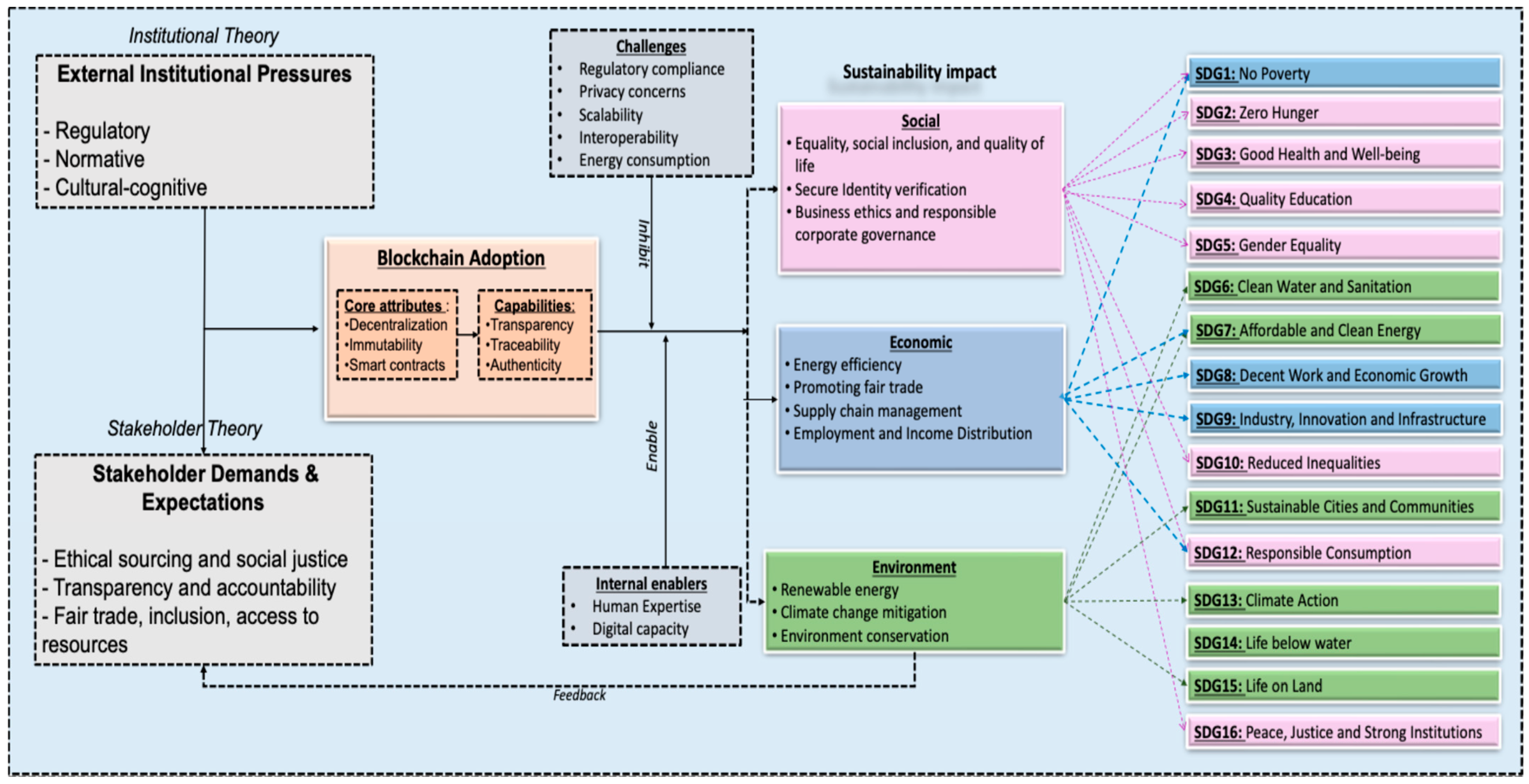

6. Comprehensive Framework for Sustainable Impact

7. Challenges and Solutions to Enhance Sustainability-Driven Blockchain Impact

7.1. Key Challenges

7.2. Moving Toward Integrated Adoption

8. Limitations and Future Research Directions

9. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Purvis, B.; Mao, Y.; Robinson, D. Three pillars of sustainability: In search of conceptual origins. Sustain. Sci. 2019, 14, 681–695. [Google Scholar] [CrossRef]

- Kapferer, J.N.; Michaut-Denizeau, A. Is luxury compatible with sustainability? Luxury consumers’ viewpoint. In Advances in Luxury Brand Management; Gardetti, A., Muthu, S., Eds.; Palgrave Macmillan: Cham, Switzerland, 2017; pp. 123–156. [Google Scholar]

- Souza, E.B.; Carlos, R.L.; de Mattos, C.A.; Scur, G. The role of blockchain platforms in enabling Corporate Social Responsibility and Environmental Management. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 5730–5743. [Google Scholar] [CrossRef]

- Saxena, A.; Singh, R.; Gehlot, A.; Akram, S.V.; Twala, B.; Singh, A.; Montero, E.C.; Priyadarshi, N. Technologies empowered environmental, social, and governance (ESG): An industry 4.0 landscape. Sustainability 2023, 15, 309. [Google Scholar] [CrossRef]

- Risso, L.A.; Ganga, G.M.D.; Godinho Filho, M.; de Santa-Eulalia, L.A.; Chikhi, T.; Mosconi, E. Present and future perspectives of blockchain in supply chain management: A review of reviews and research agenda. Comput. Ind. Eng. 2023, 179, 109195. [Google Scholar] [CrossRef]

- Kshetri, N. Blockchain’s roles in strengthening cybersecurity and protecting privacy. Telecommun. Policy 2017, 41, 1027–1038. [Google Scholar] [CrossRef]

- Sarfraz, M.; Khawaja, K.F.; Han, H.; Ariza-Montes, A.; Arjona-Fuentes, J.M. Sustainable supply chain, digital transformation, and blockchain technology adoption in the tourism sector. Humanit. Soc. Sci. Commun. 2023, 10, 557. [Google Scholar] [CrossRef]

- Ghadi, Y.Y.; Albogamy, F.R.; Alamri, S.; Mehboob, A. ChatGPT-Assisted Energy Efficiency Enhancement for Blockchain-Based IoT Networks. KSII Trans. Internet Inf. Syst. 2025, 19, 447–471. [Google Scholar]

- Parmentola, A.; Petrillo, A.; Tutore, I.; De Felice, F. Is blockchain able to enhance environmental sustainability? A systematic review and research agenda from the perspective of Sustainable Development Goals (SDGs). Bus. Strategy Environ. 2022, 31, 194–217. [Google Scholar] [CrossRef]

- Mulligan, C.; Morsfield, S.; Cheikosman, E. Blockchain for sustainability: A systematic literature review for policy impact. Telecommun. Policy 2024, 48, 102676. [Google Scholar] [CrossRef]

- Cheng, M.Y.; Chong, H.Y.; Xu, Y.S. Blockchain-smart contracts for sustainable project management. Environ. Dev. Sustain. 2024, 26, 8159–8182. [Google Scholar] [CrossRef]

- Pineda, M.; Jabba, D.; Nieto-Bernal, W.; Pérez, A. Sustainable consensus algorithms applied to blockchain: A systematic literature review. Sustainability 2024, 16, 10552. [Google Scholar] [CrossRef]

- Kshetri, N. Blockchain’s roles in meeting key supply chain management objectives. Int. J. Inf. Manag. 2018, 39, 80–89. [Google Scholar] [CrossRef]

- DiMaggio, P.J.; Powell, W.W. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Asif, M.; Searcy, C.; Castka, P. ESG and Industry 5.0: The role of technologies in enhancing ESG disclosure. Technol. Forecast. Soc. Change 2023, 195, 122806. [Google Scholar] [CrossRef]

- Liu, X.L.; Liang, W.B.; Fu, Y.L.; Huang, G.Q. Dual environmental, social, and governance disclosure based on blockchain technology. Sustainability 2024, 16, 4272. [Google Scholar] [CrossRef]

- Kouhizadeh, M.; Saberi, S.; Sarkis, J. Blockchain technology and the sustainable supply chain: Theoretically exploring adoption barriers. Int. J. Prod. Econ. 2021, 231, 107831. [Google Scholar] [CrossRef]

- Rani, P.; Sharma, P.; Gupta, I. Toward a greener future: A survey on sustainable blockchain applications and impact. J. Environ. Manag. 2024, 354, 120273. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Pitman: Bath, UK, 1984. [Google Scholar]

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L. Blockchain technology and its relationships to sustainable supply chain management. Technol. Forecast. Soc. Change 2019, 143, 307–318. [Google Scholar] [CrossRef]

- Khanfar, A.A.; Iranmanesh, M.; Ghobakhloo, M.; Senali, M.G.; Fathi, M. Applications of blockchain technology in sustainable manufacturing and supply chain management: A systematic review. Sustainability 2021, 13, 7870. [Google Scholar] [CrossRef]

- Silvestri, R.; Carloni, E.; Morrone, D.; Santovito, S. The role of blockchain technology in supply-chain relationships: Balancing efficiency and relational dynamics. J. Purch. Supply Manag. 2024, 31, 100967. [Google Scholar] [CrossRef]

- Dal Mas, F.; Massaro, M.; Ndou, V.; Raguseo, E. Blockchain technologies for sustainability in the agrifood sector: A literature review of academic research and business perspectives. Technol. Forecast. Soc. Change 2023, 187, 122155. [Google Scholar] [CrossRef]

- Hina, M.; Islam, N.; Luo, X. Towards sustainable consumption decision-making: Examining the interplay of blockchain transparency and information-seeking in reducing product uncertainty. Decis. Support Syst. 2025, 189, 114370. [Google Scholar] [CrossRef]

- Thanasi-Boçe, M.; AL-Issa, N.; Ali, O. Combating luxury counterfeiting through blockchain technology. In Blockchain Technologies in the Textile and Fashion Industry; Springer Nature Singapore: Singapore, 2022; pp. 1–16. [Google Scholar]

- Qian, C.; Gao, Y.; Chen, L. Green supply chain circular economy evaluation system based on industrial internet of things and blockchain technology under ESG concept. Processes 2023, 11, 1999. [Google Scholar] [CrossRef]

- Paul, J.; Criado, A.R. The art of writing literature review: What do we know and what do we need to know? Int. Bus. Rev. 2020, 29, 101717. [Google Scholar] [CrossRef]

- Tricco, A.C.; Lillie, E.; Zarin, W.; O’Brien, K.K.; Colquhoun, H.; Levac, D.; Moher, D.; Peters, M.D.; Horsley, T.; Weeks, L.; et al. PRISMA extension for scoping reviews (PRISMA 2020): Checklist and explanation. Ann. Intern. Med. 2018, 169, 467–473. [Google Scholar] [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ 2021, 372, n71. [Google Scholar] [CrossRef]

- PRISMA. 2022. Available online: www.prisma-statement.org/ (accessed on 20 February 2023).

- Paul, J.; Menzies, J. Developing classic systematic literature reviews to advance knowledge: Dos and don’ts. Eur. Manag. J. 2023, 41, 815–820. [Google Scholar] [CrossRef]

- Schneir, R.; Konstantinou, A.; Zimmermann, B.; Canto, D. A business case for 5G mobile broadband in a dense urban area. Telecommun. Policy 2019, 43, 101813. [Google Scholar] [CrossRef]

- Rodriguez Müller, A.P.; Martin Bosch, J.; Tangi, L. An overview of the expected public values arising from blockchain adoption in the European public sector. Int. J. Public Sect. Manag. 2024, 38, 53–76. [Google Scholar] [CrossRef]

- Xu, Y.L.; Sarfraz, M.; Sun, J.M.; Ivascu, L.; Ozturk, I. Advancing corporate sustainability via big data analytics, blockchain innovation, and organizational dynamics: A cross-validated predictive approach. Bus. Strategy Environ. 2025, 34, 1399–1418. [Google Scholar] [CrossRef]

- Cui, M.-L.; Feng, T.-T.; Wang, H.-R. How can blockchain be integrated into renewable energy? —A bibliometric-based analysis. Energy Strategy Rev. 2023, 50, 101207. [Google Scholar] [CrossRef]

- Zuo, Y. Tokenizing renewable energy certificates (RECs)—A blockchain approach for REC issuance and trading. IEEE Access 2022, 10, 134477–134490. [Google Scholar] [CrossRef]

- Bai, Y.; Hu, Q.; Seo, S.-H.; Kang, K.; Lee, J.J. Public participation consortium blockchain for smart city governance. IEEE Internet Things J. 2022, 9, 2094–2108. [Google Scholar] [CrossRef]

- Thakur, T.; Mehra, A.; Hassija, V.; Chamola, V.; Srinivas, R.; Gupta, K.K.; Singh, A.P. Smart water conservation through a machine learning and blockchain-enabled decentralized edge computing network. Appl. Soft Comput. 2021, 106, 107274. [Google Scholar] [CrossRef]

- Howson, P. Building trust and equity in marine conservation and fisheries supply chain management with blockchain. Mar. Policy 2020, 115, 103873. [Google Scholar] [CrossRef]

- Brilliantova, V.; Thurner, T.W. Blockchain and the future of energy. Technol. Soc. 2019, 57, 38–45. [Google Scholar] [CrossRef]

- Teufel, B.; Sentic, A.; Barmet, M. Blockchain energy: Blockchain in future energy systems. J. Electron. Sci. Technol. 2019, 17, 100011. [Google Scholar] [CrossRef]

- Lezzi, M.; Del Vecchio, V.; Lazoi, M. Using blockchain technology for sustainability and secure data management in the energy industry: Implications and future research directions. Sustainability 2024, 16, 7949. [Google Scholar] [CrossRef]

- Afzal, M.; Li, J.; Amin, W.; Huang, Q.; Umer, K.; Ahmad, S.A.; Ahmad, F.; Raza, A. Role of blockchain technology in transactive energy market: A review. Sustain. Energy Technol. Assess. 2022, 53, 102646. [Google Scholar] [CrossRef]

- Khosravi, A.; Säämäki, F. Beyond Bitcoin: Evaluating energy consumption and environmental impact across cryptocurrency projects. Energies 2023, 16, 6610. [Google Scholar] [CrossRef]

- Chen, Y.S.; Yu, Z. Digitalization, trust, and sustainability transitions: Insights from two blockchain-based green experiments in China’s electricity sector. Environ. Innov. Soc. Transit. 2024, 50, 100801. [Google Scholar] [CrossRef]

- Arshad, A.; Shahzad, F.; Rehman, I.U.; Sergi, B.S. A systematic literature review of blockchain technology and environmental sustainability: Status quo and future research. Int. Rev. Econ. Financ. 2023, 88, 1602–1622. [Google Scholar] [CrossRef]

- Khan, K.; Hassan, F.; Koo, J.; Mohammed, M.A.; Hasan, Y.; Muhammad, D.; Chowdhry, B.S.; Qureshi, N.M.F. Blockchain-based applications and energy effective electric vehicle charging—A systematic literature review, challenges, comparative analysis and opportunities. Comput. Electr. Eng. 2023, 112, 108959. [Google Scholar] [CrossRef]

- Truby, J.; Brown, R.D.; Dahdal, A.; Ibrahim, I. Blockchain, climate damage, and death: Policy interventions to reduce the carbon emissions, mortality, and net-zero implications of non-fungible tokens and Bitcoin. Energy Res. Soc. Sci. 2022, 88, 102499. [Google Scholar] [CrossRef]

- Wang, N.S.; Zhao, Y.H.; Li, J.; Cai, G.F. Enhancing China’s green GDP accounting through blockchain technology. Sci. Rep. 2024, 14, 29235. [Google Scholar]

- Fu, Z.; Dong, P.; Li, S.; Ju, Y.; Liu, H. How blockchain renovate the electric vehicle charging services in the urban area? A case study of Shanghai, China. J. Clean. Prod. 2021, 315, 128172. [Google Scholar] [CrossRef]

- Olivier, J.G.; Schure, K.M.; Peters, J.A.H.W. Trends in global CO2 and total greenhouse gas emissions. PBL Neth. Environ. Assess. Agency 2017, 5, 1–11. [Google Scholar]

- Yao, Y.F.; Liu, T.T.; Tian, G.X. Improve the sustainability of supply chain: A blockchain-based approach. RAIRO Oper. Res. 2025, 59, 115–148. [Google Scholar] [CrossRef]

- Zhu, Q.; Duan, Y.; Sarkis, J. Blockchain Empowerment: Unveiling Managerial Choices in Carbon Finance Investment Across Supply Chains. J. Bus. Logist. 2025, 46, e12405. [Google Scholar] [CrossRef]

- Alotaibi, E.M.; Khallaf, A.; Abdallah, A.A.N.; Zoubi, T.; Alnesafi, A. Blockchain-Driven Carbon Accountability in Supply Chains. Sustainability 2024, 16, 10872. [Google Scholar] [CrossRef]

- Luna, M.; Fernandez-Vazquez, S.; Tereñes Castelao, E.; Arias Fernández, Á. A blockchain-based approach to the challenges of EU’s environmental policy compliance in aquaculture: From traceability to fraud prevention. Mar. Policy 2024, 159, 105892. [Google Scholar] [CrossRef]

- Dehshiri, S.J.H.; Amiri, M. Evaluation of blockchain implementation solutions in the sustainable supply chain: A novel hybrid decision approach based on Z-numbers. Expert Syst. Appl. 2024, 235, 121123. [Google Scholar] [CrossRef]

- Yang, Z.; Zhu, C.; Zhu, Y.; Li, X. Blockchain technology in building environmental sustainability: A systematic literature review and future perspectives. Build. Environ. 2023, 245, 110970. [Google Scholar] [CrossRef]

- Furones, R.A.; Monzón, T.J.I. Blockchain applicability in the management of urban water supply and sanitation systems in Spain. J. Environ. Manag. 2023, 344, 118480. [Google Scholar] [CrossRef]

- Singh, A.K.; Kumar, V.R.P.; Dehdasht, G.; Mohandes, S.R.; Manu, P.; Pour Rahimian, F. Investigating the barriers to the adoption of blockchain technology in sustainable construction projects. J. Clean. Prod. 2023, 403, 136840. [Google Scholar] [CrossRef]

- Sipthorpe, A.; Brink, S.; Van Leeuwen, T.; Staffell, I. Blockchain solutions for carbon markets are nearing maturity. One Earth 2022, 5, 779–791. [Google Scholar] [CrossRef]

- Jiang, Y.; Zheng, W. Coupling mechanism of green building industry innovation ecosystem based on blockchain smart city. J. Clean. Prod. 2021, 307, 126766. [Google Scholar] [CrossRef]

- Park, A.; Li, H. The effect of blockchain technology on supply chain sustainability performances. Sustainability 2021, 13, 1726. [Google Scholar] [CrossRef]

- Schulz, K.A.; Gstrein, O.J.; Zwitter, A.J. Exploring the governance and implementation of sustainable development initiatives through blockchain technology. Futures 2020, 122, 102611. [Google Scholar] [CrossRef]

- Abbas, Z.; Myeong, S. A comprehensive study of blockchain technology and its role in promoting sustainability and circularity across large-scale industry. Sustainability 2024, 16, 4232. [Google Scholar] [CrossRef]

- ISO 14001; Environmental Management and Related Standards. International Organization for Standardization: Geneva, Switzerland, 2024. Available online: https://www.iso.org/iso-14001-environmental-management.html (accessed on 30 March 2025).

- Jimenez-Castillo, L.; Sarki, J.; Saberi, S.; Yao, T.C. Blockchain-based governance implications for ecologically sustainable supply chain management. J. Enterp. Inf. Manag. 2024, 37, 76–99. [Google Scholar] [CrossRef]

- Baig, M.I.; Yadegaridehkordi, E. Exploring moderating role of blockchain adoption on economic and environmental sustainability of organizations: A SEM-fsQCA technique. Sustain. Dev. 2024, 32, 3824–3839. [Google Scholar] [CrossRef]

- Mohamed, S.K.; Haddad, S.; Barakat, M. Does blockchain adoption engender environmental sustainability? The mediating role of customer integration. Bus. Process Manag. J. 2024, 30, 558–585. [Google Scholar] [CrossRef]

- Tian, H.; Yuzhi, J.; Xiaonan, G. Blockchain-based AMI framework for data security and privacy protection. Sustain. Energy Grids Netw. 2022, 32, 100807. [Google Scholar] [CrossRef]

- Samoggia, A.; Fantini, A.; Ghelfi, R. The promised potential of blockchain technology for the sustainability of agri-food supply chains. Front. Sustain. Food Syst. 2025, 9, 1401735. [Google Scholar] [CrossRef]

- Almasri, A.; Ying, L. Blockchain and circular economy: A pathway to sustainable supply chains. J. Clean. Prod. 2024, 435, 142395. [Google Scholar] [CrossRef]

- Bernards, N.; Campbell-Verduyn, M.; Rodima-Taylor, D. The veil of transparency: Blockchain and sustainability governance in global supply chains. Environ. Plan. C: Politics Space 2024, 42, 742–760. [Google Scholar] [CrossRef]

- Polas, M.R.H.; Jahanshahi, A.A.; Islam, M.E.; Kabir, A.I.; Sohel-Uz-Zaman, A.M.; Al Fahad, A. A journey from traditional supply chain processes to sustainability-oriented blockchain supply chain: The critical role of organizational capabilities. Bus. Strategy Environ. 2025, 34, 3522–3543. [Google Scholar] [CrossRef]

- Chen, Y. How blockchain adoption affects supply chain sustainability in the fashion industry: A systematic review and case studies. Int. Trans. Oper. Res. 2024, 31, 3592–3620. [Google Scholar] [CrossRef]

- Aslam, J.; Lai, K.H.; Kim, Y.B.; Treiblmaier, H. The implications of blockchain for logistics operations and sustainability. J. Innov. Knowl. 2024, 9, 100611. [Google Scholar] [CrossRef]

- Sahoo, S.; Kumar, S.; Sivarajah, U.; Lim, W.M.; Westland, J.C.; Kumar, A. Blockchain for sustainable supply chain management: Trends and ways forward. Electron. Commer. Res. 2024, 24, 1563–1618. [Google Scholar] [CrossRef]

- Pandey, A.K.; Daultani, Y.; Pratap, S. Blockchain technology enabled critical success factors for supply chain resilience and sustainability. Bus. Strategy Environ. 2024, 33, 1533–1554. [Google Scholar] [CrossRef]

- Lin, W.L.; Yang, Y.; Leow, N.X.; Lim, W.M.; Khee, G.K. Trends in the dynamic evolution of blockchain and circular economy: A literature review and bibliometric analysis. Bus. Strategy Environ. 2025, 34, 1062–1084. [Google Scholar] [CrossRef]

- Wong, S.M.; Yeung, J.K.W.; Lau, Y.Y.; Kawasaki, T.A. Critical Literature Review on Blockchain Technology for Sustainability in Supply Chain Management. Sustainability 2024, 16, 5174. [Google Scholar] [CrossRef]

- Singh, A.K.; Kumar, V.R.P. Integrating blockchain technology success factors for sustainable supply chain management. J. Clean. Prod. 2024, 460, 142577. [Google Scholar] [CrossRef]

- Tsang, Y.P.; Fan, Y.Q.; Lee, C.K.M.; Lau, H.C.W. Blockchain sharding for e-commerce supply chain management. Enterp. Inf. Syst. 2024, 18. [Google Scholar] [CrossRef]

- Khan, S.A.R.; Sheikh, A.A.; Hassan, N.M.; Yu, Z. Modeling the intricate association between sustainable service quality and supply chain performance: Moderating role of blockchain technology and environmental uncertainty. Sustainability 2024, 16, 4808. [Google Scholar] [CrossRef]

- Wu, W.; Fu, Y.; Wang, Z.; Liu, X.; Niu, Y.; Li, B.; Huang, G.Q. Consortium blockchain-enabled smart ESG reporting platform with token-based incentives for corporate crowdsensing. Comput. Ind. Eng. 2022, 172 Pt A, 108456. [Google Scholar] [CrossRef]

- Lim, M.K.; Li, Y.; Wang, C.; Tseng, M.L. A literature review of blockchain technology applications in supply chains: A comprehensive analysis of themes, methodologies and industries. Comput. Ind. Eng. 2021, 154, 107133. [Google Scholar] [CrossRef]

- Spanaki, K.; Gürgüç, Z.; Adams, R.; Mulligan, C. Data supply chain (DSC), Research synthesis and future directions. Int. J. Prod. Res. 2018, 56, 4447–4466. [Google Scholar] [CrossRef]

- Hsieh, C.C.; Wu, C.Y.; Lathifah, A. Cross-channel influence of blockchain technology on green supply chains under asymmetric retail platform competition. Int. J. Prod. Econ. 2025, 283, 109584. [Google Scholar] [CrossRef]

- Bosona, T.; Gebresenbet, G. The role of blockchain technology in promoting traceability systems in agri-food production and supply chains. Sensors 2023, 23, 5342. [Google Scholar] [CrossRef] [PubMed]

- Gazzola, P.; Pavione, E.; Barge, A.; Fassio, F. Using the Transparency of Supply Chain Powered by Blockchain to Improve Sustainability Relationships with Stakeholders in the Food Sector: The Case Study of Lavazza. Sustainability 2023, 15, 7884. [Google Scholar] [CrossRef]

- Prashar, D.; Jha, N.; Jha, S.; Lee, Y.; Joshi, G.P. Blockchain-based traceability and visibility for agricultural products: A decentralized way of ensuring food safety in India. Sustainability 2020, 12, 3497. [Google Scholar] [CrossRef]

- Giganti, P.; Borrello, M.; Falcone, P.M.; Cembalo, L. The impact of blockchain technology on enhancing sustainability in the agri-food sector: A scoping review. J. Clean. Prod. 2024, 456, 142379. [Google Scholar] [CrossRef]

- Maniam, P.S.G.; Acharya, N.; Sassenberg, A.M.; Soar, J. Determinants of blockchain technology adoption in the Australian agricultural supply chain: A systematic literature review. Sustainability 2024, 16, 5806. [Google Scholar] [CrossRef]

- Ellahi, R.M.; Wood, L.C.; Bekhit, A.E.D.A. Blockchain-Driven Food Supply Chains: A Systematic Literature Review. Appl. Sci. 2024, 14, 8944. [Google Scholar] [CrossRef]

- Shiraishi, C.S.H.; Roriz, C.L.; Carocho, M.; Prieto, M.A. Blockchain revolution in food supply chains: A comprehensive review. Food Chem. 2025, 467, 142331. [Google Scholar] [CrossRef]

- Panghal, A.; Pan, S.R.S.; Vern, P.; Mor, R.S.; Jagtap, S.S. Blockchain technology for enhancing sustainability in food supply chains. Int. J. Food Sci. Technol. 2024, 59, 3461–3468. [Google Scholar] [CrossRef]

- Rana, R.L.; Tricase, C.; De Cesare, L. Blockchain technology for a sustainable agri-food supply chain. Br. Food J. 2021, 123, 3471–3485. [Google Scholar] [CrossRef]

- Adams, D.; Donovan, J.; Topple, C. Achieving sustainability in food manufacturing operations and their supply chains: Key insights from a systematic literature review. Sustain. Prod. Consum. 2021, 28, 1491–1499. [Google Scholar] [CrossRef]

- Riedel, T. Addressing challenges: Adopting blockchain technology in the pharmaceutical industry for enhanced sustainability. Sustainability 2024, 16, 3102. [Google Scholar] [CrossRef]

- Maccarthy, B.L.; Das, S.; Ahmed, W.A.H. Smell the perfume: Can blockchain guarantee the provenance of key product ingredients in the fragrance industry? Sustainability 2024, 16, 6217. [Google Scholar] [CrossRef]

- Hoxha, J.; Thanasi-Boçe, M. Blockchain and AI-Driven Framework for Measuring the Digital Economy in GCC. Emerg. Sci. J. 2024, 8, 1554–1582. [Google Scholar] [CrossRef]

- Cozzio, C.; Viglia, G.; Lemarie, L.; Cerutti, S. Toward an integration of blockchain technology in the food supply chain. J. Bus. Res. 2023, 162, 113909. [Google Scholar] [CrossRef]

- Balzarova, M.; Dyer, C.; Falta, M. Perceptions of blockchain readiness for fairtrade programmes. Technol. Forecast. Soc. Change 2022, 185, 122086. [Google Scholar] [CrossRef]

- Francisco, K.; Swanson, D. The supply chain has no clothes: Technology adoption of blockchain for supply chain transparency. Logistics 2018, 2, 2. [Google Scholar] [CrossRef]

- Vinayavekhin, S.; Banerjee, A.; Li, F. “Putting your money where your mouth is”: An empirical study on buyers’ preferences and willingness to pay for blockchain-enabled sustainable supply chain transparency. J. Purch. Supply Manag. 2024, 30, 100900. [Google Scholar] [CrossRef]

- Feng, H.H.; Wang, X.; Duan, Y.Q.; Zhang, J.; Zhang, X.S. Applying blockchain technology to improve agri-food traceability: A review of development methods, benefits and challenges. J. Clean. Prod. 2020, 260, 121031. [Google Scholar] [CrossRef]

- Ma, X.Y.; Dai, D.Y. Certifying Greenness: Blockchain’s Impact on the Environmental Sustainability of Supply Chains. IEEE Access 2024, 12, 782–793. [Google Scholar] [CrossRef]

- Nazir, H.; Fan, J. Revolutionizing retail: Examining the influence of blockchain-enabled IoT capabilities on sustainable firm performance. Sustainability 2024, 16, 3534. [Google Scholar] [CrossRef]

- Liu, Y.L.; Qian, Q.; Zhang, H.; Li, J.C.; Zhong, Y.K.; Tian, G.X. Application of Sustainable Blockchain Technology in the Internet of Vehicles: Innovation in Traffic Sign Detection Systems. Sustainability 2024, 16, 171. [Google Scholar] [CrossRef]

- AlShamsi, M.; Al-Emran, M.; Daim, T.; Al-Sharafi, M.A.; Bolatan, G.I.S.; Shaalan, K. Uncovering the critical drivers of blockchain sustainability in higher education using a deep learning-based hybrid SEM-ANN approach. IEEE Trans. Eng. Manag. 2024, 71, 8192–8208. [Google Scholar] [CrossRef]

- Cerchione, R. Design and evaluation of a blockchain-based platform for Corporate Social Responsibility and Environmental disclosure. Corp. Soc. Responsib. Environ. Manag. 2025, 32, 160–175. [Google Scholar] [CrossRef]

- Fallah Shayan, N.; Mohabbati-Kalejahi, N.; Alavi, S.; Zahed, M.A. Sustainable development goals (SDGs) as a framework for corporate social responsibility (CSR). Sustainability 2022, 14, 1222. [Google Scholar] [CrossRef]

- Dadhich, M.; Opoku-Mensah, E.; Hiran, K.K.; Gyamfi, B.A.; Tuffour, P.; Mahmoud, A. Exploring the mediating roles of social networks and trust in the blockchain-social sustainability nexus. J. Econ. Policy Reform 2024, 27, 293–315. [Google Scholar] [CrossRef]

- Böckel, A.; Nuzum, A.K.; Weissbrod, I. Blockchain for the circular economy: Analysis of the research-practice gap. Sustain. Prod. Consum. 2021, 25, 525–539. [Google Scholar] [CrossRef]

- Venkatesh, V.G.; Kang, K.; Wang, B.; Zhong, R.Y.; Zhang, A. System architecture for blockchain based transparency of supply chain social sustainability. Robot. Comput. -Integr. Manuf. 2020, 63, 101896. [Google Scholar] [CrossRef]

- Ronaghi, M.H.; Mosakhani, M. The effects of blockchain technology adoption on business ethics and social sustainability: Evidence from the Middle East. Environ. Dev. Sustain. 2022, 24, 6834–6859. [Google Scholar] [CrossRef]

- Zhang, X.; Sheng, Y.F.; Liu, Z. Using expertise as an intermediary: Unleashing the power of blockchain technology to drive future sustainable management using hidden champions. Heliyon 2024, 10, e23807. [Google Scholar] [CrossRef]

- Aguilera, R.C.; Ortiz, M.P.; Ortiz, J.P.; Banda, A.A. Internet of things expert system for smart cities using the blockchain technology. Fractals 2021, 29, 2150036. [Google Scholar] [CrossRef]

- Gazzola, P.; Grechi, D.; Berettoni, D. Blockchain technologies in sustainable product authentication. Sustainability 2023, 15, 987. [Google Scholar] [CrossRef]

- Meléndez, E.I.V.; Smith, B.; Bergey, P. Food provenance assurance and willingness to pay for blockchain data security: A case of Australian consumers. J. Retail. Consum. Serv. 2025, 82, 104080. [Google Scholar] [CrossRef]

- Esmaeilian, B.; Sarkis, J.; Lewis, K.; Behdad, S. Blockchain for the future of sustainable supply chain management in Industry 4.0. Resour. Conserv. Recycl. 2020, 163, 105064. [Google Scholar] [CrossRef]

- Alofi, A.; Bokhari, M.A.; Bahsoon, R.; Hendley, R. Self-optimizing the environmental sustainability of blockchain-based systems. IEEE Trans. Sustain. Comput. 2024, 9, 396–408. [Google Scholar] [CrossRef]

- Bhavana, G.B.; Anand, R.; Ramprabhakar, J.; Meena, V.P.; Jadoun, V.K.; Benedetto, F. Applications of blockchain technology in peer-to-peer energy markets and green hydrogen supply chains: A topical review. Sci. Rep. 2024, 14, 21954. [Google Scholar] [CrossRef]

- Wu, Y.; Wu, Y.; Cimen, H.; Vasquez, J.C.; Guerrero, J.M. Towards collective energy Community: Potential roles of microgrid and blockchain to go beyond P2P energy trading. Appl. Energy 2022, 314, 119003. [Google Scholar] [CrossRef]

- Zulfiqar, M.; Kamran, M.; Rasheed, M.B. A blockchain-enabled trust aware energy trading framework using games theory and multi-agent system in smat grid. Energy 2022, 255, 124450. [Google Scholar] [CrossRef]

- Peelam, M.S.; Chaurasia, B.K.; Sharma, A.K.; Chamola, V.; Sikdar, B. Unlocking the potential of interconnected blockchains: A comprehensive study of cosmos blockchain interoperability. IEEE Access 2024, 12, 171753–171776. [Google Scholar] [CrossRef]

- McKey. 2024. Available online: https://www.greenmatch.co.uk/blog/countries-with-the-highest-carbon-footprint (accessed on 30 March 2025).

- Wang, J. A novel electric vehicle charging chain design based on blockchain technology. Energy Rep. 2022, 8, 785–793. [Google Scholar] [CrossRef]

- UNDP. Blockchain for Climate-Resilient Agriculture Finance in Africa. United Nations Development Programme. 2022. Available online: https://www.undp.org (accessed on 30 March 2025).

- WEF (World Economic Forum). Blockchain for Scaling Climate Action: Use Cases, Opportunities, and Challenges. 2022. Available online: https://www.weforum.org (accessed on 30 March 2025).

- Toucan Protocol. Building the Infrastructure for Carbon Markets on-Chain. 2023. Available online: https://www.toucan.earth (accessed on 30 March 2025).

- World Bank. Voluntary Carbon Markets and Blockchain: Trends and Risks. 2023. Available online: https://www.worldbank.org (accessed on 30 March 2025).

- LO3 Energy. Brooklyn Microgrid: Local Energy Markets Powered by Blockchain. 2022. Available online: https://www.brooklyn.energy (accessed on 30 March 2025).

- Power Ledger. Impact Report: Blockchain for Clean Energy and Emissions Reduction. 2023. Available online: https://www.powerledger.io (accessed on 30 March 2025).

- IBM. IBM Food Trust: Building a Smarter, Safer Food Supply with Blockchain. 2021. Available online: https://www.ibm.com/blockchain/solutions/food-trust (accessed on 30 March 2025).

- Circularise. How Blockchain Supports Scope 3 Emissions Tracking. 2023. Available online: https://www.circularise.com (accessed on 30 March 2025).

- Yap, K.; Chin, H.H.; Klemeš, J.J. Blockchain technology for distributed generation: A review of current development, challenges and future prospect. Renew. Sustain. Energy Rev. 2023, 175, 113170. [Google Scholar] [CrossRef]

- VeChain Foundation. VeChainThor Is One of the Most Eco-Friendly Public Blockchains Worldwide—CTI Verified. Medium. 2021. Available online: https://medium.com/vechain-foundation/vechainthor-is-one-of-the-most-eco-friendly-public-blockchains-worldwide-cti-verified-66d7aa2c5ccd (accessed on 30 March 2025).

- Bachani, V.; Bhattacharjya, A. Preferential delegated proof of stake (PDPoS)—Modified DPoS with two layers towards scalability and higher TPS. Symmetry 2023, 15, 4. [Google Scholar] [CrossRef]

- Thibault, L.T.; Sarry, T.; Hafid, A.S. Blockchain scaling using rollups: A comprehensive survey. IEEE Access 2022, 10, 93039–93054. [Google Scholar] [CrossRef]

- Chaliasos, S.; Mohnblatt, N.; Kattis, A.; Livshits, B. Pricing Factors and TFMs for Scalability-Focused ZK-Rollups. arXiv 2024, arXiv:2410.13277. [Google Scholar]

- Solaiman, E.; Robins, J. The Internet of Value: Integrating Blockchain and Lightning Network Micropayments for Knowledge Markets. arXiv 2024, arXiv:2412.19384. [Google Scholar]

- Pandey, V.; Pant, M.; Snasel, V. Blockchain technology in food supply chains: Review and bibliometric analysis. Technol. Soc. 2022, 69, 101954. [Google Scholar] [CrossRef]

- Hua, X.L.; Hu, L.Y.; Eltantawy, R.; Zhang, L.Q.; Wang, B.; Tian, Y.F.; Zhang, J.Z. Blockchain technology adoption and sustainable performance in Chinese manufacturing: Insights on learning and organizational inertia. Ind. Manag. Data Syst. 2025, 125, 604–626. [Google Scholar] [CrossRef]

- Liu, X.; Yang, Y.; Jiang, Y.; Fu, Y.; Zhong, R.Y.; Li, M.; Huang, G.Q. Data-driven ESG assessment for blockchain services: A comparative study in textiles and apparel industry. Resour. Conserv. Recycl. 2023, 190, 106837. [Google Scholar] [CrossRef]

- Hasan, H.R.; Salah, K.; Jayaraman, R.; Omar, M. Blockchain-based sustainability index score for consumable products. IEEE Access 2024, 12, 97851–97867. [Google Scholar] [CrossRef]

- United Nations. 17 SDGs Goals. 2023. Available online: https://sdgs.un.org/goals (accessed on 30 March 2025).

- Bada, A.O.; Damianou, A.; Angelopoulos, C.M.; Katos, V. Towards a green blockchain: A review of consensus mechanisms and their energy consumption. In Proceedings of the 2021 17th international conference on distributed computing in sensor systems (DCOSS), Pafos, Cyprus, 14–16 July 2021; pp. 503–511. [Google Scholar]

- Hina, M.; Islam, N.; Dhir, A. Blockchain for sustainable consumption: An affordance and consumer value-based view. Internet Res. 2024, 34, 215–250. [Google Scholar] [CrossRef]

- Casino, F.; Dasaklis, T.K.; Patsakis, C. A systematic literature review of blockchain-based applications: Current status, classification and open issues. Telemat. Inform. 2019, 36, 55–81. [Google Scholar] [CrossRef]

- Wamba, S.F.; Queiroz, M.M.; Trinchera, L. Dynamics between blockchain adoption determinants and supply chain performance: An empirical investigation. Int. J. Prod. Econ. 2020, 229, 107791. [Google Scholar] [CrossRef]

- Hariram, N.P.; Mekha, K.B.; Suganthan, V.; Sudhakar, K. Sustainalism: An integrated socio-economic-environmental model to address sustainable development and sustainability. Sustainability 2023, 15, 10682. [Google Scholar] [CrossRef]

| Stage | Description |

|---|---|

| Identification | Databases Searched: Web of Science |

| Search Strategy: (“sustainability” AND “blockchain” AND “SDGs”) AND PUBYEAR > 2015 AND PUBYEAR < 2025 | |

| Time Period Covered: Studies published from 1 January 2015 to 30 March 2025 | |

| Language: English only | |

| Screening | Inclusion Criteria: |

| - Peer-reviewed articles | |

| - Focus on blockchain and sustainability | |

| - Empirical studies or theoretical frameworks | |

| - Full-text availability | |

| Exclusion Criteria: | |

| - Non-academic publications (books, editorials, blogs) | |

| - Studies unrelated to BT, sustainability, and SDGs | |

| - Studies outside the 2015–2025 time range | |

| Eligibility | Selection Process: |

| - Records identified: 188 articles | |

| - Title and abstract screening: 32 articles excluded | |

| - Full-Text Review: 156 articles assessed, 34 removed due to lack of methodological rigor | |

| Snowballing: 9 articles added | |

| - Final Selection: 131 articles | |

| Independent Reviewers: Two researchers independently reviewed studies; discrepancies were resolved through discussion | |

| Inclusion & Synthesis | Final Analysis Covered: |

| - Thematic analysis of blockchain and sustainability | |

| - Categorization of studies based on research methods, sustainability pillars, and key findings |

| Criteria | Inclusion | Exclusion | Rationale |

|---|---|---|---|

| Publication Type | Scholarly articles (peer-reviewed) | Non-academic (books, blogs, editorials, reports) | Ensure academic credibility and rigor |

| Relevance | Articles directly addressing blockchain applications for sustainable development | Articles not directly addressing blockchain in sustainability context | Ensure relevance and specific focus on blockchain technology and sustainability |

| Peer-reviewed | Articles from peer-reviewed academic journals | Non-peer-reviewed abstracts, conference proceedings, dissertations, theses, editorials, and magazine articles | Maintain academic rigor and quality |

| Accessibility | Articles readily accessible with full-text availability | Articles not fully accessible or without full-text availability | Ensure availability for detailed review |

| Research Methodology | Empirical studies or theoretical frameworks clearly outlining blockchain’s role in sustainability | Studies employing insufficient methodological rigor or lacking clear frameworks | Ensure methodological robustness and conceptual clarity |

| Publication Year | Articles published between 1 January 2015 and 30 March 2025 | Articles published before or after specified time range | Provide current and relevant insights within defined scope |

| Language | English-language articles only | Non-English-language articles | Standardize review based on universally accessible research |

| WoS Rank | Source Title | No. of Articles | (%) |

|---|---|---|---|

| Q1 | BUSINESS STRATEGY AND THE ENVIRONMENT | 6 | 4.6 |

| Q1 | JOURNAL OF CLEANER PRODUCTION | 6 | 4.6 |

| Q1 | TELECOMMUNICATIONS POLICY | 4 | 3.1 |

| Q1 | TECHNOLOGICAL FORECASTING AND SOCIAL CHANGE | 4 | 3.1 |

| Q1 | MARINE POLICY | 3 | 2.3 |

| Q1 | RESOURCES, CONSERVATION AND RECYCLING | 2 | 1.5 |

| Q1 | JOURNAL OF BUSINESS RESEARCH | 2 | 1.5 |

| Q1 | JOURNAL OF ENVIRONMENTAL MANAGEMENT | 2 | 1.5 |

| Q1 | CORPORATE SOCIAL RESPONSIBILITY AND ENVIRONMENTAL MANAGEMENT | 2 | 1.5 |

| Q1 | COMPUTERS & INDUSTRIAL ENGINEERING | 2 | 1.5 |

| Q1 | TECHNOLOGY IN SOCIETY | 2 | 1.5 |

| Q1 | SUSTAINABLE PRODUCTION AND CONSUMPTION | 2 | 1.5 |

| Q1 | IEEE TRANSACTIONS ON ENGINEERING MANAGEMENT | 2 | 1.5 |

| Q1 | INTERNATIONAL JOURNAL OF PRODUCTION ECONOMICS | 2 | 1.5 |

| Q1 | FOOD CHEMISTRY | 1 | 0.8 |

| Q1 | COMPUTERS AND INDUSTRIAL ENGINEERING | 1 | 0.8 |

| Q1 | FUTURES | 1 | 0.8 |

| Q1 | INTERNATIONAL JOURNAL OF PRODUCTION RESEARCH | 1 | 0.8 |

| Q1 | JOURNAL OF PURCHASING AND SUPPLY MANAGEMENT | 1 | 0.8 |

| Q1 | RENEWABLE AND SUSTAINABLE ENERGY REVIEWS | 1 | 0.8 |

| Q1 | BUILDING AND ENVIRONMENT | 1 | 0.8 |

| Q1 | SCIENTIFIC REPORTS | 2 | 1.5 |

| Q1 | ENERGY REPORTS | 1 | 0.8 |

| Q1 | ROBOTICS AND COMPUTER-INTEGRATED MANUFACTURING | 1 | 0.8 |

| Q1 | ONE EARTH | 1 | 0.8 |

| Q1 | ENERGY RESEARCH & SOCIAL SCIENCE | 1 | 0.8 |

| Q1 | APPLIED SOFT COMPUTING | 1 | 0.8 |

| Q1 | JOURNAL OF RETAILING AND CONSUMER SERVICES | 1 | 0.8 |

| Q1 | SUSTAINABLE DEVELOPMENT | 1 | 0.8 |

| Q1 | ENVIRONMENT AND PLANNING C-POLITICS AND SPACE | 1 | 0.8 |

| Q1 | IEEE INTERNET OF THINGS JOURNAL | 1 | 0.8 |

| Q1 | JOURNAL OF INNOVATION & KNOWLEDGE | 1 | 0.8 |

| Q1 | INTERNATIONAL REVIEW OF ECONOMICS & FINANCE | 1 | 0.8 |

| Q1 | IEEE TRANSACTIONS ON SUSTAINABLE COMPUTING | 1 | 0.8 |

| Q1 | FINANCE RESEARCH LETTERS | 1 | 0.8 |

| Q1 | ENVIRONMENTAL INNOVATION AND SOCIETAL TRANSITIONS | 1 | 0.8 |

| Q1 | ENERGY STRATEGY REVIEWS | 1 | 0.8 |

| Q1 | INTERNET RESEARCH | 1 | 0.8 |

| Q1 | INTERNATIONAL JOURNAL OF INFORMATION MANAGEMENT | 1 | 0.8 |

| Q1 | COMPUTERS AND ELECTRICAL ENGINEERING | 1 | 0.8 |

| Q1 | DECISION SUPPORT SYSTEMS | 1 | 0.8 |

| Q1 | JOURNAL OF BUILDING ENGINEERING | 1 | 0.8 |

| Q1 | EXPERT SYSTEMS WITH APPLICATIONS | 1 | 0.8 |

| Q1 | JOURNAL OF BUSINESS LOGISTICS | 1 | 0.8 |

| Q1 | JOURNAL OF PURCHASING AND SUPPLY MANAGEMENT | 1 | 0.8 |

| Q1 | APPLIED ENERGY | 1 | 0.8 |

| Q2 | SUSTAINABILITY | 22 | 16.8 |

| Q2 | IEEE ACCESS | 5 | 3.8 |

| Q2 | PROCESSES | 1 | 0.8 |

| Q2 | INTERNATIONAL JOURNAL OF FOOD SCIENCE AND TECHNOLOGY | 1 | 0.8 |

| Q2 | BRITISH FOOD JOURNAL | 1 | 0.8 |

| Q2 | ELECTRONIC COMMERCE RESEARCH | 1 | 0.8 |

| Q2 | FRONTIERS IN SUSTAINABLE FOOD SYSTEMS | 1 | 0.8 |

| Q2 | BUSINESS PROCESS MANAGEMENT JOURNAL | 1 | 0.8 |

| Q2 | HUMANITIES AND SOCIAL SCIENCES COMMUNICATIONS | 1 | 0.8 |

| Q2 | HELIYON | 1 | 0.8 |

| Q2 | RAIRO-OPERATIONS RESEARCH | 1 | 0.8 |

| Q2 | ENTERPRISE INFORMATION SYSTEMS | 1 | 0.8 |

| Q2 | PLOS ONE | 1 | 0.8 |

| Q2 | INTERNATIONAL TRANSACTIONS IN OPERATIONAL RESEARCH | 1 | 0.8 |

| Q2 | PEER-TO-PEER NETWORKING AND APPLICATIONS | 1 | 0.8 |

| Q2 | SENSORS | 1 | 0.8 |

| Q2 | ENVIRONMENT DEVELOPMENT AND SUSTAINABILITY | 1 | 0.8 |

| Q2 | SUSTAINABLE ENERGY TECHNOLOGIES AND ASSESSMENTS | 1 | 0.8 |

| Q2 | SYSTEMS | 1 | 0.8 |

| Q2 | JOURNAL OF ENTERPRISE INFORMATION MANAGEMENT | 1 | 0.8 |

| Q2 | INDUSTRIAL MANAGEMENT & DATA SYSTEMS | 2 | 1.5 |

| Q2 | SUSTAINABLE ENERGY, GRIDS AND NETWORKS | 1 | 0.8 |

| Q2 | JOURNAL OF ECONOMIC POLICY REFORM | 1 | 0.8 |

| Q2 | APPLIED SCIENCES-BASEL | 1 | 0.8 |

| Q2 | MANAGEMENT DECISION | 1 | 0.8 |

| Q2 | SYMMETRY | 1 | 0.8 |

| Q2 | INTERNATIONAL JOURNAL OF PUBLIC SECTOR MANAGEMENT | 1 | 0.8 |

| Q3 | JOURNAL OF ELECTRONIC SCIENCE AND TECHNOLOGY | 1 | 0.8 |

| Q3 | FRACTALS | 1 | 0.8 |

| Q3 | KSII TRANSACTIONS ON INTERNET AND INFORMATION SYSTEMS | 1 | 0.8 |

| Q3 | ENERGIES | 1 | 0.8 |

| Domain | Sub-Domain | Description | Relevant SDG(s) | References |

|---|---|---|---|---|

| Environment | Renewable Energy | Research discusses peer-to-peer energy trading, secure data management, certificate tracking, optimization of electricity distribution, carbon-footprint reduction | SDG 7—Affordable and Clean Energy; SDG 9 -Industry, Innovation, and Infrastructure; SDG 13 -Climate Action) | [35,36,37,38,39,40,41,42,43,44,45] |

| Climate Change Mitigation | Studies on mitigating climate change (carbon tracking, emissions reduction, sustainability reporting, tokenizing carbon credits, real-time GHG monitoring across supply chains) | SDG 13—Climate Action; SDG 11—Sustainable Cities and Communities | [46,47,48,49,50,51,52,53,54] | |

| Environmental Conservation | Research focused on resource management, data integrity, biodiversity initiatives, tamper-proof environmental compliance, ecosystem conservation | SDG 14—Life Below Water SDG 15—Life on Land | [46,55,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70] | |

| Economic | Sustainable supply-chain management | Research related to BT integration to enhance supply-chain management, lower costs, and achieve a competitive edge | SDG 7—Affordable and Clean Energy | [13,32,56,71,72,73,74,75,76,77,78,79,80,81,82,83,84,85,86,87,88,89,90,91,92,93,94,95,96] |

| Fair trade | The role of BT on enhancing transparency within fair trade practices | SDG 8—Decent Work and Economic Growth, SDG 12—Responsible Consumption | [32,97,98,99,100,101,102,103,104] | |

| Employment and Income Distribution | The influence of BT on employment and income distribution | SDG 9—Industry, Innovation and Infrastructure | [105,106] | |

| Social | Equality, inclusion, quality of life | Research that discusses equality and social inclusion | SDG 5—Gender Equality, SDG 10—Reduced Inequalities | [107,108,109,110,111,112] |

| Secure identity verification | Research-related | SDG 16—Peace, Justice and Strong Institutions | [108,113,114] | |

| Responsible corporate governance | Research-focused | SDG 12—Responsible Consumption and Production | [12,33,34,65,75,87,90,101,109,115,116,117,118,119,120,121] |

| Blockchain Use Case | Climate Impact/Benefit | Quantified Outcome | Source |

|---|---|---|---|

| Carbon Credit Tokenization & Trading | Improves transparency and trust in voluntary carbon markets | 25+ million tons CO2 tokenized on-chain (Toucan, KlimaDAO) | [129] |

| Reduces fraud and double-counting | Blockchain can cut transaction fraud and duplication by 30–50% | [128,130] | |

| Peer-to-Peer Renewable Energy Trading | Decentralized local energy exchange lowers grid emissions | 1.6 tons CO2 reduction per household annually (Brooklyn Microgrid) | [131] |

| Increases access and efficiency of clean energy markets | 250+ GWh of green energy traded, 180,000 tons CO2 avoided (Power Ledger) | [132] | |

| Supply Chain Traceability | Tracks emissions across food and product lifecycles | Up to 40% reduction in food waste, improved logistics energy efficiency (Read more about the Greenhouse Gas Protocol: Scope 3 standard developed by World Resources Institute (2023) Available at https://ghgprotocol.org) | [133] |

| Measures and reduces Scope 3 emissions | Scope 3 = 70%+ of corporate footprint, better tracked via blockchain | [134] | |

| ESG Reporting & Climate Finance | Increases data integrity in sustainability-linked financial instruments | ESG reporting errors reduced by 20–30% in pilot studies | [128] |

| Enables transparent climate-resilient financing | Loan fraud reduced by 60% in African blockchain climate finance programs | [127] | |

| Sustainable Product Verification | Ensures ethical sourcing and lifecycle documentation of materials | Supports premium pricing and consumer trust in low-carbon goods | [117] |

| Circular Economy (Waste Tokenization) | Incentivizes recycling and reuse through tokenized systems | Used in projects like Plastic Bank to reduce plastic waste & CO2 | [71] |

| Challenge | SDG | Strategy | Key Stakeholders |

|---|---|---|---|

| Scalability & Security | SDG 9: Industry, Innovation, | Implement layer-2 solutions (e.g., sidechains, sharding, off-chain transactions) to improve throughput; strengthen cryptographic methods and threat modeling for enhanced security. | Technology providers, R&D institutions, public agencies |

| High Energy Consumption | SDG 7: Affordable & Clean Energy; SDG 13: Climate Action | Transition from PoW to energy-efficient consensus mechanisms (e.g., PoS, Proof-of-Authority); provide subsidies and support for green-energy blockchain deployments. | Energy regulators, policymakers, blockchain developers |

| Regulatory & Ethical Complexities | SDG 16: Peace, Justice & Strong Institutions | Develop harmonized international regulations; establish clear data-privacy and anti-money-laundering guidelines; create robust compliance frameworks to govern decentralized networks responsibly. | National governments, global regulatory bodies, NGOs |

| Resistance to Change & Adoption Barriers | SDG 8: Decent Work & Economic Growth | Launch targeted education and training programs to reduce knowledge gaps; establish public-awareness initiatives to communicate blockchain’s societal benefits; integrate user-friendly design on blockchain platforms. | SMEs, industry consortia, educational institutions |

| Economic & Societal Implications | SDG 10: Reduced Inequalities; SDG 1: No Poverty | Promote inclusive finance and microfinancing through blockchain; support job retraining and skill development; enforce transparent impact assessments (e.g., carbon footprint, fair labor conditions) to ensure equitable benefits distribution. | Labor ministries, multilateral organizations, private sector |

| Consumer-Centric Needs & Physical-World Tracking | SDG 12: Responsible Consumption | Develop robust IoT-based tracking systems to complement blockchain’s virtual capabilities; design consumer-oriented interfaces that offer transparency and ethical sourcing information; incentivize consumer engagement through reward schemes or certifications. | Tech start-ups, consumer advocacy groups, retailers |

| Domain | Future Research Directions |

|---|---|

| Environmental | - Exploring blockchain’s effectiveness in incentivizing sustainable behaviors (e.g., tokenization, recycling, renewable-energy adoption);- Investigating blockchain applications in biodiversity conservation and climate governance (e.g., tracking endangered species, protected areas, or habitat restoration);- Evaluating long-term impacts of blockchain-driven circular economy models on resource efficiency and stakeholder engagement;- Studying environmental footprint reduction via scalable consensus mechanisms (e.g., PoS);- Integrating blockchain with GenAI for ecosystem monitoring, predictive analytics, and sustainability reporting;- Exploring blockchain’s effectiveness in incentivizing sustainable behaviors through tokenization and reward mechanisms (e.g., recycling, renewable energy adoption). |

| Economic | - Studying blockchain’s role in reshaping market dynamics, competition, and inclusion through decentralized platforms;- Examining the regulatory implications and economic impact of central-bank digital currencies (CBDCs);- Evaluating blockchain’s effectiveness in enhancing transparency, anti-corruption practices, and fiscal accountability;- Quantifying gains in trade and logistics efficiency through blockchain-based platforms;- Conducting cross-national studies on regulatory sandbox experiments and institutional adaptation. |

| Social | - Investigating blockchain’s potential to bridge digital divides and expand access to essential services (e.g., education, finance, identity);- Longitudinal analysis of financial inclusion outcomes and social mobility impacts;- Assessing the ethical and privacy risks of blockchain-based digital identity systems, particularly in the Global South;- Exploring blockchain’s application in democratic governance, transparent elections, and humanitarian aid;- Analyzing the impact of blockchain-based credentialing on labor markets, workforce equity, and social trust;- Embedding digital justice frameworks into blockchain design and governance models. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Thanasi-Boçe, M.; Hoxha, J. Blockchain for Sustainable Development: A Systematic Review. Sustainability 2025, 17, 4848. https://doi.org/10.3390/su17114848

Thanasi-Boçe M, Hoxha J. Blockchain for Sustainable Development: A Systematic Review. Sustainability. 2025; 17(11):4848. https://doi.org/10.3390/su17114848

Chicago/Turabian StyleThanasi-Boçe, Marsela, and Julian Hoxha. 2025. "Blockchain for Sustainable Development: A Systematic Review" Sustainability 17, no. 11: 4848. https://doi.org/10.3390/su17114848

APA StyleThanasi-Boçe, M., & Hoxha, J. (2025). Blockchain for Sustainable Development: A Systematic Review. Sustainability, 17(11), 4848. https://doi.org/10.3390/su17114848