Ripple Effect or Spatial Interaction? A Spatial Analysis of Green Finance and Carbon Emissions in the Yellow River Basin

Abstract

1. Introduction

Literature Review

2. Materials and Methods

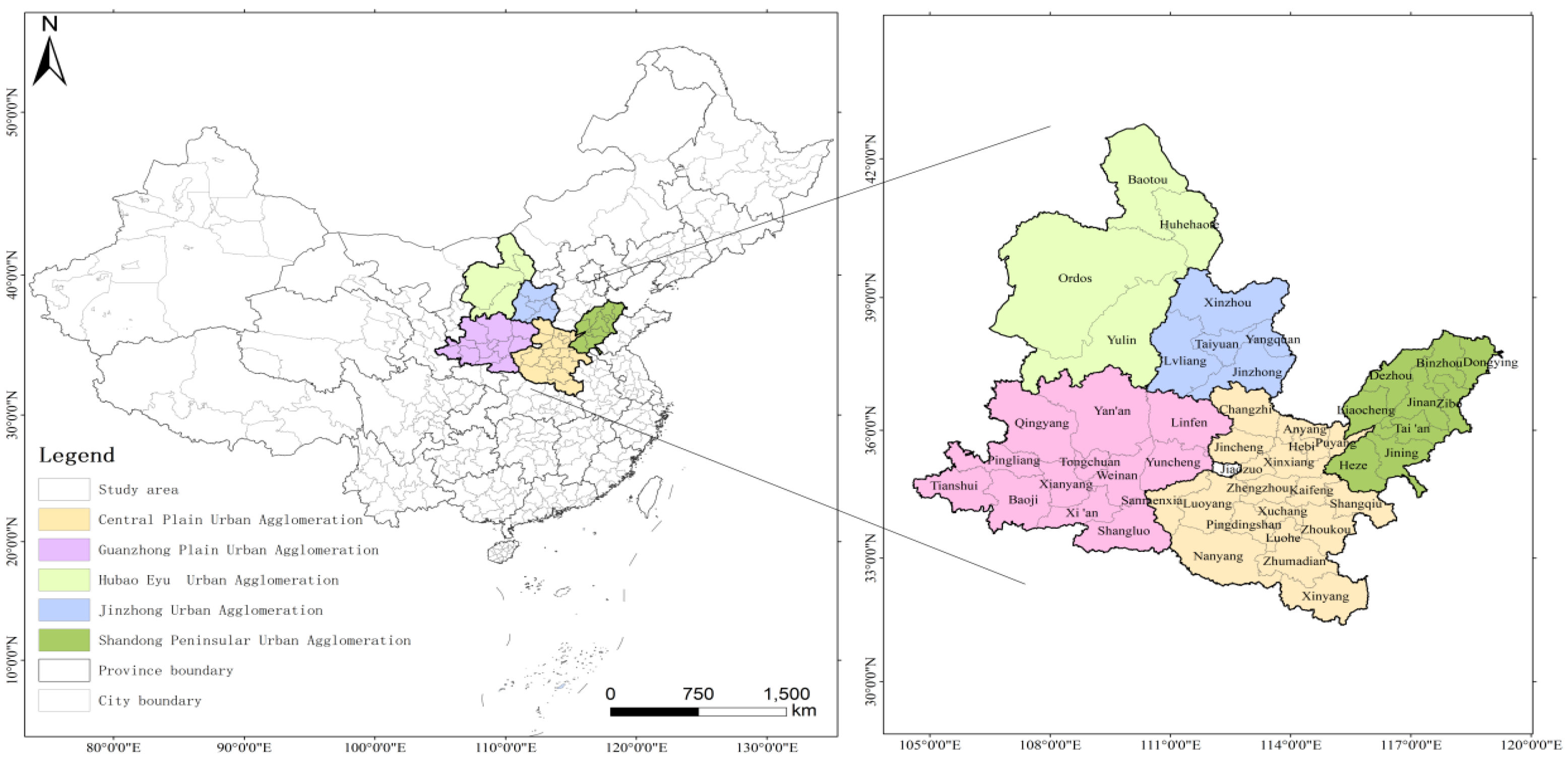

2.1. Study Area

2.2. Variable Selection

2.3. Methodology

2.3.1. Bivariate Spatial Autocorrelation

2.3.2. Kernel Density Estimation, KDE

2.3.3. Spatial Simultaneous Equation Models

2.4. Green Finance Indicator Evaluation System

Data Source

3. Results

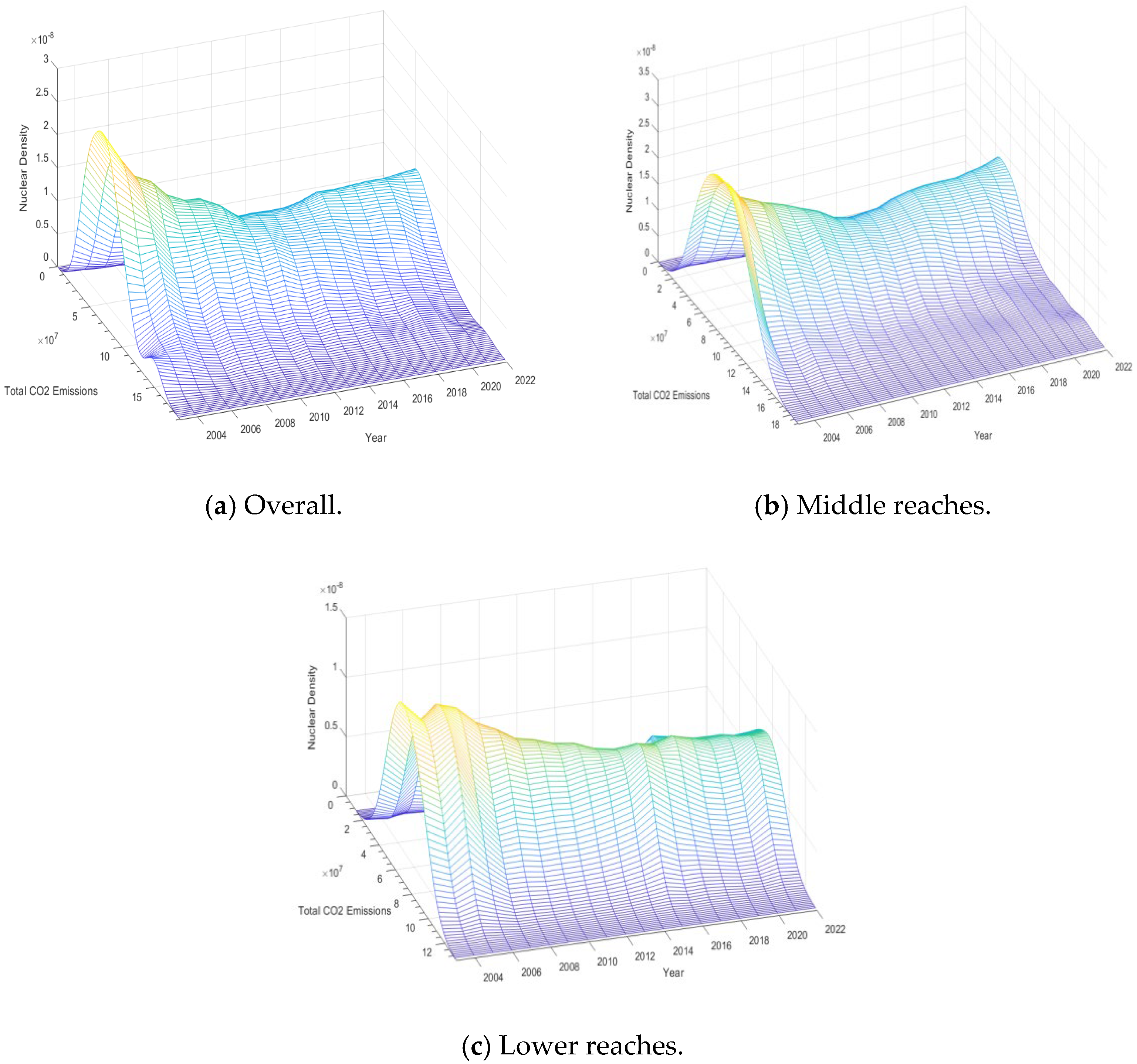

3.1. Carbon Emissions and Green Finance Index Analysis

Analysis of Current Carbon Emissions

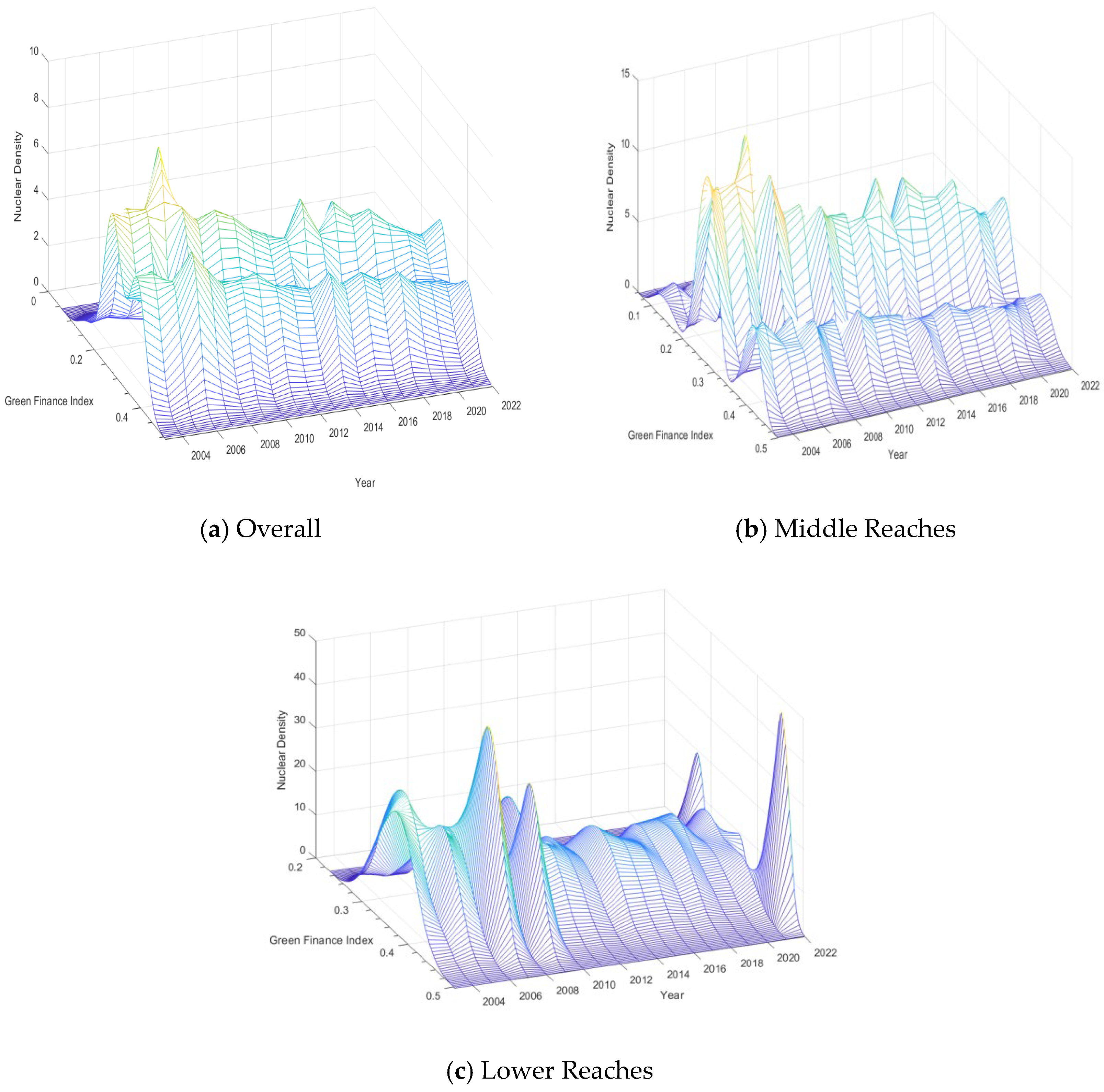

3.2. Analysis of the Current Status of the Green Finance Index

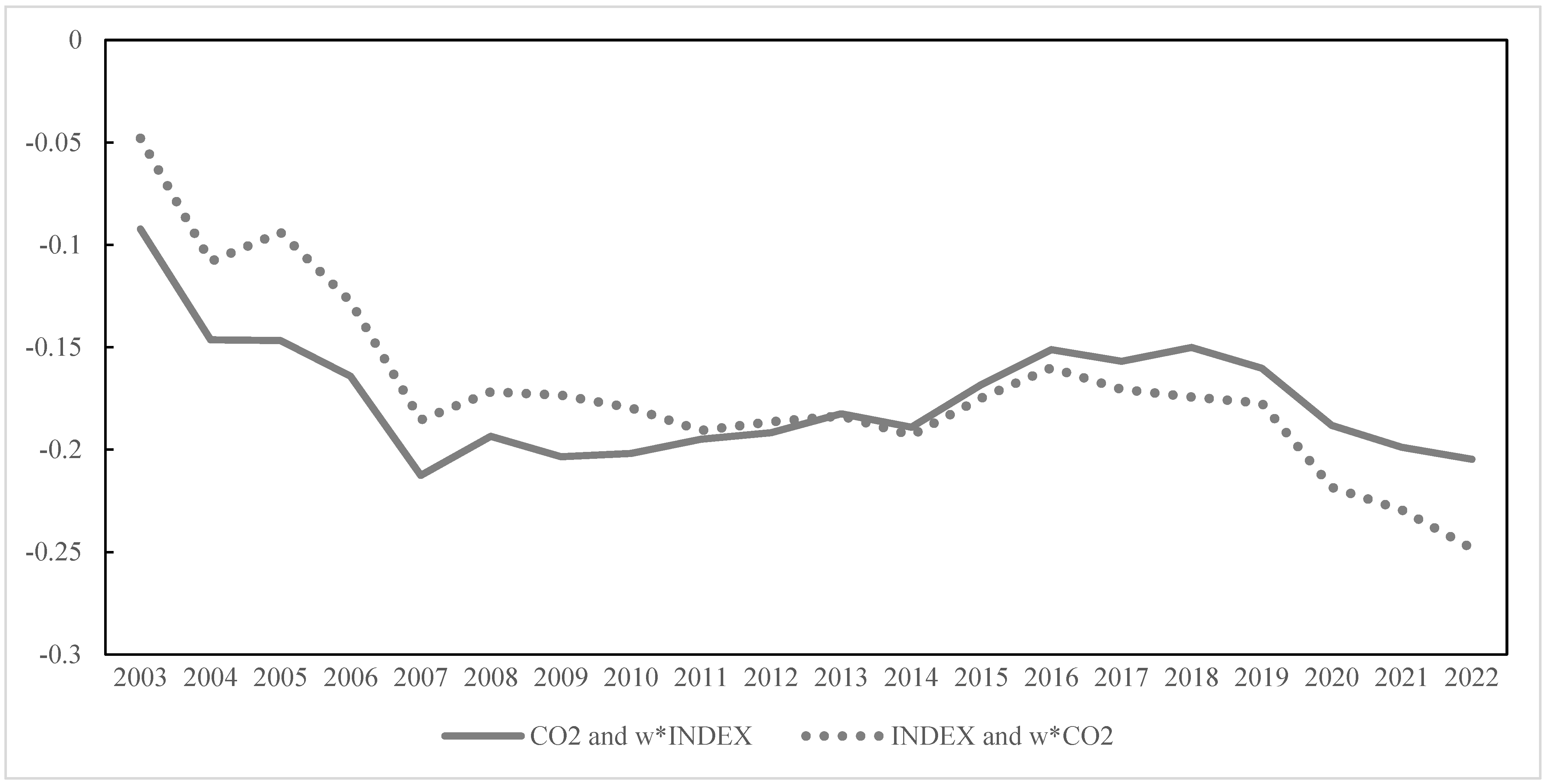

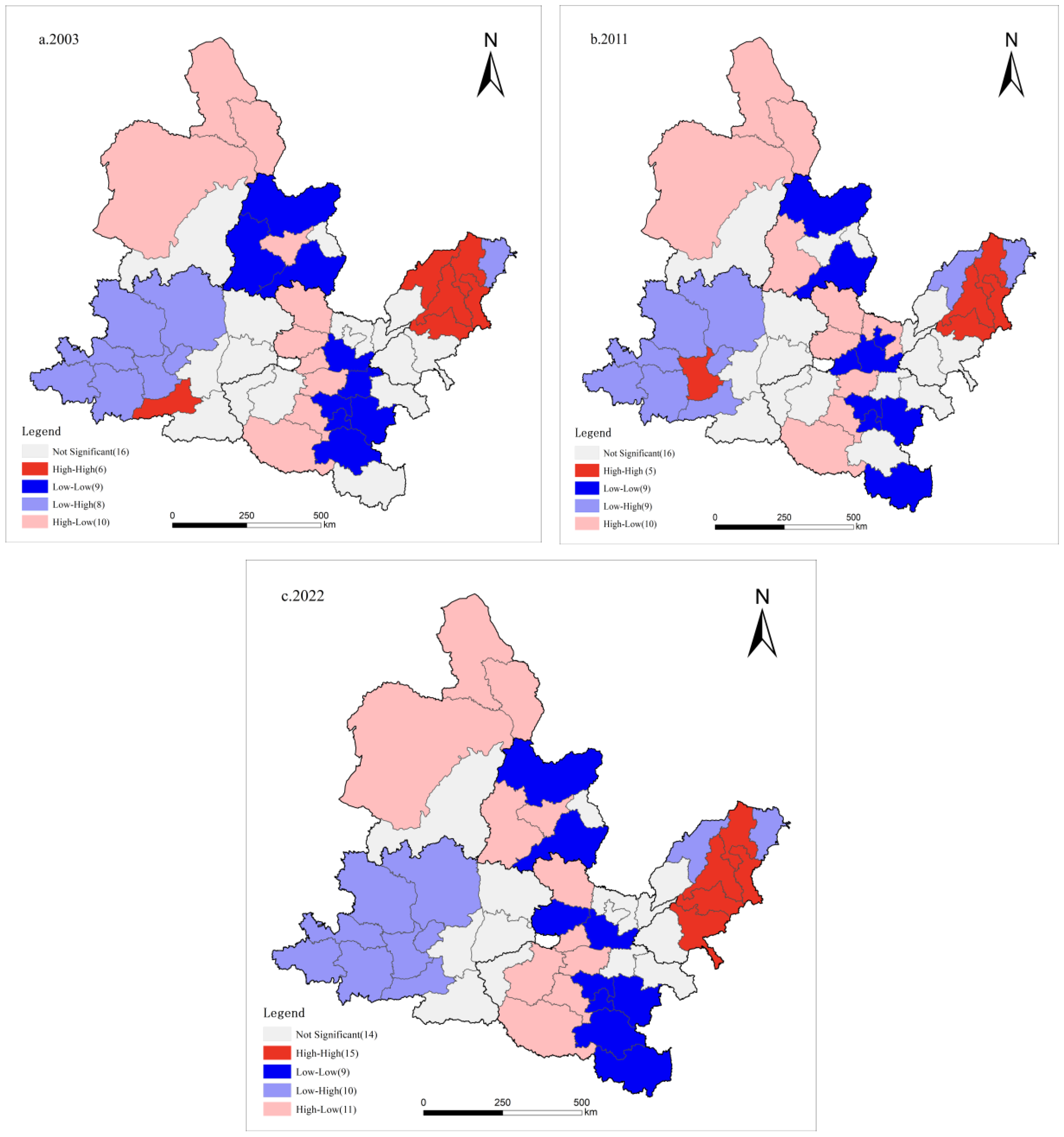

3.3. Bivariate Spatial Autocorrelation Analysis

3.3.1. Global Bivariate Spatial Autocorrelation Analysis

3.3.2. Bivariate Local Spatial Autocorrelation Analysis

3.3.3. Empirical Test

3.3.4. Robustness Test

3.3.5. Spatial Heterogeneity

4. Discussion

- (1)

- Construction of the spatial weight matrix: Current studies primarily rely on the inverse square of the geographic distance between cities to construct a spatial weight matrix, reflecting spatial correlations. However, this approach overly depends on geographic distance and overlooks the influence of economic linkages, policy synergies, and other factors on the interactions between green finance and carbon emissions. Future research should integrate economic- and policy-related factors to develop a more comprehensive spatial weight matrix, enabling a more accurate depiction of the spatial dynamics between green finance and carbon emissions.

- (2)

- Dynamics of the green finance evaluation system: The existing green finance evaluation system does not fully account for the dynamic development of the green finance market, especially in emerging areas such as fintech and blockchain applications. Future studies should examine how to incorporate these emerging financial instruments and business models into the evaluation framework. Building a flexible and dynamic system will allow for the timely reflection of changes in green finance and provide more accurate assessments of its development.

- (3)

- Micro-level empirical analysis: Current research primarily emphasizes macro-level analyses and lacks in-depth empirical studies at the micro-level. Future research should focus on how factors such as industrial structure, policies, and market mechanisms influence the development of green finance across different regions and levels. Multi-dimensional data comparisons and case studies can improve the assumptions underlying green finance development, offering a more nuanced understanding of its dynamics.

- (4)

- Cross-regional comparison and synergy analysis: Existing research tends to focus on intra-regional development characteristics, neglecting cross-regional comparisons and synergies. Future research should prioritize investigating the differences in green finance development between urban agglomerations, exploring how regional synergies can be leveraged to complement each other’s strengths. Such collaboration could drive balanced and sustainable green finance development in the middle and lower reaches of the Yellow River. Cross-regional comparisons and cooperation can optimize resource allocation and foster innovation in policies and financial instruments.

- (5)

- Intrinsic mechanisms of the spatial relationship between green finance and carbon emissions: Although this study finds a significant negative spatial autocorrelation between green finance and carbon emissions, the theoretical mechanisms behind this relationship have not been fully explored. Future research should investigate the underlying mechanisms of spatial autocorrelation, focusing on how policies, industrial structures, and market mechanisms influence the interaction between the two variables. This deeper understanding would provide more systematic and comprehensive theoretical support for the formulation of green finance policies.

- (6)

- Heterogeneity analysis within urban agglomerations: Existing studies treat urban agglomerations as homogeneous regions, overlooking the differences between cities within the clusters. Future research should explore the variations between cities in terms of industrial structure, economic development levels, and green finance infrastructure, and analyze how these differences affect the spatial relationship between green finance and carbon emissions. Such in-depth analysis will improve the accuracy of the findings, better reflecting the region’s actual situation and enhancing the precision and effectiveness of policy formulation.

5. Conclusions

Policy Implications

- (1)

- Central Plains Urban Agglomeration:

- (2)

- Guanzhong Plain Urban Agglomeration:

- (3)

- Hohhot–Baotou–Ordos–Yulin (HBOY) Urban Agglomeration:

- (4)

- Shandong Peninsula Urban Agglomeration:

- (5)

- Jinzhong Urban Agglomeration:

- (6)

- Cross-regional coordination mechanisms:

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wang, X.; Zhang, L.; Qin, Y.; Zhang, J. Spatiotemporal Evolution and Driving Factors of Carbon Emissions from High-Carbon Manufacturing Industries in China. Resour. Sci. 2020, 42, 323–333. [Google Scholar]

- Huang, D.; Shen, X.; Zhu, Y. Spatiotemporal Evolution and Influencing Factors of Manufacturing Carbon Emission Efficiency in the Yangtze River Economic Belt. Resour. Environ. Yangtze Basin 2023, 32, 1113–1126. [Google Scholar]

- Mo, H.B.; Wang, S.J. Spatiotemporal pattern evolution and spatial effect mechanisms of county-level carbon emissions in the Yellow River Basin. Geogr. Sci. 2021, 41, 1324–1335. [Google Scholar] [CrossRef]

- Wang, Y.; Shi, W. Dynamic evolution, difference decomposition, and influencing factors of urban carbon emission intensity in the Yellow River Basin. Stat. Decis. 2025, 41, 98–103. [Google Scholar] [CrossRef]

- Jiang, W.Z.; Xu, J.H.; Zhao, T. Research on the spatiotemporal pattern and heterogeneity of carbon emissions in the Yangtze River Basin based on nighttime light data. Resour. Environ. Yangtze Basin 2024, 33, 2004–2017. [Google Scholar]

- Chen, X.; Zhou, J.B.; Liao, Y.T.; Wang, S.J. Coupling coordination evolution of carbon emissions and urban high-quality development level in the Yangtze River Delta and analysis of influencing factors. World Reg. Stud. 2024, 33, 103–115. [Google Scholar]

- Bi, H.; Zhang, S.; Lu, F. Analysis of Decoupling Effects and Influence Factors in Transportation: Evidence from Guangdong Province, China. ISPRS Int. J. Geo-Inf. 2024, 13, 404. [Google Scholar] [CrossRef]

- Xu, S.; Liu, T.; Liu, Y. Spatial Spillover Effects of Green Finance on CO2 Emissions: Evidence from the Yangtze River Economic Belt. Resour. Environ. Yangtze Basin 2024, 33, 1313–1324. (In Chinese) [Google Scholar]

- Liu, H.J.; Zhang, Y.C. The path of green finance development in China in the past decade: A retrospective, effectiveness evaluation, and future prospects. China Soft Sci. 2023, 16–27. [Google Scholar]

- Xu, X.; Zou, S. Research on the coordinated development of circular economy and green finance in Hubei Province. Resour. Environ. Yangtze Basin 2023, 32, 2504–2518. [Google Scholar]

- Huang, X.L.; Wu, X.X.; Yuan, Y.; Wang, X.Y. Energy-saving effects and mechanisms of green finance reform. China Popul. Resour. Environ. 2023, 33, 27–36. [Google Scholar]

- Zhang, B.; Gong, D.W.; Yu, X. Research on the evolution path and institutional logic of green finance standards. Stat. Inf. Forum 2023, 38, 64–79. [Google Scholar]

- Xue, B.W.; Feng, Z.X. Evaluation of regional green finance development in China. J. Xi’an Jiaotong Univ. Soc. Sci. Ed. 2024, 44, 44–61. [Google Scholar] [CrossRef]

- Huang, X.W.; Zong, S.W.; Lin, Y.K. Regional differences and innovation effects of green finance development. Stat. Decis. 2022, 38, 139–142. [Google Scholar] [CrossRef]

- Zhang, Y.J. The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 2011, 39, 2197–2203. [Google Scholar] [CrossRef]

- Yan, C.; Li, T.; Lan, W. Financial development, innovation, and carbon dioxide emissions. J. Financ. Res. 2016, 1, 14–30. [Google Scholar]

- Li, Q. The carbon reduction effect of green finance reform and its impact mechanism. Mod. Econ. Res. 2025, 62–72, 87. [Google Scholar] [CrossRef]

- De Haas, R.; Popov, A.A. Finance and carbon emissions. SSRN Electron. J. 2019. [Google Scholar] [CrossRef]

- Zhao, J.; Liu, C.; Li, C. The impact of financial development on carbon emissions: “Promotion effect” or “suppression effect”? —A mediating effect model based on heterogeneity of technological progress. J. Xinjiang Univ. Philos. Humanit. Soc. Sci. Ed. 2020, 48, 1–10. [Google Scholar] [CrossRef]

- Kang, C.; Shi, G.; Guo, X. Pathways to carbon emission reduction through green finance: Insights from green technological progress and ecological industrial restructuring. Tax. Econ. 2025, 87–99. [Google Scholar]

- Zhou, D.; Chen, G.; He, D. Can green financial pilot policy reduce firms’ carbon emissions? Evidence from Chinese manufacturing firms. Econ. Change Restruct. 2025, 58, 16. [Google Scholar] [CrossRef]

- Du, M.; Zhang, J.; Hou, X. Decarbonization like China: How does green finance reform and innovation enhance carbon emission efficiency? J. Environ. Manag. 2025, 376, 124331. [Google Scholar] [CrossRef] [PubMed]

- He, Z. Green finance, carbon emission regulation, and corporate green total factor productivity. Stat. Decis. 2024, 40, 155–159. [Google Scholar] [CrossRef]

- Ji, X.; Wang, S. The impact of green finance on agricultural carbon emission intensity: Effect and mechanism test. Stat. Decis. 2025, 41, 138–143. [Google Scholar] [CrossRef]

- Wang, S.; Zhang, Y. The impact of green finance from the dual perspective of carbon emissions and carbon removal: Based on a revised carbon neutrality model. South. Financ. 2025, 1–16. [Google Scholar]

- Zhang, C.; Wang, C.; He, H.; Xu, M.; Balezentis, T.; Agnusdei, L. The impact of green finance on energy transition and carbon emission targets: Exploring the double threshold and spatial spillover effects among the regions. Struct. Change Econ. Dyn. 2025, 73, 1–10. [Google Scholar] [CrossRef]

- Xu, S.; Liu, S.; Zhang, Y. The impact of regional green finance on green consumption and its transmission mechanism: A spatial spillover perspective. J. Beijing Inst. Technol. Soc. Sci. Ed. 2025, 27, 175–192. [Google Scholar] [CrossRef]

- Zhang, Y.; Zou, G. Spatial spillover effects of green finance policies on carbon emissions. J. Wuhan Univ. Philos. Soc. Sci. Ed. 2024, 77, 60–72. [Google Scholar] [CrossRef]

- Cui, Y.; Li, X.; Liu, Y.; Zhang, T. Coupling coordination characteristics and influencing factors of green finance development and green low-carbon transformation: A case study of Hunan Province. Prog. Geogr. 2025, 44, 144–156. [Google Scholar]

- Huang, Y.; Tong, X. Threshold Effect of Green Finance on Carbon Emissions—From the Perspective of the Marine Economic Zone. Sci. Technol. Ind. 2024, 24, 112–121. [Google Scholar]

- Xiao, X.; Hu, M. Research on the Carbon Reduction Effect of Green Finance: Also on the Promotion and Suppression Effects of Carbon Emissions. Reg. Financ. Res. 2023, 74–83. [Google Scholar]

- Zhang, K.; Zhang, Y. Evolution of Regional Economic Disparities in the Yellow River Basin at Different Spatial Scales. Econ. Geogr. 2020, 40, 1–11. [Google Scholar] [CrossRef]

- Han, F.; Xie, R. Does the agglomeration of producer services reduce carbon emissions?—A spatial econometric analysis of panel data from cities at the prefecture level and above in China. Quant. Econ. Tech. Econ. Res. 2017, 34, 40–58. [Google Scholar] [CrossRef]

- Zhang, Y.; Zheng, H.Y.; Ge, L.M. The impact of sustainable development policies in resource-based cities on carbon emissions. Financ. Econ. Res. 2022, 48, 49–63. [Google Scholar] [CrossRef]

- Wang, S.J.; Su, Y.X.; Zhao, Y.B. Regional differences, spatial spillover effects, and influencing factors of energy consumption and carbon emissions in Chinese cities. Geogr. Res. 2018, 73, 414–428. [Google Scholar]

- Huang, Y.; Huang, Y.; Chen, Y.; Yang, S. Spatial Evolution of Traditional Waterside Settlements South of the Yangtze River and the Distribution of Settlement Heritage: Evidence from the Nanxi River Basin. Npj Herit. Sci. 2025, 13, 62. [Google Scholar] [CrossRef]

- Ozili, P.K. Green finance research around the world: A review of literature. Int. J. Green Econ. 2022, 16, 56–75. [Google Scholar] [CrossRef]

- Akomea-Frimpong, I.; Adeabah, D.; Ofosu, D.; Tenakwah, E.J. A review of studies on green finance of banks, research gaps and future directions. J. Sustain. Financ. Invest. 2022, 12, 1241–1264. [Google Scholar] [CrossRef]

- Liu, H.; He, C. The mechanism and test of green finance promoting high-quality urban economic development: Empirical evidence from 272 prefecture-level cities in China. Invest. Res. 2021, 40, 37–52. [Google Scholar]

- Xie, F.; Zhou, M. A study on the impact of green finance on the green development of the digital economy. Chongqing Soc. Sci. 2023, 35–50. [Google Scholar] [CrossRef]

- Mao, X.; Wang, R. Green finance and new quality productive forces: Promotion or inhibition?—From the perspective of technological innovation and environmental concern. J. Shanghai Univ. Financ. Econ. 2024, 26, 30–45. [Google Scholar] [CrossRef]

- Rubin, D.B. The Calculation of Posterior Distributions by Data Augmentation: Comment: A Noniterative Sampling/Importance Resampling Alternative to the Data Augmentation Algorithm for Creating a Few Imputations When Fractions of Missing Information Are Modest: The SIR Algorithm. J. Am. Stat. Assoc. 1987, 82, 543–546. [Google Scholar]

- Zhang, S.; Ren, C. The impact of green finance on high-quality agricultural development: An empirical test based on threshold and mediation effect models. Front. Eng. Manag. Technol. 2024, 1–12. Available online: http://kns.cnki.net/kcms/detail/34.1013.N.20241128.0949.008.html (accessed on 24 March 2025).

- Lee, L.F. Best spatial two-stage least squares estimators for a spatial autoregressive model with autoregressive disturbances. Econom. Rev. 2003, 22, 307–335. [Google Scholar] [CrossRef]

- Kelejian, H.H.; Prucha, I.R. Estimation of simultaneous systems of spatially interrelated cross sectional equations. J. Econ. 2004, 118, 27–50. [Google Scholar] [CrossRef]

| Name of Urban Agglomeration | Cities |

|---|---|

| Central Plains Urban Agglomeration | Zhengzhou, Kaifeng, Luoyang, Nanyang, Anyang, Shangqiu, Xinxiang, Pingdingshan, Xuchang, Jiaozuo, Xinyang, Hebi, Puyang, Luohe, Sanmenxia, Zhoukou, Zhumadian, Changzhi, Jincheng |

| Jinzhong Urban Agglomeration | Taiyuan, Jinzhong, Xinzhou, Yangquan, Lvliang |

| Guanzhong Plain Urban Agglomeration | Xi’an, Baoji, Tongchuan, Weinan, Xianyang, Yan’an, Shangluo, Tianshui, Pingliang, Qingyang, Yuncheng, Linfen |

| Hohhot–Baotou–Ordos–Yulin Urban Agglomeration | Hohhot, Baotou, Ordos, Yulin |

| Shandong Peninsula Urban Agglomeration | Heze, Liaocheng, Jining, Taian, Jinan, Dezhou, Binzhou, Zibo, Dongying |

| Primary Indicator | Secondary Indicator | Indicator Definition | Direction | Weight |

|---|---|---|---|---|

| Green Credit | Proportion of Environmental Project Loans | Total Environmental Project Loans in the Province/Total Loans in the Province | + | 0.0931 |

| Green Investment | Proportion of Investment in Environmental Pollution Control to GDP | Investment in Environmental Pollution Control/GDP | + | 0.1217 |

| Green Insurance | Degree of Environmental Pollution Liability Insurance Promotion | Revenue from Environmental Pollution Liability Insurance/Total Premium Revenue | + | 0.0946 |

| Green Bonds | Degree of Green Bond Development | Total Issuance of Green Bonds/Total Bond Issuance | + | 0.1563 |

| Green Support | Proportion of Environmental Protection Expenditure in the Fiscal Budget | Environmental Protection Expenditure/General Fiscal Budget Expenditure | + | 0.1068 |

| Green Funds | Proportion of Green Funds | Total Market Capitalization of Green Funds/Total Market Capitalization of All Funds | + | 0.1380 |

| Green Equity | Depth of Green Equity Development | Carbon Trading, Energy Use Rights Trading, and Pollution Rights Trading/Total Equity Market Trading Volume | + | 0.1251 |

| Second Order | Third Order | Fourth Order | |

|---|---|---|---|

| lngf | −3.8738 *** | −4.0655 *** | −3.1794 *** |

| −0.7468 | −0.7476 | −0.7045 | |

| w1y_lngf | 6.1037 ** | 6.2842 ** | 5.6679 *** |

| −2.4124 | −2.5085 | −1.9637 | |

| w1y_lnco2 | 0.9590 ** | 0.9777 ** | 0.8813 ** |

| −0.4598 | −0.4686 | −0.3787 | |

| lnhc | −0.0013 | −0.0011 | −0.0043 |

| −0.0058 | −0.0055 | −0.0077 | |

| lntech | −0.0007 | −0.0007 | −0.0023 |

| −0.0037 | −0.0035 | −0.0047 | |

| lnco2 | −0.2350 *** | −0.2268 *** | −0.2323 *** |

| −0.0347 | −0.0306 | −0.0339 | |

| w1y_lnco2 | 0.2336 * | 0.2262 * | 0.2049 * |

| −0.1264 | −0.1222 | −0.1226 | |

| w1y_lngf | 1.4425 ** | 1.4265 ** | 1.3314 ** |

| −0.6265 | −0.6202 | −0.5949 | |

| N | 980 | 980 | 980 |

| Goodness of Fit | −4.8666 | −5.3179 | −3.4524 |

| LLF | −475.901 | −512.217 | −340.747 |

| AIC | 0.2778 | 0.2955 | 0.2239 |

| SC | 0.2848 | 0.303 | 0.2296 |

| 2003–2012 Years | 2013–2022 Years | |

|---|---|---|

| lngf | −2.5618 *** | −0.8497 * |

| −0.6758 | −0.4487 | |

| w1y_lngf | 3.8818 * | 1.6189 * |

| −2.3446 | −0.948 | |

| w1y_lnco2 | 1.6123 *** | 0.5756 |

| −0.4851 | −0.3826 | |

| lnhc | −0.0021 | −0.0043 |

| −0.01 | −0.0293 | |

| lntech | −0.0011 | −0.0084 |

| −0.0073 | −0.0108 | |

| lnco2 | −0.3331 *** | −0.3529 ** |

| −0.0674 | −0.1489 | |

| w1y_lnco2 | 0.5176 ** | 0.1655 |

| −0.216 | −0.3122 | |

| w1y_lngf | 1.3757 | 0.7949 |

| −0.9197 | −0.7236 | |

| N | 490 | 490 |

| Goodness of Fit | −2.9006 | −0.5796 |

| LLF | −58.172 | 287.3027 |

| AIC | 0.2008 | 0.0382 |

| SC | 0.2096 | 0.0398 |

| Central Plains Urban Agglomeration | Guanzhong Plain Urban Agglomeration | Hohhot–Baotou–Ordos–Yulin Urban Agglomeration | Jinzhong Urban Agglomeration | Shandong Peninsula Urban Agglomeration | |

|---|---|---|---|---|---|

| lngf | −2.2191 *** | 2.0523 | −0.5624 | 0.8585 | −0.4007 |

| −0.4783 | −1.6987 | −0.532 | −0.7602 | −2.598 | |

| w1y_lngf | 3.9032 ** | 12.0963 *** | −1.6381 * | 2.9119 ** | −18.2630 * |

| −1.8414 | −3.498 | −0.9052 | −1.2558 | −10.4968 | |

| w1y_lnco2 | 1.8222 ** | −1.9512 *** | 1.1470 *** | −2.1870 *** | 0.3495 |

| −0.7227 | −0.6643 | −0.3885 | −0.2616 | −0.4559 | |

| lnhc | −0.0149 | −0.0109 | 0.0918 | 0.0166 | −0.0069 |

| −0.0274 | −0.015 | −0.0572 | −0.0319 | −0.025 | |

| lntech | −0.0001 | 0.0152 | 0.1373 ** | −0.0058 | −0.0124 |

| −0.01 | −0.0106 | −0.0677 | −0.0159 | −0.0103 | |

| lnco2 | −0.3012 | 0.1731 *** | 0.0838 | 0.1533 | 0.0274 |

| −0.207 | −0.0547 | −0.127 | −0.1108 | −0.0451 | |

| w1y_lnco2 | 0.6914 ** | 0.3245 * | −0.1298 | 0.32 | −0.0328 |

| −0.3452 | −0.1796 | −0.4488 | −0.3517 | −0.0869 | |

| w1y_lngf | 1.1963 | −2.0464 ** | −2.4217 *** | −1.4130 ** | −0.2215 |

| −0.7781 | −0.9411 | −0.7471 | −0.6326 | −1.5051 | |

| N | 380 | 240 | 80 | 100 | 180 |

| Goodness of Fit | −5.2458 | −0.4481 | 0.1562 | 0.7005 | −3.7712 |

| LLF | −10.1552 | 1.1247 | 37.4154 | 98.2621 | −47.7535 |

| AIC | 0.1501 | 0.8625 | 0.2013 | 0.5884 | 0.636 |

| SC | 0.158 | 0.9274 | 0.2336 | 0.6702 | 0.695 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ru, J.; Gan, L.; Yusufu, G. Ripple Effect or Spatial Interaction? A Spatial Analysis of Green Finance and Carbon Emissions in the Yellow River Basin. Sustainability 2025, 17, 4713. https://doi.org/10.3390/su17104713

Ru J, Gan L, Yusufu G. Ripple Effect or Spatial Interaction? A Spatial Analysis of Green Finance and Carbon Emissions in the Yellow River Basin. Sustainability. 2025; 17(10):4713. https://doi.org/10.3390/su17104713

Chicago/Turabian StyleRu, Jiayu, Lu Gan, and Gulinaer Yusufu. 2025. "Ripple Effect or Spatial Interaction? A Spatial Analysis of Green Finance and Carbon Emissions in the Yellow River Basin" Sustainability 17, no. 10: 4713. https://doi.org/10.3390/su17104713

APA StyleRu, J., Gan, L., & Yusufu, G. (2025). Ripple Effect or Spatial Interaction? A Spatial Analysis of Green Finance and Carbon Emissions in the Yellow River Basin. Sustainability, 17(10), 4713. https://doi.org/10.3390/su17104713