Human Capital Spending and Its Impact on Economic Growth in Saudi Arabia: An NARDL Approach

Abstract

1. Introduction

2. Literature Review

2.1. Theoretical Underpinning

2.2. Empirical Evidence

3. Materials and Methods

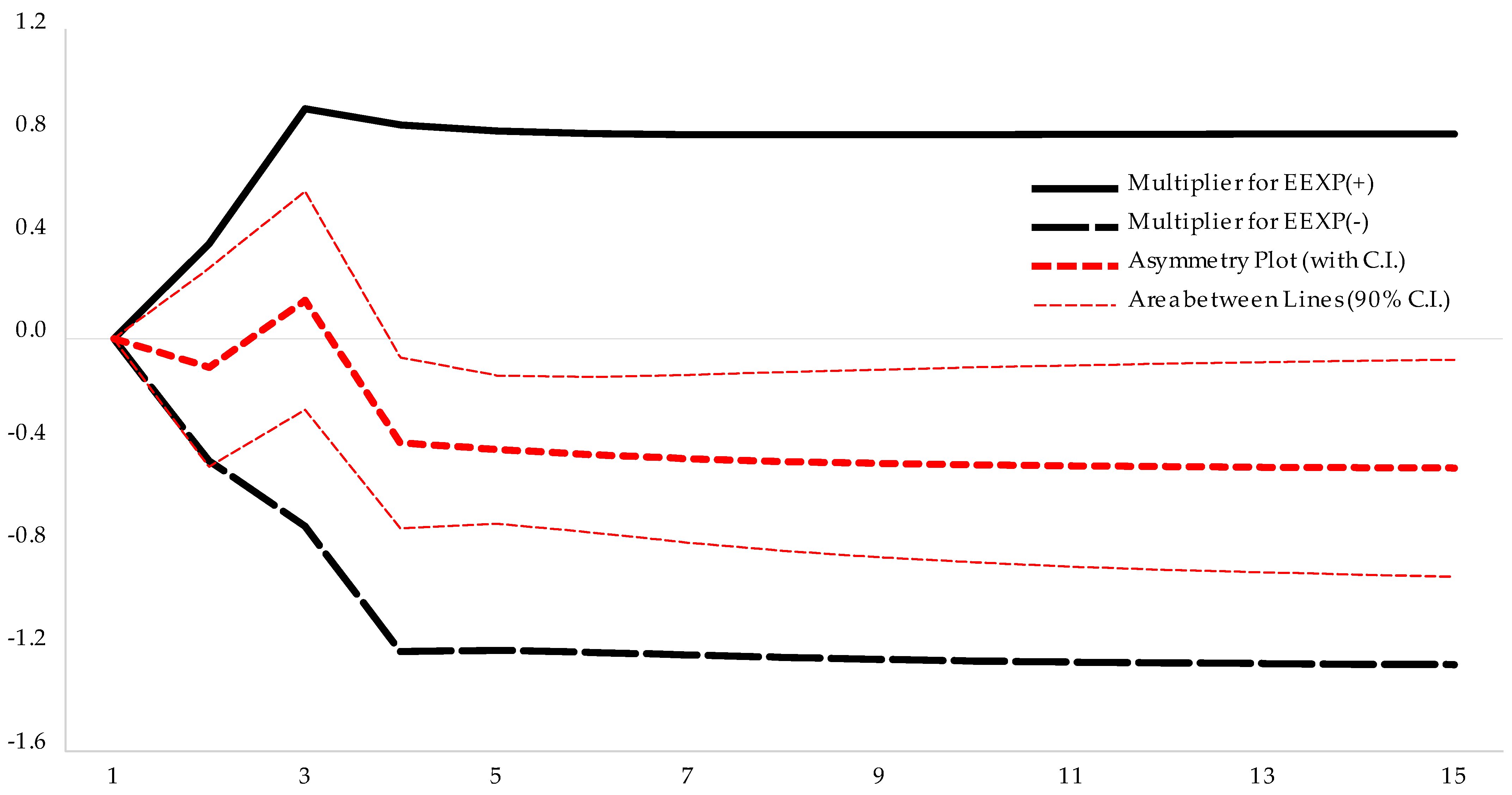

- Government education spending per capita has a long-run positive and asymmetric impact on GDP per capita.

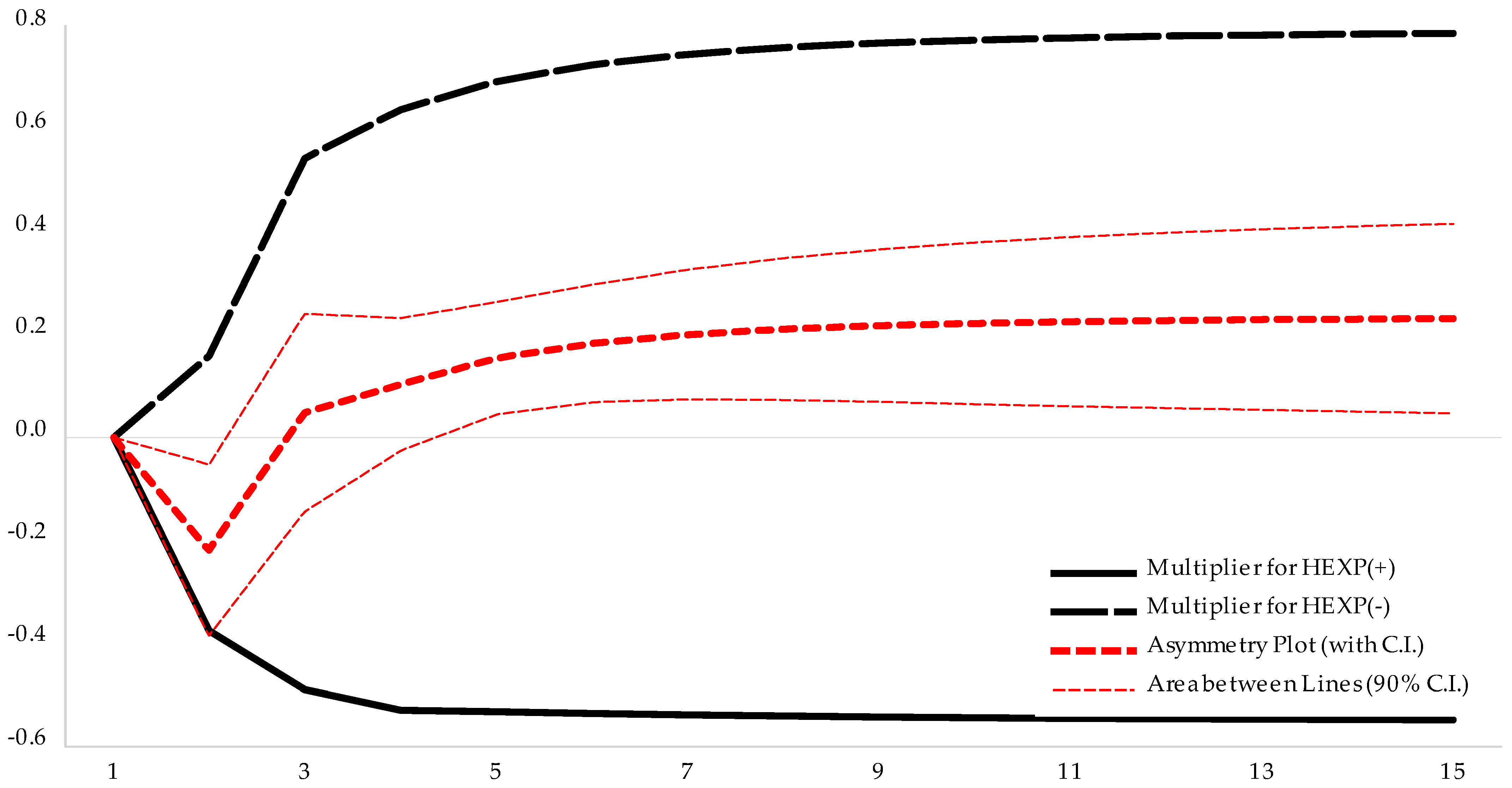

- Government healthcare spending per capita has a long-run positive and asymmetric impact on GDP per capita.

4. Results

4.1. Stationarity Test

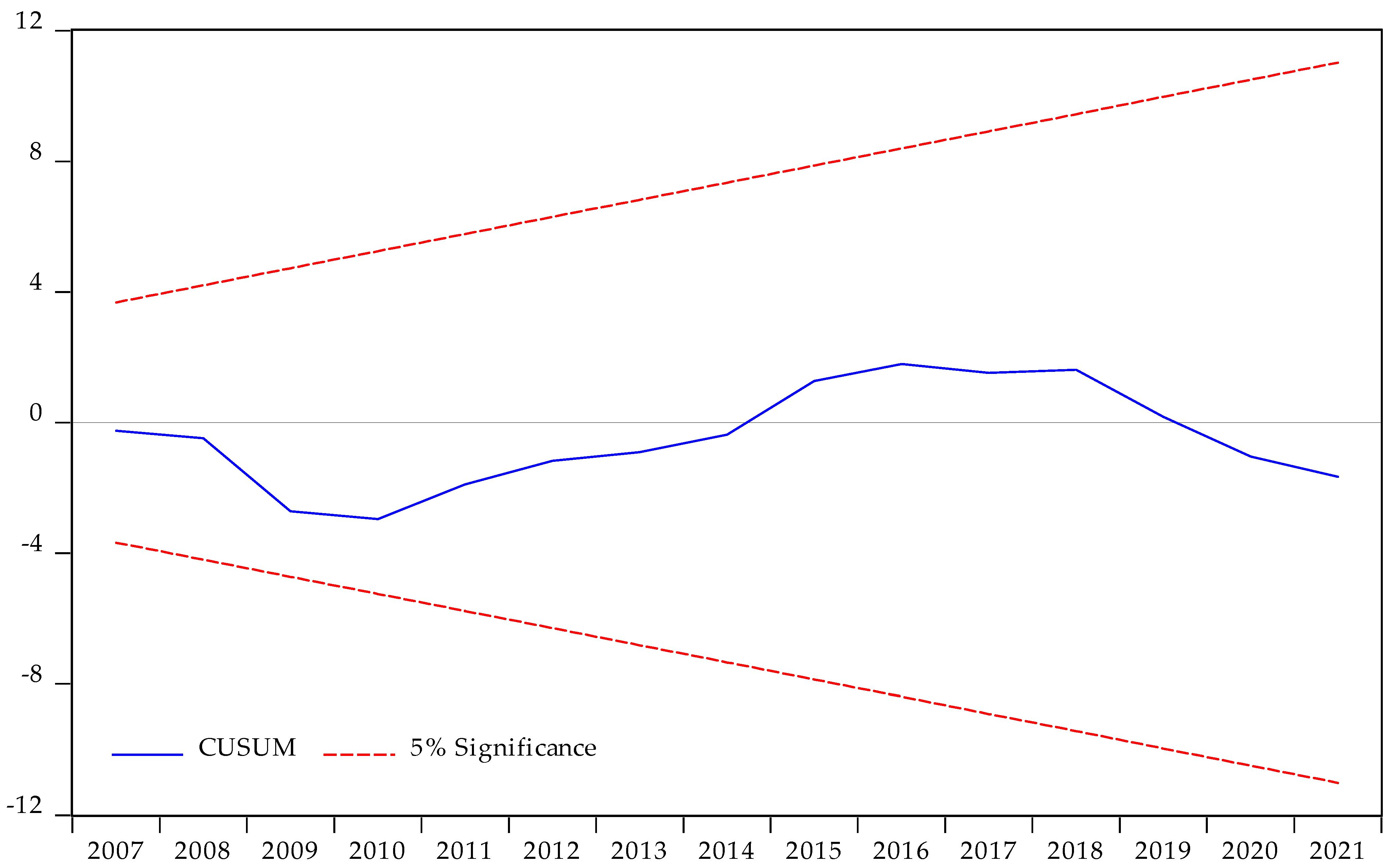

4.2. NARDL Model and Its Results

4.3. The Toda–Yamamoto Test of Causality

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Gabriel, L.F.; de Santana Ribeiro, L.C. Economic Growth and Manufacturing: An Analysis Using Panel VAR and Intersectoral Linkages. Struct. Change Econ. Dyn. 2019, 49, 43–61. [Google Scholar] [CrossRef]

- Atolia, M.; Chahrour, R. Intersectoral Linkages, Diverse Information, and Aggregate Dynamics. Rev. Econ. Dyn. 2020, 36, 270–292. [Google Scholar] [CrossRef]

- Tang, J.; Williams, A.M.; Makkonen, T.; Jiang, J. Are Different Types of Interfirm Linkages Conducive to Different Types of Tourism Innovation? Int. J. Tour. Res. 2019, 21, 901–913. [Google Scholar] [CrossRef]

- Mohamed, E.S.E. Resource Rents, Human Development and Economic Growth in Sudan. Economies 2020, 8, 99. [Google Scholar] [CrossRef]

- Nkogbu, G.O. Enhancing Sustainable Economic Growth and Development through Human Capital Development. Int. J. Hum. Resour. Stud. 2015, 5, 1. [Google Scholar] [CrossRef]

- Abdullahi, M.S. Human Resource Development and Utilization: A Tool for National Economic Growth. Mediterr. J. Soc. Sci. 2013, 4, 153–159. [Google Scholar] [CrossRef]

- Laursen, K.; Meliciani, V. The Importance of Technology-Based Intersectoral Linkages for Market Share Dynamics. Rev. World Econ. 2000, 136, 702–723. [Google Scholar] [CrossRef]

- Alba, M.F.; García Álvarez-Coque, J.M.; Mas-Verdú, F. New Firm Creation and Innovation: Industrial Patterns and Inter-Sectoral Linkages. Int. Entrep. Manag. J. 2013, 9, 501–519. [Google Scholar] [CrossRef]

- Mckenzie, P. Education and Training: Still Distinguishable? Vocat. Asp. Educ. 1995, 47, 35–49. [Google Scholar] [CrossRef]

- Singh, H.P.; Agarwal, A.; Das, J.K. Implementation of E-Learning in Adult Education: A Roadmap. Mumukshu J. Humanit. 2013, 5, 229–232. [Google Scholar]

- Singh, H.P.; Alhulail, H.N. Predicting Student-Teachers Dropout Risk and Early Identification: A Four-Step Logistic Regression Approach. IEEE Access 2022, 10, 6470–6482. [Google Scholar] [CrossRef]

- Agboola, S. Relationship between Educational Expenditure and Unemployment Rate on Economic Growth in Nigeria. Educ. J. 2018, 1, 100. [Google Scholar] [CrossRef]

- Jabbour, L.; Mucchielli, J.L. Technology Transfer Through Vertical Linkages: The Case of the Spanish Manufacturing Industry. J. Appl. Econ. 2007, 10, 115–136. [Google Scholar] [CrossRef]

- Ibeaheem, H.A.; Elawady, S.; Ragmoun, W. Saudi Universities and Higher Education Skills on Saudi Arabia. Int. J. High. Educ. Manag. 2018, 4, 69–82. [Google Scholar] [CrossRef]

- Benlagha, N.; Hemrit, W. The Impact of Government Spending on Non-Oil-GDP in Saudi Arabia (Multiplier Analysis). Int. J. Econ. Bus. Res. 2018, 15, 350. [Google Scholar] [CrossRef]

- Nishiyama, Y. Causality between Government Spending and Income: The Case of Saudi Arabia. Appl. Econ. Lett. 2019, 26, 433–435. [Google Scholar] [CrossRef]

- Alnahdi, G.H. Factors Influencing the Decision to Major in Special Education in Saudi Arabia. S. Afr. J. Educ. 2020, 40, 1–9. [Google Scholar] [CrossRef]

- Reeves, A.; Basu, S.; McKee, M.; Meissner, C.; Stuckler, D. Does Investment in the Health Sector Promote or Inhibit Economic Growth? Glob. Health 2013, 9, 43. [Google Scholar] [CrossRef]

- Awaworyi Churchill, S.; Ugur, M.; Yew, S.L. Government Education Expenditures and Economic Growth: A Meta-Analysis. BE J. Macroecon. 2017, 17, 20160109. [Google Scholar] [CrossRef]

- Cerf, M.E. The Social-Education-Economy-Health Nexus, Development and Sustainability: Perspectives from Low- and Middle-Income and African Countries. Discov. Sustain. 2023, 4, 37. [Google Scholar] [CrossRef]

- Shafuda, C.P.P.; De, U.K. Government Expenditure on Human Capital and Growth in Namibia: A Time Series Analysis. J. Econ. Struct. 2020, 9, 21. [Google Scholar] [CrossRef]

- Islam, M.S.; Alam, F. Influence of Human Capital Formation on the Economic Growth in Bangladesh During 1990–2019: An ARDL Approach. J. Knowl. Econ. 2023, 14, 3010–3027. [Google Scholar] [CrossRef]

- Alam, F.; Singh, H.P.; Singh, A. Economic Growth in Saudi Arabia through Sectoral Reallocation of Government Expenditures. SAGE Open 2022, 12, 215824402211271. [Google Scholar] [CrossRef]

- Singh, H.P.; Singh, A.; Alam, F.; Agrawal, V. Impact of Sustainable Development Goals on Economic Growth in Saudi Arabia: Role of Education and Training. Sustainability 2022, 14, 14119. [Google Scholar] [CrossRef]

- Piabuo, S.M.; Tieguhong, J.C. Health Expenditure and Economic Growth—A Review of the Literature and an Analysis between the Economic Community for Central African States (CEMAC) and Selected African Countries. Health Econ. Rev. 2017, 7, 23. [Google Scholar] [CrossRef] [PubMed]

- Singh, A.; Singh, H.P.; Alam, F.; Agrawal, V. Role of Education, Training, and E-Learning in Sustainable Employment Generation and Social Empowerment in Saudi Arabia. Sustainability 2022, 14, 8822. [Google Scholar] [CrossRef]

- Olumekor, M.; Singh, H.P.; Alhamad, I.A. Online Grocery Shopping: Exploring the Influence of Income, Internet Access, and Food Prices. Sustainability 2024, 16, 1545. [Google Scholar] [CrossRef]

- Maitra, B.; Mukhopadhyay, C.K. Public Spending on Education, Health Care and Economic Growth in Selected Countries of Asia and the Pacific. Asia Pac. Dev. J. 2013, 19, 19–48. [Google Scholar] [CrossRef]

- Mercan, M.; Sezer, S. The Effect of Education Expenditure on Economic Growth: The Case of Turkey. Procedia Soc. Behav. Sci. 2014, 109, 925–930. [Google Scholar] [CrossRef]

- Le, M.P.; Tran, T.M. Government Education Expenditure and Economic Growth Nexus: Empirical Evidence from Vietnam. J. Asian Financ. Econ. Bus. 2021, 8, 413–421. [Google Scholar]

- Gheraia, Z.; Benmeriem, M.; Abed Abdelli, H.; Saadaoui, S. The Effect of Education Expenditure on Economic Growth: The Case of the Kingdom of Saudi Arabia. Humanit. Soc. Sci. Lett. 2021, 9, 14–23. [Google Scholar] [CrossRef]

- Abubakar, A.A.; Al-Mamary, Y.H.; Preet Singh, H.; Singh, A.; Alam, F.; Agrawal, V. Exploring Factors Influencing Sustainable Human Capital Development: Insights from Saudi Arabia. Heliyon 2024, 10, e35676. [Google Scholar] [CrossRef]

- Olumekor, M.; Polbitsyn, S.N.; Khan, M.S.; Singh, H.P.; Alhamad, I.A. Ageing and Digital Shopping: Measurement and Validation of an Innovative Framework. PLoS ONE 2025, 20, e0315125. [Google Scholar] [CrossRef] [PubMed]

- Singh, H.P.; Jindal, S.; Jindal, A. Globalisation and Inclusive Growth. Gyanprastha Accman J. Manag. 2011, 3, 135–139. [Google Scholar]

- Bakari, S. The Impact of Domestic Investment on Economic Growth New Policy Analysis from Algeria. Bull. Econ. Theory Anal. 2018, 3, 35–51. [Google Scholar] [CrossRef]

- Millia, H.; Syarif, M.; Adam, P.; Rahim, M.; Gamsir, G.; Rostin, R. The Effect of Export and Import on Economic Growth In Indonesia. Int. J. Econ. Financ. Issues 2021, 11, 17–23. [Google Scholar] [CrossRef]

- Alrasheedy, A.; Alrazyeg, R. Government Expenditure and Economic Growth in Saudi Arabia. Am. Int. J. Bus. Manag. (AIJBM) 2020, 3, 126–134. [Google Scholar]

- Almohaithef, M.; Elsayed, E. Health Education in Schools: An Analysis of Health Educator Role in Public Schools of Riyadh, Saudi Arabia. Saudi J. Health Sci. 2019, 8, 31. [Google Scholar] [CrossRef]

- Daniere, A.; Becker, G.S. Human Capital: A Theoretical and Empirical Analysis, with Special Reference to Education. Pp. Xvi, 187. New York: National Bureau of Economic Research. Ann. Am. Acad. Pol. Soc. Sci. 1965, 360, 208–209. [Google Scholar] [CrossRef]

- Romer, P.M. Increasing Returns and Long-Run Growth. J. Polit. Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef]

- Lucas, R.E. On the Mechanics of Economic Development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Mankiw, N.G.; Romer, D.; Weil, D.N. A Contribution to the Empirics of Economic Growth. Q. J. Econ. 1992, 107, 407–437. [Google Scholar] [CrossRef]

- Grossman, M. On the Concept of Health Capital and the Demand for Health. J. Political Econ. 1972, 80, 223–255. [Google Scholar] [CrossRef]

- Thirlwall, A.P. The Balance of Payments Constraint as an Explanation of International Growth Rate Differences. BNL Q. Rev. 1979, 32, 45–53. [Google Scholar]

- Bloom, D.E.; Canning, D. The Health and Wealth of Nations. Science 2000, 287, 1207–1209. [Google Scholar] [CrossRef]

- Hanushek, E.A.; Woessmann, L. The Role of Cognitive Skills in Economic Development. J. Econ. Lit. 2008, 46, 607–668. [Google Scholar] [CrossRef]

- Barro, R.J. Economic Growth in a Cross Section of Countries. Q. J. Econ. 1991, 106, 407. [Google Scholar] [CrossRef]

- Eggoh, J.; Houeninvo, H.; Sossou, G. Education, Health and Economic Growth in African Countries. J. Econ. Dev. 2015, 44, 93–111. [Google Scholar] [CrossRef]

- Marquez-Ramos, L.; Mourelle, E. Education and Economic Growth: An Empirical Analysis of Nonlinearities. Appl. Econ. Anal. 2019, 27, 21–45. [Google Scholar] [CrossRef]

- Well, D.N. Accounting for the Effect Of Health on Economic Growth. Q. J. Econ. 2007, 122, 1265–1306. [Google Scholar] [CrossRef]

- Aboubacar, B.; Xu, D. The Impact of Health Expenditure on the Economic Growth in Sub-Saharan Africa. Theor. Econ. Lett. 2017, 07, 615–622. [Google Scholar] [CrossRef]

- Gaies, B. Reassessing the Impact of Health Expenditure on Income Growth in the Face of the Global Sanitary Crisis: The Case of Developing Countries. Eur. J. Heal. Econ. 2022, 23, 1415–1436. [Google Scholar] [CrossRef]

- Rahman, R. The Privatization of Health Care System in Saudi Arabia. Health Serv. Insights 2020, 13, 1178632920934497. [Google Scholar] [CrossRef]

- Yang, X. Health Expenditure, Human Capital, and Economic Growth: An Empirical Study of Developing Countries. Int. J. Health Econ. Manag. 2020, 20, 163–176. [Google Scholar] [CrossRef] [PubMed]

- Esen, E.; Çelik Keçili, M. Economic Growth and Health Expenditure Analysis for Turkey: Evidence from Time Series. J. Knowl. Econ. 2022, 13, 1786–1800. [Google Scholar] [CrossRef]

- Krueger, A.O. Importance of General Policies to Promote Economic Growth. World Econ. 1985, 8, 93–108. [Google Scholar] [CrossRef]

- Balassa, B. Exports and Economic Growth. J. Dev. Econ. 1978, 5, 181–189. [Google Scholar] [CrossRef]

- Sachs, J.; Warner, A. Natural Resource Abundance and Economic Growth; Oxford University Press: New York, NY, USA, 1995. [Google Scholar]

- Awokuse, T.O. Causality between Exports, Imports, and Economic Growth: Evidence from Transition Economies. Econ. Lett. 2007, 94, 389–395. [Google Scholar] [CrossRef]

- Sulaiman, M.; Saad, N.M. An Analysis of Export Performance and Economic Growth of Malaysia Using Co-Integraton and Error Correction Models. J. Dev. Areas 2009, 43, 217–231. [Google Scholar] [CrossRef]

- Tsen, W.H. Exports, Domestic Demand, and Economic Growth in China: Granger Causality Analysis. Rev. Dev. Econ. 2010, 14, 625–639. [Google Scholar] [CrossRef]

- Alshahrani, S.; Alsadiq, A. Economic Growth and Government Spending in Saudi Arabia: An Empirical Investigation. IMF Work. Pap. 2014, 14, 1. [Google Scholar] [CrossRef]

- Sunde, T.; Tafirenyika, B.; Adeyanju, A. Testing the Impact of Exports, Imports, and Trade Openness on Economic Growth in Namibia: Assessment Using the ARDL Cointegration Method. Economies 2023, 11, 86. [Google Scholar] [CrossRef]

- Sultan, Z.A.; Haque, M.I. Oil Exports and Economic Growth: An Empirical Evidence from Saudi Arabia. Int. J. Energy Econ. Policy 2018, 8, 281–287. [Google Scholar]

- Toda, H.Y.; Yamamoto, T. Statistical Inference in Vector Autoregressions with Possibly Integrated Processes. J. Econom. 1995, 66, 225–250. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds Testing Approaches to the Analysis of Level Relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Phillips, P.C.B.; Perron, P. Testing for a Unit Root in Time Series Regression. Biometrika 1988, 75, 335. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the Estimators for Autoregressive Time Series With a Unit Root. J. Am. Stat. Assoc. 1979, 74, 427. [Google Scholar] [CrossRef]

- Ng, S.; Perron, P. LAG Length Selection and the Construction of Unit Root Tests with Good Size and Power. Econometrica 2001, 69, 1519–1554. [Google Scholar] [CrossRef]

- Zivot, E.; Andrews, D.W.K. Further Evidence on the Great Crash, the Oil-Price Shock, and the Unit-Root Hypothesis. J. Bus. Econ. Stat. 1992, 10, 251. [Google Scholar] [CrossRef]

- Granger, C.W.J. Investigating Causal Relations by Econometric Models and Cross-Spectral Methods. Econometrica 1969, 37, 424. [Google Scholar] [CrossRef]

- Shin, Y.; Yu, B.; Greenwood-Nimmo, M. Modelling Asymmetric Cointegration and Dynamic Multipliers in a Nonlinear ARDL Framework. In Festschrift in Honor of Peter Schmidt; Springer: New York, NY, USA, 2014; pp. 281–314. [Google Scholar]

- Bakari, S.; Mabrouki, M. Impact Of Exports And Imports On Economic Growth: New Evidence From Panama. J. Smart Econ. Growth 2017, 2, 67–79. [Google Scholar]

- Fatemah, A.; Qayyum, A. Modelling the Impact of Exports on the Economic Growth of Pakistan. Turk. Econ. Rev. 2018, 5, 56–64. [Google Scholar]

- Islam, M.S. Do Education and Health Influence Economic Growth and Food Security Evidence from Bangladesh. Int. J. Happiness Dev. 2020, 6, 59. [Google Scholar] [CrossRef]

- Kutasi, G.; Marton, Á. The Long-Term Impact of Public Expenditures on GDP-Growth. Soc. Econ. 2020, 42, 403–419. [Google Scholar] [CrossRef]

- Raghupathi, V.; Raghupathi, W. Healthcare Expenditure and Economic Performance: Insights From the United States Data. Front. Public Health 2020, 8, 156. [Google Scholar] [CrossRef]

- Alghaith, T.; Liu, J.X.; Alluhidan, M.; Herbst, C.H.; Alazemi, N. A Labor Market Assessment of Nurses and Physicians in Saudi Arabia: Addressing Future Imbalances Between Need, Supply, and Demand; World Bank Group: Washington, DC, USA, 2021; Volume 1. [Google Scholar]

- Baumol, W.J. Health Care, Education and the Cost Disease: A Looming Crisis for Public Choice. Public Choice 1993, 77, 17–28. [Google Scholar] [CrossRef]

- Adam, P.; Rosnawintang, R.; Nusantara, A.W.; Muthalib, A.A. A Model of The Dynamic of the Relationship Between Exchange Rate and Indonesia’s Export. Int. J. Econ. Financ. Issues 2017, 7, 255–261. [Google Scholar]

| Variables | Intercept | Trend and Intercept | ||||||

|---|---|---|---|---|---|---|---|---|

| Level | First Difference | Level | First Difference | |||||

| t-Statistics | p-Values | t-Statistics | p-Values | t-Statistics | p-Values | t-Statistics | p-Values | |

| GDP | −2.65352 | 0.0921 | −7.64465 * | 0.0000 | −2.92130 | 0.1681 | −7.56274 * | 0.0000 |

| EXPO | −1.25587 | 0.6391 | −5.71567 * | 0.0000 | −1.93858 | 0.6139 | −5.72550 * | 0.0002 |

| EEXP | −3.16025 ** | 0.0309 | −10.6950 * | 0.0000 | −4.75476 * | 0.0027 | −10.5329 * | 0.0000 |

| HEXP | −3.62274 * | 0.0101 | −9.73190 * | 0.0000 | −5.77717 * | 0.0002 | −9.58400 * | 0.0000 |

| Variable | Intercept | Trend and Intercept | ||||||

|---|---|---|---|---|---|---|---|---|

| Level | First Difference | Level | First Difference | |||||

| Adj. t-Statistics | p-Values | Adj. t-Statistics | p-Values | Adj. t-Statistics | p-Values | Adj. t-Statistics | p-Values | |

| GDP | −2.64033 | 0.0945 | −7.47886 * | 0.0000 | −2.92108 | 0.1681 | −7.45611 * | 0.0000 |

| EXPO | −1.14644 | 0.6865 | −5.80780 * | 0.0000 | −2.08569 | 0.5360 | −6.05644 * | 0.0001 |

| EEXP | −3.16377 ** | 0.0307 | −11.6723 * | 0.0000 | −4.88670 * | 0.0019 | −11.50984 * | 0.0000 |

| HEXP | −3.65783 * | 0.0092 | −24.2035 * | 0.0001 | −5.77300 * | 0.0002 | −23.66124 * | 0.0000 |

| Variables | Intercept Only | Trend and Intercept | ||

|---|---|---|---|---|

| Level | First Difference | Level | First Difference | |

| LM Statistics | LM Statistics | LM Statistics | LM Statistics | |

| GDP | 0.57836 ** | 0.17230 | 0.06681 | 0.09519 |

| EXPO | 0.62322 ** | 0.13045 | 0.11338 | 0.11027 |

| EEXP | 0.61527 ** | 0.06709 | 0.08061 | 0.06629 |

| HEXP | 0.67767 ** | 0.22289 | 0.05816 | 0.22266 * |

| Type of Break | Type of Break | ||||

|---|---|---|---|---|---|

| Variable | Intercept | Intercept and Trend | First Diff. | Intercept | Intercept and Trend |

| GDP | −3.873 [2] | −3.802 [2] | Δ(GDP) | −8.640 * [0] | −9.949 * [0] |

| EXPO | −4.052 [0] | −3.838 [0] | Δ(EXPO) | −5.613 * [1] | −5.727 * [1] |

| EEXP | −5.980 * [0] | −5.861 * [0] | Δ(EEXP) | −10.889 * [0] | −11.262 * [0] |

| HEXP | −6.182 * [0] | −7.065 * [0] | Δ(HEXP) | −6.235 * [1] | −7.357 * [1] |

| F-Bound Test | Null: There is No Level Relationship | |||

|---|---|---|---|---|

| Test Statistics | Values | Level of Significance | I(0) | I(1) |

| Asymptotic: n = 1000 | ||||

| F-statistics | 5.260 | 5% | 2.390 | 3.380 |

| k | 5 | 1% | 3.060 | 4.150 |

| Actual Sample Size | 33 | |||

| Finite Sample: n = 35 | ||||

| 5% | 2.804 | 4.013 | ||

| 1% | 3.900 | 5.419 | ||

| Finite Sample: n = 30 | ||||

| 5% | 2.910 | 4.193 | ||

| 1% | 4.134 | 5.761 | ||

| NARDL Error Correction Regression | ||||

|---|---|---|---|---|

| Dependent Variable: D(GDP) | ||||

| Included Observations: 33 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| D(EXPO) | 0.0715 * | 0.0176 | 4.0541 | 0.0010 |

| D(EEXP_POS) | 0.3648 * | 0.0828 | 4.4065 | 0.0005 |

| D(EEXP_POS(−1)) | 0.3382 * | 0.0703 | 4.8113 | 0.0002 |

| D(EEXP_NEG) | 0.4847 * | 0.1052 | 4.6086 | 0.0003 |

| D(EEXP_NEG(−1)) | −0.0925 | 0.0942 | −0.9821 | 0.3416 |

| D(EEXP_NEG(−2)) | 0.2616 * | 0.0583 | 4.4898 | 0.0004 |

| D(HEXP_POS) | −0.3821 * | 0.0638 | −5.9900 | 0.0000 |

| D(HEXP_POS(−1)) | −0.0438 | 0.0270 | −1.6181 | 0.1265 |

| D(HEXP_POS(−2)) | −0.0224 | 0.0134 | −1.6774 | 0.1142 |

| D(HEXP_NEG) | −0.1590 * | 0.0301 | −5.2766 | 0.0001 |

| D(HEXP_NEG(−1)) | −0.1083 ** | 0.0471 | −2.2984 | 0.0363 |

| CointEq(−1) | −0.4697 * | 0.0654 | −7.1794 | 0.0000 |

| R-squared 0.8878 | ||||

| Adjusted R-squared 0.8290 | ||||

| Durbin-Watson Statistic 2.0339 | ||||

| Null Hypothesis: Coefficient is Symmetric. | |||

|---|---|---|---|

| Variable | Statistic | Value | Probability |

| Long Run | |||

| EEXP | F-statistic | 9.882076 * | 0.0067 |

| Chi-square | 9.882076 * | 0.0017 | |

| HEXP | F-statistic | 11.70779 * | 0.0038 |

| Chi-square | 11.70779 * | 0.0006 | |

| Short Run | |||

| EEXP | F-statistic | 0.021455 | 0.8855 |

| Chi-square | 0.021455 | 0.8835 | |

| HEXP | F-statistic | 1.542935 | 0.2333 |

| Chi-square | 1.542935 | 0.2142 | |

| Joint (Long Run and Short Run) | |||

| EEXP | F-statistic | 4.954710 ** | 0.0223 |

| Chi-square | 9.909420 * | 0.0071 | |

| HEXP | F-statistic | 6.377160 * | 0.0099 |

| Chi-square | 12.75432 * | 0.0017 | |

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| EXPO | 0.3084 * | 0.0835 | 3.6956 | 0.0022 |

| EEXP_POS | 0.7578 * | 0.2202 | 3.4420 | 0.0036 |

| EEXP_NEG | 1.2118 * | 0.3720 | 3.2573 | 0.0053 |

| HEXP_POS | −0.5358 * | 0.1470 | −3.6436 | 0.0024 |

| HEXP_NEG | −0.7472 * | 0.1943 | −3.8449 | 0.0016 |

| C | −1.3411 * | 0.3956 | −3.3898 | 0.0040 |

| Test Type | Null Hypothesis | Test Statistic | Values | Probabilities |

|---|---|---|---|---|

| Ramsey RESET (2) Test | The model is appropriately specified | F-statistic | 0.9908 | 0.3977 |

| Likelihood ratio | 4.6818 | 0.0962 | ||

| Test of Normality | Errors follow a normal distribution | Jarque–Bera | 0.4889 | 0.7831 |

| Breusch–Godfrey LM Test of Serial Correlation | There is no serial correlation in errors for up to ten lags | F-statistic | 0.9624 | 0.4657 |

| Obs*R-squared | 8.5546 | 0.0732 | ||

| Breusch–Pagan–Godfrey Heteroskedasticity Test | Errors are homoscedastic | F-statistic | 1.5703 | 0.1925 |

| Obs*R-squared | 21.1283 | 0.2206 | ||

| Scaled explained SS | 5.3747 | 0.9965 |

| FMOLS | DOLS | CCR | ||||

|---|---|---|---|---|---|---|

| Variable | Coefficient | t-Statistic | Coefficient | t-Statistic | Coefficient | t-Statistic |

| EXPO | 0.0843 | 4.8963 * (0.0000) | 0.1180 | 6.1353 * (0.0000) | 0.0899 | 4.7697 * (0.0000) |

| EEXP | 0.2957 | 3.1476 * (0.0036) | 0.4115 | 4.3356 * (0.0003) | 0.3090 | 3.2160 * (0.0030) |

| HEXP | −0.1165 | −2.6448 ** (0.0126) | −0.2249 | −4.0808 * (0.0005) | −0.1336 | −2.6511 ** (0.0124) |

| C | −1.4314 | −4.6517 * (0.0001) | −1.3566 | −4.6359 * (0.0001) | −1.4455 | −4.5585 * (0.0001) |

| Adjusted R-squared | 0.6106 | 0.7748 | 0.5928 | |||

| Jarque-Bera | 0.1917 (0.9085) | 1.5669 (0.4568) | 0.1999 (0.9048) | |||

| Null Hypothesis | Chi-Sq. Value | df | Prob. | Inference |

|---|---|---|---|---|

| There is no causality from EXPO to GDP | 25.1386 * | 2 | 0.0000 | Causality from EXPO to GDP |

| There is no causality from GDP to EXPO | 2.6444 | 2 | 0.2665 | No causality from GDP to EXPO |

| There is no causality from EEXP to GDP | 10.2856 * | 2 | 0.0058 | Causality from EEXP to GDP |

| There is no causality from GDP to EEXP | 2.1495 | 2 | 0.3414 | No causality from GDP to EEXP |

| There is no causality from HEXP to GDP | 17.1729 * | 3 | 0.0002 | Causality from HEXP to GDP |

| There is no causality from GDP to HEXP | 2.1049 | 3 | 0.3491 | No causality from GDP to HEXP |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alam, F.; Singh, H.P.; Singh, A.; Al-Mamary, Y.H.; Abubakar, A.A.; Agrawal, V. Human Capital Spending and Its Impact on Economic Growth in Saudi Arabia: An NARDL Approach. Sustainability 2025, 17, 4639. https://doi.org/10.3390/su17104639

Alam F, Singh HP, Singh A, Al-Mamary YH, Abubakar AA, Agrawal V. Human Capital Spending and Its Impact on Economic Growth in Saudi Arabia: An NARDL Approach. Sustainability. 2025; 17(10):4639. https://doi.org/10.3390/su17104639

Chicago/Turabian StyleAlam, Fakhre, Harman Preet Singh, Ajay Singh, Yaser Hasan Al-Mamary, Aliyu Alhaji Abubakar, and Vikas Agrawal. 2025. "Human Capital Spending and Its Impact on Economic Growth in Saudi Arabia: An NARDL Approach" Sustainability 17, no. 10: 4639. https://doi.org/10.3390/su17104639

APA StyleAlam, F., Singh, H. P., Singh, A., Al-Mamary, Y. H., Abubakar, A. A., & Agrawal, V. (2025). Human Capital Spending and Its Impact on Economic Growth in Saudi Arabia: An NARDL Approach. Sustainability, 17(10), 4639. https://doi.org/10.3390/su17104639