1. Introduction

Mineral-rich nations are expected to prosper faster than those without significant natural resources; however, they often face higher poverty, inequality, and civil instability. This paradox has drawn considerable academic and policy interest, leading to extensive research on the impact of abundant natural resources on economic growth (EG) [

1].

Rich assets haven’t proven the magic bullet for many nations to either spark or maintain EG and development, claims [

2]. Variable income from mineral resources frequently hinders economic diversification, fuels unsustainable infrastructure spending, or lines the coffers of dishonest politicians at the expense of functional democracy. They emphasized that this “paradox of plenty”, often known as the “resource curse”, is a result of a political economy rife with distorted incentives that frequently lead to subpar development outcomes.

Mineral-rich countries’ over-reliance on natural resources was linked to the phenomenon of debilitating economic performance caused by the negative impact, according to a substantial body of literature that has been written about it [

3,

4,

5,

6]. An ample supply of mineral resources may harm EG through several pathways, including poor institutional quality, political unpredictability, the Dutch Disease, long-term trends in the global costs of commodities, price swings, and squeezing out of industries [

7,

8,

9]. Nonetheless, it is also indicated that mineral wealth can considerably boost EG provided that institutions are of a sufficient caliber [

10,

11].

In the context of internationalization trade (IT), measured by trade openness, it is essential to acknowledge that the literature offers conflicting perspectives. While mainstream liberal economic theory posits that IT fosters efficiency and technology spillovers [

12,

13], critical theories such as dependency and core-periphery perspectives argue that IT—especially under conditions of weak institutions—can reinforce extractivist economic models that primarily benefit external actors rather than host countries. This dichotomy is particularly relevant for mineral-rich countries where foreign direct investment (FDI) in extractive industries may not always translate into sustainable development or equitable wealth distribution, as seen in many Latin American economies [

14,

15,

16]. Thus, the role of IT in promoting development is nuanced and heavily contingent on domestic regulatory frameworks, institutional quality, and state capacity [

17].

Similarly, the impact of economic freedom (EF)—often measured through indicators such as property rights, deregulation, and trade liberalization—also warrants a cautious interpretation [

18]. Although EF has been associated with higher efficiency and earnings [

19], empirical evidence suggests that in the absence of strong institutions and anti-corruption frameworks, EF can be exploited to facilitate rent-seeking behavior and illicit capital flows [

20]. Therefore, while EF may be positively associated with mineral rents in countries with robust legal institutions [

21], its effectiveness is not universal [

22] and must be critically examined in regions like Eastern Europe, where governance standards vary widely [

23].

The degree of governance and corruption in Eastern Europe also had an impact on the relationship between EF and resource rents. Resource rents and EF were found to be positively correlated in nations with better governance and reduced levels of corruption [

24]. Therefore, the Eastern European experience used in this analysis shows that economic independence might be a key factor in raising the rents associated with mineral resources [

24,

25]. Rents rose as a result of resource sector efficiency and profitability in nations that adopted economic reforms, strengthened property rights, decreased government interference, and opened up to international trade. However, other elements like political stability, the quality of the nation’s governance, and the country’s unique resource endowment all have an impact on how much EF translates into higher resource rents [

22,

23,

26].

The current study aims to contribute to this ongoing scholarly debate by empirically assessing how educational achievement, international trade, economic freedom, and governance conditions affect mineral resource rents in Eastern European countries from 1990 to 2021. By considering both institutional and structural dimensions, this research offers new insights into whether and how these factors interact to either alleviate or reinforce the extractivist tendencies commonly associated with resource-rich nations. The study’s contributions lie in integrating diverse theoretical perspectives—including extractivism, institutional theory, and human capital theory—into the empirical modeling of resource rent dynamics.

The mineral resource rents of a nation can be considerably affected by human capital, which refers to the skills, knowledge, and experience acquired by individuals or the community. The level of education attained by individuals, which is considered a form of human capital, has a direct impact on a country’s ability to efficiently discover, extract, manage, and profit from its mineral resources [

27].

An educated workforce is more inclined to embrace and develop technologies that improve the efficiency of extracting resources. This results in increased production and more efficient allocation of resources, leading to a higher overall mineral revenue. Countries with abundant human capital can effectively apply superior management strategies in the mining industry. This includes the implementation of improved resource allocation, strategic planning, and environmental management practices, all of which have the potential to enhance the revenue derived from mineral resources. The quality of governance and policy-making is also influenced by human capital. Leaders and legislators who have had a formal education are more inclined to enact policies that guarantee the long-term and financially beneficial utilization of resources, hence maximizing profits [

28,

29].

Numerous Eastern European nations had centrally planned economies with state-run resource sectors throughout the communist era. Even though the educational systems in these nations were frequently well-developed, the emphasis was more on meeting the demands of the state than on efficiency and innovation in the resource sector [

30,

31,

32].

The Eastern European case study in this paper emphasizes how important human capital is in deciding the profitability and efficiency of resource extraction and, in turn, the amount of mineral resource rents [

33]. MR could be maximized more effectively by nations that made educational investments and coordinated the growth of their human capital with the demands of the resource industry [

34]. On the other hand, those who fell behind in the development of their human capital experienced reduced rents and lost out on chances to profit from their natural riches [

35,

36].

The present investigation’s selection of Eastern European countries to examine the effects of IT, EG, EF, and educational attainment on natural resource rents between 1990 and 2021 is noteworthy for multiple reasons: (1) After the Soviet Union’s collapse in the early 1990s, Eastern Europe transitioned from centrally planned to market-oriented economies, necessitating an examination of how these systemic changes influenced the management and profitability of mineral resources. This period offered a unique opportunity to explore the effects of EF, governance, and education on mineral resource rents amidst significant institutional and trade law reforms. (2) Mineral resources abound in Eastern Europe, including coal, iron ore, petroleum, natural gas, and bauxite. Researching this area contributes to a better understanding of the wider consequences for fiscal stability, industrial growth, and energy security [

37].

Examining education’s role in economic outcomes in resource-rich Eastern European nations reveals insights into the impact of economic reforms and freedom. (3) Many Eastern European nations saw significant EG from 1990 to 2021, often due to EU membership and international trade. Examining how resource rents influenced this growth helps clarify the “resource curse” theory, revealing whether resource wealth aided or hindered development. (4) EU integration also expanded trade, affecting mineral resource rents through changes in export dynamics and market access [

38]. (5) Post-Cold War geopolitical shifts and EU integration transformed Eastern Europe’s resource management and economic strategies, offering insights into the relationship between IT, EG, and mineral resource rents applicable to other resource-rich nations [

39,

40].

Despite an expanding body of literature on the dynamics of mineral resource rents, several critical gaps remain, particularly within the context of Eastern Europe’s post-communist economic transformation. Much of the existing research has either narrowly focused on single variables, such as EG, EA, or IT, or examined these variables in isolation from one another, neglecting their combined and potentially synergistic effects on natural resource rents [

38,

41,

42,

43]. This fragmented approach fails to capture the structural and institutional complexities characterizing the Eastern European transition from centrally planned to market economies.

Furthermore, the integration of theoretical perspectives such as the resource curse theory, institutional economics, and endogenous growth theory into empirical studies on mineral rents remains insufficient. These frameworks are vital for understanding how education, trade liberalization, and economic freedom (EF) interact with institutional quality to influence long-term resource management outcomes. Yet, many studies treat these drivers as exogenous or context-neutral, ignoring the historical, political, and governance-specific dimensions of the Eastern European experience.

Notably, the role of education in shaping mineral rent trajectories through human capital formation and innovation remains underexplored in resource-dependent, transition economies [

44]. Although studies such as Gylfason [

42] and Hanushek [

37] suggest that education facilitates economic diversification and technological upgrades, limited empirical research investigates how EA in post-communist nations has influenced resource sector performance. This gap persists partly due to the difficulty of measuring long-term institutional effects and the delayed impact of educational investments in resource governance.

Another under-researched area concerns the effect of economic freedom on mineral resource rents in regions transitioning from authoritarianism to market liberalism. The conventional wisdom that higher EF encourages investment and efficient resource extraction [

19] may not hold in institutional environments still struggling with corruption, regulatory instability, or weak property rights enforcement. The lack of contextualized analyses explaining how EF operates in post-socialist governance structures has contributed to inconsistent and inconclusive findings in the literature.

This study offers a novel contribution by bridging these gaps through an integrated, region-specific analysis of Eastern Europe’s mineral rent dynamics from 1990 to 2021. Unlike previous studies that often examine education, trade, or economic freedom in isolation, this research synthesizes these factors within a unified empirical framework, incorporating long-term institutional and governance variables. Furthermore, it applies advanced econometric techniques, including MMQR and AMG robustness analysis, to capture both short- and long-term interactions, offering a more nuanced understanding of how human capital development, market liberalization, and trade openness collectively influence mineral rent outcomes. This is particularly significant for Eastern Europe, where post-communist transitions have created unique institutional trajectories that remain underrepresented in global resource economics literature [

45,

46]. By addressing these overlooked dimensions, the study not only advances academic indulgence but also provides actionable perceptions for legislators seeking to balance resource exploitation with sustainable economic development in transitional economies.

This study addresses these deficiencies by: (1) Synthesizing EA, EF, EG, and IT within a unified analytical framework, capturing their intertwined roles in shaping resource rent outcomes; (2) Focusing on Eastern European economies from 1990 to 2021—a region and period frequently neglected in global resource economics; (3) Exploring the mediating part of institutional quality and supremacy in determining whether education and trade act as blessings or exacerbate the resource curse; (4) Providing new empirical evidence using long-term panel data analysis, cointegration techniques, and causality testing to unpack the structural linkages between economic freedom, human capital, and mineral rent dependence.

By bridging theoretical perspectives and offering a region-specific empirical analysis, this study not only fills a significant void in the literature but also informs policymaking on how to harness education, trade, and liberalization for sustainable resource-based development in post-transition contexts.

The present investigation addresses the following questions: (1) How does EA influence the efficiency, sustainability, and technological advancement of mineral resource extraction in Eastern Europe’s post-communist economies? (2) In what ways does EF shape the governance, market allocation, and long-term viability of MR in Eastern European countries transitioning to market economies? (3) What is the dynamic relationship between MR and EG in Eastern Europe, and how has this evolved since the region’s shift from central planning to liberalized markets? (4) How has increased IT since the 1990s influenced mineral resource rent generation and Eastern Europe’s integration into global resource markets? (5) How do EF, IT, EA, and EG collectively interact, within the context of institutional quality, to determine the sustainability and management of MR in Eastern Europe?

This is how the rest of the paper is structured. A summary of pertinent socioeconomic literature is provided in

Section 2. The primary tools for calculating the extent to which mineral resource rents depend on other economic factors are covered in

Section 3. The data is presented in

Section 3 along with an introduction to the econometric model. Our main findings are presented in

Section 4.

Section 5 offers a conclusion and suggestions.

2. Literature Review

The dynamics of mineral resource rents in Eastern European countries are influenced by multifaceted factors, including EF, EA, IT, and URB. However, to comprehensively analyze these relationships, it is essential to ground the discussion within well-established theoretical frameworks, particularly the resource curse theory, institutional economics, and endogenous growth theory.

Despite various studies, there remains disagreement on whether mineral resources positively or negatively influence economic development [

47,

48]. The earliest written records of the connection between economic expansion and mineral resources date from the middle of the 17th century. William Petty, the creator of British classical political economy, is credited with developing the well-known notion that “labor is the father of wealth, the land is the mother of wealth”, which helped to advance the field of research on the connection between EG and mineral resources [

49]. Research by Auty [

50], Gelb [

51], Auty and Warhurst [

52], Sachs and Warner [

53], and Karl [

54] later formalized the “resource curse” theory to describe the paradox that many mineral-rich countries have struggled to achieve sustainable economic development.

Research by Christmann [

55] highlights that despite circular economy initiatives, mineral extraction continues to contribute significantly to global CO

2 emissions and environmental degradation, reinforcing the need for more efficient and environmentally responsible resource management [

56]. This aligns with institutional economics, which argues that governance quality and regulatory efficiency determine whether resource wealth translates into sustainable development [

57,

58].

Empirical studies have shown that countries abundant in MR often experience slower EG due to institutional weaknesses, rent-seeking behaviors, and underinvestment in EA and diversified industries [

50,

53]. This reliance on mining exports can lead to short-term growth followed by stagnation, affecting both trade and non-trade sectors [

47,

59]. Institutional economics emphasizes that the quality of institutions, such as property rights, regulatory frameworks, and government accountability, is critical for converting resource wealth into long-term development [

60]. In weak institutional contexts, as seen in many Eastern European countries transitioning from centrally planned to market economies, MR often benefits elites at the expense of broader economic diversification [

11,

61].

Economic freedom facilitates market-driven resource utilization by improving capital, labor, and resource allocation [

62,

63,

64]. High levels of EF promote private investment, entrepreneurship, and competitiveness by reducing barriers to trade and business formation [

19,

28,

63]. However, without robust institutions and regulatory safeguards, liberalization can lead to unsustainable exploitation [

64,

65,

66].

Similarly, IT promotes export-led growth and attracts FDI into resource sectors [

67], but can also increase vulnerability to global market volatility if not supported by industrial upgrading and institutional reforms [

68]. The 2025 Europe Sustainable Development Report highlights that institutional reforms and trade liberalization promote equitable resource distribution and cross-border cooperation [

69].

Many Eastern European nations made significant investments in education reform following the collapse of the Soviet Union, focusing on curriculum modernization, higher education standards, and aligning education with labor market demands [

70]. The quality of education, particularly in STEM fields, is crucial for enhancing innovation and effectiveness in the resource sector [

71]. Investment in human capital through education, training, and professional development significantly impacts a country’s ability to manage resource rents effectively [

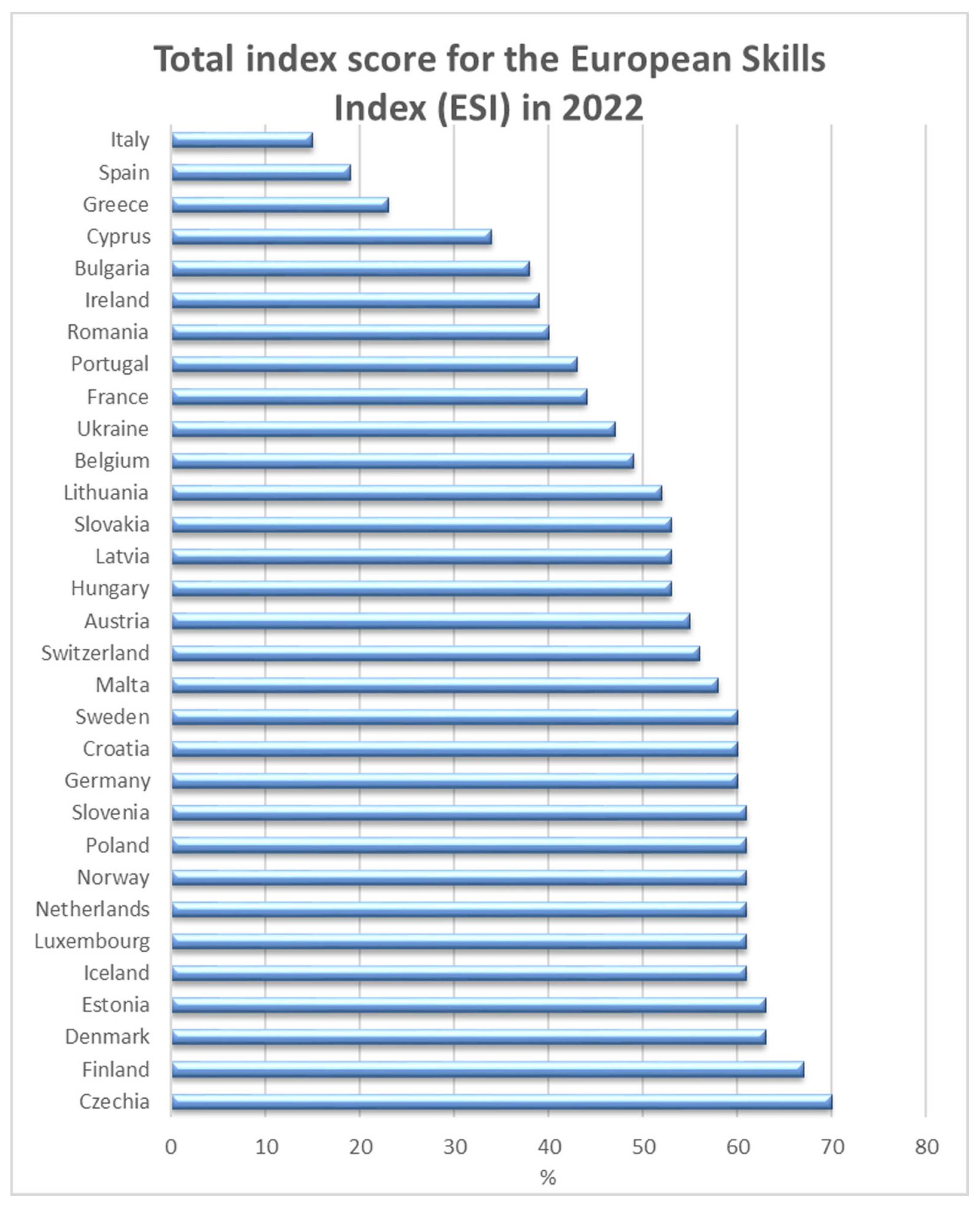

72,

73], as illustrated in

Figure 1.

Recent studies emphasize that higher educational attainment fosters green growth, supporting SDG 4 (Quality Education) [

75,

76]. Education enhances labor productivity, drives innovation in resource extraction technologies, and promotes environmental stewardship [

32,

37,

77]. Research by Gylfason [

42] and Kansheba and Marobhe [

57] further highlights that education’s impact is amplified when supported by high-quality governance [

73,

78].

Moreover, a study by Alsagr and Ozturk [

79] argues that while MR often deters green investment, educational frameworks that promote environmental awareness and technological innovation can mitigate these effects [

56].

URB, driven by industrialization and economic transformation, significantly affects mineral resource demand. Research by Kasai et al. [

80] and Yan and Liu [

81] reports that urban growth boosts infrastructure expansion and energy consumption, increasing mineral rents. However, unplanned urbanization can lead to environmental degradation and resource depletion, highlighting the need for urban policies that promote inclusive, safe, resilient, and sustainable urban development [

82,

83].

The theoretical integration enhances analytical rigor and supports a structured empirical investigation into the Eastern European context, where post-socialist transitions, institutional restructuring, and resource dependencies intersect.

Research Hypothesis

Based on the preceding literature review, the following hypotheses are formulated:

H1. EG positively influences natural resource rents by driving higher demand for resource extraction and exports, particularly in resource-dependent economies.

H2. Higher levels of EA positively influence mineral resource rents by promoting more efficient resource management and technological advancements in extraction processes.

H3. Urbanization positively influences mineral resource rents by driving higher demand for minerals through infrastructure development and industrial expansion.

H4. Higher levels of EF positively influence mineral resource rents by encouraging private investment and enabling efficient resource extraction.

3. Methodology

3.1. Data Statistics

This study employs statistical data analysis to assess the impact of mineral resource dependence in 19 Eastern European countries on EF, trade internationalization, and educational attainment from 1990 to 2021. The World Bank database provided data on international trade, urbanization, EG, and mineral resource rents, while human capital data came from the Penn World Table and EF from the Fraser Institute (see

Table 1). Some countries, including Belarus and Bosnia, were excluded due to missing human capital data.

3.2. Empirical Methodological Framework

These are the empirical models that are provided:

In this model, the interaction term EA × URB is introduced to assess whether higher educational achievement can mitigate the adverse effects of urbanization on mineral resource consumption and, consequently, on environmental degradation.

The log-linear transformation of Equations (1) and (2) appears below:

In the above equations , , , , , and stand for mineral rents, logarithmic forms of internationalization trade, economic freedom, economic growth, urbanization, and educational achievement, respectively. The elasticity figures , , , , , and disclose the relationship’s supremacy and tendency, whereas detects the discrepancy of the constant that occurs (intercept). In the case where t = 1,…, T and i = 1,….., N stand for the time frame and chosen country, respectively; for the phrases used in error correction. In the preceding equation, the letter i standpoints for the cross-section in our example, which includes the nineteen Eastern European nations (Albania, Austria, Armenia, Bulgaria, Croatia, Czech Republic, Estonia, Germany, Hungary, Latvia, Lithuania, Moldova, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, and Ukraine). The letter t stands for the operator for the time series, which spans the years 1990 through 2021. Other countries of Eastern Europe were excluded from the study area due to a lack of data for their human capital index.

To ensure robust estimation, we incorporate several diagnostic and advanced econometric techniques. Cross-sectional dependence and slope heterogeneity tests are used to check model suitability. We apply second-generation panel unit root tests, CADF and CIPS, to account for cross-sectional dependence in the data, followed by the Westerlund [

84] cointegration test, which is robust to both CD and SH and helps confirm the presence of a long-term equilibrium association between the parameters.

For capturing the nuanced and asymmetric effects of independent variables on the distribution of mineral resource rents, we adopt the Method of Moments Quantile Regression (MMQR) approach. MMQR is particularly suitable in this context for three key reasons: (1) It accommodates unobserved individual heterogeneity and allows for parameter variation across quantiles, making it ideal for understanding how education, economic freedom, trade openness, and growth affect mineral resource rents at different conditional distributions—for example, in low-rent versus high-rent scenarios. (2) It is robust to non-normality and outliers, which are common in macroeconomic panel data. (3) MMQR enables an in-depth examination of distributional heterogeneity, aligning with our objective of analyzing both resource-rich and resource-poor settings within Eastern Europe. Thus, MMQR provides deeper insights than mean-based estimators like fixed effects or pooled OLS.

To assess directionality and short-run dynamics, we implement the Dumitrescu and Hurlin [

85] heterogeneous panel Granger causality test, which is appropriate for heterogeneous panels with cross-sectional dependence.

For robustness, we incorporate additional estimators—Fixed Effects (FE), Augmented Mean Group (AMG), and Common Correlated Effects Mean Group (CCEMG). These assessments control for unobserved heterogeneity and cross-sectional dependence and allow for comparative validation of MMQR results.

For detailed formulations, test statistics, and estimation equations, refer to

Appendix A.

4. Results and Discussion

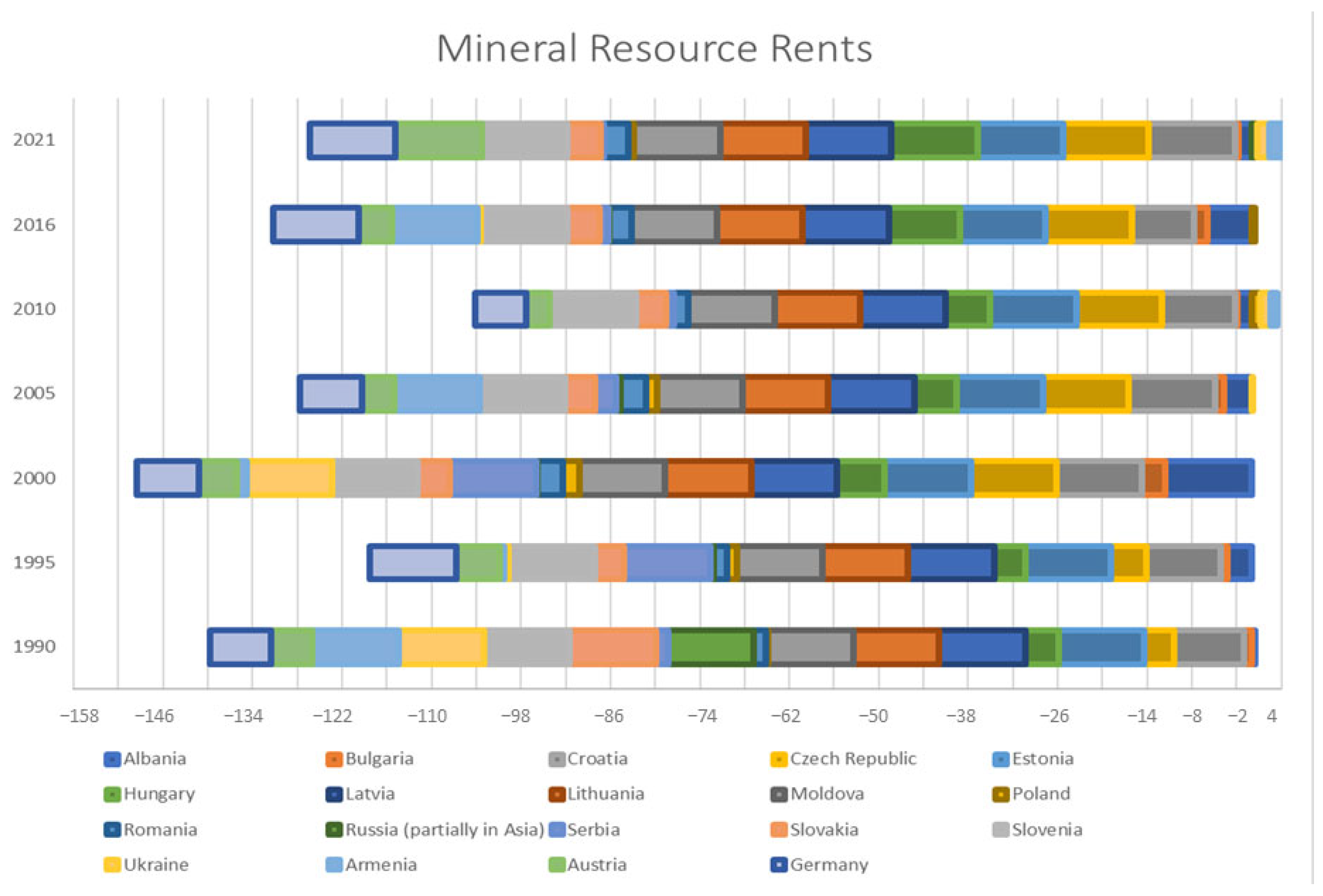

Key findings in

Table 2 reveal that mineral resource rents are generally low, with a median value of 0.000 and a mean value of 0.227, indicating significant skewness. IT is high and stable, with a mean of 4.505, while EF is moderate (mean of 1.960). GDP growth is consistent, with a mean of 8.773, and educational attainment shows uniformity (mean of 1.140). Significant variability in MR (standard deviation of 0.626) suggests diverse management practices, whereas IT (0.374) and EF (0.126) show moderate variability. The mineral resource rents in Eastern European countries are indicated by the trend shown in

Figure 2.

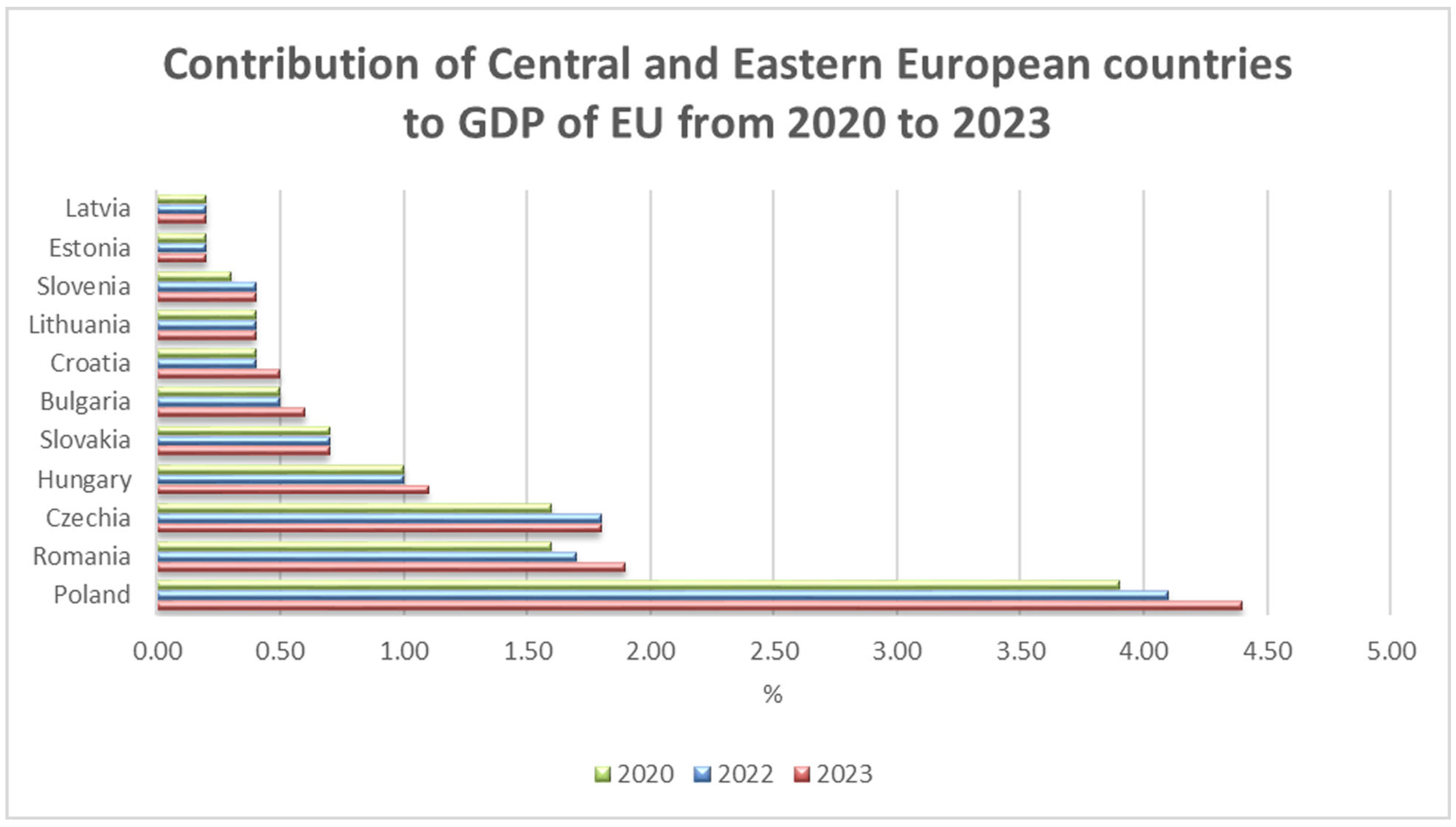

The analysis highlights that MR does not significantly contribute to GDP in most countries, and IT has promoted economic integration across Eastern Europe. EG rates vary widely (see

Figure 3), reflecting differing transitional experiences. Despite challenges, a consistent investment in human capital suggests that many nations have adapted to the need for skilled labor in transitioning economies.

The correlation matrix helps understand linear relationships between variables, with coefficients ranging from −1 (perfect negative) to 1 (perfect positive).

Table 3 explores the relationships between key economic indicators in Eastern European countries from 1990 to 2021. The results show a weak negative correlation between IT and mineral resource rents, indicating that resource-rich countries may rely less on trade. The correlation between MR and EA is near zero, indicating that mineral wealth does not significantly influence education levels, which may be driven more by national policies.

A slight negative correlation exists between MR and EG, implying slower growth in resource-dependent nations, consistent with the resource curse theory. MR also has an inverse relationship with EF, as resource wealth may lead to governance issues and reduced economic freedom. The positive correlation between IT and EA suggests that liberal trade policies may promote investment in education, supporting the idea that globalization encourages human capital development. Similarly, EF correlates positively with educational attainment, indicating that education fosters policies that support free-market economies. These findings highlight the challenges posed by mineral dependence and emphasize the benefits of IT, EF, and education for long-term growth.

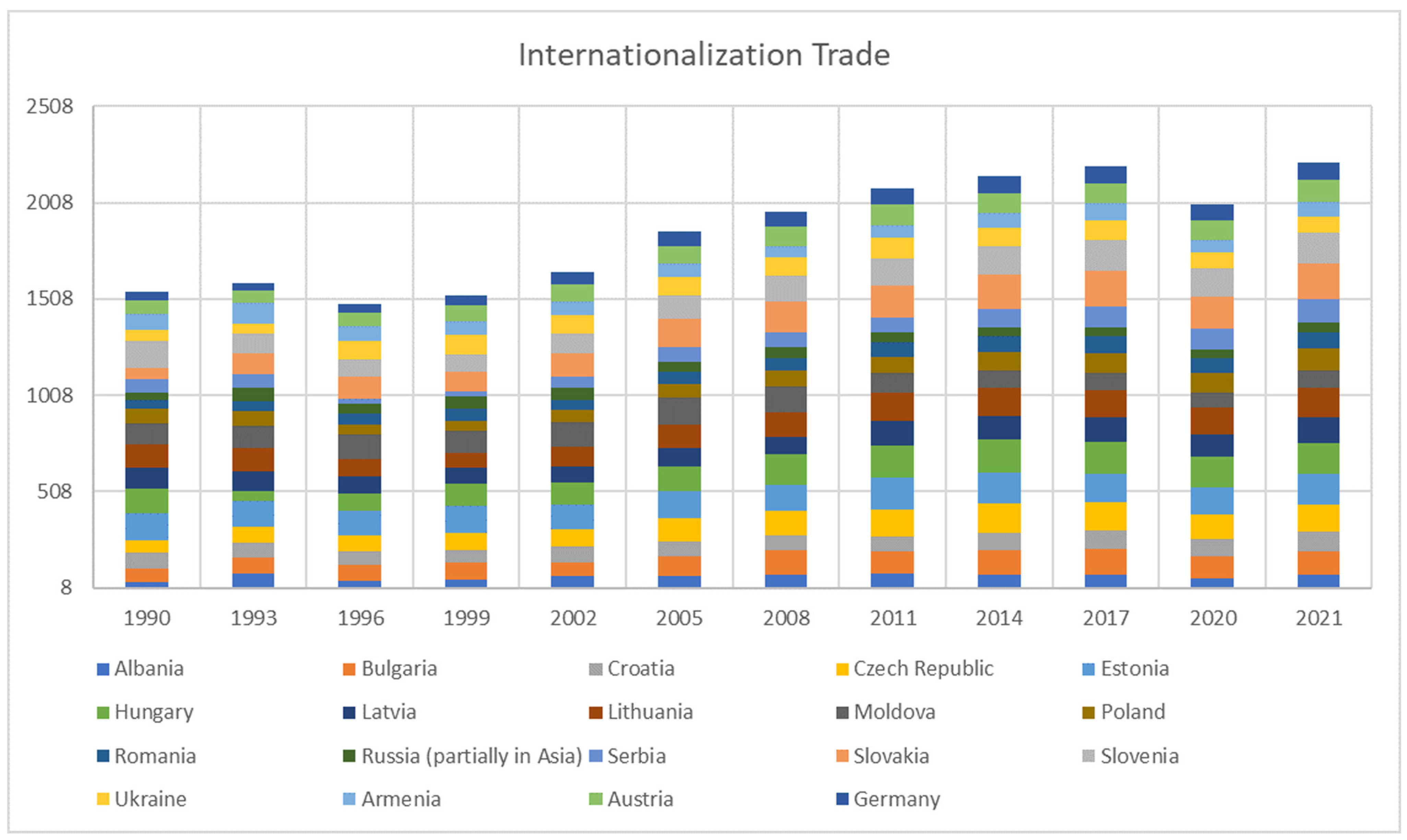

Table 4 reveals significant cross-section dependence (CD) statistics for MR, IT, EA, and EF across Eastern European countries. This indicates strong interdependence likely driven by global commodity price fluctuations, regional trade agreements, and shared policy environments. Such interlinkages suggest that economic changes or external shocks in one country can influence others. The observed variations, particularly in IT (illustrated in

Figure 4), further underscore how regional dynamics shape the co-movement of key variables like IT, EG, and MR across the region.

According to the first model, the significant results of slope heterogeneity in

Table 5 indicate that the relationship between mineral resource rents and the independent variables is heterogeneous across countries. The even higher values for the interaction model show stronger heterogeneity, suggesting that the effect of urbanization on MR varies more significantly across countries when considering the moderating role of EA. In summary, both models exhibit significant slope heterogeneity, with stronger heterogeneity observed when the interaction term EA × URB is included.

The result of

Table 6 indicates that MR is non-stationary at level, as indicated by the CIPS statistic for MR at level (I(0)), which is −0.947 and higher than the critical values at all significance levels. Nevertheless, the CIPS statistic is −3.191 following the first differencing (I(1)), which is less than the critical values and significant at the 1% level. This implies that MR becomes stationary following differencing, suggesting that shocks to mineral resource rents have long-lasting effects that level off once the trend is eliminated.

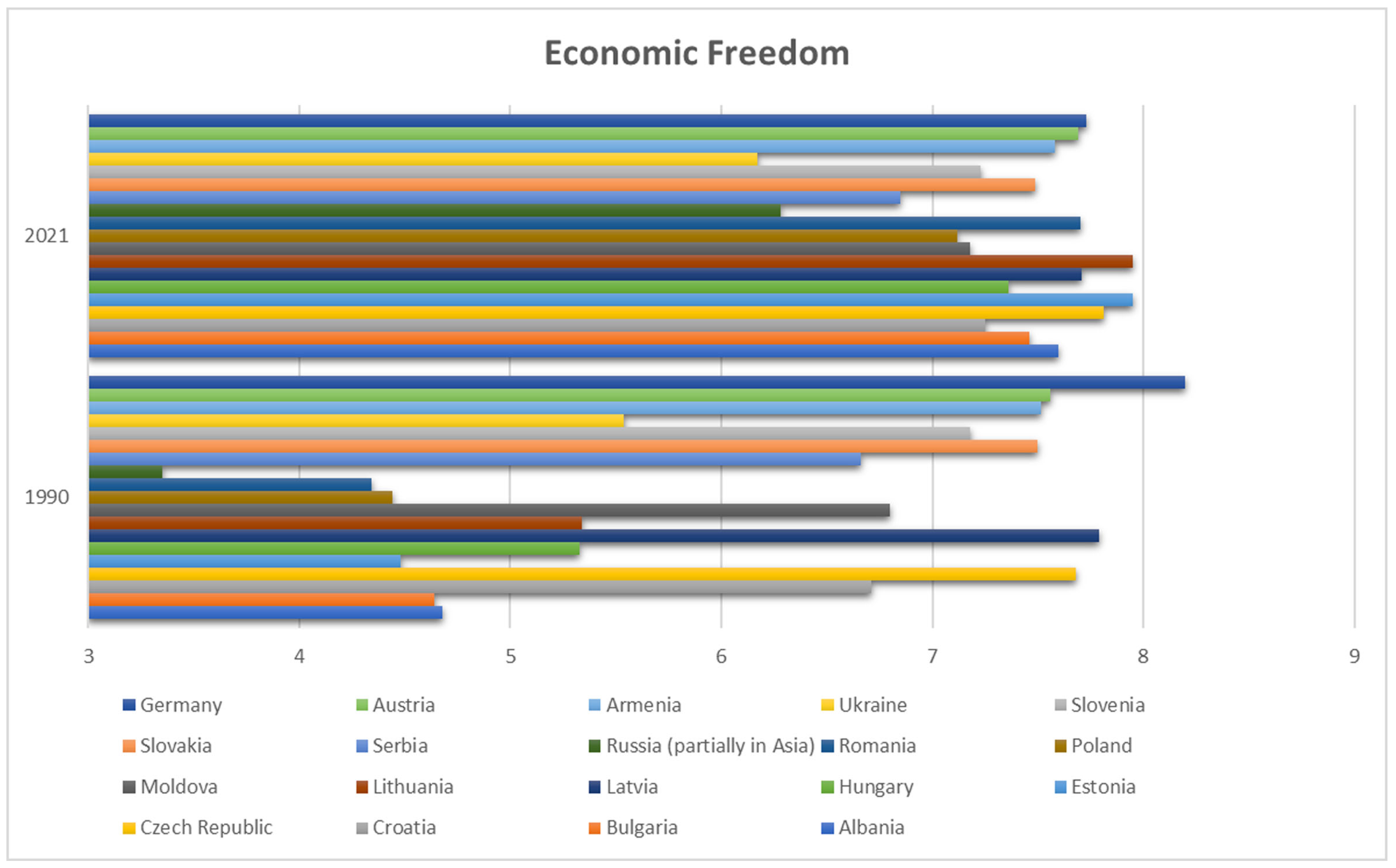

The outcomes of the CIPS and CADF unit root tests reveal important insights regarding the stationarity of the variables. IT is stationary at the 1% significance level in both CIPS and CADF tests, while EF and EG also demonstrate stationarity at the 1% level in both tests. This further supports the region’s commitment to upholding stable economic policies. The degree of economic freedom in the countries of Eastern Europe is shown in

Figure 5. URB is stationary at the 5% level in CIPS and the 1% level in CADF. Conversely, MR and EA do not show stationarity at levels, suggesting they may require differencing to achieve stationarity. After differencing, both MR and EA become stationary at the 1% significance level in CIPS and CADF tests. Overall, most variables exhibit stationarity at different levels, confirming the reliability of subsequent analyses.

In

Table 7, the Westerlund [

84] cointegration analysis for both models indicates significant relationships among the variables. In the first model, which includes IT, EF, EG, EA, and URB, the test statistics for Ga and Pa suggest weak evidence of cointegration at the 10% and 5% significance levels, respectively. In contrast, the second model shows strong cointegration, with the Ga and Pa statistics significant at the 1% level. This indicates that the inclusion of the interaction term enhances the long-term relationship between MR and the other variables, suggesting that the dynamics between these factors are more robust when considering the impact of EA on urbanization. Overall, the results support the existence of a long-term equilibrium relationship among the variables in both models, particularly in the second model.

The MMQR results (

Table 8) offer nuanced insights into the complex relationships between education, urbanization, trade openness, and mineral resource dependence across different quantiles. Educational achievement (EA) consistently exhibits a significant negative impact on mineral resource rents (MR) across the distribution, with coefficients ranging from −1.024 at the 0.25 quantile to −2.082 at the 0.90 quantile. This indicates that higher educational levels are associated with reduced reliance on mineral resources, a finding that aligns with the hypothesis that human capital fosters resource efficiency and supports a transition toward sustainable development. Similarly, a study by Qamruzzaman [

86] investigates the interplay between natural resource income, education, and environmental sustainability in resource-rich nations. The study finds that higher education levels are associated with lower CO

2 emissions and ecological footprints, reinforcing the argument that education fosters environmental awareness and technological adoption, which can reduce dependence on mineral resource rents. These outcomes position education as a core human development mechanism, providing empirical support for SDG 4 (Quality Education) by demonstrating its transformative role in building the skills and capabilities necessary for knowledge-based economic transitions.

Notably, this finding contradicts the initially expected positive linkage between education and economic activities that may intensify resource extraction (as posited in H2). Instead, the results suggest that education in Eastern Europe may be playing a transformative role, equipping individuals and institutions with the knowledge and tools to adopt cleaner technologies, improve regulatory frameworks, and diversify away from extractive industries. This reflects a human-centered sustainability pathway, where education serves as the foundation for pragmatic strategies aimed at balancing economic growth with environmental and social well-being, in line with SDG 8 (Decent Work and Economic Growth).

In the interaction model, the compound term EA × URB shows a strong and significant negative effect, especially pronounced at the lower quantiles (e.g., −7.243 at Q0.25), underscoring that the negative effect of education on MR is amplified in more urbanized settings. This finding implies that urban centers may serve as hubs for innovation, sustainability initiatives, and policy enforcement, where educated populations can more effectively manage and reduce resource dependence [

87]. This intersection of education and urbanization highlights the role of cities as engines of pragmatic sustainability by showing how urban governance can advance technological upgrading and resource efficiency.

Further, IT consistently exhibits negative effects on MR across all quantiles (from −0.161 at Q0.25 to −0.306 at Q0.90), suggesting that trade openness is linked with lower resource rent dependency. This may reflect the shift toward more service- and technology-oriented trade profiles or improved access to green technologies through global integration. A study by Dou et al. [

88] examines the role of trade openness and labor productivity on mineral rents in East Asian countries, finding that increasing trade liberalization negatively impacts mineral rents by promoting industrial upgrading and regional partnerships. Their study suggests that optimizing trade policies can help nations transition toward service- and technology-oriented economies, aligning with the current study’s findings. These results directly support SDG 8 (Decent Work and Economic Growth) by demonstrating how global market integration facilitates structural economic transitions. Similarly, research by Sun and Qamruzzaman [

89] highlights that while trade openness enhances resource use efficiency, it also poses environmental challenges through increased emissions in BRICS + T nations. This dual outcome emphasizes the need for pragmatic sustainability policies that integrate trade liberalization with environmental safeguards.

The positive coefficients for EG, though modest, indicate that higher GDP levels are associated with increased MR, supporting H1 partially. This outcome reflects the reality that economic expansion in resource-endowed Eastern European nations may still be driven by extractive sectors, highlighting a potential sustainability challenge. A study by Ajayi [

90] explored the relationship between economic growth, mineral rents, and institutional quality, finding that GDP growth contributes to higher mineral rents in the short run but may lead to economic volatility in the absence of strong governance frameworks. This underlines the critical role of governance reforms in ensuring that economic liberalization leads to equitable and sustainable outcomes.

Conversely, EF and URB are both associated with negative effects on MR. While EF’s negative impact contradicts H4, it may reflect institutional reforms and liberalized policy environments that enable better resource governance and environmental protection. Additionally, a study by Ajayi [

90] discusses the role of urbanization and economic policies in shaping environmental outcomes, emphasizing that natural resource rents and urban expansion must be carefully managed to ensure sustainability. These dynamics further confirm the role of urbanization and institutional quality in advancing pragmatic sustainability by promoting balanced, innovation-led development.

Robustness checks employing AMG (

Table 9), CCEMG (

Table 10), and FE estimators (

Table 11) strongly validate the negative influence of EA, IT, and EF on MR, reinforcing the MMQR findings. These results confirm the consistency and reliability of the estimated relationships across different model specifications. They collectively demonstrate how human capital, institutional reforms, and market integration function as complementary elements of a pragmatic sustainability strategy that balances growth and resource management.

Importantly, the robustness test results also highlight the substantial negative effect of the EA × URB interaction, providing additional empirical support for the synergistic role of education and urbanization in reducing resource dependency.

The findings presented in

Table 12 demonstrate the existence of strong causal links between the variables that are both unidirectional and bidirectional. The Granger causality analysis indicates significant bidirectional relationships among key variables. Educational achievement Granger causes IT, while IT also influences EA. Economic growth affects EA, and vice versa. Additionally, IT Granger causes economic freedom, whereas EF does not significantly influence IT. Urbanization Granger causes mineral resource rents, with no significant effect in the opposite direction. Finally, EA significantly Granger-causes EF. These causal relationships further validate the integrated, human-centered sustainability framework proposed in this study, highlighting how education and institutional capacity are central levers for advancing SDGs 4 and 8.

All these findings have substantial implications for policy in Eastern Europe. They suggest that investing in education—especially in urban regions—can play a pivotal role in reducing overreliance on mineral resources and steering countries toward more diversified and sustainable economic structures. Furthermore, promoting trade openness and strengthening institutional freedom can reinforce these transitions.

Importantly, the observed dynamics reflect a broader human-centered approach to sustainability, where education, urban innovation, and institutional governance serve as interlinked pathways for advancing pragmatic sustainability. This pragmatic approach focuses on achievable, context-specific policy actions that balance economic, environmental, and social objectives, making it particularly relevant for Eastern Europe’s complex transition context [

91,

92].

Moreover, the results also underline the importance of fostering regional cooperation and solidarity, a form of fraternal resource management, among Eastern European nations [

93]. Given the strong cross-sectional dependence and interlinked economic dynamics identified in this study, it is evident that no single country can sustainably manage its resource wealth in isolation. Enhancing collaboration through shared governance frameworks, regional partnerships, and cross-border educational and technological cooperation is essential for strengthening collective resilience [

94]. This fraternal approach not only improves the equitable distribution of resource benefits but also enhances political and economic relationships across Europe, aligning with the broader goals of European integration and cohesion. Such cooperation is critical for mitigating transboundary environmental risks and ensuring that mineral wealth contributes to shared prosperity rather than fueling competition or conflict [

95,

96].

In conclusion, the findings advocate for national policies and regionally coordinated, pragmatic sustainability strategies that recognize the interconnected nature of economies, societies, and ecosystems [

97], ensuring that Eastern Europe’s resource management transitions support long-term economic, environmental, and institutional resilience [

98].

5. Conclusions

This study analyzed the impact of economic freedom, urbanization, educational achievement, and international trade openness on mineral resource rents in Eastern European countries from 1990 to 2021, employing various econometric techniques, including descriptive analysis, correlation analysis, CIPS unit root test, Westerlund’s cointegration test, Granger causality test, Method of Moments Quantile Regression (MMQR), and robustness tests (AMG, CCEMG, and Fixed Effects). The findings reveal intricate relationships among the variables, emphasizing the critical role of educational attainment in maximizing the benefits derived from natural resources.

The MMQR results demonstrate that international trade openness consistently reduces dependency on mineral resource rents across all quantiles, suggesting that trade liberalization fosters economic diversification and technological upgrading. This directly advances SDG 8 (Decent Work and Economic Growth) by promoting inclusive and sustainable economic development through diversified trade and reduced reliance on extractive industries.

Educational achievement shows a strong and consistent negative association with mineral resource rents, indicating that investing in human capital empowers societies to adopt more efficient, environmentally sustainable, and technologically advanced economic models. This finding supports SDG 4 (Quality Education), emphasizing the role of education in equipping individuals and institutions with the skills necessary to drive economic transformation and sustainable development.

Importantly, the study finds that urbanization also significantly reduces mineral resource rents, particularly when combined with higher educational attainment. This suggests that urban centers serve as catalysts for innovation, technological advancement, and improved governance, enabling countries to transition away from resource dependency toward more diversified and sustainable economies. This result advocates for sustainable urban development as a pathway to economic resilience and environmental stewardship.

The study also highlights the importance of fostering innovation and resilient infrastructure through trade openness and economic freedom. By promoting policies that enhance industrial diversification and technological adoption, countries can better manage their natural resources sustainably and efficiently.

Additionally, the study underscores the necessity of responsible resource management. By reducing over-reliance on extractive industries through education and economic reform, Eastern European countries can minimize environmental degradation and promote long-term resource efficiency.

Institutional quality and governance emerge as critical enablers of sustainable resource management. Transparent and accountable institutions, regulatory reforms, and anti-corruption measures are essential for ensuring that economic liberalization translates into equitable and sustainable outcomes. This advocates for effective, accountable, and inclusive institutions at all levels.

In summary, this study provides evidence that SDG 4 (Quality Education) and SDG 8 (Decent Work and Economic Growth) are the most directly addressed goals. These findings offer valuable policy guidance for Eastern European nations seeking to transition toward a more resilient, diversified, and sustainable economic model. Future research should further investigate the mechanisms through which institutional reforms and human capital development can be leveraged to strengthen governance and promote long-term sustainability in resource-dependent economies.

5.1. Policy Recommendations

This study offers actionable policy insights for Eastern European nations seeking to promote sustainable socio-economic transformation through effective mineral resource management. The findings underscore the importance of strategic educational reforms that go beyond access and coverage to emphasize technical, vocational, and managerial competencies aligned with the evolving demands of the mining and resource governance sectors. Investments in human capital, particularly in STEM education, environmental sciences, and natural resource economics, can build a workforce capable of enhancing the profitability, sustainability, and technological integration of the resource sector.

While trade openness contributes to economic integration, trade policies should shift focus toward building domestic value chains by fostering resource-based industrialization. This includes incentives for domestic processing industries, regional trade cooperation, and innovation in resource extraction and refinement technologies. Such a transition from raw material exports to value-added production can reduce dependency, enhance competitiveness, and create inclusive employment opportunities.

In addition to educational and trade reforms, the findings highlight the critical role of institutional quality and regulatory coherence. The observed limited impact of economic freedom on mineral resource rents suggests that market liberalization alone is insufficient without accompanying institutional safeguards. Thus, strengthening legal frameworks, enforcing environmental and social standards, and ensuring regulatory stability are essential to preventing rent-seeking behavior, corruption, and resource mismanagement.

Governments should prioritize transparent licensing procedures, fiscal accountability, and contract enforcement mechanisms within the extractive industries. Institutions must also adopt multi-stakeholder resource governance models that include civil society, local communities, and private sector actors to improve oversight and equity in resource rent distribution.

On a broader level, global institutions and development partners should support capacity-building initiatives, anti-corruption frameworks, and environmental safeguards that align national practices with international best standards. Furthermore, the creation of regional knowledge-sharing platforms in Eastern Europe could facilitate policy learning, innovation diffusion, and harmonization of best practices across resource-rich countries.

Ultimately, economic freedom must be pursued within a framework of robust institutions, legal integrity, and long-term ecological sustainability. By integrating education, trade, and institutional reforms, Eastern European countries can effectively convert their natural resource wealth into lasting development dividends, ensuring that economic expansion aligns with sustainability objectives outlined in the 2030 Agenda.

5.2. Confines and Further Suggestions

The current work has some limitations. First, the dataset spanning from 1990 to 2021 may not fully reflect current geopolitical and economic dynamics. Additionally, data gaps and potential inaccuracies in some Eastern European countries may have influenced the robustness of our findings. While a variety of econometric techniques were employed, different model specifications or regional comparisons might yield alternative insights, and the exclusive focus on Eastern Europe limits the generalizability of the results.

Crucially, some important variables—such as social conditions, environmental policy stringency, and technological innovation—were not included in this analysis despite their relevance in shaping mineral resource rents. Moreover, we acknowledge concerns related to the inclusion of variables expressed as proportions of GDP alongside GDP itself, which may introduce redundancy or multicollinearity. While these were selected to capture the relative scale of economic variables, we recognize this as a methodological constraint. Future research is encouraged to refine the variable selection—considering absolute terms or alternative indicators—and to incorporate a broader range of institutional and governance-related factors to better capture structural determinants.

The findings of this study lay the groundwork for further investigation. Future extensions could incorporate additional explanatory variables, adopt alternative or updated data, and account for the implications of significant recent events such as the Russian-Ukrainian conflict. Furthermore, although the application of Granger causality and cointegration tests helped mitigate some endogeneity issues, concerns about reverse causality and omitted variables remain. Addressing these with instrumental variable methods or dynamic panel approaches like System GMM would improve causal inference and strengthen the credibility of the results, particularly in capturing complex feedback mechanisms.