Do Non-Agricultural Sectors Affect Food Security in Saudi Arabia?

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Description of Data

3.2. Methods of Analysis

3.2.1. Descriptive and Graphic Analyses

3.2.2. Cointegration Tests: Investigating Long-Term Relationships

3.2.3. Error Correction Model (ECM)

3.2.4. Granger Causality Test

- -

- -

- -

- The significance of α2i and β2h (≠0) is consistent with the joint dependence of X and Y;

- -

- If α2i and β2h are both equal to 0, then Y and X are independent.

3.2.5. Regression Analysis Method

3.2.6. The Impact of Industrial, Service, and Employment Sectors on Food Security: Qualitative Analysis

4. Results and Discussion

4.1. Descriptive Statistics and Graphic Results

4.2. Cointegration Test Analysis Results

4.2.1. Unit Root Tests Outcomes

4.2.2. ARDL Tests Results

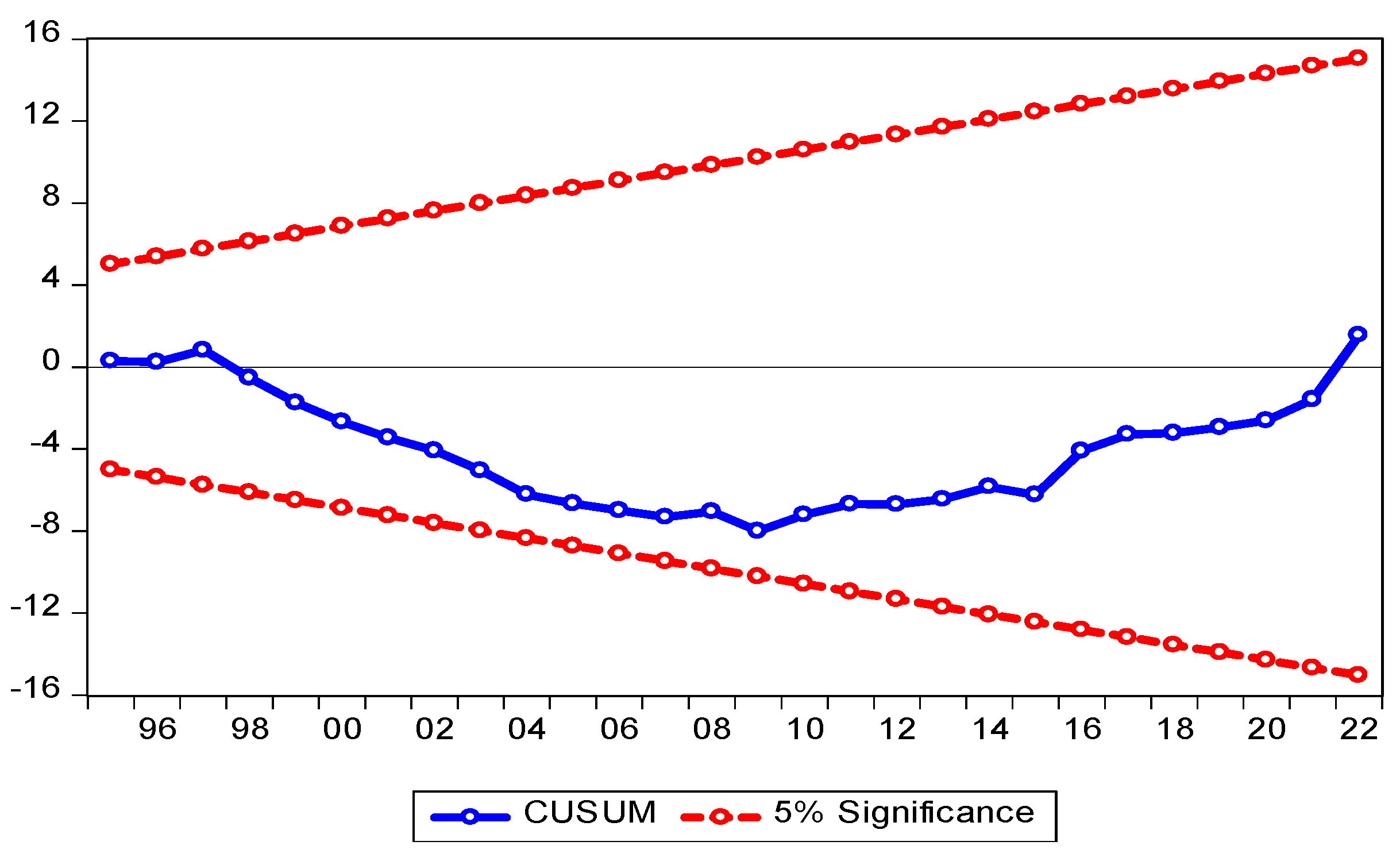

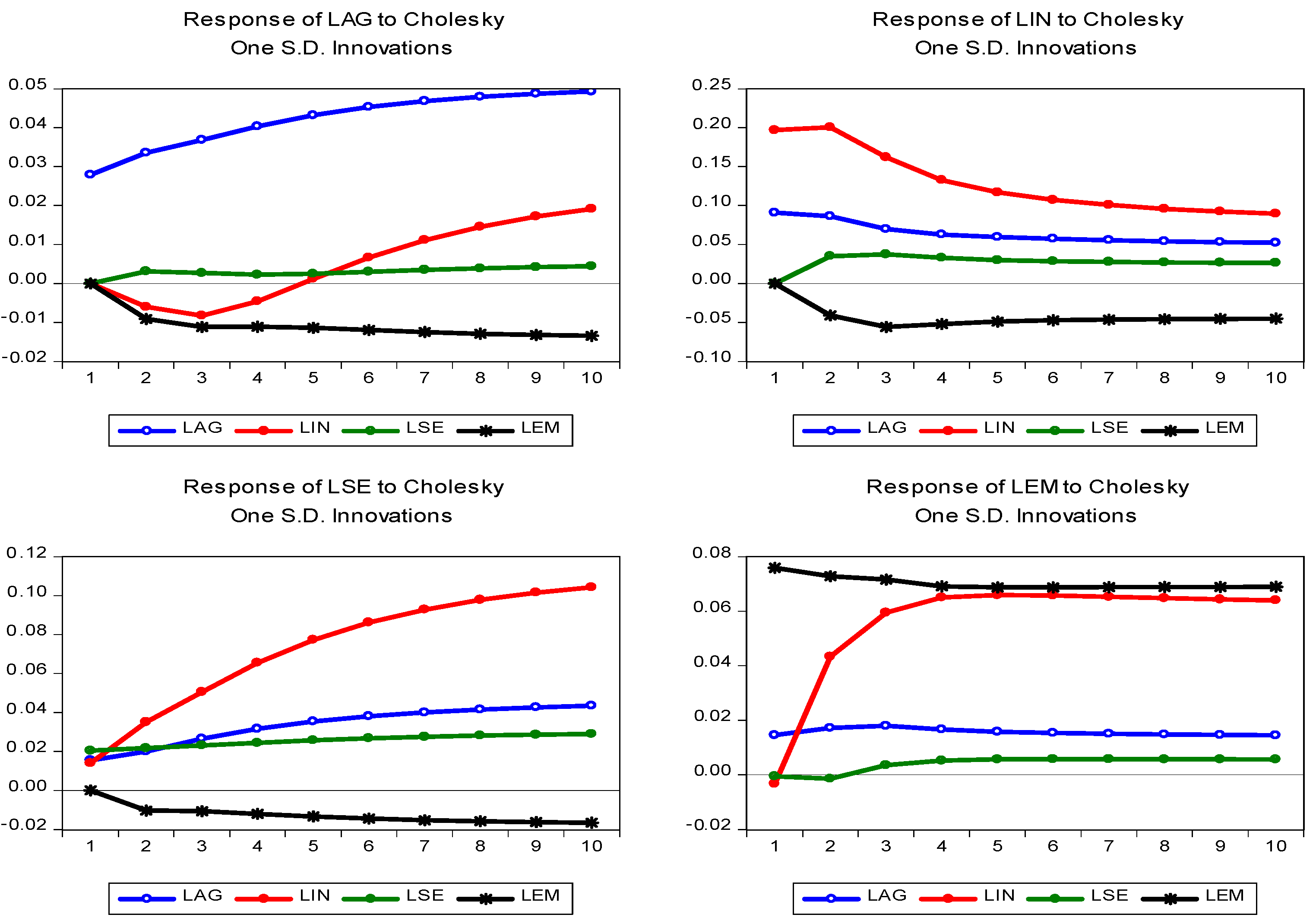

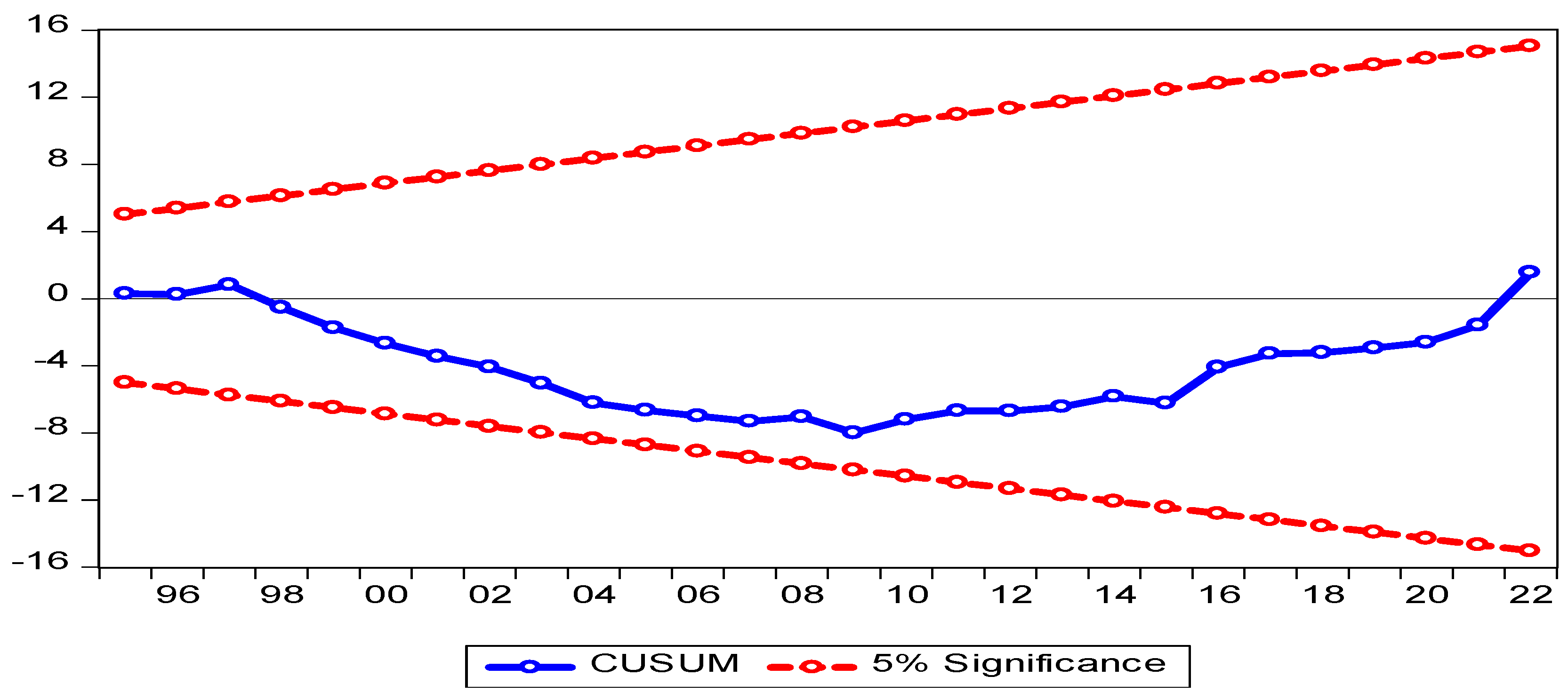

4.3. ECM Results

4.4. The Granger Causality Test Results

4.5. Regression Analysis Results

4.6. The Impact of Growth Sectors on Food Security

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kubiszewski, I.; Costanza, R.; Franco, C.; Lawn, P.; Talberth, J.; Jackson, T.; Aylmer, C. Beyond GDP: Measuring and achieving global genuine progress. Ecol. Econ. 2013, 93, 57–68. [Google Scholar] [CrossRef]

- Emam, A. Saudi Fertilizers and Their Impact on Global Food Security: Present and Future. Sustainability 2023, 15, 7614. [Google Scholar] [CrossRef]

- Asim, H.; Akbar, M. Sectoral growth linkages of agricultural sector: Implications for food security in Pakistan. Agric. Econ./Zeměd. Ekon. 2019, 65, 278–288. [Google Scholar] [CrossRef]

- Singariya, M.R.; Naval, S.C. An empirical study of intersectoral linkages and economic growth in India. Am. J. Rural Dev. 2016, 4, 78–84. [Google Scholar] [CrossRef]

- Johnston, B.F. Agriculture and structural transformation in developing countries: A survey of research. J. Econ. Lit. 1970, 8, 369–404. [Google Scholar]

- Rehman, A.; Jingdong, L.; Iqbal, M.S.; Hussain, I. A study on agricultural development in China and its comparison with India and Pakistan. Transylv. Rev. 2016, 6, 603–610. [Google Scholar]

- Lewis, W.A. Economic development with unlimited supplies of labour. Manch. Sch. 1954, 28, 139–191. [Google Scholar] [CrossRef]

- Emam, A.A. Present and Future: Does agriculture affect economic growth and environment in the Kingdom of Saudi Arabia? J. Agric. Econ.-Czech Acad. Agric. Sci. 2022, 68, 361–370. [Google Scholar] [CrossRef]

- Hirschman, A.O. The Strategy of Economic Development; Yale University Press: New Haven, CT, USA, 1958; pp. 41–97. [Google Scholar]

- Thirlwall, A.P. The terms of trade, debt and development: With particular reference to Africa. Afr. Dev. Rev. 1995, 7, 1–34. [Google Scholar] [CrossRef]

- Saikia, D. Analyzing inter-sectoral linkages in India. Afr. J. Agric. Res. 2011, 6, 6766–6775. [Google Scholar] [CrossRef]

- Rangarajan, C. Agricultural Growth and Industrial Performance in India; International Food Policy Research Institute: Washington, DC, USA, 1982. [Google Scholar]

- Feder, G. On exports and economic growth. J. Dev. Econ. 1983, 12, 59–73. [Google Scholar] [CrossRef]

- Feder, G. Growth in semi-industrial countries: A statistical analysis. In Industrialization and Growth: A Comparative Study; Oxford University Press: New York, NY, USA, 1986; pp. 263–282. Available online: https://cir.nii.ac.jp/crid/1570572699882825088 (accessed on 14 January 2025).

- Dowrick, S.J.; Gemmell, N. Industrialization, catching-up and economic growth: A comparative study across the world’s capitalist economies. Econ. J. 1991, 101, 263–275. [Google Scholar] [CrossRef]

- Singh, N. Services-Led Industrialization in India: Assessment and Lessons. Department of Economics, UC Santa Cruz, Santa Cruz, CA, USA, 2006; p. 1. Available online: https://escholarship.org/uc/item/8jn2b8z6 (accessed on 15 January 2025).

- Gemmell, N.; Lloyd, T.A.; Mathew, M. Agricultural growth and inter-sectoral linkages in a developing economy. J. Agric. Econ. 2000, 51, 353–370. [Google Scholar] [CrossRef]

- Javaid, M.; Haleem, A.; Khan, I.H.; Suman, R. Understanding the potential applications of Artificial Intelligence in Agriculture Sector. Adv. Agrochem 2023, 2, 15–30. [Google Scholar] [CrossRef]

- Bochtis, D.; Benos, L.; Lampridi, M.; Marinoudi, V.; Pearson, S.; Sørensen, C.G. Agricultural workforce crisis in light of the COVID-19 pandemic. Sustainability 2020, 12, 8212. [Google Scholar] [CrossRef]

- Benos, L.; Tsaopoulos, D.; Bochtis, D. A review on ergonomics in agriculture. Part I: Manual operations. Appl. Sci. 2020, 10, 1905. [Google Scholar] [CrossRef]

- Benos, L.; Tsaopoulos, D.; Bochtis, D. A review on ergonomics in agriculture. part II: Mechanized operations. Appl. Sci. 2020, 10, 3484. [Google Scholar] [CrossRef]

- KSA Vision 2030. Strategic Objectives and Vision Realization Programs, Saudi Vision 2030. 2019. Available online: https://www.my.gov.sa/wps/portal/snp/content/saudivision/?lang=en (accessed on 10 October 2024).

- Ministry of Environment, Water, and Agriculture. Annual Report of the Ministry of Agriculture. 2021. Available online: https://www.mewa.gov.sa/ar/InformationCenter/DocsCenter/YearlyReport/YearlyReports/%d8%a7%d9%84%d8%aa%d9%82%d8%b1%d9%8a%d8%b1%20%d8%a7%d9%84%d8%b3%d9%86%d9%88%d9%8a%20%d9%84%d9%84%d9%88%d8%b2%d8%a7%d8%b1%d8%a9%20%d9%84%d8%b9%d8%a7%d9%85%202021%d9%85.pdf (accessed on 13 December 2024).

- FAO. Crops and Livestock Products. [Dataset]. Food and Agriculture Organization of the Nations (FAO). 2014. Available online: https://www.fao.org/faostat/en/#data/QCL (accessed on 2 January 2025).

- Ali, A. Industrial Development in Saudi Arabia: Disparity in Growth and Development. Probl. Perspect. Manag. 2020, 18, 23–35. [Google Scholar] [CrossRef]

- Sallam, M. The role of the manufacturing sector in promoting economic growth in the Saudi economy: A cointegration and VECM approach. J. Asian Financ. Econ. Bus. 2021, 8, 21–30. [Google Scholar] [CrossRef]

- FAO. 2022. Available online: https://www.fao.org/faostat/ar/#data/OEA (accessed on 23 April 2024).

- World Bank. 2022. Available online: https://databank.worldbank.org/reports.aspx?source=world-development-indicators# (accessed on 23 April 2024).

- Emam, A.A. The Impacts of COVID-19: An Econometric Analysis of Crude Oil Prices and Rice Prices in the World. J. Agric. Sci. 2020, 35, 137–143. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Pesaran, B. Working with Microfit 4.0: Interactive Econometric Analysis; Oxford University Press: Oxford, UK, 1997; Available online: https://cir.nii.ac.jp/crid/1130282270030044416 (accessed on 15 January 2025).

- Venujayakanth, B.; Dudhat, A.S.; Swaminathan, B.; Ardeshana, N.J. Price integration analysis of major groundnut domestic markets in India. Econ. Aff. 2017, 62, 233–241. [Google Scholar] [CrossRef]

- Lütkepohl, H. Impulse response function. In Macroeconometrics and Time Series Analysis; Durlauf, S.N., Blume, L.E., Eds.; The New Palgrave Economics Collection; Palgrave Macmillan: London, UK, 2010. [Google Scholar] [CrossRef]

- Ivascu, L.; Sarfraz, M.; Mohsin, M.; Naseem, S.; Ozturk, I. The causes of occupational accidents and injuries in Romanian firms: An application of the Johansen cointegration and Granger causality test. Int. J. Environ. Res. Public Health 2021, 18, 7634. [Google Scholar] [CrossRef] [PubMed]

- Belloumi, M. Energy consumption and GDP in Tunisia: Cointegration and causality analysis. Energy Policy 2009, 37, 2745–2753. [Google Scholar] [CrossRef]

- Mohsin, M.; Naiwen, L.; Zia-UR-Rehman, M.; Naseem, S.; Baig, S.A. The volatility of bank stock prices and macroeconomic fundamentals in the Pakistani context: An application of GARCH and EGARCH models. Oeconomia Copernic. 2020, 11, 609–636. [Google Scholar] [CrossRef]

- Ali, M.B. Co integrating relation between macroeconomic variables and stock return: Evidence from Dhaka Stock Exchange (DSE). IJESPG (Int. J. Eng. Econ. Soc. Politic Gov.) 2023, 1, 1–14. [Google Scholar] [CrossRef]

- Zhai, X.; Geng, Z.; Zhang, X. Two-stage dynamic test of the determinants of the long-run decline of China’s monetary velocity. Chin. Econ. 2013, 46, 23–40. [Google Scholar] [CrossRef]

- Kafando, N.C. Does the Development of the Agricultural Sector Affect the Manufacturing Sector. In Building a Resilient and Sustainable Agriculture in Sub-Saharan Africa; Shimeles, A., Verdier-Chouchane, A., Boly, A., Eds.; Palgrave Macmillan: Cham, Switzerland, 2018. [Google Scholar] [CrossRef]

- Uddin, M.M.M. Causal relationship between agriculture, industry and services sector for GDP growth in Bangladesh: An econometric investigation. J. Poverty Investig. Dev. 2015, 8, 124–129. [Google Scholar]

- World Food Summit. Declaration on World Food Security; World Food Summit: Rome, Italy, 1996. [Google Scholar]

- Van Meijl, H.; Shutes, L.; Valin, H.; Stehfest, E.; van Dijk, M.; Kuiper, M.; Tabeau, A.; van Zeist, W.J.; Hasegawa, T.; Havlik, P. Modelling alternative futures of global food security: Insights from FOODSECURE. Glob. Food Secur. 2020, 25, 100358. [Google Scholar] [CrossRef]

- FAO. The State of Food and Agriculture. 1996. Available online: http://www.fao.org/3/w1358e/w1358e00.htm (accessed on 14 January 2023).

- Guiné, R.D.P.F.; Pato, M.L.D.J.; Costa, C.A.D.; Costa, D.D.V.T.A.D.; Silva, P.B.C.D.; Martinho, V.J.P.D. Food Security and Sustainability: Discussing the Four Pillars to Encompass Other Dimensions. Foods 2021, 10, 2732. [Google Scholar] [CrossRef]

- Béné, C. Resilience of local food systems and links to food security—A review of some important concepts in the context of COVID-19 and other shocks. Food Secur. 2020, 12, 805–822. [Google Scholar] [CrossRef]

- Magrini, E.; Vigani, M. Technology adoption and the multiple dimensions of food security: The case of maize in Tanzania. Food Secur. 2016, 8, 707–726. [Google Scholar] [CrossRef]

- Nosratabadi, S.; Khazami, N.; Abdallah, M.B.; Lackner, Z.S.; Band, S.; Mosavi, A.; Mako, C. Social capital contributions to food security: A comprehensive literature review. Foods 2020, 9, 1650. [Google Scholar] [CrossRef]

- Oakley, A.R.; Nikolaus, C.J.; Ellison, B.; Nickols-Richardson, S.M. Food insecurity and food preparation equipment in US households: Exploratory results from a cross-sectional questionnaire. J. Hum. Nutr. Diet. 2019, 32, 143–151. [Google Scholar] [CrossRef] [PubMed]

- Houessou, M.D.; Cassee, A.; Sonneveld, B.G. The effects of the COVID-19 pandemic on food security in rural and urban settlements in benin: Do allotment gardens soften the blow? Sustainability 2021, 13, 7313. [Google Scholar] [CrossRef]

- Ahmad, N.; Du, L.; Lu, J.; Wang, J.; Li, H.Z.; Hashmi, M.Z. Modelling the CO2 emissions and economic growth in Croatia: Is there any environmental Kuznets curve? Energy 2017, 123, 164–172. [Google Scholar] [CrossRef]

- Smutka, L.; Steininger, M.; Miffek, O. World agricultural production and consumption. Agris-Line Pap. Econ. Inform. 2009, 1, 3–12. [Google Scholar] [CrossRef]

- Otsuka, K. Food insecurity, income inequality, and the changing comparative advantage in world agriculture. Agric. Econ. 2013, 44, 7–18. [Google Scholar] [CrossRef]

- Wegren, S.K.; Elvestad, C. Russia’s food self-sufficiency and food security: An assessment. Post-Communist Econ. 2018, 30, 565–587. [Google Scholar] [CrossRef]

| Variable | Unit | Sources |

|---|---|---|

| AG | USD million | https://databank.worldbank.org/reports.aspx?source=world-development-indicators# (accessed on 23 April 2024) |

| IN | ||

| SE | ||

| EM | 1000 persons | https://www.fao.org/faostat/ar/#data/OEA (accessed on 23 April 2024) |

| AG | IN | SE | EM | |

|---|---|---|---|---|

| Mean | 29,713 | 822,177 | 296,000.0 | 46,806 |

| Median | 16,853.0 | 776,000 | 281,000 | 33,000 |

| Skewness | 0.75 | 0.78 | 1.13 | 2.41 |

| Kurtosis | 2.35 | 3.37 | 4.80 | 10.12 |

| Jarque–Bera | 3.47 | 3.31 | 10.72 | 95.45 |

| Probability | 0.176 | 0.191 | 0.005 | 0.000 |

| Observations | 32 | 32 | 32 | 32 |

| Time Series | Intercept | Intercept and Trend | Stationarity | Intercept | Intercept and Trend | Stationarity |

|---|---|---|---|---|---|---|

| ADF | Phillips–Perron | |||||

| LAG | 2.06 | −0.41 | Non-Stationary | 2.06 | −0.41 | Non-Stationary |

| LIN | −0.59 | −2.08 | Non-Stationary | −0.43 | −2.20 | Non-Stationary |

| LSE | −0.49 | −3.12 | Non-Stationary | 0.28 | −2.23 | Non-Stationary |

| LEM | −4.22 * | −1.80 | Stationary 1(0) | −2.90 ** | 5.82 * | Stationary 1(0) |

| Time Series | Intercept | Intercept and Trend | Stationarity | Intercept | Intercept and Trend | Stationarity |

|---|---|---|---|---|---|---|

| ADF | Phillips–Perron | |||||

| LAG | −2.82 *** | −3.51 *** | Stationary | −2.82 *** | −3.31 *** | Stationary |

| LIN | −4.75 * | −4.80 * | Non-stationary | −4.65 * | −4.51 * | Stationary |

| LSE | −3.13 ** | −2.94 | Non-stationary | −3.11 ** | −2.91 | Stationary |

| Model | |||

|---|---|---|---|

| LAG (Dependent Variable): Selected ARDL Model (1, 3, 1, 4) | |||

| Independent V. | Coefficient | t-Statistic | Prob. |

| LAG (-1) | 0.440 | 3.17 | 0.006 |

| LIN | −0.008 | −0.49 | 0.630 |

| LIN (-1) | −0.108 | −5.54 | 0.000 |

| LIN (-2) | 0.013 | 0.56 | 0.581 |

| LIN (-3) | 0.053 | −2.82 | 0.013 |

| LSE | 0.339 | 3.11 | 0.007 |

| LSE (-1) | 0.152 | 1.06 | 0.309 |

| LEM | 0.106 | 2.75 | 0.015 |

| LEM (-1) | −0.130 | −2.93 | 0.010 |

| LEM (-2) | 0.097 | 2.05 | 0.058 |

| LEM (-3) | 0.078 | 1.81 | 0.090 |

| LEM (-4) | −0.310 | −7.54 | 0.000 |

| C | 2.958 | 3.885602 | 0.0015 |

| R-squared 0.9995 | F-statistics 2371.54 Prob. 0.000 | ||

| Adj. R-squared 0.9990 | Durbin–Watson stat: 2.37 | ||

| Test Statistics | Results |

|---|---|

| Serial Correlation LM Test: Breusch–Godfrey | 3.78 (0.14) |

| Breusch–Pagan–Godfrey Heteroskedasticity Test | 4.28 (0.97) |

| Jarque–Bera test | 0.66 (0.72) |

| Dependent | Function | F-Statistic | ||

|---|---|---|---|---|

| LAG | LAG = f (LIN, LSE, and LEM) | 22.90 | ||

| Significance: | 10% | 1% | 5% | |

| Lower Bound: | 2.37 | 3.65 | 2.79 | |

| Upper Bound: | 3.20 | 4.66 | 3.67 | |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | 39.46 | NA | 1.11 × 10−6 | −2.36 | −2.18 | −2.30 |

| 1 | 196.48 | 261.71 * | 9.25 × 10−11 * | −11.77 * | −10.83 * | −11.47 * |

| 2 | 205.8736 | 13.15 | 1.53 × 10−10 | −11.33 | −9.64 | −10.79 |

| Long-Term Results: LAG (Dependent Variable) | Short-Term Results: LAG (Dependent Variable) | |||

|---|---|---|---|---|

| Error Correction | Coefficient | t-Value Statistic | Coefficient | t-Value Statistic |

| CointEq1 | −0.004 | −0.43 | ||

| LIN (-1) | −3.24 | −4.44 | ||

| LSE (-1) | 2.80 | 4.34 | ||

| LEM (-1) | −1.16 | −1.02 | ||

| D(LAG (-1)) | 0.33 | 1.48 | ||

| D(LIN (-1)) | −0.06 | −1.86 | ||

| D(LSE (-1)) | 0.16 | 0.91 | ||

| D(LEM (-1)) | −013 | −1.67 | ||

| C | 8.97 | 0.022 | 1.60 | |

| ECM residual serial correlation LM tests: | Lags | LM-Stat | Prob. | |

| 1 | 10.23 | 0.85 | ||

| VEC Residual Heteroskedasticity Tests: | Chi-sq: 109.50 | Prob.: 0.24 | ||

| VEC Residual Normality Tests: | Chi-sq: 109.50 | Prob.:0.24 | ||

| Null Hypothesis | F-Statistic | Prob. |

|---|---|---|

| LIN - LAG | 1.35 | 0.256 |

| LAG - LIN | 0.88 | 0.356 |

| LSE - LAG | 4.87 | 0.036 |

| LAG - LSE | 6.22 | 0.019 |

| LEM - LAG | 0.52 | 0.476 |

| LAG - LEM | 1.09 | 0.307 |

| LSE - LIN | 0.88 | 0.357 |

| LIN - LSE | 31.34 | 5 × 10−6 |

| LEM - LIN | 0.57 | 0.456 |

| LIN - LEM | 0.92 | 0.345 |

| LEM - LSE | 10.04 | 0.004 |

| LSE - LEM | 0.72 | 0.403 |

| Variable | Coefficient | t-Statistic | Prob. |

|---|---|---|---|

| LIN | −0.03 | −0.85 | 0.4017 |

| LSE | 0.59 | 18.61 | 0.0000 |

| LEM | −0.28 | −4.52 | 0.0001 |

| C | 5.78 | 10.46 | 0.0000 |

| R-squared = 0.988 Adjusted R-squared = 0.987 F-statistic = 761.412 Prob. (F-statistic) = 0.0000 Heteroskedasticity Test (Breusch–Pagan–Godfrey): 1.337 Prob = 0.28 LM-statistics (Breusch–Godfrey serial correlation of residual) F = 2.75 with Prob. = 0.08 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Emam, A.; Elmsaad, E. Do Non-Agricultural Sectors Affect Food Security in Saudi Arabia? Sustainability 2025, 17, 4625. https://doi.org/10.3390/su17104625

Emam A, Elmsaad E. Do Non-Agricultural Sectors Affect Food Security in Saudi Arabia? Sustainability. 2025; 17(10):4625. https://doi.org/10.3390/su17104625

Chicago/Turabian StyleEmam, Abda, and Egbal Elmsaad. 2025. "Do Non-Agricultural Sectors Affect Food Security in Saudi Arabia?" Sustainability 17, no. 10: 4625. https://doi.org/10.3390/su17104625

APA StyleEmam, A., & Elmsaad, E. (2025). Do Non-Agricultural Sectors Affect Food Security in Saudi Arabia? Sustainability, 17(10), 4625. https://doi.org/10.3390/su17104625