Assessing the Economic Sustainability of Airlines in the U.S. Through Labor Efficiency

Abstract

:1. Introduction

2. Literature Review

2.1. Review of Previous Studies

2.2. Research Gaps and Significance of This Study

3. Methodology

3.1. Data Envelopment Analysis (DEA) Models

- Block hour: number of hours between the aircraft door closing time at the departure of the flight and the aircraft door opening time at the arrival gate following its landing;

- Percent of maintenance: percent of maintenance expenses outsourced;

- Passenger revenue: revenue received by the airline from the carriage of passengers in scheduled operations;

- Revenue passenger miles (RPM): number of miles traveled by paying passengers, calculated by multiplying the number of paying passengers by the distance traveled;

- Available seat miles (ASM): a measure of passenger carrying capacity, calculated by multiplying the number of seats available by the distance traveled.

- = efficiency score;

- i = number of DMUs; i = 1, 2, …, n; n = 15 airlines (the number is lower for several years due to the airline merging);

- j = number of inputs; j = 1, 2, …, m (Model 1: m = 5; Model 2: m = 3; Model 3: m = 3; Model 4: m = 3; and Model 5: m = 2);

- k = number of outputs; k = 1, 2, …, l; l = 3 for all models (ASM, RPM, and total passenger revenue);

- = weight applied for inputs and outputs for DMU (i);

- = input j for DMU (i);

- = output k for DMU (i).

- Objective: to maximize efficiency () for a specific DMU under evaluation;

- Constraint 1 (input constraint): this ensures the weighted combination of all other DMUs does not use more inputs than the DMU being evaluated;

- Constraint 2 (output constraint): this indicates the composite DMU’s outputs should be at least as good as the actual DMU’s outputs multiplied by E;

- Constraint 3 (convexity constraint): this enforces variable returns to scale by making sure that the weights form a convex combination (like creating a blend of other DMUs without inflating the scale). This is what differentiates BCC from the earlier CCR model (which assumes constant returns to scale);

- Constraint 4 (non-negativity): must not have a “negative” contribution from a DMU in the benchmark. All weights must be positive or zero.

3.2. Data Collection

- September 2005: U.S. Airways (U.S.) and America West (HP) merged and started to report jointly as U.S. Airways (U.S.). Accordingly, America West is not included in the analysis;

- December 2009: Delta (DL) and Northwest (NW) merged and started to report jointly as Delta (DL);

- January 2012: United (UA) and Continental (CO) merged and started to report jointly as United (UA);

- May 2011: Southwest (WN) and AirTran (FL) merged and started to report jointly as Southwest (WN);

- December 2013: American (AA) and U.S. Airways (U.S.) merged and started to report jointly as American (AA);

- December 2016: Alaska Airlines and Virgin America merged and started to report jointly as Alaska Airlines.

4. Results

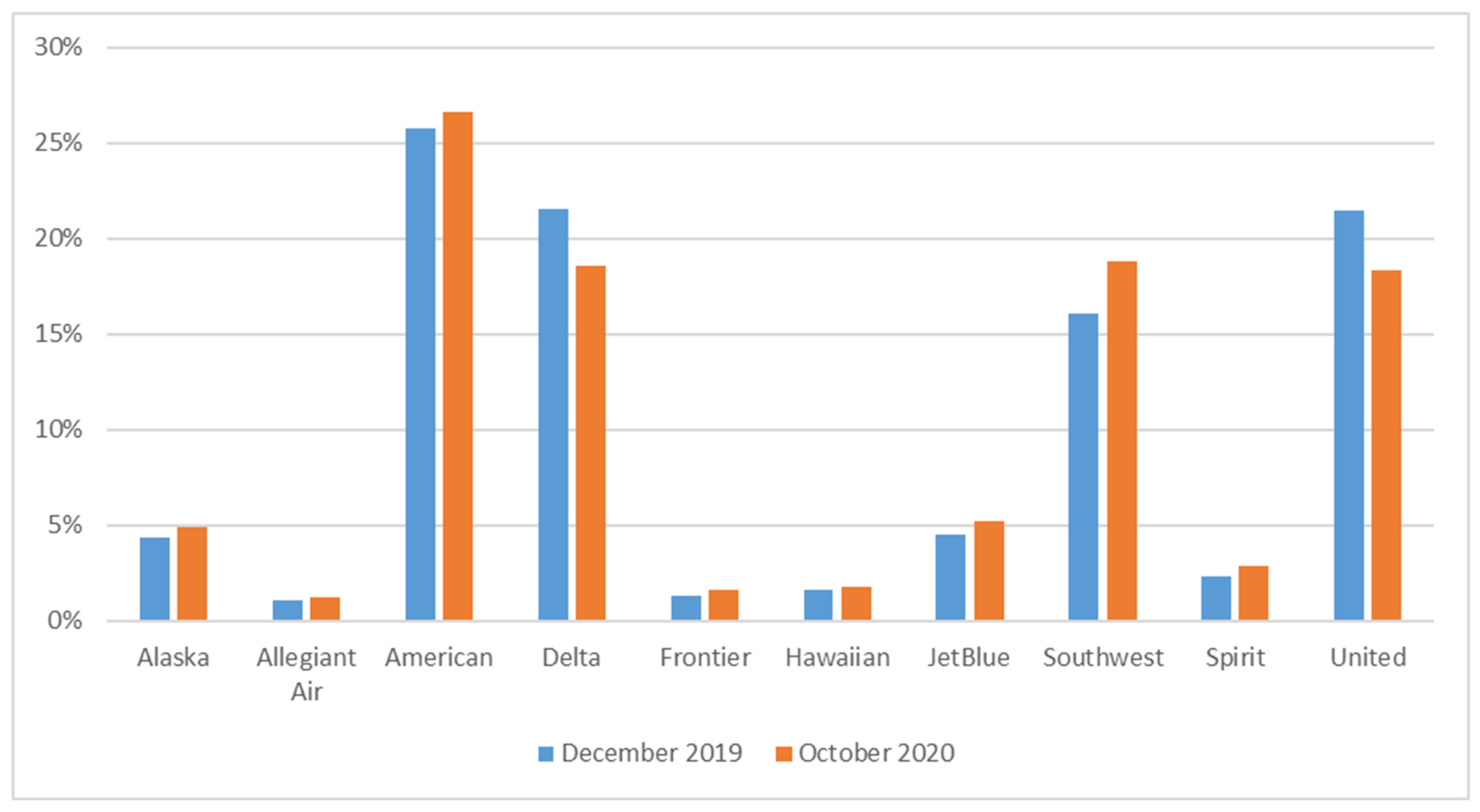

4.1. Demographic Information

4.2. Cross-Sector Efficiency Comparison Test Results

4.3. Efficiency Assessment Results

| Airlines | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| American | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Continental | 83.0% | 86.0% | 88.0% | 92.3% | 74.5% | |||||||||

| Delta | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Northwest | 87.4% | 100.0% | 100.0% | |||||||||||

| United | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 90.0% | 100.0% | 100.0% | 96.2% | 93.9% | 95.1% | 100.0% |

| U.S. Airways | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | ||||||

| Southwest | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| jetBlue | 100.0% | 100.0% | 92.6% | 92.3% | 86.1% | 89.0% | 86.8% | 80.8% | 76.6% | 80.6% | 76.6% | 85.3% | 79.6% | 84.6% |

| AirTran | 89.9% | 91.6% | 87.5% | 97.4% | 80.2% | |||||||||

| Frontier | 96.6% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 92.3% | 99.3% | 100.0% | 100.0% | 100.0% | 100.0% |

| Virgin America | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | |||||

| Alaska | 88.6% | 100.0% | 93.6% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Hawaiian | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | |

| Spirit | 93.3% | 82.4% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Allegiant | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Airlines | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| American | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Continental | 81.1% | 80.6% | 73.3% | 68.9% | 60.1% | |||||||||

| Delta | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 94.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Northwest | 89.6% | 85.6% | 79.4% | |||||||||||

| United | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 95.6% | 100.0% | 84.7% | 87.7% | 88.7% | 100.0% |

| U.S. Airways | 100.0% | 100.0% | 98.8% | 77.7% | 76.9% | 80.2% | 97.3% | 89.6% | ||||||

| Southwest | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| jetBlue | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 77.7% | 100.0% | 96.3% | 100.0% | 100.0% | 90.4% |

| AirTran | 100.0% | 95.8% | 100.0% | 97.9% | 95.8% | |||||||||

| Frontier | 98.5% | 88.8% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Virgin America | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 89.8% | 100.0% | 100.0% | |||||

| Alaska | 100.0% | 100.0% | 97.2% | 94.6% | 95.0% | 95.9% | 100.0% | 100.0% | 93.2% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Hawaiian | 100.0% | 100.0% | 100.0% | 100.0% | 90.9% | 100.0% | 100.0% | 54.5% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | |

| Spirit | 100.0% | 100.0% | 77.7% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 96.0% | 100.0% |

| Allegiant | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Airlines | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| American | 100.0% | 100.0% | 100.0% | 92.6% | 93.6% | 81.1% | 88.6% | 87.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Continental | 72.7% | 66.9% | 69.2% | 66.4% | 61.3% | |||||||||

| Delta | 93.8% | 84.3% | 85.8% | 100.0% | 100.0% | 92.9% | 95.1% | 99.6% | 94.0% | 94.7% | 96.3% | 100.0% | 100.0% | 100.0% |

| Northwest | 77.1% | 68.0% | 69.6% | |||||||||||

| United | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 95.6% | 100.0% | 86.3% | 87.3% | 87.9% | 75.9% |

| U.S. Airways | 100.0% | 90.7% | 88.7% | 87.8% | 85.0% | 76.6% | 73.8% | 73.0% | ||||||

| Southwest | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| jetBlue | 100.0% | 100.0% | 89.2% | 81.3% | 83.1% | 83.4% | 81.0% | 80.0% | 77.7% | 79.0% | 79.4% | 75.9% | 77.3% | 80.4% |

| AirTran | 100.0% | 100.0% | 100.0% | 98.8% | 97.6% | |||||||||

| Frontier | 63.2% | 62.1% | 69.6% | 68.1% | 75.5% | 59.7% | 60.3% | 57.8% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Virgin America | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 89.8% | 92.1% | 84.2% | |||||

| Alaska | 91.0% | 83.8% | 91.7% | 94.4% | 100.0% | 100.0% | 99.8% | 100.0% | 93.2% | 93.2% | 90.7% | 100.0% | 100.0% | 92.9% |

| Hawaiian | 85.2% | 80.3% | 68.0% | 59.3% | 55.2% | 51.1% | 55.2% | 54.5% | 53.6% | 53.3% | 44.4% | 42.1% | 38.5% | |

| Spirit | 100.0% | 100.0% | 80.3% | 76.0% | 85.1% | 83.9% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Allegiant | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 70.1% | 66.8% | 54.8% | 100.0% | 100.0% |

| Airlines | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| American | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Continental | 65.9% | 63.4% | 62.5% | 56.7% | 53.2% | |||||||||

| Delta | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Northwest | 100.0% | 100.0% | 100.0% | |||||||||||

| United | 97.4% | 98.1% | 89.5% | 79.0% | 71.9% | 99.9% | 95.1% | 89.9% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 88.3% |

| U.S. Airways | 91.7% | 82.5% | 75.4% | 70.8% | 75.2% | 76.7% | 80.6% | 75.2% | ||||||

| Southwest | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| jetBlue | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| AirTran | 45.1% | 46.9% | 100.0% | 100.0% | 100.0% | |||||||||

| Frontier | 28.0% | 30.1% | 77.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Virgin America | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 90.4% | 100.0% | 100.0% | |||||

| Alaska | 38.5% | 38.6% | 57.3% | 60.4% | 62.8% | 64.7% | 73.8% | 78.3% | 80.8% | 78.3% | 79.5% | 88.0% | 88.8% | 85.9% |

| Hawaiian | 100.0% | 71.4% | 63.7% | 65.0% | 57.3% | 55.5% | 59.0% | 57.8% | 51.5% | 47.5% | 51.8% | 100.0% | 37.8% | |

| Spirit | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Allegiant | 100.0% | 100.0% | 100.0% | 100.0% | 60.3% | 63.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Airlines | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| American | 100.0% | 100.0% | 100.0% | 94.9% | 89.1% | 87.1% | 73.5% | 71.6% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Continental | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | |||||||||

| Delta | 73.5% | 76.5% | 81.2% | 100.0% | 100.0% | 100.0% | 92.3% | 95.4% | 92.6% | 94.4% | 95.8% | 100.0% | 100.0% | 100.0% |

| Northwest | 57.8% | 51.6% | 62.8% | |||||||||||

| United | 100.0% | 100.0% | 100.0% | 98.1% | 84.2% | 92.6% | 92.5% | 95.4% | 98.5% | 100.0% | 100.0% | 100.0% | 100.0% | 99.9% |

| U.S. Airways | 65.6% | 61.6% | 65.5% | 60.1% | 73.8% | 54.9% | 60.2% | 100.0% | ||||||

| Southwest | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| jetBlue | 88.0% | 80.3% | 65.4% | 68.5% | 68.5% | 72.9% | 73.7% | 75.7% | 83.7% | 84.5% | 88.8% | 87.7% | 91.8% | 79.8% |

| AirTran | 73.4% | 89.0% | 87.4% | 73.2% | 100.0% | |||||||||

| Frontier | 90.9% | 91.0% | 76.3% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Virgin America | 100.0% | 86.7% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | |||||

| Alaska | 62.4% | 59.5% | 60.2% | 72.7% | 70.6% | 75.2% | 78.6% | 69.8% | 66.7% | 69.6% | 65.4% | 80.0% | 82.6% | 77.6% |

| Hawaiian | 85.5% | 100.0% | 83.4% | 91.2% | 87.2% | 79.7% | 79.8% | 77.3% | 69.2% | 82.9% | 73.7% | 66.8% | 42.5% | |

| Spirit | 88.2% | 63.7% | 81.5% | 63.1% | 64.3% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Allegiant | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

4.4. Recommendations for Improvement

5. Discussions

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Employee Types | Airline | Input Variables | Actual | Target | Potential Improvement |

|---|---|---|---|---|---|

| Pilot efficiency | Jet blue—84.6% | Pilots—average pension and benefit package | 53,447 | 45,850 | −14.21% |

| Ground staff efficiency | United—75.9% | Ground staff—employees per aircraft | 44 | 37 | −15.00% |

| Ground staff—total employee equivalent | 34,271 | 21,890 | −36.13% | ||

| jetBlue—80.4% | Ground staff—average annual wages and | 56,396 | 33,009 | −41.47% | |

| Ground staff—employees per aircraft | 18 | 8 | −53.73% | ||

| Hawaiian—38.5% | Ground staff—average annual wages | 45,348 | 24,749 | −45.42% | |

| Ground staff—employees per aircraft | 26 | 4 | −84.10% | ||

| Alaska—92.9% | Ground staff—average annual wages | 39,578 | 32,245 | −18.53% | |

| Ground staff—employees per aircraft | 29 | 8 | −72.45% | ||

| Maintenance staff efficiency | Alaska—85.9% | maintenance staff—average annual wages | 114,178 | 103,228 | −9.59% |

| maintenance staff—percent of maintenance | 63 | 40 | −36.06% | ||

| Hawaiia —37.77% | maintenance staff—percent of maintenance | 60 | 54 | −10.68% | |

| Management staff efficiency | jetBlue—79.85% | Management staff—average annual wages | 129,663 | 80,363 | −38.02% |

| Alaska—77.63% | Management staff—average annual wages | 140,001 | 82,558 | −41.03% | |

| Hawaiian—42.53% | Management staff—average annual wages | 155,003 | 72,146 | −53.46% |

References

- Airlines for America (A4A). A4A Passenger Airline Cost Index (PACI). 2020. Available online: https://www.airlines.org/dataset/a4a-quarterly-passenger-airline-cost-index-u-s-passenger-airlines/ (accessed on 1 March 2024).

- Bureau of Transportation Statistics (BTS). U.S. Airlines 2020 Net Profit Down $35 Billion from 2019. 2021. Available online: https://www.bts.gov/newsroom/us-airlines-2020-net-profit-down-35-billion-2019 (accessed on 1 March 2024).

- Bureau of Transportation Statistics (BTS). U.S. Scheduled Passenger Airlines January 2020 Number of Employees. 2020. Available online: https://www.bts.gov/newsroom/january-2020-us-passenger-airline-employment-data (accessed on 1 March 2024).

- Li, Y.; Cui, Q. Airline efficiency with optimal employee allocation: An input-shared network range adjusted measure. J. Air Transp. Manag. 2018, 73, 150–162. [Google Scholar] [CrossRef]

- Taneja, A.K. Transforming Airlines: A Flight Plan for Navigating Structural Changes; Routledge: New York, NY, USA, 2020. [Google Scholar]

- Bureau of Transportation Statistics (BTS). Search Airline Employment Data by Month. 2020. Available online: https://www.transtats.bts.gov/Employment/ (accessed on 1 March 2024).

- Massachusett Institute of Technology (MIT). MIT Airline Data Project. Global Airline Industry Program. 2022. Available online: http://web.mit.edu/airlinedata/www/default.html (accessed on 1 March 2024).

- Bureau of Transportation Statistics (BTS). U.S. Airlines Report Third Quarter 2020 Losses. 2020. Available online: https://www.bts.gov/newsroom/us-airlines-report-third-quarter-2020-losses (accessed on 1 March 2024).

- Alam, I.M.S.; Sickles, R.C. The Relationship Between Stock Market Returns and Technical Efficiency Innovations: Evidence from the US Airline Industry. J. Product. Anal. 1998, 9, 35–51. [Google Scholar] [CrossRef]

- Coelli, T.; Perelman, S.; Romano, E. Accounting for environmental influences in stochastic frontier models: With application to international airlines. J. Product. Anal. 1999, 11, 251–273. [Google Scholar] [CrossRef]

- Oum, T.H.; Fu, X.; Yu, C. New evidences on airline efficiency and yields: A comparative analysis of major North American air carriers and its implications. Transp. Policy 2005, 12, 153–164. [Google Scholar] [CrossRef]

- Chiou, Y.; Chen, Y. Route-based performance evaluation of Taiwanese domestic airlines using data envelopment analysis. Transp. Res. Part E 2006, 42, 116–127. [Google Scholar] [CrossRef]

- Barros, C.P.; Peypoch, N. An evaluation of European airlines’ operational performance. Int. J. Prod. Econ. 2009, 122, 525–533. [Google Scholar] [CrossRef]

- Kottas, A.T.; Madas, M.A. Comparative efficiency analysis of major international airlines using data envelopment analysis: Exploring effects of alliance membership and other operational efficiency determinants. J. Air Transp. Manag. 2018, 70, 1–17. [Google Scholar] [CrossRef]

- Mhlanga, O. Factors impacting airline efficiency in southern Africa: A data envelopment analysis. Geojournal 2019, 84, 759–770. [Google Scholar] [CrossRef]

- Heydari, C.; Omrani, H.; Taghizadeh, R. A fully fuzzy network DEA-range adjusted measure model for evaluating airlines efficiency: A case of Iran. J. Air Transp. Manag. 2020, 89, 101923. [Google Scholar] [CrossRef]

- Cui, Q.; Li, Y. Evaluating energy efficiency for airlines: An application of VFB-DEA. J. Air Transp. Manag. 2015, 44–45, 34–41. [Google Scholar] [CrossRef]

- Arjomandi, A.; Seufert, J.H. An evaluation of the world’s major airlines’ technical and environmental performance. Econ. Model. 2014, 41, 133–144. [Google Scholar] [CrossRef]

- Cui, Q.; Li, Y.; Yu, C.; Wei, Y. Evaluating energy efficiency for airlines: An application of virtual frontier dynamic slacks based measure. Energy 2016, 113, 1231–1240. [Google Scholar] [CrossRef]

- Cui, Q.; Li, Y. Airline dynamic efficiency measures with a dynamic RAM with unified natural & managerial disposability. Energy Econ. 2018, 75, 534–546. [Google Scholar] [CrossRef]

- Saini, A.; Truong, D.; Pan, J.Y. Airline efficiency and environmental impacts—Data envelopment analysis. Int. J. Transp. Sci. Technol. 2023, 12, 335–353. [Google Scholar] [CrossRef]

- Yang, Z.; Omrani, H.; Imanirad, R. Assessing airline efficiency with a network DEA model: A Z-number approach with shared resources, undesirable outputs, and negative data. Socio-Econ. Plan. Sci. 2024, 96, 102080. [Google Scholar] [CrossRef]

- Voltes-Dorta, A.; Britto, R.; Wilson, B. Efficiency of global airlines incorporating sustainability objectives: A Malmquist-DEA approach. J. Air Transp. Manag. 2024, 119, 102634. [Google Scholar] [CrossRef]

- Sickles, R.C.; Good, D.H.; Getachew, L. Specification of distance functions using semi- and non-parametric methods with an application to the dynamic performance of eastern and western European air Carriers1. J. Product. Anal. 2002, 17, 133–155. [Google Scholar] [CrossRef]

- Barbot, C.; Costa, Á.; Sochirca, E. Airlines performance in the new market context: A comparative productivity and efficiency analysis. J. Air Transp. Manag. 2008, 14, 270–274. [Google Scholar] [CrossRef]

- Lu, W.; Wang, W.; Hung, S.; Lu, E. The effects of corporate governance on airline performance: Production and marketing efficiency perspectives. Transp. Res. Part E Logist. Transp. Rev. 2012, 48, 529–544. [Google Scholar] [CrossRef]

- Yen, B.T.H.; Li, J.S. Route-based performance evaluation for airlines—A meta frontier data envelopment analysis approach. Transp. Res. Part E Logist. Transp. Rev. 2022, 162, 102748. [Google Scholar] [CrossRef]

- Wu, W.; Liao, Y. A balanced scorecard envelopment approach to assess airlines’ performance. Ind. Manag. Data Syst. 2014, 114, 123–143. [Google Scholar] [CrossRef]

- Tavassoli, M.; Faramarzi, G.R.; Saen, R.F. Efficiency and effectiveness in airline performance using a SBM-NDEA model in the presence of shared input. J. Air Transp. Manag. 2014, 34, 146. [Google Scholar] [CrossRef]

- Caves, D.; Christensen, L.; Tretheway, M. Economies of Density versus Economies of Scale: Why Trunk and Local Service Airline Costs Differ. RAND J. Econ. 1984, 15, 471–489. [Google Scholar] [CrossRef]

- Schmidt, P.; Sickles, R.C. Production frontiers and panel data. J. Bus. Econ. Stat. 1984, 2, 367–374. [Google Scholar] [CrossRef]

- Gillen, D.W.; Oum, T.H.; Tretheway, M.W. Airline cost structure and policy implications: A multi-product approach for Canadian airlines. J. Transp. Econ. Policy 1990, 24, 9–34. [Google Scholar]

- Bauer, W. Decomposing TFP growth in presence of cost inefficiencies, nonconstant returns to scale and technological progress. J. Product. Anal. 1990, 1, 287–299. [Google Scholar] [CrossRef]

- Cornwell, C.; Schmidt, P.; Sickles, R.C. Production frontiers with cross-sectional and time-series variation in efficiency levels. J. Econ. 1990, 46, 185–200. [Google Scholar] [CrossRef]

- Schefczyk, M. Operational Performance of Airlines: An Extension of Traditional Measurement Paradigms. Strateg. Manag. J. 1993, 14, 301–317. [Google Scholar] [CrossRef]

- Good, D.H.; Nadiri, M.I.; Roller, L.-H.; Sickles, R.C. Efficiency and productivity growth comparisons of European and U.S. air carriers: A first look at the data. J. Prod. Anal. 1993, 4, 115–125. [Google Scholar] [CrossRef]

- Baltagi, B.; Griffin, J.; Rich, D. Airline Deregulation: The Cost Pieces of the Puzzle. Int. Econ. Rev. 1995, 36, 245–258. [Google Scholar] [CrossRef]

- Good, D.H.; Röller, L.; Sickles, R.C. Airline efficiency differences between Europe and the U.S.: Implications for the pace of EC integration and domestic regulation. Eur. J. Oper. Res. 1995, 80, 508–518. [Google Scholar] [CrossRef]

- Ray, S.; Mukherjee, K. Decomposition of the Fisher Ideal Index of Productivity: A Non-Parametric Dual Analysis of U.S. Airlines Data. Econ. J. 1996, 106, 1659–1678. [Google Scholar] [CrossRef]

- Forsyth, P. Total factor productivity in Australian domestic aviation. Transp. Policy 2001, 8, 201–207. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopt, S.; Sickles, R.C. Productivity of U.S. airlines after deregulation. J. Transp. Econ. Policy (JTEP) 2007, 41, 93–112. [Google Scholar]

- Greer, M.R. Nothing focuses the mind on productivity quite like the fear of liquidation: Changes in airline productivity in the United States, 2000–2004. Transp. Res. Part A 2008, 42, 414–426. [Google Scholar] [CrossRef]

- Bhadra, D. Race to the bottom or swimming upstream: Performance analysis of U.S. airlines. J. Air Transp. Manag. 2009, 15, 227–235. [Google Scholar] [CrossRef]

- Greer, M. Is it the labor unions’ fault? dissecting the causes of the impaired technical efficiencies of the legacy carriers in the united states. Transp. Res. Part A 2009, 43, 779–789. [Google Scholar] [CrossRef]

- Assaf, A. Are U.S. airlines really in crisis? Tour. Manag. 2009, 30, 916–921. [Google Scholar] [CrossRef]

- Hong, S.; Zhang, A. An efficiency study of airlines and air cargo/passenger divisions: A DEA approach. World Rev. Intermodal Transp. Res. 2010, 3, 137–149. [Google Scholar] [CrossRef]

- Ouellette, P.; Petit, P.; Tessier-Parent, L.; Vigeant, S. Introducing regulation in the measurement of efficiency, with an application to the Canadian air carriers industry. Eur. J. Oper. Res. 2010, 200, 216–226. [Google Scholar] [CrossRef]

- Brits, A. Liberalized south African airline industry: Measuring airline total-factor productivity. J. Transp. Supply Chain. Manag. 2010, 4, 22–38. [Google Scholar] [CrossRef]

- Zhu, J. Airlines performance via two-stage network DEA approach. J. CENTRUM Cathedra 2011, 4, 260–269. [Google Scholar] [CrossRef]

- Merkert, R.; Hensher, D.A. The impact of strategic management and fleet planning on airline efficiency—A random effects Tobit model based on DEA efficiency scores. Transp. Res. Part A Policy Pract. 2011, 45, 686–695. [Google Scholar] [CrossRef]

- Wang, W.; Lu, W.; Tsai, C. The relationship between airline performance and corporate governance amongst U.S. listed companies. J. Air Transp. Manag. 2011, 17, 147–151. [Google Scholar] [CrossRef]

- Gramani, M.C.N. Efficiency decomposition approach: A cross-country airline analysis. Expert Syst. Appl. 2012, 39, 5815–5819. [Google Scholar] [CrossRef]

- Assaf, A.G.; Josiassen, A. European vs. U.S. airlines: Performance comparison in a dynamic market. Tour. Manag. 2012, 33, 317–326. [Google Scholar] [CrossRef]

- Barros, C.P.; Liang, Q.B.; Peypoch, N. The technical efficiency of U.S. airlines. Transp. Res. Part A Policy Pract. 2013, 50, 139. [Google Scholar] [CrossRef]

- Barros, C.P.; Couto, E. Productivity analysis of European airlines, 2000-2011. J. Air Transp. Manag. 2013, 31, 11. [Google Scholar] [CrossRef]

- Rai, A. Measurement of efficiency in the airline industry using data envelopment analysis. Investig. Manag. Financ. Innov. 2013, 10, 38–45. Available online: https://businessperspectives.org/images/pdf/applications/publishing/templates/article/assets/5005/imfi_en_2013_01_Rai.pdf (accessed on 1 March 2024).

- Lee, B.L.; Worthington, A.C. Technical efficiency of mainstream airlines and low-cost carriers: New evidence using bootstrap data envelopment analysis truncated regression. J. Air Transp. Manag. 2014, 38, 15–20. [Google Scholar] [CrossRef]

- Cao, Q.; Lv, J.; Zhang, J. Productivity efficiency analysis of the airlines in china after deregulation. J. Air Transp. Manag. 2014, 42, 135–140. [Google Scholar] [CrossRef]

- Lozano, S.; Gutiérrez, E. A slacks-based network DEA efficiency analysis of European airlines. Transp. Plan. Technol. 2014, 37, 623–637. [Google Scholar] [CrossRef]

- Marti, L.; Puertas, R.; Calafat, C. Efficiency of airlines: Hub and spoke versus point-to-point. J. Econ. Stud. 2015, 42, 157–166. [Google Scholar] [CrossRef]

- Barros, C.P.; Wanke, P. An analysis of African airlines efficiency with two-stage TOPSIS and neural networks. J. Air Transp. Manag. 2015, 44–45, 90–102. [Google Scholar] [CrossRef]

- Choi, K.; Lee, D.; Olson, D.L. Service quality and productivity in the U.S. airline industry: A service quality-adjusted DEA model. Serv. Bus. 2015, 9, 137–160. [Google Scholar] [CrossRef]

- Sakthidharan, V.; Sivaraman, S. Impact of operating cost components on airline efficiency in india: A DEA approach. Asia Pac. Manag. Rev. 2018, 23, 258–267. [Google Scholar] [CrossRef]

- Hermoso, R.; Latorre, M.P.; Martinez-Nuñez, M. Multivariate data envelopment analysis to measure airline efficiency in European airspace: A network-based approach. Appl. Sci. 2019, 9, 5312. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Cooper, W.W.; Seiford, L.M.; Zhu, J. (Eds.) Handbook on Data Envelopment Analysis; International Series in Operations Research and Management Science; Springer: Berlin/Heidelberg, Germany, 2011. [Google Scholar]

- Losa, E.T.; Arjomandi, A.; Hervé Dakpo, K.; Bloomfield, J. Efficiency comparison of airline groups in annex 1 and non-annex 1 countries: A dynamic network DEA approach. Transp. Policy 2020, 99, 163–174. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some Models for Estimating Technical and Scale Inefficiencies in Data Envelopment Analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef]

- ICAO. List of Low Cost Carriers. 2020. Available online: https://www.icao.int/sustainability/Documents/LCC-List.pdf (accessed on 1 March 2024).

- Bahloul, F. A Brief History of Airline Consolidation in the United States. 2024. Available online: https://www.airwaysmag.com/legacy-posts/history-us-airline-consolidation (accessed on 1 March 2024).

| Authors | Input Variables | Output Variables | Airlines |

|---|---|---|---|

| Caves, 1984 [30] | Labor cost, fuel price, flight equipment, ground property, equipment (GPE), and materials | Revenue passenger miles (RPM), RPM of charter service, revenue ton miles (RTM) of mail, and RTM of all other freight | 15 U.S. airlines from 1970 and 1981 |

| Schmidt and Sickles, 1984 [31] | Capital, labor, energy, and materials | Capacity ton miles (CTM) | 12 U.S. airlines from 1970 to 1978 |

| Gillen et al., 1990 [32] | Labor, fuel, capital, and materials | Scheduled revenue passenger kilometers, scheduled revenue freight ton kilometers, non-scheduled revenue ton kilometers, load factor, stage length, and average number of seats per departure | 7 Canadian airlines from 1964 to 1981 |

| Bauer, 1990 [33] | Labor, capital (flight equipment and landing fees), energy cost (quantity of fuel), and materials cost (advertising, insurance, commissions, and passenger meals) | Revenue passenger ton miles and revenue cargo ton miles | 12 U.S. airlines between 1970 and 1981 |

| Cornwell et al., 1990 [34] | Capital, labor, energy, and materials | Available ton miles, average stage length, and service quality | 8 U.S. airlines from 1970 to 1981 |

| Schefczyk, 1993 [35] | Available ton kilometers, facilities, affiliated companies, current asset, labor, aircraft fuel, and commission to agents | Revenue passenger kilometers, non-passenger revenue (cargo), and other revenue | 15 airlines from 1989 to 1992 |

| Good, Nadiri, Roller, and Sickles, 1993 [36] | Labor, energy/materials, and aircraft fleet | Passenger revenues, revenue ton kilometers (RTK), and incidental services | Four European airlines and eight U.S. airlines |

| Baltagi et al., 1995 [37] | Labor, fuel, and materials, | Points served, average stage length, and technical change (load factor and fuel efficiency) | 24 U.S. airlines from 1971 to 1986 |

| Good et al., 1995 [38] | Labor cost, fuel cost, materials cost, and flight equipment cost | Revenue passenger ton kilometers, revenue cargo ton kilometers, and incidental services revenue | 16 European and U.S. airlines from 1976 to 86 |

| Ray and Mukherjee, 1996 [39] | Labor, fuel, materials, flight equipment, and ground equipment | Load factor, points served, and average stage length | 21 U.S. airlines from 1983 to 1984 |

| Alam and Sickles, 1998 [9] | Flight capital (number of planes), labor (pilots, flight attendants, mechanics, and ground handlers), and gallons of aircraft fuel and materials (supplies, outside services, and non-flight capital) | Revenue ton miles (RTM), aircraft stage length, load factor, average size of the carrier’s aircraft, and percentage of a carrier’s fleet | 11 U.S. airlines from 1970 to 1990 |

| Coelli et al., 1999 [10] | Labor input (cockpit crew and flight attendant) and capital input (sum of the maximum take-off weights of all aircraft multiplied by the number of operation days) | Passenger and cargo ton kilometers available, average stage length, average load factor, and average aircraft size | 32 airlines from 1977 to 1990 (from different regions) |

| Forsyth, 2001 [40] | Employees, fuel, capital expenditure deflated by capital equipment price, and other materials | Revenue passenger kilometers (RPK) and total revenue deflated by price index | Australian domestic airlines |

| Sickles et al., 2002 [24] | Flight capital (number of planes), labor (pilots, flight attendants, mechanics, and passenger and aircraft handlers), energy (gallons of aircraft fuel), and materials (supplies, outside services, and non-flight capital) | Revenue ton miles (RTM), average stage length, average load factor, and average aircraft size | 16 European airlines from 1977 to 1990 |

| Oum, Fu, and Yu, 2005 [11] | Labor, fuel, materials, flight equipment, and ground property and equipment | Scheduled passenger service, scheduled freight service, mail service, non-scheduled passenger and freight services, and incidental services output | 10 Airlines in North America from 1990–2000 |

| Chiou and Chen, 2006 [12] | Fuel cost, personnel cost, and aircraft cost | Number of flights, seat-mile, passenger mile, and embarkation passengers | 15 Taiwanese air routes in 2001 |

| Färe, Grosskopt and Sickles, 2007 [41] | Multilateral labor index, fuel, fleet index adjusted for aircraft size and age, and material input | Revenue passenger miles (RPM) (scheduled) and revenue ton miles (RTM) (cargo and nonscheduled) | 13 U.S. airlines from 1979–1994 |

| Barbot et al., 2008 [25] | Labor (number of core business workers), fleet (number of operated aircraft), and fuel (in gallons consumed) | Available seat kilometers (ASK), revenue passenger kilometers (RPK), and revenue ton kilometers (RTK) | 49 airlines in 2005 |

| Greer, 2008 [42] | Full-time equivalent employees (FTEs) and fuel (in gallons consumed) | Seating capacity and available seat miles (ASM) | 8 U.S. airlines in 2000 and 2004 |

| Bhadra, 2009 [43] | Jet fuel, full time employees (FTEs), ratio of flight stage miles to trip stage miles, utilization of aircraft, number of seats per aircraft, and number of aircraft | Available seat miles (ASM) | 13 U.S. airlines from 1985 to 2006 |

| Greer, 2009 [44] | Labor, fuel, and fleet-wide seating capacity | Available seat miles (ASM) | 17 Major U.S. airlines from 1999 to 2008 |

| Barros and Peypoch, 2009 [13] | Number of employees, operational cost, and number of planes | Operating revenue passenger kilometers and EBIT | 27 European airlines from 2000 to 2005 |

| Assaf, 2009 [45] | Total operational cost, labor cost, aircraft fuel and oil expenses, number of planes, and load factor | Total operating revenues | 12 U.S. airlines from 2006 to 2007 |

| Hong and Zhang, 2010 [46] | Labor and capital | Total revenue, revenue passenger kilometers (RPK), and freight revenue ton kilometers (RTK) | 29 airlines from 1998 to 2002 |

| Ouellette et al., 2010 [47] | Labor, fuel, and materials | Passenger–freight ton kilometers | 7 Canadian airlines from 1960 to 1999 |

| Brits, 2010 [48] | Employees, fuel, capital, and materials | Passenger ton kilometers (PTK), freight ton kilometers (FTK), and postage ton kilometers (postage TK) | South African airlines (years unidentified) |

| Zhu, 2011 [49] | Cost per ASM, labor cost, fuel expense, and gallons of fuel used | Load factor, fleet size, revenue passenger miles (RPM), and passenger revenue | 21 U.S. airlines from 2007 to 2008 |

| Merkert and Hensher, 2011 [50] | Labor cost (FTE), available ton kilometers (ATK), full-time equivalent (FTE) price, and ATK price | Revenue passenger kilometers (RPK) and revenue ton kilometers (RTK) | 58 international airlines from 2007 to 2009 |

| Wang et al., 2011 [51] | Number of employees, fuel expense, and number of aircraft in service | Available seat miles (ASM), revenue passenger miles (RPM), and non-passenger revenue | 22 U.S. carriers and 8 non-U.S. airlines in 2006 |

| Gramani, 2012 [52] | Aircraft fuel, wages, salaries, benefits, and cost per available seat mile (CASM) | Revenue passenger mile (RPM) and flight revenue | 2 Brazilian and 2 American airlines 1997–2006 |

| Assaf and Josiassen, 2012 [53] | Labor, capital, fuel, and other operating inputs (salaries, benefits, and capital cost) | Revenue passenger kilometers (RPKs), incidental revenues (nonairline revenues), and purchasing power parity (PPP) index | 31 airlines in Europe, U.S., and Canada |

| Barros et al., 2013 [54] | Total cost, number of employees, and number of gallons | Total revenue, revenue passenger mile (RPM), load factor | 11 U.S. airlines from 1998 to 2010 |

| Barros and Couto, 2013 [55] | Number of employees, operational cost, and number of seats available | Revenue by passenger kilometers, and revenue cargo ton of freight carried | 23 European airlines from 2000 to 2011 |

| Rai, 2013 [56] | Number of planes, number of employees, and gallons of fuel consumed | Revenue passenger miles (RPM), number of departures, number of passengers, and available ton miles (ATM) | 10 U.S. airlines from 1986 to 1995 |

| Lee and Worthington, 2014 [57] | Kilometers flown, number of employees, total assets, ownership, departures, and weighted load factor | Available ton kilometers (ATK) | 42 airlines in Asia, Europe, and North America in 2006 |

| Arjomandi and Seufert, 2014 [18] | Number of full-time equivalent employees and number of flying hours divided by average daily revenue hours | The number of tons available for revenue load (pax, cargo, and mail) on each flight multiplied by the flight distance, and CO2 emissions | 48 of the world’s major full-service and low-cost carriers from six different regions over the period 2007–2010 |

| Cao, Lv, and Zhang, 2014 [58] | Labor, fuel, and number of aircraft | Total flights and revenue–ton kilometers (RTM) of passengers and freight | China’s airlines from 2005–2009 |

| Lozano and Gutiérrez, 2014 [59] | Fuel cost, non-current assets, wages and salaries, other operating costs, and selling costs | Available seat kilometers (ASK), available ton kilometers (ATK) (intermediate outputs), revenue passenger kilometers (RPK), and revenue ton kilometers (RTK) | 16 European airlines in 2007 |

| Wu and Liao, 2014 [28] | Material, energy, capital, and passenger, labor | Operating revenue, return on asset (ROA), return on investment (ROI), and net income (NI) | 38 international airlines in 2010 |

| Tavassoli, Faramarzi, and Saen, 2014 [29] | Number of passenger planes, labor, and number of cargo planes | Passenger–plane kilometers and cargo–plane kilometers (intermediate outputs); passenger kilometers and ton kilometers (final outputs) | 11 domestic airlines in Iran in 2010 |

| Lu et al., 2012 [26] | Employees (FTEs), fuel consumed, seating capacity, flight equipment, maintenance expense, and ground property and equipment | Revenue passenger miles (RPMs) and non-passenger revenue (NPR) | 30 U.S. airlines in 2010 |

| Cui and Li, 2015 [17] | Number of employees, capital stock, and tons of aviation kerosene | Revenue ton kilometers (RTK), revenue passenger kilometers (RPK), total business income, and CO2 emissions | 11 airlines in Asia, Europe, and North America from 2008–2012 |

| Marti et al., 2015 [60] | Labor costs, assets, and supplies | Operating revenue | 28 airlines in Europe in 2010 |

| Barros and Wanke, 2015 [61] | Number of employees, number of aircraft, and operating costs | Revenue ton kilometers (RTK) and revenue passenger kilometers (RPK) | 29 African airlines from 2010 to 2013 |

| Choi, Lee, and Olson, 2015 [62] | Employees number and available seat miles (ASM) | Service quality index, revenue passenger miles (RPM), and operating revenue | 12 U.S. airlines from 2008 to 2011 |

| Cui et al., 2016 [19] | Number of employees and aviation kerosene | Revenue ton kilometers (RTK), revenue passenger kilometers (RPK), and total business income (TBI). | 21 airlines in Asia, Europe, and North America |

| Kottas and Madas, 2018 [14] | Number of employees, operating costs, and number of operated aircraft, | Total operating revenue, revenue passenger kilometers (RPK), and revenue ton kilometers (RTK) | 6 U.S. airlines, 9 European airlines, and 15 Asia Pacific airlines from 2010–2016 |

| Sakthidharan and Sivaraman, 2018 [63] | Available ton kilometers (ATK), cost per available seat kilometers (CASK), fuel per ASK, CASK ex-fuel, maintenance cost per ASK, ownership per ASK, and number of employees | Revenue passenger kilometers (RPK) and freight ton kilometers (FTK) | 5 Indian airlines from 2013–2014 |

| Li and Cui 2018 [4] | Number of employees, aviation kerosene, fleet size, and sale costs | Available seat kilometers (ASK), revenue passenger kilometers (RPK), and total revenue | 29 global airlines from 2008 to 2015 |

| Cui and Li, 2018 [20] | Number of employees and aviation kerosene | Total revenue, greenhouse gases emissions, dynamic factors, and fleet size | 29 global airlines from 2009 to 2015 |

| Hermoso et al., 2019 [64] | Number of employees, total assets, destinations, degree, eigencentrality, tweets, publication, and number of videos | Sales, passengers, liked Twitter, liked Facebook, and views | 43 European airlines in 2014 |

| Mhlanga, 2019 [15] | Number of employees, available seat kilometers, operating expense, and employee expenditure | Revenue passenger kilometers (RPK) and operating revenue | 10 African airline from 2012–2016 |

| Heydari et al., 2020 [16] | Number of employees, available seat kilometers (ASK), available ton kilometers (ATK), and number of scheduled flights | Passenger kilometers performed (PKP) and ton kilometers performed (TKP) | 124 Iranian airlines in 2014 |

| Yen et al., 2022 [27] | Flight frequency, aircraft size, and fuel consumption | Passenger load factor and revenue per available seat kilometer (RASK) | Two Taiwanese airlines operating 112 international routes |

| Saini et al., 2023 [21] | Fuel consumption, number of employees, and operating expenses | Revenue passenger kilometers (RPK), available seat kilometers (ASK), and environmental performance indicators (CO2 emissions) | 13 global airlines from 2013–2015 |

| Voltes-Dorta et al., 2024 [23] | Operational costs, fuel consumption, and labor costs | Revenue passenger kilometers (RPK) and environmental and social sustainability scores | 34 global airlines from 2019 and 2022 |

| Yang et al. (2024) [22] | Fuel consumption, labor hours, and number of aircraft | Revenue passenger kilometers (RPK), customer satisfaction scores, and CO2 emissions | Iranian airlines in 2022 |

| Input Variables | Output Variables | |

|---|---|---|

| Model 1: pilot efficiency |

|

|

| Model 2: flight attendant efficiency |

|

|

| Model 3: ground staff efficiency |

|

|

| Model 4: maintenance staff efficiency |

|

|

| Model 5: management staff efficiency |

|

|

| Airlines | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| American | 22.83 | 23.70 | 19.90 | 22.15 | 23.96 | 24.83 | 25.76 | 27.14 | 41.08 | 40.42 | 42.20 | 44.53 | 45.76 | 17.34 |

| Continental | 14.11 | 15.03 | 12.36 | 14.01 | 16.17 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Delta | 19.24 | 20.97 | 18.05 | 31.89 | 35.32 | 36.92 | 37.82 | 40.43 | 40.82 | 39.85 | 41.48 | 44.54 | 47.13 | 17.12 |

| Northwest | 12.73 | 14.10 | 10.86 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| United | 20.05 | 20.24 | 16.36 | 19.68 | 21.16 | 37.16 | 38.29 | 38.90 | 37.86 | 36.56 | 37.74 | 41.30 | 43.26 | 15.36 |

| U.S. Airways | 12.05 | 12.46 | 10.78 | 12.20 | 13.34 | 14.12 | 14.94 | 15.75 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| America West | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

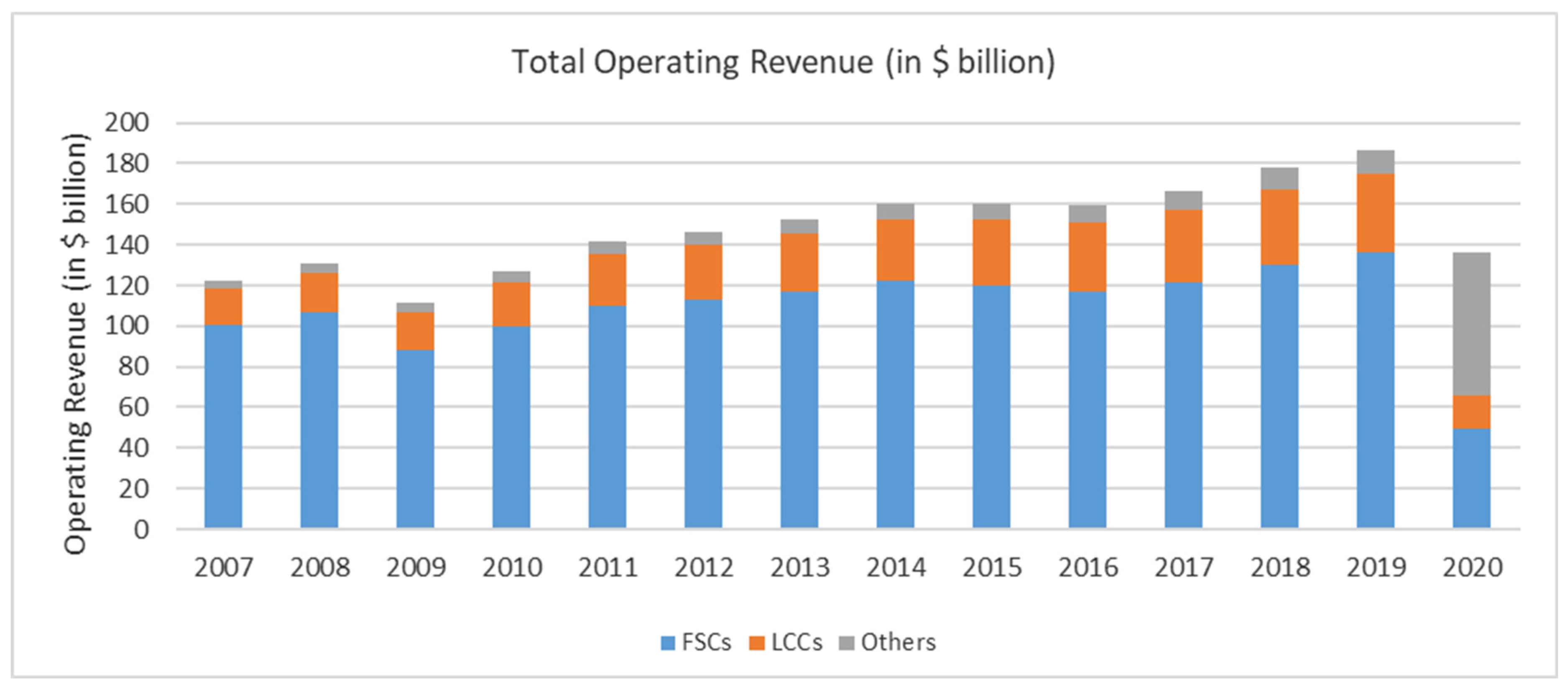

| FSCs | 101.02 | 106.49 | 88.31 | 99.93 | 109.94 | 113.02 | 116.80 | 122.22 | 119.76 | 116.83 | 121.41 | 130.37 | 136.15 | 49.81 |

| Southwest | 9.86 | 11.02 | 10.35 | 12.10 | 13.65 | 17.09 | 17.70 | 18.61 | 19.82 | 20.43 | 21.17 | 21.97 | 22.43 | 9.05 |

| jetBlue | 2.84 | 3.39 | 3.29 | 3.78 | 4.51 | 4.98 | 5.44 | 5.82 | 6.42 | 6.63 | 7.02 | 7.66 | 8.09 | 2.96 |

| AirTran | 2.31 | 2.55 | 2.34 | 2.62 | 2.94 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Frontier | 1.33 | 1.37 | 1.11 | 1.32 | 1.66 | 1.43 | 1.35 | 1.57 | 1.60 | 1.71 | 1.91 | 2.16 | 2.51 | 1.25 |

| Virgin America | 0.02 | 0.37 | 0.55 | 0.72 | 1.04 | 1.33 | 1.42 | 1.49 | 1.53 | 1.66 | 1.64 | 0.00 | 0.00 | 0.00 |

| Spirit | 0.76 | 0.79 | 0.70 | 0.78 | 1.07 | 1.32 | 1.65 | 1.93 | 2.14 | 2.32 | 2.65 | 3.32 | 3.83 | 1.81 |

| Allegiant | 0.34 | 0.48 | 0.54 | 0.64 | 0.75 | 0.87 | 0.96 | 1.10 | 1.22 | 1.32 | 1.44 | 1.60 | 1.75 | 0.93 |

| LCCs | 17.46 | 19.98 | 18.88 | 21.96 | 25.62 | 27.02 | 28.53 | 30.52 | 32.73 | 34.08 | 35.83 | 36.70 | 38.61 | 15.99 |

| Alaska | 3.08 | 3.22 | 3.01 | 3.43 | 4.31 | 4.65 | 5.15 | 5.36 | 5.59 | 5.83 | 6.29 | 8.26 | 8.77 | 3.56 |

| Hawaiian | 0.98 | 1.21 | 1.18 | 1.31 | 1.65 | 1.96 | 2.16 | 2.31 | 2.31 | 2.44 | 2.69 | 2.83 | 2.83 | 0.84 |

| Others | 4.06 | 4.43 | 4.19 | 4.74 | 5.96 | 6.61 | 7.31 | 7.67 | 7.91 | 8.27 | 8.98 | 11.09 | 11.60 | 4.41 |

| Total All Sectors | 122.54 | 130.91 | 111.37 | 126.63 | 141.53 | 146.66 | 152.63 | 160.41 | 160.40 | 159.17 | 166.22 | 178.16 | 186.36 | 70.21 |

| Airlines | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| American | 71,818 | 70,925 | 66,519 | 65,506 | 66,522 | 64,529 | 59,532 | 61,527 | 98,885 | 101,504 | 103,101 | 102,942 | 104,216 | 78,309 |

| Continental | 40,948 | 40,630 | 38,720 | 37,760 | 36,797 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Delta | 47,286 | 47,420 | 46,372 | 76,742 | 80,158 | 78,498 | 75,918 | 77,928 | 82,000 | 83,974 | 85,987 | 88,243 | 89,758 | 66,444 |

| Northwest | 29,619 | 29,124 | 29,828 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| United | 55,160 | 51,536 | 46,587 | 46,060 | 46,491 | 87,966 | 87,405 | 84,472 | 84,228 | 88,814 | 85,644 | 86,641 | 90,116 | 69,277 |

| USAirways | 34,256 | 32,683 | 31,340 | 30,876 | 31,551 | 31,241 | 32,132 | 32,843 | 0 | 0 | 0 | 0 | 0 | 0 |

| Subtotal—FSCs | 279,087 | 272,318 | 259,366 | 256,944 | 261,519 | 262,234 | 254,987 | 256,770 | 265,113 | 274,292 | 274,732 | 277,826 | 284,090 | 214,030 |

| Southwest | 33,680 | 34,680 | 34,874 | 34,230 | 36,104 | 43,840 | 42,955 | 44,169 | 47,395 | 51,037 | 54,815 | 56,262 | 58,263 | 52,199 |

| jetBlue | 9713 | 10,177 | 10,583 | 11,211 | 11,749 | 12,345 | 12,778 | 13,387 | 14,432 | 15,611 | 16,998 | 17,681 | 18,397 | 16,005 |

| AirTran | 8304 | 8259 | 8220 | 8229 | 7751 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Frontier | 5219 | 4939 | 4774 | 4309 | 4286 | 4422 | 3384 | 3932 | 2979 | 3412 | 3844 | 4234 | 4964 | 5005 |

| Virgin America | 0 | 980 | 1421 | 1770 | 2115 | 2381 | 2481 | 2489 | 2656 | 2934 | 3206 | 0 | 0 | 0 |

| Spirit | 2145 | 2410 | 1901 | 2351 | 2501 | 3725 | 3764 | 4164 | 4833 | 5756 | 7104 | 8381 | 9006 | 9175 |

| Allegiant | 1133 | 1330 | 1533 | 1585 | 1571 | 1799 | 1978 | 1938 | 2546 | 3146 | 3433 | 3904 | 4140 | 3953 |

| Subtotal—LCCs | 60,194 | 62,775 | 63,306 | 63,685 | 66,077 | 68,512 | 67,340 | 70,079 | 74,841 | 81,896 | 89,400 | 90,462 | 94,770 | 86,337 |

| Alaska | 9680 | 9628 | 8912 | 8649 | 8917 | 9176 | 9489 | 10,471 | 11,614 | 12,225 | 13,896 | 17,520 | 17,919 | 16,643 |

| Hawaiian | 3315 | 0 | 3635 | 3802 | 4265 | 4863 | 5251 | 5368 | 5520 | 6160 | 6661 | 7291 | 7458 | 5080 |

| Subtotal—Others | 12,995 | 9628 | 12,547 | 12,451 | 13,182 | 14,039 | 14,740 | 15,839 | 17,134 | 18,385 | 20,557 | 24,811 | 25,377 | 21,723 |

| Total All Sectors | 352,276 | 344,721 | 335,219 | 333,080 | 340,778 | 344,785 | 337,067 | 342,688 | 357,088 | 374,573 | 384,689 | 393,099 | 404,237 | 322,090 |

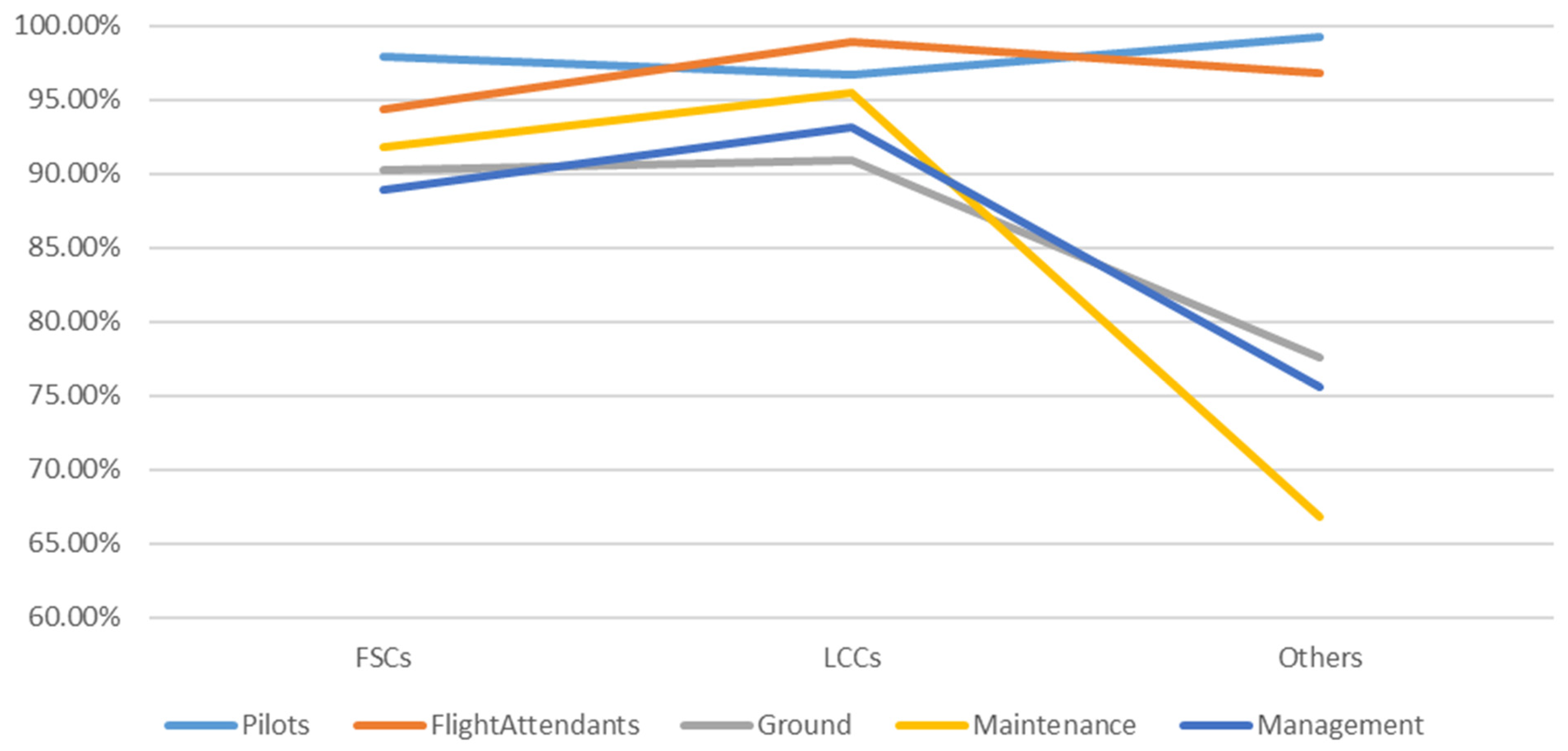

| Employee Type | Kruskal–Wallis H Test Statistic | p-Value | Pairwise Comparison | ||

|---|---|---|---|---|---|

| Pilots | 4.662 | 0.097 | N/A | ||

| Flight attendants | 11.04 | 0.004 ** | Pairs | Test Statistic | Sig. |

| FSCs–Others | −7.565 | 0.353 | |||

| FSCs–LCCs | −19.434 | 0.001 | |||

| LCCs–Others | 11.869 | 0.125 | |||

| Ground staff | 12.95 | 0.002 ** | Pairs | Test Statistic | Sig. |

| FSCs–Others | 26.738 | 0.011 | |||

| LCCs–Others | 35.968 | 0.000 | |||

| FSCs–LCCs | −9.230 | 0.228 | |||

| Maintenance staff | 59.93 | 0.000 ** | Pairs | Test Statistic | Sig. |

| FSCs–Others | 50.109 | 0.000 | |||

| LCCs–Others | 68.162 | 0.000 | |||

| FSCs–LCCs | −18.053 | 0.007 | |||

| Management staff | 33.81 | 0.000 ** | Pairs | Test Statistic | Sig. |

| FSCs–Others | 42.755 | 0.000 | |||

| LCCs–Others | 57.382 | 0.000 | |||

| FSCs–LCCs | −14.628 | 0.053 | |||

| Employee Type | Airline | Output Variables | Actual | Target | Potential Improvement |

|---|---|---|---|---|---|

| Pilots efficiency | jet Blue—84.6% | Available seat miles | 25,518 | 30,165.2 | 18.21% |

| Revenue passenger miles | 14,245 | 19,437.5 | 36.45% | ||

| Total passenger revenue | 1819 | 2150.3 | 18.21% | ||

| Flight attendant efficiency | jetBlue—90.4% | Available seat miles | 25,518 | 28,241.0 | 10.67% |

| Revenue passenger miles | 14,245 | 15,765.1 | 10.67% | ||

| Total passenger revenue | 1819 | 2013.1 | 10.67% | ||

| Ground staff efficiency | United—75.9% | Available seat miles | 60,868 | 80,244.6 | 31.83% |

| Revenue passenger miles | 38,273 | 52,737.1 | 37.79% | ||

| Total passenger revenue | 4804 | 6592.3 | 37.23% | ||

| jetBlue—80.4% | Available seat miles | 25,518 | 43,188.5 | 69.25% | |

| Revenue passenger miles | 14,245 | 25,850.1 | 81.47% | ||

| Total passenger revenue | 1819 | 2263.6 | 24.44% | ||

| Hawaiian—38.5% | Available seat miles | 5946 | 30,367.9 | 410.73% | |

| Revenue passenger miles | 3398 | 19,892.8 | 485.43% | ||

| Total passenger revenue | 467 | 1212.6 | 159.66% | ||

| Alaska—92.9% | Available seat miles | 29,282 | 42,002.5 | 43.44% | |

| Revenue passenger miles | 16,110 | 25,299.0 | 57.04% | ||

| Total passenger revenue | 2013 | 2166.4 | 7.62% | ||

| Maintenance staff efficiency | United—88.34% | Available seat miles | 60,868 | 80,845.5 | 32.82% |

| Revenue passenger miles | 38,273 | 43,323.2 | 13.20% | ||

| Total passenger revenue | 4804 | 6091.2 | 26.80% | ||

| Alaska—85.9% | Available seat miles | 29,282 | 38,807.6 | 32.53% | |

| Revenue passenger miles | 16,110 | 21,982.1 | 36.45% | ||

| Total passenger revenue | 2013 | 2343.5 | 16.42% | ||

| Hawaiian—37.77% | Available seat miles | 5946 | 20,989.8 | 253.01% | |

| Revenue passenger miles | 3398 | 12,613.3 | 271.20% | ||

| Total passenger revenue | 467 | 1236.4 | 164.75% | ||

| Management staff efficiency | jetBlue—79.85% | Available seat miles | 25,518 | 34,889.7 | 36.73% |

| Revenue passenger miles | 14,245 | 18,959.1 | 33.09% | ||

| Total passenger revenue | 1819 | 2278.1 | 25.24% | ||

| Alaska—77.63% | Available seat miles | 29,282 | 39,292.4 | 34.19% | |

| Revenue passenger miles | 16,110 | 21,205.0 | 31.63% | ||

| Total passenger revenue | 2013 | 2593.2 | 28.82% | ||

| Hawaiian—42.53% | Available seat miles | 5946 | 18,403.5 | 209.51% | |

| Revenue passenger miles | 3398 | 10,549.2 | 210.45% | ||

| Total passenger revenue | 467 | 1098.2 | 135.16% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Truong, D. Assessing the Economic Sustainability of Airlines in the U.S. Through Labor Efficiency. Sustainability 2025, 17, 4468. https://doi.org/10.3390/su17104468

Truong D. Assessing the Economic Sustainability of Airlines in the U.S. Through Labor Efficiency. Sustainability. 2025; 17(10):4468. https://doi.org/10.3390/su17104468

Chicago/Turabian StyleTruong, Dothang. 2025. "Assessing the Economic Sustainability of Airlines in the U.S. Through Labor Efficiency" Sustainability 17, no. 10: 4468. https://doi.org/10.3390/su17104468

APA StyleTruong, D. (2025). Assessing the Economic Sustainability of Airlines in the U.S. Through Labor Efficiency. Sustainability, 17(10), 4468. https://doi.org/10.3390/su17104468