Abstract

The construction industry’s small and medium-sized enterprises (SMEs) face significant financial difficulties, exacerbated by disruptions such as COVID-19. Traditional supply chain finance models, relying on core enterprise credit, fail to address the dynamic nature of this sector. This study proposes a novel approach to value co-creation among stakeholders through an evolutionary game theory framework. A stochastic model was developed to examine the strategic decisions of these parties, considering risk, penalty, and incentive coefficients. The results reveal that higher incentives encourage faster participation, while financial institutions are less sensitive to risk and penalty changes. This study provides new insights into promoting cooperative behavior and enhancing the sustainability of small and medium-sized enterprises (SMEs) in the construction industry through platform-based models.

1. Introduction

In recent years, the construction supply chain has faced significant challenges, particularly due to disruptions caused by unforeseen events, such as COVID-19. The construction industry, characterized by long project cycles, high capital intensity, and multi-tier subcontracting structures, faces unique liquidity challenges. According to Bloomberg, the average accounts receivable turnover period for construction companies in 2024 was expected to be as long as 82 days, compared to an average of only 66 days for other industries. According to the ACS Group’s 2020 financial report, due to project delays and delayed payments from owners, ACS’s accounts receivable days surged from 78 days in 2019 to 112 days in 2020 [1]. This resulted in ACS (Madrid, Spain) issuing high-interest bonds, escalating annual financing costs. Subcontractors were also forced to procure building materials due to delayed payments, while several secondary suppliers in Latin America filed for bankruptcy due to disrupted cash flow. With the presence of a multi-party financial data-sharing and dynamic risk-control platform, ACS could have been alerted to owner payment risks in advance, enabling financial institutions to provide transitional financing.

Although supply chain finance is widely regarded as a tool to alleviate financial crises for enterprises [2], the applicability of traditional supply chain finance models in the construction industry is significantly limited. The traditional supply chain finance model involves small and medium-sized enterprises (SMEs), core enterprises, financial institutions, and third-party logistics companies forming a complete supply chain, with the core enterprise at the center. Financial institutions manage the “three flows in one”—the flow of funds, information, and logistics—while collaborating with third-party logistics providers to offer financial services for the entire construction supply chain. While this model integrates resources effectively, it still faces several issues: First, the reverse factoring model, dominated by core enterprises, relies heavily on a single credit anchor, meaning financial institutions primarily depend on the creditworthiness of the core enterprise to provide financing support to upstream and downstream suppliers [3]. The basic logic of reverse factoring is that suppliers can obtain funds in advance through the guarantee of the core enterprise [4]. However, this model is overly dependent on the credit situation of the core enterprise. If the core enterprise’s financial condition changes (e.g., cash shortages, delayed payments, or bankruptcy), the stability of the entire financing chain is jeopardized, leading to increased financing difficulties for downstream suppliers or contractors. Secondly, the dynamic nature of construction projects (e.g., design changes and phased payments) and their long cycles make it difficult for traditional risk-control models to track risks in real time [5]. If a supplier’s receivables become overdue due to project delays, financial institutions must spend weeks reassessing the value of collateral, thereby increasing the risk of a liquidity breakdown. These limitations suggest that financial models relying solely on one-way credit output from the core enterprise are not well-suited to the complex and dynamic collaborative network of the construction industry.

Existing research on construction supply chain finance has primarily focused on credit risk assessments [6,7,8], neglecting a key issue: how to reconstruct a risk-sharing mechanism through multi-party collaborations to achieve value co-creation during liquidity crises. While some scholars suggest that introducing a supply chain finance platform can enhance information transparency and promote collaborations among parties [9], their analysis does not thoroughly explore how the introduction of supply chain platforms alters the collaboration rules among participants. For example, after the introduction of a construction supply chain finance platform, what actions should be taken to enable core enterprises and suppliers to accumulate cross-project credit, such that financial institutions would be willing to provide financing even without endorsements from higher-level enterprises? This would transform the collaboration between financial institutions, core enterprises, and suppliers from short-term to sustained, thereby creating greater value for future projects. This study establishes a construction supply chain finance platform, linking stakeholders, such as financial institutions, core construction enterprises, and suppliers, and discusses, from the perspective of evolutionary game theory, how to incentivize all parties to participate in value co-creation within construction projects and the industry. By transforming the traditional zero-sum game into a symbiotic relationship based on risk-sharing and information exchange, this research offers a new paradigm for addressing the complex dilemmas in the construction industry.

Through numerical simulations, we quantitatively analyzed how changes in key parameters affect the strategic decisions of participants regarding value co-creation. The results indicate that higher incentive coefficients prompt all parties to make quicker decisions to engage in value co-creation. Core enterprises, suppliers, and finance platforms are more sensitive to changes in risk coefficients, with higher risk coefficients discouraging their participation in value co-creation. In contrast, cooperative funding parties are more cautious when the potential losses from non-participation deviate significantly from the average. They are less sensitive to changes in risk and punishment coefficients. Additionally, while the finance platform and core enterprises are less responsive to changes in punishment and loss coefficients, higher values for these coefficients accelerate their participation in value co-creation.

This study begins by analyzing the key stakeholders involved in value co-creation decisions within the construction supply chain finance model. It then incorporates stochastic factors and develops a three-party evolutionary game model to examine value co-creation decisions in this context, followed by a stability analysis of the model. Finally, numerical simulations are conducted using the Matlab R2023b platform to assess how key coefficients in the construction supply chain finance model affect the value co-creation decisions of the three parties. The findings of this research address a gap in the existing literature on value co-creation within the construction supply chain finance field and provide a new perspective and framework for game-theoretic analysis in supply chain finance. Practically, this study offers valuable insights to guide decision-making for stakeholders in construction supply chain finance.

2. Literature Review

2.1. Construction Supply Chain Finance

Supply chain finance is a business model in which core enterprises use their creditworthiness to provide guarantees for small and medium-sized financing enterprises within the upstream and downstream segments of the supply chain. Based on credit enhancement, this model integrates commercial flow, logistics, information flow, and cash flow, thereby promoting collaborative operations across the entire supply chain. It can alleviate the financing difficulties faced by small and medium-sized construction enterprises. Currently, there is limited research on construction supply chain finance, so we combined research methods from supply chain finance in the manufacturing industry with the unique characteristics of the construction sector for analysis.

At present, research on supply chain finance primarily focuses on the role of financial services within the supply chain [10]. Houston et al. (2016) [11] analyzed the supply chain relationships of bankrupt companies from 1990 to 2009 and found that after a customer company declared bankruptcy, the borrowing costs for its main suppliers significantly increased. This study acknowledges the importance of establishing a reasonable supply chain finance model. Financial services in the supply chain typically operate through electronic platforms. Yu et al. (2021) [12] used a peak-over-threshold (POT) model and found that supply chains on e-commerce platforms based on Internet of Things (IoT) technology suffered less risk of loss, providing insights into establishing supply chain finance platforms. Supply chain finance presents a clear game-theory characteristic [13]. In the research process for establishing supply chain finance platforms, scholars have focused on the equilibrium dynamics of the main stakeholders in the supply chain finance credit market [14]. They applied game theory to design strategies for managing systemic risks, ensuring the sustainable development of stakeholder relationships under this model. Yan (2021) [15] and others used game theory to demonstrate the viability of the accounts receivable pledge financing model in supply chain finance, emphasizing that the involvement of core enterprises enhances the credibility of accounts receivable. Xue (2024) [16] and others used the Stackelberg theory to construct a game model for a dual-channel closed-loop supply chain consisting of manufacturers and retailers.

Current research on stakeholder relationships in supply chain finance primarily employs principal–agent theory and evolutionary game theory methods. However, these approaches have limitations: principal–agent theory assumes participants are perfectly rational and that information is symmetric, which significantly contradicts the realities of supply chain finance. Evolutionary game theory analyzes long-term strategies through group strategy evolution, but due to the long construction cycle and high capital intensity of construction projects, numerous unforeseen events influence participants’ decisions. Furthermore, evolutionary game theory ignores the impact of random disturbances. Additionally, the construction supply chain involves many participants, leading to an exponential increase in the dimensionality of strategic interactions, making the solution for Evolutionarily Stable Strategies (ESSs) potentially infeasible. Therefore, this paper introduces random perturbations and improves traditional evolutionary game methods to make the model setup more aligned with real-world conditions.

2.2. Construction Project Stakeholders in the Construction Supply Chain Finance Model

In the construction supply chain finance model, the value of a construction project is created by its participants [17]. The value of an engineering project is a multifaceted concept that includes both tangible values [18] (such as economic value) and intangible values [19] (such as long-term social benefits [20], corporate reputation, knowledge advantage, public value, etc.). Value is a subjective concept [21] and is not absolute; different stakeholders perceive and recognize value differently. Therefore, understanding value requires considering the perspectives of various stakeholders.

Currently, construction industry supply chain finance platforms are predominantly led by large construction enterprises [22], focusing mainly on the needs of core construction enterprises, with less consideration given to small and medium-sized construction enterprises and financial institutions—the primary participants in construction supply chain finance activities. Since trust between unfamiliar parties is often weak, they typically conduct credit risk assessments on small and medium-sized enterprises (SMEs) that need financing. For example, Pavlenko and Chernyak (2010) [23] demonstrated how to use probabilistic graphs to model and assess credit concentration risks. While this method offers high accuracy in credit risk assessments, it requires higher modeling skills to determine appropriate model parameters and network topology. Zhang et al. (2014) [24] proposed a multi-criteria optimization classifier based on kernel, fuzzification, and penalty factors, which can solve a convex quadratic programming problem but incurs high computational costs in practice. Therefore, Zhang et al. (2016) [25] developed a comprehensive method for credit risk assessments based on dynamic incentives, which evaluates a company’s financial situation by considering dynamic data and the credit evolution history. However, this approach does not address the timeliness of information, and financing participants still focus on the singular relationship between the borrower and the lender.

With the advancement of information technology, supply chain finance activities have gradually shifted from offline to online, giving rise to online financial platforms. The establishment of these platforms often incorporates blockchain technology to enhance transparency and automation in transactions [26], which helps address credit issues to some extent [27]. Scholars have turned their attention to how emerging technologies (such as big data and IoT technologies) can improve the security and reliability of blockchain [28] and how to incentivize stakeholders to upload more accurate and reliable data, thus reducing project costs and enhancing the value of the entire project and society [29]. Currently, construction industry supply chain finance platforms are mostly led by large construction enterprises [22], primarily focusing on the needs of core construction enterprises, with less consideration given to small and medium-sized construction enterprises and financial institutions—the main participants in construction supply chain finance activities.

Therefore, this paper emphasizes the regulatory role of construction supply chain finance platforms, which possess both reward and penalty functions. It views the main financing demand subjects—the core construction enterprises and suppliers—as a unified whole, weakening the influence of large construction enterprises on financial platform decision-making. As a result, the value co-creation decision-making process among the construction supply chain finance platform, core construction enterprises, suppliers, and cooperating financial institutions will be considered, which will be elaborated on in the next section.

2.3. The Value Co-Creation Process Under the Construction Supply Chain Finance Model

The theory of value co-creation has evolved from product-dominant logic to service-dominant logic and eventually to customer-dominant logic [30]. With the development of internet technologies, the theory of value co-creation within platform ecosystems has emerged, and academic research has increasingly focused on value co-creation in these ecosystems.

In the construction industry, there is no widely recognized method for quantifying the value co-creation process. However, this process can be analyzed by drawing on research from the retail and manufacturing sectors related to value co-creation. Companies within the supply chain, due to perceived capital pressure, order fulfillment cycles and inventory cycles [31] and adopt supply chain finance products to transfer the credit of the core enterprise upstream and downstream. While this alleviates the liquidity pressure on small and medium-sized enterprises (SMEs) in the supply chain, it also transmits risks. Xie et al. (2020) [32] found that the financing structure significantly influences the contagion effect of credit risks. Appropriate increases in bank credit and supplier credit costs can reduce this contagion effect. Banks and suppliers, which represent cooperating financial institutions and core enterprises in the later discussion, do not directly share cost information with each other. The risks arising from this situation are amplified in multi-node supply chains [33]. Therefore, Zhang et al. (2022) [34], from the perspective of value co-creation, studied the transmission of quality risks in the supply chain. They found that timely value co-creation behaviors (such as information sharing [35] and enhancing interaction and cooperation with other enterprises [36]) not only reduce risks but also create more value for the project.

Although substantial research has been accumulated in the retail and manufacturing sectors, the issue of value co-creation in the construction supply chain finance model remains an area that requires further study. The construction industry’s supply chain involves numerous nodes and extended durations. Existing research has not fully considered how risks in the supply chain affect value co-creation behaviors. Therefore, this paper models the impact of credit risk on value co-creation using a three-party stochastic evolutionary model.

3. Problem Formulations

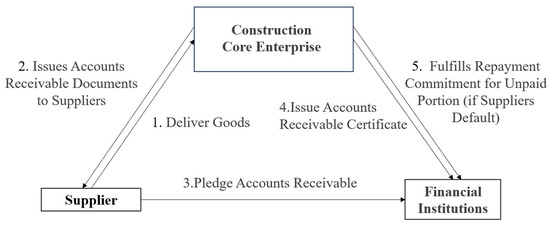

The traditional accounts receivable financing model for enterprises in the construction supply chain is shown in Figure 1. In this model, construction suppliers are located upstream in the construction supply chain, while core construction enterprises typically occupy a dominant position. When transactions occur between core enterprises and suppliers, the core enterprise often adopts a credit purchase method. In this scenario, the supplier can only sell products on credit to the core enterprise to ensure sales and avoid stagnation. This credit purchase phenomenon results in construction SMEs facing issues with the return of funds, accumulation of receivables, and insufficient cash flow to meet operational needs, leading to a demand for financing. However, due to their small scale, lack of collateralizable assets, low credit ratings, and other factors, these SMEs are unable to secure financing from financial institutions.

Figure 1.

Traditional construction supply chain accounts receivable financing model.

As a result, once a transaction is completed between a core enterprise and a supplier, the core enterprise issues an accounts receivable document to the supplier, who then pledges the document to a financial institution. If the core enterprise agrees to guarantee the financing of the SME with its creditworthiness, the core enterprise assumes the responsibility of repaying the loan on behalf of the supplier if the supplier is unable to repay. The financial institution then proceeds with the financing, and at this point, the claim of accounts receivable is transferred from the supplier to the financial institution. The core enterprise is required to repay the accounts receivable before the due date.

The traditional construction supply chain accounts receivable model, in which suppliers are forced to sell on credit, leads to the accumulation of accounts receivable. However, due to the suppliers’ lack of independent credit, reliance on corporate guarantees, and the financial institutions’ dependence on the core enterprise to extend credit, there are significant deficiencies in value co-creation. These deficiencies are primarily manifested in the following issues: information opacity and data closure between the core enterprise, supplier, and financial institution; the core enterprise provides guarantees for the supplier’s financing with its own credit, thereby bearing joint and several repayment responsibilities; the core enterprise transfers financial pressure by extending the billing period and reducing the purchase price, leaving suppliers with low profits and high financing costs; small and medium-sized suppliers rely entirely on the core enterprise’s credit during the financing process, unable to secure independent financing based on their own operational data (e.g., historical performance records and asset liquidity); and the traditional model, which relies on paper documents and manual auditing, results in a long and costly accounts receivable confirmation process.

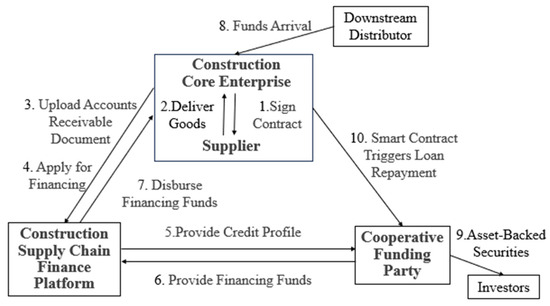

Therefore, this paper proposes an accounts receivable construction supply chain finance model based on a third-party construction supply chain finance platform, as shown in Figure 2. The construction core enterprise and suppliers form a credit and responsibility community through close collaborations, facilitated by the signing of a contract. The construction core enterprise issues electronic certificates of accounts receivable through the construction supply chain finance platform, and suppliers apply for financing on the platform using these electronic certificates. The platform integrates the core enterprise’s payment ability, the supplier’s historical fulfillment records, and industry dynamics through big data, thereby building a dynamic risk-assessment model that provides a multi-dimensional credit portrait to the cooperative funders. Through this evaluation, cooperative capital parties can offer financing with more accurate interest rates and flexible credit limits. Additionally, the core enterprise’s payment commitment and the supplier’s delivery schedule are automatically bound through smart contracts.

Figure 2.

Construction supply chain finance receivables model based on the construction supply chain finance platform.

This model treats the financing demander and the consumer—i.e., the construction supplier and core enterprise—as a unified entity connected by the payment commitment. The three parties will share the credit risk and incur additional costs by adopting the supply chain finance model. However, they have the option to participate in value co-creation (e.g., information sharing, timely repayment, and the utilization of emerging technologies to enhance the comprehensive capabilities of the enterprise and the platform) in order to obtain additional benefits and reduce costs.

Under this model, the value flow path and value co-creation mechanism for each participant are as follows: The construction supply chain financial platform utilizes emerging technologies (e.g., smart contracts) to establish a platform that enhances the transaction efficiency of each party. It collects data from each participant to establish a credit assessment model that mitigates the impact of information asymmetry. At the same time, the platform generates revenue by extracting commissions from financing transactions and attracts more participants by engaging in additional financing activities, thereby strengthening the platform’s network effect.

Cooperative funders provide continuous liquidity for the platform through long-term capital injections and information sharing. They also securitize assets through the financial platform, obtaining diversified returns and reducing the risk of default concentration. Core construction enterprises and their suppliers form a community through contracts. The suppliers obtain financing from the financial platform through the credit endorsement of the core enterprises, addressing cash flow shortages while providing goods and services on time to ensure the progress of the construction project. This timely delivery helps the core enterprise mitigate the risk of project delays due to late deliveries of materials and services by the suppliers.

Following the financial value co-creation behavior of all parties, the construction project benefits from reduced economic disputes and a lower risk of delays. This results in the acquisition of state subsidies, expedited administrative approval via a green channel, and enhanced credit scores for award-winning enterprises, which increases their likelihood of winning bids and other additional values.

3.1. Model Hypothesis

In the context of construction supply chain finance, stakeholders make dynamic decisions based on their own interests during the value co-creation process. To analyze the problem, this paper summarizes the strategy choices and basic settings of these participants:

- (1)

- The construction supply chain financial platform can choose between two strategies: “participation” and “non-participation”, with probabilities of y and 1 − y, respectively. “Participation” refers to the adoption of new technologies to improve the credibility of the financial data provided and reduce the information asymmetry dilemma among all parties. “Non-participation” means that the platform chooses not to adopt new technologies in a timely manner to optimize platform functions due to the high upfront investment costs. As a result, the platform will pay a price in terms of its reputation and other factors.

- (2)

- Construction core enterprises and suppliers can choose between two strategies: “collaboration” and “non-collaboration”, with probabilities of z and 1 − z, respectively. “Collaboration” refers to actively sharing key data, such as project progress and capital flow, cooperating with the digitization requirements of the supply chain finance platform to improve information transparency and financing efficiency. “Non-collaboration” refers to choosing not to provide complete information or delaying responses due to the costs of data sharing or concerns about commercial confidentiality. This may result in delayed financing processes and could increase the overall credit risk of the supply chain.

- (3)

- Financial institutions can choose between “support” and “wait-and-see” strategies for value co-creation, with probabilities of x and 1 − x, respectively. “Support” refers to actively connecting to the construction supply chain finance platform, using its credible data to optimize the risk-control model, offering more flexible financing products for participating enterprises. “Wait-and-see” refers to not cooperating in depth due to doubts about the authenticity of the platform’s data or concerns over industry risks, instead maintaining the traditional credit model. This approach may miss high-quality customers and reduce the institution’s competitiveness in the supply chain finance sector.

To analyze the cooperation mechanism among the three parties, the basic game settings are summarized as follows:

Hypothesis 1 (H1).

There are three players in the evolutionary game: construction supply chain finance platform, core construction enterprises, and suppliers and the financial institution.

Hypothesis 2 (H2).

Construction supply chain finance platform, core construction enterprises and suppliers, and the financial institution are all finite rational decision-makers who learn to maximize their own utility in the game process.

Hypothesis 3 (H3).

All information provided by the participants in the construction supply chain is accurate and truthful.

3.2. An Analysis of the Game Model

This game model involves three key entities: the construction supply chain finance platform, core construction enterprises and suppliers, and the financial institution. Basic returns of the cooperative funders, the construction supply chain financial platform, and the core construction enterprises and suppliers in conducting ordinary credit financing are denoted as Rp, Rs, and Ro, respectively (Rp > 0, Rs > 0, and Ro > 0). Through resource interaction and information sharing, these three parties jointly create additional value, denoted as βV, where β represents the incentive coefficient for value co-creation. The extra returns are distributed proportionally among the three parties, with the construction supply chain financial platform and the cooperative funders receiving the distribution coefficients a and b (0 ≤ a + b ≤ 1), respectively, and the core construction companies and suppliers receiving the remainder, 1 − a − b.

The initial service cost of the construction supply chain financial platform is Cp. To gain a competitive advantage, the platform opts to adopt new technologies to enhance the credibility of the platform’s financial data, thereby participating in value co-creation. However, adopting new technologies involves development costs and carries the risk of failure. As such, the platform must bear additional input and risk costs, denoted as αCp1, where α represents the risk coefficient. To guard against opportunistic behavior from core construction firms and suppliers and ensure the quality of financing, the platform must also bear the cost of Cp2 for reviewing the creditworthiness of their past projects. Additionally, the platform charges core construction firms and suppliers who do not actively participate in value co-creation a fine, θF. This fine is not a financial penalty, as it is not enforceable by law. Instead, it is usually implemented in the form of a downgrade in the firm’s credit rating, which can result in difficulties during subsequent financing processes. Here, θ refers to the credit rating downgrade factor.

If the construction supply chain financial platform chooses not to participate in value co-creation, core construction firms and suppliers may not be able to obtain financing due to insufficiently accurate data, leading to cash flow problems. This situation may damage the reputation of the construction supply chain financial platform and expose it to penalties from government regulators, resulting in a loss, γLp.

When they participate in value co-creation by sharing relevant financial data and designing differentiated interest rate financing schemes, they may incur additional costs in the short term, denoted as αCs1. If the cooperative funders do not participate in value co-creation, they will have fewer opportunities to obtain long-term, stable returns through asset-backed securities (ABSs) and will face higher auditing costs, resulting in a loss, γLs.

The conventional financing cost for core construction firms and suppliers is Co. Actively participating in value co-creation through timely repayments of loans and providing accurate information on the progress of the construction project requires more effort from the firm’s personnel in their daily work, which incurs an additional cost, denoted as αCo1.

The symbols of the relevant parameters are explained in Table 1.

Table 1.

Parameter settings for the tripartite evolutionary game in construction supply chain finance.

3.3. Analysis of Payoff Matrix

When financial institutions choose to support, construction supply chain finance platforms choose to participate, and core enterprises and suppliers choose to collaborate, an ideal cooperation state is formed. The financial institution obtains value-added distribution through data sharing with a return of Rs + aβV − Cs − αCs1, where aβV reflects the value return of its contribution. The platform incurs double costs for technology investment and credit review but receives value-added returns through synergy, with a net return of Rp + bβV − Cp − αCp1 − Cp2. The core firm and the supplier receive a residual value distribution after bearing the cost of the data synergy, αCo1, with a return of Ro + (1 – a − b)βV − Co − αCo1. None of the three parties triggers any penalties or reputational losses.

The financial institution maintains its support strategy, and the platform continues to participate, but the firm chooses not to collaborate. The financial institution is unable to capture the value-added benefit due to the lack of information about the enterprise, and the benefit drops to Rs − Cs − αCs1. The platform activates the credit penalty mechanism due to the enterprise’s default and receives compensation for θF but loses the value of the synergy, and the benefit is Rp − Cp − αCp1 − Cp2 + θF. The enterprise is downgraded due to the avoidance of the synergy, and the cost of financing is implicitly increased, and the net benefit is Ro − Co − θF.

The financial institution chooses to support, but the platform forgoes the technology investment, and the firm remains active in synergy. The financial institution loses γLs due to the platform’s lack of data credibility and the failure of the risk-control model, and the gain drops to Rs − Cs − γLs. The platform bears the reputation loss, γLp, due to the technology lag, and the gain is Rp − Cp − γLp. The enterprise completes the synergy investment, αCo1, but cannot obtain the value-added allocation due to the platform’s functional defects, and the gain is Ro − Co − αCo1.

Financial institutions continue to support, but the platform does not participate, and firms do not synergize. The financial institution increases the risk-control cost due to the dual lack of information, and the return is Rs − Cs − γLs. The platform suffers from the regulatory penalty due to inaction, and the return is Rp − Cp − γLp. The enterprise avoids collaboration, but the platform does not activate the penalty mechanism, and the return maintains the base value of Ro − Co.

The financial institution chooses to wait and see, while the platform engages, and firms collaborate. The financial institution misses out on the benefits of ABSs and other innovations and suffers a loss of γLs due to disengagement from the synergy network, resulting in a gain of Rs − Cs − γLs. The platform captures the benefits of the synergy normally, with a net gain of Rp − Cp − αCp1 − Cp2. The enterprise completes the synergy but lacks the support of the financial institution, resulting in a limited value-added allocation and a gain of Ro − Co − αCo1.

Financial institutions wait and see, platforms participate, but enterprises do not synergize. The financial institution’s loss is further expanded to Rs − Cs − γLs. The platform partially offsets the cost by fining θF, and the gain is Rp − Cp − αCp1 − Cp2 + θF. The firm is penalized but not constrained by the financial institution, and the gain is Ro − Co − θF.

The financial institution watches, and the platform does not participate, but the firm still chooses to collaborate. The financial institution’s losses are exacerbated by double disengagement, and the payoff is Rs − Cs − γLs. The platform’s reputation is damaged, and the payoff is Rp − Cp − γLp. The firm bears the cost of synergy, αCo1, but has no payoff, and the payoff is Ro − Co − αCo1.

Financial institutions wait and see, platforms do not participate, and firms do not synergize. The financial institution’s return is Rs − Cs − γLs, the platform’s return is Rp − Cp − γLp, and the firm maintains the base return of Ro − Co.

The payoff matrix for the cooperative funding parties, the construction supply chain finance platform, and core construction enterprises and suppliers are shown in Table 2.

Table 2.

Payoff matrix of the cooperative funding parties, the construction supply chain finance platform, and core construction enterprises and suppliers.

3.4. Replication of Dynamic Equations

The expected returns and average returns for the cooperative funding parties when choosing the strategies of “participating” and “not participating” in value co-creation are denoted as Es1, Es2, and Es3, respectively.

The Replicator Dynamic Equation (RDE) is a central tool in evolutionary game theory used to describe the evolution of different strategies within a population. It simulates the natural selection mechanism of “survival of the fittest”, where strategies with higher payoffs are adopted by more participants, and conversely, strategies with lower payoffs are adopted less frequently. The replicator dynamic equation for the cooperative funding parties is derived as follows:

The expected returns and average returns for the construction supply chain finance platform when choosing the strategies of “participating” and “not participating” in value co-creation are denoted as Ep1, Ep2, and Ep3, respectively.

The replicator dynamic equation for the construction supply chain finance platform is derived as follows:

The expected returns and average returns for core construction enterprises and suppliers when choosing the strategies of “participating” and “not participating” in value co-creation are denoted as Eo1, Eo2, and Eo3, respectively.

The replicator dynamic equation for core construction enterprises and suppliers is derived as follows:

Since 1 − x, 1 − y, and 1 − z are non-negative and do not affect the outcomes of the evolutionary game, we transformed the replicator dynamic equations into the following form:

4. The Construction of a Stochastic Evolutionary Game Model

4.1. Random Factors Perturbing the Three-Party Game

In the financial market, the evolution of participants in the supply chain is influenced by external, unpredictable random factors that are often challenging to model directly. Factors such as policy changes, market crashes, and unforeseen financial disruptions introduce uncertainty into the system, making it difficult to rely solely on deterministic models. On the one hand, financial market risk factors, such as exchange rate fluctuations, stock market volatility, and debt default risks, can propagate through the supply chain finance model, influencing the collective sentiment and risk preferences of participants in the construction supply chain, thus directly affecting their strategies. On the other hand, policy changes, such as government regulations on the real estate market, can also impact the construction supply chain finance model via the financial market. For example, if the government tightens regulations in the real estate market (e.g., by increasing down payment ratios or limiting loan sizes), this would directly affect liquidity in the construction industry, making financing more challenging. As a result, traditional evolutionary game models may not fully capture the strategic adjustment processes of participants. Therefore, using random models, such as stochastic models, is crucial for capturing the uncertainty caused by these external factors, helping us better understand how participants adjust to real-world market conditions. To address this uncertainty, we use Gaussian white noise, which helps represent the random fluctuations and shocks in both the construction and financial markets:

In Equations (8) to (10), σ represents the intensity of stochastic disturbances, while ω(t) denotes a one-dimensional standard Brownian motion. As a stochastic process, Brownian motion effectively captures the effect of random disturbances on game participants. In this model, Gaussian white noise is represented by ω(t). For t > 0 and a time step of h > 0, the increment ω(t + h) − ω(t) follows a normal distribution, denoted as N(0, h), which means the increment has a mean of 0 and a variance of h.

4.2. Stability Analysis of Evolutionary Equilibrium Solutions

Assuming the initial state is t = 0 with initial values of x(0) = 0, y(0) = 0, and z(0) = 0, the equilibrium solution of the replicator dynamic equations is x(t) = 0, y(t) = 0, and z(t) = 0. In other words, without external disturbances, all participants in the construction supply chain finance system would choose the “participation” strategy. However, in the real world, such an ideal situation is rarely achievable due to high uncertainty. Each participant is influenced by random factors, which can lead to unpredictable changes. Therefore, stability analysis is important to understand how these random disturbances affect the system’s balance and how participants adjust their strategies in response. It helps assess whether the system can remain stable under real-world conditions and how external shocks may impact the system’s long-term behavior. The stochastic differential equation is shown below:

The Lyapunov function is used to determine whether the solution of the system is stable. In simple terms, the Lyapunov function is a tool that helps us determine whether a system will settle into a stable state over time. Let x(t) = x(t,x0) be a solution to the equation given a continuously differentiable function V(t,x) and positive numbers; there exists c1|x|p ≤ c2|x|p, t ≥ 0. Next, the Lyapunov generator is used to describe the trend of the Lyapunov function’s variation at a given time. The Lyapunov generator represents the rate of change of the Lyapunov function as the system evolves. If the rate of change is negative, this indicates that the system is becoming more stable, because the Lyapunov function is decreasing. Let :

(1) Stability Condition: If there exists a positive constant γ such that

then the zero solution of the equation, in terms of the p-th moment, is stable. This means that the system’s state will converge toward zero over time at an exponential rate. Specifically, the expected value of the p-th moment satisfies the following inequality:

This condition indicates that, despite the presence of random disturbances, the system will remain stable, with its state exponentially decreasing toward the equilibrium point.

(2) Instability Condition: If there exists a positive constant γ such that

then the zero solution of the equation, in terms of the p-th moment, is unstable. This means that the system’s state will diverge from zero over time at an exponential rate. Specifically, the expected value of the p-th moment satisfies the following inequality:

This condition reveals that when the rate of change of the Lyapunov function is positive, the system cannot maintain stability, and its state will diverge from the equilibrium point under the influence of random disturbances.

For the replicated dynamic Equations (16)–(18) of the stochastic evolutionary game we have constructed, let , , and , with c1 = 1, c2 = 1, p = 1, and γ = 1. The Lyapunov function generators are given by ,, and . If the zero solution of the p-th moment exponential equation is to be stable, the following condition must hold:

When all three conditions are satisfied, the p-th moment exponential stability of the zero solution is achieved. This means that, over time, the proportion of non-cooperative strategies—where the financial institution, the construction supply chain finance platform, and core construction enterprises and suppliers all choose “non-participation” in value co-creation—will decay exponentially to zero. At this point, the only evolutionary stable strategy is the cooperative strategy, where the financial institution chooses “participation”, the construction supply chain finance platform chooses “participation”, and core construction enterprises and suppliers also choose “participation”.

5. Numerical Simulation and Analysis

5.1. Stochastic Taylor Expansions of Replicating Dynamic Equation

The replicator dynamic equation is a nonlinear Itô stochastic differential equation, which cannot be solved using traditional mathematical methods. Therefore, we employ a stochastic Taylor expansion to obtain a numerical solution for the equation [37]. This approach allows us to approximate the solution of the equation by discretizing the time steps. We discuss the following Itô stochastic differential equation:

The continuous-time process is discretized into a series of time steps to approximate the change in the system’s state at each small time step. Let t ∈ [t0, T], x(t0) = x0, where x0 ∈ R, and ω(t) denotes a one-dimensional standard Brownian motion. Let h = (T − t0)/N and tn = t0 + nh. Here, h represents the discretization step size, which is critical for controlling the accuracy of the approximation. The stochastic Taylor expansion of the equation is as follows:

The term is used for the discretization of the deterministic part; represents the increment of the Brownian motion, describing the contribution of the stochastic disturbance; the third term and subsequent terms are higher-order terms, which include the derivative of the Brownian motion and other secondary effects. R is the residual term, which accounts for the neglected higher-order terms, and it decreases as the step size, h, becomes smaller.

Next, the Milstein method is employed for numerical solving. This method is an improvement on the Euler method, as it takes into account the impact of the Brownian motion derivative. By adding an additional term , the accuracy is enhanced. Therefore, the equation is modified as follows:

Now, the accuracy of the method is improved. Therefore, the Milstein method is used to solve Equation (29), yielding the following results:

5.2. Parameter Sensitivity Analysis

Based on the above analysis, this paper refers to existing studies for parameter assignment methods and, in combination with practical conditions, uses Matlab R2023b to conduct a parameter sensitivity analysis. The analysis focuses on the impact of additional costs of value co-creation, value co-creation risks, penalties for non-participation in value co-creation, and the distribution ratio of additional value co-creation earnings on the strategic choices of the parties involved.

In this paper, the initial values of the parameters were determined through a literature survey and expert interviews, as shown in Table 3.

Table 3.

Initial parameter settings.

Among them, the values of V, a, and b were determined based on the China Supply Chain Finance Ecology Research Report, published by Renmin University of China, in combination with expert opinions. This report predicts that the transaction volume of the third-party supply chain fintech market will increase from 1.5 trillion in 2023 to 5.6 trillion in 2028. This indicates that financial platforms involved in value co-creation through the adoption of new technologies and other methods can achieve substantial revenue.

Pudong Development Bank established its Supply Chain Innovation Department in 2024, increasing efforts to cooperate with supply chain financial platforms and tripling the volume of online supply chain business.

Electricity eFinance is a supply chain finance platform established in collaboration with the State Grid of China, which has facilitated over CNY 550 billion in transactions from its inception until early 2024. This includes assisting 160,000 small and medium-sized micro-enterprises (SMEs) with obtaining financial services totaling more than CNY 310 billion. Additionally, many core construction enterprises and suppliers have benefited from the platform.

After expert discussions, all three parties will gain significant benefits from participating in value co-creation. Furthermore, the benefit (V) derived from value co-creation should exceed the cost of participation. Therefore, V is set to 210, and a = b = 1/3.

According to the survey, the cost of introducing an ant blockchain service to the platform is CNY 500,000 per year for every four production chains, with each node requiring 6 TB of storage space. A perfect platform requires at least eight production chains, and the cost of introducing new technology to the platform exceeds the cost of supervision. Therefore, Cp1 is set to 70.

5.2.1. Risk Coefficient

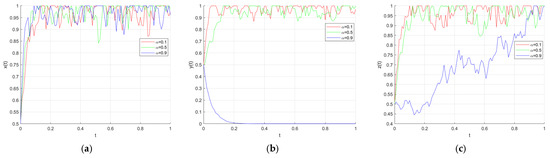

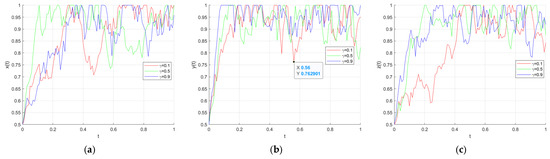

The impact of the proportion of risk taken due to additional inputs in the value co-creation process on the strategic choices of financial institutions, construction supply chain financial platforms, and construction core firms and suppliers, respectively, is shown in Figure 3.

Figure 3.

Simulation results under different risk coefficients. (a) The impact of different risk coefficients on financial institutions’ value co-creation decisions; (b) the impact of different risk coefficients on value co-creation decisions in construction supply chain finance platforms; (c) the impact of different risk coefficients on value co-creation decisions of construction core firms and suppliers.

Other things being equal, the value of α is set to 0.1, 0.5, and 0.9. Figure 2 demonstrates the evolution of the strategies of financial institutions, construction supply chain financial platforms, and construction core enterprises and suppliers. When the risk coefficient is 0.1 or 0.5, financial institutions, construction supply chain financial platforms, and construction core enterprises and suppliers converge to the stable state of participating in value co-creation. When the risk coefficient is 0.9, financial institutions converge to the stable state of participation, while construction supply chain financial platforms tend toward non-participation. The willingness of core enterprises to participate oscillates upwards and eventually converges to the state of participating in value co-creation. This suggests that construction supply chain financial platforms are more sensitive to the additional risk arising from participation in value co-creation, such as the risk of unsuccessfully introducing new technologies to the platform. The impact of the risk coefficient on financial institutions’ value co-creation decisions is minimal. A higher risk coefficient may cause construction core firms and suppliers to hesitate in participating in value co-creation in the short term.

5.2.2. Penalty Coefficient

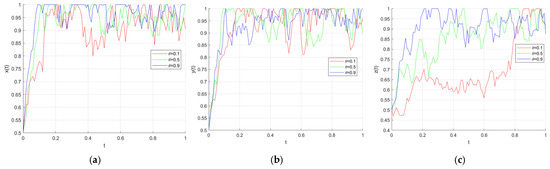

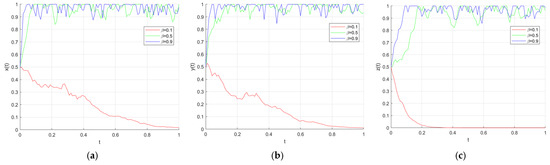

The impacts of credit rating downgrade penalty coefficients on the strategic choices of financial institutions, construction supply chain financial platforms, and construction core firms and suppliers, respectively, in the value co-creation process are shown in Figure 4.

Figure 4.

Simulation results under different penalty coefficients. (a) The impact of different penalty coefficients on financial institutions’ value co-creation decisions; (b) the impact of different penalty coefficients on value co-creation decisions in construction supply chain finance platforms; (c) the impact of different penalty coefficients on value co-creation decisions in construction core firms and suppliers.

Other things being equal, the value of θ is set to 0.1, 0.5, and 0.9. Figure 3 illustrates the evolution of the strategies of financial institutions, construction supply chain financial platforms, and construction core firms and suppliers. The penalty coefficient has little effect on financial institutions, and under different penalty coefficients, financial institutions eventually evolve toward the state of participating in value co-creation. When the penalty coefficient is 0.9, the construction supply chain financial platform and the construction core enterprises and suppliers all converge to the stable state of participating in value co-creation but at a slower speed. The stable state of the core enterprises and suppliers may be shaken by unexpected events in reality, but overall, they maintain a high level of participation. When the penalty coefficient is 0.1 or 0.9, financial institutions will eventually evolve to the state of participating in value co-creation. When the penalty coefficient is 0.1 or 0.5, the construction supply chain financial platform rapidly evolves to a stable state of participation, and the participation willingness of core construction enterprises and suppliers oscillates upward. The larger the penalty coefficient, the faster the upward oscillation.

5.2.3. Loss Coefficient

The impact of the loss magnification factor of indirect losses due to negative behaviors in the value co-creation process on the strategy choices of financial institutions, construction supply chain financial platforms, and construction core enterprises and suppliers, respectively, is shown in Figure 5.

Figure 5.

Simulation results under different loss coefficient. (a) The impact of different loss coefficients on financial institutions’ value co-creation decisions; (b) the impact of different loss coefficients on value co-creation decisions in construction supply chain finance platforms; (c) the impact of different loss coefficients on value co-creation decisions of construction core firms and suppliers.

Other conditions remaining unchanged, the value of γ is set to 0.1, 0.5, and 0.9. Figure 3 demonstrates the evolution of the strategies of financial institutions, construction supply chain financial platforms, and construction core enterprises and suppliers. When the loss coefficient is 0.1, the willingness of financial institutions, construction supply chain financial platforms, and construction core enterprises and suppliers to participate in value co-creation shows a tendency to first increase, then decrease, and finally increase and stabilize. When the loss coefficient is 0.5, the willingness of the three parties to participate rapidly evolves to the participation state. In this case, the construction supply chain financial platform and the construction core enterprises and suppliers tend to stabilize, while financial institutions remain in a stable participation state in the short term, with oscillation occurring in the long term. When the loss coefficient is 0.9, all three parties will evolve to a stable state, with financial institutions evolving more slowly.

5.2.4. Incentive Coefficient

The impact of the value-added coefficients generated by the multi-party participation in value co-creation on the strategy choices of financial institutions, construction supply chain financial platforms, and construction core enterprises and suppliers, respectively, is shown in Figure 6.

Figure 6.

Simulation results under different incentive coefficient. (a) The impact of different incentive coefficients on financial institutions’ value co-creation decisions; (b) the impact of different incentive coefficients on value co-creation decisions in construction supply chain finance platforms; (c) the impact of different incentive coefficients on value co-creation decisions of construction core firms and suppliers.

Other things being equal, the value of β is set to 0.1, 0.5, and 0.9. Figure 5 illustrates the evolution of the strategies of financial institutions, construction supply chain financial platforms, and construction core enterprises and suppliers. When the incentive coefficient is 0.1, the participation of financial institutions, construction supply chain financial platforms, and construction core enterprises and suppliers in value co-creation will tend toward a steady state of non-participation. When the incentive coefficient is 0.9, the three parties will rapidly converge to a stable state of participation. When the incentive coefficient is 0.5, all three parties will evolve to a stable state, with construction core enterprises and suppliers evolving more slowly.

6. Discussion

This study integrates supply chain finance into the traditional three-party evolutionary game model, creating an ecosystem comprising the construction supply chain finance platform, core enterprises and suppliers, and financial institutions. Moreover, we clarified the value co-creation mechanisms under the construction supply chain finance model. Through a stochastic evolutionary game model, we analyzed the stability of participants’ strategies and quantitatively assessed the impacts of risk, penalty, and incentive coefficients on their decisions.

The findings of this paper are as follows:

- (1)

- The incentive coefficient has the greatest impact on the decision of financial institutions, construction supply chain finance platforms, and construction core companies and suppliers to participate in value co-creation. A low incentive coefficient will lead each participant to choose not to engage in value co-creation.

- (2)

- Financial institutions are not particularly sensitive to changes in the penalty coefficient and risk coefficient. A reasonable loss coefficient can enable financial institutions to participate in value co-creation more quickly and stably.

- (3)

- Construction supply chain financial platforms are sensitive to changes in the risk coefficient, and an excessively high risk coefficient will lead these platforms to choose not to participate in value co-creation. A lower penalty coefficient and loss coefficient prevents construction supply chain financial platforms from participating in value co-creation in a stable manner. In the event of policy changes, market crashes, and unforeseen financial disruptions, the platforms’ willingness to participate in value co-creation will decrease.

- (4)

- A higher risk coefficient makes construction core companies and suppliers hesitate to participate in value co-creation. These parties are more sensitive to the penalty coefficient and loss coefficient. When these two parameters are low, construction core companies and suppliers will remain at a low level of participation in value co-creation for an extended period.

This paper is the first to address the value co-creation problem within the construction supply chain finance model, providing a new foundation for research into the establishment of an optimal supply chain finance platform. Additionally, in practical terms, the management recommendations of this paper are as follows:

- (1)

- Since construction supply chain finance platforms are sensitive to the proportion of additional inputs or risk-taking in the process of value co-creation, it is crucial to reduce the cost of introducing new technologies to these platforms. The government can establish special cost subsidies and tax incentives to encourage platforms to adopt new technologies. Additionally, non-sensitive data from government departments, such as housing, construction, taxation, and industry and commerce, should be made available to reduce the platforms’ data collection costs.

- (2)

- The construction supply chain financial platform should adopt stricter credit rating standards for construction core enterprises and suppliers. Third-party auditing can be introduced to select some enterprises for on-site investigations when necessary, and penalties, including transaction bans, should be enforced for data falsification. Construction core enterprises should establish strategic partnerships with suppliers to ensure mutual sharing of benefits and risks across multiple projects, allowing for more stable participation in platform-centered value co-creation.

- (3)

- Financial institutions should enhance their understanding of financial services. Meanwhile, the platform should not only strengthen its oversight of core construction enterprises and suppliers but also regularly publicize information on financial institutions that default.

- (4)

- To improve the efficiency of value co-creation, all parties involved in the construction project should reach a consensus on information sharing and interactive communication. The government can either entrust stable, reputable enterprises or take the lead in creating a large-scale construction supply chain financial platform, thereby forming a stable value co-creation ecosystem.

Future research directions include empirical validation using real-world data from platforms such as Glodon Zhirong, a comparative analysis of various supply chain finance models, and deeper exploration of stochastic factors influencing supply chain finance to enhance the model’s practical explanatory power.

Author Contributions

Conceptualization, S.Z. and C.L.; methodology, S.Z. and Y.X.; software, S.Z. and C.L.; validation, S.Z.; formal analysis, S.Z. and Y.X.; writing—original draft preparation, S.Z.; writing—review and editing, C.L.; supervision, J.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Group ACS. Annual Report. Available online: https://www.grupoacs.com/shareholders-investors/annual-report/ (accessed on 6 May 2025).

- Bak, O.; Shaw, S.; Colicchia, C.; Kumar, V. A Systematic Literature Review of Supply Chain Resilience in Small–Medium Enterprises (SMEs): A Call for Further Research. IEEE Trans. Eng. Manag. 2020, 70, 328–341. [Google Scholar] [CrossRef]

- Kouvelis, P.; Xu, F. A supply chain theory of factoring and reverse factoring. Manag. Sci. 2021, 67, 6071–6088. [Google Scholar]

- Grüter, R.; Wuttke, D.A. Option matters: Valuing reverse factoring. Int. J. Prod. Res. 2017, 55, 6608–6623. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; del Vecchio, P.; Oropallo, E.; Secundo, G. Blockchain technology for bridging trust, traceability and transparency in circular supply chain. Inf. Manag. 2022, 59, 103508. [Google Scholar]

- Liu, J.; Liu, S.; Li, J.; Li, J. Financial credit risk assessment of online supply chain in construction industry with a hybrid model chain. Int. J. Intell. Syst. 2022, 37, 8790–8813. [Google Scholar] [CrossRef]

- Wang, R.; Yu, C.; Wang, J. Construction of Supply Chain Financial Risk Management Mode Based on Internet of Things. IEEE Access 2019, 7, 110323–110332. [Google Scholar] [CrossRef]

- Al Azmi, N.; Sweis, G.; Sweis, R.; Sammour, F. Exploring Implementation of Blockchain for the Supply Chain Resilience and Sustainability of the Construction Industry in Saudi Arabia. Sustainability 2022, 14, 6427. [Google Scholar] [CrossRef]

- Zou, X.; Chen, J.; Gao, S. Network effect in shared supply chain platform value co-creation behavior in evolutionary game1. J. Intell. Fuzzy Syst. 2021, 41, 4713–4724. [Google Scholar] [CrossRef]

- Xu, X.; Chen, X.; Jia, F.; Brown, S.; Gong, Y.; Xu, Y. Supply chain finance: A systematic literature review and bibliometric analysis. Int. J. Prod. Econ. 2018, 204, 160–173. [Google Scholar] [CrossRef]

- Houston, J.F.; Lin, C.; Zhu, Z. The Financial Implications of Supply Chain Changes. Manag. Sci. 2016, 62, 2520–2542. [Google Scholar]

- Yu, H.; Zhao, Y.; Liu, Z.; Liu, W.; Zhang, S.; Wang, F.; Shi, L. Research on the financing income of supply chains based on an E-commerce platform. Technol. Forecast. Soc. Change 2021, 169, 120820. [Google Scholar] [CrossRef]

- Wang, C.; Weng, J.; He, J.; Wang, X.; Ding, H.; Zhu, Q. Stability Analysis of the Credit Market in Supply Chain Finance Based on Stochastic Evolutionary Game Theory. Mathematics 2024, 12, 1764. [Google Scholar] [CrossRef]

- Shen, B.; Wang, X.; Cao, Y.; Li, Q. Financing decisions in supply chains with a capital-constrained manufacturer: Competition and risk. Int. Trans. Oper. Res. 2020, 27, 2422–2448. [Google Scholar] [CrossRef]

- Yan, B.; Chen, Z.; Yan, C.; Zhang, Z.; Kang, H. Evolutionary multiplayer game analysis of accounts receivable financing based on supply chain financing. Int. J. Prod. Res. 2021, 62, 8110–8128. [Google Scholar] [CrossRef]

- Xue, M.; Wu, D.; Hu, H. Pricing and financing strategies of dual channel closed-loop supply chain considering capital-constrained manufacturer. Eur. J. Ind. Eng. 2024, 18, 275–301. [Google Scholar]

- Geissdoerfer, M.; Morioka, S.N.; de Carvalho, M.M.; Evans, S. Business models and supply chains for the circular economy. J. Clean. Prod. 2018, 190, 712–721. [Google Scholar] [CrossRef]

- Benitez, G.B.; Ayala, N.F.; Frank, A.G. Industry 4.0 innovation ecosystems: An evolutionary perspective on value cocreation. Int. J. Prod. Econ. 2020, 228, 107735. [Google Scholar] [CrossRef]

- Martinsuo, M.; Killen, C.P. Value Management in Project Portfolios: Identifying and Assessing Strategic Value. Proj. Manag. J. 2014, 45, 56–70. [Google Scholar] [CrossRef]

- Ahola, T.; Laitinen, E.; Kujala, J.; Wikström, K. Purchasing strategies and value creation in industrial turnkey projects. Int. J. Proj. Manag. 2008, 26, 87–94. [Google Scholar]

- Vuorinen, L.; Martinsuo, M. Value-oriented stakeholder influence on infrastructure projects. Int. J. Proj. Manag. 2019, 37, 750–766. [Google Scholar] [CrossRef]

- Yu, W.; Huang, H.; Zhu, K. Enhancing Construction Enterprise Financial Performance through Digital Inclusive Finance: An Insight into Supply Chain Finance. Sustainability 2023, 15, 10360. [Google Scholar] [CrossRef]

- Pavlenko, T.; Chernyak, O. Credit risk modeling using bayesian networks. Int. J. Intell. Syst. 2010, 25, 326–344. [Google Scholar] [CrossRef]

- Zhang, Z.; Gao, G.; Shi, Y. Credit risk evaluation using multi-criteria optimization classifier with kernel, fuzzification and penalty factors. Eur. J. Oper. Res. 2014, 237, 335–348. [Google Scholar] [CrossRef]

- Zhang, F.; Tadikamalla, P.R.; Shang, J. Corporate credit-risk evaluation system: Integrating explicit and implicit financial performances. Int. J. Prod. Econ. 2016, 177, 77–100. [Google Scholar] [CrossRef]

- Chang, S.E.; Chen, Y. When Blockchain Meets Supply Chain: A Systematic Literature Review on Current Development and Potential Applications. IEEE Access 2020, 8, 62478–62494. [Google Scholar]

- Xu, M.; Ma, S.; Wang, G. Differential Game Model of Information Sharing among Supply Chain Finance Based on Blockchain Technology. Sustainability 2022, 14, 7139. [Google Scholar] [CrossRef]

- Zhang, J.; Liu, Y. Pooling factoring financing strategy based on the big data credit evaluation technology of B2B platform. Electron. Commer. Res. 2023, 25, 987–1003. [Google Scholar] [CrossRef]

- Song, H.; Han, S.; Yu, K. Blockchain-enabled supply chain operations and financing: The perspective of expectancy theory. Int. J. Oper. Prod. Manag. 2023, 43, 1943–1975. [Google Scholar] [CrossRef]

- Ramaswamy, V.; Ozcan, K. What is co-creation? An interactional creation framework and its implications for value creation. J. Bus. Res. 2018, 84, 196–205. [Google Scholar]

- Wang, Z.; Wang, Q.; Lai, Y.; Liang, C. Drivers and outcomes of supply chain finance adoption: An empirical investigation in China. Int. J. Prod. Econ. 2020, 220, 107453. [Google Scholar] [CrossRef]

- Xie, X.; Yang, Y.; Gu, J.; Zhou, Z. Research on the contagion effect of associated credit risk in supply chain based on dual-channel financing mechanism. Environ. Res. 2020, 184, 109356. [Google Scholar] [CrossRef]

- Clemons, R.; Slotnick, S.A. The effect of supply-chain disruption, quality and knowledge transfer on firm strategy. Int. J. Prod. Econ. 2016, 178, 169–186. [Google Scholar]

- Zhang, C.; Wang, X.; Li, B.; Su, C.; Sun, L. Analysis of Quality Risk Transmission in the New Retail Service Supply Chain System with Value Co-Creation. Systems 2022, 10, 221. [Google Scholar] [CrossRef]

- Yang, M.; Xu, S.; Chen, S.-C.; Li, J.; Zhou, Y.; Tseng, M.-L. Value co-creation on social attachment toward social platforms: Evidence from developing countries. Ind. Manag. Data Syst. 2024, 124, 2689–2710. [Google Scholar] [CrossRef]

- Maity, M.; Singh, R. Market Development and Value Creation for Low Socioeconomic Segments in Emerging Markets: An Integrated Perspective Using the 4A Framework. J. Macromark. 2020, 41, 373–390. [Google Scholar] [CrossRef]

- Schoutens, W.; Studer, M. Short-term risk management using stochastic Taylor expansions under Lévy models. Insur. Math. Econ. 2003, 33, 173–188. [Google Scholar] [CrossRef]

- An, X.; Ren, S.; Wang, L.; Huang, Y. Evolutionary game analysis of collaborative application of BIM platform from the perspective of value co-creation. Eng. Constr. Arch. Manag. 2024. ahead-of-print. [Google Scholar] [CrossRef]

- Ma, Y.; Sun, Y.; Guo, Q.; Wang, X. Evolutionary game analysis of building a sustainable intelligent elderly care service platform. Sci. Rep. 2024, 14, 28653. [Google Scholar] [CrossRef]

- Feng, B.; Feng, C.; Zhao, S. Green Supply Chain Finance Credit Market under Government Regulation: An Evolutionary Game Theory Analysis. Pol. J. Environ. Stud. 2023, 32, 3999–4010. [Google Scholar] [CrossRef]

- Li, M.; Gao, X. Implementation of enterprises’ green technology innovation under market-based environmental regulation: An evolutionary game approach. J. Environ. Manag. 2022, 308, 114570. [Google Scholar] [CrossRef]

- Zhu, Q.; Zong, R.; Xu, M. Three-Party Stochastic Evolutionary Game Analysis of Supply Chain Finance Based on Blockchain Technology. Sustainability 2023, 15, 3084. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).