Assessing the Role of Financial Literacy in FinTech Adoption by MSEs: Ensuring Sustainability Through a Fuzzy AHP Approach

Abstract

1. Introduction

1.1. Research Questions: The Study Has Been Conducted Around the Following Research Questions

- What are the different financial literacy factors influencing FinTech adoption by MSEs, ensuring sustainability?

- Which of the financial literacy factors can be prioritized for FinTech adoption by MSEs, ensuring sustainability?

1.2. Research Objectives: The Following Objectives Have Been Undertaken in the Study

- To identify the relevant financial literacy factors influencing FinTech adoption in MSEs ensuring sustainability.

- To examine the significance and develop a hierarchy reflecting prioritization of each financial literacy factor influencing FinTech adoption by MSEs ensuring sustainability.

2. Literature Review

Research Gap

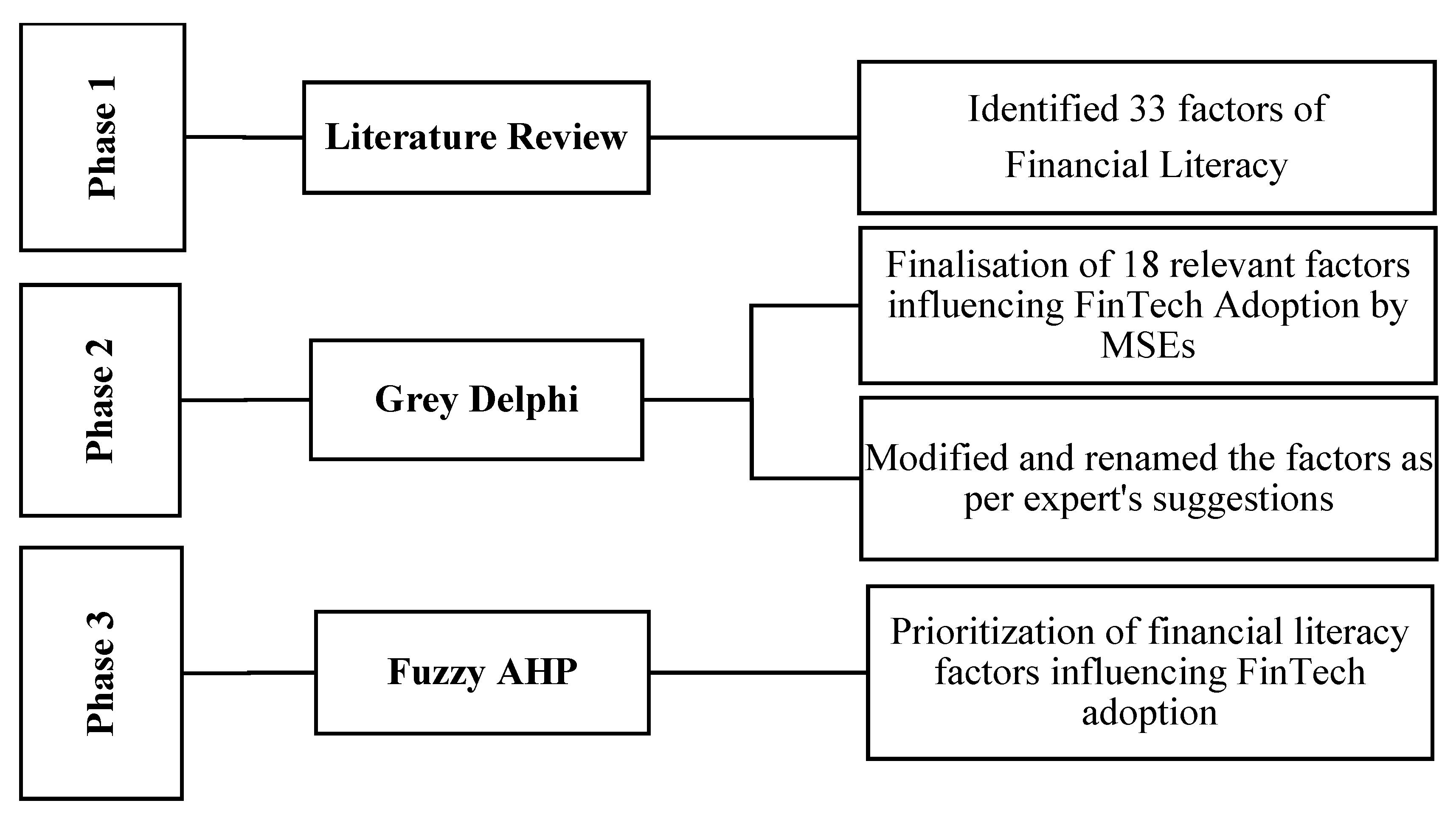

3. Methodology

3.1. Selection of Experts

4. Results and Discussions

4.1. Finalization of Factors Using Grey Delphi

4.2. Prioritization of Factors Using Fuzzy AHP

5. Conclusions

5.1. Implication

5.2. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Sl. No. | Expert’s Designation | Type of Organization | Location | Qualification | Experience | Financial Training |

|---|---|---|---|---|---|---|

| 1 | Managing Director | Stainless steel | Rourkela | MBA | 17 years | 2 |

| 2 | Managing Director | Handicraft | Puri | PhD | 19 years | 4 |

| 3 | Managing Director | Glass and Ceramic | Angul | PhD | 18 years | 6 |

| 4 | Managing Director | Handicraft | Cuttack | M.Com | 7 years | 1 |

| 5 | Managing Director | Handicraft | Bhubaneswar | MA in Economics | 6 years | 1 |

| 6 | CEO | Plastic and Fibre Industry | Angul | PhD | 13 years | 2 |

| 7 | CEO | Food processing | Cuttack | B. Com | 8 years | 1 |

| 8 | CEO | Coir products | Bhubaneswar | BBA | 10 years | 3 |

| 9 | CEO | Textile | Puri | MA in Economics | 7 years | 2 |

| 10 | CEO | Fisheries production | Jagatsinghpur | MBA | 14 years | 5 |

| 11 | Associate Professor | University | Bhubaneswar | Post Doctorate | 13 years | 3 |

| 12 | Associate Professor | University | Bhubaneswar | PhD | 10 years | 2 |

| 13 | Professor | University | Cuttack | PhD | 30 years | 6 |

| 14 | Associate Professor | University | Cuttack | PhD | 12 years | 4 |

Appendix B

| Linguistic Scale | Grey Numbers |

|---|---|

| Very low Significance (VLS) | [0, 1] |

| Low Significance (LS) | [1, 2] |

| Medium Significance (MS) | [2, 3] |

| High Significance (HS) | [3, 4] |

| Very High Significance (VHS) | [4, 5] |

Appendix C

- Arrange the complex decision problem in hierarchy structure.

- Determine the weight of the criterion using pairwise comparison at each level of the hierarchy.

- To determine the final ranks, compute the normalized weights.

| Matrix Size | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| RI | 0 | 0 | 0.58 | 0.9 | 1.12 | 1.24 | 1.32 | 1.41 | 1.45 | 1.49 |

Appendix D

| Initial Factors | E1 | E2 | E3 | E4 | E5 | E6 | E7 | E8 | E9 | E10 | E11 | E12 | E13 | E14 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| IF1 | HS | VH | HS | HS | VH | VH | HS | HS | HS | VH | MS | HS | VH | HS |

| IF2 | VH | VH | HS | VH | VH | HS | HS | VH | HS | HS | HS | MS | HS | MS |

| IF3 | MS | MS | LS | MS | LS | LS | MS | VL | VL | LS | LS | VL | VL | LS |

| IF4 | LS | LS | LS | LS | VL | LS | LS | VL | LS | LS | VL | VL | LS | VL |

| IF5 | LS | LS | LS | LS | MS | LS | MS | LS | VL | VL | LS | MS | MS | VL |

| IF6 | HS | VH | HS | HS | VH | HS | VH | VH | VH | HS | LS | MS | HS | HS |

| IF7 | VH | VH | HS | HS | HS | VH | VH | VH | HS | HS | MS | LS | MS | MS |

| IF8 | HS | HS | VH | VH | HS | VH | HS | HS | VH | HS | MS | VH | HS | VH |

| IF9 | LS | LS | LS | LS | LS | MS | LS | MS | VL | LS | LS | VL | MS | LS |

| IF10 | LS | LS | MS | LS | MS | MS | LS | MS | LS | VL | LS | MS | HS | VL |

| IF11 | HS | HS | VH | HS | MS | HS | HS | VH | HS | VH | MS | HS | HS | HS |

| IF12 | MS | MS | LS | LS | LS | LS | LS | LS | HS | MS | VL | VL | LS | VL |

| IF13 | VH | VH | VH | HS | VH | VH | HS | VH | VH | VH | HS | MS | HS | VL |

| IF14 | VH | VH | HS | VH | VH | HS | VH | VH | HS | HS | VH | VH | MS | VL |

| IF15 | HS | HS | VH | HS | VH | HS | HS | VH | VH | HS | HS | VH | HS | HS |

| IF16 | MS | LS | LS | LS | MS | LS | LS | LS | LS | VL | VL | MS | LS | MS |

| IF17 | LS | LS | VL | LS | VL | LS | VL | LS | MS | LS | MS | VL | VL | LS |

| IF18 | HS | HS | HS | HS | HS | HS | VH | MS | HS | VH | VH | VH | HS | VH |

| IF19 | VL | LS | VL | VL | VL | LS | VL | LS | VL | VL | MS | LS | MS | LS |

| IF20 | LS | VL | LS | MS | LS | LS | VL | MS | LS | MS | LS | MS | VL | VL |

| IF21 | LS | LS | VL | LS | MS | LS | LS | VL | LS | LS | VL | LS | MS | LS |

| IF22 | HS | HS | HS | MS | MS | HS | HS | HS | HS | VH | HS | VH | HS | HS |

| IF23 | LS | LS | LS | LS | LS | MS | MS | LS | VL | VL | VL | MS | VH | LS |

| IF24 | VH | VH | HS | HS | VH | VH | VH | HS | HS | MS | VL | VH | VH | HS |

| IF25 | VH | HS | HS | HS | MS | VH | VH | HS | HS | VH | VH | VL | MS | HS |

| IF26 | VH | VH | VH | VH | HS | HS | VH | MS | VH | MS | VL | HS | VH | HS |

| IF27 | LS | LS | VL | LS | LS | MS | LS | VL | LS | VL | VL | MS | HS | VL |

| IF28 | HS | HS | HS | MS | MS | MS | HS | HS | HS | VH | HS | MS | HS | HS |

| IF29 | VH | HS | HS | VH | VH | VH | VH | HS | VH | HS | VH | VH | MS | HS |

| IF30 | HS | HS | VH | HS | HS | VH | HS | HS | HS | HS | VH | VH | VH | VH |

| IF31 | VL | VL | LS | LS | LS | LS | VL | VL | VH | HS | HS | HS | VH | HS |

| IF32 | VH | HS | HS | HS | HS | HS | VH | VH | HS | HS | MS | MS | MS | HS |

| IF33 | HS | HS | VH | MS | VH | HS | HS | VH | HS | VH | HS | VH | VH | MS |

| IFs | E1 | E2 | E3 | E4 | E5 | E6 | E7 | E8 | E9 | E10 | E11 | E12 | E13 | E14 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| IF1 | [3, 4] | [4, 5] | [3, 4] | [3, 4] | [4, 5] | [4, 5] | [3, 4] | [3, 4] | [3, 4] | [4, 5] | [2, 3] | [3, 4] | [4, 5] | [3, 4] |

| IF2 | [4, 5] | [4, 5] | [3, 4] | [4, 5] | [4, 5] | [3, 4] | [3, 4] | [4, 5] | [3, 4] | [3, 4] | [3, 4] | [2, 3] | [3, 4] | [2, 3] |

| IF3 | [2, 3] | [2, 3] | [1, 2] | [2, 3] | [1, 2] | [1, 2] | [2, 3] | [0, 1] | [0, 1] | [1, 2] | [1, 2] | [0, 1] | [0, 1] | [1, 2] |

| IF4 | [1, 2] | [1, 2] | [1, 2] | [1, 2] | [0, 1] | [1, 2] | [1, 2] | [0, 1] | [1, 2] | [1, 2] | [0, 1] | [0, 1] | [1, 2] | [0, 1] |

| IF5 | [1, 2] | [1, 2] | [1, 2] | [1, 2] | [2, 3] | [1, 2] | [2, 3] | [1, 2] | [0, 1] | [0, 1] | [1, 2] | [2, 3] | [2, 3] | [0, 1] |

| IF6 | [3, 4] | [4, 5] | [3, 4] | [3, 4] | [4, 5] | [3, 4] | [4, 5] | [4, 5] | [4, 5] | [3, 4] | [1, 2] | [2, 3] | [3, 4] | [3, 4] |

| IF7 | [4, 5] | [4, 5] | [3, 4] | [3, 4] | [3, 4] | [4, 5] | [4, 5] | [4, 5] | [3, 4] | [3, 4] | [2, 3] | [1, 2] | [2, 3] | [2, 3] |

| IF8 | [3, 4] | [3, 4] | [4, 5] | [4, 5] | [3, 4] | [4, 5] | [3, 4] | [3, 4] | [4, 5] | [3, 4] | [2, 3] | [4, 5] | [3, 4] | [4, 5] |

| IF9 | [1, 2] | [1, 2] | [1, 2] | [1, 2] | [1, 2] | [2, 3] | [1, 2] | [2, 3] | [0, 1] | [1, 2] | [1, 2] | [0, 1] | [2, 3] | [1, 2] |

| IF10 | [1, 2] | [1, 2] | [2, 3] | [1, 2] | [2, 3] | [2, 3] | [1, 2] | [2, 3] | [1, 2] | [0, 1] | [1, 2] | [2, 3] | [3, 4] | [0, 1] |

| IF11 | [3, 4] | [3, 4] | [4, 5] | [3, 4] | [2, 3] | [3, 4] | [3, 4] | [4, 5] | [3, 4] | [4, 5] | [2, 3] | [3, 4] | [3, 4] | [3, 4] |

| IF12 | [2, 3] | [2, 3] | [1, 2] | [1, 2] | [1, 2] | [1, 2] | [1, 2] | [1, 2] | [3, 4] | [2, 3] | [0, 1] | [0, 1] | [1, 2] | [0, 1] |

| IF13 | [4, 5] | [4, 5] | [4, 5] | [3, 4] | [4, 5] | [4, 5] | [3, 4] | [4, 5] | [4, 5] | [4, 5] | [3, 4] | [2, 3] | [3, 4] | [0, 1] |

| IF14 | [4, 5] | [4, 5] | [3, 4] | [4, 5] | [4, 5] | [3, 4] | [4, 5] | [4, 5] | [3, 4] | [3, 4] | [4, 5] | [4, 5] | [2, 3] | [0, 1] |

| IF15 | [3, 4] | [3, 4] | [4, 5] | [3, 4] | [4, 5] | [3, 4] | [3, 4] | [4, 5] | [4, 5] | [3, 4] | [3, 4] | [4, 5] | [3, 4] | [3, 4] |

| IF16 | [2, 3] | [1, 2] | [1, 2] | [1, 2] | [2, 3] | [1, 2] | [1, 2] | [1, 2] | [1, 2] | [0, 1] | [0, 1] | [2, 3] | [1, 2] | [2, 3] |

| IF17 | [1, 2] | [1, 2] | [0, 1] | [1, 2] | [0, 1] | [1, 2] | [0, 1] | [1, 2] | [2, 3] | [1, 2] | [2, 3] | [0, 1] | [0, 1] | [1, 2] |

| IF18 | [3, 4] | [3, 4] | [3, 4] | [3, 4] | [3, 4] | [3, 4] | [4, 5] | [2, 3] | [3, 4] | [4, 5] | [4, 5] | [4, 5] | [3, 4] | [4, 5] |

| IF19 | [0, 1] | [1, 2] | [0, 1] | [0, 1] | [0, 1] | [1, 2] | [0, 1] | [1, 2] | [0, 1] | [0, 1] | [2, 3] | [1, 2] | [2, 3] | [1, 2] |

| IF20 | [1, 2] | [0, 1] | [1, 2] | [2, 3] | [1, 2] | [1, 2] | [0, 1] | [2, 3] | [1, 2] | [2, 3] | [1, 2] | [2, 3] | [0, 1] | [0, 1] |

| IF21 | [1, 2] | [1, 2] | [0, 1] | [1, 2] | [2, 3] | [1, 2] | [1, 2] | [0, 1] | [1, 2] | [1, 2] | [0, 1] | [1, 2] | [2, 3] | [1, 2] |

| IF22 | [3, 4] | [3, 4] | [3, 4] | [2, 3] | [2, 3] | [3, 4] | [3, 4] | [3, 4] | [3, 4] | [4, 5] | [3, 4] | [4, 5] | [3, 4] | [3, 4] |

| IF23 | [1, 2] | [1, 2] | [1, 2] | [1, 2] | [1, 2] | [2, 3] | [2, 3] | [1, 2] | [0, 1] | [0, 1] | [0, 1] | [2, 3] | [4, 5] | [1, 2] |

| IF24 | [4, 5] | [4, 5] | [3, 4] | [3, 4] | [4, 5] | [4, 5] | [4, 5] | [3, 4] | [3, 4] | [2, 3] | [0, 1] | [4, 5] | [4, 5] | [3, 4] |

| IF25 | [4, 5] | [3, 4] | [3, 4] | [3, 4] | [2, 3] | [4, 5] | [4, 5] | [3, 4] | [3, 4] | [4, 5] | [4, 5] | [0, 1] | [2, 3] | [3, 4] |

| IF26 | [4, 5] | [4, 5] | [4, 5] | [4, 5] | [3, 4] | [3, 4] | [4, 5] | [2, 3] | [4, 5] | [2, 3] | [0, 1] | [3, 4] | [4, 5] | [3, 4] |

| IF27 | [1, 2] | [1, 2] | [0, 1] | [1, 2] | [1, 2] | [2, 3] | [1, 2] | [0, 1] | [1, 2] | [0, 1] | [0, 1] | [2, 3] | [3, 4] | [0, 1] |

| IF28 | [3, 4] | [3, 4] | [4, 5] | [2, 3] | [2, 3] | [2, 3] | [4, 5] | [3, 4] | [3, 4] | [4, 5] | [3, 4] | [2, 3] | [3, 4] | [3, 4] |

| IF29 | [4, 5] | [3, 4] | [3, 4] | [4, 5] | [4, 5] | [4, 5] | [4, 5] | [3, 4] | [4, 5] | [3, 4] | [4, 5] | [4, 5] | [2, 3] | [3, 4] |

| IF30 | [3, 4] | [3, 4] | [4, 5] | [3, 4] | [3, 4] | [4, 5] | [3, 4] | [3, 4] | [3, 4] | [3, 4] | [4, 5] | [4, 5] | [4, 5] | [4, 5] |

| IF31 | [0, 1] | [0, 1] | [1, 2] | [1, 2] | [1, 2] | [1, 2] | [0, 1] | [0, 1] | [4, 5] | [3, 4] | [3, 4] | [3, 4] | [4, 5] | [3, 4] |

| IF32 | [4, 5] | [3, 4] | [3, 4] | [3, 4] | [3, 4] | [3, 4] | [4, 5] | [4, 5] | [4, 5] | [4, 5] | [2, 3] | [2, 3] | [2, 3] | [3, 4] |

| IF33 | [3, 4] | [3, 4] | [4, 5] | [2, 3] | [4, 5] | [3, 4] | [3, 4] | [4, 5] | [3, 4] | [4, 5] | [3, 4] | [4, 5] | [4, 5] | [2, 3] |

Appendix E

| Linguistic Scale | Triangular Fuzzy Scale | Triangular Fuzzy Reciprocal Scale |

|---|---|---|

| Just Equal (JE) | (1, 1, 1) | (1, 1, 1) |

| Equally Important (EI) | (0.5, 1, 1.5) | (0.7, 1, 2) |

| Weakly Important (WI) | (1, 1.5, 2) | (0.5, 0.7, 1) |

| Strongly More Important (SMI) | (1.5, 2, 2.5) | (0.4, 0.5, 0.7) |

| Very Strongly More Important (VSMI) | (2, 2.5, 3) | (0.3, 0.4, 0.5) |

| Absolutely More Important (AMI) | (2.5, 3, 3.5) | (0.2, 0.3, 0.4) |

References

- Choudhary, P.; Thenmozhi, M. Fintech and financial sector: ADO analysis and future research agenda. Int. Rev. Financ. Anal. 2024, 93, 103201. [Google Scholar] [CrossRef]

- Vergara, C.C.; Agudo, L.F. Fintech and sustainability: Do they affect each other? Sustainability 2021, 13, 7012. [Google Scholar] [CrossRef]

- Alrfai, M.M.; Alqudah, H.; Lutfi, A.; Al-Kofahi, M.; Alrawad, M.; Almaiah, M.A. The influence of artificial intelligence on the AISs efficiency: Moderating effect of the cyber security. Cogent Soc. Sci. 2023, 9, 2243719. [Google Scholar] [CrossRef]

- Sangwan, V.; Harshita; Prakash, P.; Singh, S. Financial technology: A review of extant literature. Stud. Econ. Financ. 2019, 37, 71–88. [Google Scholar] [CrossRef]

- Gupta, S.; Xie, Y.; Zafar, H. Fintech and Digital Payments: Developing a domain knowledge framework. J. Inf. Syst. Educ. 2024, 35, 189–202. [Google Scholar] [CrossRef]

- Almasria, N.A.; Alhatabat, Z.; Ershaid, D.; Ibrahim, A.; Ahmed, S. The mediating impact of organizational innovation on the relationship between fintech innovations and sustainability performance. Sustainability 2024, 16, 10044. [Google Scholar] [CrossRef]

- Grobys, K.; Dufitinema, J.; Sapkota, N.; Kolari, J.W. What’s the expected loss when Bitcoin is under cyberattack? A fractal process analysis. J. Int. Financ. Mark. Inst. Money 2022, 77, 101534. [Google Scholar] [CrossRef]

- Gupta, S.; Raj, S.; Gupta, S.; Sharma, A. Prioritising crowdfunding benefits: A fuzzy-AHP approach. Qual. Quant. 2022, 57, 379–403. [Google Scholar] [CrossRef] [PubMed]

- Belanche, D.; Casaló, L.V.; Flavián, C. Artificial Intelligence in FinTech: Understanding robo-advisors adoption among customers. Ind. Manag. Data Syst. 2019, 119, 1411–1430. [Google Scholar] [CrossRef]

- Bian, W.; Ge, T.; Ji, Y.; Wang, X. How is Fintech reshaping the traditional financial markets? New evidence from InsurTech and insurance sectors in China. China Econ. Rev. 2023, 80, 102004. [Google Scholar] [CrossRef]

- Chang, S.E.; Wang, M.-H. Blockchain-Enabled Fintech Innovation: A case of reengineering stock trading services. IEEE Access 2023, 11, 137125–137137. [Google Scholar] [CrossRef]

- Renduchintala, T.; Alfauri, H.; Yang, Z.; Di Pietro, R.; Jain, R. A survey of blockchain applications in the FinTech sector. J. Open Innov. Technol. Mark. Complex. 2022, 8, 185. [Google Scholar] [CrossRef]

- Rerung, A.; Paranita, E.S.; Ay, R.A.A.; Salamah, F.; Tandililing, E.M. The influence of fintech innovations, ESG reporting, and blockchain technology on financial transparency and accountability. J. Acad. Sci. 2024, 1, 111–117. [Google Scholar] [CrossRef]

- Pu, G.; Qamruzzaman, M.d.; Mehta, A.M.; Naqvi, F.N.; Karim, S. Innovative Finance, Technological Adaptation and SMEs Sustainability: The Mediating Role of Government Support during COVID-19 Pandemic. Sustainability 2021, 13, 9218. [Google Scholar] [CrossRef]

- Bhat, M.A.; Khan, S.T.; Alkhwaldi, A.F.; Abdulmuhsin, A.A. Investigating the critical drivers of Fintech adoption to promote business sustainability of SMEs. Glob. Knowl. Mem. Commun. 2024, ahead-of-print. [Google Scholar] [CrossRef]

- Chen, S.; Guo, Q. Fintech, strategic incentives and investment to human capital, and MSEs innovation. N. Am. J. Econ. Financ. 2023, 68, 101963. [Google Scholar] [CrossRef]

- Rajakumar, J.D. Towards Strengthening Technology Culture amongst MSEs: Evidence from a Field Study in Bangalore, India. J. Comp. Int. Manag. 2011, 14, 52–63. [Google Scholar]

- Chen, S.; Guo, Q. Fintech and MSEs Innovation: An Empirical Analysis. J. Law Econ. Organ. 2024, 1, 1–21. [Google Scholar] [CrossRef]

- Ahamed, G.T.; Raju, S.A.A. A Review of Challenges and Opportunities for MSMEs in India: A Roadmap for Success. Int. J. Adv. Res. Commer. Manag. Soc. Sci. 2023, 6, 89–98. [Google Scholar]

- Madi, A.K.M.; Yusof, R.M. Financial Literacy and Behavioral Finance: Conceptual foundations and research issues. J. Econ. Sustain. Dev. 2018, 9, 81–89. [Google Scholar]

- Andarsari, P.R.; Ningtyas, M.N. The role of financial literacy on financial behavior. J. Appl. Bus. Econ. 2019, 4, 24. [Google Scholar] [CrossRef]

- Hanson, T.A.; Olson, P.M. Financial literacy and family communication patterns. J. Behav. Exp. Finance 2018, 19, 64–71. [Google Scholar] [CrossRef]

- Karadag, H. Financial Management Challenges in Small and Medium-Sized Enterprises: A Strategic Management Approach. EMAJ 2015, 5, 26–40. [Google Scholar] [CrossRef]

- Anshika, N.; Singla, A.; Mallik, G. Determinants of financial literacy: Empirical evidence from micro and small enterprises in India. Asia Pac. Manag. Rev. 2021, 26, 248–255. [Google Scholar] [CrossRef]

- Ali, H.; Omar, E.N.; Nasir, H.A.; Osman, M.R. Financial Literacy of Entrepreneurs in the Small and Medium Enterprises. In Proceedings of the 2nd Advances in Business Research International Conference; Noordin, F., Othman, A., Kassim, E., Eds.; Springer: Singapore, 2018; pp. 31–38. [Google Scholar] [CrossRef]

- Kristiawati, E.; Giriati, N.; Wendy, N.; Malini, H. The Role of Financial Literacy and Entrepreneurial Orientation on MSME Sustainability: The Mediating Effect of E-Commerce. Asian J. Appl. Res. Community Dev. Empower. 2024, 8, 24–30. [Google Scholar] [CrossRef]

- National Centre for Financial Education. Executive Summary: NCFE Financial Literacy and Inclusion Survey 2019. Available online: https://ncfe.org.in/wp-content/uploads/2023/12/ExecSumm_.pdf (accessed on 3 May 2025).

- Yoshino, N.; Morgan, P.J.; Long, T.Q. Financial Literacy and Fintech Adoption in Japan; ADBI Working Paper Series; Asian Development Bank Institute: Tokyo, Japan, 2020; No. 1095; Available online: https://www.adb.org/publications/financial-literacy-fintech-adoption-japan (accessed on 4 January 2025).

- Hidayat-Ur-Rehman, I. The role of financial literacy in enhancing firm’s sustainable performance through Fintech adoption: A moderated mediation analysis. Int. J. Innov. Sci. 2024, ahead-of-print. [Google Scholar] [CrossRef]

- Basar, S.A.; Ibrahim, N.A.; Tamsir, F.; Zain, N.N.M.; Poniran, H.; Rahman, A.R.A. Adoption of i-fintech in promoting sustainable entrepreneurship: Evidence from smes in selangor, malaysia. Quantum J. Soc. Sci. Humanit. 2024, 5, 138–154. [Google Scholar] [CrossRef]

- AlSuwaidi, R.A.; Mertzanis, C. Financial literacy and FinTech market growth around the world. Int. Rev. Financ. Anal. 2024, 95, 103481. [Google Scholar] [CrossRef]

- Firmansyah, E.A.; Masri, M.; Anshari, M.; Besar, M.H.A. Factors Affecting Fintech adoption: A Systematic Literature review. FinTech 2022, 2, 21–33. [Google Scholar] [CrossRef]

- Inder, S.; Aggarwal, A.; Gupta, S.; Gupta, S.; Rastogi, S. An Integrated Model of Financial Literacy among B–School Graduates Using Fuzzy AHP and Factor Analysis. J. Wealth Manag. 2020, 23, 92–110. [Google Scholar] [CrossRef]

- Sharma, S. Enablers to Financial Literacy: A DEMATEL approach. Procedia Comput. Sci. 2022, 214, 520–527. [Google Scholar] [CrossRef]

- Agrawal, S.; Rajput, A.; Khare, A.; Sharma, P.; Sharma, R. DEMATEL Approach for Modeling Relationships among the Enablers of Financial Literacy for SMEs. J. Inform. Educ. Res. 2023, 3, 1772–1782. [Google Scholar] [CrossRef]

- Mahyarni, M.; Okfalisa, O. SMEs digitalization readiness: Sharia fintech framework using Quadruple Helix perceives. Serb. J. Manag. 2024, 19, 71–97. [Google Scholar] [CrossRef]

- Andreou, P.C.; Anyfantaki, S. Financial literacy and its influence on internet banking behavior. Eur. Manag. J. 2020, 39, 658–674. [Google Scholar] [CrossRef]

- Pandey, A.; Kiran, R.; Sharma, R.K. Investigating the impact of financial inclusion drivers, financial literacy and financial initiatives in fostering sustainable growth in North India. Sustainability 2022, 14, 11061. [Google Scholar] [CrossRef]

- Seraj, A.H.A.; Fazal, S.A.; Alshebami, A.S. Entrepreneurial Competency, Financial Literacy, and Sustainable Performance—Examining the Mediating Role of Entrepreneurial Resilience among Saudi Entrepreneurs. Sustainability 2022, 14, 10689. [Google Scholar] [CrossRef]

- Siddik, A.B.; Rahman, M.N.; Yong, L. Do fintech adoption and financial literacy improve corporate sustainability performance? The mediating role of access to finance. J. Clean. Prod. 2023, 421, 137658. [Google Scholar] [CrossRef]

- Muganyi, T.; Yan, L.; Sun, H.-P. Green finance, fintech and environmental protection: Evidence from China. Environ. Sci. Ecotechnol. 2021, 7, 100107. [Google Scholar] [CrossRef] [PubMed]

- Najib, M.; Ermawati, W.J.; Fahma, F.; Endri, E.; Suhartanto, D. FinTech in the Small Food Business and Its Relation with Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 88. [Google Scholar] [CrossRef]

- Sreenu, N. The influence of fintech and financial knowledge on sustainable business success: Exploring the mediating effect of financial accessibility in Indian. Benchmarking Int. J. 2024, ahead-of-print. [Google Scholar] [CrossRef]

- Basar, S.A.; Ibrahim, N.A.; Tamsir, F.; Rahman, A.R.A.; Zain, N.N.M.; Poniran, H.; Ismail, R.F. I-FinTech Adoption Mediation on the Financial Literacy Elements and Sustainable Entrepreneurship among Bumiputera MSMEs in Malaysia. Int. J. Econ. Financ. Issues 2024, 14, 138–147. [Google Scholar] [CrossRef]

- Nugraha, D.P.; Gufron, I.A.; Pringgondani, P.; Ilhamdi, I. The effect of Sharia financial literature, government support and Sharia Fintech on MSME sustainability. Enrich. J. Manag. 2022, 12, 1365–1372. [Google Scholar]

- Morgan, P.J.; Long, T.Q. Financial literacy, financial inclusion, and savings behavior in Laos. J. Asian Econ. 2020, 68, 101197. [Google Scholar] [CrossRef]

- Normawati, R.; Rahayu, S.; Worokinasih, S. Financial Knowledge, Digital Financial Knowledge, Financial Attitude, Financial Behaviour and Financial Satisfaction on Millennials. In Proceedings of the 1st International Conference on Law, Social Science, Economics, and Education, Jakarta, Indonesia, 6 March 2021. [Google Scholar] [CrossRef]

- Lyons, A.C.; Kass-Hanna, J. A methodological overview to defining and measuring “digital” financial literacy. Financ. Plan. Rev. 2021, 4, e1113. [Google Scholar] [CrossRef]

- Setiawan, M.; Effendi, N.; Santoso, T.; Dewi, V.I.; Sapulette, M.S. Digital financial literacy, current behavior of saving and spending and its future foresight. Econ. Innov. New Technol. 2020, 31, 320–338. [Google Scholar] [CrossRef]

- Johan, I.; Rowlingson, K.; Appleyard, L. The Effect of Personal Finance Education on the Financial Knowledge, Attitudes and Behaviour of University Students in Indonesia. J. Fam. Econ. Issues 2020, 42, 351–367. [Google Scholar] [CrossRef]

- Amagir, A.; Groot, W.; Van Den Brink, H.M.; Wilschut, A. Financial literacy of high school students in the Netherlands: Knowledge, attitudes, self-efficacy, and behavior. Int. Rev. Econ. Educ. 2020, 34, 100185. [Google Scholar] [CrossRef]

- Kawamura, T.; Mori, T.; Motonishi, T.; Ogawa, K. Is Financial Literacy Dangerous? Financial Literacy, Behavioral Factors, and Financial Choices of Households. J. Jpn. Int. Econ. 2021, 60, 101131. [Google Scholar] [CrossRef]

- Buchdadi, A.D.; Sholeha, A.; Ahmad, G.N.; Mukson. The Influence of Financial Literacy on SMEs Performance Through Access to Finance and Financial Risk Attitude as Mediation Variables. Acad. Account. Financ. Stud. J. 2020, 24, 1–16. [Google Scholar]

- Dewi, V.; Febrian, E.; Effendi, N.; Anwar, M. Financial Literacy among the Millennial Generation: Relationships between Knowledge, Skills, Attitude, and Behavior. Australas. Account. Bus. Financ. J. 2020, 14, 24–37. [Google Scholar] [CrossRef]

- Rasool, N.; Ullah, S. Financial literacy and behavioural biases of individual investors: Empirical evidence of Pakistan stock exchange. J. Econ. Financ. Adm. Sci. 2020, 25, 261–278. [Google Scholar] [CrossRef]

- Klapper, L.; Lusardi, A. Financial literacy and financial resilience: Evidence from around the world. Financ. Manag. 2019, 49, 589–614. [Google Scholar] [CrossRef]

- Zhang, W.; Siyal, S.; Riaz, S.; Ahmad, R.; Hilmi, M.F.; Li, Z. Data Security, Customer Trust and Intention for Adoption of Fintech Services: An Empirical Analysis From Commercial Bank Users in Pakistan. SAGE Open 2023, 13, 1–17. [Google Scholar] [CrossRef]

- Sayinzoga, A.; Bulte, E.H.; Lensink, R. Financial Literacy and Financial Behaviour: Experimental Evidence from Rural Rwanda. Econ. J. 2016, 126, 1571–1599. [Google Scholar] [CrossRef]

- Fong, J.H.; Koh, B.S.; Mitchell, O.S.; Rohwedder, S. Financial literacy and financial decision-making at older ages. Pac.-Basin Financ. J. 2021, 65, 101481. [Google Scholar] [CrossRef]

- Peng, C.; She, P.W.; Lin, M.K. Financial Literacy and Portfolio Diversity in China. J. Fam. Econ. Issues 2022, 43, 452–465. [Google Scholar] [CrossRef]

- Lopus, J.S.; Amidjono, D.S.; Grimes, P.W. Improving financial literacy of the poor and vulnerable in Indonesia: An empirical analysis. Int. Rev. Econ. Educ. 2019, 32, 100168. [Google Scholar] [CrossRef]

- Singh, S.; Sahni, M.M.; Kovid, R.K. What drives FinTech adoption? A multi-method evaluation using an adapted technology acceptance model. Manag. Decis. 2020, 58, 1675–1697. [Google Scholar] [CrossRef]

- Urumsah, D.; Ispridevi, R.F.; Nurherwening, A.; Hardinto, W. Fintech adoption: Its determinants and organizational benefits in Indonesia. J. Akunt. Audit. Indones. 2022, 26, 88–101. [Google Scholar] [CrossRef]

- Jung, L.S. The Relationship between Attitude and Satisfaction for Improving Continue User Intention in Fintech. Int. J. IT Bus. Strategy Manag. 2016, 2, 29–34. [Google Scholar] [CrossRef]

- Bire, A.R.; Sauw, H.M.; Maria. The effect of financial literacy towards financial inclusion through financial training. Int. J. Soc. Sci. Humanit. 2019, 3, 186–192. [Google Scholar] [CrossRef]

- Doherty, O.; Stephens, S. Hard and soft skill needs: Higher education and the Fintech sector. J. Educ. Work 2023, 36, 186–201. [Google Scholar] [CrossRef]

- Koomson, I.; Villano, R.A.; Hadley, D. Accelerating the impact of financial literacy training programmes on household consumption by empowering women. Appl. Econ. 2021, 53, 3359–3376. [Google Scholar] [CrossRef]

- Nguyen, T.a.N. Does Financial Knowledge Matter in Using Fintech Services? Evidence from an Emerging Economy. Sustainability 2022, 14, 5083. [Google Scholar] [CrossRef]

- Hendriadi, A.A.; Primajaya, A. Optimization of financial technology (fintech) with lean UX development methods in helping technical vocational education and training financial management. IOP Conf. Ser. Mater. Sci. Eng. 2020, 830, 022088. [Google Scholar] [CrossRef]

- Koomson, I.; Villano, R.A.; Hadley, D. Intensifying financial inclusion through the provision of financial literacy training: A gendered perspective. Appl. Econ. 2019, 52, 375–387. [Google Scholar] [CrossRef]

- Gerth, F.; Lopez, K.; Reddy, K.; Ramiah, V.; Wallace, D.; Muschert, G.; Frino, A.; Jooste, L. The Behavioural Aspects of Financial Literacy. J. Risk Financ. Manag. 2021, 14, 395. [Google Scholar] [CrossRef]

- Humphrey-Murto, S.; Varpio, L.; Gonsalves, C.; Wood, T.J. Using consensus group methods such as Delphi and Nominal Group in medical education research. Med. Teach. 2016, 39, 14–19. [Google Scholar] [CrossRef]

- Toronto, C. Considerations when conducting e-Delphi research: A case study. Nurse Res. 2017, 25, 10–15. [Google Scholar] [CrossRef]

- Mitchell, V.; McGoldrick, P.J. The role of geodemographic in segmenting and targeting consumer markets: A Delphi study. Eur. J. Mark. 1994, 28, 54–72. [Google Scholar] [CrossRef]

- Hallowell, M.R.; Gambatese, J.A. Qualitative research: Application of the delphi method to cem research. J. Constr. Eng. Manag. 2010, 136, 99–107. [Google Scholar] [CrossRef]

- Jorm, A.F. Using the Delphi expert consensus method in mental health research. Aust. N. Z. J. Psychiatry 2015, 49, 887–897. [Google Scholar] [CrossRef] [PubMed]

- Singh, R.; Khan, S.; Dsilva, J. A Framework for Assessment of Critical Factor for Circular Economy Practice Implementation. J. Model. Manag. 2022, 18, 1476–1497. [Google Scholar] [CrossRef]

- Chen, Z.; Pak, M. A Delphi analysis on green performance evaluation indices for ports in China. Marit. Policy Manag. 2017, 44, 537–550. [Google Scholar] [CrossRef]

- Kaviani, M.A.; Yazdi, A.K.; Ocampo, L.; Kusi-Sarpong, S. An integrated grey-based multi-criteria decision-making approach for supplier evaluation and selection in the oil and gas industry. Kybernetes 2019, 49, 406–441. [Google Scholar] [CrossRef]

- Ye, J.; Kulathunga, K. How Does Financial Literacy Promote Sustainability in SMEs? A Developing Country Perspective. Sustainability 2019, 11, 2990. [Google Scholar] [CrossRef]

- López-Medina, T.; Mendoza-Ávila, I.; Contreras-Barraza, N.; Salazar-Sepúlveda, G.; Vega-Muñoz, A. Bibliometric Mapping of Research Trends on Financial Behavior for Sustainability. Sustainability 2021, 14, 117. [Google Scholar] [CrossRef]

- Zaimovic, A.; Omanovic, A.; Dedovic, L.; Zaimovic, T. The effect of business experience on fintech behavioural adoption among MSME managers: The mediating role of digital financial literacy and its components. Fut. Bus. J. 2025, 11, 186–192. [Google Scholar] [CrossRef]

- Hasan, M.; Hoque, A.; Abedin, M.Z.; Gasbarro, D. FinTech and sustainable development: A systematic thematic analysis using human- and machine-generated processing. Int. Rev. Financ. Anal. 2024, 95, 103473. [Google Scholar] [CrossRef]

- Danilola, S.; Odeniran, A.; Otonne, A. FinTech Loan Continuance Intention: How Far Can Self-Efficacies Go? In State of the Art in Partial Least Squares Structural Equation Modeling (PLS-SEM); Radomir, L., Ciornea, R., Wang, H., Liu, Y., Ringle, C.M., Sarstedt, M., Eds.; Springer: Cham, Switzerland, 2023; pp. 491–514. [Google Scholar] [CrossRef]

- Rajan, N.; George, A.; Saravanan, S.; Kavitha, J.; Gopalakrishnan, C. An Analysis on Customer Perception towards Fintech Adoption. J. Logist. Inf. Serv. Sci. 2022, 9, 146–158. [Google Scholar] [CrossRef]

- Odisha Grameen Bank. Financial Literacy Centres. Available online: https://odishabank.in/FinLiteracy.php (accessed on 3 May 2025).

- Mission Shakti Annual Activity Report. Available online: https://missionshakti.odisha.gov.in/publication/activity-reports (accessed on 3 May 2025).

- Dalkey, N.; Helmer, O. An Experimental Application of the DELPHI Method to the Use of Experts. Manag. Sci. 1963, 9, 458–467. [Google Scholar] [CrossRef]

- Susanty, A.; Puspitasari, N.B.; Prastawa, H.; Renaldi, S.V. Exploring the best policy scenario plan for the dairy supply chain: A DEMATEL approach. J. Model. Manag. 2020, 16, 240–266. [Google Scholar] [CrossRef]

- Khan, S.; Haleem, A.; Khan, M.I. Risk management in Halal supply chain: An integrated fuzzy Delphi and DEMATEL approach. J. Model. Manag. 2020, 16, 172–214. [Google Scholar] [CrossRef]

- Romero-Collado, A. Essential elements to elaborate a study with the (e) Delphi method. Enferm. Intensiva (Engl. Ed.) 2021, 32, 100–104. [Google Scholar] [CrossRef] [PubMed]

- Bhattacharyya, R. A Grey Theory Based Multiple Attribute Approach for R&D Project Portfolio Selection. Fuzzy Inf. Eng. 2015, 7, 211–225. [Google Scholar] [CrossRef]

- Singh, R.; Khan, S.; Dsilva, J.; Centobelli, P. Blockchain Integrated IoT for Food Supply Chain: A Grey Based Delphi-DEMATEL Approach. Appl. Sci. 2023, 13, 1079. [Google Scholar] [CrossRef]

- Liu, S.; Forrest, J.Y.L. Advances in Grey Systems Research; Understanding Complex Systems; Springer: Berlin/Heidelberg, Germany, 2010. [Google Scholar] [CrossRef]

- Liu, S.; Fang, Z.; Yang, Y.; Forrest, J. General grey numbers and their operations. Grey Syst. Theory Appl. 2012, 2, 341–349. [Google Scholar] [CrossRef]

- Goyal, S.; Agarwal, S.; Singh, N.S.S.; Mathur, T.; Mathur, N. Analysis of Hybrid MCDM Methods for the Performance Assessment and Ranking Public Transport Sector: A Case Study. Sustainability 2022, 14, 15110. [Google Scholar] [CrossRef]

- Marhavilas, P.K.; Tegas, M.G.; Koulinas, G.K.; Koulouriotis, D.E. A Joint Stochastic/Deterministic Process with Multi-Objective Decision Making Risk-Assessment Framework for Sustainable Constructions Engineering Projects—A Case Study. Sustainability 2020, 12, 4280. [Google Scholar] [CrossRef]

- Lee, Y.C.; Chou, C.J. Technology Evaluation and Selection of 3DIC Integration Using a Three-Stage Fuzzy MCDM. Sustainability 2016, 8, 114. [Google Scholar] [CrossRef]

- Saaty, R. The analytic hierarchy process—What it is and how it is used. Math. Model. 1987, 9, 161–176. [Google Scholar] [CrossRef]

- Chang, D.Y. Applications of the extent analysis method on fuzzy AHP. Eur. J. Oper. Res. 1996, 95, 649–655. [Google Scholar] [CrossRef]

- Khan, A.A.; Shameem, M.; Kumar, R.R.; Hussain, S.; Yan, X. Fuzzy AHP based prioritization and taxonomy of software process improvement success factors in global software development. Appl. Soft Comput. 2019, 83, 105648. [Google Scholar] [CrossRef]

- Tronnebati, I.; Jawab, F.; Frichi, Y.; Arif, J. Green Supplier Selection Using Fuzzy AHP, Fuzzy TOSIS, and Fuzzy WASPAS: A Case Study of the Moroccan Automotive Industry. Sustainability 2024, 16, 4580. [Google Scholar] [CrossRef]

- García Mestanza, J.; Bakhat, R. A Fuzzy AHP-MAIRCA Model for Overtourism Assessment: The Case of Malaga Province. Sustainability 2021, 13, 6394. [Google Scholar] [CrossRef]

- Abusaeed, S.; Khan, S.U.R.; Mashkoor, A. A Fuzzy AHP-based approach for prioritization of cost overhead factors in agile software development. Appl. Soft Comput. 2023, 133, 109977. [Google Scholar] [CrossRef]

- Bozbura, F.; Beskese, A.; Kahraman, C. Prioritization of human capital measurement indicators using fuzzy AHP. Expert Syst. Appl. 2007, 32, 1100–1112. [Google Scholar] [CrossRef]

| Criteria | Factors | Code | Description | References |

|---|---|---|---|---|

| Financial Knowledge | Knowledge about current products and Services | IF1 | It relates to the awareness among the users about the digital products and services available in the market that offers a variety of facilities to the users. | [46,47,48,49] |

| Financial education | IF2 | Financial education helps in assessing the products and services provided by FinTech more efficiently through knowledge and skills regarding the management of personal finances, financial decisions, and financial stability. | [46,50,51,52] | |

| Basic Knowledge about finance | IF3 | The understanding about the basics of finance such as interest rate, inflation rate, tax knowledge, exchange rate, etc., leads to better perception of FinTech. | [34,51,53] | |

| Knowledge about Money Management | IF4 | It includes budgeting, debt management, tax planning, retirement planning, credit management, etc., ensuring financial planning and management of FinTech solutions. | [34,47,53] | |

| Knowledge about Savings and Investment | IF5 | It is the awareness regarding the different types of savings and investment opportunities available in the market with the adoption of FinTech and having the skill to extract the most benefits out of it. | [34,47,53] | |

| Knowledge about Risk Management | IF6 | It is the skill to assess and averse the risk related to management of financial products and services acts as a driving force for FinTech adoption. | [34,46,53] | |

| Inflation | IF7 | It is the knowledge about the inflation and its effect on the FinTech products and services. Inflation can drive both individuals and organizations to FinTech solutions because they offer cost savings, higher efficiency, and better financial management. | [37,47,48,52,54] | |

| Risk and Return | IF8 | It is the knowledge regarding perceived risk attached to financial products and services and the return to be extracted from it acts as a driving force for FinTech adoption. | [33,52,55,56] | |

| Interest rates | IF9 | It is the knowledge and skill of calculating the interest rates of the products and services offered by FinTech to assess which yields better return. It includes calculation of simple interest, compound interest, etc. | [37,47,48,52] | |

| Diversification | IF10 | It is the knowledge regarding diversification of business opportunities boosts FinTech adoption as it leads to risk reduction, new market accessibility, fosters innovation, cost efficiency, and improves user experience. | [47,52,54,55] | |

| Knowledge about data security and privacy | IF11 | It shows the customer’s knowledge about data security and privacy concerns that are associated with the adoption of FinTech services. | [57] | |

| Financial Behaviour | Basic Money Management | IF12 | The money management trend and practice followed by an individual or a business leads to adoption of FinTech solutions. | [47,54,58] |

| Savings behaviour | IF13 | The behavioural savings pattern of individuals and businesses shows their constraint and perception towards availing the benefits of FinTech solutions. | [46,55,58] | |

| Investment behaviour | IF14 | The behavioural investment pattern shows the willingness and capacity of an individual or business to explore the available financial products and services which leads to decision of FinTech adoption. | [33,47,54,55] | |

| Portfolio and diversification | IF15 | A diversified financial portfolio shows the willingness to explore different aspects of the market which leads to effective FinTech adoption. | [59,60] | |

| Financial participation | IF16 | It is the participation of individuals in different financial activities with the help of Financial Technology. | [59,61] | |

| Making payments on time | IF17 | Individuals make payments of loans and bills and better understand the fraud associated with the financial transactions with the adoption of FinTech. | [33,59] | |

| Making use of debit/credit cards | IF18 | This is the awareness about the digital debit and credit cards, loan facilities, insurance, and mutual funds with the FinTech adoption, which promotes cashless economy, ultimately connected to sustainable development goals 7 and 9. | [33,47] | |

| Household budgets management | IF19 | Household finance such as payments, lending, and investment decisions can be made with the adoption of FinTech. | [33,35,47] | |

| Financial Attitude | Influence of parents | IF20 | Traditional thoughts shared by parents in adoption of FinTech services can influence the decision-making process. | [33,50,51] |

| Financial responsibility | IF21 | Understanding of individuals’ responsibility towards financial management with adoption of FinTech plays an important role in FinTech adoption. | [47,51] | |

| Perception and Opinion | IF22 | It refers to the opinion and perception about the consequences of adoption of FinTech services. | [47,54] | |

| Importance of savings | IF23 | It refers to the long-term perception of savings with the help of financial technology. | [33,47,54] | |

| Readiness to adopt new technology | IF24 | It is an individual’s or organizational preference to adopt FinTech services over traditional services, which drives financial inclusion through digital literacy. | [62,63] | |

| Importance of preparing for future | IF25 | It refers to secured financial planning for future with the adoption of FinTech assets. | [47,49,54] | |

| Influence of friends and peers | IF26 | The degree of influence received from surrounding friends and peers to use FinTech influences the acceptance of service. | [50,51,64] | |

| Perceived Danger | IF27 | Possibility of loss such as anxiety towards opportunity cost, danger, and uncertainty faced by the consumers affects the use of FinTech. | [64] | |

| Self-Efficacy | IF28 | It is the trust or the individual’s belief in his or her capacity on successfully performing task with FinTech using different devices. | [54,64] | |

| Financial Training | Received training in finance | IF29 | It refers to specific financial training programmes for the individuals and organizations to access FinTech services and skills. | [65,66,67,68] |

| Evaluating financial products | IF30 | Financial training given to the individuals to evaluate the financial products for usage and investment and help to achieve the better profit can influence FinTech adoption and ensure sustainability by choosing eco-friendly products and making smart investments plans. | [65,69,70] | |

| Investment related news | IF31 | Regularly reading news make the individual to understand the current market situation and risk management in financial technology. | [33,71] | |

| Taking professional advice | IF32 | It refers to seeking financial advice to access financial services and support for innovative start-ups in FinTech Sector. | [33,70] | |

| Hard and soft skills | IF33 | Soft skill training programmes provided by higher education in usage of FinTech can be helpful for FinTech adoption. | [66,68] |

| Criteria | Factors | Overall Grey Weight | Crisp Weight | Decision |

|---|---|---|---|---|

| Financial Knowledge | Knowledge about current products and Services | [3.29, 4.29] | 3.79 | Selected |

| Financial education | [3.21, 4.21] | 3.71 | Selected | |

| Basic Knowledge about finance | [1, 2] | 1.5 | Rejected | |

| Knowledge about Money Management | [0.64, 1.64] | 1.14 | Rejected | |

| Knowledge about Savings and Investment | [1.07, 2.07] | 1.57 | Rejected | |

| Knowledge about Risk Management | [3.14, 4.14] | 3.64 | Selected | |

| Inflation | [3, 4] | 3.5 | Selected | |

| Risk and Return | [3.36, 4.36] | 3.86 | Selected | |

| Interest rates | [1.07, 2.07] | 1.57 | Rejected | |

| Diversification | [1.36, 2.36] | 1.86 | Rejected | |

| Knowledge about data security and privacy | [3.07, 4.07] | 3.57 | Selected | |

| Financial Behaviour | Basic Money Management | [1.14, 2.14] | 1.64 | Rejected |

| Investment behaviour | [3.29, 4.29] | 3.79 | Selected | |

| Savings behaviour | [3.29, 4.29] | 3.79 | Selected | |

| Portfolio and diversification behaviour | [3.36, 4.36] | 3.86 | Selected | |

| Financial participation | [1.14, 2.14] | 1.64 | Rejected | |

| Making payments on time | [0.79, 1.79] | 1.29 | Rejected | |

| Making use of debit/credit cards and borrowing | [3.29, 4.29] | 3.79 | Selected | |

| Household budgets management | [0.64, 1.64] | 1.14 | Rejected | |

| Financial Attitude | Influence of parents | [1, 2] | 1.5 | Rejected |

| Financial responsibility | [0.93, 1.93] | 1.43 | Rejected | |

| Perception and Opinion | [3, 4] | 3.5 | Selected | |

| Importance of savings | [1.21, 2.21] | 1.71 | Rejected | |

| Readiness to adopt new technology | [3.21, 4.21] | 3.71 | Selected | |

| Importance of preparing for future | [3, 4] | 3.5 | Selected | |

| Influence of friends and peers | [3.14, 4.14] | 3.64 | Selected | |

| Perceived Danger | [0.93, 1.93] | 1.43 | Rejected | |

| Self-Efficacy | [2.93, 3.93] | 3.43 | Selected | |

| Financial Training | Received training in finance | [3.5, 4.5] | 4 | Selected |

| Evaluating financial products | [3.43, 4.43] | 3.93 | Selected | |

| Reading news relating to investments | [1.71, 2.71] | 2.21 | Rejected | |

| Taking professional advice | [3.14, 4.14] | 3.64 | Selected | |

| Hard and soft skills | [3.29, 4.29] | 3.79 | Selected |

| Factors Having Permanent Influence on FinTech Adoption | Factors Having Circumstantial Influence on FinTech Adoption |

|---|---|

|

|

| FK | FB | FA | FT | |

|---|---|---|---|---|

| FK | 1, 1, 1 | 0.78, 1.16, 1.49 | 0.87, 1.39, 1.9 | 0.79, 1.31, 1.83 |

| FB | 0.68, 0.87, 1.28 | 1, 1, 1 | 0.58, 0.86, 1.36 | 0.52, 0.69, 1.1 |

| FA | 0.46, 0.63, 0.95 | 0.71, 1.16, 1.72 | 1, 1, 1 | 1.04, 1.5, 1.97 |

| FT | 0.55, 0.77, 1.25 | 0.94, 1.41, 1.9 | 0.51, 0.69, 0.97 | 1, 1, 1 |

| FK | FB | FA | FT | |

|---|---|---|---|---|

| FK | 1 | 1.1553 | 1.3898 | 1.3112 |

| FB | 0.9051 | 1 | 0.8968 | 0.7295 |

| FA | 0.6549 | 1.1772 | 1 | 1.5016 |

| FT | 0.8095 | 1.4135 | 0.7057 | 1 |

| FK | FB | FA | FT | Priority Vector Weight | |

|---|---|---|---|---|---|

| FK | 0.2968 | 0.2434 | 0.3481 | 0.2887 | 0.2943 |

| FB | 0.2686 | 0.2107 | 0.2246 | 0.1606 | 0.2161 |

| FA | 0.1944 | 0.248 | 0.2505 | 0.3306 | 0.2559 |

| FT | 0.2402 | 0.2978 | 0.1768 | 0.2202 | 0.2338 |

| FK1 | FK2 | FK3 | FK4 | FK5 | |

|---|---|---|---|---|---|

| FK1 | 1, 1, 1 | 0.7, 1.01, 1.3 | 1.4, 1.91, 2.41 | 1.24, 1.76, 2.27 | 1.54, 2.06, 2.57 |

| FK2 | 0.77, 1, 1.4 | 1, 1, 1 | 0.92, 1.22, 1.68 | 1.91, 2.41, 2.92 | 1.07, 1.59, 2.11 |

| FK3 | 0.43, 0.55, 0.78 | 0.59, 0.83, 1.11 | 1, 1, 1 | 1.49, 2.05, 2.59 | 0.5, 1, 1.5 |

| FK4 | 0.4, 0.56, 0.77 | 0.32, 0.42, 0.54 | 0.36, 0.49, 0.67 | 1, 1, 1 | 0.46, 0.6, 0.92 |

| FK5 | 0.38, 0.49, 0.67 | 0.47, 0.64, 0.95 | 0.7, 1, 2 | 1.11, 1.66, 2.18 | 1, 1, 1 |

| FB1 | FB2 | FB3 | FB4 | |

|---|---|---|---|---|

| FB1 | 1, 1, 1 | 0.61, 0.84, 1.33 | 0.46, 0.63, 0.88 | 0.83, 1.38, 1.91 |

| FB2 | 0.73, 1.21, 1.67 | 1, 1, 1 | 0.83, 1.35, 1.86 | 1, 1.54, 2.06 |

| FB3 | 1.15, 1.65, 2.16 | 0.55, 0.76, 1.22 | 1, 1, 1 | 0.89, 1.36, 1.89 |

| FB4 | 0.53, 0.73, 1.22 | 0.49, 0.66, 1.02 | 0.53, 0.76, 1.13 | 1, 1, 1 |

| FA1 | FA2 | FA3 | FA4 | FA5 | |

|---|---|---|---|---|---|

| FA1 | 1, 1, 1 | 0.67, 1, 1.92 | 0.48, 0.68, 0.98 | 0.56, 0.78, 1.07 | 1.16, 1.66, 2.17 |

| FA2 | 0.52, 1, 1.56 | 1, 1, 1 | 0.4, 0.5, 0.7 | 0.3, 0.4, 0.52 | 0.42, 0.58, 0.82 |

| FA3 | 1.03, 1.52, 2.06 | 1.49, 1.99, 2.49 | 1, 1, 1 | 1.47, 2, 2.51 | 0.82, 1.34, 1.84 |

| FA4 | 0.94, 1.34, 1.78 | 1.94, 2.45, 2.95 | 0.42, 0.53, 0.75 | 1, 1, 1 | 0.56, 0.78, 1.09 |

| FA5 | 0.46, 0.62, 0.88 | 1.26, 1.73, 2.34 | 0.55, 0.78, 1.22 | 0.89, 1.34, 1.78 | 1, 1, 1 |

| FT1 | FT2 | FT3 | FT4 | |

|---|---|---|---|---|

| FT1 | 1, 1, 1 | 0.5, 0.67, 1.07 | 0.68, 1, 1.96 | 0.78, 1.12, 1.41 |

| FT2 | 0.95, 1.5, 2.03 | 1, 1, 1 | 0.8, 0.94, 1.13 | 0.98, 1.52, 2.04 |

| FT3 | 0.51, 1, 1.53 | 0.91, 1.09, 1.27 | 1, 1, 1 | 1.09, 1.6, 2.1 |

| FT4 | 0.72, 0.9, 1.28 | 0.49, 0.66, 1.05 | 0.48, 0.65, 0.93 | 1, 1, 1 |

| FK | FB | FA | FT | |

|---|---|---|---|---|

| V (FK ≥ ..) | 1 | 1 | 1 | |

| V (FB ≥ ..) | 0.7170 | 0.8157 | 0.8992 | |

| V (FA ≥ ..) | 0.8932 | 1 | 1 | |

| V (FT ≥ ..) | 0.8062 | 1 | 0.9119 |

| Criteria | Criteria Weight (CW) | Criteria Rank |

|---|---|---|

| FK | 0.2927 | 1 |

| FB | 0.2099 | 4 |

| FA | 0.2614 | 2 |

| FT | 0.2360 | 3 |

| Criteria | CW | Factors | Local Weight | Local Rank | Global Weight | Global Rank |

|---|---|---|---|---|---|---|

| FK | 0.2927 | FK1 | 0.3046 | 1 | 0.0892 | 1 |

| FK2 | 0.2843 | 2 | 0.0832 | 5 | ||

| FK3 | 0.2012 | 3 | 0.0589 | 12 | ||

| FK4 | 0.0299 | 5 | 0.0088 | 18 | ||

| FK5 | 0.1801 | 4 | 0.0527 | 16 | ||

| FB | 0.2099 | FB1 | 0.2307 | 3 | 0.0675 | 9 |

| FB2 | 0.3004 | 1 | 0.0879 | 3 | ||

| FB3 | 0.2835 | 2 | 0.0830 | 7 | ||

| FB4 | 0.1854 | 4 | 0.0543 | 14 | ||

| FA | 0.2614 | FA1 | 0.1922 | 4 | 0.0563 | 13 |

| FA2 | 0.0799 | 5 | 0.0234 | 17 | ||

| FA3 | 0.2987 | 1 | 0.0874 | 4 | ||

| FA4 | 0.2264 | 2 | 0.0663 | 10 | ||

| FA5 | 0.2027 | 3 | 0.0593 | 11 | ||

| FT | 0.2360 | FT1 | 0.2346 | 3 | 0.0687 | 8 |

| FT2 | 0.3005 | 1 | 0.0880 | 2 | ||

| FT3 | 0.2839 | 2 | 0.0831 | 6 | ||

| FT4 | 0.1810 | 4 | 0.0530 | 15 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mohapatra, N.; Das, M.; Shekhar, S.; Singh, R.; Khan, S.; Tewari, L.M.; Félix, M.J.; Santos, G. Assessing the Role of Financial Literacy in FinTech Adoption by MSEs: Ensuring Sustainability Through a Fuzzy AHP Approach. Sustainability 2025, 17, 4340. https://doi.org/10.3390/su17104340

Mohapatra N, Das M, Shekhar S, Singh R, Khan S, Tewari LM, Félix MJ, Santos G. Assessing the Role of Financial Literacy in FinTech Adoption by MSEs: Ensuring Sustainability Through a Fuzzy AHP Approach. Sustainability. 2025; 17(10):4340. https://doi.org/10.3390/su17104340

Chicago/Turabian StyleMohapatra, Nargis, Mousumi Das, Sameer Shekhar, Rubee Singh, Shahbaz Khan, Lalit Mohan Tewari, Maria João Félix, and Gilberto Santos. 2025. "Assessing the Role of Financial Literacy in FinTech Adoption by MSEs: Ensuring Sustainability Through a Fuzzy AHP Approach" Sustainability 17, no. 10: 4340. https://doi.org/10.3390/su17104340

APA StyleMohapatra, N., Das, M., Shekhar, S., Singh, R., Khan, S., Tewari, L. M., Félix, M. J., & Santos, G. (2025). Assessing the Role of Financial Literacy in FinTech Adoption by MSEs: Ensuring Sustainability Through a Fuzzy AHP Approach. Sustainability, 17(10), 4340. https://doi.org/10.3390/su17104340