Business Strategies for Managing Non-Renewable Energy Dynamics in Saudi Arabia’s Manufacturing Sector

Abstract

1. Introduction

2. Literature Review

3. Data and Methodology

Analytical Strategy

4. Empirical Results

5. Discussion

5.1. Practical Implications

5.2. Limitations and Future Research

6. Conclusions and Outlook

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Xu, G.; Wang, W. China’s energy consumption in construction and building sectors: An outlook to 2100. Energy 2020, 195, 117045. [Google Scholar] [CrossRef]

- Shaari, M.S.; Lee, W.C.; Ridzuan, A.R.; Lau, E.; Masnan, F. The impacts of energy consumption by sector and foreign direct investment on CO2 emissions in Malaysia. Sustainability 2022, 14, 16028. [Google Scholar] [CrossRef]

- Satrovic, E.; Cetindas, A.; Akben, I.; Damrah, S. Do natural resource dependence, economic growth and transport energy consumption accelerate ecological footprint in the most innovative countries? The moderating role of technological innovation. Gondwana Res. 2024, 127, 116–130. [Google Scholar] [CrossRef]

- Hao, Y. The relationship between renewable energy consumption, carbon emissions, output, and export in industrial and agricultural sectors: Evidence from China. Environ. Sci. Pollut. Res. 2022, 29, 63081–63098. [Google Scholar] [CrossRef] [PubMed]

- Ozturk, I.; Aslan, A.; Kalyoncu, H. Energy consumption and economic growth relationship: Evidence from panel data for low and middle income countries. Energy Policy 2010, 38, 4422–4428. [Google Scholar] [CrossRef]

- Hoang, T.H.V.; Shahzad, S.J.H.; Czudaj, R.L. Renewable energy consumption and industrial production: A disaggregated time-frequency analysis for the U.S. Energy Econ. 2020, 85, 104433. [Google Scholar] [CrossRef]

- Sun, S.; Anwar, S. Electricity consumption, industrial production, and entrepreneurship in Singapore. Energy Policy 2015, 77, 70–78. [Google Scholar] [CrossRef]

- Shahbaz, M.; Salah Uddin, G.; Ur Rehman, I.; Imran, K. Industrialization, electricity consumption and CO2 emissions in Bangladesh. Renew. Sustain. Energy Rev. 2014, 31, 575–586. [Google Scholar] [CrossRef]

- Hassan, S.; Danmaraya, I.A.; Danlami, M.R. Energy Consumption and Manufacturing Performance in Sub-Saharan Africa: Does Income Group Matters? Int. J. Energy Econ. Policy 2018, 8, 175–180. [Google Scholar]

- Adekoya, O.B.; Ogunnusi, T.P.; Oliyide, J.A. Sector-by-sector non-renewable energy consumption shocks and manufacturing performance in the U.S.: Analysis of the asymmetric issue with nonlinear ARDL and the role of structural breaks. Energy 2021, 222, 119947. [Google Scholar] [CrossRef]

- Bei, J.; Wang, C. Renewable energy resources and sustainable development goals: Evidence based on green finance, clean energy and environmentally friendly investment. Resour. Policy 2023, 80, 103194. [Google Scholar] [CrossRef]

- Al-Ayouty, I. The effect of energy consumption on output: A panel data study of manufacturing industries in Egypt. Eur. J. Sustain. Dev. 2020, 9, 490. [Google Scholar] [CrossRef]

- Chen, X.; Shuai, C.; Wu, Y.; Zhang, Y. Understanding the sustainable consumption of energy resources in global industrial sector: Evidences from 114 countries. Environ. Impact Assess. Rev. 2021, 90, 106609. [Google Scholar] [CrossRef]

- Brodny, J.; Tutak, M. Analysis of the efficiency and structure of energy consumption in the industrial sector in the European Union countries between 1995 and 2019. Sci. Total Environ. 2022, 808, 152052. [Google Scholar] [CrossRef]

- Ziramba, E. Disaggregate energy consumption and industrial production in South Africa. Energy Policy 2009, 37, 2214–2220. [Google Scholar] [CrossRef]

- Akpan, J.; Olanrewaju, O. Sustainable energy development: History and recent advances. Energies 2023, 16, 7049. [Google Scholar] [CrossRef]

- Tutak, M.; Brodny, J. Renewable energy consumption in economic sectors in the EU-27. The impact on economics, environment and conventional energy sources. A 20-year perspective. J. Clean. Prod. 2022, 345, 131076. [Google Scholar] [CrossRef]

- Mezghani, I.; Ben Haddad, H. Energy consumption and economic growth: An empirical study of the electricity consumption in Saudi Arabia. Renew. Sustain. Energy Rev. 2017, 75, 145–156. [Google Scholar] [CrossRef]

- Chen, C.; Pinar, M.; Stengos, T. Renewable energy consumption and economic growth nexus: Evidence from a threshold model. Energy Policy 2020, 139, 111295. [Google Scholar] [CrossRef]

- Mohsin, M.; Kamran, H.W.; Atif Nawaz, M.; Sajjad Hussain, M.; Dahri, A.S. Assessing the impact of transition from nonrenewable to renewable energy consumption on economic growth-environmental nexus from developing Asian economies. J. Environ. Manag. 2021, 284, 111999. [Google Scholar] [CrossRef]

- Mighri, Z.; AlSaggaf, M.I. Asymmetric impacts of renewable energy consumption and economic complexity on economic growth in Saudi Arabia: Evidence from the NARDL model. Environ. Sci. Pollut. Res. 2023, 30, 7446–7473. [Google Scholar] [CrossRef] [PubMed]

- Alkhathlan, K.; Javid, M. Energy consumption, carbon emissions and economic growth in Saudi Arabia: An aggregate and disaggregate analysis. Energy Policy 2013, 62, 1525–1532. [Google Scholar] [CrossRef]

- Saidi, S.; Hammam, S. Do Transport Infrastructures Promote the Foreign Direct Investments Attractiveness? Empirical Investigation from Four North African Countries. Rom. Econ. J. 2018, 20. [Google Scholar]

- Al Shammre, A.S. The Impact of Using Renewable Energy Resources on Sustainable Development in the Kingdom of Saudi Arabia. Sustainability 2024, 16, 1324. [Google Scholar] [CrossRef]

- Hasan, M.M.; Nan, S.; Waris, U. Assessing the dynamics among oil consumption, ecological footprint, and renewable energy: Role of institutional quality in major oil-consuming countries. Resour. Policy 2024, 90, 104843. [Google Scholar] [CrossRef]

- Ben-Salha, O.; Hkiri, B.; Aloui, C. Sectoral energy consumption by source and output in the U.S.: New evidence from wavelet-based approach. Energy Econ. 2018, 72, 75–96. [Google Scholar] [CrossRef]

- Shin, Y.; Yu, B.; Greenwood-Nimmo, M. Modelling Asymmetric Cointegration and Dynamic Multipliers in a Nonlinear ARDL Framework. In Festschrift in Honor of Peter Schmidt: Econometric Methods and Applications; Sickles, R.C., Horrace, W.C., Eds.; Springer New York: New York, NY, USA, 2014; pp. 281–314. [Google Scholar]

- Adekoya, O.B.; Oliyide, J.A. The hedging effectiveness of industrial metals against different oil shocks: Evidence from the four newly developed oil shocks datasets. Resour. Policy 2020, 69, 101831. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, L.; Sadiq, M.; Chien, F. The impact of non-renewable energy production and energy usage on carbon emissions: Evidence from China. Energy Environ. 2024, 35, 2248–2269. [Google Scholar] [CrossRef]

- Dinh, H. Industrialization in Africa: Issues and Policies; Policy Center For The New South: Rabat, Moroco, 2023. [Google Scholar]

- Yu, C.; Moslehpour, M.; Tran, T.K.; Trung, L.M.; Ou, J.P.; Tien, N.H. Impact of non-renewable energy and natural resources on economic recovery: Empirical evidence from selected developing economies. Resour. Policy 2023, 80, 103221. [Google Scholar] [CrossRef]

- Toumi, S.; Toumi, H. Asymmetric causality among renewable energy consumption, CO2 emissions, and economic growth in KSA: Evidence from a non-linear ARDL model. Environ. Sci. Pollut. Res. 2019, 26, 16145–16156. [Google Scholar] [CrossRef]

- Jafri, M.A.H.; Liu, H.; Usman, A.; Khan, Q.R. Re-evaluating the asymmetric conventional energy and renewable energy consumption-economic growth nexus for Pakistan. Environ. Sci. Pollut. Res. 2021, 28, 37435–37447. [Google Scholar] [CrossRef] [PubMed]

- Khan, I.; Hou, F.; Zakari, A.; Tawiah, V.K. The dynamic links among energy transitions, energy consumption, and sustainable economic growth: A novel framework for IEA countries. Energy 2021, 222, 119935. [Google Scholar] [CrossRef]

- Shahbaz, M.; Raghutla, C.; Chittedi, K.R.; Jiao, Z.; Vo, X.V. The effect of renewable energy consumption on economic growth: Evidence from the renewable energy country attractive index. Energy 2020, 207, 118162. [Google Scholar] [CrossRef]

- Alper, A.; Oguz, O. The role of renewable energy consumption in economic growth: Evidence from asymmetric causality. Renew. Sustain. Energy Rev. 2016, 60, 953–959. [Google Scholar] [CrossRef]

- Bai, Q.; Raza, M.Y. Analysis of energy consumption and change structure in major economic sectors of Pakistan. Plos One 2024, 19, e0305419. [Google Scholar] [CrossRef]

- Gershon, O.; Asafo, J.K.; Nyarko-Asomani, A.; Koranteng, E.F. Investigating the nexus of energy consumption, economic growth and carbon emissions in selected african countries. Energy Strategy Rev. 2024, 51, 101269. [Google Scholar] [CrossRef]

- Wang, Z.; Bui, Q.; Zhang, B. The relationship between biomass energy consumption and human development: Empirical evidence from BRICS countries. Energy 2020, 194, 116906. [Google Scholar] [CrossRef]

- Dogan, E.; Altinoz, B.; Madaleno, M.; Taskin, D. The impact of renewable energy consumption to economic growth: A replication and extension of Inglesi-Lotz (2016). Energy Econ. 2020, 90, 104866. [Google Scholar] [CrossRef]

- Hatemi-J, A.; Uddin, G.S. Is the causal nexus of energy utilization and economic growth asymmetric in the US? Econ. Syst. 2012, 36, 461–469. [Google Scholar] [CrossRef]

- Lin, B.; Moubarak, M. Renewable energy consumption – Economic growth nexus for China. Renew. Sustain. Energy Rev. 2014, 40, 111–117. [Google Scholar] [CrossRef]

- Ghanem, A.M.; Alamri, Y.A. The impact of the green Middle East initiative on sustainable development in the Kingdom of Saudi Arabia. J. Saudi Soc. Agric. Sci. 2023, 22, 35–46. [Google Scholar] [CrossRef]

- Tugcu, C.T.; Topcu, M. Total, renewable and non-renewable energy consumption and economic growth: Revisiting the issue with an asymmetric point of view. Energy 2018, 152, 64–74. [Google Scholar] [CrossRef]

- AlNemer, H.A.; Hkiri, B.; Tissaoui, K. Dynamic impact of renewable and non-renewable energy consumption on CO2 emission and economic growth in Saudi Arabia: Fresh evidence from wavelet coherence analysis. Renew. Energy 2023, 209, 340–356. [Google Scholar] [CrossRef]

- Sarkar, B.; Chandra, D.B.; Aznarul, I.; Debajit, D.; Łukasz, P.; and Quesada-Román, A. Temporal change in channel form and hydraulic behaviour of a tropical river due to natural forcing and anthropogenic interventions. Phys. Geogr. 2024, 45, 483–517. [Google Scholar] [CrossRef]

- Iqbal, A.; Khan, J. Assessing the symmetric nature of the energy-led growth hypothesis in Pakistan. J. Energy Environ. Policy Options 2020, 3, 72–77. [Google Scholar]

- Stern, D.I. Energy and economic growth. In Routledge Handbook of Energy Economics; Routledge: Oxfordshire, UK, 2019; pp. 28–46. [Google Scholar]

- Stern, D.I. The role of energy in economic growth. Ann. New York Acad. Sci. 2011, 1219, 26–51. [Google Scholar] [CrossRef]

- Sharif, A.; Raza, S.A.; Ozturk, I.; Afshan, S. The dynamic relationship of renewable and nonrenewable energy consumption with carbon emission: A global study with the application of heterogeneous panel estimations. Renew. Energy 2019, 133, 685–691. [Google Scholar] [CrossRef]

- Ike, G.N.; Usman, O.; Alola, A.A.; Sarkodie, S.A. Environmental quality effects of income, energy prices and trade: The role of renewable energy consumption in G-7 countries. Sci. Total Environ. 2020, 721, 137813. [Google Scholar] [CrossRef]

- Çıtak, F.; Uslu, H.; Batmaz, O.; Hoş, S. Do renewable energy and natural gas consumption mitigate CO2 emissions in the USA? New insights from NARDL approach. Environ. Sci. Pollut. Res. 2021, 28, 63739–63750. [Google Scholar] [CrossRef]

- Shaukat, A.; Eatzaz, A.; and Shahid Malik, W. Measuring real exchange rate misalignment: An industry-level analysis of Pakistan using ARDL approach. Cogent Bus. Manag. 2022, 9, 2148871. [Google Scholar] [CrossRef]

- Dickey, D.A.F.; Wayne, A. Distribution of the Estimators for Autoregressive Time Series with a Unit Root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar] [CrossRef]

- Phillips, P.C.; Perron, P. Testing for a unit root in time series regression. biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Samour, A. Renewable energy, fiscal policy and load capacity factor in BRICS countries: Novel findings from panel nonlinear ARDL model. Environ. Dev. Sustain. 2024, 26, 4365–4389. [Google Scholar] [CrossRef]

- Durani, F.; Bhowmik, R.; Sharif, A.; Anwar, A.; Syed, Q.R. Role of economic uncertainty, financial development, natural resources, technology, and renewable energy in the environmental Phillips curve framework. J. Clean. Prod. 2023, 420, 138334. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Musa, M.; Gao, Y.; Rahman, P.; Albattat, A.; Ali, M.A.S.; Saha, S.K. Sustainable development challenges in Bangladesh: An empirical study of economic growth, industrialization, energy consumption, foreign investment, and carbon emissions—using dynamic ARDL model and frequency domain causality approach. Clean Technol. Environ. Policy 2024, 26, 1799–1823. [Google Scholar] [CrossRef]

- Essiz, O.; Senyuz, A. Predicting the value-based determinants of sustainable luxury consumption: A multi-analytical approach and pathway to sustainable development in the luxury industry. Bus. Strategy Environ. 2024, 33, 1721–1758. [Google Scholar] [CrossRef]

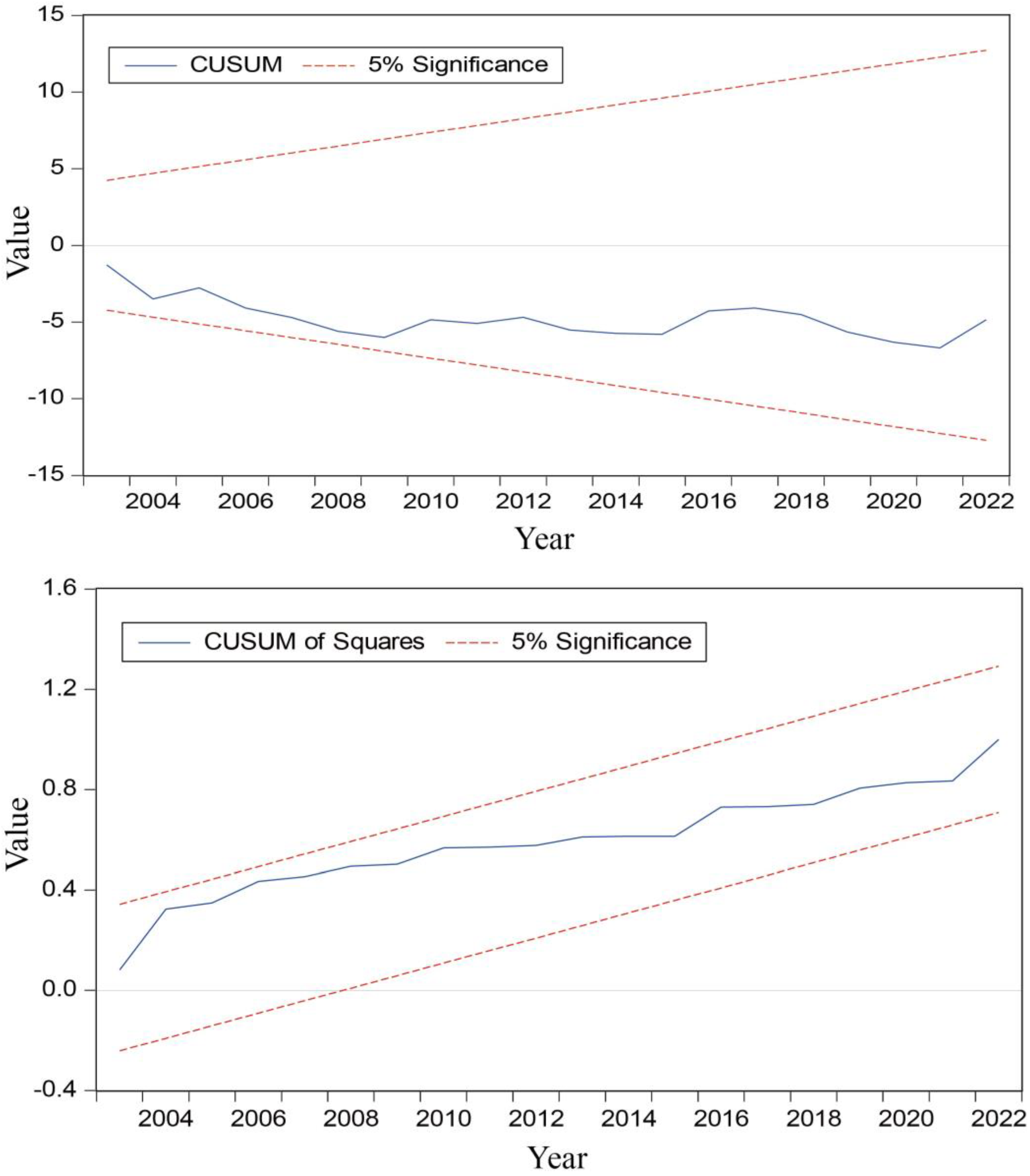

- Bahmani-Oskooee, M.; Bohl, M.T. German monetary unification and the stability of the German M3 money demand function. Econ. Lett. 2000, 66, 203–208. [Google Scholar] [CrossRef]

- Stock, J.H.; and Watson, M.W. Generalized Shrinkage Methods for Forecasting Using Many Predictors. J. Bus. Econ. Stat. 2012, 30, 481–493. [Google Scholar] [CrossRef]

- Katrakilidis, C.; Trachanas, E. What drives housing price dynamics in Greece: New evidence from asymmetric ARDL cointegration. Econ. Model. 2012, 29, 1064–1069. [Google Scholar] [CrossRef]

- Narayan, S.; Doytch, N. An investigation of renewable and non-renewable energy consumption and economic growth nexus using industrial and residential energy consumption. Energy Econ. 2017, 68, 160–176. [Google Scholar] [CrossRef]

- Brown, R.L.; Durbin, J.; Evans, J.M. Techniques for Testing the Constancy of Regression Relationships Over Time. J. R. Stat. Soc. Ser. B (Methodol.) 2018, 37, 149–163. [Google Scholar] [CrossRef]

- Abbasi, K.; Jiao, Z.; Shahbaz, M.; Khan, A. Asymmetric impact of renewable and non-renewable energy on economic growth in Pakistan: New evidence from a nonlinear analysis. Energy Explor. Exploit. 2020, 38, 1946–1967. [Google Scholar] [CrossRef]

- Baz, K.; Cheng, J.; Xu, D.; Abbas, K.; Ali, I.; Ali, H.; Fang, C. Asymmetric impact of fossil fuel and renewable energy consumption on economic growth: A nonlinear technique. Energy 2021, 226, 120357. [Google Scholar] [CrossRef]

- Kassim, F.; Isik, A. Impact of energy consumption on industrial growth in a transition economy: Evidence from Nigeria. Munich Pers. RePEc Arch. 2020. [Google Scholar]

- Elgammal, I.; Al-Modaf, O. The antecedent of the sustainable purchasing attitudes among generation Z: A terror management theory perspective. Sustainability 2023, 15, 9323. [Google Scholar] [CrossRef]

- Polzin, F.; Egli, F.; Steffen, B.; Schmidt, T.S. How do policies mobilize private finance for renewable energy?—A systematic review with an investor perspective. Appl. Energy 2019, 236, 1249–1268. [Google Scholar] [CrossRef]

- Alshehry, A.S.; Belloumi, M. Investigating the causal relationship between fossil fuels consumption and economic growth at aggregate and disaggregate levels in Saudi Arabia. Int. J. Energy Econ. Policy 2014, 4, 531–545. [Google Scholar]

- Tuna, G.; Tuna, V.E. The asymmetric causal relationship between renewable and NON-RENEWABLE energy consumption and economic growth in the ASEAN-5 countries. Resour. Policy 2019, 62, 114–124. [Google Scholar] [CrossRef]

- Ali, M.; Xiaoying, L.; Khan, A. Revealing the dynamic influence of clean energy consumption on economic sustainability in Pakistan: A pathway to sustainable development. Res. Sq. 2024. [Google Scholar] [CrossRef]

- Khan, A.; Sun, C. The asymmetric nexus of energy-growth and CO2 emissions: An empirical evidence based on hidden cointegration analysis. Gondwana Res. 2024, 125, 15–28. [Google Scholar] [CrossRef]

- Halim, M.; Rezk, W.; Darawsheh, S.; Al-Shaar, A.; Alshurideh, M. The Impact of Changes in Oil Prices on the Global and Saudi Arabia Economy. In The Effect of Information Technology on Business and Marketing Intelligence Systems; Alshurideh, M., Al Kurdi, B.H., Masa’deh, R.e., Alzoubi, H.M., Salloum, S., Eds.; Springer International Publishing: Cham, Switzerland, 2023; pp. 2519–2540. [Google Scholar]

- Miar, M.; Rizani, A.; Pardede, R.; Basrowi, B. Analysis of the effects of capital expenditure and supply chain on economic growth and their implications on the community welfare of districts and cities in central Kalimantan province. Uncertain Supply Chain Manag. 2024, 12, 489–504. [Google Scholar] [CrossRef]

- Solow, R.M. A contribution to the theory of economic growth. Q. J. Econ. 1956, 70, 65–94. [Google Scholar] [CrossRef]

- Barro, R.J. Government spending in a simple model of endogeneous growth. J. Political Econ. 1990, 98, S103–S125. [Google Scholar] [CrossRef]

- Graham, E.M.; Krugman, P.R. Foreign Direct Investment in the United States; Peterson Institute: Washington, DC, USA, 1991. [Google Scholar]

- de Long, J.B.; Summers, L.H.; Abel, A.B. Equipment Investment and Economic Growth: How Strong is the Nexus? Brook. Pap. Econ. Act. 1992, 1992, 157–211. [Google Scholar] [CrossRef]

- Shuaib, I.; Ndidi, D.E. Capital formation: Impact on the economic development of Nigeria 1960-2013. Eur. J. Bus. Econ. Account. 2015, 3, 23–40. [Google Scholar]

- Nweke, G.O.; Odo, S.I.; Anoke, C.I. Effect of capital formation on economic growth in Nigeria. Asian J. Econ. Bus. Account. 2017, 5, 1–16. [Google Scholar]

- Khondaker, A.N.; Masiur, R.S.; Karim, M.; Nahid, H.; Shaikh, A.R.; and Khan, R.A. Dynamics of energy sector and GHG emissions in Saudi Arabia. Clim. Policy 2015, 15, 517–541. [Google Scholar] [CrossRef]

- Samargandi, N.; Monirul Islam, M.; Sohag, K. Towards realizing vision 2030: Input demand for renewable energy production in Saudi Arabia. Gondwana Res. 2024, 127, 47–64. [Google Scholar] [CrossRef]

- Elgammal, I.; Alhothali, G.T. Towards green pilgrimage: A framework for action in Makkah, Saudi Arabia. Int. J. Relig. Tour. Pilgr. 2021, 9, 5. [Google Scholar] [CrossRef]

- Mujtaba, A.; Jena, P.K.; Bekun, F.V.; Sahu, P.K. Symmetric and asymmetric impact of economic growth, capital formation, renewable and non-renewable energy consumption on environment in OECD countries. Renew. Sustain. Energy Rev. 2022, 160, 112300. [Google Scholar] [CrossRef]

- Guyadeen, D.; Henstra, D.; Kaup, S.; Wright, G. Evaluating the quality of municipal strategic plans. Eval. Program Plan. 2023, 96, 102186. [Google Scholar] [CrossRef] [PubMed]

- Ewing, B.T.; Sari, R.; Soytas, U. Disaggregate energy consumption and industrial output in the United States. Energy Policy 2007, 35, 1274–1281. [Google Scholar] [CrossRef]

- Elgammal, I.; Baeshen, M.H.; Alhothali, G.T. Entrepreneurs’ responses to COVID-19 crisis: A holistic dynamic capabilities perspective in the Saudi food and beverage sector. Sustainability 2022, 14, 13111. [Google Scholar] [CrossRef]

| Augmented Dickey–Fuller | Phillips–Perron | |||

|---|---|---|---|---|

| Variables | Intercept | Trend and Intercept | Intercept | Trend and Intercept |

| Manufacturing Output | 2.577 | −1.514 | 3.18 | 1.12 |

| (−1.000) | (0.802) | (1.000) | (0.9990) | |

| (Manufacturing Output) | −4.816 | −6.197 | −3.906 | −4.428 |

| (0.000) | (0.000) | (0.012) | (0.001) | |

| Non-Renewable Energy_POS | 0.572 | −2.556 | 0.4593 | −2.629 |

| (0.986) | (0.301) | (0.982) | (0.270) | |

| Δ (Non-Renewable Energy_POS) | −4.684 | −4.667 | −4.688 | −4.637 |

| (0.000) | (0.0041) | (0.000) | (0.004) | |

| Non-Renewable Energy_NEG | −0.345 | −1.723 | −0.392 | −1.891 |

| (0.906) | (0.716) | (0.898) | (0.635) | |

| Δ (Non-Renewable Energy_NEG) | −5.074 | −5.073 | −5.107 | −5.897 |

| (0.000) | (0.001) | (0.000) | (0.000) | |

| Renewable Energy | −3.052 | −3.152 | −10.38 | −7.941 |

| (0.041) | (0.031) | (0.000) | (0.000) | |

| Δ (Renewable Energy) | −3.457 | −4.119 | −3.518 | −4.798 |

| (0.050) | (0.015) | (0.014) | (0.002) | |

| Gross Fixed Capital Formation | 0.485 | −2.8 | 0.499 | −1.725 |

| (0.983) | (0.210) | (0.984) | (0.716) | |

| Δ (Gross Fixed Capital Formation) | −2.698 | −6.829 | −6.837 | −6.929 |

| (0.068) | (0.000) | (0.000) | (0.000) | |

| Signif. | F-Statistic | Upper Bound | Lower Bound | Result |

|---|---|---|---|---|

| 10% | 10.098 | 3.01 | 1.90 | Co-integration |

| 5% | 3.48 | 2.26 | ||

| 2.50% | 3.90 | 2.62 | ||

| 1% | 4.44 | 3.07 |

| Test Statistic | Value | df | Probability |

|---|---|---|---|

| t-statistic | 2.884 | 20 | 0.009 |

| F-statistic | 8.319 | (1, 20) | 0.009 |

| Chi-square | 8.319 | 1 | 0.003 |

| No Constant and No Trend | |||

|---|---|---|---|

| Variable | Coefficient | t-Statistic | Prob. |

| NRE_POS | 0.261 * | 2.922 | 0.008 |

| NRE_NEG | −0.602 ** | −1.98 | 0.061 |

| RE | −0.174 *** | −4.316 | 0.000 |

| GFC | 0.621 *** | 9.254 | 0.000 |

| No Constant and No Trend | |||

|---|---|---|---|

| Variable | Coefficient | t-Statistic | Prob. |

| MO (−1) | −0.947 *** | −5.668 | 0.000 |

| Δ (NRE_POS) | 0.247 *** | 2.352 | 0.029 |

| Δ (NRE_NEG) | −0.571 * | −1.896 | 0.072 |

| Δ (RE) | −3.024 *** | −2.771 | 0.011 |

| Δ (RE (−1)) | 4.251 *** | 3.871 | 0.000 |

| Δ (GFC) | 0.706 *** | 8.039 | 0.000 |

| Δ (GFC (−1)) | −0.069 | −0.775 | 0.447 |

| Δ (GFC (−2)) | −0.342 *** | −3.382 | 0.003 |

| ECT (−1) | −0.947 *** | −7.784 | 0.000 |

| R-squared | 0.862 | ||

| Adjusted R-squared | 0.834 | ||

| Durbin–Watson stat | 2.016 | ||

| Diagnostic Tests | Serial Correlation | Heteroscedasticity | Normality | Model Specification |

|---|---|---|---|---|

| F-statistic | F-statistic | Chi-square | F-statistic | |

| Breusch–Pagan–Godfrey | 1.327 | |||

| (0.285) | ||||

| LM test | 3.1008 | |||

| 0.178 | ||||

| Jarque–Bera | 1.418 | |||

| (0.492) | ||||

| Ramsey RESET test | 0.462 | |||

| (0.648) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alsulamy, N.; Shoukat, A.; Elgammal, I. Business Strategies for Managing Non-Renewable Energy Dynamics in Saudi Arabia’s Manufacturing Sector. Sustainability 2025, 17, 4331. https://doi.org/10.3390/su17104331

Alsulamy N, Shoukat A, Elgammal I. Business Strategies for Managing Non-Renewable Energy Dynamics in Saudi Arabia’s Manufacturing Sector. Sustainability. 2025; 17(10):4331. https://doi.org/10.3390/su17104331

Chicago/Turabian StyleAlsulamy, Nouf, Aqsa Shoukat, and Islam Elgammal. 2025. "Business Strategies for Managing Non-Renewable Energy Dynamics in Saudi Arabia’s Manufacturing Sector" Sustainability 17, no. 10: 4331. https://doi.org/10.3390/su17104331

APA StyleAlsulamy, N., Shoukat, A., & Elgammal, I. (2025). Business Strategies for Managing Non-Renewable Energy Dynamics in Saudi Arabia’s Manufacturing Sector. Sustainability, 17(10), 4331. https://doi.org/10.3390/su17104331