1. Introduction

The building and construction sector is responsible for nearly 40% of global energy-related CO

2 emissions [

1], while also consuming approximately 30% of all extracted minerals worldwide [

2]. In light of the accelerating decarbonization imperatives outlined in international climate accords—such as the Paris Agreement—there is an urgent need for integrative assessment frameworks that align environmental life cycle impacts with the total cost of ownership (TCO). Such approaches support evidence-based policy formulation and enable techno-economic optimization in the built environment.

Life cycle environmental cost accounting (LECA), which integrates life cycle assessment (LCA) with life cycle costing (LCC), has emerged as a comprehensive methodology for evaluating the environmental and economic trade-offs of construction systems [

2]. LCA, governed by ISO 14040 [

3] and ISO 14044 [

4], assesses cradle-to-grave impacts such as energy use, emissions, and resource depletion, while LCC captures the total financial life cycle—from initial investment through operation, maintenance, and end-of-life disposal [

5].

Although the application of LCA–LCC in construction research is growing, many existing studies rely on proprietary or case-specific datasets, which limits reproducibility and cross-regional transferability [

6,

7]. Furthermore, the environmental performance of prefabricated construction remains underexplored in life cycle terms, particularly for steel-based systems, despite their increasing popularity for improving material efficiency, construction speed, and waste reduction [

8,

9].

Steel was selected as the target material for this study due to its dual characteristics: while its production phase contributes significantly to embodied carbon, it offers structural reliability, modular standardization, and recyclability, making it well-suited for industrialized prefabrication. In China, prefabricated steel structures have been increasingly adopted in mid- and high-rise commercial and institutional projects, underscoring the urgency and relevance of assessing their life cycle performance under emerging carbon regulation regimes.

Recent advances in building information modeling (BIM) have further enabled the integration of environmental and economic data into design workflows [

10,

11]. Simultaneously, emerging decision-support tools incorporate probabilistic financial models to account for policy volatility and carbon market uncertainty [

12], strengthening the foundation for data-driven sustainable planning.

Building upon these developments, this study introduces a standardized and transparent LECA framework tailored to prefabricated steel buildings. While the methodology is generalizable, the case study applies it within the Chinese context, utilizing national and international life cycle databases—such as CEADs, Ecoinvent, and the Chinese Life Cycle Database (CLCD)—to ensure accuracy and replicability. The framework also integrates a carbon financial modeling module that evaluates investment performance under variable carbon pricing scenarios [

13].

The main contributions of this research are as follows:

- (1)

The development of an integrated LCA–LCC methodology for holistic sustainability assessment in the built environment for prefabricated steel buildings;

- (2)

A focused evaluation of the life cycle performance of prefabricated steel systems, addressing a critical gap in the current literature;

- (3)

The incorporation of advanced sensitivity and uncertainty analyses to support informed decision making amid dynamic policy and market conditions.

2. Literature Review

This section provides a structured review of the academic literature relevant to this study. It begins with an overview of the theoretical foundations of environmental and economic assessment in the construction sector, focusing on life cycle assessment (LCA), life cycle costing (LCC), and their integration into life cycle environmental cost accounting (LECA). The review then explores recent advances in data sources, methodological tools, and carbon pricing mechanisms. Finally, it synthesizes empirical studies related to embodied carbon in prefabricated buildings—particularly steel-based systems—highlighting unresolved research gaps that motivated the present work.

2.1. Life Cycle Environmental Cost Accounting in Construction

The application of life cycle assessment (LCA) in the construction sector has expanded significantly over the past two decades, spurred by the growing imperative to quantify environmental impacts throughout the cradle-to-grave life cycles of buildings [

14]. Standardized methodologies, notably those outlined in ISO 14040 and ISO 14044, facilitate the systematic assessment of energy use, resource consumption, and greenhouse gas (GHG) emissions. When LCA is integrated with life cycle costing (LCC)—which captures the full spectrum of economic expenditures across a building’s lifespan—the resulting life cycle environmental cost accounting (LECA) approach offers a comprehensive dual-perspective analysis critical for promoting sustainable construction practices [

2,

15].

Numerous studies have highlighted the practical value of LECA integration in both research and industry contexts. For example, Ruben Santos et al. [

16] proposed a BIM-integrated framework that combines LCA and LCC to enable the real-time evaluation of environmental and economic impacts, thereby supporting informed design decisions during early project phases. In a global meta-analysis encompassing more than 650 cases, Martin et al. [

17] demonstrated that embodied emissions can constitute a significant portion of total life cycle GHG emissions, especially in energy-efficient buildings. This underscores the importance of addressing both embodied and operational carbon footprints, a conclusion further substantiated by Zhang et al. [

18].

Early design-stage assessments have been widely recognized as pivotal for maximizing LECA’s impact. Researchers such as Nkechi [

19] and Santos et al. [

16] emphasize that key material selections and system configurations made during this phase significantly influence a project’s long-term sustainability. Empirical studies by Petrović et al. [

20] and Zhang et al. [

21] further support the integration of environmental and economic evaluations as a strategy for guiding sustainable design processes and informing policy development.

Despite the methodological advancements, challenges remain—most notably, the limited availability and inconsistent quality of data required for robust LCA modeling, as observed by Oludolapo et al. [

22]. Nevertheless, continued methodological refinements have improved LECA’s analytical reliability. Kulczycka [

23], for instance, introduced advanced approaches to strengthen impact quantification, while Zhu [

24] demonstrated the influence of environmental cost accounting on investment decision making.

Comprehensive reviews by Grover [

25] and Parry et al. [

26] emphasize the importance of linking environmental externalities to monetary valuation frameworks, thereby translating ecological burdens into actionable economic signals. Foundational work by Stern [

27], along with guidance from international organizations such as the OECD [

28], further establishes the relevance of LECA as a tool for informing low-carbon development strategies. More recently, empirical investigations by Wang et al. [

29] and Chen et al. [

30] confirm the practical utility of LECA frameworks in supporting carbon-conscious decision making and facilitating sustainability transitions within the construction industry.

2.2. Carbon Finance and Emissions Management in the Built Environment

As regulatory pressures intensify and global economies advance toward low-carbon development trajectories, integrating financial instruments into environmental assessment has become increasingly vital for the construction sector. Carbon finance—comprising tools such as emissions trading systems (ETS), carbon taxes, and offset mechanisms—seeks to internalize the externalities associated with greenhouse gas (GHG) emissions, while simultaneously incentivizing energy efficiency and sustainable building practices [

31].

Empirical evidence from initiatives like the European Union Emissions Trading System (EU ETS) and the U.S. Acid Rain Program [

32] illustrates that well-structured, market-based mechanisms can stimulate technological innovation and deliver cost-effective emissions abatement. Within the built environment for prefabricated steel buildings, where both embodied and operational emissions are substantial, analytical models must address not only environmental burdens but also the economic behavior of stakeholders in response to carbon pricing signals [

33].

Incorporating carbon costs into life cycle costing (LCC) has proven influential in shaping design strategies and investment decisions. Madadizadeh [

34] noted that accounting for carbon pricing within LCC frameworks can significantly alter project feasibility assessments. Similarly, Chunbo [

35] demonstrated that properly calibrated carbon prices can enhance building system performance, reduce life cycle emissions, and strengthen long-term financial viability under carbon-constrained policies.

A range of integrated modeling approaches—such as those proposed by Strand et al. [

36] and Weyant [

37]—have been developed to capture the trade-offs between mitigation investments, carbon credit revenues, and project-level returns. These models provide a dynamic perspective on the interplay between financial and environmental outcomes. Further, reviews by Popp [

38] and policy insights from the OECD [

39] emphasize the importance of transparent and predictable carbon pricing in accelerating the shift toward low-carbon construction.

Lastly, Ren et al. [

40] stressed that embedding uncertainty analysis into carbon finance modeling is critical for developing resilient investment strategies, particularly in light of fluctuating carbon markets and evolving regulatory frameworks. The robust modeling of such uncertainties enhances the adaptability of sustainable construction projects to external shocks and long-term policy shifts.

Steel has received increasing attention in sustainability-related construction research due to its high embodied energy and carbon intensity, balanced by advantages in modularization, structural performance, and recyclability. Several studies have identified steel as a critical material for embodied carbon mitigation strategies, particularly in prefabricated systems [

41]. Unlike traditional materials such as concrete or timber, steel lends itself to industrialized production and end-of-life circularity, making it a focal point for LECA modeling in low-carbon construction scenarios.

2.3. Research Gaps

Despite notable advancements in integrating life cycle assessment (LCA) and life cycle costing (LCC) into comprehensive life cycle environmental cost accounting (LECA) frameworks for construction projects, several critical research gaps persist.

First, a large proportion of the existing LECA studies depend on proprietary or highly project-specific datasets, thereby limiting the generalizability, transparency, and reproducibility of their findings. While building information modeling (BIM) has improved the integration of environmental and economic assessments, there remains a strong demand for standardized LECA methodologies that leverage open-access life cycle inventory databases such as CEADs, Ecoinvent, and the Chinese Life Cycle Database (CLCD).

Second, although recent studies have begun to address modern methods of construction (MMC) such as 3D-printed housing and innovative prefabricated construction methods (IPCMs)—notably highlighting the environmental and performance advantages of such systems (e.g., Alireza Moghayedi et al. [

41,

42])—the focus has primarily been on embodied carbon, energy consumption, or technical feasibility in residential or affordable housing contexts. In contrast, the unique life cycle dynamics of prefabricated steel structures used in large-scale or industrial applications remain insufficiently explored. Existing studies tend to emphasize operational energy use or conventional construction typologies, with limited attention to the embodied carbon and life cycle cost trade-offs specific to modular steel systems [

43,

44]. Moreover, few studies explicitly incorporate carbon pricing dynamics into LECA modeling for these systems, leaving a gap in decision-support tools for carbon-regulated construction planning [

45].

Third, limited attention has been paid to the incorporation of comprehensive sensitivity and uncertainty analyses within carbon finance modeling frameworks. While uncertainties in LCA and LCC outputs have been partially examined in prior studies, few have systematically explored the volatility of key financial parameters—such as carbon pricing, retrofit investment costs, and free quota allocations—within an integrated decision-support context [

46].

In summary, although prior research has laid important groundwork for LECA application in the built environment for prefabricated steel buildings, challenges related to data openness, methodological standardization, and risk analysis remain unresolved. By explicitly addressing these gaps, this study advances the methodological frontier of life cycle carbon finance and contributes to the broader goal of transitioning toward more sustainable and low-carbon construction practices.

3. Methodology

This section outlines the integrated methodological framework employed in this study to evaluate the environmental and financial performance of prefabricated steel buildings. The analysis combined life cycle assessment (LCA) and life cycle costing (LCC) into a unified life cycle environmental cost accounting (LECA) framework, supported by public databases such as CEADs and CLCD. A carbon financial modeling module was incorporated to simulate market-based revenues and compliance costs under various policy scenarios. Finally, sensitivity and uncertainty analyses were conducted to assess the robustness of the results under changing economic and regulatory conditions. To enhance comparability, life cycle costs originally calculated in Chinese yuan (CNY) are also expressed in US dollars (USD), using the average exchange rate for the analysis year based on official exchange data. The exchange rate applied was 1 USD ≈ 6.5 CNY.

3.1. Research Framework

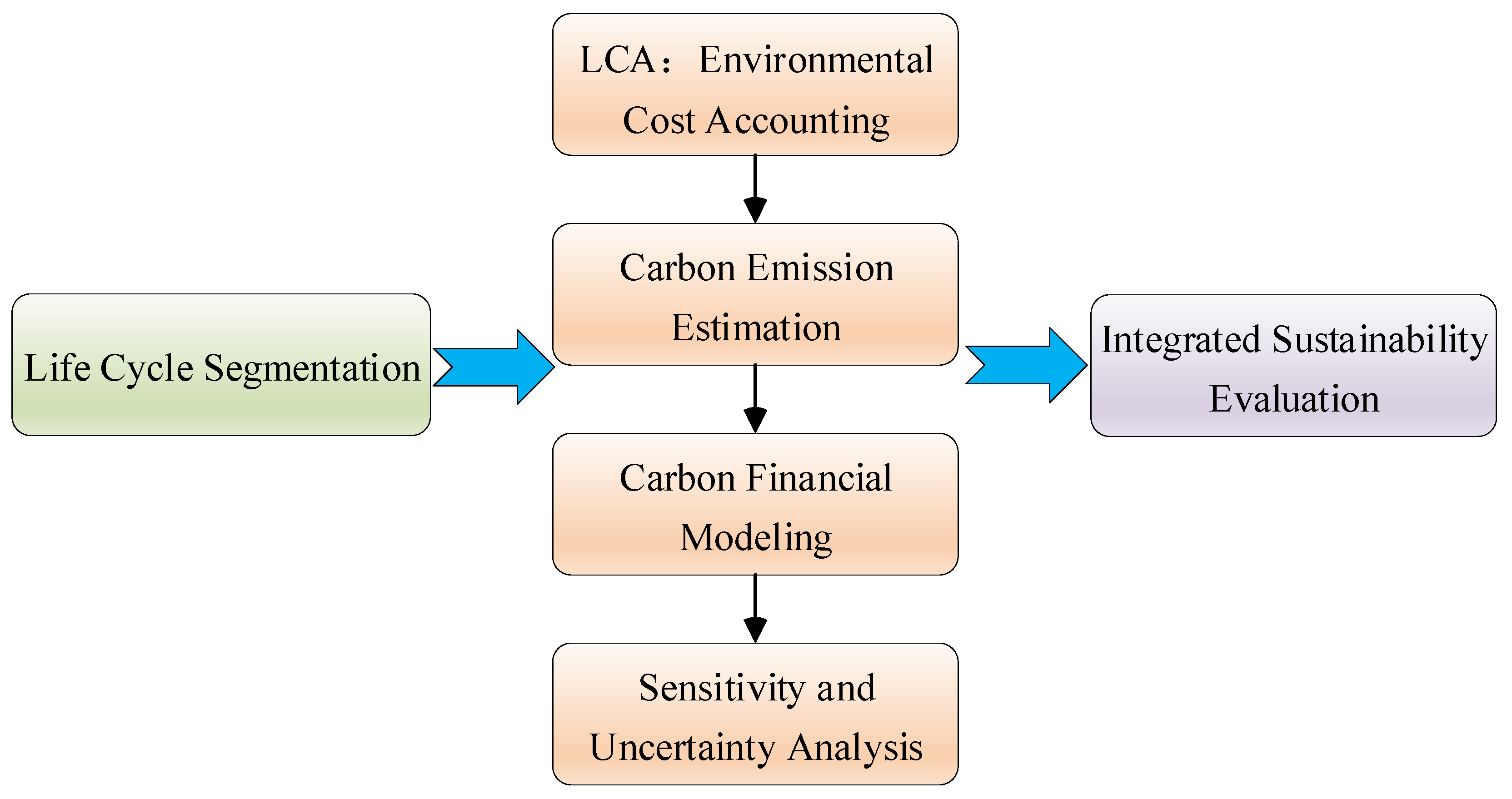

This study employed a mixed-method research framework that integrates life cycle assessment (LCA), carbon emission quantification, and financial optimization modeling to comprehensively assess the sustainability performance of prefabricated steel structures. As shown in

Figure 1, the framework is structured around five interrelated components:

- (1)

Life Cycle Segmentation: The entire life cycle of prefabricated steel buildings is delineated into distinct stages, including raw material extraction, manufacturing, transportation, on-site assembly, operational use, and end-of-life treatment;

- (2)

Environmental Cost Accounting via LCA: The environmental impacts associated with each life cycle stage were evaluated using standardized LCA methodologies, enabling the quantification of energy use, emissions, and resource consumption;

- (3)

Carbon Emission Estimation: Greenhouse gas emissions were estimated based on publicly available emission factors sourced from authoritative databases, ensuring transparency and consistency in carbon accounting;

- (4)

Carbon Financial Modeling: A dynamic financial model was developed to simulate various policy and carbon pricing scenarios, capturing the economic implications of carbon costs, emissions trading schemes, and potential offset mechanisms;

- (5)

Sensitivity and Uncertainty Analysis: Key financial and environmental parameters—such as carbon price volatility, material cost fluctuations, and emission reduction efficiency—were subjected to sensitivity analysis to evaluate the robustness of model outcomes under uncertain conditions.

To ensure methodological consistency and comparability among datasets from different sources, a data harmonization procedure was implemented prior to model integration. Although CEADs, Ecoinvent, and the Chinese Life Cycle Database (CLCD) are widely recognized for their reliability, they differ in terms of geographic coverage, system boundaries (e.g., cradle-to-gate vs. cradle-to-grave), temporal resolution, and functional units. To address these discrepancies, all the emission factors were converted to a uniform cradle-to-grave boundary, in line with the Chinese building sector’s life cycle scope. Units were standardized to a functional basis of per square meter of gross floor area. Where required, regional and temporal adjustments were made by aligning energy mixes, industrial processes, and material specifications with national Chinese averages. Preference was given to CLCD data when available, to enhance regional specificity. This harmonization approach ensures that the comparative analysis and carbon financial modeling are based on internally consistent and context-appropriate inputs.

3.2. Life Cycle Stage Definition and Functional Unit

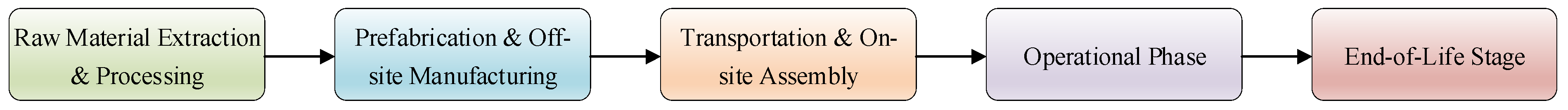

In alignment with the ISO 14040 and ISO 14044 standards for life cycle assessment (LCA), the system boundary for the prefabricated steel building examined in this study adopted a cradle-to-grave perspective. As shown in

Figure 2, the building’s life cycle was divided into five distinct and sequential stages, each contributing to the overall environmental and economic performance of the system:

- (1)

Raw Material Extraction and Processing: This stage encompasses the extraction, refinement, and upstream transportation of primary construction materials, including structural steel, cement, aluminum, and insulation composites. It captures the embodied energy and associated emissions embedded within raw material production and supply chains;

- (2)

Component Prefabrication and Off-Site Manufacturing: This phase involves the factory-based production of structural and non-structural elements. While prefabrication enhances material efficiency and reduces construction-site waste, it also entails energy use and emissions from fabrication machinery and industrial processes;

- (3)

Transportation and On-Site Assembly: Covers emissions and resource inputs associated with the transportation of prefabricated modules to the building site, as well as the energy and labor used during on-site structural assembly and installation;

- (4)

Operational Phase: Spanning a reference period of 50 years, this phase accounts for electricity consumption related to HVAC systems, lighting, and operational equipment. It also includes routine maintenance and potential retrofits, representing the most energy-intensive and long-duration stage in the building life cycle;

- (5)

End-of-Life (EoL) Stage: Involves the processes of demolition, material separation, recovery, recycling, and disposal at the end of the building’s functional life. Recyclable components—such as structural steel—are credited based on assumed recovery efficiencies (e.g., 85%), aligning with circular economy principles.

The functional unit adopted in this study is defined as one square meter (1 m2) of gross floor area (GFA) for a typical mid-rise prefabricated steel office building. All the environmental and financial indicators—including emissions, cost estimates, and return metrics—were normalized to this unit to facilitate consistent comparisons across life cycle stages and policy scenarios. This metric is widely used in LCA research and provides a meaningful reference point due to its direct relationship with material intensity, energy consumption, and construction expenditure.

3.3. Environmental Cost Accounting via LCA

To assess the environmental performance of the prefabricated steel structure, a life cycle assessment (LCA) was conducted in accordance with the principles and procedures established in ISO 14040 and ISO 14044. This standardized approach enables a comprehensive and scientifically robust evaluation of environmental impacts across all life cycle stages, ensuring consistency and comparability in sustainability assessment.

The LCA conducted in this study follows the conventional four-phase structure:

- (1)

Goal and Scope Definition

The primary objective of the LCA was to quantify the environmental impacts and associated externality costs across the construction, operation, and end-of-life phases of a prefabricated steel building system. A cradle-to-grave system boundary was applied, encompassing all the relevant material and energy flows, including raw material extraction, manufacturing, transportation, on-site assembly, building use, routine maintenance, and final demolition;

- (2)

Life Cycle Inventory (LCI) Compilation

The LCI phase involved the collection of data from peer-reviewed and publicly accessible databases, including the following:

CEADs (Carbon Emission Accounts and Datasets) for emission factors related to domestic steel production, grid electricity, and fossil fuel consumption;

Ecoinvent v3.7 for upstream process data and global material flow benchmarks;

Chinese Life Cycle Database (CLCD) for national average values on the production of common construction materials.

The key inventory elements included the material quantities, transport distances, energy demand, maintenance frequencies, and end-of-life processing rates. In cases where project-specific data were unavailable, default values were sourced from national averages and the established engineering literature;

- (3)

Impact Assessment and Monetization

The environmental impact categories considered in this study include the following:

Global warming potential (GWP), expressed in kg CO2-equivalents;

Air pollutants, specifically sulfur dioxide (SO2) and nitrogen oxides (NOx);

Water use and solid waste generation, where data were available.

To facilitate integration with financial models, these environmental impacts were monetized using established externality cost coefficients:

Air pollutants were valued based on shadow prices derived from China’s Environmental Protection Tax Law (e.g., CNY 2.8/kg for SO2 and CNY 3.5/kg for NOx);

Carbon emissions were monetized using a baseline price of CNY 60/ton, with scenario-based adjustments ranging from CNY 30 to 150/ton to reflect potential carbon pricing trajectories;

- (4)

Interpretation and Hotspot Identification

The final phase involved interpreting LCA results to identify environmental hotspots by life cycle stage and material type. Contributions from embodied emissions (e.g., structural steel and concrete) were compared with those from operational emissions (e.g., electricity used for HVAC and lighting), allowing for the assessment of trade-offs between material intensity and long-term energy performance. This analysis informs the prioritization of emission reduction strategies and design improvements.

The outcomes of this LCA-based environmental cost accounting serve as the quantitative basis for subsequent carbon financial modeling, establishing the connection between physical emissions and financial liabilities under dynamic regulatory and market conditions.

3.4. Carbon Emission Quantification

In this study, carbon emissions were estimated using the emission factor method, a widely recognized approach aligned with the methodologies outlined in the IPCC Guidelines [

43] and China’s official carbon accounting frameworks. The emission factor method provides a standardized approach for carbon accounting by multiplying measurable activity data (e.g., the quantity of materials used or energy consumed) by corresponding emission coefficients that represent the average carbon dioxide equivalent (CO

2-e) released per unit of activity. This bottom-up calculation aggregates emissions across all relevant processes in the building’s life cycle. The general formula applied is as follows:

where

is the total carbon emissions (kg CO

2),

is the activity data (e.g., tons of steel or kWh of electricity), and

is the emission factor for activity

i (e.g., kg CO

2 per unit).

The emission factors employed in this study were derived from validated and region-specific data sources. The steel, concrete, and aluminum emission factors were obtained from CEADs and Ecoinvent v3.7, capturing upstream industrial processes and production characteristics. The grid electricity emissions were based on the China Energy Statistical Yearbook, using a national average emission intensity of 0.67 kg CO2/kWh. The fuel combustion emissions (e.g., diesel for transportation and backup generators) reference IPCC 2006 default values. The end-of-life recycling credits—particularly for structural steel—were modeled using circularity factors and market-average recovery rates, reflecting material reuse within a circular economy context.

The carbon emissions were quantified for each major life cycle stage:

Embodied Emissions: These included carbon emissions from raw material extraction, component manufacturing, and the transportation of prefabricated modules;

Operational Emissions: These captured energy use over a 50-year service life, including electricity for HVAC systems, lighting, and equipment, based on assumed per-square-meter energy intensity values;

End-of-Life Emissions: These encompassed emissions from demolition activities, the transportation of construction and demolition waste (CDW), and carbon offsets attributed to material recovery and recycling.

All the emission results were normalized to the functional unit of 1 m2 of gross floor area (GFA) to ensure consistency and comparability across design options and scenario analyses. This emission quantification approach was directly integrated into the subsequent financial modeling phase, establishing the basis for translating physical emissions into carbon pricing liabilities and regulatory compliance costs under varying policy regimes.

3.5. Carbon Financial Optimization Model

To assess the carbon-related financial performance of the prefabricated steel building project, a carbon financial optimization model was developed. The model incorporated the projected revenues, emission reduction investments, carbon pricing mechanisms, and regulatory constraints, with the objective of maximizing the net financial return (Π) over the building’s operational lifespan.

The model is formulated as follows:

where

Rbase is the base operational revenue of the project,

Rcarbon is the carbon revenue (e.g., selling surplus allowances),

Cabatement is investment in emission reduction (e.g., insulation and energy systems),

Ccompliance is the cost of purchasing allowances for uncovered emissions, and

Crisk is the expected cost from carbon price volatility or regulation change.

The optimization was subject to the following constraints:

Carbon allowance cap: The total project emissions must not exceed the policy-assigned quota;

Budgetary limits: The total mitigation investment (Cabatement) must remain within the project’s financial capacity;

Emission reduction bounds: Technical limits on mitigation effectiveness are imposed, typically ranging from 5% to 30%, depending on the retrofit feasibility.

The key model input parameters were derived from baseline project assumptions and varied systematically in the scenario and sensitivity analyses. These inputs are summarized in

Table 1.

The model operated over a 50-year planning horizon, aligned with the assumed service life of the building. A real discount rate of 5% was applied to all future cash flows, consistent with standard practices in infrastructure and energy finance.

Both deterministic (baseline) and stochastic (scenario-based) simulations were conducted to evaluate the financial resilience of the project under varying carbon pricing regimes, quota allocation policies, and risk exposure levels. The model outcomes inform evidence-based decisions regarding the following:

- (1)

The optimal timing and scale of carbon abatement investments;

- (2)

The selection of cost-effective emission reduction strategies;

- (3)

Trade-offs between carbon allowance purchases and mitigation actions.

This integrated modeling approach enables the alignment of long-term financial viability with climate performance objectives, ensuring adaptability under dynamic carbon market and regulatory conditions.

3.6. Parameter Sensitivity Analysis

In light of the inherent uncertainties associated with carbon pricing trajectories, regulatory frameworks, and project-specific cost assumptions, a multi-scenario sensitivity analysis was performed to evaluate the robustness of the carbon financial optimization model. The primary objective was to examine how variations in key input parameters influenced the net financial return (Π) and to identify high-impact factors that warrant proactive risk mitigation strategies.

Parameters were selected based on their relevance to policy uncertainty, market volatility, and technical design flexibility. Both univariate (single-variable) and multivariate (combined-variable) sensitivity analyses were conducted to systematically assess the model’s response across a range of plausible input values. The tested parameters and their respective ranges are detailed in

Table 2.

To address the effects of carbon price volatility and regulatory unpredictability, the model incorporates a carbon market risk factor, representing potential financial losses arising from unhedged exposure. This is treated as a stochastic variable ranging from CNY 0 to 50,000, calibrated using the standard deviation of weekly carbon prices observed in the China ETS between 2021 and 2023. For instance, a CNY 10 per ton increase in the carbon price—assuming 3000 tons of uncovered emissions—would result in an additional compliance cost of CNY 30,000 over the life cycle of the building. This illustrative scenario underscores the potential magnitude of market-based financial exposure and reinforces the importance of incorporating such risk considerations into long-term project viability assessments.

Each scenario was simulated independently and in combination to evaluate its impact on Π, allowing for a comprehensive assessment of financial resilience under varying policy and market conditions. This sensitivity analysis provides valuable insights for decision makers, highlighting the conditions under which the project remains financially viable and identifying thresholds beyond which returns may be significantly compromised.

The results support more informed, flexible, and adaptive decision making in the context of life cycle carbon finance, particularly under evolving carbon market regimes or transitional policy environments.

4. Data Sources and Assumptions

This section details the origin, structure, and underlying assumptions of the datasets employed in this study. All the model inputs and parameter values were sourced from publicly available databases, the peer-reviewed academic literature, and official government technical documents, thereby ensuring a high degree of transparency, reproducibility, and methodological rigor.

The selected data sources were aligned with current best practices in life cycle assessment, carbon accounting, and financial modeling for the built environment. Where project-specific data were unavailable, the study relied on nationally representative averages and engineering estimates documented in reputable studies and official statistics. Assumptions related to emission factors, pricing scenarios, material lifespans, and retrofit efficiencies are explicitly defined in the corresponding sections of the methodology to ensure traceability and model validity.

4.1. Life Cycle Inventory Data

The life cycle inventory (LCI) data employed in the life cycle assessment (LCA) were sourced from a combination of authoritative and peer-reviewed databases to ensure accuracy, regional relevance, and methodological consistency. The selected sources include the following:

China Emission Accounts and Datasets (CEADs): Provided region-specific emission factors for steel production, electricity generation, and transport fuel consumption, reflecting China’s energy mix and industrial structure;

Ecoinvent v3.7 Database: Used to supplement upstream process data for prefabricated components, thermal insulation materials, and energy inputs, particularly in cases where domestic records were unavailable or incomplete;

Chinese Life Cycle Database (CLCD): Provided nationally representative average values for frequently used construction materials, including ready-mix concrete, reinforcing steel (rebar), aluminum structural frames, and prefabricated wall panels;

National Energy Statistics Yearbook (2022): Provided operational energy benchmarks, including the electricity and fossil fuel consumption intensity during the building’s use phase.

The LCI comprehensively covers all five life cycle stages defined in the system boundary:

- (1)

Raw material extraction;

- (2)

Component prefabrication and manufacturing;

- (3)

Transportation and on-site assembly;

- (4)

Operational use and routine maintenance;

- (5)

End-of-life processing, including material recovery and disposal.

Each dataset was carefully cross-referenced to ensure compatibility in terms of system boundaries, temporal scope, and functional unit equivalence. Where gaps existed, interpolation was performed using nationally standardized engineering assumptions and literature benchmarks.

4.2. Emission Factors and Environmental Cost Coefficients

To convert physical activity data into quantifiable environmental and monetary impacts, this study adopted a set of standardized emission factors and externality cost coefficients drawn from validated national and international sources. These parameters were incorporated into the LCA model to estimate both carbon emissions and their associated environmental costs across all the life cycle stages of the prefabricated steel building system.

The emission factors reflect region-specific conditions related to raw material production, energy consumption, and transportation logistics. All the values were selected to ensure alignment with the IPCC Guidelines and ISO 14040/14044 standards, thereby supporting methodological rigor and international comparability. The key emission factors applied in the study are summarized in

Table 3.

For non-GHG air pollutants such as sulfur dioxide (SO

2) and nitrogen oxides (NO

x), environmental costs are monetized using shadow pricing coefficients established under China’s Environmental Protection Tax Law and valuation guidance issued by the Ministry of Ecology and Environment. These coefficients are listed in

Table 4.

Where applicable, material recycling credits—particularly for structural steel recovered at the end of the building’s service life—were incorporated using system expansion and allocation-based approaches, consistent with the ISO/TR 14049 methodological guidelines. These credits reflect avoided emissions associated with secondary material production and support the inclusion of circular economy considerations in the assessment.

Together, these emission and cost parameters constitute the quantitative foundation for both the life cycle impact assessment (see

Section 3.3) and the carbon financial modeling framework (see

Section 3.5). Their consistent application ensures analytical transparency and enables robust scenario comparison across policy, investment, and design configurations.

4.3. Carbon Market and Financial Data

To assess the financial viability of carbon mitigation strategies, this study integrated a robust set of economic and regulatory parameters sourced from official carbon market statistics, industry investment reports, and construction finance benchmarks. These datasets form the analytical foundation for estimating abatement costs, carbon revenues, and compliance liabilities across a range of policy and pricing scenarios.

The carbon pricing mechanism within the financial model was designed to mirror the structure of China’s national Emissions Trading System (ETS). The key modeling assumptions include the following:

- (1)

A baseline carbon price of CNY 60/ton CO2, reflecting the average spot market value recorded between 2021 and 2023;

- (2)

A scenario-based carbon price range of CNY 30–150/ton, capturing regulatory uncertainty and potential market tightening over the medium-to-long term;

- (3)

A free quota allocation ratio of 70%, consistent with current practices in China’s power generation and heavy industry sectors;

- (4)

Emissions beyond the allocated quota were treated as market-based compliance obligations, requiring the purchase of allowances at prevailing carbon market prices.

All the carbon pricing variables were subjected to sensitivity analysis, as outlined in

Section 3.6 and

Section 5, enabling robust evaluation under different regulatory and market conditions.

Abatement investment costs were modeled based on prevailing industry-reported data and validated performance benchmarks from comparable building retrofit projects:

- (1)

The reference retrofit package includes HVAC system upgrades, enhanced building envelope insulation, and smart energy management systems, with a baseline investment cost of CNY 1.2 million per building;

- (2)

The emission reduction efficiency of this moderate retrofit is estimated at 20%, based on empirical case studies and operational data from similar building typologies;

- (3)

The abatement cost range spans from CNY 0.8 million to CNY 2.0 million, reflecting a spectrum from light to deep retrofit scenarios.

All the capital expenditures were amortized over the building’s 50-year life cycle using a 5% real discount rate, in accordance with standard practices in green infrastructure finance and energy performance contracting.

To address the effects of carbon price volatility and regulatory unpredictability, the model incorporates a carbon market risk factor, representing potential financial losses arising from unhedged exposure. This is treated as a stochastic variable ranging from CNY 0 to 50,000, calibrated using the standard deviation of weekly carbon prices observed in the China ETS between 2021 and 2023.

4.4. Functional Unit and Scaling Assumptions

This section presents the core modeling assumptions adopted to standardize the analysis and ensure methodological consistency across all the life cycle and financial scenarios. All the assumptions are grounded in relevant international standards, engineering practices, and peer-reviewed literature, as shown in

Table 5. These parameters formed the foundational basis for both the environmental impact assessment and carbon financial modeling conducted in this study.

- (1)

Functional Unit and Project Scope

The functional unit is defined as 1 m2 of gross floor area (GFA) for a representative mid-rise commercial office building. The case project modeled is a 12-story prefabricated steel structure with a total gross floor area (GFA) of 18,000 m2. This project is located in Taiyuan, Shanxi Province, and represents a classic steel structure project, utilizing standardized steel components throughout. Based on national building design codes and industry benchmarks, the material intensity is assumed to be 90 kg of structural steel per m2;

- (2)

Life Cycle Duration and System Boundary

A 50-year service life was assumed for the building, in accordance with ISO 15686 [

47] and the conventional expectations for commercial buildings. A cradle-to-grave system boundary was applied, encompassing raw material extraction, off-site component prefabrication, transportation, on-site assembly, operation and maintenance, and end-of-life treatment, including demolition and material recovery;

- (3)

Energy Use and Emissions

The operational energy demand was modeled using national average electricity consumption data for office buildings, with grid electricity assumed as the primary energy source. The electricity grid emission intensity was set at 0.67 kg CO2/kWh, based on current national averages. The end-of-life recycling rates were assumed to be 85% for structural steel and 25% for aluminum, with recycling credits incorporated via the system expansion method;

- (4)

Financial and Discounting Parameters

A real discount rate of 5% was applied for calculating the net present value (NPV) of future cash flows, consistent with infrastructure finance best practices. All the financial estimates are expressed in constant 2024 Chinese yuan (CNY). The carbon-related financial modeling considered both explicit carbon costs (e.g., ETS allowance purchases) and implicit costs (e.g., abatement investments and exposure to carbon price volatility);

- (5)

Data Normalization and Estimation Techniques

In cases where primary data were unavailable, literature-derived averages, engineering ratios, and linear interpolation techniques were applied to complete the dataset. All the life cycle inputs and outputs were normalized to the functional unit, enabling consistent comparisons of emissions intensity, cost allocation, and financial return metrics across different policy and design scenarios.

These assumptions were held constant in the baseline model and selectively varied during the sensitivity and scenario analyses, as discussed in

Section 5.

5. Results and Analysis

This section presents the key findings from the integrated life cycle environmental and financial simulation of the prefabricated steel building. The analysis encompassed both baseline conditions and alternative policy and design scenarios. The results were generated using the integrated assessment framework introduced in

Section 3, based on input parameters and assumptions detailed in

Section 4. The following subsections sequentially examine life cycle carbon emissions, environmental cost structures, carbon-related financial performance, and sensitivity to pricing dynamics, offering insights into the trade-offs and synergies between environmental and economic outcomes in low-carbon building design.

5.1. Baseline Life Cycle Environmental Impacts

The baseline simulation quantified the environmental footprint of the prefabricated steel building across five distinct life cycle stages, with all the results normalized to one square meter (1 m

2) of gross floor area (GFA). The distribution of CO

2 emissions and corresponding monetized environmental costs under standard construction and operational conditions is presented in

Table 6.

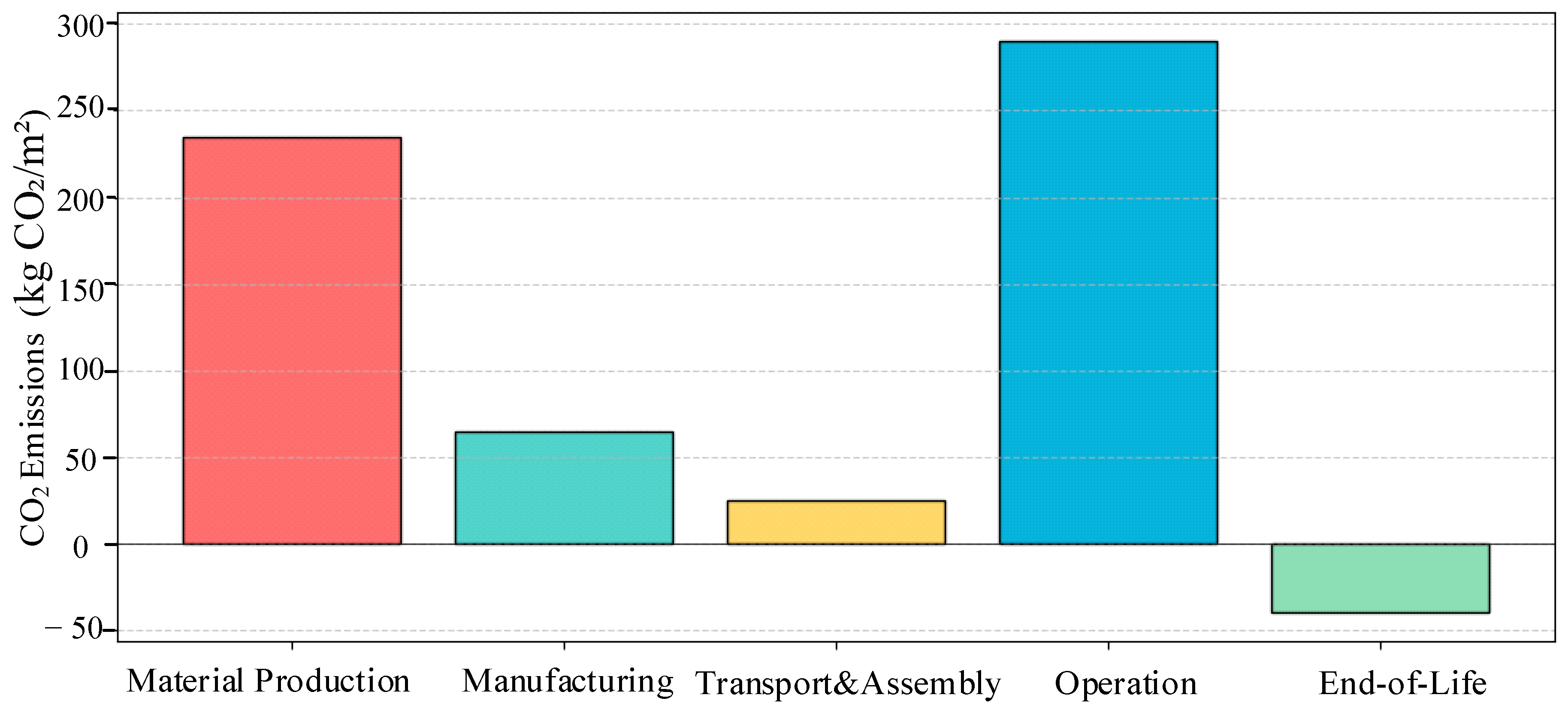

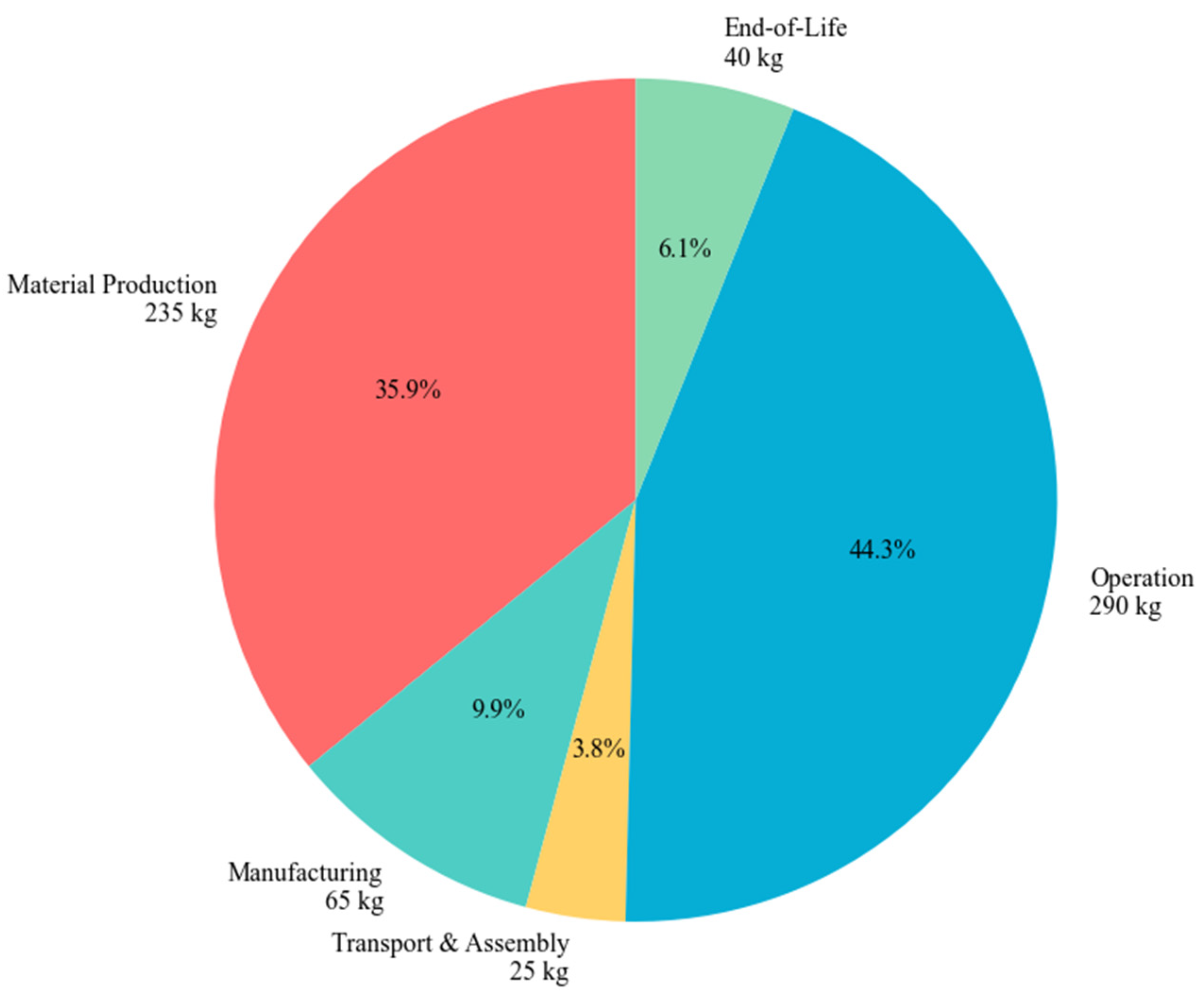

The results reveal that operational energy use and material production are the dominant contributors to life cycle emissions, collectively accounting for more than 90% of the total CO2 output:

Operational energy consumption—primarily electricity use for HVAC and lighting—represents the largest contributor, resulting in approximately 290 kg CO2/m2 over the building’s 50-year service life. This phase is associated with an environmental externality cost of roughly CNY 95/m2, underscoring the long-term impact of energy system efficiency and grid decarbonization;

Material production, including the manufacturing of structural steel, concrete, and aluminum components, contributes an estimated 235 kg CO2/m2, reflecting the high embodied carbon content of conventional construction materials. The associated environmental cost is calculated at CNY 85/m2;

Off-site prefabrication and transportation and assembly account for 65 kg CO2/m2 and 25 kg CO2/m2, respectively. Although smaller in magnitude, these stages can have notable cost implications, particularly in regions with carbon-intensive logistics networks or energy sources;

At the end-of-life stage, the model incorporates a recycling credit for recovered structural steel, yielding a net emissions offset of –40 kg CO2/m2 and corresponding environmental cost savings of CNY 10/m2. This result is consistent with circular economy principles and highlights the value of design-for-recyclability (DfR) in steel-based prefabricated systems.

In total, the net life cycle emissions were estimated at approximately 575 kg CO2/m2, with a corresponding monetized environmental cost of CNY 212/m2. These values serve as the baseline reference for the financial optimization and scenario analyses discussed in subsequent sections and highlight the importance of targeting both embodied and operational carbon in sustainable building design.

Figure 3 illustrates the emissions intensities across life cycle stages. The operational phase contributes the most (290 kg/m

2), followed by material production (235 kg/m

2), manufacturing (65 kg/m

2), and transport and assembly (25 kg/m

2). The end-of-life stage yields a net reduction of −40 kg/m

2.

Figure 4 presents the proportional contribution of each stage to the total carbon footprint. The operational phase accounts for 44.3% of total emissions, followed by material production (35.9%), manufacturing (9.9%), and transport and assembly (3.8%). The end-of-life stage contributes a net reduction equivalent to 6.1% of total emissions.

These findings reinforce the critical importance of improving operational energy efficiency and incorporating low-carbon construction materials to reduce the life cycle environmental impacts of prefabricated steel buildings.

5.2. Carbon Financial Outcomes Under Baseline Scenario

Under the baseline policy scenario, the carbon financial model assesses the economic viability of the prefabricated steel building by incorporating carbon pricing mechanisms aligned with China’s national Emissions Trading System (ETS). The analysis assumed a carbon price of CNY 60 per ton of CO2 and a 70% free quota allocation, reflecting current market conditions and regulatory practice.

Over the building’s 50-year life cycle, the total modeled emissions were estimated at 575 kg CO

2/m

2, resulting in an aggregate of approximately 10,350 metric tons of CO

2 for the entire 18,000 m

2 building. With 70% of emissions covered by freely allocated allowances, the remaining 3105 tons require either the purchase of allowances or equivalent on-site mitigation. The resulting compliance cost is calculated as follows:

This compliance obligation is incorporated into the broader financial model, along with mitigation investment costs and potential carbon revenues from trading surplus allowances.

The project adopted a moderate retrofit strategy, targeting a 20% reduction in operational emissions, involving HVAC system upgrades and enhanced building envelope insulation. The required upfront investment was CNY 1.2 million, amortized over the project’s life cycle using a 5% real discount rate, consistent with infrastructure finance norms.

Following implementation, the retrofit achieved emission reductions beyond compliance needs, generating surplus allowances that could be sold on the ETS market or banked for future use. Under baseline assumptions, this yielded an estimated carbon revenue of CNY 45,000. The total retrofit investment of CNY 1.2 million—amortized over the 50-year building life cycle—resulted in a net present value (NPV) of approximately CNY 135,000, with a corresponding payback period of 19 years at a carbon price of CNY 60/ton CO

2. These figures indicate that the proposed decarbonization strategy is not only environmentally effective but also financially attractive over the long term. As shown in

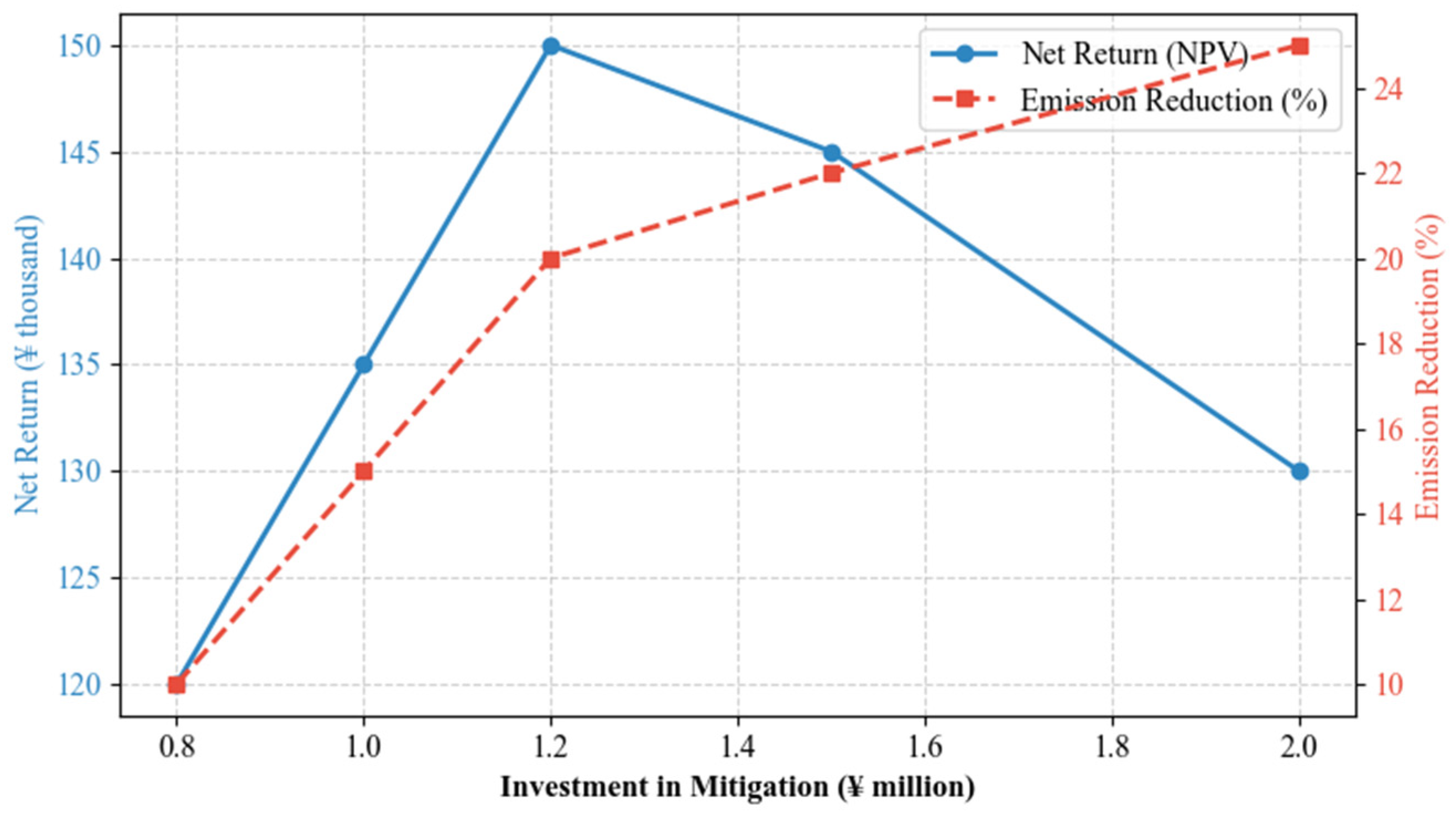

Figure 5, financial returns peak at this investment level, beyond which diminishing marginal returns are observed, underscoring the importance of strategic alignment between capital deployment and emission reduction efficacy.

After integrating all the carbon-related cash flows—including abatement expenditures, compliance costs, and risk-adjusted revenues—the project demonstrates strong economic performance, with a projected internal rate of return (IRR) exceeding 6.5% over the life cycle. These results suggest that early-stage investment in emission mitigation is not only environmentally beneficial but also financially attractive, particularly under scenarios involving stable or moderately rising carbon prices.

Figure 5 illustrates the relationship between mitigation investment levels and the corresponding net financial return (measured as the net present value, in thousands of CNY), as well as the percentage reduction in emissions. The financial return peaks at an investment level of CNY 1.2 million, corresponding to the baseline retrofit scenario. Beyond this point, diminishing marginal returns are observed, indicating an inflection point for cost-effective decarbonization investment. Emission reductions follow a similar curve, increasing with investment but tapering as the efficiency gains level off.

This analysis underscores the importance of strategically aligning carbon mitigation investments with financial performance goals, enabling stakeholders to achieve optimal environmental outcomes while maintaining economic viability in an increasingly carbon-constrained regulatory landscape.

5.3. Sensitivity to Carbon Price Volatility

Given the dynamic evolution of carbon markets, the financial performance of low-carbon construction projects is highly sensitive to fluctuations in carbon pricing. This section presents the results of a univariate sensitivity analysis, which isolated the impact of varying carbon prices on the net financial return (NPV), while holding all other variables constant.

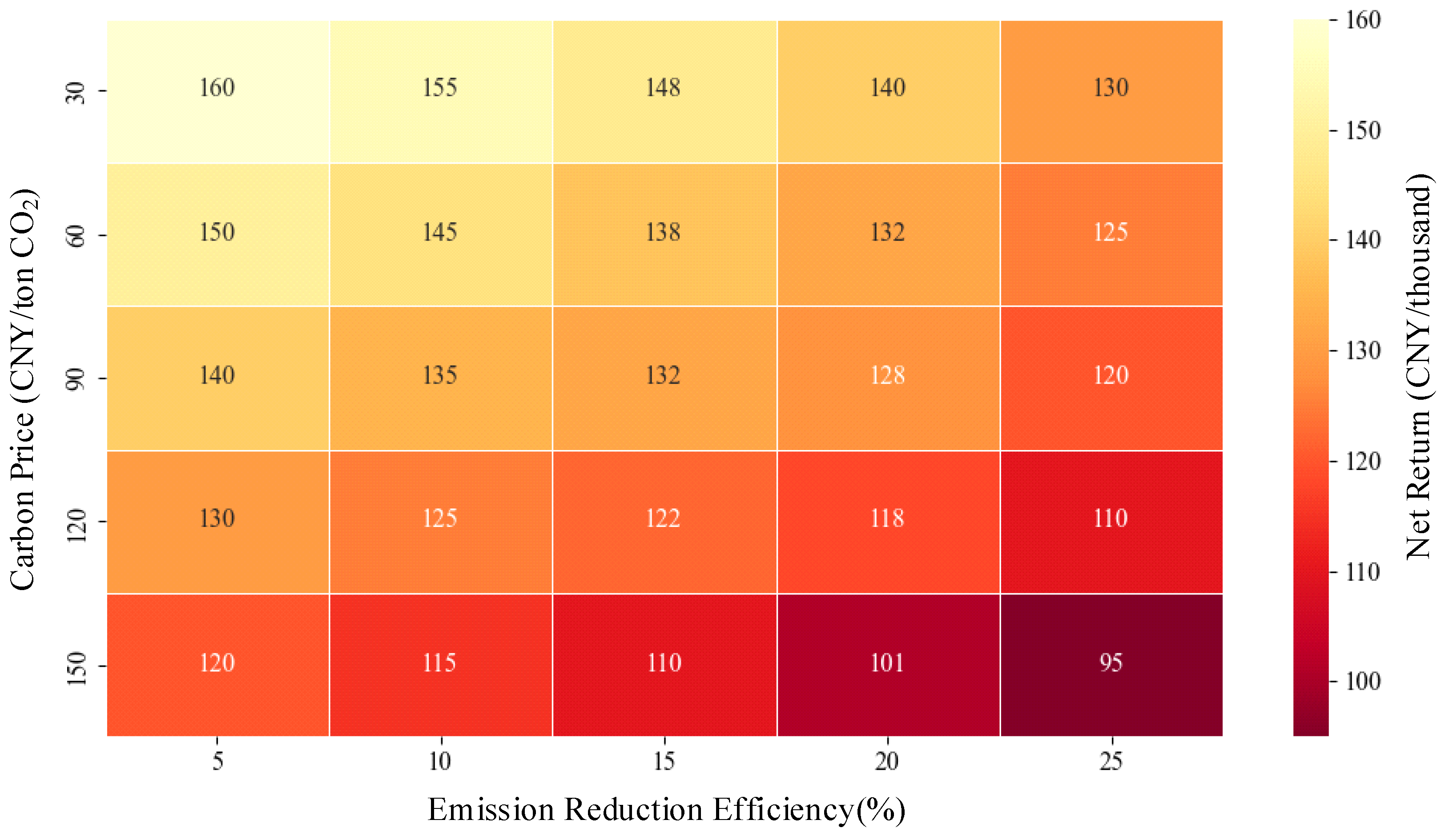

The carbon price scenarios range from CNY 30 to 150 per ton of CO

2, in line with projections from China’s national ETS development roadmap and international carbon pricing benchmarks. The analysis evaluated how changes in compliance costs and offset revenues affect overall project profitability under different pricing regimes. As illustrated in

Figure 6, the net return declines in a non-linear manner as carbon prices increase.

At CNY 30/ton, the project generates a net return of approximately CNY 160,000, primarily due to surplus allowances and limited compliance obligations.

At CNY 90/ton, the net return decreases to CNY 132,000, as the carbon liability begins to outweigh the revenue from offset sales.

At CNY 150/ton, the return further declines to CNY 101,000, approaching the threshold of financial viability for projects implementing moderate-efficiency retrofit strategies.

These results highlight the financial exposure of emission-intensive projects in high-carbon-price environments, particularly when free quota allocations decline or the offset eligibility is restricted. The findings emphasize the need for proactive carbon risk management, especially in regulatory contexts characterized by the following:

Volatile or upward-trending carbon prices under tightening emission caps;

Reduced free allowance allocations or more stringent benchmark criteria;

Restricted offset eligibility due to evolving environmental standards or policy revisions.

To mitigate such risks, project stakeholders are encouraged to adopt hedging strategies, such as the following:

The advance purchasing of carbon allowances;

Portfolio-based emissions trading;

Performance-linked carbon financing instruments.

These financial tools can help to buffer against downside risk and enhance project resilience under carbon market uncertainty.

In sum, this sensitivity analysis provides a quantitative foundation for adaptive financial planning, supporting the development of robust investment strategies for low-carbon construction in dynamic and uncertain policy environments.

6. Discussion

The simulation results yield several important insights into the environmental and financial implications of prefabricated steel buildings in a carbon-constrained construction context. This section synthesizes the theoretical relevance, practical applications, and policy significance of the findings, while acknowledging the limitations of the model and proposing avenues for future research.

6.1. Environmental Hotspots and Life Cycle Trade-Offs

The baseline life cycle assessment (LCA) results identify two primary environmental hotspots in the life cycles of prefabricated steel buildings:

- (1)

Operational energy consumption;

- (2)

Embodied emissions from material production.

Together, these two stages contribute to more than 90% of the total life cycle CO2 emissions, underscoring the critical need to address both energy efficiency and material decarbonization in the pursuit of sustainable building strategies.

The operational phase—which encompasses HVAC, lighting, and equipment use over a 50-year service life—accounts for approximately 290 kg CO2/m2. This is largely driven by electricity consumption, highlighting the pivotal role of energy-efficient building systems and the decarbonization of the power grid in achieving long-term emission reductions.

The material production stage, particularly the manufacture of structural steel and cement-based components, contributes around 235 kg CO2/m2. These results reflect the high embodied carbon associated with energy- and emissions-intensive industrial processes, corroborating findings from previous studies that underscore the carbon footprint of upstream supply chain activities in construction.

Although off-site manufacturing and transportation collectively account for a smaller share of emissions (~90 kg CO2/m2), these stages offer significant opportunities for efficiency improvements. Strategies such as logistics optimization and modal shifts (e.g., substituting rail for road transport) could further reduce emissions in these phases.

Notably, the end-of-life stage presents a unique opportunity for carbon recovery. The recycling of structural steel results in a net emission credit of −40 kg CO2/m2, reinforcing the relevance of design-for-disassembly (DfD) principles and circular material flows in the context of prefabricated steel systems.

These findings highlight a fundamental trade-off between short-term material intensity and long-term energy performance, underscoring the need for life cycle-optimized design decisions. For instance, investing in high-performance building envelopes or low-global-warming-potential (GWP) materials may increase upfront environmental impacts or costs but deliver substantial downstream benefits under carbon pricing regimes.

In conclusion, a dual emphasis on reducing both embodied and operational carbon—combined with strategies to enhance material recyclability—presents a robust pathway toward whole-life decarbonization in the building sector. This approach not only aligns with climate mitigation objectives but also supports the transition to circular and resource-efficient construction practices.

6.2. Financial Resilience Under Carbon Pricing

The sensitivity analysis demonstrates that the financial resilience of prefabricated steel building projects is highly sensitive to the trajectory of carbon prices and the design of supporting policy instruments. As carbon markets mature and emission caps tighten, projects with significant embodied and operational emissions may encounter rising compliance costs, thereby threatening their long-term financial viability.

Under the baseline scenario—assuming a carbon price of CNY 60 per ton of CO2 and a 70% free quota allocation—the project maintains acceptable financial returns, supported by moderate retrofit measures and partial exemption under the national Emissions Trading System (ETS). However, as carbon prices escalate to the CNY 120–150/ton range, the internal rate of return (IRR) declines substantially, even when accounting for carbon revenues from surplus allowances or offset sales. This trend reinforces a central tenet of carbon finance: higher emission exposure results in greater financial volatility and downside risk.

To enhance financial resilience in carbon-sensitive contexts, developers and policymakers can adopt the following strategic approaches:

- (1)

Advance-stage mitigation investments—such as HVAC system upgrades, LED lighting, or building automation—can reduce long-term compliance costs and frequently yield positive net present value (NPV) when future carbon liabilities are included in financial planning;

- (2)

Internalizing projected carbon costs within capital budgeting frameworks enables a more accurate life cycle cost–benefit analysis and supports the identification of the most cost-effective decarbonization pathways;

- (3)

Carbon-related financial instruments, including forward contracts, voluntary offset mechanisms, and green performance-linked bonds, can be leveraged as hedging tools to protect against unexpected spikes in carbon prices.

Importantly, the simulation results suggest that buildings designed to remain viable under high-carbon-price conditions (e.g., CNY 100–150/ton) exhibit superior risk-adjusted returns over time. This supports the emerging concept of carbon-resilient infrastructure—projects that not only align with environmental targets but also demonstrate improved long-term financial robustness in the face of regulatory uncertainty.

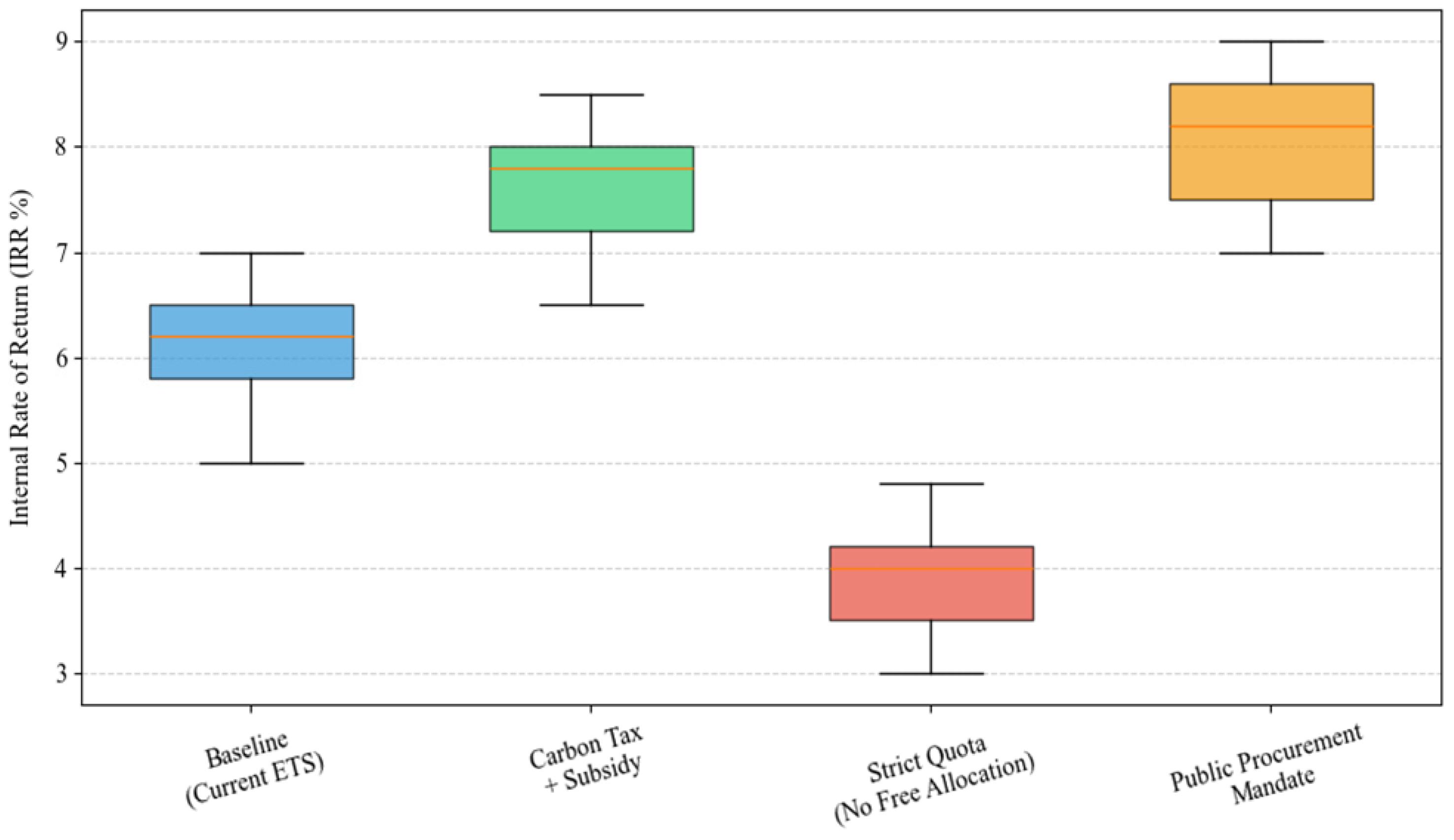

Figure 7 illustrates the internal rate of return (IRR) outcomes under four distinct policy regimes:

- (1)

ETS baseline with partial free allowance allocation;

- (2)

Carbon tax + government subsidies;

- (3)

Strict quota regime with no free allocation;

- (4)

Public procurement mandates requiring low-carbon performance compliance.

The results indicate that the strict quota scenario yields the lowest median IRR (~4%), reflecting the full cost burden of carbon compliance. In contrast, the carbon tax + subsidy and procurement mandate scenarios deliver significantly higher IRRs (exceeding 7.5%) due to incentive structures and assured market demand. The ETS baseline scenario results in a moderate IRR of approximately 6.2%.

These findings underscore the fact that financial resilience is shaped not only by technical design or investment level but also by the architecture of carbon policy. Achieving a balance between regulatory rigor and market-based incentives is essential to enhancing the financial attractiveness of low-carbon buildings in a future characterized by increasing carbon constraints.

6.3. Policy Recommendations and Strategic Implications

The findings of this study offer actionable insights for both policymakers and industry stakeholders seeking to accelerate the decarbonization of the construction sector while maintaining economic viability. The following implications outline key opportunities to align climate policy, financial mechanisms, and industry practices in support of a net-zero built environment.

- (1)

Policy Implications

Expand carbon pricing to the building sector: While China’s national Emissions Trading System (ETS) currently targets power generation and heavy industries, the results of this study indicate that prefabricated buildings possess sufficiently high carbon footprints to justify inclusion. The introduction of sector-specific benchmarks for embodied and operational carbon intensity could enhance transparency, foster accountability, and incentivize low-carbon innovation throughout the construction value chain.

Refine carbon allowance allocation mechanisms: The analysis highlights the financial significance of free quota allocation. To ensure fair and performance-based incentives, policymakers should adopt differentiated allocation strategies based on metrics such as the embodied carbon per square meter, thereby rewarding early adopters of low-emission technologies and climate-aligned design choices.

Leverage public procurement as a transformation tool: Government-led projects—particularly in infrastructure and affordable housing—can serve as powerful levers for market change. Requiring whole-life carbon disclosure and establishing minimum life cycle performance thresholds in public tenders would create a demand–pull mechanism for carbon-efficient building systems and materials.

Strengthen carbon-aligned financial instruments: Facilitating access to green credit, performance-linked loans, and carbon-adjusted return metrics can bridge the gap between environmental policy goals and private sector financing mechanisms. This alignment is essential for mobilizing capital toward decarbonized construction at scale.

- (2)

Industry Implications

Integrate carbon cost forecasting into early-stage project decisions: Project developers and designers should incorporate carbon pricing trajectories, regulatory risks, and life cycle carbon models—such as the LECA framework proposed in this study—into feasibility analyses. This will enable more informed decisions on material choices, system configurations, and retrofit investment timing.

Scale digitalization and industrialized construction methods: While off-site manufacturing contributes a modest share to total emissions, it offers substantial potential for improving material efficiency, quality assurance, and design-for-disassembly (DfD). As such, prefabrication and digital modeling should be viewed as enablers of circular and low-carbon construction practices.

Accelerate material innovation and supply chain engagement: Given that material production remains a dominant emission hotspot, collaboration with low-carbon material suppliers, the adoption of environmental product declarations (EPDs), and participation in carbon labeling schemes are critical steps toward supply chain decarbonization and increased transparency.

Collectively, these implications underscore the need for a coordinated, multi-level response—one that harmonizes policy ambition, market readiness, and technical capacity. Only through such alignment can the construction sector credibly advance toward carbon neutrality, while ensuring long-term economic resilience and environmental integrity.

6.4. Comparison with Prior Studies

The findings of this study regarding the significant contributions of material production and operational energy consumption to life cycle carbon emissions align well with previous research. Zhang et al. [

18] and Röck et al. [

17] similarly emphasized the critical role of embodied carbon, particularly highlighting material production as a major emission hotspot in various building typologies. Additionally, our analysis validates the economic feasibility of moderate retrofit investments under carbon pricing conditions, which corresponds with life cycle economic analyses conducted by Schmidt et al. [

33] and Petrović et al. [

20].

Comparisons with recent assessments of prefabricated modular buildings, such as studies by Byron et al. [

8] and Wei et al. [

45], further underscore the environmental benefits of prefabrication processes, notably through reduced on-site waste and lower construction-phase energy use. However, the relatively high embodied carbon intensity of prefabricated steel structures identified in our study also highlights the critical need for targeted emission reductions during material production, echoing the conclusions reached by O’Hegarty et al. [

44].

6.5. Limitations and Future Research

While the integrated framework developed in this study provides a robust methodology for assessing life cycle sustainability and carbon-related financial outcomes in prefabricated steel buildings, several limitations warrant attention.

First, the analysis relied on generalized design parameters and publicly available emission factors to ensure transparency and reproducibility. However, such inputs may not fully reflect variations in regional construction methods, material supply chains, or actual energy consumption. Future studies should enhance data fidelity by incorporating real-world life cycle inventories and metered operational data from representative case buildings.

Second, the current model focuses primarily on carbon emissions, omitting other environmental dimensions such as water use, land impact, or hazardous material release. A multi-criterion assessment incorporating methods like ReCiPe or TRACI could provide a more holistic view of sustainability performance.

Third, the analysis was conducted at the individual building level over a static 50-year period. In practice, dynamic interactions—such as phased retrofits, district-level energy systems, and evolving policy landscapes—may influence long-term performance. Expanding the model to include temporal and spatial system interactions would improve strategic planning capabilities.

Finally, behavioral factors—such as user responses to retrofits or investor perceptions of carbon pricing—are not explicitly modeled. Integrating stakeholder behavior through participatory modeling or scenario co-design could enhance real-world applicability.

As a practical next step, we recommend applying the proposed framework to an actual prefabricated building project equipped with sub-metered energy tracking. This would allow the validation of model assumptions, calibration of emission profiles, and refinement of investment outcomes under live policy and market conditions.

Additionally, this study adopted generalized assumptions regarding geographic location, climatic conditions, component-specific maintenance cycles, and end-of-life scenarios, including demolition and recycling rates. These factors, though not explicitly varied in the current model, are known to influence life cycle impacts and should be considered when applying the framework to specific regional contexts. Future studies are encouraged to incorporate spatial and climate-sensitive data and disaggregated component-level analysis to improve the granularity and contextual accuracy of life cycle sustainability assessments.

7. Conclusions

This study presents an integrated assessment framework that combines life cycle assessment (LCA), carbon emission quantification, and scenario-based financial modeling to evaluate the sustainability performance of prefabricated steel buildings under dynamic carbon pricing conditions. By linking environmental impacts with economic feasibility, the framework supports informed decision making in both building design and policy development.

The results indicate that life cycle carbon emissions are primarily driven by material production and operational energy use, together accounting for more than 90% of the total carbon footprint. Based on standardized datasets and publicly available emission factors, the baseline emissions were estimated at approximately 575 kg CO2/m2, with an associated monetized environmental cost of CNY 212/m2.

Economically, this study demonstrates that moderate carbon mitigation investments—such as HVAC retrofits and envelope insulation—can deliver positive net financial returns under baseline carbon prices (CNY 60/ton CO2). However, investment outcomes are sensitive to carbon market fluctuations, quota allocation schemes, and mitigation efficiencies, underscoring the need for carbon-aware, risk-adjusted financial planning.

This research contributes a reproducible, data-driven approach to life cycle environmental costing and carbon finance evaluation for prefabricated construction. The proposed financial modeling framework effectively translates carbon price signals into project-level investment decisions. Moreover, the findings offer actionable insights for carbon allowance policy design, green procurement implementation, and the development of carbon-aligned financial instruments in the construction sector.

Several limitations are acknowledged. First, while key life cycle stages were modeled, parameters such as material degradation, maintenance cycles, and end-of-life scenarios were treated using generalized assumptions. Second, geographic and climatic variability was not explicitly modeled but may affect outcomes. Third, although the framework is transferable in structure, its application to other materials or infrastructure types would require customized life cycle data and policy inputs. Future studies may address these gaps through region-specific datasets, operational dynamics, and stakeholder-informed modeling extensions.

Based on these findings, practitioners are advised to adopt moderate carbon mitigation strategies with high cost-effectiveness, while policymakers should enhance carbon quota mechanisms and green procurement standards to foster decarbonized construction. Researchers are encouraged to further integrate carbon pricing dynamics and financial uncertainty into life cycle modeling to enhance realism and applicability.