Sustainable Emerging Technologies: Battle for Dominant Design

Abstract

1. Introduction

2. Literature Review, Definitions, and Hypotheses

2.1. Discontinuous vs. Disruptive SETs

2.1.1. Discontinuous SET

2.1.2. Disruptive SET

Evolution of the Term Disruption

Definition of Disruptive Technology

2.2. Battle for the New Dominant Design

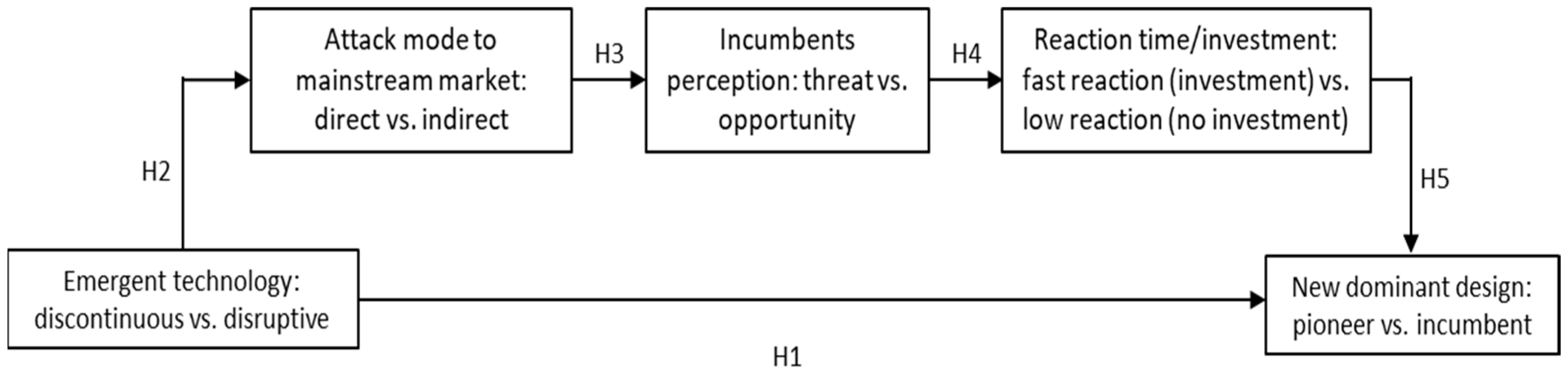

- Main Hypothesis

- Mediating Hypotheses

3. Conclusions, Implications, and Contributions

3.1. Conclusions

3.2. Contributions

3.3. Practical Applications

3.4. Directions for Future Research

3.5. Limitations

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Section A1. Sistematic Reviews | |

| Disruptive Technology | |

| Paper | Contribution |

| Cubero et al. (2021) [20] | Cubero et al. (2021) [20] review how disruptive innovations are commercialized and propose a three-phase framework: value proposition validation, business model creation, and mainstream market sales. It identifies key factors like market orientation, learning, and user involvement. The study emphasizes early commercialization efforts and aims to bridge academic research with entrepreneurial practice. |

| Martínez-Vergara and Valls-Pasola (2021) [21] | Martínez-Vergara and Valls-Pasola (2021) [21] critically review how the term “disruptive innovation” has been used in academic literature. It identifies widespread conceptual confusion and proposes a clearer framework based on innovation type, market impact, and performance trajectory. The authors distinguish disruptive innovation from radical and incremental types. Their revised definition aims to guide both researchers and practitioners. The work contributes to building a more consistent theoretical foundation for future studies. |

| Petzold et al. (2019) [18] | Petzold et al. (2019) [18] present a process-based view of disruptive innovation, emphasizing the dynamic unfolding of events and actions over time. Unlike traditional linear models, it highlights how disruptive innovation emerges through the synchronization of technologies, business models, and market opportunities. The study identifies three phases: Initiation, niche market entry, and mainstream disruption. Success depends on timing, strategic adaptability, and managing stakeholder perceptions. A process model is proposed to guide a better understanding and management of disruptive innovation trajectories. |

| Si and Chen (2020) [19] | Si and Chen (2020) [19] examine the development and impact of disruptive innovation from a strategic management perspective. They trace the evolution of the concept and identify how new entrants disrupt markets dominated by incumbents. The authors distinguish between low-end and new-market disruptions. They emphasize the importance of business model innovation in enabling disruptive strategies. Finally, the study suggests ways incumbents can respond to or adopt disruptive innovations. |

| Yu and Hang (2010) [17] | Yu and Hang (2010) [17] offer a comprehensive review of Disruptive Innovation Theory, clarifying key concepts and addressing common misunderstandings. They evaluate the predictive power of the theory and summarize research on how to enable disruptive innovation from internal, external, marketing, and technological perspectives. The authors highlight numerous inhibitors and enablers for successful implementation. They propose future research directions, including collaboration with start-ups, understanding emerging markets, and refining technological strategies. The review aims to organize fragmented literature and guide both scholars and managers. |

| Antonio, J.L. and Kanbach, D.K. (2023) [22] | Antonio and Kanbach (2023) [22] conduct a systematic review to identify the key contextual factors influencing disruptive innovation. They propose a framework categorizing these factors into technological, market, organizational, and institutional dimensions. Their study highlights how external and internal conditions shape the emergence and success of disruptive innovations. |

| Dominant Design | |

| Fernández, E. and Valle, S. (2019) [5] | Fernández and Valle (2019) [5] propose a decision-making model to establish the dominant design. Their model considers technological, market, and strategic factors that influence which design becomes dominant. |

| Van de Kaa et al. (2011) [4] | Through a literature review, Van de Kaa et al. (2011) [4] identify 29 factors that influence dominant design and present a framework to address the likelihood of a format achieving dominance. |

| Section A2. Additional Articles on Disruptive vs. Discontinuous Technology | |

| Paper | Contribution |

| Bessant, J. (2008) [36] | Bessant (2008) [36] examines how European firms handle discontinuous innovation, which involves radical technological shifts disrupting existing markets. The study highlights challenges such as organizational inertia and resistance to change, proposing strategies for firms to adapt and thrive. The author emphasizes the need for proactive learning, experimentation, and collaboration to manage disruptive transitions effectively. |

| Bockmühl, S., König, A., Enders, A., Hungenberg, H. and Puck, J. (2011) [100] | Bockmühl et al. (2011) [100] investigate how incumbents respond to technological discontinuities, focusing on the intensity, timeliness, and success of their reactions. Their empirical study finds that faster and more aggressive responses increase the likelihood of maintaining a competitive edge. |

| Gobble, M. (2016) [46] | Gobble (2016) [46] explores the concept of disruptive innovation, clarifying its definition and distinguishing it from other forms of innovation. The article examines how disruptive innovations start in niche markets before eventually reshaping entire industries. The study emphasizes the importance of recognizing true disruption to make informed innovation and investment decisions. |

| Kilkkii, K., Mäntylä, M., Karhu, K., Hämmäinen, H. and Ailisto, H. (2018) [76] | Kilkkii et al. (2018) [76] propose a disruption framework to better understand the dynamics of technological and market disruptions. Their model categorizes disruptions based on changes in value creation, market structure, and business models. The study highlights how firms can anticipate and respond to disruptions by recognizing key signals and adapting their strategies. |

| König, A., Graf-Vlachy, L and Schöberl, M. (2021) [102] | König et al. (2021) [102] replicate and extend Gilbert’s (2005) [94] study on how firms perceive and respond to discontinuous change. They examine the role of opportunity and threat perception in shaping organizational inertia and strategic adaptation. Their findings confirm that firms reacting to change as a threat often struggle with inertia, while those seeing it as an opportunity are more adaptive. |

| Lepore, J. (2014) [39] | Lepore (2014) [39] critiques the widespread adoption of disruptive innovation theory, arguing that it is often misused to justify risky business decisions. She challenges Clayton Christensen’s framework, suggesting that historical examples of disruption are selectively interpreted. |

| Linton, J.D. (2002) [33] | Linton (2002) [33] explores methods for forecasting the diffusion of disruptive and discontinuous innovations in the market. The study highlights the limitations of traditional diffusion models and proposes alternative approaches to better predict adoption patterns. |

| Montoya, J.S. and Kita, T. (2018) [49] | Montoya and Kita (2018) [49] analyze how exponential growth in product performance impacts the theory of disruptive innovation. They argue that rapid technological advancements can accelerate market shifts, challenging traditional disruption models. Their findings highlight the need to refine disruption theory to account for exponential technological progress. |

| Muller, E. (2020) [65] | Muller (2020) [65] examines the concept of disruption by comparing Uber and Airbnb, arguing that Uber aligns more closely with disruptive innovation theory. The study refines the criteria for identifying true disruptive innovations. |

| Park, C. (2018) [71] | Park (2018) [71] explores how incumbents can act as disruptors by leveraging disruptive strategies in the high-performance and low-cost CPU and foundry markets. The author examines cases where incumbents drive disruption through aggressive innovation, cost reduction, and business model shifts. The study challenges the traditional view that disruption mainly comes from new entrants, showing how incumbents can reshape industries. |

| Ritala, P., Huotari, P. and Kryzhanivska, K. (2022) [45] | Ritala et al. (2022) [45] analyze how S&P 500 firms communicate about disruption and integrate it into their strategies. The study examines the language, framing, and strategic positioning of disruption in corporate reports and public statements. It finds that firms use disruption talk both as a defensive measure and as a way to signal innovation leadership. |

| Section A3. Additional Articles on Dominant Design | |

| Paper | Contribution |

| Brem, A. and Nylund, P. (2022) [110] | Brem and Nylund (2021) [110] conceptualize ‘standard inertia’—factors impeding the emergence of new standards—and examine how dominant designs can embed subsets of underlying designs, potentially affecting entire technology ecosystems. |

| Chen, P., Williams, C. and Agarwal, R. (2012) [90] | In this study, Chen et al. (2012) [90] explore the challenges firms face as they transition from new entrants to incumbents. They highlight how pre-entry experiences influence a firm’s ability to adapt and succeed in evolving markets, particularly when confronted with disruptive innovations. |

| Ferràs-Hernández, X., Nylund, P. A. and Brem, A. (2023) [87] | Ferràs-Hernández et al. (2023) [87] explore the emergence of dominant designs in artificial intelligence (AI) and how industry standards evolve in this rapidly changing field. The study examines the competition between different AI technologies, highlighting factors that influence the establishment of a dominant design, such as technological performance, market adoption, and regulatory forces. |

| Khanagha, S., Ramezanzadeh, M.T., Mihalache, O.R. and Volberda, H.W. (2018) [66] | Khanagha et al. (2018) [66] examine how firms respond to technological disruption in heterogeneous market environments, where uncertainty and complexity are high. They introduce the concept of “embracing bewilderment” which highlights how organizations can leverage ambiguity as a strategic advantage rather than a barrier. The study finds that successful firms adopt adaptive learning, experimentation, and flexible decision-making to navigate disruption. |

| Nylund, P. A., Brem, A., and Agarwal, N. (2022) [1] | Nylund et al. (2022) [1] explore how enabling technologies contribute to mitigating climate change by shaping dominant designs in environmental innovation ecosystems. The study highlights that technological standardization and industry-wide adoption are crucial for scaling sustainable innovations. It examines factors that drive the emergence of dominant designs, such as policy support, market demand, and collaborative innovation efforts. |

| Suarez, F.F. and Utterback, J.M. (1995) [86] | Suarez and Utterback (1995) [86] analyze how the emergence of a dominant design in an industry influences firm survival, benefiting those that adopt it while marginalizing others. Their study highlights that market entry timing and adaptability are key factors for long-term competitiveness. |

References

- Nylund, P.A.; Brem, A.; Agarwal, N. Enabling Technologies Mitigating Climate Change: The Role of Dominant Designs in Environmental Innovation Ecosystems. Technovation 2022, 117, 102271. [Google Scholar] [CrossRef]

- Schumpeter, J. Capitalism, Socialism and Democracy; Harper & Brothers: New York, NY, USA, 1942; ISBN 978-0-613-91343-0. [Google Scholar]

- Nair, A.; Ahlstrom, D. Delayed Creative Destruction and the Coexistence of Technologies. J. Eng. Technol. Manag. 2003, 20, 345–365. [Google Scholar] [CrossRef]

- Van De Kaa, G.; Van Den Ende, J.; De Vries, H.J.; Van Heck, E. Factors for Winning Interface Format Battles: A Review and Synthesis of the Literature. Technol. Forecast. Soc. Change 2011, 78, 1397–1411. [Google Scholar] [CrossRef]

- Fernández, E.; Valle, S. Battle for Dominant Design: A Decision-Making Model. Eur. Res. Manag. Bus. Econ. 2019, 25, 72–78. [Google Scholar] [CrossRef]

- Riaz, A.; Riaz, N.; Khan, A.N.; Raza, H. Sustainable Practices as a Path to Achieving Sustainable Development Goals: A Systematic Literature Review and Bibliometric Analysis by Using VosViewer Software. Sustain. Bus. Soc. Emerg. Econ. 2023, 5, 373–388. [Google Scholar] [CrossRef]

- Foster, R. Innovation: The Attacker’s Advantage; Summit Books: New York, NY, USA, 1986. [Google Scholar]

- Christensen, C.M. The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail; Harvard Business School Press: Boston, MA, USA, 1997; ISBN 978-0-07-103869-0. [Google Scholar]

- Kim, W.C.; Mauborgne, R. Blue Ocean Strategy. Harv. Bus. Rev. 2004, 82, 76–85. [Google Scholar]

- Gilbert, B.A. Creative Destruction: Identifying Its Geographic Origins. Res. Policy 2012, 41, 734–742. [Google Scholar] [CrossRef]

- Klepper, S.; Simons, K.L. Dominance by Birthright: Entry of Prior Radio Producers and Competitive Ramifications in the U.S. Television Receiver Industry. Strateg. Manag. J. 2000, 21, 997–1016. [Google Scholar] [CrossRef]

- Macher, J.T.; Richman, B.D. Organisational responses to discontinuous innovation: A case study approach. Int. J. Innov. Manag. 2004, 8, 87–114. [Google Scholar] [CrossRef]

- Markides, C.; Geroski, P.A. Fast Second: How Smart Companies Bypass Radical Innovation to Enter and Dominate New Market; Jossey-Bass: San Francisco, CA, USA, 2005; ISBN 978-0-7879-7154-0. [Google Scholar]

- Maine, E.; Garnsey, E. Commercializing Generic Technology: The Case of Advanced Materials Ventures. Res. Policy 2006, 35, 375–393. [Google Scholar] [CrossRef]

- Bergek, A.; Berggren, C.; Magnusson, T.; Hobday, M. Technological Discontinuities and the Challenge for Incumbent Firms: Destruction, Disruption or Creative Accumulation? Res. Policy 2013, 42, 1210–1224. [Google Scholar] [CrossRef]

- Obal, M. Why Do Incumbents Sometimes Succeed? Investigating the Role of Interorganizational Trust on the Adoption of Disruptive Technology. Ind. Mark. Manag. 2013, 42, 900–908. [Google Scholar] [CrossRef]

- Yu, D.; Hang, C.C. A Reflective Review of Disruptive Innovation Theory. Int. J. Manag. Rev. 2010, 12, 435–452. [Google Scholar] [CrossRef]

- Petzold, N.; Landinez, L.; Baaken, T. Disruptive Innovation from a Process View: A Systematic Literature Review. Creat. Innov. Manag. 2019, 28, 157–174. [Google Scholar] [CrossRef]

- Si, S.; Chen, H. A Literature Review of Disruptive Innovation: What It Is, How It Works and Where It Goes. J. Eng. Technol. Manag. 2020, 56, 101568. [Google Scholar] [CrossRef]

- Cubero, J.N.; Gbadegeshin, S.A.; Consolación, C. Commercialization of Disruptive Innovations: Literature Review and Proposal for a Process Framework. Int. J. Innov. Stud. 2021, 5, 127–144. [Google Scholar] [CrossRef]

- Martínez-Vergara, S.J.; Valls-Pasola, J. Clarifying the Disruptive Innovation Puzzle: A Critical Review. Eur. J. Innov. Manag. 2021, 24, 893–918. [Google Scholar] [CrossRef]

- Antonio, J.L.; Kanbach, D.K. Contextual Factors of Disruptive Innovation: A Systematic Review and Framework. Technol. Forecast. Soc. Change 2023, 188, 122274. [Google Scholar] [CrossRef]

- Kahneman, D. Thinking, Fast and Slow; Farrar. Strauss and Giroux: New York, NY, USA, 2011; ISBN 978-0-374-27563-1. [Google Scholar]

- Thaler, R. Misbehaving. The Making of Behavioral Economics; W. W. Norton & Company: New York, NY, USA, 2015; ISBN 978-0-393-35279-5. [Google Scholar]

- Porter, M.E. Technology and competitive advantage. J. Bus. Strategy 1985, 5, 60–78. [Google Scholar] [CrossRef]

- Burgelman, R.A.; Rosenbloom, R.S. Technology Strategy: An Evolutionary Process Perspective. In Research on Technological Innovation, Management and Policy; JAI Press: Greenwich, UK, 1989; Volume 4, pp. 1–23. ISBN 978-1-55938-083-6. [Google Scholar]

- Utterback, J.M. Mastering the Dynamics of Innovation; Harvard Business School Press: Boston, MA, USA, 1994; ISBN 978-0-07-103858-4. [Google Scholar]

- Kim, W.C.; Mauborgne, R. Blue Ocean Strategy: How to Create Uncontested Market Space and Make the Competition Irrelevant; Harvard Business School Press: Boston, MA, USA, 2005. [Google Scholar]

- De Meyer, A.; Loch, C.H. Technology Strategy. In Handbook of New Product Development Management; Routledge: London, UK, 2007; p. 22. ISBN 978-0-08-055440-2. [Google Scholar]

- Schilling, M.A. Strategic Management of Technological Innovation; McGraw-Hill: New York, NY, USA, 2017; ISBN 978-0-07-066712-9. [Google Scholar]

- Popper, K.R. Conjectures and Refutations: The Growth of Scientific Knowledge; Harper and Row: New York, NY, USA, 1963; ISBN 978-1-306-71706-9. [Google Scholar]

- Popper, K.R. The Logic of Scientific Discovery, 2nd ed.; Routledge: London, UK, 1968; ISBN 978-1-68422-876-8. [Google Scholar]

- Linton, J.D. Forecasting the Market Diffusion of Disruptive and Discontinuous Innovation. IEEE Trans. Eng. Manag. 2002, 49, 365–374. [Google Scholar] [CrossRef]

- Anderson, P.; Tushman, M.L. Technological Discontinuities and Dominant Designs: A Cyclical Model of Technological Change. Adm. Sci. Q. 1990, 35, 604. [Google Scholar] [CrossRef]

- Sood, A.; Tellis, G.J. Demystifying Disruption: A New Model for Understanding and Predicting Disruptive Technologies. Mark. Sci. 2011, 30, 339–354. [Google Scholar] [CrossRef]

- Bessant, J. Dealing with Discontinuous Innovation: The European Experience. Int. J. Technol. Manag. 2008, 42, 36. [Google Scholar] [CrossRef]

- Danneels, E. Disruptive Technology Reconsidered: A Critique and Research Agenda. J. Prod. Innov. Manag. 2004, 21, 246–258. [Google Scholar] [CrossRef]

- Markides, C. Disruptive Innovation: In Need of Better Theory. J. Prod. Innov. Manag. 2006, 23, 19–25. [Google Scholar] [CrossRef]

- Lepore, J. The Disruption Machine: What the Gospel of Innovation Gets Wrong. New Yorker, 16 June 2014. Available online: http://www.newyorker.com/magazine/2014/06/23/the-disruption-machine (accessed on 23 April 2025).

- Schmidt, G.M.; Druehl, C.T. When Is a Disruptive Innovation Disruptive? J. Prod. Innov. Manag. 2008, 25, 347–369. [Google Scholar] [CrossRef]

- Urbinati, A.; Chiaroni, D.; Chiesa, V.; Franzò, S.; Frattini, F. An Exploratory Analysis on the Contextual Factors That Influence Disruptive Innovation: The Case of Uber. Int. J. Innov. Technol. Manag. 2018, 15, 1850024. [Google Scholar] [CrossRef]

- Utterback, J.M.; Acee, H.J. Disruptive technologies: An expanded view. Int. J. Innov. Manag. 2005, 9, 1–17. [Google Scholar] [CrossRef]

- Corsi, S.; Di Minin, A. Disruptive Innovation … in Reverse: Adding a Geographical Dimension to Disruptive Innovation Theory. Creat. Innov. Manag. 2014, 23, 76–90. [Google Scholar] [CrossRef]

- Williamson, P.J.; Wan, F.; Eden, Y.; Linan, L. Is Disruptive Innovation in Emerging Economies Different? Evidence from China. J. Eng. Technol. Manag. 2020, 57, 101590. [Google Scholar] [CrossRef]

- Ritala, P.; Huotari, P.; Kryzhanivska, K. Disruption Talk: An Analysis of Disruption-Related Communication, Strategies, and Outcomes in S&P 500 Firms. Technol. Anal. Strateg. Manag. 2022, 34, 406–417. [Google Scholar] [CrossRef]

- Gobble, M.M. Defining Disruptive Innovation. Res. Technol. Manag. 2016, 59, 66–71. [Google Scholar] [CrossRef]

- Adner, R.; Snow, D. Old Technology Responses to New Technology Threats: Demand Heterogeneity and Technology Retreats. Ind. Corp. Change 2010, 19, 1655–1675. [Google Scholar] [CrossRef]

- Hill, T.J. Manufacturing Strategy. Text and Cases, 2nd ed.; Palgrave: Hampshire, UK, 2000; ISBN 978-1-349-13726-8. [Google Scholar]

- Montoya, J.S.; Kita, T. Exponential Growth in Product Performance and Its Implications for Disruptive Innovation Theory. Int. J. Bus. Inf. 2018, 13, 1–36. [Google Scholar]

- Tushman, M.L.; Anderson, P. Technological Discontinuities and Organizational Environments. Adm. Sci. Q. 1986, 31, 439. [Google Scholar] [CrossRef]

- Sood, A.; Tellis, G.J. Technological Evolution and Radical Innovation. J. Mark. 2005, 69, 152–168. [Google Scholar] [CrossRef]

- Lynn, G.S.; Morone, J.G.; Paulson, A.S. Marketing and Discontinuous Innovation: The Probe and Learn Process. Calif. Manag. Rev. 1996, 38, 8–37. [Google Scholar] [CrossRef]

- Veryzer, R.W. Discontinuous Innovation and the New Product Development Process. J. Prod. Innov. Manag. 1998, 15, 304–321. [Google Scholar] [CrossRef]

- Heidbrink, I. Renewable vs Fossil Fuel: How a Fossil-Fuel Powered Industry Pushed a Renewable Resource out of the Ice Market in the Nineteenth and Early Twentieth Centuries. Int. J. Marit. Hist. 2022, 34, 172–182. [Google Scholar] [CrossRef]

- Schubert, E.F.; Kim, J.K. Solid-State Light Sources Getting Smart. Science 2005, 308, 1274–1278. [Google Scholar] [CrossRef]

- Christensen, C.M.; McDonald, R.; Altman, E.J.; Palmer, J.E. Disruptive Innovation: An Intellectual History and Directions for Future Research. J. Manag. Stud. 2018, 55, 1043–1078. [Google Scholar] [CrossRef]

- Christensen, C.M.; Raynor, M.E. The Innovator’s Solution: Creating and Sustaining Successful Growth; Harvard Business School Press: Boston, MA, USA, 2003; ISBN 978-1-4221-9657-1. [Google Scholar]

- Habtay, S.R.; Holmén, M. Incumbents’ Responses to Disruptive Business Model Innovation: The Moderating Role of Technology vs. Market-Driven Innovation. Int. J. Entrep. Innov. Manag. 2014, 18, 289. [Google Scholar] [CrossRef]

- Pisano, G.P. You Need an Innovation Strategy. Harv. Bus. Rev. 2015, 93, 44–54. [Google Scholar]

- Christensen, C.M. The Ongoing Process of Building a Theory of Disruption. J. Prod. Innov. Manag. 2006, 23, 39–55. [Google Scholar] [CrossRef]

- Schuelke-Leech, B.-A. A Model for Understanding the Orders of Magnitude of Disruptive Technologies. Technol. Forecast. Soc. Change 2018, 129, 261–274. [Google Scholar] [CrossRef]

- Christensen, C.M.; Raynor, M.; McDonald, R. What Is Disruptive Innovation? Harv. Bus. Rev. 2015, 93, 44–53. [Google Scholar]

- Govindarajan, V.; Kopalle, P.K. Disruptiveness of Innovations: Measurement and an Assessment of Reliability and Validity. Strateg. Manag. J. 2006, 27, 189–199. [Google Scholar] [CrossRef]

- Bower, J.L.; Christensen, C.M. Disruptive Technologies: Catching the Wave. Harv. Bus. Rev. 1995, 73, 43–53. [Google Scholar]

- Muller, E. Delimiting Disruption: Why Uber Is Disruptive, but Airbnb Is Not. Int. J. Res. Mark. 2020, 37, 43–55. [Google Scholar] [CrossRef]

- Khanagha, S.; Ramezan Zadeh, M.T.; Mihalache, O.R.; Volberda, H.W. Embracing Bewilderment: Responding to Technological Disruption in Heterogeneous Market Environments. J. Manag. Stud. 2018, 55, 1079–1121. [Google Scholar] [CrossRef]

- King, A.A.; Baatartogtokh, B. How Useful Is the Theory of Disruptive Innovation? MIT Sloan Manag. Rev. 2015, 57, 77–90. [Google Scholar]

- Nagy, D.; Schuessler, J.; Dubinsky, A. Defining and Identifying Disruptive Innovations. Ind. Mark. Manag. 2016, 57, 119–126. [Google Scholar] [CrossRef]

- Govindarajan, V.; Kopalle, P.K. The Usefulness of Measuring Disruptiveness of Innovations Ex Post in Making Ex Ante Predictions. J. Prod. Innov. Manag. 2006, 23, 12–18. [Google Scholar] [CrossRef]

- Tellis, G.J. Disruptive Technology or Visionary Leadership?*. J. Prod. Innov. Manag. 2006, 23, 34–38. [Google Scholar] [CrossRef]

- Park, C. Incumbents as Disruptor and Their Disruptive Behaviour Enabling Disruptive Innovation: Case Study of High Performance and Low Cost CPU and Foundry Market. Technol. Anal. Strateg. Manag. 2018, 30, 1437–1454. [Google Scholar] [CrossRef]

- Adner, R.; Levinthal, D.A. Technology Speciation and the Path of Emerging Technologies. In Wharton on Managing Emerging Technologies; John Wiley: New York, NY, USA, 2000; pp. 54–77. ISBN 978-0-471-36121-3. [Google Scholar]

- Lindsay, J.; Hopkins, M. FROM EXPERIENCE: Disruptive Innovation and the Need for Disruptive Intellectual Asset Strategy. J. Prod. Innov. Manag. 2010, 27, 283–290. [Google Scholar] [CrossRef]

- Bohnsack, R.; Pinkse, J. Value Propositions for Disruptive Technologies: Reconfiguration Tactics in the Case of Electric Vehicles. Calif. Manag. Rev. 2017, 59, 79–96. [Google Scholar] [CrossRef]

- Gans, J.S. Keep Calm and Manage Disruption. MIT Sloan Manag. Rev. 2016, 57, 83–90. [Google Scholar]

- Kilkki, K.; Mäntylä, M.; Karhu, K.; Hämmäinen, H.; Ailisto, H. A Disruption Framework. Technol. Forecast. Soc. Change 2018, 129, 275–284. [Google Scholar] [CrossRef]

- Marques Lameirinhas, R.A.; Torres, J.P.N.; De Melo Cunha, J.P. A Photovoltaic Technology Review: History, Fundamentals and Applications. Energies 2022, 15, 1823. [Google Scholar] [CrossRef]

- Alberti-Alhtaybat, L.v.; Al-Htaybat, K.; Hutaibat, K. A Knowledge Management and Sharing Business Model for Dealing with Disruption: The Case of Aramex. J. Bus. Res. 2019, 94, 400–407. [Google Scholar] [CrossRef]

- Dedehayir, O.; Nokelainen, T.; Mäkinen, S.J. Disruptive Innovations in Complex Product Systems Industries: A Case Study. J. Eng. Technol. Manag. 2014, 33, 174–192. [Google Scholar] [CrossRef]

- Fernández, E.; Valle, S.; Perez-Bustamante, G. Disruption Versus Discontinuity: Definition and Research Perspective From Behavioral Economics. IEEE Trans. Eng. Manag. 2020, 67, 963–972. [Google Scholar] [CrossRef]

- Salon, D.; Breetz, H.L.; Wiers, H.; King, D. Electric Vehicles for All? Opportunities and Challenges for Large-Scale Adoption. Transp. Res. Part D Transp. Environ. 2025, 144, 104776. [Google Scholar] [CrossRef]

- Dragna, E.C.; Ioana, A.; Constantin, N. Methods of Steel Manufacturing–The Electric Arc Furnace. IOP Conf. Ser. Mater. Sci. Eng. 2018, 294, 012017. [Google Scholar] [CrossRef]

- Regattieri, A.; Piana, F.; Bortolini, M.; Gamberi, M.; Ferrari, E. Innovative Portable Solar Cooker Using the Packaging Waste of Humanitarian Supplies. Renew. Sustain. Energy Rev. 2016, 57, 319–326. [Google Scholar] [CrossRef]

- Ibrahim, I.D.; Sadiku, E.R.; Hamam, Y.; Kupolati, W.K.; Ndambuki, J.M.; Jamiru, T.; Eze, A.A.; Snyman, J. Recent Recycling Innovations to Facilitate Sustainable Packaging Materials: A Review. Recycling 2023, 8, 88. [Google Scholar] [CrossRef]

- Brem, A.; Nylund, P.A.; Schuster, G. Innovation and de Facto Standardization: The Influence of Dominant Design on Innovative Performance, Radical Innovation, and Process Innovation. Technovation 2016, 50–51, 79–88. [Google Scholar] [CrossRef]

- Suarez, F.F.; Utterback, J.M. Dominant Designs and the Survival of Firms. Strateg. Manag. J. 1995, 16, 415–430. [Google Scholar] [CrossRef]

- Ferràs-Hernández, X.; Nylund, P.A.; Brem, A. The Emergence of Dominant Designs in Artificial Intelligence. Calif. Manag. Rev. 2023, 65, 73–91. [Google Scholar] [CrossRef]

- Klepper, S. Entry, Exit, Growth, and Innovation over the Product Life Cycle. Am. Econ. Rev. 1996, 86, 562–583. [Google Scholar]

- Helfat, C.E.; Lieberman, M.B. The Birth of Capabilities: Market Entry and the Importance of Pre-History. Ind. Corp. Change 2002, 11, 725–760. [Google Scholar] [CrossRef]

- Chen, P.; Williams, C.; Agarwal, R. Growing Pains: Pre-entry Experience and the Challenge of Transition to Incumbency. Strateg. Manag. J. 2012, 33, 252–276. [Google Scholar] [CrossRef]

- Teece, D.J. Profiting from Technological Innovation: Implications for Integration, Collaboration, Licensing and Public Policy. Res. Policy 1986, 15, 285–305. [Google Scholar] [CrossRef]

- Moore, G.A. Crossing the Chasm. Marketing and Selling Disruptive Products to Mainstream Customers, 3rd ed.; Harper Collins Publishers: New York, NY, USA, 2002; ISBN 978-0-06-229298-8. [Google Scholar]

- Wezel, F.C.; Lomi, A. ‘Built to Last‘ or ‘New and Improved’? Trajectories of Industrial Evolution in the European Motorcycle Industry, 1885–1993. Eur. Manag. Rev. 2009, 6, 107–119. [Google Scholar] [CrossRef]

- Gilbert, C.G. Unbundling the Structure of Inertia: Resource Versus Routine Rigidity. Acad. Manag. J. 2005, 48, 741–763. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect Theory: An Analysis of Decision under Risk. Econometrica 1979, 47, 263. [Google Scholar] [CrossRef]

- Ariely, D. Predictably Irrational: The Hidden Forces That Shape Our Decisions; Harper Collins: New York, NY, USA, 2008; ISBN 978-0-06-135323-9. [Google Scholar]

- Kahneman, D.; Knetsch, J.L.; Thaler, R.H. Anomalies: The Endowment Effect, Loss Aversion, and Status Quo Bias. J. Econ. Perspect. 1991, 5, 193–206. [Google Scholar] [CrossRef]

- Tversky, A.; Kahneman, D. The Framing of Decisions and the Psychology of Choice. Science 1981, 211, 453–458. [Google Scholar] [CrossRef]

- Gilbert, C.; Bower, J.L. Disruptive Change. When Trying Harder Is Part of the Problem. Harv. Bus. Rev. 2002, 80, 94–101. [Google Scholar]

- Bockmühl, S.; König, A.; Enders, A.; Hungenberg, H.; Puck, J. Intensity, Timeliness, and Success of Incumbent Response to Technological Discontinuities: A Synthesis and Empirical Investigation. Rev. Manag. Sci. 2011, 5, 265–289. [Google Scholar] [CrossRef]

- Lettice, F.; Thomond, P. Allocating Resources to Disruptive Innovation Projects: Challenging Mental Models and Overcoming Management Resistance. Int. J. Technol. Manag. 2008, 44, 140. [Google Scholar] [CrossRef]

- König, A.; Graf-Vlachy, L.; Schöberl, M. Opportunity/Threat Perception and Inertia in Response to Discontinuous Change: Replicating and Extending Gilbert (2005). J. Manag. 2021, 47, 771–816. [Google Scholar] [CrossRef]

- Dewald, J.; Bowen, F. Storm Clouds and Silver Linings: Responding to Disruptive Innovations Through Cognitive Resilience. Entrep. Theory Pract. 2010, 34, 197–218. [Google Scholar] [CrossRef]

- Tripsas, M.; Gavetti, G. Capabilities, Cognition, and Inertia: Evidence from Digital Imaging. Strateg. Manag. J. 2000, 21, 1147–1161. [Google Scholar] [CrossRef]

- Osiyevskyy, O.; Dewald, J. Explorative Versus Exploitative Business Model Change: The Cognitive Antecedents of Firm-Level Responses to Disruptive Innovation. Strateg. Entrep. J. 2015, 9, 58–78. [Google Scholar] [CrossRef]

- Shankar, V.; Carpenter, G.S.; Krishnamurthi, L. The Advantages of Entry in the Growth Stage of the Product Life Cycle: An Empirical Analysis. J. Mark. Res. 1999, 36, 269. [Google Scholar] [CrossRef]

- Cernansky, R. Vogue Business. 2019. Available online: https://www.voguebusiness.com/technology/econyl-sustainability-fabric-prada-gucci-burberry (accessed on 23 April 2025).

- Ansari, S.S.; Garud, R.; Kumaraswamy, A. The Disruptor’s Dilemma: TiVo and the U.S. Television Ecosystem: The Disruptor’s Dilemma. Strateg. Manag. J. 2016, 37, 1829–1853. [Google Scholar] [CrossRef]

- Vecchiato, R. Disruptive Innovation, Managerial Cognition, and Technology Competition Outcomes. Technol. Forecast. Soc. Change 2017, 116, 116–128. [Google Scholar] [CrossRef]

- Brem, A.; Nylund, P. The Inertia of Dominant Designs in Technological Innovation: An Ecosystem View of Standardization. IEEE Trans. Eng. Manag. 2024, 71, 2640–2648. [Google Scholar] [CrossRef]

- Langlois, R.N.; Robertson, P.L. Firms, Markets and Economic Change; Routledge: London, UK, 1995; ISBN 978-1-280-32525-0. [Google Scholar]

- Bower, J.L. Managing the Resource Allocation; Richard D. Irwin: Homewood, IL, USA, 1970; ISBN 978-0-07-103212-4. [Google Scholar]

- Grove, A.S. Only the Paranoid Survive: How to Exploit the Crisis Points That Challenge Every Company and Career; Doubleday: New York, NY, USA, 1996; ISBN 978-0-385-48382-7. [Google Scholar]

- Granstrand, O.; Patel, P.; Pavitt, K. Multi-Technology Corporations: Why They Have “Distributed” Rather Than “Distinctive Core” Competencies. Calif. Manag. Rev. 1997, 39, 8–25. [Google Scholar] [CrossRef]

- Reinhardt, R.; Gurtner, S.; Griffin, A. Towards an Adaptive Framework of Low-End Innovation Capability—A Systematic Review and Multiple Case Study Analysis. Long Range Plann. 2018, 51, 770–796. [Google Scholar] [CrossRef]

- Hüsig, S.; Hipp, C.; Dowling, M. Analysing Disruptive Potential: The Case of Wireless Local Area Network and Mobile Communications Network Companies. R&D Manag. 2005, 35, 17–35. [Google Scholar] [CrossRef]

- Augustin, M.A.; Hartley, C.J.; Maloney, G.; Tyndall, S. Innovation in Precision Fermentation for Food Ingredients. Crit. Rev. Food Sci. Nutr. 2024, 64, 6218–6238. [Google Scholar] [CrossRef]

- Fairley, P. The Greening of GE. IEEE Spectr. Technol. Insid. 2005. Available online: https://spectrum.ieee.org/the-greening-of-ge (accessed on 25 April 2025). [CrossRef]

- Voldsgaard, A.; Rüdiger, M. Innovative Enterprise, Industrial Ecosystems, and Sustainable Transition: The Case of Transforming DONG Energy to Ørsted. In Handbook of Climate Change Mitigation and Adaptation; Lackner, M., Sajjadi, B., Chen, W.-Y., Eds.; Springer International Publishing: Cham, Switzerland, 2022; pp. 3633–3684. ISBN 978-3-030-72578-5. [Google Scholar]

- Madjdi, F.; Hüsig, S. The Heterogeneity of Incumbents’ Perceptions and Response Strategies in the Face of Potential Disruptions. Foresight 2011, 13, 14–33. [Google Scholar] [CrossRef]

- Suarez, F.F. Battles for Technological Dominance: An Integrative Framework. Res. Policy 2004, 33, 271–286. [Google Scholar] [CrossRef]

- Hopp, C.; Antons, D.; Kaminski, J.; Salge, T.O. The Topic Landscape of Disruption Research—A Call for Consolidation, Reconciliation, and Generalization. J. Prod. Innov. Manag. 2018, 35, 458–487. [Google Scholar] [CrossRef]

| Current Competition | Introduction of a Sustainable Emerging Technology (SET) | |||||

|---|---|---|---|---|---|---|

| Contenders | Incumbents | SET Pioneers | ||||

| Technology | Current dominant design | Discontinuous SET | Disruptive SET | |||

| Potential disruptive SET |  | Disruptive SET | ||||

| Market | Mainstream market | Mainstream market | New market (niche) Low-end market High-end market Developing country market Mainstream market |  | Mainstream market | |

| Basis for competition | Order-winning criterion | Drastic order-of-magnitude increase in the order-winning criterion | Order-winning criterion |  | Order-qualifying criterion on mainstream market: New order-winning criterion | |

| Competence-enhancing technology | Competence-enhancing/destroying technology | Competence-destroying technology | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fernández, E.; Valle, S.; Pérez-Bustamante, G. Sustainable Emerging Technologies: Battle for Dominant Design. Sustainability 2025, 17, 4285. https://doi.org/10.3390/su17104285

Fernández E, Valle S, Pérez-Bustamante G. Sustainable Emerging Technologies: Battle for Dominant Design. Sustainability. 2025; 17(10):4285. https://doi.org/10.3390/su17104285

Chicago/Turabian StyleFernández, Esteban, Sandra Valle, and Guillermo Pérez-Bustamante. 2025. "Sustainable Emerging Technologies: Battle for Dominant Design" Sustainability 17, no. 10: 4285. https://doi.org/10.3390/su17104285

APA StyleFernández, E., Valle, S., & Pérez-Bustamante, G. (2025). Sustainable Emerging Technologies: Battle for Dominant Design. Sustainability, 17(10), 4285. https://doi.org/10.3390/su17104285