1. Introduction

According to neoclassical economics, technology upgrading is crucial for economic growth, social stability, and sustainable development [

1,

2]. In this process, innovation serves as a primary driving force, and growth in total factor productivity (TFP) represents its main manifestation [

3]. As such, exploring how to enhance innovation and TFP growth has become a popular topic in development economics [

4,

5,

6]. A potential key determinant is liquidity conditions. Firms under financial pressure tend to exhibit weaker innovation capabilities and lower TFP throughout their life cycle [

7,

8]. In practice, many firms encounter significant constraints or financial frictions that hinder their allocation of resources to research and development (R&D), especially in developing economies [

9,

10]. In response to this situation, governments typically use fiscal subsidies, tax incentives, or financial support to improve firms’ liquidity conditions. However, the effectiveness of such financial support policies in stimulating innovation and TFP growth remains debatable, and the existing theoretical and empirical evidence, which is limited, is predominantly available in developed countries [

11,

12]. To bridge this gap, this paper attempted a new step to examine the impact of financial support policies on firms’ innovation and TFP within the context of China, the world’s largest developing economy.

The essence of innovation is

creative destruction, a process in which new technologies update or replace old ones [

1,

2,

6]. As the core driver of long-term growth, innovation contributes to firms’ competitiveness, operational performance, and sustainable development. The primary outcome of innovation activities—TFP—was proposed by Solow [

3] and measures the contribution of technology (intangible factors) to economic growth. TFP growth comprehensively reflects the technology upgrading of firms.

1 While innovation and TFP growth are vital, there exists a dilemma. Since innovation is a high-cost, high-risk, long-cycle activity that needs large R&D investment, firms with limited financial resources often struggle to engage in it. One potential solution is to improve firms’ liquidity conditions through financial support policies, enabling them to allocate more resources to R&D investments.

In theory, financial support policies can foster innovation and TFP growth through several channels. Firstly, these initiatives alleviate credit constraints and reduce credit costs, which directly lowers the cost of innovation activities [

8,

12]. Meanwhile, they mitigate financial risks and boost entrepreneurs’ willingness to engage in risky decisions like innovation [

13,

14]. Secondly, more favorable liquidity conditions increase the likelihood of firms’ technology upgrading and TFP improvement [

15]. By employing financial support policies, firms will allocate a larger share of their resources to R&D, thus boosting their quantity and quality in innovation [

9,

11]. Thirdly, a financial support policy may reshape the firm’s asset mix, thereby promoting innovation and TFP growth. On the one hand, such policies make firms more forward-looking and encourage them to allocate assets to the long term, which contributes to their success in innovation—a high-risk and long-cycle activity [

16,

17]. On the other hand, these policies lead to less reliance on tangible assets as loan collateral. In practice, firms often rely on tangible assets to secure external financing, leading to over-investment in tangible assets. By employing financial support policies, they can reduce their tangible assets and allocate more resources to innovation activities [

15]. Moreover, financial support policies prompt firms to invest more in intangible assets that are crucial for technology upgrading [

2,

18]. Overall, financial support policies can potentially improve liquidity conditions, promote R&D investment, and optimize asset allocation, thereby stimulating firm innovation and TFP growth.

Recognizing the crucial role that financial support plays, recent research has increasingly focused on it. Some scholars and practitioners point to financial support as a potential way to promote technology upgrading, and they argue that financial institutions can stimulate TFP by allocating resources to innovative sectors. In line with this perspective, the literature has intensively documented the positive impact of financial support on innovation, including increased innovation output, improved product quality, and increased R&D on new products [

7,

17,

19,

20,

21]. However, some evidence challenges this view, suggesting that financial support may not always effectively promote innovation and TFP [

22,

23,

24,

25]. On the contrary, they argue that innovation depends more on firms’ strategies and is less related to liquidity conditions: this phenomenon is known as the

liquidity paradox [

22]. Accordingly, the relationship between financial support and firms’ innovation remains inconclusive and is ultimately an empirical question.

One reason behind this discrepancy is that most studies focus on the impact of variations in external financing on firms’ technology upgrading, by regression innovation (or TFP) on an indicator proxied for financial support (see [

23] for a review). However, this approach suffers from significant challenges of endogeneity issues [

26], which arise from (i) reverse causality—firms with strong innovation capabilities are more likely to attract support from financial institutions (banks)—and (ii) omitted variables—there may be unobservable factors simultaneously affecting both financial support and the firm’s innovation, such as regional financial development levels. Ordinary least squares (OLSs) or fixed effects (FEs) models often fail to address these issues, resulting in biased estimates. To resolve this challenge, we utilized the “Technology and Finance Integration” pilot (henceforth, TFI) in China, a financial support policy dedicated to enhancing firms’ liquidity conditions for innovation.

TFI is one of the first large-scale, innovation-oriented financial support pilots in China, covering 49 prefecture-level cities and over 40% of technology firms (see

Section 2 for a brief outline of TFI). To date, the Ministry of Science and Technology (MST) has launched two waves of TFI, in 2011 and 2016. In line with the

Medium- and Long-Term Plan for the Development of Science and Technology in China (of which, TFI is a part; source:

https://www.gov.cn/gongbao/content/2006/content_240244.htm, accessed on 17 October 2024), the main objectives of this place-based policy are to reduce information friction between the financial sector and firms, lower the financing costs of R&D activities, and improve firms’ liquidity conditions. To achieve these goals, TFI mandates local government to act as an intermediary between financial institutions and firms’ R&D departments, thereby establishing a new system of financial resource management, in which the government, financial institutions, and firms collaborate. This quasi-natural experiment has yielded an unexpected shock, providing an exogenous variation that enables us to isolate the impact of financial support on firms’ innovation and TFP growth.

Using TFI as a quasi-natural experiment, and based on a panel of Chinese listed firms from 2006 to 2022, this paper explored the causal effects of financial support policies on firms’ innovation and TFP in the context of China. Firstly, we examined whether TFI can enhance firms’ innovation and TFP. Secondly, given that the policy effects may vary by firm or regional characteristics, we investigated heterogeneity across firms’ uncertainty perceptions, ownership structure, and regional financial development levels. Thirdly, to interpret our main findings, it was necessary to explore the underlying mechanisms by which financial support policies affect firms’ innovation and TFP. To that end, we constructed a general equilibrium model to generalize the logic chain, and we then explored the mediating roles of liquidity conditions, R&D investment, and asset allocation. By undertaking these works, this paper sought to answer the following three questions:

- (i)

Is the financial support policy (TFI) beneficial to firms’ innovation and TFP in a transitioning economy? This was our primary question.

- (ii)

If so, which types of firms experience greater innovation and TFP under financial support policies? Answering this question will help guide the expansion of pilots and inform the development of related policies.

- (iii)

What are the potential mechanisms by which financial support policies affect firms’ innovation and TFP? Answering this question will not only help explain our main findings but will also shed light on intermediary pathways to strengthen the policy effects.

Our work is valuable both theoretically and practically. Theoretically, we have established a causal link between financial support and innovation, as well as financial support and TFP, offering a plausible explanation for the underlying mechanisms, thus complementing the scarce empirical evidence on this topic. Moreover, our theoretical explanation with a general equilibrium model generalizes this issue, and it can be extended to other financial support-related concerns. Practically, we focused on a transitioning economy that urgently needed technology upgrading to achieve sustainable and high-quality development. In China, despite the central role of innovation, R&D investment remains woefully insufficient. According to the OECD Science and Technology Indicators database, China’s R&D investment intensity lags far behind that of developed countries, falling to less than one third of theirs (source:

https://www.oecd.org/en/data/datasets/main-science-and-technology-indicators.html accessed on 4 October 2024). Therefore, it is both urgent and critical to explore effective strategies, such as financial support policies, for fostering innovation and TFP growth. Against this backdrop, our findings have practical implications and provide valuable insights for the refinement of financial support policies in developing countries.

The remainder of this study is structured as follows:

Section 2 introduces the evolution, objectives, and initiatives of TFI.

Section 3 presents a theoretical model for generalizing intuition and guiding our empirical work.

Section 4 outlines our empirical strategy, data, and econometric models.

Section 5 shows our results, supplemented by a set of robustness checks.

Section 6 explores the underlying mechanisms by which we give an interpretation of our main findings.

Section 7 is a brief discussion, and

Section 8 concludes and summarizes our policy implications.

2. Technologyand Finance Integration Pilot

In this section, we provide a brief overview of the evolution, objectives, and initiatives of the TFI pilot, and we discuss how these initiatives could potentially link to firms’ innovation and TFP growth.

Inherent challenges, such as high risk, substantial investment requirements, information asymmetry, and inadequate collateral, have placed technology firms in a predicament of high financing costs and limited access to financial resources. Especially since 2005, the Chinese government’s series of tight monetary policies has increased the difficulty of financing and has exacerbated the challenges faced when undergoing innovation activities. To tackle these challenges, the Medium- and Long-Term Plan for the Development of Science and Technology of China was proposed in 2006, emphasizing the need to enhance the security system for R&D investments and establish venture capital guiding funds. In 2008, the State Council of China further reinforced the importance of strengthening fiscal and financial support for innovation activities, mobilizing financial resources to facilitate technology upgrading. Against this backdrop, the Chinese government launched a series of financial support programs to promote R&D investments.

TFI, one of the first large-scale, innovation-oriented financial support pilots, is precisely such a pioneer. Similar to other pilot policies, TFI follows a “pilot–promotion” way. The pilot cities are selected through a bottom-up, self-reporting process initiated by local governments. In this process, local governments first submit their applications to the MST, which are then reviewed and evaluated by experts, based on factors such as prior initiatives, resource endowments, and economic development characteristics. To date, the MST has progressively launched two waves of TFI pilots, covering 49 prefecture-level cities and over 40% of technology firms in China.

2 In November 2011, 16 regions with relatively concentrated technology and financial resources, including Shanghai, Beijing, and Tianjin, were selected as the first wave of pilots. In June 2016, the second wave of TFI was expanded to nine additional cities, such as Zhengzhou, Ningbo, and Qingdao. TFI primarily focuses on innovating investment methods in technology, increasing financial support for technology firms, and guiding various types of venture capital to engage in firms’ innovation activities.

To promote the pilot cities in achieving their objectives, the MST has established several requirements. Firstly, it mandates local financial institutions to provide targeted support for firms’ R&D activities. Information asymmetry is a significant obstacle to firms obtaining R&D funding through bank loans. In the policy design, the pilot government can act as an intermediary to reduce the negative effects of information asymmetry. Specifically, it can organize experts to review technology loan projects, establish credit systems, and offer professional advice to banks, thus reducing information asymmetry between banks and firms. Secondly, it requires pilot cities to increase fiscal subsidies for R&D. Fiscal subsidies are an important tool in fiscal policy, typically taking the form of non-repayable financial transfers. They serve as a signaling mechanism, conveying support for technology firms, thereby boosting their confidence and enthusiasm in R&D activities. Thirdly, it requires pilot areas to guide social capital participation in innovation. Some pilot city governments have proposed preferential income tax deductions for qualified equity investment funds, to attract financial resources to flow into innovation activities. Throughout all these processes, local governments also play a supervisory role, aimed to alleviate the credit friction between the financial institutions technology firms.

3. Model

To generalize the intuition and guide our empirical work, we constructed a simple general equilibrium model, with heterogeneous firms exposed to financial support, in the spirit of Dixit and Stiglitz [

27], Helpman and Krugman [

28], and Melitz [

29].

3 In this model, we depict the impact of financial support policies from two aspects: (i) lowering credit costs, and (ii) alleviating credit constraints. These features align with the design of the TFI pilot, as we discussed in

Section 2. For analytical simplicity, we assumed that the firms’ capital input was entirely financed through collateralized loans and that the financing rates varied across the liquidity conditions. In the analysis, we assumed that the financial support expanded the firms’ credit boundaries and that the expansion was inversely related to the capital price. Empirically oriented readers can skip to the model predictions in

Section 3.2 and see how the theory connects to our empirics in

Section 3.3.

3.1. Model Setting

3.1.1. Demand

The representative consumer consumes a variety of goods (

N), with a utility function in the constant elasticity of substitution (CES) form:

4

where

denotes the substitution elasticity between varieties, and

represents the demand for goods,

i. Let

P denote the market price index,

, where

is the price of goods,

i. Given the consumer’s budget constraint

R, the market demand faced by a firm’s

i is

3.1.2. Production

Firms’ production activities encompass both intermediate goods and final products. The production of intermediate goods requires labor

l and capital

k, in a constant return to scale (CRS) Cobb–Douglas function,

where

is the output of the intermediate goods, and where

is the output elasticity of the labor (homogeneous across firms). As discussed above, the labor wage is standardized to 1, and the capital interest rate is

. Following the cost minimization principle, the unit cost of producing intermediate goods for the firm is (see

Appendix B for derivations)

Clearly, increases with , .

Firms use intermediate goods to produce final goods. Given the firm TFP

, the production function for final goods

. Without loss of generality, we assume

. Then, the variable cost for a firm producing

units of final goods is

. Additionally, each firm incurs a fixed sunk cost.For simplicity, we assume that fixed costs are completely sunk once the firm decides to produce. Considering partially recoverable fixed costs does not affect our main findings. Following Guadalupe [

30], the firm’s fixed cost is

, where

measures the fixed cost expenditure elasticity with respect to financing costs,

M is the mass of firms in the market, and

measures the extent of the external congestion faced by firms.

3.1.3. Innovation Activities

Next, we introduce an endogenous technology upgrading process. We assume that firms must pay an entry cost

before entering the market to capture a random TFP. Following Melitz [

29], we assume that the productivity follows a Pareto distribution

and

, where a smaller value of

corresponds to a higher TFP for the firm. Firms can choose their innovation investments

to allow their TFP to increase to

. The unit innovation cost for the firm is directly related to its initial productivity level. Here,

represents the unit innovation cost, indicating that a higher initial productivity (or a smaller

) results in a lower innovation cost.

3.1.4. Equilibrium

To engage in production and innovation, firms need to secure external financing. The credit constraints they face can be categorized into two aspects: credit demand and financing channels. Credit demand reflects a firm’s need for external credit, while financing channels represent the maximum access of a firm’s limit borrowing. Financial support helps alleviate credit constraints, and we use to denote the degree of a firm’s credit constraint. The smaller the , the more stringent the firm’s credit constraints. We assume that firms need to finance a proportion of their innovation investment through credit, where represents the firm’s external financing requirement. It is assumed that this external financing requirement is exogenously given. Firms are required to repay their loans at the end of each period, meaning that financial support directly influences the firm’s innovation investment decisions.

The profit maximization problem faced by firms with financing constraints is as follows:

We consider only cases where the budget constraint is binding. Given the initial productivity and credit demand, this implies that the capital price (credit constraint) faced by the firm must exceed a critical threshold

, and

denotes the cut-off TFP. By combining the zero-profit condition, the free entry condition, and the market clearing condition, we can derive the firm’s optimal innovation investment, profit margin, and relative market share in equilibrium (see

Appendix B for derivations).

Optimal Innovation Investment: Firm Market Share:

where

denotes revenues (sales) of a firm’s

i,

, and

denotes the Lagrange multiplier. Since

,

and

, we have

.

3.2. Model Predictions

We characterize financial support as (i) a reduction in financing costs, and (ii) a relaxation of financing constraints. Both of these lead to a relationship in our model,

. On this basis, we observe the effect of financial support on firms’ innovation decisions by differentiating Equation (1) with respect to

:

where

and

. Since

and

, we have

and the firms’ innovation investments decrease with financial constraints.

Clearly, liquidity conditions influence firms’ innovation investment through at least two channels: (i) the cost effect, as represented by the first term, where the increased variable production costs decreases innovation investment; and (ii) the credit constraint effect, as reflected in the second term, where the reduced available credit crowds out the funds available for R&D. Since financial support lowers financing costs and eases credit constraints, it enhances R&D investment, ultimately driving greater innovation and TFP growth. This leads to our main proposition, as below:

Proposition 1. Financial support boosts a firm’s innovation and TFP improvement, primarily through the dual channels of cost reduction and credit constraint relaxation. That is, An additional prediction is that financial support will improve a firm’s operating performance. As shown in Equations (

2) and (

3), a firm’s profitability decreases monotonically with

r, and its relative market share is in direct proportion to its productivity. Since financial support reduces

r and boosts a firm’s TFP, it leads to higher profitability, greater sales, and an expanded market share. This yields Proposition 2.

Proposition 2. Financial support enhances a firm’s operating performance, reflecting in scale effects and market share effects. That is, 3.3. Extended Discussion: From Theory to Empirics

The model predictions in Propositions 1 and 2 are informative. Here, we provide a few remarks on how the generalized model predictions relate to our stylized empirical evidence.

First, Proposition 1 implies that a firm’s optimal innovation investment is negatively correlated with financing costs. Since both innovation and TFP increase monotonically with innovation investment, this also indicates that financial support fosters a firm’s innovation and TFP growth. Thus, it is to be expected that growth in a firm’s innovation and TFP will be observed upon the introduction of TFI. To verify this testable proposition, we conducted an empirical analysis using panel data from Chinese listed firms over the period 2006–2022. Our identification relied on the difference-in-differences (DID) model, a widely used policy-evaluation approach that leverages spatial variation in TFI rollout and compares changes in innovation and TFP between treated and control firms before and after the TFI implementation. Compared to standard OLS or FE models, DID effectively mitigates endogeneity concerns, allowing for a more accurate isolation of the impact of financial support on a firm’s innovation and TFP.

Secondly, better liquidity conditions and increased innovation constitute the potential mechanisms through which TFI operates its effect. From Proposition 1, the impact of financial support on innovation and TFP can be decomposed into cost-reduction and credit-relaxing effects, both of which improve a firm’s liquidity conditions and, in turn, positively influence innovation investment. This outlines a logical chain with which we could interpret our baseline results: increased financial support (TFI)—improved liquidity conditions and higher R&D investments—innovation and TFP growth. Following the main analysis, we tested these two plausible mechanisms, utilizing the rich financial information of Chinese listed firms. Note that our model abstracts from time, and that we were not able to capture the firms’ dynamic decisions. According to Chen et al. [

15] and Anderson [

18], as liquidity conditions improve, firms may optimize their asset allocation, which boosts innovation and TFP growth. This also presents a potential channel to test.

Thirdly, in addition to its innovation performance, TFI may also improve a firm’s operational performance. According to Proposition 2, financial support is positively correlated with profitability, sales, and market share. To demonstrate the validity of our model settings and strengthen the logical chain, we will also provide supporting evidence regarding the impact of TFI on the firms’ operational performance.

7. Discussion

Overall, our empirical results effectively replicated the theoretical predictions. In this section, we provide a brief discussion to highlight the key findings.

Firstly, we found compelling evidence that financial support is conducive to firms’ innovation and TFP growth. Financial support policies alleviate liquidity constraints, enabling firms to allocate more resources to high-risk, long-term-yet-high-return innovation activities, which, in turn, leads to technology upgrading and improved innovation performance [

2,

4]. Our extended analysis further supports this argument, revealing a positive correlation between TFI and firms’ operating performance. The impact of innovation activities on operational performance appears to be immediate, boosting profitability, sales, and market share. There are several studies available for comparison. For instance, Ganau [

11] demonstrated that financial support policies ease credit constraints and stimulate TFP, which accelerates the localization of short-term economic growth. Qiu et al. [

12] argued that innovation subsidies reduce internal resource competition within firms, improving the allocation of innovation investments and enhancing firms’ competitiveness. Our work also documents the positive impact of financial support policies on innovation performance, but, unlike these studies on developed countries, we focused on a developing, transitioning economy. We also fit into the previous literature examining the effects of tax reductions, fiscal subsidies, and other general financial support [

14,

16,

17,

18,

19]. They mostly measured financial support using a single or composite indicator, either of which are inevitably subject to endogeneity issues. In contrast, by employing a quasi-natural experiment, our identification largely mitigated endogeneity, yielding more robust and credible results.

Secondly, we uncovered the heterogeneous effects of financial support policies, in terms of firms’ uncertainty perception, ownership structure, and regional financial development. Uncertainty perception is a key determinant in a firm’s engagement in risky decisions, such as innovation activities [

4,

8]. Firms are more likely to develop new products or business models when they perceive uncertainty or increased market competition. However, these firms may suffer from liquidity constraints, limiting their ability to allocate sufficient resources to R&D investment. Accordingly, with the introduction of financial support policies, they respond more strongly, resulting in greater innovation and TFP growth [

22,

43]. This also offers an important insight, which is that financial support policies should prioritize firms with high uncertainty perception, to achieve more effective policy outcomes. Within China’s organizational structure, private firms should be the primary beneficiaries of financial support policies, as they are more likely to face liquidity constraints [

15]. In response, the Chinese government has continuously emphasized support for private firms, particularly small firms and micro-firms, and it has introduced a range of relief measures [

14,

17]. Additionally, compared to large state-owned firms, private firms are more active and play a significant role in innovation in developing economies. Given this, financial support should be more geared toward private firms. The regional financial development level is a crucial factor influencing the effectiveness of financial support policies. An efficient financial system is essential for fostering connections between financial institutions and firms and is key to enhancing the impact of financial support policies [

23,

30,

34]. To further maximize the role of financial support, it is necessary to improve the overall level of regional financial development, thereby reducing financial frictions and information asymmetries.

Thirdly, we established a clear and solid logical chain to interpret our main findings: financial support policies—liquidity conditions improve, R&D investments increase, asset allocations optimize—firms’ innovation and TFP grows. By incorporating financing costs and credit constraints into a general equilibrium model with heterogeneous firms, we have provided a generalized depiction of the role of financial support, and we have theoretically established the link between financial support and firms’ innovation investment. The model shows that financial support improves firms’ liquidity conditions and stimulates R&D investment, thereby fostering firms’ innovation and TFP. On the one hand, financial support directly reduces firms’ financing costs and alleviates the external credit constraints needed for innovation [

11,

30]. Using extensive information from Chinese listed firms, we found that financial support policies yield a comprehensive effect on improving firms’ liquidity conditions. With the introduction of TFI, firms experience a decrease in liquidity constraints, financing costs, and financial risks, while external subsidies significantly increase. This lays the foundation for firms to engage in high-risk, long-term innovation activities, constituting a reasonable mechanism. On the other hand, the improvement in liquidity conditions stimulates firms’ R&D investment, both in terms of scale and growth rate. Financial support policies enable firms to allocate more resources to R&D activities, which directly leads to innovation and TFP growth [

5,

14,

16]. Moreover, we found that the optimization of asset structure also acts as a potential mechanism through which financial support can be exerted. Financial support enables firms to have more foresight and direct debt financing toward the long term, which aligns with the features of innovation activities [

15,

18]. Meanwhile, with eased credit constraints, firms reduce their holdings of fixed assets and shift their investments toward intangible assets, which is beneficial for innovation and TFP growth [

33,

34,

41].

8. Conclusions and Policy Implications

Technology upgrading is crucial for economic growth, social stability, and sustainable development, and financial support plays a potential role in promoting it. From the micro perspective, this study explored the impact of financial support on firms’ innovation and TFP. To facilitate empirical analysis, we began by constructing a heterogeneous model of a firm with endogenous technology progress, to theoretically explain how financial support would impact firms’ innovation activities and productivity from the micro perspective. Then, using data from Chinese listed firms during 2006–2022, we employed a time-varying DID approach to examine how a financial support initiative—the Technology and Finance Integration (TFI) policy—affected firms’ innovation (both quantity and quality) and TFP.

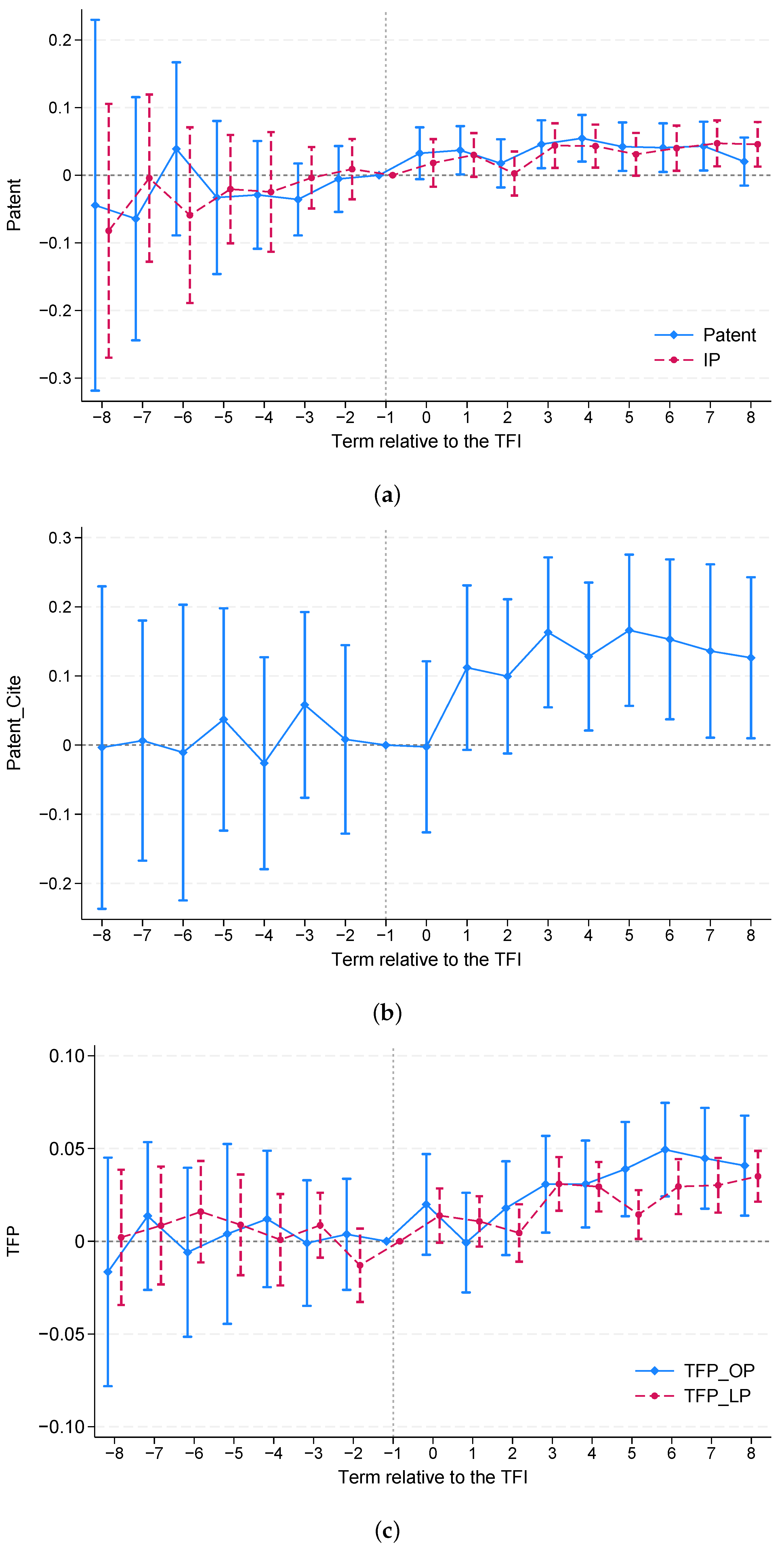

Our results indicate that TFI led to an approximately 4% increase in patent applications, primarily driven by a 3.1% rise in invention patents. In addition, the quality of firms’ innovation improved significantly. After TFI, the total number of patent citations across the firms increases by 9.3%, on average. Consequently, we observed a corresponding improvement in TFP, ranging from 2.2 to 2.4%. These findings were robust across a range of tests, such as various DID estimators, alternative variable measurements, matched DID, DDD estimation, exclusion of concurrent policies, and placebo tests. Our event study revealed no pre-existing trends in the treatment effects for all the above outcome variables. Moreover, we found that the policy effect was more pronounced in firms with higher perceived uncertainty, private firms, and those located in regions with more advanced financial development. An extended analysis showed that TFI also boosted firms’ operating performance, including profitability, sales, and market share.

On this basis, we explored the potential mechanisms through which TFI exerts it effects, in three aspects: liquidity conditions, R&D investments, and asset mix allocation. Our findings were as follows: Firstly, financial support significantly improved firms’ liquidity conditions. Specifically, with the introduction of TFI, firms experienced a relaxation of credit constraints, a mitigation of financial risks, a reduction in financing costs, and an increase in external subsidies. Secondly, TFI boosted firms’ R&D investments, both in absolute terms and growth rate. Thirdly, financial support reshaped the asset allocation strategies of firms. Following TFI, firms allocated more loans to the long term. We observed that long-term loans significantly increased, while short-term debt significantly decreased. The same pattern applied to their ratio in loans. Additionally, firms reduced investments in fixed assets and increased investments in intangible assets. The intangibilization of their asset mix contributed to technology upgrading and TFP growth.

Overall, this study provides compelling theoretical and empirical evidence for the role of financial support in promoting firms’ innovation and TFP, offering valuable insights for the development of financial and innovation policies. We suppose the contributions of this paper are threefold. First, by constructing a heterogeneous model of firm with endogenous technology progress, we have theoretically explained the impact of financial support on firms’ innovation behavior and productivity. The heterogeneous model of a firm builds on trade and endogenous innovation literature, yet it has seen limited application in the field of finance support. Secondly, utilizing a quasi-natural experiment, we have provided micro-level causal evidence on the relationship between financial support, innovation, and TFP. This work effectively mitigates potential endogeneity, and the findings were supported by a series of robustness tests. Thirdly, from the perspectives of liquidity conditions, R&D investments, and asset mix allocation, we have uncovered the mechanisms by which financial support influences firms’ innovation activities and TFP, thereby deepening our understanding of the role of financial support.

Based on our findings, we derived the following policy implications. Firstly, our results suggest that the TFI significantly enhances firms’ liquidity conditions and boosts their R&D investments. As a result, firms’ innovation and TFP improve substantially. Therefore, the scope of pilot cities for the TFI initiative should be expanded, and financial support should be strengthened to fully leverage its potential in promoting innovation. Secondly, credit relaxation and asset allocation are important channels through which the policy achieves its effects. As such, pilot governments should take a leading role in facilitating and promoting these efforts. Specifically, to maximize the impact of credit support, pilot governments should establish a comprehensive database of technology experts and create an online consultation platform. They should also organize experts to assess loan projects for tech firms, provide professional advice to banks, and offer loan guarantees to technology firms. These initiatives can help reduce information asymmetry between financial institutions and firms, thereby mobilizing more social capital for innovation. Thirdly, heterogeneity analysis shows that the policy’s innovation effects are weaker in regions with lagging financial development. Therefore, local governments should focus on fostering financial development in these areas, to enhance the effectiveness of financial support.

It is worth noting that the theoretical model and empirical research design in this paper have certain limitations, which are open to further research. In terms of the theoretical model, our static design abstracts time, and future research could consider dynamic decision-making processes by firms. As for the empirical research design, although a series of robustness checks were conducted, it remains challenging to fully account for unobservable factors, such as concurrent policies. A more precise evaluation of the effects of financial support will require more granular data and improvements in identification strategies. In particular, the policy effects that we identified are more akin to local average treatment effects (LATEs). Broader comparative analyses in the context of other economies would enhance the external validity of our conclusions. Furthermore, the outcome scope could be expanded to other potential social and environmental impacts of financial policies, as well as their long-term sustainability, which will constitute our next step. Specifically, examining the impact on particular sectors, such as green technology or creative industries, may provide more targeted and effective assessments of policy outcomes.