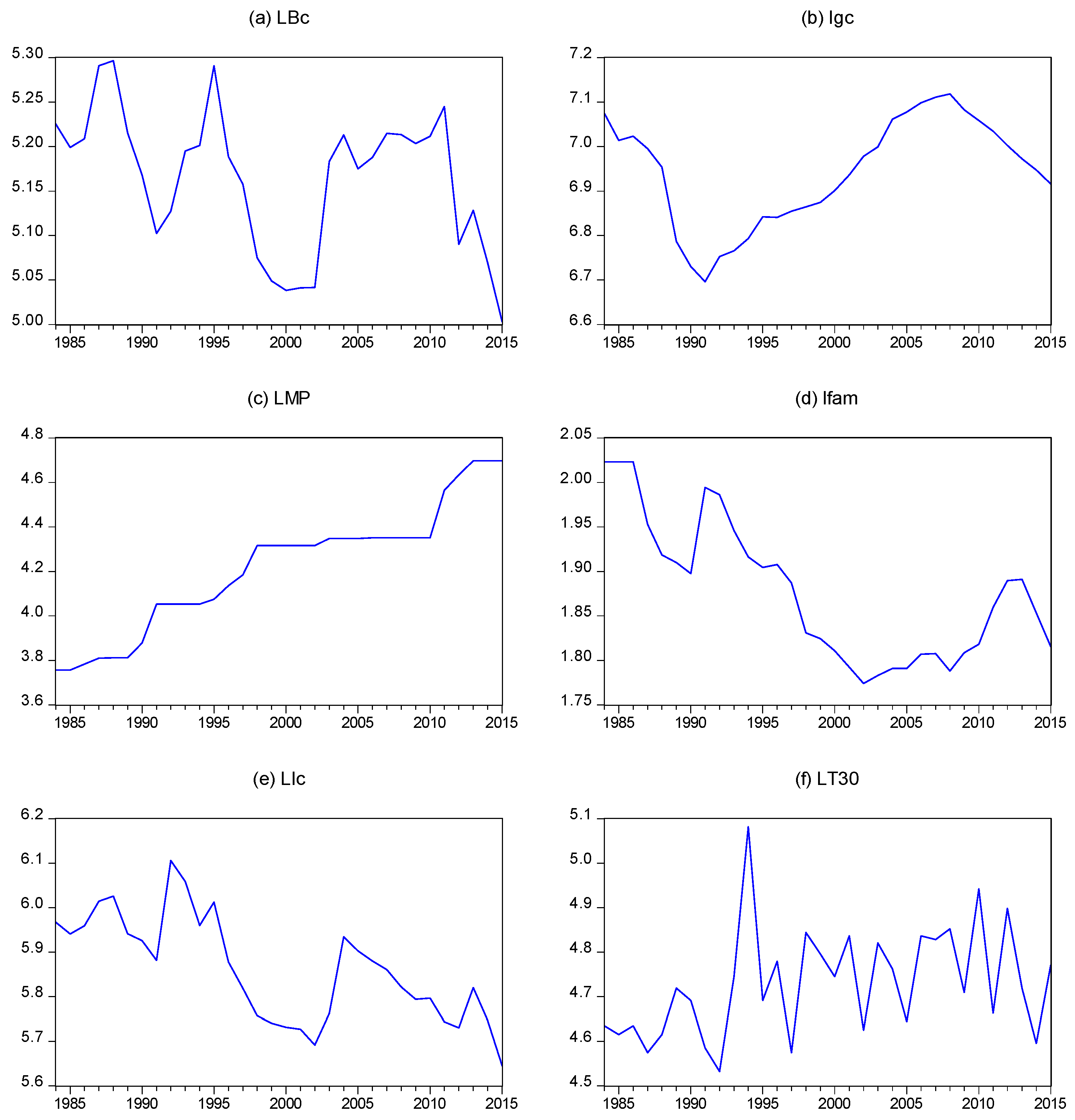

Once the co-integration relationship between the variables has been established, the VECMX model can be applied to the co-integration series based on the Granger representation theorem. The vector error correction model with Exogenous Variables (VECMX) includes LBc, LMp, LGc, and LFam as endogenous variables and LIc and LT30 as exogenous variables, running on a data sample from 1980 to 2012.

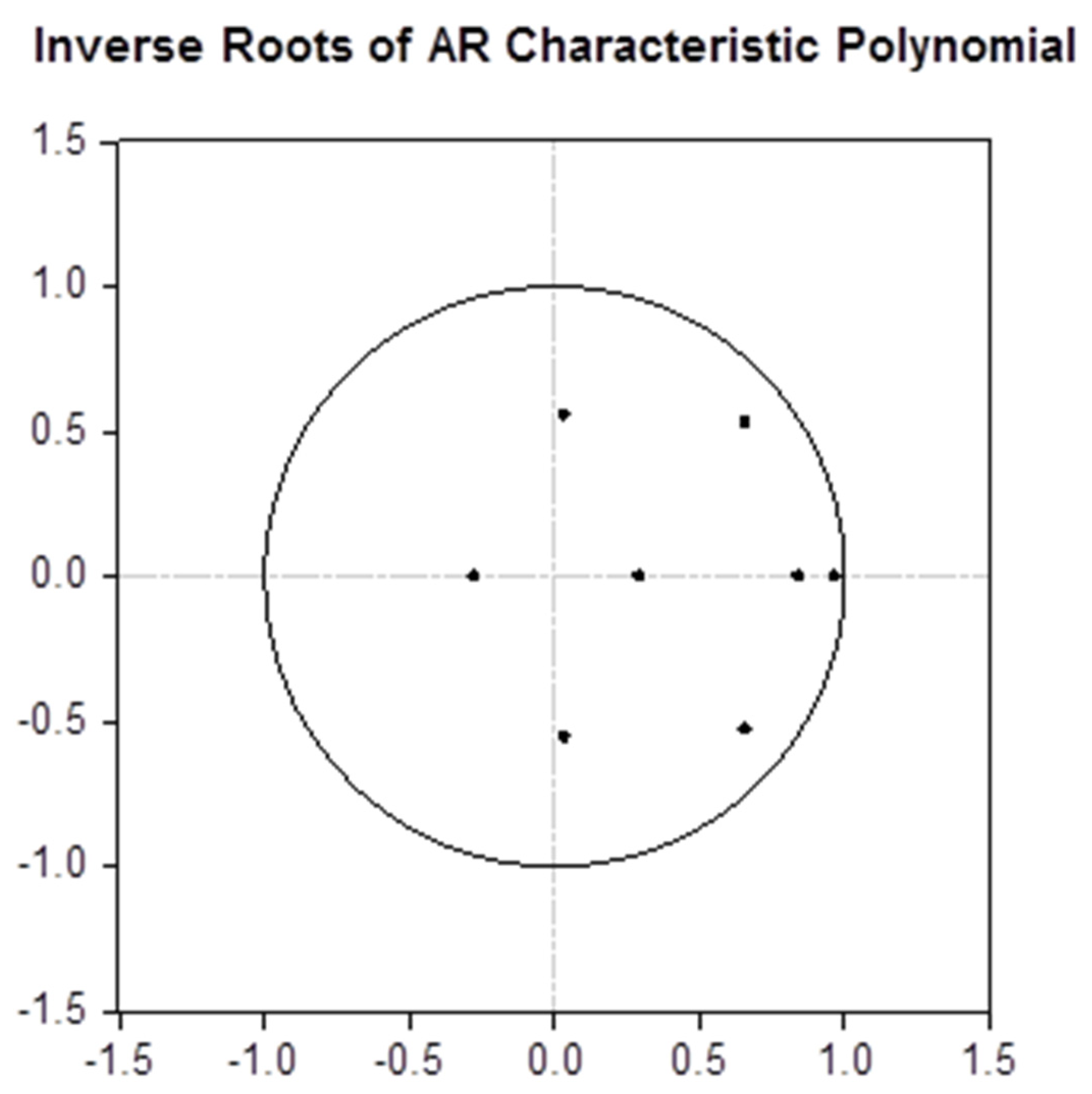

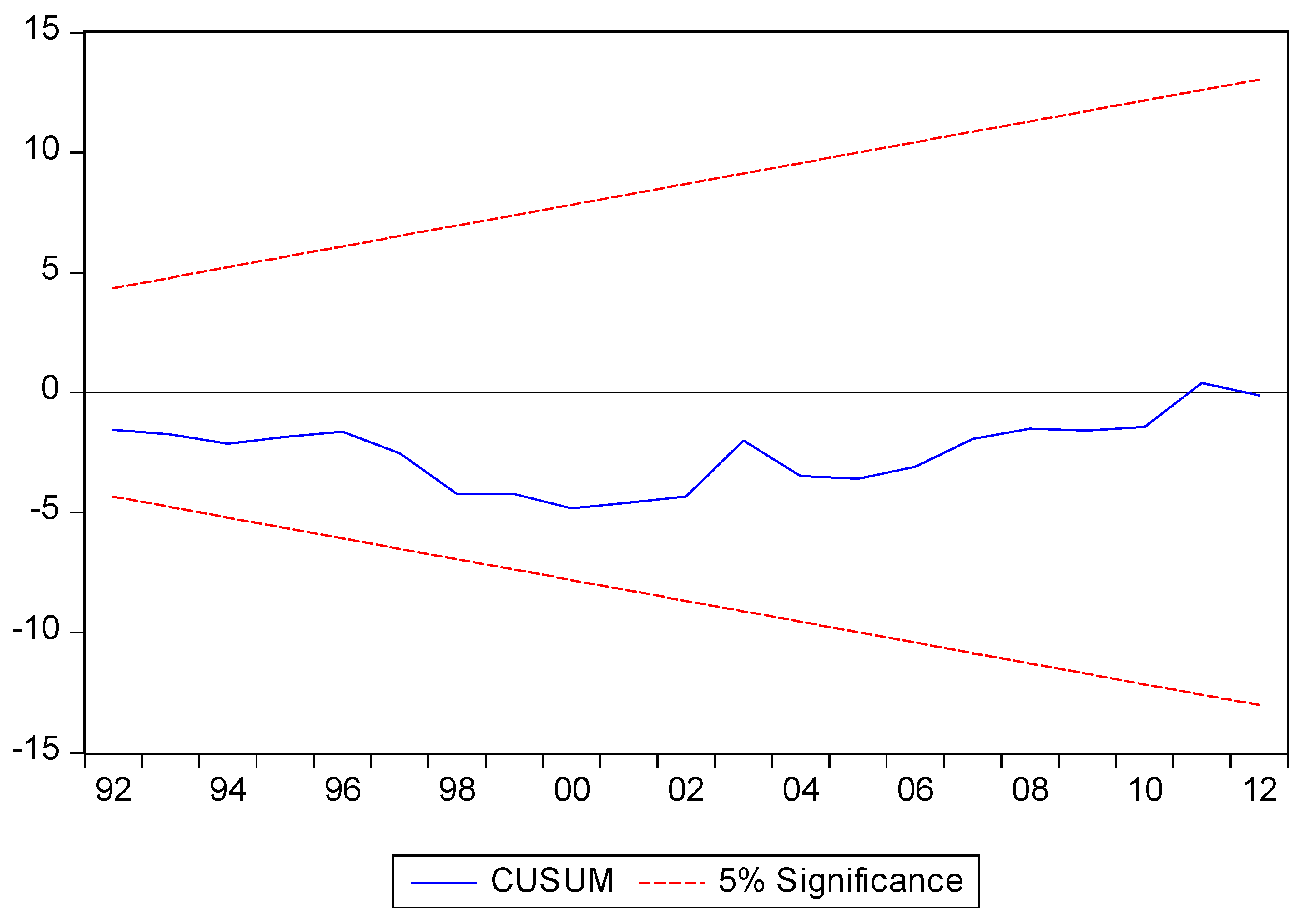

The VECMX model suggested in this study has been proven to be an excellent fit, as evidenced by the high values of its coefficient of determination (R2) or the corrected coefficient R2, F-statistic, and Durbin-Watson statistics. Furthermore, diagnostic tests have confirmed that our developed VECMX model is free from serial correlation, normal error, or conditional heteroskedasticity. Based on these results, we can confidently conclude that the VECMX model is robust and reliable for the given data.

The VECMX was used to evaluate the long-term and short-term elasticities. The following sections will interpret and benchmark the coefficients for international studies.

5.1. VECMX Long Run Model Results

Co-integration between variables indicates a long-term correlation between the variables being examined. As a result, the VECMX model can be implemented. Based on one cointegrating vector,

Table 10 and Equations (10) and (11) demonstrate the enduring relationship between billed amount, marginal price, income, and family size in Amman from 1980 to 2015.

By selecting ECT equal to zero and rearranging the equation

According to the data presented in the table above, marginal pricing and long-term water demand have a significant negative correlation. This means that for every 1% increase in marginal price, there is a corresponding decrease in water usage of 0.306%. However, the elasticity value is less than one, indicating that changes in water price do not significantly impact the amount of water demanded. These findings are consistent with prior research on water demand elasticity [

41]. However, it is essential to consider that variables such as financial constraints, water scarcity, and the relatively low cost of water play a role in shaping consumer behavior. Consequently, demand management strategies that rely only on price adjustments may not be sufficient.

It has been found that family size significantly and positively impacts the demand for water in Amman. Specifically, a 1% increase in family size is expected to result in a 0.36% increase in water demand. Over the Long-term, family composition changes can alter water usage patterns in various ways. For instance, when children leave home, the fixed usage of water is shared among fewer individuals, which can lead to a rise in per capita water demand. This finding is consistent with the study conducted by Arbués, F. et al. (2000) [

65].

The presented table demonstrates that personal income does not significantly affect long-term water demand, with GDP probability exceeding 5%. The findings suggest that changes in income levels do not significantly influence water usage patterns due to the negligible impact of water costs on overall household budgets. The results align with existing research on water demand elasticity and imply that income-based water demand management strategies are unlikely to be effective [

40]. This finding is particularly relevant in regions that face significant water scarcity and low water pricing, such as Amman. As such, alternative strategies must be explored to manage water demand better and ensure efficient water usage.

5.2. VECMX Short Run Model Results

The VECMX model provides correction terms that consider influences of deviations in the connection between the variables from long-run equilibrium and short-run parameters.

The predicted coefficient of speed adjustment (α) is −0.4768, statistically significant at the 5% level. The coefficient −0.4768 indicates that if the model encounters a disturbance in period t, it will gradually approach the long-term equilibrium, reaching 48% of the equilibrium level in period t + 1.

The short-term results indicate that the propelling force behind the water demand in Amman is derived from the six independent variables included in the estimated model.

Table 11 depicts the short-run coefficient, and its associated T-statistic indicates its statistical significance.

Our study has conclusively demonstrated that the primary factors determining water demand in Amman are the household size and the system input. These two factors play a critical and significant role in determining the total amount of water utilized. Conversely, while the marginal price is statistically significant, its impact on consumer behavior is relatively insignificant due to its inelastic nature, as it has a value of less than one.

Both marginal price and family size have a negative effect on water demand. When a marginal price has a negative movement by 1%, the billed water demand will rise by 0.796%. Similarly, as the family size increases by 1%, the billed water demand will decrease by 0.619% (

Table 11).

In the short term, the estimated water price coefficient exhibits a negative and statistically significant relationship. However, the value is less than one, indicating an inelastic response. This implies that policies predicated on demand-driven pricing mechanisms may not be able to incentivize individuals toward the efficient utilization of water resources entirely. There are several factors contributing to this phenomenon. Firstly, water is indispensable for fundamental purposes such as drinking and sanitation, making it irreplaceable. Secondly, due to habitual behavior, individuals tend to maintain their current water consumption levels. Lastly, the relatively small proportion of the water bill in contrast to overall family disposable income is a contributing factor. Finally, water is considered a fundamental commodity distributed within a monopolistic framework, restricting consumers from exercising provider choice. This finding is consistent with international research and empirical investigations conducted in nations grappling with water scarcity [

14,

40,

41]. The marginal price elasticity is −0.796, which aligns with Sebri (2014) [

40].

The predicted elasticity of family size shows a negative and statistically significant relationship in the short term. An increase in the number of households is expected to correlate positively with aggregate demand; however, economies of scale result in a reduction in per capita consumption when household size expands. Empirical evidence supporting this claim is provided by Espey et al. (1997) [

44] and Sebri el al. (2014) [

40], who found that larger households tend to be more efficient in water usage on an individual basis. This means that even though a household with more people may use more water for cooking or hygiene, the increase is not proportional to the number of individuals. The household size elasticity of −0.619 falls within the range established by Sebri (2014) [

24]. This emphasizes the importance of considering household demographics, like family size when setting water pricing policies for fairness.

It is crucial to understand that the amount of water supplied significantly impacts individual water usage. Incremental growth of 1% in water supplies will lead to a proportional increase of 0.682% in per capita water demand. Although the impact of system input on water demand is typically insignificant, in areas such as Jordan, where water resources are limited, it is vital to ensure a reliable water supply to meet increasing demand. This can provide better access to water for domestic, commercial, and agricultural purposes, leading to a higher per capita water demand. This finding is consistent with the case studies conducted in countries facing water scarcity, such as Jordan [

52]. Nevertheless, it is essential to note that in places with limited water resources, the potential growth in system input may be constrained by resource limitations, infrastructural constraints, or exorbitant prices. These limitations can have a detrimental impact on the correlation between water demand and system input.

The short-run results of the billed water demand variable show that the income level (LGc) and temperature (LT30) have an insignificant positive relationship with water demand. Meanwhile, the lagged water consumption shows a negligible relationship with water demand.

The association between water consumption and per capita real GDP at basic prices is negligible. This indicates that short-term and long-term water demand is unresponsive to changes in personal income. Such outcomes are typical, as customers are usually unaware of the cost of water. Moreover, Changes in income levels do not always immediately affect water usage patterns. In this case, the low water bill compared to individual income due to low water prices may be a factor. However, despite their income levels, water scarcity may still constrain individuals’ water consumption. The income elasticity is 0.169, which falls within the range Sebri (2014) mentioned [

40]. Therefore, the inelasticity of water demand concerning income implies that strategies based on income to manage water demand are likely to be impractical [

20].

Our research observed a positive correlation between the frequency of days with temperatures exceeding 30 °C and water consumption (LT30). However, this variable is deemed insignificant in the short term and does not exert any discernible impact on water demand. It is noteworthy to mention that elevated temperatures can naturally result in a rise in water demand. However, in regions with limited water resources, such as the one under consideration, the correlation between temperature and per capita water demand may exhibit variations compared to areas with ample water availability. The impact of temperature on water demand can frequently be mitigated or even reversed due to diverse adaptive strategies and policy measures that are more prevalent in regions facing water scarcity. Moreover, as a means of addressing the issue of water scarcity, individuals and communities frequently adopt water conservation practices or employ water-efficient technologies, which can effectively alleviate the impact of temperature on water consumption. Furthermore, these findings align with the existing international literature, as demonstrated by studies conducted by Gaudin (2006) [

66] and Arbues et al. (2003) [

12].

Effective water management in arid areas like Amman requires a comprehensive and multi-faceted approach, considering such regions’ unique socio-economic and environmental challenges. The findings of our study suggest that traditional pricing strategies may not be optimal due to the inelastic nature of water demand. Instead, a diversified approach that includes improving infrastructure, tailoring strategies for households of varying sizes, and promoting water conservation practices is essential. It is crucial to control non-revenue water by reducing water losses and enhancing system efficiency. Investments in water-saving technologies, public education, and awareness campaigns are necessary to foster sustainable water use habits. It is also critical to ensure equitable access to water, particularly for lower-income households. Climate-adaptive strategies should focus on broader climate change effects on water resources, and continuous monitoring and evaluation of water usage patterns and demographic changes are vital to ensure the effectiveness and relevance of these policies. By adopting this comprehensive approach, we aim to achieve sustainability and equity in water use, which is essential for effectively managing water resources in arid regions like Amman.

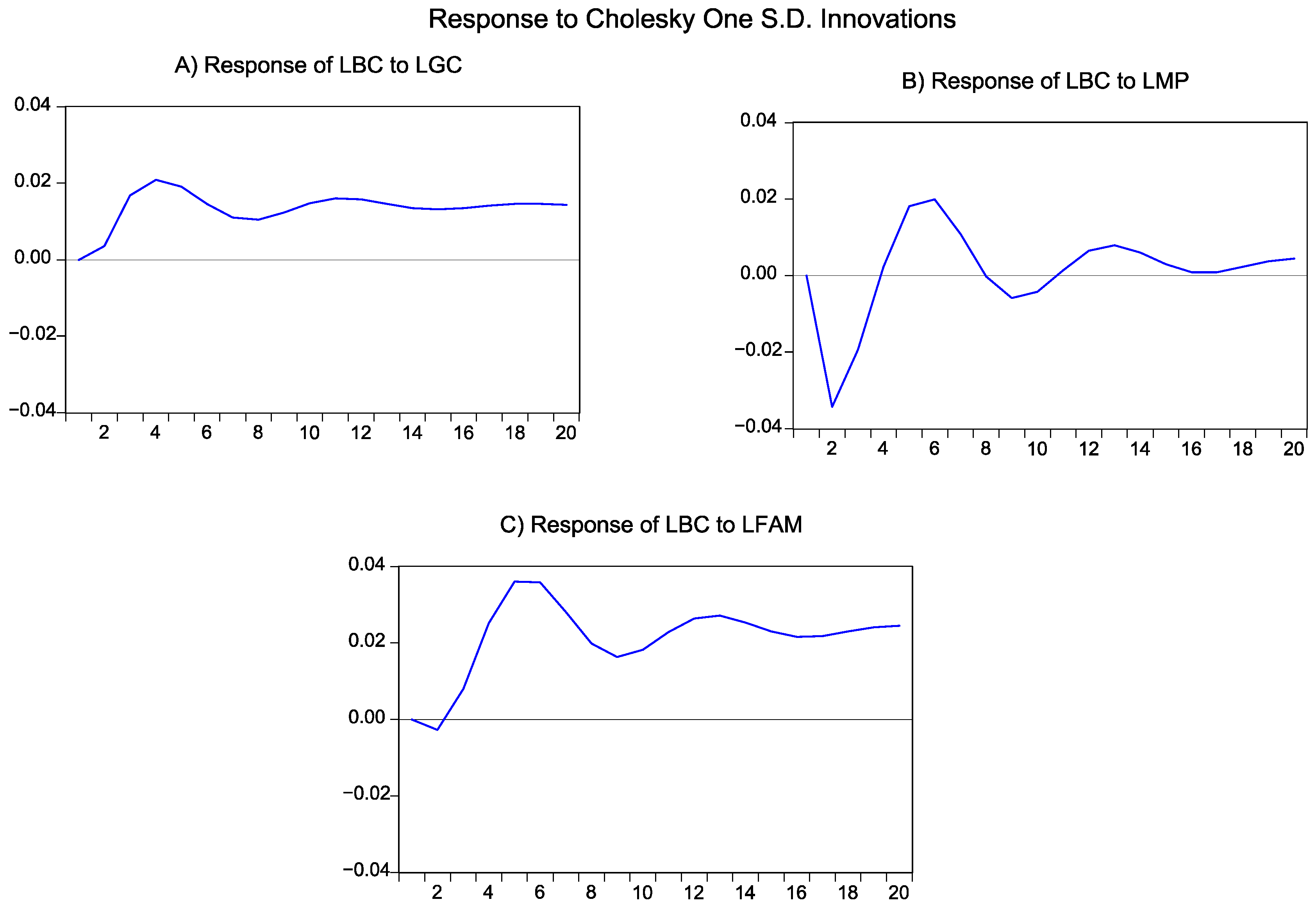

5.4. Impulse Response Function (IRF)

IRF analysis is used to track the impact or movement of a shock on one variable and how that shock will affect that variable or other variable in the present and future. The IRF graph shown in

Figure 4 depicts how a variable behaves in reaction to the shock of another variable.

Figure 4A shows the response of the billed amount for the following several periods caused by a shock in GDP. The increase in economic activity level, represented by GDP, will increase the billed amount in the short term by an insignificant amount. In the long run, the billed amount will be stable and do not change. This goes with the result of short and long run.

Figure 4B shows the billed amount response to marginal price: a sudden increase in the marginal water price will decrease the billed amount (the subscriber will tend to reduce his consumption). Although small, the price change has a short effect on the billed amount as it will re-increase after three time periods and then fluctuate over the time horizon until it returns to it is original value; this supports the conclusion of a deficit in supply.

Figure 4C shows the billed amount response to family size; a sudden increase in the family size will lead to a decrease in the billed amount in the short term, and then the billed amount will re-increase after two time periods. Then the water demand will decrease after ten years. The adaptation of water-saving techniques can explain this.

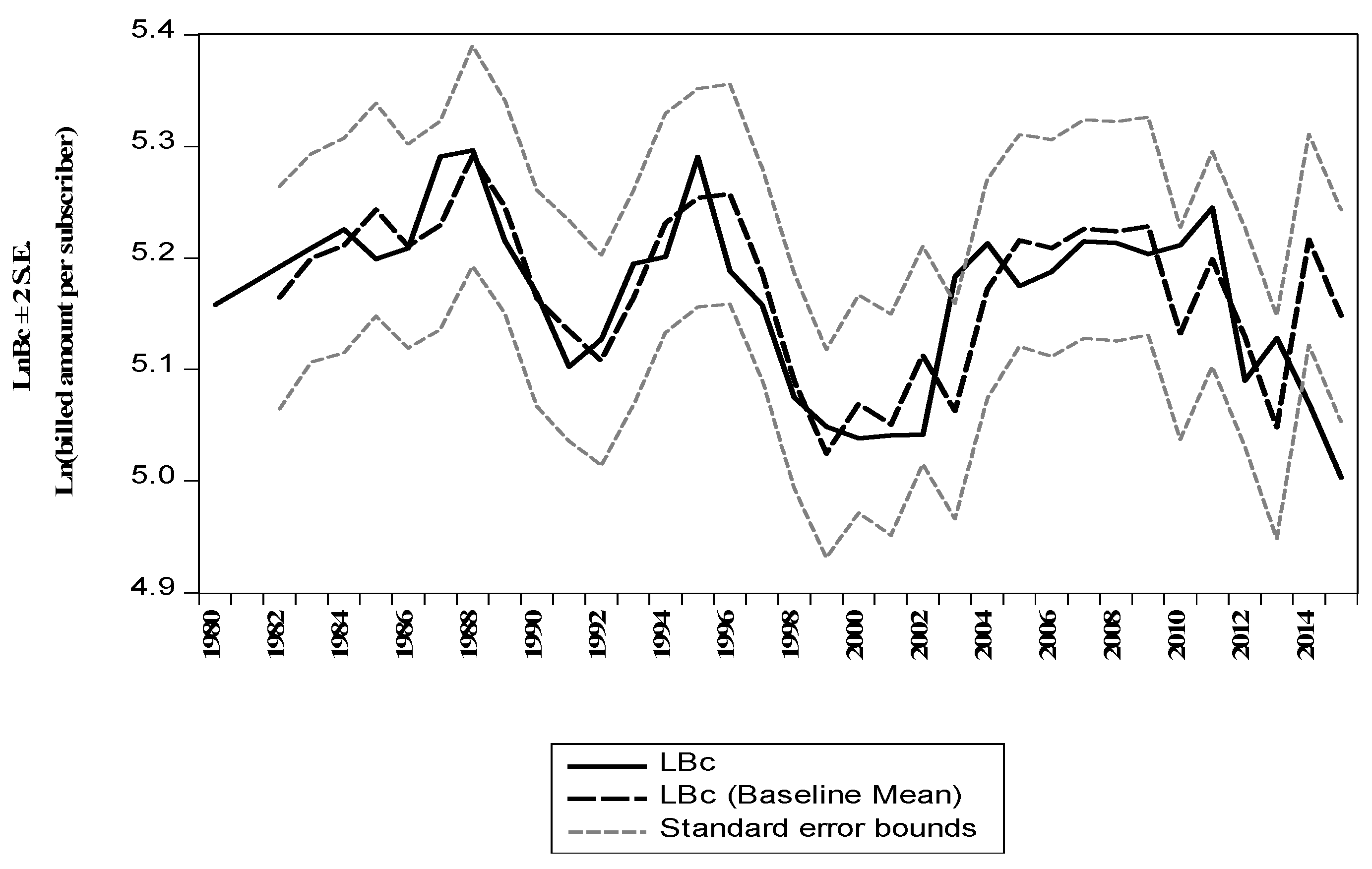

A first model Equation (9) test is accomplished as a within-sample forecast. The forecast is performed using a stochastic simulation and static and dynamic solutions. The results of the sample are shown in

Figure 5. As depicted, estimated values are very close to actual values. All estimates are within the two standard error bounds (small dotted lines), indicating a good fit.

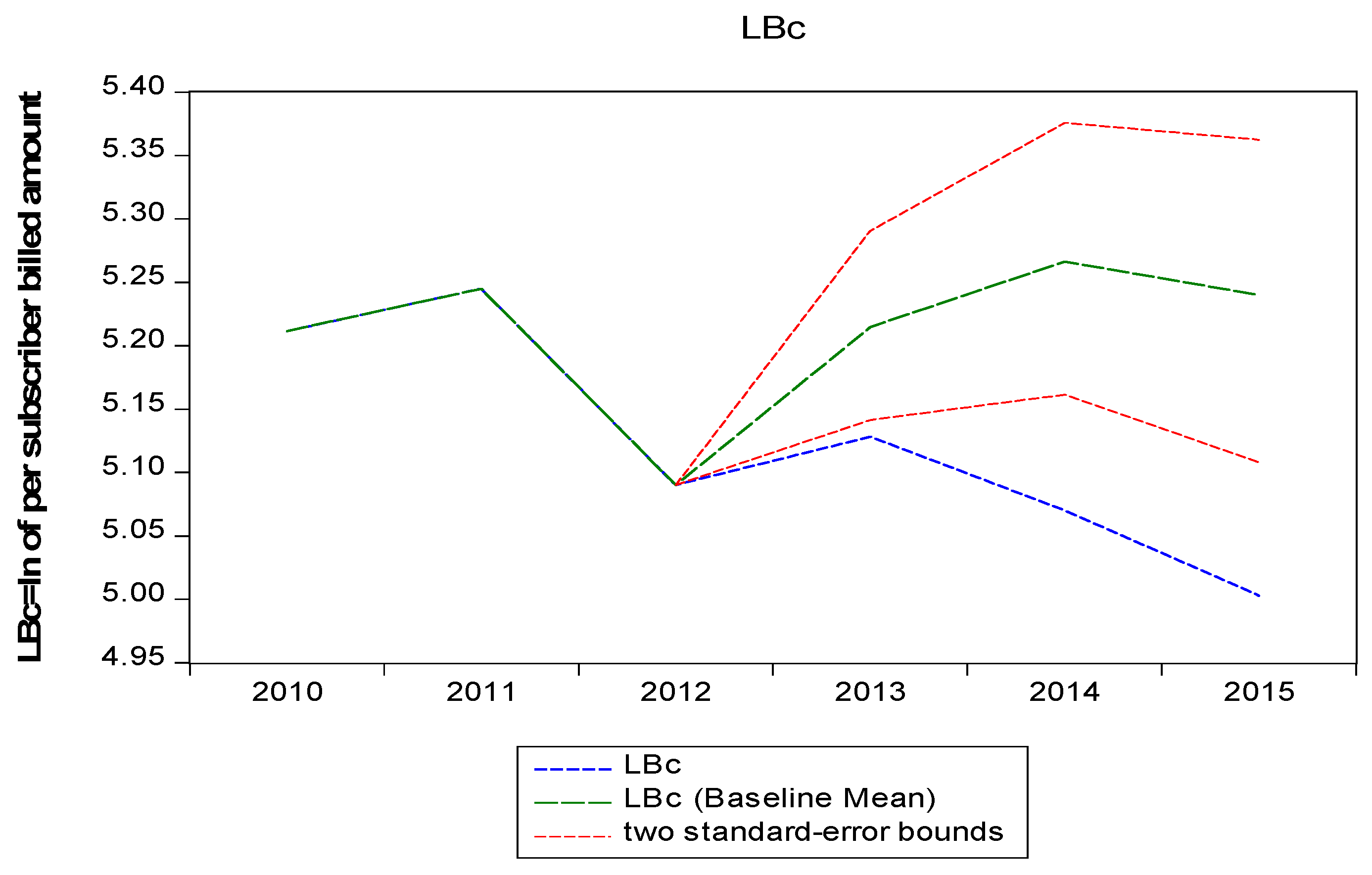

A second, forward, out-of-sample validation is performed using the model presented in Equation (9) and the leftover observations for 2013–2015. The results are shown in

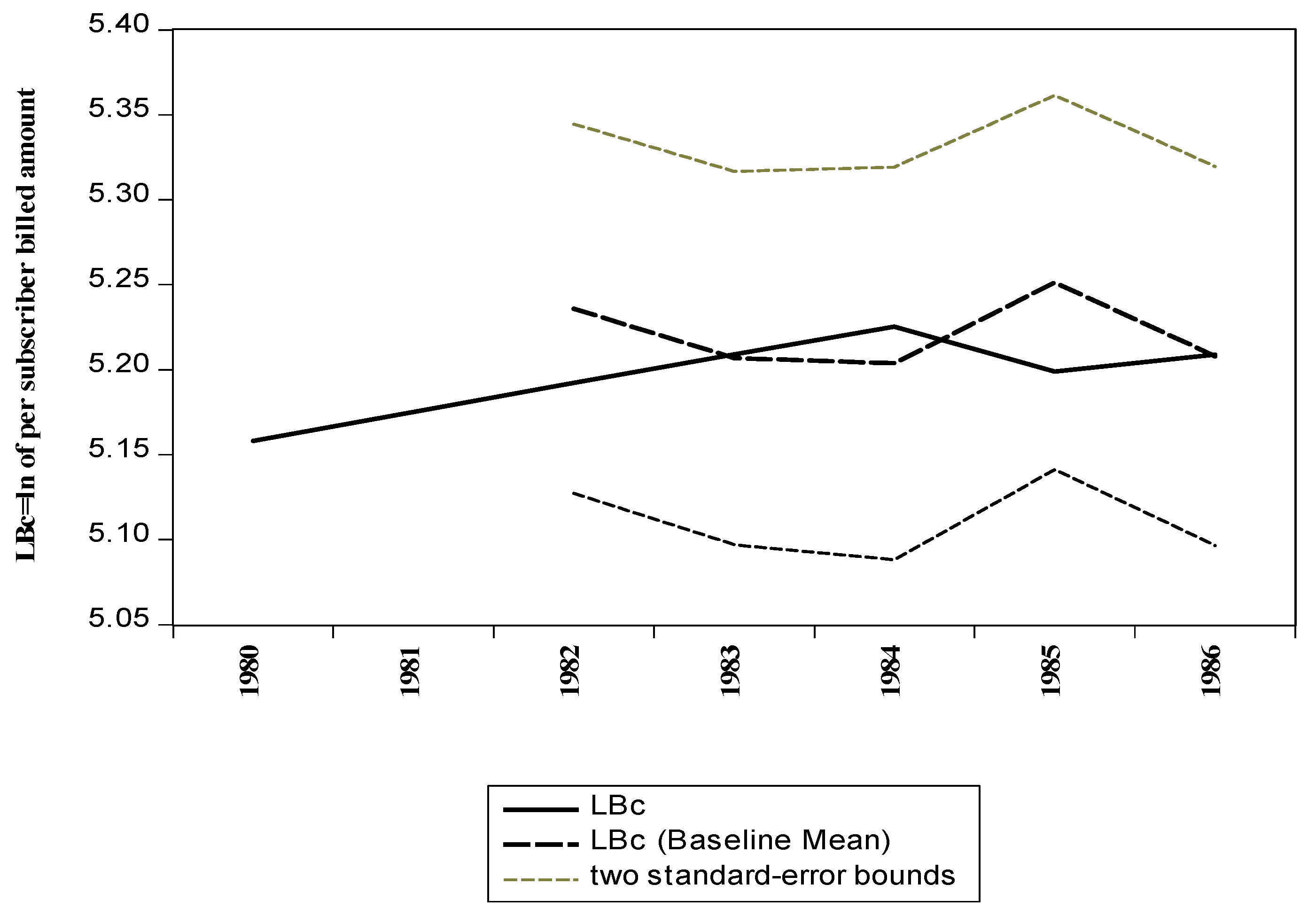

Figure 6. Again, forecasted values are within the two standard error bounds and close to the actual values. This confirms the good fit of the model. Similarly, a backward forecast is performed for the years 1980–1983. The prediction uses a VECM (from 1984–2015). The estimation results are shown in

Figure 7. They confirm the good fit.