The Influence of New Energy Industry Agglomeration on Regional Green Innovation Performance—Evidence from China

Abstract

1. Introduction

2. Literature Review

2.1. Industrial Agglomeration and Green Innovation Performance

2.2. New Energy Industry Agglomeration

3. Mechanism Analysis and Research Hypothesis

4. Data and Methods

4.1. Variable Description

4.1.1. Explanatory Variable

4.1.2. Explained Variable

- (1)

- The indicators were standardized using the extreme value method. Xij represents the value of the j indicator in the i region, while Yij denotes the standardized value of each indicator. The specific formulas are shown in Equations (2) and (3):

- (2)

- The proportion of the j indicator in the i region relative to all regions for the j indicator is calculated. The specific formula is shown in Equation (4):

- (3)

- The entropy value of the j indicator is calculated. The specific formula is shown in Equation (5):

- (4)

- The redundancy of information entropy is calculated, with the specific formula shown as (6).

- (5)

- The entropy weight of the j indicator is calculated, with the specific formula shown as (7).

- (6)

- The comprehensive score of the i region is calculated, with the specific formula shown as (8).

4.1.3. Regulating Variables

4.1.4. Control Variables

4.1.5. Data Description

4.1.6. Model Construction

- (1)

- Benchmark Regression Model

- (2)

- Regulatory effect model

- (3)

- Spatial Dobbin model

5. Empirical Findings and Discourse

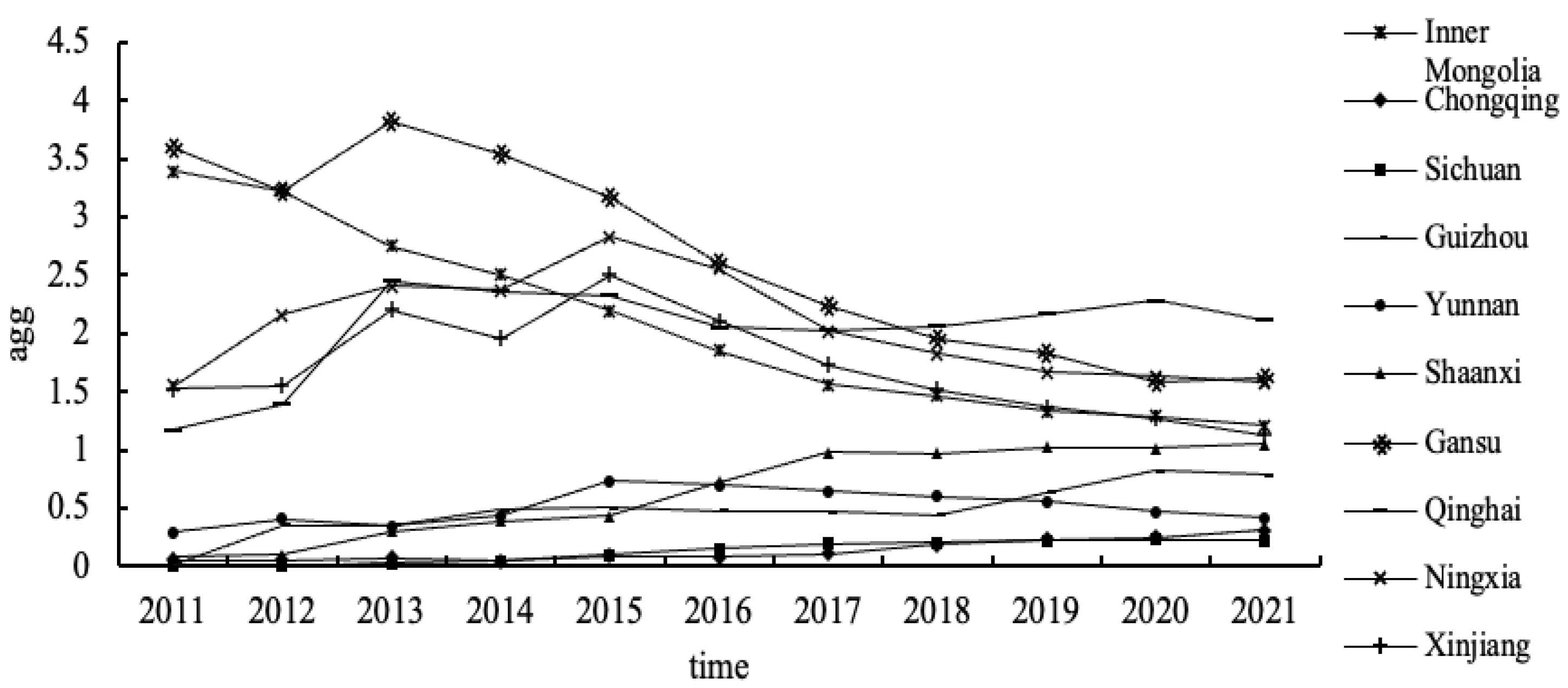

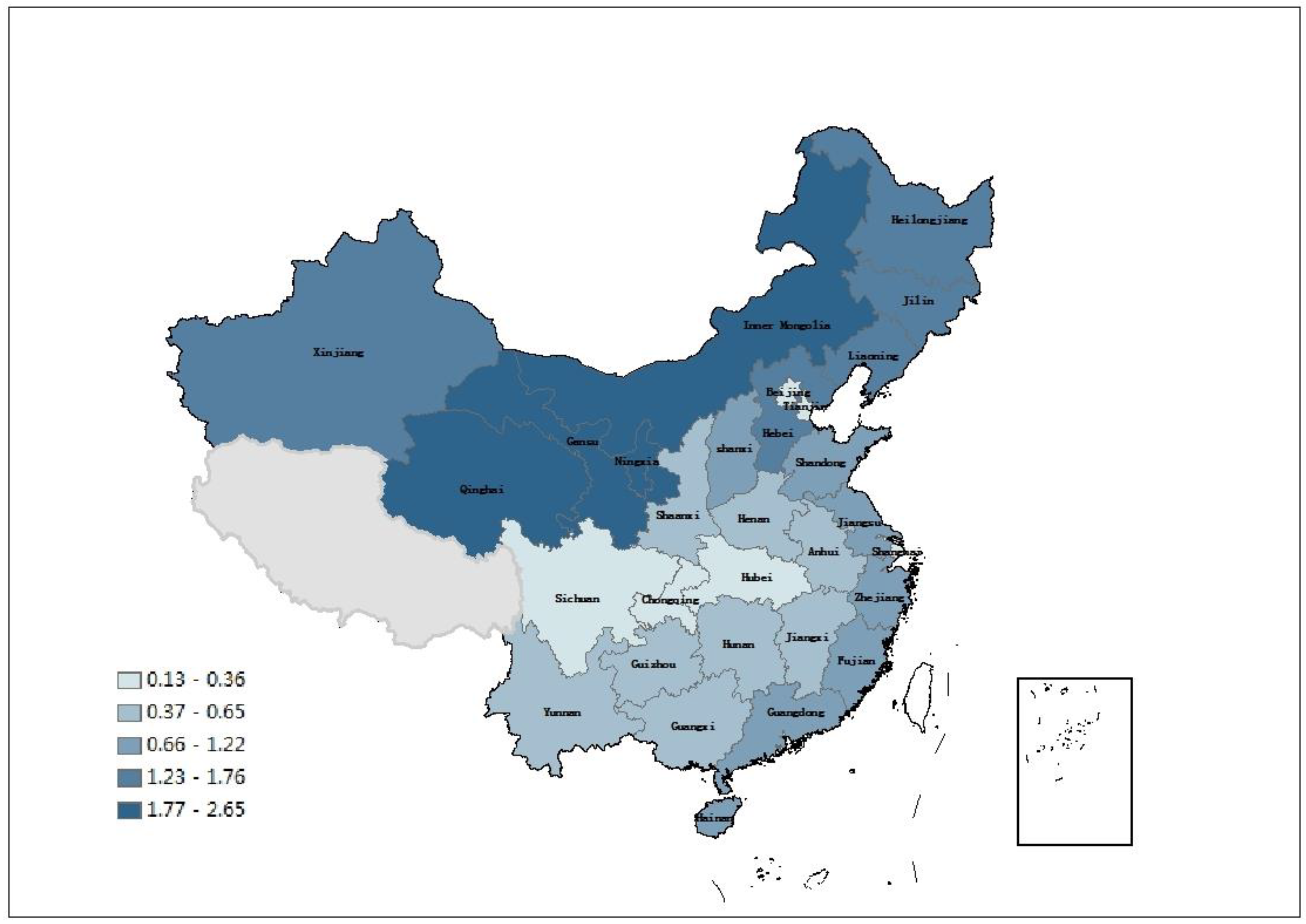

5.1. Measurement Outcomes of New Energy Industry Agglomeration Level

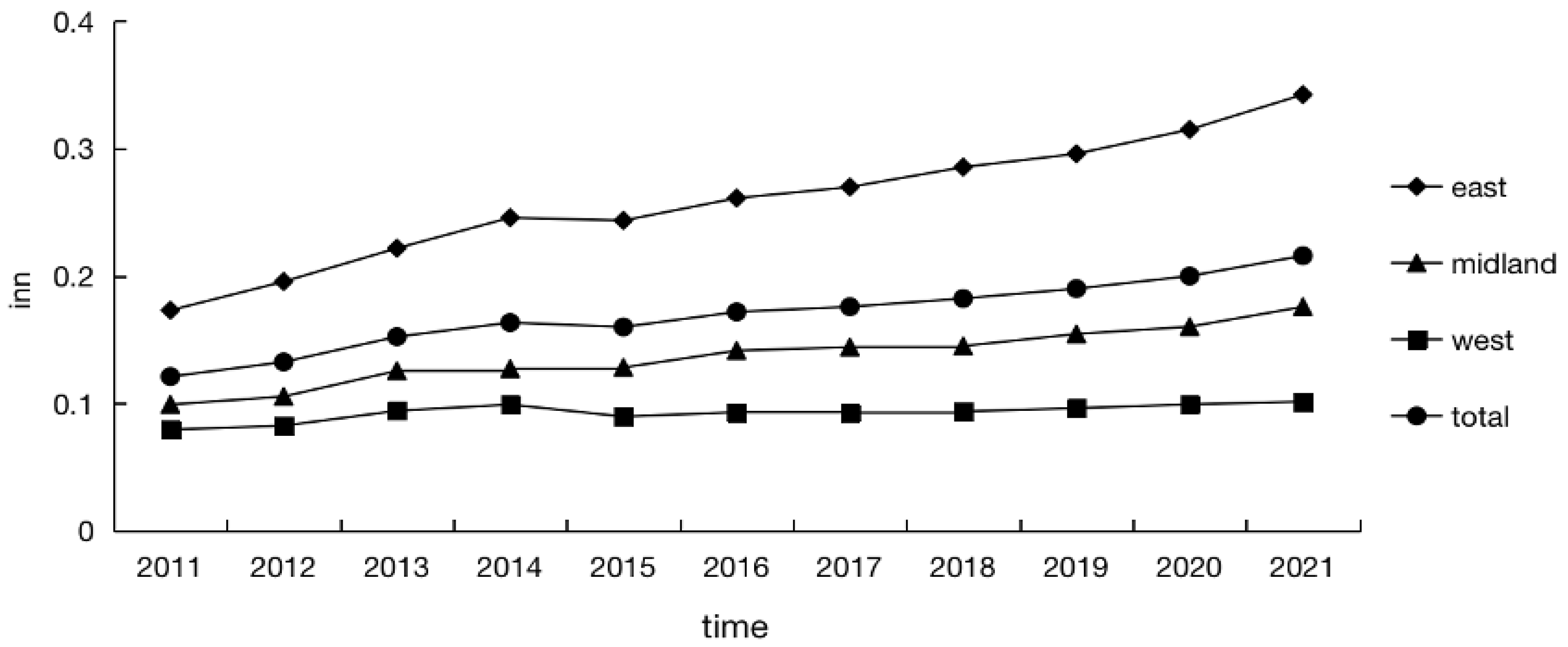

5.2. Measurement Outcomes of Green Innovation Performance

5.3. Results of Baseline Regression

5.4. Regional Heterogeneity Test

5.5. Robustness and Endogenous Test

5.5.1. Replace the Explained Variable

5.5.2. Replacing Explanatory Variables

5.5.3. Increase Control Variable

5.5.4. SYS-GMM

6. Further Discussion

6.1. Regulatory Effect of Opening Up

6.2. Spatial Spillover Effect

7. Conclusions and Policy Implications

7.1. Conclusions

7.2. Policy Implications

- (1)

- Strengthen the role of policy in guiding and supervising new energy industry development. Local governments should take into account various factors such as industrial development foundation, economic status, endowment advantages, and technological conditions to rationally guide and plan industrial layout, maximizing the positive externalities of industrial agglomeration. In regions with lower levels of new energy industry agglomeration, tailor-made approaches should be adopted to develop new energy industry clusters with regional characteristics. In regions with higher levels of new energy industry agglomeration, it is essential to manage their scale judiciously to prevent overcrowding resulting from indiscriminate development. Additionally, while the government attracts new energy industry agglomeration via various preferential measures, it is imperative to establish rigorous evaluation mechanisms and regulatory platforms to accurately identify enterprises in urgent need of support. This helps to prevent false agglomeration resulting from “policy rent-seeking” behavior by companies.

- (2)

- Strengthen collaboration within each region’s new energy industry, promote the formation of a national green innovation network for new energy technologies, and actively break down interregional technological monopolies and market barriers. The new energy industry, being knowledge-intensive, may exhibit monopolistic tendencies in technology and resources, which are not conducive to the coordinated advancement of green innovation performance across regions. On one hand, establishing interregional green innovation alliances within the new energy industry can foster a network of green technology innovation, facilitating information sharing and technological exchange among regions. On the other hand, establishing robust incentive and management systems, such as comprehensive innovation reward mechanisms and intellectual property protection mechanisms, is essential. These measures aim to eliminate institutional barriers that impede the flow of innovation factors between regions, thereby fostering a conducive external environment for the interregional mobility of innovation factors. Via interregional knowledge spillover exchanges and interactions, achieving common progress in the green innovation performance of each region will enhance the overall green innovation performance of the country.

- (3)

- Deepen external openness and optimize the innovation environment. Firstly, broadening the domestic and international spatial pattern of openness, seizing the opportunities presented by the “Belt and Road” initiative and the establishment of high-quality free trade zones, and constructing a global network for external openness, especially in the relatively less open regions like the northwest. Secondly, the proportion of high-tech and high-quality product imports should be increased to enhance the quality of technology transfer, fully harnessing the technology spillover effects brought about by import trade and strengthening the absorption and re-creation of green innovation elements by enterprises.

7.3. Research Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Liang, Y.; Hao, X. Can the Agglomeration of New Energy Industries Improve Environmental Efficiency?—Evidence from China. Sustainability 2022, 14, 8961. [Google Scholar] [CrossRef]

- Goldemberg, J. The Promise of Clean Energy. Energy Policy 2006, 34, 2185–2190. [Google Scholar] [CrossRef]

- Lin, B.; Li, Z. Towards World’s Low Carbon Development: The Role of Clean Energy. Appl. Energy 2022, 307, 118160. [Google Scholar] [CrossRef]

- Zhang, F.; Gallagher, K.S.; Myslikova, Z.; Narassimhan, E.; Bhandary, R.R.; Huang, P. From Fossil to Low Carbon: The Evolution of Global Public Energy Innovation. WIREs Clim. Chang. 2021, 12, e734. [Google Scholar] [CrossRef]

- Diaz-Rainey, I.; Ashton, J.K. Investment Inefficiency and the Adoption of Eco-Innovations: The Case of Household Energy Efficiency Technologies. Energy Policy 2015, 82, 105–117. [Google Scholar] [CrossRef]

- Du, K.; Li, J. Towards a Green World: How Do Green Technology Innovations Affect Total-Factor Carbon Productivity. Energy Policy 2019, 131, 240–250. [Google Scholar] [CrossRef]

- Guinot, J.; Barghouti, Z.; Chiva, R. Understanding Green Innovation: A Conceptual Framework. Sustainability 2022, 14, 5787. [Google Scholar] [CrossRef]

- Lee, S.-H.; Park, S.; Kim, T. Review on Investment Direction of Green Technology R&D in Korea. Renew. Sustain. Energy Rev. 2015, 50, 186–193. [Google Scholar] [CrossRef]

- Zhan, H.; Hou, M.; Tan, F. Influence of intelligentization on enterprise green innovation: Evidence from listed companies of new energy industry in China. Resour. Sci. 2022, 44, 984–993. [Google Scholar] [CrossRef]

- Liu, J.; Chen, T.; Chen, Z. Revolution of New Energy Industry: Spatio-Temporal Dynamics and Drivers of Technological Diffusion in Zhejiang, China. Front. Environ. Sci. 2022, 10, 1058372. [Google Scholar] [CrossRef]

- Niu, X.; Li, C. On China’s Strategic Orientation, Policy Framework and Role of Government in Renewable Energy Sources. Chin. Public Adm. 2014, 3, 100–103. [Google Scholar] [CrossRef]

- Song, M.; Chen, Y.; An, Q. Spatial Econometric Analysis of Factors Influencing Regional Energy Efficiency in China. Environ. Sci. Pollut. Res. 2018, 25, 13745–13759. [Google Scholar] [CrossRef] [PubMed]

- Xingang, Z.; Jieyu, W.; Xiaomeng, L.; Pingkuo, L. China’s Wind, Biomass and Solar Power Generation: What the Situation Tells Us? Renew. Sustain. Energy Rev. 2012, 16, 6173–6182. [Google Scholar] [CrossRef]

- Liu, Y.; Xiao, L.; Wang, H.; Lin, L.; Dai, S. Investigation on the Spatiotemporal Complementarity of Wind Energy Resources in China. Sci. China Technol. Sci. 2012, 55, 725–734. [Google Scholar] [CrossRef]

- Li, Y.; Wu, X.-P.; Li, Q.-S.; Tee, K.F. Assessment of Onshore Wind Energy Potential under Different Geographical Climate Conditions in China. Energy 2018, 152, 498–511. [Google Scholar] [CrossRef]

- Su, Y.; Yu, Y. Spatial Agglomeration of New Energy Industries on the Performance of Regional Pollution Control through Spatial Econometric Analysis. Sci. Total Environ. 2020, 704, 135261. [Google Scholar] [CrossRef]

- Dong, L.; Liang, H.; Gao, Z.; Luo, X.; Ren, J. Spatial Distribution of China’s Renewable Energy Industry: Regional Features and Implications for a Harmonious Development Future. Renew. Sustain. Energy Rev. 2016, 58, 1521–1531. [Google Scholar] [CrossRef]

- Peng, H.; Shen, N.; Liao, H.; Wang, Q. Multiple Network Embedding, Green Knowledge Integration and Green Supply Chain Performance—Investigation Based on Agglomeration Scenario. J. Clean. Prod. 2020, 259, 120821. [Google Scholar] [CrossRef]

- Li, X.; Lai, X.; Zhang, F. Research on Green Innovation Effect of Industrial Agglomeration from Perspective of Environmental Regulation: Evidence in China. J. Clean. Prod. 2021, 288, 125583. [Google Scholar] [CrossRef]

- Zhang, X.; Yao, S.; Zheng, W.; Fang, J. On Industrial Agglomeration and Industrial Carbon Productivity—Impact Mechanism and Nonlinear Relationship. Energy 2023, 283, 129047. [Google Scholar] [CrossRef]

- Wang, Y.; Bai, Y.; Quan, T.; Ran, R.; Hua, L. Influence and Effect of Industrial Agglomeration on Urban Green Total Factor Productivity—On the Regulatory Role of Innovation Agglomeration and Institutional Distance. Econ. Anal. Policy 2023, 78, 1158–1173. [Google Scholar] [CrossRef]

- Li, T.; Shi, Z.; Han, D.; Zeng, J. Agglomeration of the New Energy Industry and Green Innovation Efficiency: Does the Spatial Mismatch of R&D Resources Matter? J. Clean. Prod. 2023, 383, 135453. [Google Scholar] [CrossRef]

- Pan, L.; Chen, J.; Chai, B. Research on the Impact of New Energy Power Generation Industry Agglomeration on Regional Green Economic Efficiency. J. Chin. Soc. Power Eng. 2022, 42, 1051–1060. [Google Scholar] [CrossRef]

- Martinez-Ros, E.; Kunapatarawong, R. Green Innovation and Knowledge: The Role of Size. Bus. Strateg. Environ. 2019, 28, 1045–1059. [Google Scholar] [CrossRef]

- Fan, J.; Teo, T. Will China’s R&D Investment Improve Green Innovation Performance? An Empirical Study. Environ. Sci. Pollut. Res 2022, 29, 39331–39344. [Google Scholar] [CrossRef]

- He, K.; Chen, W.; Zhang, L. Senior Management’s Academic Experience and Corporate Green Innovation. Technol. Forecast. Soc. Chang. 2021, 166, 120664. [Google Scholar] [CrossRef]

- Bhatti, S.M.; Al Mamun, A.; Wu, M.; Naznen, F.; Kanwal, S.; Makhbul, Z.K.M. Modeling the Significance of Green Orientation and Culture on Green Innovation Performance: Moderating Effect of Firm Size and Green Implementation. Environ. Sci. Pollut. Res. 2023, 30, 99855–99874. [Google Scholar] [CrossRef]

- Tang, C.; Xu, Y.; Hao, Y.; Wu, H.; Xue, Y. What Is the Role of Telecommunications Infrastructure Construction in Green Technology Innovation? A Firm-Level Analysis for China. Energy Econ. 2021, 103, 105576. [Google Scholar] [CrossRef]

- Stucki, T.; Woerter, M.; Arvanitis, S.; Peneder, M.; Rammer, C. How Different Policy Instruments Affect Green Product Innovation: A Differentiated Perspective. Energy Policy 2018, 114, 245–261. [Google Scholar] [CrossRef]

- Lambertini, L.; Poyago-Theotoky, J.; Tampieri, A. Cournot Competition and “Green” Innovation: An Inverted-U Relationship. Energy Econ. 2017, 68, 116–123. [Google Scholar] [CrossRef]

- Zeng, W.; Li, L.; Huang, Y. Industrial Collaborative Agglomeration, Marketization, and Green Innovation: Evidence from China’s Provincial Panel Data. J. Clean. Prod. 2021, 279, 123598. [Google Scholar] [CrossRef]

- Stucki, T. What Hampers Green Product Innovation: The Effect of Experience. Ind. Innov. 2019, 26, 1242–1270. [Google Scholar] [CrossRef]

- Ding, J.; Liu, B.; Shao, X. Spatial Effects of Industrial Synergistic Agglomeration and Regional Green Development Efficiency: Evidence from China. Energy Econ. 2022, 112, 106156. [Google Scholar] [CrossRef]

- Wang, H.; Hao, W. Impact of high-tech industrial agglomeration on the efficiency of green innovation in China. China Soft Sci. 2022, 08, 172–183. [Google Scholar]

- Wu, C.; Shen, Y. Effect of Equipment Manufacturing Industrial Concentration on Green Innovation Efficiency in China. Sci. Technol. Prog. Policy 2019, 36, 54–63. [Google Scholar]

- Wu, R.; Lin, B. Does Industrial Agglomeration Improve Effective Energy Service: An Empirical Study of China’s Iron and Steel Industry. Appl. Energy 2021, 295, 117066. [Google Scholar] [CrossRef]

- Guo, L.; Shen, M. The Comparative Study of New Energy Industrial Agglomeration Level in China’s Provincial Administrative Region Based on Panel Data. Ecol. Econ. 2018, 34, 81–85. [Google Scholar]

- Wang, H.; Zhang, X.; Bin, H.; Li, M. Study on Agglomeration Measurement and Structure Optimization of Strategic Emerging Industries-Taking New Energy Industry as an Example. Inq. Econ. Issues 2018, 10, 179–190. [Google Scholar]

- Agterbosch, S.; Vermeulen, W.; Glasbergen, P. Implementation of Wind Energy in the Netherlands: The Importance of the Social–Institutional Setting. Energy Policy 2004, 32, 2049–2066. [Google Scholar] [CrossRef]

- Kuik, O.; Branger, F.; Quirion, P. Competitive Advantage in the Renewable Energy Industry: Evidence from a Gravity Model. Renew. Energy 2019, 131, 472–481. [Google Scholar] [CrossRef]

- Shi, D.; Yang, D. The Role of Chinese Alternative Energy Industry in World Arena and Role-promoting Measures. Sino-Glob. Energy 2012, 17, 29–35. [Google Scholar]

- Binz, C.; Gosens, J.; Hansen, T.; Hansen, U.E. Toward Technology-Sensitive Catching-Up Policies: Insights from Renewable Energy in China. World Dev. 2017, 96, 418–437. [Google Scholar] [CrossRef]

- Ericsson, K.; Nilsson, L.J.; Nilsson, M. New Energy Strategies in the Swedish Pulp and Paper Industry—The Role of National and EU Climate and Energy Policies. Energy Policy 2011, 39, 1439–1449. [Google Scholar] [CrossRef]

- Haas, R.; Panzer, C.; Resch, G.; Ragwitz, M.; Reece, G.; Held, A. A Historical Review of Promotion Strategies for Electricity from Renewable Energy Sources in EU Countries. Renew. Sustain. Energy Rev. 2011, 15, 1003–1034. [Google Scholar] [CrossRef]

- Li, Q.; Wang, M.; Xiangli, L. Do Government Subsidies Promote New-Energy Firms’ Innovation? Evidence from Dynamic and Threshold Models. J. Clean. Prod. 2021, 286, 124992. [Google Scholar] [CrossRef]

- Cheng, Y.; Yao, X. Carbon Intensity Reduction Assessment of Renewable Energy Technology Innovation in China: A Panel Data Model with Cross-Section Dependence and Slope Heterogeneity. Renew. Sustain. Energy Rev. 2021, 135, 110157. [Google Scholar] [CrossRef]

- Zhao, J.; Dong, K.; Dong, X.; Shahbaz, M. How Renewable Energy Alleviate Energy Poverty? A Global Analysis. Renew. Energy 2022, 186, 299–311. [Google Scholar] [CrossRef]

- Yu, Y.; Lin, Z.; Liu, D.; Hou, Y. Exploring the Spatially Heterogeneous Impacts of Industrial Agglomeration on Regional Sustainable Development Capability: Evidence from New Energy Industries. Environ. Dev. Sustain. 2023, 1–26. [Google Scholar] [CrossRef]

- Jang, S.; Kim, J.; von Zedtwitz, M. The Importance of Spatial Agglomeration in Product Innovation: A Microgeography Perspective. J. Bus. Res. 2017, 78, 143–154. [Google Scholar] [CrossRef]

- Yang, H.; Xu, X.; Zhang, F. Industrial Co-Agglomeration, Green Technological Innovation, and Total Factor Energy Efficiency. Environ. Sci. Pollut. Res. 2022, 29, 62475–62494. [Google Scholar] [CrossRef]

- Diodato, D.; Neffke, F.; O’Clery, N. Why Do Industries Coagglomerate? How Marshallian Externalities Differ by Industry and Have Evolved over Time. J. Urban Econ. 2018, 106, 1–26. [Google Scholar] [CrossRef]

- Iammarino, S.; McCann, P. The Structure and Evolution of Industrial Clusters: Transactions, Technology and Knowledge Spillovers. Res. Policy 2006, 35, 1018–1036. [Google Scholar] [CrossRef]

- Liu, X.; Zhang, X. Industrial Agglomeration, Technological Innovation and Carbon Productivity: Evidence from China. Resour. Conserv. Recycl. 2021, 166, 105330. [Google Scholar] [CrossRef]

- Xia, H.; Dai, L.; Sun, L.; Chen, X.; Li, Y.; Zheng, Y.; Peng, Y.; Wu, K. Analysis of the Spatiotemporal Distribution Pattern and Driving Factors of Renewable Energy Power Generation in China. Econ. Anal. Policy 2023, 80, 414–428. [Google Scholar] [CrossRef]

- McCauley, S.M.; Stephens, J.C. Green Energy Clusters and Socio-Technical Transitions: Analysis of a Sustainable Energy Cluster for Regional Economic Development in Central Massachusetts, USA. Sustain. Sci. 2012, 7, 213–225. [Google Scholar] [CrossRef]

- Huang, X. The Roles of Competition on Innovation Efficiency and Firm Performance: Evidence from the Chinese Manufacturing Industry. Eur. Res. Manag. Bus. Econ. 2023, 29, 100201. [Google Scholar] [CrossRef]

- Yin, X.; Guo, L. Industrial Efficiency Analysis Based on the Spatial Panel Model. EURASIP J. Wirel. Commun. Netw. 2021, 2021, 28. [Google Scholar] [CrossRef]

- Zhang, L.; Ni, Z. Scientific and Technological Talent Agglomeration and Regional Innovation Efficiency-Empirical Test Based on Spatial Spillover and Threshold Effect. Soft Sci. 2022, 36, 45–50. [Google Scholar] [CrossRef]

- Wang, J.; Li, J.; Zhang, Y. How does Policy Uncertainty Affect Enterprise’s Innovation Performance: An Analysis of Mediating Role of Interregional R&D Factor Flow. Sci. Technol. Prog. Policy 2022, 39, 105–113. [Google Scholar]

- Caldara, D.; Iacoviello, M.; Molligo, P.; Prestipino, A.; Raffo, A. The Economic Effects of Trade Policy Uncertainty. Int. Financ. Discuss. Pap. 2019, 2019, 1–49. [Google Scholar] [CrossRef]

- Wang, J.; Guo, D. Siphon and Radiation Effects of ICT Agglomeration on Green Total Factor Productivity: Evidence from a Spatial Durbin Model. Energy Econ. 2023, 126, 106953. [Google Scholar] [CrossRef]

- Zhang, G.; Li, T. The Innovation Efficiency Pattern Evolution and Spatial Econometric Analysis of Beijing, Tianjin and Hebei. Areal Res. Dev. 2017, 36, 13–18. [Google Scholar]

- Gao, K.; Yuan, Y. Government Intervention, Spillover Effect and Urban Innovation Performance: Empirical Evidence from National Innovative City Pilot Policy in China. Technol. Soc. 2022, 70, 102035. [Google Scholar] [CrossRef]

- Yang, H.; Li, L.; Liu, Y. The Effect of Manufacturing Intelligence on Green Innovation Performance in China. Technol. Forecast. Soc. Chang. 2022, 178, 121569. [Google Scholar] [CrossRef]

| Hierarchy | Measurement Indicators | Weight | Attribute |

|---|---|---|---|

| Innovation Input Capability | full-time equivalent of R&D personnel | 20.12% | Positive |

| internal R&D fund expenditure | 18.71% | Positive | |

| investments in industrial pollution control | 12.09% | Positive | |

| Innovation Output Level | the number of patent applications | 22.35% | Positive |

| sales revenue from new products | 20.51% | Positive | |

| green coverage rate in developed areas | 0.59% | Positive | |

| Energy Consumption | electricity consumption | 1.38% | Negative |

| Environmental Pollution | total industrial sulfur dioxide emissions | 1.43% | Negative |

| total industrial wastewater emissions | 1.44% | Negative | |

| generation of general industrial solid waste | 1.37% | Negative |

| Type | Variable Name | Symbol | Mean | Min | Max | SD |

|---|---|---|---|---|---|---|

| Explained variable | Green innovation performance | inn | 0.168 | 0.066 | 0.898 | 0.135 |

| Explanatory variable | New energy industry agglomeration | agg | 0.976 | 0.004 | 3.813 | 0.751 |

| regulated variable | Opening up | open | 0.265 | 0.008 | 1.548 | 0.291 |

| Control variable | Foreign investment level | fdi | 0.019 | 0.000 | 0.080 | 0.015 |

| government intervention | gov | 0.249 | 0.107 | 0.643 | 0.103 | |

| Marketization index | market | 8.039 | 3.359 | 12.390 | 1.914 | |

| Infrastructure level | Infralevel | 39.090 | 5.129 | 145.037 | 24.440 |

| Inn | ||||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| agg | −0.047 ** | −0.060 *** | ||

| (0.019) | (0.019) | |||

| agg_2 | 0.017 *** | 0.017 *** | ||

| (0.005) | (0.005) | |||

| l.agg | −0.054 *** | −0.065 *** | ||

| (0.019) | (0.019) | |||

| l.agg_2 | 0.018 *** | 0.017 *** | ||

| (0.005) | (0.005) | |||

| fdi | 0.342 | 0.329 | ||

| (0.326) | (0.337) | |||

| gov | −0.202 * | −0.204 * | ||

| (0.109) | (0.110) | |||

| market | 0.004 | 0.007 | ||

| (0.006) | (0.006) | |||

| Infralevel | −0.005 *** | −0.005 *** | ||

| (0.001) | (0.001) | |||

| _cons | 0.132 *** | 0.340 *** | 0.148 *** | 0.329 *** |

| (0.012) | (0.061) | (0.012) | (0.064) | |

| province | Yes | Yes | Yes | Yes |

| year | Yes | Yes | Yes | Yes |

| N | 330 | 330 | 300 | 300 |

| r2 | 0.310 | 0.409 | 0.285 | 0.378 |

| inn | |||

|---|---|---|---|

| (1) | (2) | (3) | |

| East | Midland | West | |

| agg | −0.060 *** | 0.072 *** | 0.024 *** |

| (0.019) | (0.027) | (0.008) | |

| agg_2 | 0.017 *** | −0.019 * | −0.005 *** |

| (0.005) | (0.011) | (0.002) | |

| fdi | 0.342 | 0.321 | −1.275 *** |

| (0.326) | (0.384) | (0.268) | |

| gov | −0.202 * | −0.267 *** | −0.097 ** |

| (0.109) | (0.088) | (0.040) | |

| market | 0.004 | 0.004 | 0.001 |

| (0.006) | (0.006) | (0.002) | |

| Infralevel | −0.005 *** | 0.003 *** | 0.000 |

| (0.001) | (0.001) | (0.000) | |

| _cons | 0.340 *** | 0.003 | 0.131 *** |

| (0.061) | (0.050) | (0.025) | |

| Control variable | Yes | Yes | Yes |

| province | Yes | Yes | Yes |

| year | Yes | Yes | Yes |

| r2 | 0.409 | 0.867 | 0.603 |

| N | 330 | 330 | 330 |

| inn2 | inn | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| L.inn | 1.109 *** | |||

| (0.029) | ||||

| agg | −0.273 *** | −0.062 *** | −0.021 ** | |

| (0.094) | (0.018) | (0.010) | ||

| agg_2 | 0.081 *** | 0.015 *** | 0.007 *** | |

| (0.026) | (0.005) | (0.002) | ||

| inagg | −0.179 * | |||

| (0.101) | ||||

| inagg_2 | 0.221 *** | |||

| (0.058) | ||||

| fdi | 4.582 *** | −0.382 | 0.348 | 0.553 |

| (1.621) | (0.328) | (0.317) | (0.341) | |

| gov | 1.293 ** | −0.117 | −0.228 ** | 0.118 * |

| (0.543) | (0.104) | (0.107) | (0.060) | |

| market | 0.057 ** | 0.008 | 0.004 | 0.004 |

| (0.028) | (0.006) | (0.005) | (0.005) | |

| Infralevel | 0.010 ** | −0.005 *** | −0.005 *** | 0.000 |

| (0.004) | (0.001) | (0.001) | (0.000) | |

| ers | 4.315 *** | |||

| (1.049) | ||||

| province | Yes | Yes | Yes | Yes |

| year | Yes | Yes | Yes | Yes |

| _cons | −0.591 * | 0.245 *** | 0.331 *** | −0.071 |

| (0.301) | (0.068) | (0.059) | (0.052) | |

| r2 | 0.169 | 0.445 | 0.442 | |

| N | 330 | 330 | 330 | 210 |

| AR (2)-p | 0.595 | |||

| Hansen test-p | 0.686 | |||

| inn | ||

|---|---|---|

| (1) | (2) | |

| agg | 0.106 *** | 0.094 *** |

| (0.022) | (0.023) | |

| agg_2 | −0.019 *** | −0.020 *** |

| (0.007) | (0.007) | |

| agg × open | −0.595 *** | −0.645 *** |

| (0.099) | (0.100) | |

| agg_2 × open | 0.149 *** | 0.185 *** |

| (0.048) | (0.049) | |

| tra | 0.075 * | 0.139 *** |

| (0.044) | (0.044) | |

| Control variable | No | Yes |

| province | Yes | Yes |

| year | Yes | Yes |

| _cons | 0.132 *** | 0.255 *** |

| (0.013) | (0.055) | |

| r2 | 0.516 | 0.564 |

| N | 330 | 330 |

| variable | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Moran I | 0.199 | 0.204 | 0.211 | 0.211 | 0.247 | 0.257 | 0.198 | 0.138 | 0.148 | 0.155 | 0.162 |

| Z-value | 2.026 | 2.076 | 2.114 | 2.102 | 2.427 | 2.509 | 2.029 | 1.551 | 1.656 | 1.702 | 1.763 |

| p-value | 0.021 | 0.019 | 0.017 | 0.018 | 0.008 | 0.006 | 0.021 | 0.06 | 0.049 | 0.044 | 0.039 |

| LM test | LM-error test | 9.56 *** |

| Robust LM-error test | 9.35 *** | |

| LM-lag test | 16.695 *** | |

| Robust LM-lag test | 16.485 *** | |

| LR test | LR Test (SAR) | 117.17 *** |

| LR Test (SEM) | 118.29 *** | |

| Wald test | Wald Test (SAR) | 140.39 *** |

| Wald Test(SEM) | 137.74 *** |

| inn | |||

|---|---|---|---|

| (1) | (2) | (3) | |

| Individual Fixed | Time Fixed | Individual and Time Fixed | |

| agg | −0.115 *** | 0.134 *** | −0.124 *** |

| (0.017) | (0.023) | (0.017) | |

| agg_2 | 0.025 *** | −0.029 *** | 0.027 *** |

| (0.004) | (0.007) | (0.004) | |

| Control variable | Yes | Yes | Yes |

| W × agg | 0.222 *** | −0.148 *** | 0.197 *** |

| (0.026) | (0.041) | (0.033) | |

| W × agg_2 | −0.035 *** | 0.042 *** | −0.033 *** |

| (0.008) | (0.013) | (0.009) | |

| W × Control variable | Yes | Yes | Yes |

| province | Yes | No | Yes |

| year | No | Yes | Yes |

| rho | 0.275 *** | 0.048 | 0.115 ** |

| (0.047) | (0.069) | (0.054) | |

| Variance sigma2_e | 0.001 *** | 0.007 *** | 0.001 *** |

| 0.000 | (0.001) | 0.000 | |

| N | 330 | 330 | 330 |

| r2 | 0.495 | 0.099 | 0.011 |

| Variable | Direct Effect | Indirect Effect | Total Effect |

|---|---|---|---|

| agg | −0.101 *** | 0.249 *** | 0.148 *** |

| (0.017) | (0.036) | (0.042) | |

| agg_2 | 0.023 *** | −0.037 *** | −0.014 |

| (0.005) | (0.010) | (0.012) | |

| Control variable | Yes | Yes | Yes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yue, J.; Duan, H. The Influence of New Energy Industry Agglomeration on Regional Green Innovation Performance—Evidence from China. Sustainability 2024, 16, 2029. https://doi.org/10.3390/su16052029

Yue J, Duan H. The Influence of New Energy Industry Agglomeration on Regional Green Innovation Performance—Evidence from China. Sustainability. 2024; 16(5):2029. https://doi.org/10.3390/su16052029

Chicago/Turabian StyleYue, Jingui, and Heying Duan. 2024. "The Influence of New Energy Industry Agglomeration on Regional Green Innovation Performance—Evidence from China" Sustainability 16, no. 5: 2029. https://doi.org/10.3390/su16052029

APA StyleYue, J., & Duan, H. (2024). The Influence of New Energy Industry Agglomeration on Regional Green Innovation Performance—Evidence from China. Sustainability, 16(5), 2029. https://doi.org/10.3390/su16052029