The Impact of Curbing Housing Speculation on Household Entrepreneurship in China

Abstract

1. Introduction

2. Institutional Background and the Measurement of HPR Stringency

2.1. Institutional Background of HPR Policy in China

2.2. The Measurement of HPR Stringency

3. Data and Method

3.1. Data and Summary Statistics

3.2. Empirical Strategy

4. Results

4.1. Main Results

4.2. Heterogeneity Analysis

4.3. Possible Mechanism

5. Robustness Checks, Intensive Margin Estimates, and City-Level Evidence

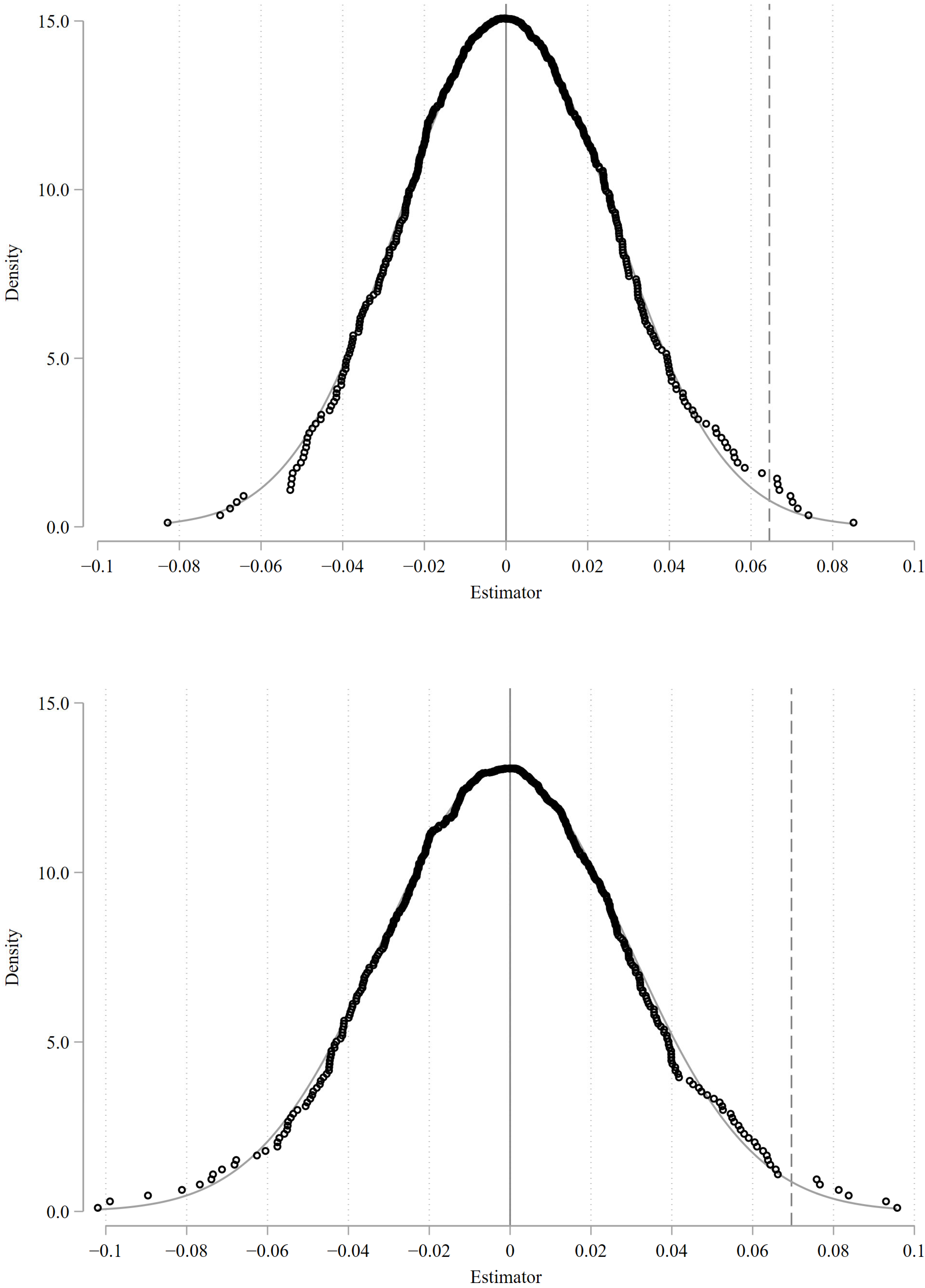

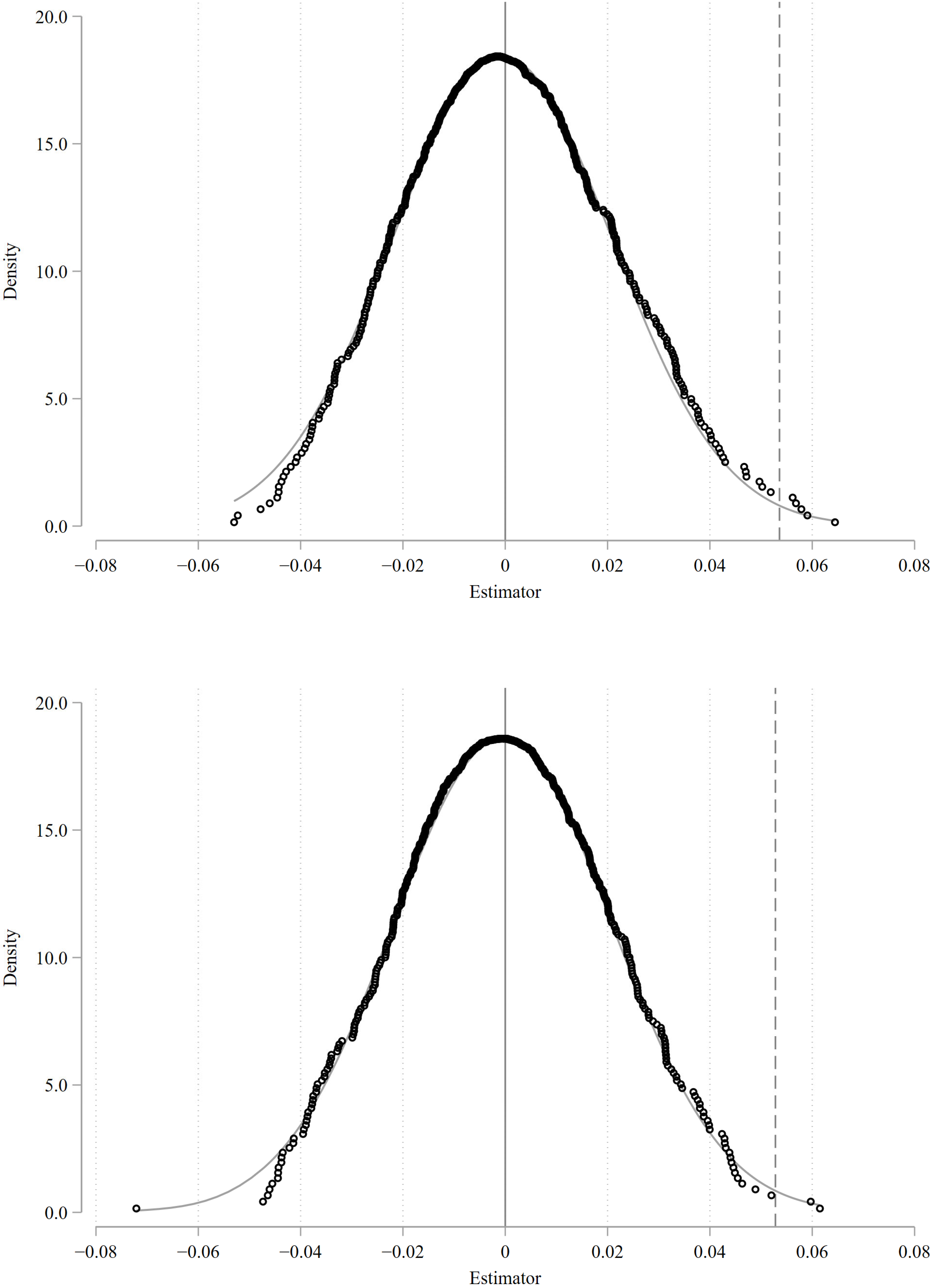

5.1. Robustness Checks

5.2. Discussion on Intensive Margin

5.3. Evidence at the City Level

6. DID Estimation Results

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wortman, M.S. Theoretical foundations for family-owned business: A conceptual and research-based paradigm. Fam. Bus. Rev. 1994, 7, 3–27. [Google Scholar] [CrossRef]

- Heck, R.K.Z.; Trent, E.S. The prevalence of family business from a household sample. Fam. Bus. Rev. 1999, 12, 209–224. [Google Scholar] [CrossRef]

- Rogoff, E.G.; Heck, R.K. Evolving research in entrepreneurship and family business: Recognizing family as the oxygen that feeds the fire of entrepreneurship. J. Bus. Ventur. 2003, 18, 559–566. [Google Scholar] [CrossRef]

- Glaeser, E.L.; Kerr, W.R.; Ponzetto, G.A. Clusters of Entrepreneurship. J. Urban Econ. 2010, 67, 150–168. [Google Scholar] [CrossRef]

- Hurst, E.; Lusardi, A. Liquidity Constraints, Household Wealth, and Entrepreneurship. J. Political Econ. 2004, 112, 319–347. [Google Scholar] [CrossRef]

- Evans, D.S.; Jovanovic, B. An Estimated Model of Entrepreneurial Choice under Liquidity Constraints. J. Political Econ. 1989, 97, 808–827. [Google Scholar] [CrossRef]

- Doms, M.; Lewis, E.; Robb, A. Local Labor Force Education, New Business Characteristics, and Firm Performance. J. Urban Econ. 2010, 67, 61–77. [Google Scholar] [CrossRef]

- Davidsson, P.; Honig, B. The Role of Social and Human Capital among Nascent Entrepreneurs. J. Bus. Ventur. 2003, 18, 301–331. [Google Scholar] [CrossRef]

- Adelino, M.; Schoar, A.; Severino, F. House Prices, Collateral, and Self-Employment. J. Financ. Econ. 2015, 117, 288–306. [Google Scholar] [CrossRef]

- Schmalz, M.C.; Sraer, D.A.; Thesmar, D. Housing Collateral and Entrepreneurship. J. Financ. 2017, 72, 99–132. [Google Scholar] [CrossRef]

- Harding, J.P.; Rosenthal, S.S. Homeownership, Housing Capital Gains and Self-employment. J. Urban Econ. 2017, 99, 120–135. [Google Scholar] [CrossRef]

- Bracke, P.; Hilber, C.A.; Silva, O. Mortgage Debt and Entrepreneurship. J. Urban Econ. 2018, 103, 52–66. [Google Scholar] [CrossRef]

- Corradin, S.; Popov, A. House prices, home equity borrowing, and entrepreneurship. Rev. Financ. Stud. 2015, 28, 2399–2428. [Google Scholar] [CrossRef]

- Robb, A.M.; Robinson, D.T. The capital structure decisions of new firms. Rev. Financ. Stud. 2014, 27, 153–179. [Google Scholar] [CrossRef]

- Stiglitz, J.E.; Weiss, A. Credit rationing in markets with imperfect information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Kerr, S.P.; Kerr, W.R.; Nanda, R. House Money and Entrepreneurship; No. w21458; National Bureau of Economic Research: Cambridge, MA, USA, 2015. [Google Scholar]

- Li, L.; Wu, X. Housing Price and Entrepreneurship in China. J. Comp. Econ. 2014, 42, 436–449. [Google Scholar] [CrossRef]

- Cai, D.; He, C.; Fang, X. Effects of Expectation of Real Estate Price on Family Entrepreneurship. Financ. Econ. Sci. 2015, 6, 108–118. (In Chinese) [Google Scholar]

- Case, K.E.; Shiller, R.J. Is There a Bubble in the Housing Market? Brook. Pap. Econ. Act. 2003, 2, 299–362. [Google Scholar] [CrossRef]

- Gao, Z.; Sockin, M.; Xiong, W. Economic Consequences of Housing Speculation. Rev. Financ. Stud. 2020, 33, 5248–5287. [Google Scholar] [CrossRef]

- Mian, A.; Sufi, A. The Consequences of Mortgage Credit Expansion: Evidence from the U.S. Mortgage Default Crisis. Q. J. Econ. 2009, 124, 1449–1496. [Google Scholar] [CrossRef]

- Keys, B.J.; Mukherjee, T.; Seru, A.; Vig, V. Financial Regulation and Securitization: Evidence from Subprime Mortgage Loans. J. Monet. Econ. 2009, 56, 700–720. [Google Scholar] [CrossRef]

- Glaeser, E.L.; Gyourko, J. The Impact of Building Restrictions on Housing Affordability. FRB New York Econ. Policy Rev. 2003, 9, 21–39. [Google Scholar]

- Glaeser, E.L.; Gyourko, J.; Saks, R.E. Why Have Housing Prices Gone Up? Am. Econ. Rev. 2005, 95, 329–333. [Google Scholar] [CrossRef]

- Saiz, A. The Geographic Determinants of Housing Supply. Q. J. Econ. 2010, 125, 1253–1296. [Google Scholar] [CrossRef]

- Aalbers, M.B. The Financialization of Housing: A Political Economy Approach, 1st ed.; Routledge: Oxfordshire, UK, 2016. [Google Scholar]

- Dariusz, W. The Dark Side of NY–LON: Financial Centres and the Global Financial Crisis. Urban Stud. 2013, 50, 2736–2752. [Google Scholar]

- Wu, J.; Gyourko, J.; Deng, Y. Evaluating Conditions in Major Chinese Housing Markets. Reg. Sci. Urban Econ. 2012, 42, 531–543. [Google Scholar] [CrossRef]

- Du, Z.; Zhang, L. Home-purchase Restriction, Property Tax and Housing Price in China: A Counterfactual Analysis. J. Econ. 2015, 188, 558–568. [Google Scholar] [CrossRef]

- Sun, W.; Zheng, S.; Geltner, D.M.; Wang, R. The Housing Market Effects of Local Home Purchase Restrictions: Evidence from Beijing. J. Real Estate Financ. Econ. 2017, 55, 288–312. [Google Scholar] [CrossRef]

- Zou, Y.; Meng, F.; Zhong, N.; Zhao, W. The Diffusion of the Housing Purchase Restriction Policy in China. Cities 2022, 120, 103401. [Google Scholar] [CrossRef]

- Li, V.J.; Cheng, A.W.W.; Cheong, T.S. Home Purchase Restriction and Housing Price: A Distribution Dynamics Analysis. Reg. Sci. Urban Econ. 2017, 67, 1–10. [Google Scholar] [CrossRef]

- Castro, P.M.; Zermeño, M.G. Being an Entrepreneur Post-COVID-19—Resilience in Times of Crisis: A Systematic Literature Review. J. Entrep. Emerg. Econ. 2021, 13, 721–746. [Google Scholar]

- Lungu, A.E.; Bogoslov, I.A.; Stoica, E.A.; Georgescu, M.R. From Decision to Survival—Shifting the Paradigm in Entrepreneurship during the COVID-19 Pandemic. Sustainability 2021, 13, 7674. [Google Scholar] [CrossRef]

- Jia, S.; Wang, Y.; Fan, G. Home-purchase Limits and Housing Prices: Evidence from China. J. Real Estate Financ. Econ. 2018, 56, 386–409. [Google Scholar] [CrossRef]

- Somerville, T.; Wang, L.; Yang, Y. Using Purchase Restrictions to Cool Housing Markets: A Within-market Analysis. J. Urban Econ. 2020, 115, 103189. [Google Scholar] [CrossRef]

- Yu, Y.; Zhang, S. Urban Housing Prices, Purchase Restriction Policy and Technological Innovation. China Ind. Econ. 2017, 6, 98–116. (In Chinese) [Google Scholar]

- Chen, T.; Liu, L.; Xiong, W.; Zhou, L.A. Real Estate Boom and Misallocation of Capital in China; Working Paper 2017; Princeton University: Princeton, NJ, USA, 2017. [Google Scholar]

- Sun, W.; Zhang, S.; Lin, C.; Zheng, S. How do Home Purchase Restrictions Affect Elite Chinese Graduate Students’ Job Search Behavior? Reg. Sci. Urban Econ. 2021, 87, 103644. [Google Scholar] [CrossRef]

- Chinco, A.; Mayer, C. Misinformed Speculators and Mispricing in the Housing Market. Rev. Financ. Stud. 2016, 29, 486–522. [Google Scholar] [CrossRef]

- Haughwout, A.; Lee, D.; Tracy, J.S.; Van der Klaauw, W. Real Estate Investors, the Leverage Cycle, and the Housing Market Crisis; Staff Reports 514; Federal Reserve Bank of New York: New York, NY, USA, 2011. [Google Scholar]

- Rong, Z.; Wang, W.; Gong, Q. Housing Price Appreciation, Investment Opportunity, and Firm Innovation: Evidence from China. J. Hous. Econ. 2016, 33, 34–58. [Google Scholar] [CrossRef]

- Lu, B.; Tan, X.; Zhang, J. The Crowding out Effect of Booming Real Estate Markets on Corporate TFP: Evidence from China. Account. Financ. 2019, 58, 1319–1345. [Google Scholar] [CrossRef]

- Jia, J.; Gu, J.; Ma, G. Real Estate Boom and Firm Productivity: Evidence from China. Oxf. Bull. Econ. Stat. 2021, 83, 1218–1242. [Google Scholar] [CrossRef]

- Wu, J.; Gyourko, J.; Deng, Y. Evaluating the Risk of Chinese Housing Markets: What We Know and What We Need to Know. China Econ. Rev. 2016, 39, 91–114. [Google Scholar] [CrossRef]

- Fang, H.; Gu, Q.; Xiong, W.; Zhou, L. Demystifying the Chinese Housing Boom. NBER Macroecon. Annu. 2015, 30, 105–166. [Google Scholar] [CrossRef]

- Chaney, T.; David, S.; David, T. The Collateral Channel: How Real Estate Shocks Affect Corporate Investment. Am. Econ. Rev. 2012, 102, 2381–2409. [Google Scholar] [CrossRef]

- Aladangady, A. Housing Wealth and Consumption: Evidence from Geographically Linked Microdata. Am. Econ. Rev. 2017, 107, 3415–3446. [Google Scholar] [CrossRef]

- Shi, J.; Wang, Y.; Wu, W. The Crowding-out Effect of Real Estate Markets on Corporate Innovation: Evidence from China. In Proceedings of the Asian Finance Association (AsianFA) Conference, Bangkok, Thailand, 18–19 January 2016. [Google Scholar]

- Liang, W.; Lu, M.; Zhang, H. Housing Prices Raise Wages: Estimating the Unexpected Effects of Land Supply Regulation in China. J. Hous. Econ. 2016, 33, 70–81. [Google Scholar] [CrossRef]

- Huang, X.; Min, L.; Meng, X.; Liu, X.; Khan, Y.A.; Abbas, S.Z. Housing Investment and Family Entrepreneurship: Evidence from China. PLoS ONE 2023, 18, e0285699. [Google Scholar] [CrossRef]

- Fan, G.Z.; Li, H.; Li, J.; Zhang, J. Housing Property Rights, Collateral, and Entrepreneurship: Evidence from China. J. Bank. Financ. 2022, 143, 106588. [Google Scholar] [CrossRef]

- Stuart, T.E.; Sorenson, O. Social Network and Entrepreneurship. In Handbook of Entrepreneurship Research: Disciplinary Perspectives; Alvarez, S.A., Agarwal, R., Sorenson, O., Eds.; Springer: New York, NY, USA, 2005. [Google Scholar]

- Gimeno, J.; Folta, T.B.; Cooper, A.C.; Woo, C.Y. Survival of the Fittest? Entrepreneurial Human Capital and the Persistence of Underperforming Firms. Adm. Sci. Q. 1997, 42, 750–783. [Google Scholar] [CrossRef]

- Chandler, G.N.; Hanks, S.H. An Examination of the Substitutability of Founders Human and Financial Capital in Emerging Business Ventures. J. Bus. Ventur. 1998, 13, 353–369. [Google Scholar] [CrossRef]

- Ucbasaran, D.; Westhead, P.; Wright, M. Habitual Entrepreneurs. In Habitual Entrepreneurs; Edward Elgar Publishing: Cheltenham, UK, 2006. [Google Scholar]

- Miralles, F.; Giones, F.; Riverola, C. Evaluating the Impact of Prior Experience in Entrepreneurial Intention. Int. Entrep. Manag. J. 2016, 12, 791–813. [Google Scholar] [CrossRef]

- Shane, S.A. Prior Knowledge and the Discovery of Entrepreneurial Opportunities. Organ. Sci. 2000, 11, 448–469. [Google Scholar] [CrossRef]

- Corbett, A.C. Experiential Learning within the Process of Opportunity Identification and Exploitation. Entrep. Theory Pract. 2005, 29, 473–491. [Google Scholar] [CrossRef]

- Cressy, R. Credit rationing or entrepreneurial risk aversion? An alternative explanation for the Evans and Jovanovic finding. Econ. Lett. 2000, 66, 235–240. [Google Scholar]

- Knight, F.H. Risk, Uncertainty and Profit; University of Illinois at Urbana-Champaign’s Academy for Entrepreneurial Leadership Historical Research Reference in Entrepreneurship; Vernon Art and Science Inc.: Wilmington, DE, USA, 1921. [Google Scholar]

- Wu, B.; Knott, A.M. Entrepreneurial Risk and Market Entry. Manag. Sci. 2006, 52, 1315–1330. [Google Scholar] [CrossRef]

- Paulson, A.L.; Townsend, R. Entrepreneurship and financial constraints in Thailand. J. Corp. Financ. 2004, 10, 229–262. [Google Scholar] [CrossRef]

- Liu, S.; Zhang, S. Housing Wealth Changes and Entrepreneurship: Evidence from Urban China. China Econ. Rev. 2021, 69, 101656. [Google Scholar] [CrossRef]

- Han, B.; Han, L.; Zhou, Z. Housing Market and Entrepreneurship: Micro Evidence from China. SSRN Electron. J. 2020, 3676832. [Google Scholar] [CrossRef]

- Greve, A.; Salaff, J.W. Social Networks and Entrepreneurship. Entrep. Theory Pract. 2003, 28, 1–22. [Google Scholar] [CrossRef]

- Sanders, J.M.; Nee, V. Immigrant Self-employment: The Family as Social Capital and the Value of Human Capital. Am. Sociol. Rev. 1996, 61, 231–249. [Google Scholar] [CrossRef]

- Yueh, L. Self-employment in Urban China: Networking in a Transition Economy. China Econ. Rev. 2009, 20, 471–484. [Google Scholar] [CrossRef]

- Ferrara, E.L.; Chong, A.; Duryea, S. Soap Operas and fertility: Evidence from Brazil. Am. Econ. J. Appl. Econ. 2012, 4, 1–31. [Google Scholar] [CrossRef]

| Dimensions | Requirements |

|---|---|

| (1) The restriction on the number of houses a household could purchase | 1: allow purchase of two additional houses, regardless of the number of houses a household currently owns. 2: allow purchase of one additional house, regardless of the number of houses a household currently owns. 3: prohibit the purchase of a fourth home. 4: prohibit the purchase of a third home. 5: prohibit the purchase of a second home. |

| (2) The restriction on the location of houses | 1: the purchase restriction is only applied to houses located in designated areas of the municipal districts of a city. 2: the purchase restriction is only applied to houses located in the municipal districts of a city. 3: the purchase restriction applies to houses located in all districts of a city. |

| (3) The restriction on the scope of checking houses owned by households | 1: only houses owned by households located in designated areas of the municipal districts of a city count (For the type of home purchase restrictions that are applied to additional housing units regardless of the number of housing units a household currently owns, there is no need to look into the number and location of houses in a household. In this dimension, we assign a value of 1 to this type in order to represent the lowest stringency compared with the type of home purchase restrictions that are applied to the maximum number of housing units a household can own in a city). 2: only those located in the municipal districts of a city count. 3: those located in all districts of a city count. |

| (4) The restriction on local households holding hukou in suburban districts of a city | 1: households holding hukou in suburban districts of a city are allowed to purchase houses in municipal districts of a city. 2: households holding hukou in suburban districts of a city are not allowed to purchase houses in municipal districts of a city unless they have proof of income tax or social insurance payment in municipal districts of a city for certain years. |

| (5) The restriction on the type of houses | 1: the purchase restriction only applied to newly built houses. 2: the purchase restriction applies to both newly built and second-hand houses. |

| (6) The restriction on the size of houses | 1: the purchase restriction applies to houses with a floor area less than or equal to 90 square meters. 2: the purchase restriction applies to houses with a floor area less than or equal to 144 square meters. 3: the purchase restriction applies to houses with a floor area less than or equal to 180 square meters. 4: the purchase restriction applies to houses of any size. |

| (7) The restriction on households with household heads being single | 1: there is no further restriction on households with a household head who is single. 2: there is a further restriction on households with a household head who is single. |

| Year | (1) Number | (2) Area | (3) Checked Area | (4) Suburban hukou | (5) Type | (6) Size | (7) Single | Entropy | PCA | Equal- Weight | Multipli-cation | Number of HPR-Cities |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010 | 2.29 | 2.65 | 1.35 | 1.00 | 2.00 | 4.00 | 1.00 | 0.68 | 1.80 | 0.65 | 28.00 | 17 |

| 2011 | 3.81 | 2.10 | 2.43 | 1.07 | 1.98 | 3.88 | 1.00 | 0.75 | 1.98 | 0.72 | 47.62 | 42 |

| 2012 | 3.76 | 2.09 | 2.41 | 1.07 | 1.96 | 3.89 | 1.02 | 0.75 | 1.98 | 0.72 | 47.04 | 46 |

| 2013 | 3.76 | 2.13 | 2.41 | 1.07 | 1.96 | 3.89 | 1.04 | 0.75 | 1.99 | 0.72 | 47.30 | 46 |

| 2014 | 4.00 | 2.33 | 2.67 | 1.00 | 2.00 | 4.00 | 1.33 | 0.80 | 2.13 | 0.77 | 53.33 | 6 |

| 2015 | 4.00 | 2.60 | 3.00 | 1.00 | 2.00 | 4.00 | 1.40 | 0.84 | 2.21 | 0.80 | 56.00 | 5 |

| 2016 | 3.83 | 2.11 | 2.72 | 1.06 | 1.72 | 3.67 | 1.22 | 0.76 | 2.01 | 0.72 | 47.78 | 18 |

| 2017 | 3.82 | 2.03 | 2.39 | 1.03 | 1.82 | 3.85 | 1.27 | 0.75 | 2.00 | 0.72 | 47.21 | 33 |

| 2018 | 3.85 | 1.92 | 2.28 | 1.03 | 1.82 | 3.82 | 1.21 | 0.73 | 1.96 | 0.70 | 46.23 | 39 |

| 2019 | 3,85 | 1.92 | 2.28 | 1.03 | 1.82 | 3.82 | 1.23 | 0.73 | 1.96 | 0.70 | 46.33 | 39 |

| Variable | Obs. | Mean | S.D. | Min | Max |

|---|---|---|---|---|---|

| Entrepreneurship (engage in business project) | 27,616 | 0.146 | 0.353 | 0 | 1 |

| Entrepreneurship (self-employment) | 27,616 | 0.191 | 0.393 | 0 | 1 |

| HPR stringency (entropy method) | 27,616 | 0.597 | 0.351 | 0 | 0.905 |

| HPR stringency (principal component analysis) | 27,616 | 1.580 | 0.934 | 0 | 2.440 |

| HPR stringency (equal-weight method) | 27,616 | 0.570 | 0.350 | 0 | 0.9 |

| HPR stringency (multiplication method) | 27,616 | 37.90 | 23.75 | 0 | 60 |

| Housing mortgage limit | 27,616 | 0.492 | 0.100 | 0.3 | 0.7 |

| Housing resale limit | 27,616 | 0.121 | 0.516 | 0 | 4 |

| Household annual income (RMB 10 thousand) | 27,616 | 14.053 | 41.800 | 0 | 3852.2 |

| Household size | 27,616 | 3.354 | 1.874 | 1 | 26 |

| Household assets (RMB 10 thousand) | 27,616 | 193.560 | 338.355 | 0 | 10,270 |

| Household housing assets (RMB 10 thousand) | 27,616 | 105.677 | 203.289 | 0 | 6297.4 |

| Household non-housing assets (RMB 10 thousand) | 27,616 | 87.884 | 249.624 | 0 | 10,220 |

| Household debt (RMB 10 thousand) | 27,616 | 9.418 | 51.958 | 0 | 5190.4 |

| Household housing debt (RMB 10 thousand) | 27,616 | 6.832 | 32.020 | 0 | 2500 |

| Household non-housing debt (RMB 10 thousand) | 27,616 | 2.587 | 39.437 | 0 | 5190.4 |

| Old dependent ratio | 27,616 | 0.048 | 0.124 | 0 | 0.8 |

| Young dependent ratio | 27,616 | 0.115 | 0.157 | 0 | 0.75 |

| Unhealthy family member | 27,616 | 0.305 | 0.461 | 0 | 1 |

| Household-head age | 27,616 | 48.686 | 11.052 | 18 | 65 |

| Household-head gender | 27,616 | 0.679 | 0.467 | 0 | 1 |

| Household-head marriage status | 27,616 | 0.874 | 0.332 | 0 | 1 |

| Household-head years of schooling | 27,616 | 11.709 | 3.632 | 0 | 22 |

| Household-head health insurance | 27,616 | 0.960 | 0.196 | 0 | 1 |

| City average housing price (RMB 10 thousand) | 27,616 | 1.806 | 1.270 | 0.460 | 5.489 |

| City GDP Per capita (RMB 10 thousand) | 27,616 | 103174 | 28,708.05 | 3.863 | 20.074 |

| City proportion of the tertiary industry | 27,616 | 0.601 | 0.099 | 0.325 | 0.810 |

| City population density | 27,616 | 981.279 | 591.582 | 112.291 | 2305.63 |

| City fixed investment per capita (RMB 10 thousand) | 27,616 | 55,587.8 | 26,018.36 | 0.365 | 13.502 |

| City real estate investment share of GDP | 27,616 | 0.193 | 0.106 | 0.0214 | 1.198 |

| City college enrollments share of population | 27,616 | 0.061 | 0.034 | 0.00003 | 0.126 |

| Dependent Variable: Entrepreneurship | ||||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| HPR stringency | 0.0519 *** | 0.0623 *** | 0.0557 *** | 0.0645 *** |

| (0.0187) | (0.0185) | (0.0185) | (0.0250) | |

| Ln Household income | / | 0.00925 *** | 0.00927 *** | 0.00926 *** |

| / | (0.00176) | (0.00176) | (0.00176) | |

| Household size | / | 0.00644 ** | 0.00637 ** | 0.00647 ** |

| / | (0.00322) | (0.00322) | (0.00322) | |

| Ln Housing assets | / | 0.000483 | 0.000435 | 0.000506 |

| / | (0.000457) | (0.000460) | (0.000462) | |

| Ln Non-housing assets | / | 0.0416 *** | 0.0415 *** | 0.0415 *** |

| / | (0.00236) | (0.00237) | (0.00237) | |

| Ln Housing debt | / | −0.000721 | −0.000713 | −0.000718 |

| / | (0.000662) | (0.000662) | (0.000663) | |

| Ln Non-housing debt | / | 0.00454 *** | 0.00453 *** | 0.00453 *** |

| / | (0.000778) | (0.000779) | (0.000780) | |

| Old dependent ratio | / | 0.00196 | 0.00218 | 0.00291 |

| / | (0.0277) | (0.0277) | (0.0276) | |

| Young dependent ratio | / | 0.00734 | 0.00782 | 0.00779 |

| / | (0.0285) | (0.0285) | (0.0285) | |

| Unhealthy family member | / | −0.00797 | −0.00796 | −0.00822 |

| / | (0.00598) | (0.00598) | (0.00598) | |

| Age | / | 0.00379 | 0.00382 | 0.00346 |

| / | (0.00383) | (0.00383) | (0.00384) | |

| Age squared | / | −5.01 × 10−5 | −5.03 × 10−5 | −4.64 × 10−5 |

| / | (4.10 × 10−5) | (4.11 × 10−5) | (4.12 × 10−5) | |

| Gender | / | 0.00361 | 0.00385 | 0.00335 |

| / | (0.00747) | (0.00749) | (0.00747) | |

| Married | / | −0.0170 | −0.0168 | −0.0166 |

| / | (0.0133) | (0.0133) | (0.0133) | |

| Years of schooling | / | −0.00141 | −0.00145 | −0.00145 |

| / | (0.00186) | (0.00186) | (0.00187) | |

| Health insurance | / | 0.00501 | 0.00495 | 0.00410 |

| / | (0.0152) | (0.0152) | (0.0152) | |

| Ln housing prices | / | −0.0133 | −0.0145 | |

| / | (0.0303) | (0.0322) | ||

| Housing mortgage limit | / | −0.00174 | 0.0174 | |

| / | (0.0386) | (0.0403) | ||

| Housing resale limit | / | −0.00386 | −0.000359 | |

| / | (0.00442) | (0.00473) | ||

| Ln GDP per capita | / | 0.0735 ** | ||

| / | (0.0343) | |||

| Tertiary industry share | / | 0.0570 | ||

| / | (0.108) | |||

| Ln Population density | / | 0.0657 ** | ||

| / | (0.0292) | |||

| Ln Fixed investment per capita | / | 0.0275 ** | ||

| / | (0.0129) | |||

| Real estate share of GDP | / | −0.143 * | ||

| / | (0.0811) | |||

| College enrollments share | / | −0.281 | ||

| / | (0.516) | |||

| Household fixed effects | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes |

| Constant | 0.143 *** | −0.526 *** | −0.400 | −0.271 |

| (0.00556) | (0.0964) | (0.300) | (0.652) | |

| Observations | 27,616 | 27,616 | 27,616 | 27,616 |

| R-squared | 0.719 | 0.733 | 0.733 | 0.733 |

| Dependent Variable: Entrepreneurship | ||||||

|---|---|---|---|---|---|---|

| Instrumental Variables | Housing Supply Elasticity × Long-Term Interest Rate | Land Supply Area per Capita | Both IVs | |||

| First-Stage | 2SLS | First-Stage | 2SLS | First-Stage | 2SLS | |

| HPR stringency | / | 0.0521 ** | / | 0.0711 ** | / | 0.0503 ** |

| / | (0.0279) | / | (0.0354) | / | (0.0248) | |

| Housing supply rate | 10.79 *** | / | 9.886 *** | / | ||

| (0.375) | / | (0.382) | / | |||

| Land supply per capita | / | / | −0.132 *** | −0.0640 *** | / | |

| / | / | (0.00611) | (0.00609) | / | ||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Household fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 25,891 | 25,891 | 25,891 | 25,891 | 25,891 | 25,891 |

| R-squared | 0.781 | 0.364 | 0.778 | 0.360 | 0.785 | 0.364 |

| Cragg-Donald Wald F statistic | 791.190 | / | 338.114 | / | 802.773 | / |

| Kleibergen-Paap rk Wald F statistic | 432.673 | / | 174.807 | / | 293.072 | / |

| Hansen J statistic | / | / | / | / | / | 0.181 |

| DWH test | / | 0.133 | / | 0.163 | / | 0.149 |

| Dependent Variable: Entrepreneurship | ||||||

|---|---|---|---|---|---|---|

| Group | Multiple-Home | Single-Home | No Mortgage | With Mortgage | With Previous Experiences | No Previous Experiences |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| HPR stringency | 0.0836 *** | 0.0186 * | 0.167 ** | 0.0295 | 0.137 *** | 0.00910 ** |

| (0.0248) | (0.00983) | (0.0828) | (0.0284) | (0.0441) | (0.00427) | |

| Household and city controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Household and year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 5071 | 17,795 | 18,099 | 4767 | 4187 | 23,429 |

| R-squared | 0.790 | 0.749 | 0.751 | 0.777 | 0.794 | 0.713 |

| Dependent Variable: Entrepreneurship | ||||||

|---|---|---|---|---|---|---|

| Variables | Risk-Loving | Risk-Neutral | Risk-Averse | Large-Asset | Medium-Asset | Small-Asset |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| HPR stringency | 0.227 ** | 0.0401 | 0.0726 | 0.174 *** | 0.0530 | 0.0213 |

| (0.105) | (0.0561) | (0.0607) | (0.0637) | (0.0496) | (0.0382) | |

| Household and city controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Household and year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 1003 | 5632 | 10,315 | 9205 | 9205 | 9206 |

| R-squared | 0.782 | 0.789 | 0.764 | 0.829 | 0.813 | 0.674 |

| Dependent Variables | Purchase New Home | Plan to Purchase | Self-Assessed Home Values | Self-Assessed Home Equity | ||||

|---|---|---|---|---|---|---|---|---|

| Multi-Home | Single-Home | Multi-Home | Single-Home | Multi-Home | Single-Home | Multi-Home | Single-Home | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| HPR stringency | −0.0586 *** | −0.0108 *** | −0.0580 *** | −0.0152 | −0.0120 | −0.438 | 0.508 | −0.410 |

| (0.0167) | (0.00398) | (0.0116) | (0.00997) | (0.445) | (0.576) | (0.323) | (0.591) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 9133 | 16,886 | 9133 | 16,886 | 9133 | 16,886 | 9133 | 16,886 |

| R-squared | 0.546 | 0.443 | 0.547 | 0.561 | 0.886 | 0.874 | 0.898 | 0.902 |

| Dependent Variables | House Prices Expectation | Type of Entrepreneurship | |||

|---|---|---|---|---|---|

| Multi-Home | Single-Home | Opportunity | Necessity | Innovation | |

| (1) | (2) | (3) | (4) | (5) | |

| HPR stringency | −0.245 ** | −0.0201 | 0.0363 *** | −0.0960 | 0.0216 ** |

| (0.121) | (0.0803) | (0.0118) | (0.105) | (0.00908) | |

| Household and city controls | Yes | Yes | Yes | Yes | Yes |

| Household and year fixed effects | Yes | Yes | Yes | Yes | Yes |

| Observations | 4059 | 7937 | 27,616 | 27,616 | 25,051 |

| R-squared | 0.472 | 0.474 | 0.576 | 0.517 | 0.534 |

| Dependent Variables | Gift Exchange | Gift-Giving | Entrepreneurship | Entrepreneurship |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| HPR stringency | 0.888 *** | 0.583 *** | ||

| (0.0684) | (0.0890) | |||

| Gift exchange | 0.00725 *** | |||

| (0.00171) | ||||

| Gift-giving | 0.00907 *** | |||

| (0.00185) | ||||

| Household and city controls | Yes | Yes | Yes | Yes |

| Household and year fixed effects | Yes | Yes | Yes | Yes |

| Observations | 27,050 | 25,642 | 27,050 | 25,642 |

| R-squared | 0.345 | 0.354 | 0.555 | 0.556 |

| Dependent Variable: Entrepreneurship | ||||

|---|---|---|---|---|

| High Gift Exchange | Low Gift Exchange | More Siblings | Few Siblings | |

| (1) | (2) | (3) | (4) | |

| HPR stringency | 0.0933 ** | 0.0374 | 0.0271 ** | −0.0707 |

| (0.0438) | (0.0275) | (0.0123) | (0.133) | |

| Controls | Yes | Yes | Yes | Yes |

| Household and year fixed effects | Yes | Yes | Yes | Yes |

| Observations | 15,990 | 11,060 | 13,373 | 13,068 |

| R-squared | 0.486 | 0.594 | 0.566 | 0.534 |

| Dependent Variable: Entrepreneurship. | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| PCA | Equal-Weight | Multiplication | Self-Employed | Operating Assets | Operating Income | 11–15 | Non-First-Tier Cities | Tracking Samples | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

| HPR stringency | 0.0696 ** | 0.0529 ** | 0.00256 ** | 0.0550 *** | 0.0481 *** | 0.0442 ** | 0.0738 *** | 0.0422 ** | 0.102 ** |

| (0.0286) | (0.0237) | (0.00107) | (0.0188) | (0.0223) | (0.0223) | (0.0268) | (0.0206) | (0.0452) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 27,616 | 27,616 | 27,616 | 27,616 | 27,616 | 27,616 | 15,062 | 18,572 | 8242 |

| R-squared | 0.734 | 0.734 | 0.734 | 0.688 | 0.691 | 0.705 | 0.756 | 0.740 | 0.733 |

| Dependent Variables | Enterprise Income | Enterprise Assets | Project Numbers | Employee Numbers |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| HPR stringency | 0.159 ** | 0.242 *** | 0.0199 *** | 0.0121 ** |

| (0.0619) | (0.0679) | (0.00765) | (0.00595) | |

| Controls | Yes | Yes | Yes | Yes |

| Household and year fixed effects | Yes | Yes | Yes | Yes |

| Observations | 27,341 | 27,341 | 27,341 | 27,341 |

| R-squared | 0.707 | 0.744 | 0.652 | 0.660 |

| Dependent Variables | Logarithmic Value of the Number of New Enterprises | |||

|---|---|---|---|---|

| Two-Way Fixed Effect | IV1 | IV2 | Both IVs | |

| (1) | (2) | (3) | (4) | |

| HPR stringency | 0.117 *** | 0.671 * | 0.865 * | 0.881 ** |

| (0.0419) | (0.381) | (0.490) | (0.438) | |

| Controls | Yes | Yes | Yes | Yes |

| Household and year fixed effects | Yes | Yes | Yes | Yes |

| Observations | 459 | 302 | 302 | 302 |

| R-squared | 0.971 | 0.163 | 0.355 | 0.411 |

| Dependent Variable: Entrepreneurship | ||||||

|---|---|---|---|---|---|---|

| 10 Control Cities | 20 Control Cities | |||||

| Entrepreneurship | Entrepreneurship | |||||

| (1) | (2) | (3) | (4) | (5) | (6) | |

| HPR | 0.0316 *** | 0.0626 *** | 0.0536 *** | 0.0234 *** | 0.0579 *** | 0.0528 *** |

| (0.0108) | (0.0201) | (0.0171) | (0.0070) | (0.0184) | (0.0203) | |

| Controls | No | Yes | Yes | No | Yes | Yes |

| Fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Time Trends | No | No | Yes | No | No | Yes |

| Observations | 8772 | 5749 | 5749 | 14,498 | 8351 | 8351 |

| R-squared | 0.587 | 0.590 | 0.597 | 0.424 | 0.426 | 0.434 |

| Dependent Variable: Entrepreneurship | ||||||

|---|---|---|---|---|---|---|

| 10 Control Cities | 20 Control Cities | |||||

| Dependent Variable | Opportunity | Necessity | Innovation | Opportunity | Necessity | Innovation |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| HPR | 0.0211 ** | 0.00938 | 0.0466 *** | 0.0106 ** | 0.00240 | 0.0399 *** |

| (0.00862) | (0.0127) | (0.0148) | (0.00476) | (0.0104) | (0.0118) | |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Time Trends | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 5749 | 5749 | 5749 | 8351 | 8351 | 8351 |

| R-squared | 0.539 | 0.512 | 0.512 | 0.546 | 0.518 | 0.512 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, Y.; Ma, Q.; Gan, L. The Impact of Curbing Housing Speculation on Household Entrepreneurship in China. Sustainability 2024, 16, 1913. https://doi.org/10.3390/su16051913

Sun Y, Ma Q, Gan L. The Impact of Curbing Housing Speculation on Household Entrepreneurship in China. Sustainability. 2024; 16(5):1913. https://doi.org/10.3390/su16051913

Chicago/Turabian StyleSun, Yongzhi, Qiong Ma, and Li Gan. 2024. "The Impact of Curbing Housing Speculation on Household Entrepreneurship in China" Sustainability 16, no. 5: 1913. https://doi.org/10.3390/su16051913

APA StyleSun, Y., Ma, Q., & Gan, L. (2024). The Impact of Curbing Housing Speculation on Household Entrepreneurship in China. Sustainability, 16(5), 1913. https://doi.org/10.3390/su16051913