Does Environmental Protection Law Bring about Greenwashing? Evidence from Heavy-Polluting Firms in China

Abstract

1. Introduction

2. Theory and Hypothesis Development

2.1. EPL and Greenwashing

2.2. EPL, Government Subsidy and Greenwashing

2.3. EPL, Slack Resources and Greenwashing

3. Data and Methodology

3.1. Data Sources

3.2. Variables

3.2.1. Dependent Variable

3.2.2. Independent Variables

3.2.3. Moderator Variables

3.2.4. Control Variables

3.3. Model

3.3.1. DID Model

3.3.2. Parallel Trend Test Model

3.3.3. Placebo Test Model

3.3.4. Expectation Effect Model

4. Results

4.1. Basic Results

4.2. Robustness Tests Results

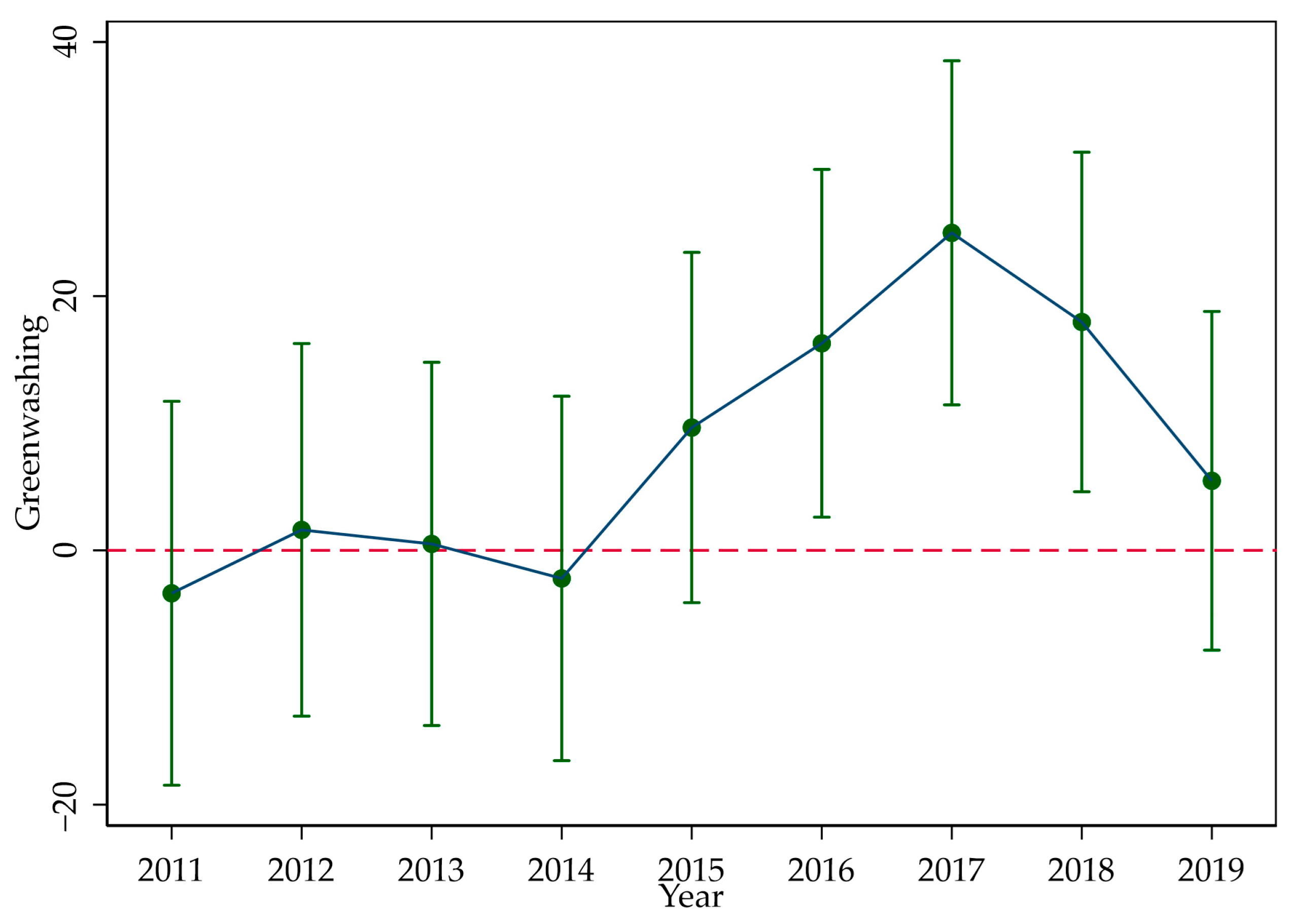

4.2.1. Parallel Trend Assumption

4.2.2. PSM-DID

4.2.3. Placebo Test

4.2.4. Other Robustness Tests

- Shorten time window

- 2.

- Expectation effect

4.3. Moderate Effect

4.4. Heterogeneity Analyses

4.4.1. Heterogeneity of Diversification Degree

4.4.2. Heterogeneity of Ownership Concentration

4.4.3. Heterogeneity of Firm Size

5. Discussion

5.1. Key Findings

5.2. Implications for Research

5.3. Implications for Practice

5.4. Limitaions and Future Research

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Skare, M.; Hasić, T. Corporate Governance, Firm Performance, and Economic Growth—Theoretical Analysis. J. Bus. Econ. Manag. 2016, 17, 35–51. [Google Scholar] [CrossRef]

- Mueller, P. Exploring the Knowledge Filter: How Entrepreneurship and University–Industry Relationships Drive Economic Growth. Res. Policy 2006, 35, 1499–1508. [Google Scholar] [CrossRef]

- Grossman, G.M.; Krueger, A.B. Economic Growth and the Environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- Huang, R.-J.; Zhang, Y.; Bozzetti, C.; Ho, K.-F.; Cao, J.-J.; Han, Y.; Daellenbach, K.R.; Slowik, J.G.; Platt, S.M.; Canonaco, F.; et al. High Secondary Aerosol Contribution to Particulate Pollution during Haze Events in China. Nature 2014, 514, 218–222. [Google Scholar] [CrossRef]

- Uddin, M.M.M. Revisiting the Impacts of Economic Growth on Environmental Degradation: New Evidence from 115 Countries. Environ. Ecol. Stat. 2021, 28, 153–185. [Google Scholar] [CrossRef]

- Yu, Y.; Li, K.; Duan, S.; Song, C. Economic Growth and Environmental Pollution in China: New Evidence from Government Work Reports. Energy Econ. 2023, 124, 106803. [Google Scholar] [CrossRef]

- Why Is China’s Smog So Bad? Researchers Point Far Away to a Melting Arctic. Available online: https://www.science.org/content/article/why-china-s-smog-so-bad-researchers-point-far-away-melting-arctic (accessed on 19 February 2024).

- Liu, Y.; Wang, A.; Wu, Y. Environmental Regulation and Green Innovation: Evidence from China’s New Environmental Protection Law. J. Clean. Prod. 2021, 297, 126698. [Google Scholar] [CrossRef]

- Fang, Z.; Kong, X.; Sensoy, A.; Cui, X.; Cheng, F. Government’s Awareness of Environmental Protection and Corporate Green Innovation: A Natural Experiment from the New Environmental Protection Law in China. Econ. Anal. Policy 2021, 70, 294–312. [Google Scholar] [CrossRef]

- Kourula, A.; Moon, J.; Salles-Djelic, M.-L.; Wickert, C. New Roles of Government in the Governance of Business Conduct: Implications for Management and Organizational Research. Organ. Stud. 2019, 40, 1101–1123. [Google Scholar] [CrossRef]

- Wang, L.; Wang, C.; Huang, R. Port-Based Supply Chain Decisions Considering Governmental Pollution Tax. Oper. Res. 2022, 22, 4769–4800. [Google Scholar] [CrossRef]

- Bosquet, B. Environmental Tax Reform: Does It Work? A Survey of the Empirical Evidence. Ecol. Econ. 2000, 34, 19–32. [Google Scholar] [CrossRef]

- Williams, R.C. Growing State–Federal Conflicts in Environmental Policy: The Role of Market-Based Regulation. J. Public Econ. 2012, 96, 1092–1099. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R.J.R.; Shimamoto, K. Industrial Characteristics, Environmental Regulations and Air Pollution: An Analysis of the UK Manufacturing Sector. J. Environ. Econ. Manag. 2005, 50, 121–143. [Google Scholar] [CrossRef]

- Xiang, D.; Lawley, C. The Impact of British Columbia’s Carbon Tax on Residential Natural Gas Consumption. Energy Econ. 2019, 80, 206–218. [Google Scholar] [CrossRef]

- Jia, W.; Xie, R.; Ma, C.; Gong, Z.; Wang, H. Environmental Regulation and Firms’ Emission Reduction—The Policy of Eliminating Backward Production Capacity as a Quasi-Natural Experiment. Energy Econ. 2024, 130, 107271. [Google Scholar] [CrossRef]

- Zhou, D.; Qiu, Y.; Wang, M. Does Environmental Regulation Promote Enterprise Profitability? Evidence from the Implementation of China’s Newly Revised Environmental Protection Law. Econ. Model. 2021, 102, 105585. [Google Scholar] [CrossRef]

- Shen, C.; Li, S.; Wang, X.; Liao, Z. The Effect of Environmental Policy Tools on Regional Green Innovation: Evidence from China. J. Clean. Prod. 2020, 254, 120122. [Google Scholar] [CrossRef]

- Zhang, D. Environmental Regulation, Green Innovation, and Export Product Quality: What Is the Role of Greenwashing? Int. Rev. Financ. Anal. 2022, 83, 102311. [Google Scholar] [CrossRef]

- Adomako, S.; Nguyen, N.P. Human Resource Slack, Sustainable Innovation, and Environmental Performance of Small and Medium-Sized Enterprises in Sub-Saharan Africa. Bus. Strategy Environ. 2020, 29, 2984–2994. [Google Scholar] [CrossRef]

- Lu, L.-H.; Wong, P.-K. Performance Feedback, Financial Slack and the Innovation Behavior of Firms. Asia Pac. J. Manag. 2019, 36, 1079–1109. [Google Scholar] [CrossRef]

- Troilo, G.; De Luca, L.M.; Atuahene-Gima, K. More Innovation with Less? A Strategic Contingency View of Slack Resources, Information Search, and Radical Innovation. J. Prod. Innov. Manag. 2014, 31, 259–277. [Google Scholar] [CrossRef]

- Yang, M.; Yuan, Y.; Yang, F.; Patino-Echeverri, D. Effects of Environmental Regulation on Firm Entry and Exit and China’s Industrial Productivity: A New Perspective on the Porter Hypothesis. Environ. Econ. Policy Stud. 2021, 23, 915–944. [Google Scholar] [CrossRef]

- Wang, C.; Lin, Y. Does Bargaining Power Mitigate the Relationship between Environmental Regulation and Firm Performance? Evidence from China. J. Clean. Prod. 2022, 331, 129859. [Google Scholar] [CrossRef]

- Wang, Q.; Xu, X.; Liang, K. The Impact of Environmental Regulation on Firm Performance: Evidence from the Chinese Cement Industry. J. Environ. Manag. 2021, 299, 113596. [Google Scholar] [CrossRef]

- Walker, K.; Wan, F. The Harm of Symbolic Actions and Green-Washing: Corporate Actions and Communications on Environmental Performance and Their Financial Implications. J. Bus. Ethics 2012, 109, 227–242. [Google Scholar] [CrossRef]

- Zhang, D. Green Financial System Regulation Shock and Greenwashing Behaviors: Evidence from Chinese Firms. Energy Econ. 2022, 111, 106064. [Google Scholar] [CrossRef]

- Cai, W.; Ye, P. How Does Environmental Regulation Influence Enterprises’ Total Factor Productivity? A Quasi-Natural Experiment Based on China’s New Environmental Protection Law. J. Clean. Prod. 2020, 276, 124105. [Google Scholar] [CrossRef]

- Lu, S.; Cheng, B. Does Environmental Regulation Affect Firms’ ESG Performance? Evidence from China. Manag. Decis. Econ. 2023, 44, 2004–2009. [Google Scholar] [CrossRef]

- Parguel, B.; Benoît-Moreau, F.; Larceneux, F. How Sustainability Ratings Might Deter “Greenwashing”: A Closer Look at Ethical Corporate Communication. J. Bus. Ethics 2011, 102, 15–28. [Google Scholar] [CrossRef]

- Hu, S.; Wang, A.; Du, K. Environmental Tax Reform and Greenwashing: Evidence from Chinese Listed Companies. Energy Econ. 2023, 124, 106873. [Google Scholar] [CrossRef]

- Zhang, D. Subsidy Expiration and Greenwashing Decision: Is There a Role of Bankruptcy Risk? Energy Econ. 2023, 118, 106530. [Google Scholar] [CrossRef]

- Yu, E.P.; Luu, B.V.; Chen, C.H. Greenwashing in Environmental, Social and Governance Disclosures. Res. Int. Bus. Financ. 2020, 52, 101192. [Google Scholar] [CrossRef]

- Zhang, D. Are Firms Motivated to Greenwash by Financial Constraints? Evidence from Global Firms’ Data. J. Int. Financ. Manag. Account. 2022, 33, 459–479. [Google Scholar] [CrossRef]

- DiMaggio, P.J.; Powell, W.W. The Iron Cage Revisited: Institutional Isomorphism and Collective Rationality in Organizational Fields. Am. Sociol. Rev. 1983, 48, 147. [Google Scholar] [CrossRef]

- Scott, W. Institutions and Organizations; Sage: Thousand Oaks, CA, USA, 1995. [Google Scholar]

- Peng, L.; Li, Y.; van Essen, M.; Peng, M.W. Institutions, Resources, and Strategic Orientations: A Meta-Analysis. Asia Pac. J. Manag. 2020, 37, 499–529. [Google Scholar] [CrossRef]

- Wang, X.; Chen, S.; Wang, Y. The Impact of Corporate Social Responsibility on Speed of OFDI under the Belt and Road Initiative. Sustainability 2023, 15, 8712. [Google Scholar] [CrossRef]

- Campbell, J.L. Why Would Corporations Behave in Socially Responsible Ways? An Institutional Theory of Corporate Social Responsibility. Acad. Manag. Rev. 2007, 32, 946–967. [Google Scholar] [CrossRef]

- Zeng, S.X.; Xu, X.D.; Yin, H.T.; Tam, C.M. Factors That Drive Chinese Listed Companies in Voluntary Disclosure of Environmental Information. J. Bus. Ethics 2012, 109, 309–321. [Google Scholar] [CrossRef]

- Ding, D.; Liu, B.; Chang, M. Carbon Emissions and TCFD Aligned Climate-Related Information Disclosures. J. Bus. Ethics 2023, 182, 967–1001. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Revisiting the Relation between Environmental Performance and Environmental Disclosure: An Empirical Analysis. Account. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Kong, D.; Liu, J.; Wang, Y.; Zhu, L. Employee Stock Ownership Plans and Corporate Environmental Engagement. J. Bus. Ethics 2024, 189, 177–199. [Google Scholar] [CrossRef]

- Lee, M.T.; Raschke, R.L. Stakeholder Legitimacy in Firm Greening and Financial Performance: What about Greenwashing Temptations?☆. J. Bus. Res. 2023, 155, 113393. [Google Scholar] [CrossRef]

- Li, F.; Lu, X.; Wang, J. Corporate Social Responsibility and Goodwill Impairment: Evidence from Charitable Donations of Chinese Listed Companies. Available online: https://www.researchgate.net/publication/367409847_Corporate_Social_Responsibility_and_Goodwill_Impairment_Evidence_from_Charitable_Donations_of_Chinese_Listed_Companies (accessed on 15 February 2024).

- Pope, S.; Peillex, J.; El Ouadghiri, I.; Gomes, M. Floodlight or Spotlight? Public Attention and the Selective Disclosure of Environmental Information. J. Manag. Stud. 2024. [Google Scholar] [CrossRef]

- Gollop, F.M.; Roberts, M.J. Environmental Regulations and Productivity Growth: The Case of Fossil-Fueled Electric Power Generation. J. Polit. Econ. 1983, 91, 654–674. [Google Scholar] [CrossRef]

- Ring, P.; Bigley, G.; D’Aunno, T.; Khanna, T. Perspectives on How Governments Matter. Acad. Manag. Rev. 2005, 30, 308–320. [Google Scholar] [CrossRef]

- Liu, D.; Chen, T.; Liu, X.; Yu, Y. Do More Subsidies Promote Greater Innovation? Evidence from the Chinese Electronic Manufacturing Industry. Econ. Model. 2019, 80, 441–452. [Google Scholar] [CrossRef]

- Kleine, M.; Heite, J.; Huber, L.R. Subsidized R&D Collaboration: The Causal Effect of Innovation Vouchers on Innovation Outcomes. Res. Policy 2022, 51, 104515. [Google Scholar] [CrossRef]

- Mulier, K.; Samarin, I. Sector Heterogeneity and Dynamic Effects of Innovation Subsidies: Evidence from Horizon 2020. Res. Policy 2021, 50, 104346. [Google Scholar] [CrossRef]

- Květoň, V.; Horák, P. The Effect of Public R&D Subsidies on Firms’ Competitiveness: Regional and Sectoral Specifics in Emerging Innovation Systems. Appl. Geogr. 2018, 94, 119–129. [Google Scholar] [CrossRef]

- Chen, J.; Lu, Q.; Heng, C.S.; Tan, B.C.Y. The Signaling Effect of Entrepreneurship Subsidies on Initial Public Offering Investor Valuation: An Anticorruption Campaign as a Quasi-Natural Experiment. Strateg. Entrep. J. 2023, 17, 633–670. [Google Scholar] [CrossRef]

- Chen, J.; Heng, C.S.; Tan, B.C.Y.; Lin, Z. The Distinct Signaling Effects of R&D Subsidy and Non-R&D Subsidy on IPO Performance of IT Entrepreneurial Firms in China. Res. Policy 2018, 47, 108–120. [Google Scholar] [CrossRef]

- Lerner, J. The Government as Venture Capitalist: The Long-Run Impact of the SBIR Program. J. Bus. 1999, 72, 285–318. [Google Scholar] [CrossRef]

- Meuleman, M.; De Maeseneire, W. Do R&D Subsidies Affect SMEs’ Access to External Financing? Res. Policy 2012, 41, 580–591. [Google Scholar] [CrossRef]

- Huang, Z.; Liao, G.; Li, Z. Loaning Scale and Government Subsidy for Promoting Green Innovation. Technol. Forecast. Soc. Chang. 2019, 144, 148–156. [Google Scholar] [CrossRef]

- Bentley, F.S.; Kehoe, R.R. Give Them Some Slack—They’re Trying to Change! The Benefits of Excess Cash, Excess Employees, and Increased Human Capital in the Strategic Change Context. Acad. Manag. J. 2020, 63, 181–204. [Google Scholar] [CrossRef]

- Tan, J.; Peng, M.W. Organizational Slack and Firm Performance during Economic Transitions: Two Studies from an Emerging Economy. Strateg. Manag. J. 2003, 24, 1249–1263. [Google Scholar] [CrossRef]

- Donnelly, R.; Purkayastha, S.; Manolova, T.S.; Edelman, L.F. Institutional Distance, Slack Resources, and Foreign Market Entry. J. Int. Bus. Stud. 2023, 55, 194–211. [Google Scholar] [CrossRef]

- Khan, S.J.; Mir, A.A. Ambidextrous Culture, Contextual Ambidexterity and New Product Innovations: The Role of Organizational Slack and Environmental Factors. Bus. Strategy Environ. 2019, 28, 652–663. [Google Scholar] [CrossRef]

- Modi, S.B.; Cantor, D.E. How Coopetition Influences Environmental Performance: Role of Financial Slack, Leverage, and Leanness. Prod. Oper. Manag. 2021, 30, 2046–2068. [Google Scholar] [CrossRef]

- Falco, S.E.D.; Renzi, A. The Role of Sunk Cost and Slack Resources in Innovation: A Conceptual Reading in an Entrepreneurial Perspective. Entrep. Res. J. 2015, 5, 167–179. [Google Scholar] [CrossRef]

- Bourgeois, L.J. On the Measurement of Organizational Slack. Acad. Manag. Rev. 1981, 6, 29–39. [Google Scholar] [CrossRef]

- Liu, H.; Ding, X.; Guo, H.; Luo, J. How Does Slack Affect Product Innovation in High-Tech Chinese Firms: The Contingent Value of Entrepreneurial Orientation. Asia Pac. J. Manag. 2014, 31, 47–68. [Google Scholar] [CrossRef]

- Lin, W.-T. How Do Managers Decide on Internationalization Processes? The Role of Organizational Slack and Performance Feedback. J. World Bus. 2014, 49, 396–408. [Google Scholar] [CrossRef]

- Wong, C.W.Y.; Lai, K.-H.; Shang, K.-C.; Lu, C.-S. Uncovering the Value of Green Advertising for Environmental Management Practices. Bus. Strategy Environ. 2014, 23, 117–130. [Google Scholar] [CrossRef]

- Tang, K.; Qiu, Y.; Zhou, D. Does Command-and-Control Regulation Promote Green Innovation Performance? Evidence from China’s Industrial Enterprises. Sci. Total Environ. 2020, 712, 136362. [Google Scholar] [CrossRef] [PubMed]

- Jacquemin, A.P.; Berry, C.H. Entropy Measure of Diversification and Corporate Growth. J. Ind. Econ. 1979, 27, 359–369. [Google Scholar] [CrossRef]

- Song, H.J.; Kang, K.H. The Moderating Effect of CEO Duality on the Relationship between Geographic Diversification and Firm Performance in the US Lodging Industry. Int. J. Contemp. Hosp. Manag. 2019, 31, 1488–1504. [Google Scholar] [CrossRef]

- Huang, C.J.; Liao, T.-L.; Chang, Y.-S. Over-Investment, the Marginal Value of Cash Holdings and Corporate Governance. Stud. Econ. Financ. 2015, 32, 204–221. [Google Scholar] [CrossRef]

- Thakur, A.; Bhatia, A. Firm-Specific Antecedents Affecting Product Diversification: Evidence from India. Transnatl. Corp. Rev. 2021, 13, 293–306. [Google Scholar] [CrossRef]

- Chen, S.; Xu, K.; Nguyen, L.T.; Yu, G. TMT’s Attention towards Financial Goals and Innovation Investment: Evidence from China. Sustainability 2018, 10, 4236. [Google Scholar] [CrossRef]

- Wang, K.; Shailer, G. Ownership Concentration and Firm Performance in Emerging Markets: A Meta-Analysis. J. Econ. Surv. 2015, 29, 199–229. [Google Scholar] [CrossRef]

- Carney, M.; Gedajlovic, E. The Coupling of Ownership and Control and the Allocation of Financial Resources: Evidence from Hong Kong. J. Manag. Stud. 2002, 39, 123–146. [Google Scholar] [CrossRef]

- Chen, J.; Hong, H.; Stein, J.C. Forecasting Crashes: Trading Volume, Past Returns, and Conditional Skewness in Stock Prices. J. Financ. Econ. 2001, 61, 345–381. [Google Scholar] [CrossRef]

- Branstetter, L.G.; Li, G.; Ren, M. Picking Winners? Government Subsidies and Firm Productivity in China. J. Comp. Econ. 2023, 51, 1186–1199. [Google Scholar] [CrossRef]

- Elsayed, K. Reexamining the Expected Effect of Available Resources and Firm Size on Firm Environmental Orientation: An Empirical Study of UK Firms. J. Bus. Ethics 2006, 65, 297–308. [Google Scholar] [CrossRef]

- Huang, W.; Chen, S.; Nguyen, L.T. Corporate Social Responsibility and Organizational Resilience to COVID-19 Crisis: An Empirical Study of Chinese Firms. Sustainability 2020, 12, 8970. [Google Scholar] [CrossRef]

- He, F.; Qin, S.; Liu, Y.; Wu, J. CSR and Idiosyncratic Risk: Evidence from ESG Information Disclosure. Finance Res. Lett. 2022, 49, 102936. [Google Scholar] [CrossRef]

- He, L.; Liu, R.; Zhong, Z.; Wang, D.; Xia, Y. Can Green Financial Development Promote Renewable Energy Investment Efficiency? A Consideration of Bank Credit. Renew. Energy 2019, 143, 974–984. [Google Scholar] [CrossRef]

| Code | Description | Code | Description |

|---|---|---|---|

| B6 | Coal mining and dressing industry | C25 | Industries of petroleum processing, coking, and nuclear fuel processing |

| B7 | Oil and natural gas exploitation industry | C26 | Manufacturing of chemical raw materials and chemical products |

| B8 | Ferrous metal ore mining and dressing industry | C27 | Pharmaceutical industry |

| B9 | Non-ferrous metal ore mining and dressing industry | C28 | Chemical fiber manufacturing |

| B10 | Non-metallic ore mining and dressing industry | C29 | Industry of rubber and plastic products |

| C15 | Alcohol, beverage and refined tea manufacturing | C30 | Industry of non-metallic mineral products |

| C17 | Textile industry | C31 | Industry of ferrous metal smelting and rolling processing |

| C18 | Textile garment and apparel industry | C32 | Industry of non-ferrous metal smelting and rolling processing |

| C19 | Leathers, furs, feathers and related products and footwear industry | D44 | Industry of electric power and heat production and supply |

| C22 | Papermaking and paper product industry |

| Variables | Obs | Mean | S.D. | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|---|---|---|

| (1) Greenwashing | 9283 | 4.416 | 1.034 | 1.000 | |||||

| (2) ESG_Per | 9283 | 20.86 | 6.979 | −0.596 *** | 1.000 | ||||

| (3) ESG_Dis | 9283 | 0.0129 | 1.163 | 0.588 *** | 0.298 *** | 1.000 | |||

| (4) Inds | 9283 | 0.476 | 0.202 | 0.060 *** | 0.003 | 0.074 *** | 1.000 | ||

| (5) Size | 9283 | 1.947 | 1.543 | 0.224 *** | 0.187 *** | 0.454 *** | −0.059 *** | 1.000 | |

| (6) AssGr | 9283 | 0.538 | 0.499 | −0.040 *** | −0.007 | −0.056 *** | −0.050 *** | 0.001 | 1.000 |

| (7) TobinQ | 9283 | 51.02 | 16.30 | −0.063 *** | −0.076 *** | −0.151 *** | 0.034 *** | −0.381 *** | 0.049 *** |

| (8) BroSiz | 9283 | 37.60 | 5.883 | 0.077 *** | 0.010 | 0.101 *** | 0.058 *** | 0.215 *** | −0.034 *** |

| (9) IndDirPro | 9283 | 9.013 | 1.859 | −0.025 ** | 0.088 *** | 0.059 *** | −0.070 *** | 0.097 *** | 0.005 |

| (10) OwnCon | 9283 | 0.149 | 0.521 | 0.107 *** | 0.070 *** | 0.199 *** | 0.003 | 0.315 *** | −0.011 |

| (11) FixAss | 9283 | 0.235 | 0.182 | 0.171 *** | −0.082 *** | 0.121 *** | 0.338 *** | 0.094 *** | −0.113 *** |

| (12) Lev | 9283 | 0.335 | 0.472 | 0.146 *** | −0.026 ** | 0.148 *** | −0.102 *** | 0.499 *** | −0.030 *** |

| (13) SOE | 9283 | 23.11 | 1.350 | 0.075 *** | 0.111 *** | 0.202 *** | −0.027 ** | 0.310 *** | −0.091 *** |

| (14) Sub | 9281 | 16.75 | 3.061 | 0.070 *** | 0.081 *** | 0.165 *** | 0.001 | 0.283 *** | 0.004 |

| (15) Slack | 9147 | 2.024 | 3.553 | −0.088 *** | 0.005 | −0.099 *** | 0.038 *** | −0.209 *** | 0.019 * |

| Variables | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | (15) |

| (7) TobinQ | 1.000 | ||||||||

| (8) BroSiz | −0.146 *** | 1.000 | |||||||

| (9) IndDirPro | 0.033 *** | −0.396 *** | 1.000 | ||||||

| (10) OwnCon | −0.106 *** | 0.072 *** | 0.072 *** | 1.000 | |||||

| (11) FixAss | −0.151 *** | 0.194 *** | −0.049 *** | 0.113 *** | 1.000 | ||||

| (12) Lev | −0.349 *** | 0.116 *** | 0.032 *** | 0.061 *** | 0.077 *** | 1.000 | |||

| (13) SOE | −0.188 *** | 0.269 *** | 0.001 | 0.204 *** | 0.183 *** | 0.240 *** | 1.000 | ||

| (14) Sub | −0.098 *** | 0.043 *** | 0.038 *** | 0.056 *** | 0.048 *** | 0.096 *** | 0.013 | 1.000 | |

| (15) Slack | 0.198 *** | −0.090 *** | 0.005 | 0.001 | −0.176 *** | −0.391 *** | −0.115 *** | −0.082 *** | 1.000 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | Greenwashing | Greenwashing | ESG Performance | ESG Disclosure |

| Post × Treat | 0.1243 *** | 0.1316 *** | −0.0324 | 0.7190 *** |

| (0.0355) | (0.0357) | (0.0319) | (0.1656) | |

| Size | −0.0598 ** | 0.2910 *** | 1.5517 *** | |

| (0.0245) | (0.0219) | (0.1137) | ||

| AssGr | −0.0289 * | 0.0188 | −0.0778 | |

| (0.0166) | (0.0148) | (0.0769) | ||

| TobinQ | 0.0035 | 0.0261 *** | 0.2028 *** | |

| (0.0083) | (0.0074) | (0.0386) | ||

| BroSiz | −0.0082 | 0.0031 | −0.0376 | |

| (0.0102) | (0.0091) | (0.0472) | ||

| IndDirPro | −0.0099 *** | 0.0127 *** | 0.0157 | |

| (0.0025) | (0.0022) | (0.0115) | ||

| OwnCon | 0.0004 | 0.0010 | 0.0096 | |

| (0.0014) | (0.0012) | (0.0063) | ||

| FixAss | 0.3195 *** | −0.2619 ** | 0.4984 | |

| (0.1231) | (0.1102) | (0.5715) | ||

| Lev | 0.5299 *** | −0.7592 *** | −1.3824 *** | |

| (0.0916) | (0.0820) | (0.4250) | ||

| SOE | −0.0890 | 0.1504 ** | 0.3882 | |

| (0.0670) | (0.0600) | (0.3108) | ||

| Constant | −0.0144 | 1.5086 *** | −2.5673 *** | −15.9474 *** |

| (0.0109) | (0.5716) | (0.5117) | (2.6527) | |

| Firm FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 9276 | 9276 | 9276 | 9276 |

| R-squared | 0.6455 | 0.6485 | 0.6436 | 0.7895 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variables | Greenwashing | ESG Performance | ESG Disclosure | ||

| PSM-DID | 2013–2017 | Expectation Effect | |||

| Post × Treat | 0.1327 *** | 0.1612 *** | 0.1448 ** | −0.0776 | 0.5054 * |

| (0.0357) | (0.0410) | (0.0582) | (0.0521) | (0.2698) | |

| Treat2014 | −0.0167 | 0.0620 | 0.3030 | ||

| (0.0629) | (0.0563) | (0.2917) | |||

| Size | −0.0530 ** | −0.0694 * | −0.0530 ** | 0.2851 *** | 1.5598 *** |

| (0.0248) | (0.0418) | (0.0248) | (0.0222) | (0.1151) | |

| AssGr | −0.0892 *** | 0.0441 | −0.0893 *** | 0.0786 *** | −0.1024 |

| (0.0316) | (0.0367) | (0.0316) | (0.0283) | (0.1465) | |

| TobinQ | 0.0042 | −0.0142 | 0.0041 | 0.0259 *** | 0.2057 *** |

| (0.0083) | (0.0127) | (0.0083) | (0.0075) | (0.0386) | |

| BroSiz | −0.0099 | −0.0201 | −0.0099 | 0.0042 | −0.0421 |

| (0.0102) | (0.0149) | (0.0102) | (0.0092) | (0.0474) | |

| IndDirPro | −0.0099 *** | −0.0167 *** | −0.0099 *** | 0.0122 *** | 0.0121 |

| (0.0025) | (0.0036) | (0.0025) | (0.0023) | (0.0118) | |

| OwnCon | 0.0006 | 0.0020 | 0.0006 | 0.0010 | 0.0114 * |

| (0.0014) | (0.0020) | (0.0014) | (0.0012) | (0.0063) | |

| FixAss | 0.2768 ** | 0.2956 | 0.2776 ** | −0.2189 * | 0.4924 |

| (0.1250) | (0.1805) | (0.1250) | (0.1119) | (0.5797) | |

| Lev | 0.5177 *** | 0.3469 ** | 0.5171 *** | −0.7378 *** | −1.3282 *** |

| (0.0924) | (0.1381) | (0.0924) | (0.0827) | (0.4287) | |

| SOE | −0.0865 | −0.1804 * | −0.0866 | 0.1586 *** | 0.4611 |

| (0.0675) | (0.1084) | (0.0675) | (0.0604) | (0.3130) | |

| Constant | 1.3751 ** | 2.1268 ** | 1.3784 ** | −2.4598 *** | −16.1459 *** |

| (0.5785) | (0.9730) | (0.5786) | (0.5179) | (2.6833) | |

| Firm FE | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| Observations | 9225 | 4577 | 9225 | 9225 | 9225 |

| R-squared | 0.6480 | 0.7626 | 0.6480 | 0.6439 | 0.7881 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | Greenwashing | |||

| Low Subsidy | High Subsidy | Low Slack | High Slack | |

| Post × Treat | 0.0700 | 0.2440 *** | 0.1407 * | 0.0506 |

| (0.0751) | (0.0938) | (0.0835) | (0.0898) | |

| Size | −0.1299 ** | −0.1192 * | −0.1222 ** | 0.0460 |

| (0.0606) | (0.0697) | (0.0578) | (0.0584) | |

| AssGr | −0.0434 | −0.0117 | −0.0420 ** | −0.0684 *** |

| (0.0345) | (0.0318) | (0.0207) | (0.0254) | |

| TobinQ | −0.0101 | 0.0027 | 0.0533 * | −0.0002 |

| (0.0103) | (0.0211) | (0.0299) | (0.0125) | |

| BroSiz | 0.0021 | −0.0208 | −0.0055 | −0.0098 |

| (0.0210) | (0.0228) | (0.0222) | (0.0236) | |

| IndDirPro | −0.0122 ** | −0.0110 ** | −0.0051 | −0.0160 *** |

| (0.0052) | (0.0048) | (0.0050) | (0.0055) | |

| OwnCon | −0.0017 | 0.0024 | 0.0022 | −0.0027 |

| (0.0028) | (0.0035) | (0.0031) | (0.0034) | |

| FixAss | 0.2971 | 0.2030 | 0.2586 | 0.1902 |

| (0.2202) | (0.3320) | (0.2422) | (0.3268) | |

| Lev | 0.4231 *** | 0.7548 *** | 0.3784 * | 0.3913 * |

| (0.1531) | (0.2304) | (0.2133) | (0.2079) | |

| SOE | −0.1349 | 0.0573 | 0.0958 | −0.1329 |

| (0.0905) | (0.1250) | (0.1190) | (0.1166) | |

| Constant | 3.1314 ** | 2.9385 * | 2.8088 ** | −0.5670 |

| (1.3839) | (1.6783) | (1.4060) | (1.3368) | |

| Firm FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 4510 | 4525 | 4484 | 4477 |

| R-squared | 0.6596 | 0.6972 | 0.6607 | 0.6707 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | Greenwashing | |||

| High Diversity HHI | Low Diversity HHI | Low Diversity Entropy | High Diversity Entropy | |

| Post × Treat | 0.2568 *** | 0.0775 | 0.0801 | 0.2548 *** |

| (0.0984) | (0.0805) | (0.0805) | (0.0985) | |

| Constant | 1.1409 | 1.2090 | 1.3304 | 1.1235 |

| (1.4521) | (1.3821) | (1.3608) | (1.4604) | |

| Controls | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 4431 | 4414 | 4417 | 4434 |

| R-squared | 0.6815 | 0.6775 | 0.6771 | 0.6804 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | Greenwashing | |||

| Low Concentration Largest Holder | High Concentration Largest Holder | Low Concentration Top 10 Holder | High Concentration Top 10 Holder | |

| Post × Treat | −0.0016 | 0.2462 *** | 0.0723 | 0.1653 * |

| (0.0859) | (0.0869) | (0.0814) | (0.0867) | |

| Constant | 2.2688 | 1.7063 | 4.0084 *** | 2.4697 * |

| (1.4480) | (1.5328) | (1.3718) | (1.4711) | |

| Controls | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 4603 | 4608 | 4584 | 4568 |

| R-squared | 0.6603 | 0.6761 | 0.6621 | 0.6919 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | Greenwashing | |||

| Small Size Log (Asset) | Large Size Log (Asset) | Small Size Log (Market Capitalization) | Large Size Log (Market Capitalization) | |

| Post × Treat | 0.0025 | 0.2719 *** | 0.0484 | 0.3110 *** |

| (0.0737) | (0.0972) | (0.0772) | (0.1018) | |

| Constant | 0.3166 | 0.1327 | 0.5480 | −0.2718 |

| (0.4107) | (0.4282) | (0.4306) | (0.4114) | |

| Controls | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 4576 | 4582 | 4553 | 4535 |

| R-squared | 0.6328 | 0.6922 | 0.6316 | 0.7085 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Y.; Chen, S.; Li, Y.; Ramos, D.L. Does Environmental Protection Law Bring about Greenwashing? Evidence from Heavy-Polluting Firms in China. Sustainability 2024, 16, 1782. https://doi.org/10.3390/su16051782

Zhang Y, Chen S, Li Y, Ramos DL. Does Environmental Protection Law Bring about Greenwashing? Evidence from Heavy-Polluting Firms in China. Sustainability. 2024; 16(5):1782. https://doi.org/10.3390/su16051782

Chicago/Turabian StyleZhang, Ying, Shouming Chen, Yujia Li, and Disney Leite Ramos. 2024. "Does Environmental Protection Law Bring about Greenwashing? Evidence from Heavy-Polluting Firms in China" Sustainability 16, no. 5: 1782. https://doi.org/10.3390/su16051782

APA StyleZhang, Y., Chen, S., Li, Y., & Ramos, D. L. (2024). Does Environmental Protection Law Bring about Greenwashing? Evidence from Heavy-Polluting Firms in China. Sustainability, 16(5), 1782. https://doi.org/10.3390/su16051782