Multivariate Analysis of the Sustainable Development of the Silver Economy in the European Union Countries

Abstract

1. Introduction

2. Silver Economy

- Improving the health and quality of life of Europeans with a focus on older people;

- Supporting the long-term sustainability and efficiency of health and social care systems;

- Enhancing the competitiveness of EU industry through business and expansion in new markets.

3. Research Methodology and Data

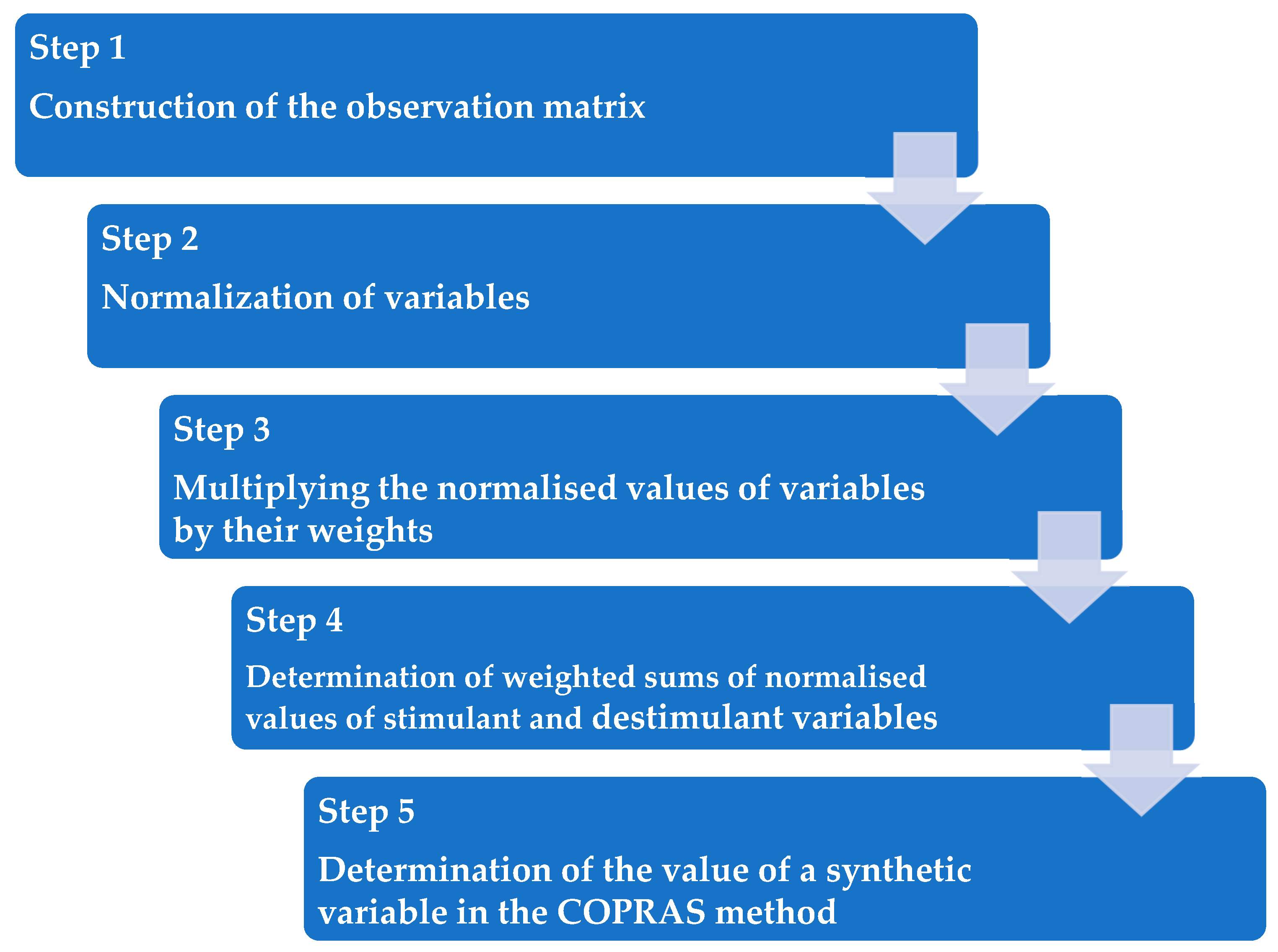

3.1. The COPRAS Method in a Dynamic Approach

- Step 1

- Step 2

- Step 3

- Step 4

- Step 5

- ;

- —the best object in period t, for t = 1, …, T;

- —the worst object in period t, for t = 1, …, T.

3.2. Analysis of the Dynamics of the Synthetic Variable—The DTW Method

- Boundary, meaning that the first (last) element of the first sequence must be matched with the first (last) element of the second one;

- Monotonicity, meaning that warping path can move only right or up or right-up of its current position;

- Step size, meaning that every index from the sequence X must be matched with at least one index from the sequence Y.

3.3. Data Used in This Study

- x1—share of population aged 65+ in total population—destimulant;

- x2—old-age dependency ratio—destimulant;

- x3—activity ratio of persons aged 65+—stimulant;

- x4—employment ratio of persons aged 55–64—stimulant;

- x5—share of old age pensions in GDP—destimulant;

- x6—share of inactive persons aged 55–74 willing to work, but not seeking employment—destimulant;

- x7—at-risk-of-poverty rate for pensioners aged 65+—destimulant;

- x8—share of social protection benefits for elderly persons in GDP—destimulant.

4. Results of Empirical Analysis

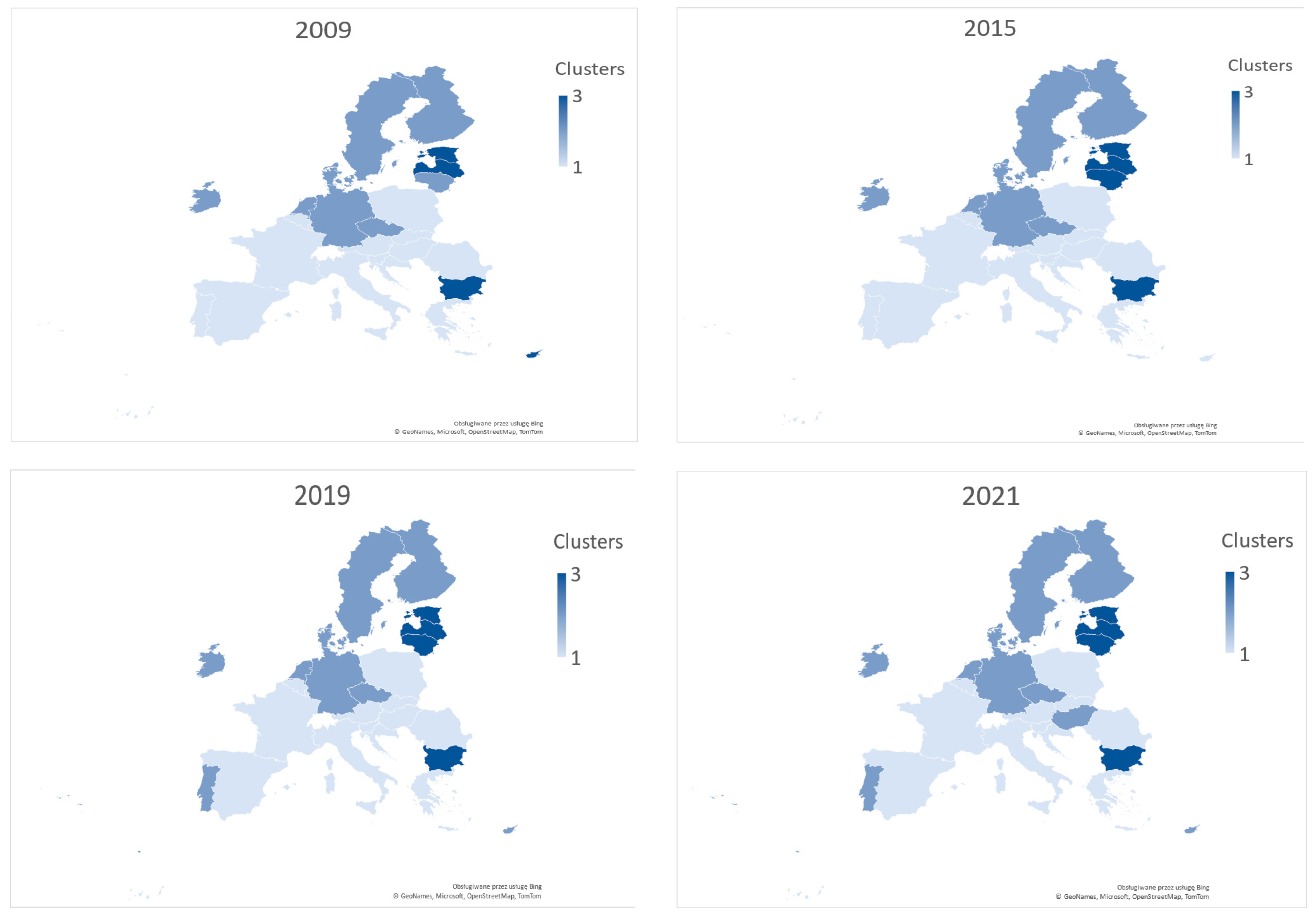

4.1. Results of Cluster Analysis in 2009, 2015, 2019, 2021

- Czechia, Denmark, Finland, Germany, Ireland, The Netherlands, and Sweden.

- Austria, Belgium, Croatia, France, Greece, Italy, Luxembourg, Malta, Poland, Slovakia, Slovenia, Spain, and Romania.

- Bulgaria, Estonia, and Latvia.

4.2. Rankings of the EU Countries (2009–2021)

- The following countries were in the best situation in terms of selected variables compared to other EU countries in the period 2009–2021: Estonia (2011–2021), Cyprus (2009–2011), Portugal (2009–2014), Ireland (2015–2021), Romania (2009), and Sweden (2010, 2012–2021).

- The worst situation in terms of selected variables compared to other EU countries in the period 2009–2021 was observed in the following countries: Belgium (2009–2012, 2021), Greece (2012–2018), Spain (2013–2015), France (2009–2010), Croatia (2016–2021), Luxembourg (2016–2020), Hungary (2009–2015), Romania (2021), Slovenia (2019–2020), and Slovakia (2011).

- High percentage of elderly people,

- High burden on GDP with pensions, and

- Lower professional activity due to potentially higher pensions.

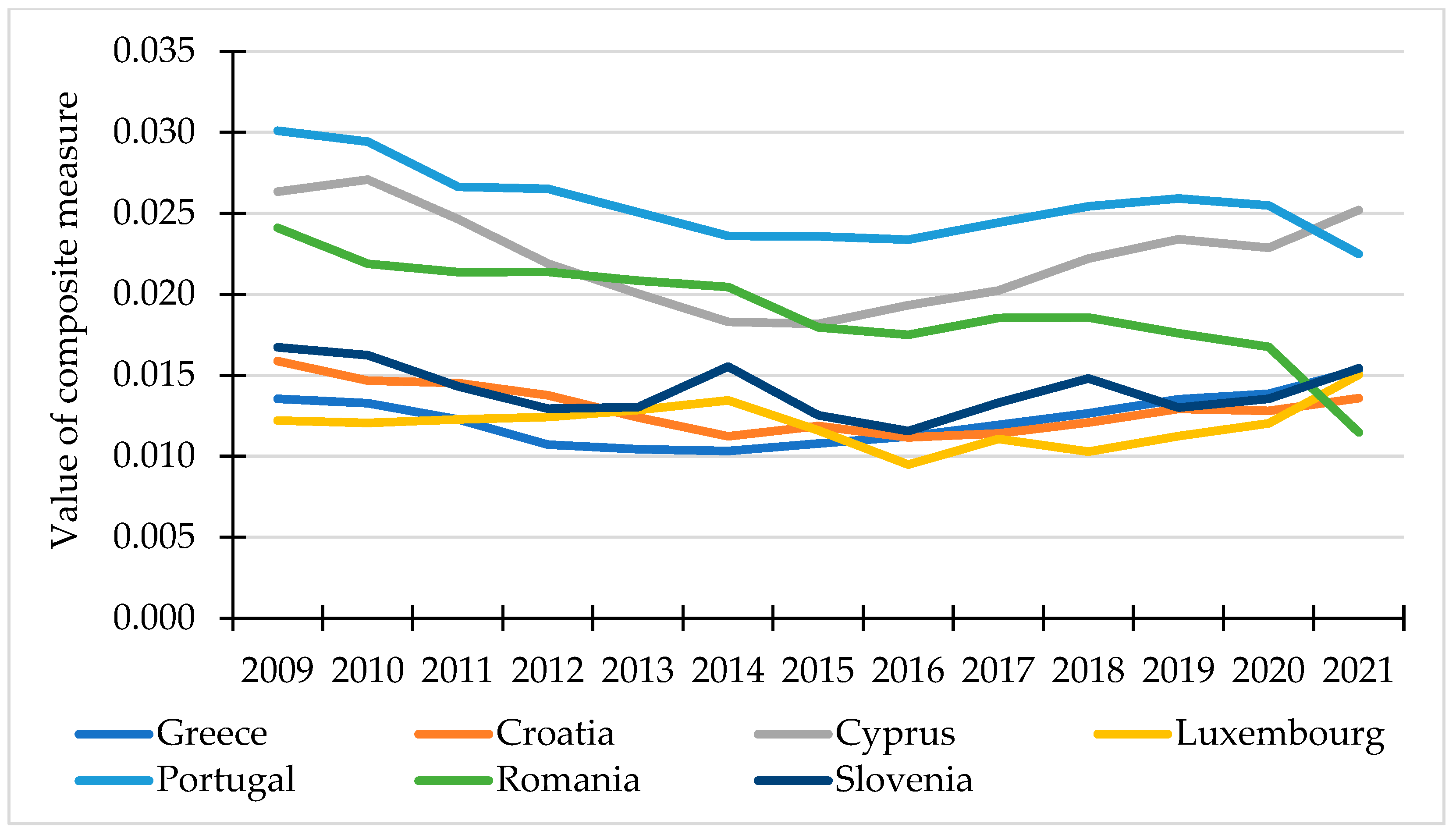

4.3. Clustering Countries According to the Dynamics of the Synthetic Variable

- The first cluster consisted of Romania, Croatia, Portugal, Luxembourg, Slovenia, Greece, Cyprus (Figure 5). In these countries, the value of the synthetic variable decreased or remained more or less constant in the years 2009–2021.

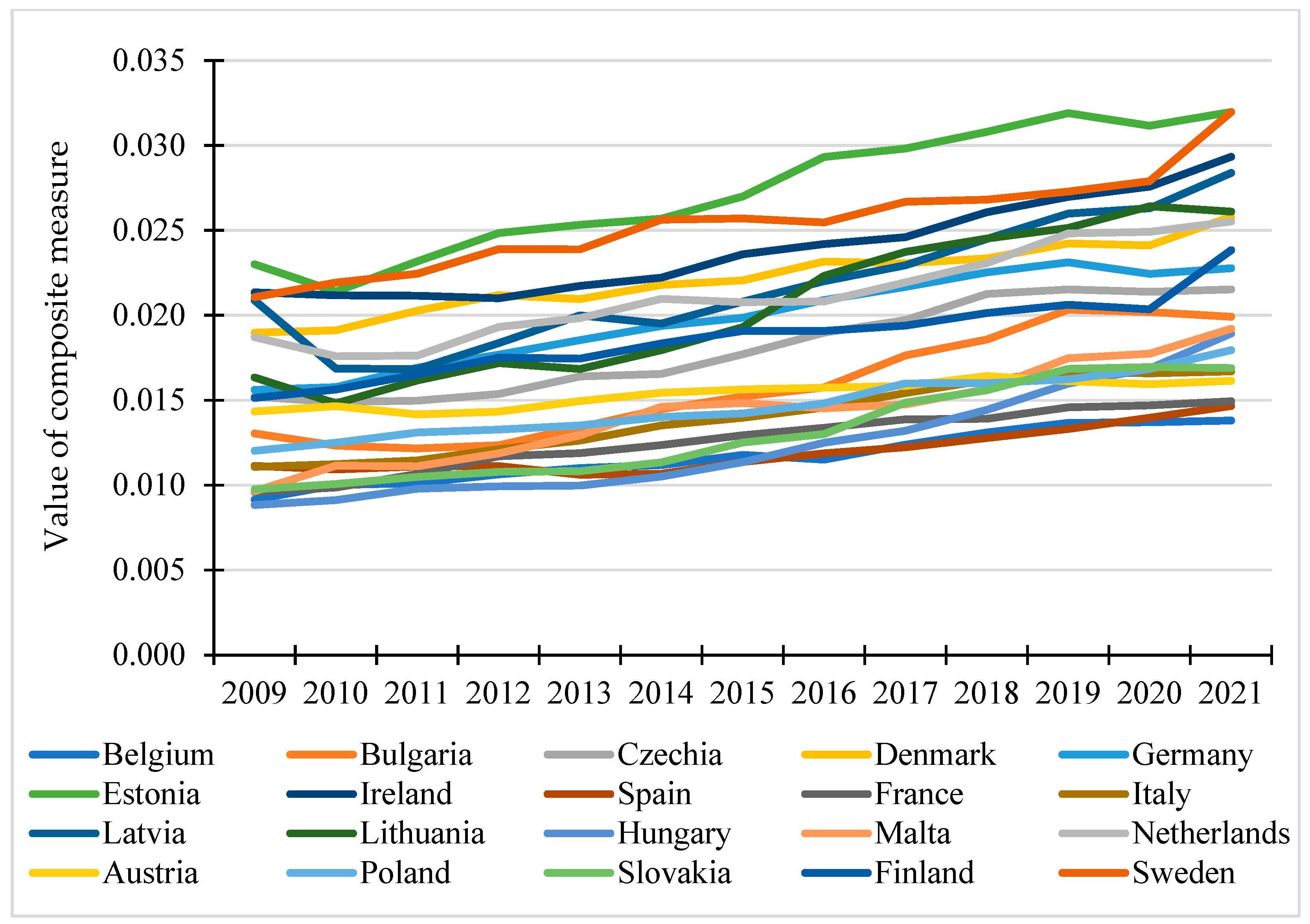

- The second cluster included the remaining EU countries in which the value of the synthetic variable increased in the years 2009–2021 (Figure 6).

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Descriptive Statistics | Variables | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| x2 | x3 | x4 | x5 | x6 | x7 | x2 | x3 | x4 | x5 | x6 | x7 | |

| 2009 | 2010 | |||||||||||

| min | 16.00 | 1.40 | 29.10 | 4.10 | 0.66 | 4.20 | 16.50 | 1.50 | 29.30 | 3.90 | 0.72 | 3.70 |

| max | 30.90 | 17.00 | 68.60 | 11.50 | 12.44 | 53.50 | 31.40 | 16.50 | 69.10 | 11.60 | 12.53 | 42.30 |

| mean | 24.07 | 5.86 | 44.58 | 7.41 | 3.89 | 20.60 | 24.43 | 5.64 | 44.51 | 7.57 | 4.17 | 16.09 |

| median | 25.20 | 4.90 | 43.00 | 7.00 | 3.04 | 19.40 | 25.60 | 4.70 | 42.80 | 7.00 | 3.43 | 16.20 |

| standard deviation | 3.75 | 3.80 | 9.89 | 1.77 | 2.62 | 12.06 | 3.76 | 3.61 | 9.31 | 1.80 | 2.85 | 8.39 |

| coefficient of variation | 0.16 | 0.65 | 0.22 | 0.24 | 0.67 | 0.59 | 0.15 | 0.64 | 0.21 | 0.24 | 0.68 | 0.52 |

| skewness | −0.40 | 1.21 | 0.38 | 0.44 | 1.42 | 1.22 | −0.41 | 1.35 | 0.52 | 0.33 | 1.30 | 1.13 |

| 2011 | 2012 | |||||||||||

| min | 17.20 | 1.80 | 29.30 | 4.00 | 0.72 | 3.50 | 17.80 | 1.80 | 30.90 | 4.10 | 1.04 | 4.40 |

| max | 31.40 | 14.50 | 70.70 | 12.70 | 12.10 | 37.80 | 32.00 | 14.60 | 71.60 | 13.90 | 13.73 | 31.20 |

| mean | 24.80 | 5.57 | 45.17 | 7.58 | 4.54 | 15.19 | 25.36 | 5.67 | 46.08 | 7.80 | 4.97 | 14.93 |

| median | 25.90 | 4.90 | 42.70 | 7.00 | 3.57 | 14.50 | 26.50 | 5.00 | 44.20 | 7.30 | 4.24 | 14.80 |

| standard deviation | 3.76 | 3.24 | 9.85 | 2.01 | 2.73 | 7.93 | 3.80 | 3.22 | 9.94 | 2.19 | 2.88 | 6.33 |

| coefficient of variation | 0.15 | 0.58 | 0.22 | 0.27 | 0.60 | 0.52 | 0.15 | 0.57 | 0.22 | 0.28 | 0.58 | 0.42 |

| skewness | −0.47 | 1.09 | 0.54 | 0.64 | 1.12 | 0.94 | −0.53 | 1.00 | 0.60 | 0.80 | 1.11 | 0.51 |

| 2013 | 2014 | |||||||||||

| min | 18.40 | 1.70 | 31.50 | 4.20 | 1.38 | 4.30 | 19.00 | 1.70 | 33.00 | 4.40 | 1.14 | 4.40 |

| max | 32.70 | 13.30 | 72.30 | 13.00 | 12.14 | 28.60 | 33.10 | 11.90 | 72.80 | 13.50 | 11.68 | 35.40 |

| mean | 26.00 | 5.61 | 47.27 | 8.04 | 5.41 | 14.07 | 26.69 | 5.77 | 48.65 | 8.10 | 5.18 | 14.46 |

| median | 26.90 | 5.10 | 45.20 | 7.70 | 4.67 | 13.50 | 27.40 | 5.40 | 46.00 | 7.20 | 4.81 | 13.90 |

| standard deviation | 3.81 | 3.03 | 10.06 | 2.22 | 2.78 | 6.17 | 3.81 | 2.91 | 10.08 | 2.32 | 2.76 | 7.30 |

| coefficient of variation | 0.15 | 0.54 | 0.21 | 0.28 | 0.51 | 0.44 | 0.14 | 0.50 | 0.21 | 0.29 | 0.53 | 0.50 |

| skewness | −0.58 | 0.79 | 0.55 | 0.44 | 0.45 | 0.41 | −0.63 | 0.46 | 0.47 | 0.52 | 0.40 | 1.02 |

| 2015 | 2016 | |||||||||||

| min | 19.70 | 1.90 | 32.70 | 4.60 | 1.30 | 4.30 | 20.20 | 1.40 | 35.30 | 4.60 | 1.18 | 5.70 |

| max | 33.70 | 11.80 | 73.20 | 14.30 | 11.55 | 39.80 | 34.30 | 13.50 | 74.10 | 14.30 | 17.29 | 45.50 |

| mean | 27.40 | 5.76 | 50.30 | 8.03 | 4.91 | 15.74 | 28.03 | 5.81 | 52.40 | 7.99 | 5.05 | 16.68 |

| median | 27.90 | 5.30 | 48.30 | 7.30 | 4.14 | 14.00 | 28.30 | 5.00 | 50.50 | 7.00 | 4.56 | 14.20 |

| standard deviation | 3.79 | 2.83 | 10.21 | 2.46 | 2.80 | 9.04 | 3.79 | 3.09 | 10.27 | 2.45 | 3.34 | 9.61 |

| coefficient of variation | 0.14 | 0.49 | 0.20 | 0.31 | 0.57 | 0.57 | 0.14 | 0.53 | 0.20 | 0.31 | 0.66 | 0.58 |

| skewness | −0.65 | 0.58 | 0.25 | 0.62 | 0.60 | 1.22 | −0.67 | 0.58 | 0.15 | 0.66 | 1.83 | 1.54 |

| 2017 | 2018 | |||||||||||

| min | 20.50 | 2.10 | 36.90 | 4.40 | 1.35 | 7.00 | 20.60 | 1.90 | 38.60 | 4.20 | 1.40 | 6.40 |

| max | 34.80 | 13.50 | 75.20 | 13.70 | 15.20 | 46.60 | 35.20 | 14.20 | 76.70 | 13.20 | 15.26 | 53.80 |

| mean | 28.64 | 6.18 | 54.63 | 7.93 | 4.76 | 17.82 | 29.25 | 6.50 | 56.85 | 7.88 | 4.70 | 19.00 |

| median | 28.70 | 5.50 | 53.50 | 7.60 | 4.08 | 14.60 | 29.60 | 5.80 | 55.90 | 7.50 | 3.58 | 15.40 |

| standard deviation | 3.78 | 3.04 | 10.17 | 2.41 | 2.96 | 10.62 | 3.79 | 3.17 | 10.07 | 2.39 | 3.38 | 11.96 |

| coefficient of variation | 0.13 | 0.49 | 0.19 | 0.30 | 0.62 | 0.60 | 0.13 | 0.49 | 0.18 | 0.30 | 0.72 | 0.63 |

| skewness | −0.72 | 0.54 | 0.04 | 0.51 | 1.71 | 1.49 | −0.76 | 0.51 | −0.06 | 0.42 | 1.74 | 1.66 |

| 2019 | 2020 | |||||||||||

| min | 20.70 | 2.30 | 40.40 | 4.10 | 1.02 | 7.40 | 20.90 | 2.80 | 41.50 | 4.00 | 1.04 | 7.10 |

| max | 35.80 | 14.60 | 76.50 | 13.20 | 14.64 | 53.80 | 36.40 | 14.10 | 76.30 | 14.50 | 13.94 | 49.40 |

| mean | 29.77 | 6.83 | 58.38 | 7.85 | 4.43 | 19.68 | 30.34 | 6.84 | 58.97 | 8.53 | 4.64 | 20.20 |

| median | 30.40 | 6.60 | 58.50 | 7.50 | 3.70 | 15.60 | 31.10 | 6.30 | 59.60 | 8.30 | 3.72 | 16.10 |

| standard deviation | 3.83 | 3.26 | 10.01 | 2.41 | 3.17 | 11.81 | 3.89 | 3.23 | 9.65 | 2.59 | 3.29 | 11.12 |

| coefficient of variation | 0.13 | 0.48 | 0.17 | 0.31 | 0.72 | 0.60 | 0.13 | 0.47 | 0.16 | 0.30 | 0.71 | 0.55 |

| skewness | −0.75 | 0.49 | −0.07 | 0.39 | 1.71 | 1.59 | −0.75 | 0.56 | −0.11 | 0.36 | 1.45 | 1.37 |

| 2021 | ||||||||||||

| min | 21.00 | 2.40 | 43.80 | 3.60 | 0.89 | 9.10 | ||||||

| max | 37.00 | 14.70 | 76.90 | 13.30 | 17.06 | 51.20 | ||||||

| mean | 30.87 | 7.24 | 60.66 | 8.09 | 4.68 | 19.93 | ||||||

| median | 31.60 | 6.20 | 62.80 | 7.90 | 3.35 | 15.80 | ||||||

| standard deviation | 3.93 | 3.56 | 8.94 | 2.47 | 3.77 | 11.23 | ||||||

| coefficient of variation | 0.13 | 0.49 | 0.15 | 0.31 | 0.81 | 0.56 | ||||||

| skewness | −0.78 | 0.63 | −0.08 | 0.25 | 1.64 | 1.55 | ||||||

References

- United Nations. Available online: https://www.un.org/en/global-issues/ageing (accessed on 1 September 2024).

- Schulz, E.; Radvansky, M. Impact of Ageing Populations on Silver Economy, Health and Long-Term Care Workforce. NEUJOBS Policy Brief. 2014. No. D12. Available online: http://www.neujobs.eu/sites/default/files/publication/2014/02/NEUJOBS_PolicyBrief_D12.4.pdf (accessed on 20 August 2024).

- Starzenie się Ludności w Unii Europejskiej—Stan Obecny i Prognoza; Kancelaria Senatu: Warszawa, Poland, 2018. Available online: https://www.senat.gov.pl/gfx/senat/pl/senatopracowania/160/plik/ot-662.pdf (accessed on 25 August 2024).

- Reshetnikova, L.; Boldyreva, N.; Perevalova, M.; Kalayda, S.; Pisarenko, Z. Conditions for the Growth of the “Silver Economy” in the Context of Sustainable Development Goals: Peculiarities of Russia. J. Risk Financ. Manag. 2021, 14, 401. [Google Scholar] [CrossRef]

- World Health Organization. World Health Statistics 2016: Monitoring Health for the SDGs Sustainable Development Goals. 2016. Available online: https://www.who.int/publications/i/item/9789241565264 (accessed on 20 November 2024).

- Gutman, G. Meeting the challenges of global aging: The need for a gerontological approach. In Proceedings of the Geriatrics 2006, the International Congress of Elderly Health, Istanbul, Turkey, 2–6 April 2006. [Google Scholar]

- Szukalski, P. (Ed.) Przygotowanie do Starości. Polacy Wobec Starzenia Się; Instytut Spraw Publicznych: Warszawa, Poland, 2009. [Google Scholar]

- Kohlbacher, F.; Herstatt, C. (Eds.) The Silver Market Phenomenon. Business Opportunities in an Era of Demographic Change; Springer: Berlin/Heideiberg, Germany, 2010. [Google Scholar]

- Álvarez-Diez, R.C. The evolution research on Silver Economy: Current researches, trends, and implications for future directions. Transinformação 2023, 35, e237325. [Google Scholar] [CrossRef]

- European Commission. Growing the European Silver Economy (Background Paper). 2015. Available online: https://digital-strategy.ec.europa.eu/en/library/growing-silver-economy-background-paper (accessed on 10 September 2024).

- Klimczuk, A. The Silver Economy as a Constructive Response in Public Policy on Aging. In Strategic Approach to Aging Population: Experiences and Challenges; Bojanić, I.B., Erceg, A., Eds.; J.J. Strossmayer University of Osijek: Osijek, Croatia, 2021; pp. 19–35. Available online: https://nbn-resolving.org/urn:nbn:de:0168-ssoar-73702-7 (accessed on 10 August 2024).

- Klimczuk, A. Comparative analysis of national and regional models of the silver economy in the European Union. Int. Int. J. Ageing Later Life 2016, 11, 1–29. [Google Scholar] [CrossRef]

- Wierzbicka, W.; Farelnik, E. Population Aging and the Potential for Developing a Silver Economy in the Polish National Cittaslow Network. Sustainability 2024, 16, 6768. [Google Scholar] [CrossRef]

- Rogelj, V.; Bogataj, D. Social infrastructure of silver economy: Literature review and research agenda. IFAC-PapersOnLine 2019, 52, 2680–2685. [Google Scholar] [CrossRef]

- Marcucci, G.; Ciarapica, F.; Poler, R.; Sanchis, R. A bibliometric analysis of the emerging trends in silver economy. IFAC-PapersOnLine 2021, 54, 936–941. [Google Scholar] [CrossRef]

- Edvardsson, M.C.V.V.B.; Vigolo, V.; Colurcio, M. Fifty years of research on silver economy: A bibliometric analysis. Sinergie IJM’s Essays 2022, 40, 149–171. [Google Scholar] [CrossRef]

- Frąckiewicz, E.; Iwański, R. (Eds.) Srebrna Gospodarka. Perspektywa Interdyscyplinarna; Wydawnictwo Akademii Sztuki w Szczecinie: Szczecin, Poland, 2021. [Google Scholar]

- Szukalski, P. Trzy kolory: Srebrny: Co to takiego silver economy? Polityka Społeczna 2012, 5–6, 6–10. [Google Scholar]

- Leśna-Wierszołowicz, E. Silver economy as a response to demographic changes. Pr. Nauk. Uniw. Ekon. We Wrocławiu 2018, 529, 162–169. [Google Scholar] [CrossRef]

- Golinowska, S. Srebrna gospodarka—Element strategii rozwoju regionalnego. Małopolskie Stud. Reg. 2014, 2–3, 17–29. [Google Scholar]

- Laperche, B.; Boutillier, S.; Djellal, F.; Ingham, M. Innovating for elderly people: The development of geront’innovaations in the French silver economy. Technol. Anal. Strateg. Manag. 2018, 31, 462–476. [Google Scholar] [CrossRef]

- Zsarnoczky, M. Silver Tourism; Slovak University of Agriculture in Nitra: Nitra, Slovakia, 2016; pp. 556–563. [Google Scholar]

- Penrose, E. The Theory of the Growth of the Firm, 3rd ed.; Oxford University Press: New York, NY, USA, 1995. [Google Scholar]

- Grupp, H. Foundations of the Economics of Innovation; Edward Elgar: Cheltenham, UK, 1998. [Google Scholar]

- Swann, G.M.P. The Economics of Innovation: An Introduction; Edward Elgar: Cheltenham, UK, 2009. [Google Scholar]

- McGuirk, H.; Lenihan, A.C.; Lenihan, N. Awareness and potential of the silver economy for enterprises: A European regional level study. Small Enterp. Res. 2022, 29, 6–19. [Google Scholar] [CrossRef]

- Batsaikhan, U. Embracing the Silver Economy. Available online: http://bruegel.org/2017/04/embracing-the-silver-economy/ (accessed on 1 April 2019).

- Przywojska, J.; Podgórniak-Krzykacz, A.; Warwas, I. Environmental education of the elderly—Towards an active, inclusive and trust-based ecosystem. Innov. Eur. J. Soc. Sci. Res. 2023, 36, 453–480. [Google Scholar] [CrossRef]

- Griva, A.; Mitroulia, M.; Armakolas, S. Strategic management of the silver economy: A European perspective. Eur. J. Manag. Mark. Stud. 2024, 9, 1–17. [Google Scholar] [CrossRef]

- Chen, X. The Benefits of Re-employment Among the Elderly: Perspectives on the Silver Economy and Re-employment Willingness. Adv. Econ. Manag. Res. 2024, 12, 874. [Google Scholar] [CrossRef]

- Greco, F.; Tregua, M.; Carignani, F.; Bifulco, F. Silver entrepreneurship: A new trend in startups. Sinergie Ital. J. Manag. 2022, 40, 123–148. [Google Scholar] [CrossRef]

- Sanchis, R.; Mula, J.; Marcucci, G.; Bevilacqua, M. A Framework Proposal for Research into Silver Labour from a Resilient Perspective. IFAC-PapersOnLine 2021, 54, 930–935. [Google Scholar] [CrossRef]

- Oget, Q. When Economic Promises Shape Innovation and Networks: A Structural Analysis of Technological Innovation in the Silver Economy. J. Innov. Econ. Manag. 2021, 35, 55–80. [Google Scholar] [CrossRef]

- Butt, S.A.; Draheim, D. Ethical Challenges of ICT for the Silver Economy. In Proceedings of the Eighth International Conference on eDemocracy & eGovernment (ICEDEG), Quito, Ecuador, 28–30 July 2021; pp. 152–155. [Google Scholar] [CrossRef]

- Qi, J.; Wang, T.; Huai, F. The significance of senior education in the Internet era for the construction of lifelong education system. Appl. Math. Nonlinear Sci. 2024, 9, 1–14. [Google Scholar] [CrossRef]

- Shahvaroughi Farahani, M. The Impacts of Aging on Economic Growth and Sustainable Development (Case Study of G20 Countries). Iran. Sociol. Rev. 2022, 12, 85–100. [Google Scholar]

- Vera-Sanso, P. Will the SDGs and the UN Decade of Healthy Ageing Leave Older People Behind? Prog. Dev. Stud. 2023, 23, 391–407. [Google Scholar] [CrossRef]

- Cizelj, B. Silver economy—A reply to challenges of population aging. Mednar. Inov. Posl. J. Innov. Bus. Manag. 2022, 14, 1–5. [Google Scholar] [CrossRef]

- Lipp, B.; Peine, A. Ageing as a driver of progressive politics? What the European Silver Economy teaches us about the co-constitution of ageing and innovation. Ageing Soc. 2024, 44, 1481–1493. [Google Scholar] [CrossRef]

- Nahal, S.; Ma, B. The Silver Dollar—Longevity Revolution Primer; Bank of America Merrill Lynch: New York, NY, USA, 2014; Available online: https://www.longfinance.net/programmes/sustainable-futures/london-accord/reports/the-silver-dollar-longevity-revolution-primer/ (accessed on 27 August 2024).

- European Commission. Available online: https://digital-strategy.ec.europa.eu/en/policies/eip-aha (accessed on 10 September 2024).

- Brodny, J.; Tutak, M.; Grebski, W.; Bindzár, P. Assessing the level of innovativeness of EU-27 countries and its relationship to economic, environmental, energy and social parameters. J. Open Innov. Technol. Mark. Complex. 2023, 9, 100073. [Google Scholar] [CrossRef]

- Augustyński, I.; Jurek, Ł. Being old in the age of aging: Macro-level determinants of change in perception of old age threshold in EU countries. Eur. Res. Stud. 2021, 24, 767–784. [Google Scholar] [CrossRef]

- Dehnel, G.; Gołata, E.; Walesiak, M. Assessment of changes in population ageing in regions of the V4 countries with application of multidimensional scaling. Argum. Oecon. 2020, 1, 77–100. [Google Scholar] [CrossRef]

- Ortega-Gil, M.; ElHichou-Ahmed, C.; Mata-García, A. Effects of Immigrants, Health, and Ageing on Economic Growth in the European Union. Int. J. Environ. Res. Public Health 2022, 20, 224. [Google Scholar] [CrossRef]

- MacQueen, J. Some methods for classification and analysis of multivariate observations. In Proceedings of the Fifth Berkeley Symposium on Mathematical Statistics and Probability, Berkeley, CA, USA, 21 June–18 July 1965; pp. 281–297. [Google Scholar]

- Małys, Ł. The approach to supply chain cooperation in the implementation of sustainable development initiatives and company’s economic performance. Equilibrium. Quart. J. Econ. Policy 2023, 18, 255–286. [Google Scholar] [CrossRef]

- Bernardelli, M.; Korzeb, Z.; Niedziółka, P. The banking sector as the absorber of the COVID-19 crisis? economic consequences: Perception of WSE investors. Oecon. Copernic. 2021, 12, 335–374. [Google Scholar] [CrossRef]

- Konya, S. Panel Estimation of the Environmental Kuznets Curve for CO2 Emissions and Ecological Footprint: Environmental Sustainability in Developing Countries. Folia Oeconomica Stetinenesia 2022, 22, 123–145. [Google Scholar] [CrossRef]

- Khare, I.; Rodrigues, L.L.R.; Gulvady, S.; Bhakta, S.S.; Nair, G.K.; Hussain, A. Impact of Business Intelligence on Company Performance: A System Dynamics Approach. Folia Oeconomica Stetin. 2023, 23, 183–203. [Google Scholar] [CrossRef]

- Murrja, A.; Ndreca, P.; Maloku, S.; Meço, M. Analysis of Production Risk in Intensive Chicken Farms—The Case of Kosovo. Folia Oeconomica Stetin. 2023, 23, 294–310. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Kaklauskas, A.; Šarka, V. The new method of multictiteria complex proportional assessment projects. In Technological and Economic Development of Economy; Zavadskas, E.K., Linnert, P., Eds.; Business Management; Technika: Vilnius, Lithuania, 1994; Volume 3, pp. 131–140. [Google Scholar]

- Bellman, R.; Kalaba, R. On adaptive control processes. IRE Trans. Automat. Contr. 1959, 4, 1–9. [Google Scholar] [CrossRef]

- Rabiner, L.; Rosenberg, A.; Levinson, S. Considerations in dynamic time warping algorithms for discrete word recognition. IEEE Trans. Acoust. Speech Signal. Process. 1978, 26, 575–582. [Google Scholar] [CrossRef]

- Sakoe, H.; Chiba, S. Dynamic programming algorithm optimization for spoken word recognition. IEEE Trans. Acoust. Speech Signal. Process. 1978, 26, 43–49. [Google Scholar] [CrossRef]

- Myers, C.S.; Rabiner, L.R. A comparative study of several dynamic time-warping algorithms for connected word recognition. Bell Syst. Tech. J. 1981, 60, 1389–1409. [Google Scholar] [CrossRef]

- Sankoff, D.; Kruskal, J. (Eds.) Time Warps, String Edits, and Macromolecules: The Theory and Practice of Sequence Comparison; Addison-Wesley: Reading, MA, USA, 1983. [Google Scholar]

- Aach, J.; Church, G.M. Aligning gene expression time series with time warping algorithms. Bioinformatics 2001, 17, 495–508. [Google Scholar] [CrossRef]

- Müller, M. Information Retrieval for Music and Motion; Springer: Berlin/Heidelberg, Germany, 2007. [Google Scholar]

- Arici, T.; Celebi, S.; Aydin, A.S.; Temiz, T.T. Robust gesture recognition using feature pre-processing and weighted dynamic time warping. Multimed. Tools Appl. 2014, 72, 3045–3062. [Google Scholar] [CrossRef]

- Stübinger, J. Statistical arbitrage with optimal causal paths on high-frequency data of the S&P 500. Quant. Financ. 2019, 19, 921–935. [Google Scholar] [CrossRef]

- Dmytrów, K.; Bieszk-Stolorz, B. Mutual relationships between the unemployment rate and the unemployment duration in the Visegrad Group countries in years 2001–2017. Equilibrium. Q. J. Econ. Econ. Policy 2019, 14, 129–148. [Google Scholar] [CrossRef]

- Dmytrów, K.; Landmesser, J.; Bieszk-Stolorz, B. The Connections between COVID-19 and the Energy Commodities Prices: Evidence through the Dynamic Time Warping Method. Energies 2021, 14, 4024. [Google Scholar] [CrossRef]

- Dmytrów, K.; Bieszk-Stolorz, B.; Landmesser-Rusek, J. Sustainable Energy in European Countries: Analysis of Sustainable Development Goal 7 Using the Dynamic Time Warping Method. Energies 2022, 15, 7756. [Google Scholar] [CrossRef]

- Giorgino, T. Computing and visualizing dynamic time warping alignments in R: The dtw package. J. Stat. Softw. 2009, 31, 1–24. [Google Scholar] [CrossRef]

- Sardá-Espinosa, A. Time-series clustering in R using the dtwclust package. R J. 2019, 11, 22–43. [Google Scholar] [CrossRef]

- Miłek, D. Spatial differentiation in the social and economic development level in Poland. Equilibrium. Q. J. Econ. Econ. Policy 2018, 13, 487–507. [Google Scholar] [CrossRef]

- Pietrzak, M.B.; Ziemkiewicz, B. Cluster analysis of digital economy in the old European Union countries. In Mathematical Methods in Economics MME 2018, Proceedings of the 36th International Conference, Jindřichův Hradec, Czechia, 12–14 September 2018; Váchová, L., Kratochvíl, V., Eds.; MatfyzPress, Publishing House of the Faculty of Mathematics and Physics Charles University: Prague, Czechia, 2018; pp. 422–427. [Google Scholar]

- Rollnik-Sadowska, E.; Dąbrowska, E. Cluster analysis of effectiveness of labour market policy in the European Union. Oecon. Copernic. 2018, 9, 143–158. [Google Scholar] [CrossRef]

- Szymańska, A. National fiscal frameworks in the post-crisis European Union. Equilibrium. Q. J. Econ. Econ. Policy 2018, 13, 623–642. [Google Scholar] [CrossRef]

- Kovacova, M.; Kliestik, T.; Valaskova, K.; Durana, P.; Juhaszova, Z. Systematic review of variables applied in bankruptcy prediction models of Visegrad group countries. Oecon. Copernic. 2019, 10, 743–772. [Google Scholar] [CrossRef]

- Gnat, S. Spatial weight matrix impact on real estate hierarchical clustering in the process of mass valuation. Oecon. Copernic. 2019, 10, 131–151. [Google Scholar] [CrossRef]

- Thalassinos, E.; Cristea, M.; Noja, G.G. Measuring active ageing within the European Union: Implications on economic development. Equilibrium. Q. J. Econ. Econ. Policy 2019, 14, 591–609. [Google Scholar] [CrossRef]

- Poliak, M.; Svabova, L.; Konecny, V.; Zhuravleva, N.A.; Culik, K. New paradigms of quantification of economic efficiency in the transport sector. Oecon. Copernic. 2021, 12, 193–212. [Google Scholar] [CrossRef]

- Senin, P. Dynamic Time Warping Algorithm Review; Information and Computer Science Department University of Hawaii at Manoa: Honolulu, HI, USA, 2008. [Google Scholar]

- Ward, J.H. Hierarchical Grouping to Optimize an Objective Function. J. Am. Stat. Assoc. 1963, 58, 236–244. [Google Scholar] [CrossRef]

- Przybysz, K.; Stanimir, A. How Active Are European Seniors—Their Personal Ways to Active Ageing? Is Seniors’ Activity in Line with the Expectations of the Active Ageing Strategy? Sustainability 2023, 15, 10404. [Google Scholar] [CrossRef]

- UNECE/European Commission. 2018 Active Ageing Index: Analytical Report. 2019. Available online: https://unece.org/DAM/pau/age/Active_Ageing_Index/ECE-WG-33.pdf (accessed on 28 August 2024).

- Tkalec, I. The Interplay between Active Ageing and Silver Economy—A QCA Analysis. Cah. RESUME 2017, 3, 1–12. [Google Scholar] [CrossRef]

- Krzyminiewska, G. Silver economy in rural areas in the context of (un)sustainable development. Ann. PAAAE 2019, 21, 212–219. [Google Scholar] [CrossRef]

- Jóźwiak, J.; Kotowska, I.E. Przewidywane Zmiany Liczby i Struktury Wieku Ludności w Polsce do 2035 r. i ich Skutki Ekonomiczne, W: Problemy Demograficzne Polski i ich Skutki Ekonomiczne. Raport z Pierwszego Posiedzenia Narodowej rady Rozwoju; Kancelaria Prezydenta Rzeczpospolitej Polskiej: Warszawa, Poland, 2010; p. 54. [Google Scholar]

- Bran, F.; Popescu, M.-L.; Stanciu, P. Perspectives of Silver Economy in European Union. Rev. De Manag. Comp. Int. 2016, 17, 130–135. [Google Scholar]

- Migration Data Portal. Available online: www.migrationdataportal.org/themes/older-persons-and-migration (accessed on 10 November 2024).

| Years | Cluster Number | ||||||

|---|---|---|---|---|---|---|---|

| 1 | 24.127 | 5.147 | 37.060 | 7.547 | 3.391 | 16.407 | |

| 2009 | 2 | 24.013 | 5.938 | 54.275 | 7.825 | 3.450 | 16.100 |

| 3 | 23.975 | 8.400 | 53.400 | 6.100 | 6.646 | 45.350 | |

| 1 | 26.663 | 4.506 | 43.069 | 8.363 | 4.826 | 12.844 | |

| 2015 | 2 | 28.100 | 7.629 | 61.843 | 8.500 | 4.186 | 11.943 |

| 3 | 29.125 | 7.475 | 59.025 | 5.875 | 6.512 | 33.975 | |

| 1 | 29.114 | 4.250 | 50.164 | 8.129 | 3.520 | 15.014 | |

| 2019 | 2 | 30.000 | 9.256 | 66.978 | 8.411 | 4.980 | 16.167 |

| 3 | 31.575 | 10.425 | 67.775 | 5.625 | 6.361 | 43.925 | |

| 1 | 30.254 | 4.362 | 52.508 | 8.685 | 3.044 | 15.738 | |

| 2021 | 2 | 31.040 | 9.500 | 68.290 | 8.190 | 6.508 | 15.820 |

| 3 | 32.475 | 10.975 | 68.050 | 5.875 | 5.455 | 43.825 |

| Countries | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Belgium | 26 | 25 | 26 | 26 | 23 | 24 | 23 | 24 | 23 | 23 | 22 | 24 | 25 |

| Bulgaria | 18 | 19 | 20 | 19 | 16 | 17 | 15 | 14 | 14 | 13 | 13 | 13 | 13 |

| Czechia | 14 | 13 | 13 | 13 | 13 | 13 | 13 | 12 | 11 | 11 | 11 | 11 | 12 |

| Denmark | 8 | 7 | 7 | 6 | 5 | 5 | 5 | 5 | 6 | 7 | 8 | 8 | 6 |

| Germany | 13 | 11 | 9 | 10 | 10 | 9 | 8 | 8 | 9 | 9 | 10 | 10 | 10 |

| Estonia | 4 | 5 | 3 | 2 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Ireland | 5 | 6 | 6 | 7 | 4 | 4 | 3 | 3 | 3 | 3 | 3 | 3 | 3 |

| Greece | 17 | 17 | 19 | 25 | 26 | 27 | 27 | 25 | 25 | 25 | 23 | 23 | 21 |

| Spain | 21 | 23 | 23 | 23 | 25 | 25 | 25 | 22 | 24 | 24 | 24 | 22 | 24 |

| France | 25 | 26 | 24 | 22 | 22 | 21 | 19 | 19 | 20 | 22 | 21 | 21 | 23 |

| Croatia | 12 | 15 | 14 | 15 | 21 | 23 | 22 | 26 | 26 | 26 | 26 | 26 | 26 |

| Italy | 22 | 21 | 21 | 20 | 20 | 19 | 18 | 17 | 17 | 16 | 17 | 19 | 18 |

| Cyprus | 2 | 2 | 2 | 4 | 7 | 11 | 11 | 10 | 10 | 10 | 9 | 9 | 8 |

| Latvia | 7 | 9 | 10 | 9 | 8 | 8 | 6 | 7 | 7 | 6 | 4 | 5 | 4 |

| Lithuania | 11 | 14 | 12 | 12 | 12 | 12 | 9 | 6 | 5 | 5 | 6 | 4 | 5 |

| Luxembourg | 19 | 20 | 18 | 18 | 19 | 20 | 24 | 27 | 27 | 27 | 27 | 27 | 22 |

| Hungary | 27 | 27 | 27 | 27 | 27 | 26 | 26 | 21 | 22 | 21 | 20 | 16 | 15 |

| Malta | 24 | 22 | 22 | 21 | 18 | 16 | 16 | 18 | 19 | 18 | 15 | 14 | 14 |

| The Netherlands | 9 | 8 | 8 | 8 | 9 | 6 | 7 | 9 | 8 | 8 | 7 | 7 | 7 |

| Austria | 16 | 16 | 16 | 14 | 14 | 15 | 14 | 15 | 16 | 15 | 19 | 20 | 19 |

| Poland | 20 | 18 | 17 | 16 | 15 | 18 | 17 | 16 | 15 | 17 | 18 | 17 | 16 |

| Portugal | 1 | 1 | 1 | 1 | 2 | 3 | 4 | 4 | 4 | 4 | 5 | 6 | 11 |

| Romania | 3 | 4 | 5 | 5 | 6 | 7 | 12 | 13 | 13 | 14 | 14 | 18 | 27 |

| Slovenia | 10 | 10 | 15 | 17 | 17 | 14 | 20 | 23 | 21 | 20 | 25 | 25 | 20 |

| Slovakia | 23 | 24 | 25 | 24 | 24 | 22 | 21 | 20 | 18 | 19 | 16 | 15 | 17 |

| Finland | 15 | 12 | 11 | 11 | 11 | 10 | 10 | 11 | 12 | 12 | 12 | 12 | 9 |

| Sweden | 6 | 3 | 4 | 3 | 3 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 |

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010 | 0.979 | 1 | ||||||||||

| 2011 | 0.965 | 0.982 | 1 | |||||||||

| 2012 | 0.929 | 0.949 | 0.980 | 1 | ||||||||

| 2013 | 0.875 | 0.911 | 0.937 | 0.971 | 1 | |||||||

| 2014 | 0.834 | 0.879 | 0.896 | 0.937 | 0.979 | 1 | ||||||

| 2015 | 0.767 | 0.808 | 0.846 | 0.900 | 0.955 | 0.967 | 1 | |||||

| 2016 | 0.709 | 0.746 | 0.789 | 0.841 | 0.903 | 0.910 | 0.969 | 1 | ||||

| 2017 | 0.723 | 0.759 | 0.792 | 0.841 | 0.905 | 0.915 | 0.968 | 0.993 | 1 | |||

| 2018 | 0.723 | 0.758 | 0.785 | 0.831 | 0.898 | 0.913 | 0.965 | 0.988 | 0.995 | 1 | ||

| 2019 | 0.669 | 0.702 | 0.736 | 0.780 | 0.851 | 0.866 | 0.937 | 0.970 | 0.974 | 0.976 | 1 | |

| 2020 | 0.604 | 0.634 | 0.675 | 0.717 | 0.787 | 0.809 | 0.893 | 0.949 | 0.951 | 0.954 | 0.984 | 1 |

| 2021 | 0.535 | 0.580 | 0.615 | 0.643 | 0.719 | 0.749 | 0.830 | 0.871 | 0.874 | 0.889 | 0.902 | 0.941 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bieszk-Stolorz, B.; Dmytrów, K.; Frąckiewicz, E. Multivariate Analysis of the Sustainable Development of the Silver Economy in the European Union Countries. Sustainability 2024, 16, 10703. https://doi.org/10.3390/su162310703

Bieszk-Stolorz B, Dmytrów K, Frąckiewicz E. Multivariate Analysis of the Sustainable Development of the Silver Economy in the European Union Countries. Sustainability. 2024; 16(23):10703. https://doi.org/10.3390/su162310703

Chicago/Turabian StyleBieszk-Stolorz, Beata, Krzysztof Dmytrów, and Ewa Frąckiewicz. 2024. "Multivariate Analysis of the Sustainable Development of the Silver Economy in the European Union Countries" Sustainability 16, no. 23: 10703. https://doi.org/10.3390/su162310703

APA StyleBieszk-Stolorz, B., Dmytrów, K., & Frąckiewicz, E. (2024). Multivariate Analysis of the Sustainable Development of the Silver Economy in the European Union Countries. Sustainability, 16(23), 10703. https://doi.org/10.3390/su162310703