4.1. Fertilizer Trade Flows

The total amount of fertilizer trade imported to the EU from foreign countries is about 21,678,331 t in 2023, whereas the highest peak in the last five years was registered in 2019, with about 26,767,111 t. On the export side, its amount was 9,944,451 t in 2023 and the highest peak in 2021 (12,875,435 t) [

32].

Table 2 presents the top ten importers from foreign countries to the EU, plus China. It is important to distinguish between the total imports before and after the start of the Russia–Ukraine conflict in 2021. Prior to the onset of the conflict in 2021, the top ten nations accounted for approximately 36% of the total imports, with Russia occupying the lead position with approximately 16%. In 2023, Russia declined to the fourth place of the top ten (1.19%), soon after Egypt (11.18%), United States (4.82%), and Trinidad and Tobago (3.54%). In terms of China, it covered less than 0.01% of the total imports in 2019, but its rate increased up to 0.46% in 2023.

Table 3 illustrates the top-three importers over the timespan 2019–2023, namely, Russia, Egypt, and Trinidad and Tobago, whereas in the category “Others” it includes Belarus, USA, Norway, Ukraine, UK, Morocco, and Serbia (

Appendix A illustrate the detailed values in each country). Specifically, it focuses on the four most traded fertilizers, such as ammonia, urea, urea ammonium nitrate, and NPK fertilizers. In terms of ammonia, the leading importer to the EU was Trinidad and Tobago (495,049 t), whereas in terms of urea, the top importer was Egypt (2,216,258 t). As concerns urea ammonium nitrate, Russia was the leading importer, as well as for NPK fertilizers (561,723 t and 537,366 t, respectively). However, before the start of the Russia–Ukraine conflict, Russia was the leading importer for all four fertilizers. It means that, after the beginning of the conflict, the international trade changed in favour of Egypt, and Trinidad and Tobago.

4.2. Fertilizer Virtual Carbon Flows

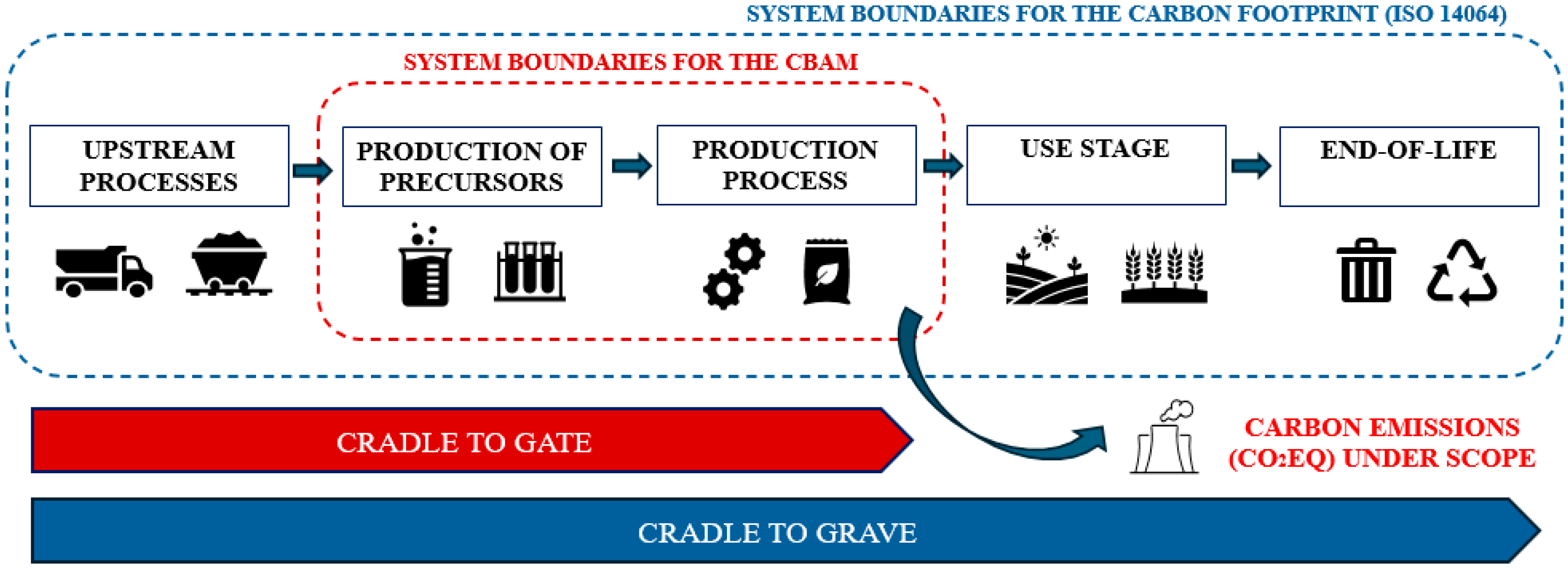

The analysis of virtual carbon flows is essential to understand how carbon emissions circulate from foreign countries to the EU (and vice versa, in terms of net virtual flows). This analysis is essential to comprehend the different environmental impacts associated with the production of fertilizers in light of the carbon leakage and the CBAM, also considering that: (i) producers and consumers are located at various places in different parts of the world, and they have significant differences in virtual GHGs; and (ii) China is increasingly carrying out the load of virtual GHGs. In order to better comprehend the carbon emissions associated with fertilizer production at the global scale, the current analysis calculates the CO

2eq emissions according to the WWA emission factors, and the CS ones (

Figure 2).

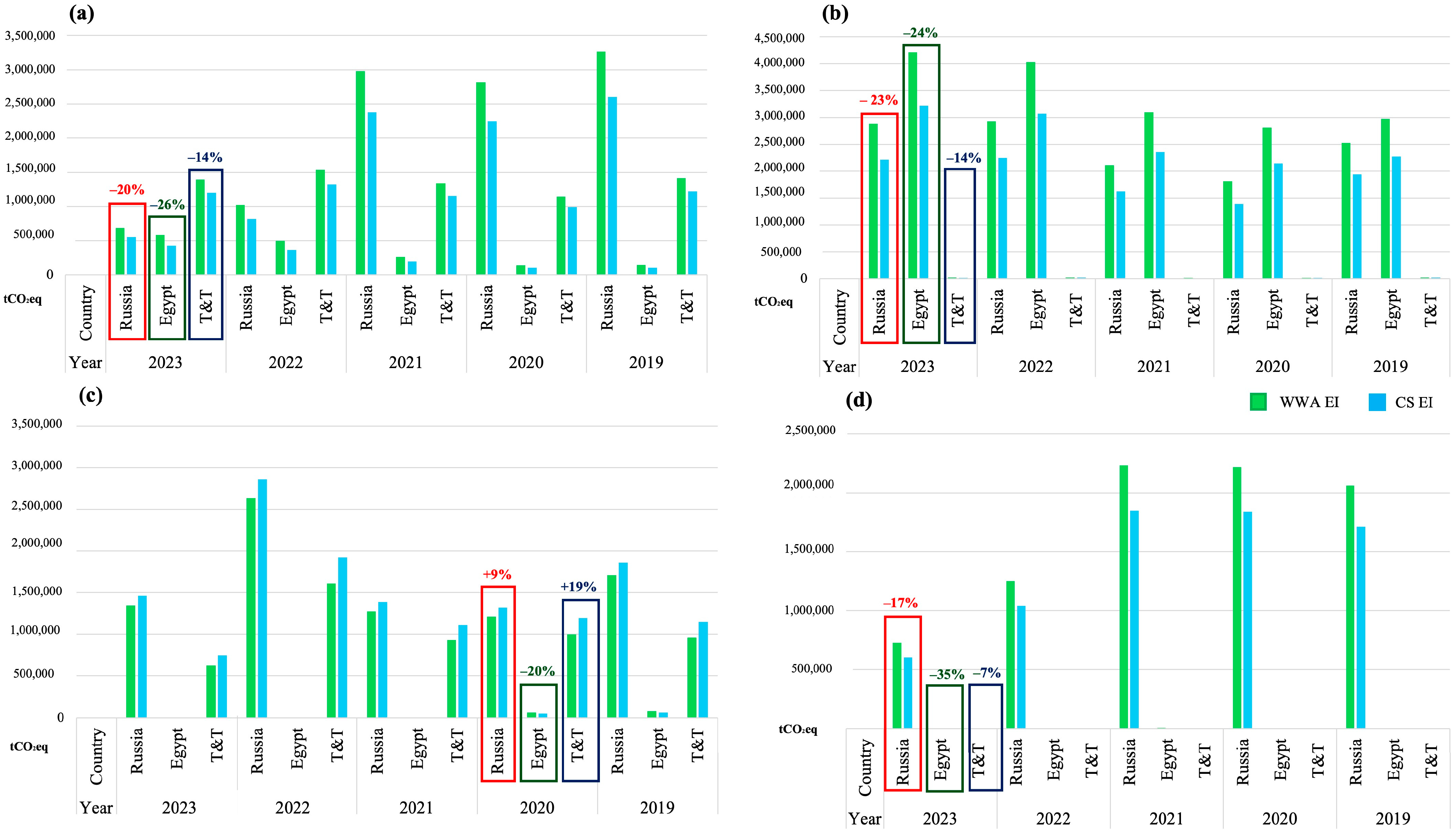

By considering the carbon virtual flows in Russia, Egypt, and Trinidad and Tobago, four different scenarios should be considered in light of ammonia, urea, urea ammonium nitrate, and NPK fertilizers.

In the field of ammonia, the amount of carbon virtual flows estimated with the WWA emission factor is about 20%, 26%, and 14% higher compared to the CS emission factor of Russia, Egypt, and Trinidad and Tobago, respectively. It means that the application of the CS emission factor compared to the WWA one would provide different values, as follows (year = 2023): (i) in Russia, WWA = 689,995 tCO2eq > CS = 550,528 tCO2eq; (ii) in Egypt, WWA = 583,737 tCO2eq > CS = 430,558 tCO2eq; (iii) in Trinidad and Tobago, WWA = 1,396,038 tCO2eq > CS = 1,202,969 tCO2eq.

In the field of urea, the application of the WWA emission factor provides results that are 23%, 24%, and 14% higher compared to the application of the CS emission factor. On the contrary, when considering urea ammonium nitrate, it results that the WWA emission factor creates a bias in the opposite direction, at least as regards Russia and Trinidad and Tobago. Precisely, results calculated according to the WWA emission factor are 9% and 19% lower compared to results estimated through the CS emission factor. Last, the highest differences between WWA and CS emission factors are calculated for NPK fertilizers, as follows: (i) in Russia, WWA = 725,444 tCO2eq > CS = 601,850 tCO2eq (+17%); (ii) in Egypt, WWA = 1262 tCO2eq > CS = 823 tCO2eq (+35%); and (iii) in Trinidad and Tobago, WWA = 2483 tCO2eq > CS = 2299 tCO2eq.

Table 4 presents the CO

2eq emissions according to the WWA emission factors, and CS emissions factors for Belarus, USA, Norway, Ukraine, UK, Morocco, and Serbia. When comparing WWA with CS results, it turns out that the WWA values are penalizing, with significant impacts on the assessment of the CO

2eq emissions associated with the production of urea ammonium nitrate and NPK fertilizers in Norway and the United Kingdom. Among others, it results that: (i) the CO

2eq emissions calculated with the WWA for the NPK fertilizers in the United Kingdom are 170% higher compared to those assessed with the CS emission factor; (ii) the CO

2eq emissions calculated with the WWA for the urea ammonium nitrate in the United Kingdom are 125% higher compared to those assessed with the CS emission factor; and (iii) the CO

2eq emissions calculated with the WWA for the NPK fertilizers in Norway are 121% higher compared to those assessed with the CS emission factor. Moreover, several other significant results could be highlighted, for instance, for the production of NPK fertilizers in the USA, the assessment of the CO

2eq emissions by using the WWA is 71% compared to the assessment by using the CS emission factors. On the contrary, no particular differences are found between WWA and CS factors in Serbia or Ukraine, where sometimes the CS values are higher than the WWA ones.

China represents a separate case, since its CS emission factors are much higher than the WWA ones, and this compromises the environmental impact assessments associated with fertilizer production within its boundaries.

Table 5 illustrates the virtual carbon flows from China to the EU for ammonia, urea, urea ammonium nitrate (even if its trade from China to the EU is rather null), and NPK fertilizers distinguishing between WWA and CS emission factors. The comparison is based on the WWA as a reference value. Considering 2023 as a reference year, it results that: (i) for ammonia, WWA = 798 tCO

2eq < CS = 1098 tCO

2eq (−37%); (ii) for urea, WWA = 256,433 tCO

2eq < CS = 291,939 tCO

2eq (−13%); and (iii) for the NPK fertilizers, WWA = 1526 tCO

2eq < CS = 1616 tCO

2eq (−5%). These differences, far from marginal, can compromise the mechanism for calculating virtual carbon flows within the CBAM.

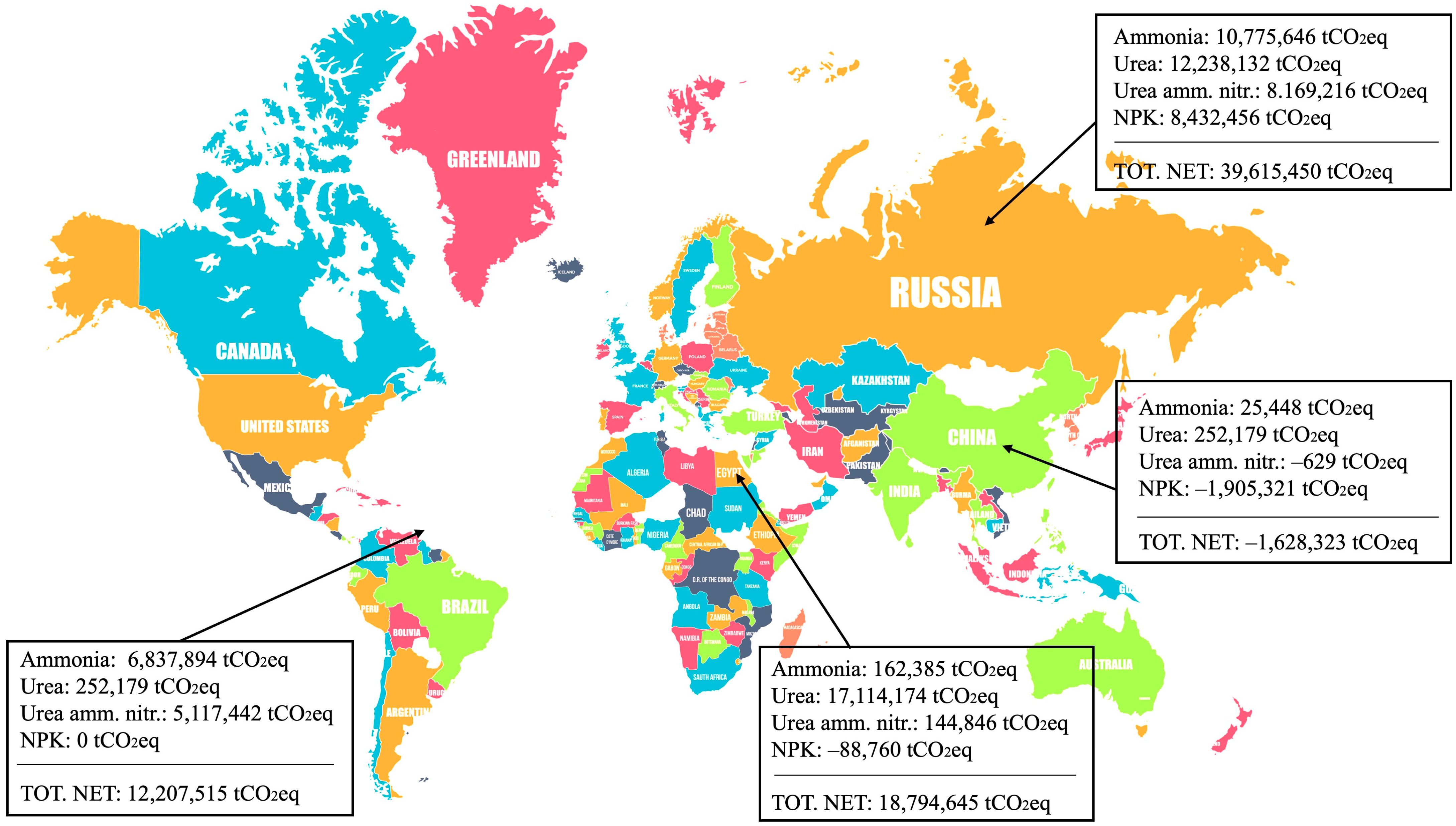

In terms of net virtual carbon flows from foreign countries to the EU,

Figure 3 presents the results at an aggregate level considering the WWA emission factors in the timespan 2019–2023.

Appendix B presents the net fertilizers trade (net trade = imports − exports). Overall, the balance of the net virtual carbon flows presents the vast majority of GHGs in Russia (net value = 39,615,450 tCO

2eq), followed by Egypt (net value = 18,784,645 tCO

2eq), and Trinidad and Tobago (net value = 12,207,515 tCO

2eq). China, on the other hand, has a negative net balance, which means that emissions are higher in the EU and not in China (net value = −1,628,323 tCO

2eq).

4.3. Some Indicators to Interpret the Carbon Leakage

The assessment of the carbon emissions associated with the production of fertilizers can provide some insights on the functioning of the CBAM. However, it takes on a worrying significance if looking at some indicators such as kgCO2eq/person or tCO2eq/km2, where the CO2eq are the net carbon emissions estimated with the WWA emission factors. These indicators could integrate the use of the CBAM and could help interpret the carbon leakage phenomenon, for a better estimation of the effects of the production of specific commodities in each country from an environmental standpoint.

In Russia, which is the largest country in the world (17,864,345 km

2), and which accounts for about 145,440,000 inhabitants [

37], the impacts are somehow slight, but the situation changes when coming to Trinidad and Tobago, which accounts for 1,500,000 inhabitants and less than 5120 km

2. These indicators, based on 2023 as a reference year (see

Appendix C), illustrate that: (i) in Russia, the carbon emissions associated with the fertilizer trade account for 38 kgCO

2eq/person and 0.31 tCO

2eq/km

2; (ii) in Egypt, the emissions are 41 kgCO

2eq/person and 4.77 tCO

2eq/km

2; (iii) in Trinidad and Tobago, they are 1360 kgCO

2eq/person and 398 tCO

2eq/km

2; and (iv) in China, they are −0.13 kgCO

2eq/person and −0.01 tCO

2eq/km

2.

However, a more significant indicator should compare the CO

2eq associated with the net trade of fertilizers with the Gross Domestic Product (GDP, expressed in USD), to comprehend the weight of carbon emissions on the GDP [

38]. In other words, it could help policy makers and public authorities understand how much the environmental impacts of the production of fertilizers load on the richness of a certain country. Precisely, (i) in Russia, it results in 0.003, which means that, considering one USD produced through the sale of local products, the production of fertilizers is responsible for solely 0.003 kgCO

2eq; (ii) in Egypt, it is equal to 0.013; (iii) in Trinidad and Tobago, it is 0.43; and (iv) in China, −1.06 (considering its negative net trade balance and its impressive GDP, which is around USD 18 trillion).