Intelligent Manufacturing and Green Innovation—Evidence from China’s Listed Manufacturing Firms

Abstract

1. Introduction

2. Theoretical Background

2.1. Intelligent Manufacturing and Green Innovation

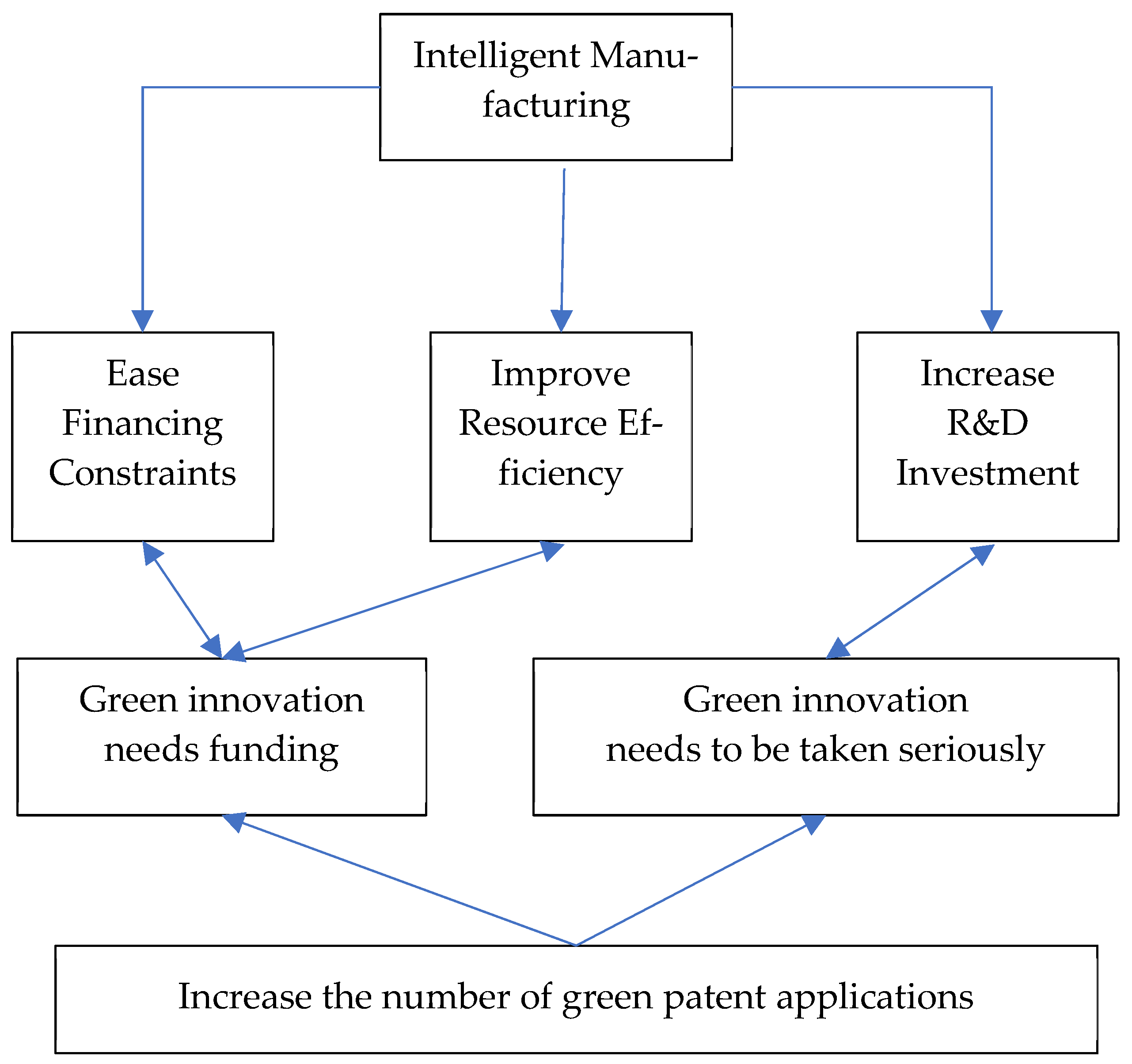

2.2. How Intelligent Manufacturing Drives a Green Transition

2.3. The Impact of Business Ownership and the Region

3. Data Source and Research Methods

3.1. Sample Selection and Data Source

- (1)

- Exclude firms listed after 2019;

- (2)

- Exclude financial and insurance sectors;

- (3)

- Exclude non-manufacturing firms;

- (4)

- Exclude firms with missing key data;

- (5)

- Exclude firms marked as ST or delisted;

- (6)

- For firms selected multiple times for the pilot, only the first selection is retained.

- (1)

- Green patents are a direct output of green technological innovation and are easily quantifiable;

- (2)

- Since intelligent manufacturing in China is in its early stages, using green patent applications allows for a more timely assessment, avoiding delays in patent approvals that could introduce confounding factors.

3.2. Definitions of Variables

3.3. Model Setting

4. Empirical Analysis

4.1. Descriptive Statistics

4.2. Benchmark Regression and Robust Test

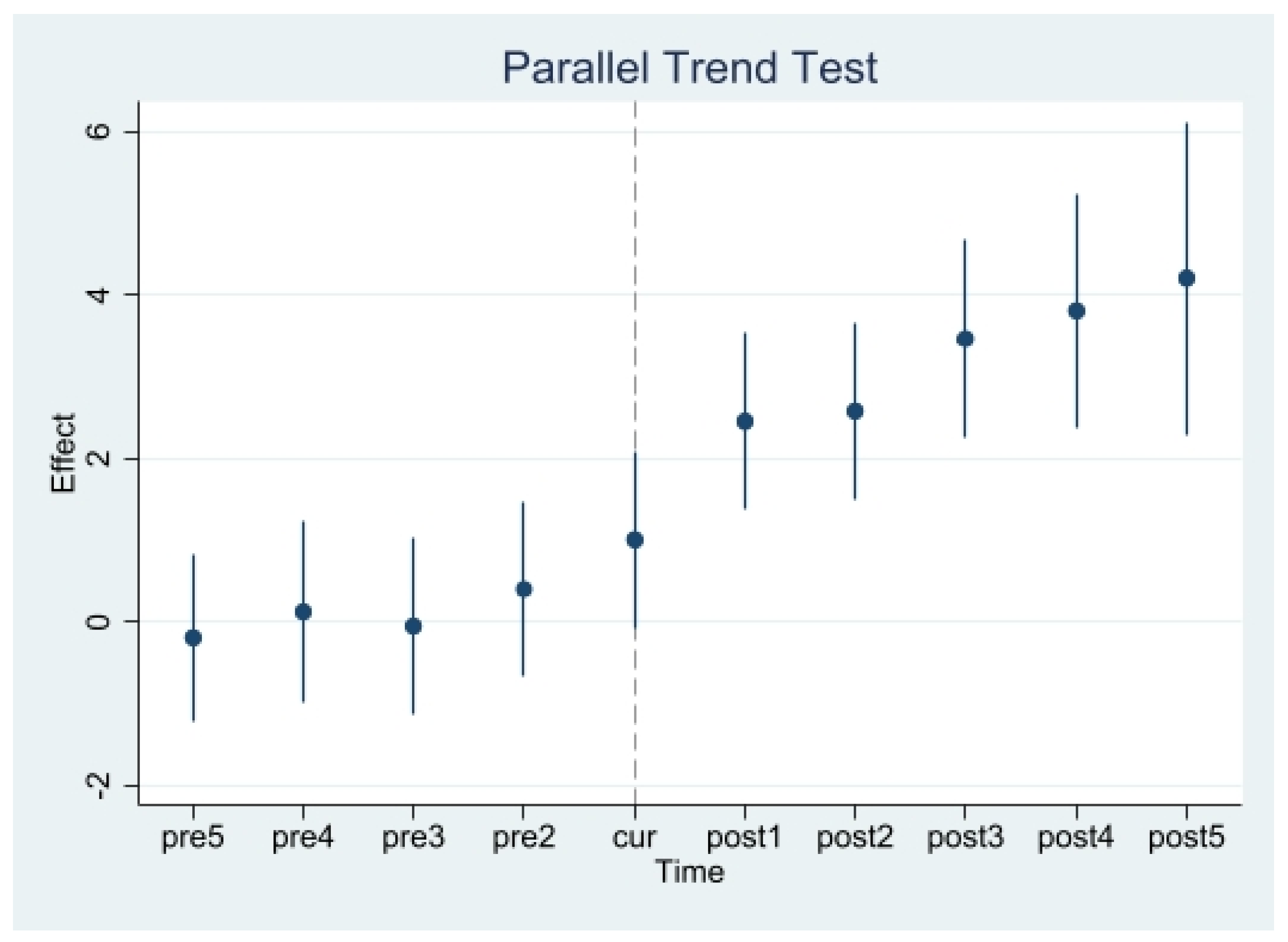

4.3. Parallel Trend Test

5. Mechanism Analysis

5.1. Mechanism Test Methods

5.2. Mechanism Test Results and Analysis

6. Heterogeneity

6.1. Business Ownership

6.2. Location

7. Concluding Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Huang, Q.-H.; Yu, Y.-Z.; Zhang, S.-L. Internet Development and Productivity Growth in Manufacturing Industry: Internal Mechanism and China Experiences. China Ind. Econ. 2019, 8, 5–23. (In Chinese) [Google Scholar]

- Nordhaus, W. Climate Change: The Ultimate Challenge for Economics. Am. Econ. Rev. 2019, 109, 1991–2014. [Google Scholar] [CrossRef]

- Chen, D.; Wang, L.; Chen, A. Digitalization and Strategic Management Theory: Review, Challenges and Prospects. J. Manag. World 2020, 36, 220–236+20. (In Chinese) [Google Scholar]

- Qi, Y.; Xiao, X. Transformation of Enterprise Management in the Era of Digital Economy. J. Manag. World 2020, 36, 135–152+250. (In Chinese) [Google Scholar]

- Liu, Y.; Dong, J.; Wei, J. Digital Innovation Management: Theoretical Framework and Future Research. J. Manag. World 2020, 36, 198–217+219. (In Chinese) [Google Scholar]

- Bukht, R.; Heeks, R. Defining, Conceptualizing and Measuring the Digital Economy; Development Informatics Working Papers 68; University of Manchester: Manchester, UK, 2017. [Google Scholar]

- Jones, I.C.; Tonetti, C. Nonrivalry and the Economics of Data. Am. Econ. Rev. 2020, 110, 2819–2858. [Google Scholar] [CrossRef]

- He, Y.; Wang, W. Theoretical Explanation of Marketization of Data Elements. Contemp. Econ. Res. 2021, 4, 33–44. (In Chinese) [Google Scholar]

- Li, J.; Zhang, J.-J.; Dong, X.-F. How Digital Economy Affects Enterprise Innovation Ability: Internal Mechanism and Empirical Evidence. Bus. Manag. J. 2022, 44, 5–22. (In Chinese) [Google Scholar]

- Qi, H.-J.; Cao, X.-Q.; Liu, Y.-X. The Influence of Digital Economy on Corporate Governance: Analyzed from Information Asymmetry and Irrational Behavior Perspective. Reform 2020, 4, 50–64. (In Chinese) [Google Scholar]

- Chen, X.-H.; Zhang, H.-W. How does the Digital Economy Affect the Level of Enterprise Risk-taking? Bus. Manag. J. 2021, 43, 93–108. (In Chinese) [Google Scholar]

- Xiao, H.; Li, P. Ecological Governance of Platform Enterprises’ CSR. J. Manag. World 2019, 35, 120–144+196. (In Chinese) [Google Scholar]

- Wan, P.-B.; Yang, M.; Chen, L. How Do Environmental Technology Standards Affect the Green Transition of China’s Manufacturing Industry—A Perspective from Technological Transformation. China Ind. Econ. 2021, 9, 118–136. (In Chinese) [Google Scholar]

- Wang, J.; Liu, B. Environmental Regulation and Enterprises’ TFP—An Empirical Analysis Based on China’s Industrial Enterprises Data. China Ind. Econ. 2014, 3, 44–56. (In Chinese) [Google Scholar]

- Bao, J.; Miao, Y.; Chen, F. Low Carbon Economy: Revolution in the Way of Human Economic Development. China Ind. Econ. 2008, 4, 153–160. (In Chinese) [Google Scholar]

- Levinson, A. Technology, International Trade, and Pollution from US Manufacturing. Am. Econ. Rev. 2009, 99, 2177–2192. [Google Scholar] [CrossRef]

- Dai, X.; Yang, S.-Z. Digital Empowerment, Source of Digital Input and Green Manufacturing. China Ind. Econ. 2022, 9, 83–101. (In Chinese) [Google Scholar]

- Aghion, P.; Askenazy, P.; Berman, N.; Cette, G.; Eymard, L. Credit Constraints and the Cyclicality of R&D Investment: Evidence from France. J. Eur. Econ. Assoc. 2012, 10, 1001–1024. [Google Scholar]

- Xu, J.; Cui, J.-B. Low-Carbon Cities and Firms’ Green Technological Innovation. China Ind. Econ. 2020, 12, 178–196. (In Chinese) [Google Scholar]

- Xiong, L.; Yan, S.; Yang, M. Financial Development, Environmental Regulation and Industrial Green Technological Innovation: From the Perspective of Directed Endogenous Growth. China Ind. Econ. 2023, 12, 99–116. (In Chinese) [Google Scholar]

- Lu, J.; Yan, Y.; Wang, T.-X. The Microeconomic Effects of Green Credit Policy—From the Perspective of Technological Innovation and Resource Reallocation. China Ind. Econ. 2021, 1, 174–192. (In Chinese) [Google Scholar]

- Yuan, L.; Zhou, Z. Environmental Trading Program and Reallocation of Green Patents. China Ind. Econ. 2022, 12, 127–145. (In Chinese) [Google Scholar]

- Qi, S.Z.; Lin, S.A.; Cui, J.B. Do Environmental Rights Trading Schemes Induce Green Innovation? Evidence from Listed Firms in China. Econ. Res. J. 2018, 53, 129–143. (In Chinese) [Google Scholar]

- Song, M.; Zhou, P.; Si, H.-T. Financial Technology and Enterprise Total Factor Productivity—Perspective of “Enabling” and Credit Rationing. China Ind. Econ. 2021, 4, 138–155. (In Chinese) [Google Scholar]

- Popp, D. International innovation and diffusion of air pollution control technologies: The effects of NOX and SO2 regulation in the US, Japan, and Germany. J. Environ. Econ. Manag. 2005, 51, 46–71. [Google Scholar] [CrossRef]

- Kaplan, S.N.; Zingales, L. Do investment-cash flow sensitivities provide useful measures of financing constraints? Q. J. Econ. 1997, 112, 169–215. [Google Scholar] [CrossRef]

- Li, B.; Zhao, F. Fixed Capital, Accelerated Depreciation and Economic Fluctuation Effects. China Rev. Political Econ. 2017, 8, 190–202. (In Chinese) [Google Scholar]

- Zhang, C.-S.; Liu, G.-C. The Existence, Dynamic Characteristics, and Economic Growth Effects of Optimal Financial Structure. J. Manag. World 2016, 1, 66–77. (In Chinese) [Google Scholar]

| Variable Name | Variable Symbol | Variable Description |

|---|---|---|

| Labor input | Number of employees in the enterprise | |

| Capital investment | Net fixed assets ($M) | |

| Debt-to-asset ratio | Total Liabilities/Total Assets | |

| Basic earnings per share | Net income for the period attributable to shareholders of common stock/weighted average number of common shares outstanding for the period | |

| The size of the enterprise | The logarithm of the total number of assets | |

| The age of listing | Current year—the year in which the company was listed | |

| GDP per capita in a region | The per capita GDP of the enterprise in the current period (million CNY/person) |

| Variable | Mean | Std. | Min | Max |

|---|---|---|---|---|

| 1.992 | 6.326 | 0.000 | 45.000 | |

| 0.055 | 0.142 | 0.000 | 1.000 | |

| 0.015 | 0.120 | 0.000 | 1.000 | |

| 4915.635 | 11,294.986 | 9.000 | 229,154.000 | |

| 2294.617 | 7356.121 | 0.000 | 224,866.586 | |

| 0.412 | 1.405 | −0.195 | 178.345 | |

| 0.394 | 0.869 | −16.460 | 37.170 | |

| 21.966 | 1.208 | 14.127 | 29.216 | |

| 8.926 | 7.046 | 0.000 | 30.000 | |

| 0.074 | 0.031 | 0.016 | 0.165 |

| GPA | GPAR | |

|---|---|---|

| IM | 2.705 *** | 0.0178 ** |

| (0.277) | (0.00867) | |

| L | 0.0000288 *** | 0.000000168 |

| (0.00000801) | (0.000000251) | |

| K | 0.0000874 *** | 0.000000662 ** |

| (0.00000978) | (0.000000306) | |

| DAR | 0.00435 | −0.000142 |

| (0.0200) | (0.000627) | |

| ROE | −0.0102 | −0.000273 |

| (0.0479) | (0.00150) | |

| lnsize | 0.263 *** | −0.00256 |

| (0.0785) | (0.00246) | |

| Age | −3.072 ** | 0.0100 |

| (1.273) | (0.0399) | |

| PGDP | 0.0723 | −0.147 |

| (3.381) | (0.106) | |

| _cons | 23.21 ** | 0.0298 |

| (10.98) | (0.344) | |

| Fe_id | YES | YES |

| Fe_year | YES | YES |

| N | 17,132 | 17,132 |

| R2 | 0.649 | 0.518 |

| adj. R2 | 0.596 | 0.447 |

| Variable | Mean | Std. | Min | Max |

|---|---|---|---|---|

| 0.990 | 2.378 | −10.987 | 14.823 | |

| 242.234 | 771.067 | 0.001 | 22,562.813 | |

| 188.166 | 857.890 | 0.000 | 73,839.000 |

| Variable | KZ | DaA | RD |

|---|---|---|---|

| IM | −0.266 ** | 96.86 *** | 242.9 *** |

| (0.123) | (16.25) | (45.89) | |

| L | 0.0000103 *** | 0.0133 *** | 0.0310 *** |

| (0.00000356) | (0.000470) | (0.00133) | |

| K | −0.00000896 ** | 0.0766 *** | 0.0338 *** |

| (0.00000435) | (0.000574) | (0.00162) | |

| DAR | 0.0541 *** | −0.483 | −1.057 |

| (0.00890) | (1.176) | (3.320) | |

| ROE | −0.774 *** | −9.660 *** | 14.55 * |

| (0.0213) | (2.811) | (7.938) | |

| lnsize | 0.0717 ** | −12.12 *** | −27.41 ** |

| (0.0349) | (4.606) | (13.01) | |

| Age | −0.730 | −160.1 ** | −126.4 |

| (0.565) | (74.70) | (211.0) | |

| PGDP | 9.984 *** | 1682.5 *** | 2173.6 *** |

| (1.502) | (198.4) | (560.3) | |

| _cons | 5.445 | 1573.6 ** | 1518.6 |

| (4.876) | (644.1) | (1819.0) | |

| Fe_id | YES | YES | YES |

| Fe_year | YES | YES | YES |

| N | 17,132 | 17,131 | 17,132 |

| R2 | 0.653 | 0.943 | 0.631 |

| adj. R2 | 0.601 | 0.934 | 0.577 |

| State-Owned Enterprises | Private Enterprise | |

|---|---|---|

| IM | 4.522 ** | 2.713 *** |

| (2.030) | (0.804) | |

| L | 0.000195 *** | 0.000316 *** |

| (0.0000527) | (0.0000254) | |

| K | 0.000459 *** | 0.000659 *** |

| (0.0000581) | (0.0000404) | |

| DAR | −0.217 | −0.0182 |

| (2.334) | (0.0434) | |

| ROE | 0.114 | 0.106 |

| (0.359) | (0.143) | |

| lnsize | −0.519 | −0.698 *** |

| (0.727) | (0.216) | |

| Age | 3.205 | 2.216 |

| (16.00) | (3.017) | |

| PGDP | 25.38 | −2.610 |

| (28.10) | (9.730) | |

| _cons | −36.34 | 0.234 |

| (229.5) | (19.60) | |

| Fe_id | YES | YES |

| Fe_year | YES | YES |

| N | 4572 | 12498 |

| R2 | 0.627 | 0.731 |

| adj. R2 | 0.574 | 0.688 |

| EAST | MID | WEST | |

|---|---|---|---|

| IM | 1.585 | 3.251 ** | 12.28 *** |

| (1.419) | (1.407) | (0.854) | |

| L | 0.000308 *** | −0.00000293 | 0.000144 *** |

| (0.0000361) | (0.0000536) | (0.0000457) | |

| K | 0.000581 *** | −0.000161 | 0.000172 *** |

| (0.0000439) | (0.000120) | (0.0000364) | |

| DAR | −0.540 | 0.0336 | 0.599 |

| (0.718) | (0.0552) | (0.525) | |

| ROE | 0.609 ** | −0.282 | −0.0799 |

| (0.273) | (0.318) | (0.110) | |

| lnsize | −1.043 *** | 1.496 *** | −0.392 |

| (0.404) | (0.470) | (0.253) | |

| Age | 3.177 | −6.942 | 0.0245 |

| (6.032) | (6.253) | (9.577) | |

| PGDP | −10.91 | 5.275 | −0.437 |

| (15.18) | (45.59) | (22.89) | |

| _cons | −1.595 | 43.56 | 8.456 |

| (46.50) | (62.94) | (112.1) | |

| Fe_id | YES | YES | YES |

| Fe_year | YES | YES | YES |

| N | 12,243 | 2609 | 2274 |

| R2 | 0.648 | 0.678 | 0.694 |

| adj. R2 | 0.593 | 0.631 | 0.650 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, X.; Pan, J.; Meng, X. Intelligent Manufacturing and Green Innovation—Evidence from China’s Listed Manufacturing Firms. Sustainability 2024, 16, 10376. https://doi.org/10.3390/su162310376

Xu X, Pan J, Meng X. Intelligent Manufacturing and Green Innovation—Evidence from China’s Listed Manufacturing Firms. Sustainability. 2024; 16(23):10376. https://doi.org/10.3390/su162310376

Chicago/Turabian StyleXu, Xiaoshu, Jiangpei Pan, and Xuechen Meng. 2024. "Intelligent Manufacturing and Green Innovation—Evidence from China’s Listed Manufacturing Firms" Sustainability 16, no. 23: 10376. https://doi.org/10.3390/su162310376

APA StyleXu, X., Pan, J., & Meng, X. (2024). Intelligent Manufacturing and Green Innovation—Evidence from China’s Listed Manufacturing Firms. Sustainability, 16(23), 10376. https://doi.org/10.3390/su162310376