Antecedent and Consequence of Innovation Output: Evidence from Thailand

Abstract

1. Introduction

2. Literature Review

2.1. Theoretical Perspective

2.2. Innovation Output

2.3. R&D Investment

2.4. Competitive Advantage

3. Methodology

4. Findings and Discussion

5. Summary and Suggestions for Future Study

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lee, P.M.; O’neill, H.M. Ownership Structures and R&D Investments of U.S. and Japanese Firms: Agency and Stewardship Perspectives. Acad. Manag. J. 2003, 46, 212–225. [Google Scholar] [CrossRef]

- Zahra, S.A.; Covin, J.G. The financial implications of fit between competitive strategy and innovation types and sources. J. High Technol. Manag. Res. 1994, 5, 183–211. [Google Scholar] [CrossRef]

- Geroski, P. The Profitability of Innovating Firms. RAND J. Econ. 1993, 24, 198–211. [Google Scholar] [CrossRef]

- Turulja, L.; Bajgoric, N. Innovation, firms’ performance and environmental turbulence: Is there a moderator or mediator? Eur. J. Innov. Manag. 2019, 22, 213–232. [Google Scholar] [CrossRef]

- The World Bank. Thailand Now an Upper Middle-Income Economy. 2011. Available online: https://www.worldbank.org/en/news/press-release/2011/08/02/thailand-now-upper-middle-income-economy (accessed on 22 September 2024).

- Yodudom, S.; Tanachote, B.; Treesilvattanakul, K. Determinants of Thailand’s national innovative capacity. Chulalongkorn Bus. Rev. 2020, 42, 19–38. [Google Scholar]

- The World Bank. TSRI and World Bank Partner to Strengthen Innovation in Thailand. 2023. Available online: https://www.worldbank.org/en/news/press-release/2023/05/16/tsri-and-world-bank-partner-to-strengthen-innovation-in-thailand (accessed on 22 September 2024).

- World Intellectual Property Organization (WIPO). Global Innovation Index 2023: Innovation in the Face of Uncertainty; World Intellectual Property Organization: Geneva, Switzerland, 2023. [Google Scholar] [CrossRef]

- Huda, N.; Al, I.; Adha, F. The Role of Research and Development Expenditure on GDP Growth: Selected Cases of ASEAN 5 Plus 4 Asia Major Countries; INDEF Working Paper; The Institute for Development of Economics and Finance: Jakarta, Indonesia, 2020; Volume 5. [Google Scholar]

- UNESCO Institute for Statistics. Gross Domestic Expenditure on R&D (GERD) as a Percentage of GDP. 2023. Available online: http://data.uis.unesco.org/index.aspx?queryid=74 (accessed on 22 September 2024).

- Artz, K.W.; Norman, P.M.; Hatfield, D.E.; Cardinal, L.B. A longitudinal study of the impact of R&D, patents, and product innovation on firm performance. J. Prod. Innov. Manag. 2010, 27, 725–740. [Google Scholar] [CrossRef]

- Hall, L.A.; Bagchi-Sen, S. A study of R&D, innovation, and business performance in the Canadian biotechnology industry. Technovation 2002, 22, 231–244. [Google Scholar] [CrossRef]

- Medda, G. External R&D, product and process innovation in European manufacturing companies. J. Technol. Transf. 2020, 45, 339–369. [Google Scholar] [CrossRef]

- Sudirjo, F. The Effects of R&D Intensity and Product Orientation On Innovativeness and Competitive Advantage of The Woodcraft Industry. J. Manaj. Dan Agribisnis 2023, 20, 202–213. [Google Scholar] [CrossRef]

- Parthasarthy, R.; Hammond, J. Product innovation input and outcome: Moderating effects of the innovation process. J. Eng. Technol. Manag. 2002, 19, 75–91. [Google Scholar] [CrossRef]

- Zhu, H.; Zhao, S.; Abbas, A. Relationship between R&D grants, R&D investment, and innovation performance: The moderating effect of absorptive capacity. J. Public Aff. 2020, 20, e1973. [Google Scholar] [CrossRef]

- Greve, H.R. A behavioral theory of R&D expenditures and innovations: Evidence from shipbuilding. Acad. Manag. J. 2003, 46, 685–702. [Google Scholar] [CrossRef]

- Lin, B.; Xie, Y. Positive or negative? R&D subsidies and green technology innovation: Evidence from China’s renewable energy industry. Renew. Energy 2023, 213, 148–156. [Google Scholar] [CrossRef]

- Wang, S.; Guidice, R.M.; Tansky, J.W.; Wang, Z.M. When R&D spending is not enough: The critical role of culture when you really want to innovate. Hum. Resour. Manag. 2010, 49, 767–792. [Google Scholar] [CrossRef]

- Un, C.A.; Cuervo-Cazurra, A.; Asakawa, K. R&D collaborations and product innovation. J. Prod. Innov. Manag. 2010, 27, 673–689. [Google Scholar] [CrossRef]

- Aziz, N.N.A.; Samad, S. Innovation and Competitive Advantage: Moderating Effects of Firm Age in Foods Manufacturing SMEs in Malaysia. Procedia Econ. Financ. 2016, 35, 256–266. [Google Scholar] [CrossRef]

- Kuncoro, W.; Suriani, W.O. Achieving sustainable competitive advantage through product innovation and market driving. Asia Pac. Manag. Rev. 2018, 23, 186–192. [Google Scholar] [CrossRef]

- Salim, I.M.; Sulaiman, M.; Lumpur, K. Organizational Learning, Innovation and Performance: A Study of Malaysian Small and Medium Sized Enterprises. Int. J. Bus. Manag. 2011, 6, 118–125. [Google Scholar] [CrossRef]

- Udriyah Tham, J.; Azam, S.M.F. The effects of market orientation and innovation on competitive advantage and business perfor- mance of textile SMEs. Manag. Sci. Lett. 2019, 9, 1419–1428. [Google Scholar] [CrossRef]

- Chamsuk, W.; Fongsuwan, W.; Takala, J. The Effects of R&D and Innovation Capabilities on the Thai Automotive Industry Part’s Competitive Advantage: A SEM Approach. Manag. Prod. Eng. Rev. 2017, 8, 101–112. [Google Scholar] [CrossRef]

- Distanont, A.; Khongmalai, O. The role of innovation in creating a competitive advantage. Kasetsart J. Soc. Sci. 2020, 41, 15–21. [Google Scholar] [CrossRef]

- Kammerlander, N.; van Essen, M. Research: Family Firms Are More Innovative Than Other Companies. Harv. Bus. Rev. 2017, 25, 2–6. [Google Scholar]

- Kroll, H.; Kou, K. Innovation output and state ownership: Empirical evidence from China’s listed firms. Ind. Innov. 2019, 26, 176–198. [Google Scholar] [CrossRef]

- Helfat, C.E. Know-how and asset complementarity and dynamic capability accumulation: The case of R&D. Strateg. Manag. J. 1997, 18, 339–360. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and micro foundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Forsman, H.; Temel, S. Innovation and business performance in small enterprises. An enterprise-level analysis. Int. J. Innov. Manag. 2011, 15, 641–665. [Google Scholar] [CrossRef]

- Freel, M.S. Do Small Innovating Firms Outperform Non-Innovators? Small Bus. Econ. 2000, 14, 195–210. [Google Scholar] [CrossRef]

- Guo, B.; Wang, J.; Wei, S.X. R&D spending, strategic position and firm performance. Front. Bus. Res. China 2018, 12, 14. [Google Scholar] [CrossRef]

- Liao, Z.; Tow, M. Do competitive strategies drive R&D? An empirical investigation of Japanese high-technology corporations. J. High Technol. Manag. Res. 2002, 13, 143–156. [Google Scholar]

- Chen, Y.; Ibhagui, O.W. R&D-firm performance nexus: New evidence from NASDAQ listed firms. N. Am. J. Econ. Financ. 2019, 50, 101009. [Google Scholar] [CrossRef]

- Siripong, W.; Phramhan, N.; Pimpakarn, P.; Panyaying, R.; Saengsri, S.; Malawaichan, I.; Suttipun, M. The relationship between research and development disclosure and financial performance of listed companies in the Stock Exchange of Thailand (SET). MUT J. Bus. Adm. 2019, 16, 173–190. [Google Scholar]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Wang, C.L.; Ahmed, P.K. Dynamic capabilities: A review and research agenda. Int. J. Manag. Rev. 2007, 9, 31–51. [Google Scholar] [CrossRef]

- Weerawardena, J.; Mavondo, F.T. Capabilities, innovation and competitive advantage. Ind. Mark. Manag. 2011, 40, 1220–1223. [Google Scholar] [CrossRef]

- Sakhonkaruhatdej, K.; Khorchurklang, S.; Changkaew, L. Dynamic Capabilities, Competitive Advantage and Business Success of Thai Food Processing Industry. Kasem Bundit J. 2016, 17, 225–238. [Google Scholar]

- OECD/Eurostat. OECD Proposed Guidelines for Collecting and Interpreting Technological Innovation Data—Oslo Manual; OECD: Paris, France, 1997. [Google Scholar] [CrossRef]

- Thornhill, S. Knowledge, innovation and firm performance in high- and low-technology regimes. J. Bus. Ventur. 2006, 21, 687–703. [Google Scholar] [CrossRef]

- Griliches, Z. Issues in assessing the contribution of research and development to. Bell J. Econ. 1979, 10, 92–116. [Google Scholar] [CrossRef]

- National Innovation Agency: NIA (Public Organization). Strategic Role of the National Innovation Agency (Public Organization). 2015. Available online: https://www.nia.or.th/frontend/bookshelf/Ap5WqX9hFP5CI/62d41cfdd3813.pdf (accessed on 22 September 2024).

- Brouwer, E.; Kleinknecht, A. Innovative output, and a firm’s propensity to patent. An exploration of CIS micro data. Res. Policy 1999, 28, 615–624. [Google Scholar] [CrossRef]

- Hall, B.H.; Lerner, J. The financing of R&D and innovation. In Handbook of the Economics of Innovation, 1st ed.; Elsevier BV: Amsterdam, The Netherlands, 2010; Volume 1, Issue 1 C. [Google Scholar] [CrossRef]

- Brown, A.E. New Definitions for Industrial R&D. Res. Manag. 1972, 15, 55–57. [Google Scholar] [CrossRef]

- Bremser, W.G.; Barsky, N.P. Utilizing the balanced scorecard for R&D performance measurement. R D Manag. 2004, 34, 229–238. [Google Scholar] [CrossRef]

- Ministry of Finance. Ministry of Finance Announcement: Set Criteria, Methods and Conditions for Exempting Income Tax. For Expenses for Research and Development of Technology and Innovation. 2016. Available online: https://www.rd.go.th/fileadmin/user_upload/kormor/newlaw/mfp391.pdf (accessed on 22 September 2024).

- Kim, W.S.; Park, K.; Lee, S.H.; Kim, H. R & D investments and firm value: Evidence from China. Sustainability 2018, 10, 4133. [Google Scholar] [CrossRef]

- Vithessonthi, C.; Racela, O.C. Short- and long-run effects of internationalization and R&D intensity on firm performance. J. Multinatl. Financ. Manag. 2016, 34, 28–45. [Google Scholar] [CrossRef]

- Lome, O.; Heggeseth, A.G.; Moen, Ø. The effect of R&D on performance: Do R&D-intensive firms handle a financial crisis better? J. High Technol. Manag. Res. 2016, 27, 65–77. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Healy, P.; Serafeim, G.; Srinivasan, S.; Yu, G. Market competition, earnings management, and persistence in accounting profitability around the world. Rev. Account. Stud. 2014, 19, 1281–1308. [Google Scholar] [CrossRef]

- Miles, R.E.; Snow, C.C.; Meyer, A.D.; Coleman, H.J., Jr. Organizational Strategy, Structure, and Process. Acad. Manag. Rev. 1978, 3, 546–562. [Google Scholar] [CrossRef]

- Porter, M.E. Competitive Strategy. Meas. Bus. Excell. 1997, 1, 12–17. [Google Scholar] [CrossRef]

- Liao, Z.; Greenfield, P.F. The synergy of corporate R&D and competitive strategies: An exploratory study in Australian high-technology companies. J. High Technol. Manag. Res. 2000, 11, 93–107. [Google Scholar] [CrossRef]

- Sukglun, A.; Suttapong, K.; Pianroj, N. Strategies for creating competitive advantage for smart farm ing enterprise. Exec. J. 2018, 38, 91–100. [Google Scholar]

- McGrath, R.G.; Nerkar, A. Real options reasoning and a new look at the R&D investment strategies of pharmaceutical firms. Strateg. Manag. J. 2004, 25, 1–21. [Google Scholar] [CrossRef]

- Kim, Y.; Gu, B. Strategic R&D subsidies and product differentiation with asymmetric market size. Procedia Econ. Financ. 2015, 30, 447–454. [Google Scholar] [CrossRef]

- Ding, L.; Velicer, W.F.; Harlow, L.L. Effects of estimation methods, number of indicators per factor, and improper solutions on structural equation modeling fit indices. Struct. Equ. Model. Multidiscip. J. 1995, 2, 119–144. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis: A Global Perspective, 7th ed.; Pearson Prentice Hall: Hoboken, NJ, USA, 2010. [Google Scholar]

- Parnell, J.A.; Carolina, N.; Lester, D.L.; Ko, M.A. How environmental uncertainty affects the link between business strategy and performance in SMEs. Manag. Decis. 2012, 50, 546–568. [Google Scholar] [CrossRef]

- The Office of National Higher Education Science Research and Innovation Policy Council (NXPO). Annual Report 2019. 2019. Available online: https://www.nxpo.or.th/th/wp-content/uploads/2020/06/AR-%E0%B8%AA%E0%B8%AD%E0%B8%A7%E0%B8%8A-Final.pdf (accessed on 22 September 2024).

- Eichhorn, B.R. Common Method Variance Techniques; SAS Institute Inc.: Cleveland, OH, USA, 2014; Volume 1, Issue 11. [Google Scholar]

- Hair, J.; Tatham, R.; Anderson, R.; Black, W. Multivariate Data Analysis, 5th ed.; Prentice-Hall: Hoboken, NJ, USA, 1998. [Google Scholar]

- Bagozzi, R.P.; Yi, Y. On the evaluation of structural equation models. J. Acad. Mark. Sci. 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Hulland, J. Use of Partial Least Squares (PLS) in strategic management research: A review of four recent studies. Strateg. Manag. J. 1999, 20, 195–204. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Field, A. Discovering Statistics Using IBM SPSS Statistics, 5th ed.; Sage: Los Angeles, CA, USA, 2015. [Google Scholar]

- Hu, L.T.; Bentler, P.M. Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Struct. Equ. Model. A Multidiscip. J. 1999, 6, 1–55. [Google Scholar] [CrossRef]

- Schermelleh-Engel, K.; Moosbrugger, H.; Müller, H. Evaluating the fit of structural equation models: Tests of significance and descriptive goodness-of-fit measures. Methods Psychol. Res. Online 2003, 8, 23–77. [Google Scholar]

- The World Bank. Research and Development Expenditure (% of GDP). 2022. Available online: https://data.worldbank.org/indicator/GB.XPD.RSDV.GD.ZS (accessed on 22 September 2024).

| Variables | Symbol | Measurement Scale |

|---|---|---|

| Innovation output | INNO | Five-level Likert scale |

| R&D spending | RD | Five-level Likert scale |

| Competitive advantage | CA | Five-level Likert scale |

| Variable | Items | Factor Loading | Cronbach’ Alpha | CR | AVE | Item–Total Correlation |

|---|---|---|---|---|---|---|

| Innovation output | Product innovation Process innovation | 0.773 0.880 | 0.803 | 0.948 | 0.731 | 0.635–0.739 0.430–0.747 |

| R&D spending | The firm has a policy of investing in R&D on a regular basis. | 0.761 | 0.886 | 0.947 | 0.694 | 0.302–0.822 |

| The firm has expenses associated with R&D. | 0.821 | |||||

| The firm has expenses in R&D personnel. | 0.912 | |||||

| The firm has outsourced its R&D. | 0.521 | |||||

| The firm has expenses on land, buildings, and structures for R&D. | 0.668 | |||||

| The firm spends on software used for R&D. | 0.640 | |||||

| The firm has expenses on machinery and equipment for R&D. | 0.763 | |||||

| Competitive Advantage | Differentiation | 0.775 | 0.833 | 0.947 | 0.750 | 0.310–0.682 |

| Cost leadership | 0.787 | 0.361–0.601 | ||||

| Niche Market | 0.688 | 0.465–0.658 | ||||

| Quick Response | 0.731 | 0.357–0.605 |

| Variables | Frequency | Percent | ||

|---|---|---|---|---|

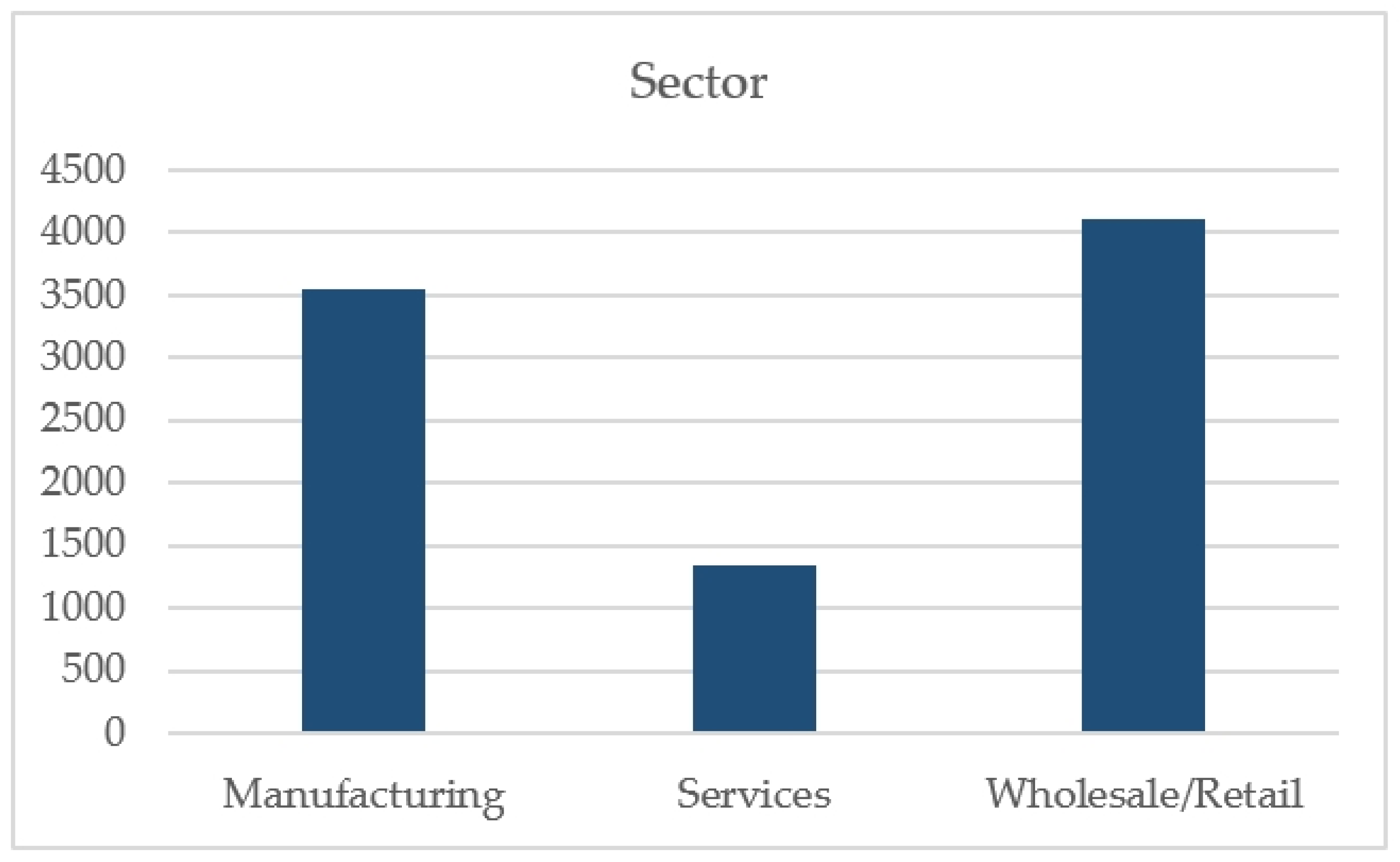

| Industries | ||||

| Manufacturing | 115 | 76.16 | ||

| Service | 16 | 10.59 | ||

| Wholesale and retail | 20 | 13.25 | ||

| Employees | ||||

| <100 | 58 | 38.41 | ||

| 100–499 | 57 | 37.75 | ||

| 500–999 | 19 | 12.58 | ||

| 1000> | 17 | 11.26 | ||

| Variables | Mean | SD | Max. | Min. |

| Business age | 31.07 | 17.54 | 100.00 | 2.00 |

| Variables (n = 151) | INNO | R&D | CA |

|---|---|---|---|

| INNO | 1 | 0.501 ** | 0.738 ** |

| RD | - | 1 | 0.427 ** |

| CA | - | - | 1 |

| MEAN. | 3.440 | 2.727 | 3.789 |

| MIN. | 1.125 | 1.00 | 2.40 |

| MAX. | 5.00 | 4.574 | 4.85 |

| SD | 0.687 | 0.775 | 0.458 |

| SKEWNESS | −0.415 | −0.007 | −0.226 |

| KURTOSIS | 0.357 | −0.407 | 0.136 |

| Fit Measure | Model Fit | Acceptable Fit * |

|---|---|---|

| 1. χ 2 /df | 117.287/61/Sig 0.00 | 1 < χ2/df < 3 |

| 2. CFI | 0.950 | 0.95 ≤ CFI < 0.97 |

| 3. TLI | 0.936 | 0.95 ≤ TLI < 0.97 |

| 4. RMSEA | 0.078 | 0.05 < RMSEA ≤ 0.08 |

| 5. SRMR | 0.057 | 0.05 < SRMR ≤ 0.10 |

| Hypothesized Path | Std.Coef. | SE | p-Value | Results | |

|---|---|---|---|---|---|

| Direct effect | |||||

| H1 | RD → INNO | 0.584 *** | 0.068 | 0.000 | Supported |

| H2 | RD → CA | −0.026 | 0.088 | 0.768 | Rejected |

| H3 | INNO → CA | 0.938 *** | 0.071 | 0.000 | Supported |

| Indirect effect | |||||

| H4 | RD → INNO → CA | 0.548 *** | 0.088 | 0.000 | Supported |

| Total effect | 0.522 | 0.072 | 0.000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Suttipun, M.; Insee, K. Antecedent and Consequence of Innovation Output: Evidence from Thailand. Sustainability 2024, 16, 9758. https://doi.org/10.3390/su16229758

Suttipun M, Insee K. Antecedent and Consequence of Innovation Output: Evidence from Thailand. Sustainability. 2024; 16(22):9758. https://doi.org/10.3390/su16229758

Chicago/Turabian StyleSuttipun, Muttanachai, and Krittiga Insee. 2024. "Antecedent and Consequence of Innovation Output: Evidence from Thailand" Sustainability 16, no. 22: 9758. https://doi.org/10.3390/su16229758

APA StyleSuttipun, M., & Insee, K. (2024). Antecedent and Consequence of Innovation Output: Evidence from Thailand. Sustainability, 16(22), 9758. https://doi.org/10.3390/su16229758