Abstract

In order to implement the dual-carbon strategy and achieve sustainable economic development, it is essential to guarantee environmental protection through the establishment of an effective environmental rule of law. This study employs a quasi-natural experiment, namely the establishment of environmental protection courts in China’s intermediate people’s courts, to investigate the impact on the ESG performance of A-share listed companies from 2010 to 2022. A double-difference model is utilized for this purpose. This study reveals that the specialization of environmental justice is an effective means of promoting the ESG performance of enterprises. The results of mechanism tests indicate that the specialization of environmental justice has a positive impact on the ESG performance of enterprises, primarily by enhancing external supervision and garnering greater media attention and analyst interest. Furthermore, heterogeneity analysis reveals that the influence of environmental justice specialization on corporate ESG performance is particularly pronounced in eastern regions, contexts characterized by high environmental uncertainty and heavily polluting enterprises. These findings offer invaluable insights into the development of environmental justice and the advancement of sustainable economic growth.

1. Introduction

Against a background of mounting global concern for environmental protection, the ESG performance of companies has assumed the role of a key indicator for measuring sustainability and social responsibility [1]. ESG is an effective instrument for reaching carbon neutrality. Around two-thirds of global emissions and 75% of GDP are predicted to be decarbonized by the middle of this century [2]. In order to achieve this objective, China has formulated a dual-carbon strategy. Enterprises serve an essential role in the coordination of economic development and ecological and environmental protection. The legalization of enterprises is an essential measure for ensuring the sustainable development of businesses, representing a pivotal step for China in achieving its carbon neutrality goal. Since the objective of comprehensive legal reform was proposed, the reform of the legal system to promote ecological and environmental protection has constituted an important part of it. Consequently, comprehensive studies on how environmental justice reform affects microenterprise ESG performance are crucial for building a legally governed China and advancing the growth of highly qualified sustainable enterprises.

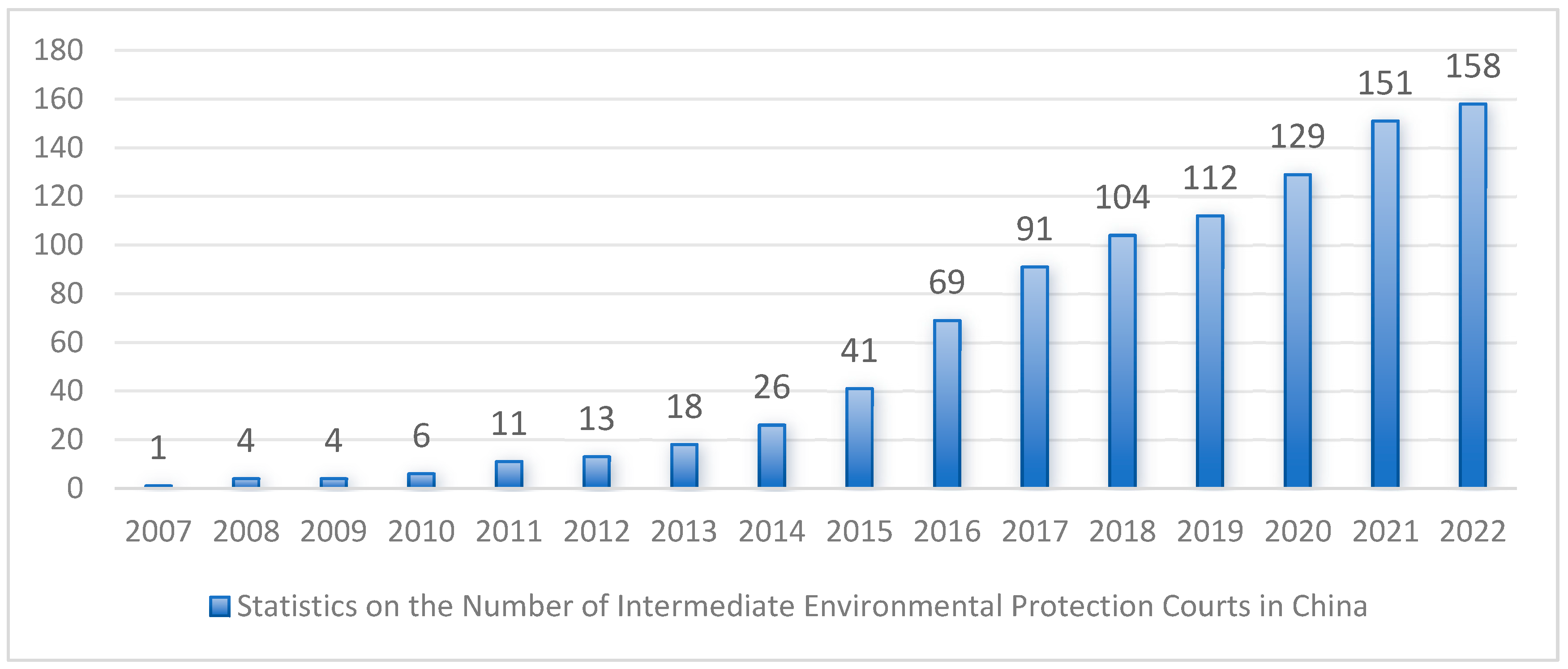

The Chinese government has implemented a number of initiatives to promote the improvement of corporate ESG performance to ensure that the dual carbon target is achieved as scheduled. In terms of market-based instruments, the Chinese government has established measures such as emissions trading to reduce pollutant emissions [3]. In terms of administrative intervention measures, environmental regulation systems represented by environmental penalties have played a major role in environmental governance [4,5]. In addition, temporary measures such as restricting the number of vehicles in the city during major political events can also temporarily improve the environment [6,7]. Although these measures are all aimed at reducing the occurrence of polluting behavior, the problem of environmental pollution has not been effectively addressed as a result. A critical phase in standardizing environmental governance is the formation of the legal system as a long-term tool for controlling environmental contamination. The establishment of the legal system in environmental governance mainly involves the following two aspects. The first is environmental legislation. For example, China first promulgated the Environmental Protection Law of the People’s Republic of China in 1989 and then issued the new Environmental Protection Law in 2015. These have all made clear legal provisions for environmental pollution behavior from a legislative perspective [5]. However, in addition to specific provisions in legislation, the judiciary is also essential to the legal system’s efficient operation [8]. In response to the environmental crisis, foreign countries began exploring an environmental court system in the 1950s, setting up specialized environmental trial bodies to resolve environmental litigation disputes. Subsequently, in order to address the progressively more severe environmental issues in the process of economic and social development, China gradually explored environmental justice reform in 2007 on the basis of learning from foreign experience and established China’s first environmental protection court in Guizhou. In 2022, China had established an environment protection court in 158 cities nationwide.

With growing awareness of environmental protection, environmental justice plays an increasingly important role in maintaining ecological balance and safeguarding the public’s environmental rights and interests. China has built an environmental justice system from the highest to the lowest levels, ensuring that environmental conflicts are resolved effectively. In the practice of environmental justice, the following factors primarily influence this study’s decision to examine intermediate environmental courts rather than high-level, grassroots, or county-level municipal environmental courts. First, considering the framework of China’s environmental justice system, the Higher People’s Court is mainly responsible for formulating judicial policies and judicial interpretations, supervising and guiding the work of lower courts, and coordinating and interacting with the necessary departments in the field of environmental justice; thus, it plays a macro-led role. An important role in the environmental justice system is played by the Intermediate People’s Court. On the one hand, it has jurisdiction over the more important and complex environmental cases and has richer trial resources and a higher degree of specialization. On the other hand, it has a guiding and modeling effect on the trial work of the people’s courts at the grass-roots level. Although grassroots environmental courts are close to the public and the places where environmental disputes occur, they are relatively limited in terms of trial resources, degree of specialization, and trial influence. For example, in 2021, up to 99% of China’s environmental administrative cases were tried under ordinary procedures, and less than 1% were tried under summary procedures. In intermediate people’s courts, 55.81% of first-instance cases are approved. Second, for listed companies, grassroots or county-level municipal environmental courts may face greater pressure and disruption in handling environmental cases involving locally listed companies due to their close local ties. In contrast, intermediate-level environmental courts are relatively more independent and impartial and are able to hear cases more objectively and ensure the correct application of the law. Finally, intermediate environmental courts have obvious advantages in terms of case jurisdiction, trial resources, degree of specialization, and trial influence, and are better able to adapt to the needs of complex environmental cases.

At present, most of the research on environmental courts has carried out extensive discussions on the cost of equity capital, environmental protection expenditures, and investment behavior of enterprises. However, there has been minimal study on the effects of environmental courts on the ESG performance of enterprises [9,10,11]. As a representational change in regional environmental justice reform, the introduction of environmental justice courts can considerably impact corporate environmental behavior decisions [12]. On the one hand, companies will increase their investment in environmental protection in the short term in order to meet local regulatory requirements [10]. On the other hand, for companies to achieve sustainable development, they must always enhance their ESG performance in order to balance economic growth and environmental conservation [13].

Therefore, this study builds a progressive double-difference model to examine the effect of environmental justice specialization on local businesses’ ESG performance using data from Chinese A-share listed companies between 2010 and 2022. This study finds the following: First, the formation of environmental protection courts can greatly improve the ESG performance of local businesses. Second, in terms of the mechanism of action, environmental justice reform can improve the ESG performance of enterprises by attracting media attention and analyst attention. Third, the heterogeneity analysis shows that environmental justice specialization has a greater impact on enhancing the ESG of companies in the eastern area, with high environmental uncertainty and heavy pollution.

This study makes three research contributions. Firstly, from a research perspective, it contributes to the judicial perspective on the impact of regional rule of law reform on corporate governance conduct. Existing research mainly focuses on the impact of corporate governance and capital structure from the perspectives of legislative behavior, technological change, and personality traits. Few studies have examined the effect of rule of law reform on company ESG performance against the backdrop of China’s rule of law development. Secondly, in terms of research contents, it examines the impact of prefecture-level environmental protection courts on company ESG performance, as well as their mechanism of action. It supplements existing research on the establishment of environmental protection courts. Finally, in terms of research significance, the results provide positive evidence for the implementation effect of China’s dual-carbon strategy, which provides valuable reference for global environmental governance and sustainable growth.

2. Institutional Background, Literature Review, and Theoretical Analysis

2.1. Institutional Background

The rule of law is fundamental to environmental governance, and the rule of law in China can effectively promote corporate social responsibility [14]. Since the People’s Republic of China’s Environmental Protection Law was first promulgated in 1989, the country has gradually established a comprehensive legal framework for environmental protection. Nevertheless, in practice, the level of compliance with environmental legislation remains inadequate. The concept of environmental justice continues to encounter challenges, including instances of non-compliance with legal standards, leniency in law enforcement, and a lack of accountability. The judicial system continues to encounter significant challenges. Given the aforementioned circumstances, China has steadily built a network of large-scale judicial institutions since 2007, when the first environmental protection court was established at the Guiyang Intermediate People’s Court in Guizhou province. In 2014, the Supreme People’s Court of China published the ‘Opinions on Comprehensively Strengthening the Trial of Environmental Resources to Provide Strong Judicial Protection for Promoting the Construction of an Ecological Civilization’. This document announced the establishment of the Environmental Resources Trial Tribunal, bringing specialist environmental justice to the national level. Figure 1 illustrates the establishment of environmental protection courts in recent years. It demonstrates that since their inception in 2007, the number of such courts has grown rapidly, reaching 158 by the end of 2022. This evidence supports the assertion that a robust foundation has been laid for the advancement of environmental justice.

Figure 1.

Statistics on the number of environmental courts in China.

Numerous specialized environmental trial bodies, such as environmental protection circuit courts, environmental protection college courts, and environmental protection tribunals, have been established in China. Among these, the environmental protection tribunals have played the most significant role in judicial reform, due to their specialization and expertise. The specialized trial mechanism and high-quality trial efficiency of the environmental protection tribunals have led to a notable enhancement in the level of environmental justice in China. In particular, the following aspects are worthy of note: (1) The trial team for environmental resource cases is constituted of experts in the relevant field. In order to ensure the highest standards of professionalism, environmental courts require judges with backgrounds in the relevant field to hear cases. Additionally, they establish a team of consultants who specialize in legal issues in the environmental field, providing guidance and interpretation of cases and ensuring the hearing of environmental cases is conducted professionally. (2) The efficiency of the trial process for environmental resource cases. In contrast to the previous practice of holding separate trials for civil, criminal, and administrative cases, environmental courts have adopted a three-in-one trial model for civil and administrative cases, which has resulted in a notable improvement in the efficiency of case trials. (3) Regional coordination of the scope of environmental resource case trials. Currently, environmental cases are often concentrated in specific water areas, regions, or other natural geographical distributions, which have a natural attribute. However, the administrative attribute of traditional cases makes it challenging for judicial organs to govern them according to administrative divisions. The establishment of environmental protection courts overcomes the administrative division restrictions of traditional case trials, enabling cases to be tried across administrative regions and greatly improving regional coordination.

Through more than a decade of practice in environmental justice reform, China’s environmental justice system has become increasingly mature. It is of great significance to environmental protection in China and globally. First, at the level of ecological environmental protection, environmental courts have been set up in key areas, such as watersheds, regions, and nature reserves, to focus on solving local ecological problems and promoting regional ecological environmental protection. For example, a dual-carbon ecological circuit court was set up in Dongshan Court to help protect the “green carbon + blue carbon” carbon sink ecosystem. In 2022, the Supreme People’s Court and Procuratorate issued a total of 3 batches of 15 guiding cases and 15 batches of 144 typical cases. The content involved public interest litigation, natural resource utilization, watershed judicial protection, biodiversity, and wetland protection. The system of judicial rules centered on the concepts of green justice, such as environmental justice, risk prevention, and ecological restoration, has been consolidated. Secondly, from the perspective of green and sustainable economic and social development, environmental justice reform has prompted enterprises to realize sustainable economic and social development through green transformation [15,16]. Environmental justice reform has increased enterprises’ green factor input and enhanced enterprises’ green level. It provides an important guarantee for the reduction of environmental pollution and the green low-carbon economic development. Finally, China’s environmental justice reform provides governance experience for global ecological environmental protection. With the increasingly severe global environmental problems, China’s active exploration and innovation in the field of environmental justice has provided Chinese wisdom and Chinese programs for international environmental governance. For example, China has held a number of consecutive international judicial forums on ecological civilization, accumulating useful experience for the practice and development of global environmental justice.

2.2. Literature Review, Theoretical Analysis, and Research Hypotheses

2.2.1. Specialization in Environmental Justice and Corporate ESG Performance

Specialization of environmental justice refers to a system in which a special environmental court hears environmental cases in accordance with specialized environmental justice procedures [11]. The environmental court system is designed to address several key issues, including the lack of sufficient evidence to proceed with environmental trials, the scarcity of qualified personnel to conduct such trials, and the absence of impartiality in monitoring and assessment institutions. It is anticipated that the establishment of this specialized judicial framework will contribute to an enhanced level of environmental protection [17]. Currently, more and more scholars are conducting research on the establishment of environmental courts. Legal and financial theories establish the link between law and the development of micro-market entities and the macroeconomy [18,19]. Based on this theoretical framework, existing studies have shown that environmental justice specialization can influence corporate behavior by exerting a deterrent effect, lowering the price of equity capital for businesses, and increasing their green innovation [9,20,21]. According to the reputation trading idea, ethical business practices can improve a company’s reputation, which is a significant intangible asset [22]. Maintaining a good reputation helps a company build trust and win the support of stakeholders [11,23]. In light of the above theory, the ever-changing legal environment necessitates that companies devote greater attention to sustainable development, which in turn prompts them to enhance their ESG performance. Consequently, the establishment of environmental courts will influence the local businesses’ strategic decisions.

For a company to achieve high-quality sustainable development, it must deeply integrate the ESG concept into its value system. While focusing on the company’s own economic benefits, it is also necessary to consider its impact on society and the environment. Currently, academic study on ESG primarily focuses on its impacting elements, economic consequences, and variable construction. Regarding influencing factors, scholars have studied the influence of organizational characteristics, government policies, public and media supervision, etc. on business ESG performance [24,25,26,27]. For the economic consequences, several studies have focused on the impact of ESG performance on corporate financial performance, market competition, financial lending, etc. [28,29,30]. In terms of variable construction, scholars have undertaken extensive research on the logical framework of ESG and explored a more scientific and reasonable ESG performance evaluation system to measure the comprehensive performance of enterprises [31,32]. However, there are few studies that discuss the impact of environmental justice on corporate ESG performance. On the one hand, from the perspective of policy regulation, the implementation of environmental protection laws positively affects ESG performance. As part of the rule of law system, institutional reforms in the judicial sector can further ensure compliance with the law. The impact on corporate ESG performance is worth exploring [33]. On the other hand, some scholars have pointed out that the establishment of environmental protection courts can promote pollution control. As the main body of pollution control, the strengthening of the rule of law will also have a subtle but significant impact on corporate ESG performance, as follows:

Firstly, the specialization of environmental justice has resulted in enhanced judicial efficiency and the implementation of mandatory safeguards for companies seeking to improve their ESG performance. The environmental protection court has shifted the management of environmental resource cases from decentralization to centralization within the traditional court system. The formation of specialized institutions has contributed to an increase in judicial efficiency in cases of environmental governance responsibility, thereby forming a significant constraint on corporate environmental pollution [9]. For example, prior to the inception of the Environmental Protection Court, the separation of powers within the judicial system resulted in the adjudication of environmental cases in distinct legal arenas, namely civil, criminal, and administrative courts. Subsequently, the establishment of the Environmental Protection Court saw the consolidation of all environmental civil, criminal, and administrative cases within a single judicial institution. This avoids the necessity for multiple trials. Furthermore, the trial of environmental cases by professionals as well as the breaking of geographical restrictions will also markedly enhance judicial efficiency. When companies face improvements in judicial standards and efficiency, in order to fulfill their own requirements for legitimacy, they tend to invest in the field of green sustainable development to adapt to an increasingly improved judicial system, thereby promoting the ESG performance of the company [34].

Secondly, specialization in environmental justice can have a deterrent effect on the rule of law, prompting companies to prioritize their own sustainable development and consequently enhance their ESG performance. The current environmental policy actions implemented by the Chinese government can be classified into two categories: market-incentive-based environmental policies and command-and-control-based environmental policies [35]. In comparison to the former, command-and-control environmental regulations primarily regulate corporate polluting behavior through a rigorous system of laws and regulations. Mandatory compliance is the most distinctive feature [15]. According to the notion of deterrence, the presence of punishment alters a person’s assessment of the balance between the illegal benefits and costs [36]. As a form of command-and-control environmental policy, the specialization of environmental justice increases the risk of enterprises being sued for environmental issues. Once sued, they face the risk of fines and a decline in reputation, which seriously affects regular manufacturing and business activity of the enterprise. Before the reform of the environmental justice system, China also introduced corresponding environmental laws and regulations to govern corporate polluting behavior, such as the implementation of the Environmental Protection Law. Between local economic growth and environmental protection, the government often gives priority to economic growth, resulting in ineffective environmental governance [9]. However, following the reform of the environmental justice system, there is increasing pressure to adjudicate and litigate environmental cases, and the level of environmental law enforcement by local governments has improved, which has a greater legal deterrent effect on enterprises. On the one hand, it will prompt enterprises to reduce environmental pollution from the source. On the other hand, it will also make enterprises more willing to assume their social responsibilities and promote their own sustainable development.

Finally, an environmental justice specialization can effectively encourage corporate investment in green initiatives, promote green production practices, facilitate corporate transformation towards sustainability, and enhance corporate ESG performance [21]. On the one hand, stakeholders such as business owners, creditors, and distributors prefer environmentally friendly companies. The Porter hypothesis proposes that suitable environmental legislation might encourage corporate innovation. An increasingly sound legal system allows the capital originally invested in production activities to be diverted to environmental protection investments aimed at environmental governance. Companies seek long-term growth by growing investment in green innovation [16]. On the other hand, the legal and institutional theory emphasizes that the acquisition of organizational legitimacy depends on its consistency with its surroundings [37]. Environmental legitimacy is one of the most crucial forms of legitimacy that businesses must maintain. As the primary source of environmental pollution and governance, companies are inevitably affected by environmental legislation in terms of their production and operations, as well as their capital allocation. Consequently, they invest capital in green activities [10]. In summary, this study proposes:

Hypothesis 1 (H1).

Specialization in environmental justice promotes corporate ESG performance.

2.2.2. The Channel Mechanism of Environmental Justice Specialization and Corporate ESG Performance—Media Attention

In an informal institutional environment, media attention can impact a company’s ESG performance by exposing negative cases and achieving external supervision [38]. The specialization of environmental justice as an important part of judicial system reform will also attract media attention. When enterprises face a harsh legal environment, the possibility of litigation risks being reported by the media will increase. Once negative news is reported, it will reduce the good image that the enterprise has established in the minds of stakeholders in the past. First of all, media attention will reduce the asymmetry between users of internal and external information. Higher media attention can reduce external monitoring costs, financing costs, and governance costs [39]. This makes companies pay more attention to the impact of media coverage of legal proceedings on themselves, which forces them to enhance their ESG performance and reduce the risk of facing litigation. Secondly, media attention will increase the direct financial costs of companies through the reputation effect, which exposes them to the risk of fines and litigation due to negative ESG news [40]. Businesses will focus more on their ESG performance when they are under media scrutiny, which will lower the incidence of unnecessary operating expenses. Finally, media attention can also affect strategic changes in a company. In order to prevent their reputation from deteriorating, companies are motivated to change their business strategies to the changing external environment [41]. In summary, the specialization of environmental justice has received close media attention, and corporate ESG performance will improve. Therefore, we propose the following:

Hypothesis 2 (H2).

Specialization in environmental justice can attract more media attention to improve corporate ESG performance.

2.2.3. The Channel Mechanism of Environmental Justice Specialization and Corporate ESG Performance—Analyst Attention

Analysts serve as information intermediates in the stock market, assisting investors in better understanding a company’s risks, performance, and long-term prospects. On the one hand, by using the information provided by analysts, banks and venture capital institutions can have a more detailed grasp of the true situation of the enterprise, which can alleviate the debt difficulties faced by the enterprise [42]. Meanwhile, analysts will issue positive analysis reports for companies with good ESG performance, increasing the value of non-financial information [43]. On the other hand, the monitoring hypothesis suggests that analysts reduce the likelihood of management opportunism by alleviating information asymmetry. Analysts’ attention can play a monitoring role in the company [44]. Aware of the pressures associated with environmental justice specialization, companies may focus more on their ESG performance to avoid legal risks and negative market reactions. However, some companies may adopt strategies to exaggerate their ESG performance in an attempt to project a favorable image in the market. Analysts, as collectors and readers of market information, pay close attention to a company’s ESG performance. When a company overstates its ESG performance, it attracts the attention of analysts. At this point, analysts are monitoring the company to prevent it from overstating its ESG performance or hiding negative results from the market. Analysts can not only reduce the company’s earnings management behavior and excessive board remuneration through monitoring effects, but also play a monitoring role in terms of the company’s environmental policies [45]. In summary, the specialization of environmental justice has made analysts pay more attention to the legal issues faced by companies and has made analysts focus more intently on the environmental protection behavior of companies, thereby improving the ESG performance of companies. Therefore, we propose the following:

Hypothesis 3 (H3).

Specialization in environmental justice can attract more analyst attention to improve corporate ESG performance.

3. Research Design

3.1. Samples and Data

The data in this study are selected from all Chinese A-share listed companies from 2010 to 2022. The pilot cities for environmental courts were first established in 2007 in Qingzhen City, Guizhou Province, and then gradually expanded to other cities in China each year. By the end of 2022, a total of 158 pilot cities in China had set up intermediate environmental protection courts. Since the number of pilot cities from 2007 to 2010 was small, the data in this study start from 2010. The sample was selected based on the following criteria: (1) Sample of listed companies excluded from trading anomalies (ST, *ST, and PT). (2) Financial and insurance companies were excluded. (3) Companies with missing values were excluded. After completing the above procedures, this study winsorized all continuous variables designed to less than 1% and more than 99%, and finally obtained 33,052 observations.

The following sources provided the data. (1) The Environmental Protection Court was manually collected from the website of the China Intermediate People’s Court as well as local media reports. (2) ESG data was sourced from the WIND database. (3) Other financial data was sourced from the China Stock Market & Accounting Research Database (CSMAR).

3.2. Variable Definition

3.2.1. Environmental Court

Following existing research practices, this study uses the establishment of the first intermediate environmental court in a prefecture-level city in China as a quasi-natural experiment [9,10,11]. The value is 1 if the intermediate environmental protection court is founded in the city where the business is located at the prefecture level in a given year; otherwise, it is 0 [9]. This is carried out as follows: First, to find out which cities have formed environmental protection courts and when they were initially established, visit the official websites of China’s 293 prefecture-level city intermediate people’s courts. In accordance with Model (1), enterprises situated in cities where environmental courts have been established are designated as the treatment group, while those in other cities serve as the control group. A multiple-time-point double-difference regression is employed to analyze the data. In particular, if the city where the enterprise is located has established an environmental court, the variable ‘Treat’ is assigned a value of 1, indicating that the enterprise is part of the treatment group. Conversely, if there is no environmental court in the city where the enterprise is located, the variable ‘Treat’ is assigned a value of 0, indicating that the enterprise is part of the control group. Post is a dummy variable for policy implementation, which is 1 after policy implementation and 0 otherwise. The cross-product of the two, Court, is the core explanatory variable of this study.

3.2.2. Corporate ESG Performance

This study uses the Sino-Securities Index ESG rating to measure corporate performance [20,34]. At present, China has not yet formulated a unified ESG evaluation standard. The existing ESG ratings are mainly from third-party institutions, such as the Sino-Securities Index, Bloomberg, SynTao Green Finance, and the Wind ESG Index System. Among them, the Sino-Securities Index ESG rating, which has covered all A-share listed companies since 2009, is the ESG rating system with the longest track record in China and is consistent with the sample period of this study. The three pillars of the Sino-Securities Index ESG rating system are Environment, Society and Corporate Governance, with each pillar containing specific indicators at different levels [20]. The Environment (E) pillar assesses the impact of the company’s production and operations on the natural environment, as well as the steps taken to resolve environmental concerns. The environment pillar includes five aspects: environmental pollution, environmental management, environmental friendliness, resource utilization, and climate change. It reflects the enterprise’s policies, measures and performance in environmental protection, response to climate change and resource conservation. The social (S) pillar focuses on the fulfillment of corporate responsibility to various stakeholders in society, as well as the contribution of enterprises in social development. The social (S) pillar covers five aspects: human capital, product responsibility, supply chain, social contribution, and data security and privacy. It reflects the fulfillment of the enterprise’s responsibilities to various stakeholders. The Corporate Governance (G) Pillar assesses the enterprise’s governance structure, decision-making mechanism and management level to ensure sustainable development and maximize shareholders’ interests. The Corporate Governance Pillar covers six areas: corporate governance structure, shareholders’ rights and interests, disclosure quality, governance risks, external sanctions, and business ethics. It assesses the level of governance and the science and transparency of the decision-making of the enterprise. It is then further refined into 44 key indicators. The score for each sub-indicator is within the range of 0–100, and the scores calculated from the underlying indicator are summarized according to the weights to get the total ESG score. The final classification is AAA, AA, A, BBB, BB, B, CCC, CC and C, totaling nine ratings. In this study, values are assigned in order from low to high: 1, 2, 3, 4, 5, 6, 7, 8 and 9. Referring to existing literature, this study selects the average ESG performance of the last two quarters of the year and the first two quarters of the following year as the dependent variable [34]. The purpose of this is to be able to mitigate the effects of specific events in certain years and to mitigate endogeneity problems such as reverse causation.

3.2.3. Control Variables

In order to ascertain the factors that may impact the corporate ESG performance, we have identified a series of control variables. It has been shown in previous studies that these variables may have an impact on corporate ESG performance [4,9,13]. These include enterprise size (Size), enterprise age (Age), asset–liability ratio (Lev), net profit rate of total assets (Roa), dual position (Dual), shareholding of the largest shareholder (Top1), TobinQ, Inst, Liquid, Mfee, Fixed, Ato, and Soe. For a detailed definition of each variable, please refer to Table 1.

Table 1.

Definition of variables.

3.3. Model Design

To study the impact of environmental justice reforms on corporate ESG performance, we have built the following model:

Among them, represents the ESG performance of listed company i in year t. indicates the dummy variable set up in the environmental protection court of the prefecture-level city where the listed company is located in year t. means control variables. indicates the individual fixed effect. indicates a fixed effect of time. represents the random disturbance term. In order to control potential confounding factors, this study employs a fixed effects model, with year and individual fixed effects, and cluster standard errors by the firm.

4. Analysis of Empirical Results

4.1. Descriptive Statistics

Table 2 presents the descriptive statistics of the key variables. The findings reveal that the mean enterprise ESG score stands at 4.14, with a minimum of 1.25, and a maximum of 6. This suggests that the ESG performance of most corporations falls between the BBB-BB range. The aforementioned observations highlight significant variations across companies. Furthermore, by integrating the financial data of firms with the environmental court status of pilot cities, it is evident that the average Did value is 0.411, indicating that 41.1% of the sampled listed companies are situated in cities that have established intermediate environmental courts. All other variables align with existing research findings.

Table 2.

Descriptive statistics.

4.2. Baseline Regression Analysis

Table 3 summarizes the results of the Environmental Court’s baseline regression study of business ESG performance. In column (1), without control variables or fixed effects, the Court coefficient is 0.158, showing a significant association at the 1% level. Column (2) incorporates pertinent control variables but omits fixed effects, yielding a Court coefficient of 0.089, also significant at the 1% level. Column (3) introduces fixed effects for firm and year without additional control variables, resulting in a Court coefficient of 0.087, significant at the 1% level. Finally, in column (4), where all control variables are accounted for and firm- and year-specific fixed effects are controlled concurrently, the establishment of the environmental protection court exhibits a significant correlation with firm ESG at the 1% level, with a regression coefficient of 0.078. These regression outcomes underscore that the Environmental Protection Court significantly enhances the ESG performance of local enterprises, thereby validating hypothesis H1.

Table 3.

Environmental justice reform and corporate ESG performance.

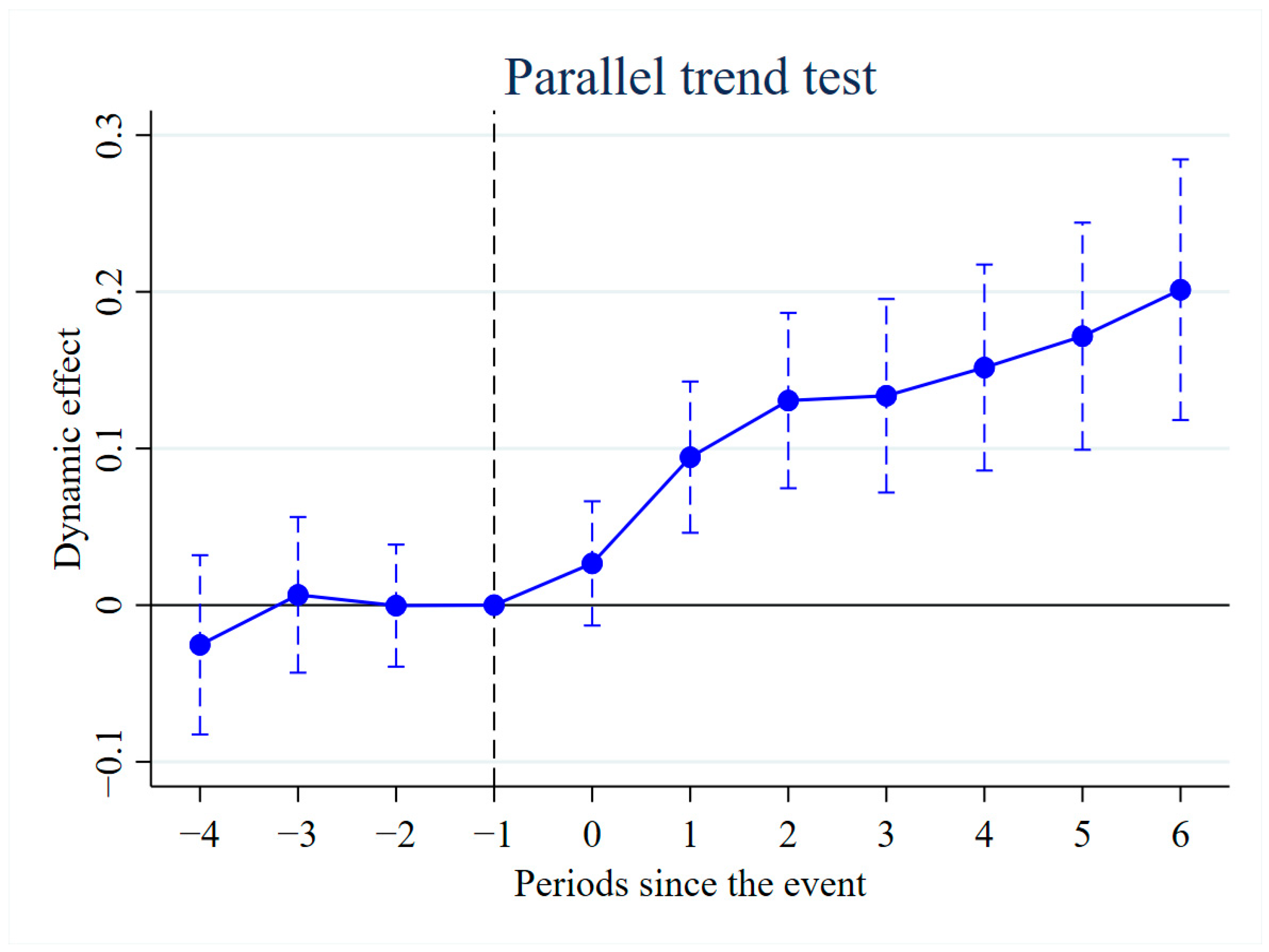

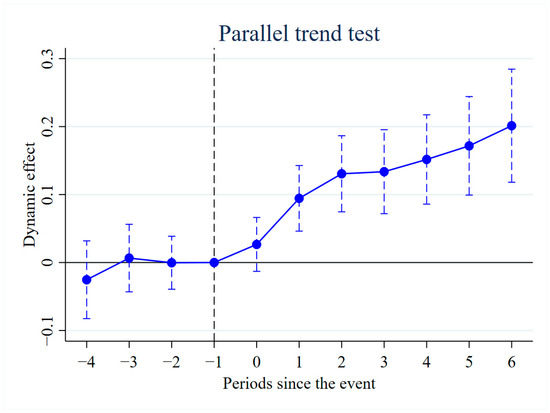

4.3. Parallel Trend Test

This study employs the event study method to ascertain whether the parallel trend has been established. Given the disparate times at which data trading platforms were established across the globe, it is not feasible to employ a single dummy variable with a specific year as the threshold for the event. Instead, it is essential to utilize a dummy variable that reflects the relative temporal proximity of the establishment of data trading platforms in each city. In light of existing studies, the pertinent model has been formulated for testing, and the specific validation equations are as follows:

The time dummy variables represent observations from the n years preceding the first establishment of an environmental court in each city, the current year, and the n years following this initial establishment. The dummy variables for the absence of an environmental court are set to zero. To enhance the clarity and intuitiveness of the results, the time period preceding the period preceding the fourth (period before 4) has been grouped together, as have the results following the sixth (after 6) period. Prior to the initiative’s implementation, the regression parameters of the experimental and control groups did not vary much, as seen in Figure 2. This suggests that the environmental court supports the parallel trend idea. Following the implementation of the initiative, the correlation coefficient exhibited a significantly positive trend, demonstrating a consistent increase with the establishment of environmental protection courts. This further indicates that the establishment of environmental protection courts in prefecture-level cities in China fosters sustainable enterprise development.

Figure 2.

Parallel trend test.

4.4. Robust Test

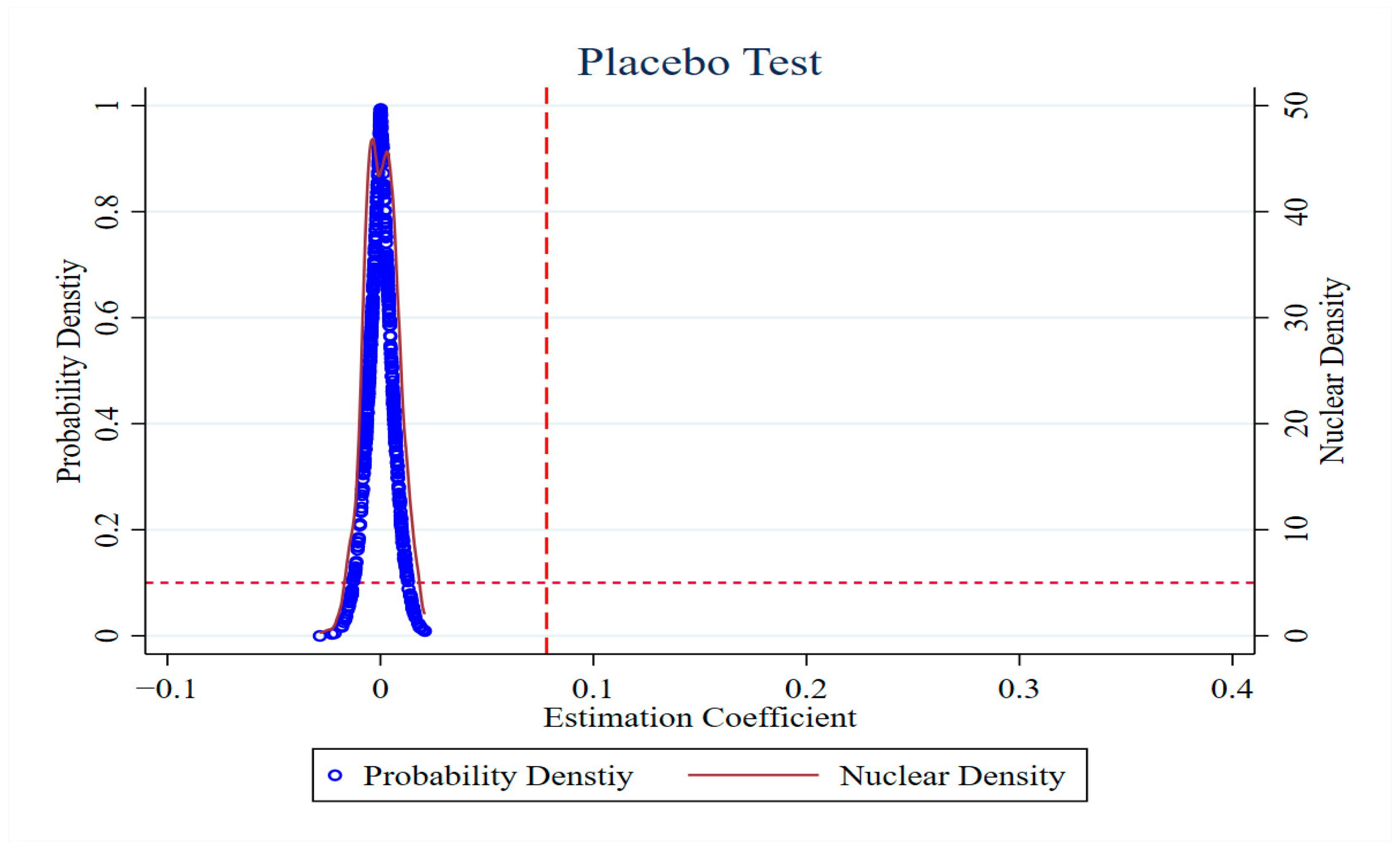

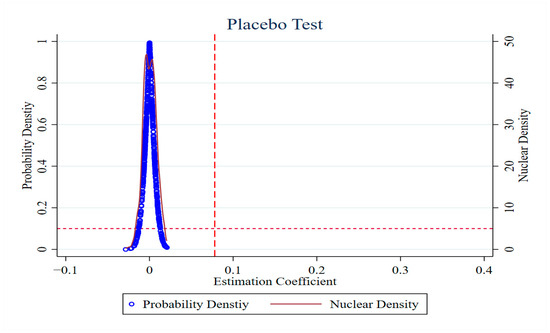

4.4.1. Placebo Test

In order to eliminate the potential influence of other unidentified variables on the ESG performance of the pilot firms, this study employs a placebo test in accordance with the methodology proposed by La Ferrara et al. [46]. Specifically, 500 random samples are taken from the baseline regression to construct the ‘pseudo-policy variables’, and the model (1) is re-estimated to test the distribution of the coefficients and p-values. Figure 3 shows that the regression coefficients have a mean value of roughly zero, which is significantly lower than the benchmark regression coefficients. The estimated coefficients exhibit a tendency to adhere to a normal distribution. The vast majority of the p-values exceed 0.1, indicating that the observed effect is not statistically significant at the 10% level. Consequently, it is possible to conclude that the impact of environmental protection courts on corporate ESG performance is not attributable to other omitted factors. This reinforces the credibility of the findings given in this study.

Figure 3.

Placebo Test.

4.4.2. PSM-DID

It is possible that cities with and without environmental courts may differ in terms of resource endowments, environmental challenges, and other factors, which could lead to systematic differences in the firms located in these areas and introduce bias in our estimates. To limit the influence of such disparities, this study employs the propensity score matching method to match samples with environmental courts before regression. This is achieved by controlling for the effects of size, age, gearing ratio, total net asset margin, two job titles, the shareholding ratio of the first largest shareholder, Tobin’s Q value, the shareholding ratio of institutional investors, quick ratio, management expense ratio, share of fixed assets, total asset turnover, and the nature of property rights on the establishment of intermediate environmental tribunals. Subsequently, 1:1 nearest matching and radius matching were employed, and none of the aforementioned matching variables exhibited significant differences after matching. The PSM-DID estimation results are shown in Table 4. Columns (1) and (2) report the regression results after propensity score matching. The table’s data indicates that all of Court’s regression coefficients are significant at the 1% level, further confirming the validity of the findings reported in this study.

Table 4.

Robustness tests.

4.4.3. Replacement of the Explanatory Variables

It is possible that inconsistencies may exist between the ESG rating results produced by different rating agencies, which could in turn result in errors being introduced into the regression results. To lessen the effect of this component, the Bloomberg ESG rating indicator system is employed as a proxy for the dependent variable, with a view to further investigating the impact of environmental justice reforms on corporate ESG performance. Bloomberg is a more mainstream ESG rating organization outside China. Its business covers more than 100 countries, and it has issued rating reports for 11,800 companies, and the ESG rating information it provides is highly consistent and comparable. Compared with the ESG indicators of other domestic rating agencies, Bloomberg has issued ESG ratings for A-share listed companies since 2011, which has a longer observation period and is also applicable to the time interval of the observations in this study. As the Bloomberg ESG data set commences in 2011, the sample period has been adjusted to 2011–2022. As shown in column (3) of Table 4, the basic findings are still strong once the explanatory variables are replaced.

4.4.4. Elimination of the Four Municipalities

The disparities in resource endowments, locational advantages, and policy orientations between cities may result in the attainment of advantages and disadvantages in the realization of corporate ESG objectives across different regions. It can be reasonably asserted that China’s four largest municipalities (Beijing, Shanghai, Tianjin, and Chongqing) are well positioned to meet the requirements of the aforementioned cities. To eliminate the potential impact of this variable, we conducted a new regression analysis, excluding the data from the four municipalities (Beijing, Shanghai, Tianjin, and Chongqing) in China. After eliminating the four municipalities, the coefficient is 0.101, indicating statistical significance at the 1% level. The regression findings are shown in column (4) of Table 4. This lends even more credence to the validity of the findings of this investigation.

4.4.5. Exclusion of Other Policies

During the specified observation period, the People’s Republic of China proceeded to establish circuit courts of the Supreme People’s Court in six prefectures, including Shenzhen, Shenyang, Nanjing, Zhengzhou, Chongqing, and Xi’an. This process commenced in 2015 and was completed in the aforementioned order. The establishment of the SPC Circuit Courts is dedicated to three key objectives: first, the promotion of the enforcement of the Constitution and laws; second, active participation in judicial reforms; and third, the upholding of social fairness and justice. To guarantee the validity of the findings reported in this research, we have excluded the sample data pertaining to the establishment of the circuit courts of the Supreme People’s Court. This is because the establishment of these courts may potentially lead to biased regression results with regard to environmental judicial reform and firms’ ESG. Even with the previously specified exclusion, the regression results, which are displayed in column (5) of Table 4, are still significant at the 5% level.

4.4.6. Lagged One-Period Explanatory Variables

In the regression model, average ESG performance is employed to mitigate the impact of endogeneity issues, such as reverse causation. In consideration of potential lags in policy effects, the regression is conducted with one-period lagged ESG performance. As demonstrated in column (6) of Table 4, the regression outcomes are not significantly divergent from the benchmark regression, thereby substantiating the conclusions of this study.

4.5. Mechanism Test

The preceding analysis indicates that environmental justice reforms have the potential to garner increased attention from both the media and analysts, which in turn could lead to enhanced corporate ESG performance. In order to substantiate these two impact mechanisms, we conduct an empirical investigation through the use of group tests.

4.5.1. The Impact of Media Attention

The circulation of media reports can engender certain monitoring and governance effects, thereby increasing the costs borne by companies for environmental violations, monitoring, and control. This, in turn, can contribute to the improvement of corporate ESG performance. In light of the aforementioned studies, the total number of online media reports on environmental issues plus 1 takes the natural logarithm is taken to indicate media attention [47]. According to the median grouping of industry years, there are two categories of media attention: high and low. Table 5 presents the findings. It demonstrates that the influence of environmental justice reform on corporate ESG performance is more pronounced in the subgroup with low media attention. The findings suggest that environmental justice reform can effectively garner greater media attention, which in turn enhances corporate ESG performance, thereby substantiating research hypothesis H2.

Table 5.

Results of the media attention test.

4.5.2. The Impact of Analyst Attention

Analysts are able to objectively and rationally analyze the financial and non-financial conditions of companies, alleviate the information asymmetry behavior of external stakeholders, monitor corporate behavior, and thus enhance corporate ESG performance. In this study, we refer to existing research that employs the number of securities analysts focusing on the same listed company to take the natural logarithm to express the analysts’ attention [48]. This is grouped according to the median industry year and divided into two groups of analysts with high and low attention to the study. Table 6 shows that the regression findings are stronger in the sample group with low analyst attention versus the sample group with high analyst attention. This suggests that environmental justice reform can enhance analysts’ attention and guide more stakeholders to promote corporate ESG performance, thereby verifying research hypothesis H3.

Table 6.

Results of the analyst attention test.

4.6. Heterogeneity Analysis

4.6.1. Regional Variations in Enterprise

In China, the “territorial principle” of environmental protection governance often presents local governments with a trade-off between economic development and environmental protection. This is due to the fact that the current appraisal system is oriented towards economic growth. As a judicial institution, the efficiency of environmental courts is also contingent upon the characteristics of local legislation. Consequently, the aforementioned factors may give rise to strategic decision-making challenges for local firms in disparate regions, which in turn may result in variations in their ESG performance. China’s diverse natural conditions and resource endowments give rise to a multitude of regional development characteristics. Accordingly, this study divides China into three distinct regions—the East, Central, and West—for the purpose of conducting group regression analysis. Table 7’s columns (1) through (3) display the findings of the grouped regression. In the eastern region, the coefficients for environmental justice reform are considerably positive at the 1% level; however, in the central and western regions, they are not significant. These findings suggest that, due to the strong economic power and more perfect legalization in the eastern region, the environmental awareness of enterprises is influenced by the improvement of the judicial environment. In contrast, enterprises in other areas should focus more on their businesses’ sustainable development.

Table 7.

Heterogeneity analysis.

4.6.2. Heterogeneity of Company Pollution Levels

The enhancement of ESG performance among firms is contingent upon a complex interplay of factors, including the government’s legally mandated regulations and the heterogeneous external environment faced by firms with varying levels of pollution. In comparison to firms that do not engage in significant pollution, those that do often contend with adverse external circumstances, including stringent financing constraints and elevated levels of environmental protection pressure. Consequently, the policy impact may be more pronounced in this group. In accordance with the “Management Catalog of Industry Categories for Environmental Protection Verification of Listed Companies in China”, the sample is divided into two categories: heavy polluters and non-heavy polluters. These categories are then grouped into regressions. The coefficients of heavy pollutants are statistically significant at the 1% level, as shown by the regression results in Table 7’s columns (4) and (5), whereas the regression coefficients of non-heavy polluters are not. This corroborates the aforementioned conjecture.

4.6.3. Heterogeneity of Environmental Uncertainty

The implementation of environmental justice reform measures may exhibit a degree of variability contingent upon the external environmental context within which firms operate. When firms face higher environmental uncertainty, the local government may implement environmental judicial reforms more strongly, thereby enhancing the level of legalization in the region. This ultimately leads to firms being more inclined to improve their ESG performance in order to adapt to the increasingly stringent legal environment. Consequently, the impact of environmental judicial reforms on firms’ ESG performance may be more pronounced in the group with high environmental uncertainty. To test this conjecture, abnormal fluctuations in sales revenue are used as a measure of environmental uncertainty [49]. The regressions are classified into two categories, namely high and low environmental uncertainty, based on the median “firm-year.” As illustrated in columns (6) and (7) of Table 7, the regression coefficients of environmental justice reform on ESG performance are more pronounced at the 1% level in the sample with high environmental uncertainty than in the sample with low environmental uncertainty, thereby substantiating the aforementioned conjecture.

5. Conclusions, Implications, and Limitations

5.1. Conclusions

The global community continues to grapple with the complex challenge of achieving sustainable development. The integration of ESG considerations into business operations offers a framework for aligning corporate sustainability with broader societal objectives. Additionally, the reform of environmental justice offers pertinent regulations regarding environmental governance practices at the level of the rule of law. Both of these areas have garnered significant interest from industry and academic circles. Accordingly, this study employs a sample comprising Chinese A-share listed companies from 2010 to 2022 to investigate the influence of environmental justice specialization on corporate ESG performance. The findings of this study are presented below. Firstly, it was found that environmental justice specialization has a significant positive impact on corporate ESG performance. This result remains consistent even after conducting a series of robustness tests. Secondly, the mechanism test indicates that environmental justice specialization can attract greater media and analyst attention by enhancing firms’ external monitoring, which in turn enhances firms’ ESG performance. Finally, this study investigates the heterogeneity of the impact of environmental justice specialization on corporate ESG performance in terms of geographic distribution, environmental uncertainty, and corporate pollution type. With respect to geographic distribution, the environmental justice specialization has been observed to exert a more pronounced influence on ESG performance in the eastern region. With regard to environmental uncertainty, the environmental justice specialization has been found to enhance corporate ESG performance to a greater extent when environmental uncertainty is elevated. Among the categories of corporate pollution, the environmental justice specialization has been seen to exert a more pronounced impact on firms that engage in substantial pollution. In conclusion, the environmental justice reform, as exemplified by the environmental court, plays a pivotal role in the implementation of China’s dual-carbon strategy.

5.2. Policy Recommendations

The following suggestions are offered for the relevant authorities to take into account in light of the investigation’s findings. Firstly, the government should continue to pursue the promotion of environmental justice through judicial reform, the establishment of a unified system and standards of judicial procedure, and the enhancement of the fairness of environmental justice. Furthermore, the effectiveness of environmental law enforcement should be improved, thereby ensuring a seamless and coherent continuum among legislation, justice, and law enforcement. While prioritizing the enhancement of judicial efficacy, it is imperative to persist in guaranteeing the professionalism and autonomy of environmental judicial personnel, thereby bolstering the fairness and efficacy of environmental governance. Secondly, enterprises should prioritize the enhancement of their ESG performance and refrain from involvement in environmental litigation disputes in light of the increasingly rigorous rule of law. Moreover, enterprises should enhance the transparency of their environmental information, cultivate a positive reputation, and cultivate a favorable public opinion atmosphere for the green development of enterprises. Thirdly, the central and western regions should speed up the reform of environmental justice. Increase support in the areas of human resources, legislation, and policy guidance. Improve the environmental justice coordination mechanism and jointly respond to cross-regional environmental problems. Effectively protect the sustainable development of local enterprises. Ultimately, with regard to the principal supervisory body, it is incumbent upon society, the public, the media, and other external stakeholders to enhance their awareness of judicial rights. This will ensure the maintenance of consistent external pressure for the corporate ESG performance enhancement, thereby enabling them to play their roles in ecological and environmental sharing and common governance and co-construction.

5.3. Research Limitations

The present study is limited by three factors. First, the data sources are restricted. Furthermore, the responses of firms to environmental justice specialization may also vary depending on factors such as the nature, size, and strategy of the firms in question. It is therefore important to consider that the results of this study may not be applicable to all firms and should be carefully considered in practical applications. Further research could provide greater insight into the impact of environmental justice specialization on firms in specific industries. Secondly, this study examines the role played by external monitoring mechanisms in the ESG performance of firms as a consequence of environmental justice reforms. However, further investigation is required to ascertain whether internal governance behaviors of firms affect the relationship between the two in comparison to external monitoring. Thirdly, it has been demonstrated that the specialization in environmental justice has an effect on the ESG performance of corporations. Furthermore, it has been established that this impact may extend to firms in the supply chain and affect their ESG disclosure practices. These results lay the groundwork for additional research.

Author Contributions

Conceptualization, Y.M.; methodology, X.Y.; software, X.Y.; validation, X.Y.; formal analysis, X.Y.; investigation, X.Y.; resources, X.Y.; data curation, X.Y.; writing—original draft preparation, X.Y.; writing—review and editing, X.Y.; visualization, X.Y.; supervision, Y.M.; project administration, Y.M.; funding acquisition, Y.M. All authors have read and agreed to the published version of the manuscript.

Funding

This study was funded by the Fundamental Research Funds for the Provincial Universities of Liaoning, China.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data were created or analyzed in this study.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Bai, X.; Zhao, W.; Tian, G. ESG certification, green innovation, and firm value: A quasi-natural experiment based on SynTao Green Finance’s ESG ratings: A pre-registered report. Pac.-Basin Financ. J. 2024, 86, 102453. [Google Scholar] [CrossRef]

- Xie, Y. The interactive impact of green finance, ESG performance, and carbon neutrality. J. Clean. Prod. 2024, 456, 142269. [Google Scholar] [CrossRef]

- Tian, B.; Yu, J.; Tian, Z. The impact of market-based environmental regulation on corporate ESG performance: A quasi-natural experiment based on China’s carbon emission trading scheme. Heliyon 2024, 10, e26687. [Google Scholar] [CrossRef] [PubMed]

- Wang, X.; Ye, Y. Environmental protection tax and firms’ ESG investment: Evidence from China. Econ. Model. 2024, 131, 106621. [Google Scholar] [CrossRef]

- He, Y.; Zhao, X.; Zheng, H. How does the environmental protection tax law affect firm ESG? Evidence from the Chinese stock markets. Energy Econ. 2023, 127, 107067. [Google Scholar] [CrossRef]

- Viard, V.B.; Fu, S. The effect of Beijing’s driving restrictions on pollution and economic activity. J. Public Econ. 2015, 125, 98–115. [Google Scholar] [CrossRef]

- Song, Y. The effect of the end-number license plate driving restriction on reducing air pollution in China. China Econ. Rev. 2024, 87, 102252. [Google Scholar] [CrossRef]

- Xue, Y.; He, S. Judicial reforms and corporate governance: The contribution of circuit courts to ESG performance improvement. Financ. Res. Lett. 2024, 66, 105683. [Google Scholar] [CrossRef]

- Zeng, H.; Ren, L.; Chen, X.; Zhou, Q.; Zhang, T.; Cheng, X. Punishment or deterrence? Environmental justice construction and corporate equity financing––Evidence from environmental courts. J. Corp. Financ. 2024, 86, 102583. [Google Scholar] [CrossRef]

- Li, X.; Li, M.; Zeng, H. Environmental judicial reform and corporate investment behavior—Based on a quasi-natural experiment of environmental courts. J. Environ. Manag. 2024, 365, 121640. [Google Scholar] [CrossRef]

- Wang, Y.; Zhang, M. The role of environmental justice: Environmental courts, analysts’ earnings pressure and corporate environmental governance. Environ. Impact Assess. Rev. 2024, 104, 107299. [Google Scholar] [CrossRef]

- Qi, X.; Wu, Z.; Xu, J.; Shan, B. Environmental justice and green innovation: A quasi-natural experiment based on the establishment of environmental courts in China. Ecol. Econ. 2023, 205, 107700. [Google Scholar] [CrossRef]

- Jiang, Y.; Ni, H.; Guo, X.; Ni, Y. Integrating ESG practices and natural resources management for sustainable economic development in SMEs under the double-carbon target of China. Resour. Policy 2023, 87, 104348. [Google Scholar] [CrossRef]

- Gao, W.; Wang, Y.; Wang, F.; Mbanyele, W. Do environmental courts break collusion in environmental governance? Evidence from corporate green innovation in China. Q. Rev. Econ. Financ. 2024, 94, 133–149. [Google Scholar] [CrossRef]

- Zhang, S.; Wei, Y. Assessing the effects of different types of environmental supervision policies on green economy efficiency of China. J. Environ. Manag. 2024, 368, 122282. [Google Scholar] [CrossRef]

- Chen, J.; Chen, Z. How does environmental regulations affect digital green innovation of high-pollution enterprises? Empirical evidence from China. Heliyon 2024, 10, e33725. [Google Scholar] [CrossRef]

- Lv, Y.; Wang, F.; Liu, G.; Ren, R. The impact of environmental court construction on the quality of corporate environmental information disclosure. Int. Rev. Financ. Anal. 2024, 95, 103512. [Google Scholar] [CrossRef]

- Bai, M.; Shen, L.; Li, Y.; Yu, C.-F. Does legal justice promote stakeholder justice? Evidence from a judicial reform in China. Int. Rev. Financ. Anal. 2024, 94, 103326. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-De-Silanes, F.; Shleifer, A.; Vishny, R.W. Legal Determinants of External Finance. J. Financ. 1997, 52, 1131–1150. [Google Scholar] [CrossRef]

- Yang, Y.; Wang, B.; Su, X. Judicial quality and corporate ESG performance: Evidence from the establishment of circuit courts. Financ. Res. Lett. 2024, 65, 105610. [Google Scholar] [CrossRef]

- Zhang, G.; Chen, D. Environmental Justice and Corporate Green Innovation: The Role of Legitimacy Pressures. Sustainability 2024, 16, 5599. [Google Scholar] [CrossRef]

- Hu, Y.; Tian, Y. The role of green reputation, carbon trading and government intervention in determining the green bond pricing: An externality perspective. Int. Rev. Econ. Financ. 2024, 89, 46–62. [Google Scholar] [CrossRef]

- Meng, T.; Dato Haji Yahya, M.H.; Ashhari, Z.M.; Yu, D. ESG performance, investor attention, and company reputation: Threshold model analysis based on panel data from listed companies in China. Heliyon 2023, 9, e20974. [Google Scholar] [CrossRef]

- Christophe, S.E.; Hsieh, J.; Lee, H. Reputation and recency: How do aggressive short sellers assess ESG-Related Information? J. Bus. Res. 2024, 180, 114718. [Google Scholar] [CrossRef]

- Li, Y.; Zhu, C. Regional digitalization and corporate ESG performance. J. Clean. Prod. 2024, 473, 143503. [Google Scholar] [CrossRef]

- Tong, Y.; Lau, Y.W.; Binti Ngalim, S.M. Do pilot zones for green finance reform and innovation avoid ESG greenwashing? Evidence from China. Heliyon 2024, 10, e33710. [Google Scholar] [CrossRef] [PubMed]

- Zhao, X.; Huang, X.; Liu, F.; Pan, L. Executive power discrepancy and corporate ESG greenwashing. Int. Rev. Financ. Anal. 2024, 96, 103533. [Google Scholar] [CrossRef]

- Cao, Q.; Zhu, T.; Yu, W. ESG investment and bank efficiency: Evidence from China. Energy Econ. 2024, 133, 107516. [Google Scholar] [CrossRef]

- Choi, S.Y.; Ryu, D.; You, W. ESG activities and financial stability: The case of Korean financial firms. Borsa Istanb. Rev. 2024, 24, 945–951. [Google Scholar] [CrossRef]

- Wang, H.; Jiao, S.; Ma, C. The impact of ESG responsibility performance on corporate resilience. Int. Rev. Econ. Financ. 2024, 93, 1115–1129. [Google Scholar] [CrossRef]

- Muck, M.; Schmidl, T. Comparing ESG score weighting approaches and stock performance differentiation. Financ. Res. Lett. 2024, 67, 105924. [Google Scholar] [CrossRef]

- Zhang, N.; Yang, C.; Wang, S. Research progress and prospect of environmental, social and governance: A systematic literature review and bibliometric analysis. J. Clean. Prod. 2024, 447, 141489. [Google Scholar] [CrossRef]

- He, X.; Jing, Q.; Chen, H. The impact of environmental tax laws on heavy-polluting enterprise ESG performance: A stakeholder behavior perspective. J. Environ. Manag. 2023, 344, 118578. [Google Scholar] [CrossRef]

- Chen, X.; Wang, J. The Impact of Regional Carbon Emission Reduction on Corporate ESG Performance in China. Sustainability 2024, 16, 5802. [Google Scholar] [CrossRef]

- Li, S.; Zhu, X.; Zhang, T. Optimum combination of heterogeneous environmental policy instruments and market for green transformation: Empirical evidence from China’s metal sector. Energy Econ. 2023, 123, 106735. [Google Scholar] [CrossRef]

- Bhattacherjee, A.; Shrivastava, U. The effects of ICT use and ICT Laws on corruption: A general deterrence theory perspective. Gov. Inf. Q. 2018, 35, 703–712. [Google Scholar] [CrossRef]

- MacCormick, N.; Weinberger, O. An Institutional Theory of Law: New Approaches to Legal Positivism; Springer Science & Business Media: Berlin/Heidelberg, Germany, 1986; Volume 3. [Google Scholar]

- Zhou, W.; Chen, F.; Zhu, Y.; Xiang, L.; Lei, L. Media attention, negative reports and textual information of banks’ ESG disclosure. Int. Rev. Econ. Financ. 2024, 96, 103583. [Google Scholar] [CrossRef]

- An, Y.; Jin, H.; Liu, Q.; Zheng, K. Media attention and agency costs: Evidence from listed companies in China. J. Int. Money Financ. 2022, 124, 102609. [Google Scholar] [CrossRef]

- Tan, D. Making the news: Heterogeneous media coverage and corporate litigation. Strateg. Manag. J. 2016, 37, 1341–1353. [Google Scholar] [CrossRef]

- Bednar, M.K.; Boivie, S.; Prince, N.R. Burr under the saddle: How media coverage influences strategic change. Organ. Sci. 2013, 24, 910–925. [Google Scholar] [CrossRef]

- Ferrer, E.; Santamaría, R.; Suárez, N. Does analyst information influence the cost of debt? Some international evidence. Int. Rev. Econ. Financ. 2019, 64, 323–342. [Google Scholar] [CrossRef]

- Coram, P.J.; Mock, T.J.; Monroe, G.S. Financial analysts’ evaluation of enhanced disclosure of non-financial performance indicators. Br. Account. Rev. 2011, 43, 87–101. [Google Scholar] [CrossRef]

- Jung, B.; Sun, K.J.; Yang, Y.S. Do financial analysts add value by facilitating more effective monitoring of firms’ activities? J. Account. Audit. Financ. 2012, 27, 61–99. [Google Scholar] [CrossRef]

- Gao, Z.; Quan, X.; Xu, X. Under watchful eyes: Analyst site visits and firm earnings management. Int. Rev. Financ. Anal. 2022, 83, 102269. [Google Scholar] [CrossRef]

- Ferrara, E.L.; Chong, A.; Duryea, S. Soap operas and fertility: Evidence from Brazil. Am. Econ. J. Appl. Econ. 2012, 4, 1–31. [Google Scholar] [CrossRef]

- He, F.; Guo, X.; Yue, P. Media coverage and corporate ESG performance: Evidence from China. Int. Rev. Financ. Anal. 2024, 91, 103003. [Google Scholar] [CrossRef]

- Yao, J.; Wang, D. The impact of analyst attention on the firms’ innovation paths from a life cycle perspective: Evidence from China. Heliyon 2023, 9, e18940. [Google Scholar] [CrossRef]

- Choe, J.-M. The effect of environmental uncertainty and strategic applications of IS on a firm’s performance. Inf. Manag. 2003, 40, 257–268. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).