Research on the Application of Conjoint Analysis in Carbon Tax Pricing for the Sustainable Development Process of China

Abstract

1. Introduction

2. Literature Review

2.1. International Experience with Carbon Emission Policies

2.2. Current Status and Challenges of China’s Carbon Tax Policy

2.3. Relationship Between Willingness to Pay and Carbon Tax Acceptance

2.4. Implementation Barriers and Transparency of Carbon Tax Policies

2.5. Research Hypotheses

2.6. Summary

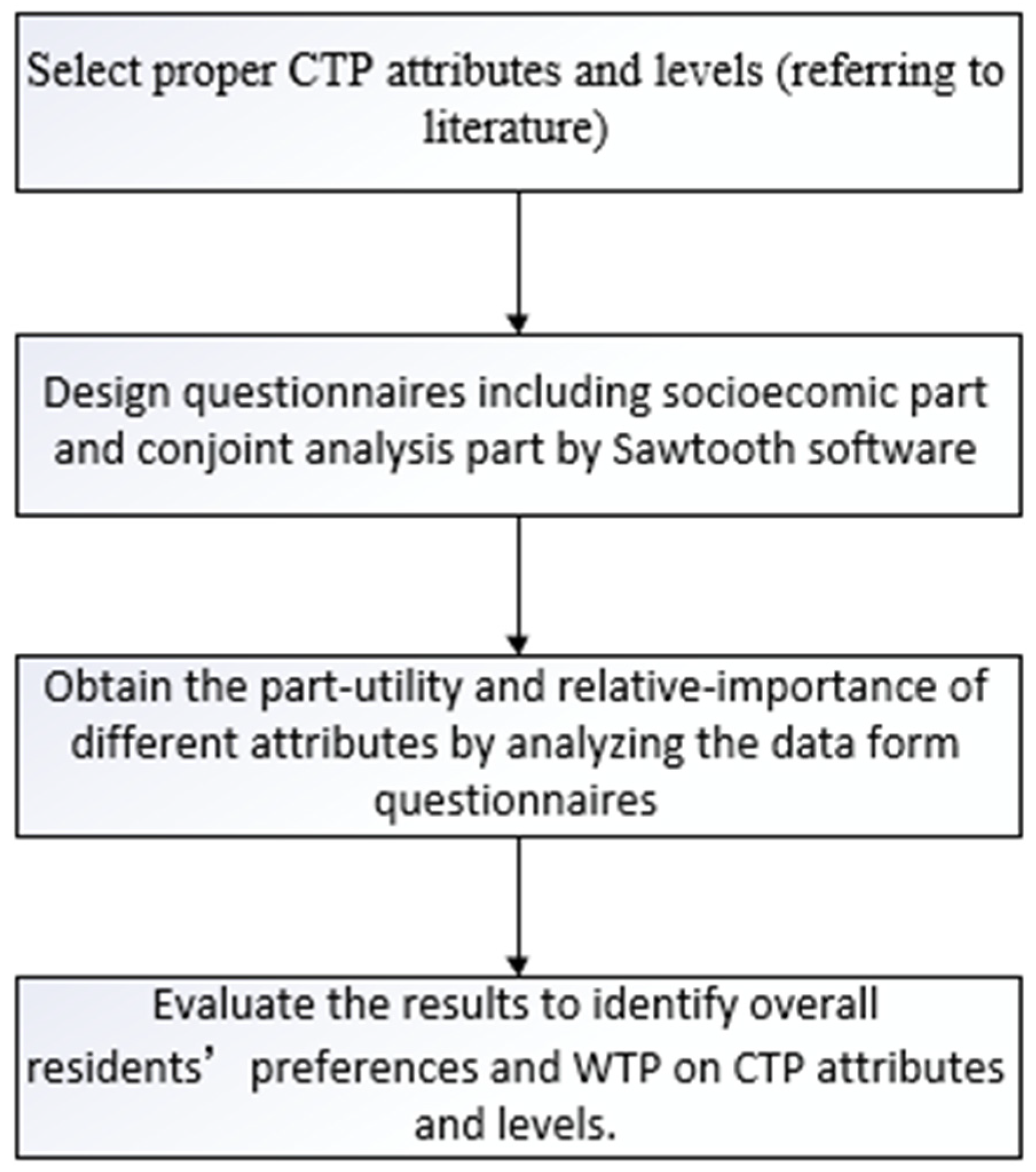

3. Methodology

3.1. Conjoint Analysis Method

3.2. Experimental Process Design

3.3. Mathematical Model and Data Processing

4. Results

4.1. Socioeconomic Characteristics of the Respondents

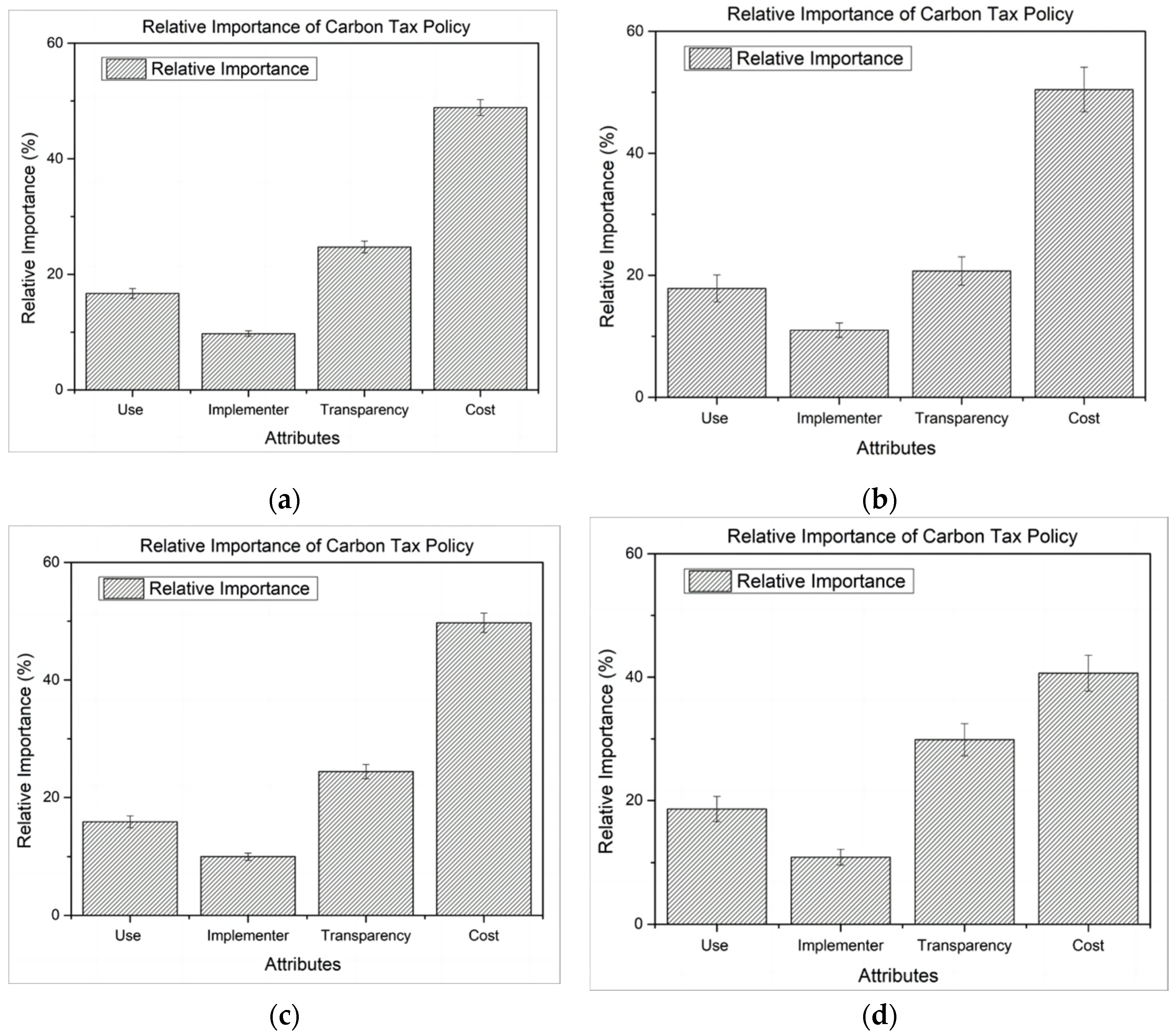

4.2. Relative Importance

4.3. Willingness to Pay for CTP

5. Discussion

5.1. Relative Importance of CTP Attributes

5.2. Differences in WTP Based on CTP Understanding Level

5.3. Implications for Policymakers

6. Conclusions

- While 96.77% of the respondents acknowledged the impacts of climate change, only 82.61% were aware of the carbon tax policy, indicating the potential for heightened awareness.

- Among Shanghai residents, the annual cost of the carbon tax policy was most critical (48.87%), followed by transparency in policy implementation (24.72%), carbon tax revenue use (16.68%), and the identity of the policy implementers (9.73%).

- Our findings suggest that carbon taxation can be an effective tool for environmental governance in China, particularly when it is combined with transparent policy implementation and strategic revenue allocation. The willingness to pay (WTP) for carbon tax policies among Shanghai residents was found to be significant, with an average WTP of 1435.28 CNY/year. This indicates robust public readiness to invest in policies aimed at combating climate change, especially when these policies are perceived as equitable and transparent.

- Transparency in the carbon tax policy implementation process has emerged as a crucial factor influencing public acceptance. Our results indicate that enhancing transparency, from no progress reporting to regular updates on the official website, could increase the WTP by as much as CNY 2847.26.

- Revenue allocation significantly impacts public perceptions. The respondents show a strong preference for carbon tax revenues to be invested in low-carbon technologies and clean energy initiatives, reflecting a growing awareness of the potential benefits of carbon taxation beyond mere cost concerns. This finding is consistent with research in other countries, such as Norway and Sweden, where the allocation of revenues to visible environmental projects has bolstered public support [22,40] (Metcalf, 2019; Scharin and Wallström, 2018).

7. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Questionnaire 1

- Sociodemographic characteristics part.

- Gender: Female, Male

- Age: 16–30, 31–45, 46–60, >60

- Marriage: married, single

- Education level: Middle School, High School, Bachelor’s degree, Above bachelor’s degree

- Number of family members: 1, 2, 3, 4, 5, 6, >6

- Residence: Urban, Rural

- Family disposable income per year (CNY): 0–30,000, 30,000–50,000, 50,000–100,000, 100,000–200,000, >200,000, Inconvenient

- Annual electricity consumption: 0–1000, 1000–2500, 2500–5000, >5000

- Annual gas consumption: 0–800, 800–1500, 1500–3000, >3000

- Annual gasoline consumption: 0–2500, 2500–5000, 5000–10,000, >10,000

- How to Consider the Impact of Climate Change on Your Life: None, little, some, huge.

- How to evaluate your understanding on carbon tax: None, some, clearly.

- A explanation of policy attributes and classification is as follows:

- General tax budget (the income treasury is redistributed according to the will of the state)

- Subsidies/grants for clean energy technology (to encourage the development of new technologies for low carbon dioxide emissions and new bases for absorbing and storing carbon dioxide in the air)

- Subsidies/grants for low-carbon technologies or CCUS (encourage the development of new energy technologies that do not emit carbon dioxide and other pollutants)

- Energy companies

- Bank

- Government

- No process report (the process and data will not be disclosed to the public throughout the process)

- Report regularly on the official website (provide the relevant process and data of carbon tax collection by quarter or year)

- Regularly report on the official website under the supervision of an independent third party (provide carbon tax collection-related progress and data on a quarterly or annual basis under the supervision of a non-interested third-party)

- Next part is Choice-based conjoint analysis part. Please pick one option from each question. And all of the options indicated four attributes as follow: Use of Carbon Tax Revenue, Carbon tax policy implementers, Transparency of carbon tax policy implementation process and Cost of Carbon Tax.

- Which of the following carbon tax policies do you prefer?

- Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier, No process report, 700 CNY

- Subsidies/grants for clean energy technology, Energy Supplier, no process report, 150 CNY

- General tax budget, Government, Regularly report on the official website under the supervision of an independent third party, 1200 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Bank, Regularly report on the official website under the supervision of an independent third party, 1200 CNY

- Which of the following carbon tax policies do you prefer?

- General tax budget, Bank, Regularly report on the official website under the supervision of an independent third party, 150 CNY

- General tax budget, Government, Regularly report on the official website under the supervision of an independent third party, 150 CNY

- Subsidies/grants for clean energy technology, Government, No process report, 2000 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Government, Report regularly on the official website, 700 CNY

- Which of the following carbon tax policies do you prefer?

- Subsidies/grants for clean energy technology, Government, Report regularly on the official website, 700 CNY

- Subsidies/grants for clean energy technology, Bank, Regularly report on the official website under the supervision of an independent third party, 350 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier

- Regularly report on the official website under the supervision of an independent third party, 2000 CNY

- General tax budget, Government, No process report, 150 CNY

- Which of the following carbon tax policies do you prefer?

- Subsidies/grants for low-carbon technologies or CCUS, Government, Regularly report on the official website under the supervision of an independent third party, 2000 CNY

- General tax budget, Bank, Report regularly on the official website, 2000 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Bank, No process report, 350 CNY

- General tax budget, Energy Supplier, No process report, 1200 CNY

- Which of the following carbon tax policies do you prefer?

- Subsidies/grants for clean energy technology, Bank, No process report, 150 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Government, No process report, 1200 CNY

- Subsidies/grants for clean energy technology, Energy Supplier, Report regularly on the official website, 1200 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 700 CNY

- Which of the following carbon tax policies do you prefer?

- Subsidies/grants for clean energy technology, Government, Report regularly on the official website, 350 CNY

- Subsidies/grants for clean energy technology, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 1200 CNY

- General tax budget, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 150 CNY

- General tax budget, Bank, Report regularly on the official website, 150 CNY

- Which of the following carbon tax policies do you prefer?

- General tax budget, Government, No process report, 350 CNY

- Subsidies/grants for clean energy technology, Bank, No process report, 700 CNY

- Subsidies/grants for clean energy technology, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 700 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Government, Regularly report on the official website under the supervision of an independent third party, 1200 CNY

- Which of the following carbon tax policies do you prefer?

- Subsidies/grants for low-carbon technologies or CCUS, Government, Report regularly on the official website, 1200 CNY

- Subsidies/grants for clean energy technology, Bank, No process report, 700 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Bank, Regularly, Report on the official website under the supervision of an independent third party, 700 CNY

- General tax budget, Energy Supplier, No process report, 350 CNY

- Which of the following carbon tax policies do you prefer?

- Subsidies/grants for clean energy technology, Government, Regularly, Report on the official website under the supervision of an independent third party, 2000 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier, No process report, 150 CNY

- General tax budget, Government, Report regularly on the official website, 350 CNY

- General tax budget, Bank, No process report, 2000 CNY

- Which of the following carbon tax policies do you prefer?

- Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier, Report regularly on the official website, 2000 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Bank, Report regularly on the official website, 350 CNY

- Subsidies/grants for clean energy technology, Government, No process report, 700 CNY

- General tax budget, Bank, Regularly report on the official website under the supervision of an independent third party, 700 CNY

- Which of the following carbon tax policies do you prefer?

- Subsidies/grants for clean energy technology, Energy Supplier, Report regularly on the official website, 350 CNY

- Subsidies/grants for clean energy technology, Bank, Report regularly on the official website, 150 CNY

- General tax budget, Government, Report regularly on the official website, 2000 CNY

- General tax budget, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 1200 CNY

- Which of the following carbon tax policies do you prefer?

- Subsidies/grants for low-carbon technologies or CCUS, Bank, Regularly report on the official website under the supervision of an independent third party, 2000 CNY

- Subsidies/grants for clean energy technology, Government, No process report, 350 CNY

- General tax budget, Energy Supplier, No process report, 150 CNY

- Subsidies/grants for clean energy technology, Bank, Regularly report on the official website under the supervision of an independent third party, 700 CNY

Appendix B. Questionnaire 2

- Sociodemographic characteristics part.

- Gender: Female, Male

- Age: 16–30, 31–45, 46–60, >60

- Marriage: married, single

- Education level: Middle School, High School, Bachelor’s degree, Above bachelor’s degree

- Number of family members: 1, 2, 3, 4, 5, 6, >6

- Residence: Urban, Rural

- Family disposable income per year (CNY): 0–30,000, 30,000–50,000, 50,000–100,000, 100,000–200,000, >200,000, Inconvenient

- Annual electricity consumption: 0–1000, 1000–2500, 2500–5000, >5000

- Annual gas consumption: 0–800, 800–1500, 1500–3000, >3000

- Annual gasoline consumption: 0–2500, 2500–5000, 5000–10,000, >10,000

- How to Consider the Impact of Climate Change on Your Life: None, little, some, huge.

- How to evaluate your understanding on carbon tax: None, some, clearly.

- A explanation of policy attributes and classification is as follows:

- General tax budget (the income treasury is redistributed according to the will of the state)

- Subsidies/grants for clean energy technology (to encourage the development of new technologies for low carbon dioxide emissions and new bases for absorbing and storing carbon dioxide in the air)

- Subsidies/grants for low-carbon technologies or CCUS (encourage the development of new energy technologies that do not emit carbon dioxide and other pollutants)

- Energy companies

- Bank

- Government

- No process report (the process and data will not be disclosed to the public throughout the process)

- Report regularly on the official website (provide the relevant process and data of carbon tax collection by quarter or year)

- Regularly report on the official website under the supervision of an independent third party (provide carbon tax collection-related progress and data on a quarterly or annual basis under the supervision of a non-interested third-party)

- Next part is Choice-based conjoint analysis part. Please pick one option from each question. And all of the options indicated four attributes as follow: Use of Carbon Tax Funds, Carbon tax policy implementers, Transparency of carbon tax policy implementation process and Cost of Carbon Tax.

- Which of the following carbon tax policies do you prefer?

- Subsidies/grants for clean energy technology, Bank, Regularly report on the official website under the supervision of an independent third party, 700 CNY

- General tax budget, Government, No process report, 700 CNY

- General tax budget, Bank, No process report, 2000 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Government, Report regularly on the official website, 150 CNY

- Which of the following carbon tax policies do you prefer?

- Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 350 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Bank, No process report, 700 CNY

- Subsidies/grants for clean energy technology, Government, No process report, 150 CNY

- Subsidies/grants for clean energy technology, Energy Supplier, Report regularly on the official website, 350 CNY

- Which of the following carbon tax policies do you prefer?

- General tax budget, Bank, Report regularly on the official website, 1200 CNY

- Subsidies/grants for clean energy technology, Energy Supplier, No process report, 2000 CNY

- Subsidies/grants for clean energy technology, Bank, Regularly report on the official website under the supervision of an independent third party, 700 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Bank, No process report, 350 CNY

- Which of the following carbon tax policies do you prefer?

- General tax budget, Energy Supplier, Report regularly on the official website, 2000 CNY

- Subsidies/grants for clean energy technology, Government, Regularly report on the official website under the supervision of an independent third party, 350 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Government, No process report, 350 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 150 CNY

- Which of the following carbon tax policies do you prefer?

- Subsidies/grants for clean energy technology, Energy Supplier, No process report, 1200 CNY

- General tax budget, Energy Supplier, Report regularly on the official website, 700 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Government, Report regularly on the official website, 150 CNY

- General tax budget, Bank, Regularly report on the official website under the supervision of an independent third party, 350 CNY

- Which of the following carbon tax policies do you prefer?

- General tax budget, Government, No process report, 700 CNY

- Subsidies/grants for clean energy technology, Bank, No process report, 1200 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier Report regularly on the official website, 350 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Government, Report regularly on the official website, 2000 CNY

- Which of the following carbon tax policies do you prefer?

- General tax budget, Government, No process report, 350 CNY

- Subsidies/grants for clean energy technology, Bank, No process report, 700 CNY

- Subsidies/grants for clean energy technology, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 700 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Government, Regularly report on the official website under the supervision of an independent third party, 1200 CNY

- Which of the following carbon tax policies do you prefer?

- General tax budget, Bank, No process report, 150 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier No process report, 700 CNY

- Subsidies/grants for clean energy technology, Bank, Regularly report on the official website under the supervision of an independent third party, 1200 CNY

- Subsidies/grants for clean energy technology, Government, Regularly report on the official website under the supervision of an independent third party, 2000 CNY

- Which of the following carbon tax policies do you prefer?

- General tax budget, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 350 CNY

- Subsidies/grants for clean energy technology, Bank, Report regularly on the official website, 150 CNY

- Subsidies/grants for clean energy technology, Government, Regularly report on the official website under the supervision of an independent third party, 1200 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Bank, Report regularly on the official website, 2000 CNY

- Which of the following carbon tax policies do you prefer?

- General tax budget, Government, No process report, 700 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Bank, Regularly report on the official website under the supervision of an independent third party, 2000 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Energy Supplier No process report, 1200 CNY

- General tax budget, Energy Supplier, Report regularly on the official website, 700 CNY

- Which of the following carbon tax policies do you prefer?

- Subsidies/grants for clean energy technology, Bank, Report regularly on the official website, 2000 CNY

- Subsidies/grants for low-carbon technologies or CCUS, Government, Regularly report on the official website under the supervision of an independent third party, 150 CNY

- General tax budget, Government, Report regularly on the official website, 1200 CNY

- Subsidies/grants for clean energy technology, Energy Supplier, Regularly report on the official website under the supervision of an independent third party, 350 CNY

- Which of the following carbon tax policies do you prefer?

- Subsidies/grants for low-carbon technologies or CCUS, Bank, Regularly report on the official website under the supervision of an independent third party, 2000 CNY

- Subsidies/grants for clean energy technology, Government, No process report, 350 CNY

- General tax budget, Energy Supplier, No process report, 150 CNY

- Subsidies/grants for clean energy technology, Bank, Regularly report on the official website under the supervision of an independent third party, 700 CNY

References

- Huang, G.; Xu, Z.; Qu, X.; Cao, J.; Long, S.; Yang, K.; Hou, H.; Wang, Y.; Ma, X. Critical climate issues toward carbon neutrality targets. Fundam. Res. 2022, 2, 396–400. [Google Scholar] [CrossRef] [PubMed]

- Xu, H.; Xia, B.; Jiang, S. The Impact of Industrial Added Value on Energy Consumption and Carbon Dioxide Emissions: A Case Study of China. Sustainability 2023, 15, 16201. [Google Scholar] [CrossRef]

- Hao, J.; Gao, F.; Fang, X.; Nong, X.; Zhang, Y.; Hong, F. Multi-factor decomposition and multi-scenario prediction decoupling analysis of China’s carbon emission under dual carbon goal. Sci. Total Environ. 2022, 841, 156788. [Google Scholar] [CrossRef] [PubMed]

- Chang, W.-Y.; Wang, S.; Song, X.; Zhong, F. Economic effects of command-and-control abatement policies under China’s 2030 carbon emission goal. J. Environ. Manag. 2022, 312, 114925. [Google Scholar] [CrossRef] [PubMed]

- OECD. Environmental Taxation: A Guide for Policy Makers. 2011. Available online: https://www.oecd.org/env/tools-evaluation/48164926.pdf (accessed on 13 January 2023).

- International Monetary Fund. Fiscal Monitor: How to Mitigate Climate Change. 2019. Available online: https://www.imf.org/en/Publications/FM/Issues/2019/09/12/fiscal-monitor-october-2019 (accessed on 18 October 2022).

- Maestre-Andrés, S.; Drews, S.; van den Bergh, J. Perceived fairness and public acceptability of carbon pricing: A review of the literature. Clim. Policy 2019, 19, 1186–1204. [Google Scholar] [CrossRef]

- World Bank. State and Trends of Carbon Pricing. 2019. Available online: https://openknowledge.worldbank.org/handle/10986/31755 (accessed on 18 October 2022).

- Saez, E. Tax Incidence and Efficiency Costs of Taxation. 2019. Available online: https://eml.berkeley.edu/~saez/course131/taxincidence_ch19.pdf (accessed on 18 October 2022).

- McEldowney, J.; Salter, D. Environmental taxation in the UK: The climate change levy and policy making Denning Law. Denning LJ 2015, 28, 37–65. [Google Scholar] [CrossRef]

- Shmelev, S.E.; Speck, S.U. Green fiscal reform in Sweden: Econometric assessment of the carbon and energy taxation scheme Renew. Sustain. Energy Rev. 2018, 90, 969–981. [Google Scholar] [CrossRef]

- Ionescu, L. The economics of the carbon tax: Environmental performance, sustainable energy, and green financial behavior. Geopolit. Hist. Int. Relat. 2020, 12, 101–107. [Google Scholar] [CrossRef]

- Carattini, S.; Kallbekken, S.; Orlov, A. How to win public support for a global carbon tax. Nature 2019, 565, 289–291. [Google Scholar] [CrossRef]

- Szasz, J. Which approaches to climate policy decrease carbon dioxide emissions? Evidence from US states, 1997–2017. Energy Res. Soc. Sci. 2023, 97, 102969. [Google Scholar] [CrossRef]

- Benavente, J.M.G. Impact of a carbon tax on the Chilean economy: A computable general equilibrium analysis. Energy Econ. 2016, 57, 106–127. [Google Scholar] [CrossRef]

- Olivier, J.G.J.; Bouwman, A.F.; Van der Maas, C.W.M.; Berdowski, J.J.M. Emission database for global atmospheric research (EDGAR). Environ. Monit. Assess. 1994, 31, 93–106. [Google Scholar] [CrossRef] [PubMed]

- Tsang, F.; Burge, P. Paying for Carbon Emissions Reduction; RAND Corporation: Santa Monica, CA, USA, 2011; Available online: https://www.rand.org/pubs/occasional_papers/OP312.html (accessed on 18 January 2023).

- Alberini, A.; Bigano, A.; Ščasný, M.; Zvěřinová, I. Preferences for Energy Efficiency vs. Renewables: What Is the Willingness to Pay to Reduce CO2 Emissions? Ecol. Econ. 2018, 144, 171–185. [Google Scholar] [CrossRef]

- Kotchen, M.J.; Boyle, K.J.; Leiserowitz, A.A. Willingness-to-pay and policy-instrument choice for climate-change policy in the United States. Energy Policy 2013, 55, 617–625. [Google Scholar] [CrossRef]

- Fabre, A.; Douenne, T. Can We Reconcile French People with the Carbon Tax? Disentangling Beliefs from Preferences; FAERE—French Association of Environmental and Resource Economists: Paris, France, 2019; Available online: https://ideas.repec.org/p/fae/wpaper/2019.10.html (accessed on 18 January 2024).

- Farrell, N. What factors drive inequalities in carbon tax incidence? Decomposing socioeconomic inequalities in carbon tax incidence in Ireland. Ecol. Econ. 2017, 142, 31–45. [Google Scholar] [CrossRef]

- Rausch, S.; Metcalf, G.E.; Reilly, J.M. Distributional impacts of carbon pricing: A general equilibrium approach with micro-data for households. Energy Econ. 2011, 33, S20–S33. [Google Scholar] [CrossRef]

- Carattini, S.; Baranzini, A.; Thalmann, P.; Varone, F.; Vöhringer, F. Green taxes in a post-Paris world: Are millions of nays inevitable? Environ. Resour. Econ. 2017, 68, 97–128. [Google Scholar] [CrossRef]

- Hammerle, M.; Best, R.; Crosby, P. Public acceptance of carbon taxes in Australia. Energy Econ. 2021, 101, 105420. [Google Scholar] [CrossRef]

- Douenne, T.; Fabre, A. French attitudes on climate change, carbon taxation and other climate policies. Ecol. Econ. 2020, 169, 106496. [Google Scholar] [CrossRef]

- Marten, M.; van Dender, K. The Use of Revenues from Carbon Pricing; OECD Taxation Working Papers 2019, No. 43; OECD Publishing: Paris, France, 2019. [Google Scholar] [CrossRef]

- Conway, D.; Richards, K.; Richards, S.; Keenlyside, P.; Mikolajczyk, S.; Streck, C.; Ross, J.; Anthony Liu, A.; Tran, A. Carbon Tax Guide: A Handbook for Policy Makers; No. 129668; The World Bank: Washington, DC, USA, 2017; pp. 1–172. Available online: http://documents.worldbank.org/curated/en/728421535605566659/Carbon-Tax-Guide-A-Handbook-for-Policy-Makers (accessed on 18 January 2024).

- Morris, A.C. Proposal 11: The Many Benefits of a Carbon Tax. 15 Ways to Rethink the Federal Budget; Brookings Institution: Washington, DC, USA, 2013; pp. 63–69. Available online: https://www.ourenergypolicy.org/wp-content/uploads/2013/07/Carbon-Tax.pdf (accessed on 15 October 2024).

- Orme, B.K. Getting Started with Conjoint Analysis: Strategies for Product Design and Pricing Research; Madison (WI) Research Publishers LLC: Manhattan Beach, CA, USA, 2006. [Google Scholar]

- Green, P.E.; Rao, V.R. Conjoint measurement-for quantifying judgmental data. J. Mark. Res. 1971, 8, 355–363. [Google Scholar] [CrossRef]

- Johnson, R.M. Trade-off analysis of consumer values. J. Mark. Res. 1974, 11, 121–127. [Google Scholar] [CrossRef]

- Alriksson, S.; Öberg, T. Conjoint analysis for environmental evaluation. Environ. Sci. Pollut. Res. 2008, 15, 244–257. [Google Scholar] [CrossRef] [PubMed]

- Lieder, M.; Asif, F.M.A.; Rashid, A. A conjoint analysis of circular economy value propositions for consumers: Using “washing machines in Stockholm” as a case study. J. Clean. Prod. 2018, 172, 264–273. [Google Scholar] [CrossRef]

- Beggs, S.; Cardell, S.; Hausman, J. Assessing the potential demand for electric cars. J. Econom. 1981, 17, 1–19. [Google Scholar] [CrossRef]

- Daniels, R.F.; Hensher, D.A. Valuation of environmental impacts of transport projects: The challenge of self-interest proximity. J. Transp. Econ. Policy 2000, 34, 189–214. [Google Scholar]

- Gao, S.; Smits, M.; Wang, C. A conjoint analysis of corporate preferences for the sectoral crediting mechanism: A case study of Shanxi Province in China. J. Clean. Prod. 2016, 131, 259–269. [Google Scholar] [CrossRef]

- Klahr, D.; Wallace, J.G. An information processing analysis of some Piagetian experimental tasks. Cogn. Psychol. 1970, 1, 358–387. [Google Scholar] [CrossRef]

- Raz, C.; Piper, D.; Haller, R.; Nicod, H.; Dusart, N.; Giboreau, A. From sensory marketing to sensory design: How to drive formulation using consumers’ input? Food Qual. Prefer. 2008, 19, 719–726. [Google Scholar] [CrossRef]

- Bigsby, H.R.; Ozanne, L.K. The purchase decision: Consumers and environmentally certified wood products. For. Prod. J. 2002, 52, 100–105. [Google Scholar]

- Scharin, H.; Wallström, L. Public support for carbon taxes: The role of political communication and trust. Environ. Politics 2018, 27, 1085–1105. [Google Scholar]

- Klenert, D.; Mattauch, L.; Combet, E.; Edenhofer, O.; Hepburn, C.; Rafaty, R.; Stern, N. Making carbon pricing work for citizens. Nat. Clim. Change 2018, 8, 669–677. [Google Scholar] [CrossRef]

- Carattini, S.; Carvalho, M.; Fankhauser, S. Overcoming public resistance to carbon taxes. Wiley Interdisciplinary Reviews. Clim. Change 2018, 9, e531. [Google Scholar] [CrossRef]

- Awunyo-Vitor, D.; Ishak, S.; Seidu Jasaw, G. Urban Households’ willingness to pay for improved solid waste disposal services in Kumasi Metropolis, Ghana. Urban Stud. Res. 2013, 2013, 659425. [Google Scholar] [CrossRef]

- Capasso, S.; Cicatiello, L.; De Simone, E.; Gaeta, G.L.; Mourão, P.R. Fiscal transparency and tax ethics: Does better information lead to greater compliance? J. Policy Model. 2021, 43, 1031–1050. [Google Scholar] [CrossRef]

- Duan, H.X.; Lü, Y.-L.; Li, L. Chinese public’s willingness to pay for CO2 emissions reductions: A case study from four provinces/cities. Adv. Clim. Change Res. 2014, 5, 100–110. [Google Scholar] [CrossRef]

- Yang, J.; Zou, L.; Lin, T.; Wu, Y.; Wang, H. Public willingness to pay for CO2 mitigation and the determinants under climate change: A case study of Suzhou, China. J. Environ. Manag. 2014, 146, 1–8. [Google Scholar] [CrossRef]

- Klok, J.; Larsen, A.; Dahl, A.; Hansen, K. Ecological tax reform in Denmark: History and social acceptability. Energy Policy 2006, 34, 905–916. [Google Scholar] [CrossRef]

- Sun, C.; Yuan, X.; Yao, X. Social acceptance towards the air pollution in China: Evidence from public’s willingness to pay for smog mitigation. Energy Policy 2016, 92, 313–324. [Google Scholar] [CrossRef]

- Khastar, M.; Aslani, A.; Nejati, M. How does carbon tax affect social welfare and emission reduction in Finland? Energy Rep. 2020, 6, 736–744. [Google Scholar] [CrossRef]

| Attributes | Levels |

|---|---|

| Use of carbon tax revenue | General tax budget |

| Subsidies/grants for clean energy technology | |

| Subsidies/grants for low-carbon technologies or CCUS | |

| Carbon tax policy implementers | Bank |

| Energy supplier | |

| Government | |

| Transparency of carbon tax policy implementation process | No process report |

| Report regularly on the official website | |

| Regularly report on the official website under the supervision of an independent third party | |

| Cost of carbon tax (CNY) | 150 |

| 350 | |

| 700 | |

| 1200 | |

| 2000 |

| Socioeconomic Characteristics | Percentage (%) | |

|---|---|---|

| Gender | Male | 41.24% |

| Female | 58.76% | |

| Age | 16–30 | 53.17% |

| 31–45 | 42.48% | |

| 46–60 | 3.85% | |

| >60 | 0.50% | |

| Marriage | Married | 67.58% |

| Single | 32.42% | |

| Educational level | Middle school or below | 2.48% |

| High school | 62.86% | |

| Bachelor | 30.93% | |

| Master or above | 3.73% | |

| Family members | 1 | 1.12% |

| 2 | 3.73% | |

| 3 | 39.63% | |

| 4 | 27.70% | |

| 5 | 20.50% | |

| 6 | 5.84% | |

| >6 | 1.49% | |

| Residence | Urban | 85.84% |

| Rural | 14.16% | |

| Family disposable income | 0–30,000 | 2.11% |

| 30,000–50,000 | 8.70% | |

| 50,000–100,000 | 19.38% | |

| 100,000–200,000 | 40.37% | |

| >200,000 | 27.08% | |

| Inconvenient | 2.36% | |

| Annual electricity consumption | 0–1000 | 33.17% |

| 1000–2500 | 42.24% | |

| 2500–5000 | 20.99% | |

| >5000 | 3.60% | |

| Annual gas consumption | 0–800 | 41.86% |

| 800–1500 | 37.14% | |

| 1500–3000 | 18.14% | |

| >3000 | 2.86% | |

| Annual gasoline consumption | 0–2500 | 35.78% |

| 2500–5000 | 30.43% | |

| 5000–10,000 | 26.46% | |

| >10,000 | 7.33% | |

| Climate change impact | None | 3.23% |

| Little | 20.75% | |

| Some | 59.01% | |

| Huge | 17.02% | |

| Understanding of carbon tax | None | 17.39% |

| Some | 67.08% | |

| Clear | 15.53% | |

| Attributes | Levels | Annual Willingness to Pay (CNY) |

|---|---|---|

| Use of carbon tax revenue | General tax budget | 0.00 |

| Subsidies/grants for clean energy technology | 503.90 | |

| Subsidies/grants for low-carbon technologies or CCUS | 611.81 | |

| Carbon tax policy implementers | Bank | 0.00 |

| Energy supplier | 160.55 | |

| Government | 424.81 | |

| Transparency of carbon tax policy implementation process | No process report | 0.00 |

| Report regularly on the official website | 1122.74 | |

| Regularly report on the official website under the supervision of an independent third party | 1482.05 | |

| Mean | 1435.28 |

| Attributes | Levels | Willingness to Pay | ||

|---|---|---|---|---|

| Educational Level (CNY) | ||||

| High School | Bachelor’s Degree | Master’s Degree or Above | ||

| Use of carbon tax revenue | General tax budget | 0.00 | 0.00 | 76.72 |

| Subsidies/grants for clean energy technology | 698.28 | 297.40 | 0.00 | |

| Subsidies/grants for low-carbon technologies or CCUS | 743.72 | 443.06 | 392.44 | |

| Carbon tax policy implementers | Bank | 0.00 | 0.00 | 0.00 |

| Energy supplier | 163.26 | 119.92 | 65.99 | |

| Government | 495.88 | 338.70 | 283.56 | |

| Transparency of carbon tax policy implementation process | No process report | 0.00 | 0.00 | 0.00 |

| Report regularly on the official website | 1246.08 | 977.76 | 1521.10 | |

| Regularly report on the official website under the supervision of an independent third party | 1608.80 | 1344.60 | 2033.16 | |

| Mean | 1652.00 | 1173.81 | 1457.65 | |

| Attributes | Levels | Willingness to Pay | |||

|---|---|---|---|---|---|

| Family Disposable Income per Year (CNY) | |||||

| 0–30,000 | 30,000–50,000 | 100,000–200,000 | >200,000 | ||

| Use of carbon tax revenue | General tax budget | 108.95 | 0.00 | 0.00 | 0.00 |

| Subsidies/grants for clean energy technology | 0.00 | 1070.62 | 501.02 | 472.23 | |

| Subsidies/grants for low-carbon technologies or CCUS | 118.10 | 1320.41 | 541.81 | 681.99 | |

| Carbon tax policy implementers | Bank | 0.00 | 0.00 | 0.00 | 0.00 |

| Energy supplier | 188.23 | 385.03 | 183.64 | 43.75 | |

| Government | 470.71 | 441.62 | 387.75 | 395.71 | |

| Transparency of carbon tax policy implementation process | No process report | 0.00 | 0.00 | 0.00 | 0.00 |

| Report regularly on the official website | 456.71 | 907.38 | 1067.22 | 1489.62 | |

| Regularly report on the official website under the supervision of an independent third party | 575.60 | 1064.44 | 1333.90 | 2048.86 | |

| Mean | 639.43 | 1729.83 | 1338.45 | 1710.72 | |

| Attributes | Levels | Willingness to Pay | ||

|---|---|---|---|---|

| Understanding of Carbon Tax (CNY) | ||||

| None | Some | Clear | ||

| Use of carbon tax revenue | General tax budget | 0 | 0 | 0 |

| Subsidies/grants for clean energy technology | 442.13 | 455.66 | 979.07 | |

| Subsidies/grants for low-carbon technologies or CCUS | 342.12 | 554.78 | 1749.54 | |

| Carbon tax policy implementers | Bank | 0.00 | 0.00 | 0.00 |

| Energy supplier | 123.40 | 158.68 | 86.41 | |

| Government | 335.19 | 420.21 | 478.93 | |

| Transparency of carbon tax policy implementation process | No process report | 0.00 | 0.00 | 0.00 |

| Report regularly on the official website | 850.72 | 1010.37 | 2847.26 | |

| Regularly report on the official website under the supervision of an independent third party | 1122.91 | 1342.81 | 3597.32 | |

| Mean | 1072.16 | 1314.17 | 3246.18 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, J.; Li, C.; Ji, X.; Zhang, L.; Chen, Y. Research on the Application of Conjoint Analysis in Carbon Tax Pricing for the Sustainable Development Process of China. Sustainability 2024, 16, 9407. https://doi.org/10.3390/su16219407

Zhang J, Li C, Ji X, Zhang L, Chen Y. Research on the Application of Conjoint Analysis in Carbon Tax Pricing for the Sustainable Development Process of China. Sustainability. 2024; 16(21):9407. https://doi.org/10.3390/su16219407

Chicago/Turabian StyleZhang, Jiahao, Chaolin Li, Xiangnan Ji, Li Zhang, and Yanjun Chen. 2024. "Research on the Application of Conjoint Analysis in Carbon Tax Pricing for the Sustainable Development Process of China" Sustainability 16, no. 21: 9407. https://doi.org/10.3390/su16219407

APA StyleZhang, J., Li, C., Ji, X., Zhang, L., & Chen, Y. (2024). Research on the Application of Conjoint Analysis in Carbon Tax Pricing for the Sustainable Development Process of China. Sustainability, 16(21), 9407. https://doi.org/10.3390/su16219407