Competition in Remanufacturing with Asymmetric Demand Information

Abstract

1. Introduction

- What are an OEM’s and an IR’s optimal production quantities?

- How does asymmetric information influence an IR’s encroachment decision?

- How does asymmetric information affect an OEM’s equilibrium profit?

- How do these decisions impact consumer surplus, social welfare, and environmental impact?

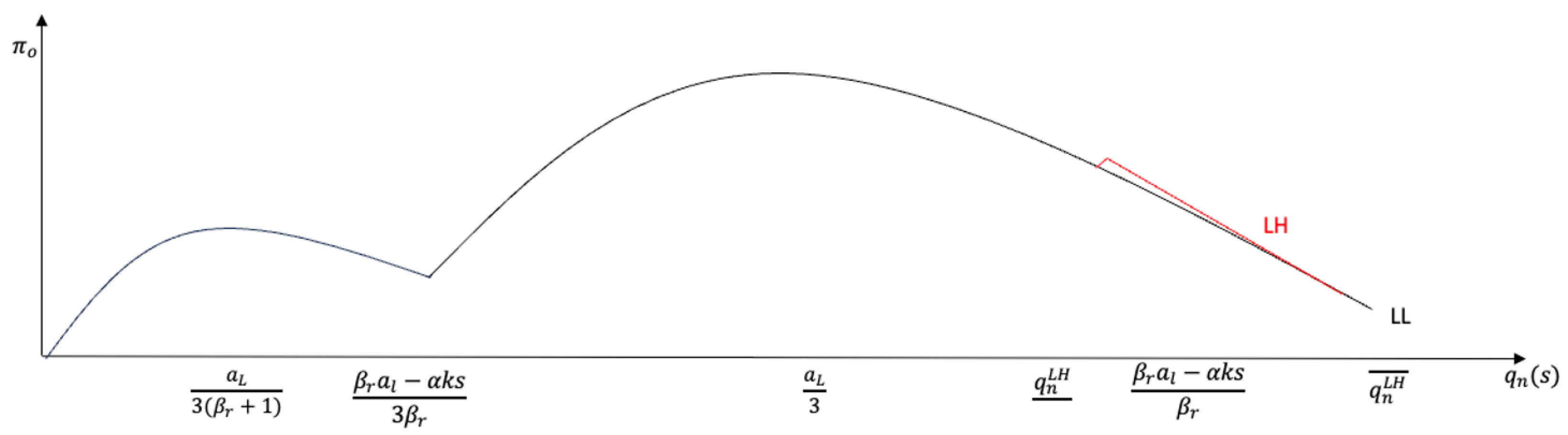

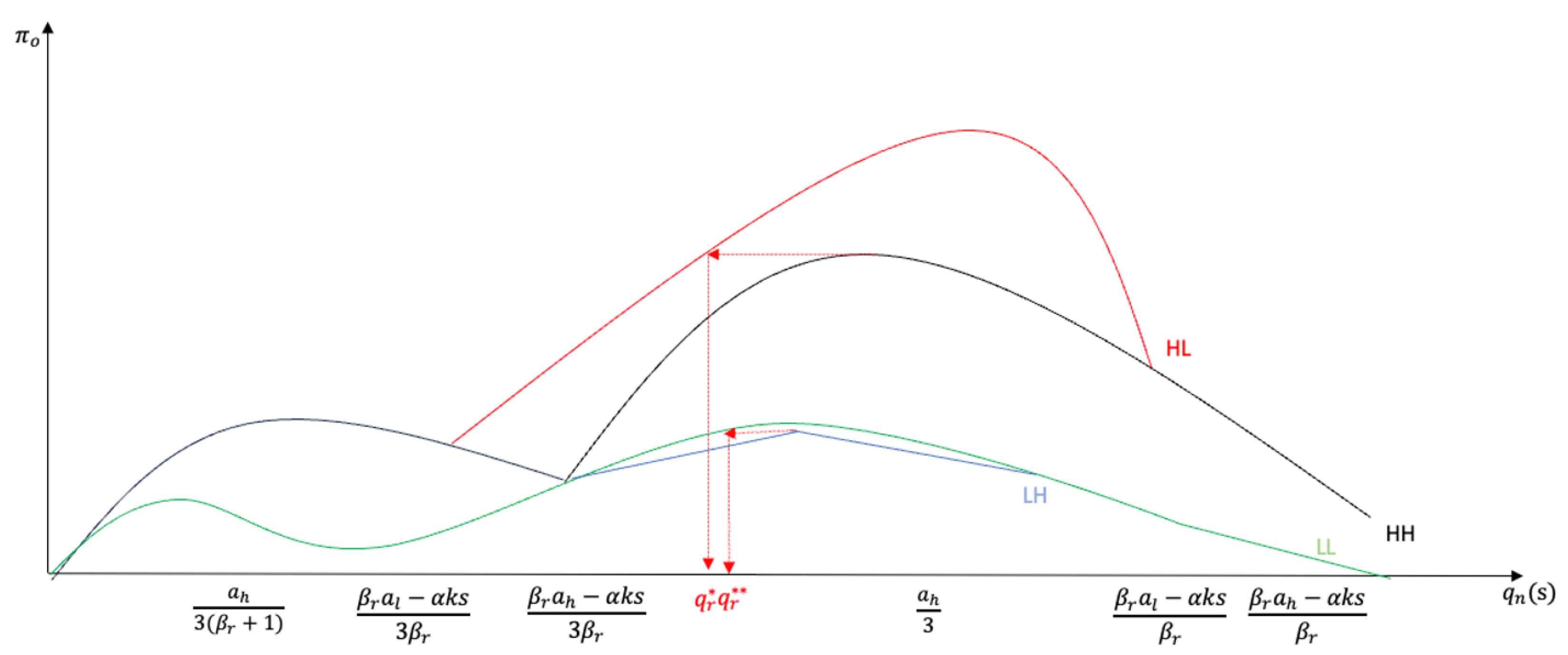

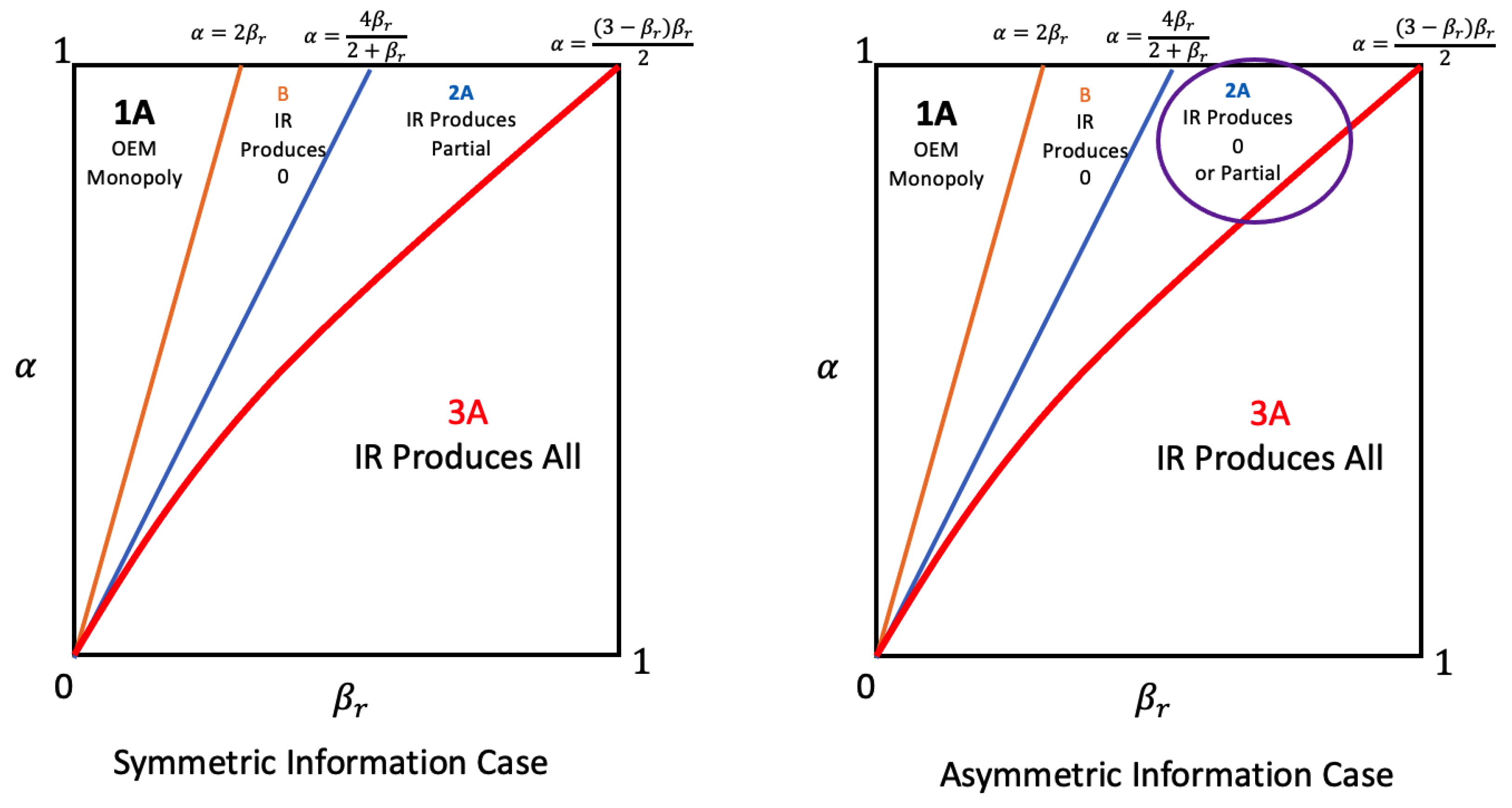

- First, we study how an OEM competes with an IR when information about the market size is available to both the OEM and IR. The specific aspects of competition studied are the decisions that the OEM and IR make about production quantity and quality levels and the decision that the IR makes about whether to encroach on the end market. For the latter, we find that the keys to the IR’s encroachment decision are its production cost advantage and the consumers’ preference for remanufactured products. The IR does not encroach on the market if its cost advantage and the consumers’ willingness to pay are low. When an IR’s cost advantage is moderate and the consumers’ willingness to pay is low, however, the IR encroaches on the market but does not remanufacture the full quantity available on the market (i.e., the quantity of products available for remanufacturing). When the IR’s cost advantage is high, the IR not only encroaches on the market but also remanufactures the full quantity available on the market. The OEM’s decisions about production quantity and quality levels also depend on the IR’s cost advantage and the consumers’ willingness to pay for the IR’s product. If the IR’s cost advantage and the consumers’ preference for the IR’s product are low, the OEM does not need to make adjustments to have the monopoly. If the IR’s cost advantage is moderate and the consumers’ willingness to pay for the IR’s product is low, the OEM can maintain the monopoly only if the OEM improves its product quality. If the OEM is unable to improve product quality sufficiently to deter IR encroachment, however, the OEM alters its quantity and quality based on the specific market conditions. If the consumers’ willingness to pay for the IR’s product is low and/or the IR’s cost advantage is low (high and low , which is explained in detail in Section 3), the OEM increases its product quality. If the consumers’ preference for the IR’s product is high and/or the IR’s cost advantage is high (low and high ), the OEM reduces its production quantity to limit the available product that the IR can collect and remanufacture.

- Second, we model whether it is profitable for the OEM to share market information with the IR. We find that the OEM can benefit from sharing market information with the IR. When the market size is high, the OEM’s and IR’s optimal quantities are the same as in the benchmark model, where the OEM and IR have equal market information. Thus, hiding market information from the IR does not positively or negatively impact the OEM. However, when the market size is low, the OEM’s decision to hide market information from the IR hurts the OEM’s profits. To understand why, note that if the market size is low and the OEM does not share market information, the OEM’s optimal decision is to substantially reduce its production quantity to prevent the IR from encroaching on the market. If the OEM shares market information with the IR, however, its production quantity is higher than the quantity when information is not shared, even with IR encroachment. Hence, it is in the OEM’s interest to share market information with the IR when the market size is low.

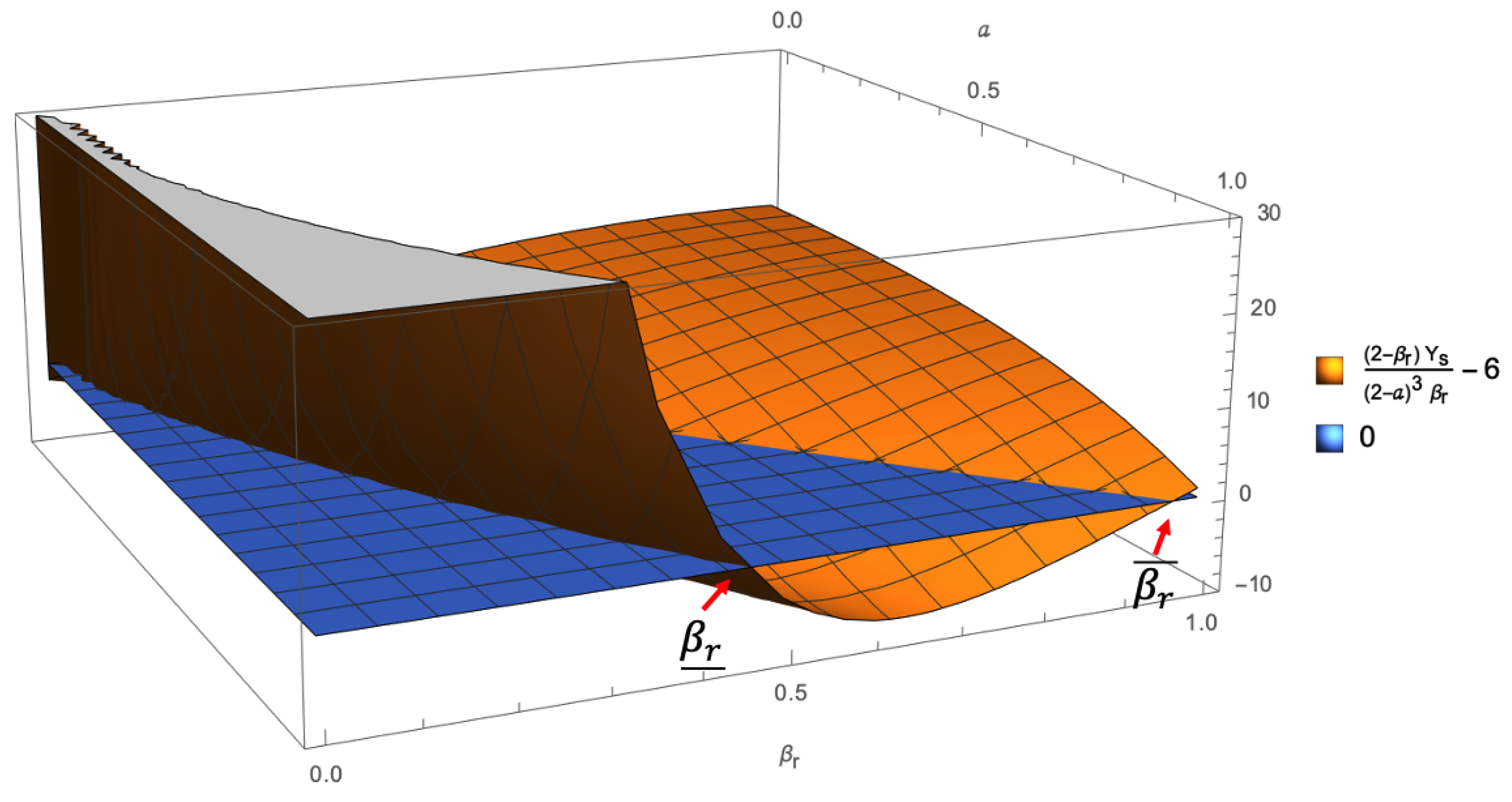

- Third, we study how IR remanufacturing decisions affect consumer surplus, social surplus, and environmental impact. We find that consumer surplus increases when the IR engages in remanufacturing, while social surplus increases only when either the OEM’s or IR’s product is strongly favored. Additionally, we find that IR encroachment always has lower environmental impact due to two reasons. First, remanufacturing’s use of most of the original components decreases its environmental impact. Second, if the IR encroaches on the market, the OEM lowers its own production quantity to limit the availability of products for the IR to remanufacture. Hence, when the IR encroaches on the market, the lower overall production quantity results in a lower environmental impact.

2. Literature Review

2.1. Remanufacturing

2.2. Information Asymmetry

3. Model Notations and Assumptions

- The OEM determines the new product’s quantity and quality levels and starts selling the product.

- The IR collects products from the market and resells them to consumers.

- The market clearing price is realized. The profits of the OEM and IR are realized.

4. Results

4.1. Analysis of Benchmark Model: Full Information

- When , denoted as Region A, the OEM is a monopolist, and the IR does not encroach on the market; the OEM’s and IR’s optimal quantities are , , and .

- When , denoted as Region B, the IR does not encroach on the market, and the OEM’s and IR’s optimal quantities are , , and .

- When , denoted as Region C, the IR remanufactures part of the available products, and the OEM’s and IR’s optimal quantities are , , and .

- When , denoted as Region D, the IR remanufactures all available products, and the OEM’s and IR’s optimal quantities are , , and .

4.2. Analysis of Benchmark Model: No Information

4.3. Asymmetric Information Model

- The OEM, observing the market size, sets his production quantity and product quality levels.

- Using the OEM’s production quantity as a signal of market size, the IR decides the quantity of used products to remanufacture.

- The market clearing price is realized. The profits of the OEM and the IR are realized.

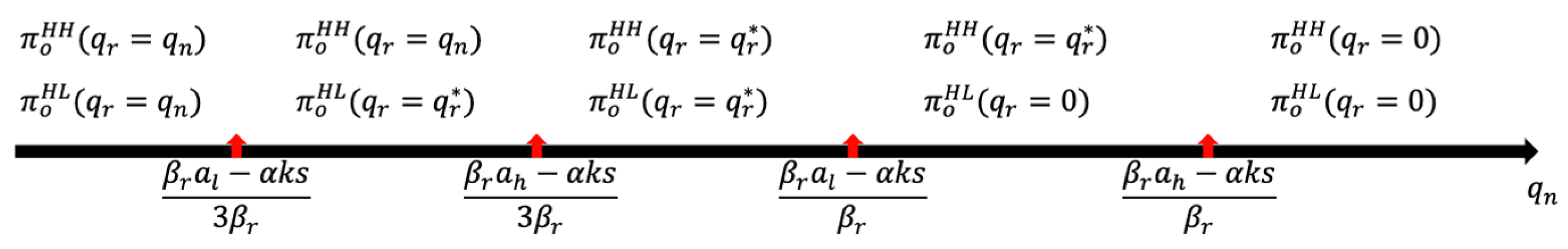

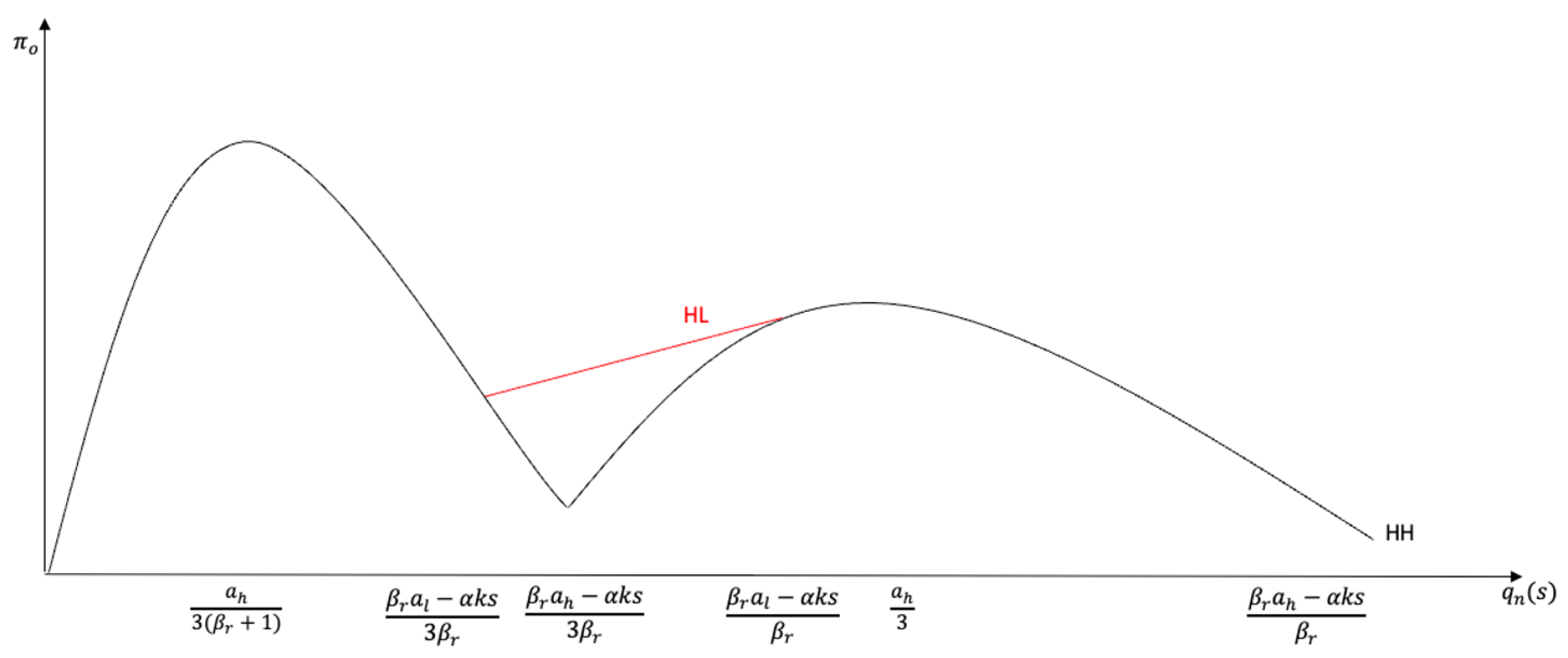

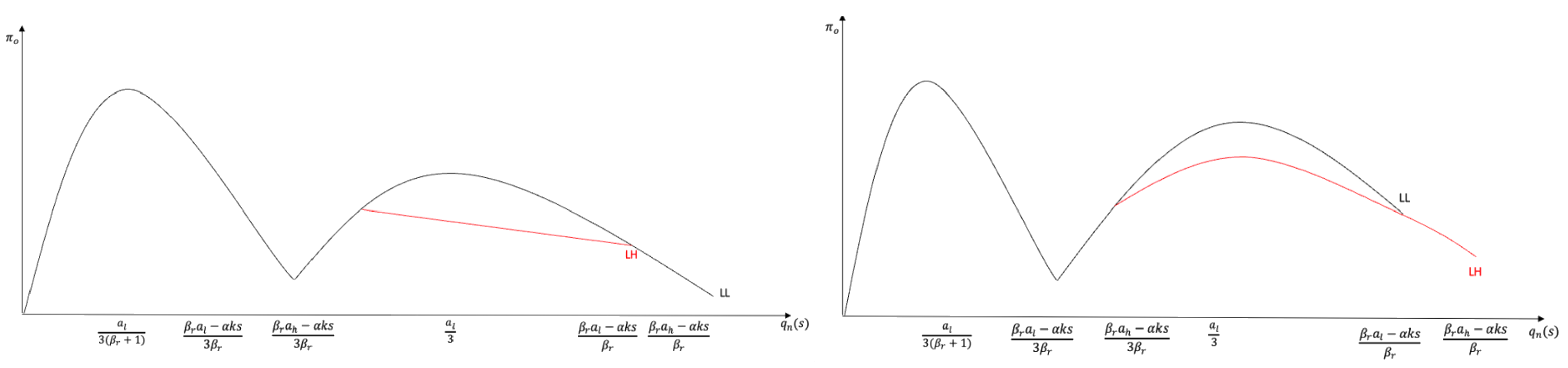

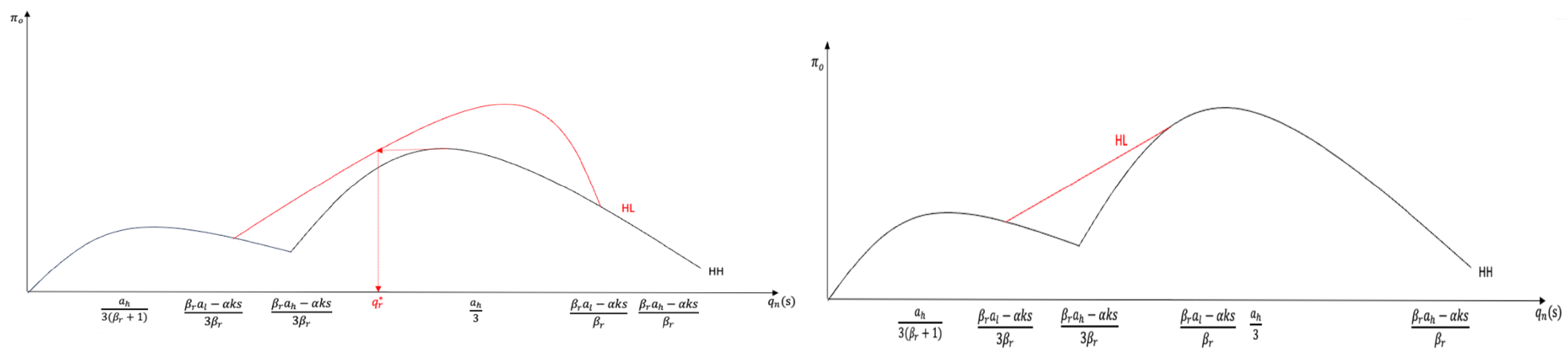

4.4. Analysis of Asymmetric Information Model

- When the market size is high, i.e., , the OEM’s and IR’s optimal quantities are those obtained from the benchmark model above, when the OEM and IR have equal information. Thus, it is sensible for the OEM to share his market information with the IR.

- When the market size is low, i.e., , the OEM may make different decisions from the benchmark model. The detailed strategy depends on model parameters and is listed in Table 2.

5. Discussion on Socioeconomic Benefit and Policy Implications

5.1. Consumer and Social Welfare

5.2. Environmental Impact

- When the IR’s entry is deterred by the OEM (Region B), the environmental impact is the same as when the IR does not encroach on the market (Region A).

- When the IR enters the market but does not remanufacture all products on the market (Region C), the environmental impact is higher than when the IR does not encroach on the market (Regions A and B) if . Lower α and higher increase the environmental impact in Region C.

- When the IR enters the market and remanufactures all products on the market (Region D), the environmental impact is higher than when IR does not encroach on the market (Regions A and B) if . A lower increases the environmental impact in Region D.

6. Conclusions and Future Directions

- The OEM sells both new and remanufactured products, and both parties know the true market size.

- The IR does not encroach on the market but instead sells the remanufactured products to the OEM under asymmetric information conditions.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| OEM | Original Equipment Manufacturer |

| IR | Independent Remanufacturer |

Appendix A. Proofs of Propositions, Corollary, and Theorems

| Symbol | Definition |

|---|---|

| , | The market bases for high market and low market, respectively |

| Manufacturing cost efficiency of the IR | |

| Consumers’ willingness to pay for the remanufactured product | |

| s | Quality level of the product |

| , | Prices made by the OEM and IR, respectively |

| k | Scaling parameter |

| , | Profit functions of the OEM and IR, respectively |

| , | Demand functions of the OEM and IR, respectively |

- When , the following apply:

- –

- When , cost efficiency is high. The dominant strategy is Case 3-A, where the IR produces the same amount as the OEM: , .

- –

- When , cost efficiency is low, but , the customers’ preference for the IR’s product, is high, so the dominant strategy is Case 2-A, where the IR produces her optimal amount: , .

- When , the following apply:

- –

- When , the dominant strategy is Case 3-A, where the IR produces the same amount as the OEM: , .

- –

- When , the dominant strategy is Case 2-A, where the IR produces her optimal amount: , .

- –

- When , the dominant strategy is Case 2-B, where the IR’s optimal amount is 0: , .

- When , the following apply:

- –

- When , the dominant strategy is Case 3-A, where the IR produces the same amount as the OEM: , .

- –

- When , the dominant strategy is Case 2-A, where the IR produces her optimal amount: , .

- –

- When , the dominant strategy is Case 2-B, where the IR’s optimal amount is 0: , .

- –

- When , the dominant strategy is Case 2-A, where the IR produces a 0 amount: , .

- When , the following apply:

- –

- When , cost efficiency is high. The dominant strategy is Case 3-A, where the IR produces the same amount as the OEM: , .

- –

- When , cost efficiency is low, but , the customers’ preference for the IR’s product, is high, so the dominant strategy is Case 2-A, where the IR produces her optimal amount.: , .

- When , the following apply:

- –

- When , the dominant strategy is Case 3-A, where the IR produces the same amount as the OEM: , .

- –

- When , the dominant strategy is Case 2-A, where the IR produces her optimal amount: , .

- –

- When , the dominant strategy is Case 2-B, where the IR’s optimal amount is 0: , .

- When , the following apply:

- –

- When , the dominant strategy is Case 3-A, where the IR produces the same amount as the OEM: , .

- –

- When , the dominant strategy is Case 2-A, where the IR produces her optimal amount: , .

- –

- When , the dominant strategy is Case 2-B, where the IR’s optimal amount is 0: , .

- –

- When , the dominant strategy is Case 2-A, where the IR produces a 0 amount: , .

References

- Remanufacturing, Inc. Available online: https://www.inc.com/encyclopedia/remanufacturing.html (accessed on 5 January 2021).

- Parker, D.; Riley, K.; Robinson, S.; Symington, H.; Tewson, J.; Jansson, K.; Ramkumar, S.; Peck, D. Remanufacturing Market Study. European Remanufacturing Network (ERN). 2015. Available online: https://www.remanufacturing.eu/assets/pdfs/remanufacturing-market-study.pdf (accessed on 5 January 2021).

- Ferguson, M.E.; Toktay, L.B. The effect of competition on recovery strategies. Prod. Oper. Manag. 2006, 15, 351–368. [Google Scholar] [CrossRef]

- Ferrer, G.; Swaminathan, J.M. Managing new and remanufactured products. Manag. Sci. 2006, 52, 15–26. [Google Scholar] [CrossRef]

- Ferrer, G.; Swaminathan, J.M. Managing new and differentiated remanufactured products. Eur. J. Oper. Res. 2010, 203, 370–379. [Google Scholar] [CrossRef]

- Örsdemir, A.; Kemahlıoğlu-Ziya, E.; Parlaktürk, A.K. Competitive quality choice and remanufacturing. Prod. Oper. Manag. 2014, 23, 48–64. [Google Scholar] [CrossRef]

- Huang, H.; Meng, Q.; Xu, H.; Zhou, Y. Cost information sharing under competition in remanufacturing. Int. J. Prod. Res. 2019, 57, 6579–6592. [Google Scholar] [CrossRef]

- Wu, C.H.; Wu, H.H. Competitive remanufacturing strategy and take-back decision with OEM remanufacturing. Comput. Ind. Eng. 2016, 98, 149–163. [Google Scholar] [CrossRef]

- Wu, C.H. Price and service competition between new and remanufactured products in a two-echelon supply chain. Int. J. Prod. Econ. 2012, 140, 496–507. [Google Scholar] [CrossRef]

- Li, Z.; Gilbert, S.M.; Lai, G. Supplier encroachment under asymmetric information. Manag. Sci. 2014, 60, 449–462. [Google Scholar] [CrossRef]

- Zhang, J.; Li, S.; Zhang, S.; Dai, R. Manufacturer encroachment with quality decision under asymmetric demand information. Eur. J. Oper. Res. 2019, 273, 217–236. [Google Scholar] [CrossRef]

- Zhang, F.; Chen, H.; Xiong, Y.; Yan, W.; Liu, M. Managing collecting or remarketing channels: Different choice for cannibalisation in remanufacturing outsourcing. Int. J. Prod. Res. 2021, 59, 5944–5959. [Google Scholar] [CrossRef]

- Debo, L.G.; Toktay, L.B.; Van Wassenhove, L.N. Market segmentation and product technology selection for remanufacturable products. Manag. Sci. 2005, 51, 1193–1205. [Google Scholar] [CrossRef]

- Oraiopoulos, N.; Ferguson, M.E.; Toktay, L.B. Relicensing as a secondary market strategy. Manag. Sci. 2012, 58, 1022–1037. [Google Scholar] [CrossRef]

- Wang, L.; Cai, G.; Tsay, A.A.; Vakharia, A.J. Design of the reverse channel for remanufacturing: Must profit-maximization harm the environment? Prod. Oper. Manag. 2017, 26, 1585–1603. [Google Scholar] [CrossRef]

- Atasu, A.; Sarvary, M.; Van Wassenhove, L.N. Remanufacturing as a marketing strategy. Manag. Sci. 2008, 54, 1731–1746. [Google Scholar] [CrossRef]

- Atasu, A.; Souza, G.C. How does product recovery affect quality choice? Prod. Oper. Manag. 2013, 22, 991–1010. [Google Scholar] [CrossRef]

- Sun, X.; Tang, W.; Chen, J.; Li, S.; Zhang, J. Manufacturer encroachment with production cost reduction under asymmetric information. Transp. Res. Part E Logist. Transp. Rev. 2019, 128, 191–211. [Google Scholar] [CrossRef]

- Johnson, J.P.; Myatt, D.P. On the simple economics of advertising, marketing, and product design. Am. Econ. Rev. 2006, 96, 756–784. [Google Scholar] [CrossRef]

- Cho, I.K.; Kreps, D.M. Signaling games and stable equilibria. Q. J. Econ. 1987, 102, 179–221. [Google Scholar] [CrossRef]

| Region | s | ||

|---|---|---|---|

| A—OEM monopoly | 0 | ||

| B—The IR produces 0 | 0 | ||

| C—The IR produces partial quantity | |||

| D—The IR produces all quantity |

| Region | s | ||

|---|---|---|---|

| A—OEM monopoly | 0 | ||

| B—The IR produces 0 | 0 | ||

| C—The IR produces 0 or partial quantity | or | or 0 | |

| D—The IR produces all quantity |

| Region | s | ||||

|---|---|---|---|---|---|

| A | 0 | ||||

| B | 0 | ||||

| C | |||||

| D |

| Region | Environmental Impact | ||

|---|---|---|---|

| A | |||

| B | |||

| C | ↓ | ↑ | |

| D | ↓ |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, Y.; Shen, W.; Li, J.; Liao, Y. Competition in Remanufacturing with Asymmetric Demand Information. Sustainability 2024, 16, 471. https://doi.org/10.3390/su16020471

Sun Y, Shen W, Li J, Liao Y. Competition in Remanufacturing with Asymmetric Demand Information. Sustainability. 2024; 16(2):471. https://doi.org/10.3390/su16020471

Chicago/Turabian StyleSun, Yaqin, Wenjing Shen, Jiacan Li, and Yi Liao. 2024. "Competition in Remanufacturing with Asymmetric Demand Information" Sustainability 16, no. 2: 471. https://doi.org/10.3390/su16020471

APA StyleSun, Y., Shen, W., Li, J., & Liao, Y. (2024). Competition in Remanufacturing with Asymmetric Demand Information. Sustainability, 16(2), 471. https://doi.org/10.3390/su16020471