Applying Fuzzy Decision-Making Trial and Evaluation Laboratory and Analytic Network Process Approaches to Explore Green Production in the Semiconductor Industry

Abstract

1. Introduction

2. Literature Review

2.1. Market Orientation

2.2. Green Technology

2.3. Externalities

2.4. Corporate Social Responsibility

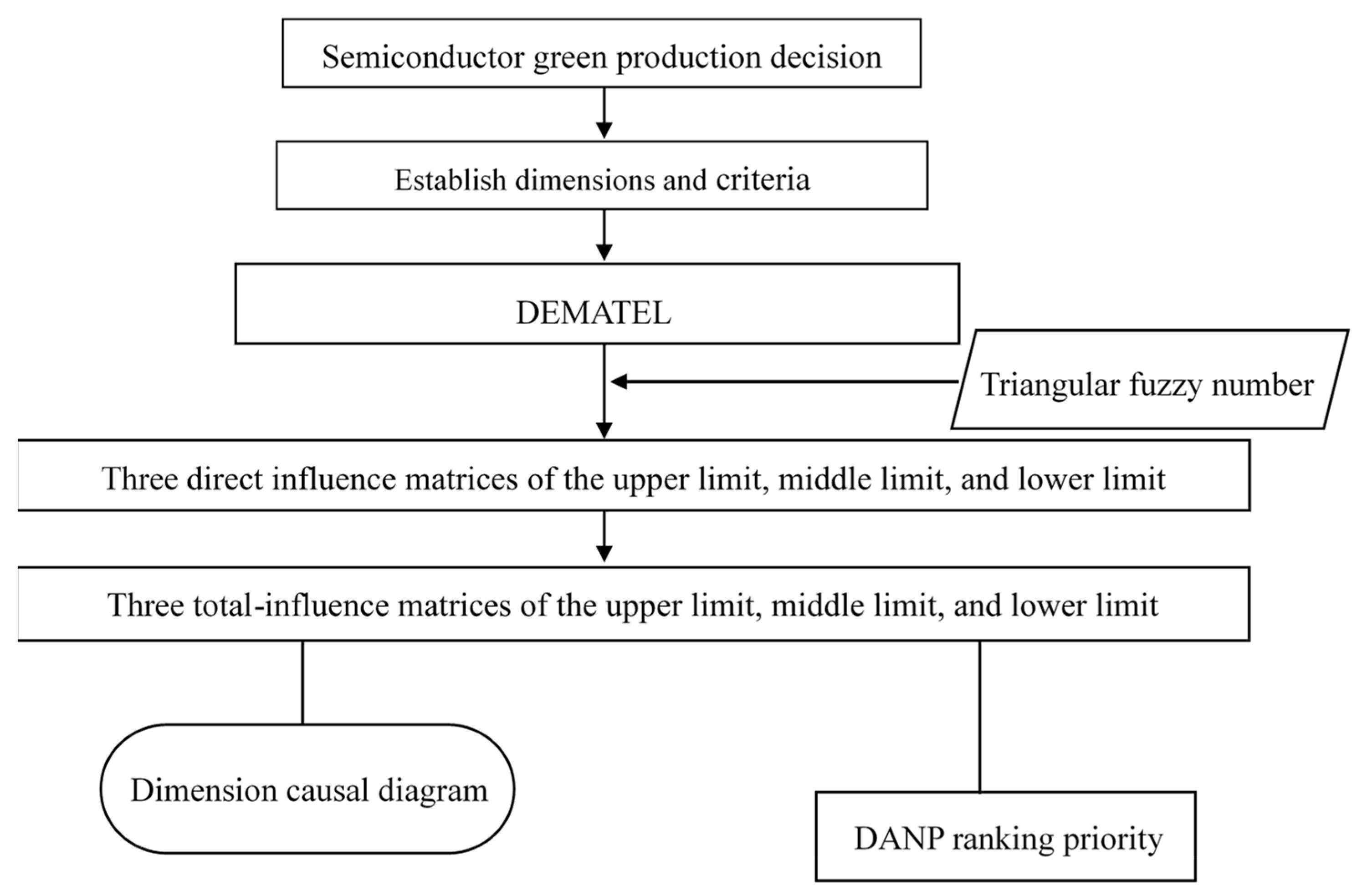

3. Methodology

3.1. Fuzzy DEMATEL Approach

- Step 1: Convert direct-influence data into triangular fuzzy numbers

- Step 2: Compute the normalized direct influence

- Step 3: Obtain the criteria-based total-influence matrix

- Step 4: Compute the causal correlation for each dimension

3.2. Fuzzy DANP Approach

- Step 1: Creating the normalized matrix and determining the weights for the supermatrix.

- Step 2: Achieve the weight of the supermatrix

- Step 3: Determines the average criteria weight values across the lower, middle, and upper limit matrices.

3.3. Data Collection

4. Results and Discussion

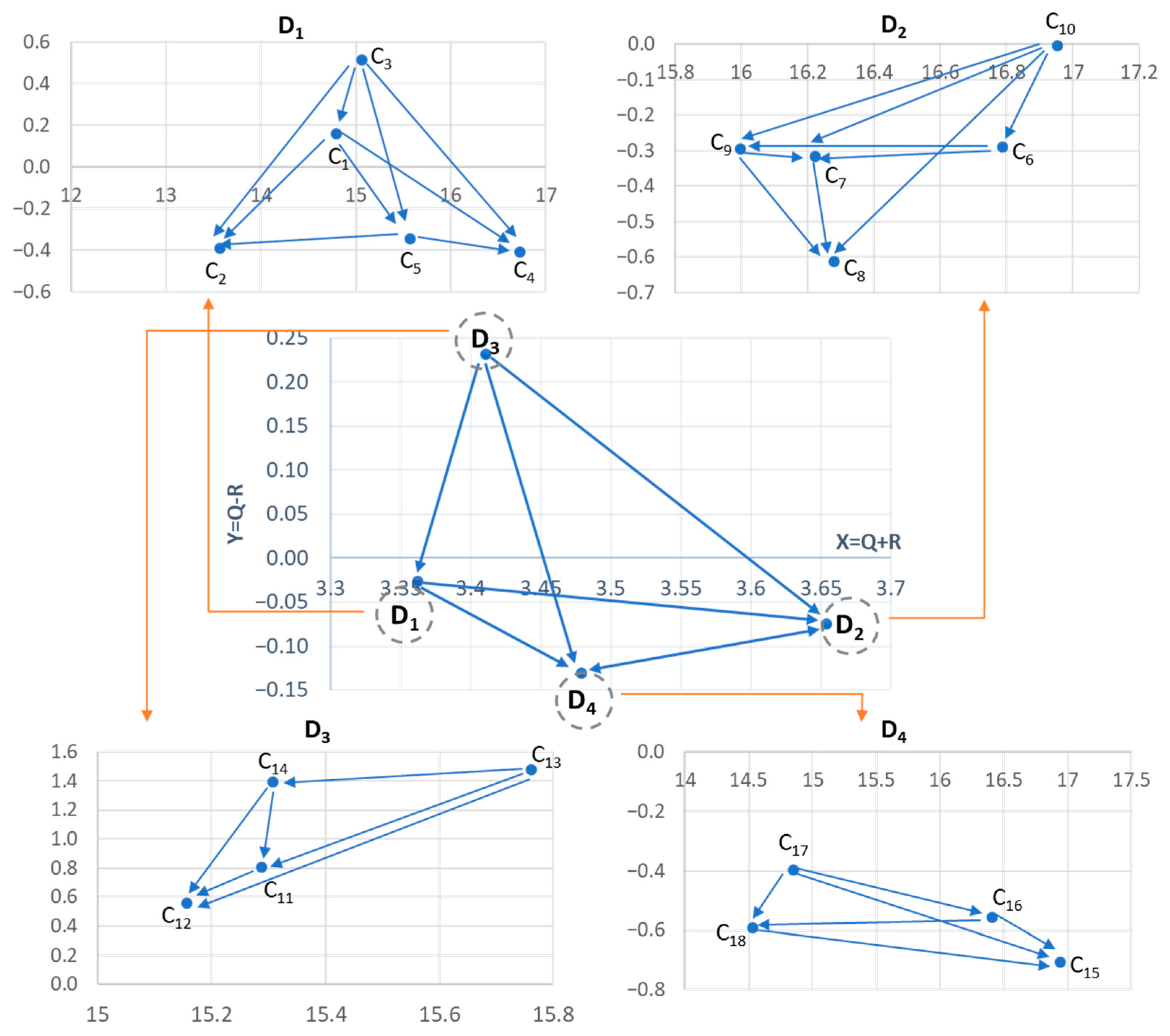

4.1. Results of Fuzzy DEMATEL Approach

4.2. Analysis Results of Fuzzy DANP Approach

5. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

References

- Tsai, B.H.; Huang, Y.M. Comparing the substitution of nuclear energy or renewable energy for fossil fuels between the United States and Africa. Sustainability 2023, 15, 10076. [Google Scholar] [CrossRef]

- Pao, H.T.; Chen, C.C. The dynamic interaction between circular economy and the environment: Evidence on EU countries. Waste Manag. Res. 2022, 40, 969–979. [Google Scholar] [CrossRef] [PubMed]

- Tsai, B.H.; Chen, C.C. Forecasting interactive relationships and long-term equilibrium of CO2 emissions in industrial interdependent regions. Carbon Manag. 2020, 11, 57–67. [Google Scholar] [CrossRef]

- Tsai, B.H.; Chang, C.J.; Chang, C.H. Elucidating the consumption and CO2 emissions of fossil fuels and low-carbon energy in the United States using Lotka-Volterra models. Energy 2016, 100, 416–424. [Google Scholar] [CrossRef]

- Tsai, B.H. Modeling energy consumption and carbon dioxide emissions of fossil fuels and nuclear energy using Lotka-Volterra equations. Appl. Ecol. Environ. Res. 2022, 20, 1435–1455. [Google Scholar] [CrossRef]

- Lyu, Y.F. An empirical analysis on the relationship between green economy and inflation in China. Appl. Ecol. Environ. Res. 2019, 17, 8969–8983. [Google Scholar] [CrossRef]

- Baines, T.; Brown, S.; Benedettini, O.; Ball, P. Examining green production and its role within the competitive strategy of manufacturers. J. Ind. Eng. Manag. 2012, 5, 53–87. [Google Scholar] [CrossRef]

- Zameer, H.; Wang, Y.; Yasmeen, H. Reinforcing green competitive advantage through green production, creativity and green brand image: Implications for cleaner production in China. J. Clean. Prod. 2020, 247, 119119. [Google Scholar] [CrossRef]

- Wen, R.M.; Liang, J.W. Abatement of waste gases and water during the processes of semiconductor fabrication. J. Environ. Sci. 2002, 14, 482–488. [Google Scholar]

- Liao, W.W. A study on the correlations among environmental education, environment-friendly product development, and green Innovation Capability in an Enterprise. Eurasia J. Math. Sci. Technol. Educ. 2017, 13, 5435–5444. [Google Scholar] [CrossRef]

- Liu, Z.; Zhao, Y.; Yin, Z. Low-power soft transistors triggering revolutionary electronics. Innovation 2024, 5, 100616. [Google Scholar] [CrossRef] [PubMed]

- Go beyond the limit: Rationally designed mixed-dimensional perovskite/semiconductor heterostructures and their applications. Innovation 2022, 4, 100363.

- Narver, J.C.; Slater, S.F. The effect of a market orientation on business profitability. J. Mark. 1990, 54, 20–35. [Google Scholar] [CrossRef]

- Lee, K.H.; Kim, J.W. Integrating suppliers into green product innovation development: An empirical case study in the semiconductor industry. Bus. Strat. Environ. 2011, 20, 527–538. [Google Scholar] [CrossRef]

- Chen, Y.S. The driver of green innovation and green image-green core competence. J. Bus. Ethics 2008, 81, 531–543. [Google Scholar] [CrossRef]

- Miao, C.; Fang, D.; Sun, L.; Luo, Q. Natural resources utilization efficiency under the influence of green technological innovation. Resour. Conserv. Recycl. 2017, 126, 153–161. [Google Scholar] [CrossRef]

- Hopkins, M. Corporate Social Responsibility and International Development; Earthscan: London, UK, 2007. [Google Scholar]

- Alniacik, U.; Alniacik, E.; Genc, N. How corporate social responsibility information influences stakeholders’ intentions. Corp. Soc. Responsib. Environ. Manag. 2011, 18, 234–245. [Google Scholar] [CrossRef]

- Maden, C.; Arıkan, E.; Telci, E.E.; Kantur, D. Linking corporate social responsibility to corporate reputation: A study on understanding behavioral consequences. Procedia-Soc. Behav. Sci. 2012, 58, 655–664. [Google Scholar] [CrossRef]

- Cho, S.Y.; Lee, C.; Pfeiffer, R.J., Jr. Corporate social responsibility performance and information asymmetry. J. Account. Public Policy 2013, 32, 71–83. [Google Scholar] [CrossRef]

- Flammer, C. Corporate social responsibility and shareholder reaction: The environmental awareness of investors. Acad. Manag. J. 2013, 56, 758–781. [Google Scholar] [CrossRef]

- Lins, K.V.; Servaes, H.; Tamayo, A. Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. J. Financ. 2017, 72, 1785–1824. [Google Scholar] [CrossRef]

- Huang, C.Y.; Liu, Y.W.; Tzeng, G.H. Derivations of factors influencing the technology acceptance of smart TV by using the DEMATEL based network process. Smart Innov. Syst. Technol. 2012, 15, 457–469. [Google Scholar]

- Lin, K.P.; Tseng, M.L.; Pai, P.F. Sustainable supply chain management using approximate fuzzy DEMATEL method. Resour. Conserv. Recycl. 2018, 128, 134–142. [Google Scholar] [CrossRef]

- Islami, I.; Sadoddin, A.; Barani, H.; Asgharpourmasouleh, A.; Akhbari, M. Modeling socio-ecological structure of local communities participation for managing livestock drinking water using the agent-based approach. Appl. Ecol. Environ. Res. 2017, 15, 1173–1192. [Google Scholar] [CrossRef]

- Ho, C.Y.; Tsai, B.H.; Chen, C.S. Exploring green marketing orientations toward sustainability the hospitality industry in the COVID-19 pandemic. Sustainability 2021, 13, 4348. [Google Scholar] [CrossRef]

- Hossain, M.I.; Amin, M.A.; Baldacci, R.; Rahman, M.H. Identification and prioritization of green lean supply chain management factors using fuzzy DEMATEL. Sustainability 2023, 15, 10523. [Google Scholar] [CrossRef]

- Gabus, A.; Fontela, E. Perceptions of the world problem antique: Communication procedure, communicating with those bearing collective responsibility. In DEMATEL Report 1; Battelle Memorial Institute Geneva Research Centre: Geneva, Switzerland, 1973. [Google Scholar]

- Fontela, E.; Gabus, A. The DEMATEL Observer; Battelle Geneva Research Center: Geneva, Switzerland, 1976. [Google Scholar]

- Masoud, Z.N.; Reza, M.; Mohammad, A. The application of fuzzy analytic hierarchy process (FAHP) approach to selection of optimum underground mining method for Jajarm Bauxite Mine, Iran. Expert Syst. Appl. 2009, 36, 8218–8226. [Google Scholar]

- Dong, J.; Wan, S.; Chen, S.M. A fuzzy best-worst method based on triangular fuzzy numbers for multi-criteria decision-making. Inf. Sci. 2021, 547, 1080–1104. [Google Scholar] [CrossRef]

- Gölcük, I.; Baykasoglu, A. An analysis of DEMATEL approaches for criteria interaction handling within ANP. Expert Syst. Appl. 2015, 46, 346–366. [Google Scholar] [CrossRef]

- Yang, J.L.; Tzeng, G. An integrated MCDM technique combined with DEMATEL for a novel cluster-weighted with ANP method. Expert Syst. Appl. 2011, 38, 160–168. [Google Scholar]

- Jaworski, B.J.; Kohli, A.K. Market orientation: Antecedents and consequences. J. Mark. 1993, 57, 53–70. [Google Scholar] [CrossRef]

- Fic, K.; Platek, A.; Piwek, J.; Frackowiak, E. Sustainable materials for electrochemical capacitors. Mater. Today 2018, 21, 437–454. [Google Scholar] [CrossRef]

- Zhou, F.; Wang, X.; Lim, M.K.; He, Y.D.; Li, L.X. Sustainable recycling partner selection using fuzzy DEMATEL-AEW-FVIKOR: A case study in small-and-medium enterprises (SMEs). J. Clean. Prod. 2018, 196, 489–504. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Schiederig, T.; Tietze, F.; Herstatt, C. Green innovation in technology and innovation management. R&D Manag. 2012, 42, 180–192. [Google Scholar]

- Li, S. Natural extreme events, government subsidies and corporate environment responsibility: Evidence from China’s energy sector. Energy Econ. 2022, 114, 106278. [Google Scholar] [CrossRef]

- Mortha, A.; Hesary, F.T.; Vo, X.V. The impact of a carbon tax implementation on non-CO2 gas emissions: The case of Japan. Australas. J. Environ. Manag. 2021, 28, 355–372. [Google Scholar] [CrossRef]

- Hu, J.W.; Hu, Y.; Bein, H. Constructing a corporate social responsibility fund using fuzzy multiple criteria decision making. Int. J. Fuzzy Syst. 2011, 13, 195–205. [Google Scholar]

- Saaty, T.L. Decision Making with Dependence and Feedback: The Analytic Network Process; RWS Publications: Pittsburgh, PA, USA, 1996. [Google Scholar]

- Yoo, Y.; Cho, K. Key Taits of leading sustainable firms in the semiconductor industry. Sustainability 2024, 16, 4563. [Google Scholar] [CrossRef]

| Dimensions/Elements | Description |

|---|---|

| Market Orientation (D1) | |

| Inter-functional coordination (c1) | The semiconductor firms coordinate industry resources to create beneficial value for target consumers [13,34]. |

| Competitor orientation (c2) | The semiconductor firms realize potential competitors’ long-term strategies, short-term weaknesses, and strengths of potential competitors [13,34]. |

| Consumer orientation(c3) | The semiconductor firms provide two-way mutually beneficial services and products from the perspective of target consumers [13,34]. |

| Long-term profits (c4) | The semiconductor firms take profit as the primary goal and pursues positive returns from long-term profits [13]. |

| Benefit orientation (c5) | The semiconductor firms obtain sufficient benefits from the market [13]. |

| Green Technology (D2) | |

| Sustainable materials (c6) | The semiconductor firms are engaged in the production of resource-saving products, which reduce environmental pollution during production and are easy to recycle and return to nature after being discarded [35]. |

| Energy saving (c7) | The semiconductor firms can achieve a relatively low ratio of energy consumption compared to performance [36]. |

| Synergy(c8) | The semiconductor firms emphasize the synergistic benefits of green technology and the mutual influence between manufacturers and brand owners [37]. |

| Technological innovation (c9) | To achieve better production efficiency and product quality while carrying out production, the semiconductor firms carry out software and hardware updates of production equipment, as well as innovations and breakthroughs in related technologies [38]. |

| Low toxicity (c10) | The semiconductor firms guarantee that no harmful or toxic substances will be produced in the human body or the environment [38]. |

| Externalities (D3) | |

| Government subsidies (c11) | The government provides relevant policies and subsidies to motivate and assist enterprises to implement green transformation [39]. |

| Carbon trading (c12) | The Paris Agreement and the Kyoto Protocol treat carbon dioxide emissions as tradable commodities and use market mechanisms to reduce greenhouse gas emissions [40]. |

| Regulations (c13) | As the requirements for environmental protection are becoming stricter, enterprises must abide by regulations [40]. |

| Punishment (c14) | Violation of the government’s environment-related laws and regulations will be punished and fined [40]. |

| Corporate Social Responsibility (D4) | |

| Corporate image (c15) | The semiconductor firms establish a good corporate image in the minds of legislators and the public [17,41]. |

| Environmental safety (c16) | The semiconductor firms avoid production that pollutes the environment and develops products with low environmental loads [17,41]. |

| Social care (c17) | The semiconductor firms are engaged in social welfare and charity activities, assisting disadvantaged groups and cultivating new-generation talents [17,41]. |

| Workplace environment (c18) | The semiconductor firms provide a friendly and safe environment for employees to concentrate on their work and ensure their health [17,41]. |

| Category | Number of Experts |

|---|---|

| Ages | |

| ≤30 | 20 |

| 31~40 | 13 |

| 41~50 | 14 |

| ≥50 | 8 |

| Education level | |

| Bachelor | 10 |

| Master | 42 |

| Ph.D | 3 |

| Years of working experiences | |

| Less than 1 year | 15 |

| Between 2 and 3 years | 3 |

| Between 4 and 10 years | 8 |

| Between 11 and 20 years | 15 |

| More than 21 years | 14 |

| Elements | c1 | c2 | c3 | c4 | c5 | c6 | c7 | c8 | c9 | c10 | c11 | c12 | c13 | c14 | c15 | c16 | c17 | c18 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| c1 | 0.348 | 0.378 | 0.400 | 0.467 | 0.438 | 0.448 | 0.435 | 0.442 | 0.434 | 0.444 | 0.377 | 0.380 | 0.375 | 0.366 | 0.479 | 0.449 | 0.408 | 0.410 |

| c2 | 0.353 | 0.293 | 0.350 | 0.410 | 0.390 | 0.396 | 0.381 | 0.386 | 0.382 | 0.394 | 0.335 | 0.341 | 0.332 | 0.323 | 0.414 | 0.391 | 0.358 | 0.358 |

| c3 | 0.421 | 0.397 | 0.360 | 0.483 | 0.455 | 0.473 | 0.459 | 0.471 | 0.452 | 0.468 | 0.395 | 0.396 | 0.391 | 0.377 | 0.490 | 0.463 | 0.426 | 0.413 |

| c4 | 0.435 | 0.414 | 0.430 | 0.443 | 0.475 | 0.494 | 0.479 | 0.483 | 0.472 | 0.490 | 0.417 | 0.422 | 0.410 | 0.398 | 0.514 | 0.491 | 0.447 | 0.444 |

| c5 | 0.411 | 0.396 | 0.408 | 0.477 | 0.385 | 0.457 | 0.448 | 0.449 | 0.437 | 0.453 | 0.390 | 0.394 | 0.383 | 0.378 | 0.476 | 0.453 | 0.412 | 0.409 |

| c6 | 0.418 | 0.402 | 0.427 | 0.499 | 0.459 | 0.446 | 0.489 | 0.503 | 0.482 | 0.506 | 0.433 | 0.436 | 0.423 | 0.411 | 0.523 | 0.506 | 0.447 | 0.438 |

| c7 | 0.407 | 0.390 | 0.410 | 0.484 | 0.449 | 0.485 | 0.417 | 0.474 | 0.465 | 0.489 | 0.419 | 0.424 | 0.408 | 0.395 | 0.504 | 0.482 | 0.428 | 0.422 |

| c8 | 0.400 | 0.381 | 0.411 | 0.474 | 0.433 | 0.481 | 0.450 | 0.420 | 0.452 | 0.479 | 0.409 | 0.407 | 0.403 | 0.394 | 0.496 | 0.485 | 0.430 | 0.428 |

| c9 | 0.406 | 0.385 | 0.406 | 0.475 | 0.441 | 0.481 | 0.463 | 0.470 | 0.405 | 0.482 | 0.406 | 0.412 | 0.401 | 0.389 | 0.495 | 0.478 | 0.427 | 0.426 |

| c10 | 0.436 | 0.417 | 0.437 | 0.515 | 0.472 | 0.521 | 0.506 | 0.520 | 0.497 | 0.455 | 0.437 | 0.449 | 0.431 | 0.417 | 0.535 | 0.518 | 0.458 | 0.452 |

| c11 | 0.413 | 0.393 | 0.409 | 0.486 | 0.454 | 0.497 | 0.480 | 0.486 | 0.470 | 0.495 | 0.370 | 0.428 | 0.420 | 0.405 | 0.491 | 0.485 | 0.435 | 0.429 |

| c12 | 0.401 | 0.387 | 0.396 | 0.478 | 0.442 | 0.483 | 0.471 | 0.473 | 0.459 | 0.483 | 0.413 | 0.364 | 0.411 | 0.398 | 0.487 | 0.477 | 0.422 | 0.415 |

| c13 | 0.446 | 0.425 | 0.438 | 0.521 | 0.484 | 0.527 | 0.511 | 0.526 | 0.497 | 0.524 | 0.449 | 0.452 | 0.390 | 0.445 | 0.528 | 0.524 | 0.467 | 0.465 |

| c14 | 0.432 | 0.408 | 0.422 | 0.503 | 0.472 | 0.511 | 0.497 | 0.509 | 0.485 | 0.506 | 0.432 | 0.440 | 0.434 | 0.368 | 0.521 | 0.510 | 0.452 | 0.448 |

| c15 | 0.428 | 0.409 | 0.429 | 0.497 | 0.460 | 0.495 | 0.482 | 0.492 | 0.472 | 0.488 | 0.417 | 0.417 | 0.404 | 0.395 | 0.453 | 0.487 | 0.448 | 0.445 |

| c16 | 0.410 | 0.390 | 0.407 | 0.480 | 0.444 | 0.487 | 0.472 | 0.486 | 0.463 | 0.480 | 0.409 | 0.414 | 0.404 | 0.393 | 0.501 | 0.426 | 0.428 | 0.431 |

| c17 | 0.377 | 0.360 | 0.377 | 0.444 | 0.406 | 0.439 | 0.426 | 0.437 | 0.418 | 0.429 | 0.374 | 0.369 | 0.367 | 0.355 | 0.468 | 0.436 | 0.349 | 0.395 |

| c18 | 0.377 | 0.351 | 0.358 | 0.429 | 0.398 | 0.417 | 0.404 | 0.420 | 0.403 | 0.414 | 0.357 | 0.354 | 0.354 | 0.348 | 0.449 | 0.421 | 0.381 | 0.335 |

| Dimensions | D1 | D2 | D3 | D4 |

|---|---|---|---|---|

| Market Orientation (D1) | 0.4088 (0.291, 0.350, 0.586) | 0.4451 (0.328, 0.384, 0.623) | 0.3791 (0.266, 0.317, 0.554) | 0.4352 (0.317, 0.375, 0.614) |

| Green Technology (D2) | 0.4335 (0.308, 0.374, 0.618) | 0.4735 (0.357, 0.414, 0.649) | 0.4137 (0.301, 0.353, 0.587) | 0.4689 (0.351, 0.409, 0.647) |

| Externalities (D3) | 0.4405 (0.318, 0.381, 0.623) | 0.4945 (0.382, 0.434, 0.667) | 0.4137 (0.305, 0.353, 0.583) | 0.4722 (0.356, 0.411, 0.649) |

| Corporate Social Responsibility (D4) | 0.4115 (0.290, 0.350, 0.594) | 0.4512 (0.335, 0.389, 0.630) | 0.3833 (0.271,0.320, 0.559) | 0.4283 (0.312, 0.366, 0.607) |

| Dimensions | Q | R | ||

|---|---|---|---|---|

| Market Orientation (D1) | 1.6682 (1.202, 1.426, 2.377) | 1.6942 (1.206, 1.455, 2.422) | 3.3624 (2.408, 2.880, 4.799) | −0.0260 (−0.005, −0.029, −0.045) |

| Green Technology (D2) | 1.7896 (1.317, 1.550, 2.502) | 1.8644 (1.402, 1.622, 2.569) | 3.6540 (2.720, 3.172, 5.071) | −0.0748 (−0.085, −0.072, −0.067) |

| Externalities (D3) | 1.8210 (1.362, 1.579, 2.522) | 1.5898 (1.143, 1.343, 2.283) | 3.4108 (2.505, 2.922, 4.805) | 0.2312 (0.219, 0.236, 0.239) |

| Corporate Social Responsibility (D4) | 1.6743 (1.207, 1.426, 2.390) | 1.8047 (1.336, 1.531, 2.516) | 3.4790 (2.543, 2.988, 4.906) | −0.1304 (−0.129, −0.135, −0.127) |

| Dimension | Criteria Name | Average Weight Value | Rank | Intra-Dimension Weight Value | Rank within Dimension |

|---|---|---|---|---|---|

| Market Orientation (D1) | Internal cross-functional coordination (c1) | 0.0466 | 16 | 0.1919 | 3 |

| Competitor orientation (c2) | 0.0441 | 18 | 0.1818 | 5 | |

| Consumer orientation (c3) | 0.0462 | 17 | 0.1905 | 4 | |

| Long-term profit (c4) | 0.0550 | 9 | 0.2268 | 1 | |

| Benefit orientation (c5) | 0.0507 | 15 | 0.2090 | 2 | |

| Green Technology (D2) | Sustainable material (c6) | 0.0550 | 10 | 0.2041 | 1 |

| Energy saving (c7) | 0.0531 | 13 | 0.1971 | 4 | |

| Low toxicity (c8) | 0.0545 | 12 | 0.2021 | 3 | |

| Synergy (c9) | 0.0523 | 14 | 0.1938 | 5 | |

| Green innovation (c10) | 0.0547 | 11 | 0.2029 | 2 | |

| Externalities (D3) | Government subsidy (c11) | 0.0576 | 6 | 0.2531 | 2 |

| Carbon trading (c12) | 0.0581 | 5 | 0.2553 | 1 | |

| Regulations (c13) | 0.0567 | 7 | 0.2492 | 3 | |

| Punishment (c14) | 0.0552 | 8 | 0.2424 | 4 | |

| Corporate Social Responsibility (D4) | Corporate image (c15) | 0.0711 | 1 | 0.2734 | 1 |

| Environmental safety (c16) | 0.0682 | 2 | 0.2620 | 2 | |

| Social care (c17) | 0.0608 | 3 | 0.2335 | 3 | |

| Workplace environment (c18) | 0.0601 | 4 | 0.2311 | 4 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tsai, B.-H. Applying Fuzzy Decision-Making Trial and Evaluation Laboratory and Analytic Network Process Approaches to Explore Green Production in the Semiconductor Industry. Sustainability 2024, 16, 7163. https://doi.org/10.3390/su16167163

Tsai B-H. Applying Fuzzy Decision-Making Trial and Evaluation Laboratory and Analytic Network Process Approaches to Explore Green Production in the Semiconductor Industry. Sustainability. 2024; 16(16):7163. https://doi.org/10.3390/su16167163

Chicago/Turabian StyleTsai, Bi-Huei. 2024. "Applying Fuzzy Decision-Making Trial and Evaluation Laboratory and Analytic Network Process Approaches to Explore Green Production in the Semiconductor Industry" Sustainability 16, no. 16: 7163. https://doi.org/10.3390/su16167163

APA StyleTsai, B.-H. (2024). Applying Fuzzy Decision-Making Trial and Evaluation Laboratory and Analytic Network Process Approaches to Explore Green Production in the Semiconductor Industry. Sustainability, 16(16), 7163. https://doi.org/10.3390/su16167163