Relational Global Value Chain Carbon Emissions and Their Network Structure Patterns: Evidence from China

Abstract

1. Introduction

2. Modeling and Data Description

2.1. Relational GVC Carbon Decomposition Modeling

2.2. SDA Decomposition of Carbon Emissions Changes

2.3. Description of Data

3. Empirical Findings

3.1. China’s Relational GVC Emissions: An Overall Analysis

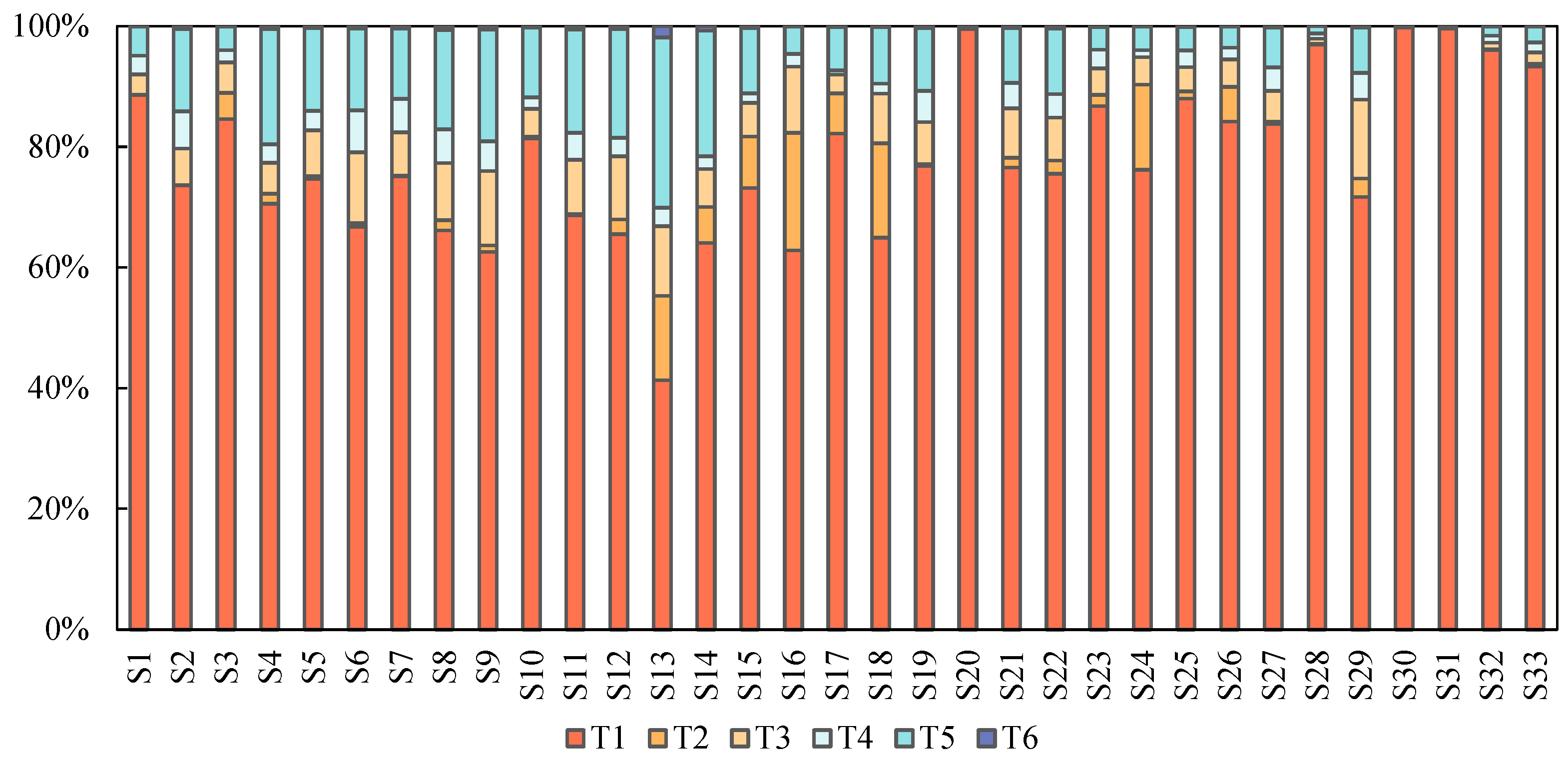

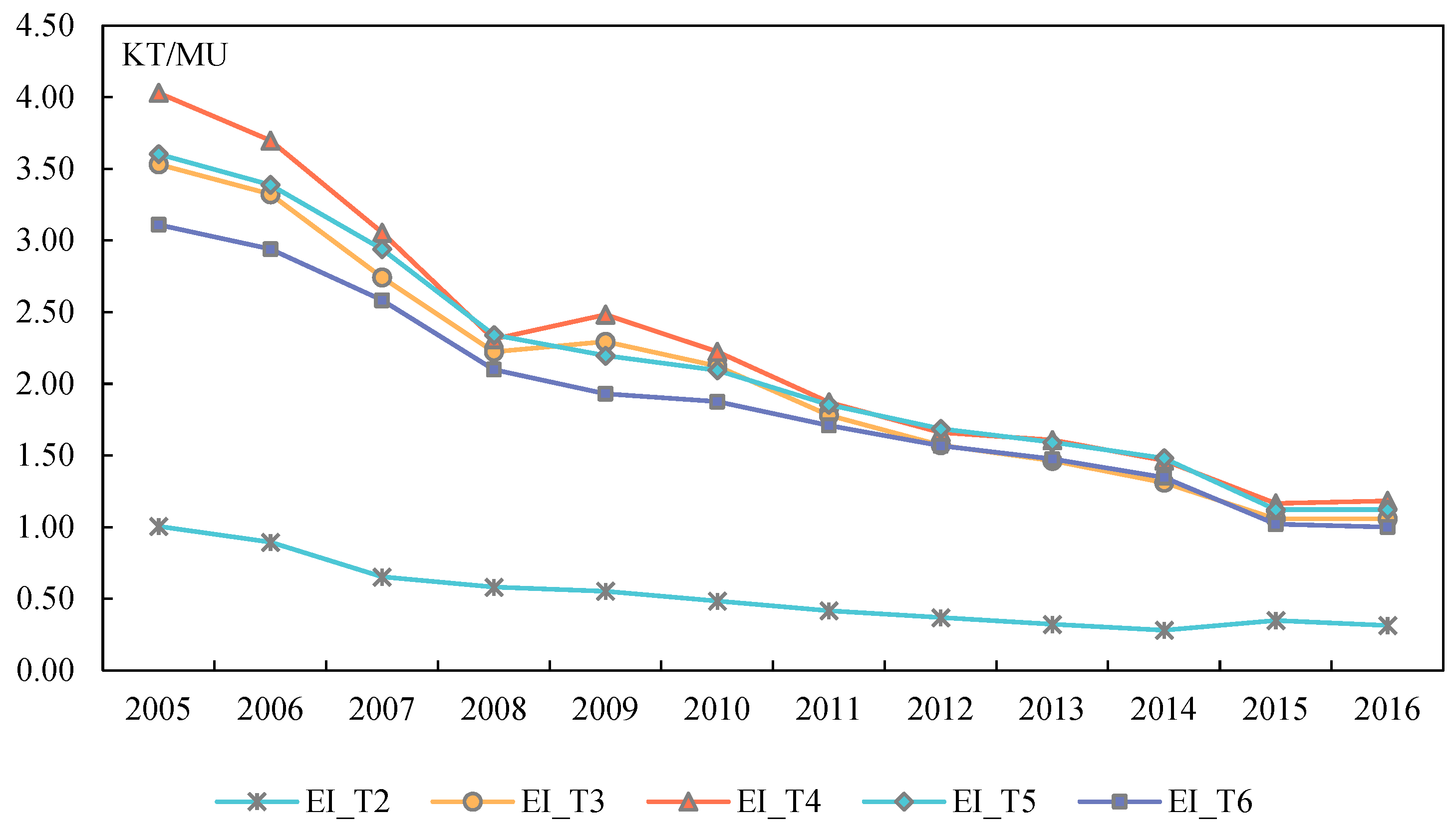

3.2. China’s Relational GVC Emissions: Sectoral Analysis

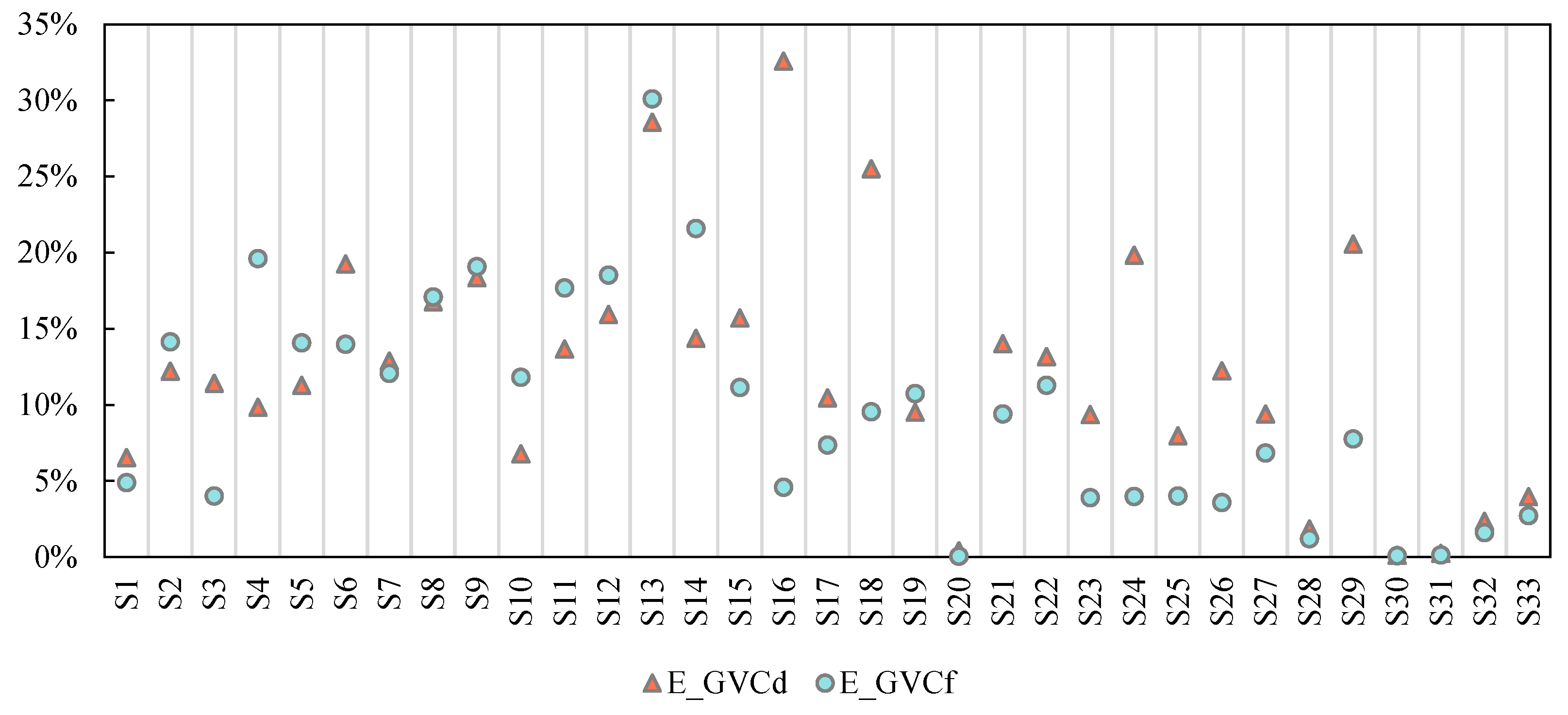

3.3. Relational GVC Activities in China: Economic and Environmental Trade-Offs

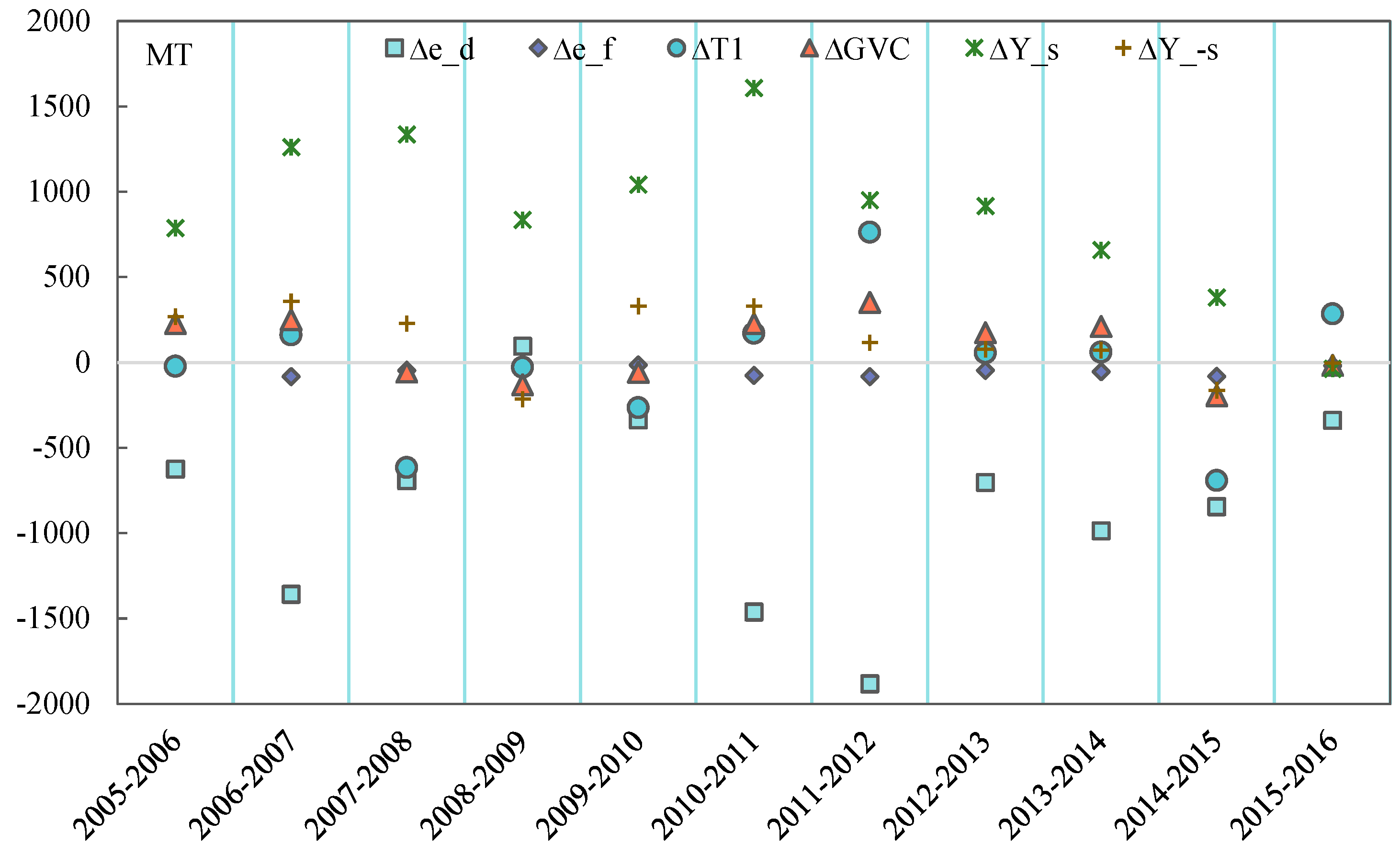

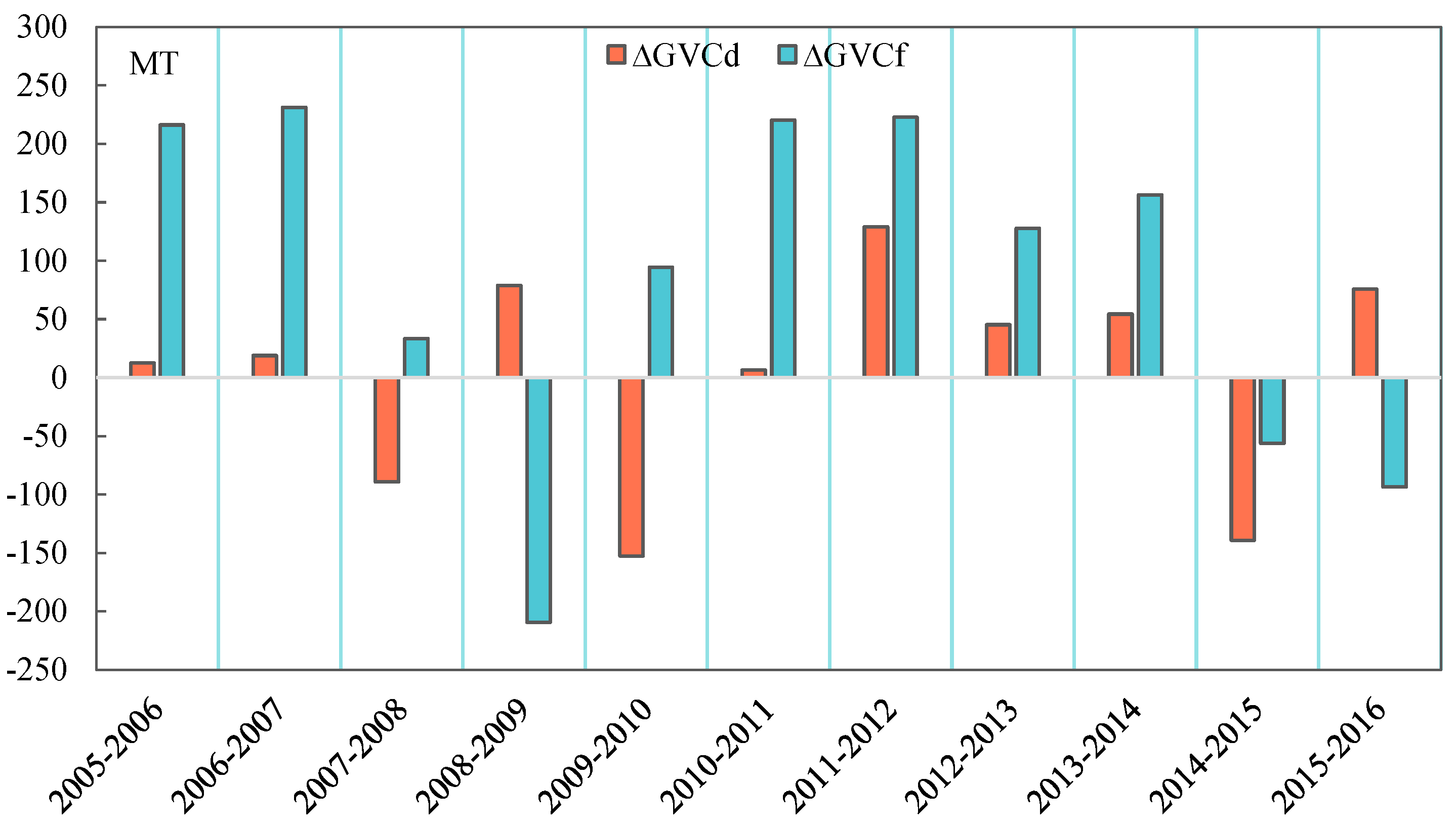

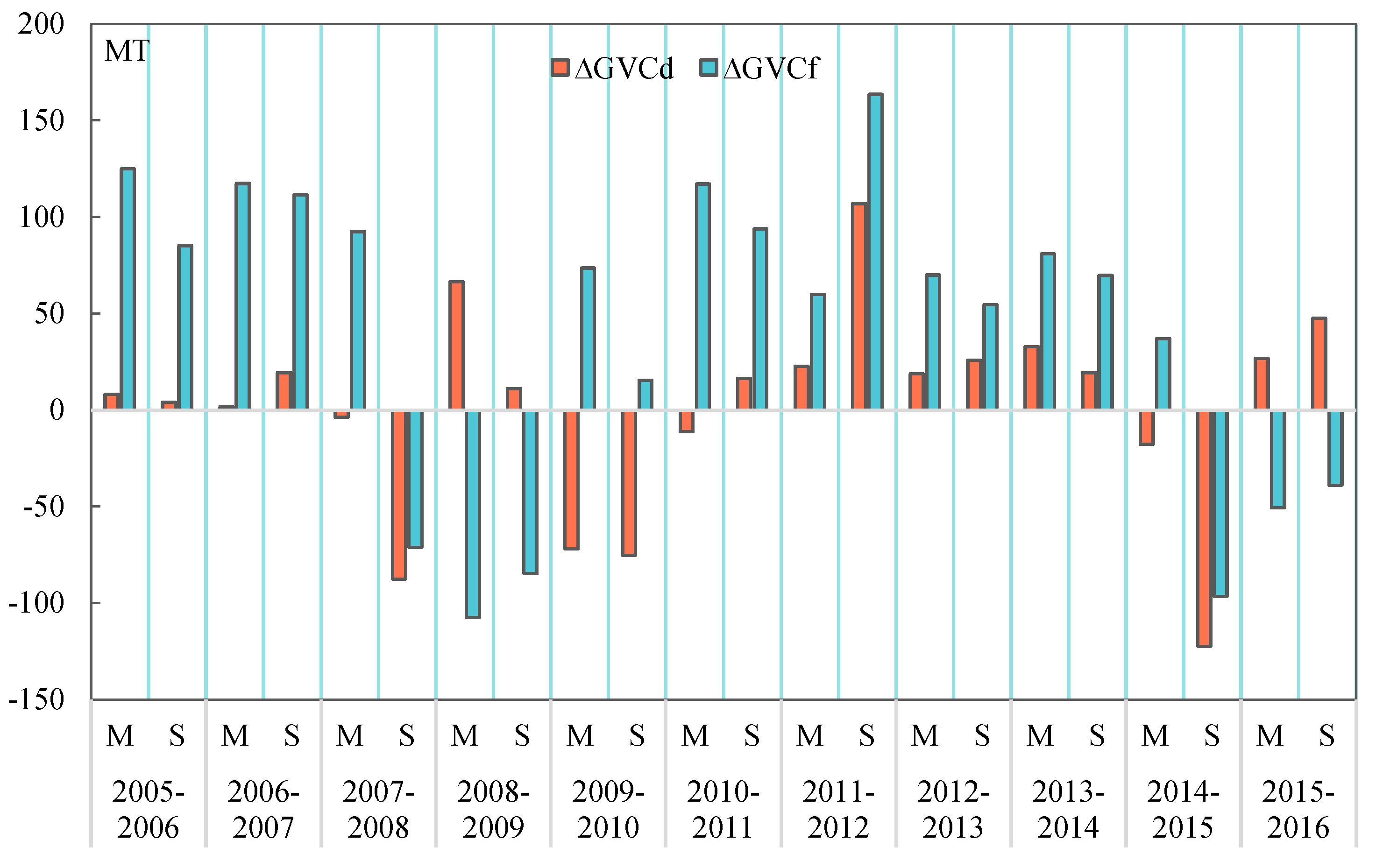

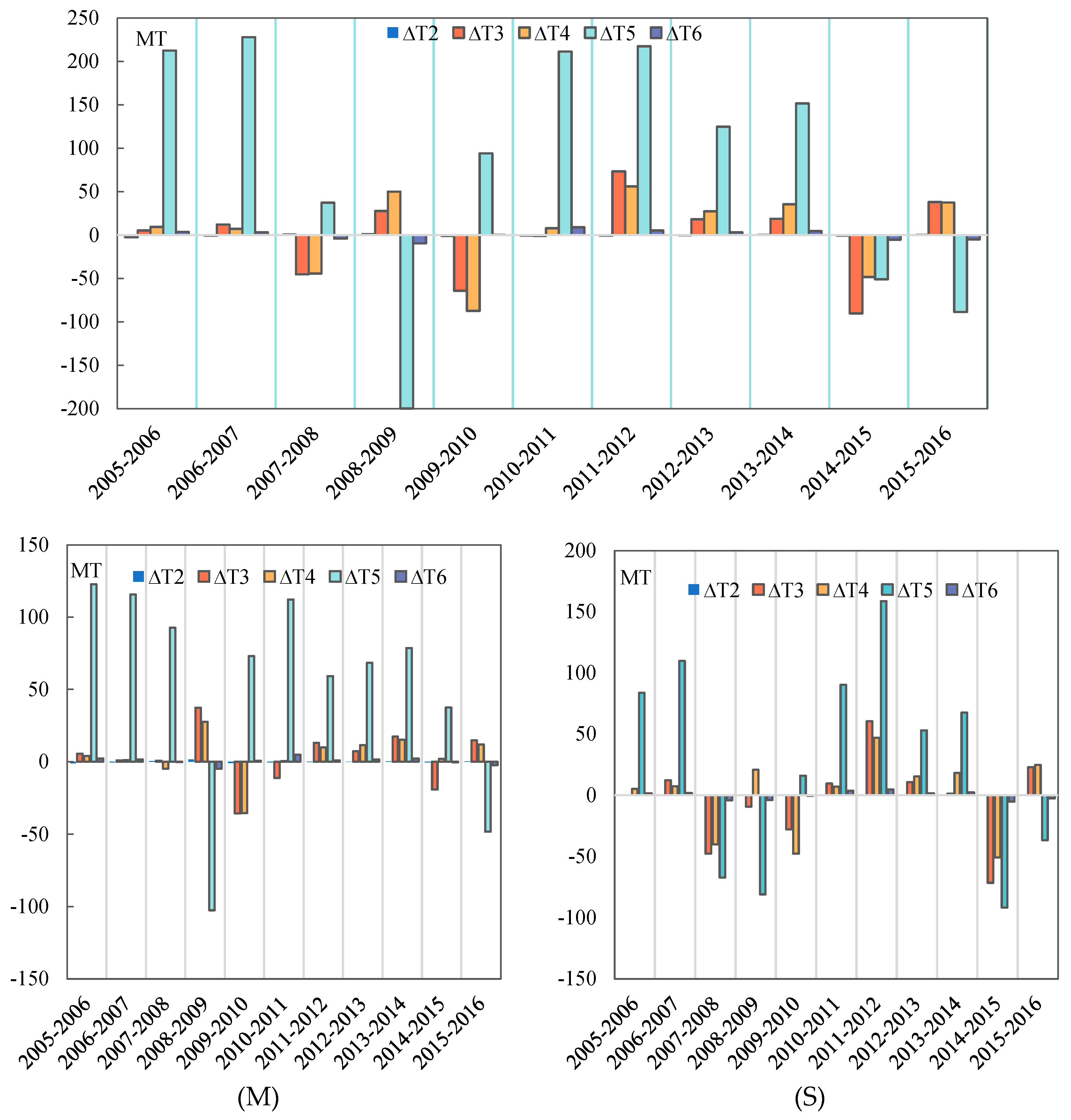

3.4. SDA Results of China’s Carbon Emission Changes

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Meng, B.; Peters, G.P.; Wang, Z.; Li, M. Tracing CO2 emissions in global value chains. Energy Econ. 2018, 73, 24–42. [Google Scholar] [CrossRef]

- Meng, B.; Liu, Y.; Gao, Y.; Li, M.; Wang, Z.; Xue, J.; Andrew, R.; Feng, K.; Qi, Y.; Sun, Y.; et al. Developing countries’ responsibilities for CO2 emissions in value chains are larger and growing faster than those of developed countries. One Earth 2023, 6, 167–181. [Google Scholar] [CrossRef]

- Zhu, K.; Guo, X.; Zhang, Z. Reevaluation of the carbon emissions embodied in global value chains based on an inter-country input-output model with multinational enterprises. Appl. Energy 2022, 307, 118220. [Google Scholar] [CrossRef]

- Li, M.; Meng, B.; Gao, Y.; Wang, Z.; Zhang, Y.; Sun, Y. Tracing CO2 emissions in global value chains: Multinationals vs. domestically-owned firms. Resour. Conserv. Recycl. 2023, 190, 106828. [Google Scholar] [CrossRef]

- Yan, Y.; Li, X.; Wang, R.; Pan, A. Global value chain and export-embodied carbon emissions: New evidence from foreign-invested enterprises. Econ. Model. 2023, 127, 106449. [Google Scholar] [CrossRef]

- Yan, Y.; Li, X.; Wang, R.; Zhao, Z.; Jiao, A. Decomposing the carbon footprints of multinational enterprises along global value chains. Struct. Change Econ. Dyn. 2023, 66, 13–28. [Google Scholar] [CrossRef]

- Kano, L.; Tsang, E.W.; Yeung, H.W.C. Global value chains: A review of the multi-disciplinary literature. J. Int. Bus. Stud. 2020, 51, 577–622. [Google Scholar] [CrossRef]

- Soontornthum, T.; Cui, L.; Lu, V.N.; Su, J. Enabling SMEs’ learning from global value chains: Linking the logic of power and the logic of embeddedness of interfirm relations. Manag. Int. Rev. 2020, 60, 543–571. [Google Scholar] [CrossRef]

- Lakhani, T.; Kuruvilla, S.; Avgar, A. From the firm to the network: Global value chains and employment relations theory. Br. J. Ind. Relat. 2013, 51, 440–472. [Google Scholar] [CrossRef]

- Alfaro-Urena, A.; Manelici, I.; Vasquez, J.P. The effects of joining multinational supply chains: New evidence from firm-to-firm linkages. Q. J. Econ. 2022, 137, 1495–1552. [Google Scholar] [CrossRef]

- Laari, S.; Wetzel, P.; Töyli, J.; Solakivi, T. Leveraging supply chain networks for sustainability beyond corporate boundaries: Explorative structural network analysis. J. Clean. Prod. 2022, 377, 134475. [Google Scholar] [CrossRef]

- Sun, K.; Ye, J.; Yue, Y.; Xiao, N. Tracing carbon emissions and intensity in relational global value chain activities. J. Clean. Prod. 2023, 429, 139579. [Google Scholar] [CrossRef]

- Henderson, J.; Dicken, P.; Hess, M.; Coe, N.; Yeung, H.W.C. Global production networks and the analysis of economic development. Rev. Int. Political Econ. 2002, 9, 436–464. [Google Scholar] [CrossRef]

- Yue, Y.; Hou, J.; Zhang, M.; Ye, J. Does the sticky relationships of global value chains help stabilize employment? Evidence from China. Struct. Change Econ. Dyn. 2024, 69, 632–651. [Google Scholar] [CrossRef]

- Allen, T. Information frictions in trade. Econometrica 2014, 82, 2041–2083. [Google Scholar] [CrossRef]

- Antràs, P.; Chor, D. Global Value Chains. In NBER Working Papers No.28549; NBER: Cambridge, MA, USA, 2021. [Google Scholar]

- Antràs, P. Conceptual aspects of global value chains. World Bank Econ. Rev. 2020, 34, 551–574. [Google Scholar] [CrossRef]

- Agostino, M.; Brancati, E.; Giunta, A.; Scalera, D.; Trivieri, F. Firms’ efficiency and global value chains: An empirical investigation on Italian industry. World Econ. 2020, 43, 1000–1033. [Google Scholar] [CrossRef]

- Gereffi, G.; Humphrey, J.; Sturgeon, T. The governance of global value chains. Rev. Int. Political Econ. 2005, 12, 78–104. [Google Scholar] [CrossRef]

- Cusolito, A.P.; Safadi, R.; Taglioni, D. Inclusive Global Value Chains: Policy Options for Small and Medium Enterprises and Low-Income Countries; OECD and World Bank Publications: Washington, DC, USA, 2016. [Google Scholar]

- Xing, Y.; Wang, R.; Dollar, D. Global Value Chain Development Report 2023: Resilient and Sustainable Gvcs. In Turbulent Times; Simon & Schuster: New York, NY, USA, 2023. [Google Scholar]

- Koopman, R.; Wang, Z.; Wei, S.J. Tracing value-added and double counting in gross exports. Am. Econ. Rev. 2014, 104, 459–494. [Google Scholar] [CrossRef]

- Miroudot, S.; Ye, M. Multinational production in value-added terms. Econ. Syst. Res. 2020, 32, 395–412. [Google Scholar] [CrossRef]

- Xiao, H.; Meng, B.; Ye, J.; Li, S. Are global value chains truly global? Econ. Syst. Res. 2020, 32, 540–564. [Google Scholar] [CrossRef]

- Wang, Z.; Wei, S.J.; Yu, X.; Zhu, K. Measures of participation in global value chains and global business cycles (No. w23222). In NBER Working Paper; NBER: Cambridge, MA, USA, 2017. [Google Scholar]

- Wang, Z.; Wei, S.J.; Yu, X.; Zhu, K. Tracing Value Added in the Presence of Foreign Direct Investment (No. w29335). In NBER Working Paper; NBER: Cambridge, MA, USA, 2021. [Google Scholar]

- Alfaro, L.; Chor, D.; Antras, P.; Conconi, P. Internalizing global value chains: A firm-level analysis. J. Political Econ. 2019, 127, 508–559. [Google Scholar] [CrossRef]

- Karabay, B. A new dimension in global value chains: Control vs. delegation in input procurement. J. Int. Econ. 2022, 137, 103584. [Google Scholar] [CrossRef]

- Cadestin, C.; De Backer, K.; Desnoyers-James, I.; Miroudot, S.; Rigo, D.; Ye, M. Multinational enterprises and global value chains: The OECD analytical AMNE database. In OECD Trade Policy Papers; OECD: Paris, France, 2018. [Google Scholar]

- Piccardi, C.; Riccaboni, M.; Tajoli, L.; Zhu, Z. Random walks on the world input–output network. J. Complex Netw. 2018, 6, 187–205. [Google Scholar] [CrossRef]

- Pu, Y.; Li, Y.; Zhang, J. Features and evolution of the ‘Belt and Road’ regional value chain: Complex network analysis. World Econ. 2022, 46, 2134–2156. [Google Scholar] [CrossRef]

- Hong, W.; Ma, T.; Guo, R.; Yang, X.; Li, X.; Sun, M.; Chen, Y.; Zhong, Y. Carbon emission characteristics of urban trip based on multi-layer network modeling. Appl. Geogr. 2023, 159, 103091. [Google Scholar] [CrossRef]

- Baldwin, R.; Venables, A.J. Spiders and snakes: Offshoring and agglomeration in the global economy. J. Int. Econ. 2013, 90, 245–254. [Google Scholar] [CrossRef]

- Yang, P.; Mi, Z.; Yao, Y.F.; Cao, Y.F.; Coffman, D.M.; Liu, L.C. Solely economic mitigation strategy suggests upward revision of nationally determined contributions. One Earth 2021, 4, 1150–1162. [Google Scholar] [CrossRef]

- Wang, L.; Yue, Y.; Xie, R.; Wang, S. How global value chain participation affects China’s energy intensity. J. Environ. Manag. 2020, 260, 110041. [Google Scholar] [CrossRef]

- Gao, Y.; Meng, B.; Suder, G.; Ye, J.; Sun, Y. Making global value chains visible: Transnational corporations versus domestically owned firms. Transnatl. Corp. J. 2023, 30, 1–47. [Google Scholar] [CrossRef]

- Hou, J.; Yue, Y.; Wang, Q.; Ye, J.; Zhang, M. Spillover-feedback effects of employment, energy, economy and environment (4E) between domestic-owned and foreign-invested enterprises: Taking China as an example. J. Clean. Prod. 2023, 382, 135276. [Google Scholar] [CrossRef]

- Fan, T.; Lü, L.; Shi, D.; Zhou, T. Characterizing cycle structure in complex networks. Commun. Phys. 2021, 4, 272. [Google Scholar] [CrossRef]

- Fortanier, F.; Miao, G.; Kolk, A.; Pisani, N. Accounting for firm heterogeneity in global value chains. J. Int. Bus. Stud. 2020, 51, 432–453. [Google Scholar] [CrossRef]

- Hou, J.; Yue, Y.; Wang, Y.; Ye, J. Decarbonization without borders: Evidence from China. Sci. Total Environ. 2023, 892, 164653. [Google Scholar] [CrossRef] [PubMed]

- Meng, B.; Gao, Y.; Ye, J.; Zhang, M.; Xing, Y. Trade in factor income and the US-China trade balance. China Econ. Rev. 2022, 73, 101792. [Google Scholar] [CrossRef]

- Su, B.; Ang, B.W.; Li, Y. Input-output and structural decomposition analysis of Singapore’s carbon emissions. Energy Policy 2017, 105, 484–492. [Google Scholar] [CrossRef]

- Su, B.; Ang, B.W. Structural decomposition analysis applied to energy and emissions: Frameworks for monthly data. Energy Econ. 2023, 126, 106977. [Google Scholar] [CrossRef]

- Xiao, Y.; Yong, C.; Hu, W.; Wang, H. Factors Influencing Carbon Emissions in High Carbon Industries in the Zhejiang Province and Decoupling Effect Analysis. Sustainability 2023, 15, 15975. [Google Scholar] [CrossRef]

- Wang, W.; Hu, Y.; Lu, Y. Driving forces of China’s provincial bilateral carbon emissions and the redefinition of corresponding responsibilities. Sci. Total Environ. 2023, 857, 159404. [Google Scholar] [CrossRef]

- Wang, H.; Shang, L.; Tang, D.; Li, Z. Research Themes, Evolution Trends, and Future Challenges in China’s Carbon Emission Studies. Sustainability 2024, 16, 2080. [Google Scholar] [CrossRef]

- Miller, R.E.; Blair, P.D. Input-Output Analysis: Foundations and Extensions; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar]

- Liu, Y.; Ma, R.; Guan, C.; Chen, B.; Zhang, B. Global trade network and CH4 emission outsourcing. Sci. Total Environ. 2022, 803, 150008. [Google Scholar] [CrossRef] [PubMed]

- Ferrarini, B. Vertical trade maps. Asian Econ. J. 2013, 27, 105–123. [Google Scholar] [CrossRef]

- Ferrantino, M.J.; Taglioni, D. Global value chains in the current trade slowdown. World Bank Econ. Premise 2014, 137, 30. [Google Scholar]

- Jiang, M.; An, H.; Gao, X.; Liu, S.; Xi, X. Factors driving global carbon emissions: A complex network perspective. Resour. Conserv. Recycl. 2019, 146, 431–440. [Google Scholar] [CrossRef]

- Li, C.; Zhang, X. The Influencing Mechanisms on Global Industrial Value Chains Embedded in Trade Implied Carbon Emissions from a Higher-Order Networks Perspective. Sustainability 2022, 14, 15138. [Google Scholar] [CrossRef]

- Fang, G.; Huang, M.; Zhang, W.; Tian, L. Exploring global embodied carbon emissions transfer network—An analysis based on national responsibility. Technol. Forecast. Soc. Chang. 2024, 202, 123284. [Google Scholar] [CrossRef]

- Huang, X.; Zhao, X.; Jiao, A.; Zheng, J. Network Effects in Global Carbon Transfer: New Evidence from a Carbon-Connectedness Network Centered on China. Sustainability 2024, 16, 4116. [Google Scholar] [CrossRef]

- Jiang, M.; Gao, X.; Guan, Q.; Hao, X.; An, F. The structural roles of sectors and their contributions to global carbon emissions: A complex network perspective. J. Clean. Prod. 2019, 208, 426–435. [Google Scholar] [CrossRef]

- Zheng, H.; Gao, X.; Zhou, J.; Liu, D.; Xi, X.; Sun, X. Characteristics of industrial driving effects network and impacts on carbon emissions. J. Environ. Plan. Manag. 2021, 1–25. [Google Scholar] [CrossRef]

- Cheng, Y.; Zhao, L.; Yi, H.; Wang, C.; Wang, K.; Zhen, J. What network roles affect the decline of the embodied carbon emission reduction pressure in China’s manufacturing sector foreign trade? J. Clean. Prod. 2024, 449, 141771. [Google Scholar] [CrossRef]

- Kano, L. Global value chain governance: A relational perspective. J. Int. Bus. Stud. 2018, 49, 684–705. [Google Scholar] [CrossRef]

- Tsekeris, T. Global value chains: Building blocks and network dynamics. Phys. A Stat. Mech. Its Appl. 2017, 488, 187–204. [Google Scholar] [CrossRef]

- Dietzenbacher, E.; Los, B. Structural decomposition techniques: Sense and sensitivity. Econ. Syst. Res. 1998, 10, 307–324. [Google Scholar] [CrossRef]

- Corsatea, T.D.; Lindner, S.; Arto, I.; Román, M.V.; Rueda-Cantuche, J.M.; Velázquez Afonso, A.; Amores, F.; Neuwahl, F. World Input-Output Database Environmental Accounts. Update 2000–2016; Publications Office of the European Union: Luxembourg, 2019. [Google Scholar]

- Xing, Y.; Huang, S. Value captured by China in the smartphone GVC–A tale of three smartphone handsets. Struct. Chang. Econ. Dyn. 2021, 58, 256–266. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R.J.; Strobl, E. The environmental performance of firms: The role of foreign ownership, training, and experience. Ecol. Econ. 2008, 65, 538–546. [Google Scholar] [CrossRef]

- Jiang, X.; Shen, J.H.; Lee, C.C.; Chen, C. Supply-side structural reform and dynamic capital structure adjustment: Evidence from Chinese-listed firms. Pac. Basin Financ. J. 2021, 65, 101482. [Google Scholar] [CrossRef]

- World Bank. World Development Report 2020: Trading for Development in the Age of Global Value Chains; The World Bank: Washington, DC, USA, 2020. [Google Scholar]

- Antràs, P.; Chor, D. Organizing the global value chain. Econometrica 2013, 81, 2127–2204. [Google Scholar]

- Lou, Y.; Wang, L.; Chen, G. Toward stronger robustness of network controllability: A snapback network model. IEEE Trans. Circuits Syst. I Regul. Pap. 2018, 65, 2983–2991. [Google Scholar] [CrossRef]

| Output | Intermediate Use | Final Demand | Total Output | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Iutput | 1 | 2 | G | 1 | 2 | G | ||||||||

| Intermediate Inputs | 1 | |||||||||||||

| 2 | ||||||||||||||

| G | ||||||||||||||

| Value added | ||||||||||||||

| Total input | ||||||||||||||

| Abbreviation | Variable Explanation | ||

|---|---|---|---|

| Carbon intensity effect | Carbon intensity effect of DOEs | ||

| Carbon intensity effect of FIEs | |||

| Input–output structural effect | Interaction effect between DOEs | Interaction effect between DOEs | |

| Domestic GVC relationship effect | Interaction effect between FIEs | ||

| Chain structure effect between DOEs and FIEs | |||

| Circle structure effect between DOEs and FIEs | |||

| Cross-border GVC relationship effect | Chain structure effect between domestic and foreign firms | ||

| Circle structure effect between domestic and foreign firms | |||

| Final demand effect | Domestic final product demand effect | Final product demand effect on DOEs | |

| Final product demand effect on FIEs | |||

| Final product demand effect on foreign firms | |||

| Foreign final product demand effect | Final product demand of foreign countries on DOEs | ||

| Final product demand of foreign countries on FIEs | |||

| Final product demand of foreign countries on foreign firms | |||

| Variable | Obs | Mean | Std. Dev. | Min | Max | |

|---|---|---|---|---|---|---|

| Carbon emissions | DOEs | 408 | 228,875.4 | 636,100.6 | 0 | 4,185,184.2 |

| FIEs | 408 | 12,198.1 | 25,416.5 | 0 | 149,911.2 | |

| Total | 408 | 241,073.5 | 659,510.9 | 0 | 4,311,789.9 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yue, Y.; Hou, J.; Yue, N.; Wang, H. Relational Global Value Chain Carbon Emissions and Their Network Structure Patterns: Evidence from China. Sustainability 2024, 16, 6940. https://doi.org/10.3390/su16166940

Yue Y, Hou J, Yue N, Wang H. Relational Global Value Chain Carbon Emissions and Their Network Structure Patterns: Evidence from China. Sustainability. 2024; 16(16):6940. https://doi.org/10.3390/su16166940

Chicago/Turabian StyleYue, Youfu, Junjun Hou, Nuoya Yue, and Haofan Wang. 2024. "Relational Global Value Chain Carbon Emissions and Their Network Structure Patterns: Evidence from China" Sustainability 16, no. 16: 6940. https://doi.org/10.3390/su16166940

APA StyleYue, Y., Hou, J., Yue, N., & Wang, H. (2024). Relational Global Value Chain Carbon Emissions and Their Network Structure Patterns: Evidence from China. Sustainability, 16(16), 6940. https://doi.org/10.3390/su16166940