The Impact of Factor Price Distortions on Export Technology Complexity: Evidence from China

Abstract

1. Introduction

2. Literature Review

2.1. Research on Factor Price Distortions

2.2. The Impact of Factor Price Distortions on Export Technology Complexity

2.3. The Role of FDI and Trade Openness in Factor Price Distortions Affecting Export Technical Complexity

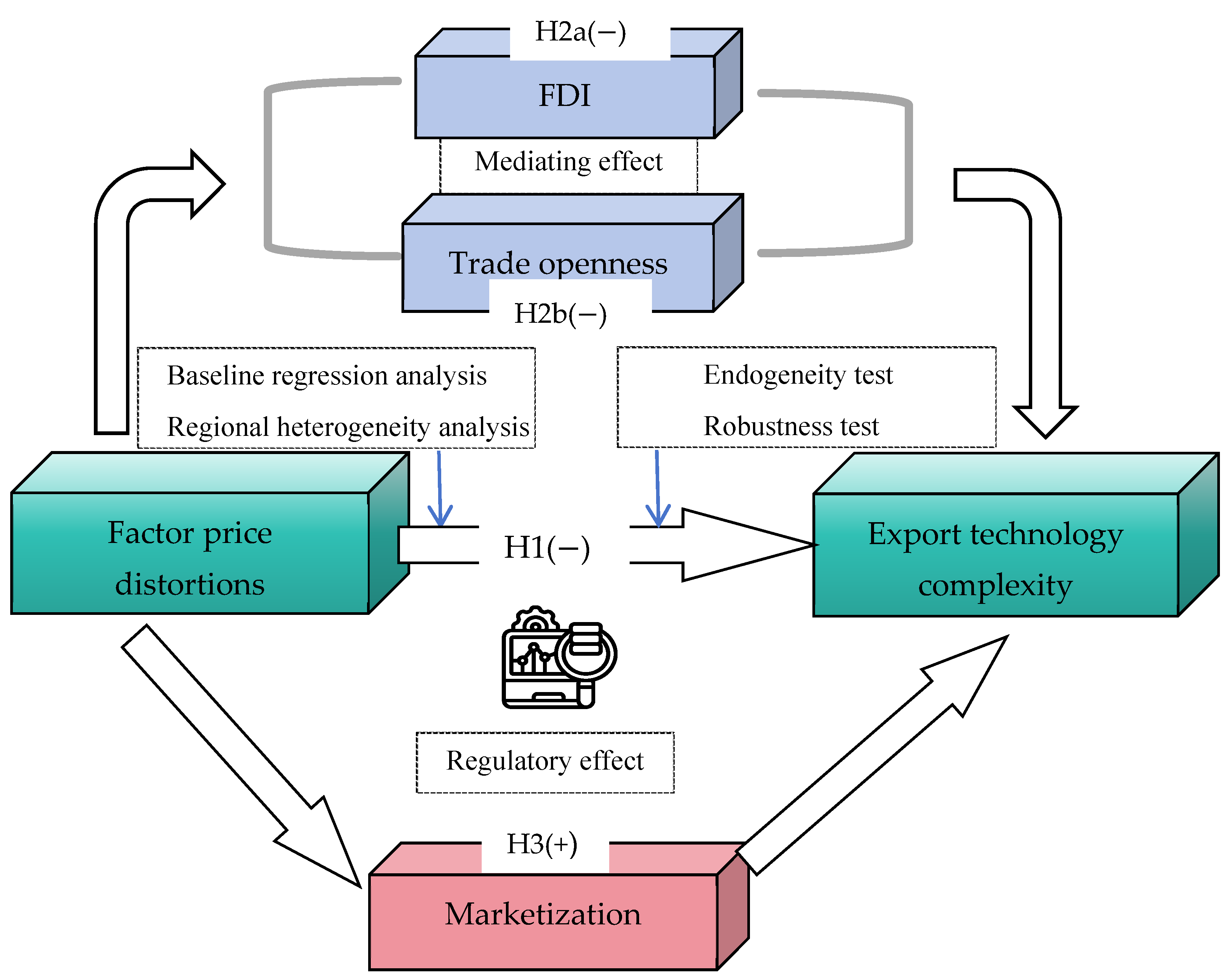

3. Theoretical Analysis and Hypothesis

3.1. The Impact of Factor Price Distortions on Export Technology Complexity

3.2. The Indirect Impacts of Factor Price Distortions on Export Technology Complexity

3.3. Marketization Plays a Positive Regulatory Role

4. Research Designs

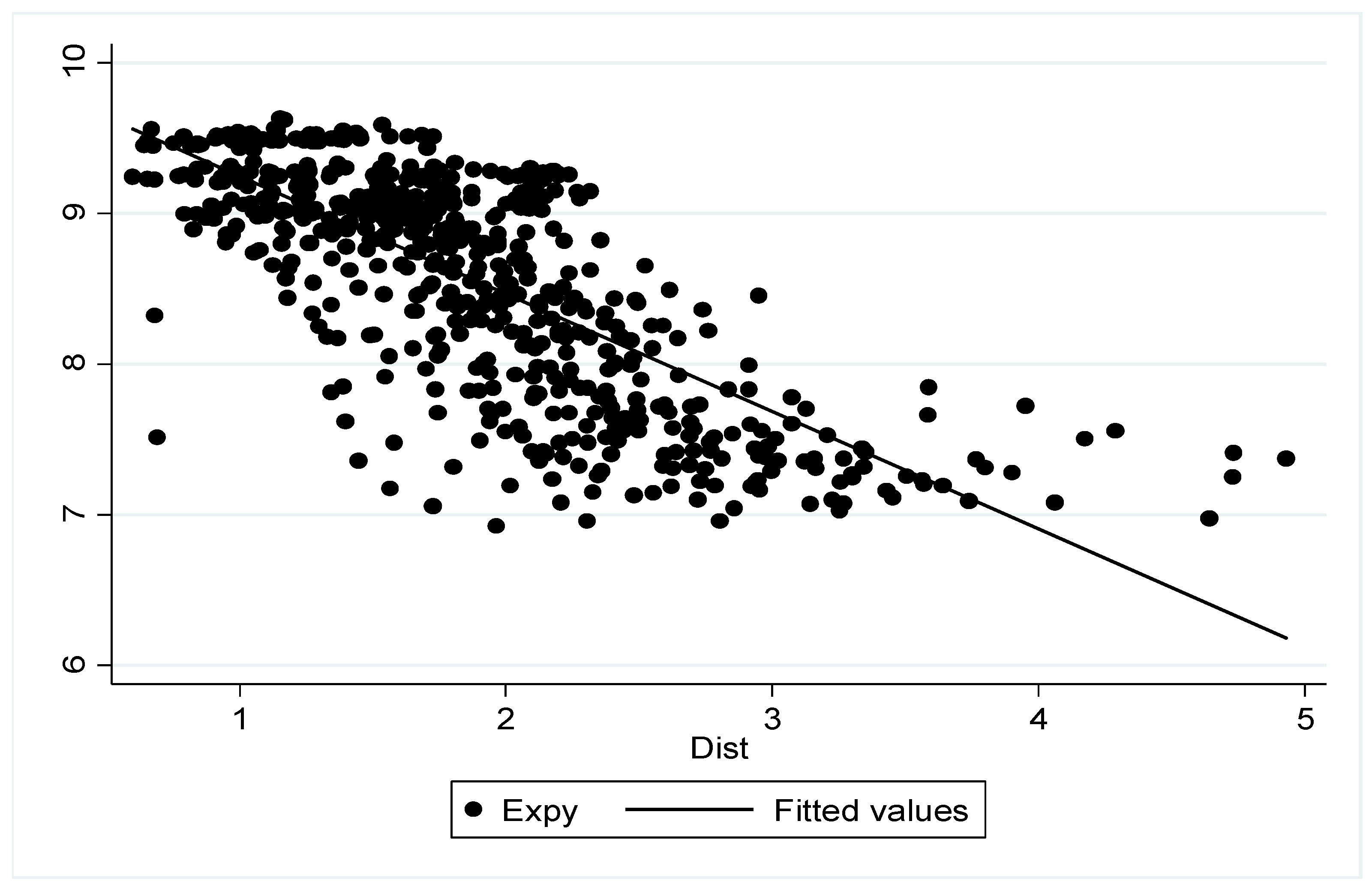

4.1. Variables

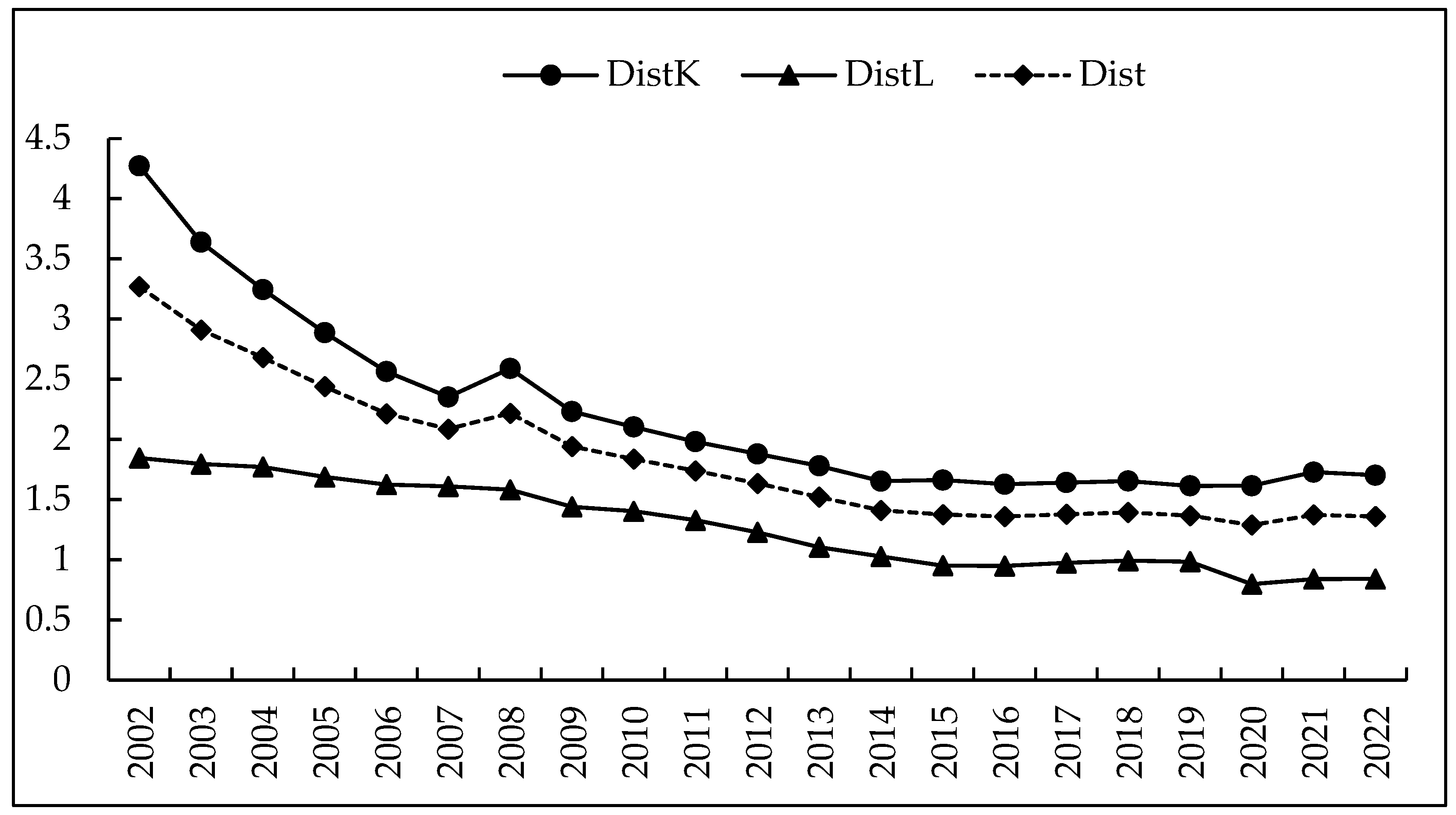

4.1.1. Explanatory Variable

4.1.2. The Explained Variable

4.1.3. Mediating Variables

4.1.4. Control Variables

4.2. Model Construction

4.3. Description of the Data Source

5. Results

5.1. Main Effects Analysis

5.2. Divide Effect Analysis

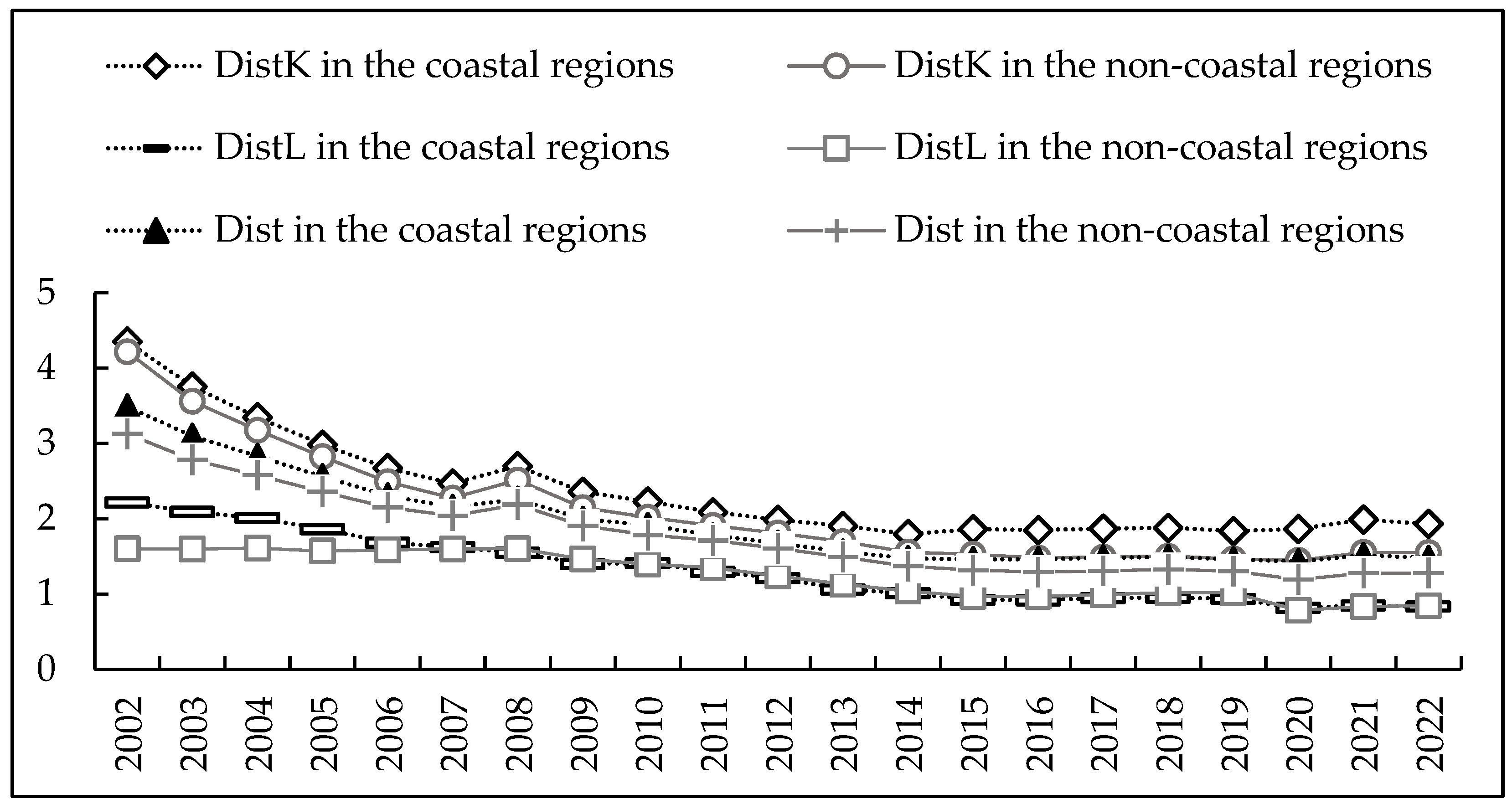

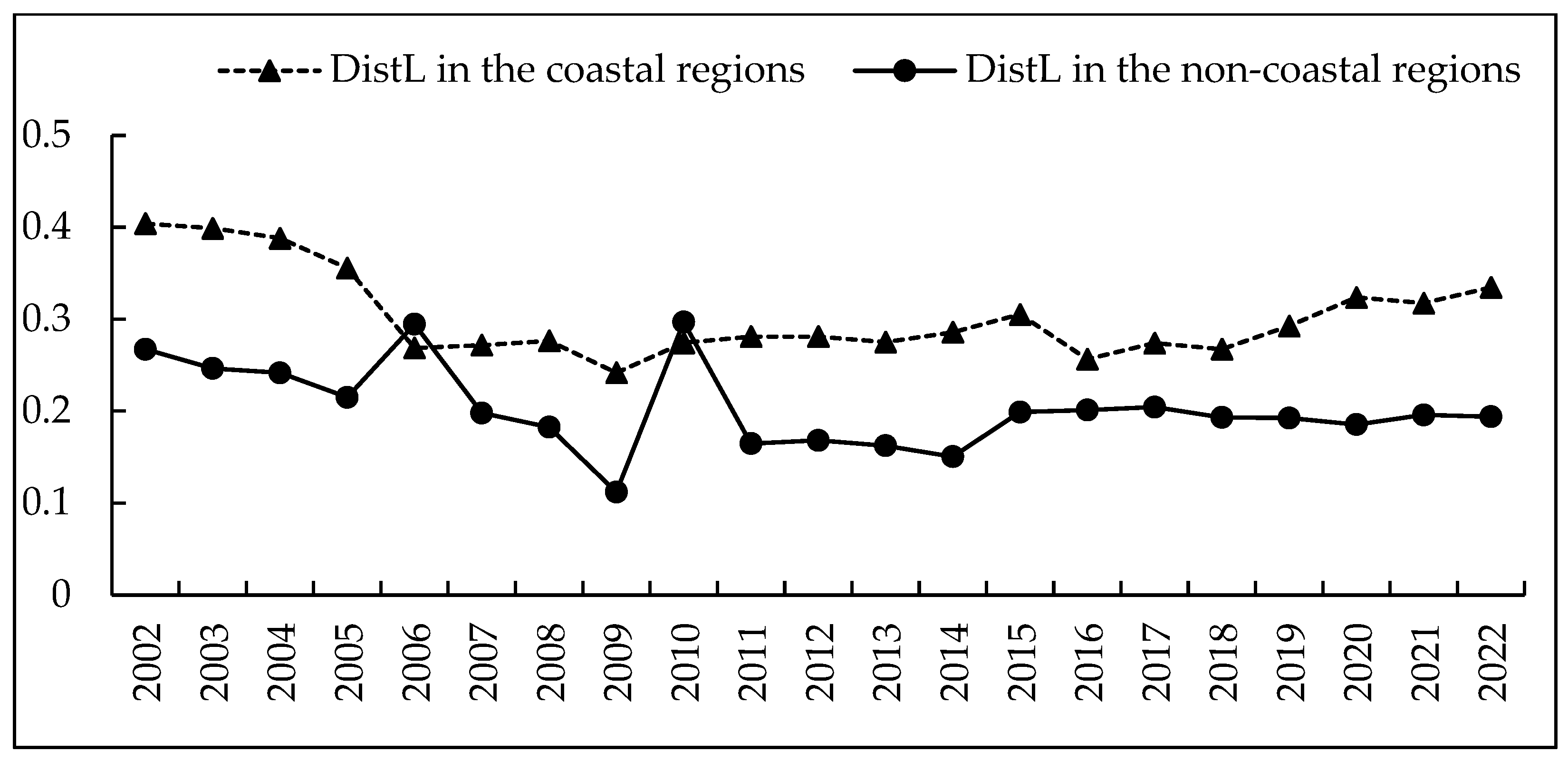

5.3. Heterogeneity Tests

5.4. Endogeneity Analysis

5.5. Robustness Checks

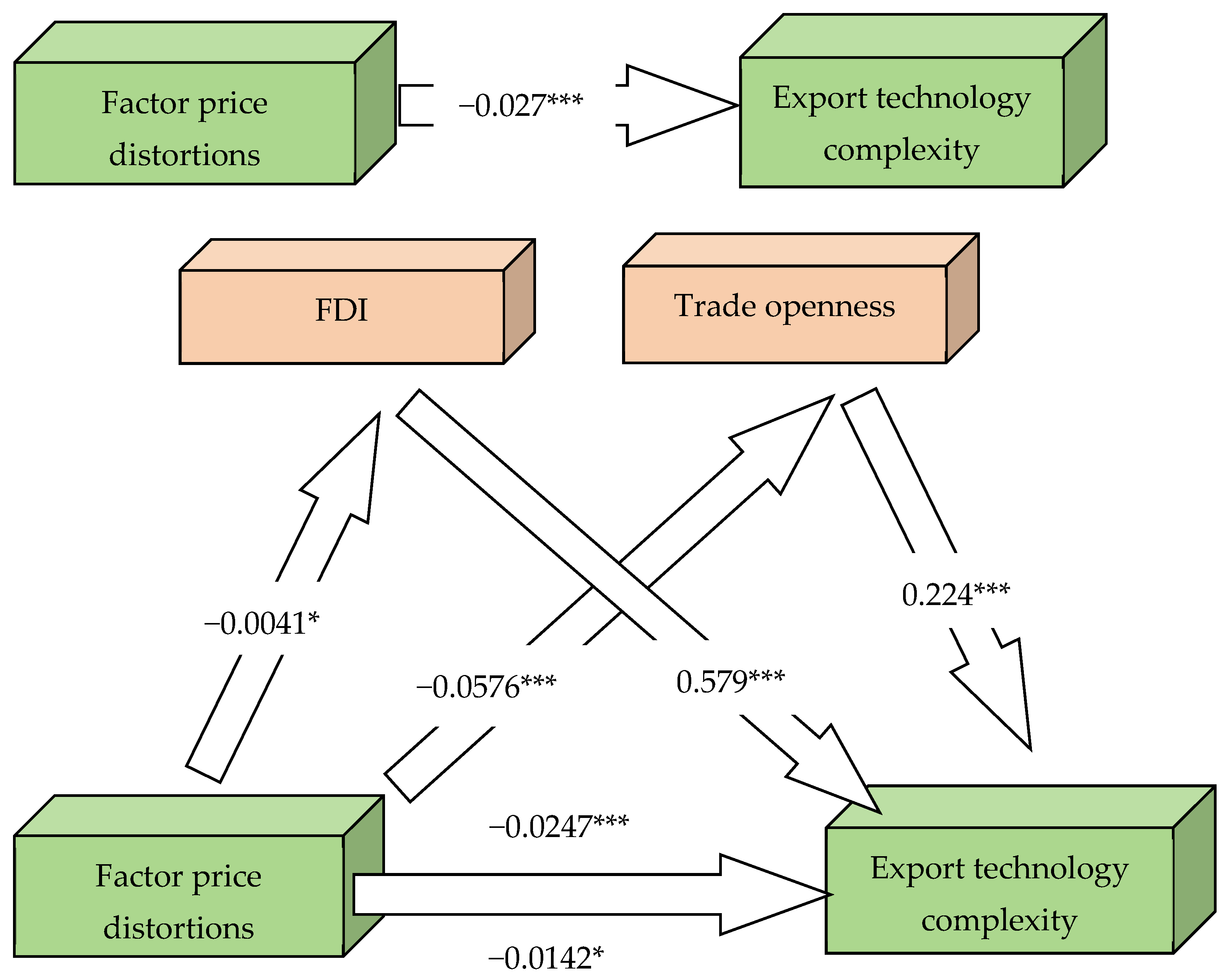

5.6. Mechanism Tests

5.6.1. Mediator Effect Analysis

5.6.2. Regulatory Effect Analysis

6. Conclusions, Implications and Research Limitations

6.1. Conclusions

6.2. Implications

6.3. Research Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Aboal, D.; Arza, V.; Rovira, F. Technological content of exports. Econ. Innov. New Technol. 2017, 26, 661–682. [Google Scholar] [CrossRef]

- Cao, X.P.; Hanson-Rasmussen, N. Dynamic Change in the Export Technology Structure of China’s Environmental Goods and Its International Comparison. Sustainability 2018, 10, 14. [Google Scholar] [CrossRef]

- Huang, X.H.; Chen, X.H.; Liu, H. Measurement of industrial export complexity and its dynamic evolution mechanism analysis-Based on empirical studies on metal products exports from 52 economies in 1993–2006. Manag. World 2010, 3, 44–55. [Google Scholar]

- Xu, B.; Lu, J.Y. Foreign direct investment, processing trade, and the sophistication of China’s exports. China Econ. Rev. 2009, 20, 425–439. [Google Scholar] [CrossRef]

- Ma, Y.Y.; Sheng, B. Service-oriented manufacturing industry and export technology complexity: A study based on the perspective of trade added value. Ind. Econ. Res. 2018, 4, 1–13+87. [Google Scholar]

- Wang, S.; Zhu, Y. An inquiry into the effect of trade facilitation on China’s digital product exports to countries along the “Belt and Road”. Int. Rev. Econ. Financ. 2024, 93, 1246–1259. [Google Scholar] [CrossRef]

- Chen, W.L.; Hu, Y.; Liu, B.; Wang, H.; Zheng, M.B. Does the establishment of Pilot Free Trade Test Zones promote the transformation and upgradation of trade patterns? Econ. Anal. Policy 2022, 76, 114–128. [Google Scholar] [CrossRef]

- Yang, S.B.; Jahanger, A.; Hossain, M.R.; Wang, Y.M.; Balsalobre-Lorente, D. Enhancing export product quality through innovative cities: A firm-level quasi-natural experiment in China. Econ. Anal. Policy 2023, 79, 462–478. [Google Scholar] [CrossRef]

- Liu, Z.Z.; Zheng, S.C.; Zhang, X.Y.; Mo, L. The Impact of Green Finance on Export Technology Complexity: Evidence from China. Sustainability 2023, 15, 15. [Google Scholar] [CrossRef]

- Xu, Y.Z.; Xu, L.L. The Convergence between Digital Industrialization and Industrial Digitalization and Export Technology Complexity: Evidence from China. Sustainability 2023, 15, 18. [Google Scholar] [CrossRef]

- Yang, Y.Z.; Wang, Q.H.; Gao, Y.; Zhao, L.X. Does Environmental Regulation Promote the Upgrade of the Export Technology Structure: Evidence from China. Sustainability 2022, 14, 13. [Google Scholar] [CrossRef]

- Liu, N.; Chen, G.C.; Yang, J.Y. The impact of market segmentation on the technology complexity of manufacturing export-is based on the perspective of industrial aggregation and technological change. Econ. Manag. 2024, 38, 53–64. [Google Scholar]

- Yang, X.M.; Zhang, S.L.; Li, B. Internal and external two-way value chain participation and China’s export technology upgrading: Based on the data analysis of China’s manufacturing industry sector. World Econ. Res. 2023, 12, 13–27+132. [Google Scholar]

- Ouyang, X.L.; Sun, C.W. Energy savings potential in China’s industrial sector: From the perspectives of factor price distortion and allocative inefficiency. Energy Econ. 2015, 48, 117–126. [Google Scholar] [CrossRef]

- Tao, Z.; Huang, X.Y.; Dang, Y.J.; Qiao, S. The impact of factor market distortions on profit sustainable growth of Chinese renewable energy enterprises: The moderating effect of environmental regulation. Renew. Energy 2022, 200, 1068–1080. [Google Scholar] [CrossRef]

- Mitchell, M.F.; Moro, A. Persistent Distortionary Policies with Asymmetric Information. Am. Econ. Rev. 2006, 96, 387–393. [Google Scholar] [CrossRef]

- Zhang, S.F.; Chen, C.C.; Huang, D.H.; Hu, L. Measurement of factor price distortion: A new production function method with time-varying elasticity. Technol. Forecast. Soc. Chang. 2022, 175, 12. [Google Scholar] [CrossRef]

- Kong, Q.; Chen, A.; Wong, Z.; Peng, D. Factor price distortion, efficiency loss and enterprises’ outward foreign direct investment. Int. Rev. Financ. Anal. 2021, 78, 101912. [Google Scholar] [CrossRef]

- Peters, M. Heterogeneous Markups, Growth, and Endogenous Misallocation. Econometrica 2020, 88, 2037–2073. [Google Scholar] [CrossRef]

- Wang, M.Y.; Zhang, Z.Y.; Liu, X.Y.; Xu, S.W. Labor price distortion and export product markups: Evidence from China labor market. China Econ. Rev. 2023, 77, 28. [Google Scholar]

- Zong, J.F.; Yang, Q. Does factor distortion affect China’s export technology complexity? J. Soc. Sci. Jilin Univ. 2013, 53, 106–114. [Google Scholar]

- Pi, J.C.; Song, D.Q. The Threshold Effect of Factor Price Distortion on Technological Content of Exports: Evidence from China. China World Econ. 2020, 28, 51–77. [Google Scholar] [CrossRef]

- Zhu, S.J.; Fu, X.L. Drivers of Export Upgrading. World Dev. 2013, 51, 221–233. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, H.Y.; Liu, Y.H.; Huang, Q.B. Impact of Embedded Global Value Chain on Technical Complexity of Industry Export-An Empirical Study Based on China’s Equipment Manufacturing Industry Panel. Sustainability 2020, 12, 14. [Google Scholar] [CrossRef]

- Maiti, D. Market imperfections, trade reform and total factor productivity growth: Theory and practices from India. J. Product. Anal. 2013, 40, 207–218. [Google Scholar] [CrossRef]

- Gao, X.; Kong, S. Judicial improvement, market integration, and export technical complexity-a quasi-natural experiments based on the creation of circuit courts. PLoS ONE 2024, 19, 26. [Google Scholar] [CrossRef] [PubMed]

- Jie, Y. Factor price distortion among regions in China and its influence on China’s economic growth. PLoS ONE 2023, 18, 26. [Google Scholar]

- Yu, D.H.; Sun, T.; Zhang, X.Y. How the factor price distortions affect the international competitiveness of the manufacturing industry. China’s Ind. Econ. 2018, 2, 63–81. [Google Scholar]

- Qiao, S.; Zhao, D.H.; Guo, Z.X.; Tao, Z. Factor price distortions, environmental regulation and innovation efficiency: An empirical study on China’s power enterprises. Energy Policy 2022, 164, 11. [Google Scholar] [CrossRef]

- Yang, S.; Wu, J. The Sustainability of the Fishery Industry and Environmental Development: A Study on Factor Market Distortions. Int. J. Environ. Res. Public Health 2023, 20, 3017. [Google Scholar] [CrossRef] [PubMed]

- Borensztein, E.; De Gregorio, J.; Lee, J.W. How does foreign direct investment affect economic growth? J. Int. Econ. 1998, 45, 115–135. [Google Scholar] [CrossRef]

- Song, D.Q.; Pi, J.C. The economic effects of factor price distortion: A literature review. Comp. Econ. Soc. Syst. 2020, 3, 171–181. [Google Scholar]

- Lin, B.Q.; Chen, Z.Y. Does factor market distortion inhibit the green total factor productivity in China? J. Clean. Prod. 2018, 197, 25–33. [Google Scholar] [CrossRef]

- Jiang, D.H.; Lin, H.L.; Khan, J.; Han, Y.Q. Professor independent directors, marketization process and corporate innovation performance: Empirical evidence from Chinese A-share listed companies. Int. J. Manpow. 2023, 44, 152–175. [Google Scholar] [CrossRef]

- de Bettignies, J.E.; Liu, H.F.; Robinson, D.T.; Gainulline, B. Competition and Innovation in Markets for Technology. Manag. Sci. 2023, 69, 4753–4773. [Google Scholar] [CrossRef]

- García-Belenguer, F.; Santos, M.S. Investment rates and the aggregate production function. Eur. Econ. Rev. 2013, 63, 150–169. [Google Scholar] [CrossRef]

- Yang, M.A.; Yang, F.X.; Sun, C.W. Factor market distortion correction, resource reallocation and potential productivity gains: An empirical study on China’s heavy industry sector. Energy Econ. 2018, 69, 270–279. [Google Scholar] [CrossRef]

- Zhang, J.; Wu, G.Y.; Zhang, J.P. China’s inter-provincial material capital stock estimation: 1952–2000. Econ. Res. Econ. Study 2004, 10, 35–44. [Google Scholar]

- Cao, Y.Q.; Zhao, S.K.; Zhang, H. Inter-provincial RD capital stock: Framework, inspection, and spatial dynamic analysis. Sci. Res. 2022, 40, 1401–1412. [Google Scholar]

- Han, D.D.; Shen, K.Y. Mechanism and empirical analysis of the influence of traditional factor price distortion and technological progress bias on total factor productivity. Soc. Sci. 2024, 1, 129–142. [Google Scholar]

- Xu, M.M.; Lin, B.Q. Energy efficiency gains from distortion mitigation: A perspective on the metallurgical industry. Resour. Policy 2022, 77, 10. [Google Scholar] [CrossRef]

- Zhang, S.F.; Luo, J.Y.; Huang, D.H.; Xu, J.J. Market distortion, factor misallocation, and efficiency loss in manufacturing enterprises. J. Bus. Res. 2023, 154, 8. [Google Scholar] [CrossRef]

- Hausmann, R.; Hwang, J.; Rodrik, D. What you export matters. J. Econ. Growth 2007, 12, 1–25. [Google Scholar] [CrossRef]

- Li, X.Q.; Xiao, L.M. The impact of urban green business environment on FDI quality and its driving mechanism: Evidence from China. World Dev. 2024, 175, 17. [Google Scholar] [CrossRef]

- Luqman, M. Transition towards natural resource rents and green technology to achieve China’s COP26 success: A novel insights in the case of trade openness and environmental pollution. Resour. Policy 2024, 92, 105021. [Google Scholar] [CrossRef]

- Fan, G.; Wang, X.L.; Zhang, L.W.; Zhu, H.P. Report on the relative process of marketization in various regions in China. Econ. Res. 2003, 3, 9–18+89. [Google Scholar]

- Liang, S.; Tan, Q.M. Can the digital economy accelerates China’s export technology upgrading? Based on the perspective of export technology complexity. Technol. Forecast. Soc. Chang. 2024, 199, 15. [Google Scholar] [CrossRef]

- Wang, M.X.; Wang, Y.X. Does Factor Market Distortion Inhibit Enterprise Innovation? Empirical Evidence from Chinese Industrial Enterprises. J. Knowl. Econ. 2023, 12, s13132. [Google Scholar] [CrossRef]

- Xu, C.; Guo, J.B.; Cheng, B.D.; Liu, Y. Exports, Misallocation, and Total Factor Productivity of Furniture Enterprises. Sustainability 2019, 11, 18. [Google Scholar] [CrossRef]

- Shi, B.T.; Xian, G.M. Factor price distortions and the export behavior of Chinese industrial enterprises. China’s Ind. Econ. 2012, 2, 47–56. [Google Scholar]

- Dai, K.Z. The influence of technology market development on the complexity of export technology and its mechanism of action. China’s Ind. Econ. 2018, 7, 117–135. [Google Scholar]

- Kong, Q.X.; Tong, X.; Peng, D.; Wong, Z.; Chen, H. How factor market distortions affect OFDI: An explanation based on investment propensity and productivity effects. Int. Rev. Econ. Financ. 2021, 73, 459–472. [Google Scholar] [CrossRef]

- Cheng, H.; Wang, Z.Q.; Peng, D.; Kong, Q.X. Firm’s outward foreign direct investment and efficiency loss of factor price distortion: Evidence from Chinese firms. Int. Rev. Econ. Financ. 2020, 67, 176–188. [Google Scholar] [CrossRef]

- Yuan, H.L.; Liu, C.; Fang, Y.X. Factor price distortion and the export product quality of Chinese enterprises. Contemp. Financ. Econ. 2023, 3, 119–130. [Google Scholar]

- Tan, R.P.; Lin, B.Q.; Liu, X.Y. Impacts of eliminating the factor distortions on energy efficiency-A focus on China’s secondary industry. Energy 2019, 183, 693–701. [Google Scholar] [CrossRef]

| Variables | Type of Variables | Variable Declaration | References |

|---|---|---|---|

| Expy | Explained variable | × PRODY | Hausman et al. (2007) [43] |

| Dist | Explanatory variable | García-Belenguer et al. (2013) and Yang et al. (2018) [36,37] | |

| DistK | Explanatory variable | capital marginal output/capital price | |

| DistL | Explanatory variable | labor marginal output/labor price | |

| FDI | Mediating variable | regional FDI/regiona GDP | Li and Xiao (2024) [44] |

| OL | Mediating variable | regional total import and export volume/regional GDP | Luqman (2024) [45] |

| MI | Moderating variable | marketization index | Fan et al. (2003) [46] |

| Variables | N | Mean | Standard Deviation | Minimum Value | Maximum Value |

|---|---|---|---|---|---|

| Expy | 630 | 8.5663 | 0.7374 | 6.9220 | 9.6308 |

| Dist | 630 | 1.8764 | 0.6920 | 0.6817 | 4.9294 |

| DistK | 630 | 2.2095 | 0.9272 | 0.7061 | 6.8542 |

| DistL | 630 | 1.2744 | 0.5040 | 0.0969 | 3.5795 |

| FDI | 630 | 0.0238 | 0.0223 | 0.0001 | 0.1635 |

| OL | 630 | 0.3075 | 0.3577 | 0.0076 | 1.7113 |

| MI | 630 | 0.7437 | 0.2043 | 0.2243 | 1.2864 |

| Gov | 630 | 0.2259 | 0.1053 | 0.0811 | 0.7583 |

| DI | 630 | 0.3537 | 0.0860 | 0.1001 | 0.5738 |

| 630 | 10.3535 | 0.8040 | 8.0886 | 12.1564 | |

| 630 | 0.0625 | 0.0428 | 0.0153 | 0.2901 | |

| RTA | 630 | 3.3147 | 0.3264 | 2.6376 | 4.1819 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| Full sample | ||||

| Dist | −0.140 *** (0.0119) | −0.0271 *** (0.00908) | −0.142 ** (0.0551) | −0.0656 ** (0.0270) |

| Gov | 1.455 *** (0.0985) | 0.753 *** (0.0652) | 0.242 (0.458) | 0.745 *** (0.153) |

| DI | −0.151 (0.0940) | 0.349 *** (0.0737) | 0.237 (0.398) | 1.221 *** (0.202) |

| PGDP | 0.871 *** (0.0124) | 0.171 *** (0.0238) | 0.855 *** (0.0614) | 0.317 *** (0.0645) |

| IL | −0.0495 *** (0.00960) | 0.0264 ** (0.0120) | −0.0111 (0.0260) | −0.0726 * (0.0397) |

| RTA | −0.268 *** (0.0430) | −0.0433 * (0.0259) | −0.629 *** (0.199) | 0.0638 (0.0993) |

| Constant | 0.457 ** (0.180) | 5.601 *** (0.188) | 1.934** (0.709) | −151.4 *** (22.08) |

| Controll variables | Yes | Yes | Yes | Yes |

| Province | Yes | Yes | No | Yes |

| Year | No | Yes | No | Yes |

| Estimation method | FE | FE | OLS | XTSCC |

| 0.984 | 0.996 | 0.886 | 0.971 | |

| N | 630 | 630 | 630 | 630 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| Full sample | Sub-sample | |||

| Dist | −0.0271 *** (0.00908) | |||

| DistK | −0.0207 *** (0.00580) | |||

| DistL_1 | 0.00918 (0.00732) | |||

| 0.0140 * (0.00741) | ||||

| Gov | 0.753 *** (0.0652) | 0.726 *** (0.0642) | 0.703 *** (0.0670) | 0.664 *** (0.0663) |

| DI | 0.349 *** (0.0737) | 0.328 *** (0.0723) | 0.288 *** (0.0742) | 0.0670 (0.0819) |

| PGDP | 0.171 *** (0.0238) | 0.163 *** (0.0237) | 0.164 *** (0.0244) | 0.203 *** (0.0271) |

| IL | 0.0264 ** (0.0120) | 0.0274 ** (0.0120) | 0.0270 ** (0.0121) | 0.681 *** (0.169) |

| RTA | −0.0433 * (0.0259) | −0.0430 * (0.0257) | −0.0367 (0.0260) | −0.0792 *** (0.0275) |

| 5.601 *** (0.188) | 5.681 *** (0.191) | 5.570 *** (0.191) | 5.400 *** (0.211) | |

| 0.996 | 0.996 | 0.996 | 0.996 | |

| N | 630 | 630 | 630 | 540 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| Expy | Expy | Expy | Expy | |

| Dist | −0.0474 *** (0.00961) | |||

| DistK | −0.0324 *** (0.00627) | |||

| DistL_1 | −0.00472 (0.00866) | |||

| −0.00293 (0.00996) | ||||

| 0.0409 *** (0.00750) | ||||

| DistK | 0.0250 *** (0.00556) | |||

| DistL_1 | 0.0224 *** (0.00756) | |||

| DistL_2 | 0.0249 ** (0.00986) | |||

| Gov | 0.67 2 *** (0.0653) | 0.667 *** (0.0645) | 0.68 3 *** (0.0669) | 0.644 *** (0.0664) |

| DI | 0.370 *** (0.0720) | 0.343 *** (0.0712) | 0.295 *** (0.0737) | 0.0688 (0.0815) |

| PGDP | 0.107 *** (0.0260) | 0.118 *** (0.0254) | 0.146 *** (0.0250) | 0.198 *** (0.0270) |

| IL | 0.0242 ** (0.0117) | 0.0258 ** (0.0118) | 0.0266 ** (0.0120) | 0.701 *** (0.169) |

| RTA | −0.0280 (0.0254) | −0.0308 (0.0255) | −0.0358 (0.0259) | −0.0791 *** (0.0274) |

| 6.147 *** (0.209) | 6.059 *** (0.206) | 5.736 *** (0.198) | 5.455 *** (0.211) | |

| 0.996 | 0.996 | 0.996 | 0.996 | |

| N | 630 | 630 | 630 | 540 |

| Variables | Lag One Phase | The First Steps | The Second Step |

|---|---|---|---|

| Expy | Dist | Expy | |

| Dist | −0.1911 *** (0.0337) | ||

| L.Dist | −0.0268 *** (0.00926) | ||

| 0.7905 *** (0.0224) | |||

| Gov | 0.732 *** (0.0677) | —0.2116 *** (0.0871) | 0.1357 (0.1523) |

| DI | 0.378 *** (0.0759) | −0.0033 (0.0830) | 0.1567 (0.1370) |

| PGDP | 0.170 *** (0.0249) | −0.0513 *** (0.0211) | 0.8113 *** (0.0289) |

| IL | 0.239 ** (0.120) | −1.4512 *** (0.2452) | −0.1497 (0.1955) |

| RTA | −0.0342 (0.0274) | 0.0818 *** (0.0398) | −0.5719 *** (0631) |

| Constant | 5.677 *** (0.199) | 0.6982 *** (0.1964) | 2.3496 *** (0.0289) |

| 0.995 | 0.916 | 0.871 | |

| N | 600 | 600 | 600 |

| Variables | Model 1 | Model 2 |

|---|---|---|

| Expy | SExpy | |

| Dist | −0.0467 ** (0.0182) | −0.0689 ** (0.0323) |

| Gov | 0.0692 (0.0981) | 2.517 *** (0.235) |

| DI | 0.682 *** (0.105) | 0.869 *** (0.263) |

| PGDP | −0.0736 * (0.0432) | 0.511 *** (0.0844) |

| IL | 0.00810 (0.00824) | 0.883 ** (0.426) |

| RTA | −0.0147 (0.0265) | −0.222 ** (0.0919) |

| Constant | 9.438 *** (0.450) | −3.882 *** (0.669) |

| 0.981 | 0.977 | |

| N | 330 | 630 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| The second step of FDI | The third step of FDI | The second step of OL | The third step of OL | |

| Dist | −0.0041 * (0.00227) | −0.0247 *** (0.00902) | −0.0576 *** (0.0179) | −0.0142 * (0.00822) |

| 0.579 *** (0.165) | ||||

| 0.224 *** (0.0190) | ||||

| Gov | 0.0443 *** (0.0163) | 0.727 *** (0.0649) | 0.687 *** (0.129) | 0.599 *** (0.0599) |

| DI | 0.0164 (0.0184) | 0.339 *** (0.0730) | −0.183 (0.145) | 0.390 *** (0.0662) |

| PGDP | 0.0255 *** (0.00593) | 0.156 *** (0.0239) | 0.614 *** (0.0469) | 0.0332 (0.0243) |

| IL | 0.00518 * (0.00300) | 0.0234 * (0.0119) | 0.0639 *** (0.0237) | 0.0120 (0.0108) |

| RTA | 0.0117 * (0.00646) | −0.0501 * (0.0257) | −0.221 *** (0.0510) | 0.00628 (0.0236) |

| −0.238 *** (0.0470) | 5.739 *** (0.191) | −4.472 *** (0.372) | 6.605 *** (0.189) | |

| 0.312 | 0.996 | 0.441 | 0.997 | |

| N | 630 | 630 | 630 | 630 |

| Variable Name | Model 1 | Model 2 |

|---|---|---|

| The benchmark regression | The moderating effect | |

| Dist | −0.0295 *** (0.00897) | −0.0144 * (0.00862) |

| −0.183 *** (0.0433) | −0.106 ** (0.0418) | |

| C_MIC_Dist | 0.206 *** (0.0239) | |

| Gov | 0.708 *** (0.0651) | 0.539 *** (0.0643) |

| DI | 0.306 *** (0.0733) | 0.287 *** (0.0690) |

| PGDP | 0.192 *** (0.0240) | 0.115 *** (0.0243) |

| IL | 0.0319 *** (0.0119) | 0.0321 *** (0.0112) |

| RTA | −0.0390 (0.0255) | −0.0349 (0.0240) |

| 5.512 *** (0.187) | 6.208 *** (0.193) | |

| 0.996 | 0.996 | |

| N | 630 | 630 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, C.; Yang, D.; Liu, T. The Impact of Factor Price Distortions on Export Technology Complexity: Evidence from China. Sustainability 2024, 16, 6879. https://doi.org/10.3390/su16166879

Wang C, Yang D, Liu T. The Impact of Factor Price Distortions on Export Technology Complexity: Evidence from China. Sustainability. 2024; 16(16):6879. https://doi.org/10.3390/su16166879

Chicago/Turabian StyleWang, Chenggang, Dongxue Yang, and Tiansen Liu. 2024. "The Impact of Factor Price Distortions on Export Technology Complexity: Evidence from China" Sustainability 16, no. 16: 6879. https://doi.org/10.3390/su16166879

APA StyleWang, C., Yang, D., & Liu, T. (2024). The Impact of Factor Price Distortions on Export Technology Complexity: Evidence from China. Sustainability, 16(16), 6879. https://doi.org/10.3390/su16166879