Adopting the Materiality Principle in Sustainable Operations Management

Abstract

1. Introduction

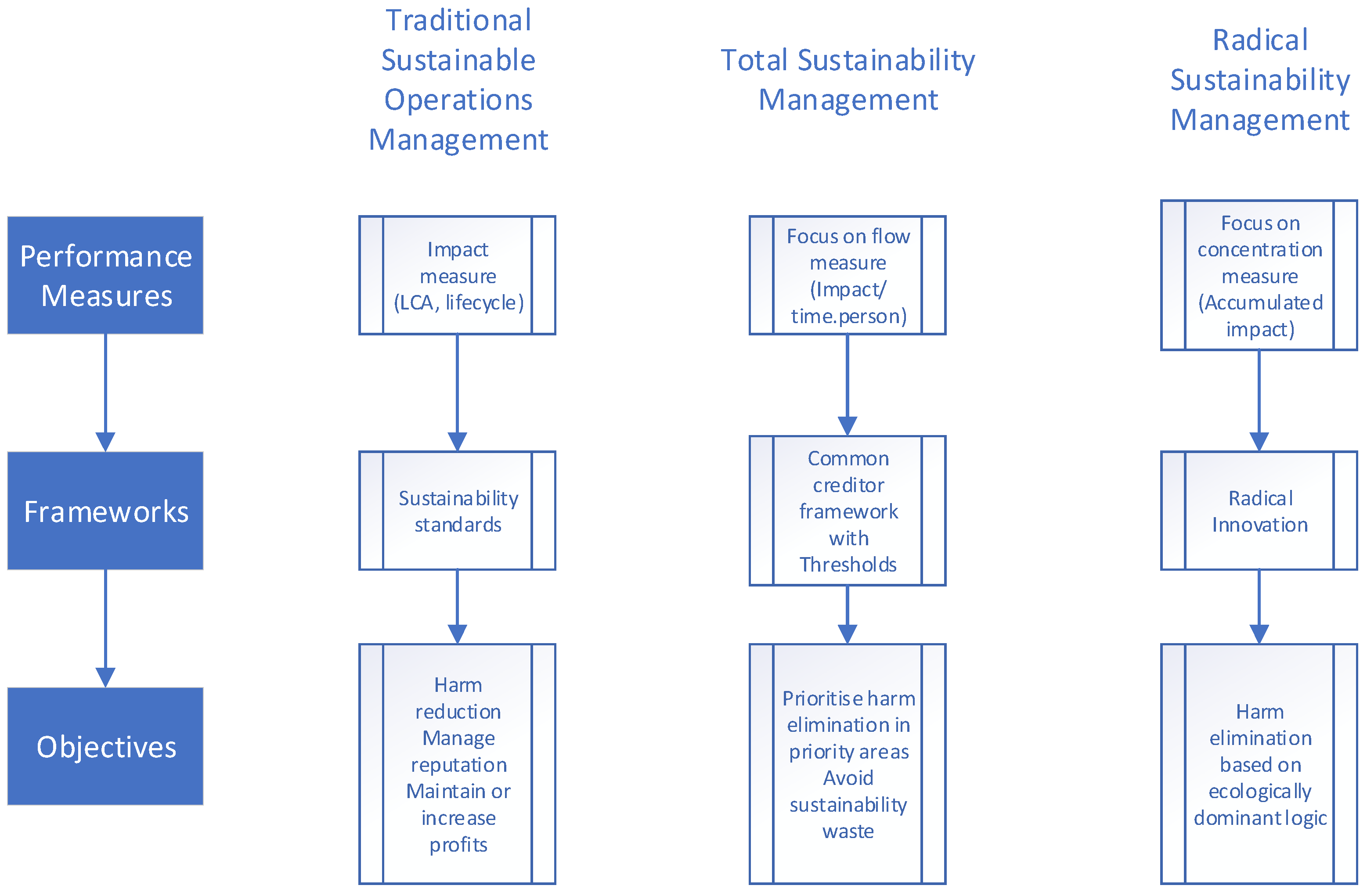

1.1. Literature Review: Sustainable Operations Management

1.2. Theoretical Framework

2. Methodology: Framework Instrumentalization

2.1. Benchmark Definition

2.2. Benchmark

- Our sustainability measure automatically adjusts with the population. If the population grows, the thresholds decrease. For example, a population of 9 billion takes the materiality threshold to 0.020 g/s.

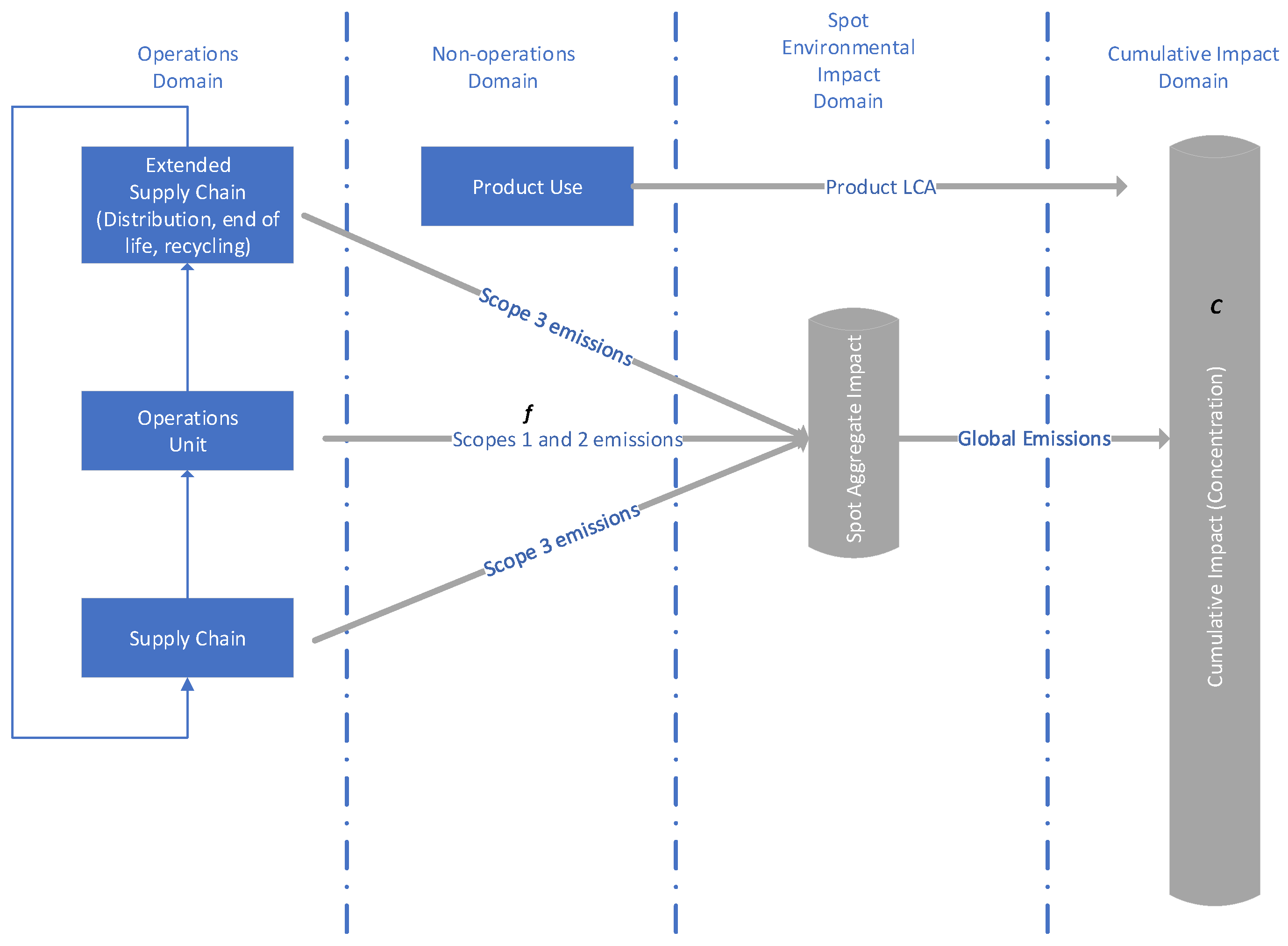

- Any individual can typically be engaged in only one operation at a time, i.e., they are either commuting, at work, or at home, etc. When individuals are at work, they contribute to operations emissions, but they stop commuting emissions. This ignores “background emissions”, e.g., electricity consumption at home that could happen at the same time as commuting. It is not challenging to expand the example to include background emissions, but we omit these as our focus is on industry-scale operations systems in the case studies.

- Only direct emissions are considered, i.e., the lifecycle emissions of the car are not considered. This is because the mining emissions will be attached to miners at work, the fuel refining emissions to refinery workers, etc. Attaching flow emissions to what a person does at a specific point in time removes the risk of accounting for an impact twice, and it captures emissions intensity “as it happens”.

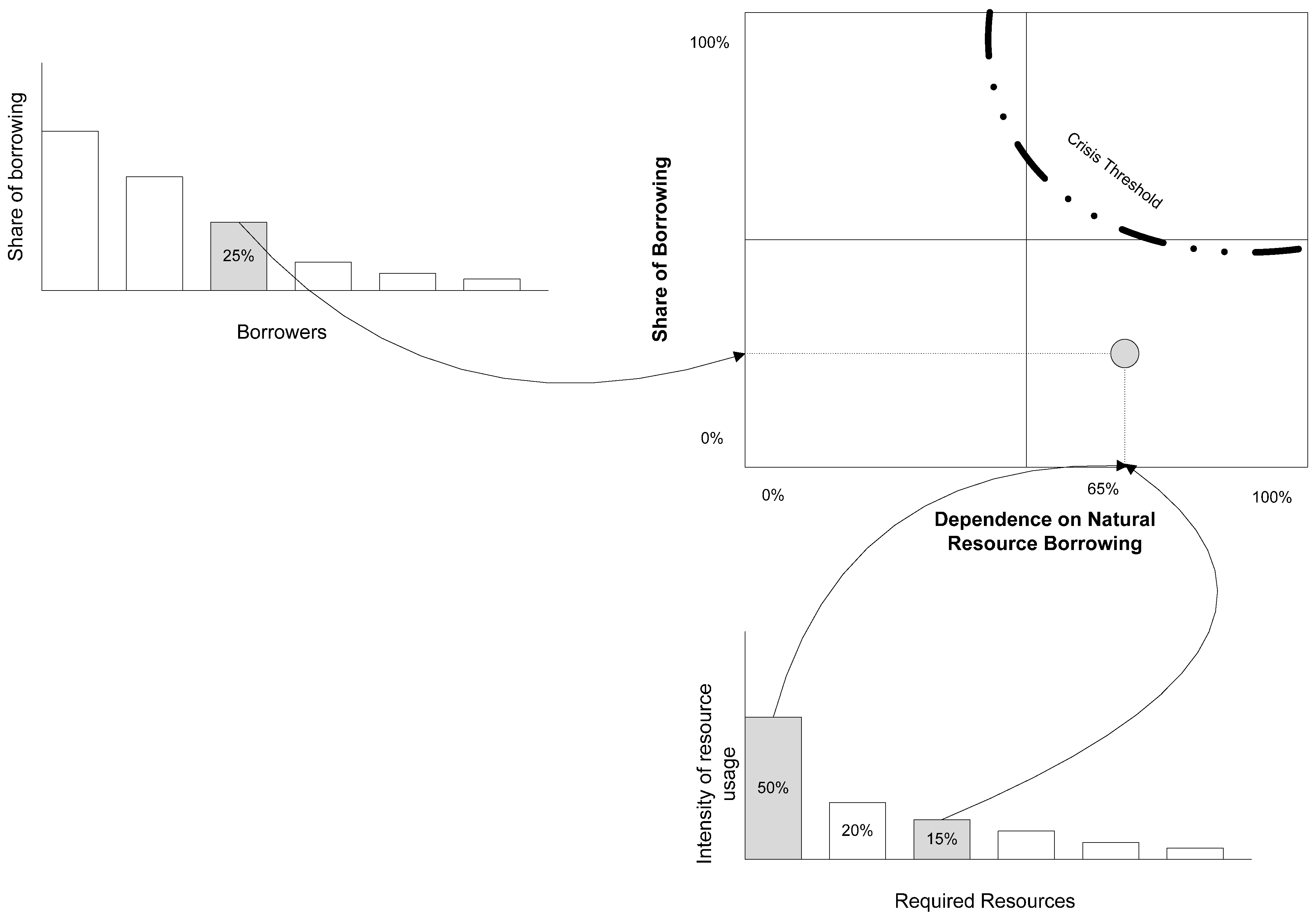

- In this example, we only use one dimension of the framework (dependence on natural resources). To use the second dimension, an estimate of the percentage of emissions compared to all planetary emissions is needed. At an individual level of analysis, doing so generates very small numbers, so it is more useful to look up at a higher level of analysis. For example, in the UK, only 20% of commuters use a car, which would confirm landing in the central band of Figure 2. The US figure of 50% raises more environmental concerns. The case studies in the following sections will further demonstrate the use of the second dimension.

2.3. Case Studies

3. Case Studies

3.1. Case Study A—UK Domestic Freight Provider

3.2. Case Study B—UK University

3.3. Case Study C—Green Surfboard Design

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Gray, R. Is accounting for sustainability actually accounting for sustainability...and how would we know? An exploration of narratives of organisations and the planet. Account. Organ. Soc. 2010, 35, 47–62. [Google Scholar] [CrossRef]

- Cho, C.H.; Laine, M.; Roberts, R.W.; Rodrigue, M. Organized hypocrisy, organisational facades, and sustainability reporting. Account. Organ. Soc. 2015, 40, 78–94. [Google Scholar] [CrossRef]

- Pagell, M.; Shevchenko, A. Why research in sustainable supply chain management should have no future. J. Supply Chain Manag. 2014, 50, 44–55. [Google Scholar] [CrossRef]

- Shevchenko, A.; Lévesque, M.; Pagell, M. Why firms delay reaching true sustainability. J. Manag. Stud. 2016, 53, 911–935. [Google Scholar] [CrossRef]

- Chewning, E.G.; Higgs, J.L. What Does “Materiality” Really Mean? J. Corp. Account. Financ. 2002, 13, 61–71. [Google Scholar] [CrossRef]

- Nunes, B.; Bennett, D. Green operations initiatives in the automotive industry. Benchmarking Int. J. 2010, 17, 396–420. [Google Scholar] [CrossRef]

- Fiandrino, S.; Tonelli, A.; Devalle, A. Sustainability materiality research: A systematic literature review of methods. theories and academic themes. Qual. Res. Account. Manag. 2022, 19, 665–695. [Google Scholar] [CrossRef]

- Baumuller, J.; Sopp, K. Double materiality and the shift from non-financial to European sustainability reporting: Review outlook, and implications. J. Appl. Account. Res. 2022, 23, 8–28. [Google Scholar] [CrossRef]

- Winroth, M.; Almstrom, P.; Andersson, C. Sustainable production indicators at factory level. J. Manuf. Technol. Manag. 2016, 27, 842–873. [Google Scholar] [CrossRef]

- Nunes, B.; Batista, L.; Masi, D.; Bennett, D. Sustainable Operations Management: Key Practices and Cases; Routledge/Taylor and Francis: Abingdon, Oxford, UK, 2023. [Google Scholar]

- Kleindorfer, P.R.; Singhal, K.; Van Wassenhove, L.N. Sustainable operations management. Prod. Oper. Manag. 2005, 14, 482–492. [Google Scholar] [CrossRef]

- Atasu, A.; Corbett, C.J.; Huang, X.; Toktay, L.B. Sustainable operations management through the perspective of Manufacturing and Service Operations Management. Manuf. Serv. Oper. Manag. 2020, 22, 146–157. [Google Scholar] [CrossRef]

- Felsberger, A.; Reiner, G. Sustainable industry 4.0 in production and operations management: A systematic literature review. Sustainability 2020, 12, 7982. [Google Scholar] [CrossRef]

- Jaehn, F. Sustainable operations. Eur. J. Oper. Res. 2016, 253, 243–264. [Google Scholar] [CrossRef]

- Sanders, N.R.; Boone, T.; Ganeshan, R.; Wood, J.D. Sustainable supply chains in the age of AI and digititalization: Research challenges and opportunities. J. Bus. Logist. 2019, 40, 229–240. [Google Scholar] [CrossRef]

- Seuring, S.; Muller, M. Core issues in sustainable supply chain management—A Delphi study. Bus. Strategy Environ. 2007, 17, 455–466. [Google Scholar] [CrossRef]

- Walker, H.; Seuring, S.; Sarkis, J.; Klassen, R. Sustainable operations management: Recent trends and future directions. Int. J. Oper. Prod. Manag. 2014, 34, 5. [Google Scholar] [CrossRef]

- ISO 14040:2006; Environmental Management—Lifecycle Assessment—Principles and Framework; Second Edition. International Organization for Standardization: Geneva, Switzerland, 2006.

- Montabon, F.; Pagell, M.; Wu, Z. Making sustainability sustainable. J. Supply Chain Manag. 2015, 52, 11–27. [Google Scholar] [CrossRef]

- Pagell, M.; Wu, Z. Building a more complete theory of sustainable supply chain management using case studies of 10 exemplars. J. Supply Chain Manag. 2009, 45, 37–56. [Google Scholar] [CrossRef]

- Van Wassenhove, L.N. Sustainable innovation: Pushing the boundaries of traditional operations management. Prod. Oper. Manag. 2019, 28, 2930–2945. [Google Scholar] [CrossRef]

- Sterner, E. Green procurement of buildings: A study of Swedish clients’ considerations. Constr. Manag. Econ. 2002, 20, 21–30. [Google Scholar] [CrossRef]

- Middle, G.; Middle, I. The inefficiency of environmental impact assessment: Reality or myth? Impact Assess. Proj. Apprais. 2010, 28, 159–168. [Google Scholar] [CrossRef]

- Levy, J.K.; Hipel, K.W.; Kilgour, D.M. Using environmental indicators to quantify the robustness of policy alternatives to uncertainty. Ecol. Model. 2000, 130, 79–86. [Google Scholar] [CrossRef]

- WCED. Report of the World Commission on Environment and Development: Our Common Future; Oxford University Press: New York, NY, USA, 1987. [Google Scholar]

- Elemure, I.; Dhakal, H.N.; Leseure, M.; Radulovic, J. Integration of lean green sustainability in manufacturing: A review of current state and future perspectives. Sustainability 2023, 15, 20261. [Google Scholar] [CrossRef]

- Hahn, T.; Figge, F.; Pinkse, J.; Preuss, L. Trade-offs in corporate sustainability: You can’t have your cake and eat it. Bus. Strategy Environ. 2010, 19, 217–229. [Google Scholar] [CrossRef]

- Leseure, M. Sustainability performance frontiers. Univers. J. Oper. Manag. 2023, 2, 16–30. [Google Scholar] [CrossRef]

- Wu, Y.; Zhang, K.; Xie, J. Bad greenwashing, good greenwashing: Corporate social responsibility and information transparency. Manag. Sci. 2020, 66, 7. [Google Scholar] [CrossRef]

- Thamo, T.; Pannell, D.J. Challenges in developing effective policy for soil carbon sequestration: Perspectives on additionality. leakage, and permanence. Clim. Policy 2016, 16, 973992. [Google Scholar] [CrossRef]

- Caramazza, F.; Ricci, L.; Salgado, R. International financial contagion in currency crises. J. Int. Money Financ. 2004, 23, 51–70. [Google Scholar] [CrossRef]

- Nunes, B.; Alamino, R.C.; Shaw, D.; Bennett, D. Modelling sustainability performance to achieve absolute reductions in socio-ecological systems. J. Clean. Prod. 2016, 132, 32–44. [Google Scholar] [CrossRef]

- Richardson, K.; Steffen, W.; Lucht, W.; Bendtsen, J.; Cornell, S.E.; Donges, J.F.; Druke, M.; Fetzer, I.; Bala, G.; von Bloh, W.; et al. Earth beyond six of nine planetary boundaries. Sci. Adv. 2023, 9, 1–16. [Google Scholar] [CrossRef]

- Corbett, C.J.; Klassen, R.D. Extending the Horizons: Environmental Excellence as Key to Improving Operations. Manuf. Serv. Oper. Manag. 2006, 8, 5–22. [Google Scholar] [CrossRef]

- Conlen, M. How Much Carbon Dioxide Are We Emitting; NASA Science Editorial Team: Washington, DC, USA, 2021. Available online: https://science.nasa.gov/science-research/earth-science/climate-science/how-much-carbon-dioxide-are-we-emitting/ (accessed on 22 July 2024).

- Hickman, R.; Banister, D. Looking over the horizon: Transport and reduced CO2 emissions in the UK by 2030. Transp. Policy 2007, 14, 377–387. [Google Scholar] [CrossRef]

- McKinnon, A.C. CO2 Emissions from Freight Transport in the UK; Logistics Research Centre, Heriot-Watt University: Edinburgh, UK, 2007. [Google Scholar]

- Goldratt, E.M. Theory of Constraints; North River Press: Great Barrington, MA, USA, 1999. [Google Scholar]

- Katayama, H.; Bennett, D. Lean production in a changing competitive world: A Japanese perspective. Int. J. Oper. Prod. Manag. 1996, 16, 8–23. [Google Scholar] [CrossRef]

- Mendoza, D.; Terpou, K. Sustainability Reporting in Universities; Blue Paper Report; Chalmers Innovations Kontor Väst: Göteborg, Sweden, 2014. [Google Scholar]

- Taylor, M.; Watts, J. Revealed: The 20 Firms Behind a Third of All Carbon Emissions; The Guardian: London, UK, 2019; Available online: https://www.theguardian.com/environment/2019/oct/09/revealed-20-firms-third-carbon-emissions (accessed on 22 July 2024).

- Riley, T. Just 100 Companies Responsible for 71% of Global Emissions, Study Says; The Guardian: London, UK, 2017; Available online: https://www.theguardian.com/sustainable-business/2017/jul/10/100-fossil-fuel-companies-investors-responsible-71-global-emissions-cdp-study-climate-change (accessed on 22 July 2024).

- World Resources Institute. World Greenhouse Gas Emissions in 2019. Available online: https://www.wri.org/data/world-greenhouse-gas-emissions-2019 (accessed on 22 July 2024).

| Perception of Natural Systems | Valid Environmental Strategy [24] | Impact of Harm Reduction | Impact of Harm Elimination |

|---|---|---|---|

| Nature constant | Exploit nature | None, wasted effort | None, wasted effort |

| Nature balanced | Engineer nature | None, wasted effort | Effective to avoid large shocks |

| Nature ephemeral | Preserve nature | Preserve nature | Preserve nature |

| Nature resilient | Adapt to nature | None, wasted effort | Stops ability of ecosystem to improve integrity and vigour |

| Concern | How It Is Addressed by the Framework |

|---|---|

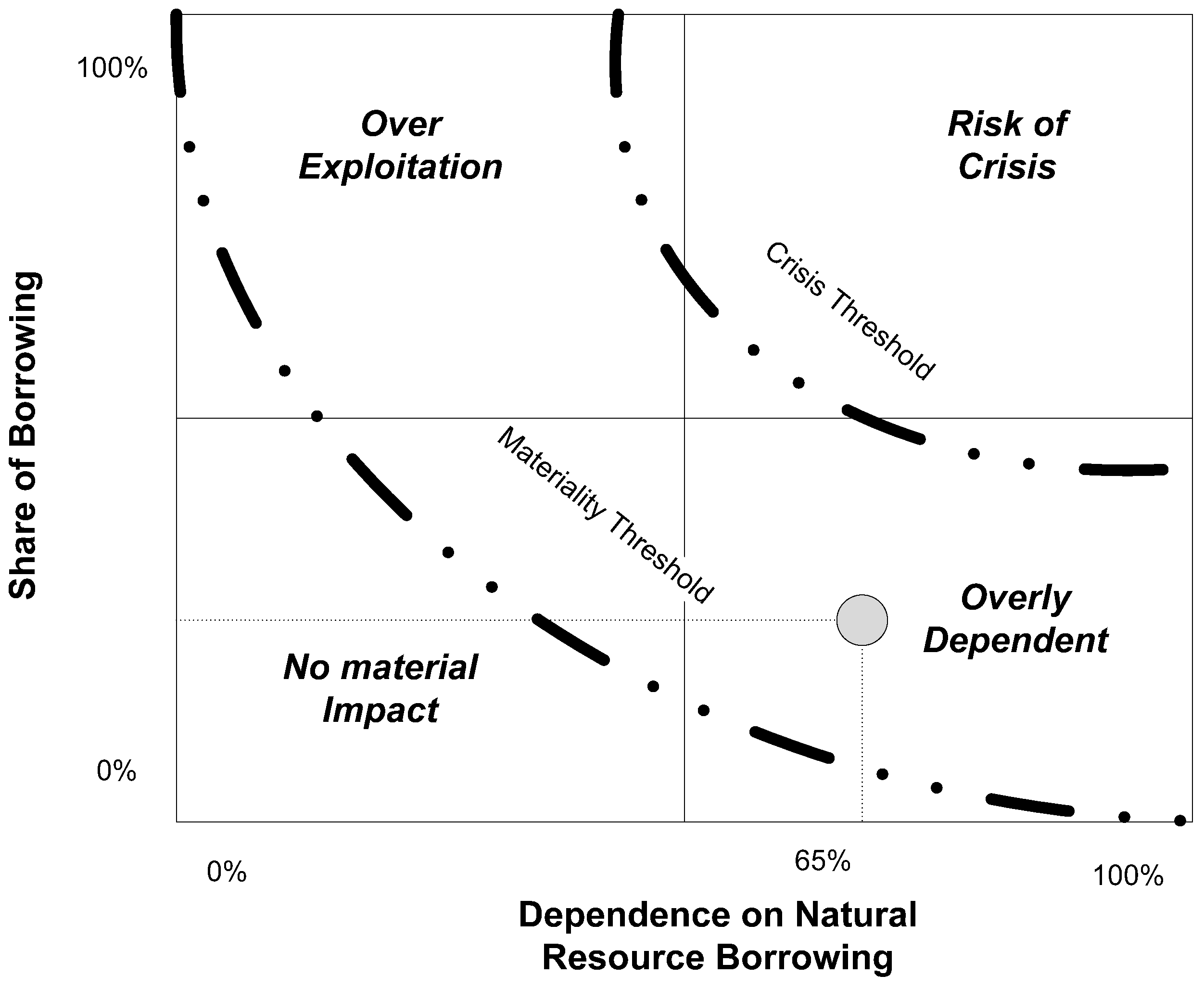

| Poor allocation of priorities | An actor can assess directly how urgent sustainable initiatives are from their position in the common creditor frame. |

| Wasted effort | Actors should not invest in sustainability initiatives in the no material impact zone, unless these initiatives result in efficiency or economic improvements in their own right. |

| Uncertain impact assessment | The positions of the threshold lines are uncertain, but actors can use their relative positions to others to gain a sense of the extent to which they could participate in the emergence of an ecological crisis. Work on ecological modelling could define the thresholds more explicitly. Alternatively, mutually agreed-upon thresholds could be used. |

| Impact pathways | Once actors are aware of their position, they can “look up” at the next hierarchical level to see if they are part of an unsustainable system, and at what level. They can also “drill down” to a lower level to assess which sub-system or unit is generating a concerning or unstainable position. |

| Materiality Threshold | Crisis Threshold | |

|---|---|---|

| Planetary (in tons per second) | 187 | 756 |

| Per person (in grams per second). Global population = 8,115,094,060. | 0.023 | 0.093 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Leseure, M.; Bennett, D. Adopting the Materiality Principle in Sustainable Operations Management. Sustainability 2024, 16, 6572. https://doi.org/10.3390/su16156572

Leseure M, Bennett D. Adopting the Materiality Principle in Sustainable Operations Management. Sustainability. 2024; 16(15):6572. https://doi.org/10.3390/su16156572

Chicago/Turabian StyleLeseure, Michel, and David Bennett. 2024. "Adopting the Materiality Principle in Sustainable Operations Management" Sustainability 16, no. 15: 6572. https://doi.org/10.3390/su16156572

APA StyleLeseure, M., & Bennett, D. (2024). Adopting the Materiality Principle in Sustainable Operations Management. Sustainability, 16(15), 6572. https://doi.org/10.3390/su16156572