1. Introduction

The basis of sustainable development has emerged from the idea of addressing economic and environmental problems together. From a historical perspective, the concept of sustainability was formulated at the first United Nations conference on the environment in 1972. However, it has only really taken shape since 1987, when the publication of the Brundtland Report (“Our Common Future”) clarified the goals of sustainable development. The report highlights that humanity has the ability to make development sustainable to ensure that it meets the needs of the present without compromising the ability of future generations to meet their own [

1].

Sustainable development is introduced in various pillars, such as environmental, social, economic and technological terms. Environmental sustainability is the ability to preserve and protect the natural environment over time through appropriate practices and policies. Social sustainability, on the other hand, focuses on the well-being of people and communities. It is about promoting equity, human rights, access to education, healthcare and decent work. As for economic sustainability, it is an approach whereby economic activities are conducted in such a way as to preserve and promote long-term economic well-being. In practice, it aims to create a balance between economic growth, resource efficiency and social equity. Finally, technological sustainability constitutes another pillar of sustainable development. Technologically sustainable practices include but are not limited to the utilization of clean and efficient technologies that do not pollute nature, reduction in fossil fuels, expansion of alternative energy sources as well as the development of green technologies.

Although sustainable development highlights the connections between the environmental, social and economic and technological aspects of development, environmental sustainability has recently taken center stage, due to the unprecedented impact of climate change on the environment, economies and societies. Climate change refers to long-term shifts in temperatures and weather patterns. Although such shifts can be natural, due to changes in the sun’s activity or large volcanic eruptions, human activities have been considered the main driver of climate change since the 1800s. Burning of fossil fuels like coal, oil and gas generates greenhouse gas (GHG) emissions and causes temperatures to rise [

2]. To tackle climate change, climate action is proposed as the 13

th goal of the 17 Sustainable Development Goals (SDGs) specified in the 2030 Agenda for Sustainable Development that was adopted by all United Nations members in 2015.

Despite the updated national pledges by jurisdictions in the 2023 United Nations Climate Change Conference (Conference of the Parties—COP28), the international community is far from achieving the Paris Agreement goal of limiting global warming to well below 2 °C, preferably to 1.5 °C. The 2023 Emission Gap Report reveals that fully implementing unconditional Nationally Determined Contributions (NDCs) made under the Paris Agreement points to limiting the rise in global temperature to 2.9 °C above pre-industrial levels by the end of the century [

3].

To ensure the full and effective implementation of the United Nations Framework Convention on Climate Change (UNFCC) and to comply with the climate mitigation goals of the Paris Agreement, vast amounts of investment in low-carbon infrastructure and clean technologies will be needed over the next decades. The Sharm el-Sheikh Implementation Plan also highlights that almost USD 4 trillion per year needs to be invested in renewable energy up until 2030 to be able to reach the global net zero emission target by 2050 [

4]. With energy accounting for more than two-thirds of global emissions, energy transition holds the key to tackling climate change and the global energy crisis. Furthermore, a global transformation to a low-carbon economy is expected to require investment of at least USD 4–6 trillion per year, including energy investments. Meanwhile, there is a huge financing gap that needs to be addressed.

Due to the limited fiscal policy space in the aftermath of COVID-19 and the still prevailing global energy crisis, public investment alone is insufficient for achieving the transition. Thus, private sector resources should play a complementary role. However, many barriers exist against the private sector’s climate investments. Large uncertainties about the development of climate-related technologies, lower and potentially delayed financial returns of climate projects, and unclear future climate policies (i.e., carbon policies) are among these barriers. Since private sector investments in climate-friendly, low-carbon or green technologies are significantly reliant on current and future policies (both economic and climate policies), there is great concern among private sector actors about policy uncertainty. It is definitely more pronounced for capital-intensive and irreversible investments [

5].

This study aims to test the EKC hypothesis that proposes an inverted U-shaped curve between affluence and environmental degradation, while also investigating the role that policy uncertainty might play on climate change, both in emerging and developed economies. We investigate the interrelation between carbon dioxide (CO

2) emissions and selected variables; namely, the real GDP per capita, squared real GDP per capita, renewable share in consumption, the EPU, the CPU and population. As highlighted by [

6], global greenhouse gas emissions started growing again just after the peak of the pandemic, reaching the level of 53.8 gigatons CO

2 equivalent in 2022, which is 2.3% higher than in 2019 and 1.4% higher than in 2021. As also reflected by [

6], China, the United States, India, the EU27, Russia and Brazil were the six largest greenhouse gas emitters in 2022. Together they account for 50.1% of the global population, 61.2% of global GDP, 63.4% of global fossil fuel consumption and 61.6% of global GHG emissions.

It might be argued that high levels of economic activity might lead to significant environmental problems or damages that negatively impact sustainable development. The reversed argument might also be valid, as there is a need for combating environmental problems without compromising economic prosperity. From the viewpoint of emerging countries, they have started their economic development process later than developed ones and will definitely need higher levels of energy to continue their economic development. Thus, an investigation of the relationship between economic growth and the environment will be helpful in devising appropriate policies to support the sustainable development of different country groups.

We also acknowledge that energy, being one of the basic inputs of production, has been the main contributor to climate change since the 2000s. Global GHG emissions primarily (76%) consist of CO

2 resulting from the combustion of fossil fuels. Therefore, it is undoubted that renewable energy produced domestically, and its inexhaustible nature, will substantially support decarbonization efforts while also improving energy independence of jurisdictions. The recent energy crisis also stressed the importance of diversifying the energy mix in favor of renewable energy. On a positive note, the renewable energy capacity around the world more than doubled in the 10 years between 2013 and 2022 [

7]. However, progress has been quite uneven, as large capacities have been built up in Europe and huge progress, especially in the last decade, has been made in China. Arguing for the crucial role of renewable energy in decarbonization efforts, we test the EKC hypothesis via incorporating the renewable energy indicator to the model.

Finally, we try to find evidence for the potential role of policy uncertainties in climate change. While starting with an investigation of the interaction between economic policy uncertainty (EPU) and climate change in a group of countries, the study expands the discussion on the interaction of climate policy uncertainty (CPU) with climate change in a subset of countries. Examining these relationships comparatively for emerging and developed countries that have different levels of GDP, renewable energy, EPU, CPU and CO2 emissions level, our study highlights the differences between the two country groups.

The research contributes to the existing body of literature in two dimensions. First, to the best of our knowledge, this is the first study to investigate the impact of CPU on climate change, differentiating between emerging and developed countries. The EPU index introduced by [

8] has been frequently used by prior studies, but the CPU index introduced by [

5] is a new indicator used to assess the evolution of domestic climate policy uncertainty over time and is the first of its kind. Both indexes use the same methodology and reflect the frequency of articles in leading newspapers, which contain specific terms either related to economic policy uncertainty or climate policy uncertainty. The second contribution of this study is that it proposes new evidence related to the EKC hypothesis, differentiating between emerging and developed countries.

The remainder of this study is ordered as follows.

Section 2 reviews the literature in three channels: first focusing on the drivers of climate change, second focusing on the EPU, more specifically the impact of EPU on climate change, and third, the impact of CPU on climate change and how climate policies affect innovation and investments in low-carbon technologies. Research questions and hypotheses are also discussed in

Section 2, along with the related literature review.

Section 3 describes the data and presents the model and methodology.

Section 4 discusses empirical estimation results based on the ex-ante hypotheses put forward. Finally,

Section 5 concludes the study.

2. Literature Review, Research Questions and Hypotheses

2.1. Literature on Determinants of Climate Change (Environmental Degradation)

Energy, being the basic input of production, is at the heart of the climate challenge. About 80 percent of the global population lives in countries that are net importers of fossil fuels, making them vulnerable to geopolitical shocks and crises. Fossil fuels such as coal, oil and gas, are by far the largest contributor to climate change, accounting for over 75 percent of global greenhouse gas emissions and nearly 90 percent of all CO

2 emissions [

9]. Based on [

10], global energy-related CO

2 emissions grew by 0.9% in 2022, reaching a new high of over 36.8 Gt. The same report also highlights that industrial emissions declined by 1.7% to 9.2 Gigatone the year before. While this decrease is attributed to the manufacturing curtailments in several regions, the global decline was largely driven by a 161 Megatone CO

2 decrease in China’s industry emissions, reflecting a 10% decline in cement production and a 2% decline in steelmaking.

Although energy is the main driver of CO

2 emissions, it is also a key to the solution. Renewable energy sources, which are available in abundance and provided by the sun, wind, water, waste, and heat from the Earth, are replenished by nature and emit little to no greenhouse gases or pollutants into the air. Due to the recent technological progress and efficiency gains addressing the high set-up costs of wind and solar power, the competitiveness of wind and solar sources has improved. Their competitiveness has also been supported by much sharper increases in gas and coal prices. The figures show that investment in clean energy has boosted, with a 14.8% growth in 2021–2022 and 7.6% in 2022–2023, driven by renewables and electric vehicles [

11]. Although renewable energy has reached unprecedented global growth rates over the last decade, its share in total final energy consumption has remained steady—at around 17 percent. This was mainly because of the fact that global energy consumption grew at a similar rate. Thus, it will definitely take time to accumulate adequate low-carbon energy capacity and increase the share of renewable energy in total final consumption. Furthermore, global energy statistics of IEA indicate that while fossil-based sources dominate all other sources with 61.4% of total electricity output, 28.5% of the world’s total electricity is generated using renewable sources [

12]. Although renewable energy capacity around the world more than doubled in the 10 years between 2013 and 2022 [

7], the progress has been quite uneven, with large capacities being built up in Europe and huge progress, especially in the last decade, happening in China. Thus, the potential of renewable sources is yet to be fully harnessed in most of the regions of the world.

In addition to better utilization of renewable energy, recently introduced circular waste management methods, specifically related to mine methane have also great potential in emission reductions. These technologies help improve the quality and volume of gas extraction from technogenic reservoirs of mine methane while allowing the possibility to achieve sustainable mining [

13,

14].

Since CO

2 emissions constitute 76% of the total global greenhouse gas emissions [

15], many studies use CO

2 emissions as a proxy for ‘climate change’ or ‘environmental degradation’. While environmental degradation covers an extensive range of issues related to the pollution of air, water and soil, greenhouse gas emissions, climate change, biodiversity and waste management, ‘climate change’ focuses on air pollution and carbon emissions. Thus, climate change might be considered a subset of environmental degradation. However, many studies as well as ours use these two terms interchangeably.

Earlier literature frequently investigated the drivers of CO

2 emissions. The investigated factors include economic growth, energy consumption, foreign direct investment (FDI), foreign trade, and renewable energy for different country groups. For instance, the authors of [

16] report that energy consumption, urbanization, trade and industrialization are key determinants of environmental degradation in the MENA region. Similarly, another study focusing on 59 Belt and Road countries found that economic growth, energy consumption, urbanization, foreign direct investment (FDI) and financial development surge environmental degradation [

17]. The results are quite similar to another study that found economic growth and energy consumption as the key determinants of environmental degradation in 16 EU countries [

18]. The authors of [

19] also found that economic growth, energy consumption, financial development, urbanization and non-renewable energy consumption escalate environmental degradation, whereas renewable energy consumption impedes environmental degradation.

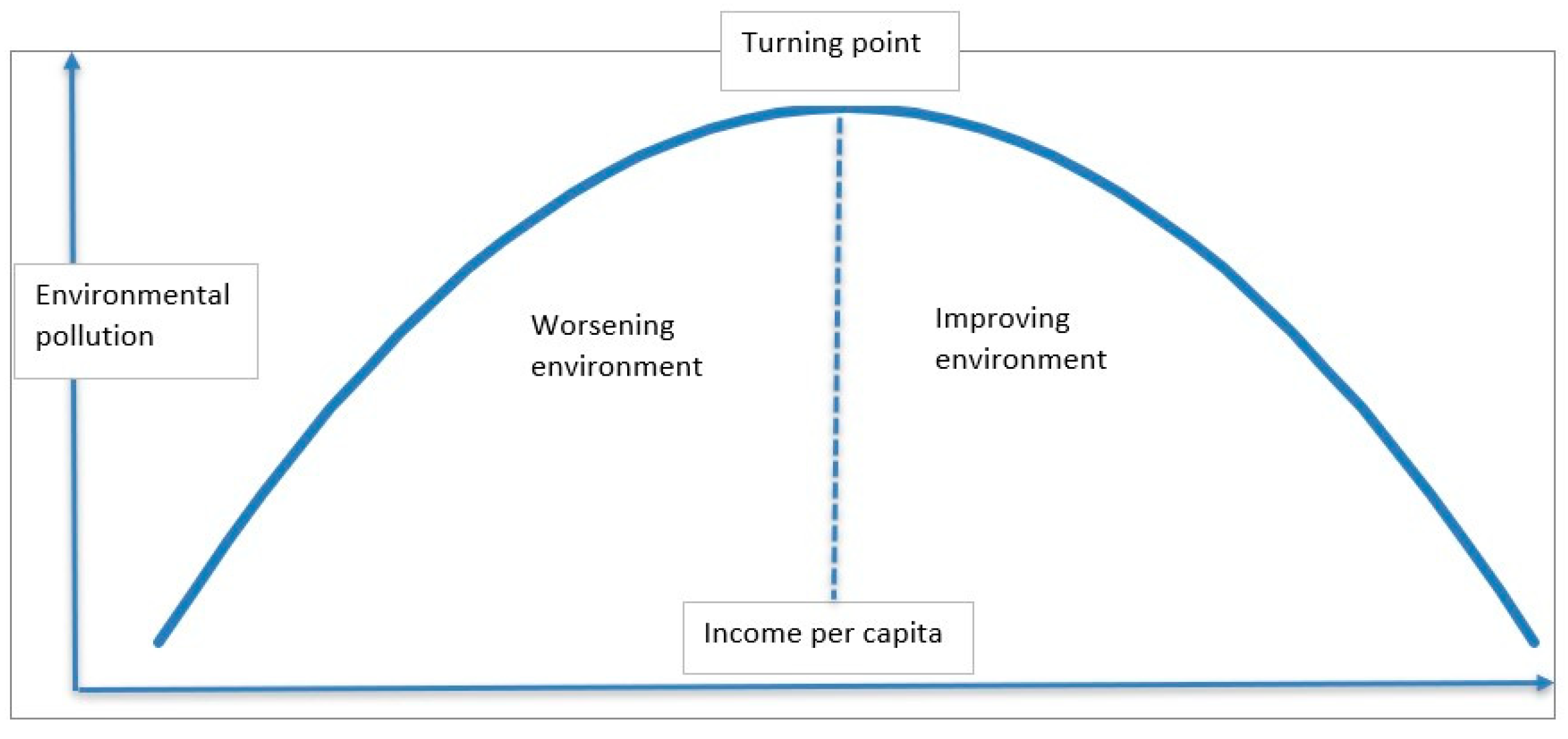

However, all these studies stated above are built on [

20], which conceptualizes the Environmental Kuznets Curve (EKC). Later, the authors of [

21] proposed a non-linear relationship between economic growth and environmental degradation, illustrated by the inverted U-shaped curve. EKC hypothesizes that a rise in real GDP per capita initially leads to an increase in CO

2 emissions in the first stages of economic growth due to fossil-based energy consumption, but after reaching a certain turning point, it leads to a decrease in CO

2 emissions due to the adoption of clean technologies, policies and clean energy demand (

Figure 1).

A recent study testing the EKC hypothesis in BRIC and G7 countries [

22] confirmed the EKC hypothesis for G7 countries and argued that a turning point takes place earlier if the renewable consumption variable is added to the model. However, the study found no evidence supporting the evidence for the BRIC countries.

Contrary to the studies that confirm the EKC hypothesis and argue for the efficiencies gained from the adoption of clean technologies and policies, there are some studies that have found evidence in the opposite direction and confirm the Jevons paradox [

23]. The Jevons paradox is first expressed in relation to the use of coal and argues that an increase in the efficiency of using a resource leads to increased use of that resource rather than to a reduction. Later, the authors of [

24] used energy data from the Energy Information Administration and developed models that provide empirical support for the Jevons paradox on a macro level. They found that high efficiency is associated with high levels of resource consumption. The authors of [

25] also provide evidence for the existence of the Jevons paradox and apply it to complex systems. They explain the myth of efficiency and explore its implications for resource usage, particularly regarding oil.

More recent literature investigates the impact of specific factors on climate change. For instance, the authors of [

26] investigate the association of environmental innovations, namely the effect of green technologies on CO

2 emissions, in 15 EU countries. In the model, they try to find the interrelation of environmental innovations, renewable energy consumption, GDP per capita and the degree of economic openness with CO

2 emissions. Their results reveal that environmental innovations would reduce CO

2 emissions in the long run, while the effect of environmental innovations is reversed in the short run, indicating a possible rebound effect.

In summary, an examination of this line of literature reveals that most of the literature uses CO2 emissions as a proxy for climate change or environmental degradation and tries to find the determinants of CO2 emissions. The studies discussed above either employ Panel Autoregressive Distributed Lag (ARDL) or Panel Augmented Mean Group (AMG) estimators to investigate their research question. They also check the causality among investigated variables.

2.2. Literature on the Impact of EPU on Climate Change (Environmental Degradation)

Economic policy uncertainty might simply be defined as ‘the situation in which the future economic environment is difficult to predict, and there is a high degree of risk or unknowns involved’. This can be caused by a variety of factors, including political instability, changes in government or macroeconomic policies, natural disasters, and volatility in financial markets. As seen in

Figure 2, the global economic policy uncertainty index depicts that recent events, such as the financial crisis, oil price shocks or fluctuations, Brexit, the US–China trade war, the COVID-19 pandemic, the Russia–Ukraine conflict and the subsequent energy crisis, have surged the global economic policy uncertainty [

27].

Empirical studies related to the impact of policy uncertainty on various other economic indicators rely on the extent to which policy uncertainty may be thoroughly captured with high-quality indicators. The authors of [

8] developed a now widely used indicator of global and country-based economic policy uncertainty, achieving a major step in constructing a breakthrough index that defines policy uncertainty from an economic perspective. They constructed their index based on newspaper article counts. Each national EPU index reflects the relative frequency of own-country newspaper articles that contain a trio of terms related to the economy (E), policy (P) and uncertainty (U) in that month. Going one step further and merging the index with firm-level data, they also empirically show that economic policy uncertainty is associated with greater stock price volatility, reduced investment and employment in policy-sensitive sectors like defense and healthcare. Following this phenomenal research, other researchers have used their index and applied it to other empirical settings. For example, several studies report that EPU affects economic growth [

28], energy prices [

29], stock markets [

30] and firm-level investment [

31].

The EPU literature related to our study is the one that deals with the environmental impacts of EPU. The evidence for the direction (positive or negative) of interaction between EPU and the environment is mixed and does not have a real consensus. While some studies [

32,

33] report that EPU surges environmental degradation, other studies [

34,

35] find that EPU plunges environmental degradation.

We base our discussion on the ex-ante hypotheses of [

32] that propose two channels that relate EPU with environmental degradation: i. consumption (mitigating) effect, and ii. investment (escalating) effect. According to the consumption effect, EPU lessens the use of energy consumption and pollution-intensive commodities, negatively affecting economic activity and growth as a result mitigating environmental degradation. However, the investment effect asserts that EPU impedes the investment in renewable energy, environmentally related R&D and innovation, which ultimately escalates the environmental degradation.

Last but not least, the authors of [

36] explore the impact of EPU and geopolitical risk (GPR) on environmental degradation in selected emerging countries. Their findings reveal that EPU and non-renewable energy consumption escalate environmental degradation proxied by ecological footprint (EF), whereas GPR and renewable energy decrease EF. They also find both uni-directional and bi-directional causality between a few variables.

2.3. Literature on Climate Policy Uncertainty (CPU)

In the earlier literature, studies particularly investigating the impact of climate policy uncertainties on climate change do not exist, at least as cross-country analysis. This might be attributed to the fact that there was no indicator to measure the policy uncertainty from a climate perspective until the authors of [

5] constructed the CPU index. They filled the gap with their phenomenal research and constructed a Climate Policy Uncertainty (CPU) index. Similar to the study in [

8], the authors of [

5] created a lexicon of words for each of the three components (climate, policy and uncertainty). The first category includes terms such as “CO

2”, or “climate change” which refer to a specific environmental or climate change concern. It also includes terms referring to technologies addressing these concerns such as “solar PV” or “renewable energy”. The second category includes terms related to policy-making such as “regulation”, “legislation”, or “tax”, but also terms more specific to climate change mitigation policies such as “emissions trading system” or “cap and trade”. The third category includes the words “uncertain”, “uncertainty”, “vague” and “unclear”. Selected articles have to include at least one term from each category. Merging their CPU index with a global firm-level dataset, they empirically reveal that CPU is associated with economically and statistically significant decreases in investment, particularly in pollution-intensive sectors that are most exposed to climate policies and among capital-intensive companies.

As for the theoretical contributions to this line of literature, the authors of [

37] model policy uncertainty as a stochastic shock to capital tax and show that policy uncertainty leads to suboptimal investment in green services and creates a high risk-premium for green investment.

Although cross-country analyses are rare in this field, the authors of [

38] analyze the role of renewable energy policies across countries (Germany, Spain and Greece) and find political instability to be a critical determinant of investments in solar energy.

We also reviewed another line of literature that investigates the impact of climate policies on innovation and investments in low-carbon technologies. Reviewing this line of literature, we recognized that the logic associated with climate policy in driving innovation might be traced back to [

39], which argues that a change in relative prices for factors of production is itself a driver toward the invention of a particular kind of technology. This shift to a particular type of technology aims to economize the use of a factor of production that has become more expensive. Hicks, in his Theory of Wages, postulates the idea that relative factor prices influence the type of technological progress, in particular that high wages induce labor-saving innovations.

However, later studies such as [

40] argued that market failures, technology path dependencies and behavioral factors justify the need for coordinated climate policy action to switch innovation systems from a dirty to clean pathway to deliver emission reductions at the pace required for global net zero. The authors of [

41] highlighted the same idea, asserting that there is a path dependence in the direction of technical change. Firms in economies with significant innovation in dirty technologies will find it more profitable to innovate in dirty technologies in the future, given existing information and skills are already present. Similarly, firms more exposed to clean innovation are more likely to direct their research energies to clean innovation in the future due to a directed knowledge spillover effect. Such path dependency coupled with the environmental externality (where the loss in aggregate productivity or consumer utility induced by environmental degradation is not factored in) will induce the economy to innovate in dirty technologies more than what is deemed as socially optimum. Thus, this situation will require government intervention (policy) to “redirect” technical change. Additionally, they claim that the cost will increase in the case of any delay in intervention and the economy will face environmental disaster if there is no intervention.

Along with these theoretical arguments, there are some empirical findings regarding the impact of climate policy uncertainties and innovation. The authors of [

42] find that a change in the stringency index of climate policies induces an increase in new patents, driving innovation in low-carbon technologies. In addition, [

43] shows that policy uncertainties negatively impact innovation, particularly in innovation-intensive industries.

Based on our inquiries of this line of literature on climate policies and innovation, we understand that various studies argue for government interventions, namely for the climate policies in our setting, to redirect technical change from dirty to clean technologies. According to these studies, the lack of proper climate policies or the existence of climate policy uncertainties is expected to discourage innovation in clean technologies.

A thorough review of these three lines of literature reveals that climate change is still untapped territory. Our research will be a contribution to the climate literature, which is still evolving. Specifically, it contributes to prior versions of the literature with a comparison of emerging and developed countries and an investigation of an additional variable, the CPU.

2.4. Research Questions and Hypotheses

An examination of the above literature helped determine research questions and set the hypotheses of our study. Our research aims to test the EKC hypothesis, while also exploring the interrelation between climate change and policy uncertainties (EPU and CPU) in an attempt to find evidence from emerging and developed economies. The research will focus on answering the three questions below:

1. Does the EKC hypothesis work for emerging and developed countries?

We tested the EKC hypothesis for two country groups to explore whether or not an inverted-U shape relationship between real GDP per capita and climate change exists.

2. What kind of impact do policy uncertainties have on climate change (environmental degradation)?

The interrelation between climate change and policy uncertainties is explored. Policy uncertainty is proxied by a country-specific Economic Policy Uncertainty (EPU) Index in one set of panel regressions, and a Climate Policy Uncertainty (CPU) Index in another set of regressions, for a subset of countries. Climate change (environmental degradation) is proxied by CO2 emission levels.

3. Is there a difference between emerging and developed countries in terms of the interaction between policy uncertainties and climate change (environmental degradation)?

Emerging and developed countries differ by their policy uncertainty levels, proxied by EPU and CPU, and this study differentiates between these two country groups. Based on these three research questions specified, our study bases its discussion on the ex-ante hypotheses of [

32] that propose two channels that relate EPU with environmental degradation: consumption (mitigating) effect and investment (escalating) effect.

Investment (Escalating) Effect: EPU/CPU impedes the investment in renewable energy, diminishes environmentally related R&D and discourages innovation in clean (climate-friendly) technologies, which ultimately escalates environmental degradation.

Consumption (Mitigating) Effect: EPU/CPU mitigates the use of energy and pollution-intensive commodities, meaning that the economic activity and growth will be negatively affected. As a result, environmental degradation will be mitigated.

4. Estimation Results and Discussion

In order to determine the appropriate estimator, some assumption checks are employed. Since there is cross-sectional dependence and cointegration between variables and determining that slope coefficients are heterogeneous, a panel ARDL estimator is applied.

4.1. Cross-Sectional Dependence Test

Cross-sectional dependence in the data was tested with Breusch–Pagan LM, Peseran Scaled LM and Peseran CD tests. Since the probability value shows a 5% level of significance in all individual variables, confirmed by all three tests, the null hypothesis of no cross-sectional dependence is rejected. Thus, we report that there is cross-sectional dependence in all series. Furthermore, after estimating a simple ordinary panel regression with EPU and with CPU separately, we also confirm that residuals are cross-sectionally correlated. We report results utilizing the E-views 12 software package. We mostly rely on Peseran’s CD test as it is more robust to small samples (

Table 2).

4.2. Slope Homogeneity Test

The slope homogeneity test of [

49] is called the delta test, and its adjusted version reveals that the slope coefficients of all individual variables as well as the overall model are heterogeneous. We report results utilizing the Stata 16 software package (

Table 3).

4.3. Unit Root Tests

Under the existence of cross-sectional dependence, we apply cross-sectionally augmented Im, Pesaran and Shin (IPS) tests for unit roots in panel models [

50] to test for stationarity. CIPS test statistics are the sample averages of the individual cross-sectionally augmented ADF (CADF) statistics. The results of the CIPS tests for the panel are presented in

Table 4a,b, utilizing E-views 12 software. The CIPS test results indicate that the only variable that is stationary in the level is the log_REN in Model 1, while other variables are integrated order 1, except the population variable, which is integrated order 2 in both models. While running the model, we used adequately differenced versions of variables, based on the results of the unit root test.

4.4. Cointegration Tests

Although all three tests, namely the test of [

51], the tests of [

52,

53,

54], and the test of [

55], reveal cointegration in Model 1, the evidence for cointegration is mixed for Model 2. Based on our cointegration tests by Stata 16, the test of [

51] finds no cointegration in Model 2, while the tests of [

52,

53,

54] conclude the existence of cointegration. The test of [

55] also finds that some panels are cointegrated in Model 2. The panel ARDL model can also be applied in the case of no clear cointegration; thus, we also applied panel ARDL to Model 2 (

Table 5).

4.5. PMG Estimation Results

To estimate the coefficients in Model 1 with EPU and in Model 2 with CPU, we applied the pooled mean group estimator of [

48]. The PMG estimation results are reported in

Table 6a,b for emerging and developed countries. We utilized Stata 16 to obtain the estimation results. The test results indicate that the EKC hypothesis is verified only in Model 1 and for emerging countries in the long term. However, it should be kept in mind that Model 1 is superior to Model 2, as it has more cross-sectional items than Model 2 due to the limited availability of country-based data for the CPU variable in Model 2. This means that for emerging countries, CO

2 emissions increase at the first stages of economic growth due to fossil-based consumption. In other words, a rise in the level of economic activity is associated with an upsurge in the climate change problem. However, after a certain point, CO

2 emissions decrease due to the adoption of clean technologies, policies and clean energy demand, thanks to the improvements in the affluence of countries.

In Model 1 with EPU, the population escalates climate change in both country groups in the long term, which is in line with the definition of climate change set by the United Nations that addresses human activities as the main cause of the climate change problem since the 1800s. Furthermore, EPU is negatively related to climate change in emerging countries in the long term, confirming the consumption effect theorized earlier in the literature. Based on the consumption effect, the EPU decreases the use of energy and pollution-intensive commodities, ultimately mitigating climate change. The negative relationship between EPU and CO2 emissions might be attributed to the potential impact of economic policy uncertainties on the level of economic activity. It means that when uncertainties increase, economic agents might subsequently decrease overall economic activity, and lower levels of production leads to a decline in CO2 emissions. It might also be attributed to the future expectations regarding the economic policy uncertainties in these countries and the impact of those on the current economic activity. On the other hand, in developed countries, EPU is not significantly associated with climate change. This might be attributed to the possibility that developed countries are mature or economically developed enough to avoid implications of economic policy uncertainties on determining their economic activities. This shows that uncertainty is not affecting these countries’ development policies or decisions on economic activities, ultimately having no effect on climate change. Finally, consistent with our ex-ante expectations, renewable energy consumption reduces CO2 emissions and alleviates climate change to a large extent in both country groups in the short term.

In Model 2, with CPU, we find no evidence supporting the EKC hypothesis for any country groups. The signs of the coefficients of real GDP per capita and squared real GDP per capita variables are positive and negative, respectively, as expected by the EKC hypothesis. However, they appear to be insignificant based on a 5% significance level. Thus, we are not able to confirm the EKC hypothesis for Model 2. However, this might be resulting from the utilization of fewer cross-sectional items (countries) in Model 2. In addition, similar to Model 1, the sign of the coefficient of renewable energy consumption variable appears as significantly negative for developed countries both in the short term and long term. This finding points out the importance of energy policies that have the target of reducing energy-related emissions in an attempt to address climate change. Developed countries are better than emerging ones, in terms of utilization of clean energy sources. Finally, the most striking finding is that CPU alleviates the climate change problem for EMEs, suggesting that the consumption hypothesis is at play again. CPU is negatively related to CO2 emissions only in the short term, contrarily to EPU, which is negatively related to climate change in the long term. This might be attributed to the possibility that economic policy uncertainties mostly stem from economic shocks and are considered a primary concern for the longer-term economic activity in emerging countries, while the topic of climate policy uncertainties might be considered a fairly new subject area and a secondary concern for decisions. However, at this point, the limitations regarding the availability of CPU data for EMEs should be borne in mind. Our CPU data include only two emerging countries.

5. Conclusions

Since the turn of the 21

st century, the world has experienced many episodes of high economic policy uncertainty. Recent events such as the financial crisis, oil price shocks or fluctuations, Brexit, the US–China trade war, the COVID-19 pandemic, the Russia–Ukraine conflict and the subsequent energy crisis have surged global economic policy uncertainty. While economic policy uncertainty is well known in the literature and tested many times for varying empirical settings, climate policy uncertainty is a fairly new subject area. This is mostly attributable to the fact that jurisdictions around the globe are only just devising their climate policies and there was no indicator that measures climate policy uncertainty until the authors of [

5] constructed the CPU index.

The purpose of our study is to test the EKC hypothesis while also investigating the interrelation of EPU or CPU with climate change for emerging and developed countries.

Climate change is proxied by the level of CO2 emissions in a country. In order to determine the relationship between selected indicators, we employ a PMG estimator. The first set of panel regressions includes EPU (Model 1), whereas the second set includes the CPU (Model 2). The estimations reveal different results for the two country groups, showing that one size does not fit all in terms of potential policy recommendations.

This study found that the EKC hypothesis is verified only in Model 1 and for emerging countries. An increase in the level of economic activities will generate more carbon dioxide emissions due to fossil-based energy consumption, at least at the initial stages of economic growth. Verifying the EKC hypothesis for emerging countries, we might argue that there is good potential for emerging countries to save money and time on environmental costs via the adoption of clean technologies and related policies. From the viewpoint of emerging countries, they have started their economic development process later than developed ones, and will definitely need higher levels of energy to continue their economic development. Therefore, climate policies need to go hand-in-hand with other objectives such as economic development and energy security. The policies related to sustainable economic growth would be critical in the upcoming future in helping alleviate the climate change problem, while also addressing development concerns of jurisdictions, specifically the EMEs.

The estimation results further indicate that EPU and CPU are negatively related to climate change in emerging countries, confirming the consumption effect theorized earlier in the literature. Based on the consumption effect, the EPU or CPU decreases the use of energy and pollution-intensive commodities, ultimately mitigating climate change. It might be pointed out that policies should be clear and publicly announced to avoid information asymmetries.

Consistent with our ex-ante expectations, an increase in the share of renewable energy in consumption reduces CO2 emissions and alleviates climate change to a large extent in both country groups in the short term. Thus, we might argue that energy transition holds the key to tackling climate change on a global scale.

Energy transition refers to the shift from fossil-based systems of energy production and consumption—including oil, natural gas and coal—to renewable energy sources like wind, solar, geothermal, hydro and biomass. Jurisdictions should further promote renewable energy utilization, by enhancing vehicles such as subsidies, feed-in-tariffs, tax exemptions, direct tax credits, etc. for renewable energy. They can also allocate part of the public revenues gained through national emission trading systems (ETS) to investments in renewable energy and energy efficiency. Government support for energy storage solutions will also be critical for achieving uninterrupted renewable energy targets, ultimately helping improve energy security and affordability.

In addition, the commitment by developed countries to jointly mobilize USD 100 billion in climate finance per year to developing countries in support of climate action is central to achieving the targets. However, there is room for improvement in the ambition of targets, disclosing clear transition plans and timelines for meeting targets, both from public and private stakeholders.

Given the inadequacy of public sector resources, the scale and speed of the private sector’s engagement in climate solutions should be improved. To attract private sector capital to climate investments, the risks and uncertainties borne by private investors should be mitigated. This can be achieved either by designing new innovative financial instruments or utilizing those that already exist. Blended finance, structured finance or risk-sharing applications as well as derisking instruments and guarantee mechanisms are just a few to address this need. Recently, new initiatives like the Private Sector Investment Lab by the World Bank Group or the Global Innovation Lab for Climate Finance by the U.N. have also been designed to drive more private investment. However, the role of multilateral development banks (MDBs) might be better leveraged in catalyzing private climate finance, particularly in emerging countries. First, MDBs might blend international climate and public development finance with their own resources to scale up climate finance. Second, they can develop pipelines of projects and technologies and increase the supply of bankable projects. Third, they can influence policies in an attempt to shape policy frameworks to attract green private investment. Last but not least, they might play a critical role in the capacity building of emerging countries via technical assistance.

Furthermore, the role of innovation and technology in green transition cannot be ignored. Based on OECD Green Growth indicators, an environmentally related government R&D budget, as a percentage of total government R&D, and a renewable energy public R&D budget, as a percentage of total energy public R&D, do not seem promising in many countries despite recent improvements. When country groups are compared with each other, there seems a huge gap in the renewable energy public R&D budget, as a percentage of total energy public R&D indicators, in favor of developed countries. This is most likely because of the fact that developed countries have more fiscal space to support renewable energy and more inclination to innovations in general. These arguments are supported by the estimation results of our study as well. A list of these indicators is reported in

Appendix C for emerging (

Table A1) and developed (

Table A2) country groups.

Finally, our study has a few limitations. Due to the unavailability of CPU data for all countries and the need to find the intersection of countries whose EPU and CPU data are simultaneously available, the sample size is small for the second set of panel regressions. The sample size problem is more pronounced with respect to emerging countries. Our research tries to find the interrelation between the variables rather than finding the drivers of climate change. Thus, we believe that we are not subject to omitted variables bias.

There is room for further improvement in the future research. This study might be replicated such that it includes more countries in the analysis, specifically in the application of the CPU model. On the condition that an adequate sample size is attained, the inclusion of additional variables to the model might also enhance the discussions. Furthermore, the test of the EKC hypothesis might be conducted for different country groups, such as high-income OECD, high-income non-OECD, BRICS or G7 countries. Finally, rather than using a panel of countries, this study might be replicated for individual countries, utilizing higher frequency data as well as additional indicators, such as manufacturing investment data for specific countries.