Abstract

This study examines the dynamics of owner behavior, agency costs, and M&A outcomes in the Korean market, aiming to explore how ownership concentration influences conflicts among principal groups and impacts M&A performance. Using empirical data from Korean M&A transactions, we analyze the effects of ownership concentration and cash payment preferences on firm value. Our findings indicate that while ownership concentration can reduce owner–manager conflicts, it heightens principal–principal conflicts, especially with moderate ownership, weak governance, or financial distress. Control-focused owners prefer cash payments, which can lower acquiring firm announcement returns under high ownership concentrations. Effective governance is crucial for fostering responsible decision-making and sustainable practices in M&As. This research underscores the importance of balanced ownership structures and robust governance mechanisms in mitigating agency conflicts and promoting sustainable M&A performance.

1. Introduction

This study investigates the relationship between ownership concentration and corporate value, focusing on the dual role of agency conflicts in merger and acquisition (M&A) data. Principal–agent (PA) conflicts arise when managers (agents) prioritize their interests over those of shareholders (principals), potentially leading to inefficient management practices. Conversely, principal–principal (PP) conflicts occur when major shareholders use their control to extract private benefits at the expense of minority shareholders. While the literature [1,2,3] suggests that concentrated ownership can mitigate PA conflicts, it may exacerbate PP conflicts. As ownership concentration increases, the largest shareholder is also likely to gain private benefits through control, even if it dilutes minority shareholder wealth [2,4]. Both types of conflict are known to influence various firm aspects, including capital structure [5,6], financing decisions [7], and M&A outcomes [8].

This study aims to address the research gap regarding the simultaneous effects of PA and PP conflicts on M&A performance, examining the behavior of owners contributing to PP conflicts, particularly in conditions where such behavior is likely.

Firms in emerging markets typically have weak governance [8] and high ownership concentrations [9]; consequently, controlling shareholders often actually control corporate management [10]. By prioritizing their own control or seeking personal gains, dominant shareholders can trigger conflicts of interest with other general shareholders (PP conflicts) and potentially adversely affect the company’s management performance.

Family members or controlling shareholders, who often serve as principals in PA and PP conflicts, prioritize maintaining control over their firms [1,3]. Mergers and acquisitions, especially those that involve stock payments, can alter a firm’s ownership structure. Thus, the payment method in an M&A transaction becomes more than just an investment decision; it is also a control decision for the owners. Focusing on this dimension, this study explores the relationship between M&A payment methods and owners’ control-retention motives.

A decision by an owner with moderate ownership to opt for cash-only payments in an M&A is likely driven by control concerns, which could increase PP conflicts. The market tends to react negatively to M&A announcements, particularly if control-driven decisions result in higher agency costs. This study argues that choosing cash-only M&A payments is often less about enhancing corporate value and more about satisfying owners’ control preferences. A preference for control can be detrimental to firms that face financial constraints or cash flow issues. Karampatsas et al. [11] and Yang et al. [12] support this view by showing that firms with fewer financial constraints are more likely to opt for cash payments in M&A transactions. Interestingly, this study finds that higher ownership concentration positively impacts announcement returns for firms whose internal control mechanisms are not weak and the owner’s stake is not moderate. This finding suggests that concentrated ownership in such situations may reduce agency costs through effective managerial oversight.

This empirical analysis utilizes data on M&As in the Korean market between 2001 and 2017. South Korea was considered an emerging market from the early 2000s to the 2010s and was deemed to have among the most advanced economic and capital market development in that period. During this time, the average ownership concentration among listed companies was quite high at 37%, with major shareholders having significant corporate control. Consequently, research on governance structures [13,14,15,16,17] has been vigorous in Korea. Han and Shin [17] provide evidence that variables related to corporate governance (major shareholder and foreign ownership percentages) have a positive (+) relationship with M&A performance (using cumulative abnormal returns (CARs)) in listed Korean companies. Moreover, the major shareholder percentage is a critical explanatory variable in M&A decision-making in Korea; thus, listed Korean companies are a suitable sample for exploring and empirically analyzing agency problems between controlling and general shareholders. Further, the study is an initial study on the joint effect of major shareholder percentages and cash payments on M&A performance and finds significant empirical results. These conditions make the Korean market fertile ground for attempts to understand how agency problems affect M&A decisions.

This study contributes to the literature by offering insights into the nuanced effects of ownership concentration on M&A performance. It provides stakeholders with the tools required to determine whether an owner’s involvement is aimed at enhancing corporate value or safeguarding personal control. Its empirical focus on owner behavior in choosing M&A payment methods deepens our understanding of how different ownership levels and concerns about corporate control can influence M&A decisions.

The remainder of this paper is organized as follows. Section 2 reviews the literature, and Section 3 presents our hypotheses. Section 4 and Section 5 describe the study’s empirical methodology and our sample data. Section 6 presents the results of the empirical analysis, while Section 7 verifies the robustness of our results. Finally, Section 8 presents the study conclusions.

2. Literature Review

2.1. Agency Problems and Ownership Concentration

Jensen and Meckling [5] note that increased ownership concentration incentivizes large shareholders to monitor managerial activities. However, concentration also enables majority shareholders to obtain private benefits at the expense of minority shareholders [2,4]. Corporate control incentives are significant factors and influence key executives or major shareholders’ decision-making behaviors [18]. For example, a major shareholder who highly values control might ignore a good investment opportunity if they realize it could alter the company’s governance structure. While concentrated ownership can mitigate principal–agent (PA) conflicts [19], it exacerbates principal–principal (PP) conflicts [1,3]. Consequently, the net effect on shareholder value remains unclear. Studies also suggest a nonlinear relationship may exist between ownership and agency costs [20], underscoring the need to explore large shareholder behaviors that exacerbate agency costs.

2.2. Ownership and Payment Preferences in M&A Transactions

M&As require larger capital investments compared to other investment opportunities. Moreover, they can significantly influence the control structure of large shareholders; this is especially true when stock is used as payment, a method that directly changes a firm’s ownership structure. Consequently, in M&As, the largest shareholders have a greater incentive to monitor management or participate actively in decision-making. Ownership structures play a crucial role in M&A decision-making processes [21]. Controlling shareholders often resist stock payments because of the potential dilution of their control [1,18]. They typically prefer cash payments, not to enhance corporate value, but to preserve their control. This behavior can significantly increase the agency costs associated with PP conflicts.

2.3. Corporate Control Mechanisms and Owner Behavior

Agency problems can be alleviated through various corporate control mechanisms, such as the presence of outside directors or foreign investors [15,22,23]. Centralized ownership is prevalent in Korea, making such mechanisms essential for minimizing agency conflicts between controlling and minority shareholders [23,24]. Agency costs are likely mitigated when alternative corporate control mechanisms are active.

2.4. Cash Payments and Financial Constraints

Financially constrained firms must carefully weigh their options when considering cash-only M&A payments [25]. Such firms face a trade-off between preserving control and risking financial distress [26]. Firms with easier access to financial markets have greater flexibility when choosing payment methods and are less likely to resort to cash-only transactions [11,12]. Therefore, cash-only payments are generally not advisable for firms facing financial constraints, particularly if owners seek to maintain control at the expense of corporate value.

This literature review breaks down the complex relationships among ownership concentration, agency problems, and M&A outcomes to lay the foundation for a more nuanced understanding of these dynamics.

3. Hypotheses

Traditional agency theory suggests a negative relationship between agency costs and ownership concentration [5]; however, this relationship is complicated by the presence of principal–principal (PP) conflicts. This study focuses on owner behavior, given the ambiguous results regarding how ownership concentration affects M&A outcomes. Owners motivated by control are more likely to opt for cash M&A payments, increasing the likelihood of PP conflicts. This leads to the following hypotheses:

Hypothesis 1.

In cash-based mergers, ownership concentration negatively impacts merger performance due to PP conflicts. Specifically, PP conflicts intensify at moderate levels of ownership concentration, particularly when adequate control mechanisms to monitor major shareholders’ actions are lacking.

At intermediate ownership levels, major shareholders possess sufficient power to influence company decisions but lack the absolute control to dictate outcomes unilaterally. This partial control can lead to conflicts with minority shareholders, who may oppose the decisions favoring the major shareholders’ interests. These conflicts are particularly exacerbated in the absence of robust governance structures, as there are fewer mechanisms to mediate disputes and ensure that decisions align with the broader shareholder interests. Consequently, this tension can negatively impact corporate performance, as conflicting interests lead to inefficient decision-making and potential value erosion.

Hypothesis 2.

In cash-based mergers, PP conflicts arising from major shareholder ownership are significantly exacerbated when the company faces financial challenges.

In financially distressed firms, cash M&A payments intensify PP conflicts, as major shareholders may prioritize control over financial prudence, further deteriorating the firm’s financial health instead of mitigating principal–agent conflicts [11,18]. The hypotheses focus on the nuanced effects of ownership concentration and financial distress on M&A outcomes, emphasizing the need for balanced ownership structures and effective governance mechanisms to manage PP conflicts and support corporate value.

4. Methodology

We use the sum of the ownership of the largest shareholder and their special relations (Large_share) as a proxy for ownership concentration. We create a dummy variable, Cashonly, which equals one if the bidders pay only cash in M&A transactions and zero otherwise. Hypothesis 1 predicts a negative relationship between bidders’ CARs (cumulative abnormal returns), which measure the total impact of an event on a company’s stock price by summing the differences between expected and actual stock returns over a specific period, and ownership concentration when bidders choose cash-only M&A payments. Therefore, Model (1) is constructed to examine the joint effect of ownership level and cash-only payments:

In Model (1), we anticipate that the coefficient of the interaction term will be negative and statistically significant. However, the impact of ownership level on M&A outcomes remains ambiguous due to its influence on various agency problems [4,9]. Consequently, when the interaction term is excluded from Model (1), the ownership level effect is not statistically significant. We propose that owners who prefer cash payments are likely to exacerbate PP conflicts due to their focus on control rather than enhancing corporate value. To explore Hypothesis 1, we investigate how equity ownership concentration influences PP conflict from four different angles.

First, we examine the link between owners’ cash preference behaviors and their ownership levels. Behaviors vary with ownership levels, becoming more pronounced at intermediate levels [1]. Faccio and Masulis [18] identify ownership ranging from 20 to 60% as intermediate and observe that firms within this range tend to prefer cash financing. They argue that controlling shareholders within this range of ownership have heightened control concerns. Consequently, the coefficient of the interaction variable in Model (1) is negative and statistically significant for ownership concentrations between 20 and 60%.

Second, we analyze the relationship between the agency costs incurred by controlling shareholders and the presence of other corporate control mechanisms. If the results of Model (1) stem from agency costs incurred by controlling shareholders, ownership concentration impacts diminish or vanish in the presence of active corporate control mechanisms. External directors serve to monitor the actions of a company’s largest shareholders, who also act as managers. In the Korean market, a high proportion of external directors on a board is considered an effective control mechanism [15,22,23,27]. Thus, we assess the external director ratio (=number of external directors/total number of directors) and hypothesize that the effects of the interaction between ownership concentration and cash-only payments in Model (1) are negative and statistically significant when the ratio of external directors is low.

Third, foreign shareholders or investors play crucial governance roles by monitoring the actions of the largest shareholders [28]. In the Korean stock market, foreign investors, primarily institutional, are considered effective monitors who help reduce agency costs [15,22,23,27,29]. However, we find no evidence that variations in the foreign equity ratio influence Korean M&A decisions. Bhaumik and Selarka [9] observe improved M&A outcomes in India for bidders with foreign stakes exceeding 26%. To maintain consistency with prior research, we use 26% as the cutoff for foreign equity. We find no evidence that variations in the foreign equity ratio influence Korean M&A decisions. Although cutoffs like 10%, 15%, and 30% yield similar results, we follow Bhaumik and Selarka [9], who observe improved M&A outcomes in India for bidders with foreign stakes exceeding 26%. Therefore, to ensure consistency and credibility with prior research, we adopt 26% as the cutoff for foreign equity. For our critical analysis on ownership levels, we explore ranges such as 10% to 60%, 15% to 60%, and 20% to 60%. When owners with cash payment preferences and minimal foreign shareholdings are involved, their ownership concentration is more likely to intensify PP conflicts than reduce PA conflicts. Thus, in Model (1), we predict a negative joint effect of ownership concentration and cash-only payments for bidders with low foreign ownership. When owners with cash payment preferences and minimal foreign shareholdings are involved, their ownership concentration is more likely to intensify PP conflicts than diminish PA conflicts. Thus, in Model (1), we predict a negative joint effect of ownership concentration and cash-only payments for bidders with low foreign ownership.

Fourth, competitive threats in the product market can mitigate agency problems [26,30,31]. Giroud and Mueller [26] suggest that corporate governance’s influence on firm value varies with the level of market competition. They find that firms with poor governance are more likely to engage in value-decreasing acquisitions in noncompetitive product markets. Lee and Byun [16,32] suggest that competitive threats in Korea’s product market can substitute for internal corporate governance mechanisms. We calculate the Herfindahl–Hirschman index (HHI) annually for private Korean firms with external audits and listed Korean firms, classifying industries according to the two-digit Korean Standard Industrial Classification (KSIC). For robustness, we employ the four-firm concentration ratio (CR4 index), summing the market shares of the four largest firms in the same industry. Firms are deemed not facing a competitive threat if their HHI (or CR4) exceeds each year’s median. We anticipate the interaction variable in Model (1) will have a significantly negative effect for firms facing fewer competitive threats.

In summary, we suggest that the effect of the interaction variable between ownership concentration and cash-only payments is the result of controlling shareholders’ agency costs. If this is supported, the impact should be strong in all four subsamples: (1) 20–60% ownership concentration, (2) low outside director ratios, (3) less than 26% foreign ownership, and (4) low product market competitive threats.

In Hypothesis 2, we address how firm financial constraints impact their ability to employ cash M&A payments, noting that financially constrained firms struggle with cash payments [11] and weigh cash payment decisions more carefully due to the trade-off between control incentives and financial distress costs [18]. Consequently, opting for cash-only payments likely imposes a burden on financially constrained firms. We predict that the interaction variable will have a pronounced negative effect in Model (1) for firms with financial constraints. We employ two measures to assess financial constraints. First, we calculate the Kaplan–Zingales (KZ) index as per Lamont et al. [33], acknowledging its widespread use in the literature. However, the KZ index has limited relevance for Korean firms because it is based on US firms [34]. Lee and Kim [34] introduce an index tailored to the Korean market, drawing on Almeida et al.’s [35] demonstration that financially constrained firms are positive and significantly sensitive to the ratio of cash flow to cash holdings. This index includes the firm’s R&D growth rate, cash and cash equivalents ratio, and sales growth rate, as these indicators are extremely sensitive to cash flow ratios. Firms are scored from three points (upper 30%) to one point (lower 30%) based on these criteria, with the average score serving as a financial constraint index. Following Lee and Kim [34], we differentiate between the lower 30% (financially constrained firms) and higher 30% (financially unconstrained firms).

Moreover, we evaluate the debt capacity of bidders and consider firms with greater debt capacity as more capable of making cash payments [18]. Debt capacity is measured two ways: first, through a collateral variable (=property, plant, and equipment (PPE)/book value of total assets), as proposed by Faccio and Masulis [18]. This is based on the premise that firms with higher proportions of tangible assets can more readily secure debt financing. Firms below the collateral variable’s median value each year are deemed to have low debt capacity. Additionally, we use corporate bond ratings to assess firms’ access to public debt markets, acknowledging that rated firms have access to public debt markets [11,36]. Faulkender and Petersen [37] observe that firms with access to public debt markets exhibit higher capital structures than those without such access. Therefore, cash-only M&A payments are challenging for firms that are unable to secure cash through debt.

Thus, we anticipate that the combined effects of ownership concentration and cash-only M&A payments in Model (1) are negative and statistically significant for bidders that face financial constraints or have limited ability to make cash payments. This suggests that owners balance their control incentives against financial distress costs, a decision that heightens agency costs as ownership concentration increases.

5. Data and Variables

5.1. Data

Our sample encompasses domestic Korean M&A transactions that took place from 2001 to 2017. We merge two databases to assemble our sample dataset, incorporating firms and their M&A activities. Financial and accounting data are sourced from TS2000, while M&A deal data are obtained from the Thomson Reuters Securities Data Corporation M&A database (Refinitiv’s SDC Platinum). We exclude firms without audited financial reports and those operating in the financial and insurance sectors (KSIC 64–66).

The inclusion criteria for M&A deals in this study are designed to ensure relevance and robustness. Bidders must be public companies to ensure the availability of comprehensive financial and governance data. Transactions must have been successfully completed to study the actual impact of M&A deals. The deal announcement dates must fall between 1 January 2001 and 31 December 2017 to provide a contemporary analysis. To exclude excessively small transactions and ensure significant corporate impact, deals must report transaction values exceeding USD 1 million. Acquirers must increase their ownership from less than 10% before the deal to more than 40% afterward to capture deals that significantly alter corporate control, excluding minor stake increases (e.g., a 5% acquisition is not substantial, especially if the acquirer already holds 30%). Bidders must have access to essential financial and accounting data and must not be experiencing capital impairment to allow for robust empirical analysis while controlling for firm characteristics. Additionally, the bidding and target firms must not belong to the same conglomerate to avoid conflicts of interest and ensure independent M&A activities are analyzed. For cases where both the bidder and target are publicly traded, they must not share the same major shareholders or institutional investors. Bidders must have over 130 price observations during the estimation period (−208, −9) before the announcement date for calculating CAR. The firms that meet these criteria result in an M&A dataset that comprises 842 observations.

5.2. Measuring Ownership Concentration

We utilize the common equity shares held by the largest shareholder and their special relations, such as family members, as a measure of ownership concentration. Additionally, we consider the sum of the common equity held by blockholders who have at least a 5% stake, excluding the largest shareholder and their special relations, as a control variable. Table 1 displays the statistics on the ownership structures of Korean listed firms from 2000 to 2017.

Table 1.

Statistics on ownership concentration.

Table 1 reveals that, between 2000 and 2017, on average, the ownership held by the largest shareholder (Largest_share) is 26.35% and that held by large shareholders (Large_share) is 39.09%. Each variable has minimal variance between the mean and median values for any given year, suggesting that ownership concentration in Korean firms remained stable throughout the 2000s. A comparison of data from the early 2000s with that utilized in this study indicates that, despite an almost 70% increase in the number of listed firms, the ownership concentration level has consistently been around 40% for controlling shareholder ownership. The “Large_share” variable, which includes the shares held by the largest shareholder’s family, serves as a proxy for ownership concentration.

5.3. Control Variables

This study incorporates control variables consistent with the literature on CARs around M&A announcements, including the public status of firms, relative transaction value, and acquirer’s book size [36,38]. However, data on the number of bidders, which would indicate the levels of bidding competition [38,39] and takeover defense [39], are not available. Thus, we assume a single bidder for each M&A transaction, and no defense strategies, such as poison pills or defensive recapitalizations, are considered. The study includes a dummy variable for tender offers, reflecting the associated agency costs [38]; in our sample, only one M&A transaction had a tender offer.

Additionally, financial and accounting variables complement the control variables. Lee et al. [40] demonstrate that the sales growth rate has a significantly positive effect on investment activity in the Korean market, while leverage has a significantly negative impact. To et al. [41] use firm size, leverage, and book-to-market ratios as control variables to analyze corporate investment decisions. We incorporate a firm price–cost margin (PCM) variable [39], indicative of a firm’s product usage scarcity, and the fixed assets ratio. Dang et al. [42] indicate that empirical results in corporate finance research may vary based on how firm size is measured. Therefore, we use three firm size measurements—assets, market capitalization, and sales—and our findings remain consistent across these measurements. In the results presented, firm size is measured using market capitalization.

This study also accounts for external blockholders’ influence. Edmans [43] identifies blockholders as effective monitors of management; their motivation increases as their shares become more concentrated [5]. Several studies on foreign investments in the Korean market argue that greater foreign blockholdings result in fewer agency problems in monitoring management [15,22,23,27,29]. Consequently, foreign holdings are used as an additional control variable.

5.4. Descriptive Statistics and Univariate Comparisons

Table 2 presents the summary statistics for the M&A transactions in our dataset. Out of the full sample, 555 observations exhibit controlling shareholder ownership concentrations ranging from 20% to 60%, accounting for 69.1% of the whole dataset. Only 40.9% of the dataset involves cash transactions. Table 2 suggests that, compared to other data types, cash-only payments tend to result in faster completion of M&A transactions. Compared to other firms, those with ownership concentrations between 20% and 60% experience more time between their M&A announcement and completion. Another observation is that cash-only transactions generally have lower transaction values than other transaction types. This suggests that larger transactions often include stock financing, as cash-only payments may strain firms. In our M&A dataset, bidders initially hold an average stake of 0.16% in their target firms, which increases to an average of 82.4% post-M&A, signifying a significant transfer of control of the target companies.

Table 2.

Descriptive statistics of M&A transactions.

Table 3 displays summary statistics for the sample firms’ financial and accounting variables. The mean and median of the PCM have opposite signs; other control variables also exhibit significant differences between their mean and median values. To mitigate the impact of outliers, we winsorize the financial ratio variables (Leverage, B/M ratio, PCM, Fixed_ratio, and Sales_growth) at the top and bottom 1%. Testing our hypotheses with both winsorized and raw un-winsorized data yields similar results, although the adjusted r-squared value is lower due to the influence of extreme values. Appendix A provides the definitions of these variables.

Table 3.

Descriptive statistics of financial and accounting data.

This study proposes that ownership concentration and agency problems affect firm value through the payment methods used in M&As. We employ both the market (CARm) and adjusted market (CARad) models to calculate acquiring firms’ abnormal returns. While many studies in the US market have used market models [36,38,39], the market-adjusted model is deemed more suitable for M&A scenarios when firms may engage in multiple M&As during the estimation period [44]. Han and Shin [17], Kim and Jung [45], and Kim and Kim [46] apply these models to the Korean market; moreover, our findings are consistent regardless of the model used.

Table 4 reports the descriptive statistics of the CARs. The average CAR(−5,1)ad, CAR(−5,3)ad, CAR(−5,5)ad, CAR(−5,1)m, CAR(−5,3)m, and CAR(−5,5)m are 0.0468, 0.0374, 0.0325, 0.566, 0.0513, and 0.0488, respectively, and all are statistically significant at the 1% level. This aligns with recent Korean evidence suggesting the market responds favorably to bidders’ M&A announcements [17,45,46]. Notably, the bidders’ CARs vary widely, with a difference between the maximum and minimum CARs of approximately 2. Daily stock returns are significant, often exceeding 10% or dropping a similar amount around M&A announcements, primarily on the announcement day. To accurately capture the stock price movements due to M&A announcements, we utilize CAR(−5,3) and CAR(−5,5); the results remain consistent regardless of the dependent variable used. The results reported are based on CAR(−5,3)ad.

Table 4.

Descriptive statistics of CARs.

Table 5 shows the CARs for the subsample based on ownership level and M&A payment method. CAR(−5,3) for the full M&A sample is positive and statistically significant at the 1% level, irrespective of ownership concentration. CAR(−5,3) for M&As with cash-only payments is positive but only statistically significant when the ownership level is below 20%. Conversely, CAR(−5,3) for M&As that involve non-cash-only payments is positive and statistically significant. The difference in CAR(−5,3) between the non-cash-only and cash-only samples is positive and statistically significant when ownership concentration is between 20% and 60%. This suggests that the largest shareholders who opt for cash-only payments may exacerbate PP conflicts and have a negative effect on corporate value.

Table 5.

CARs by ownership level and payment method.

6. Empirical Results

6.1. Results for Hypothesis 1

Table 6 presents the results of the regression analysis examining how ownership concentration impacts bidders’ CARs and focusing on cash-only payments, using CAR(−5,3) as the dependent variable. Column (1) reveals that the coefficient of ownership concentration (Owner_share) is 0.0003, which lacks statistical significance, suggesting how ownership concentration affects bidders’ CARs is uncertain. This finding aligns with Bhaumik and Selarka [9], who argue that due to agency conflicts between large and minority shareholders, ownership concentration may not necessarily enhance M&A outcomes. Using a Korean sample, Han and Shin [17] conduct an empirical analysis of variables related to corporate governance (major shareholder and foreign shareholder shares) and M&A performance (CAR). They find that for listed Korean companies, firms with higher shares of major or foreign shareholders had higher CARs for acquiring firms. In our analysis, while the relationship between major shareholder share and CAR was positive, it was not statistically significant; however, the foreign shareholder share had statistically significant positive effects in nearly all models.

Table 6.

PP conflict effects of ownership concentration on short-term M&A performance.

In Column (2), our Model (1) explores the combined effect of ownership level and cash-only payments. Here, the coefficient of the interaction between ownership concentration and cash-only payments (Owner_share × Cashonly) is −0.0017 and statistically significant at the 5% level. This supports the theory of a negative relationship between ownership concentration and announcement returns for bidders that opt for cash-only payments.

Columns (3) to (8) further analyze the regression results across different ownership concentration intervals. Owners who prioritize control tend to choose cash payments to satisfy their control incentives, especially at intermediate ownership levels like the 20–60% range observed in India [18]. Column (3) focuses on the 20–60% ownership level subsample where the coefficient of the interaction variable (Owner_share × Cash only) is −0.0028, which is significant at the 5% level and higher than the full sample result. Columns (4) and (5) analyze the subsamples with 10–60% and 15–60% as intermediate ownership levels; the interaction coefficients are −0.0024 and −0.0023, respectively, and both are statistically significant.

However, the negative joint effect between ownership concentration and cash-only payments disappears at extreme levels of ownership concentration. Martin [1] observes that in the United States, firms with 5–25% managerial ownership are likelier to opt for stock-only payments. Columns (6), (7), and (8) show the interaction variable’s coefficients for ownership levels of less than 20%, more than 60%, and 5–25%, respectively; none of these are statistically significant.

In conclusion, the adverse joint effect of ownership concentration and cash-only payments on bidders’ CARs is pronounced and statistically significant for those with intermediate levels of ownership. Intermediate ownership suggests that the largest or controlling shareholders’ preference for cash payments, which is driven by control incentives, may adversely impact minority shareholders’ financial interests. While concentrated ownership mitigates PA conflicts, it introduces PP conflicts [2]; these are particularly pronounced when controlling shareholders pursue control incentives, leading to increased agency costs. Thus, Table 6’s findings support Hypothesis 1, highlighting the negative implications of the agency costs induced by controlling shareholders’ behaviors.

Table 7 explores whether the combined effect of ownership concentration and cash-only payments is influenced by other corporate control mechanisms. Columns (1) and (2) report the regression outcomes using a subsample divided by the median ratio of outside directors. Korean firms with high ratios of outside directors are known to effectively monitor and check large shareholders [15,22,23,27]. In Column (1), the interaction variable’s coefficient (Owner_share × Cash only) is −0.0027 and statistically significant at the 5% level, indicating reduced propensity for PP conflict in firms with a substantial number of outside directors. The results in Column (2), however, show that the joint effects are not statistically significant, underscoring the impact of a robust outside director presence in mitigating PP conflict. This analysis is consistent across samples with ratios of outside directors below the median and in the lowest quantile, with significantly negative joint effects on bidders’ CARs only when the outside director ratio falls below the listed firms’ average.

Table 7.

Effects of ownership concentration by corporate control mechanism.

Korean evidence also highlights that foreign investors serve as effective monitors, reducing agency costs [15,23,27,29]. Bhaumik and Selarka [9] note that bidders with foreign stakes of over 26% exhibit superior M&A outcomes. Columns (3) and (4) explore subsamples segmented by foreign investors’ common equity stake. In Column (3), the interaction variable’s coefficient is −0.0017 and statistically significant, suggesting that firms with foreign stakes of less than 26% see the negative joint effects of ownership concentration and cash-only payments. Unreported results reveal this effect is significantly negative only for firms with foreign stakes under 10%, with both the low and high groups showing significantly negative joint effects at the 5% level. Thus, at high levels of foreign ownership (10% or more in our analysis), these joint effects are not significant, indicating that increased foreign ownership enhances monitoring of controlling shareholders.

Columns (5) to (8) investigate how the joint effects of ownership concentration and cash-only payments on bidders’ CARs vary with competitive threats in product markets. Employing samples categorized by low and high HHI and CR4 index values, the interaction variable’s (Owner_share × Cashonly) coefficient is significantly negative only in environments with limited competitive threats (high HHI or CR4 index). Competitive markets deter value-decreasing M&A decisions, even with weak corporate governance [26]. In Korea, competitive pressure acts as a corporate control mechanism [16,32]. If the joint effects stem from PP conflicts due to ownership concentration, they should not be insignificant in scenarios where controlling shareholders face minimal competitive threats. The findings reported in Columns (5) to (8) support this hypothesis.

In conclusion, our analysis confirms that ownership concentration and cash-only payments have a negative and statistically significant joint effect on short-term M&A performance. Owners who prioritize control opt for cash payments due to their control incentives, focusing their decisions on control concerns to the detriment of corporate value. Hypothesis 1, which proposes a positive link between firms opting for cash-only payments and the interplay of ownership concentration and agency costs, is supported, particularly when owners’ control incentives are pronounced (i.e., at intermediate ownership levels) or when existing monitoring mechanisms are ineffective. These outcomes underscore the joint effect of ownership concentration, suggesting that cash-only payments are motivated by PP conflicts driven by owners with strong control incentives or preferences for cash payments.

6.2. Results of Hypothesis 2

When owners prioritize control, their choice of payment method reflects a balance between corporate control and potential distress costs. Firms with limited cash often raise capital for cash payments [18], and owners’ cash preferences impact corporate value, influenced by financial constraints or debt capacity. Ownership concentration might harm corporate value through PP conflicts linked to cash preferences. We hypothesize that ownership concentration combined with cash-only payments is more pronounced for financially constrained bidders or those with low debt capacity.

Table 8 shows whether the joint effect of ownership concentration and cash-only payments varies with financial constraints. Column 1 indicates financially constrained firms (top KZ index quantile) with a significant interaction variable coefficient (Owner_share*Cashonly) of −0.005 at the 5% level. Using a tailored financial constraints index for Korean listed firms [22], Columns (2) and (3) confirm significantly negative joint effects solely for financially constrained firms.

Table 8.

Effects of ownership concentration by financial constraints.

Columns (4) to (7) examine the joint effects on bidders’ cumulative abnormal returns (CARs), focusing on firms with less ability to make cash payments. Column (4) reveals negative joint effects at the 1% significance level for firms with reduced debt capacity, measured by tangible assets proportion [18]. Assessing public debt market access through corporate bond ratings [11,36], the comparison in Columns (6) and (7) shows significantly negative joint effects only for non-rated firms.

In conclusion, bidders opting for cash-only payments, particularly those financially constrained, likely see a decline in corporate value. Financial capacity for cash payments is crucial [11,18]. Financially constrained bidders choosing cash-only payments face negative impacts from ownership concentration on CARs compared to those avoiding cash-only methods. Thus, ownership concentration among cash-preferring bidders tends to escalate PP conflicts, especially when financial limitations persist.

7. Robustness

7.1. Nonlinear Relationship

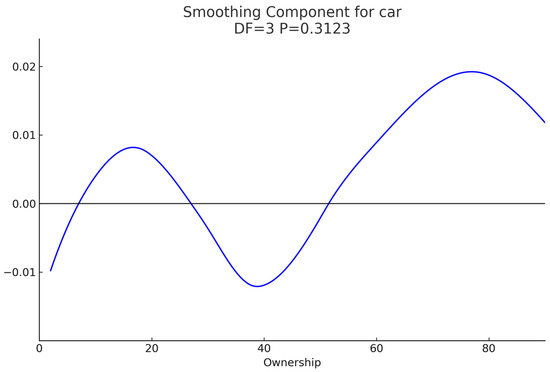

We uncover a nonlinear relationship between ownership concentration and bidders’ CARs. Specifically, we observe a negative relationship when bidders opt for cash-only payments and ownership concentration is at an intermediate level. To elucidate this, we employ smoothing component plots constructed using cubic splines.

Figure 1 is generated from a generalized additive model. A generalized additive model (GAM) is used to analyze complex, nonlinear relationships between variables, focusing on inference about unknown smooth functions. Similar to regression analysis for linear relationships, GAMs help identify nonlinear relationships between factors. This GAM incorporates a cubic smoothing spline to illustrate the nonlinear dynamics that affect the CARs of bidders selecting cash-only payments. The plot reveals that the smoothing component initially increases from a lower threshold of ownership concentration, then dips around the 20% mark. Subsequently, it rises again from around the 40% ownership level. Notably, this component remains negative as ownership concentration spans from about 30% to nearly 50%, highlighting the nonlinear relationship between ownership concentration and announcement returns.

Figure 1.

Smoothing component plot using a cubic spline.

This analysis is part of our examination of nonlinear relationships, serving to enhance the robustness of our findings. It significantly contributes to our understanding by demonstrating that ownership concentration’s impact on M&A performance, particularly in cash-only payment conditions, defies simple linear characterization.

7.2. Endogeneity Issue

Despite this study’s consistent similar results across various subsamples, we acknowledge that firms with differing ownership concentration levels may have unique characteristics and investment opportunities. Potentially, these inherent differences could influence the outcomes of this research. To mitigate this concern, we implement propensity score matching in our analysis. Propensity score matching, proposed by Rosenbaum and Rubin (1983), uses logistic regression to score and pair samples with similar characteristics. This method allows for the analysis of the relationship between two variables within matched samples, ensuring the observed relationship is not influenced by other factors.

We define our treatment group as firms with ownership concentrations ranging from 20% to 60% that opt for cash-only payments. Conversely, our control group comprises firms outside this ownership concentration range and those not selecting cash-only payment methods. In our matching process, we employ financial variables like size, leverage, book-to-market ratio, price–cost margin (PCM), fixed asset ratio, sales growth, and return on assets, alongside Mahalanobis distances within the same industry, as our matching criteria. Matching precision is enhanced by utilizing the pooled estimate of common standard deviations, facilitated by SAS’s “caliper = r” option, where “r” represents a multiple of the pooled estimate. Following Austin [47], who suggests that setting “r = 0.2” could reduce up to 99% of the bias associated with measured confounders, we adopt “caliper = 0.2”.

Table 9 presents the statistics for both the treatment and control groups post-matching, revealing narrowed mean value differences across several variables, including blockholder share, size, and PCM, indicating successful matching of observations that have similar firm characteristics. This suggests that the matching process was effective in creating comparable groups, which is crucial for drawing reliable inferences from the subsequent analyses.

Table 9.

Statistics of matched samples.

Table 10 outlines the regression outcomes using these matched samples. The findings in Columns (1)–(4) echo those from Table 6. Specifically, Column (2) shows a negative coefficient of -0.0032 for the interaction variable (ownership concentration and cash-only payment), which is statistically significant at the 1% level. This indicates that for firms with high ownership concentrations, the preference for cash-only payments significantly reduces announcement returns. Column (3) reports a positive and significant coefficient for the interaction variable, suggesting that in some contexts, ownership concentration can positively impact firm value, though the specific conditions are less clear. In Column (4), the coefficient is nonsignificant, indicating no substantial effect in this specification.

Table 10.

Regression results using matched samples.

Table 7 highlights that the negative joint effect of ownership concentration and cash-only payments on announcement returns is more pronounced when corporate control mechanisms are weaker. This is further corroborated in Column (6) of Table 10, where the interaction variable’s coefficient is −0.0048 and significant at the 1% level, underscoring the pronounced effects amid competitive market threats. This suggests that weak governance exacerbates the negative impacts of ownership concentration and cash-only payments on firm value.

Moreover, Table 8 identifies the adverse effects of ownership concentration and cash-only payments on financially constrained firms. This is reiterated in Columns (7) and (8) of Table 10, where the interaction variable coefficients are significantly negative, with a larger coefficient value in Column (8) than in Column (7), indicating greater financial constraints in the former. This demonstrates that financially constrained firms are more negatively impacted by ownership concentration and cash-only payment preferences, highlighting the compounded risk of financial distress under these conditions.

In conclusion, the propensity score matching analysis validates the main findings discussed in Section 6, demonstrating consistency across matched samples and reinforcing the study’s robustness against potential endogeneity concerns. The coefficients indicate that ownership concentration combined with cash-only payments generally reduces firm value, especially in contexts of weak governance and financial constraints. This underscores the importance of considering ownership structure and payment method in M&A transactions to mitigate adverse outcomes.

8. Conclusions

This study explores the multifaceted impact of ownership concentration on M&As, emphasizing that owners prioritizing control often prefer cash transactions, which can intensify PP conflicts and harm corporate value, especially in financially constrained firms. Our empirical findings reveal that high ownership concentration combined with cash-only payments significantly reduces M&A announcement returns, particularly when corporate governance is weak and financial constraints are present. Effective governance structures, ethical decision-making processes, and responsible business practices are crucial for mitigating these adverse effects and fostering sustainable M&A performance.

Our research highlights the importance of stakeholder scrutiny, particularly by minority shareholders and creditors, to ensure cash payment decisions align with the firm’s financial health and long-term sustainability rather than private interests. The study also underscores the significant role of robust governance mechanisms in reducing agency costs and supporting sustainable M&A outcomes.

In Korea’s unique corporate governance landscape during the 2000s, we observed significant insights into the dynamics of PP conflicts. While this study focuses on Korea, the implications extend to both developed and emerging markets. Future research should investigate how PP conflicts during M&As impact corporate value across various governance frameworks and market conditions. Additionally, studies should examine specific mechanisms through which major shareholders influence M&A transactions and how robust governance practices can mitigate these effects.

In summary, this study highlights the need for balanced ownership structures and effective oversight in M&A strategies to ensure long-term corporate value and stability. Future research directions include exploring the universality of these findings in different contexts and identifying actionable insights for policy-making and strategic management, with a focus on sustainable innovation and ethical governance.

Author Contributions

Conceptualization, S.K.; formal analysis, S.-w.C.; writing—original draft, J.-y.J. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The original contributions presented in the study are included in the article, further inquiries can be directed to the corresponding author.

Acknowledgments

J.-y.J. appreciates support from Inha University.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

| Variables | Description |

| CARad, CARm | Short- or long-term cumulative abnormal returns surrounding an M&A announcement date. This return is estimated using the adjusted market model: CARad (or market model: CARm) |

| Owner_share | Common equity shares of the largest shareholders and their special relations, such as family |

| Cashonly | Equals 1 if the M&A payment method is cash-only and 0 otherwise |

| Stockonly | Equals 1 if the M&A payment method is stock only and 0 otherwise |

| Foreigner_share | Foreigners’ common equity shares over total shares |

| Blockholders share | Other blockholders’ common equity shares, not including the largest shareholder and their special relations, over total shares |

| Size | The natural log of market capitalization |

| Leverage | Total debt/total assets |

| B/M ratio | Total assets/(book value of equity + market value of equity) |

| PCM | (Sales—cost of sales—general and administrative expenses)/sales |

| Fixed ratio | Fixed assets/total assets |

| Sales_grow | Net income/total assets |

| Listed_target | Equals 1 if the target is a listed firm and 0 otherwise |

| Relative_value | Transaction value of an M&A/bidder’s total assets |

References

- Martin, K.J. The method of payment in corporate acquisitions, investment opportunities, and management ownership. J. Financ. 1996, 51, 1227–1246. [Google Scholar] [CrossRef]

- Villalonga, B.; Amit, R. How do family ownership, control and management affect firm value? J. Financ. Econ. 2006, 80, 385–417. [Google Scholar] [CrossRef]

- Shim, J.; Okamuro, H. Does ownership matter in mergers? A comparative study of the causes and consequences of mergers by family and non-family firms. J. Bank Financ. 2011, 35, 193–203. [Google Scholar] [CrossRef]

- Purkayastha, S.; Veliyath, R.; George, R. The roles of family ownership and family management in the governance of agency conflicts. J. Bus. Res. 2019, 98, 50–64. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Nicodano, G.; Regis, L. A trade-off theory of ownership and capital structure. J. Financ. Econ. 2019, 131, 715–735. [Google Scholar] [CrossRef]

- Sun, J.; Ding, L.; Guo, J.M.; Li, Y. Ownership, capital structure and financing decision: Evidence from the UK. Br. Acc. Rev. 2016, 48, 448–463. [Google Scholar] [CrossRef]

- Claessens, S.; Djankov, S.; Lang, H. The separation of ownership and control in East Asian corporations. J. Financ. Econ. 2000, 58, 81–112. [Google Scholar] [CrossRef]

- Bhaumik, S.K.; Selarka, E.E. Does ownership concentration improve M&A outcomes in emerging markets? Evidence from India. J. Corp. Financ. 2012, 18, 717–726. [Google Scholar]

- Baek, J.; Kang, J.; Park, K. Corporate governance and firm value: Evidence from the Korean Financial Crisis. J. Financ. Econ 2004, 77, 265–313. [Google Scholar] [CrossRef]

- Karampatsas, N.; Petmezas, D.; Travlos, N.G. Credit ratings and the choice of payment method in mergers and acquisitions. J. Corp. Financ. 2014, 25, 474–493. [Google Scholar] [CrossRef]

- Yang, J.; Guariglia, A.; Guo, J. To what extent does corporate liquidity affect M&A decisions, method of payment and performance? Evidence from China. J. Corp. Financ. 2019, 54, 128–152. [Google Scholar]

- Park, S.P.; Lee, E.; Jang, H. Role of controlling shareholders in the corporate governance of Korean firms. Korea J. Financ. 2004, 17, 163–201. [Google Scholar]

- Park, J. The impact of foreign investors on Korea firm’s performance and value. Korean Corp. Manag. Rev. 2011, 38, 203–215. [Google Scholar]

- Song, D.; Jung, S. Corporate governance structure and managerial compensation in Korea. Korean J. Financ. Manag. 2014, 31, 179–206. [Google Scholar]

- Lee, J.H.; Byun, H.S. Does competition treat discipline-controlling shareholders? Focusing on the incentive to pursue a private benefit based on the ownership-control disparity. Korean J. Financ. Stud. 2016, 45, 671–712. [Google Scholar]

- Han, M.Y.; Shin, Y.K. The corporate governance and mergers effects. J. Bus. Educ. 2018, 35, 121–147. [Google Scholar] [CrossRef]

- Faccio, M.; Masulis, R.W. The choice of payment method in European mergers and acquisitions. J. Financ. 2005, 60, 1345–1388. [Google Scholar] [CrossRef]

- Wen, K.; Agyemang, A.; Alessa, N.; Sulemana, I.; Osei, A. The moderating role of ownership concentration on financing decisions and firm’s sustainability: Evidence from China. Sustainability 2023, 15, 13385. [Google Scholar] [CrossRef]

- Morck, R.; Shleifer, A.; Vishny, R.W. Alternative mechanisms for corporate control. Am. Econ. Rev. 1988, 79, 842–852. [Google Scholar]

- Caprio, L.; Croci, E.; Del Giudice, A.D. Ownership structure, family control, and acquisition decisions. J. Corp. Financ. 2011, 17, 1636–1657. [Google Scholar] [CrossRef]

- Jung, H.; Song, D.S.; Sim, J.W. A study on the relation between outside director characteristics and real earnings management. Korea Int. Acc. Rev. 2013, 49, 531–552. [Google Scholar]

- Park, B. The relationship between ownership (and outside directors) and firm value in KOSDAQ. Korean J. Financ. Manag. 2007, 24, 45–73. [Google Scholar]

- Kim, J. Impact of large shareholders on board structure in Korean companies. J. Strateg. Manag. 2007, 10, 1–22. [Google Scholar]

- Merkoulova, Y.; Zivanovic, B. Financial constraints and financing sources in mergers and acquisitions. Pac.-Basin Financ. J. 2022, 74, 101814. [Google Scholar] [CrossRef]

- Giroud, X.; Mueller, H.M. Corporate governance, product market competition, and equity prices. J. Financ. 2011, 66, 563–600. [Google Scholar] [CrossRef]

- Jeon, I.; Lee, J. Effect of the ratio of outside directors and foreign ownership on cost of capital. Tax. Acc. Res. 2020, 63, 117–136. [Google Scholar]

- Shleifer, A.; Vishny, R.W. Large shareholders and corporate control. J. Polit. Econ. 1986, 94, 461–488. [Google Scholar] [CrossRef]

- Garner, J.L.; Kim, W.Y. Are foreign investors really beneficial? Evidence from South Korea. Pac.-Basin Financ. J. 2013, 25, 62–84. [Google Scholar] [CrossRef]

- Holmstrom, B. Moral hazard in teams. Bell J. Econ. 1982, 13, 324–340. [Google Scholar] [CrossRef]

- Tang, Y. When does competition mitigate agency problems? J. Corp. Financ. 2018, 51, 258–274. [Google Scholar] [CrossRef]

- Lee, J.H.; Byun, H.S. Product market competition and corporate risk-taking. Asian Rev. Financ. Res. 2016, 29, 37–75. [Google Scholar]

- Lamont, Q.; Polk, C.; Saa-Requejo, J. Financial constraints and stock returns. Rev. Financ. Stud. 2001, 14, 529–554. [Google Scholar] [CrossRef]

- Lee, B.; Kim, D. The effect of financial constraints on stock returns in Korea. Korean J. Financ. Assoc. 2017, 30, 395–432. [Google Scholar]

- Almeida, H.; Campello, M.; Weisbach, M.S. The cash flow sensitivity of cash. J. Financ. 2004, 59, 1777–1804. [Google Scholar] [CrossRef]

- Harford, J.; Uysal, V.B. Bond market access and investment. J. Financ. Econ. 2014, 112, 147–163. [Google Scholar] [CrossRef]

- Faulkender, M.; Petersen, M.A. Does the source of capital affect capital structure? Rev. Financ. Stud. 2006, 19, 45–79. [Google Scholar] [CrossRef]

- Kim, J.H. Asset specificity and firm value: Evidence from mergers. J. Corp. Financ. 2018, 48, 375–412. [Google Scholar] [CrossRef]

- Ahern, K.R. Bargaining power and industry dependence in mergers. J. Financ. Econ. 2012, 103, 530–550. [Google Scholar] [CrossRef]

- Lee, K.; Ryu, Y.; Ji, S. A study on the relevance of between main financial index and investment activity. Korean J. Bus. Admin. 2012, 25, 323–343. [Google Scholar]

- To, T.Y.; Navone, M.; Wu, E. Analyst coverage and the quality of corporate investment decisions. J. Corp. Financ. 2018, 51, 164–181. [Google Scholar] [CrossRef]

- Dang, C.; Li, Z.; Yang, C. Measuring firm size in empirical corporate finance. J. Bank Financ. 2018, 86, 159–176. [Google Scholar] [CrossRef]

- Edmans, A. Blockholders and corporate governance. Annu. Rev. Financ. Econ. 2014, 6, 23–50. [Google Scholar] [CrossRef]

- Bouwman, C.H.S.; Fuller, K.; Nain, A.S. Market valuation and acquisition quality: Empirical evidence. Rev. Financ. Stud. 2009, 22, 633–679. [Google Scholar] [CrossRef]

- Kim, B.; Jung, J. What causes the size effect and the diversification effect in the global M&A transactions? Korean J. Financ. Stud. 2016, 45, 507–529. [Google Scholar]

- Kim, S.; Kim, C. A study on the effect of credit ratings on M&A activity. Asian Rev. Financ. Res. 2020, 33, 339–375. [Google Scholar]

- Austin, P.C. An introduction to propensity score methods for reducing the effects of confounding in observational. Multivarate Behav. Res. 2011, 46, 339–424. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).