Does the Opening of High-Speed Rail Change Urban Financial Agglomeration?

Abstract

1. Introduction

2. Literature Review

3. Variables and Model

3.1. Variable Selection

3.2. Econometric Model

4. Results

4.1. Basic Regression

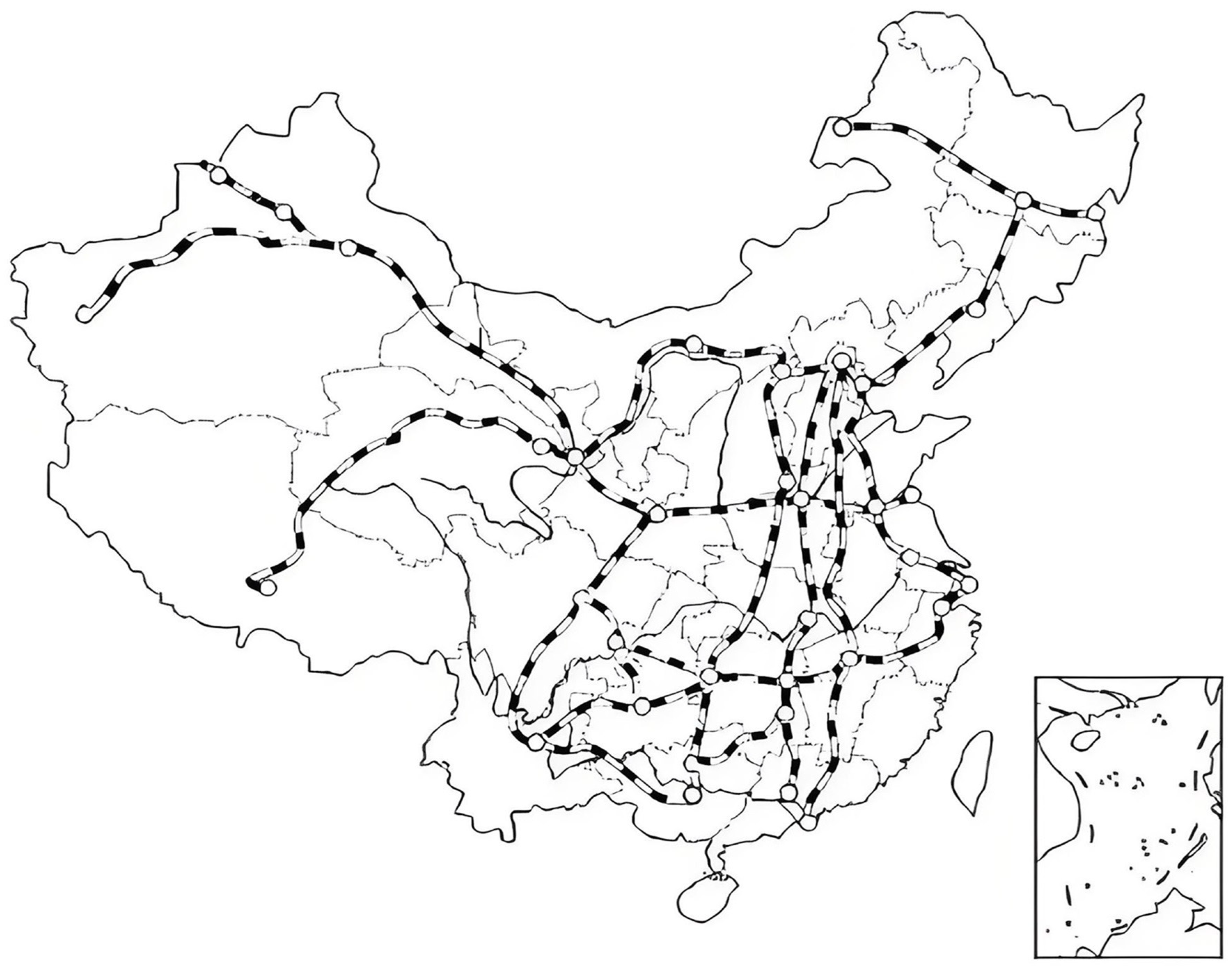

4.2. Endogeneity

4.3. Robustness

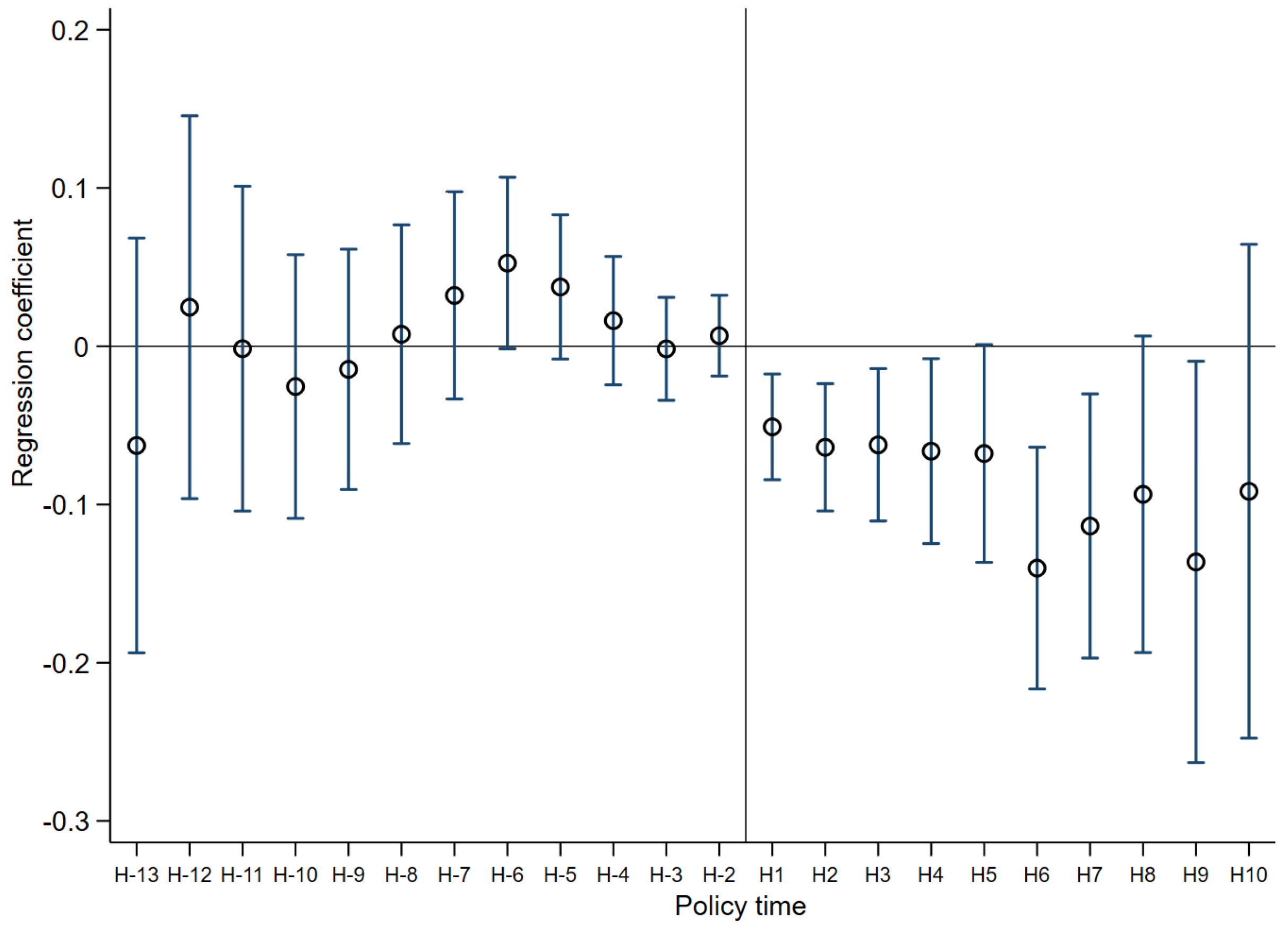

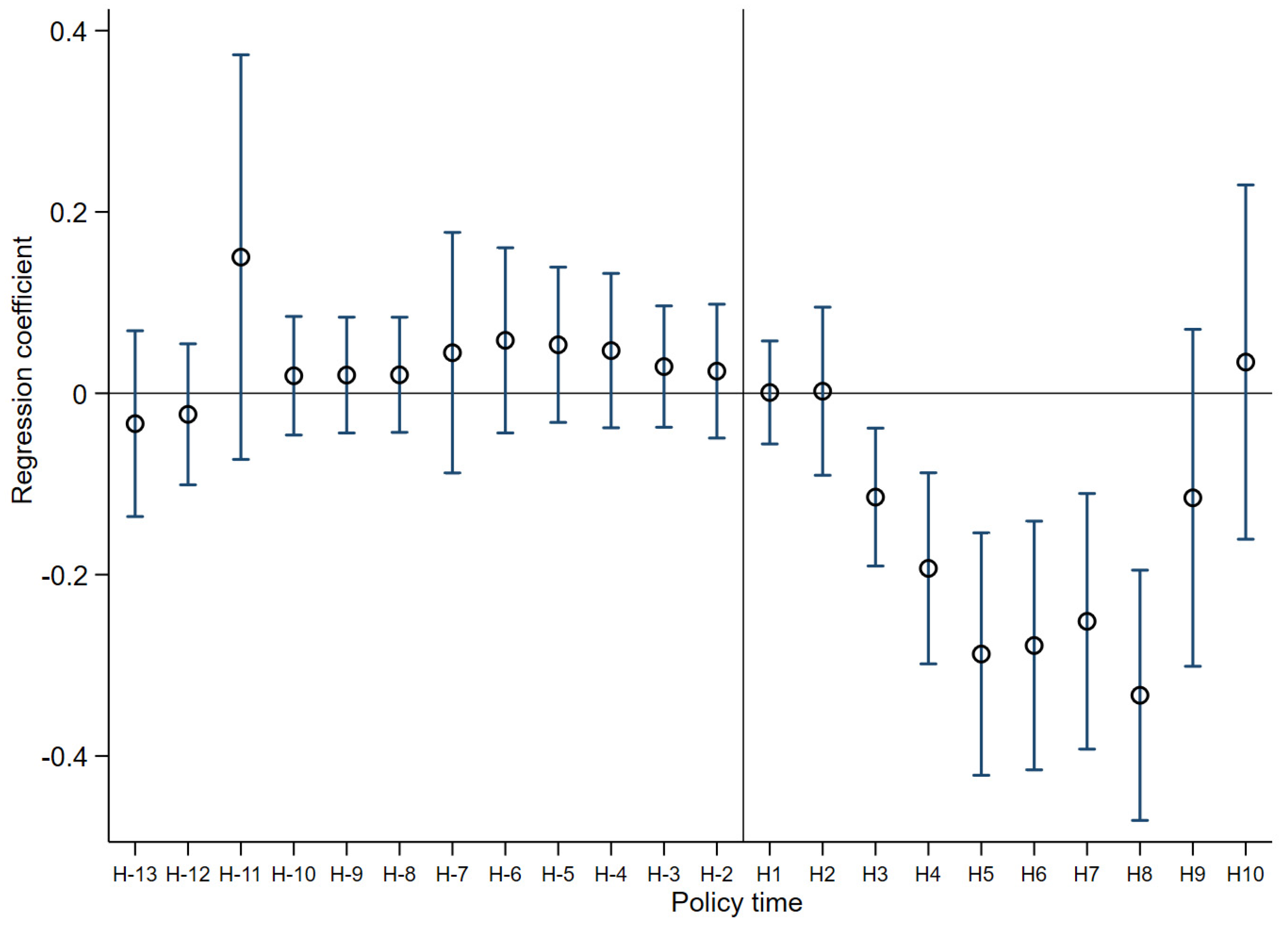

4.3.1. Parallel Trend Test

4.3.2. Propensity Score Matching Test

4.3.3. Placebo Test

4.3.4. Excluding Provincial Capital and National Central Cities

5. Mechanisms, Heterogeneity, and Spatial Effect

5.1. Mechanism Analysis

5.1.1. Regional Innovation

5.1.2. Industrial Structure

5.2. HSR Intensity Analysis

5.3. Heterogeneity Analysis

5.4. Spatial Effect Analysis

5.4.1. Spatial Econometric Model

- (1)

- 0–1 adjacency matrix (): This can concisely and intuitively represent the bordering positions of prefecture-level cities in geospatial terms. If cities i and j are adjacent, ; otherwise, .

- (2)

- Geographic distance matrix (): The construction of the adjacency matrix is intuitive, but it ignores the influence of distance differences among non-adjacent cities. Therefore, we also construct a geographic distance matrix, reflecting the degree of proximity between cities, for regression. Specifically, the Euclidean distance () between city i and city j is calculated, and then the matrix is constructed using the reciprocal of the square of this distance, which is

- (3)

- Economic distance matrix (): The geographic distance matrix reflects the differences in the geographical locations of cities. However, the spatial effects are not only related to geographical factors but may also be influenced by socioeconomic factors. We take the GDP per capita (e) of city i and city j as a measure and construct an economic distance matrix by using the reciprocal of the absolute value of the difference between them, which is

- (4)

- Nested matrix (): In order to examine the integrated effects of geographic and economic factors, we further construct a spatial nested matrix containing both factors for analysis. The equation is . Here, is the reciprocal distance matrix. The in diagonal elements represents the average value of the GDP per capita in city i. represents the average GDP per capita of all cities in the sample interval.

5.4.2. Spatial Correlation Test

5.4.3. Spatial Regression

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| AGGE | AGGD | HSR | AGGE | AGGD | HSR | AGGE | AGGD | HSR | AGGE | AGGD | HSR | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2005 | 0.108 *** (3.167) | 0.376 *** (12.203) | 0.047 *** (2.678) | 0.218 *** (13.342) | 0.120 *** (3.359) | 0.372 *** (11.571) | 0.011 ** (2.552) | 0.064 *** (13.629) | ||||

| 2006 | 0.133 *** (3.872) | 0.505 *** (15.915) | 0.058 *** (3.297) | 0.375 *** (22.189) | 0.123 *** (3.440) | 0.504 *** (15.196) | 0.013 *** (3.026) | 0.095 *** (19.401) | ||||

| 2007 | 0.133 *** (3.863) | 0.530 *** (16.396) | 0.058 *** (3.288) | 0.389 *** (22.606) | 0.131 *** (3.663) | 0.533 *** (15.797) | 0.012 *** (2.882) | 0.100 *** (19.951) | ||||

| 2008 | 0.143 *** (4.167) | 0.527 *** (16.216) | 0.326 *** (9.798) | 0.056 *** (3.143) | 0.385 *** (22.220) | 0.174 *** (9.858) | 0.136 *** (3.803) | 0.534 *** (15.743) | 0.147 *** (4.282) | 0.014 *** (3.136) | 0.099 *** (19.662) | 0.067 *** (13.172) |

| 2009 | 0.144 *** (4.176) | 0.513 *** (15.568) | 0.254 *** (7.395) | 0.063 *** (3.526) | 0.367 *** (20.942) | 0.128 *** (7.064) | 0.139 *** (3.866) | 0.539 *** (15.644) | 0.169 *** (4.741) | 0.015 *** (3.308) | 0.095 *** (18.814) | 0.065 *** (12.472) |

| 2010 | 0.158 *** (4.585) | 0.315 *** (9.553) | 0.245 *** (7.056) | 0.067 *** (3.732) | 0.207 *** (11.844) | 0.111 *** (6.088) | 0.134 *** (3.742) | 0.394 *** (11.415) | 0.146 *** (4.072) | 0.014 *** (3.120) | 0.061 *** (12.289) | 0.035 *** (6.905) |

| 2011 | 0.139 *** (4.064) | 0.192 *** (5.642) | 0.244 *** (6.998) | 0.059 *** (3.363) | 0.097 *** (5.451) | 0.161 *** (8.726) | 0.088 ** (2.499) | 0.267 *** (7.477) | 0.292 *** (7.978) | 0.010 ** (2.450) | 0.035 *** (7.136) | 0.055 *** (10.584) |

| 2012 | 0.130 *** (3.807) | 0.521 *** (15.620) | 0.273 *** (7.811) | 0.057 *** (3.216) | 0.367 *** (20.685) | 0.178 *** (9.580) | 0.077 ** (2.188) | 0.553 *** (15.879) | 0.328 *** (8.950) | 0.009 ** (2.208) | 0.094 *** (18.401) | 0.059 *** (11.265) |

| 2013 | 0.220 *** (6.311) | 0.528 *** (15.724) | 0.319 *** (9.077) | 0.106 *** (5.788) | 0.367 *** (20.556) | 0.217 *** (11.635) | 0.149 *** (4.128) | 0.562 *** (16.034) | 0.302 *** (8.242) | 0.028 *** (5.645) | 0.095 *** (18.380) | 0.072 *** (13.669) |

| 2014 | 0.220 *** (6.315) | 0.536 *** (15.917) | 0.325 *** (9.264) | 0.102 *** (5.576) | 0.370 *** (20.653) | 0.203 *** (10.894) | 0.169 *** (4.679) | 0.568 *** (16.169) | 0.255 *** (6.959) | 0.024 *** (4.972) | 0.095 *** (18.488) | 0.056 *** (10.724) |

| 2015 | 0.217 *** (6.253) | 0.524 *** (15.343) | 0.284 *** (8.083) | 0.103 *** (5.642) | 0.353 *** (19.429) | 0.184 *** (9.867) | 0.157 *** (4.353) | 0.587 *** (16.445) | 0.263 *** (7.182) | 0.024 *** (5.071) | 0.093 *** (17.792) | 0.056 *** (10.689) |

| 2016 | 0.216 *** (6.224) | 0.523 *** (15.270) | 0.281 *** (8.021) | 0.105 *** (5.747) | 0.349 *** (19.130) | 0.187 *** (10.047) | 0.172 *** (4.758) | 0.586 *** (16.364) | 0.245 *** (6.701) | 0.026 *** (5.300) | 0.092 *** (17.680) | 0.061 *** (11.689) |

| 2017 | 0.235 *** (6.752) | 0.474 *** (13.761) | 0.229 *** (6.541) | 0.118 *** (6.468) | 0.311 *** (16.993) | 0.164 *** (8.868) | 0.180 *** (4.975) | 0.546 *** (15.171) | 0.225 *** (6.161) | 0.035 *** (7.011) | 0.083 *** (15.943) | 0.055 *** (10.585) |

| 2018 | 0.216 *** (6.240) | 0.383 *** (11.227) | 0.218 *** (6.235) | 0.114 *** (6.259) | 0.256 *** (14.132) | 0.156 *** (8.449) | 0.169 *** (4.690) | 0.519 *** (14.526) | 0.202 *** (5.557) | 0.037 *** (7.327) | 0.064 *** (12.449) | 0.048 *** (9.282) |

Appendix B

| AGGE | AGGD | AGGE | AGGD | AGGE | AGGD | AGGE | AGGD | |

|---|---|---|---|---|---|---|---|---|

| Spatial error: LM test | 2008.231 *** | 983.925 *** | 1223.831 *** | 394.808 *** | 17.172 *** | 3.197 * | 4115.277 *** | 2031.174 *** |

| Spatial error: robust LM test | 293.155 *** | 322.823 *** | 1062.504 *** | 249.254 *** | 15.202 *** | 0.805 | 3928.442 *** | 1828.472 *** |

| spatial lag: LM test | 1728.932 *** | 784.664 *** | 162.945 *** | 185.515 *** | 1.975 | 3.492 * | 186.865 *** | 239.668 *** |

| spatial lag: robust LM test | 13.856 *** | 123.562 *** | 1.617 | 39.961 *** | 0.005 | 1.100 | 0.030 | 36.966 *** |

| Spatial lag: LR test | 12.98 *** | 81.01 *** | 26.24 *** | 82.30 *** | 30.33 *** | 90.50 *** | 38.79 *** | 64.81 *** |

| Spatial error: LR test | 1370.82 *** | 1378.96 *** | 1350.63 *** | 1339.64 *** | 1451.08 *** | 1330.21 *** | 1331.63 *** | 1392.48 *** |

| Hausman | 65.55 *** | 43.23 *** | 70.88 *** | 34.38 *** | 55.78 *** | 43.09 *** | 78.25 *** | 38.46 *** |

References

- Zhang, X.L. Has Transport lnfrastructure Promoted Regional Economic Growth?—With an Analysis of the Spatial Spillover Effects of Transport lnfrastructure. Soc. Sci. China 2012, 34, 60–77+206. [Google Scholar]

- Lu, J.; Song, J.T.; Liang, Y.S. The Simulation of Spatial Distribution Patterns of China’s HSR-economic Zones Based on the 2D Time-space Map. Acta Geogr. Sin. 2013, 68, 147–158. [Google Scholar]

- Liu, Y.Z.; Li, Y. High-speed Rails and City Economic Growth in China. J. Financ. Res. 2017, 11, 18–33. [Google Scholar]

- Hu, Y.; Deng, T.; Zhang, J. Can Commuting Facilitation Relieve Spatial Misallocation of Labor? Habitat Int. 2020, 106, 102136. [Google Scholar] [CrossRef]

- Sun, P.Y.; Zhang, T.T.; Yao, S.J. Tariff Transmission, Domestic Transport Costs and Retail Prices. Econ. Res. J. 2019, 54, 135–149. [Google Scholar]

- Zhang, X.; Wu, W.; Zhou, Z. Geographic Proximity, Information Flows and Corporate Innovation: Evidence from the High-Speed Rail Construction in China. Pac. Basin Financ. J. 2020, 61, 101342. [Google Scholar] [CrossRef]

- Wang, X.; Zhu, Y.; Ren, X.; Gozgor, G. The impact of digital inclusive finance on the spatial convergence of the green total factor productivity in the Chinese cities. Appl. Econ. 2023, 55, 4871–4889. [Google Scholar] [CrossRef]

- Du, Y.; Wang, Q.; Zhou, J. How does digital inclusive finance affect economic resilience: Evidence from 285 cities in China. Int. Rev. Financ. Anal. 2023, 88, 102709. [Google Scholar] [CrossRef]

- Yue, H.; Zhou, Z.; Liu, H. How does green finance influence industrial green total factor productivity? Empirical research from China. Energy Rep. 2024, 11, 914–924. [Google Scholar] [CrossRef]

- Fan, W.; Wang, F.; Liu, S.; Chen, T.; Bai, X.; Zhang, Y. How does financial and manufacturing co-agglomeration affect environmental pollution? Evidence from China. J. Environ. Manag. 2023, 325, 116544. [Google Scholar] [CrossRef]

- Guan, C.; Hu, Q. Does high-speed railway impact urban logistics industry agglomeration? Empirical evidence from China’s prefecture-level cities. Socio-Econ. Plan. Sci. 2023, 87, 101557. [Google Scholar] [CrossRef]

- Han, D.; Attipoe, S.G.; Han, D.; Cao, J. Does transportation infrastructure construction promote population agglomeration? Evidence from 1838 Chinese county-level administrative units. Cities 2023, 140, 104409. [Google Scholar] [CrossRef]

- Chen, H.; Zhu, T.; Zhao, L. High-Speed Railway Opening, Industrial Symbiotic Agglomeration and Green Sustainable Development—Empirical Evidence from China. Sustainability 2024, 16, 2070. [Google Scholar] [CrossRef]

- Kwilinski, A.; Lyulyov, O.; Pimonenko, T. Spillover Effects of Green Finance on Attaining Sustainable Development: Spatial Durbin Model. Computation 2023, 11, 199. [Google Scholar] [CrossRef]

- Huang, C.; Han, Q.; Tan, X.; Hua, Y.; Shang, L. High-speed rail operations, the cross-regional mobility of highly skilled talent, and regional innovation—Evidence from the Yangtze River delta in China. Appl. Econ. 2024, 1–18. [Google Scholar] [CrossRef]

- Wang, L.; Wu, Y.; Chen, Y.; Dai, Y. Distance produces the fear of loss: Customer geographic proximity and corporate cash holdings. Int. Rev. Financ. Anal. 2023, 87, 102572. [Google Scholar] [CrossRef]

- Atack, J.; Bateman, F.; Haines, M. Did Railroads Induce or Follow Economic Growth? Urbanization and Population Growth in the American Midwest, 1850–1860. Soc. Sci. Hist. 2010, 34, 171–197. [Google Scholar] [CrossRef]

- Vickerman, R. High-speed rail in Europe: Experience and Issues for Future Development. Ann. Reg. Sci. 1997, 31, 21–38. [Google Scholar] [CrossRef]

- Chen, Z.; Haynes, K.E. Impact of high speed rail on housing values: An observation from the Beijing–Shanghai line. J. Transp. Geogr. 2015, 43, 91–100. [Google Scholar] [CrossRef]

- Wang, Y.F.; Ni, P.F. Economic Growth Spillover and Spatial Optimization of High-speed Railway. China Ind. Econ. 2016, 2, 21–36. [Google Scholar]

- Krugman, P. Increasing Returns and Economic-geography. J. Political Econ. 1991, 99, 483–499. [Google Scholar] [CrossRef]

- Ran, W.; Rong, W. Exploring Financial Agglomeration and the Impact of Environmental Regulation on the Efficiency of the Green Economy: Fresh Evidence from 30 Regions in China. Sustainability 2023, 15, 7226. [Google Scholar] [CrossRef]

- Iyare, S.; Moore, W. Financial Sector Development and Growth in Small Open Economies. Appl. Econ. 2011, 43, 1289–1297. [Google Scholar] [CrossRef]

- Gordon, I.R. Quantitative Easing of an International Financial Centre: How Central London Came So Well Out of the Post-2007 Crisis. Camb. J. Reg. Econ. Soc. 2016, 9, 335–353. [Google Scholar] [CrossRef]

- Nicolae, P.V. Theoretical and Practical Considerations on Financial Autonomy and Balance Local Budgets in Romania. Econ. Ser. 2015, 2, 231–238. [Google Scholar]

- Ding, X.; Liu, X. Renewable Energy Development and Transportation Infrastructure Matters for Green Economic Growth? Empirical Evidence from China. Econ. Anal. Policy 2023, 79, 634–646. [Google Scholar] [CrossRef]

- Wang, Z.L.; Lin, X.Y.; Gao, H.W. A Study on the Impact of Transportation Infrastructure on Financial Agglomeration: An Evidence Based on Railways and Highways. Macroeconomics 2020, 12, 47–61+120. [Google Scholar]

- Laulajainen, R. Financial Geography: A Banker’s View; Taylor and Francis: Oxfordshire, UK, 2003. [Google Scholar]

- Vickerman, R. High-speed rail and regional development: The case of intermediate stations. J. Transp. Geogr. 2015, 42, 157–165. [Google Scholar] [CrossRef]

- Zhang, K.Z.; Tao, D.J. Economic Distribution Effects of Transportation Infrastructure: Evidence from the Opening of High Speed Rail. Econ. Perspect. 2016, 6, 62–73. [Google Scholar]

- Qin, Y. ‘No county left behind?’ The Distributional Impact of High-Speed Rail Upgrades in China. J. Econ. Geogr. 2017, 17, 489–520. [Google Scholar] [CrossRef]

- Behrens, K.; Lamorgese, A.R.; Ottaviano, G.I. Changes in Transport and Non-Transport Costs: Local vs Global Impacts in a Spatial Network. Reg. Sci. Urban Econ. 2007, 37, 625–648. [Google Scholar] [CrossRef]

- Li, H.C.; Tjia, L.; Hu, S.X. Agglomeration and Equalization Effect of High Speed Railway on Cities in China. J. Quant. Tech. 2016, 33, 127–143. [Google Scholar]

- Wang, Y.; Zhang, F. High-speed rail and distribution of economic activities: Evidence from prefecture-level cities in China. Res. Transp. Bus. Manag. 2023, 51, 101065. [Google Scholar] [CrossRef]

- Chen, M.; Liu, X.; Xiong, X.; Wu, J. Has the opening of high-speed rail narrowed the inter-county economic gap? The perspective of China’s state-designated poor counties. Int. Rev. Econ. Financ. 2023, 88, 1–13. [Google Scholar] [CrossRef]

- He, L.Y.; Liu, S. Impact of China Railway Express on Regional Resource Mismatch—Empirical Evidence from China. Sustainability 2023, 15, 8441. [Google Scholar] [CrossRef]

- Zhao, J.; Huang, J.C.; Liu, F. China High-speed Railways and Stock Price Crash Risk. J. Manag. World 2018, 34, 157–168+192. [Google Scholar]

- Zhou, W.T.; Yang, R.D.; Hou, X.S. High-speed Rail Network, Location Advantage and Regional Innovation. Econ. Rev. 2021, 4, 75–95. [Google Scholar]

- Alexander, B.; Dijst, M. Professional Workers at Work: Importance of Work Activities for Electronic and Face-to-Face Communications in the Netherlands. Transportation 2012, 39, 919–940. [Google Scholar] [CrossRef]

- Bian, Y.C.; Wu, L.H.; Bai, J.H. Does High-speed Rail Improve Regional Innovation in China? J. Financ. Res. 2019, 6, 132–149. [Google Scholar]

- Zhu, Z.J.; Huang, X.H.; Wang, H. Does Traffic Infrastructure Promote Innovation? A Quasi-natural Experiment Based on the Expansion of the High-speed Railway Network in China. J. Financ. Res. 2019, 11, 153–169. [Google Scholar]

- Zhang, J.B. Research on the Impact of Transportation Infrastructure Construction on Industrial Structure Transformation. J. Yunnan Univ. Financ. Econ. 2018, 34, 35–46. [Google Scholar]

- Gong, Q.; Zhang, Y.L.; Lin, Y.F. Industrial Structure, Risk Feature and Optimal Financial Structure. Econ. Res. J. 2014, 49, 4–16. [Google Scholar]

- Chen, F.; Shao, M.; Dai, J.; Chen, W. Can the opening of high-speed rail reduce environmental pollution? An empirical research based on difference-in-differences model. Clean Technol. Environ. Policy 2024, 1–13. [Google Scholar] [CrossRef]

- Nie, L.; Zhang, Z. Is high-speed rail heading towards a low-carbon industry? Evidence from a quasi-natural experiment in China. Resour. Energy Econ. 2023, 72, 101355. [Google Scholar] [CrossRef]

- Sun, W.Z.; Niu, D.X.; Wan, G.H. Transportation Infrastructure and Industrial Structure Upgrading: Evidence from China’s High-speed Railway. J. Manag. World 2022, 38, 19–34+58+35–41. [Google Scholar]

- Hu, M.; Xu, J. How Does High-Speed Rail Impact the Industry Structure? Evidence from China. Urban Rail. Transit. 2022, 8, 296–317. [Google Scholar] [CrossRef]

- Brezdeń, P.; Sikorski, D. Processes of Spatial Concentration and Specialisation of Industry by the Intensity of R & D Work in the Lower Silesian Voivodeship (Poland). Quaest. Geogr. 2023, 42, 19–36. [Google Scholar]

- Chen, C.-L.; Vickerman, R. Can transport infrastructure change regions’ economic fortunes? Some evidence from Europe and China. Reg. Stud. 2017, 51, 144–160. [Google Scholar] [CrossRef]

- Ma, G.R.; Cheng, X.M.; Yang, E.Y. How Does Transportation Infrastructure Affect Capital Flows—A Study from High-speed Rail and Cross-region Investment of Listed Companies. China Ind. Econ. 2020, 6, 5–23. [Google Scholar]

- Dong, X.; Zheng, S.; Kahn, M.E. The role of transportation speed in facilitating high skilled teamwork across cities. J. Urban Econ. 2020, 115, 103212. [Google Scholar] [CrossRef]

- Niu, D.; Sun, W.; Zheng, S. Travel costs, trade, and market segmentation: Evidence from China’s high-speed railway. Pap. Reg. Sci. 2020, 99, 1799–1826. [Google Scholar] [CrossRef]

- Hall, B.H.; Jaffe, A.B.; Trajtenberg, M. The NBER Patent Citation Data File: Lessons, Insights and Methodological Tools. NBER Work. Pap. 2001, 8498. [Google Scholar] [CrossRef]

| Variable | Measurement | Observations | Mean | Standard Deviation | Min | Max |

|---|---|---|---|---|---|---|

| Urban financial agglomeration (AGGE) | Measured using the location quotient of financial employees | 3914 | 1.0505 | 0.4098 | 0.1283 | 3.7625 |

| Urban financial agglomeration (AGGD) | Measured using the location quotient of household saving deposits | 3949 | 0.9949 | 1.0647 | 0.0202 | 14.9231 |

| HSR opening (HSR) | If the HSR opens in the first half of the year, it takes the value of 1; otherwise, it takes the value of 0 | 3962 | 0.2845 | 0.4512 | 0 | 1 |

| Economic development level (GDP) | Using 2003 as the base period for deflation, we obtain the GDP as constant prices (unit: CNY 1 billion) | 3962 | 583.439 | 849.1944 | 8.6300 | 8594.93 |

| Highway passenger traffic (PAS) | Measured using the urban highway passenger volume (unit: 10,000 people) | 3932 | 8115.325 | 13,909.9 | 56 | 286,557 |

| Population growth rate (POP) | Measured using the urban natural population growth rate (unit: %) | 3936 | 5.8812 | 5.5671 | −16.64 | 113 |

| Human capital level (EMP) | Measured using the proportion of urban financial employees (unit: %) | 3914 | 0.0039 | 0.0036 | 0.0001 | 0.0443 |

| Foreign direct investment (FDI) | According to the China–US exchange rate published in the China Statistical Yearbook, the foreign direct investment in the city is converted into RMB (unit: CNY 10,000) | 3746 | 552,051.5 | 1,389,276 | 0 | 2.05 × 107 |

| Government regulation (GOV) | Measured as the proportion of local government expenditure to GDP (unit: %) | 3954 | 0.2022 | 0.2213 | 0.0154 | 6.0406 |

| AGGE | AGGD | AGGE | AGGD | |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| HSR | −0.0586 ** (−2.52) | −0.0742 * (−1.96) | ||

| HSR_1 | −0.0758 *** (−2.85) | −0.1107 *** (−2.80) | ||

| Control | yes | yes | yes | yes |

| Constant | 1.1498 *** (3.16) | 1.2968 ** (2.34) | 1.1574 *** (3.20) | 1.3205 ** (2.37) |

| City fixed effect | yes | yes | yes | yes |

| Year fixed effect | yes | yes | yes | yes |

| Observations | 3853 | 3843 | 3853 | 3843 |

| AGGE | AGGD | AGGE | AGGD | |

|---|---|---|---|---|

| (5) | (6) | (7) | (8) | |

| HSR | −0.1304 *** (−2.69) | −0.3016 *** (−3.02) | ||

| HSR_1 | −0.1599 *** (−3.31) | −0.3657 *** (−3.74) | ||

| Control | yes | yes | yes | yes |

| City fixed effect | yes | yes | yes | yes |

| Year fixed effect | yes | yes | yes | yes |

| Observations | 2422 | 2422 | 2422 | 2422 |

| Kleibergen–Paap rk LM | 126.970 | 126.970 | 128.454 | 128.454 |

| Cragg–Donald Wald F | 12.877 | 12.877 | 13.483 | 13.483 |

| Kleibergen–Paap rk Wald F | 12.358 | 12.358 | 12.726 | 12.726 |

| Hansen J | 13.220 | 10.959 | 9.614 | 7.617 |

| AGGE | AGGD | AGGE | AGGD | |

|---|---|---|---|---|

| (9) | (10) | (11) | (12) | |

| HSR | −0.1401 *** | −0.2769 *** (−3.28) | ||

| HSR_1 | −0.1653 *** (−3.46) | −0.3216 *** (−3.67) | ||

| Control | yes | yes | yes | yes |

| City fixed effect | yes | yes | yes | yes |

| Year fixed effect | yes | yes | yes | yes |

| Observations | 2422 | 2422 | 2422 | 2422 |

| Kleibergen–Paap rk LM | 126.970 | 126.970 | 128.454 | 128.454 |

| Cragg–Donald Wald F | 12.877 | 12.877 | 13.483 | 13.483 |

| Kleibergen–Paap rk Wald F | 12.358 | 12.358 | 12.726 | 12.726 |

| Hansen J | 13.220 | 10.959 | 9.614 | 7.617 |

| AGGE | AGGD | AGGE | AGGD | |

|---|---|---|---|---|

| (13) | (14) | (15) | (16) | |

| HSR | −0.0318 (−1.54) | −0.0416 ** (−2.00) | ||

| HSR_1 | −0.0458 ** (−2.10) | −0.0347 ** (−2.11) | ||

| Control | yes | yes | yes | yes |

| Constant | 1.0883 *** (3.93) | 0.3086 (0.81) | 1.0939 *** (3.95) | 0.3043 (0.80) |

| City fixed effect | yes | yes | yes | yes |

| Year fixed effect | yes | yes | yes | yes |

| Observations | 3550 | 3550 | 3550 | 3550 |

| 1 Year Advanced | 2 Years Advanced | 3 Years Advanced | ||||

|---|---|---|---|---|---|---|

| AGGE | AGGD | AGGE | AGGD | AGGE | AGGD | |

| (17) | (18) | (19) | (20) | (21) | (22) | |

| HSR | −0.0327 (−1.59) | −0.0538 (−1.10) | −0.0244 (−1.26) | −0.0198 (−0.49) | −0.0289 (−1.48) | −0.0083 (−0.25) |

| Control | yes | yes | yes | yes | yes | yes |

| Constant | 1.1103 *** (3.57) | 1.0957 * (1.89) | 0.9091 * (1.71) | −0.7680 (−1.45) | 0.7808 (1.40) | −1.0255 * (−1.74) |

| City fixed effect | yes | yes | yes | yes | yes | yes |

| Year fixed effect | yes | yes | yes | yes | yes | yes |

| Observations | 3679 | 3679 | 3396 | 3396 | 3113 | 3113 |

| AGGE | AGGD | AGGE | AGGD | |

|---|---|---|---|---|

| (23) | (24) | (25) | (26) | |

| HSR | −0.0529 ** (−2.05) | −0.0780 ** (−1.98) | ||

| HSR_1 | −0.0707 ** (−2.34) | −0.0934 ** (−2.34) | ||

| Control | yes | yes | yes | yes |

| Constant | 0.8665 *** (2.99) | 0.4748 (0.97) | 0.8809 *** (3.07) | 0.4872 (0.99) |

| City fixed effect | yes | yes | yes | yes |

| Year fixed effect | yes | yes | yes | yes |

| Observations | 3542 | 3542 | 3542 | 3542 |

| PAT | AGGE | AGGD | PAT | AGGE | AGGD | |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| PAT | −0.0022 *** (−5.11) | −0.0049 ** (−2.46) | −0.0022 *** (−5.09) | −0.0048 ** (−2.44) | ||

| HSR | 14.1949 *** (6.70) | −0.0279 (−1.26) | 0.0092 (0.37) | |||

| HSR_1 | 16.4457 *** (6.35) | −0.0397 (−1.59) | −0.0078 (−0.29) | |||

| Control | yes | yes | yes | yes | yes | yes |

| Constant | −112.1802 ** (−2.20) | 0.9462 *** (3.01) | 0.8896 ** (1.98) | −112.8118 ** (−2.21) | 0.9547 *** (3.05) | 0.9023 ** (2.00) |

| City fixed effect | yes | yes | yes | yes | yes | yes |

| Year fixed effect | yes | yes | yes | yes | yes | yes |

| Observations | 3880 | 3880 | 3880 | 3880 | 3880 | 3880 |

| cited | AGGE | AGGD | cited | AGGE | AGGD | |

|---|---|---|---|---|---|---|

| (7) | (8) | (9) | (10) | (11) | (12) | |

| cited | −0.0023 *** (−4.61) | −0.0054 ** (−2.53) | −0.0023 *** (−4.61) | −0.0053 ** (−2.50) | ||

| HSR | 13.4488 *** (6.60) | −0.0282 (−1.31) | 0.0122 (0.50) | |||

| HSR_1 | 16.1011 *** (6.31) | −0.0387 (−1.62) | −0.0013 (−0.05) | |||

| Control | yes | yes | yes | yes | yes | yes |

| Constant | −111.0551 ** (−2.19) | 0.9372 *** (2.95) | 0.8398 * (1.89) | −111.9082 ** (−2.21) | 0.9450 *** (2.99) | 0.8500 * (1.90) |

| City fixed effect | yes | yes | yes | yes | yes | yes |

| Year fixed effect | yes | yes | yes | yes | yes | yes |

| Observations | 3880 | 3880 | 3880 | 3880 | 3880 | 3880 |

| t_ind | AGGE | AGGD | t_ind | AGGE | AGGD | |

|---|---|---|---|---|---|---|

| (7) | (8) | (9) | (10) | (11) | (12) | |

| t_ind | −0.0028 * (−1.77) | −0.0055 * (−1.89) | −0.0027 * (−1.74) | −0.0054 * (−1.87) | ||

| HSR | 0.7617 ** (2.03) | −0.0559 ** (−2.46) | −0.0564 (−1.53) | |||

| HSR_1 | 0.7042 * (1.85) | −0.0733 *** (−2.82) | −0.0828 ** (−2.09) | |||

| Control | yes | yes | yes | yes | yes | yes |

| Constant | 90.2044 *** (10.29) | 1.4040 *** (3.54) | 1.8060 *** (2.60) | 90.2536 *** (10.30) | 1.4103 *** (3.57) | 1.8145 *** (2.62) |

| City fixed effect | yes | yes | yes | yes | yes | yes |

| Year fixed effect | yes | yes | yes | yes | yes | yes |

| Observations | 3952 | 3952 | 3952 | 3952 | 3952 | 3952 |

| AGGE | AGGD | AGGE | AGGD | |

|---|---|---|---|---|

| (17) | (18) | (19) | (20) | |

| HSRQ | −0.0458 *** (−3.48) | −0.0930 *** (−3.26) | ||

| HSRQ_1 | −0.0507 *** (−3.66) | −0.1090 *** (−3.30) | ||

| Control | yes | yes | yes | yes |

| Constant | 1.0684 *** (3.18) | 1.1057 ** (2.34) | 1.0604 *** (3.17) | 1.0757 ** (2.31) |

| City fixed effect | yes | yes | yes | yes |

| Year fixed effect | yes | yes | yes | yes |

| Observations | 3962 | 3962 | 3962 | 3962 |

| AGGE | AGGD | AGGE | AGGD | |

|---|---|---|---|---|

| (21) | (22) | (23) | (24) | |

| HSR | −0.1213 *** (−3.18) | −0.2290 ** (−2.52) | ||

| HSR_1 | −0.1361 *** (−3.10) | −0.2561 *** (−2.86) | ||

| mHSR | 0.1246 *** (2.68) | 0.2638 *** (2.62) | ||

| mHSR_1 | 0.1268 ** (2.54) | 0.2884 *** (2.90) | ||

| wHSR | 0.0767 (1.49) | 0.3387 *** (3.32) | ||

| wHSR_1 | 0.0744 (1.32) | 0.3369 *** (3.39) | ||

| Control | yes | yes | yes | yes |

| Constant | 1.3643 *** (4.19) | 1.8172 *** (3.05) | 1.3683 *** (4.26) | 1.8273 *** (3.08) |

| City fixed effect | yes | yes | yes | yes |

| Year fixed effect | yes | yes | yes | yes |

| Observations | 3962 | 3962 | 3962 | 3962 |

| AGGE | AGGD | AGGE | AGGD | AGGE | AGGD | AGGE | AGGD | |

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| W*AGGE/W*AGGD | 0.3145 *** (9.04) | 0.3755 *** (8.87) | 0.5205 *** (7.36) | 0.6115 *** (10.49) | 0.3012 *** (5.53) | 0.4884 *** (10.41) | 0.8009 *** (23.15) | 0.8564 *** (32.64) |

| HSR | −0.0454 * (−1.90) | 0.0206 (0.70) | −0.0274 (−1.16) | 0.0367 (1.21) | −0.0356 (−1.60) | 0.0101 (0.34) | −0.0432 * (−1.89) | −0.0110 (−0.33) |

| W*HSR | −0.0624 * (−1.73) | −0.2820 *** (−2.85) | −0.1019 ** (−2.36) | −0.3266 *** (−2.68) | −0.0955 ** (−2.46) | −0.2882 *** (−3.05) | −0.1277 *** (−2.69) | −0.2992 ** (−2.41) |

| Control | yes | yes | yes | yes | yes | yes | yes | yes |

| Constant | 0.8360 *** (4.95) | −0.9280 *** (−3.14) | 0.5816 *** (2.94) | −1.1284 *** (−3.49) | 0.8583 *** (4.52) | −0.9238 *** (−3.89) | 0.2083 (1.26) | −1.2093 *** (−3.38) |

| City fixed effect | yes | yes | yes | yes | yes | yes | yes | yes |

| Year fixed effect | yes | yes | yes | yes | yes | yes | yes | yes |

| Observations | 3962 | 3962 | 3962 | 3962 | 3962 | 3962 | 3962 | 3962 |

| Direct: HSR | −0.0492 ** (−2.08) | 0.0002 (0.01) | −0.0308 (−1.30) | 0.0237 (0.74) | −0.0411 * (−1.84) | −0.0203 (−0.55) | −0.0454 * (−1.95) | −0.0176 (−0.50) |

| Indirect: HSR | −0.1069 ** (−2.32) | −0.4245 ** (−2.55) | −0.2478 ** (−2.51) | −0.7968 ** (−2.11) | −0.1449 *** (−3.01) | −0.5313 *** (−2.69) | −0.8463 *** (−2.72) | −2.1927 ** (−2.13) |

| Total: HSR | −0.1561 *** (−3.66) | −0.4242 ** (−2.32) | −0.2786 *** (−2.88) | −0.7731 ** (−2.00) | −0.1860 *** (−3.99) | −0.5516 ** (−2.49) | −0.8917 *** (−2.89) | −2.2104 ** (−2.11) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hu, S.-R.; Jiang, R.-A.; Lu, Z.-Y.; Yin, X.-X. Does the Opening of High-Speed Rail Change Urban Financial Agglomeration? Sustainability 2024, 16, 4509. https://doi.org/10.3390/su16114509

Hu S-R, Jiang R-A, Lu Z-Y, Yin X-X. Does the Opening of High-Speed Rail Change Urban Financial Agglomeration? Sustainability. 2024; 16(11):4509. https://doi.org/10.3390/su16114509

Chicago/Turabian StyleHu, Shu-Rui, Ren-Ai Jiang, Zhe-Yuan Lu, and Xiao-Xue Yin. 2024. "Does the Opening of High-Speed Rail Change Urban Financial Agglomeration?" Sustainability 16, no. 11: 4509. https://doi.org/10.3390/su16114509

APA StyleHu, S.-R., Jiang, R.-A., Lu, Z.-Y., & Yin, X.-X. (2024). Does the Opening of High-Speed Rail Change Urban Financial Agglomeration? Sustainability, 16(11), 4509. https://doi.org/10.3390/su16114509